Quick Notes

Petrol & Diesel Pricing in India: Tracking Taxes

Tax revenue from crude oil

Tax on crude imports in India include basic customs duty of INR1/tonne (t), countervailing duty (CVD) of INR1/t and INR50/t as national calamities contingent duty (NCCD). In 2019-20, before the pandemic reduced oil imports, India imported about 270 million tonnes (MT) of crude oil which means a revenue of over INR14.54 billion from crude imports. Domestic crude production invited basic excise of INR1/t, INR50/t as NCCD and a cess of 20 percent calculated ad valorem (Introduced in 2016). In 2019-20, India produced 32.2 MT crude. This would translate into INR1.6422 billion from basic excise and NCCD. The price of crude (Indian basket) in 2019-20 was US$60.47/barrel (b) which translates into a revenue of INR857.65/t as ad valorem cess at an Indian rupee US dollar exchange rate of INR70.88. In total, domestic production of 32.2 MT of crude would have raised a revenue of over INR27.616 billion from cess in 2019-20. Effectively domestic crude production, that is less than an eighth of the volume of crude imports, would have generated twice as much revenue for the government in taxes and levies. Overall, crude oil imports and domestic production generated a total revenue of roughly INR43.8 billion in 2019-20.

Tax revenue from petrol and diesel

In 2019-20, petrol imports amounted to 2.146 MT and diesel imports 2.796 MT. Taxes on petrol imports include customs duty of 2.5 percent, CVD of INR1.4/l (litre), special additional duty (SAD) of INR11/l agricultural and infrastructure development cess (AIDC) of INR2.5/l and an additional customs duty of INR13/l. Imported diesel attracted a customs duty of 2.5 percent, CVD of INR1.8/l, SAD of INR8/l, AIDC of INR4/l and additional customs duty of INR8/l. The average price of imported petrol in 2019-20 was US$66.94/b, the price of imported diesel was US$71.78/b, and the Indian rupee to US dollar exchange rate was INR70.88. In total, the taxes should have raised a revenue of over INR83 billion from imported petrol and over INR73 billion from imported diesel in 2019-20.

Central levies on the price of petrol at the pump included basic excise of INR1.4/l with SAD, AIDC and road and infrastructure cess (RIC) adding to about INR20.6/l. For diesel basic excise was INR1.8/l with other components of excise adding about INR17.03/l. This gives a revenue of about INR931 billion from petrol and over INR1881 billion from diesel in 2019-20 (indicative approximation, does not include higher tax rates for branded petrol and diesel).

On 1 April 2022, the share of taxes in the retail price of a litre of petrol in Delhi was 43.65 percent compared to 45.5 percent in March, and the share of taxes in diesel was 38.04 percent compared to 39.79 percent in March. A year earlier, the share of taxes in the retail price of petrol was 63.22 percent and that in diesel was 56.77 percent in Delhi. Excise on petrol was higher by about INR5/l and the VAT (value added tax) higher by INR5.54/l while the excise on diesel higher by INR10/l and the VAT (state tax) higher by less than INR1/l, the retail price of petrol was INR91.17/l and the retail price of diesel was INR81.47/l. The price of the Indian basket of crude has increased by over 48 percent since April 2021 from US$63.4/barrel (b) to US$94.07/b in February 2022. The increase in international crude prices is being passed through to consumer since March 2022 after a pause during state election campaigns in the previous months.

Source: Petroleum Planning & Analysis Cell (PPAC)

Source: Petroleum Planning & Analysis Cell (PPAC)

