-

CENTRES

Progammes & Centres

Location

India’s nationally determined contribution (NDC) to the Paris Agreement (PA) with quantitative targets are to (i) reduce the emissions intensity of gross domestic product (GDP) carbon dioxide (CO2) emissions per unit of GDP> by 33 to 35 percent by 2030 from 2005 level (ii) achieve about 40 percent cumulative installed capacity for electric power generation from non-fossil fuel based energy resources by 2030 with the help of transfer of technology and low cost international finance including from the green climate fund (GCF) (iii) create an additional carbon sink of 2.5 to 3 billion tons of CO2 equivalent through additional forest and tree cover by 2030.

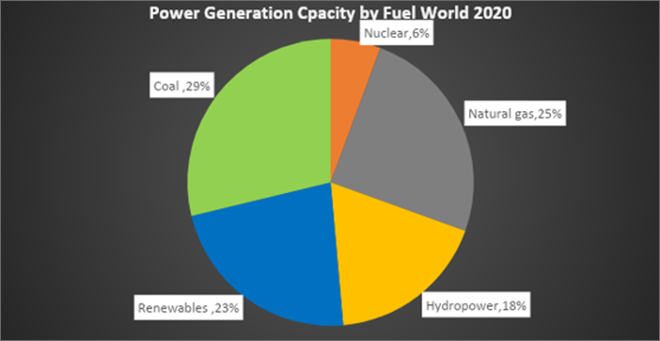

According to government data, India’s CO2 intensity in 2021 was 28 percent lower than the CO2 intensity in 2005. The target of 30-33 percent reduction in CO2 intensity compared to 2005 levels is thus within reach. In September 2021, India’s non-fossil fuel power generating capacity of 154,825 megawatts (MW) was about 39.8 percent of the total installed power generating capacity of about 388,848 MW. There is no doubt that the NDC target of 40 percent of non-fossil fuel generating capacity will be achieved almost a decade ahead of the deadline. New renewable energy (RE) capacity—excluding nuclear and hydro power— accounted for over 26 percent of total power generation capacity, the second largest share after coal. Solar, wind, small hydropower, biomass, and others accounted for over 65 percent of non-fossil fuel-based capacity while large hydropower 30 percent and nuclear just over 4 percent. India’s overachievement of its PA targets is not a surprise. In 2015, the carbon action tracker (CAT) observed that India will overachieve its energy and emission-related NDC targets for 2030 by a wide margin. According to a study of the group of 20 large economies’ (G20) progress towards meeting their NDCs, India, the third largest CO2 emitter was amongst the six countries on track to achieve their NDC targets and the only country endorsed by all seven of seven studies consulted that India would achieve its goals. To put this in perspective, a comparison with China and the USA, the largest and second largest emitters is warranted. Some studies conclude that China is on track to meet its NDCs while others say that there is only a 16 percent probability that it will hit the target. However, the CAT categorically states that China is on track to achieve its NDC goals by 2030 and is likely to overachieve its carbon intensity and non-fossil fuel share goals. In the case of the USA, most studies conclude that its current policy trajectory is more than 15 percent higher than its average unconditional NDC target. One recent study puts the probability of USA achieving the target at less than 2 percent. It must be noted here that the NDCs of the largest emitters are not necessarily comparable. India and China have only offered reduction of CO2 emission intensity rather than absolute reduction in CO2 emissions, but China has proposed a higher rate of reduction than India. Even when carbon intensity is reduced substantially, absolute levels of CO2 emissions of China and India will continue to increase. While China has indicated that its CO2 emissions will peak in 2030, India has not offered a peaking year. India’s goal of increasing its share of non-fossil fuels applies only to capacity for power generation and not to the share of power generated. In the case of China, the non-fossil fuel share applies to the entire primary fuel basket.

In 2015, when the PA was formulated, CAT rated India’s NDC pledges as ‘medium’, suggesting that they were in line with the effort sharing approaches that focus on equal cumulative per person emissions but also observed that they were at the least ambitious end of what would be fair contribution. CAT commented that this was not consistent with limiting warming to below 2°C unless other countries make much deeper reductions and comparably greater effort.

The most recent report from CAT rates India’s climate targets and policies as “highly insufficient,” indicating that India’s climate policies and commitments are not consistent with the Paris Agreement’s 1.5°C temperature limit. Using strong language, the CAT report declares that India must increase its unconditional NDC target to significantly reduce the speed of emissions growth and set an ambitious conditional target to curb its expected growth in emissions from its dependency on fossil fuels and begin the shift to a net zero economy with international support.

According to reports from the Government of India (GOI), the rate of decarbonisation will improve even under current policies. The Ministry of Finance (MOF) of the GOI observes that under current goals (CG) scenario, a reduction in emissions intensity of GDP by 58-59 percent over the 2005 levels in constant dollar terms by 2030 is possible. Under an aspirational goals (AG) scenario, a reduction of 60-61 percent over 2005 levels is achievable by 2030. The MOF has projected that 50 percent of power generation could come from non-fossil fuels—RE, nuclear, and hydropower—under the CG scenario which would increase to 56 percent under the AG scenario by 2030.

