Setting the Context

India has one of the largest defence industrial bases (DIB) in the developing world, comprising a vast network of research and development (R&D) and production entities and employing several thousand scientists, engineers and other workers. The Indian DIB has historically been dominated by the public sector, whose performance has been lackluster leaving India dependent on external sources for crucial arms and ammunitions.[a] Such dependence has been a source of embarrassment for the country which in moments of crisis has had to reach out to friendly foreign nations with a list of emergency procurements.[1]

The question is why India has not been able to source, if not all, at least a major part of its arms requirements, from its indigenous base. What is the accountability of the public sector—the pillar of India’s arms industry which continues to have a dominant role in the country’s armament research and production?

This paper first examines India’s motivations for defence production before evaluating the key performance parameters of the defence public sector units involved in both R&D and manufacturing. This is followed by a discussion on the government initiatives designed to improve the functioning of the public sector. A prognosis for the public sector is provided by way of mapping the progress of the private sector in defence production.

Motivations of Indian Defence Production

Defence experts have long debated whether a developing country like India should even engage in defence production—let alone strive for autarky in arms manufacture. Some have hinted that “attempts at autarky are increasingly a fool’s pursuit” and “all but the most powerful states must abandon any hopes of sustaining autonomous arms production.”[2] Such argument is premised on techno-economic factors and is also partly influenced by the changing nature of the global arms industry; it is now widely accepted that modern weapons contain more advanced and miniaturised technology than in the past. This would mean that weapons have become so expensive that only advanced industrialised countries with large defence budgets could afford to develop, manufacture and upgrade them.[b] Having greater financial resources, such countries can afford bigger production lines, thus obtaining economies of scale—something which is prohibitive for countries with an inadequate industrial base or smaller budgets. That India’s arms production has been costly in comparison to import options, gives credence to this line of argument. The Stockholm International Peace Research Institute (SIPRI) once observed that India’s production cost of aircraft like the HJT-16 basic trainer, MiG-21, HF-24 and Gnat fighters, Alouette helicopter and HS-748 transports were 150 to 190 percent of the cost of similar aircraft that Indian could have imported.[3]

If the growing cost of the modern weapons is an inhibiting factor, the forces of globalisation in the post-Cold War era have not helped, either. To tide over the growing cost of modern arms, the global defence industry has undergone “significant changes,” entailing “an increasing level of cooperation between defense firms, involving coproduction/ development, partnerships, mergers and acquisitions and joint ventures.”[4] India too, has attempted, with limited success, to open its arms industry to foreign companies while encouraging domestic enterprises to seek partnerships with global original equipment manufacturers (OEMs), including through the offset guidelines of the Ministry of Defence’s (MoD) arms procurement manual.[c]

While the forces of globalisation have provided certain opportunities for emerging defence manufactures to be part of the global supply chain, these manufacturers, as some argue, would nonetheless be “better off if [their] defence-industry policy follows a limited goal that is focused on the niche markets.”[5] The forces of globalisation, the argument goes, are against a country like India to develop an independent and broad-based DIB. Yet such limitations have not deterred India from establishing a large DIB. It has continuously strived for greater self-sufficiency, even though, barring a few achievements with strategic systems pertaining to nuclear weapons and missiles, and to some extent naval shipbuilding—the overall performance of the domestic arms industry has remained largely unsatisfactory.

Nonetheless, India is now on a far stronger footing to undertake indigenous arms production. As the fourth largest military spender in the world, ahead of several advanced defence manufacturing countries (the UK, France and Germany, among others),[6] boasting an ever-growing defence budget, India has the financial muscle to sustain a relatively autonomous defence industrial base. How it leverages its purchasing power to develop a credible arms industry is a different matter altogether.

A question that emerges is why India has gone on a defence industrialisation path. There are three broad motivations for countries resorting to domestic arms production. First is the security of supply that guarantees steady flow of arms and spare parts for use in times of need. With the possibility of a collusive, two-front war with Pakistan and China being very much part of India’s defence planning, indigenous production of arms is the surest way of defending the country’s sovereignty and territorial integrity.

India has often looked to improve its security of supply by diversifying its supplier base. That option, however, has had its own pitfalls. In the past, India had been a victim of arms embargoes, especially those imposed by the US which suddenly decided to stop arms supply after the 1965 war and 1998 nuclear test. Although India-US relations have vastly improved in recent years, the fear of US sanctions has not waned completely. Under the Countering American Adversaries Through Sanctions Act (CAATSA), India, like some other recipients of Russian arms, is at the mercy of US foreign policy machinations.[7] India’s overwhelming dependency on Russia is also partly why New Delhi, despite criticism from its Western partners, adopted a “studied public neutrality” towards Russian military aggression against Ukraine.[8]

During the Kargil war of 1999, when India sought external arms and other assistance to repel the Pakistani intruders from mountainous heights, it had to swallow the bitter pill of its external dependence. Nearly two decades after the conclusion of that war, General VP Malik, head of the Indian army at the time, reveals that “[I]n every urgent purchase during the Kargil war, no matter from which country, they exploited us as much as they could.”[9] He noted that in response to India’s request for few guns and ammunition “one country supplied refurbished old weapons”, while “another country” supplied “1970 vintage ammunition.”[10] The height of exploitation, Malik informs, was reserved for satellite imagery which India bought at the cost INR 36,000 per image. As New Delhi found later on, the images were three years old and barely useful. The ongoing war in Ukraine has also exposed India’s vulnerability for its dependence on Russia, with the Indian air force postponing its plan to upgrade its Su-30MKI fighters because of the prevailing situation.[11]

Linked to supply security is the tactical benefit that domestic production provides. Underscoring the importance of the domestic DIB for battlefield surprises, PM Narendra Modi, in an address to the domestic industry, noted that “uniqueness and surprise elements can only happen when the equipment is developed in your own country.”[12]

To be sure, India has often attempted to customise imported arms through incorporation of India Specific Enhancements (ISE), thus retaining a technological edge over adversaries. However, there is a difference between the customisation undertaken by the foreign vendors and that which is carried out by domestic entities. Getting a good price for ISE is not an easy task, as the government found out while negotiating a contract to purchase Rafale fighters from France.[13]

By comparison, the limited experience of customisation through the domestic industry seems to be satisfactory. The integration of BrahMos missile with SU-30 fighter aircraft, allowing it the capability to strike deep inside enemy’s territory at a stand-off distance of more than 400 km,[14] is one example of how leaning on domestic industry could prove beneficial. The Hindustan Aeronautics Ltd (HAL) that license-manufactures SU-30 fighters, successfully integrated the missile into the aircraft at a much lower cost than demanded by Russia. According to RK Tyagi, who was at the helm of HAL when the decision of integration was taken, the budget his company was allocated to undertake the integration was a mere INR 0.8 billion in comparison to the INR 13 billion (US$200 million) that Russia quoted.[15]

