-

CENTRES

Progammes & Centres

Location

Grid connected battery energy storage system (BESS) is a technology option that can accommodate high share of renewable energy and contribute to grid stability. India’s proposed target of 500 GW (gigawatts) of renewable energy (RE) capacity by 2030 requires that intermittent solar is paired with BESS to supply power day and night and through summer, winter and monsoon. BESS is projected as the most suitable option for India because it requires short run flexibility that will align peak solar generation in the middle of the day with evening peak demand. The International Energy Agency (IEA) expects India to have about 140 GW of battery storage by 2040, the largest in any country. The government estimates that India will require 27 GW of grid‐connected BESS by 2030. A more recent academic study estimates that India will require 63GW/252 GWh (gigawatt hour) BESS to achieve the goal of 500 GW of solar energy generation capacity.

India got its first grid-scale advanced lithium-ion battery storage system in 2019 when a 10 MW (megawatt) / 10 MWh (megawatt hour) system offering one hour storage was deployed on Tata Power distribution networks in Delhi. The project by AES and Mitsubishi with energy storage technology and integration services provider Fluence, itself a joint venture of Siemens and AES initiated the process of investigating the optimal deployment of energy storage for the distribution of Tata Power’s 2,000 MW electricity network. In March 2021, Tata Power in collaboration with lithium-ion battery and storage company Nexcharge installed a 150 KW (kilowatt)/528 kWh (kilowatt hour) battery storage system offering six hour storage to improve the supply reliability at the distribution level and reduce peak load on its distribution transformers. The BESS systems designed to charge during the off-peak hours and discharge the power during peak hours, are expected to support the distribution transformers to manage peak load, regulate voltage, improve power factor, regulate frequency, settle deviations, support grid stabilisation, prevent overload of power transformer, manage reactive power and defer CAPEX (capital expenditure). More recently Tata Power Solar Systems received a letter of award from the Solar Energy Corporation of India (SECI) for the engineering, procurement and construction (EPC) of an INR 9.45 billion (US $126 million) 100 MW solar project with a 120 MWh battery in Chhattisgarh. It is too early to assess the success of these initiatives but developments in industrialised countries offer some lessons.

While there are several BESS systems operating in industrialised countries, the one that has grabbed consistent media attention is the Hornsdale Power Reserve (HPR) project in South Australia. HPR, a 100 MW/129 MWh system is the largest lithium-ion BESS in the world built by Tesla and operated by a French company. HPR that started operations in December 2017, was expected to provide two distinct services: 1) Energy arbitrage; and 2) contingency spinning reserve. In 2017, after a large coal plant tripped offline unexpectedly, HPR was able to inject several megawatts of power into the grid within milliseconds, arresting the fall in grid frequency until a gas generator could respond. By arresting the fall in frequency, the BESS was able to prevent a likely cascading blackout. But in September 2021, the Australian Energy Regulator (AER), the body that oversees the country’s wholesale electricity and gas markets, filed a federal lawsuit against the HPR for failing to provide “frequency control ancillary services” numerous times over the course of four months in the summer and fall of 2019. Another Tesla battery, the 300 MW BESS also in Australia caught fire in July 2021. In 2020 there were some high-profile safety-related issues with battery storage, including an explosion at an Arizona Public Service facility and multiple storage-related fires in South Korea.

Until 2019, technological optimism dominated the BESS market. Since then, concerns over reliability, safety and prospects for return on investment are being raised. According to an academic study, in competitive electricity markets investing in storage is not profitable but it increases consumer surplus, reduces electricity production cost and in certain cases reduces emissions. This means even in open competitive markets, policy must provide for subsidies or payment for capacity in BESS. In India, electricity markets are not competitive and implicit subsidies can be built into system costs. The BESS projects listed above are invariably funded by low-cost capital from international development agencies that are aggressively promoting decarbonisation in India. How this model will play out in the long run when BESS systems must be scaled up dramatically is unclear.

In India, thermal generators are currently utilised for providing ancillary support but they are classified as ramp-limited resources (RLRs) because they take time to ramp up and down but sustain energy output for indefinite periods. Batteries (stationary or in electric vehicles) and hydro generators are classified as energy-limited resources (ELRs) as they can respond at sub-second time intervals but cannot sustain energy output. The debate over uncontrollable (or weather dependent) RE which makes the provision of relatively expensive stand-by ancillary services necessary and controllable fossil fuel-based sources of energy is not new.

In 1867, Karl Marx observed that the energy sources powering industrialisation had to be ‘dependable, urban and completely under the control of man’. Dismissing the ‘horse’ as the worst form of energy, he observed that the horse had a head of its own, was costly to maintain and was limited in factory applications’. He also dismissed wind because it was ‘inconsistent and uncontrollable’. He had more charitable views on the kinetic energy of flowing water, but he noted that ‘it could not be controlled at will, failed at certain seasons and was essentially local’. Marx’s vote was for coal (with water in the steam turbine of Watt) which he said was ‘entirely under the control of man, mobile, and a means of locomotion, and also urban unlike wind and water that were scattered up and down the countryside.’

