Quick Notes

Natural Gas Consumption in India: The Tale of Two Sectors

Background

The

Vision 2030 report on natural gas infrastructure by the Petroleum and Natural Gas Regulatory Board (PNGRB) released in 2013 stated that “realistic demand” for natural gas will grow at a CAGR (compounded average growth rate) of

6.8 percent to 516.97 mmscmd (metric million standard cubic meters per day) in 2020-21. Gas-based generation was to contribute to roughly

46 percent of the demand, whilst the share of fertiliser sector was expected to fall from

25 percent in 2013 to about

20 percent in 2021. The share of the CGD (city gas distribution) segment was expected to increase from

6 percent to about 9 percent in the same period, whilst industry was to account for a share of about

7 percent in 2020-21. Petrochemicals was to contribute

15 percent, while iron & steel about

2 percent by 2020-21. According to the report, “realistic demand” considered limiting factors that were likely to restrict growth. The reality in the early 2020s could not have been more different.

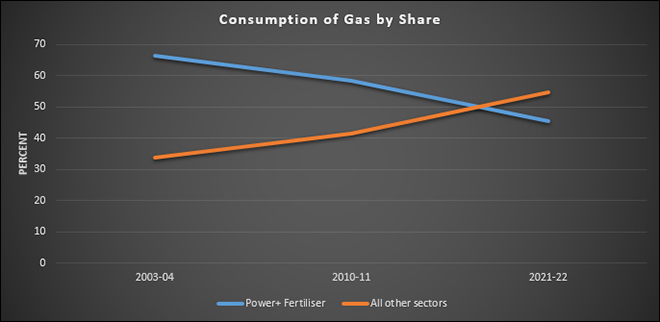

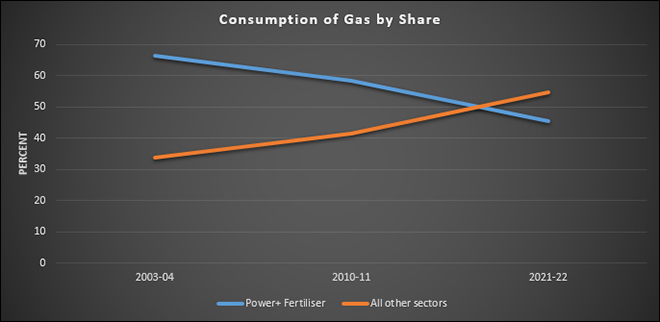

Natural gas consumption fell from

2011-12 levels primarily on the account of the reduction in domestic gas availability. Consumption picked up only in 2015-16, as liquified natural gas (LNG) was relatively cheap and imports grew. Natural gas consumption matched consumption levels of

176.58 mmscmd in 2011-12 only in 2019-20 with consumption of

175.74 mmscmd. Though consumption has started growing after the end of pandemic-related lockdowns, it is nowhere near projected levels. Another stark deviation from the projections is the sectors that would contribute to growth. The fertilizer sector is the largest consumer of natural gas today accounting for about 30 percent of consumption. The power sector which hwas expected to be the largest consumer of gas has fallen to third place accounting for only about

15 percent of consumption in 2021-22, while CGD which was expected to account for only about 9 percent of consumption has the second largest share in consumption accounting for about

20 percent in 2021-22. Different factors influenced consumption growth of natural gas in the fertilizers and CGD which account for 50 percent of consumption.

Fertiliser Sector

The fertiliser sector is prioritised in

gas allocation policy, a system of rationing scarce domestic natural gas. Though prioritisation continues, the volume of domestic gas that can be allocated to the fertiliser industry (and other priority industries) has been declining because of the decline in the production of natural gas. In 2012-13, over 76 percent of total gas consumed by the fertiliser industry was domestically produced. In contrast over

68 percent of the natural gas used for fertiliser production was imported LNG in 2021-22.

Fertiliser is sold to farmers at a

70 percent discount to the cost of production and the fertiliser industry receives the difference as subsidy. Until 2015, the fertiliser industry was supplied with domestic natural gas at a price of

US$4.2/mmBtu (net calorific value basis) under the administrative price mechanism (APM). When the government shifted to a new pricing formula for domestic natural gas in 2015 the price of domestic gas supplied to the fertiliser industry increased to about

US$4.66/mmBtu (on a gross calorific value basis), but fell to about US$2.99/mmBtu in March 2022. The formula-based price for domestic gas has since been increased to US$6.10/mmBtu and the price of imported LNG is hovering around US$20-35/mmBtu. As fertiliser production is critical for the agriculture sector gas price increases are absorbed by government subsidies.

Pooling of gas prices (domestic and imported) for the fertiliser industry allows uniform price for all fertiliser plants irrespective of the share of LNG they use.

Additionally, the investment of about

INR 500 billion for the revival of closed fertilizer plants and the investment in the 2,650 km Jagdishpur-Haldia & Bokaro-Dhamra natural gas pipeline, known as ‘

pradhan mantri urja ganga’ for a ‘second green revolution’ as the government put it, is driving consumption of natural gas. Many fertiliser plants that historically used naphtha as

feedstock have switched or are about to switch over to natural gas use which will drive consumption of gas. Analysts highlight increase in

fertiliser subsidies on account of increase in imported LNG prices and recommend a switch to greener options, but change is not likely in the near term given the complex strategic nature of food production.

City Gas Distribution Sector

In 2007, PNGRB (Petroleum and Natural Gas Regulatory Board) planned to expand CGD networks from

30 to over 3000 cities in India to supply CNG (compressed natural gas) for transport and piped natural gas (PNG) connections to households and industries. In October 2015, India had a total of 1026 CNG stations and over 3 million PNG connections. In March 2022 there were 4013 CNG stations (GAGR 21.51 percent) and over 9 million PNG connections (CAGR 17.16 percent). The national gas grid is to be expanded to about

35,000 km from the current 20,000 km. After completion of 11

th CGD auction,

96 percent of India’s population and 86 percent of its geographic area is expected to be covered under CGD network. The claim that 86 percent of the population is covered under CGD only implies potential access and not actual use. There are

300 million LPG connections compared to 9 million (or about 3 percent) PNG connections.

In 2021-22, 48 percent of CGD consumption was sourced from LNG imports. Unlike the fertiliser industry the CGD industry can, in theory, pass on increase in the price of gas to consumers. However domestic consumers of PNG

are price sensitive which limits the ability of CGD operators to allow full pass through of increase in LNG import costs to consumers. Industrial consumers are also price sensitive, and they can switch to cheaper alternatives if pollution mandates are not enforced.