Globally, cumulative emission in 2100 is expected to be 2,083 Gt CO2 (Giga tons of CO2) if PA commitments are met. To have a 50 percent chance of limiting warming to 2°C, cumulative emissions would need to be reduced further to 1,579 Gt CO2. Assuming a constant rate of annual decline in global emissions, this would require that the annual rate of decline to be 1 percent to reach the NDCs, and 1.8 percent to have a 50 percent chance of staying under 2°C. While the average rate of decline would need to increase by 80 percent, this does not mean that the NDCs would need to increase by as much. According to detailed country-wise analysis, the needed increase in the NDCs for the largest emitters, is 7 percent for China, 38 percent for the USA and 55 percent for India. This means that India needs to increase its 30 percent carbon intensity cut target to over 46 percent which can be achieved even under the CG scenario.

India was deliberately not ambitious in setting its NDCs for the PA because the government did not aim for a “temperature goal” but a “best effort” path keeping in mind the development imperatives of the country. Now that India has overachieved its best effort targets, it is probably time to better its best effort and ratchet up its NDCs.

Source: Central Electricity Authority

Source: Central Electricity Authority Source: World Energy Outlook 2021

Source: World Energy Outlook 2021The All-India Power Engineers' Federation (AIPEF) opposed the Union government’s order to link 33 kilovolt (kV) sub-stations with the power grid, saying it is an "attempt towards privatisation" of the electricity sector through the "backdoor". The country’s power engineers will "oppose tooth and nail" the move of the Union government. The order of Union government dated September 1 sent to state government directs that all the 33 kV power sub-stations running under electric distribution companies of the state and their network will be merged with transmission companies. The order also envisages to form a joint venture of the state’s transmission companies and the central government’s power grid. Orders to power grid on these lines have already been issued by the union government. West Bengal is opposing the draft Electricity Amendment Bill 2021 because the present Electricity Act provides for more than one discom (distribution company) operating in one area and cited Mumbai as an example.

RPSG group flagship CESC would focus on distribution for growth as electricity generation, especially thermal power, but it will not remain its core area of focus. The group made it clear that the company will be a greener one and regressive thermal power will not be the growth driver. Most of the subsidiaries of CESC which are in distribution business have made a turnaround except the one in Kota, Rajasthan. Recently, Eminent Electricity Distribution, the power distribution arm of RPSG group, had its own distribution licence for Chandigarh beating the likes of Tata Power, Adani, NTPC, Vedanta and others. The company was floated after consolidating all non-Kolkata power distribution business of the company earlier this year as part of the group restructuring of the distribution business. Besides Kolkata, different subsidiaries of CESC had distribution licences in other cities. These include Noida, Malegaon, Kota, Bharatpur, Bikaner. Chandigarh would be the latest addition in the list. The RPSG group had planned to demerge CESC’s distribution and generation business as well along with other businesses but later that plan was put on hold following regulatory issues.

In a sign that economic activity is fast returning to normal levels after getting badly affected during the peak of second wake in April-May period, the country’s largest power exchange, Indian Energy Exchange (IEX) has reported a 37 percent growth in the volume of electricity traded at the exchange in July 2021. The total volume of electricity traded at the exchange stood at 7322 million kWh in July 2021, 37 percent higher than the same month last year. Along with a pickup economic activity, competitive power prices coupled with flexible procurement and a diverse spectrum of market segments have enabled the exchange to increase trading of electricity. Besides, the exchange is also providing participants to accrue significant financial savings by securing electricity from the platform. According to the power demand data published by the National Load Dispatch Centre, the national peak demand on 7 July at 200.6 GW was the highest ever, registering a 17.6 percent YoY increase while the energy consumption at 125.5 billion kWh grew 10.6 percent on a YoY basis. During the month, India's manufacturing PMI rose to a 3-month high at 55.3. With easing of lockdown restrictions, economic activities as well as power consumption accelerated. While the increase in power demand has been contributing to the electricity volume growth at IEX, the Exchange's role as the most flexible, competitive and transparent platform for power procurement for the distribution utilities and industries has been the most key aspect towards its increasing role and impact.

India’s power consumption grew 18.6 percent in August to 129.51 billion kWh and remained higher than the pre-COVID level due to improved economic activities amid easing of lockdown curbs by states, according to power ministry data. The country’s power consumption in August last year stood at 109.21 billion kWh, lower than 111.52 billion kWh in the same month in 2019, as per the data. The commercial and industrial power demand and consumption got affected from April onwards this year due to lockdown restrictions imposed by states to contain the deadly second wave of COVID-19. Peak power demand met or the highest supply in a day stood at 196.24 GW in August, which is 17.1 percent higher compared to a year ago. The peak power demand in August 2020 stood at 167.52 GW, lower than 177.52 GW in the same month in 2019, showing the adverse impact of the pandemic on power demand. The government had imposed a nationwide lockdown on 25 March 2020 to contain the spread of coronavirus. The lockdown was eased in a phased manner, but it hit the economic and commercial activities and resulted in lower commercial and industrial demand for electricity in the country. April 2021 saw year-on-year growth of nearly 38.5 per cent in power consumption. The second wave of COVID-19 started in the middle of April this year and affected the recovery in commercial and industrial power demand as states started imposing restrictions in the latter part of the month. After a gap of six months, power consumption had recorded 4.6 per cent year-on-year growth in September 2020, and 11.6 percent in October 2020. In November, power consumption growth slowed to 3.12 percent, mainly due to early onset of winters.