Marx’s observations on characteristics of energy such as ‘certainty’ ‘mobility’ and ‘controllability’ that would make certain sources of energy indispensable for industrialisation were accurate. Solar energy is the horse with a head of its own. But it is already urban (as opposed to being scattered up and down the countryside) because photovoltaic (PV) panels can convert sunlight into electricity from urban roof tops. The hope is that Elon Musk’s lithium-ion battery will tame the ‘uncertain and uncontrollable’ horse that is solar energy and make it mobile (in batteries).

But for this to happen, the cost of solar energy and storage have to fall at a rate predicted by Moor’s law. Gordon Moore, Co-founder of Intel, famously said in 1965 that the circuit density of semiconductors (made of high-grade silicon) will double every 18 months. Moore’s law as it has come to be known has proved to be true in the micro-chip industry. The number of transistors on a circuit has doubled almost every two years and the cost has fallen dramatically. In the last 50 years, the power of a given sized microchip has increased by a factor of over a billion, but the power output of a solar panel has merely doubled. From 1976 to 2019, the cost of PV modules dropped from US$106/watt to US$0.38/watt. This is nowhere near a Moore scale decline but impressive. Most of the cost declines of PV are on account of lower input material cost (solar grade silicon) and on account of increased scale of production (economies of scale), lower labour costs through manufacturing automation and lower waste from efficient processing. In other words, the cost declines of PV modules are the result of production experience and not the result of a breakthrough in fundamental physics. Solar has not managed to make a break-through on the scale of micro-chips because of fundamental technical limitations of crystalline silicon. Most projections for scaling up energy storage in batteries make optimistic assumptions of cost declines on a Moore scale. Unless this assumption proves to be accurate, projections for scaling up BESS will not materialise as the cost of storage will become an unsurmountable barrier for poor countries.

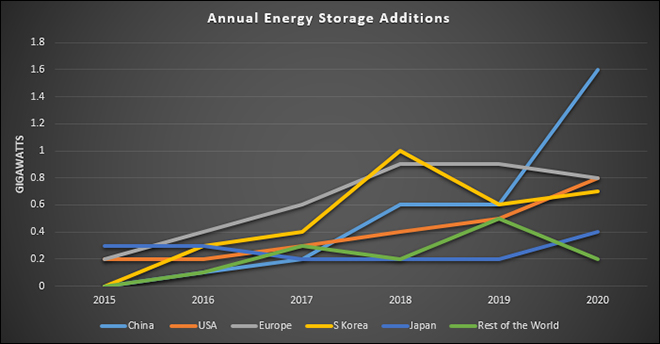

Source: International Energy Agency

Source: International Energy AgencyReliance Industries Ltd (RIL) is reaping the benefits of an increase in production from its oil and gas assets. The higher production from RIL-BP controlled Dhirubhai-6 (D6) block in the Krishna Godavari (KG) Basin will coincide with the government significantly hiking the price allowed for selling domestically produced natural gas. RIL’s share of production from the KG-D6 basin sequentially rose by 18.4 percent to 39.2 billion cubic feet equivalent (BCFe) during the quarter ending 30 September of the current financial year. This stood at 33.1 BCFe in April-June 2021. There was nil production from this asset in July-September 2020. The gas produced from this asset, awarded under the New Exploration Licensing Policy (NELP) regime, is priced in line with a government approved formula instituted in March 2016. The KG-D6 asset is enlisted under the Deepwater, Ultra Deepwater, and High Pressure-High Temperature area (collectively called difficult discoveries) category. This allows RIL and BP marketing freedom including pricing freedom, subject to a ceiling price on the basis of landed price of alternative fuels. The landed price is calculated once in six months and applied prospectively for the next six months. According to the Ministry of Petroleum and Natural Gas, the price data used for calculation of ceiling price in US$/million metric British thermal units (mmBtu) shall be the trailing four quarters data with one quarter lag. Under this pricing regime, RIL-BP was allowed to sell natural gas produced from KG-D6 subject to a price ceiling of US$3.62/mmBtu during the first half of financial year 2021-22 (till 30 September 2021). This drove up RIL’s revenue from the oil and gas business sequentially by 28.3 percent to INR16.44 billion (bn) (US$29 million) in Q2FY22. However, these earnings are expected to multiply when the year closes since the notified gas price ceiling has been almost doubled to US$6.13/mmBtu for the remaining six months of the current financial year. In addition to the existing production, first gas is expected from the KG D6 – MJ Field by Q3FY23. RIL-BP expects to produce 1 BCF of gas per day, in a phased manner, from the integrated development of KG-D6 by 2023. This will be approximately 25 percent of India’s production and 15 percent of demand.

