-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Renita D’Souza, ‘Improving Access to Agricultural Credit: New Perspectives’, ORF Occasional Paper No. 230, January 2020, Observer Research Foundation.

Introduction

India saw a dozen significant farmer protests in 2018 alone.[1] These protests were an overwhelming manifestation of the desperation of the average Indian farmer due to the deepening agrarian crisis in the rural economy.[2] The more tragic manifestation of the agrarian crisis is the alarming number of farmer suicides across the country. While Maharashtra has consistently recorded the highest number of suicides, Telangana, Andhra Pradesh, Karnataka, Chhattisgarh and Madhya Pradesh have frequented the list of states most affected by this problem from 2010 to 2016.[3]

The trend of declining growth in the agricultural sector is not new. This is exhibited by the stark difference between the growth rates of the industry and the services sectors at about nine percent per annum for the 10th Five Year Plan (2002–07) on the one hand, and the agriculture sector at around 2.3 percent per annum, on the other. Even in the five years that followed, the per annum growth rate of agriculture stayed below the target rate of four percent. Between 2012–13 and 2016–17, the per annum growth rate for the agricultural sector stood at just 3.2 percent. According to estimates by the Central Statistics Office (CSO), the growth rate in agriculture and allied activities stood at 3.4 percent in 2017–18 while it is expected to hover around 3.8 percent in 2018–19. These growth figures are particularly disappointing for a country that is the fastest-growing economy in the world.[4]

Low agricultural growth implies lower productivity and incomes for those engaged in agriculture. This is reflected in the contribution of agriculture to GDP over the years relative to the share of the workforce employed in agriculture (See Table 1). Since Independence, the contribution of agriculture to India’s GDP has steadily declined. However, the number of people depending on agriculture for employment has not reduced at a rate that ensures commensurate rise in the productivity of the workforce. This explains why a decline in the contribution of agriculture to GDP has translated into low agricultural productivity and incomes.

Table 1 Share of the Primary, Secondary and Tertiary Sectors in Employment and GDP across years (in percent)

| Sector | 1981 | 1991 | 2001 | 2016–17 | ||||

| Employment | GDP | Employment | GDP | Employment | GDP | Employment | GDP | |

| Primary | 68.87 | 41.8 | 66.75 | 34.92 | 59.9 | 27.3 | 42.74 | 15.11 |

| Secondary | 13.48 | 21.58 | 12.77 | 24.48 | 11.9 | 24.28 | 23.79 | 31.12 |

| Tertiary (Services) | 17.65 | 36.62 | 20.5 | 40.6 | 28.2 | 48.42 | 33.48 | 53.77 |

Source: Sangeeta Shroff, Rethinking India’s Battles against Chronic Agrarian Distress[5]

The primary causes of this chronic agrarian crisis include the following: (1) heavy dependence on monsoons and the inability to mitigate uncertainty associated with the vagaries of nature due to, amongst others, poor irrigation facilities; (2) lack of access to suitable technology; (3) anomalies and inefficiencies in agricultural markets and the marketing ecosystems; and (4) lack of institutional credit at affordable rates. The last of these causes must be emphasised more than the others given its ability to contribute in tackling the remaining causes. Revival of growth or even sustaining it requires falling back on the virtuous cycle triggered by investment; and as such private investment in agriculture demands financial inclusion of farmers.

It is widely recognised that there is a positive relationship between agricultural credit and agricultural growth. For a farmer, access to affordable institutional credit becomes crucial to start and sustain a good crop cycle based on quality inputs such as seeds, fertilisers, machinery and equipment, and sufficient supply of water and power. In an indirect manner, credit facilitates other important agricultural functions such as marketing, warehousing, storage and transportation, all of which are crucial to productivity. Agricultural credit plays an important role in providing essentials during adversity. To be able to absorb the shock of crop failure due to reasons such as drought and pest infestation or loss incurred due to price crash, the farmers must be financially equipped. Table 2 highlights the need of such preparedness and shows how often agricultural households have had to face various forms of crop or livestock related distress events.

Table 2 Percentage of Households that Faced Various Forms of Distress Events

| Distress Event | Percentage of households that faced the event |

| Crop failure due to excessive, very low or untimely rainfall | 53.8 |

| Sudden decline in productivity of crops due to pest infestation, etc. | 27.6 |

| Sudden fall in market price of crops | 18.2 |

| Loss of livestock due to flood, diseases, etc. | 9.8 |

Source: NABARD All India Rural Financial Inclusion Survey (NAFIS) 2016–17[6]

An article published in The Hindu on 20 June 2019 examined the question, ‘Does credit induce agricultural growth?’ The article concluded that there is a limited role that credit plays in promoting agricultural growth. It argued that the credit intensity of agriculture has risen exponentially over the years which means that the efficiency of agricultural credit in generating agricultural productivity has gone down. The thesis of this paper differs from this conclusion.

Towards a New Understanding of ‘Financial Inclusion’

Based on the definitions proposed by the committees chaired by Dr C. Rangarajan and Dr Raghuram Rajan, financial inclusion is considered a welfare-oriented exercise that involves improving access and affordability of various financial products and services such as payment services, savings products, insurance products and inflation-protected pensions. This definition underlies several government interventions for improving financial access. Viewing the problem of financial exclusion as a market failure with no market-oriented solutions is no longer true, given the emergence of several alternative financial models. This paper discusses some of these solutions. [7]

Financial exclusion must also be clearly defined; an exercise that will highlight what needs to change and give insights for appropriate solutions. According to Leyshon, Signoretta and French,[8] it refers to the barriers or limitations that prevent people from using financial services. It ranges from not having access to a bank account, to financial illiteracy. Several dimensions of barriers have been identified, including: physical exclusion, caused by the problems of travelling to avail services; access exclusion, caused by processes of risk assessment; condition exclusion, when the conditions attached to products are unsuitable or unacceptable to the consumers; price exclusion, when the price of products is unaffordable; marketing exclusion, where certain consumers are unaware of products due to marketing strategies that target others; and, self-exclusion, when people decide to exclude themselves voluntarily on the basis of past rejections or fear that they would be rejected. [9]

Avenues of financial inclusion must be sensitive to the financial realities characterising the farmers. Financial inclusion must be accompanied by a mechanism that reduces the risk associated with lending, the probability of loan failures. This requires empowering the farmers to utilise the credit obtained to adopt appropriate agricultural practices, use high-quality inputs, leverage the latest technology available to tackle weather and climate uncertainties and improve productivity. There is a need to envision a system that can provide the necessary structure for this cycle. This may also call for alternative financial models disbursing credit to farmers. At the least, the basic principle that financial inclusion models of credit allocation need to adhere to is as follows: Minimisation of the probability of economic loss for both lender and borrower (operationalised in the context of the Indian farmer). Therefore, there is a need to highlight the limitations of conventional financial institutions in this regard and enumerate new models of credit disbursements.

Measures for Improving Access to Agricultural Credit in India: A Survey

This section provides a comprehensive survey of the efforts that have been made to improve agricultural credit in India since Independence. These measures conform to the conventional notion of financial inclusion that has prevailed in the country. It can be argued that all of these initiatives stand in clear violation of the principle mentioned earlier. This survey is essential as it sets the precedents to which alternatives have to be defined.