Power demand across Gujarat soared to a record high, thanks to the increased consumption of electricity in the agriculture sector amid the stalled monsoon. With more and more farmers drawing groundwater using pumps to save their crops, the electricity demand from the agriculture space, too, has reached near its all-time high level. The state’s maximum power demand stood at 19,431 MW, which is the highest so far, shows the daily data compiled by the Western Region Load Dispatch Centre (WRLDC), which is a central government entity. Previously, the power demand had touched a high of 19,360 MW in April this year. The surge in demand is primarily attributed to the growing usage of electricity by farmers for irrigation purposes. The state government also raised the time for supply of power to farmers to 10 hours a day, which has also contributed to the higher consumption.

The West Bengal Power Development Corporation Ltd (WBPDCL) has generated 23,874.2 million kWh in 2020-21, the highest since inception, and registered a record profit of INR 2.52 billion in the same period despite the pandemic and lockdown. Its Bakreswar and Santaldih plants were ranked third and eighth respectively by Central Electricity Agency. More than 100 percent ash utilisation has been achieved at Santaldih, Kolaghat and Bandel power stations during the financial year.

The ministry of power has started working on the plan to ensure 24-hour electricity availability in all the villages. In 2015, only 10 to 12 hours of electricity was available in the villages. In urban areas of the country, electricity is available 24 hours at some places and work is on to ensure power availability for 24 hours. There is a demand of 200,000 MW power in the country while the total power generation capacity has reached 3,84,000 MW.

The average power supply per day was 22.17 hours in rural areas and 23.36 hours in cities during June 2021, Parliament was informed. As per independent surveys, the availability of power in rural areas has gone up from an average of 12 hours in 2015-16 to 20.50 hours in the year 2020; and in the urban areas, the availability of power has gone up to 22.23 hours. Under the Saubhagya scheme, as of 31 March 2021, all the states have reported 100 percent electrification of all the willing un-electrified households, identified before 31 March 2019. The present installed generation capacity in the country is around 384 GW, which is more than sufficient to meet the power demand in the country. The government has received a proposal from one of the states for a uniform power tariff throughout the country. The government is promoting competition through power exchanges. Most of the time, there is one rate for the power traded in the power exchanges for all the buyers in the country. Efforts are being made to increase the share of power purchases through power exchanges.

Tata Power and Adani Group have been told to submit revised bids for Southeast UP (Uttar Pradesh) Power Transmission Company by the power transmission company’s lenders. Tata Power and Adani had submitted binding offers for the company in the second week of August alongside three other bidders – Power Grid Corporation of India, Sterlite and REC Power Development and Consultancy. However, both of their offers were conditional on lenders securing reversal of a suspension order on a 1,600-km project the company is carrying out, imposed by the state power transmission authority for delays in completion.

The Delhi government is planning to create a 600 MW network of ‘power banks’ around the national capital on the lines of the 10 MW ‘Battery Energy Storage System’ created by Tata Power Delhi Distribution Limited (TPDDL) plant in northwest Delhi’s Rohini. The Rohini facility costs around INR 550 million, but Delhi government is looking to reduce costs by innovating further.

BHEL (Bharat Heavy Electricals Limited) has played a key role in the successful implementation of ultra-high voltage direct current (UHVDC) link between the western and southern region grid. According to the company, the project will bring relief to the power deficit southern grid. BHEL, in partnership with Hitachi-ABB Power Grids Limited, had secured this landmark order from Power Grid Corporation of India Limited in 2016. Significantly, this is the second ultra-high voltage direct current (UHVDC) transmission project by BHEL. Prior to this, it had successfully executed, the first of its kind in the world, Agra Converter Terminal for North-East Agra +800 kV, 6000 MW, Multi-Terminal HVDC link in September-2016 (Bipole-1) and September-2017 (Bipole-2). BHEL has been associated with HVDC projects in India since their inception by establishing the first HVDC link in the country between Barsoor (Chhattisgarh) and Lower Sileru (Andhra Pradesh).

About 92 percent of the total farmers in Andhra Pradesh have given their consent to the power utilities to implement the DBT (direct benefit transfer) scheme and signed agreements for the installation of meters in the farmlands, according to the state energy department. Under the DBT scheme, the government will deposit the entire amount of electricity bill(s) into the accounts of farmers, and the farmers would pay to the discoms (distribution companies). The state government has introduced the DBT for the free power scheme, which the Union government also suggested implementing to improve the quality of power with accountability. The DBT scheme, which was implemented as a pilot project in Srikakulam district, was successful with 98.6 percent of the farmers giving their consent voluntarily. As of now, there is no practical assessment or accurate measurement of the electricity load in the agriculture sector in the state.

Youth Congress activists protested in Aizawl over the steep hike in power tariff. They accused the government of robbing the people by hiking power tariffs and issuing bogus power bills. The government has hiked power tariff by 20.7 percent, which came into effect in April, at a time when people are facing hardship and livelihood crisis due to the pandemic. Power bills issued in August were mostly high and some poor families, who consumed very fewer kWhs of electricity were asked to pay consumption charges ranging from INR10,000 to INR100,000.