The second motivation that has driven India’s arms production is techno-economic in nature. Justifications such as conserving foreign exchange, developing state-of-the-art defence manufacturing bases with backward/forward linkage with larger civilian industry, and creating employment opportunities have driven India’s defence industrialisation process. The foreign exchange rationale was particularly significant in the early years of India’s independence, when low foreign exchange reserves motivated India to opt for license production of Russian weapons over direct import of Western ones.[16]

With India’s total exchange reserves exceeding US$600 billion (at the beginning of 2022-23[17]), such shortages are not a dire problem for Indian decision-makers today. Nevertheless, other economic benefits remain important. This is particularly true for the Modi government, which has put ‘Make in India’ and ‘Atmanirbhar Bharat’ at the centre of its economic policy to boost industrial and economic growth while propelling India as a global innovation and manufacturing hub. New Delhi has identified 10 ‘Champion Sectors’ including defence and aerospace industry for ‘renewed focus’ because of their “potential to become global champions, drive double digit growth in manufacturing and generate significant employment opportunities.”[18] The Modi government also claims to have created “innumerable new jobs” in the defence industry since the announcement of Make in India.[19]

The third motivation is what Bitzinger refers to as ‘techno-nationalism’.[20] Techno-nationalism, as defined by some, is a kind of “thinking that links technological innovation and capabilities directly to a nation’s national security, economic prosperity and social stability.”[21] In the field of arms production, the techno-nationalistic impulse drives a country to strive for self-sufficiency not for the sake of it but to attain strategic autonomy and larger geopolitical goals while exerting regional and global influence. Bitzinger notes this techno-nationalist impulse is particularly ubiquitous in countries such as India, China, Japan, South Korea and Indonesia which have regional or global ambitions. He further observes that the model does not mind the additional cost necessitated by domestic production, nor does it foreswear foreign technology dependency; rather it “paradoxically involves the exploitation of imported technology in order to eventually realize self-sufficiency.”[22]

The license-based production model that India has adopted for its armament programmes—fighter jets, tanks, submarines, helicopters, anti-tank missile and a host of other arms—is partly motivated to allow the domestic industry to learn from others’ technological advancement. For instance, while importing technologies for domestic production of aircraft (such as MiG and Su-30 fighters), India has continued to develop its own fighters: LCA and now the fifth-generation Advanced Medium Combat Aircraft (AMCA).[d]

India’s commitment to self-reliance has been enshrined in a number of government reports and policy announcements. In 1992, the Self-Reliance Committee, headed by then scientific adviser to the defence minister, Dr APJ Abdul Kalam (who would later be President of India), formulated a roadmap by which India would progressively increase self-reliance in defence procurement from then 30 percent to 70 percent by 2005.[23] The Make in India initiative and the Atmanirbhar Bharat Abhiyan launched by the present government also accord a strong focus on autarky. However, owing to various factors explained later, self-reliance remains a distant dream.

Similar to techno-nationalist impulses are what Kinsella and Chima have described as ‘symbolic motivations’ behind India’s defence, space, and nuclear programmes. Analysing articles published over a period of over two decades in a popular Indian weekly, they find a strong resonance of three distinct symbolic impulses—asserting autonomy in global affairs, gaining international status and prestige, and boosting self-image—behind India’s armament/strategic programmes.[24]

Techno-nationalism/symbolic motivation is evident with the successive Indian governments. India’s first PM Jawaharlal Nehru equated self-reliance in armament production with the country’s independence.[25] The current regime of PM Modi has gone to the extent of linking self-reliance in defence production with India’s role as a net security provider in the Indian Ocean region and the country’s strategic/friendly ties with others.[26] Defence exports have been a key tool in boosting India’s external image and geopolitical influence. Exports, even in the form of gifts, have increasingly been used as a tool by the government to strengthen its geopolitical hold, especially with neighbours.[e]

Public Sector Defence Industry: An Overview

India’s public sector defence industry is part of a larger set up of government-owned/controlled production units and research labs that the country has nurtured since independence. The government-driven techno-industrial development is largely the consequence of the socialistic and centralised planning system that PM Nehru established for socio-economic growth before it was taken to an extreme form by his daughter Indira Gandhi (who was PM of India during 1966-77 and 1980-84);[27] elaborate rules and regulations were put in place that gave the state exclusive power for industrial development while limiting the role of private players through a restrictive industrial licensing policy, that specified who can produce what, where and how much.[28]

In the field of arms production, 18 Ordnance Factories (OFs) that India inherited from British India formed the core of India’s defence industry. This was supported by an aircraft company, Hindustan Aircraft (established in 1940), a rudimentary R&D set up (which was latter converted into the Defence Research and Development Organisation (DRDO) in 1958), and an electronics company (Bharat Electronics Ltd) that was set up in 1954. The number of public sector entities in the defence sector has grown since. A boost for public sector expansion came in the form of the 1962 debacle in a brief but bloody border war with China that exposed deficiencies in India’s defence preparedness. In the aftermath of the war, plans were made to expand the armed forces, boost domestic arms production, and improve R&D.[29] The government was willing to spend more on defence; the average growth of defence expenditure went from barely five percent in the ‘50s to over 16 percent in the following decade, with the first post-war budget growing by 133 percent.[30]

The goal of domestic production in the aftermath of the 1962 military debacle was to “materially reduce dependence on external sources of supply.”[31] India’s immediate focus was expanding the OFs to meet the requirements of the army, which faced the brunt of China’s unprovoked aggression. Between 1962 and the mid-1980s, 11 new OFs were set up, as well as a number of Public Sector Undertakings (PSUs)—BEML (1964) and MIDHANI (1973). DRDO was also to expanded in order to deepen indigenous R&D.

At present, the public sector entities functioning directly under administrative control of the MoD consist of 17 Defence Public Sector Undertakings (DPSUs), including seven new ones created in October 2021 by corporatising the erstwhile 41 departmentally-run OFs.[f] While DPSUs remain the main players in India’s arms production, there are also several other PSUs and government-sponsored joint ventures (JVs) engaged in some form of defence production and quality monitoring of platforms, systems and armament.[g] Among the non-MoD-owned PSUs, notable is the Cochin Shipyard Ltd (CSL) which constructed India’s first indigenous aircraft carrier. Among the JVs, biggest is BrahMos Aerospace Pvt. Ltd (BAPL), set up through an inter-government agreement signed in 1998 between the DRDO and NPOM of Russia. With a total operating income of INR 32.50 billion (in 2020-21),[32] the JV has been a success. It has delivered different versions of the supersonic missile to all the three services and tested its first export success in 2021 when it secured a US$375-million contract from the Philippines.[33]

Among the older DPSUs, except for the four shipyards—Mazagon Dock Shipbuilders Ltd (MDSL), Goa Shipyard Ltd (GSL), Garden Reach Shipbuilders and Engineers (GRSE) and Hindustan Shipyard Ltd (HSL)[34]— other entities are dedicated for a specific role: military aviation (HAL), electronics (BEL), special alloys (MIDHANI), missiles (Bharat Dynamics Ltd, BDL), and earth moving equipment (BEML). The seven new DPSUs (converted out of the OFs) are also similarly organised into different specialisations—ammunition and explosives; vehicles; weapons and equipment; troop comfort items; military-grade components and ancillary products; opto-electronics items; and parachutes.

