-

CENTRES

Progammes & Centres

Location

Most climate scientists believe that carbon dioxide (CO2) emissions must be reduced by at least 50 percent by 2050 to avoid the most dangerous impacts of global climate change. To achieve this objective while also continuing with current lifestyles, countries must decarbonise by reducing the amount of CO2 emission intensity (CO2 produced for each unit gross domestic product

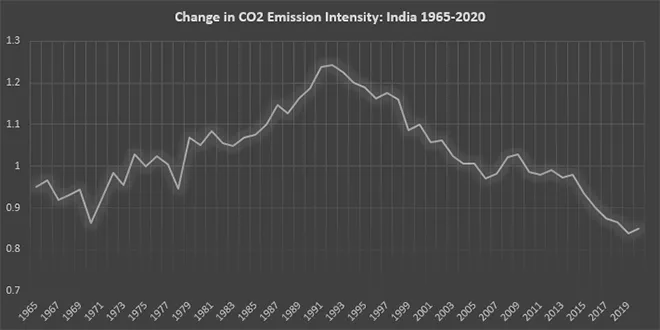

In 2010, India committed to a reduction of CO2 intensity by 20-30 percent of 2005 levels by 2020. This called for India to achieve an average reduction of over 2 percent in a year. India’s CO2 emission intensity fell from 1.005 in 2005 to about 0.849 in 2020 which is an annual decrease of nearly 1.03 percent and a total decline of over 15 percent (GDP in constant dollars). In 2015, India committed to reducing its CO2 intensity by 33-35 percent of 2005 levels by 2030 as part of its offer to the Paris Agreement. India is on course to achieve this target and if current trends in CO2 intensity decline continue, India is likely to overachieve the goal by a huge margin.

Some countries in Organisation for Economic Cooperation and Development (OECD) have achieved lower rates but this was not necessarily because of a shift towards alternative fuels or greater efficiency in using energy as a study on OCED countries that examined historic decarbonisation rates reveals. Structural changes in the economy played a part. Overall, the study shows that at a national scale, achieving a 4 percent per year or greater rate of decarbonisation is unprecedented in recent history. Decarbonisation rates sustained from 1971-2006 range across the 26 OECD nations from a 3.6 percent per year decline in CO2 emissions per unit of GDP in Sweden to a 0.7 percent per year increase in carbon intensity of the economy in Portugal. The un-weighted average rate for all 26 nations was 1.5 percent per year, only 16.5 percent faster than long-term global decarbonisation rates (1.3 percent per year).

Only five nations achieve sustained decarbonisation rates more than double the long-term global historic average: Sweden (at 3.6 percent per year), Ireland (at 3.2 percent), the United Kingdom (UK) and France (each at 2.8 percent), and Belgium (at 2.6 percent). Six other nations achieved rates between 50 and 100 percent greater than the global average rate: Germany (2.5 percent per year), the United States, Denmark, and Poland (each at 2.3 percent), Hungary and the Netherlands (at 2.0 percent).

In contrast to Sweden and France, Ireland and the UK relied principally on gains on energy intensity to drive overall de-carbonisation. Nearly 89 percent of decarbonisation in Ireland and 78 percent in the UKderive from reductions in energy use per unit of GDP. Normally, improvements in energy intensity are considered a proxy for improvements in end-use energy efficiency. This is not necessarily true. Changes in the sectoral makeup of a nation's economy can significantly impact the energy intensity of economic output, as relatively energy-intensive agriculture or industry gives way to services. Improvements in the energy efficiency of power generation technologies will show up as changes in energy intensity trends, even though such measures are related to energy supply-side policies and factors.

In the case of the UK, both forces were seen to be prevalent. Manufacturing as a share of UK GDP declined from 28 percent in 1971 to 11 percent in 2006, a 59 percent decline, nearly double the average decline for OECD nations. Imports as a share of UK GDP also rose notably, from 21 percent in 1971 to 30 percent in 2006, although this compares favourably to the climb in imports in other OECD nations over this period.

Additionally, the UK electricity mix shifted heavily from coal-fired power to natural gas in under the ‘dash for gas’ policy in the 1990s, after Margaret Thatcher decided to punish coal mining unions using the newly abundant production of North Sea gas fields. Owing to the lower carbon output of natural gas relative to coal, the ‘dash for gas’ initiative contributed to the decarbonisation of the UK energy supply, but it also helped drive energy intensity gains, as older coal-fired power stations were replaced by modern, combined cycle natural gas plants with operating efficiencies almost double that of an older coal-fired plant.