According to the Indian Energy Exchange (IEX), the electricity market achieved a new milestone with a record all-time high monthly volume of 9,538 million kWh in August, achieving 74 percent year-on-year growth. The national peak demand at 196 GW saw an increase of 17 percent while energy consumption at 129.51 billion kWh also grew 17 percent. The market, however, continued to work uninterrupted facilitating the distribution utilities and industries in addressing the increased power demand in the most flexible, competitive, transparent and efficient manner. The day-ahead market traded 6,649 million kWh volume during August with average price of electricity at INR 5.06/kWh marking 48 percent growth.

The power ministry has decided to issue a statutory order allowing about 4,400 MW capacity of two plants run by Tata Power and Adani Power at Mundra in Gujarat to sell electricity on the power exchanges for a month. About 3,200 MW capacity of Tata Power’s Mundra Ultra Mega Power Project and nearly 1,200-MW of Adani Power’s project at the same location will be allowed to run and sell on the power exchanges to ease the electricity supply and also take pressure off the domestic coal based plants. The projects of total 8,000 MW capacity on India’s western coast have imported coal stocks but were not operating fully in the absence of compensation for high fuel cost.

The union power ministry has set up a regulatory compliance division to monitor the various regulatory parameters and their compliances by power distribution companies (discoms) as well as state commissions. The ministry will soon have a separate wing to watch over compliance by all regulatory commissions. The forum of regulators resolved to prepare norms on various regulatory parameters and issues. The ministry is working on resource adequacy guidelines and guidelines for procurement of power in line with load fluctuation requirement, contract-term, energy mix, and renewable obligations etc. Both guidelines are expected in the next two to three months.

Government’s think tank NITI Aayog has valued state-owned power generation assets at INR 398.32 billion which can be monetised by the financial year 2025, according to the National Monetisation Pipeline (NMP). The finance minister announced a INR 6 trillion NMP that will look to unlock value in infrastructure assets across sectors ranging from power to road and railways.

The high court (HC) commenced the final hearing in a batch of petitions filed by renewable energy companies having power purchase agreements (PPAs) with the Andhra Pradesh government. The power companies had moved the high court challenging the single judge order directing them to negotiate the power tariffs with Andhra Pradesh Electricity Regulation Commission (APERC). The government, through a GO in 2019, had constituted a price negotiation committee to review power tariffs in the state. It proposed to reduce power tariffs as per prevailing market prices and formed the committee to negotiate the same with power generation companies. The power companies moved the high court challenging the GO, contending that the PPAs cannot be reviewed as they were finalised through a competitive bidding. They also argued that formation of the price negotiation committee was in violation of Electricity Act. Considering the arguments, the high court set aside the GO and directed the companies to negotiate power tariffs with the APERC. The court also directed to pay the tariff derived by the state government subject to outcome of APERC proceedings over fixation of tariffs. The companies again moved appeal petitions challenging the order.

The UP (Uttar Pradesh) government’s decision to reduce cross-subsidy charges on procuring power through power exchanges will help the industry to bring down its operational costs according to the Indian Energy Exchange Ltd (IEX) said. The Uttar Pradesh Electricity Regulatory Commission (UPERC) in a tariff order dated 29 July, 2021 announced reduction of up to INR 0.64/kWh in the cross-subsidy charges on procuring power through power exchanges. Energy marketplace IEX enables almost 4,500+ commercial and industrial consumers located across India to leverage open access through the exchange platform to procure electricity at attractive prices and accrue operational efficiency as well as the financial savings. Uttar Pradesh Power Corporation Ltd is drafting a proposal for a one-time settlement (OTS) scheme for consumers in rural as well as urban areas. If all goes as per plan, the scheme will be launched by September-end. The scheme is also likely to cover farmers who have tube wells in the 5 KVA load category. According to the UP government, consumers should be given waiver on late fee surcharge as many faced financial constraints during coronavirus pandemic. The scheme is likely to give relief to middle-class consumers, both urban and rural, who have a connection of less than 5 KVA load. The OTS scheme will only be availed through an online process to avoid any discrepancy in future. The scheme would be open to the public for 15 days and only those consumers who get themselves registered online by paying a minimum amount between INR1,000 and INR2,000 would qualify for the scheme.

According to Iraq’s electricity ministry Iranian gas supplied to the central and southern regions was reduced to 8 million cubic metres per day from 49 million, causing a risk of serious power shortages. The electricity ministry has been in contact with the Iranian energy ministry and Iran’s embassy in Baghdad to clarify the reasons for the reduction. A reduction in Iranian gas supplies led the Iraqi national power system to lose about 5500 MW.

Kuwait plans to attract outside investors to fund several power projects under a public-private partnership programme that will cover more than half of its future electricity needs over the next two decades. About 7,500 MW of the 14,000 MW it needs over the next 20 years will come through these partnerships, which industry sources say will require investments of billions of dollars. The projects under the public-private partnership (PPP) umbrella include the Al-Zour 2 & 3 plant, which has a capacity of 2,700 MW; Al-Khiran, with 1,800 MW of capacity; and Al-Shaqaya and Al-Debdiba, with a combined capacity of 3,000 MW. Kuwait’s electricity capacity is estimated at 17,000 MW, and about 14,000 MW are scheduled to be added over the next twenty years.