The public sector, given its size, expertise and experience, has a share of nearly 80 percent in India’s defence production (see Table 1). Of the total production of the public sector, the nine older DPSUs have a share of 55-60 percent. Seven out of nine old DPSUs are also listed in stock exchanges with a combined market-cap of about INR 850 billion (see Table 2 for select indicators of the DPSUs).

Table 1. Share of Public Sector in India’s Defence Sales

| Year |

DPSUs

(INR bn)

|

OFB (INR bn) |

Other PSUs /JV (INR bn) |

Private Sector (INR bn) |

Total (INR bn) |

Share of the Public Sector (%) |

| 2016-17 |

404.27 |

148.25 |

46.98 |

141.04 |

740.54 |

81 |

| 2017-18 |

434.64 |

148.29 |

51.80 |

153.47 |

788.20 |

81 |

| 2018-19 |

453.87 |

128.16 |

55.67 |

173.50 |

811.20 |

79 |

| 2019-20 |

476.55 |

92.27 |

62.95 |

158.94 |

790.71 |

80 |

| 2020-21 |

467.11 |

146.35 |

60.29 |

172.68 |

846.43 |

80 |

| 2021-22 |

557.90 |

119.13 |

72.22 |

199.20 |

948.45 |

79 |

| 2021-22 |

631.07 |

169.98 |

67.83 |

199.25 |

1068.13 |

81 |

Source: Department of Defence Production (DDP), MoD, “Dashboard”.[35]

Table 2. DPSUs: Select Indicators, 2020-21

| Name |

Year of Establishment |

M-Cap (INR bn)* |

No. of Employees (2020-21) ^ |

Revenue (INR bn)@ |

Exports (INR mn)US$ |

R&D Expenditure (INR bn) |

Order Book (INR bn)# |

| HAL |

1963 |

332.67 |

26432 |

227.55 |

2175.6 |

14.64 |

792.29 |

| BEL |

1954 |

304.82 |

9172 |

140.64 |

3728.4 |

8.87 |

577.00 |

| BDL |

1970 |

60.96 |

2812 |

19.14 |

781.2 |

0.53 |

114.00 |

| BEML |

1964 |

52.28 |

6053 |

35.57 |

282.4 |

0.71 |

101.80 |

| MIDHANI |

1973 |

33.10 |

764 |

8.13 |

194.2 |

0.30 |

13.50 |

| MDSL |

1934 |

42.88 |

3683 |

40.48 |

0.0 |

0.85 |

470.23 |

| GRSE |

1934 |

21.19 |

1856 |

11.41 |

874.9 |

0.12 |

246.05 |

| HSL |

1952 |

--- |

827 |

3.93 |

0.0 |

0.00 |

26.73 |

| GSL |

1967 |

--- |

1264 |

8.60 |

3.3 |

0.10 |

143.27 |

| New DPSUs |

2021 |

--- |

77199^^ |

--- |

1402.8US$$ |

0.91^^^ |

519.39## |

Notes. *: Market capitalisation (M-Cap) on Bombay Stock Exchange as on March 31, 2021; ^: Excluding casual labour; @: Revenue from operations (net); US$: Export of goods on free on board (FOB) basis; # As on February 02, 2022; ^^: As of January 2021; $$: Figures for 2019-20; ^^^: As of 2018-19; ##: As on September 30, 2020;

Source: Compiled by author from reports of the Standing Committee on Defence and Ministry of Finance.

Unlike the DPSUs, which are captive production units, DRDO is a dedicated defence R&D agency under the MoD. The agency traces its origin to 1948 when the government set up the Defence Science Organisation (DSO). In 1958, under the instruction of then Defence Minister, Krishna Menon, the DSO was merged with the Technical Development Establishments (TDEs) of the three services to establish the present-day DRDO. The organisation is headed by a chairman who is also the Secretary in Department of Defence R&D, which was set up in 1980 to improve the administrative efficiency of the organisation. Like the DPSUs, the DRDO has also grown over the years: from about 10 labs in late 1950s to 52 labs and other establishments at present. Its R&D cuts across the entire range of defence technologies: missiles, aeronautics, armaments, combat vehicles, electronics, life sciences, and strategic materials.

Although the DRDO has been in existence for more than 60 years, the agency came into prominence in the 1980s when the government sanctioned many high-profile defence projects including the Integrated Guided Missile Development Programme (IGMDP) and the Light Combat Aircraft (LCA). To support the high-profile R&D, its budget was also increased, from less than two percent of the defence budget till 1960s to more than four percent by 1980s.

With personnel strength of 21,969, including 6,966 scientists,[36] the DRDO has a budget of INR 213.30 billion (~ US$2.7 billion), amounting to 3.4 percent of the MoD’s total budget of 2022-23.[37] Between 2014-2019, it completed 258 projects worth INR 106.43 billion.[38] Till 2021, DRDO developed products which are either inducted into the armed forces or approved for production amounts up to INR 3,033.89 billion (or about US$39 billion).[39] Some notable products that have been inducted or are in the process of induction include Agni, Prithvi, Akash, Astra and BrahMos missiles, MBT Arjun, LCA Tejas, Netra AEW&C, HUMSA and ALTAS sonars, and ATAGS gun systems.

Performance of the Public Sector

As the biggest player in India’s defence industry, the public sector has a key role in designing, developing and manufacturing crucial arms and other items for defence and security forces. Inherent in these efforts is a key responsibility of making India self-reliant.

The public sector has been at the forefront of supplying major arms and other equipment to the armed forces, which few countries in the world could develop and manufacture. As the DRDO often boasts, India is one of the four countries to have Multi Level Strategic Capability; one of four countries to have Airborne Early Warning & Control System (AEW&CS); one of five countries to have our own Fourth plus generation fighter aircraft; one of five countries to have developed and manufactured a Ballistic Missile Defence Programme; one of seven countries to have developed its own Main Battle Tank; and one of select few countries to have its own Electronic Warfare and Multi Range Radar Program.[40] India is also as one of few countries to have constructed an aircraft carrier and demonstrated an anti-satellite test (ASAT) capability.

These feats do not, however, distract from the glaring weakness of the Indian defence industry, particularly in the public sector. Despite decades of existence, not a single Indian company has found a place in the world’s top 20 defence companies,[h] even though the country is now the fourth largest military spender in the world. Moreover, the public sector is currently unable to meet the growing requirements of the Indian armed forces. As Table 3 shows, between 2018-19 and 2020-21, the public sector’s total sales amounted to 57 percent of India’s defence procurement, whereas the overall contribution of Indian industry is 72 percent. Moreover, if the trends of the past three years are any indication, the public sector, like the defence industry as a whole, is losing its share in India’s total procurement—an indication of the continuing and growing importance of imports to India’s defence preparedness.