Issues

Strategic goals unrelated to the energy and environmental concerns are driving growth of consumption in the fertiliser segment. Since the time of the green revolution, domestic production of fertilisers has benefited from policies that support the twin goals of

food security and protection of

farmer incomes. This has meant prioritising the availability of natural gas, key input for fertiliser production, to the fertiliser industry, and subsidising the price of natural gas to limit the price of fertilisers. Consumption of natural gas in the fertiliser segment irrespective of price is driven by the expectation that subsidies from the government will cover for overall increase in input prices. Though the fertiliser industry has complained that government guarantees are inadequate and do not materialise on time, it is a credible assurance that the industry implicitly depends on. Labelled moral hazard in economic theory, this is not a guarantee that can be extended to all gas consuming sectors.

In the case of CGD, drivers of consumption are energy and environment related. Initially consumption was driven by concerns over urban pollution caused by liquid transportation fuels and

court enforced mandates to use alternatives such as natural gas that were expected to reduce pollution levels. Later the prospect of

replacing subsidised bottled LPG for cooking in households provided the impetus for expanding PNG connections. This not only reduced the

subsidy burden on LPG but also freed up LPG cylinders for distribution in rural areas which proved to

be politically valuable. Another factor that facilitated growth of gas as transportation fuel was its price competitiveness over substitutes derived from oil. Gas that

is lightly taxed compared to heavily taxed petroleum products such as petrol and diesel made gas a cheaper option as fuel for transportation. Industrial use of natural gas over cheaper options such as

coal and petcoke is promoted by environmental mandates.

These factors have contributed to the growth of gas consumption by CGD sector, but they may not be sustainable in the long term. The value of gas as a competitive fuel may be eroded as the share expensive imported LNG in CGD continues to increase. Inadequate returns from domestic connections may also inhibit expansion of CGD. Transaction costs in CGD such as the cost of customer acquisition is high. In densely populated cities it is as high as

INR 15,000 per customer and could be higher in less densely populated towns. Access to land and right of way also inhibit expansion of PNG pipeline network. The policy to offer

open access in pipelines to competing CNG suppliers may reduce investment in CGD networks. However, in the short-term growth momentum in the CGD sector is likely to be sustained especially if its competitiveness over petroleum is maintained.

Source: PPAC

Source: PPAC

Monthly News Commentary: Oil

India’s Oil Import bill Doubles

India

Demand

India’s crude oil import bill nearly doubled to US$119 billion (bn) in the fiscal year that ended on 31 March, as energy prices soared globally following the return of demand and war in Ukraine. India, the world’s third biggest oil consuming and importing nation, spent US$119.2 bn in 2021-22 (April 2021 to March 2022), up from US$62.2 bn in the previous fiscal year, according to data from the Oil Ministry’s Petroleum Planning & Analysis Cell (PPAC). Oil prices started to surge from January and rates crossed US$100 per barrel in the following month before touching US$140 per barrel in early March. Prices have since receded and are now around US$106 per barrel. According to PPAC, India imported 212.2 million tonnes (MT) of crude oil in 2021-22, up from 196.5 MT in the previous year. This was, however, lower than pre-pandemic imports of 227 MT in 2019-20. The spending on oil imports in 2019-20 was US$101.4 bn. The imported crude oil is turned into value-added products like petrol and diesel at oil refineries, before being sold to automobiles and other users. The nation consumed 202.7 MT of petroleum products in 2021-22, up from 194.3 MT in the previous fiscal, but lower than pre-pandemic 214.1 MT demand in 2019-20. Import of petroleum products in 2021-22 fiscal was 40.2 million tonnes worth US$24.2 bn. On the other hand, 61.8 MT of petroleum products were also exported for US$42.3 bn. India had spent US$62.2 bn on the import of 196.5 MT of crude oil in the previous 2020-21 fiscal, when global oil prices remained subdued in the wake of the COVID-19 pandemic. According to PPAC, India’s oil import dependence was 85 percent in 2019-20, which declined marginally to 84.4 percent in the following year before climbing to 85.5 percent in 2021-22.

India, the world’s third biggest oil importer and consumer, is

looking at boosting oil purchases from Brazil. Currently India imports only a fraction of its oil imports from Brazil. At present, Indian companies Bharat Petroleum Corporation (BPCL) and Oil and Natural Gas Corporation (ONGC) have made investment in Brazil’s oil and gas exploration sector. India wants to import oil from Brazil under "long-term special contracts". Brazil, which is ramping up its oil output by 10 percent to 3.3 million barrels per day, is willing to meeting Indian demand for oil. India, which meets about 84 percent of its oil needs through imports, is looking at ways to cut its import bill including stepping up use of bio-fuels.

India is considering joining the International Energy Agency (IEA)’s second initiative this year for a co-ordinated release of 120 million barrels of oil from emergency reserves of member countries to calm global oil prices. India is an IEA associate and not a full member as it does not have the mandated 90 days reserves. IEA members hold emergency reserves of 1.5 billion barrels under public ownership. The 120 million barrels amount to 8 percent of those stockpiles. This is equivalent to 4 million barrels a day for 60 days against a daily global supply of approximately 100 million barrels before the pandemic. In

dia has a daily consumption of 4.5 million barrels per day of crude and has a stockpile of 39 million barrels, or roughly 8-9 days of supply, spread across three locations. The coordinated drawdown is the second this year after the 1 March decision to release 62 million barrels. Such collective action under the banner of IEA, which was formed in 1974, had earlier been taken in 2011, 2005, and 1991 since IEA.

According to India’s Finance Ministry, the Union government is

exploring "all viable options" to procure crude oil at affordable rates. However, the Ministry’s review report painted a rather dire picture, saying the rise in imports in March because of a 20 percent month-on-month increase in crude oil prices "does not portend well for the economy in the year ahead". India’s procurement of discounted crude oil from Russia has drawn criticism from the US (United States). According to reports, President Joe Biden’s administration has been left disappointed by some of India’s reaction to Russia's invasion of Ukraine and has warned it against aligning itself with Russia.

As oil prices dived on news that the US was considering record release from the reserves, India said it supports the initiative to let out from the strategic stockpile to cool rising oil prices. Oil prices plunged on news that the US was considering releasing up to 180 million barrels from its strategic petroleum reserve (SPR). International benchmark Brent crude fell around 4 percent to US$108.85 per barrel. According to Ministry of Petroleum and Natural Gas,

India maintains SPR of 5.33 MT, or equivalent of about 9.5 days of crude oil requirement. In addition, oil marketing companies (OMCs) currently have a capacity of 64.5 days. While OMCs paused retail price revision during the period when international oil prices spiked to a 14-year high of US$139, petrol and diesel prices have been since 22 March revised 9 times, totalling INR6.4 per litre. The opposition parties have accused the government of holding the rates when five states including Uttar Pradesh and Punjab went to the polls and raising prices after the elections were completed. India is dependent on imports to meet 85 percenttr of its oil needs.