Rescuers used helicopters and water cannon in a fitful fight to save a Turkish power plant from being engulfed by deadly wildfires testing the leadership of President Recep Tayyip Erdogan. Experts warn that climate change in countries such as Turkey increases both the frequency and intensity of wildfires.

Tropical Storm Henri made landfall near Westerly, Rhode Island, USA with winds of 60 mph leaving thousands without power. Tropical storm warnings were extended from coastal Connecticut and Rhode Island to the luxurious oceanfront estates of the Hamptons on the eastern end of Long Island, New York, with over 100,000 power outages reported for customers up the northern East Coast, most in Rhode Island.

18 September: Petroleum products will not be included under the Goods and Services Tax (GST), Union Finance Minister Nirmala Sitharaman said. Sitharaman announced a reduction in GST rate on biodiesel, which is supplied to oil marketing companies for blending with diesel, from 12 percent to 5 percent.

Source: The Economic Times

16 September: India’s gasoil consumption slowed in the first half of September from the previous month, staying below pre-COVID levels as a pick-up in monsoon rains hit mobility and demand for fuel from the agriculture sector, preliminary sales data showed. Diesel sales by the country’s state fuel retailers came in at 2.1 million tonnes (mt) during 1-15 Sepember, a decline of about 1.5 percent from last year and down 6.8 percent from the same period in 2019, the data showed. State retailers Indian Oil Corp, Hindustan Petroleum Corp and Bharat Petroleum Corp Ltd own about 90 percent of the country’s retail fuel outlets. Sales of gasoil, which accounts for about two-fifths of India’s overall refined fuel consumption, are directly linked to industrial activity in Asia's third-largest economy. In contrast, gasoline sales stayed above the pre-COVID levels at 1.02 mt as people continued to prefer using personal vehicles over public transport and shared mobility for safety reasons. India has not yet fully opened its public transport sector, which mostly use diesel. September gasoline sales were up 8.3 percent from the same period in 2019 and rose by 3.4 percent from August, the data showed.

Source: The Economic Times

18 September: PNGRB (Petroleum and Natural Gas Regulatory Board) invited bids for giving out city gas retailing licence in 65 geographical areas (GAs) including Jammu, Nagpur, Pathankot and Madurai. Bids for the 65 GAs being offered in the 11th city gas licensing round are due on 15 December, PNGRB said. Presently, there are 228 geographical areas authorised by PNGRB in 27 states and UTs covering approximately 53 percent of the country's geographical area and 70 percent of its population. In the last city gas distribution (CGD) bidding round - the 10th CGD bidding round, 50 GAs were authorised for the development of CGD network. In the present round, 203 districts clubbed into 65 GAs are being offered. During 2018 and 2019, PNGRB gave out licences to retail CNG to automobiles and piped cooking gas to household kitchens in 136 GAs. This extended coverage of the city gas network to 406 districts and around 70 percent of the country’s population. The push for city gas expansion is part of the government's plan for raising the share of natural gas in the country's energy basket to 15 percent by 2030 from the current 6.3 percent. The 65 GAs to be bid out in the 11th CGD bidding round include Jammu, Udhampur, Samba and Kathua districts in the Union Territory of Jammu and Kashmir.

Source: The Economic Times

15 September: The compressed natural gas (CNG) sales in Gujarat contracted by 13 percent in 2020-21 as its consumption reduced due to the restricted vehicular movement following the imposition of curbs to tackle Covid. The provisional sales of CNG in the state declined to 6.49 lakh metric tonnes in April-March 2021 as compared to 7.45 lakh metric tonnes in April-March 2020. This is revealed in the data compiled by the petroleum planning and analysis cell (PPAC) of the Union ministry of petroleum and natural gas. City gas distribution (CGD) players attributed the reduction in CNG sales to the Covid-induced restrictions, especially the nation-wide lockdown imposed in the first quarter of the fiscal 2021. In fact, CNG sales were down 32 percent in the first two quarters of 2020-21. The CNG sales in the state are primarily driven by autorickshaws, school vans, public transport, and cabs, including those operated by aggregators. According to Crisil Ratings, sales volume of city gas is set to soar 25-27 percent in 2021-22. This includes CNG used by vehicles and piped natural gas (PNG) used by homes and industries.

Source: The Economic Times

16 September: Coal India Ltd (CIL) warned the adviser to the federal power ministry in February of an impending fuel shortage as utilities tapped inventories and curbed purchases despite rising coal-fired power output, documents show. India, which has the world’s fourth largest coal reserves, is facing a shortage of the fuel and has urged utilities to import coal as supplies at several plants run low. CIL generally asks utilities to stock up before the annual monsoon season when rains squeeze output and make transport more difficult. But the company was more worried this year as coal-fired power output picked up with coronavirus-related restrictions easing, while utilities tapped stockpiles instead of buying fresh supplies, CIL said. Coal-fired power output grew nearly a fifth during the first eight months of 2021, outpacing overall generation growth of 13.2 percent. Coal accounts for more than 70 percent of India’s power capacity.

Source: The Economic Times

19 September: A Calcutta High Court (HC) division bench upheld a single-bench order on payment of dearness allowance to employees of state-run power utilities. West Bengal State Electricity Distribution Co Ltd (WBSEDCL) and West Bengal State Electricity Transmission Co Ltd (WBSETCL) were told to pay DA in accordance with the central rate between 2016 and 2019, with an additional 10 percent interest on the dues. The payout will amount to a few hundred crores.

