Hydrogen in India, coal block auctions — and other news and analyses from the energy sector.

Quick notes

Hydrogen: Versatile Zero Carbon Energy Carrier

Why Hydrogen?

The idea of using hydrogen as an energy carrier is not new but this time there is hope that hydrogen will finally make a difference to energy supply and emission reduction. Part of the reason is that the hydrogen-electricity (“hydricity”) model is expected to be far cheaper than an electricity only model for decarbonisation of the energy sector. Apart from balancing intermittency of renewables, hydrogen can also facilitate decarbonisation of heavy industry (iron & steel, chemicals, cement, shipping and long-haul surface transport) which has proved to be a challenge for electricity from renewables. The progress made in reducing the cost of producing low carbon hydrogen is also another reason for the revival of interest in hydrogen.

Science

Hydrogen is not an energy source but an energy carrier like electricity; it must be produced using other primary energy sources such as fossil fuels, nuclear energy or renewable energy. But hydrogen is a stock based chemical energy carrier which has several advantages over flow-based energy carriers like electricity. The calorific value (thermal power) of hydrogen per unit volume is very low compared to natural gas, LPG, petrol and diesel. Though the calorific value of hydrogen per unit mass is very high (roughly three times that of jet fuel), it has to be liquified at -253°C to be compared with petroleum-based liquid fuels.

Production

The two most common methods of producing hydrogen are (1) conversion of hydrocarbons by partial oxidisation or reforming (2) electrolysis of water using electricity produced from fossil fuels, nuclear or renewable energy. Hydrogen can also be produced by other means such as thermal dissociation of water at high temperatures. Worldwide 2 percent of primary energy is used for hydrogen production. 6 percent of global natural gas supply and 2 percent of coal supply goes into producing hydrogen. Only 2 percent of hydrogen is produced through the electrolysis of water. Less than 0.7 percent of hydrogen is produced from renewables.

Demand

In 2018, the global demand for hydrogen was about 115 MT. Out of this 60 percent was for pure hydrogen and 40 percent was for hydrogen-based fuels. Globally 33 percent of hydrogen is used in oil refining; 27 percent for ammonia production; 11 percent for methanol production; 3 percent for direct reduction of steel.

Economics

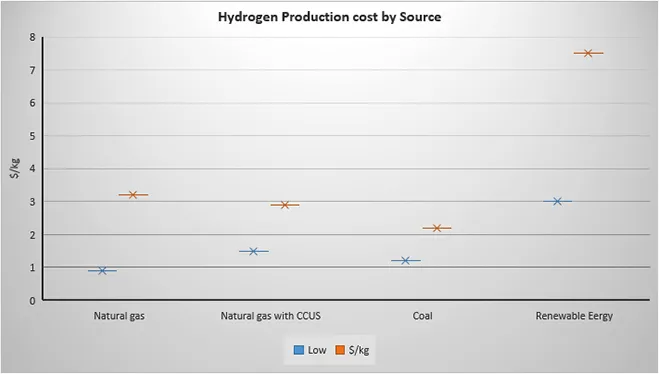

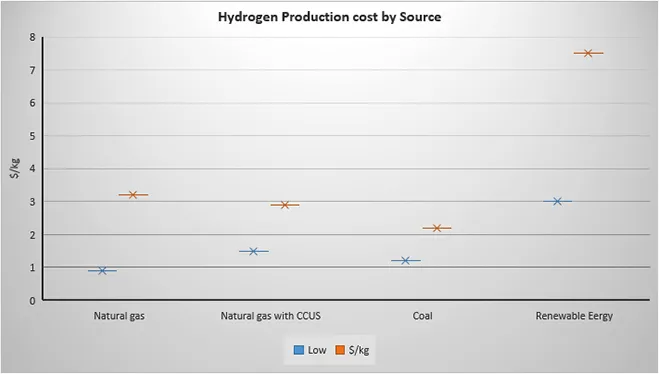

The process of converting electricity to hydrogen, shipping it, storing it and then converting it back to electricity in a fuel cell could potentially reduce the delivered energy to about 30 percent of the initial energy used. This makes hydrogen more expensive than electricity or natural gas used to produce it. The current cost of producing hydrogen varies across the world depending on the method used, the price of electricity/natural gas and increasingly also the price of carbon. Globally the lowest hydrogen production costs of about $1-2/kg are in the Middle East using natural gas without CCUS and the most expensive at $6/kg is through the electrolysis of water using renewable generated electricity in Europe. Tax on CO2 emission is currently seen as the best means to trigger the transition to clean energy including hydrogen. It is estimated that a carbon price of more than €50/tCO2 is required to make low carbon hydrogen competitive with fossil fuel-based hydrogen in Europe. Higher carbon price is required for renewable energy-based hydrogen. In the EU, carbon contracts for difference could bridge the difference between the required carbon price and the existing EU ETS price of €25/tCO2. In general, a carbon price of $50/tCO2 is expected to facilitate use of hydrogen in steel production and a price of $60/tCO2 facilitate a shift from coal to hydrogen in cement production. A price of over $75/tCO2 could facilitate a shift to hydrogen for ammonia production and a price of $145/tCO2 could potentially replace fuel oil with hydrogen in ships. Technological improvements are expected to produce a 30 percent cost reduction in hydrogen production by 2030. The cost of electrolysis-produced hydrogen has decreased by 60 percent in the past 10 years from $10-$15/kg to approximately $4-$6/kg.

Benefits

The biggest advantage of hydrogen over other fuels is that using hydrogen yields only water and no greenhouse gases, particulates, SO2 or ground level ozone. Hydrogen can be produced from a variety of domestic resources, such as natural gas, nuclear power, biomass and renewable power like solar and wind. As a stock-based energy carrier, hydrogen can be used to store, move, and deliver energy produced from other sources in cars, in houses, for portable power, and in many more applications. Yet another significant advantage of hydrogen is that hydrogen-based fuel cells are far more efficient than heat or combustion engines. While heat and combustion engines that convert heat to mechanical (or electrical) energy are subject to the Carnot efficiency limit for energy conversion, fuel cells that directly convert chemical energy to electricity are not subject to this limit and therefore can have efficiency rates of 60 percent or more.

Risks

Hydrogen carries safety risks as it is combustible over a wide range of concentrations at atmospheric pressure. Hydrogen has very low ignition energy (about an order of magnitude lower than flammable petroleum fuels) which means that the risk of electrostatic hazard is high for hydrogen. Transporting hydrogen through pipelines is the lowest cost option for transporting hydrogen; but hydrogen can embrittle the steel and welding used to fabricate pipelines. This explains why compared to natural gas hydrogen hardly has any dedicated infrastructure for transport. Globally hydrogen has about 300 km of pipelines while natural gas 3 mn km of pipelines. However, it is possible to transport a blend of natural gas with up to 15 percent of hydrogen in existing pipelines with minor modifications. Research is on to address the problem of transporting hydrogen economically.

Hydrogen in India

The most recent push for hydrogen came from India’s supreme court which has asked the Government of Delhi to explore the option of using hydrogen to fuel buses to address pollution. The government of Delhi has put out a call for research proposals on hydrogen and fuel cells with a budget of about ₹60 mn. But India’s hydrogen initiatives predate the current global revival of interest in hydrogen by at least two decades. Back in 2004, India set up a National Hydrogen Energy Board to examine hydrogen production using nuclear energy, coal gasification, biomass combustion and renewable energy. The Board called for a green initiative for future transport (GIFT) along with a Green Initiative for Power Generation (GIP). The target was to produce 1 mn hydrogen powered vehicles and 1000 MW power generation capacity by 2020. The initiative concluded that Indian coal can be gasified to produce hydrogen economically with carbon price of $25/tCO2 and that a carbon price of $100/tCO2 could substantially improve the economics of hydrogen production from coal. The key problem identified was the high ash content in Indian coal. The hydrogen initiative suggested setting up 5 coal gasification plants between 2013 and 2017 and increase it to 10 coal gasification plants by 2020. The hydrogen produced through gasification was to be packed by compression or liquefaction. The initiative also considered the use of nuclear energy to split water and use small reformers and reduce costs by a factor of 3 to 4. All the issues that are currently discussed in the context of hydrogen such as developing storage, manufacturing fuel cells, setting up stational power generation, addressing the high cost of transporting hydrogen, optimising internal combustion engines to use hydrogen were discussed by India’s hydrogen initiative two decades ago. Though few of suggestions of India’s 2004 hydrogen initiative witnessed any progress in the following two decades, India now has the opportunity to revisit the proposals of the hydrogen initiative and invest in hydrogen technologies. Coal gasification with CCUS holds promise given the abundance of domestic reserves. The cost of capturing CO2 in a natural-gas-to-hydrogen plant is roughly three times that of a coal-gasification-to-hydrogen plant owing to greater added capital costs related to CO2 capture in the natural gas plant (monoethanolamine scrubber plus CO2 compressor) versus that of the coal plant (compressor only). In addition, the natural gas reformer plant pays a greater efficiency penalty than does the coal plant (relative to the case in which CO2 is vented), so its increase in variable costs (feed and fuel) is greater.