Similarly, Ireland underwent a substantial economic transition during the period 1971 to 2006. While manufacturing held a relatively constant share of Ireland's GDP over this period, the nation saw the share of GDP derived from the relatively energy-intensive agriculture sector fall from 15 percent in 1971 to just 1 percent in 2006. At the same time, the share of GDP from services other than retail and wholesale trade, restaurants and hotels roughly doubled in share, from 22 percent of Ireland's economy in 1971 to 41 percent in 2006. It is, thus, conceivable that sectoral economic transitions account for the large bulk of Ireland's improvement in energy intensity over this time.

Sweden and France achieve sustained accelerated improvements in the carbon intensity of energy supply of 2.5 percent and 2 percent per year, respectively, from 1971 to 2006, roughly double any other OECD nation over this period primarily through a shift in power generation from fossil fuels to nuclear power. Except Ireland, in no cases were sustained energy intensity improvement rates observed much more than 2 percent per year, with most nations experiencing rates ranging from 1 to 1.5 percent per year. These rates fall far short of the assumed global rates of energy intensity gains more than 2.5 percent per year in global mitigation predicted in the scenarios developed by the International Energy Agency.

Nations experiencing the fastest rates of energy intensity improvement are characterized more by significant shifts in the sectoral makeup of their economies, rather than the aggressive pursuit of energy efficiency measures, including Ireland, the UK, the US, and Poland. This indicates the substantial contribution of sectoral transitions to energy intensity improvement rates and makes it difficult to discern the impact of energy efficiency policy efforts on energy intensity trends. In India too, the structural composition of growth shifting away from industry and move towards less energy intensive services sector was among the key reasons for gains in CO2 emission intensity.

Looked at in isolation from the rest of the world the figures from OCED countries may give a false sense of optimism that de-carbonisation goals are within the realm of the achievable. But when we look at the world as a complete system it becomes clear that sectoral shifts from manufacturing to services in OECD countries was possible because of the export of carbon intensive manufacturing to the developing world. Japan had an explicit policy of locating heavily polluting industries in foreign countries. European Union (EU) reduced carbon dioxide emissions by 6 percent from 1990 to 2008 by exporting production to developing countries. In the same period EU import of embodied carbon from developing countries increased 36 percent. 18 percent of embodied carbon was through exports from China. The export of pollution does not contribute to an overall reduction in carbon emissions. It merely transfers carbon guilt from one country to another. But in a world which allocates carbon mitigation responsibility by country exporting pollution to another country appears to be a strategic means to score climate points.

Source: British Petroleum for CO2 emission; world bank for GDP; Note: GDP values used for arriving at CO2 intensity are in constant 2010 US $

Source: British Petroleum for CO2 emission; world bank for GDP; Note: GDP values used for arriving at CO2 intensity are in constant 2010 US $Coal India Limited (CIL) achieved highest ever coal off-take, production, and over burden removal (OBR), posting growths of 16.7 percent, 14.1 percent and 3.6 percent respectively in these performance parameters in July 2021. The company clocked 30.7 percent growth in supplies to the power sector during April- July period with a whopping 39 million tonnes (mt) increase, over the same period a year ago. Off-take to the power sector for July 2021 at 39 mt registered 17 percent growth compared to 33.3 mt that the company supplied during July 2020. CIL’s total coal off-take also increased by a staggering 46.7 mt during the first four months of the current fiscal, registering a 28.4 percent growth. CIL’s efforts to liquidate its pithead stock resulted in a reduction of 43.4 mt ending July, backed by increased appetite for coal.

Tata Steel has set up a 2 million tonnes per annum (MTPA) coal preparation plant at Jamadoba under its Jharia division. Tata Steel’s Jharia division has taken several initiatives of automation and digitalisation which has helped in improving operational excellence. Built from cutting-edge technology, the 2 MTPA coal preparation plant has been transformed from the oldest running washery in Asia (in operation since 1952) to one of the most modern washeries across the globe.