Source: The Economic Times

18 September: The power ministry has directed setting up of District Level Committees to exercise oversight over all power-related schemes of the Central government, as also its impact on the people. This is being done in order to ensure the involvement and oversight of the people in the process of power sector reforms, and their implementation in the country, the ministry said. According to the ministry order, the committee of a district will meet at district headquarters at least once in three months to review and coordinate overall development of power supply infrastructure in the district.

Source: The Economic Times

17 September: The Supreme Court (SC) has issued notice to Adani Power while allowing a rare curative petition filed by Gujarat Urja Vikas Ltd (GUVNL) against an order passed in July 2019 letting the company terminate a power purchase agreement. The curative order comes as a major relief to the Gujarat utility as according to industry estimates the payable compensation to Adani Power stood at nearly INR110 bn. Law experts said the curative judgments, particularly in power sector, are very rare. Adani Power had terminated the 1,000 Mw power purchase agreement with GUVNL from its plant in Mundra, citing non-coal supply by Gujarat Mineral Development Corporation. The company claimed that the power supply was conditional to coal supply.

Source: The Economic Times

16 September: The AAP (Aam Aadmi Party) said if it is voted to power in Uttar Pradesh, it will provide 300 units of free electricity to domestic consumers, waive "inflated" bills and ensure 24-hour power supply, a move aimed at replicating its Delhi model. AAP leader and Delhi Deputy Chief Minister Manish Sisodia also announced providing free electricity to farmers. The AAP has made similar promises in Punjab, Uttarakhand and Goa where assembly polls are due early next year. In the last Delhi assembly elections, the AAP had promised free electricity up to 200 units to domestic consumers and after that up to 200 units at half the price, which is believed to have played an important role in the elections. The Arvind Kejriwal-led party, which has decided to contest all 403 assembly seats in Uttar Pradesh, alleged that electricity tariff is so expensive in Uttar Pradesh that it is becoming very difficult for people to pay the bills. He said electricity is not a luxury but a basic necessity and it is the responsibility of every government to make it available to every citizen. The party promised to provide 300 units of electricity free of cost to all domestic consumers per billing cycle, waive outstanding bills of 38 lakh families and ensure 24-hour power supply.

Source: The Economic Times

21 September: Reliance Industries Ltd, Tata Power, Adani Solar, Acme Solar and Vikram Solar are likely to bid for contracts under the production-linked incentive (PLI) scheme for solar modules. The government is expecting a grand response to the programme with bids at nearly four times the 10 GW tender. Large companies are evincing interest and are expected to commit end-to-end solar manufacturing. The union cabinet had in April approved the PLI scheme for manufacture of high efficiency solar photovoltaic module with a INR45 bn outlay. The incentives are expected to add 10 GW of high-efficiency integrated solar PV manufacturing plants and bring direct investment of around INR172 bn in solar PV manufacturing.

Source: The Economic Times

21 September: India added 521 MW of rooftop solar in the second quarter (Q2) of calendar year (CY) 2021, a 53 percent quarter-on-quarter (q-o-q) increase compared to 341 MW installed in Q1 2021, according to the report titled ‘India Rooftop Solar Market Report Q2 2021’. It said that rooftop solar installations were up 517 percent year-on-year (y-o-y) compared to the 85 MW installed in Q2 2020. According to the report, this quarter’s installation numbers were skewed due to a large amount of residential rooftop solar capacity commissioned in Gujarat. The report said that in the first half (1H) of 2021, 862 MW of rooftop solar capacity was added -- a 210 percent increase compared to the same period of last year. According to the report, at the end of Q2 2021, cumulative rooftop solar installations reached 6.1 GW.

Source: The Economic Times

18 September: The researchers at the Indian Institute of Technology (IIT) Delhi have designed a device that can generate electricity from water drops, raindrops, water streams, and even from ocean waves using the 'triboelectric effect' and 'electrostatic induction'. The electricity generated by the device called 'Liquid-solid Interface Triboelectric Nanogenerator' can be stored in batteries for further use. As per a statement from IIT Delhi, the device consists of specially designed nanocomposite polymers and contact electrodes and can generate a few milliwatt (mW) power, which is sufficient to power small electronic devices like watches, digital thermometers, radio frequency transmitters, healthcare sensors and pedometers. When compared to conventional methods, such as the use of the piezoelectric effect, it can generate significantly more electricity. Professor Neeraj Khare from the Department of Physics in IIT Delhi and his team at the Nanoscale Research Facility (NRF), IIT Delhi, have been working on harvesting electrical energy from to be wasted mechanical vibrations using the triboelectric effect. The group has filed an Indian patent on the various aspects of the use of ferroelectric polymer for harvesting mechanical energy including the present device. The Ministry of Science and Technology and the Ministry of Electronics and Information Technology have supported the research work under the NNetRA project. The IIT Delhi research team also explored the underlying mechanism of the electricity generated when the water drop comes in contact with the solid surface and it was found that saline water drops generate more electricity.