The timeline of the agricultural credit initiatives in India can be traced back to the early 20th century, with measures that sought to establish and strengthen the credit co-operative movement. The objective of this movement was to provide affordable credit to farmers, especially the small and marginal ones. The Agricultural Credit Department was set up in the Reserve Bank of India, through the RBI Act, 1934, to provide refinancing to the co-operative credit structure. The co-operative movement failed to sustain its momentum in the following years as it was burdened by delays in repayment of credit.[10]

Until 1966, the disbursement of agricultural credit was primarily the mandate of the co-operative credit societies. On the recommendation of the All India Rural Credit Committee (1969), the commercial banks were also enrolled in doing the same in a proactive manner. This new mandate gained further prominence following the nationalisation of commercial banks in 1969.[11]

The intervention of applying concessional interest rates to those below the poverty line was introduced in 1972. Priority sector lending was launched in 1974 so as to statutorily earmark a fraction of credit to areas deemed as priority sectors. Within these sectors, agriculture and weaker sections were demarcated as two distinct categories in 1980. Small farmers were explicitly identified as beneficiaries under the category of ‘weaker sections’ while implicitly so under the category of ‘agriculture.’ The targets under priority sector lending are subject to stringent enforcement. Failing to achieve them incurs penalties for the banks, the severity of which varies directly with the size of the shortfall. As such, this endeavour has yielded positive results in increasing access to agricultural credit.[12]

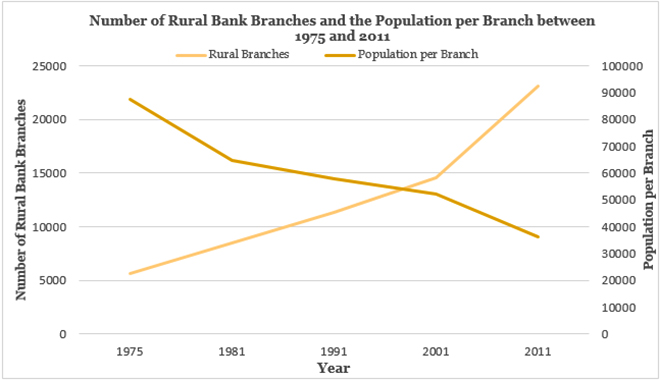

The introduction of concessional interest rates and priority sector lending emphasised the need of commercial banks to further expand their agricultural credit disbursement following the dismal performance of agricultural output in 1966 and 1967. The recommendations of the Narasimham Committee on rural credit (1975) were a setback in the appraisal of the performance of commercial banks and the co-operative credit structure in extending agricultural credit. The committee recommended the setting up of Regional Rural Banks (RRBs) to compensate for the shortfall in meeting agricultural credit needs (See Figure 1). The establishment of the National Bank for Agriculture and Rural Development (NABARD) in 1982 was expected to provide further impetus to adequately meeting agricultural credit needs.[13]

Figure 1 Number of Rural Bank Branches and the Population per Branch between 1975 and 2011

The increase in rural bank branches received a major boost from the nationalisation of commercial banks in 1969, especially through the launch of the Lead Bank Scheme. In this scheme, a lead bank was assigned to different areas with the primary responsibility of mapping the credit needs within its jurisdiction and to meet them through adequate banking and credit facilities. These banks were also charged with the responsibility of overseeing that rural and semi-urban branches under them maintain credit–deposit ratio of 60 percent.[15]

During the period 1976–2014, the commercial banks became the primary lending institutions, and their branches in rural areas increased exponentially from 7,690 to 44,699. As a result of a large number of rural bank branches and a reduced population per branch rate, the credit disbursement to farmers improved significantly. An important intervention for expanding the coverage of agricultural credit, especially to small and marginal farmers, involved the establishment of the Regional Rural Banks. At the end of March 2014, there were 57 RRBs managing an aggregate network of 19,082 branches across 642 districts throughout the country.[16]

Under the aegis of the Self-Help Groups (SHG)–Bank linkage programme initiated by NABARD to connect the informal workforce to the formal banking sector, the SHGs employ their pooled resources to disburse loans to their members through the agency of the banks. The banks issue credit against the groups’ guarantee and the size of loans could be multiple times that of the resources deposited with the banks. NABARD is responsible for refinancing such credit, and the progress made by this initiative is reflected in 73.18 lakh savings-linked SHGs and 44.51 lakh credit-linked SHGs covering about 9.5 crore households in India in 2014.[17]

In 2004, schemes were launched aimed at doubling the agricultural credit in the following three years. These included issuing fresh credit to farmers reeling under natural calamities, restructuring of debt, providing relief to farmers caught in the web of informal lenders, and one-time settlement for small and marginal farmers.[18]

The Kisan Credit Card (KCC) is a mechanism instituted to assist the farmers in accessing timely and adequate credit from the banking sector for crop cultivation, post-harvest and marketing needs, maintenance of farm assets and investment credit for purchasing high-value agricultural assets. The conventional method of credit disbursement has been replaced by KCC, ATM-enabled debit card, which allows disbursement of credit. The use of KCC has a wide coverage, catering to the customers of commercial banks, RRBs and co-operatives.[19]

Following the economic reforms in the 1990s, interest rates were deregulated both on deposits and credit disbursements. However, in the aftermath of the food crisis in 2006–07, an interest subvention scheme on short-term credit was brought into force wherein the interest rates on agricultural credit were subsidised. The impact of this scheme on the demand for short-term credit is discussed in the next section of this paper.[20]

Indian banks introduced the Basic Savings Bank Deposit Account (BSBDA) to decrease the costs involved in operating bank accounts. As such, these accounts are characterised by minimal account balance, minimal charges and simplified Know Your Customer (KYC) norms. The launch of the ATM machine and the widening of its coverage is a significant strategy among financial inclusion measures. The Business Correspondent (BC) model of financial inclusion has been brought into force, wherein agents replace and function instead of brick and mortar branches, to provide basic banking services in locations where establishing bank branches is difficult. In 2014, the Government of India introduced the Pradhan Mantri Jan Dhan Yojana to enhance access and affordability of financial services (such as a basic savings bank account, credit, insurance, pension and remittance facilities) to the weaker sections of society. [21]

An examination of the history of institutional credit to farmers in India shows that since Independence, there has been a significant emphasis on prioritising lending to small farmers by increasing the quantum of credit to be disbursed to them at affordable rates. Following the economic liberalisation reforms, the focus tilted towards concerns of profitability. As such, interest rates were deregulated and restrictions on lending were relaxed. During the period after 2005, the mandate of the banking sector continued to remain anchored in profitability and commercial concerns but with a renewal of the commitment towards universal financial inclusion. This transition of the nation’s banking policy has not done much to improve access and affordability of formal credit to small and marginal farmers.[22]

Financial Inclusion of Farmers in India: A Brief Profile

CRISIL Inclusix, India’s first financial inclusion index, launched in 2013, increased from 50.1 in the fiscal year 2013 to 58 in 2016. This improvement in the index captures progress across the four dimensions of financial inclusion: (i) branch penetration; (ii) deposit penetration; (iii) credit penetration; and (iv) insurance penetration. According to the 2017 iteration of the Global Findex Report, the number of bank-account holders in India has risen from 53 percent in 2014 to 80 percent in 2017 on account of 281.7 million Jan Dhan accounts. However, as many as 48 percent of these accounts are inactive, i.e., no deposit and withdrawal happened using these accounts in 2017. The failure of the BC model can be attributed to the following reasons: an inappropriate commission structure for the BC agents entail low recovery of costs and reduced profitability; too much work adversely affecting the quality of service provision; very little commission despite a lot of work breeding indifference towards the quality of work among BCs; and the low usage of BSBDA accounts.[23]

