-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Mannat Jaspal and Jesse Scott, “The State of the Global Energy Transition,” ORF Issue Brief No. 802, May 2025, Observer Research Foundation.

Introduction

The energy transition today is not only an instrument for delivering climate action but is also a key part of the toolkit of policymakers and industry leaders to advance diplomatic efforts and economic growth agendas. Globally, such policies are reshaping the role of fossil fuels in the energy mix and redefining the relationship between economic growth and carbon emissions.

At the heart of current policy debates are two perspectives: one sees advantages in delaying the phase-down of fossil fuels, and the other focuses on the merits of accelerating innovation leadership in clean-energy technologies. On fossil fuels, policy ideas range from advocating a complete phase-out to outright climate change denial. On clean energy, concerns include missing out on emerging global markets—such as solar and electric vehicles (EVs)—and replacing fossil fuel dependencies with new vulnerabilities in critical minerals supply chains.

Different jurisdictions are projecting divergent messages. The European Union (EU), a leader in climate regulation, is implementing a Carbon Border Adjustment Mechanism (CBAM) to price and tax carbon emissions entering its borders. Meanwhile, in the United States (US), the Trump administration is aggressively advocating the expanded use of fossil fuel, referring to it as “liquid gold”.[1] Elsewhere, countries are grappling with how to balance decarbonisation targets with energy security, economic competitiveness, and development needs. These sharp contrasts in political signalling reflect the complex interrelationships between climate, energy, national security, and economic goals—often sensationalised in the media and by activist discourses on both sides.

A realistic starting point for the clean energy transition is the recognition that, over the last 150 years, fossil fuels have lifted millions out of poverty and shaped the modern world. Today, fossil fuel energy and feedstock-based products are deeply enmeshed in our daily lives: shaping how we live, dress, eat, and communicate. The rise in global population and Gross Domestic Product (GDP) has mirrored the growth in fossil fuel use, underscoring its role in driving economic prosperity—albeit at the cost of rising emissions.[2] By 2040, the global population is projected to grow by 20 percent, and GDP by 90 percent,[3] putting immense pressure on the energy system, with global energy demand anticipated to rise by at least 50 percent.[4] Another key reality is that countries start the energy transition from different situations, depending on their natural resource endowments, infrastructure, level of economic development, energy access, and historical contributions to greenhouse gas emissions.

Looking ahead, digital and green areas are driving fast-growth industries and cutting-edge technologies. Every major economy is vying for leadership in key areas of information technology and clean energy. Despite differing starting points, countries are aiming for the same core menu of solutions for the energy transition: prioritising energy efficiency, expanding renewable electricity and electrification of end-use, adopting indirect electrification for intensive energy loads through e-fuels such as green hydrogen or its derivatives, and pursuing carbon removal by both natural (forests) and technological (carbon capture and storage) means.

The energy transition today is poised between these perspectives. On the one hand, oil, coal, and natural gas still provide around 4/5ths of global primary energy.[5] On the other hand, International Energy Agency (IEA) tracking shows that of the US$3-trillion investment in energy in 2024, US$2 trillion flowed to clean-energy technologies and infrastructure.[6]

Technological Factors

Solar and wind have become powerful, cost-effective alternatives to fossil fuels in several sectors. However, their variable nature and intermittency require partnership with large grids for balancing, along with energy storage technologies. Battery energy storage systems (BESS) are crucial for managing short-term demand peaks and supply surpluses. Longer-duration energy storage solutions include hydroelectric dams and various thermal technologies. Other clean energy sources—such as nuclear, geothermal, and run-of-river hydro—offer steady (baseload) and/or dispatchable power. Improving energy efficiency, decarbonising the electricity sector, and scaling electrification in key end-use sectors—such as building heating and cooling, passenger and short-haul transportation, and low-temperature industrial heat—are the lowest-hanging fruit in the energy transition landscape in much of the world.

The transportation sector has been one of the biggest clean technology growth areas with the rise of electric vehicles. While EVs have won the race in short-haul and passenger transport, there is less certainty about the dominant technologies for long-haul trucking, shipping, and aviation sectors, where weight and distance require more energy-dense fuels, perhaps including fuel cells, e-fuels, or sustainable biofuels.