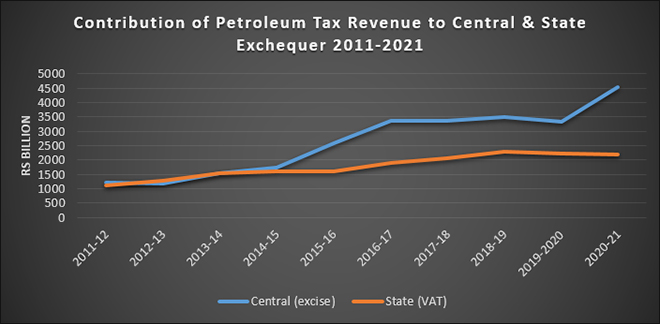

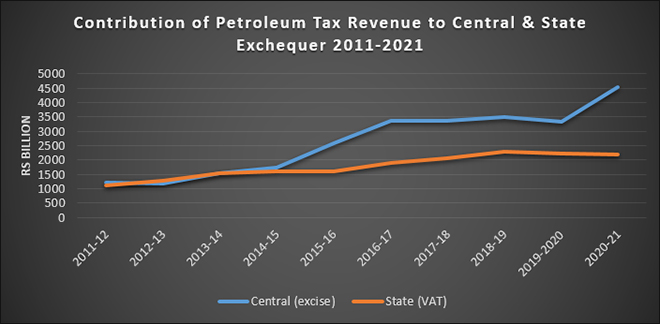

Since 2015, the Union government has used the low crude price environment, extended to 2020 by the pandemic to substantially increase the taxes on petrol and diesel. The burden of tax increase on diesel was far higher than that on petrol. Between March 2014 and October 2021, the excise on petrol increased by over 200 percent and the excise on diesel by over 600 percent. The VAT on petrol in Delhi increased by about 97 percent and that on diesel by about 118 percent in the same period. Other states also increased VAT substantially in this period. Central excise revenue from oil increased by over 163 percent from INR1.72 trillion in 2014-15 to over INR4.5 trillion in 2020-21. In the same period (March 2014-October 2021), VAT revenue from oil products increased by over 35 percent from over INR1.6 trillion to over INR2.1 trillion. The Centre needs to share only the revenue from basic excise duty on petrol and diesel with the states. For example, of the basic excise on petrol of INR1.4/l, only 42 percent or INR0.58/l out of the total excise of INR32.9/l in 2020-21 is shared with the states. For diesel only about INR0.75/l out of the total excise of INR42.33/l is shared with the states.

Utilisation of Petroleum Tax Revenue

It is fairly simple to estimate the tax revenue generated from petroleum products, but it is far less so when it comes to identifying how the revenue raised is utilised by the Union Government. Clues from remarks by the government add to the ambiguity. During the last week of October 2020, the Union Government stated that taxes on petrol and diesel will be increased to mobilise additional revenue for COVID-19 relief. The statements made by government representatives to the media reiterated this claim. However, in response to a specific question in the Lok Sabha in March 2022 on the quantum excise revenue raised from petroleum products and whether the government is using the revenue to fund a free COVID-19 vaccination programme, the government responded that the excise duty rates on petrol and diesel were calibrated to generate resources for infrastructure and other developmental items of expenditure keeping in view the fiscal position.

In 2021, the comptroller auditor general (CAG) of India noted that the Oil Industry Development Board (OIDB) did not receive any funds out of the over INR1 trillion collected from 2009-10 to 2019-20 as cess on crude oil. The Parliamentary Standing Committee on Petroleum & Natural Gas of the 15th Lok Sabha (2014-15) noted that the funds collected as cess on crude was being allocated by the Ministry of Finance (MOF) in violation of the OIDB Act. The response of the MOF was that the government was financing various activities from the budget that included proceeds from the cess on crude and that this qualified as development of the oil industry which was part of the mandate of the OIDB. The CAG noted that treatment of the crude cess as part of the general pool of tax defeated the very purpose of levy of the cess which was to create a non-lapsable pool of funds for a specified use. On the whole, it appears that crude and petroleum product pricing that used to be a black hole of subsidies is now evolving into the black hole of tax revenue.

The International Energy Agency (IEA) published a report titled Petroleum Product Pricing in India: Where have all the subsidies gone? in 2006. It concluded that though the Indian energy market would be better off if the government would implement a consistent, transparent, and rational fuel pricing system, it is unlikely to be done because of its political implications. If an updated version of the report on petroleum pricing is prepared today, the key conclusion may be retained word for word, but the question posed in the title may have to be changed to: where has all the tax revenue gone?