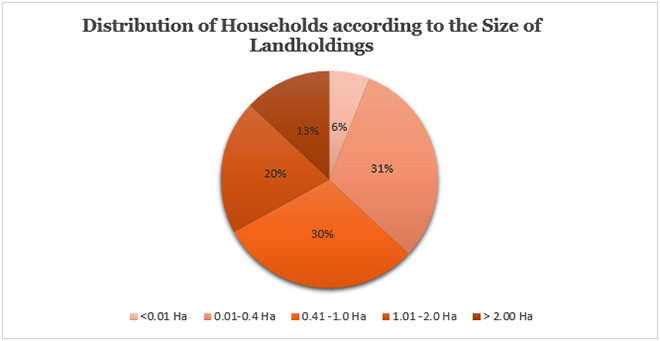

Access to institutional credit demands the ownership of assets and income that evaluates the creditworthiness of a potential borrower. Lack of such creditworthiness implies access exclusion (mentioned in the definition of financial exclusion earlier). It is imperative then to survey the distribution of assets across agricultural households. Figure 2 shows that 87 percent of agricultural households possess land which is less than or equal to two hectares. This means that in accordance with the definition of the Reserve Bank of India, 87 percent farmers are either small or marginal.[24]

Figure 2 Distribution of Households according to the Size of Landholdings

The size of income varies positively with the size of landholdings. The data suggest that, on average, small and marginal farmers either belong to the Economically Weaker Sections (EWS) or Low-Income Groups (LIG). Small and marginal farmers who are deprived of land resources also end up being deprived of income. This takes away from their credentials the access to an institutional loan.[25]

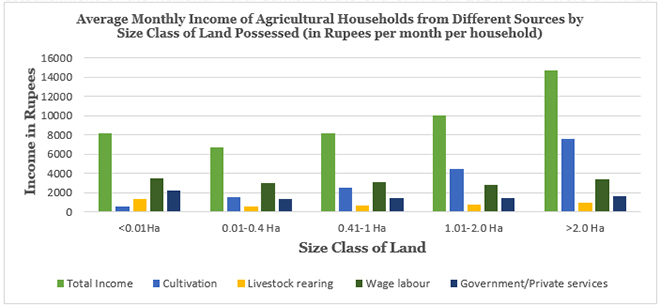

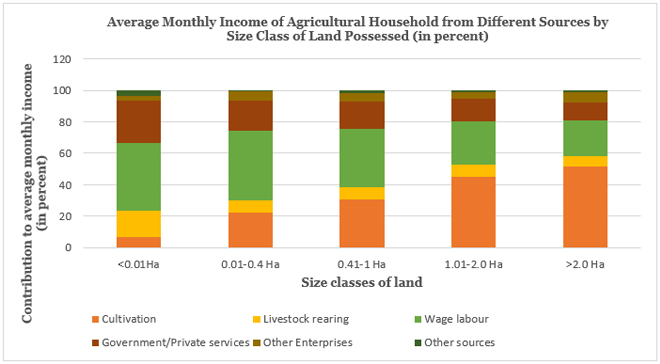

Figures 3 and 4 disaggregate the average monthly income of the agricultural households from different sources viz. cultivation, livestock rearing, government/private services, casual wage labour, and show a strong negative correlation between the size of income and the contribution of wage labour to income. Figures 3 and 4 depict a positive correlation between the size of income and the contribution of cultivation to income as well. There is also a strong reliance of income on informal unstable sources such as casual wage labour. This again reduces the ability to avail institutional credit. The above finding highlights the need for policy intervention for a shift in contribution to agricultural household income from informal to formal sources.[26]

Figure 3 Average Monthly Income of Agricultural Household from Different Sources by Size Class of Land Possessed

Figure 4 Average Monthly Income of Agricultural Household from Different Sources by Size Class of Land Possessed (in percent)

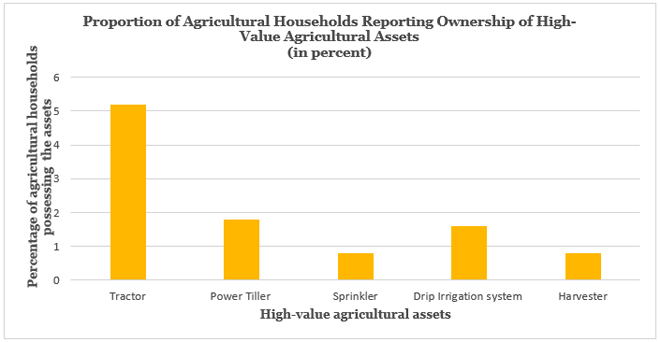

The question of increasing incomes from cultivation makes the issue of ownership of high-value agricultural assets relevant. Figure 5 summarises the profile of such ownership among agricultural households.[27] The ownership percentages are disappointing, and the focus of policy should be affordable access to agricultural assets whether through ownership or some rental model of access.

Figure 5 Proportion of Agricultural Households Reporting Ownership of High-Value Agricultural Assets (in percent)

About 55 percent of the agricultural households have savings. The average savings in 2016 per household stood at INR 9,657, of which 94 percent have been saved in institutions. On average, an agricultural household saved around INR 804 on a monthly basis. Given the average monthly income of INR 8,931, only a meagre nine percent of the income earned is being saved.[28]

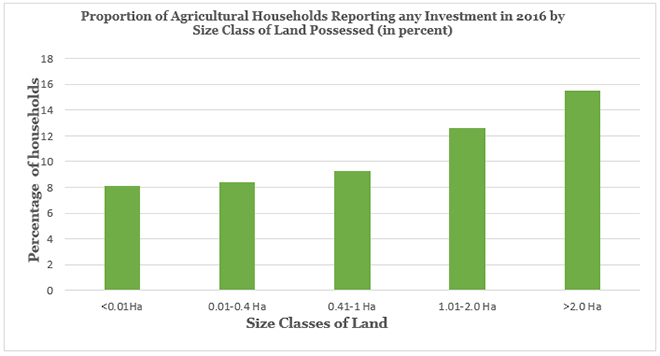

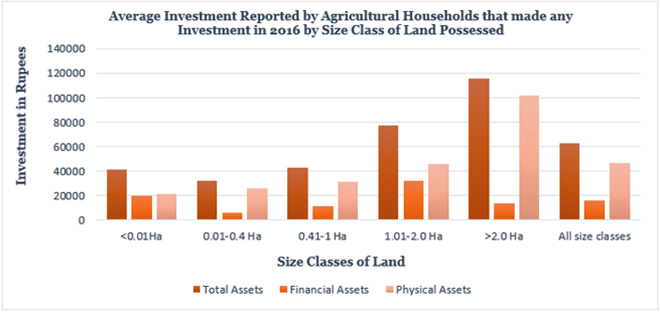

The percentage of agricultural households having any investment in the year 2016 was at a dismal 10.4 percent. Analysing this number across various size classes of land generates Figure 6 and Figure 7.[29] There is a positive correlation between the percentage of agricultural households having any investment in the year 2016 and the size of income.