LPG

In a bid to promote the use of gas cylinders and prevent the adverse effects of burning wood or coal for cooking, the Uttarakhand State Minister of Department of Food, Civil Supplies and Consumer Affairs Rekha Arya announced that "at least three free-of-cost cylinders will be provided to Below Poverty Line (BPL) women". Officials of the department have been directed to make a proposal to fix the budget and also identify the locations where availability of cylinders needs to be on priority. Several women still rely on fuelwood for cooking in the state's villages. This often leads to chronic health issues among them. And not just LPG (liquefied petroleum gas) cylinders, fortified salt will also be available for consumers at ration shops.

Retail Prices

Civil aviation minister Jyotiraditya

Scindia said a dozen states that have not reduced VAT (Value Added Tax) on jet fuel are being nudged to lower levies, and backed bringing the commodity under the GST (Goods and Services Tax) umbrella. Indian carriers have been grappling with high aviation turbine fuel as several opposition-ruled states maintain high VAT, ranging between 20 percent and 30 percent.

Petrol prices in Rajasthan’s Sri Ganganagar district rose to INR123 per litre, making it the costliest in the country. The unprecedented hike has impacted over 80 percent of petrol pumps bringing them on the verge of closure, confirmed petrol pump owners. In fact, the price of diesel in the district is INR105.31 per litre, which yet remains one of the highest prices in India. However, in the neighbouring state of Punjab, petrol and diesel are cheaper by INR17 and INR11 per litre respectively. Petrol consumers from Rajasthan can be seen making beeline at filling stations of Punjab, while those in Sri Ganganagar have very limited consumers. In fact, According to Sri Ganganagar District Petrol Pump Dealers Association, 80 percent of petrol pumps are on the verge of closure as an impact of this huge difference in fuel costs.

Refining

Reliance Industries Ltd

(RIL), operator of the world’s biggest oil refining complex, has ordered at least 15 million barrels of Russian oil since Russia invaded Ukraine in February. RIL has bought an average 5 million barrels a month for the June quarter. Before the Ukraine war, Indian refiners, including Reliance, rarely bought Russian oil owing to high freight costs. Indian refiners have snapped up the cheap barrels as India, the world’s third-biggest oil importer and consumer, is hit hard by high oil prices. India imports about 85 percent of its 5 million barrels per day (bpd) oil needs. Refinitiv’s tanker flow data shows a supply of about 8 million barrels of Russian oil, mainly Urals, at the Reliance-operated Sikka port in western India, for arrival between 5 April and 9 May. RIL is scheduled to received its first parcel of Russia’s ESPO oil in early May, the Refinitiv data shows. RIL operates two refineries at the Jamnagar complex in western India that can process about 1.4 million bpdof oil.

Rajasthan CM (Chief Minister) Ashok Gehlot reviewed the ongoing construction work of an

oil refinery and a petrochemical complex in Barmer and asked HPCL to expedite the project. According to the CM, the state will emerge as a hub of petroleum-based industries, and there will be a lot of employment once the petrochemical complex, which is being constructed along with the refinery at Pachpadra (Barmer), starts functioning. The CM reviewed the progress of nine main refinery units and four petrochemical unitsand also urged the local youth to set up small units in the petrochemical complex. Meanwhile, the State Mines and Petroleum Minister assured that his department will extend all possible cooperation to complete the work of the refinery within the stipulated time.

India’s busiest ports at Kandla in Gujarat and Mumbai are further clogged with LPG import vessels as the state-owned oil companies refuse to go beyond a small list of ports that have been designated by the government to give freight subsidies for bringing in the cooking fuel from overseas. Under the PDS Kerosene and Domestic LPG Subsidy Scheme of 2002, the government has categorised ports at Kandla, Mumbai, JNPT, Jamnagar, Hazira, Mangalore, Kochi, Chennai, Haldia, and Vizag as 'Designated Ports' for giving ocean freight subsidy. This subsidy is not available for imports done at other ports and so there is a clamour to get the ships only at these ports. The oil industry and the Petroleum Ministry have made a case for expanding the list of designated ports, but the Finance Ministry shot down the proposal.

Mangalore Refinery and Petrochemicals Limited

(MRPL) has bought 1 million barrels of Russian Urals crude for May loading via a tender, a rare purchase driven by the discount offered. Refiners in India, have been snapping up Russian oil through spot tenders since Russia’s invasion of Ukraine on 24 February, taking advantage of deep discounts as other buyers back away. With MRPL’s purchase, India has so far booked at least 14 million barrels of Russian oil since 24 February, compared with nearly 16 million barrels in all of 2021. The Urals oil discount to dated Brent has hit a record for the post-Soviet era as buyers stayed away from Russian oil. Unlike several Western countries, India has not banned Russian oil imports.

Production

India’s crude oil production fell by 2.6 percent year-on-year (Y-o-Y) to 29.69 MT in the last fiscal year, ended March 2022, against 30.49 MT in FY21 largely due to lower production by ONGC. The output in FY22 was lower by 11.67 percent compared to the target for the said year. According to the Ministry of Petroleum and Natural Gas, production during March was 25.26 lakh tonnes (lt), indicating a decline of 12.49 percent than the target for the month as well as lower by 3.37 percent than the production in March 2021. Crude oil production by ONGC in the nomination block during March 2022 was 16.82 lt, which is 12.62 percent lower than the target for March and 1.84 percent lower when compared with production of March 2021. Overall crude oil production by the PSU oil explorer in FY22 was 19.45 MT — which is 13.82 percent and 3.62 percent lower than target for the period and production during corresponding period of last year, respectively. Indian refineries processed 2.23 MT on crude oil during March, which is marginally higher than the target for the month and 6.44 percent higher than the output in March 2021. Overall the refineries processed 241.70 MT, which is 0.97 percent and 8.99 percent higher than target for the period and production during corresponding period of last year, respectively, on account of a rebound in economic and industrial activity.

Vedanta-owned

Cairn Oil and Gasoline is betting on its shale exploration programme in its prolific Rajasthan asset, estimating that shale oil and fuel manufacturing could cut back India’s oil and fuel import by 10 percent when manufacturing kicks in. Shale is a kind of pure fuel trapped in fine-grained sedimentary rocks known as shales. Cairn’s onshore Rajasthan oilfields – Mangala, Bhagyam, and Aishwariya (MBA) – are its flagship and most prolific property. They collectively produce as much as 20 percent of India’s whole crude output.

Niti Aayog has recommended that the government extend oilfield contracts with companies without seeking alterations to the terms of the original agreement, a proposal that can help end a six-year-old legal dispute over renewal of Vedanta’s Rajasthan block, the country’s largest onland oilfield. The Aayog has also not supported the current policy of the government seeking 10 percent additional profit petroleum from the contractor during the extended period. If the oil ministry agrees to Aayog’s recommendation and proposes a change in the policy to the Cabinet, it can end the long-drawn dispute with Vedanta.