The colours of Hydrogen

Green Hydrogen is produced from electrolysis of water using renewable energy.

Yellow Hydrogen is produced using electrolysis of water using nuclear energy.

Blue hydrogen is produced by reforming methane with carbon capture and storage.

Grey hydrogen is produced by reforming methane without using carbon capture and storage.

LPG: liquefied petroleum gas, tCO2: tonne of carbon dioxide, kg: kilogram, CCUS: carbon capture utilisation and storage, km: kilometre, ETS: Emissions Trading System

Source: International Energy Agency

Source: International Energy Agency

Monthly News Commentary: Coal

Strong Competition at Coal Block Auctions

India

Domestic Production & Demand

CIL produced 46.8 MT of coal last month, registering a growth of 18.4 percent. CIL had produced 39.5 MT of coal in the corresponding month of the previous fiscal. The increase in absolute terms was 7.4 MT. With its production impeded by the Covid-19-induced slowdown during the first four months of the present fiscal, CIL started logging positive growth from August onward on monthly basis. For the first time in this fiscal, CIL posted a positive growth of 0.9 percent in cumulative production till October so far. Production during April-October was 282.9 MT which was 2.5 MT more than that during the same period last year. By November, CIL hopes to neutralise the negative growth and start on the path of recovery. As the country’s core sector output contraction narrowed sharply to 0.8 percent in September 2020, growth in the coal sector was 21.2 percent, the highest among all the eight core sector industries, compared to the same month last year. CIL’s contribution was sizeable in this. Besides coal, only two other core sectors clocked positive growth during September. CIL accounts for over 80 percent of the domestic coal output. According to India Ratings India’s coal demand will continue to improve y-o-y) as the end-user industrial activities gradually gain pace with unlocking and inventory levels at power stations being normalized. India’s coal sector that coal offtake continued to recover strongly in October 2020 to 54.5 MT higher by 8.7 percent month-on-month and 20.1 percent y-o-y. The increased demand was also partially fed by the inventory built at power stations. Also, domestic coal production continued to improve in October 2020 to 50.7 MT higher by 15.6 percent month-on-month and 13.9 percent y-o-y.

Coal Transport

CIL has issued tenders for all 35 mining projects identified for mechanised transportation of dry fuel and setting up coal handling plants and silos for rapid loading at an estimated cost of ₹125 bn. Under mechanised transportation, coal would be moved through piped conveyor belt mode promoting cleaner environment. With reduced movement of coal-laden trucks on roads, it brings down dust pollution to the comfort of people residing in the proximity of the mines. First-mile connectivity refers to transportation of coal from CIL’s pitheads to despatch points. Coal handling plants and silos for rapid loading system would be commissioned across six of CIL’s subsidiaries, under the tenders. To come up by FY24 at an estimated investment of ₹125 bn, the coal handling capacity of the 35 projects will be 406 MTPA. Currently, CIL spends around ₹34 bn on coal transportation costs which could be brought down substantially with the introduction of mechanised coal transport in the first mile. CIL expects more than 12 percent internal rate of return once it switches over to the mechanised transport means. Already, mechanised conveyor system and computerised loading is operational in 19 projects of CIL having 151 MTPA capacity. Coal handling at the Mormugao Port Trust would be reduced by more than 50 percent by introducing alternative tourism projects including launching of a Roll On Roll Off ferry service.

Coal Block Auctions for Commercial Mining

The Centre is planning to go for the next round of auction of blocks in January and also appealed to the states to cooperate with commercial mine allottees to facilitate early operationalisation of the blocks as it would create a positive atmosphere and boost confidence of investors. Of the total 35 coal mines successfully auctioned in the last 10 tranches of auction, only 14 blocks could begin operations. Before the sale of blocks began, the Jharkhand government was of the view that if the auction took place during Covid-19 times, not much revenue would be generated. Jharkhand had earlier expressed apprehensions about subdued participation from bidders during the auctions. The recent auction of coal mines for commercial mining witnessed "fierce competition" and the 19 blocks that went under the hammer can generate total revenues of around ₹70 bn per annum and create more than 69,000 jobs once they are operationalised. The auction of blocks for commercial mining has opened the coal sector to the private players. 42 companies participated in the auction, out of which 40 were private players. Total 76 bids were received for 23 mines, wherein 19 mines had received two or more bids and were found eligible for opening of technical bids. In June the auction process for 41 coal blocks for commercial mining was launched. Some of the companies that have bagged blocks include Adani Enterprises, Vedanta, Hindalco Industries and Jindal Power.

Vedanta Ltd emerged highest bidder for a coal block in Odisha offering a premium of 21 percent while Hindalco Industries placed a winning bid for another coal block in Jharkhand offering 14.25 percent premium in India’s pilot auction of mines for commercial purposes. The country’s first commercial coal auctions began with five blocks. Vedanta placed the highest bid for Radhikapur West coal mine with 312 MT of geological reserves, pipping EMIL Mines and Minerals Resources Ltd and Jindal Steel and Power Ltd. Hindalco Industries is close to winning the Chakla mine in Jharkhand with 76.05 MT. Adani Enterprises, Agarwal Mining and Stratatech Mineral Resources Pvt Ltd were the other bidders for the block. The day 1 of e-auction has witnessed strong competition, with auction of some of the mines going on for more than 3-4 hours. In all the mines auctioned, the final offer received is above 10 percent signalling strong demand for coal mines in the market. The Takli Jena Bellora North and Takli Jena Bellora South coal mine in Maharashtra with 117.26 MT reserves and the Marki Mangli II mine in Maharashtra received the highest premium of 30.75 percent each among blocks auctioned. Yazdani International Pvt Ltd placed the winning bid for Marki Mangli II while Aurobindo Realty and Infrastructure emerged highest bidder for the other block in Maharashtra. JMS Mining Pvt Ltd has placed the highest bid for the Urtan mine in Madhya Pradesh with 55.391 MT reserves at 10.50 percent. The total annual revenue estimated to be generated to states from the coal blocks is ₹15.57 bn. Total 19 coal mines will be auctioned by the coal ministry. The bids will be sent by the Nominated Authority for final approval to the coal ministry. The auction process of 38 coal mines for sale of coal was launched by the coal ministry on 18 June 2020. A total of 76 bids were received for 23 coal mines. But the required two or more bids were received for only 19 coal mines. The Cabinet Committee on Economic Affairs approved the methodology for auction of coal and lignite mines for sale on a revenue-sharing basis.

Sarda Energy and Minerals Ltd won a coal mine in Chhattisgarh by agreeing to part with whopping 66.75 percent revenue to pip seven other firms including Adani Enterprises, Hindalco Industries and JSW Steel. This is the highest revenue share offered by any bidder in the first tranche of commercial coal mine auctions. The pilot tranche of commercial coal auctions is expected to generate about ₹70 bn annually for five states of Jharkhand, Madhya Pradesh, Odisha, Chhattigarh and Maharashtra. The maximum revenue is expected to be earned by the Jharkhand government, which moved the Supreme Court against holding of the coal mines auction by the Central government.