India, grappling with its worst power crisis in five years, has asked Qatar to expedite delivery of 58 delayed liquefied natural gas (LNG) cargoes. Asia’s third largest economy is suffering its worst power shortage since March 2016 due to a crippling coal shortage amidst high global energy prices. Infrastructure maintenance at supplier Qatargas prevented it from delivering 50 LNG cargoes to India this year, prompting India’s oil ministry to write a letter seeking delivery of those cargoes. The ministry is also seeking eight additional cargoes which were delayed last year at New Delhi’s request after COVID-induced lockdowns lowered demand for the super-cooled fuel. India’s top gas importer, Petronet LNG, has long-term deals to buy 7.5 million tonnes per year (mtpa) of LNG from Qatar and 1.44 mtpa from Exxon’s Gorgon project in Australia. Indian customers in August started deferring imports of spot LNG due to high prices. As per Petronet LNG, the Indian power sector reduces its intake of LNG once prices rise above about US$10/mmBtu.

Torrent Gas Ltd has commenced supply of natural gas to domestic households and industries in Uttar Pradesh (UP)’s Gorakhpur town. The state’s Chief Minister inaugurated Phase 1 of the city gas distribution (CGD) network in Gorakhpur. Torrent Gas, the CGD utility of the diversified Torrent Group with group revenues of INR210 bn (US$2.8 bn), has been authorised by the Petroleum and Natural Gas Regulatory Board (PNGRB) to establish and operate the CGD network and provide compressed natural gas (CNG) and Piped Natural Gas (PNG) in 15 districts across UP, including Gorakhpur. Through this investment, Torrent intends to connect over 825,000 residences in UP with PNG supply and set up over 225 CNG stations in UP over the coming years.

India will bargain for supply of undelivered gas quantities of past years when it negotiates renewal of its multi-billion dollar LNG import deal with Qatar. Petronet LNG Ltd’s 7.5 million tonnes (mt) a year liquefied natural gas import deal with Qatargas is ending in 2028. Renewal, if any, has to be confirmed 5 years ahead of that. Talks for renewal will start next year and will be conditioned on Qatargas delivering in 2022 the 50 cargoes or shiploads of LNG that weren’t taken in 2015. As regards the cargoes that were not taken, it was decided that India can see the cargoes anytime during the remainder of the contract that ends in 2028. In case, Qatar is unable to meet the request, the deferred cargoes can be delivered in 2029.

According to Fitch Ratings, the 62 percent increase in natural gas prices by the Indian government will boost the profitability of upstream companies in the country and support their investment spending. The price for gas from fields that were assigned by the state to oil companies, mainly Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL), increased to US$2.90/mmBtu for October 2021-March 2022, from US$1.79/ mmBtu in the previous six months. Domestically produced gas is supplied on a priority basis to certain sectors, with 30 percent of it being consumed by power producers, around 27 percent by the fertiliser sector and 19 percent by city gas distributors in FY21. As per the Fitch, the gas price increase will hit the fertiliser sector's profitability by increasing working-capital requirements. The government also increased the price ceiling for gas produced from deepwater and other difficult fields to US$6.13/mmBtu from US$3.62/mmBtu.

CNG price in the national capital was increased by INR2.28/kg and piped cooking gas supplied to households by INR2.10 following a 62 percent hike in natural gas prices. This revision in prices would result in an increase of INR2.28 per kg in the consumer price of CNG in Delhi, and INR2.55/kg in Noida, Greater Noida and Ghaziabad. The new consumer price of INR47.48/kg in Delhi and INR53.45/kg in Noida, Greater Noida and Ghaziabad would be effective from 6.00 am on 2 October 2021. The price of CNG being supplied by IGL (Indraprastha Gas Ltd) in Gurugram would be INR55.81/kg; in Rewari INR56.50; Karnal and Kaithal INR54.70; Muzaffarnagar, Meerut and Shamli INR60.71; Kanpur, Fatehpur and Hamirpur INR63.97; and in Ajmer it would be INR62.41/kg from 6.00 am on October 2. The consumer price of PNG supplied to households in Delhi has been increased by INR2.10/standard cubic metre (scm) to INR33.01/scm. The applicable price of domestic PNG to households in Noida, Greater Noida and Ghaziabad would be INR32.86/scm.

Equinor ASA is boosting natural gas exports to ease Europe’s supply crunch, sacrificing some oil production in the process. The Norwegian giant has halted the re-injection of gas that had been used to boost oil output at the Gina Krog field, and will export the fuel instead. The company is ramping up production at other gas fields, including the giant Troll. The change at Gina Krog will provide an extra 8 million cubic meters (mcm) a day of gas. While this is a relatively small addition to Norway’s total supply, which exceeds 320 million cubic meters a day, every molecule of fuel will count in Europe this winter. The continent’s gas inventories are at their lowest seasonal level in at least a decade. Flows from its biggest supplier, Russia, are capped and competition with Asia for LNG cargoes is intense. As per the Equinor, both gas and oil prices will stay high this winter, assuming average weather conditions.