Transport

The rate of petrol in Parbhani district in Maharashtra reached INR122.67 a litre, one of the highest prices in the country, mainly due to the higher transportation cost. The steep rise is also attributed to the long distance of over 400 km between Parbhani city located in the Marathwada region and the fuel depot at Manmad in the Nashik district in north Maharashtra. The round-trip distance for a tanker transporting fuel to Parbhani from the Panewadi-based depot in Manmad is nearly 730 km. The fuel depot at Panewadi is the nearest to Parbhani compared to other such depots in Maharashtra. When contacted, an official at the HPCL regional office in Aurangabad city said that the prices of fuel at a specific location depend on the distance between that location and the nearest depot.

Rest of the World

World

The International Energy Agency

(IEA) is still examining details of a planned second round of the coordinated release of oil reserves. Japan aims to make a decision on its release plan swiftly after receiving official notification from the IEA to make the cooperative action effective.

OPEC/OPEC+

Libya halted oil production from its El Feel oilfield and two sources at Zueitina oil port said exports there had been suspended after protesters calling for Tripoli-based Prime Minister Abdulhamid al-Dbeibah to resign, took over the sites. Halting operations in El Feel and Zueitina would cripple Libya’s oil production which averaged 1.21 million barrels per day before the latest outages. The force majeure on El Feel curtails the North African nation's production by 70,000 barrels per day. Libya has had two competing governments since March when the eastern-based parliament appointed Fathi Bashagha to replace Dbeibah, renewing a standoff between the east and west of the country. Dbeibah has refused to cede power to Bashagha who has not made into Tripoli yet.

The OPEC (Organization of the Petroleum Exporting Countries) cut its forecast for growth in world oil demand in 2022 citing the impact of Russia’s invasion of Ukraine, rising inflation as crude prices soar, and the resurgence of the Omicron coronavirus variant in China. In a report, the

OPEC said world demand would rise by 3.67 million bpd in 2022, down 480,000 bpd from its previous forecast. The invasion in February sent oil prices soaring above US$139 a barrel, the highest since 2008, worsening inflationary pressures. Crude has since fallen as the US and other nations announced plans to tap strategic oil stocks to boost supply, but remains over US$100. Even so, world oil consumption is expected to surpass the 100 million bpd mark in the third quarter, as OPEC has predicted. On an annual basis according to OPEC, the world last used more than 100 million bpd of oil in 2019.

Kuwait has raised the official selling prices (OSPs) for two crude grades it sells to Asia in May to record levels. The producer has set May Kuwait Export Crude (KEC) price at US$9.30 a barrel above the average of Oman/Dubai quotes, up US$4.50 from the previous month. It also raised the May Kuwait Super Light Crude (KSLC) OSP to US$9.65 a barrel above Oman/Dubai quotes, up US$3.70. The price hike for KEC was 10 cents more than that for Saudi’s Arab Medium crude in the same month.

Kazakh oil production excluding condensate fell to 1.55 million barrels per day (bpd) in March, down 3 percent from February, amid export problems from the Black Sea Caspian Pipeline Consortium (CPC) terminal. The fall in Kazakh oil output was because of lower intake in the Caspian Pipeline Consortium (CPC) system in the second half of March owing to storm damage to loading facilities at its Black Sea terminal situated in the south of Russia. More than 80 percent of Kazakhstan’s crude is exported via the CPC pipeline to the port of Yuzhnaya Ozereyevka, close to Novorossiisk, supplying around 1.2 percent of global oil demand. CPC terminal damage affected operations of Kazakhstan’s giant Tengiz and Kashagan oilfields led by Western oil majors including Chevron, Exxon Mobil, Total, Eni and Shell. Chevron-led Tengizchevroil, operator of the giant Tengiz oilfield, decreased its March oil output the most among other Kazakh producers, by 6 percent from February to 622,209 bpd. TCO is the biggest exporter of oil via CPC pipeline and relies on the pipeline as its main route for oil deliveries. Lower oil intake in the CPC system hit its output almost immediately.

North & South America

Exxon Mobil Corp found oil in three new wells drilled off the coast of Guyana, raising recoverable oil and gas potential from its discoveries to nearly 11 billion barrels. The discoveries continue a run of exploration successes that date to 2015, and lifts potential oil and gas volumes by nearly 1 billion barrels. Exxon and partners Hess Corp and CNOOC Ltd are responsible for almost all oil and gas output in the South American country. Guyana has emerged as a key source for Exxon’s future production, with 31 oil discoveries in its giant Stabroek block so far. It and partners said they plan to pump 1.2 million barrels of oil and gas per day from the block by 2027. Exxon discovered hydrocarbon-bearing sandstone at Barreleye-1, Patwa-1 and Lukanani-1 wells. The new findings are located southeast of its existing Liza and Payara oil developments, Exxon's first and third projects in Guyana.

The US Interior Department has issued a

decision to limit roughly half the National Petroleum Reserve-Alaska to oil and gas leasing. The decision rolls back an approach taken by the prior Trump administration, and it drew criticism from Alaska’s US senators. The reserve covers about 36,000 square miles (92,000 square kilometres (km)) on Alaska's North Slope. Under the decision, about 18,000 square miles (48,000 square km) would be open to oil and gas leasing. That includes some lands closest to existing leases centred on the Greater Mooses Tooth and Bear Tooth units and the Umiat field, the decision states. Plans advanced during the Trump administration would have allowed for oil and gas leasing on about 29,000 square miles (75,000 square km).

Guyana sold its first share of crude oil from the country’s newest offshore production facility to Exxon Mobil for about US$106 mn, the government said. One of South America’s poorest nations, Guyana plans to use proceeds from oil in the short term to build roads, bridges, houses, gas-fired power plants and solar energy projects. The second platform is set to reach its full 220,000 bpd capacity in the third quarter. The 1-million-barrel cargo of the new crude, called Unity Gold, was sold through a competitive bidding process that Exxon won with a bid of US$106 per barrel, according to the Guyana ministry of natural resources.

Brazilian state-run oil company

Petrobras will cut LPG or cooking gas prices by about 5.6 percent at the refinery gate starting. Petrobras, as the company is formally known, said that its price for LPG, used as cooking gas, will fall to 4.23 reais ($0.8942) per kilogram from 4.48 reais per kilogram previously.

The Canadian government approved

a US$12 billion offshore oil project proposed by Norway’s Equinor ASA, after an environmental assessment concluded it would not cause significant adverse effects. The Bay du Nord project would involve building a floating platform to drill an estimated resource of 300 million barrels of light crude oil in the Atlantic Ocean, about 500 km (310 miles) off the coast of Canada’s Newfoundland and Labrador province.