Spot Auctions

CIL’s spot coal auction tripled to 16.8 MT in October compared to same month last year, on the back of increase in demand from the power sector. The increase of 190 percent or 11 MT during the month signals demand resumption for coal after a Covid led hiatus. Volume booking in e-auctions for the first seven months of the ongoing fiscal ending October at 59 MT, increased by 28 MT translating into a growth of 90 percent. For a comparable period last year CIL booked 31 MT. October’20 auction sale, in addition to the four prevailing windows, included a new auction outlet called special spot for coal importers, under which 1.6 MT of coal was booked. CIL in a first, has introduced this category meant exclusively for coal importers to contain imports from abroad. To boost demand, CIL has brought down the reserve price close to zero during the first half of the present fiscal. It was only in October, as a bellwether, CIL introduced an add-on ranging from zero to a maximum of 10 percent over the notified price to test the market trend.

Rest of the World

Coal Consumption in China

China’s National Energy Administration had approved four coal mine projects in western Xinjiang region to ensure stable energy supply. The four coal mines involved total investments at 4.06 bn yuan ($616.97 mn) and annual capacity at 6 MT. China will buy $1.467 bn worth of thermal coal from Indonesia next year. The trade deal was signed between APBI and China Coal Transportation and Distribution. Indonesia, the world’s top exporter of thermal coal, has resorted to diplomatic channels to promote coal sales around Southeast Asia, particularly in Vietnam, as exports to China slowed. China’s imports from Indonesia, the world’s biggest shipper of thermal coal used in power plants, dropped 24.5 percent in the first 10 months of 2020 to 86.88 MT compared to 115.03 MT during the same period last year.

China’s coal imports nearly halved in October from a year ago, after record arrivals in the first half of the year and as the world’s biggest coal importer bought less fuel from Australia amid souring relations between Beijing and Canberra. The country imported a total of 253.16 MT between January and October, not far from the 299.67 MT of coal it imported in 2019. Australia supplied over 40 percent of China’s total coking coal imports and about 57 percent of its thermal coal in 2019. China imported nearly twice the amount of coking coal from Mongolia in September than from Australia.

China has launched a safety inspection effort targeting all working coal mines and coal-mining projects after several recent fatal accidents. The world’s largest coal miner and coal consumer reported more than 100 coal mining accidents in 2020. National coal mine safety authorities vowed to tighten scrutiny over local government checks on coal safety. The latest campaign is expected to put a brake on expansion of coal production and further tighten supply of the fuel, as stringent curbs on coal imports halved October arrivals in China. China produced 3.13 BT of coal in the first 10 months, up just 0.1 percent from the corresponding period last year. The most-active thermal coal futures at the Zhengzhou Commodity Exchange hit a record high of $94.28/tonne.

Reduction in Coal Investment

South Korea will reduce the operations of coal-fuelled power plants this winter to cut fine dust emissions as it battles unhealthy air. It is resuming a campaign kicked off last winter to rein in fine dust, a combination of domestic coal and automotive emissions as well as pollutants wafted in from neighbouring China and North Korea. The operations of eight of the nation’s 60 coal power plants will be halted during the season. Japanese engineering giant Toshiba will not build any more coal-fired power plants and will shift to renewable energy in a bid to reduce greenhouse emissions. But none of its existing coal-power construction projects will be scrapped which has around 10 underway worldwide. Japan’s 140 coal-fired power plants provide nearly a third of its total electricity generation.

A new law in Vietnam could delay four major coal-fired power projects worth a combined $9.1 bn, a US as the Southeast Asian country looks to up the amount of energy it generates from renewable sources. Vietnam’s revised law on public-private partnerships could affect the Nam Dinh 1, Vung Ang 2, Vinh Tan 3 and Song Hau 2, coal projects, which each have a capacity of 1.2 to 2.0 GW.

Environmental groups are demanding that Poland scrap a plan to merge state-run energy groups after they have shifted coal assets into a separate entity because it won’t deliver on EU climate targets. Merging PGE with peers Tauron and Enea after offloading their coal assets into a separate state entity would boost the companies’ investment potential. The plan has been approved by the state assets ministry, which is working on details. The report showed that if the plan is implemented, in 2030 Poland will generate 92.2 TWh of electricity from coal, or more than five times more than it should if it followed EU climate policies. PGE has no other choice than discarding coal to be able to attract financing for investment.

South African investors have pulled out of a local multi-billion dollar coal-fired power plant project, putting its construction at risk as opposition to the use of fossil-fuels in the country grows despite crippling power shortages. Across the world, investors are coming under increasing pressure to ditch coal, the most polluting of fossil fuels, and switch to greener energy. The latest exits from the 630 MW Thabametsi coal-based power plant project in the water-scarce northern Limpopo province follow the withdrawal last month of South Korea’s Korea Electric Power Corp, and South Africa’s big four banks last year after they were targeted by environmental activists.

Coal Exporters

Indonesia coal output in the January to October period was 459 MT. Domestic coal consumption in the same time period stood at 109 MT. Indonesia’s full-year domestic coal consumption target stands at 155 MT, higher than last year’s 138 MT.

CIL: Coal India Ltd, MT: million tonnes, y-o-y: year-on-year, MTPA: million tonnes per annum, mn: million, bn: billion, GW: gigawatt, EU: European Union, TWh: terawatt hour

National: Oil

LPG prices rise ₹50 per cylinder, lack of clarity on subsidies

8 December. Cooking gas or LPG (liquefied petroleum gas) prices have increased ₹50 per cylinder this month but industry executives said there is not much clarity on whether most customers would receive subsidies to cushion the impact. Cooking gas price has risen to ₹644 per cylinder in Delhi in December from ₹594 in November. Prices, which vary from state to state, had remained unchanged at ₹594 a cylinder since July this year. Since May, most cooking gas customers have not received subsidies as the combination of international oil price collapse and domestic refill rate increases brought parity between subsidised and market rates. In June last year, a subsidised cooking gas cylinder cost ₹497 in Delhi. Since then, the total price increase has been ₹147. The subsidy for a customer in Delhi was ₹240 in June 2019. The government has not yet intimated state oil companies about whether customers buying refills in December would be eligible for subsidies, said industry executives. For the government, cooking gas subsidy has shrunk to ₹11.26 bn in the first half of this financial year from ₹226.35 bn for the entire 2019-20. LPG subsidy had fallen 28 percent in 2019-20 from ₹314.47 bn in 2018-19 as oil prices stayed low and domestic refill rates rose.

Source: The Economic Times

Petrol prices highest in more than 2 years

8 December. Diesel prices have risen ₹3.41 per litre and petrol ₹2.65 per litre in three weeks following a spike in international oil prices. Petrol now costs ₹83.71 in Delhi and ₹90.34 in Mumbai while diesel is available for ₹73.87 in Delhi and ₹80.51 in Mumbai. Current rates are highest since 4 October 2018 for petrol and 30 July this year for diesel. State oil companies are expected to daily revise domestic rates of petrol and diesel in line with international prices of the respective fuel. But this year, rates have been revised far less frequently, with prices staying frozen for months at times. Rates of petrol and diesel have risen following a spike in international crude oil prices that are up a quarter since the beginning of November. Crude oil is trading a little above $48 a barrel currently.

Source: The Economic Times

Haryana petrol pumps to stay closed

7 December. Haryana Petroleum Dealer Welfare Association (HPDWA) has extended support to the farmers’ nationwide protest and decided to close all petrol stations in the state on 8 December. The association has also formed a three-member committee to support farmers by opening fuel stations for farmers at Singhu and Tikri borders by filling free diesel in tractors of farmers marching to Delhi in protest for their demands. The decision was taken in a state-level meeting of HPDWA at Panipat. HPDWA said farmers had been protesting for more than a week on Delhi border. The association has decided to support farmers’ agitation and all pumps in Haryana will remain closed on 8 December.

Source: The Economic Times

Mumbai crosses ₹90-mark for petrol, highest among metros

7 December. Petrol breached the ₹90-mark in Mumbai, while the price of diesel skyrocketed to over ₹80. The petrol rate in Mumbai (₹90.05) was the highest among all metro cities. Across Maharashtra, petrol prices in as many as 27 districts have soared over the ₹90-mark, while diesel rates in 16 districts have crossed ₹80. Parbhani had the highest petrol rate at ₹92.47 a litre, which was also the highest in the country. At ₹81.69, the cost of diesel in Amravati was the highest in the state. Petrol price in Mumbai was hiked by 27 paise and was retailing at ₹90.05 at the pumps, while diesel rate increased by 30 paise and was priced at Rs 80.23 a litre. Petrol rates in the city were high as compared to Delhi (₹83.41), Kolkata (₹84.90), Chennai (₹86.25), Bengaluru (₹86.20) and Hyderabad (₹86.75). The fuel hikes will pinch the pockets of motorists especially at a time when car and bike sales have risen in the city. With diesel comprising 65 percent transportation costs, the spree of hikes will lead to at least 7-8 percent increases in freight rates across the state, transporters said.