Similarly, transitioning high-temperature industrial processes—typically those requiring over 600 degrees centigrade—remains challenging. While many processes below this threshold can use alternatives like geothermal heat, for example, hard-to-electrify processes still lack widely commercialised, scalable technologies and involve high capital costs.[7] For example, in the cement industry globally, nearly half of emissions come from the decomposition of limestone into lime and CO2.[8] Yet, credible roadmaps exist for achieving carbon-neutral cement production in Europe by 2050, with the potential for carbon-negative outcomes over the value chain.[9] Alternative solutions such as carbon capture and storage (CCS), hydrogen, and sustainable biofuels have gained policy attention. For example, where some processes continue to emit CO2, in G20 countries at least 95 percent of these emissions need to be captured by means of CCS by 2030.[10]

Many low-carbon technologies are off-track to deliver in line with climate targets. According to McKinsey,[11] the gap between current progress and required deployment is substantial. So far, the biggest successes have come from less complex or more commercially viable technologies, such as solar PV. In contrast, while the CCS pipeline appears large on paper, most projects have not reached final investment decisions (FID), putting their realisation at risk.[12] For hydrogen, clean production must scale up 25 times in Europe and nearly 20 times in the US by 2030. Similarly, only around 25 percent of projected sustainable aviation fuel (SAF) capacity in Europe and 30 percent in the US has reached FID.[13] During this middle phase of the energy transition, hybrid systems may emerge, with fossil fuels increasingly serving as backup support for baseload renewables, rather than the other way around as it currently stands.

On the other end of the spectrum, fossil fuel companies are leveraging technological innovations to reduce fugitive emissions and to improve energy efficiency. For example, satellite and Artificial Intelligence (AI)-based[14] advancements have greatly improved methane leak detection and resolution. The electrification of mining equipment, drilling fleets,[15] and fracking units is also helping to curtail carbon emissions to a certain extent.