In a major move, Andhra Pradesh Mineral Development Corporation (APMDC) has set the stage to launch coal mining at Suliyari coal block in Singrauli district of Madhya Pradesh (MP). As per Department of Mines and Geology, Govt. of Andhra Pradesh this was the first time APMDC has begun coal exploration in other states. APMDC won Suliyari coal block spread over 1,298 hectors through an open bidding conducted by the Centre.

According to Union Coal Ministry there is no mandatory provision in the Mines and Mineral (Development and Regulation) (MMDR) Act to revise the coal royalty rates every three years though Odisha has been making the demand since long. The rate of coal royalty which is 14 percent at present, was last revised on 10 May 2012. Odisha government, during the 2020-21 financial year, had received coal royalty worth over INR 18.55 billion (US $252 million). Being a major coal-bearing state, Odisha has been continuously demanding revision of coal royalty alleging that it has been facing severe loss due to non-revision of the royalty for years.

The Union Cabinet approved a pact between India and Russia regarding cooperation on coking coal, a key steel making raw material, for which domestic players remain dependent on imports from a select group of countries. Around 85 percent of India’s coking coal demand is met through imports. The cooperation with Russia will help India reduce its dependence on far-located countries like Australia, South Africa, Canada, and the US) for sourcing of coking coal. It will also reduce per-tonne cost of steel production, as Russia is geographically closer compared to the said countries. The objective of the Memorandum of Understanding (MoU) is to strengthen cooperation between India and Russia in the steel sector. The activities involved in the cooperation are aimed at diversifying the source of coking coal. The pact shall benefit the entire steel sector by reducing input cost and cost of steel production in the country. It will also provide an institutional mechanism for co-operation in the coking coal sector between India and Russia.

Coal-fired power plants are proving hard to shut down in developing economies because they are cheap and convenient, but keeping them going is pumping out carbon dioxide at a rate far beyond the level needed to achieve net-zero emissions by 2050. Coal, which is being phased out of the power system in many industrialised nations, is still a vital fuel for generation in many developing economies and may remain so for decades to come. Countries outside the Organization for Economic Cooperation and Development (OECD), a grouping of mainly industrialised nations, accounted for 80 percent of worldwide coal consumption in 2019, the last year before the pandemic according to BP’s annual energy report. OECD countries relied on coal to meet less than 13 percent of their total primary energy in 2020. That figure rises to more than 21 percent in the non-OECD outside China and 57 percent in China itself. OECD countries obtained around 27 exajoules (EJ) of energy from coal, rising to 42 EJ in the non-OECD outside China, and another 82 EJ in China itself. For developing countries, coal-fired plants remain cheap to build and easy to add to grids that have limited capacity to cope with the intermittent generation of renewable power. In OECD economies, coal is rapidly being replaced by a mix of wind, solar, and gas-fired generation, aided by advanced grid management with battery storage being developed as a backup. Outside the OECD, especially outside China, newer forms of generation are spreading more slowly and coal remains in favour. Coal has become the default choice for the poor, and is set to remain so even as wealthier states shift to new technology. If OECD countries want to cut global coal combustion faster, they must provide more technical and financial help to non-OECD counterparts to overcome barriers and adopt new technology. For OECD policymakers and climate campaigners, the focus has been on restricting coal mine production and the provision of concessional finance to build new coal-fired power stations. Without that kind of assistance, coal-fired generation outside the OECD is unlikely to reduce significantly by 2050.

According to the National Development and Reform Commission (NDRC), China will release more than 10 mt of coal from state reserves to ensure steady supply to the market. The fifth such release this year will come from dozens of reserve hubs and key ports nationwide. The four previous releases this year totalled more than 5 mt. The NDRC in April urged power plants, coal miners and major coal transport hubs to boost reserves of the fuel because of concerns over tight supplies and an expected demand surge. It had vowed to build coal stockpiles to more than 120 mt in government-deployable reserves in 2021. Benchmark spot thermal coal prices soared as high as 995 yuan (US $153.89) a tonne in late June before the planner announced that it would release more coal reserves. China also increased coal imports in June to the highest level so far this year. The nation now has about 40 mt of coal in its reserve bases.