Source: The Economic Times

India keen on US allowing resumption of oil supplies from Iran, Venezuela: Pradhan

3 December. India, the world's third-largest energy consumer, wants the new US (United States) administration to allow resumption of oil supplies from Iran and Venezuela so as to give the country more options to meet its requirements, Oil Minister Dharmendra Pradhan said. Iran was India’s second-biggest supplier of crude oil after Saudi Arabia till 2010-11, but Western sanctions over its suspected nuclear programme led to reduced volumes. India stopped importing crude oil from Iran following the re-imposition of economic sanctions in May 2019, by the US. Venezuela was India’s fourth-biggest oil supplier but import dwindled after Washington imposed sanctions on Venezuela’s state oil company PDVSA in January 2019, to put pressure on socialist President Nicolas Maduro. India is 85 percent dependent on imports to meet its oil needs. Two-third of its imports come from the Middle-East with Iraq and Saudi Arabia being the largest suppliers. Pradhan said India is all for reasonable and responsive pricing of crude. India consumed just 6 percent of the world’s primary energy and its per capita consumption is one-third of the global average, he said adding India will drive the growth in global energy demand.

Source: The Economic Times

Petrol, diesel become dearer after OMCs raise retail prices

3 December. Oil Marketing Companies (OMCs) increased the prices of petrol and diesel after keeping the retail prices unchanged for the past couple of days. The pump price of petrol increased by 17 paisa per litre to ₹82.66 a litre in Delhi from a level of ₹82.49 a litre a day earlier. Similarly, the diesel price increased by 19 a litre to ₹72.84 a litre in the national capital as compared to ₹72.66 per litre on the previous day. The prices of auto fuel have also increased across the country but the level of rise has been different depending on the taxation structure in each state. In the past 14 days, due prices have risen 11 days with petrol prices rising by ₹1.60 per litre and diesel by ₹2.38 a litre.

Source: The Economic Times

IOC, HPCL in octane war with super petrol for premium cars, bikes

2 December. IOC (Indian Oil Corp) and HPCL (Hindustan Petroleum Corp Ltd) have launched a high-octane war - literally - with super-premium petrol to corner the expanding niche of high-performance supercars and superbikes as competition promises to intensify with the imminent privatisation of BPCL (Bharat Petroleum Corp Ltd). HPCL has been priming the market with soft launch of 99-octane petrol under ‘poWer 99’ brand in 21 cities since 2017, IOC raised the bar by going full-throttle with a 100-octane version under ‘XP 100’ brand. Oil Minister Dharmendra Pradhan said XP100 has put India in an elite group of six countries, including the US (United States) and Germany. India currently uses petrol with 91 octanes. The premium versions sold by IOC, HPCL and BPCL have engine cleaning agents as additives. In the first phase XP 100 will be available at select pumps in Delhi, Gurgaon, Noida, Agra, Jaipur, Chandigarh, Ludhiana, Mumbai, Pune and Ahmedabad. In the second phase, it will be rolled out in Chennai, Bangalore, Hyderabad, Kochi and Kolkata. These cities have been selected on the basis of their aspirational demographics and availability of high-end cars and bikes dealerships in these cities. The companies had launched the premium versions of petrol and diesel around 2008, coinciding with the entry of a slew of zippy cars and bikes in India.

Source: The Economic Times

National Gas

GSPL surrenders licence to build gas link to Jammu-Srinagar

8 December. Gujarat State Petronet Ltd (GSPL) wants to pull out of a northern India gas pipeline project that would link Punjab state to the hilly areas of Jammu and Srinagar due to high construction costs. GSPL in August wrote to the Petroleum and Natural Gas Regulatory Board (PNGRB) to surrender authorisation to extend the pipeline beyond Punjab to Jammu and Srinagar citing low gas demand and technical complexities, according to a letter. GSPL won a licence in 2011 to lay the 740 km pipeline from Bathinda in Punjab state, with the condition that extension to Jammu and Srinagar would depend on a technical and commercial feasibility report. The PNGRB asked GSPL in February to build part of the pipeline from Bathinda to the border of Punjab by the end of this year and extend it to Jammu and Srinagar by 24 February 2022. The oil ministry said the government is considering giving financial assistance for the project to help kick-start economic growth and the use of gas in a region that has trailed the rest of the country. India is strengthening gas infrastructure to raise the share of the cleaner fuel in its energy mix to 15 percent by 2030, up from 6.3 percent now. The federal government has provided financial aid to two projects -- the 2,500km pipeline linking the states of Uttar Pradesh, Bihar, Jharkhand, West Bengal and Odisha; and the 1,656 km grid in the north east.

Source: The Economic Times

H-Energy to commission Maharashtra LNG terminal in March

3 December. India’s H-Energy will commission its Jaigarh liquefied natural gas terminal (LNG) at Jaigarh port in Western Maharashtra state in March 2021, the company said. H-Energy will deploy Hoegh LNG Holding’s floating storage and regasification unit (FSRU) for 10 years. The FSRU, built in 2017, has storage capacity of 170,000 cubic meters and has a peak regasification capacity of about 6 million tonnes per annum. The FSRU will deliver regasified LNG to the 56 km Jaigarh-Dabhol pipeline connecting to the National Gas grid. The FSRU is also capable of reloading LNG onto other LNG vessel’s for providing bunkering services

Source: The Economic Times

IGX gets PNGRB nod to operate as Gas Exchange for 25 years

3 December. The Indian Energy Exchange (IEX) said its arm, Indian Gas Exchange (IGX), has secured authorization from the Petroleum and Natural Gas Regulatory Board (PNGRB) to operate as a Gas Exchange. IGX has secured the necessary authorization to operate as a Gas Exchange as per the provisions of the PNGRB (Gas Exchange) Regulations, 2020 for a period of 25 years, IEX said. India is eying to increase the share of gas in its overall energy mix from 6 percent to 15 percent by 2030.

Source: The Economic Times

India to see $66 bn investment in gas infrastructure

2 December. India will see a massive $66 bn investment in the building of gas infrastructure as the government pushes for greater use of the cleaner fuel with a view to cutting down carbon emissions, Oil Minister Dharmendra Pradhan said. The government is targeting raising the share of natural gas in its energy basket to 15 percent by 2030 from the current 6.3 percent. This will entail gas consumption rising manifolds from current 160-170 million standard cubic meters per day. To cater to this, liquefied natural gas (LNG) import capacity is being raised, new pipelines laid to transport the fuel, and city gas infrastructure expanded to take the fuel to users, he said.

Source: The Economic Times

National: Coal

India’s coal import drops 19 percent to 117 mt during April-October this fiscal

7 December. India's coal import saw a drop of 18.6 percent to 116.81 million tonnes (mt) during April-October this fiscal as against the same period a year ago. India had imported 143.63 mt of coal during the corresponding period of FY 2019-20, according to a provisional compilation by mjunction services, based on monitoring of vessels' positions and data received from shipping companies. mjunction -- a joint venture between Tata Seel and SAIL -- is a B2B e-commerce company and also publishes research reports on coal and steel verticals. However, the country’s coal import increased to 21.50 mt in October this year as against 18.28 mt in the corresponding month of the previous fiscal, it said. Of the total import in October 2020, non-coking coal was at 14.46 mt. In October 2019, the import was 13.57 mt. Coking coal import stood at 4.92 mt in October 2020, up from 2.79 mt imported in the same month last fiscal. During the April-October period this year, the non-coking coal import was at 77.67 mt as compared to 98.73 mt in the same period a year ago. Coking coal import during April-October was recorded at 23.89 mt, lower than 28.63 mt imported during the same period a year ago.