Source: Indirect taxes: Reserve Bank of India; Oil Excise: PPAC

Source: Indirect taxes: Reserve Bank of India; Oil Excise: PPAC

Monthly News Commentary: Natural Gas

Ukraine Crisis boosts LNG Trade

India

LNG

The restructuring of gasification assets will unlock value, provide flexibility for RIL. Gasification Undertaking is proposed to be transferred, as a going concern on Slump Sale basis, by way of a Scheme of Arrangement. The Appointed Date for the Scheme is 31 March 2022 or such other date as may be approved by the Board. The Scheme has been filed with both Mumbai and Ahmedabad NCLTs and will require approvals of Shareholders, Creditors, and NCLT. Gasification assets are proposed to be transferred to a subsidiary which will provide flexibility to induct suitable strategic partners and distinct sets of investors. Collaborative and asset-light approach to unlock value of syngas, specifically induction of investors in gasifier subsidiary and capturing value of upgradation in RIL through partnerships and investments in different chemical streams.

GAIL (India) Ltd is playing smart by advancing LNG (liquefied natural gas) shipments from the US (United States), using the flexibility in its contract to make a killing from the arbitrage created by runaway demand and skyrocketing prices in Europe. Simultaneously, the utility is looking at short-term contracts of 3-5 years for 1-2 cargos a month from early 2023 to meet an anticipated domestic demand on growing pace of economic activities, commissioning of new fertiliser manufacturing capacities, and expansion of city gas networks. GAIL intends to use 4-5 US cargoes for arbitrage. GAIL’s long-term US LNG contract for nearly 6 million tonnes (mt) LNG a year is benchmarked to Henry Hub and costs US$5.45 per unit. Gas prices in Europe are linked to Brent crude, which has spiked to US$90/barrel. While flaring Brent alone jacked up gas prices in Europe and other crude-linked markets such as Japan and South Korea, the harsh winter drove them to three times the Henry Hub as demand spurted. Prices in the spot market shot up to US$27-30 per unit. In addition to the US, GAIL has a 2.5 mt LNG contract with Russia’s Gazprom, 4.8 mt deal through Petronet LNG, in which it is a promoter, with Qatar and 0.4 mt with the Gorgon project in Australia. GAIL had first signed time-swap deals for its US LNG in 2017-18. Under three deals signed that year, the company bought LNG from international companies and sold an equivalent amount of Henry Hub-indexed volumes during 2018-19. That time-swap was done as it did not find buyers for imported LNG. As per the GAIL, gas is the transition fuel towards the goal of reaching net-zero by 2070.

Gas Trade

Global energy major ExxonMobil is looking at signing more long-term gas sales deals with India as rising spot prices have added to the appeal of longer duration contracts. At present Exxon has a long-term contract to annually supply 1.5 mt of LNG to Indian firm Petronet LNG. India is the world’s fourth biggest importer of gas. And the fuel’s demand in India is set to grow as India’s Prime Minster has set a target to raise the share of gas in the country’s energy mix to 15 percent by 2030 from the current 6.2 percent. Companies are investing billions of dollars to build pipelines and gas import terminals to meet the rising demand in India.

Production

Reliance Industry Ltd (RIL) is seeking a minimum of US$14 for selling natural gas being produced from coal seams in a block in Madhya Pradesh. The company sought bids from users for the sale of 0.65 million standard cubic meters per day (mmscmd) of gas from its coal-bed methane (CBM) block SP-(West)-CBM-2001/1 for a one-year period. The company has kept the starting ticker for ‘V’ at US$1/mmBtu (million metric British thermal units), which means bidders will have to quote at least US$1 plus 14 percent of dated Brent crude oil to buy the CBM gas. Currently, Brent crude oil is trading above US$92.5/barrel and at this price, the floor rate for Reliance gas comes to US$13 per mmBtu. Adding ‘V’ of US$1, the minimum price comes to US$14/mmBtu. The government dictated price for gas produced by state-owned firms such as ONGC is US$2.90/ mmBtu.