Algeria has decided to abandon the 11.5 bcm per year GME (Gaz Maghreb Europe) gas pipeline crossing Morocco to supply Spain and Portugal, due to tensions with Morocco. The country will now deliver natural gas to Spain exclusively through the 8 bcm per year Medgaz pipeline, which already operates at full capacity. Algeria is considering raising LNG exports to ensure gas supply to Spain and increasing the capacity of the Medgaz gas pipeline. In 2020, Algeria exported 8.7 bcm of natural gas via pipelines to Spain, accounting for about a quarter of the country's total gas imports, and 1.3 bcm to Portugal.

According Qatar’s Energy Minister, the current gas market condition is not a healthy one to be in and called on joint efforts towards energy transition. As per his view, it was time to "set aside emotions" and realise that a successful energy transition cannot be achieved by producers alone and that it must be a joint effort including end- users. The Minister, who is also the chief executive of state-owned Qatar Petroleum, the world’s top LNG supplier, said in September that current high gas prices reflect a lack of investment as well as a shortage of supply but he did not regard the situation as a crisis.

Reliance Industries Ltd (RIL) has exited all its business in the upstream oil and gas shale play that was based out of the United States (US). Reliance Eagleford Upstream Holding (REULP), a wholly-owned step-down subsidiary of RIL, announced the signing of agreements with Ensign Operating III, a Delaware limited liability company, to divest its interest in certain upstream assets in the Eagleford shale play of Texas, US. RIL had divested all of its interest in certain upstream assets in the Marcellus shale play of southwestern Pennsylvania. Those assets were sold to Northern Oil and Gas, (NOG), a Delaware corporation. In April 2020, the falling demand for crude oil in the US will adversely impact investments made by Indian companies in the shale business there. For RIL, its investment in US shale has been providing it negative returns on equity. When crude oil prices drop, production of alternative fuels like shale oil and gas becomes unviable.

According to Russia, Europe was to blame for the current energy crisis, after soaring gas prices spurred accusations that Moscow is withholding supplies to pressure the West. Russia is of the view that one of the factors influencing the prices was the termination of "long-term contracts" in favour of the spot market. European and UK gas prices surged by more than 25 percent, energised by soaring demand before the northern hemisphere winter. Critics have accused Moscow of intentionally limiting gas supplies to Europe in an effort to hasten the launch of Nord Stream 2, a controversial pipeline connecting Russia with Germany.

Major Chinese energy companies are in advanced talks with US exporters to secure long-term LNG supplies, as soaring gas prices and domestic power shortages heighten concerns about the country's fuel security. At least five Chinese firms, including state major Sinopec Corp and China National Offshore Oil Company (CNOOC) and local government-backed energy distributors like Zhejiang Energy, are in discussions with US exporters, mainly Cheniere Energy (LNG) and Venture Global. The discussions could lead to deals worth tens of billions of dollars that would mark a surge in China’s LNG imports from the US in coming years. At the height of a Sino-US trade war in 2019, gas trade briefly came to a standstill. LNG export facilities can take years to build, and there are several projects in North America in the works that are not expected to start exporting until the middle of the decade. Natural gas prices in Asia have jumped more than fivefold this year, sparking fears of power shortages in the winter. The new purchases will also cement China’s position as the world's top LNG buyer, taking over from Japan this year. According to a consultancy Poten & Partners, Chinese companies are heavily exposed to Brent-related pricing for LNG and the US purchases give some diversity to the pricing.

Pakistan accepted an LNG cargo at the highest-ever price of US$30.6 /mmBtu from Qatar Petroleum on the grounds of averting a possible gas crisis in the upcoming peak winter month. The Pakistan LNG Limited (PLL) had floated emergency bids for two cargoes to be supplied in November, as the firms involved, Gunvor and ENI, had defaulted on their commitments. The PLL has short- and long-term agreements with Gunvor and the ENI for one LNG cargo each every month, but both suppliers refused to honour their part of the agreements. As a result, the state-owned firm had to call a tender on emergency basis for two LNG cargoes for the months of December and January. The PLL has been facing criticism for lacking proper strategies and ensuring LNG supplies when its prices were low in the international market. At the same time the state-owned entities had restricted the private sector from importing LNG as it could challenge the monopoly enjoyed by the public sector.

Vietnam approved a US$2.3 bn LNG power plant due to be co-developed by Vietnamese and South Korean companies and to start commercial operations in 2026-27. The country’s demand for electricity is forecast to rise 10 percent annually in the coming years and its LNG imports will rise to 10 mt by 2030 and 15 mt by 2035. According to the Vietnam’s industry ministry, the country will begin importing LNG from 2022.