Source: The Economic Times

Transportation of coal by Indian Railways is less efficient than power transmission: IEEFA

3 December. Transportation of coal by Indian Railways to generators is less efficient and increasingly less competitive than moving actual electricity through cables, according to a recent report titled ‘Indian Railways at the Junction’ by the Institute for Energy Economics and Financial Analysis (IEEFA). It said that Indian Railways is on track to becoming a major renewable energy generator with its in-house solar project plans, however, it should use sections of its extensive network for electricity transmission infrastructure. The report said that the national transporter should consider the feasibility of locating High Voltage Direct Current (HVDC) lines underground on suitable sections of its right of way. According to the report, Indian Railways should reconsider its plans to increase coal evacuation as a first step in reducing its over-dependence on coal freight. With forecasts for lower growth in electricity demand and stalling thermal coal requirements, some coal evacuation projects may no longer be either necessary or financially viable. The report said that prior to Covid-19, 40 percent of lines and all of the important freight routes were operating at above 100 percent of line capacity due to severe congestion on the network, but the suspension of passenger services during the pandemic saw movement of more freight and a greater diversity of cargoes, at twice the speed, bringing in new revenue and improved service.

Source: The Economic Times

Coal India output rises 3.4 percent to 52 mt in November

2 December. Coal India Ltd (CIL) reported a 3.4 percent rise in production at 51.7 million tonnes (mt) in November. The company had posted an output of 50 mt in the corresponding month of the previous fiscal, CIL said. Production during April-November 2020 increased to 334.5 mt, over 330.4 mt in the corresponding period of 2019-20, it said. Offtake of coal by CIL in November increased to 51.3 mt, as against 47.5 mt in the same month last fiscal. CIL accounts for over 80 percent of domestic coal output.

Source: The Economic Times

National: Power

Spot power trade grew 61 percent in November: IEX

7 December. Indian Energy Exchange (IEX) registered trading volume of 6,164 mn units in November, registering a 61 percent year-on-year (yoy) growth, while the average market price declined by 4 percent to ₹2.73 from 2.85 yoy during the same month last year, the company said. As per the data published by NLDC (National Load Dispatch Centre), the national peak demand in November saw an increase of 3.2 percent while the energy consumption registered 3.15 percent growth. IEX said the real-time electricity market saw an all time high volume of 894 mn units in November since commencement on 1 June 2020 and registered a 10 percent growth on month-on-month basis.

Source: The Economic Times

Kashmir gets customer care facility for better power supply, grievance redressal

7 December. Jammu and Kashmir Lieutenant Governor Manoj Sinha inaugurated an e-Customer Care Service of the Kashmir Power Distribution Corp Ltd (KPDCL) to provide real-time enquiry and grievance redressal to power consumers in the Valley. The new service will now allow customers to call and register their complaints regarding the power supply. The Customer Care Centre facilitated with modern technology will work round the clock to receive complaints through various modes such as telephone. According to the KPDCL, the new initiative aims to resolve electricity-related problems in their respective areas faced by customers. Lauding the new initiative, locals expressed gratitude towards the administration and said that the Customer Care Centre would solve several power-related issues.

Source: The Economic Times

Andhra Pradesh power tariffs will not be hiked for second year: Energy Minister

7 December. Andhra Pradesh (AP) Energy Minister Balineni Srinivasa Reddy said for the second consecutive year, the government will not increase electricity tariffs in the state. The Minister launched the new logo of AP State Energy Conservation Mission (APSECM). The Minister said discoms in the state have recently filed their Annual Revenue Requirement (ARR) before the Andhra Pradesh Electricity Regulatory Commission (APERC). The Minister said that the government allocated ₹83.53 bn for the free power scheme, ₹7.17 bn towards subsidised power to aqua farmers and ₹17.07 bn towards domestic subsidy. Energy secretary Srikant Nagulapalli said power utilities are exploring ways to improve existing systems.

Source: The Economic Times

Lenders of Jhabua power plant are locked in tough negotiations with NTPC

7 December. Lenders to the Avantha Group’s distressed 600 MW Jhabua power plant are locked in tough negotiations over the completion of the deal with NTPC Ltd almost a year after it was declared the winning bidder due to concerns over power demand due to the economic downturn caused by the Covid-19 pandemic. The deadlock over this asset highlights the challenges to debt resolution to distressed power plants in India besieged by lack of power purchase agreements (PPAs), coal linkages and the economic recession caused by the Covid 19 pandemic which has hurt corporate demand. Jhabua was also the first time that the state-run power producer had bid for any stressed project. The company has decided against buying any stressed projects outside the Insolvency and Bankruptcy Code. Lenders said the project has PPAs and NTPC has apprehensions that state discoms may renege the contracts due to lack of demand post Covid.

Source: The Economic Times

Winter power demand in Delhi rises, crosses last year levels

6 December. Plummeting temperatures in the city have seen the winter power demand surpassing that of the corresponding period last year, discom (distribution companies) said. Delhi's early winter is getting reflected in the city’s power demand. The peak power demand in November 2020 surpassed the peak power demand of November 2019, BSES discom said. In the first five days of December also, Delhi’s peak power demand has been more than the peak power demand of December 2019 on three corresponding days. A similar pattern was witnessed in October too. The peak power demand of the national capital in this winter can go up to 5480 MW, surpassing last year's winter demand. Last year, it had peaked at 5343 MW. The peak winter power demand in BRPL and BYPL areas had reached 2020 MW and 1165 MW respectively during last winter. This year, it is expected to reach 2200 MW and 1270 MW for BRPL and BYPL respectively.

Source: The Economic Times

Discoms supply record 14.8 GW power in Madhya Pradesh

6 December. A record 14,856 MW power was successfully supplied by electricity distribution companies (discoms) in Madhya Pradesh. The state faced a peak demand of 14,856 MW and the same was supplied by power companies operating in the state. This was the highest-ever power supply in the history of the state, a Jabalpur-based public relations officer of MP Power Management Company said. A demand of more than 14,000 MW has been recorded in the state during the past ten days which was supplied successfully. The previous highest peak demand was 14,555 MW, recorded on 3 February this year. During the peak demand, Madhya Pradesh West Zone Power Distribution Company (Indore and Ujjain Division) supplied maximum power of 6,077 MW, Madhya Pradesh Madhya Pradesh Power Distribution Company (Bhopal and Gwalior Division) 4,752 MW and Madhya Pradesh East Region Power Distribution Company (Jabalpur, Sagar and Rewa division) recorded supply of 4,028 MW.

Source: The Economic Times

Puducherry government opposed to privatising power distribution: CM

6 December. Puducherry Chief Minister (CM) V Narayanasamy said the territorial government was against the Centre’s move to privatise power distribution. He said he had received a letter a few days back from the Centre urging the territorial government to privatise power distribution. Puducherry does not have an Electricity Board and distribution of power has been done traditionally through a department. The power sector is not suffering any loss. Hence, there is no room for any move to privatise power distribution, the CM said.

Source: The Economic Times

ADB approves $190 mn loan for upgradation of Bengaluru power distribution system

5 December. Asian Development Bank (ADB) has approved a $190 mn (₹14 bn) loan for modernisation and upgradation of power distribution system in Karnataka’s capital city of Bengaluru. The funding for the Bengaluru Smart Energy Efficient Power Distribution Project by ADB includes a $100 mn sovereign loan and a $90 mn without sovereign guarantee loan to Bangalore Electricity Supply Company Ltd (BESCOM). BESCOM is one of five state-owned distribution utilities and the largest in Karnataka. ADB said the project will convert 7,200 km of overhead distribution lines to underground cables with parallel installation of 2,800 km of fiber optic communication cables. Moving the distribution lines underground protects them from natural hazards and interference, reducing technical and commercial losses by about 30 percent. The fiber optic cables will be used for smart metering systems, distribution automation system (DAS) in the distribution grid, and other communication networks. The project will install 1,700 automated ring main units adapted with a DAS to monitor and control the distribution line switchgears from the control center, it said.

Source: The Economic Times

MSEDCL floats instalment scheme for consumers to clear power dues

4 December. The Maharashtra State Electricity Distribution Company Ltd (MSEDCL) has offered an instalment scheme to high- and low-tension domestic, commercial and industrial consumers to help them clear their pending and current electricity bills. The distribution firm said the scheme would also offer to reinstate the power supply of defaulters. Consumers who have filed court cases regarding electricity bills can also avail the instalment scheme, provided they agree to withdraw the cases unconditionally. The consumers whose power supply has not been disconnected will be allowed to clear the arrears in three instalments without making any down payment. Those whose supply has been disconnected will have to make 30 percent down payment and will be allowed to clear the arrears in 12 instalments. They will also have to submit an application for reconnection and pay the required reconnection charges, the firm said. Consumers with sanctioned load of more than 2 0 kilowatt hour (kWh) can submit an application at the divisional office, while those having less than 20 kWh load can approach the sub-divisional office and high-tension consumers can approach the circle offices. They will have to pay only 2 percent of the arrears, while applying for the instalment scheme. The offices will take a decision on the applications within seven days. If there is a court case, it will take 15 days. The MSEDCL website will also have a separate portal to enable consumers to apply online for the instalment scheme.