Table 3. Public Sector’s Contribution to India’s Defence Procurement

| |

MoD’s Total Procurement (INR bn) |

Domestic Defence Sales (INR bn) |

Domestic Defence Sales as % of MoD’s Procurement |

Sales of Public Sector as % of MoD’s Procurement |

| Public Sector |

Private Sector |

| 2018-19 |

934.74 |

637.70 |

173.50 |

86.78 |

68.22 |

| 2019-20 |

1083.40 |

631.77 |

158.94 |

72.98 |

58.31 |

| 2020-21 |

1393.40 |

673.75 |

172.68 |

60.75 |

48.35 |

| Total |

3411.54 |

1943.22 |

505.12 |

71.77 |

56.96 |

Note: Procurement consists of both revenue and capital. Public sector includes DPSUs and other PSUs and government-sponsored Joint Ventures.

Source: Compiled by author from Lok Sabha, “Indigenous Production of Defence Equipment” and DDP, “Dashboard”.[41]

From the perspective of the public sector, their declining share in defence procurement is not the only concern. Not all the sales of the public sector are made to the Indian armed forces; a part is to non-defence clients and also in the form of exports. For instance, 22 percent of sales turnover of the BEL, India’s second biggest defence company, came from the non-defence segment in 2021-22.[42] Likewise over 15 percent of OFB’s total value of sales was to clients other than the Indian armed forces.[43]

The inability of the public sector in meeting the requirements of the armed forces has resulted in India being highly dependent on external sources. If Britain, followed by the Soviet Union/Russia, were the major suppliers of arms during the Cold War, Israel and the US have emerged as big suppliers in the post-Cold War period.[44] The US, in particular, has been quite successful in bagging mega defence deals worth US$20 billion between 2008 and 2020.[45]

Another concern is that a great deal of sales of the public sector (and indeed the larger defence industry) is dependent on imported inputs for domestic manufacturing. According to an estimate by the MoD, the total value of intermediate goods i.e., parts, components, spares and raw materials (alloys and other special materials) imported by the DPSUs and OFs and their domestic suppliers totaled INR 363 billion in 2017-18,[46] representing 62 percent of their (DPSUs & OFs) value of sales in that year.

The import dependency of the Indian public sector is perhaps best illustrated by HAL, India’s biggest defence company. As reported to the Indian Parliament, HAL has achieved indigenous content (by value) of more than 50 percent in all but one platform it presently manufactures (Table 4). This does not appear to be a mean achievement given that aircraft manufacturing involves high-end technologies and advanced materials. However, this needs deeper examination to understand what the higher indigenous content (IC) means. HAL, like other defence entities, estimates IC based on the value of the products, taking into account the cost of materials, labour, overhead charges and also the profit. From the self-reliance point of view, what is important is the indigenisation of materials, in which HAL’s capacity is barely minimum.

Table 4. Indigenous Content in HAL-Manufactured Aircrafts and Helicopters

| Platform |

Indigenous Content by Value (%) |

| LCA Tejas Mk1/Mk1A |

53.55 |

| Su-30MKI |

51.48 |

| Do-228 |

44.19 |

| Advanced Light Helicopter |

55.89 |

| Light Combat Helicopter |

54.09 |

| Light Utility Helicopter |

52.01 |

Source: Lok Sabha, “Defence Aircraft and Helicopters”[47]

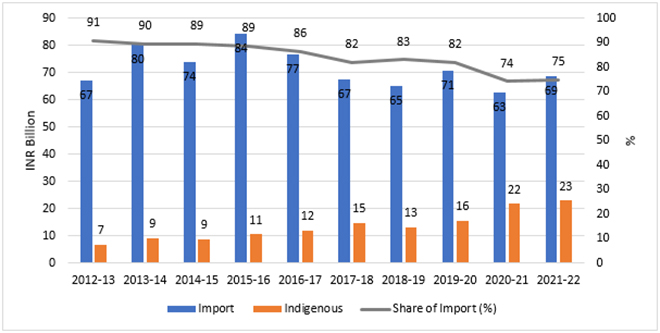

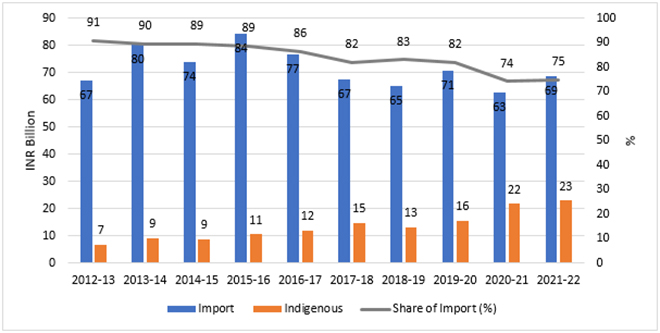

As Figure 1 brings out, India’s premier military aircraft company is dependent to the extent of over 80 percent on imported materials. The Comptroller and Auditor General of India (CAG) once castigated the HAL for its poor indigenisation in the indigenously designed Advanced Light Helicopter (ALH), noting: “As against the envisaged indigenisation level of 50 percent, about 90 percent of the value of material used in each helicopter is procured from foreign suppliers.”[48]

Figure 1. Share of Import in HAL’s Material Consumption

Note: Material consists of raw materials, components and spare parts

Source: Compiled from HAL, Annual Report (relevant years)

Import dependency varies from one public sector enterprise to another as it does from platform to platform, depending on the technological complexity. The erstwhile ordnance factories, which mostly operated in the lower end of the technology spectrum, have a high indigenous content (IC) of over 90 percent.[49] Another segment where the Indian public sector has achieved a high degree of indigenisation is warship building. The domestic shipyards have achieved 80 percent indigenisation in the latest versions of destroyers and frigates.[50] The first ever aircraft carrier, INS Vikrant built by the CSL, contains IC of 76 percent.[51]

It is, however, worth noting that high indigenisation, particularly of imported items, has not necessarily led to new homegrown products. For example, the Armoured Vehicles Nigam Ltd (AVNL), a new DPSU that emerged out of amalgamation of 12 erstwhile OFs, claims to have achieved indigenisation of 100 percent in engines of Russian-origin T-72 and T-90 tanks.[52] This has not led the company to design and manufacture an indigenous engine for powering the indigenous Arjun tank—a task that the DRDO has now taken up.