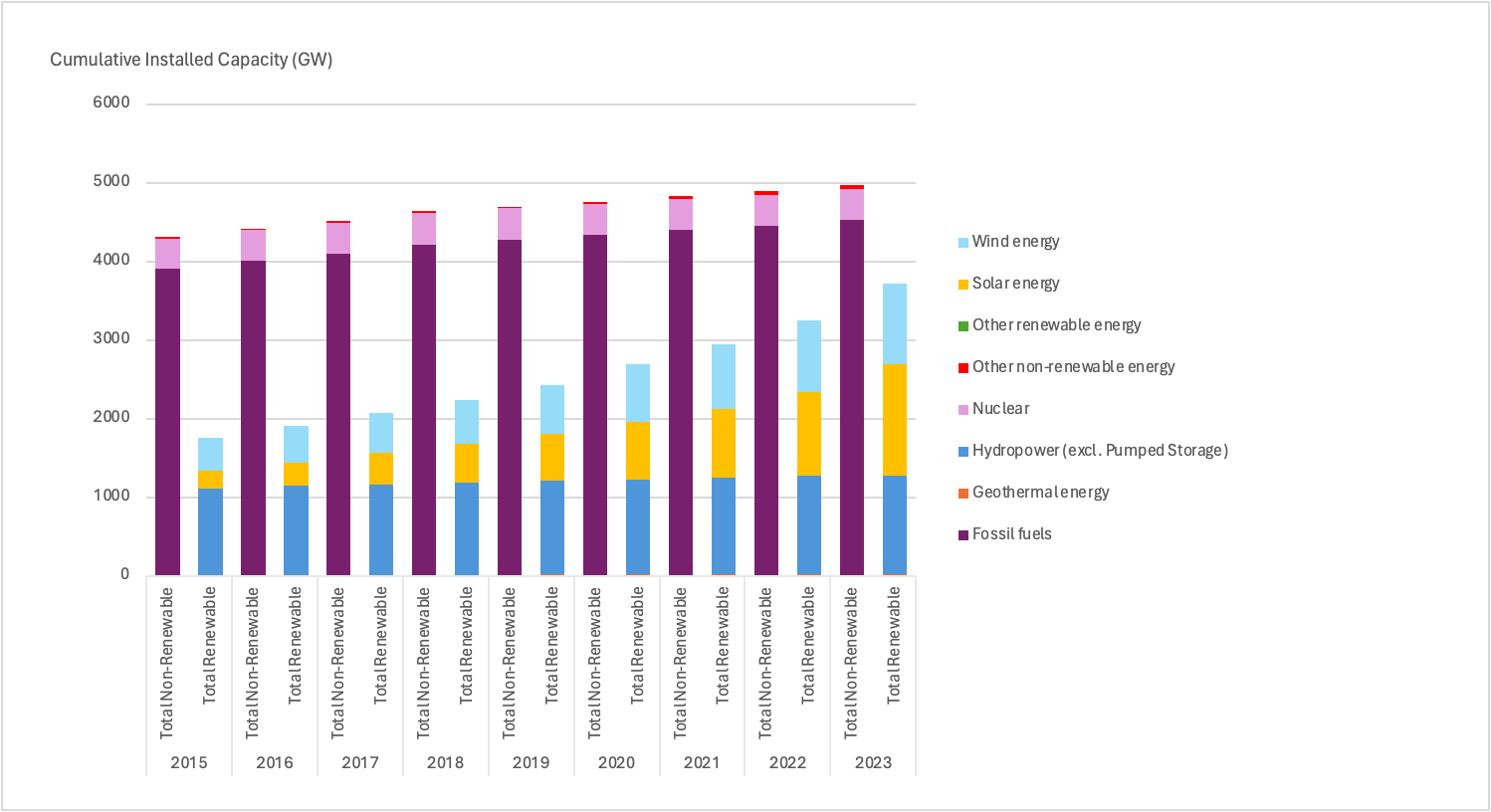

Figure 1: Global Power Capacity by Technology (2015-2023)

Source: IRENA Renewable Energy Statistics Data[16]

Political Considerations

The political momentum for climate action, carbon neutrality, and international cooperation on energy transitions has been unprecedented since the historic 2015 Paris Agreement, ratified by over 195 parties[17] and covering 90 percent of global emissions.[18] According to the United Nations, 107 countries responsible for 82 percent of global GHGs have committed to net-zero targets by mid-century, either through law, policy documents, or official announcements.[19] This policy signalling has encouraged more than 9,000 companies, over 1,000 cities, and 600 large financial institutions to join the ‘Race to Zero’ pledge, launched in 2020, aiming to halve global emissions by 2030.[20]

The industrial policies of many countries today—such as the European Green Deal, launched in 2019, the US Inflation Reduction Act of 2020 passed under the Biden Administration (although its future is unclear under the current Trump 2.0 presidency), and India’s Atmanirbhar Bharat, launched in 2020—all aim to boost domestic manufacturing and establish market leadership in clean energy, making energy transition technologies pillars of the economic agenda. Similarly, large-scale infrastructure initiatives like China’s Belt and Road Initiative include energy projects in their portfolio of international investments—energy accounts for 46 percent of Chinese investment in the MENAT (Middle East and North Africa plus Turkey) region, exceeding US$126 billion between 2005 and 2022.[21]

It is therefore unsurprising that hydrocarbon-exporting countries like the Arab Gulf states—heavily reliant on fossil exports for revenues—are looking to diversify and explore cleaner energy alternatives. The United Arab Emirates (UAE) and Saudi Arabia, for example, have made notable domestic investments in renewable energy and hydrogen production,[22] and have emerged as prominent capital providers for energy transitions globally. Their aims include becoming more energy self-reliant, as well as managing their exposure to changes in global market demand for fossil fuels and/or the effects of carbon tariffs and sustainability regulations. Nonetheless, as of 2024, in the Middle East, only US$ 0.20 is invested towards clean energy for every dollar spent on fossil fuels.[23] Announced pledges aim to raise this to US$ 0.70 per dollar in fossil fuels by 2030.[24] Globally, to be on track for net-zero emissions by 2050, annual oil, coal and gas investments must fall by more than half—from just over US$ 1 trillion in 2024 to below US$ 450 billion per year by 2030.[25]

Meanwhile, clean energy, climate security, and related geopolitical risks are rising issues for diplomacy between states. Bilateral and multilateral trade agreements contain important chapters on clean energy. Over the past five years, India has deepened cooperation with both the EU and the US through agreements on renewable energy, storage, and grid modernisation.[26] Most recently, under Trump 2.0, the US-India partnership has expanded to include a focus on liquefied natural gas (LNG) as a means of reinforcing energy security while facilitating a transition towards lower-carbon fuels.[27]

Crisis situations are increasingly shaping policy decisions. For instance, while limited in operating hours and emissions, Germany’s 2022 move to temporarily suspend coal power plant closures amidst gas shortages drew global attention.[28] Energy security is a pressing concern, especially for countries in the Global South. But energy security means a number of different, interlinked things: the availability of energy supply, the cost of energy to consumers and to the economy as a whole, the resilience of energy systems against external shocks—including climate-induced extreme weather—and questions of national security or dependency.

The affordable availability of energy is a central issue. Globally, 685 million people still lack a reliable energy source,[29] impacting health, education, and economic development. Most of them rely on traditional biomass fuels, but expanding access need not depend on coal—particularly in rural areas, where solar microgrids, CNG cooking systems, and waste-to-energy units are often faster and more cost-effective solutions. Many societies also have large groups of energy-poor consumers, who have access in principle but struggle to pay bills.