Figure 6 Proportion of Agricultural Households Reporting any Investment in 2016 by Size Class of Land Possessed (in percent)

Figure 7 Average Investment Reported by Agricultural Households that made any Investment by Size Class of Land Possessed

There is greater preference for physical assets rather than financial assets across all size classes of land. NAFIS defines financial assets as “investments in bank deposits including fixed and recurring deposits, in shares/ bonds, or investments made in Post Office deposits like Kisan Vikas Patra, etc.” and physical assets as “purchase or construction of house, investment in livestock, buying equipment for non-farm business, buying farm machines/ irrigation equipment, or investment in major repairs which increases the life of the asset/ building (NAFIS, p. 54).”[30]

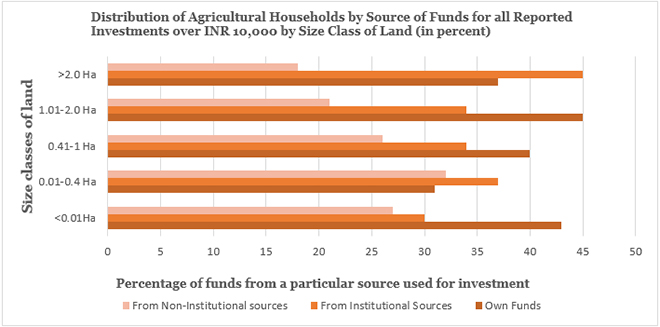

Figure 8 shows that the primary sources of investment are personally owned funds and those acquired from institutional sources.[31] The reliance on non-institutional sources decreases with an increase in the size of land possessed.

Figure 8 Distribution of Agricultural Households by Source of Funds for all Reported Investments over INR 10,000 by Size Class of Land (in percent)

The above analysis reveals that in order to increase investment in high-value agricultural assets, which drives agricultural productivity, farmers’ household incomes must be increased and access to institutional credit, encouraged.

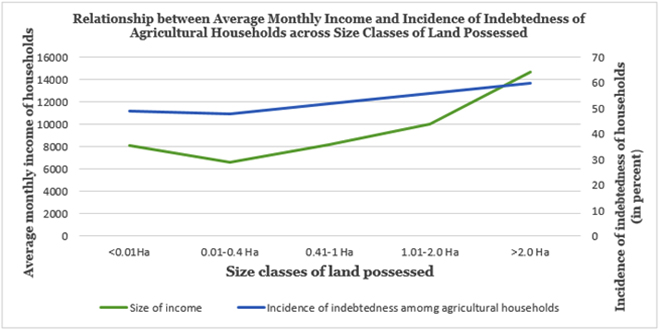

Figure 9 shows how the trajectory of the size of income across households possessing land of varied sizes is same as that of the incidence of indebtedness. This relationship is true of the direction of change, i.e., increase or decrease (but not of the rate of change, i.e., rate of increase or decrease). This relationship can be explained by the fact that the level of income is important in determining access to credit.[32]

Figure 9 Relationship between Average Monthly Income and Incidence of Indebtedness of Agricultural Households across Size Classes of Land Possessed

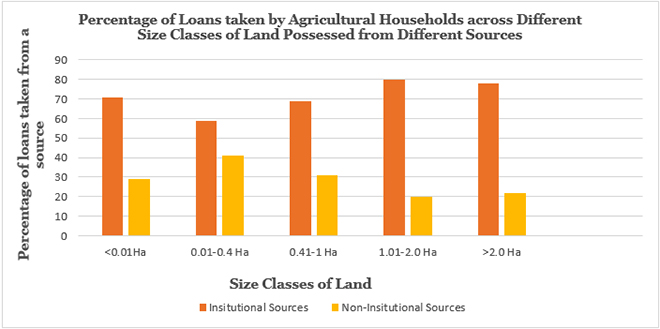

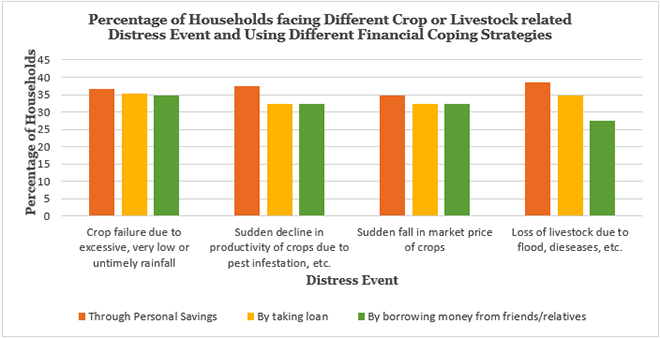

As is shown in Figure 10, agricultural households belonging to any size class of land possessed prefer to avail loans from institutional sources rather than non-institutional ones. Figure 11 highlights how agricultural households rely on informal sources such as borrowing money from friends or relatives as much as on personal savings and loans to cope up with agricultural distress events. Given the fact that a large percentage of loans are from institutional sources, the balance of advantage seems to tilt towards formal sources of coping with distress events. However, for the sake of argument, even if it is assumed that all the loans used for dealing with agricultural distress are formal, still a percentage as large as around 30 of the cumulative resources (personal savings plus loans plus borrowings from friends/relatives) is sourced from friends/relatives; the situation still demands initiatives that will drastically reduce this percentage.[33]

Figure 10 Percentage of Loans taken by Agricultural Households across Different Size Classes of Land Possessed from Different Sources

Figure 11 Percentage of Households facing Different Crop or Livestock related Distress Event and Using Different Financial Coping Strategies

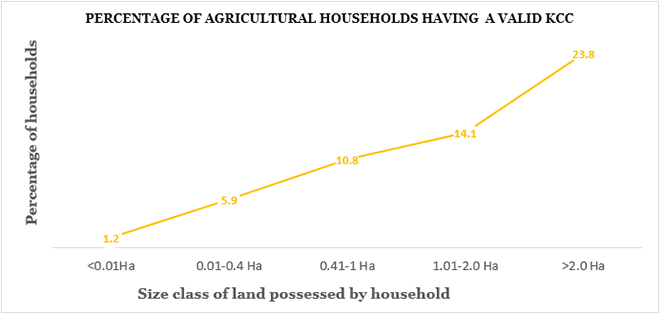

According to NAFIS 2016–17, only 10.5 percent of the agricultural households surveyed own a Kisan Credit Card. The ownership of KCC with respect to the size of land possessed is shown in Figure 12. This figure also shows that the proportion of households in any size class of land possessed owning a KCC varies positively with the size of land possessed. The constituencies that need the provision the most have it the least. NAFIS 2016–17 also finds that 66 percent of KCC owners have utilised the credit limit sanctioned to them. This is a positive finding. Unfortunately, the credit limit sanctioned varied directly with the size of land possessed, which means that those who need credit assistance the most found less of it, at least in terms of the credit limit sanctioned to them.[34]