Indeed, very few Indian public sector manufacturing entities produce high-value items based on technologies developed indigenously. License-based production, which India has adopted since independence, has been the leitmotif in India’s major arms production programmes. Between 2016 and 2020, licensed production represented 58 percent of India’s total arms acquisitions.[53] The OFB, which traces its origin to British rule, once had 90 percent of its turnover coming from technologies developed outside the organisation.[54]

Barring a few items developed by the manufacturing entities themselves, DRDO has been entrusted with the task of the development of major platforms, apart from all the strategic systems. However, DRDO has not always been able to deliver as per the agreed time, budget, and specifications. Submitting before the Parliamentary Standing Committee on Defence (2017-18), the government noted delays and cost overruns in 28 projects each costing INR 1 billion. The projects include fighter aircraft (naval version), missiles, aircraft engine, and aircraft upgrades.[55] There are also instances where the DRDO has failed in its mission to develop necessary technologies, leading to short-closure of projects after they incurred a great deal of time and expense.[56]

In a 2021 report, The CAG noted the short-closure of a project to develop a Millimeter Wave (MMW) device—an MTCR (Missile Technology Control Regime)-controlled item that has application in seeker and precision-guided munition—after spending more than a decade and INR 665.1 million. The auditor’s concern was less the failure, but more the way the project was handled, leading to its “irregular closure.” The auditor observed that despite the three years initially envisaged for product development, the lab took more than 12 years before short-closing the project. It incurred INR 180 million in creating an air-conditioned room just before the project was shut down.[57]

Apart from inadequate indigenisation, the DPSUs exhibit inefficiencies in a host of parameters such as exports, labour productivity and innovation. The public sector, which enjoyed monopoly in domestic arms production till 2001, has historically been a reluctant player in the global arms market. Their attitude appears to have changed little even after the government’s prodding (through the setting export targets) and articulation of industry-friendly export promotion measures. The private sector, with far less experience, has had more success in exports, though much of its international sales are in the form of parts, components, assemblies and sub-assemblies.[58]

The DPSUs may be the big players, but when it comes to productivity, they fare poorly. Compared to global companies, the labour productivity of the DPSUs is less than one-fifth.[59] At times, the low labour productivity of the public sector companies has been a stumbling block in India’s acquisition process. For instance, the French aircraft manufacture, Dassault Aviation, refused to accept HAL’s high labour requirement to produce 108 Rafale fighter aircraft under transfer of technology (ToT) in its factory. The French company had quoted 31.2 million man-hours in its bid document, against which HAL insisted on a much higher labour content amounting to 2.7 times the total French labour hours. This was one of the factors that finally led to a stalemate in contract negotiations before the deal’s ultimate cancellation.[i] (The government instead decided to sign a separate contract with France for off-the-shelf procurement of 36 Rafales).

Low labour productivity is often connected to poor human resource (HR) management.[60] This is best illustrated in the case of DRDO, which has had near-monopoly in defence R&D. The agency faces a huge shortage of the personnel required to execute all the projects whose number has grown over the years. Against a sanctioned personnel strength of 34,000 (including 8,700 scientists), it has 24,000 as of January 2019. Instead of managing HR judiciously, DRDO is often deputing scientists to perform tasks for which they are overqualified. For instance, the Civil Works and Estates wing of the organisation, responsible for construction and estate management on behalf of the DRDO, has an authorised strength of 53 officers who are drawn from the Civil Works Officers Cadre (CWOC). On the ground, the Wing has 76 officers, including 38 scientists who were deputed down without the government’s approval.[61]

The public sector, especially the manufacturing entities, have historically been lethargic on the innovation front, reflecting what the former defence minister, AK Antony, had once termed as a “miserly attitude” towards R&D.[62] Except for HAL and BEL, other production agencies have negligible R&D spending (see Table 2).

With the DPSUs spending very little on R&D, the burden of defence research has largely been shouldered by the DRDO. However, with about 7,000 scientists and a budget of less than US$3 billion (compared to over US$100 billion for the US), there is a limit to what the R&D agency could deliver, even if it is made to perform to its full potential. The limited resources at the disposal of the DRDO leaves little leeway to spend on futuristic technologies as it is mostly preoccupied with Mission Mode projects—which are applied research in nature and involve designing of prototypes—to meet the immediate requirement of the services.

The DPSUs’ meagre spending on R&D has manifested in its innovation record. Measured in term of patents, the most objective criteria of measuring innovation, the public sector has little to show. Till March 2012, the OFB and the DPSUs together had 23 patents.[63] The number of IPRs has increased in recent years, largely due to the government’s prodding of the Mission Raksha Gyan Shakti. As on May 2022, 16 DPSUs have a portfolio of 1,391 patents, against 4,290 IPR fillings. Nearly 75 percent of the all the patents are, however, obtained by two organisations—HAL (633) and BEL (287)—indicating that the innovation has not percolated to the range and depth of the Indian defence industry.[64]

Reform in the Defence Public Sector

Even though the public sector has been the mainstay in India’s arms production, it has historically received little attention as to how its performance could be improved. It is only recently that the government has shown some interest in reforming the public sector and indeed the larger defence industry.

The biggest initiative undertaken to reform the public sector in recent years pertains to the OFs, which were earlier functioning as a government arsenal on no-profit-no-loss basis. In October 2021, all the factories were converted into seven DPSUs. The bold step of corporatisation, first suggested in 2005, is intended to improve “efficiency, autonomy, and innovation.”[j] As corporate entities, the new DPSUs are free to work on profit-motive and be accountable for their performance.

For the older DPSUs, the government has taken two steps: it declared an intention of privatising the BEML, and the listing of several DPSUs in the stock exchange. The decision to privatise BEML, taken by the Cabinet in 2019, has not, however, progressed for unspecified reasons. Nonetheless, if taken to the intended conclusion, it would be the first time that control of a public sector defence company would move to private hands. The stock exchange listings, done for five DPSUs (HAL, GRSE, MDSL, BDL and MIDHANI) are intended to improve corporate governance and infuse greater accountability.

Along with the structural reforms, the government has also prodded the DPSUs to improve their functioning and contribute more to the larger defence industrial production. Provisions have been announced to enable the public sector to reduce their import dependency, with the PM giving a reduction target of INR 150 billion by 2025. To this effect, public sector production entities have been given greater leeway to develop indigenous supply chain through long-term partnership with other domestic players.

In a radical reform of India’s higher defence management, the government, in December 2019, appointed the first ever Chief of Defense Staff (CDS) and under him created a new department, the Department of Military Affairs (DMA). Among other functions, the DMA is tasked with promoting defence indigenisation. The DMA has so far announced five lists of 509 items banned for direct import after a specific timeline. Though the list is not public sector-specific, most of the big items will be awarded to government-controlled companies which are already the nominated agencies for these items.

More significantly, the creation of the DMA and its defence industry charter are likely to have a salutary effect in containing (if not ending) the ‘battle royale’ that has historically put a barrier of mistrust between the users (armed forces) and the public sector, to the detriment of domestic defence industrial advancement.[65] The mistrust has often manifested in stringent demands from the users and a keen preference to import. The CAG, in one of its reports, had noted how the Indian army disadvantaged the indigenously developed MBT Arjun in comparative trials with Russian T-90 tank by demanding eight stringent performance parameters from the former while relaxing the same demand for the Russian one.[66] The supreme auditor also noted how the Indian air force ignored a domestic player in the procurement of aircraft tires and tubes in favour of a Polish firm which was selected on a “pick and choose basis” even though the foreign firm’s previous supplies were found defective.[67]

Compared to the production entities, the DRDO has seen little meaningful reform. Recent reforms undertaken by the R&D agency include reorganising the labs under different technology clusters (to bring more synergy) and establishing five labs under young scientists. Important recommendations such as the creation of a Defence Technology Commission, suggested by the Rama Rao Committee in 2007, to bring focused attention of the higher political leadership on R&D, have been put on the backburner.