Since 2022, Russia’s invasion of Ukraine, its impact on gas markets, and energy-related sanctions by the EU and US have demonstrated how rich countries can use energy as a geopolitical weapon. This has, in turn, strengthened the case for accelerating energy transitions. The EU’s response to the 2022-23 energy crisis was to double down on renewable energy deployment. That strategy, however, has led to growing awareness about the importance of the critical minerals and supply chains that are crucial for clean energy proliferation. The concentration of these resources in a few countries poses global risks to energy transitions worldwide. For instance, in early 2025, in a stand-off with the US, China banned exports of gallium and germanium—key metals for electronics and semiconductor manufacturing.[30]

Just and inclusive transition policies are an important political dimension of the energy transition. These include support and retraining for displaced fossil fuel workforces, land and water rehabilitation in areas affected by badly managed extraction, and education reforms to equip the next generation of workers with skills for the clean energy sector. Another crucial aspect of the energy transition is shielding vulnerable energy consumers—those in energy poverty as well as energy-intensive industries—from price shocks, whether caused by global fossil fuel market volatility or the upfront investment costs of clean energy.

A key challenge is that many governments and policymakers continue to treat climate and energy transition goals as “tomorrow” problems, which they can avoid tackling with bold decisions today. This tendency does not help business planning, leading to frustration—both publicly and privately. Without appropriate policy signalling from governments, businesses struggle to secure financing and build value chains essential to their transition strategies. This uncertainty delays investments and innovation in moving from brown to green.