Figure 12 Percentage of Agricultural Households having a Valid KCC

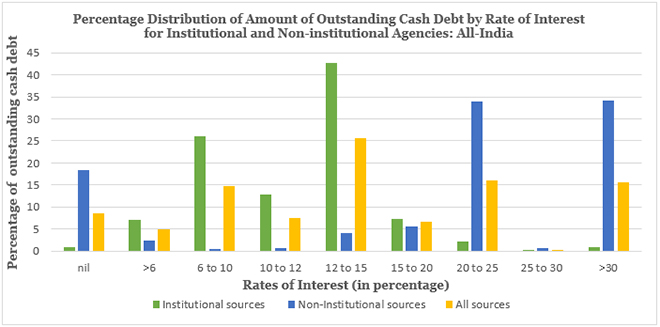

Of the total credit disbursed in rural areas by institutional agencies, as much as 42.6 percent was charged at an interest rate in the range of 12–15 percent. As far as non-institutional credit is concerned, about 68.6 percent was extended at rates of interest greater than 20 percent. In fact, around 34.1 percent of the loans were provided at a rate greater than 30 percent.[35]

Those who can borrow from banks or co-operatives, are also paying interest rates as high as 12 percent (at par with market rates). Those who access loans from Microfinance Institutions (MFIs), Self-Help Groups (SHGs) and informal sources do so at exorbitant rates of about 30–35 percent. The reason why credit comes at such a high cost is sound financial arithmetic.[36]

Consider the case of banks. Suppose they acquire their capital at a base rate of 4–5 percent. The cost of disbursing loans includes costs incurred on transactions such as processing loan applications, collecting repayments, etc. Therefore, a bank needs to charge at least 9–12 percent to break even. The need to maintain healthy balance sheets translates into lower loan disbursements to poor farmers at subsidised rates.[37]

MFIs provide non-collateralised loans but at exorbitant rates. They acquire their loan capital at around 12 percent. The transaction costs of disbursing loans amount to about 14 percent. Therefore, breaking even would require them to charge an interest rate of about 30 percent. Their profit margins further push the rates to 35–37 percent (Figure 13).[38]

Figure 13 Percentage Distribution of Amount of Outstanding Cash Debt by Rate of Interest for Institutional and Non-institutional Agencies: All-India

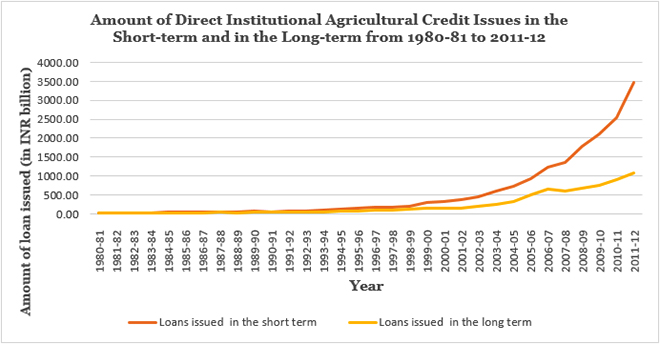

Both short-term and long-term agricultural credit in India rose between 1980–81 and 2011–12 (Figure 14). However, the rate of increase in short-term credit exceeds that in long-term credit. This has negative implications for the expansion of productive capacity of the farmers and their ability to acquire debt and withstand debt shocks. The rate of increase in long-term credit is consistent with the data on ownership of high-value agricultural assets.[40]

Figure 14 Amount of Direct Institutional Agricultural Credit Issues in the Short-term and in the Long-term from 1980–81 to 2011–12

Has the policy of interest subvention translated into appreciable gains in the demand for credit? The answer to this question is an unfortunate ‘No’ and has been inferred from the following evidence.

The cost of inputs as a proportion of short-term credit financed by institutional sources has increased from 16.8 percent in 1997–98 to 84.06 percent in 2011–12 and higher up to 99.97 percent in 2012–13. This is inconsistent with the fact that about 64 percent of total outstanding credit was sourced from institutional agencies. Furthermore, the pattern of credit disbursement suggests lower loan issues in months of maximum agricultural activity, i.e., the time of sowing in the Rabi season than in other months. For instance, about 46 percent of the annual loan issue occurred in the months of January to March in 2008–09. This figure stood at 62 percent in 2013–14. Therefore, it can be inferred that instead of increasing demand for short-term agricultural credit, the interest subvention scheme might have been exploited as an arbitrage opportunity.[42]

Recommendations

This section articulates financial inclusion models of credit allocation which are in conformity with the minimally essential principle already mentioned earlier. Minimally, the basic principle that financial inclusion models of credit allocation need to adhere to is as follows: Minimisation of the probability of economic loss for both lender and borrower (operationalised in the context of the Indian farmer).

The previous section showed that the variables of financial inclusion—namely savings, investment and even credit—are determined to a significant degree by the size of landholdings and the level of income of agricultural households. In aspiring to double farmers’ incomes and rescue those in a debt trap, India has to change this reality, especially as regards credit. Dependence of access to credit on the level of income and landholdings defeats the purpose of financial inclusion. On average, approximately 50 percent of agricultural households have availed credit.[43] What about access to institutional credit to the remaining 50 percent? Furthermore, will the 50 percent who are indebted be able to pay back the loans in time? Reeling under the burden of the debt trap has led several farmers to commit suicide, the most horrific manifestation of the agrarian distress in the country.

There is a dire need to replace existing collateral requirements and assessments of creditworthiness with systems that measure repayment capacity on the basis of optimum utilisation of disbursed credit; an agricultural credit system based on the productive capacity of the borrower and not on securities as collateral. The success of such a credit system is deemed to rely upon the monitoring of credit utilisation so as to ensure appropriate and efficient utilisation of credit resources.

The crop loan scheme, also known as the investment loan or production loan recommended by the Mirdha Committee on co-operation in 1965, is based on the above insight. Crop loans are essentially short-term loans disbursed before the beginning of the sowing season and are recovered after harvest. The crops to be produced are the collateral. As has been stipulated by the RBI in its manual on short-term and medium-term loans for agricultural purposes (1966), the loan is disbursed according to the projected harvest and the nature of cultivation practices in the concerned area. More specifically, the determinants of the loan include the need of finance for seeds, fertilisers, pesticides and agricultural equipment; these needs are to be catered to by a loan in kind. The determinants of the loan to be disbursed in cash include costs involving labour, rentals to be made for tractors and other agricultural machinery, tillage, land preparation, electricity, irrigation, transport and harvesting costs. For appropriate utilisation of issued credit, regular follow-up by a bank manager or field supervisor is deemed essential. Damage to crop and consequent losses in the face of natural calamities or other distress events are tackled by the modification of time of repayment and other such terms and conditions of the loan.

Some important drawbacks of the crop loan system are as follows: The implementation of the crop loan scheme exhibited a significant departure from the primary principle underlying the scheme, i.e., loans should be issued on the basis of productive capacity and not on existing property titles. Mortgage of land has continued to remain important for crop loans. The loans in kind have been disappointingly sparse.