Competition from the Private Sector

The public sector had a monopoly over India’s arms production till 2001, when the Vajpayee government took the decision to open up the defence industry to the Indian private as well as foreign companies. The present government has taken the private sector’s participation to a new level through the Make in India initiative and the Atmanirbhar Bharat Abhiyan (self-reliant India mission).[k] As a result, the role of the private sector is slowly but steadily increasing. The share of the private sector in India’s defence production, which was negligible at the turn of the century, has jumped to nearly 20 percent by 2021-22 (see Table 1).

The private sector, for its part, has grabbed every opportunity that has come its way over the years. This is clearly evident from its engagement in defence-related work flowing from the MoD’s offset guidelines.[68] Of 271 Indian companies working with foreign defence suppliers to execute the latter’s offset liabilities, an overwhelming number is from the private sector.

Inherent in the private sector’s growing interest and share in defence production is its capability to deliver items (e.g., artillery guns) earlier the exclusive purview of the public sector. In some instances, the private sector has also been able to bag orders (such as artillery gun, electronic surveillance equipment and big military infrastructure project) with direct competition with foreign companies.[69] Furthermore, the private sector has begun to break the monopoly of the public sector in some complex areas. The monopoly of HAL in aircraft manufacturing was for instance broken when the MoD in September 2021 signed a contract with the Airbus to enable the TATA consortium to manufacture 40 military transport aircraft (of 5–10-ton category) in India.[70] These aircrafts are meant to replace Avro aircrafts which were earlier license manufactured by HAL.

The private sector’s growing capability to supply much-needed equipment can further be gleaned from the list of equipment handed over to the Indian army in August 2022. Out of dozen or so pieces of equipment handed over, six were supplied by the private sector, including multi-mode hand grenades, downlink equipment, Landing Craft, Infantry Protected Mobility Vehicle (IPMV), Quick Reaction Fighting Vehicles,[71] and Long-range rockets.[72]

To encourage the private sector, the MoD’s procurement manual has provided it with a level-playing filed and carved out dedicated procedure to enable it to manufacture big-ticket items. Under the Strategic Partnership (SP) model, first introduced in a procurement manual in 2020, four segments have initially been identified—fighter aircraft, helicopters, submarines and armoured fighting vehicles (AFV) / Main Battel Tanks (MBT)—for exclusive participation of the private sector.[73] Though not a single project has moved to the execution phase because of procedural and other complexities, it nonetheless indicates the government’s openness to bring in private sector at par with the DPSUs.[74]

The role of the private sector in defence R&D is also slowly increasing, driven by the policy initiatives from the government. To encourage R&D within the industry, by start-ups, and by academia, the MoD has so far announced three schemes—Innovations for Defence Excellence (iDEX), Technology Development Fund (TDF), and Make category. Some of these schemes have started bearing fruit, albeit on a modest scale. For instance, the iDEX scheme, which was announced in 2018 to “foster innovation and technology development” in defence and aerospace through financial assistance, has led to the signing of 102 contracts.[75] In a boost to the scheme, a Bengaluru-based Deep Tech start-up, QNu Labs, successfully developed advanced quantum communication technology for hack-proof communication over a distance more than 150 km. Importantly, the Indian army, for which the technology was curated, has begun the process of its deployment by issuing a commercial tender to the company, indicating the success of the technology and prowess of India’s private innovation ecosystem.[76] Enthused by the iDEX’s success, the government has also brought a new version, iDEX Prime, with enhanced funding support of INR 100 million.

A boost for private sector in R&D came in form of Union Budget 2022-23, when the finance minister announced the government’s intention to encourage the industry “to take up design and development of military platforms and equipment in collaboration with DRDO and other organisations through SPV [Special Purpose Vehicle] model.” To encourage the industry, she further announced the freeing up of 25 percent of the defence R&D budget for the industry, start up, and academia.[77]

Consequent to the budget announcement, the government has identified 18 items for the industry-led design and development under difference procurement routes.[l] These include: hypersonic glide vehicles, light weight tanks, multi-role helicopters, low orbit pseudo satellites, and anti-jamming systems.[78] In addition, the funding to the industry under the TDF, which was earlier capped at INR 100 million, has been increased fivefold to INR 500 million.[79]

Recognising the role of the private sector, the government has also allocated a separate budget for procurement. In 2022-23, of the INR 845.98 billion earmarked for capital procurement from the domestic industry, INR 211.49 (25 percent) is separately allocated to the private sector.

Conclusion

The public sector has been the primary beneficiary of India’s drive for self-sufficiency in arms production and research. Beginning with a modest base at the time of independence, the sector now consists of a sprawling infrastructure catering to both R&D and manufacturing and a vast pool of workforce of nearly 152,000. However, the sector has not performed to expectation. With less than 60-percent share in India’s defence procurement, the public sector is mainly responsible for India’s continuing arms import dependency. The public sector also exhibits a host of inefficiencies, manifested in its poor indigenisation of input materials, inadequate innovation, sub-optimal management of human resources, and meagre export sales.

The entry of the private sector, initially into production and increasingly into R&D, is beginning to make a dent on the monopoly status of the public sector, though the latter still remains the dominant player in India’s arms industry. However, its dominance is likely to reduce further with the growing success of the private enterprises. In a very short time, the private sector has shown its competence in obtaining orders through competition and making rapid progress in technology development. With government’s policy increasingly providing a level playing field for private entities, its footprint is likely to increase in the future, reducing the role of the public sector even further.

However, given the size, experience and expertise of the public sector, it is in India’s interest to ensure that it plays a far more meaningful role than they are now discharging. The government, being its biggest stakeholder, needs to demand strict accountability in regard to quality, timeline, productivity and innovation. At the same time, the government must encourage public sector manufacturers to step up their in-house R&D while increasing its R&D budget. With an R&D budget of less than US$3 billion, and a pool of about 7,000 scientists (in DRDO), it currently lacks the resources to help India achieve self-reliance, especially in the big military platforms.

Endnotes

[a] According to SIPRI, India was the largest arms importer during 2018-22, accounting for 11 percent of total global arms import. Pieter D. Wezeman, Justine Gadon and Siemot T. Wezeman, “Trends in International Arms Trade, 2022,” SIPRI Fact Sheet, March 2023.

[b] The prohibitive cost of successive generations of military equipment is best illustrated by Norman Augustine, who in his 1983 book articulated an aphorism that “In the year 2054, the entire [US]defence budget will purchase just one aircraft. This aircraft will have to be shared by the Air Force and Navy 3 ½ days each per week except for leap year, when it will be made available to the Marines for the extra day.” Quoted in “Defence spending in a time of austerity,” The Economist, August 26, 2010.

[c] India’s offset guidelines, which were first published in 2005 and have been revised several times, mandate foreign companies to plough back at least 30 percent of the contract amount to the Indian industry. Laxman Kumar Behera, “Defence Offsets: International Best Practices and Lessons for India,” IDSA Monograph, No. 45, June 2015, file:///C:/Users/Laxman/Downloads/monograph45.pdf.