Exxon Mobil Corp decided

to invest US$10 billion in a fourth oil production project off the coast of Guyana, the largest in the South American country. Guyana is one of Exxon’s top bets for future production growth, with as much as 1.2 million bpd of oil and gas expected to be produced by 2027. Exxon and partners Hess Corp and CNOOC Ltd Consortium started production in Guyana in 2019 and are responsible for all output in the country. They have discovered more than 10 billion barrels of recoverable oil. Exxon’s Yellowtail development in the Stabroek block is expected to produce about 250,000 barrels of oil per day starting in 2025. The US$10 billion project is one of up to 10 that the companies plan to install in Guyana.

Brazilian state-run oil company

Petrobras has discovered an oil accumulation in the southern portion of the Campos Basin. The oil was found in a pioneering well in the Alto de Cabo Frio Central block, which is owned by Petrobras and BP. As per the company, the oil-bearing interval was verified by electrical profiles and oil samples, which will be further characterized by laboratory analysis.

Asia Pacific

The Nepal government is considering to declare a two-day holiday in public sector offices to reduce fuel consumption, as the country battles a foreign exchange crisis and the price of petroleum products sky-rockets. The Central Bank of Nepal and Nepal Oil Corporation advised the government to give two days government holiday. The advice to the government sees significant savings for

Nepal Oil Corporation which is selling fuel at subsidised rates and suffering huge losses at the present global rates.

Japan’s ruling Liberal Democratic Party

(LDP) urged the government to introduce jet fuel subsidies and launch a tourism campaign as part of a relief package to cushion the blow from global commodity inflation driven up by the Ukraine war. Whilst the proposal did not mention the size of spending, it called on the government to act swiftly by drawing on existing budget reserves of 5.5 trillion yen (US$43.9 billion). Prime Minister Fumio Kishida has instructed his cabinet to compile measures to cushion the blow from rising fuel and food costs by the end of the month.

China’s oil demand is estimated to rebound to 14.26 million bpd in the second quarter of 2022 after the country’s zero-COVID policy dampened consumption in the first quarter, China National Petroleum Corp (CNPC) researcher said. Oil consumption was assessed at 13.9 million bpd in the first quarter to 31 March, down 3 percent from a year earlier. The reduced oil demand followed stringent mobility restrictions across China, including a two-stage lockdown in financial hub of Shanghai which could reduce fuel demand by 200,000 barrels per day, having recorded thousands of daily COVID-19 cases since March.

Russia

According to the IEA,

the impact of sanctions and buyer aversion on Russian oil will take full effect from May onwards. Countering that, expected lower demand in China, output increases from OPEC+ producers and beyond plus a record draw on emergency oil storage by the US and its IEA member allies ought to prevent any sharp deficit, the IEA said. Global demand is now expected to be balanced with supply in the second quarter at 98.3 million bpd, with the potential to calm soaring energy price inflation. It had previously expected market balance to be next achieved in the fourth quarter. Chinese coronavirus lockdowns and lower than expected first-quarter demand, especially from the US, prompted the IEA to lower its global oil demand forecast for the year by 260,000 bpd.

Russian petrochemical producer

Sibur has diverted cargoes of LPG to Turkey because of it was unable to offload them in the Amsterdam-Rotterdam-Antwerp region. The Refinitiv Eikon ship tracking system shows four tankers from the Baltic Sea port of Uts-Luga carrying in total 48,000 tonnes of LPG were destined for ARA in the second half of March. Traders said that Navigator Luga and Navigator Libra have been diverted to the Turkish port of Dortyol. The cargoes were bought by Aygaz, Turkey’s largest importer and distributor of LPG. Although, Sibur has not been placed under Western sanctions following the Ukraine crisis, one trader said offloading had become complicated because banks are refusing to facilitate payments for products from Russia. Whilst the sanctions do not restrict purchases of Russian oil products, including LPG, restrictions on the Russian financial system have complicated payments, insurance and freight.

News Highlights: 27 April – 3 May 2022

National: Oil

IOC launches methanol-blended petrol on pilot basis in Assam

2 May: Indian Oil Corporation (IOC) rolled out M15 petrol – 15 percent blend of methanol with petrol -- on a pilot basis in Assam’s Tinsukia district. Union Minister of State for Petroleum and Natural Gas Rameswar Teli launched the M15 petrol in the presence of Niti Aayog member VK Saraswat and IOC chairman SM Vaidya. Teli said that blending fuel with methanol will provide respite from the rising prices.

Steps are being taken by IOC to make India self-sufficient in energy, he said. The pilot rollout was done in Tinsukia by the company due to the ready availability of methanol, which is being manufactured by Assam Petrochemical Ltd in the vicinity of Digboi refinery.

India’s ONGC struggling to move Russian oil to Asia as sanctions bite

27 April: India’s Oil and Natural Gas Corp

(ONGC) is struggling to find a vessel to ship 700,000 barrels of crude from Russia’s Far East, in a growing sign that complex trades involving one of Moscow's biggest partners are being interrupted by Western sanctions. Several Indian companies including ONGC have stakes in Russian oil and gas assets, and India has been buying more Russian crude since Moscow invaded Ukraine, snapping up the popular Urals crude grade, while other buyers have shunned Russian exports. ONGC has a 20 percent stake in the Sakhalin 1 project that produces a Russian grade known as Sokol, which ONGC exports through tenders. Sokol is mostly bought by North Asian buyers and loaded from South Korea. Indian refiners rarely buy the Sokol grade, as difficult logistics make the crude costly. This year, India has bought more than twice as much crude from Russia in the two months since its invasion of Ukraine as it did in all of 2021.

National: Gas

BPCL, HPCL walk away with city gas licenses in latest bid round

28 April: Bharat Petroleum Corporation Limited

(BPCL) and Hindustan Petroleum Corporation Limited (HPCL) have bagged two licenses each for retailing CNG (compressed natural gas) to automobiles and piped cooking gas to households in the latest bid round, regulator PNGRB (Petroleum and Natural Gas Regulatory Board) said. Seven companies had put in 21 bids for city gas licences in five areas in states like Uttar Pradesh and West Bengal. The PNGRB had offered five Geographical Areas (GAs), spread over 27 districts in five states, in the 11A city gas distribution (CGD) bid round. BPCL won the license for a GA comprising districts such as Lakhimpur Kheri, Sitapur, and Mahrajganj in Uttar Pradesh and another for Chhattisgarh’s Koriya, Surajpur, Balrampur, and Surguja districts have been clubbed into one GA, PNGRB said. HPCL won the license for a GA made up of Banka in Bihar as well as Dumka, Godda, Jamtara, and Pakur districts in Jharkhand. It also won the license for GA made up of Birbhum, Murshidabad, Malda, and Dakshin Dinajpur districts of West Bengal. GAIL Gas Ltd, a unit of state gas utility GAIL (India) Limited, won the license for the Kodagan, Bastar, Sukma, Bijapur, and Dantewada districts in Chhattisgarh. Bids for the 5 GAs were received on 6 April, it said. The sixth GA of Yanam in Puducherry has been added to the bid round and bids for this area are due on 10 May. After this bid round, about 88 percent of the country’s area would be authorised for the development of city gas distribution (CGD) network to provide access to natural gas to approximately 98 percent of the population, the PNGRB said.