Banks have demonstrated risk-averse behaviour in their lending under the crop loan scheme. The reasons underlying this behaviour should be determined, since it defeats the core objective of the crop loan scheme. One possible reason is that repayment of loans is to be financed by the sale proceeds of the agricultural produce. It is known that the agricultural marketing infrastructure in the country is weak. Another important question that needs to be reflected upon is as follows: Has loan disbursal under the crop loan scheme translated into greater agricultural productivity? The answer is an emphatic ‘No’ which is clear from the agricultural performance since Independence. Without putting in place transmission mechanisms between credit and productivity, risk-averse bank lenders will continue to be a problem for the successful implementation of the crop loan scheme. In the context of low agricultural productivity, inadequate implementation of the crop loan scheme is also to blame, since studies have shown that the share of small and marginal farmers in total crop credit was less than their share in land operated. Furthermore, small farmers were also deprived of the total amount of crop credit they were entitled to.[44]

It is important to envision modifications to the existing crop loan system or articulate the blueprint of an alternative system. Often, although a loan is provided, the farmer fails to benefit from it on account of distress events. Crop loans or any other mode of formal credit needs to be embedded within a larger ecosystem which enables the farmer to utilise the credit optimally even in the face of distress events. It is unfortunate that around one-third of the agricultural households rely on informal sources of funds for coping with issues like crop failure, pest infestation, price shocks, floods, and disease. Distress events cannot be accounted for by merely modifying terms and conditions of repayment or other aspects of the loan issued. This measure ignores the possibility of chronic distress due to structural anomalies of an economy which can push the farmer into a debt trap, as is the case in India. In addition to facilitating affordable access to high-quality input factors such as seeds, fertilisers, machinery, equipment, the required ecosystem must assist the farmers in mitigating climatic uncertainties and provide information on agricultural best practices to deal with agricultural distress. This ecosystem may require collaboration between credit lenders and various agricultural enterprises. In the Indian context, providing credit at affordable rates in the absence of the above-mentioned ecosystem cannot be regarded as financial inclusion because such a myopic view of the term does not take into account the risks that an Indian farmer needs to be underwritten for.

The exponential growth in the country’s food grain production from 51 million tonnes in 1950–51 to about 252 million tonnes in 2014–15 has not translated into higher incomes and poverty reduction for the farmers.[45] The prime reasons explaining this situation are the fragmented marketing ecosystem and the dominance of intermediaries in the supply chain of agricultural produce. These reasons can perhaps explain the fear of default and risk of Non-Performing Assets (NPAs) in the crop loan scheme where repayment is based on sale proceeds of agricultural produce. Market reform is imminent for any formal credit mechanism akin to crop loans.

There is a shortage of market infrastructure for agricultural produce in India. The Agricultural Produce Market Committee (APMC) markets in India, the primary market infrastructure, are present only in 23 states and five Union Territories in India. The norm of the National Commission on Farmers that there should be at least one regulated market within a radius of 5 kms is also not being fulfilled.[46]

Although, theoretically, the APMCs are run by the state governments, the business in these markets actually has been hijacked and cartelised by the traders and commission agents operating in these markets. The APMC Act restricts the farmer from selling his produce outside the market and mandates that the sale happens only through the commissioned agents.[47]

Open auction platforms exist only in around two-thirds of the regulated markets and 25 percent of them have common drying yards, 10 percent have cold storage units, while grading facilities exist only in less than one-third of them, and electronic weighbridges are available only in a few markets.[48]

To correct the above-mentioned anomalies in the agricultural marketing landscape, some reforms have been recommended for implementation by the state governments in their respective APMC markets. One of the primary changes brought about by these reforms is the freedom of the farmer to sell to anyone anywhere. Unfortunately, hardly any states have implemented this reform.[49]

The electronic National Agricultural Market (e-NAM) has been launched to provide a national unified platform, a single national market also allowing interstate trading of agricultural produce, which ensures transparent price discovery and elimination of middlemen so as to enable the farmer to get the right price. However, this initiative has proven to be a non-starter.[50]

Markets and marketing are naturally the territory of the private sector. There is an urgent need for the governments to understand this and open up this domain to the private sector. Of course, this comes with some qualifications. This measure is intended for the farmers. Hence, the private players cannot overshadow the farmers’ interest. To this extent, government regulations are reasonable.

The first step is to give farmers and consumers the freedom to organise themselves as markets. The natural profit maximising outcome of this will be the launch of online markets by private players as such markets will ensure the desired price discovery. The role of the government here is to act against the resistance towards this move. Also, the government needs to design an adequate framework governing such markets to help them achieve competition, fair bidding, transparent price discovery and ethical market practices.

Thriving private markets will enable the development of a robust marketing supply chain since well-functioning markets imply profits and growth of the sector. The profits of those operating in the agricultural supply chain are interlinked. After all, only after the produce is sold to the end-consumer at a profit will each of those in the chain make profit. Hence, incubating each of the components in the supply chain in isolation may not make much sense. This will involve heavy investments. Yet, the profits to be made in such a venture is quite appreciable. Entities such as Star Agri, SV Agri, Cold Star Logistics are some such ventures.[51] The government needs to create an environment conducive for such investments so that more players enter this domain.

An important input for the farmers is information, be it about inputs or outputs. A lot of enterprises are currently focused on providing information about inputs. But output related information need not always come from the online markets. The government can undertake information dissemination of price of agricultural produce on its own and encourage the same as a viable business opportunity for the private sector which can tackle the information asymmetry facing the farmers.

There is a need to empower the farmers to move beyond being a producer to becoming an agripreneur who understands agricultural marketing and beyond. An action plan needs to be drawn up to achieve this objective keeping in mind the poorest farmer. The most vulnerable farmer must gain access to and understand the dynamics of the export markets as well.

The strong reliance of agricultural households’ incomes on casual wage labour needs to be replaced by formal earnings. This will help tackle the problems of irregularity of income and lack of reliable income documentation which adversely affect access to credit. India’s industrialisation in recent times has become rural in nature. With organised large-scale manufacturing sector which accounts for about 80 percent of the total manufacturing output shifting to rural areas in order to leverage cheap land and labour,[52] an avenue is opened to correct the spatial and regional disparities confronting the nation. In fact, most of the disguised unemployed that form part of the 50 percent that relies on agricultural income can now be absorbed into the formal manufacturing sector located in rural areas.

This trend of a ruralising manufacturing sector can be capitalised upon to generate greater formal employment in the rural areas so that the share of casual wage labour is reduced and that of formal income increases. Hence, the policymakers need to understand this trend and steer it according to their own development agenda. It must be ensured that deficiencies in infrastructure, power and connectivity should not impede this ruralisation phenomenon. Policymakers need to investigate the factors that can catalyse this process and identify measures that can create an enabling environment for the same.

Conventional economic theory presumes that the economic behaviour of the homo economicus, the rational economic man, has being driven solely by self-interest. Empirical evidence suggests the contrary. Humans are altruistic, they care about being fair, their choices are motivated by reciprocity, and they adhere to social norms. Behavioural economics is replete with literature that seeks to explain such behavioural tendencies.[53] To give an example in the Indian context, consider the Ujjwala scheme in association with which PM Narendra Modi appealed to the public to give up their LPG subsidy if they were in a position to do so. Standard economic theory would predict that no one would give up their subsidy. However, many did give it up. To be exact, since the launch of the scheme in 2016, 1.03 crore people have given up their subsidy (as of December 2018).[54]

In the context of investments, those who are driven purely by the motive of higher returns are catered to by conventional investments. But what about those who wish to employ their investible resources to achieve some social outcomes besides earning a return? Impact investments are the answer. Impact investment lies between pure philanthropy and exclusively commercial investments.[55] It challenges the traditionally accepted trade-off between social return and financial return.