Source: The Economic Times

17 September: Eastern Coalfields Ltd (ECL), a subsidiary of Coal India Ltd (CIL), has commissioned a 250 kilowatt (kW) rooftop solar power project, ramping up its total installed solar rooftop capacity to 692 kW. The project was commissioned on Wednesday, CIL said. The implemented through the Solar Energy Corporation of India (SECI), the newly installed 250 kW plant set up at ECL’s headquarters in Sanctoria for captive consumption, has an average generation of 3.65 lakh units per annum. The previously installed 442 kW capacity rooftop solar power projects are spread across ECL for consumption in hospitals, area offices and guest houses. Average annual generation from these solar projects is 6.45 lakh units. With installation of the recent project, ECL’s total solar generation has jumped to 10.10 lakh units. CIL is serious in its intent to pursue solar power generation as an alternative green energy source and has laid out plans to install 3,000 MW solar power by 2024.

Source: The Economic Times

15 September: AMP Energy India said Vice President M Venkaiah Naidu has inaugurated its 2.4 MW solar power plant at Pondicherry University. The project is one of the largest solar power plants at a central university in the country. It is spread over 15 buildings, 2 car parks and 2 land parcels in the university campus. The plant would be instrumental in supplying solar energy to meet about 40 percent of the university’s energy needs. By adopting solar power, Pondicherry University will benefit from reduced energy costs and will contribute to reducing emissions of around 2,900 tons of CO2 every year. The project has been developed under the 97.5 MW rooftop scheme by Solar Energy Corporation of India (SECI). Pondicherry University and Amp Energy India have signed a Power Purchase Agreement (PPA) under this scheme for procurement of solar power for 25 years.

Source: The Economic Times

15 September: Tata Steel commissioned a 5-tonne per day (TPD) carbon capture plant at its Jamshedpur Works, making it the country's first steel company to adopt such a carbon capture technology that extracts CO2 (carbon dioxide) directly from the blast furnace gas. Tata Steel will reuse the captured CO2 on site to promote circular carbon economy. This carbon capture and utilisation (CCU) facility uses amine-based technology and makes the captured carbon available for onsite reuse. The depleted CO2 gas is sent back to the gas network with increased calorific value. This project has been executed with technological support from Carbon Clean, a global leader in low-cost CO2 capture technology. In September 2020, Tata Steel had joined hands with the Council of Scientific and Industrial Research (CSIR) to work in the field of carbon capture, utilisation and storage (CCUS), to build a strong ecosystem in the country for meeting the decarbonisation commitments under the Paris Agreement.

Source: The Economic Times

15 September: With India is exploring multiple options to lower its carbon footprints, the government said the country would produce three times more nuclear power from its current level and called for greater India-US (United States) cooperation for clean energy sectors such as biofuels and hydrogen. The move will help India substantially increase its share of non-fossil fuel in total energy mix in sync with its pledges under the Paris Agreement. Though India’s share of installed capacity of non-fossil fuel-based electricity generation has already reached nearly 39 percent of its total power generation capacity against its existing target of 40 percent by 2030, the step towards nuclear energy would help it upgrade its climate action goal.

Source: The Economic Times

20 September: Fuel prices have risen in Afghanistan’s Kabul and locals have urged the Taliban-led government to step in to prevent overcharging from companies and importers of fuel. Gas prices have risen by 15 Afs per kilo and petrol prices have risen by four Afs. Shopkeepers in Kabul claim that the fuel importing companies have hiked the fuel prices due to which the fuel prices have risen. Local residents have asked the Taliban-led government to prevent overcharging on fuel by stopping the extortion by fuel importing companies.

Source: The Economic Times

17 September: Oil prices barely moved on Friday even as more supply came back online in the US (United States) Gulf of Mexico following two hurricanes, with benchmark contracts on track to post weekly gains of around 4 percent as the output recovery is seen lagging demand. Preliminary data from the US Energy Information Administration showed US crude exports in September have slipped to between 2.34 million barrels per day (bpd) and 2.62 million bpd from 3 million bpd in late August.

Source: The Economic Times

17 September: China’s oil consumption is likely to peak around 2026 at 800 million tonnes (mt), or about 16 million barrels per day, according to Sinopec Corp. Natural gas will become China’s top fossil fuel resource around 2050, Sinopec Corp said.

Source: The Economic Times

17 September: Iranian fuel and petrochemical exports have boomed in recent years despite stringent US (United States) sanctions, leaving Iran well placed to expand sales swiftly in Asia and Europe if Washington lifts its curbs. The US imposed sanctions on Iran’s oil and gas industry in 2018 to choke off the Islamic Republic's main source of revenues in a dispute with Tehran over its nuclear work. The steps crippled crude exports but not sales of fuel and petrochemicals, which are more difficult to trace. Crude can be identified as Iranian by its grade and other features, while big oil tankers are more easily tracked via satellite. Iran exported petrochemicals and petroleum products worth almost US$20 billion in 2020, twice the value of its crude exports, oil ministry and central bank figures show.

Source: The Economic Times

15 September: Russia’s energy ministry is due to prepare a report in the coming days about the possibility of Rosneft exporting natural gas to Europe via the new Nord Stream 2 pipeline. Currently, Kremlin-controlled Gazprom has exclusive rights for Russian pipeline gas exports. Novak said that Rosneft had asked the government for permission to export natural gas and the government was reviewing the request. Oil-focused Rosneft and its shareholder, BP, have long sought to export natural gas to Europe as exports are more lucrative than domestic sales. Russia announced that it had completed construction of the US $11 billion Nord Stream 2 to Germany, doubling its gas exporting capacity via the Baltic Sea. Germany’s energy regulator said it had four months to complete operating certification for the new pipeline.