National: Coal

India falls 7.6 percent short of coal supply targets to utilities in April

3 May: India fell short of domestic coal supply targets to utilities by 7.6 percent in April, as output from mines owned by companies for self-use were 33 percent lower than required and a shortage of trains for delivery further exacerbated a crippling power crisis. India faced its worst power crisis in over six years in April as demand hit a record high. Local supplies are crucial as coal inventories at utilities are at the lowest pre-summer levels in at least nine years and electricity demand is expected to rise at the fastest pace in nearly four decades.

CIL’s priority is to ensure power plants are well-stocked with coal: CMD

1 May: Stating that ensuring adequate fuel supply to thermal power plants is its "priority", public sector miner Coal India Limited (CIL) has asked its employees to step up efforts and breach the production and offtake target of 700 million tonnes (MT) for FY23. In a letter to the employees of Coal India Limited (CIL), the company’s chairman-cum-managing director (CMD) Pramod Agrawal said that the company’s priority is to make sure that the electricity generating units are well stocked with domestic fuel amidst the ongoing power shortage. The country, he said, looks up to CIL for fuelling its energy needs.

CIL’s total offtake peaked to a record high of 662 MT in FY22, reflecting a sharp 15.3 percent growth over FY21. The FY22 supplies also took a leap of 13.7 percent and 9 percent against pandemic-free fiscals of 2019-20 and 2018-19, respectively. The 87.4 MT annual increment in FY22 is more than the combined rise of 85.1 MT of last six years. Coal Secretary A. K. Jain had earlier said that the ongoing power crisis is mainly on account of the sharp decline in electricity generation from different fuel sources, and not due to the non-availability of domestic coal. Jain had attributed the low coal stocks at power plants to several factors such as increased power demand due to the boom in the economy post-COVID-19, early onset of summer, rise in the price of gas and imported coal and sharp fall in electricity generation by coastal thermal power plants.

Eight trains cancelled for coal transport in Uttar Pradesh

28 April: In a bid to help the state maintain power supply in the scorching heat, the railway board has

cancelled eight express trains in UP (Uttar Pradesh) till further notice to provide hassle free passage to coal laden freight trains for thermal power stations. The move came after consulting the UP government, which has recorded a steep surge in power demand amidst rising mercury. State Power Minister A.K. Sharma emphasized on recovering the power dues from defaulters.

National: Power

All measures being taken to ensure uninterrupted power supply: Punjab Power Minister

2 May: Punjab Power Minister Harbhajan Singh said that all measures are being taken to ensure uninterrupted supply of electricity to consumers in the state. He said that the state power utility, PSPCL

(Punjab State Power Corporation Limited), is geared up to meet the increased demand for electricity during the coming paddy sowing season. The power demand has already crossed 8,500 MW and the power corporation is meeting this demand, which is 40 percent more than the previous year, he said. He said all measures are being taken to ensure uninterrupted supply of electricity to all sections of the state, be it agricultural, industrial, commercial or domestic consumers.

Goa industries association slams government over electricity woes

2 May: An association of industries in Goa said member units were facing power outages despite it agreeing to bear the extra cost of the state government buying electricity from the open market. Goa State Industries Association President Damodar Kochkar said the outages were a result of poor power distribution infrastructure in the state, adding that industries were not bothered by a slight rise in tariff, but electricity must be available for them to carry out operations. He said a plot was given to the electricity department in Verna Industrial Estate in South Goa to set up a substation to cater to units there, but it was catering to all coastal villages in the vicinity and was overloaded. The state is collecting infrastructure tax and must upgrade power utilities immediately to give relief to industries, Kochkar said.

Quick, concrete steps needed to tackle power problem facing India: Delhi CM

29 April: Chief Minister (CM) Arvind

Kejriwal said his government is somehow handling the power supply situation in Delhi, and called for quick, concrete steps to tackle the crisis facing the country. The power situation in the whole of India is very grave, he said. Amidst a deepening coal shortage crisis, the Delhi government warned that there may be problem in providing uninterrupted electricity supply to important establishments in the capital including Metro trains and hospitals. Delhi Power Minister Satyendar Jain had held an emergency meeting to assess the situation and wrote to the Centre requesting it to ensure adequate coal availability to power plants supplying electricity to Delhi.

Mumbai peak demand crosses 3.6 GW even before May

28 April: The peak electricity demand for Mumbai crossed 3,660 MW, up from its usual high of 3,500 MW in summer. Experts and power utility officials fear that this could rise to nearly 4,000 MW with a rise in temperature in May. As for consumers, the increase in consumption and the rising power purchase costs could have an impact on monthly power bills, power experts said.

Centre allocates 207 MW additional power to J&K amid rise in demand

28 April: In order to meet the increasing electricity demand in Jammu and Kashmir (J&K),

the Central government allocated 207 MW additional power to the UT (Union territory). The Union government has allocated the additional power from the unallocated quota of Central Generating Stations of Northern Region Pool to Jammu and Kashmir. The order issued by the Union ministry of power in this regard will come into effect from midnight and the UT is expected to receive the additional supply. The UT’s Power Development Department (PDD) is also making dedicated efforts on all fronts to meet the rising demand for electricity, exploring practical and viable solutions to address the needs of the end consumers. The PDD has allocated additional INR520 mn between 1 and 25 April to purchase power from the open market, also known as Energy Exchange. However, due to increased number of bidding, electricity worth only INR104.1 mn could be supplied to the UT. The early onset of summer and an unprecedented hot weather conditions in the months of March and April, experienced for the first time in the past 122 years and 50 years, respectively, have raised the power demand in the Jammu division. In April 2021, the power demand for Jammu division was 830 MW per day, which has increased to 900 MW this year. The PDD is using all its resources, including purchases from the Energy Exchange, to ensure the supply of 770 MW to the Jammu division.

TANGEDCO to double power production, upgrade distribution by 2030 in TN

27 April: The Tamil Nadu Generation and Distribution Corporation Limited

(TANGEDCO) will double up the power production in the state by 2030. The TANGEDCO will double up the power production by 2030 as well as upgrade the distribution system for an uninterrupted power supply. Currently, the power production in the state is 33,877 megawatt (MW) and the TANGEDCO is aiming to touch 77,153 MW by 2030. The state was also buying power through medium and short-term open assess arrangements for an uninterrupted power supply despite the operational issues. Providing electricity connection to one lakh farmers through a scheme initiated on 29 September 2021, and completed on 29 March 2022, had helped in irrigation of 2.13 lakh acres of farmland and was a major milestone achieved for the Tamil Nadu power department.