Impact investments in India have gained a lot of traction and have a bright future as well. An appetite for economic growth, scope for social progress and robust financial markets based on the principle of the rule of law have interacted with each other to boost the growth of impact investments in India. The cumulative assets in impact investments between 2010 and 2016 in India stood at US$5.2 billion, of which US$1.1 billion was invested in 2016 alone. In 2016, financial inclusion as an area of social impact accounted for 43 percent of the total impact investment deals, while clean energy, agriculture and education accounted for 21 percent, 13 percent and five percent, respectively. However, the scenario has completely changed in 2018 with agriculture accounting for about 67 percent of the deals, with the share of energy and microfinance having reduced to about 33 percent and 25 percent, respectively.[56]

Impact investment funds in agriculture have been received in the form of debt investment in co-operatives and food enterprises, equity investments in retailers and ag-tech firms that seek to achieve optimal utilisation of input factors and energy, efficient management of scarce resources and those that attempt to mitigate climatic uncertainties, enterprises that seek to ensure seamless access to inputs, information and capital, etc.[57] In this paper, we argue how impact investments are ideal as credit resources for the Indian small and marginal farmers.

Impact investments are referred to as ‘patient’ capital, in that it is patient about the size of the return as well as the tenure after which this return can be expected. Given that impact investors are interested in the social impact (of course different investors have different preferences for social versus financial return), the returns can be tied to the realisation of the social outcome being promised. For example, in the face of subsequent droughts, successive crop failures, the farmer would find it very difficult to pay back the loan. In such cases, the social impact could be freeing the farmer from the debt trap. The payment of the rate of return could be tied to this objective. As such, ‘patient’ capital relieves the farmer of the pressures surmounting as a result of accumulating debt burden.

Yet, there is a significant chance that the interest concessions given under impact investments may be exploited for arbitrage. Even the chances of deferring or even defaulting on payment for no valid reason may fracture the credit discipline of the beneficiaries. Hence, a lot of thought needs to be given as to how the impact investment instruments should be articulated and operationalised.

The impact investment ecosystem needs to be further developed by initiating measures related to tax and regulatory regimes, measures for encouraging, incubating and nurturing social enterprises, transparency and accountability measures by formulating robust methods of measuring social impact, steps to secure investor protection and public trust.

Charitable donations which have no obligation of returning the money attached to them provide greater flexibility in designing credit instruments for small and marginal farmers in India. A revolving fund can be created to park the donations, repaid loans and the interest paid on loans. Given evidence of arbitrage exploitation in the past, interest-free loans are not a good idea. Also, credit instruments can be sympathetic to farmers in deep debt crisis and waive off loans. However, to avoid wilful default driven by the expectation of loan waivers, such waivers cannot be blanket announcements and must be provided on a case by case basis. High-risk low-quality credit assets can be financed by philanthropic sources. Hence, these resources have the potential of extending credit access to the underserved.

Conventional methods of assessing lending risks will almost always deem small and marginal farmers as high-risk, low-quality credit assets. What worsens the matter is the lack of reliable income documentation and proper record of land titles.

FarmDrive in Kenya has championed an interesting alternative for assessing creditworthiness of small landholding farmers. The enterprise has developed a farm management application which helps maintain appropriate records of farming activities. Along with this data, FarmDrive collects social, economic, agronomic, satellite and environmental data pertaining to the farmer and aggregates them by employing some machine learning algorithm which, in turn, generates a credit score. The enterprise has also developed decision-making tools which assist financial institutions to design better agricultural credit instruments for small and marginal farmers.[58]

With mobile phone penetration among agricultural households in India being as high as 89.1 percent,[59] the prospects of replicating the FarmDrive model in the nation must be assessed. The government has assigned more than INR 11 lakh crore to the disbursement of agricultural credit under the commitment of Priority Sector Lending. Unfortunately, less than 20 percent of the small landholding farmers access credit from the formal banking sector. More than 100 million farmers have to take recourse to informal sources for their credit needs.[60] Partly, this failure can be attributed to the mechanisms of assessing creditworthiness. In this scenario, RBI along with the rural banking ecosystem including NABARD, the RRBs, the scheduled commercial banks and the co-operatives need to consider moving towards such a creditworthiness assessment system as pioneered by FarmDrive. Of course, there is a significant role for start-ups in this context which can collaborate with the formal banking system to deliver the much-required credit lending system for small and marginal farmers.

The achievements of farMart, a fintech player in the agricultural lending sector in India, must be mentioned here. This firm was launched in 2018 with its headquarters located in Delhi-NCR. The firm has internalised well the peculiarities of the Indian agricultural credit system and curated innovative solutions to tackle them. Farmers usually confront difficulties in fulfilling the Know Your Customer (KYC) norms on the basis of the Aadhar Card, Pan Card, etc. farMart has evolved a mechanism which evaluates 50 data points to assess the creditworthiness of the farmer. These data points relate to the following: personal details such as age, gender and family background; size and ownership status of land; alternative livelihood sources; repayment capacity based on financial credentials; and loan repayment history. This mechanism allows the financial institutions to determine the risk involved in disbursing the loan with ease. To minimise the risk of diverging the loan for other purposes not agricultural in nature, farMart allocates cashless loans by issuing a virtual credit card that the farmers can use at points of sale for purchasing high-quality inputs such as seeds and fertilisers at retail outlets which belong to farMart’s network of retail partners. Given the agricultural market anomalies in India, farMart has introduced market linkage programmes which help farmers to get better rates for their produce and convert them into cash for repayment of loans. Such systems resonate with the notion discussed earlier in this paper of a larger ecosystem which enables the farmer to utilise the credit optimally even in the face of distress events.[61]

Till date, farMart has disbursed INR 1.5 crore reaching about 2,500 farmers and is active in areas in Uttar Pradesh, namely Hardoi, Barabanki, Ayodhya and Raebareli.[62] There is a need to scale efforts such as farMart in which the government needs to play a decisive role. There is a need to build an enabling ecosystem for enterprises such as farMart to flourish. Tax concessions, investment flows and infrastructural requirements which form a part of such enabling ecosystem must be strengthened by policy intervention or even public private partnership (PPP) models. Here, the gains from collaboration between the government, impact investors and fintech players need to be emphasised.

Conclusion

Ensuring food security, practising climate smart agriculture and achieving the broader goal of sustainable agriculture has a bearing upon the achievement of the Sustainable Development Goals agenda of 2030. Each of these objectives in turn depends crucially upon access to agricultural credit. This emphasises the importance of solving outstanding issues in the context of agricultural credit disbursement in India.

The agricultural crisis is India is deepening. It has in recent times pushed the economy in the direction of a slowdown. While it is equally true that the economy needs land and labour reforms, it needs to be innovative in solving longstanding problems like financial exclusion.

As outlined in this paper, India has tried various measures of financial inclusion. The level of financial inclusion has also responded to these measures but not to the extent of attaining universal financial inclusion. The exorbitant market rates of interest levied by banks and Microfinance institutions seek to adhere to sound principles of lending. However, they are in stark contrast to what is needed by the farmers. In fact, the principles of lending and the design of products they underlie are not compatible to the financial realities of the farmers in India.This paper highlights certain innovations that can be incorporated into the architecture of the lending framework. Rather than depend on capital that always seeks a return, Indian circumstances can do well by adopting the notion of “patient” capital or philanthropic resources. There is a need to articulate an ecosystem for disbursing such capital, the operational and regulatory frameworks, setting up institutions and harmonising standards.