[d] In a reply to the Indian Parliament, the junior defence minister, Ajay Bhatt informed that the “Process for obtaining Cabinet Committee on Security’s (CCS) approval for design and prototype development of Advanced Medium Combat Aircraft (AMCA) has been initiated.” Rajya Sabha, “Government Plans on AMCA,” Unstarred Question No. 1329, Answered on March 14, 2022.

[e] Two major defence items gifted by India to neighbouring countries in recent years include a refurbished submarine to Myanmar and a Dornier aircraft to Sri Lanka. The gifts are intended to counter the influence of China in these countries. See Rezaul H Laskar, “India gifts submarine to Myanmar, gains edge over China,” The Hindustan Times, October 21, 2020; “India gifts Dornier to Sri Lanka a day ahead of Chinese vessel arrival,” The Hindustan Times, August 16, 2022.

[f] The seven new DPSUs are: Munitions India Ltd (MIL), Armoured Vehicles Nigam Ltd (AVNL), Advanced Weapons and Equipment India Ltd (AWEIL), Troop Comforts Ltd (TCL), Yantra India Ltd (YOL), India Optel Ltd (IOL) and Gliders India Ltd (GIL).

[g] Agencies responsible for quality monitoring include: Directorate General of Quality Assurance (DGQA), Directorate General of Aeronautical Quality Assurance (DGAQA), Missile System Quality Assurance Agency (MSQAA), Directorate General of Naval Armament Inspection (DGNAI), and Strategic System Quality Assurance Group (SSQAG).

[h] HAL and BEL with a global rank of 41st and 61st, respectively are the only two Indian companies that figure in the world’s top-100 defence companies in 2021. Among the top-20 defence companies, US tops the list with 08 companies followed by China (07), Europe (04) and Russia (01). Defense News, “Top-100 for 2021”.

[i] The other critical factor that contributed to statement in the contract negotiation was Dassault’s refusal to guarantee the quality of aircrafts to be produced by HAL. CAG, “Capital Acquisition in Indian Air Force,” Report No. 3 of 2019, p. 124.

[j] As corporate entities, the board of directors of the DPSUs are empowered to take certain independent decisions earlier the prerogative of the MoD.

[k] Some of the steps taken to encourage private participation include simplification of the industrial licensing process, opening up of government-owned trial and testing facilities for use by the private companies and articulation of an industry friendly export guidelines, among others.

[l] Of the 18 items, 14 are planned to be executed under Make-I, 2 under SPV model and one each under iDEX and Make-II. See Lok Sabha, “Industry Led Design and Development in Defence Sector,” Unstarred Question No. 4964, Answered on April 01, 2022.

[1] Snehesh Alex Philip, “Armed forces working on 100 emergency procurement contracts amid tensions with China,” ThePrint, July 21, 2020, (accessed on August 14, 2022).

[2] Ash Rossiter and Brendon J. Cannon, “Making arms in India? Examining New Delhi’s renewed drive for defence-industrial indigenization,” Defence Studies, Vol. 19, No. 4, 2019, p. 355.

[3] The arms trade with the third world (Stockholm: Almqvist & Wiksell, 1971), pp. 737-38.

[4] Çağlar Kurç and Richard A. Bitzinger, “Defense Industries in the 21st Century: A Comparative Analysis–The Second E-Workshop,” Comparative Strategy, Vol. 37, No. 4, 2018, p. 255.

[5] Kurç and Bitzinger, “Defense Industries in the 21st Century,” p. 255.

[6] Nan Tian et al., “Trends in World Military Expenditure, 2022,” SIPRI Fact Sheet, April 2023. (accessed on October 10, 2023).

[7] Laxman Kumar Behera and G Balachandran, “Implication of CAATSA for India’s Defence Relations with Russia and America,” IDSA Issue Brief, April 26, 2018, (accessed on August 16, 2022).

[8] Ashley J. Tellis, “‘What is in our Interest’: India and the Ukraine War,” Carnegie Endowment for International Peace, April 25, 2022.

[9] Ajay Sura, “India overcharged for satellite images, arms during Kargil,” The Times of India, December 14, 2019.

[10] Sura, “India overcharged for satellite images, arms during Kargil”.

[11] “Amid Ukraine-Russia war, IAF’s Rs 35,000 crore plan to upgrade Su-30 fighter fleet put on backburner,” The Times of India, May 08, 2022.

[12] Press Information Bureau (PIB), “Ministry of Defence organizes post budget webinar ‘Aatmanirbharta in Defence - Call to Action,’” February 25, 2022.

[13] Comptroller and Auditor General of India (CAG), “Capital Acquisition in Indian Air Force,” Report No. 3 of 2019, pp. 130-31.

[14] PIB, “Successful firing of Brahmos Air Launched Missile from Su-30 MKI Aircraft,” November 22, 2017.

[15] R.K. Tyagi, “Inside story: How Brahmos missile got integrated with Sukhoi-30 fighter plane,” ThePrint, November 29, 2017.

[16] S. Nihal Singh, “Why India goes to Moscow for Arms,” Asian Survey, Vol. 24, No. 7, 1984, pp. 707-20; Amit Gupta, “Techno-nationalism vs. techno globalization: India’s miliary acquisitions and arms production dilemma,” Comparative Strategy, Vol. 41, No. 2, 2022.

[17] Reserve Bank of India, “Weekly Statistical Supplement”.

[18] Ministry of Finance, Economic Survey 2017-18, Vol. II, p. 125.

[19] PIB, “8 Years Seva, Sushasan, Garib Kalyan”.

[20] Richard A. Bitzinger, “Defense Industries in Asia and the Technonationalist Impulse,” Contemporary Security Policy, Vol. 36, No. 3, 2015, pp. 453-472.

[21] Alex Capri, “Techno-nationalism: What is it and how will it change global commerce,” Forbes, December 20, 2019.

[22] Richard A. Bitzinger, “Defense Industries in Asia and the Technonationalist Impulse,” pp. 453-472.

[23] Laxman Kumar Behera, “Indian Defence Industry: Issues of Self-Reliance,” IDSA Monograph, July 2013, p. 32. (accessed on August 15, 2022)

[24] David Kinsella and Jugdep S. Chima, “Symbols of statehood: military industrialization and public discourse in India,” Review of International Studies, Vol. 27, 2001, pp. 353-373.

[25] Ajay Singh, “Quest for Self-Reliance,” in Jasjit Singh, India’s Defence Spending: Assessing Future Needs (Delhi: Hardev Printers, 2001), pp. 127.

[26] “India’s self-reliance in defence sector to boost global standing,” Mint, August 27, 2020.

[27] Sanjaya Baru, 75 years of Indian economy: re-emerge, reinvest, re-engage (New Delhi: Rupa, 2022), pp. 57-64.

[28] Arvind Panagaria, “The India economy at 75,” The Round Table, Vol. 111, No. 3, 2022, pp. 275-290.

[29] Lorne J. Kavic, India’s Quest for Security: Defence Policies, 1947-1965 (Berkeley: University of California Press, 1967), pp. 192-207.