16 November: Amidst increasing demands to reduce taxes after reduction in excise duty on petrol and diesel by the Centre, the Congress government in Rajasthan announced slashing VAT (Value Added Tax) to make petrol and diesel cheaper by INR4 per litre and INR5 per litre, respectively, from midnight. The Centre on 3 November had cut excise duty on petrol by INR5 and on diesel by INR10 to bring down fuel rates in the country. Following the excise duty cut, BJP-ruled states, Punjab and Odisha had reduced VAT on fuel to further reduce the prices. Some Congress-ruled states, including Rajasthan, however, had not cut VAT and had demanded further reduction in central excise duty. After the Rajasthan cabinet meeting, Transport Minister Pratap Singh Khachariyawas said that the decision was taken to give relief to the public. He targeted the Modi government over the expensive petrol and diesel and alleged that the government was working to weaken states. Khachariyawas said that there should be a one nation one rate policy for petrol and diesel and the transportation cost should be borne by the Centre. He said that before Modi government came to power in 2014, the crude oil price in international market was US$111 per barrel and the rate of petrol in the country was INR61 per litre and INR59 per litre but when the crude oil price in international market is US$82 per barrel, the fuel in the country is expensive because the Modi government has increased excise duty by INR40-45 per litre in six years.

16 November: India's gasoil demand contracted by about a fifth during the first 15 days of November from the pre-COVID levels, after a festive season-led brief recovery last month, preliminary sales data of state-run refiners showed. India’s gasoil consumption, which accounts for about two-fifths of the country’s fuel demand, typically rises during a month-long festival season that ended with the celebration of Diwali as diesel-guzzling trucks hit the road and industrial activity gathers pace. Gasoil consumption totalled 2.43 million tonnes (mt) between 1-15 November, a decline of about 15.3 percent from last year and down 19.35 percent from the same period in 2019, the data showed. In contrast, gasoline sales continued to stay above pre-COVID levels, rising to 1.04 million tonnes (mt), as people continued to prefer using personal vehicles over public transport for safety reasons. Gasoline sales in the first half of November were up 1.2 percent from the same period in 2019 and rose by 0.5 percent from last year, the data showed. State retailers - Indian Oil Corp, Bharat Petroleum Corp and Hindustan Petroleum Corp - control about 90 percent of the fuel stations in the country.

15 November: India will have "massive additional" areas for oil exploration and production by 2025, Union Petroleum and Natural Gas Minister Hardeep Singh Puri said. India will double its oil and gas exploration acreage in the northeast part of the country. He said that India aims to expand its gas pipeline network to 34,000 km.

12 November: The government is pushing the public sector behemoth ONGC (Oil and Natural Gas Corporation) to involve private sector companies and service providers wherever possible to help raise oil and gas production, Petroleum Secretary Tarun Kapoor said. India is 85 percent dependent on imports to meet its oil needs, and a way to cut the high import bill is to increase domestic production. Discoveries that the company hasn't been able to develop or areas that it hasn't been able to explore are some of the examples where the ONGC can involve the private sector and foreign companies. ONGC, he said, should identify areas where it can get private sector expertise and efficiencies. Mumbai High, which was discovered in 1974, and B&S that was put into production in 1988 are ONGC’s mainstay assets, contributing two-thirds of its current oil and gas production. Without these assets, the company will be left with only smaller fields. In October 2017, the Directorate General of Hydrocarbons (DGH), the ministry’s technical arm, had identified 15 producing fields with a collective reserve of 791.2 million tonne of crude oil and 333.46 billion cubic meters of gas, for handing over to private firms in the hope that they would improve upon the baseline estimate and its extraction. A year later, as many as 149 small and marginal fields of ONGC were identified for private and foreign companies on the grounds that the state-owned firm should focus only on big ones. The first plan couldn’t go through because of strong opposition from ONGC. The second plan went to the Cabinet, which on 19 February 2019, decided to bid out 64 marginal fields of ONGC.

10 November: Bringing petrol, diesel and other petroleum products under the single national GST (Goods and Services Tax) regime will reduce taxes on these products and increase the revenue of both the Centre and states, Union Minister Nitin Gadkari said. Finance Minister Nirmala Sitharaman will definitely try to bring petrol and diesel under GST if she gets the support of the state governments, Gadkari said. The GST Council had decided to continue keeping petrol and diesel out of the GST purview, as subsuming the current excise duty and VAT into one national rate will impact revenues. Including petrol and diesel under GST will have resulted in a reduction in near record-high rates. Sitharaman had said the Council discussed the issue only because the Kerala High Court had asked it to do so but felt it was not the right time to include petroleum products under GST.

10 November: India’s top gas importer Petronet LNG will seek higher volumes at better prices from Qatar Gas during negotiations for an extension of its long-term liquefied natural gas (LNG) deal beyond 2028. Petronet and Qatar Gas need to negotiate the extension of their current deal for 7.5 million tonnes per annum (mtpa) of LNG by the end of 2023. Any extension of the deal would be based on recent contracts signed by Qatar Gas with China, Bangladesh and Pakistan, where gas prices are linked to a slope of about 10.2 percent of the Brent crude price on a delivered ex-ship basis. In contrast, India’s LNG deal with Qatar is based on a slope of about 12.7 percent of the three-month average Brent price. Gas demand in India is set to surge as the nation wants to raise the share of the cleaner fuel in its energy mix to 15 percent by 2030 from the current 6 percent. In the current scenario buying gas under long term contracts is the best bet. Gas under such deals is costing Petronet about $10.2 per million metric British thermal units (mmBtu), compared to spot prices of about $30 per mmBtu.