Buoyed by a rebound in the price of coal, Australian miners of the resource are dusting off expansion plans and raising capital for new projects and acquisitions. New Hope Corp, a major thermal coal producer, raised about Australian $200 million (US$152 million) whose use may include further growth expansion and opportunistic M&A activity. And Stanmore Resources’s majority owner, Singapore-listed Golden Energy and Resources (GEAR), will increase a loan facility to $70 million, partly to help the Australian coal miner advance its Isaac Plains project. New Hope and Golden Energy are seen by analysts and bankers as potential suitors for some of BHP Group’s Australian coal assets, including the Mt Arthur thermal coal mine and its stake in a steelmaking coal project with Japan’s Mitsui. Final bids are due for the assets in coming weeks, which BHP could sell separately or together. Australia’s Whitehaven Coal expected a government decision by 30 August on approval for its Vickery coal mine extension, after a court ruled in May that climate change factors must be considered in the decision. Whitehaven announced a 39.2 percent fall in fourth-quarter saleable coal production, hurt by downtime at the Narrabri mine following geological challenges and repair work.

Several labuorers trapped and allegedly a few killed following an explosion that happened inside a coal mine in Pakistan’s Balochistan province. The labourers were working inside the mine in the Marwar area of the provincial capital of Quetta when the explosion happened due to the accumulation of toxic gas inside the mine. Rescue operation to retrieve the trapped miners is underway. These coal mines are infamous for occasional blasts in which many people have lost their lives.

Indonesia set its coal benchmark price at the highest in more than a decade, the energy and minerals ministry document showed, supported by sustained demand from China. The energy and minerals ministry set the benchmark coal price at US $115.35 (INR 8481)/tonne in July, higher than the US $100.33 (INR 7377)/tonne in June and the highest since US $117.6 (INR 8647)/tonne in May, 2011. China unofficially banned imports from its top supplier Australia last year, with Chinese buyers informally told by custom officials not to purchase Australian coal. China signed a deal worth around US $1.5 (INR 110) billion to buy Indonesian thermal coal last year.

A 208-wagon coal train derailed in South Africa over the weekend partially shutting a rail line that links mines to the Richards Bay export terminal, hampering exports at a time of high coal prices. The coal train derailed near Vryheid in the northern part of the country’s KwaZulu-Natal province, the second derailment on the coal line this year. Companies including Exxaro Resources, Glencore and Anglo American's coal spin-off Thungela Resources export coal through the Richards Bay coal terminal. Thermal coal prices have surged to multi-year highs boosted by strong demand on the back of rebounding global economies and supply constraints, with local coal producers growing frustrated at logistics disruptions preventing them from taking advantage of the higher prices. South Africa exported 70.2 mt of coal through the terminal last year, with India and Pakistan being the largest importers.

According to the Energy Information Administration (EIA), US coal production fell in 2020 to its lowest level since 1965 due to low global demand in the wake of the coronavirus pandemic. As per the EIA, the pandemic slowed global demand for coal, and some US mines were idled for extended periods to slow the spread of the virus among workers, with exports declining significantly in April 2020. US coal-fired generation fell 20 percent year-on-year and exports were 26 percent lower in 2020 than in 2019. Coal production in Wyoming, where more coal is produced than in any other state, was 21 percent lower in 2020 than it was in 2019, while the second-largest producer West Virginia saw an annual slide of 28 percent. Coal had been the primary fuel for US power plants for much of the last century, but its use has been declining since peaking in 2007.

10 August: Prime Minister (PM) Narendra Modi launched Ujjwala 2.0—the second phase of the Pradhan Mantri Ujjwala Yojana (PMUY)—by handing over LPG (liquefied petroleum gas) connections in Mahoba in Uttar Pradesh, and said his government’s aim is to ensure that benefit of the country’s resources reach all. After the formal launch, the PM distributed free gas connections to 10 women virtually. Uttar Pradesh Chief Minister (CM) Adityanath handed over the documents to the women on behalf of the PM. During Ujjwala 1.0 launched in 2016, a target was set to provide LPG connections to 5o million women members of BPL households. Subsequently, the scheme was expanded in April 2018 to include women beneficiaries from seven more categories such as SC and ST communities and forest dwellers. Also, the target was revised to 80 million LPG connections. This was achieved in August 2019, seven months ahead of schedule. In the Union Budget for 2021-22, provision for an additional 10 million LPG connection under the scheme was announced. These 10 million additional connections under Ujjwala 2.0 aim to provide deposit-free LPG connections to those low-income families who could not be covered under the earlier phase of PMUY. Along with a deposit-free LPG connection, Ujjwala 2.0 will provide first refill and hotplate free of cost to the beneficiaries. The enrolment procedure will require minimum paperwork. In Ujjwala 2.0, migrants will not be required to submit ration cards or address proof, and a self-declaration will suffice. Ujjwala 2.0 will help achieve the PM’s vision of universal access to LPG.