Source: The Economic Times

Maharashtra government unveils ₹80 bn underground transmission network plan

3 December. In light of the recent blackout in the entire Mumbai Metropolitan Region (MMR), the state government has sanctioned a plan to build an underground transmission network – an 80 km line from Aarey to Kudus, in Palghar district. It is projected that the entire project will cost around ₹80 bn. On 12 October, the entire Mumbai and its adjacent regions had suffered a major power blackout due to grid failure which was happened because of a technical fault. Therefore, the government had decided to fast-track the underground high-voltage direct current (HVDC) cables project. The first-of-its-kind project would provide an additional 1,000 MW of electricity to Mumbai. The HVDC technology is tailor-made and modular in design, requires less footprint compared to conventional technology and has a unique feature of Black Start, which ensures faster restoration of power supply in the event of widespread grid disturbances. The HVDC scheme has been identified as a critical bulk power injection scheme for Mumbai, which will act as a virtual generating station. The 1,000 MW underground Kudus-Aarey HVDC link will be completed in the next three years.

Source: The Economic Times

Punjab and Haryana High Court stays Chandigarh electricity distribution company privatisation bid

2 December. The government’s plan to initiate privatisation in the power distribution sector beginning with sell-off of utilities in Union Territories (UT) has hit a roadblock. The Punjab and Haryana high court stayed the Centre’s privatisation bid of Chandigarh electricity distribution company saying it is illegal and the utility cannot be completely sold to private companies. Chandigarh was the first Union Territory to issue tender inviting bids to sell off its power distribution company. The Central government had in May announced privatisation of discoms in union territories as part of its Atma Nirbhar Bharat plan. The last date for bid submission was 30 December 2020. The court said issue will require detailed deliberations as it touches the employment scheme of the society in general. Finance Minister Nirmala Sitharaman had in May said privatisation of distribution business of UT could provide a model for emulation by other utilities across the country. The Centre is also working on privatisation of other union territories. Recently, Uttar Pradesh shelved the privatisation plan of its power distribution companies due to agitation by employee trade unions.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Vudu Park in Visakhapatnam to get a smart solar flower

7 December. The Greater Visakhapatnam Municipal Corp (GVMC) will install a smart solar flower at VMRDA Park (popularly known as Vuda Park) with around ₹40 lakh as part of on-going renovation works. The smart solar flower, which works on a mechanism similar to a sunflower, is a ground-mounted solar system that follows the sun all day. GVMC believes that the smart solar power will become another attraction at this popular park. Even though the park belongs to the Visakhapatnam Metropolitan Region Development Authority (VMRDA), GVMC has included the facelift for the park as a convergence project under the Vizag Smart City project. GVMC will spend a total of ₹335 mn on park facelift works.

Source: The Economic Times

India’s leadership on solar, industry transition reason to believe climate goals can be achieved: UN

6 December. India's leadership on solar and industry transition is the reason to believe the world can achieve its climate goals, UN (United Nations) Deputy Secretary General Amina Mohammed said, asserting that as governments look to restart their economies after Covid-19, it is vital to pursue a recovery that is not only sustainable, resilient and fair, but also job-rich. She said the European Union and its Member States had a strong history of leadership on climate action, including the commitment to achieve net zero emissions by 2050.

Source: The Economic Times

Government issues guidelines for implementing feeder-level solarisation under PM-KUSUM scheme

5 December. The government issued guidelines for implementation of feeder-level solarisation under the PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan) scheme after consultation with state governments. In February 2019, the government had approved the launch of the PM-KUSUM scheme to provide financial and water security to farmers through harnessing solar energy capacities of 25.75 GW by 2022. PM-KUSUM scheme Component-C provides for solarisation of grid-connected agriculture pumps. After consultation with states, it was decided to also allow feeder-level solarisation where instead of putting solar panels at each individual agriculture pump, a single solar power plant of capacity adequate to supply power to an agriculture feeder or multiple feeders will be installed. The MNRE (Ministry of New and Renewable Energy) said that under Component-C of PM-KUSUM scheme, solarisation of 4 lakh grid-connected pumps are targeted for sanction by 2020-21. Also, 50 percent of these are to be solarised through feeder level solarisation and balance through individual pump solarisation. The MNRE said it will be mandatory to use indigenously manufactured solar panels with indigenous solar cells and modules.

Source: The Economic Times

Mizoram enters country’s solar power map with 2 MW plant

5 December. Mizoram earned a place on India’s solar power map with the commissioning of a two MW capacity solar power plant. Mizoram Power Minister R Lalzirliana inaugurated the state’s first solar power plant, built at the cost of ₹140 mn, at Tlungvel in Aizawl district. The Minister said that with the commissioning of the 2 MW solar power plants, Mizoram has made its entry onto the solar map of the country and it was a proud moment for the state. The state government-funded solar plant solar plant, construction of which was started in August 2018, is spread over five acres of land and has 5,340 solar modules. The plant is expected to generate 3 million units annually. Power Department said that a 20 MW solar power plant is currently under construction at Vankal in Khawzawl district in southern Mizoram.

Source: The Economic Times

New Tripura airport terminal building to be run on solar power

3 December. The newly built terminal building of Maharaja Bir Bikram (MBB) Airport in Agartala, which is expected to be operational in the next three months, will be run on solar power. As part of green development initiative of Prime Minister Narendra Modi, the Airports Authority of India (AAI) is installing a 2 MW solar power plant for the energy requirement of the terminal building. Airport director Rajiv Kapoor said the initial energy assessment of the new terminal is estimated to be a little more than 2 MW daily for illumination, cooling, water supply and other electrical device operations, which would be supplied from non-conventional sources.

Source: The Economic Times

Government invites bids for setting up solar power systems in homes

2 December. In the midst of stiff opposition against that Goa Tamnar Transmission Project Ltd (GTTPL) project, and a debate on why solar power is not being generated in the state, the Goa Energy Development Agency (GEDA) has invited bidders to design, manufacture, supply, install, test and commission solar PV (photovoltaic) systems at various households in Goa. Earlier this year, in June, the state cabinet decided to implement the rural village electrification scheme for households to help 90 houses in Sanguem, Quepem, Sattari and Canacona get electricity through renewable energy. The scheme aims at bringing electricity, through renewable sources, to un-electrified remote villages, hamlets and wards where grid connectivity is either not feasible or not cost-effective.

Source: The Economic Times

International: Oil

Russia’s Transneft expects to complete tainted oil payments by mid-2021

7 December. Russian oil pipeline monopoly Transneft said it expected to complete compensation payments for contaminated oil by around mid-2021 and that it had already paid out over $143 mn, more than half of what is due. Up to 5 million tonnes (mt) of tainted oil was sent to central Europe via the Druzhba pipeline last year, in one of the most serious crises ever to hit Russian energy exports. Transneft has already paid some compensation to companies from Kazakhstan, as well as to French energy giant Total and Hungary’s MOL. Belarus, Russia's large oil buyer, is yet to receive compensation. Belarusian energy company Belneftekhim has said it was expecting over $61 mn in compensation for the 563,000 tonnes of contaminated oil it received. That translates roughly to $15 per barrel, the highest possible level of compensation expected from Transneft. Transneft's Grishanin said the company expected oil flows via its system, which transports more than 80 percent of all Russia's oil, to reach 440-450 mt next year, on a par with 2020. Grishanin said the finance ministry was currently working on a dividend policy for the state-owned companies, including Transneft, which had to cut their investments and saw profits plummet due to the fallout from the Covid-19 pandemic.