15 November: The combustion of coal, mainly in power plants followed by industrial and household settings, has resulted in an increase in the premature mortality rate in India and it needs to phase down from coal as its main source of energy and invest more on renewable and cleaner sources, according to the policy recommendations in "The Lancet Countdown on Health and Climate Change" report. Data from the 2021 global Lancet Countdown report shows that there has been a nine-percent increase in the number of deaths related to coal-derived PM2.5 in India in 2019 compared to 2015.

14 November: India’s coal import rose by 12.6 percent to 107.34 million tonnes (mt) in the first six months of 2021-22. The country had imported 95.30 mt of the coal in April-September 2020-21, according to provisional data compiled by mjunction services, based on monitoring of vessels’ positions and data received from shipping companies. Mjunction — a joint venture between Tata Steel and SAIL--is a B2B e-commerce company and also publishes research reports on coal and steel verticals. However, the country’s coal import dropped to 14.85 mt in September, against 19.04 mt in the corresponding month of previous fiscal, it said. Of the total import in September, non-coking coal was at 9.22 mt, against 11.97 mt imported in September last year. Coking coal import was at 4.27 mt, down from 4.58 mt imported in September 2020.

10 November: West Bengal Chief minister (CM) Mamata Banerjee announced a INR100 bn comprehensive compensation package for landowners, sharecroppers and industrial units coming within the command area of Deocha Pachami, the largest coal block in Asia located to the west of Birbhum. Banerjee said that the state government will invest INR350 bn for coal lifting in the Deocha Pachami block — spread over 3,400 acres of land having an estimated coal reserve of 1,198 million tonnes and 1,400 million cubic metre of basal deposits. Banerjee outlined a broad idea about the modus operandi of the state government in this coal mining project. The work will begin with the shallow mines spread over Dewanganj-Harisingha block.

14 November: The AP (Andhra Pradesh) government will apprise Union Home Minister Amit Shah of the outstanding dues to the tune of INR60.15 bn from Telangana power utilities during the 29th southern zonal council meeting in Tirupati. It will also request the Union government to prevail on Telangana and facilitate payment of arrears to APGenco at the earliest. As power generation in Telangana was not enough to meet the demand at the time of bifurcation, APGenco had supplied the deficit power to Telangana discoms. APGenco distributed 8,890 million units from 2 June 2014 to 10 June 2017 to Telangana as per AP Reorganisation Act, 2014. For the same, an undisputed due of INR34.41 bn and INR28.41 bn towards late payment surcharge, which is the cost of power supplied during that period, have remained unpaid. The two states agreed on payment of these dues on different occasions, including at a joint meeting between the power utilities of both states on 19 August 2019.

15 November: The state government has started preparing a 100 percent renewable energy plan with the assistance of the Union government to achieve the goal of cent percent use of renewable energy. Environment Minister Nilesh Cabral, in a letter to the Union government, stated that Goa is in the process of preparing a 100 percent renewable energy plan with assistance from the Union ministry of new and renewable energy (MNRE). Goa requires approximately 540 MW power during the day and 640 MW during peak hours, 6pm to 11pm. The government has notified a solar policy with 50 percent subsidy on benchmark cost. However, till date, only about 15 MW installations have been completed. The state government has decided to set up floating solar power plants at Selaulim, Amthanem, Anjunem and Chapoli dams on a design, build, finance and operate model for a period of 25 years and has invited expression of interest (EoI) for selection of solar power developers.

13 November: Indian Oil Corporation (IOC) and NTPC Ltd have signed an agreement for collaborating on renewable energy. NTPC Group posted a net profit of US$1.85 billion in FY21. It has also set an aim of a 10 percent reduction in net energy intensity. NTPC has an installed capacity of about 67 gigawatt (GW) across 70 power projects, with 18 GW under construction. It has set an ambitious aim of 60 GW renewable energy capacity by 2032 from the existing 4.7 GW. NTPC has won 4.32 GW of renewable energy bids since the last financial year. It plans to invest INR1 trillion between 2019 and 2024 to become a 130GW power producer by 2032.

12 November: Billionaire Gautam Adani said his logistics-to-energy conglomerate will invest US$70 billion over the next decade to become the world’s largest renewable energy company and produce the cheapest hydrogen on the Earth. Adani Green Energy Ltd (AGEL), the world’s largest solar power developer, is targeting 45 gigawatts of renewable energy capacity by 2030 and will invest US$20 billion to develop a 2 GW per year solar manufacturing capacity by 2022-23. Adani Transmission Ltd (ATL), India’s largest private sector power transmission and retail distribution company, is looking to increase the share of renewable power procurement from the current 3 percent to 30 percent by FY 2023 and to 70 percent by FY 2030. Adani Group already is the world’s largest solar power developer. Stating that green hydrogen, produced from renewable energy, is a miracle fuel and a miracle feedstock, he said India’s exponential growth in renewables, producing green hydrogen cheaply could transform the nation into a net exporter of green energy.