Financial Imperatives

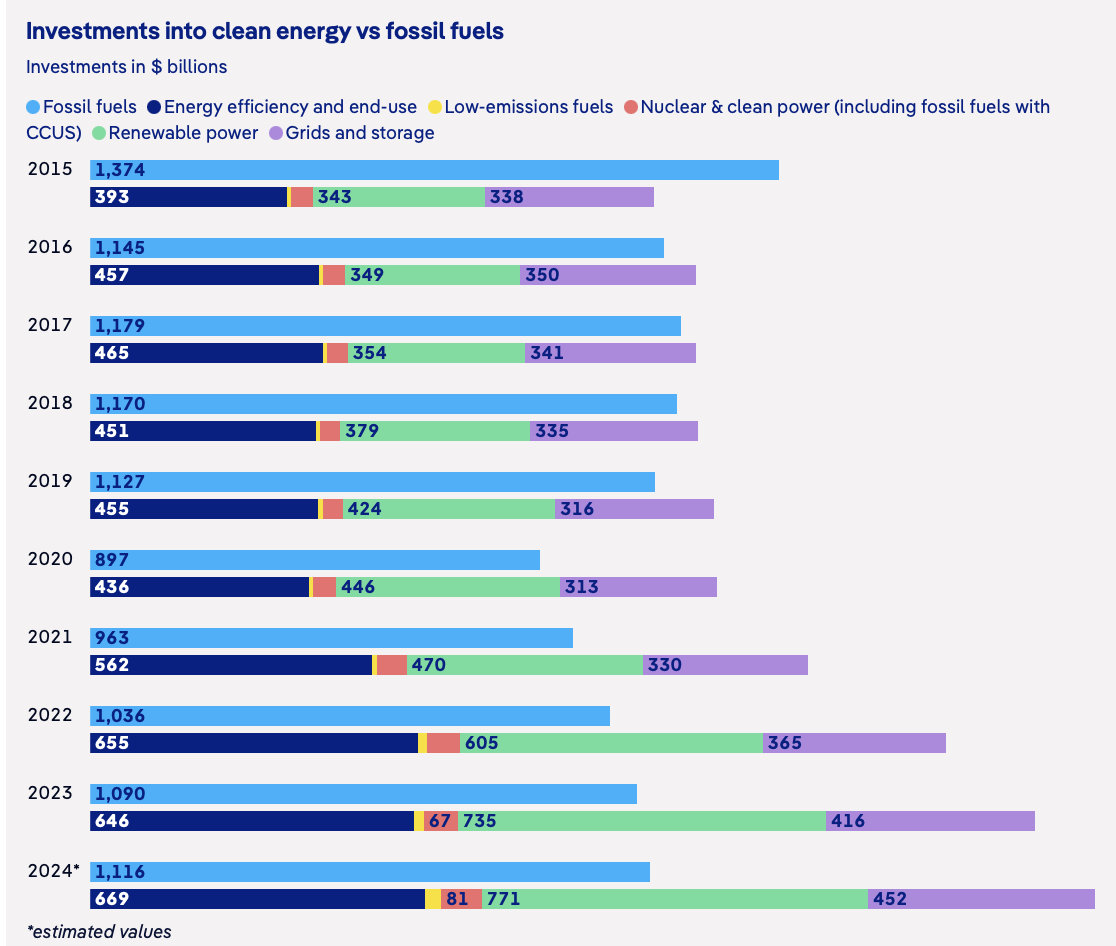

As noted above, IEA tracking shows that investments in clean energy are now twice those in fossil fuels (see Figure 2).[31] In 2023, global investments in renewable capacity additions rose by 27 percent year-on-year from 2022.[32] Wind and solar PV now yield 2.5 times more energy per dollar invested compared to a decade earlier.[33] At the same time, fossil fuel investments are increasingly facing uncertainties owing to the financial risk of stranded assets.

This acceleration in clean energy investment can be attributed to strong policy support and fundamental technological advancements that increase the competitiveness of renewables. Energy security imperatives have helped to reinforce policy support, for example towards accelerated permitting processes for new power generation sites.

Figure 2: Global Investments in Clean Energy and Fossil Fuels (2015-2024)

Source: World Energy Investment 2024 [34]