CGD/CNG

A joint venture of billionaire Gautam Adani-run group’s gas arm and Total of France walked away with the most 14 licenses to retail CNG (compressed natural gas) to automobiles and piped cooking gas (PNG) to households in the latest city gas bidding round, according Petroleum and Natural Gas Regulatory Board (PNGRB). Adani Total Gas Ltd won city gas rights in 14 out of the 52 geographical areas (GAs) for which PNGRB declared results. Hyderabad-based Megha Engineering and Infrastructure Ltd (MEIL) won 13 GAs, while state-owned Indian Oil Corporation (IOC) was adjudged winner in 8 GAs. As many as 65 GAs were offered for bidding in the 11th city gas distribution (CGD) licensing round. Of this, bids were received for 61 GAs but results for only 52 GAs were announced. The results of the remaining 9 GAs have been withheld due to the model code of conduct being in place in Uttar Pradesh and Uttrakhand for assembly elections. PNGRB has written to the Election Commission and results of the 9 GAs which fall in the two states will be announced once its approval is received. IOC cornered high potential GAs such as Jammu and Madurai. The hotly contested GA of Nagpur went to a consortium that included HCG (KCE) Pvt Ltd and Haryana City Gas. Adani Total won three GAs each in Assam and Chhattisgarh, four in Maharashtra including Amravati, one each in Jharkhand and Odisha and two in Madhya Pradesh. IOC won city gas license for Kurnool/Guntur in Andhra Pradesh, Jammu, Beed/Jalgaon in Maharashtra, Kikar and Dharmapuri in Rajasthan, Madurai and Kanyakumari in Tamil Nadu and Mednipore in West Bengal. Privatisation-bound Bharat Petroleum Corporation Ltd (BPCL) won license for 4 GAs.

Policy & Governance

The Delhi High Court (HC) stayed the notices issued by PNGRB in connection with declaring Adani Total Gas Limited’s City Gas Distribution Network for Ahmedabad city, Daskroi, and Khurja as a common carrier or contract carrier. The company explained that while CGD Network refers to the infrastructure laid down by a company for supplying gas, a common carrier is a pipeline that is used by more than one entity for gas transportation by paying tariff for such transportation.

The government should bring natural gas under the Goods and Services Tax (GST) regime to realise Prime Minister (PM) vision for a gas-based economy and raising the share of the environment-friendly fuel in India's energy basket, an industry body that represents the likes of Reliance Industries as well state-owned firms, has said. Natural gas is currently outside the ambit of GST, and existing legacy taxes — central excise duty, state VAT, central sales tax — continue to be applicable on the fuel.

Rest of the World

Europe

Europe’s call for US LNG continues to run hot in February and is poised to remain the top destination for the US shipments for the third month in a row. About three quarters of US LNG volumes went to Europe in January as skyrocketing demand lifted prices and the US LNG exports. The US LNG exports overall last month hit 7.3 mt. So far this month, the US has exported 3.56 mt of LNG, similar to the half-way market in December, which was the second highest on record. At least half of US LNG shipped this month has gone to Europe, as companies look to secure new supplies. Worries over a cut-off of Russian gas, which accounts for about 35 percent of European consumption, have contributed to the exports. The European LNG benchmark on the Dutch exchange traded at US$23.35 per mmBtu, below the Asia spot gas at US$24.70 per mmBtu and below November's about $31 per mmBtu. According to the Panama Canal, it was seeing increased seasonal demand for passage, but there were fewer LNG vessels crossing the canal due to warmer temperatures in Asia.

Africa

The French firm, TotalEnergies, aimed to restart a US$20 billion LNG project in the north of Mozambique that was halted by an insurgent group with links to Islamic State almost a year ago. The attack on the town of Palma, on the doorstep of the project and home to many gas workers, prompted TotalEnergies to withdraw all staff and declare force majeure, putting a halt to all works until security was restored.

Tanzania has appointed a US based law firm as its transaction advisor for negotiations with energy companies over the construction of a LNG project, valued at US$30 billion (bn). Construction of an LNG export terminal near huge offshore natural gas discoveries in deep water south of the East African country has been held up for years by regulatory delays. The negotiations resumed in November, as Tanzania’s President pushes for speeding up the start of the project, which has stalled due to delayed Host Government Agreements. Tanzania Petroleum Development Corporation (TPDC) had signed an agreement with the UK office of law firm Baker Botts to help the government in the negotiations. Norway’s Equinor operates Tanzania's Block 2, in which ExxonMobil holds a stake and which is estimated to hold more than 20 trillion cubic feet (tcf) (0.6 trillion cubic metres(tcm)) of gas. Equinor aims to work on the LNG project with Shell, which operates Block 1 and Block 4 off Tanzania, with 16 trillion cubic feet in estimated recoverable gas

Middle East

Qatar’s Emir said that Qatar’s LNG production capacity will rise to 126 mt a year by 2027. Qatar is building a carbon capture facility - the biggest in the Middle East - which will isolate and store 2.5 mt of carbon per year in four years. By 2030, the facility will isolate 9 mt per year. Meanwhile, Iran’s President said Iran has high capacity for gas production for domestic use and exports and will play an important role in international markets.