[30] Laxman Kumar Behera, “Changing contours of Indian defence expenditure: Past as Prologue?,” in Harsh Pant (ed.), Handbook of Indian Defence Policy (London: Routledge, 2015), pp. 227-229.

[31] Kavic, India’s Quest for Security, p. 193.

[32] CARE Rating Ltd., “BrahMos Aerospace Private Ltd”, Press Release, March 07, 2022. (accessed on August 10, 2022).

[33] Dinakar Peri, “Philippines inks deal worth $375 million for BrahMos missiles,” The Hindu, January 28, 2022.

[34] Laxman Kumar Behera and S. N. Misra, “India’s Naval Shipbuilding Industry: Key Gaps and Policy Options,” Defence Studies, Vol. 12, No. 3, 2012, pp. 434-451.

[35] Department of Defence Production (DDP), MoD, “Dashboard”. (accessed on July 01, 2023)

[36] DRDO, Annual Report 2021, p. 4.

[37] Laxman Kumar Behera, “High on Revenue, Low on Capital: India’s Defence Budget 2023-24,” ORF Issue Brief No. 614, February 2023.

[38] CAG, “Defence Research and Development Organisation,” Report No. 15 of 2021, p. 5.

[39] KG Narayanan (ed.), Endeavours in Self-Reliance: Defence Research (1983-2018) (Delhi: DESIDOC, 2022), p. 425.

[40] DRDO, “Empowering India Through Self-Reliance,” p. ii.

[41] Lok Sabha, “Indigenous Production of Defence Equipment,” Starred Question No. 160, February 11, 2022, and DDP, “Dashboard”.

[42] Bharat Electronics Ltd, Annual Report 2021-22, p. 7.

[43] CAG, “Ordnance Factories and Defence Public Sector Undertakings,” Report No. 25 of 2021, p. 11.

[44] K Subrahmanyam, “Arms and Politics,” Strategic Analysis, Vol. 29, No. 1, 2005, pp. 177-186; Laxman Kumar Behera and G Balachandran, “Implication of CAATSA for India’s Defence Relations with Russia and America”.

[45] U.S. Department of State, “U.S. Security Cooperation with India,” Fact Sheet, January 20, 2021. (Accessed on August 16, 2022).

[46] DDP, “Policy for Indigenisation of Components and Spare used in Defence Platforms for DPSUs/OFB,” March 08, 2019.

[47] Lok Sabha, “Defence Aircraft and Helicopters,” Unstarred Question No. 2270, Answered on July 29, 2022.

[48] CAG, “Performance Audit of Activities of Public Sector Undertakings,” Report No. 10 of 2010-11, p. 23.

[49] Standing Committee on Defence, 17th Lok Sabha, “Demands for Grants 2021-22,” 22nd Report, p. 16.

[50] Laxman Kumar Behera, “Examining India’s Defence Innovation Performance,” Journal of Strategic Studies, Vol. 44, No. 6, 2021, p. 832.

[51] PIB, “Delivery of Indigenous Aircraft Carrier (IAC) ‘Vikrant,’” July 28, 2022.

[52] Standing Committee on Defence, 17th Lok Sabha, “Demands for Grants 2022-23,” 29th Report, p. 17

[53] Lucie Béraud-Sudreau et al., “Arms-Production Capabilities in the Indo-Pacific Region: Measing Self-Reliance,” SIPRI, October 2022, p. 16.

[54] “Initiatives of Ordnance Factory Board,” Ayudh XXXX, 2014, p. 6.

[55] Standing Committee on Defence, 16th Lok Sabha, “Demand for Grants 2018-19,” 43rd Report, Annexure ‘E’.

[56] Rajya Sabha, “Projects Discontinued Closed by DRDO,” Unstarred Question No. 974, Answered on March 05, 2018.

[57] CAG, “Defence Research and Development Organization,” Report No. 15 of 2021, pp. 59-61.

[58] Laxman Kumar Behera, “Made in India: an aspiring brand in global arms bazaar,” Defense & Security Analysis, Vol. 38, No. 3, 2022, pp.336-348.

[59] Laxman Kumar Behera, Indian Defence Industry: An Agenda for Making in India (New Delhi: Pentagon Press, 2016), pp. 51.

[60] Laxman Kumar Behera, “Examining India’s Defence Innovation Performance,” p. 840.

[61] CAG, “Defence Research and Development Organisation,” pp. v.

[62] “Defence industry should speed up investment in R&D: Antony”, The Economic Times, January 31, 2013.

[63] Lok Sabha, “Defence Research and Production,” Unstarred Question No. 5056, Answered on May 07, 2012.

[64] Department of Defence Production, “Mission Raksha Gyan Shakti”. (accessed on August 13, 2022)

[65] Laxman Kumar Behera, “Indian Defence Industry: A Reform Agenda,” in Gurmeet Kanwal and Neha Kohli (ed), Defence Reforms: A National Imperative (New Delhi: Pentagon, 2018), p. 189. For a broader discussion on India’s civil-military relations see Anit Mukherjee, The Absent Dialogue: Politicians, Bureaucrats, and the Military in India (New York: Oxford University Press, 2020).

[66] CAG, “Union Government (Defence Services): Army, Ordnance Factories and Defence Public Sector Undertakings,” Report No. 35 of 2014, p. 163.

[67] CAG, “Union Government (Defence Services): Air Force,” Report No. 14 of 2018, pp. 20-28.

[68] Defence Offset Management Wing, “List of IOPs,” (accessed on August 09, 2022).

[69] Laxman Kumar Behera, India’s Defence Economy: Planning, Budgeting, Industry and Procurement (London: Routledge, 2021), p. 74.

[70] PIB, “MoD signs contract with Airbus Defence & Space, Spain for acquisition of 56 C-295MW transport aircraft for IAF,” September 24, 2021.

[71] PIB, “Raksha Mantri hands over indigenously-developed equipment & systems to Indian Army in New Delhi,” August 16, 2022.

[72] Manu Pubby, “Defence companies to fly high as MoD okays emergency buys sans import,” The Economic Times, September 11, 2022.

[73] Ministry of Defence, Defence Acquisition Procedure 2020, pp. 480-81. (accessed on August 14, 2022).

[74] Shishir Gupta, “Defence ministry to allow private companies to develop military helicopters,” The Hindustan Times, July 17, 2022.

[75] Rajya Sabha, “Restructuring of Defence Forces,” Unstarred Question No. 2452, Answered on August 08, 2022.

[76] PIB, “MoD all set to take a leap in Quantum Communication Technology to celebrate ‘Azadi Ka Amrit Mahotsav,’” August 14, 2022.

[77] Ministry of Finance, “Union Budget 2022-23 (budget speech of the finance minister),” p. 15. (accessed 08 August 2022).

[78] Lok Sabha, “Industry led Design and Development in Defence Sector,” Unstarred Question No. 4964, Answered on April 01, 2022.

[79] PIB, “Funding under Technology Development Fund scheme of DRDO enhanced to Rs 50 crore per project from Rs 10 crore,” June 08, 2022.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

PREV

PREV