Source: The Economic Times

Global oil prices may remain range bound between $40-50 per barrel in 2021

7 December. Global crude oil prices are expected to be range bound and between $40-50 a barrel in 2021 as major oil producers have decided on a modest output rise from January that earlier anticipated, analysts have said on the emerging oil pricing scenario. The news of a successful coronavirus has ignited the oil market again with crude price moving up mire than 20 percent in a month to hover close to $50 a barrel now. However, analysts believe oil prices may not see any big rise even in 2021 as demand conditions continue to remain below the peak levels. The OPEC+ decision now not to go for any big time increase in oil production in first two quarters of 2021, any major price fall of crude has been averted and crude may be range bound even in 2021.

Source: The Economic Times

Iran prepares to raise oil exports if sanctions eased

6 December. Iran has instructed its oil ministry to prepare installations for production and sale of crude oil at full capacity within three months, ahead of a possible easing of US (United States) sanctions after President-elect Joe Biden takes office. President Hassan Rouhani said that Iran exported more than 2 mn barrels a day before US President Donald Trump exited the 2015 nuclear deal with six powers in 2018 and reimposed sanctions that have hit Iran’s economy hard by sharply cutting its vital oil exports. US President-elect Joe Biden, who will take office on 20 January, has said that he would return to the pact and would lift sanctions if Tehran returned to “strict compliance with the nuclear deal”. Rouhani said that his country was preparing for a speedy increase of its oil production. It is estimated that Iran exports less than 300,000 barrels of oil per day (bpd), compared to a peak of 2.8 mn bpd in 2018.

Source: Reuters

Denmark to end oil and gas hunt in North Sea in 2050

4 December. Denmark’s government agreed with a majority in parliament to put and end to all oil and gas exploration and extraction in the North Sea by 2050 as well as cancel its latest licensing round. The future of Denmark’s oil and gas operations in the North Sea has been a political issue after the Nordic country agreed last year on one of the world’s most ambitious climate targets of reducing emissions by 70 percent by 2030 and being climate neutral in 2050. The deal agreed by lawmakers late will cancel a planned eighth licensing round and any future tenders, while also making 2050 the last year in which to extract fossil fuels in the North Sea. Denmark is estimated to produce 83,000 barrels of crude oil and another 21,000 barrels of oil equivalent in 2020.

Source: Reuters

OPEC+ agrees slight easing of oil cuts from January

3 December. OPEC (Organization of the Petroleum Exporting Countries) and Russia agreed to slightly ease their deep oil output cuts from January by 500,000 barrels per day (bpd) but failed to find a compromise on a broader and longer term policy for the rest of next year. The increase means the OPEC and Russia, a group known as OPEC+, would move to cutting production by 7.2 mn bpd, or 7 percent of global demand from January, compared with current cuts of 7.7 mn bpd. The curbs are being implemented to tackle weak oil demand amid a second coronavirus wave. OPEC+ had been expected to extend existing cuts until at least March, after backing down from earlier plans to boost output by 2 mn bpd. But after hopes for a speedy approval of anti-virus vaccines spurred an oil price rally at the end of November, several producers started questioning the need to keep such a tight rein on oil policy, as advocated by OPEC leader Saudi Arabia. OPEC+ sources have said Russia, Iraq, Nigeria and the United Arab Emirates have all to a certain extent expressed interest in supplying the market with more oil in 2021. Russian Deputy Prime Minister Alexander Novak said the group would now gather every month to decide on output policies beyond January with monthly increases not exceeding 500,000 bpd. Novak said compensatory cuts for countries which overproduced in previous months had been extended until March 2021. OPEC+ has to strike a delicate balance between pushing up oil prices enough to help their budgets but not by so much that rival US (United States) output surges. U.S. shale production tends to climb above $50 a barrel.

Source: Reuters

International: Gas

Turkey’s actions worsen gas dispute ahead of summit: EU

7 December. European Union (EU) Foreign Ministers said that Turkey had failed to help resolve a dispute over natural gas resources in the eastern Mediterranean, but they left any decision on retaliatory sanctions for an EU summit. The 27 Ministers, who were tasked to evaluate the grounds for economic sanctions on Ankara, did not go beyond agreeing Turkey had aggravated tensions since October, when EU leaders voiced a threat to impose punitive measures in December. Turkish President Tayyip Erdogan said his country would not “bow down to threats and blackmail” but repeated his call for negotiations over the conflicting claims to continental shelves and rights to potential energy resources. Tensions flared in August when Turkey sent a survey vessel to map out energy-drilling prospects in waters claimed by Greece. Germany, current holder of the EU’s six-month presidency, holds the key to whether sanctions go ahead. It had hoped to mediate between Athens and Ankara, but was angered when Turkey resumed its gas exploration off Cyprus in October after a pause.

Source: Reuters

Asian LNG prices rise to nearly two-year high on winter demand

4 December. Asian spot prices for liquefied natural gas (LNG) rose to a nearly two-year high this week as demand continued to be firm for heating during winter and as buyers faced supply issues, traders said. The average LNG price for January delivery into Northeast Asia was estimated at about $8.10 per million metric British thermal units (mmBtu), up 70 cents from the previous week. Shell, for instance, sold a cargo for late January delivery to BP at $8 per mmBtu, according to data from S&P Global Platts. South Korea’s Korea Gas Corp likely bought seven LNG cargoes for delivery in winter through a tender and could be seeking more. South Korea will reduce the operations of coal-fuelled power plants this winter to cut fine dust emissions, which in turn is stoking demand for LNG in power generation, traders said. Eight of the nation’s 60 coal power plants will be halted during the season. Russia’s Sakhalin LNG likely sold a cargo at about $7.50 per mmBtu while Trafigura may have sold a mid-January cargo to Centrica at above $8 per mmBtu. Taiwan’s CPC Corp may also have bought about 5 to 6 cargoes for delivery over January to February instead of the initial two that it had sought, the source added.

Source: Reuters

Japan’s Inpex signs gas sales agreement with Indonesia gas utility

3 December. A unit of Japan’s Inpex Corp has made an agreement to sell natural gas from its Masela gas project to Indonesia's gas utility company, Indonesia's upstream oil and gas regulator said. Indonesia approved last year Inpex’s revised development plan for the $20 bn Masela project, which is among the biggest gas ventures in the Southeast Asian country. It is expected to produce around 9.5 million tonnes (mt) of liquefied natural gas per year and supply 150 million cubic feet of natural gas daily through pipelines.

Source: The Economic Times

China launches 1.1k km section of China-Russia East gas pipeline

3 December. Operations have started on the middle portion of the China-Russia East natural gas pipeline, allowing natural gas from the Power of Siberia system in Russia to be transmitted to the smog-prone Beijing-Tianjin-Hebei region in northern China. The 1,110 km pipeline aims to help improve air quality in the region, where about a quarter of China’s steelmaking capacity is located, by adding 27 million cubic metres gas supply per day, China Oil & Gas Piping Network Corp (PipeChina) said. This portion starts at Changling city in Jilin and ends at Yongqing city in Hebei. The pipeline also connects the existing gas pipelines in northeastern and northern China, as well as the gas storage projects in Dalian, Tangshan and Liaohe. The northern part of the China-Russia East gas pipeline started operations in December 2019 and has transmitted nearly 4 billion cubic meters (bcm) natural gas, according to PipeChina. China had started construction on the southern portion of the China-Russia East pipeline in July, extending the route to Shanghai in eastern China. Volumes of Russian gas transported via the pipeline could reach 38 bcm per annum once the line is completed by 2025.

Source: Reuters

Eni strikes deals to reopen Egypt’s Damietta LNG plant

2 December. Italian energy group Eni has struck deals with Spanish gas firm Naturgy and Egyptian partners to resolve disputes over a shuttered gas plant it part owns in northern Egypt. Eni said that the new agreements would pave the way for the liquefied natural gas (LNG) plant in the port city of Damietta to restart operations by the first quarter of next year. The new deal, which still needs the green light from European Union authorities as well as other conditions to be met, will allow Eni to increase its LNG portfolio and strengthen its gas foothold in the Eastern Mediterranean. Naturgy said that it will receive a series of cash payments totalling around $600 mn under the deal, which when completed will result in its departure from Egypt and the end of its joint venture with Eni. Eni, one of the biggest foreign oil and gas producers in Africa, discovered Egypt’s biggest-ever gas field Zohr in 2015 and has other assets in the Mediterranean. Like other majors, Eni is looking to decarbonise and sees LNG and gas as important resources in that transition. Eni said it would take over UFG’s marketing of natural gas in Spain, bolstering its presence in the European market. Naturgy has been renegotiating supply contracts after a gas price slump caused by lower demand and oversupply.