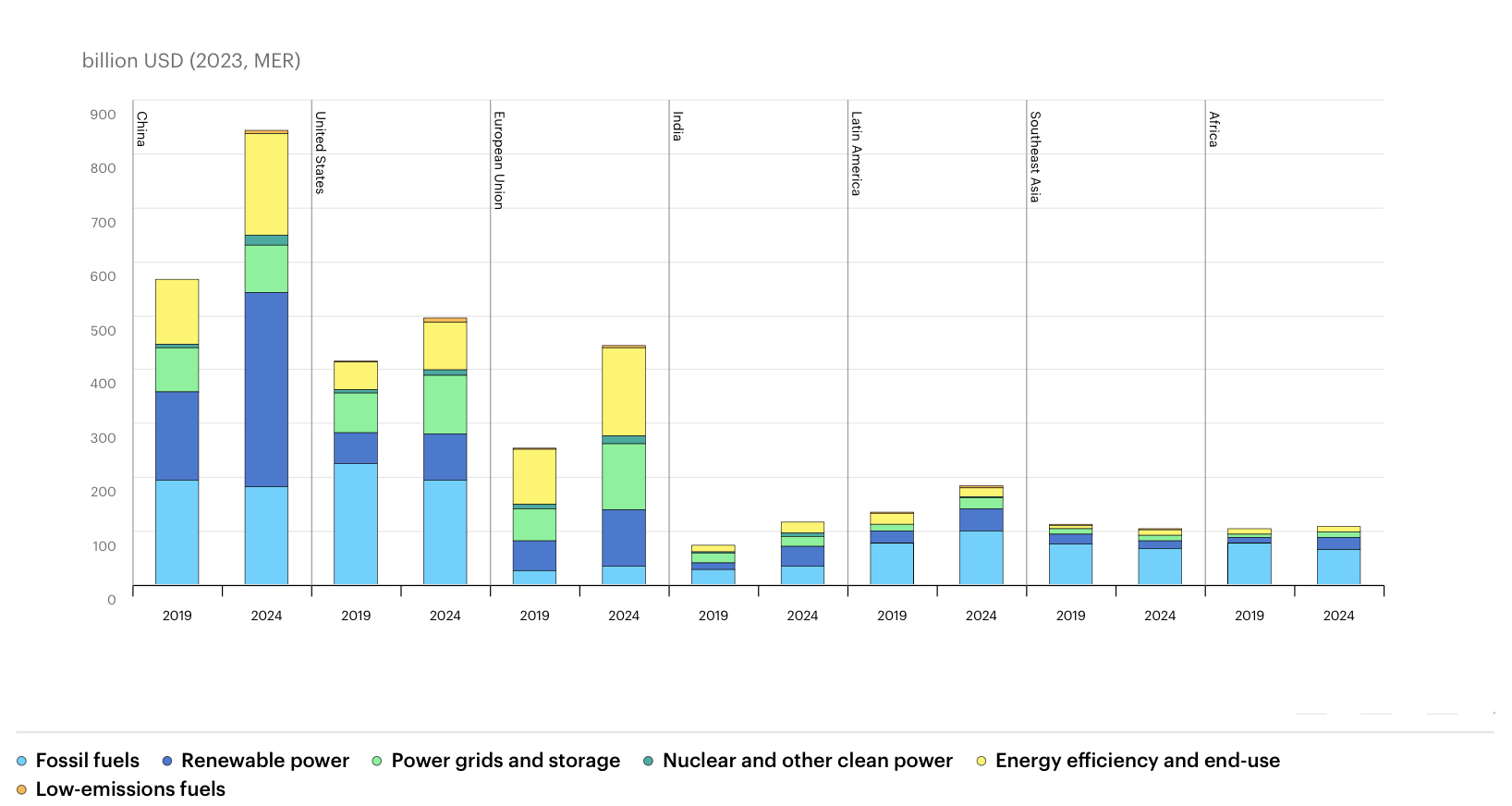

Nonetheless, this big picture remains concerning because of the geographic concentration of clean-energy investments. The majority continues to flow into advanced economies and China (see Figure 3), while emerging markets and developing economies (EMDEs) receive only 15 percent of the total global clean-energy spending.[35] In 2023, for every US dollar invested in battery storage in advanced economies and China, only one cent reached other EMDEs.[36] This pattern will not result in a global energy transition. Ensuring that investment flows into these countries is essential.

Figure 3: Annual Investments in Clean Energy by Select Country and Region (2019-2024)

Source: World Energy Investment 2024[37]

The fundamental problem is the higher cost of capital in developing countries—typically at least twice that of advanced economies.[38] This cost difference is owing to often misplaced sovereign and political risk assessments. Global credit rating agencies follow antiquated methodologies that fail to reflect the changing realities of developing economies or account for local conditions, which domestic ratings agencies may better understand and price. A lack of local currency lending for clean energy also pushes up borrowing costs, making hedging unaffordable and pushing the least developed countries towards unsustainable debt situations. Additionally, the majority of energy investments in EMDEs are made through the public sector, primarily governments and state-owned enterprises.[39]

Financing costs also reflect climate risks and their disproportionate impact on many developing countries. As a result, countries most vulnerable to climate change—and most in need of clean energy investment—face a premium on borrowed capital. The type of finance available in EMDEs also reflects investment biases—debt financing is prominent in the power sector in Asia, while equity shares dominate the fuel supply, particularly in the Middle East and Eurasia.[40] In such scenarios, it becomes increasingly difficult for Global South countries to escape from dependencies on fossil fuels.

Global investments in energy transition technologies (see Figure 4) must rise sharply to meet net-zero targets. Crucially, investments in renewable energy—including power generation, grids, and storage—need to double to deliver the target of tripling global renewable capacity by 2030.[41] Simultaneously, investments in low-emission fuels must grow tenfold, while the rate of energy efficiency improvements should double.[42] To meet the COP28 UAE Consensus targets, between 2024 and 2030, annual investments in renewable power, grids and flexibility, energy efficiency, and conservation must increase almost four times to US$ 4.5 trillion each year from US$ 1.29 trillion.[43]

While there is a strong business case for certain mature technologies—notably solar PV—many clean-energy technologies will continue to rely on regulatory support and concessional financing mechanisms to ensure off-take and scale in the near term. Delivering an energy transition that meets global and national targets is not a chicken-and-egg problem; conscious and prudent investments in crucial clean-energy technologies must lead the way. If investments lag, innovation and manufacturing advancements will also stagnate, derailing progress and jeopardising targets.

Conclusion: The Middle Transition

The current “mid-way” stage of the energy transition is not simple. Fossil fuels remain a huge factor in global trade, geopolitics, and macroeconomics. The energy transition requires a pragmatic and inclusive approach—across technologies and through partnerships among governments, the private sector, investors, and civil society. Cooperation is essential to overcome the technological constraints, political bottlenecks, and financial gaps discussed in this brief.

Four priorities can guide us to the future, enabling us to track progress through the “noise” of news and debate.

Inclusivity

Achieving climate action goals requires both an “all clean technologies on deck” and an “all parties on deck” approach. Investments in renewable energy sources, energy efficiency, sustainable fuels, and clean hydrogen are critical to support maximum decarbonisation, along with CCS and nuclear energy where countries/sectors choose these options. Although the recent UNFCCC COPs held in the UAE (COP28) and Azerbaijan (COP29), respectively, faced criticism for being hosted by oil producers, meaningful action on climate and energy transitions cannot be achieved in isolation. These COPs reflect an effort to mobilise all countries, including those with substantial fossil fuel revenues.

Policy Certainty

Well-designed and consistent government policies are essential to provide investors clarity, give businesses the confidence to invest, and also to influence consumer perceptions and behaviour to promote the uptake of clean technologies and circular economy practices of repair and recycling. Besides the well-known instruments of carbon pricing, subsidies for renewables, tax credits, product mandates, and stricter emissions regulations, a skilled workforce will be key to the success of the energy transition. This requires integrating education and training programmes into policy planning. Robust climate risk modelling—covering both adaptation and policy risks—should be undertaken across the economy.