Source: Business Standard

10 August: The government has granted auto fuel retailing licence to seven new entities including Reliance Industries Ltd (RIL) and a joint venture of Reliance and BP, Minister of State for Petroleum and Natural Gas Rameswar Teli said. The licences were given under a new liberalised rule that allows any entity with a minimum net worth of INR2.5 billion to apply for authorisation to retail petrol and diesel. RIL already had a fuel retailing licence, under which it had set up over 1,400 petrol pumps in the country. But this licence was transferred to its subsidiary Reliance BP Mobility (RBML). Besides doing away with the earlier requirement of investing INR 20 billion in oil and gas sector to be eligible for a fuel retailing licence, the new liberalised petrol pump norms require licensees to set up a minimum of 100 outlets with at least 5 percent of them in remote areas. State-owned oil marketing companies—Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL)—currently own most of the 77,709 petrol pumps in the country. BP had a few years back secured a licence to set up 3,500 pumps but has not yet started doing so. It has since decided to venture into the business with RIL with plans to scale up RIL's present network strength to 5,500.

Source: The Economic Times

9 August: India’s fuel demand rose 7.9 percent in July compared with the same month last year. Consumption of fuel, a proxy for oil demand, totalled 16.83 million tonnes (mt), data from the Petroleum Planning and Analysis Cell (PPAC) of the oil ministry showed. Sales of gasoline, or petrol, were 16.4 percent higher from a year earlier at 2.63 mt. Cooking gas or liquefied petroleum gas (LPG) sales increased 4.6 percent to 2.37 mt, while naphtha sales fell 5.3 percent to 1.21 mt. Sales of bitumen, used for making roads, were 3.8 percent up, while fuel oil use edged lower 5.1 percent in July.

Source: Reuters

7 August: Agartala, Gas leak from a pipeline of the ONGC (Oil and Natural Gas Corp) at Dhananjoynagar in South Tripura district triggered panic. Locals saw in the morning that gas was gushing out of the pipeline. A team of technical experts from ONGC was rushed to the spot and the leakage was plugged, bringing the situation under control.

Source: The Economic Times

9 August: A total royalty of INR79.3 billion was provided to states from coal mining during April-December 2020, Parliament was informed. A royalty of INR21 billion went to Jharkhand, followed by INR 15.75 billion to Chhattisgarh, INR 14.89 billion to Madhya Pradesh, and INR 11.65 billion to Odisha, Coal Minister Pralhad Joshi said. The 10 states that were provided royalty are Chhattisgarh, Jharkhand, Odisha, Madhya Pradesh, Maharashtra, Telangana, West Bengal, Assam, Uttar Pradesh, and Meghalaya.

Source: The Economic Times

8 August: India exported 8 lakh tonnes of coal to its neighbouring nations, including Nepal, in the fiscal year ended March 2021. Of the said quantity, the maximum 77.20 percent was exported to Nepal, followed by 13.04 percent to Bangladesh, according to the coal ministry’s Provisional Coal Statistics 2020-21. Coal was exported mainly to Nepal 0.618 million tonnes (mt), followed by Bangladesh 0.104 mt, it said. In FY21, import of raw coal of the country was 214.995 mt valued at INR 1,160.37 billion against import of 248.537 mt valued at INR 1,527.32 billion in 2019-20.