National: Non-Fossil Fuels/ Climate Change Trends

India to add 30 GW offshore wind power capacity: Power Minister

3 May: India plans to set up 30,000 megawatts (MW) of offshore wind power capacity alongside 50,000 MW of solar capacity, Power and Renewable Energy Minister R.K. Singh said. India has focused programs for capacity addition and accelerating the energy transition, the Minister said.

Indian wind energy sector envisions flow of INR800 bn in coming years

3 May: High on the pioneering clean energy initiative undertaken by Prime Minister (PM) Narendra Modi, which aims to make India the frontline nation globally in clean energy generation, the Indian wind energy has envisioned an investment flow of over INR800 bn (US$10.50 billion) over the next few years in the Indian wind energy sector.

Various wind energy companies operating in India have invested close to INR250 bn in wind energy equipment manufacturing capacity but there are still many companies who are getting equipment from outside. Indian Wind Turbine Manufacturers Association (IWTMA) chairman Tulsi Tanti, said that India is now the hottest market for clean energy projects and was hopeful that more and more companies will head to India and invest in various clean energy projects ranging from equipment, generation, transmission, and services. "There is a fabulous market here and investors have a great opportunity to leverage talent and other things for exports too," added Tanti.

Azure Power Fully Commissions Its 90 MW Solar Project in Assam

3 May: Azure Power, India’s leading provider of sustainable energy solutions and a major producer of renewable power, announced the successful

commissioning of its Assam 90 MW solar power plant, which is the largest in the state. Azure Power has an operational capacity of more than 2,900 MW high-performing renewable energy assets in India.

Andhra Pradesh to procure 7 GW solar power from SECI

2 May: As part of its long-term planning, keeping the coal crisis and future energy needs in mind, the state

government has decided to procure 7,000 MW solar power from the Solar Energy Corporation of India (SECI) at 2.49 per unit against the prevailing market exchange price of 12-16. The SECI will start supplying 3,000 MW from September 2024 in the first tranche, 3,000 MW from September 2025 in the second tranche and 1,000 MW from September 2026 in the third tranche. State Energy Minister Peddireddi Ramachandra Reddy said Andhra Pradesh has decided to procure power from SECI at a highly cost-effective price compared to the market rates.

International: Oil

Brazil looking to auction Ametista deepwater oil block in 2022: Energy ministry

3 May: Brazil’s government is trying to add a 12th block to an auction of oil exploration areas expected, the energy ministry said. The Ametista block is located at the South border of the region known as the pre-salt and has promising potential for deepwater oil volumes, the ministry said. If included in the auction, which is likely, Ametista will be licensed under a production sharing agreement. The block is south of the Equinor and Exxon Mobil Corporation Bacalhau oil block. Seismic data shows potential for volumes above a thick layer of salt under the Atlantic seabed. Brazil’s oil regulator, known as the ANP, is planning to put on permanent offer for the first time later this year exploration blocks in the pre-salt area. Eleven exploration and production areas have been already approved to be offered, ANP head Rodolfo Saboia said. Unlike regular oil rounds in Brazil, blocks will be permanently available for companies interested in buying drilling rights, even if they do not receive a bid in the first day of listing.

Iraq exports over 100 million barrels of crude oil in April: Oil ministry

1 May: Iraq exported about 101 million barrels of crude oil in April, bringing in revenues of 10.55 billion US (United States) dollars, the Iraqi oil ministry said. The average selling price for crude oil in April was 104.09 dollars per barrel, according to the ministry. A total of 98.1 million barrels were exported from oil fields in central and southern Iraq via the Port of Basra, and about 2.99 million barrels from the northern province of Kirkuk via the Turkish port of Ceyhan on the Mediterranean, the ministry said. Oil prices have risen in global markets since the outbreak of the Russian-Ukrainian crisis, benefiting Iraq and other oil export countries. Iraq’s economy heavily relies on crude oil exports, which account for more than 90 percent of the country's revenues.

OPEC Fund to finance US$14.3 mn for Nigeria-Morocco gas pipeline

30 April: The OPEC (Organization of the Petroleum Exporting Countries) Fund for International Development will finance US$14.3 million for the second phase of the

studies in the submarine Nigeria-Morocco gas pipeline project. The Australian company WorleyParsons announced that it has been awarded the second phase of the studies, which is progressing in accordance with the initial project planning. In January, the Islamic Development Bank has signed an agreement with Morocco to provide US$15.45 million to the Nigeria-Morocco gas pipeline studies. This gas pipeline project would cover 7,000-km long through 13 west African countries, and extend to Europe, according to WorleyParsons.

Activists turn off German oil pipelines in North Sea drilling protest

27 April: German climate activists turned off crude oil pipelines at five locations, demanding the country look for other ways to reduce its dependence on Russian gas than starting new fossil fuel-based infrastructure projects such as deep-sea drilling. In mid-March, Finance Minister Christian Lindner said Germany should rethink its ban on allowing new drilling for oil and gas in the North Sea as it looks for new energy sources after Russia’s invasion of Ukraine. The activists entered the pipelines' emergency stations in teams of two and activated shut-off valves that allow the flow of oil and gas to be safely turned off in case of emergency.

International: Gas

Japan’s ENEOS withdraws from Myanmar gas project

2 May: Japanese energy conglomerate ENEOS Holdings said it will

withdraw from a gas project in coup-hit Myanmar, days after its Thai and Malaysian partners announced they would pull out. The company is involved in the Yetagun project off southern Myanmar along with the Japanese government and Mitsubishi Corporation. Together they hold a 19.3 percent stake in the gas field, which has been operational for two decades.

Russia’s Gazprom expects 4 percent fall in gas output in 2022

28 April: Russia’s Gazprom expects about a 4 percent fall in gas output this year, Deputy Chief Executive Vitaly Markelov said. Markelov said the group expected output to fall to 494.4 billion cubic meters (bcm) from 514.8 bcm last year, without elaborating. This would be Gazprom’s lowest production since 2017 when it stood at 471 bcm. Gazprom halted gas supplies to Poland and Bulgaria in a payments row with Europe, which is trying to wean itself off Russian energy. Russia’s Economy Ministry expects oil and gas production to fall this year, with gas output declining to 702.4-720.9 bcm from 763.5 bcm in 2021.

International: Coal

South African coal miners turn to trucks as rail service deteriorates

3 May: Mining companies in South Africa have resorted to trucking coal to ports to meet a surge in European demand since the war in Ukraine started, bypassing the deteriorating rail infrastructure they blame for billions of dollars in lost revenue. Poor maintenance, a lack of spare parts for trains, copper cable theft and vandalism have disrupted state logistics firm Transnet's freight rail services, causing coal and iron ore exports to fall in recent years. In April, Transnet declared force majeure on contracts with producers but with coal prices near record highs, mining firms including Glencore have turned to trucks. Trucking coal costs about four times more than rail, according to miner Menar. It has started using trucks but said the high coal prices mean miners can absorb the cost, for now. At Canyon Coal’s Khanye Colliery some 90 km (55 miles) from Johannesburg, it takes about 80 trucks - each carrying 34 tonnes - to replace one average Transnet train, making it unsustainable financially, boosting emissions and clogging roads.