Source: The Economic Times

18 September: Authorities in Brazil have approved commercial operations of the first phase of Gas Natural Acu’s (GNA) gas-fired power plant, the project’s second largest shareholder, China’s State Power Investment Corp (SPIC), said. Located at Porto do Acu, Rio de Janeiro, the first phase of the project, known as GNA I, involves total investment of US $1 billion and has installed power generation capacity of 1.338 gigawatts (GW), which is able to supply power to 6 million households. Construction of the second phase of the project, which is designed to have 1.681 GW installed capacity, is scheduled to begin in November, making the project the largest liquefied natural gas (LNG)-to-power complex in Latin America, SPIC said. The project is jointly developed by GNA, a Brazilian joint venture between BP, Siemens and Prumo Logistica, and China’s SPIC, which acquired a 33 percent stake in August last year. The plant will eventually have the capacity to generate 6.4 GW of power. It is due to be completed in four phases.

Source: The Economic Times

15 September: Spain’s left-wing government approved a fresh package of measures, including a tax cut, to curb soaring household electricity bills that have hurt businesses and angered voters. Under the so-called "shock plan" passed by Socialist Prime Minister Pedro Sanchez's cabinet, a special electricity tax will drop to 0.5 percent -- the minimum allowed by European Union Rules -- from 5.1 percent until the end of the year. Under pressure from the opposition and consumer groups to reduce electricity bills, his government in July reduced the value-added tax (VAT) on electricity bills to 10 percent from 21 percent and suspended a power generation tax to provide relief to consumers. The average monthly household electricity bill in Spain has risen by 62 percent over the past year to 108 euros. Sanchez has promised to bring annual electricity costs for households down to levels seen in 2018, the year he came to power.

Source: The Economic Times

20 September: Deep in the Oman desert lies one of BP's more lucrative projects, a mass of steel pipes and cooling towers that showcases the British energy giant’s pioneering natural gas extraction technology. The facility earned BP Plc more than US $650 million in profits in 2019. Yet the oil major agreed to sell a third of its majority stake in the project. The deal exemplifies a larger strategy to liquidate fossil-fuel assets to raise cash for investments in renewable-energy projects that BP concedes won’t make money for years. BP’s big bet is emblematic of the hard choices confronting Big Oil. All oil majors face mounting pressure from regulators and investors worldwide to develop cleaner energy and divest from fossil fuels, a primary source of greenhouse-gas emissions that cause global warming. That scrutiny has increased since early August, when the United Nations panel on climate change warned in a landmark report that rising temperatures could soon spiral out of control.

Source: The Economic Times

17 September: Ontario Teachers' Pension Plan Board (OTPP), Canada’s third-largest pension fund, announced new interim targets to cut the carbon emissions intensity of its portfolio as part of a plan to reach net-zero emissions by 2050. OTPP, which manages C$227.7 billion (US$180.11 billion) in assets, plans to reduce emissions intensity by 45 percent by 2025 and 67 percent by 2030, from 2019 levels. Fellow pension fund Caisse de depot et placement du Quebec also has a net-zero target by 2050, but environmental campaigners said OTPP's interim targets are the strongest climate commitment yet from a Canadian pension fund.

Source: The Economic Times

16 September: The Czech parliament approved a law setting the framework for aid to renewable energy projects, which industry players hope will restart a boom in green projects. The law sets rules for the development of renewable resources in the coming years when billions of euros will be available for investments from European Union (EU) programmes for modernisation. It also allows for auctions for new capacity. The Czech Republic is the EU’s third largest coal consumer, according to Eurostat. A government commission has set 2038 as the year for complete departure from coal as fuel in power plants, although the debate continues and experts expect high carbon prices may shut down coal power plants much sooner. The central European country gets 16 percent of its energy needs from renewables, and needs large investments to meet its share on the EU’s climate targets. The Czech Republic’s main power utility CEZ has pledged to slash the proportion of coal in its portfolio to 12.5 percent in 2030 from 36 percent last year, and invest billions of euros into renewables, mainly solar.

Source: The Economic Times

15 September: US (United States) oil producer Chevron Corp pledged to triple to US$10 billion its investments in low-carbon fuel and projects through 2028. Oil producers globally, under mounting pressure to join the fight against climate change, have stepped up plans to transition to less carbon-intensive production. Shareholders and governments are insisting they plot a path to sharply cut greenhouse gas emissions by 2050. Chevron said half of its spending will go to curb emissions from fossil fuel projects, with US $3 billion for carbon capture and offsets, US $2 billion for greenhouse gas reductions, US $3 billion for renewable fuels and US $2 billion for hydrogen energy. It reaffirmed a goal of paring greenhouse gas intensity by 35 percent through 2028, compared to 2016 levels from its oil and gas output. However, it did not commit to 2050 net-zero emission reduction targets as some rivals have. European oil producers have ambitious plans to shift away from fossil fuels with large investments in renewables and mid-century net-zero emission targets. Chevron, Exxon Mobil Corp and Occidental Petroleum sought to reduce carbon emissions per unit of output while backing carbon capture and storage.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.