Source: The Economic Times

5 August: In a sign that economic activity is fast returning to normal levels after getting badly affected during the peak of second wake in April-May period, the country’s largest power exchange, Indian Energy Exchange (IEX) has reported a 37 percent growth in the volume of electricity traded at the exchange in July, 2021. The total volume of electricity traded at the exchange stood at 7322 million units in July 2021, 37 percent higher than the same month last year. Along with a pick up economic activity, competitive power prices coupled with flexible procurement and a diverse spectrum of market segments have enabled the exchange to increase trading of electricity. Besides, the exchange is also providing participants to accrue significant financial savings by securing electricity from the platform. According to the power demand data published by the National Load Dispatch Center, the national peak demand on 7 July at 200.6 GW was the highest ever, registering a 17.6 percent YoY increase while the energy consumption at 125.5 billion units grew 10.6 percent on a YoY basis. During the month, India's manufacturing PMI rose to a 3-month high at 55.3. With easing of lockdown restrictions, economic activities as well as power consumption accelerated. While the increase in power demand has been contributing to the electricity volume growth at IEX, the Exchange's role as the most flexible, competitive and transparent platform for power procurement for the distribution utilities and industries has been the most key aspect towards its increasing role and impact.

Source: The Economic Times

5 August: The average power supply per day was 22.17 hours in rural areas and 23.36 hours in cities during June 2021, Parliament was informed. As per independent surveys, the availability of power in rural areas has gone up from an average of 12 hours in 2015-16 to 20.50 hours in the year 2020; and in the urban areas, the availability of power has gone up to 22.23 hours, Power Minister R K Singh said. He said that under the Saubhagya scheme, as of 31 March 2021, all the states have reported 100 percent electrification of all the willing un-electrified households, identified before 31 March 2019. He said the present installed generation capacity in the country is around 384 GW, which is more than sufficient to meet the power demand in the country. The government has received a proposal from one of the states for a uniform power tariff throughout the country. The government is promoting competition through power exchanges. Most of the time, there is one rate for the power traded in the power exchanges for all the buyers in the country. Efforts are being made to increase the share of power purchases through power exchanges.

Source: The Economic Times

9 August: By next March, South Delhi Municipal Corporation is targeting to install solar panels at most of its schools, community halls and office buildings. The civic body claims it will generate a revenue of around INR90 million annually with the 13 MW solar panels, in addition to eliminating the electricity cost at the selected buildings. As of now, 209 school buildings have the solar facility to generate 73 lakh units of electricity and the total generation capacity stands at 9.3 MW.

Source: The Economic Times

9 August: Public sector hydropower major SJVN Ltd Chairman and Managing Director Nand Lal Sharma reviewed the operational performance of its two mega facilities—the 1,500 MW Nathpa-Jhakri Hydro Power Station and the 412 MW Rampur Hydro Power Station. He said that the SJVN has set record power generation from all its generating units, including renewable projects, in July with 1,580 million units surpassing the previous record of 1,563 million units during this month in 2020. He said that the SJVN operates all of its power stations with the highest level of competence of international standards.

Source: The Economic Times

7 August: India needs low-cost capital to help domestic entrepreneurs execute global scale projects in areas like green hydrogen, solar energy, electric vehicles and battery manufacturing, Niti Aayog CEO (Chief Executive Officer) Amitabh Kant said. He said India is in a very unique position in hydrogen and it should be moving towards green hydrogen in the oil refining and fertiliser sectors. He noted that the government has pushed for green energy and India is the fourth largest in the world in renewable energy installed capacity. He said as far as the net-zero emission target is concerned, the developed world has given itself more than 40 years, and seven years for transition. A very active campaign has been going on for the last two years to get every country to sign on to a net-zero goal for 2050. He said that India's per capita energy use is one-third of the global average but the country is the fourth largest emitter, so it will face pressure to accept some trajectory of emission reduction.

Source: The Economic Times

4 August: The Bengaluru Metro Rail Corporation Ltd (BMRCL) is making a fresh attempt to exploit the potential of solar energy at its properties by partnering with private firms. The corporation had announced similar plans in Baiyappanahalli and Peenya depots but the project did not take off. BMRCL confirmed that all stations proposed under Namma Metro’s Phase II, Phase II-A (Outer Ring Road) and Phase II-B (connecting airport) are designed for the installation of solar panels. The BMRCL’s annual report also states that the stations and depot areas will have solar-based power systems. Most Metro corporations across the country including New Delhi, Mumbai, Kochi, and Chennai have already installed solar plants in the stations and depots for drawing electricity to meet the day-to-day power demands for lighting and other auxiliary requirements.

Source: The Economic Times

10 August: Iraq plans to increase oil production to 8 million barrels per day (BPD) by the end of 2027, Iraqi Oil Minister Ihsan Abdul Jabbar said. The oil ministry said that oil-producing countries reconsidered their plans because of the challenges facing the oil market.