The perception towards the poor farmers in the country needs to change. Instead of looking at them as high-risk, low-quality credit assets, they must be viewed as an untapped credit market. The features of this market, more specifically, the character of the demand of this market, need to be understood to develop tailored products that cater effectively to this market. The concept of the regulatory sandbox can be used effectively in this context to develop the right credit instruments for the Indian farmers. Here, the Indian fintech companies must be encouraged to play their part. Global best practices must also be referred to for guidance and direction in this regard.

An important reason why poor farmers in India are high-risk, low-quality assets is because they are not insulated from the vagaries of nature and do not have the wherewithal to reduce the risk of loan failure. Therefore, financial inclusion cannot stop at providing capital. It has to ensure that the probability of loan failure is minimised.

Endnotes

[1]Bhasker Tripathi, “Explained: Why Farmers are Angry in India’s Fastest-growing Farm Economy”, Business Standard, 30 November 2018.

[2] Saumya Bansal, “Farmers Protest over the Deepening Agrarian Crisis in India”, Media India Group, 21 December 2018.

[3] Deeptiman Tiwary, “NDA, UPA Failed to Curb Farmer Suicides”, The Times of India, 3 August 2014; “In 80% Farmer-suicides due to Debt, Loans from Banks, Not Moneylenders”, The Indian Express, 7 January 2017; P. Sainath, “Maharashtra Crosses 60,000 Farm Suicides”, People’s Archive of Rural India, 21 July 2014; National Crime Records Bureau Report on Farmer’s Suicides in India; Accident Suicide in India 2013; Accident death and Suicide in India 2013.

[4] Sangeeta Shroff, Rethinking India’s Battles against Chronic Agrarian Distress, The Hindu Centre for Politics and Public Policy, 8 April 2019; “Agriculture, Manufacturing to push GDP grow to 7.2% in 2018-19: CSO”, The Hindu, 7 January 2019.

[5] Sangeeta Shroff, Rethinking India’s Battles against Chronic Agrarian Distress, The Hindu Centre for Politics and Public Policy, 8 April 2019.

[6] NABARD All India Rural Financial Inclusion Survey 2016–17, NABARD,https://www.nabard.org/auth/writereaddata/tender/1608180417NABARD-Repo-16_Web_P.pdf

[7] Ibid.

[8] A. Leyshon, P. Signoretta and S. French, The Changing Geography of British Banks and building society branch nerworks, 1995-2003, 2006.

[9] NABARD All India Rural Financial Inclusion Survey 2016–17, op. cit.

[10] Anwarul Hoda and Prerna Terway, Credit Policy for Agriculture in India – An Evaluation: Supporting Indian Farms the Smart Way: Rationalising Subsidies and Investments for Faster, Inclusive and Sustainable Growth, Working Paper 302, Indian Council for Research on International Economic Relations, June 2015.

[11] Ibid.

[12] Ibid.; Pallavi Chavan and T. Sivamurugan, “Formal Credit and Small Farmers in India,” in How Do Small Farmers Fare? Evidence from Village Studies in India, ed. Madhura Swaminathan and Sandipan Bakshi (Delhi: Tulika Books, 2017).

[13] Anwarul Hoda and Prerna Terway, op. cit.

[14] Ibid.

[15] Ibid.

[16] Ibid.

[17] Ibid.; Tojo Jose, “What is Self-Help Group-Bank Linkage Programme”, IndianEconomy.net, 5 April 2017,

[18] Anwarul Hoda and Prerna Terway, op. cit.

[19] NABARD All India Rural Financial Inclusion Survey 2016–17, op. cit.

[20] Anwarul Hoda and Prerna Terway, op. cit.

[21] Renita D’Souza, “Examining Mobile Banking as a Tool for Financial Inclusion in India”, Observer Research Foundation, 30 October 2018.

[22] Pallavi Chavan and T. Sivamurugan, op. cit.

[23] Renita D’Souza, op. cit.

[24] NABARD All India Rural Financial Inclusion Survey 2016–17, op. cit. This survey was conducted between January 2017 and June 2017.

[25] Ibid.

[26] Ibid.

[27] Ibid.

[28] Ibid.

[29] Ibid.

[30] Ibid.

[31] Ibid.

[32] Ibid.

[33] Ibid.

[34] Ibid.

[35] Ibid.

[36] Ibid.

[37] Amartya Lahiri and Dilip Mookherjee, “Transforming Indian Agriculture: The Role of Credit Policy”, Ideas for India, 14 December 2015.

[38] Ibid.

[39] Key Indicators of Debt and Investment in India, NSSO 7Oth Round, 2013, MoSPI, December 2014.

[40]Ibid.

[41] Anwarul Hoda and Prerna Terway, op.cit.

[42] Ibid.

[43] NABARD All India Rural Financial Inclusion Survey 2016–17, op. cit.

[44] Pallavi Chavan and T. Sivamurugan, op. cit.

[45]Vishal Menon “Access to Market Information Can Double Farmers’ Income, Reduce Losses”, Democracy News Live, 16 March 2018.

[46] Kiran Pandey, “6 reasons Why India has Failed to Solve the Riddle of Agriculture Marketing“, DownToEarth, 7 January 2019.

[47] Rajalakshmi Nirmal, “Mandis in a Fix”, The Hindu, 29 July 2018.

[48] A Narayanamoorthy and P Alli, “Agriculture Market Reforms are a Must”, The Hindu Business Line, 8 January 2018.

[49] Rajalakshmi Nirmal, op.cit.

[50] Ibid.

[51] “Agri-logistics in India: Challenges and Emerging Solutions”, YourStory, 24 May 2013.

[52] Ejaz Ghani, “The De-urbanization of India’s Manufacturing”, Livemint, 1 February 2018.

[53] Stephan Meier, “A Survey of Economic Theories and Field Evidence on Pro‐Social Behavior”, Working Paper No.06-6 (Federal Reserve Bank of Boston, 2006).

[54] Radheshyam Jadhav, “Just 4% of LPG Users have Opted Out of Subsidies”, The Hindu Businessline, 29 January 2019.

[55] China Social Impact Investment Report 2016, China Development Research Foundation and China Social Entrepreneur Foundation, 25 August 2016.

[56] Vivek Pandit and Toshan Tamhane, Impact Investing: Purpose-driven Finance finds its place in India (McKinsey & Company, September 2017); Shamika Ravi, Emily Gustafsson-Wright, Prerna Sharma and Izzy Boggild-Jones, The Promise of Impact Investing in India, Research Paper No. 072019 (Brookings India Research Centre, July 2019).

[57] Shamika Ravi, Emily Gustafsson-Wright, Prerna Sharma and Izzy Boggild-Jones, op. cit.

[58] “Credit Scoring”, FarmDrive; Emma Cosgrove, “Eight Agtech Startups Venturing into Fintech”, 11 December 2017.

[59] NABARD All India Rural Financial Inclusion Survey 2016–17, op. cit.

[60] Meha Agarwal, “Agri-Fintech Startup farMart Looks to Bring Cashless Loans to India’s Distressed Farmers”, Inc42, 3o May 2019.

[61] Ibid.

[62] Ibid.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Renita DSouza is a PhD in Economics and was a Fellow at Observer Research Foundation Mumbai under the Inclusive Growth and SDGs programme. Her research ...

Read More +