12 November: Daimler India Commercial Vehicles (DICV) announced that it aims to make its Chennai plant operations 100 percent CO2 (carbon dioxide) neutral by 2025 and it has unveiled a series of goals under ‘Seven Statements for Sustainability’, to reduce its carbon footprint and protect the local environment. In the first phase of the roadmap unveiling, DICV announced its goals for sustainability in operations, laying out initiatives planned to 2025 and beyond. DICV will also increase green cover density of Chennai plant by at least 10 percent by 2025 by planting mini forests of native trees and increasing bio-diversity and planting an additional 2,000 trees using organic farming methods. Some of the factory's existing sustainability initiatives include the installation of an energy-generation plant with over 10,000 polycrystalline solar power panels (compensates for around 3,300 tonnes of CO2 emissions/year) and a storage pond that holds more than 60,000 kilolitres of water.

11 November: By 2030, Kolkata will mostly run on non-fossil fuel, Kolkata’s outgoing mayor Firhad Hakim told an online meeting that connected Kolkata with the COP26 Climate Summit in Glasgow. From 2030, the city’s public transport will mainly run on CNG (compressed natural gas) and electricity. Already 100 e-buses are plying and another 1,000 will be added to the fleet soon, Hakim said. Hakim said the state government planned to set up 3,500 charging stations in greater Kolkata and promised that piped CNG would reach the city in two years. Kolkata is one of the more polluted cities in India and much of the filthy air is because of diesel-driven public transport. Environment experts said that the government had often not shown the promptness that Hakim promised to hold out.

16 November: The International Energy Agency (IEA) upped its average Brent crude oil price assumption for 2022 to US$79.40 a barrel, but predicted a rally may ease off as prices that hit a three-year high last month push up global production. The Paris-based IEA said that much of the uptick in supply is due to come from the United States (US). A hurricane battered the main US production and export hub in the Gulf coast in late August, but US output made up for half the increase in global oil production last month. But the IEA said in its monthly report that US production, despite climbing, would not return to pre-pandemic levels until the end of next year. It is due to account for 60 percent of non-OPEC+ supply gains in 2022. The IEA’s price assumption reflects forward prices for Brent crude. The agency does not always include a reference to price assumptions in its report, but does so when it considers the assumption important to understanding its oil supply and demand forecasts, the agency said. The IEA price assumption of US$79.40 a barrel for Brent in 2022 is US$2.60 higher than in the agency's last monthly report. The agency’s assumption for 2021 is US$71.50 a barrel.

16 November: Sri Lanka has temporarily shut its only oil refinery as part of efforts to manage dwindling foreign exchange reserves, the Energy Minister Udaya Gammanpila said, triggering long queues at petrol stations. The 51-year old Sapugaskanda Oil Refinery, which has a capacity of 50,000 barrels per day, was closed, he said. He said fuel imports would resume once the government was able to raise sufficient dollars but did not give details of a timeline. Sri Lanka is also attempting to negotiate a US$500 million credit line with India to buy fuel and boost reserves, which dropped to US$2.27 billion at the end of October. During the first nine months of 2021, Sri Lanka spent US$692 million on fuel imports, its highest import expenditure.

11 November: Brazil’s state-run oil company Petrobras signed a contract to sell its Shale Industrialisation Unit (SIX) for US$33 million to Forbes & Manhattan Resources, it said. The refining unit is in Parana state on one of the world’s largest reserves of oil shale, a sedimentary rock with organic matter that can be converted to oil and gas by heating. It is the third refinery Petrobras has sold in its divestment strategy that will in total sell eight refineries. Petrobras said US$3 million has been paid to guarantee the sale.

12 November: The Pakistan government has decided to continue gas supply to the power and fertiliser sectors, while domestic and industrial consumers will suffer shortages amidst a major gas shortfall in the country during the winter season. The Cabinet Committee on Energy decided supply of gas to “dedicated” consumers, including power and fertiliser plants, would remain stable.

12 November: Liquefied natural gas (LNG) distributor and importer ENN Natural Gas Co Ltd said it has received a license to supply LNG as a bunker fuel. The license, which is the first in China, will enable the company to become a LNG bunker supplier at the port of Zhoushan, said Ye Dongsheng, president of ENN Singapore at a recent bunkering conference at Zhoushan. As such, the firm will be expecting delivery of an 8,500 cubic-metre LNG bunkering vessel for supporting operations in 2022. ENN issued plans to purchase 90 percent of ENN Zhoushan held by ENN Technology, ENN Group and ENN Holdings via cash, and share issue. The acquisition will further expand the scale of ENN’s assets and also increase the company’s business layout in the field of natural gas.