China to cut coal import tariffs to zero from 1 May

28 April: China will cut import tariffs for all types of coal to zero from 1 May 2022, until 31 March 2023, the Finance Ministry said, as Beijing strives to ensure energy security amid soaring global prices and supply disruption concerns. Import tariffs for anthracite and coking coal, mainly used in steelmaking, will be cut to zero from the current 3 percent, and rates for other kinds of coal will be down from 3-6 percent. China imported 323.33 million tonnes (MT) of coal in 2021, about 8 percent of its total coal consumption. However, the removal of coal import tariffs is seen having little impact on China’s coal purchases in 2022, as domestic output holds at record levels while sea-borne prices have surged to historically highs. Some traders said the move could benefit its imports from Russia. China’s spot coal prices are around 1,200 yuan (US$181.61) a tonne, with term-contract prices capped by the government at 770 yuan.

International: Power

Europe’s electricity market not in need of redesign: Regulators

29 April: Europe’s electricity market does not need a radical redesign, but policymakers should consider more measures to support the shift to low-carbon energy and protect consumers from high costs, EU (European Union) energy market regulators said. In response, the European Commission last year asked the EU agency for the cooperation of energy regulators (ACER) to assess how Europe’s electricity market is functioning. Most EU countries are already using tax cuts and subsidies to shield consumers from the recent jump in energy prices, but states disagree on whether Europe’s electricity market itself needs redesigning. Spain and Portugal secured EU approval to cap the cost of gas used for power in their domestic markets, and both along with other countries had initially pushed for an EU-wide price cap. ACER said any interventions should focus on the root cause of electricity price spikes - currently, high gas costs - but that the bigger the intervention, the more risk of distorting the market. One option could be temporary price limits that kick in if prices surge over a short period, it said, although it warned that could undermine the incentive to limit demand in such situations.

Sweden rejects power grid exemption requests

27 April: The Swedish Energy Markets Inspectorate (Ei) has turned down six requests by the country's electricity transmissions system operator (TSO) to limit the capacity it must make available to power traders, it said. European Union (EU) rules stipulate that

TSOs must make at least 70 percent of the capacity of power cables running between different price zones available to traders, as a way to ensure the free flow of power in the internal electricity market.

International: Non-Fossil Fuels/ Climate Change Trends

Mexico opposition party pitches free solar panels for housing

1 May: Mexico’s biggest opposition party proposed installing solar panels for free onto residential housing, staking out its renewable energy credentials as it seeks to challenge the ruling party of president Andres Manuel Lopez Obrador. The president’s plan sought to tighten CFE control of the market at the expense of private companies. That caused friction with investors in solar and wind power generation as well as manufacturers with commitments to use more clean energy. The solar panels would be paid for by a subsidy currently going to CFE, and be free for people in the lowest energy consumption bracket. The first phase of the initiative aimed to reach around 5 million households.

US solar industry warns of slowdown due to supply chain disruptions, tariff uncertainty

28 April: The US

(United States) solar industry is warning of a big slowdown in project installations this year as global supply chain disruptions and the threat of new US tariffs on panel imports from Southeast Asia hit home. The US power company Southern Co) said nearly a gigawatt of its planned solar energy projects would be delayed by a year, the latest in a string of warnings from companies and industry representatives citing the two issues. A slowdown in the solar industry’s growth could pose a threat to the Biden administration's climate goals, which include decarbonizing the US power sector by 2035 through the widespread adoption of wind and solar energy. The delay to November 2024 applies to five planned solar facilities in Georgia that add up to 970 megawatt (MW) of capacity, according to a regulatory document. That's enough capacity to power 184,000 homes. The projects are being developed by Nextera, EDF Renewables and Consolidated Edison, according to regulatory documents. Georgia Power has 30-year contracts to buy the power from those facilities. Southern has committed to reducing its carbon emissions to "net zero" by 2050, in part by procuring large amounts of solar energy. NextEra said it expected about 2.1 to 2.8 GW of its solar and energy storage projects to shift.

Australia’s Origin buys large solar farm project

28 April: Australia’s second largest power producer,

Origin Energy, has bought a large solar farm development project in the most populous state of New South Wales as it makes a push to replace capacity from the country’s biggest coal-fired plant. Origin said it had acquired from Reach Solar the Yarrabee Solar Farm development project, designed with an initial capacity of 450 megawatt (MW), with state approval to expand to up to 900 MW.

Bosnia’s ERS to add 430 MW of renewables by 2026

27 April: Bosnia’s second-largest power utility

ERS plans to add 430 megawatt (MW) of renewable energy sources by 2026 at a cost of €800 million (US$851 million), ERS General Manager Luka Petrovic said. Majority state-run utility ERS will carry out the largest portion of projects targeting solar, wind and hydro sources, Petrovic said. ERS, based in Bosnia’s autonomous Serb Republic, operates two coal-fired power plants with a combined capacity of 600 MW and three big and several small hydropower plants with a total capacity of 617 MW. ERS plans to start building the 125 MW Buk Bijela hydro power plant, the part of a system of three hydro power plants on the Drina river agreed under a deal by the Serb Republic and Serbia to diversify their future energy mix. Work has already begun on building three smaller hydro-power plants on the river Bistrica with total capacity of 39.5 MW. Petrovic said projects, including the wind farm Hrgud with capacity of 48 MW and solar power station Trebinje 1 with capacity of 73 MW, will bring ERS a direct profit of €150-200 million a year, pending the sale price of electricity. Unlike its Balkan neighbours which rely on imports to cover much of their energy needs, Bosnia is able to export power due in part to its hydropower capacity, which provides 40 percent of its electricity. The rest comes from coal-fired plants.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

For more energy insights follow the links below:

- Hydrogen: Versatile Zero Carbon Energy Carrier: https://www.orfonline.org/research/energy-news-monitor-27/

- Tax revenue from petroleum products in India: Golden eggs that may kill the goose?: https://www.orfonline.org/expert-speak/indias-tax-revenue-from-petroleum-products/

- Challenges in Optimising Power Demand & Supply: https://www.orfonline.org/expert-speak/challenges-in-optimising-power-demand-and-supply-68178/

- India’s Natural Gas Exchange: One Small Step or a Giant Leap?: https://www.orfonline.org/research/india-natural-gas-exchange-one-small-step-or-a-giant-leap/Natuhttps://www.orfonline.org/expert-speak/natural-gas-india-cinderella-goldilocks-66385/

- Natural gas in India: From Cinderella to Goldilocks (May 2020): https://www.orfonline.org/expert-speak/natural-gas-india-cinderella-goldilocks-66385/

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: PPAC

Source: PPAC