Scaled-up Infrastructure and Financing

Scaling renewable and grid infrastructure is crucial for the energy transition: without them, clean electrification will struggle to keep pace with growing energy demand. Development finance institutions and multilateral banks need to move beyond discussions about blended finance to making actual de-risking investments in early-stage projects, attracting private investment via guarantees and first-loss capital. While some efforts are underway, a significant scale-up is needed. Transition finance mechanisms, supported by harmonised policies and credible standards, must scale up to enable decarbonisation in high-emitting sectors. Additionally, there is an urgent need to review the rating metrics that unfairly penalise developing countries by putting high-risk premiums on capital.

International Cooperation

An inclusive, cooperative, and equitable approach remains essential to build consensus and momentum toward achieving global climate goals. Platforms such as the G20, BRICS,[a] and new initiatives such as IMEC (India–Middle East–Europe Economic Corridor) and I2U2,[b] can be leveraged to reinforce and ring-fence the energy transition agenda, preventing setbacks from geopolitical rifts or national-level changes in government. However, for international agreements and partnerships to be effective, they must move beyond talk and small-scale cooperation. Key global actors, including India, the UAE, and the EU, must prioritise radically joined-up and scaled-up clean energy financing and technology cooperation to accelerate decarbonisation.

Endnotes

[a] BRICS is an intergovernmental organisation comprising 10 countries—Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates.

[b] I2U2 is a strategic partnership formed between India, Israel, United Arab Emirates, and the US.

[1] Ed Pearcey, “‘Drill, Baby, Drill’: Trump Hails America’s ‘Liquid Gold’, ” Power Technology, January 21, 2025, https://www.power-technology.com/news/drill-baby-drill-trump-hails-americas-liquid-gold/?cf-view

[2] Samantha Gross, “Why Are Fossil Fuels So Hard to Quit?,” Brookings Institution, June 8, 2020, https://www.brookings.edu/articles/why-are-fossil-fuels-so-hard-to-quit/

[3] Copenhagen Economics, Energy Transitions Commission, The Future of Fossil Fuels: How to Steer Fossil Fuels Use in a Transition to a Low-carbon Energy System, January 2017, London, Energy Transitions Commission, 2017, https://www.energy-transitions.org/wp-content/uploads/2020/05/ETC-Copenhagen-Economics-The-future-of-fossil-fuels-Summary-Paper.pdf

[4] “The Future of Fossil Fuels: How to Steer Fossil Fuels Use In a Transition to a Low-carbon Energy System”

[5] Hannah Ritchie and Pablo Rosado, “Fossil Fuels,” Our World in Data, January 2024, https://ourworldindata.org/fossil-fuels#article-citation

[6] IEA, World Energy Investment 2024: Overview and Key Findings, June 2024, Paris, International Energy Agency, 2024, https://www.iea.org/reports/world-energy-investment-2024/overview-and-key-findings

[7] Mannat Jaspal and Neha Khanna, A Roadmap for Green and Transition Finance in India, Observer Research Foundation and Climate Policy Initiative, September 2024, https://www.orfonline.org/public/uploads/posts/pdf/20240911145312.pdf

[8] “A Roadmap for Green and Transition Finance in India”

[9] The European Cement Association, “CEMBUREAU’s Net Zero Roadmap,” CEMBUREAU, https://cembureau.eu/library/reports/cembureau-s-net-zero-roadmap/

[10] IRENA, World Energy Transitions Outlook 2024, November 2024, Abu Dhabi, International Renewable Energy Agency, 2024, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2024/Nov/IRENA_World_energy_transitions_outlook_2024.pdf

[11] Diego Hernandez Diaz et al., “The Energy Transition: Where Are We Really?,” Mckinsey & Company, August 27, 2024, https://www.mckinsey.com/industries/electric-power-and-natural-gas/our-insights/the-energy-transition-where-are-we-really#/

[12] Diaz et al., “The Energy Transition: Where Are We Really?”

[13] Diaz et al., “The Energy Transition: Where Are We Really?”