Source: Reuters

7 August: US (United States) energy firms added oil and natural gas rigs for the fifth time in six weeks although growth in the rig count over the past few months has slowed as drillers continue to focus on capital discipline despite firmer oil prices. The oil and gas rig count, an early indicator of future output, rose three to 491 in the week to 6 August, energy services firm Baker Hughes Co said in its closely followed report. US oil rigs rose two to 387, while gas rigs held steady at 103. Pioneer, the largest producer in the top US oilfield in the Permian Basin, this week forecast tepid shale growth in coming years. US crude futures were trading around US $68 a barrel, putting the contract down about over 7 percent due to worries that rising coronavirus cases will hurt oil demand. Even though oil prices were over 40 percent higher so far this year, most energy firms remain focused on returning capital to investors. Some, however, are raising spending in 2021 after cutting drilling and completion expenditures over the past two years.

Source: The Economic Times

7 August: Energy prices for millions of Britons are expected to rocket from October after the energy regulator Ofgem (Office of Gas and Electricity Markets) said it would increase its cap on the most widely used tariffs by about 12-13 percent, due to soaring global gas prices. A cap on electricity and gas bills came into effect in January 2019 and was aimed at ending what former British Prime Minister Theresa May called "rip-off" prices charged by energy companies. Ofgem said the rise was driven by a 50 percent increase in wholesale energy costs over the last six months. Ofgem said anyone worried about paying their bills should contact their supplier and said customers may be able to save money by shopping around for a new deal. Ofgem calculates the cap using a formula that includes wholesale gas prices, energy suppliers' network costs and costs of government policies such as renewable power subsidies. The cap is updated twice a year. Since the previous cap update announced in February many British wholesale gas contract prices have doubled. Gas prices have soared globally this year owing to factors including low stock levels, outages at gas plants and gas fields curbing domestic supply and imports from Norway while a buying spree in Asia has led to fewer international deliveries of liquefied natural gas (LNG). With wholesale energy prices accounting for about 40 percent of an average dual-fuel (gas and electricity) bill, Ofgem said there was no option but to make a significant increase to the cap. The price cap was originally due to end in 2023 but the government said last month it would prepare legislation to allow it to continue beyond this date.

Source: The Economic Times

9 August: Germany’s hard coal imports could rise to 35-36 million tonnes (mt) in 2021, coal importers group VDKi said. The final import figures could be affected by a whole range of variables. In January, VDKi had forecast that coal imports would fall to 26.7 mt this year in Germany—Europe’s biggest coal importer—citing lower coal usage by steelmakers during the COVID-19 crisis and price competition in power generation with gas and renewables. Coal burning for electricity rose by 35.6 percent year-on-year in the first half of 2021, the group reported last month, as cold weather and lower wind speeds increased the need for thermal generation to cover for wind power shortfalls. An increase in imports in 2021, if it materialised, would break a five-year pattern of consecutive annual falls, but the general trend to drive coal out of power generation in Germany remains firmly intact. Germany is also removing existing hard coal capacity from the market via subsidised closure tenders, while a different scheme with fixed compensations applies to domestically-mined brown coal-to-power stations.

Source: The Economic Times

6 August: China’s coal inventories have dropped to near historic lows since August due to peak summer electricity demand and transportation bottlenecks exacerbated by last month's severe floods and typhoon. To cope with tight coal supplies the government has rallied top miners, such as China National Coal Group and Jinneng Holding Group to ramp up supplies and also pledged to release more fuel from the state reserve. Coal stocks held by miners have fallen 26 percent year-on-year and inventories at key ports dropped 21 percent. As a result, spot thermal coal prices at northern ports hovered near record highs of more than 1,050 yuan (US $162.44) per tonne. Chinese coal consumption had in the first half of 2021 expanded by one-tenth over a year earlier to 2.1 billion tonnes.

Source: The Economic Times

5 August: Rescuers used helicopters and water cannon in a fitful fight to save a Turkish power plant from being engulfed by deadly wildfires testing the leadership of President Recep Tayyip Erdogan. Experts warn that climate change in countries such as Turkey increases both the frequency and intensity of wildfires.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

For more energy insights follow the links below:

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.