15 November: China’s October coal output rose to the highest since at least March 2015, after Beijing approved a raft of coal mine expansions to tame record prices and boost supply. The world’s biggest producer and consumer of the dirty fossil fuel churned out 357.09 million tonnes (mt) of coal last month, up from 334.1 mt in September, data from the National Bureau of Statistics showed. Output over the first 10 months of 2021 was 3.3 billion tonnes, up 4 percent year-on-year. Since July, China has approved expansions at more than 153 coal mines, which could add 55 mt of coal output in the fourth quarter, the National Development and Reform Commission (NDRC) said. The central government, striving to put an end to power shortages, has also forbidden local governments to shut coal mines without authorisation and urged a restart at closed mines as soon as they have rectified any problems. The increase comes as India, backed by China and other coal-dependent developing nations, brokered a last minute amendment at the COP26 climate talks in Glasgow at the weekend to change the final wording of the agreement to "phase down" rather than "phase out" the use of coal. President Xi Jinping said that China will start cutting its use of coal from 2026. Thermal coal currently provides about 60 percent of the country’s electricity needs. China’s top planning body said that daily coal production had reached a record high of 12.05 million tonnes, after a cold snap a week earlier knocked daily output down by more than 1 mt. Spot thermal coal prices have fallen to about half their levels of a month ago at about 1,000 yuan (US$156.70) a tonne at northern ports, thanks to the raft of intervention measures rolled out by Beijing.

15 November: Indonesia’s coal consumption for power generation is likely to rise by 3.1 percent next year compared to 2021, amidst calls to pare back use of the fossil fuel. Indonesia is expected to use 119 million tonnes (mt) in 2022, up from the 115.6 million tonnes (mt) of coal set to be used this year. Coal demand by state utility Perushaan Listrik Negara (PLN) itself is expected at 68.43 mt next year, while 50.76 mt is likely to be used by independent power plants. Indonesia’s coal production and exports rose in the January to October period, the energy ministry said. Production through October rose 9.4 percent to 512 mt, up from 467.88 mt in the same period last year. January-October exports rose 36.6 percent to 367 mt from 268.62 mt last year. Indonesia, the eighth biggest emitter of greenhouse gas in the world, plans to phase out coal for electricity by 2056, as part of a plan to reach net zero carbon emissions by 2060 or earlier. However, the government in April raised its 2021 coal output target, raising questions about the country’s commitment to fighting climate change. Indonesia set its benchmark coal price at a record high US$215.01 per tonne on higher demand for winter.

16 November: China will encourage power consumers to trade directly with renewable power generators in cross-province spot electricity trading, and will gradually add bulk power users and power sellers into the trade. The announcement is part of a reply from the National Development and Reform Commission (NDRC) to the State Grid Corp which proposed a draft trading rule on cross-region spot power trading. The NDRC did not disclose the details of the proposed trading rule. China, the world’s biggest greenhouse gases emitter, has been striving to boost renewable power consumption as it has vowed to bring its carbon emissions to a peak by 2030. Currently, more than 60 percent of electricity comes from coal-fired power plants. As renewable power sources are mainly in the far-west part of the country, thousands of kilometres away from the major power consumers, the government is keen to encourage cross-region power trade. In 2020, cross-province power trading reached 558.75 billion kilowatt-hours, about 17.6 percent of China's total power trading, according to data from China Electricity Council.

15 November: RWE plans to invest €50 billion (US$57 billion) through 2030 to double its green energy capacity to 50 gigawatts (GW), as Germany’s largest power producer outlined its plan to become a global renewables heavyweight. The investment plan, unveiled and the largest in RWE's 123-year history, comes as rival utilities and cash-rich oil majors are muscling in on the renewables sector, all hoping to shift to wind and solar capacity and away from fossil fuels. RWE's strategy update follows a major restructuring that saw it take over the renewables activities of former division Innogy and E.ON, turning it into one of Europe’s largest renewables players in the process. RWE’s nuclear and coal-fired power plants in 2020 accounted for 31 percent of the group’s 40.7 GW total installed capacity.

10 November: Australia will set up a A$1 billion (US$740 million) fund to invest in companies to develop low-emissions technology, Prime Minister Scott Morrison said, as the country seeks to cut carbon emissions and hit net-zero targets by 2050. Under the plan, the federal government will commit A$500 million to the fund, matched by private investors, which will be used to back early stage companies in developing technologies including carbon capture and storage. The federal government will introduce legislation to establish the fund, in order to allow the Clean Energy Finance Corp to fund carbon capture and storage, which is not allowed under its existing terms. The move came a day after the federal government pledged A$178 million (US$132 million) to ramp up the rollout of hydrogen refuelling and charging stations for electric vehicles. Australia, heavily reliant on exports of coal and gas, has been targeting carbon capture and storage, and hydrogen development to help cut emissions, while still allowing for the use of gas and coal. Australia said it would target net-zero carbon emissions by 2050 to ease international criticism, but added it would not legislate the goal and instead rely on consumers and companies to drive emission reductions.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

For more energy insights follow the links below:

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.