[14] Shell, “Reducing Methane Emissions,” https://www.shell.com/what-we-do/oil-and-natural-gas/flaring/_jcr_content/root/main/section/call_to_action_copy/links/item0.stream/1717058731986/fff5cf570e2deae605c4888bd894629d48a25290/methane-infographic-factsheet.pdf

[15] ExxonMobil, 2024 Advancing Climate Solutions Executive Summary, Houston, ExxonMobil Corporate, 2024, https://corporate.exxonmobil.com/-/media/global/files/advancing-climate-solutions/2024/2024-advancing-climate-solutions-report.pdf

[16] IRENA, Renewable Energy Statistics 2024, July 2024, Abu Dhabi, International Renewable Energy Agency, 2024, https://www.irena.org/Publications/2024/Jul/Renewable-energy-statistics-2024

[17] United Nations, “Climate Action: The Paris Agreement,” https://www.un.org/en/climatechange/paris-agreement

[18] “CAT Net Zero Target Evaluations,” Climate Action Tracker, December 14, 2023, https://climateactiontracker.org/global/cat-net-zero-target-evaluations/.

[19] United Nations, “For a Livable Climate: Net-zero Commitments Must be Backed By Credible Action,” https://www.un.org/en/climatechange/net-zero-coalition

[20] “For a Livable Climate: Net-zero Commitments Must be Backed By Credible Action”

[21] Ariel Ezrahi, An Energy and Sustainability Road Map for the Middle East, Washington DC, Atlantic Council, 2024, https://www.atlanticcouncil.org/in-depth-research-reports/report/an-energy-and-sustainability-road-map-for-the-middle-east/

[22] Ezrahi, “An Energy and Sustainability Road Map for the Middle East”

[23] IEA, World Energy Investment 2024: Middle East, June 2024, Paris, International Energy Agency, 2024, https://www.iea.org/reports/world-energy-investment-2024

[24] “World Energy Investment 2024: Middle East”

[25] “World Energy Investment 2024: Overview and Key Findings”

[26] Ministry of External Affairs, https://www.mea.gov.in/bilateral-documents.htm?dtl/38322/, 2024

[27] Office of Communications, The White House, https://www.whitehouse.gov/remarks/2025/02/remarks-by-president-trump-and-prime-minister-narendra-modi-of-the-republic-of-india-in-joint-press-conference/, 2025

[28] Darrell Proctor, “Germany Restarts Coal-Fired Generation to Support Winter Power Supply,” Power, October 5, 2023, https://www.powermag.com/germany-restarts-coal-fired-generation-to-support-winter-power-supply/

[29] “Bridging the Energy Gap Takes Center Stage at UN’s International Clean Energy Day Celebrations,” IRENA, January 24, 2025, https://www.irena.org/News/articles/2025/Jan/Bridging-the-Energy-Gap-Takes-Center-Stage-at-UNs-International-Clean-Energy-Day-Celebrations

[30] Mannat Jaspal, The Energy Quest: Elevating the Quad’s Role in the Indo-Pacific, Observer Research Foundation and Australian National University, December 15, 2023, https://www.orfonline.org/research/the-energy-quest-elevating-the-quad-s-role-in-the-indo-pacific

[31] International Energy Agency (IEA), World Energy Investment 2024: Overview and Key Findings, June 2024, Paris, IEA, 2024, https://www.iea.org/reports/world-energy-investment-2024/overview-and-key-findings

[32]“World Energy Transitions Outlook 2024”

[33] “World Energy Investment 2024: Overview and Key Findings”

[34] Holly Young, “Who is funding fossil fuel expansion?,” Deutsche Welle, December 11, 2024, https://www.dw.com/en/who-is-funding-fossil-fuel-expansion/a-70666716; “World Energy Investment 2024”

[35] “World Energy Investment 2024: Overview and Key Findings”

[36]“World Energy Investment 2024: Overview and Key Findings”

[37] “World Energy Investment 2024: Overview and Key Findings”

[38] Michael Purton, “Clean Energy Investment is Set to Double That of Fossil Fuels – Here’s How Developing Nations Can Also Benefit,” World Economic Forum, August 28, 2024, https://www.weforum.org/stories/2024/08/clean-energy-investment-just-transition/

[39] “World Energy Investment 2024: Overview and Key Findings”

[40] Cecilia Tam et al., “Who is Investing in Energy Around the World, and Who is Financing It?,” International Energy Agency, June 25, 2024, https://www.iea.org/commentaries/who-is-investing-in-energy-around-the-world-and-who-is-financing-it

[41] “World Energy Investment 2024: Overview and Key Findings”

[42] “World Energy Investment 2024: Overview and Key Findings”

[43] “World Energy Transitions Outlook 2024”

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Mannat Jaspal is currently serving as a Director & Fellow - Climate and Energy, at the ORF Middle East, UAE. Her research delves into the ...

Read More +

Professor Jesse Scott is a Senior Fellow at the Observer Research Foundation, as well as adjunct faculty at the Hertie School in Berlin since 2019. ...

Read More +