Source: Reuters

International: Coal

China issues coal buying mandate amid supply shortage, price gains

8 December. China's central state planner issued a mandate to coal buyers to sign medium and long-term contracts to ensure stable supplies next year, against the backdrop of recent gains in coal prices. The National Development and Reform Commission (NDRC) said coal miners should provide at least 80 percent of output to medium and long-term contracts, which are encouraged to be signed before the end of the year. It also specified that the contracts, which range between three to five years, must cover 80 percent of domestic coal consumption at power plants using imported coal and 75 percent at power companies that only use domestic sources. The amount of coal traded must reach at least 200,000 tonnes per contract for power generation, whereas coal used for metallurgical, construction materials, chemical and other industries must be at least 100,000 tonnes per contract, according to the NDRC. China, the world's top coal importer, has been encouraging coal buying companies including power plants and steel makers to sign long-term contracts to stabilize prices, ensure market supply and help bolster struggling domestic coal miners. The country has an informal coal import quota, as authorities instructed traders and downstream users to maintain total 2020 imports around the 2019 level. In late November, China had also signed a deal to buy nearly $1.5 bn worth of thermal coal from top exporter Indonesia next year, with the Indonesian Coal Mining Association saying it hopes to increase coal exports to China to 200 million tonnes (mt) in 2021.

Source: The Economic Times

Malaysia’s CIMB commits to phase out coal financing by 2040

8 December. Malaysia’s CIMB Group Holdings Bhd committed to phase out coal from its portfolio by 2040, saying it was the first banking group in Malaysia and Southeast Asia to do so. Big international banks have been exiting coal financing at an accelerated rate this year amid pressure from non-governmental organisations (NGOs) and a global energy transition. The lender, Malaysia’s second largest by assets, said its new ‘Coal Sector Guide’ will prohibit asset-level or general corporate financing for new thermal coal mines and coal-fired power plants, as well as expansions, except when there are existing commitments. The firm represents the first globally significant financial institution in the developing world to commit to a coal exit strategy, Tim Buckley, Director of Energy Finance Studies at the Institute for Energy Economics and Financial Analysis said.

Source: Reuters

International: Power

Deer Park, Texas facility hit by power outage: Shell

4 December. Royal Dutch Shell Plc experienced a power outage that caused a process upset at multiple units at its Deer Park, Texas, facility, where it operates a 318,000 barrel per day (bpd) joint venture refinery. Power outage at the Deer Park facility was due to a transmission line event outside of Shell, the company said adding power returned and units were stabilized.

Source: Reuters

International: Non-Fossil Fuels/ Climate Change Trends

Unit 1 of UAE’s first nuclear reactor reaches 100 percent power capacity: ENEC

8 December. The United Arab Emirates' Barakah Nuclear Energy Plant has reached 100 percent of the reactor power capacity for Unit 1 of the facility during testing, the Emirates Nuclear Energy Corp (ENEC) said. The plant in the Al Dhafrah Region of Abu Dhabi, capital of the UAE (United Arab Emirates), is the first nuclear power plant in the Arab world and part of the Gulf oil producer's efforts to diversify its energy mix. Commercial operations are expected to begin in early 2021. When completed Barakah, which is being built by Korea Electric Power Corp (KEPCO), will have four reactors with 5,600 MW of total capacity. Construction of Unit 3 is 93 percent complete and Unit 4 is 87 percent complete. Unit 2 is complete and is awaiting licensing.

Source: The Economic Times

China turns on nuclear-powered 'artificial sun'

5 December. China successfully powered up its "artificial sun" nuclear fusion reactor for the first time, marking a great advance in the country's nuclear power research capabilities. The HL-2M Tokamak reactor is China’s largest and most advanced nuclear fusion experimental research device, and scientists hope that the device can potentially unlock a powerful clean energy source. Located in southwestern Sichuan province and completed late last year, the reactor is often called an "artificial sun" on account of the enormous heat and power it produces. Chinese scientists have been working on developing smaller versions of the nuclear fusion reactor since 2006. They plan to use the device in collaboration with scientists working on the International Thermonuclear Experimental Reactor -- the world's largest nuclear fusion research project based in France, which is expected to be completed in 2025.

Source: The Economic Times

Pakistan starts fuel loading in 1.1 GW Chinese-assisted nuclear power plant in Karachi

3 December. Pakistan has started loading fuel to its Chinese-assisted 1,100 MW nuclear power plant in Karachi for testing in run-up to its commercial operations in April 2021. The fuel loading for the newly built Karachi Nuclear Power Plant Unit-2 (K-2) began after obtaining fuel load permit from the Pakistan Nuclear Regulatory Authority. K-2 is a pressurised water reactor based on the Chinese HPR-1000 technology and a third generation plant equipped with advanced safety features. K-2 is one of the two 1,100 MW nuclear power plants being constructed in Karachi. The other plant, K-3, is expected to become operational by the end of 2021. The completion of these nuclear power plants has remained largely on schedule despite the Covid-19 outbreak.

Source: The Economic Times

Climate goals need 6 percent yearly fossil fuel cuts: UN

3 December. Oil, gas and coal production must fall six percent a year in order to limit catastrophic global warming, the United Nations (UN) warned, even as high-polluting nations bank on fossil fuels to drive their Covid-19 recoveries. The UN’s annual Production Gap assessment measures the difference between the Paris Agreement climate goals and nations' planned production of fossil fuels. But the report authors stressed that emissions need lowering immediately, and that the Covid-19 pandemic offered governments a golden opportunity to rebuild their economies without relying on polluting fuels. The UN Environment Programme report on said fossil fuel production needs to fall 6 percent each year in order to achieve such emissions cuts.

Source: The Economic Times

German utility Uniper eyes 4 GW of renewables capacity beyond 2025: CEO

3 December. German utility Uniper is planning to develop 4 GW of solar and wind power projects beyond 2025, Chief Executive Officer (CEO) Andreas Schierenbeck said. This includes the group’s business in Russia, where the company so far only operates fossil-fuel based power stations.

Source: Reuters

Germany scraps renewable fee on green hydrogen to encourage new technology

2 December. Germany’s government lifted a charge levied on power prices to support renewable energy for producers of so-called green hydrogen, part of a bid to encourage the nascent technology for low-carbon fuels. The Berlin cabinet decided to waive the renewable energy fee under the EEG feed-in tariff law for electricity derived from wind and solar sources following an economy ministry initiative. Green hydrogen, which is produced via electrolysis while conventional hydrogen is produced using fossil fuels, is meant to help decarbonise energy used in industry, transport and for heating buildings. The EEG surcharge was introduced to support the expansion of carbon-free green power from wind and solar plants. The government capped it to help household customers for whom it makes up a fifth of their power bills, and because renewable production costs have fallen steeply.

Source: Reuters

Ardern declares climate emergency, pledges carbon neutral New Zealand government

2 December. New Zealand promised its public sector would become carbon neutral by 2025 as it declared a climate emergency, a symbolic move that critics said needed to be backed with greater actions to reduce emissions. Prime Minister Jacinda Ardern said the climate emergency declaration was based on the Intergovernmental Panel on Climate Change’s findings that to avoid more than 1.5 degree Celsius rise in global warming, emissions would need to fall by around 45 percent from 2010 levels by 2023 and reach zero by around 2050. New Zealand joins 32 other countries including Japan, Canada, France and Britain that have declared a climate emergency. In her first term she passed a Zero Carbon Bill, which sets the framework for net zero emissions by 2050 with an exemption for farming, and banned new offshore oil and gas exploration. Nearly half of New Zealand’s greenhouse gas emissions come from agriculture, mainly methane. The government promised the public sector will achieve carbon neutrality by 2025. Government agencies would have to measure and report emissions and offset any they can’t cut by 2025. The programme will be backed by a NZ$200 mn ($141 mn) fund to finance replacing coal boilers and help purchase electric or hybrid vehicles. Greenpeace welcomed the declaration, but challenged the government to follow through with policy and action.

Source: Reuters

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: International Energy Agency

Source: International Energy Agency PREV

PREV