The Abu Dhabi National Oil Company, also known as ADNOC, announced the discovery of between 1.5 to 2 tcf of raw gas in an offshore area located in the emirate’s northwest. ADNOC said the discovery came about in partnership with a consortium led by Italy's Eni and Thailand’s PTT Exploration and Production Company Limited, which were awarded concession rights in the area. The 2019 agreement saw Eni and PTTEP vowing to invest US$230 million (mn) to explore for oil and gas and appraise existing discoveries in two blocks ning a total of 8,000 square kilometers (3,000 miles). For their natural gas discovery, the companies relied in part on insights from a massive 3D seismic survey underway in Abu Dhabi, according to ADNOC. In December, ADNOC announced the discovery of up to 1 billion barrels of oil in another block of Abu Dhabi.

In recent days, amid technical problems with gas imports from Iran to Turkey, the latter requested that the Gas Supply Company of Azerbaijan (AGSC) import additional amounts of gas to eliminate the temporary deficit. Previously, Azerbaijan’s Energy Minister stated that the Shah Deniz field has supplied more than 85 billion cubic meters (bcm) of natural gas to the Turkish gas market since 2007. Furthermore, in the first 11 months of 2021, TANAP transported 5.1 (bcm) of natural gas to Turkey. The two countries agreed to set a target of US$15 bn in mutual trade turnover by 2023. It should be noted that, so far, Turkey is Azerbaijan's second-largest investor followed by the United Kingdom.

North and South America

High global natural gas prices are breaking a two-year logjam of new US LNG projects with at least three of the multibillion-dollar proposals likely achieving enough supply contracts to start construction this year. A Louisiana project that received a green light in 2019 was the last wholly new US plant to receive a go-ahead, benefiting from then-strong demand from China and utilities swapping to LNG from coal. However, super-hot demand for the fuel in northern Europe and China have pushed global gas prices to near record highs, reviving financing prospects for plants that chill natural gas into liquid for transport by seaborne tankers. A key benchmark price for natural gas deliveries in northern Europe has more than quadrupled from a year ago, to about US$30 per mmBtu. Europe’s declining gas production and increased dependency on Russia for its supplies also has driven worldwide LNG prices higher and focused attention on the need for new LNG plants in the United States and Asia. China stopped taking most US LNG by imposing a 25 percent tariff on imports in mid-2019 at the height of a US-China trade war. However, in November, top Chinese energy companies agreed to buy more US gas than ever before through long term contracts.

The US natural gas production and demand will both rise in 2022 as the economy continues to grow, the US Energy Information Administration (EIA) said. EIA projected that dry gas production will rise to 96.09 billion cubic feet per day (bcfd) in 2022 and 97.97 bcfd in 2023 from a record 93.59 bcfd in 2021. The agency projected that gas consumption would rise to 84.27 bcfd in 2022 from 82.92 bcfd in 2021, before sliding to 83.85 bcfd in 2023. That compares with a record 85.29 bcfd in 2019. EIA’s projections in February for 2022 were bigger than its January forecasts of 96.04 bcfd for supply and 82.77 bcfd for demand. The agency’s forecast US LNG exports would reach 11.35 bcfd in 2022 and 12.13 bcfd in 2023, up from a record 9.77 bcfd in 2021. That is a little lower to its January forecast of 11.54 bcfd in 2022.

The US LNG company Cheniere Energy had finished construction of a sixth liquefaction unit at its Sabine Pass LNG export plant in Louisiana, paving the way for higher commercial exports. Contractor Bechtel Group finished building the sixth LNG processing train ahead of schedule and within budget. The work began in June 2019. Completion brings total production capacity at its Sabine Pass facility to about 30 million tonnes per annum (MTPA) of LNG. Cheniere's other LNG plant, in Corpus Christi, Texas, produces another 15 MTPA. Cheniere this year could make a final investment decision on a proposed expansion to its Corpus Christi facility that would boost its production capacity by more than 10 MTPA.

Russia & the Far East

According to analysis by the think tank Bruegel, the European Union (EU) could cope with a short term halt to all Russian gas imports, but doing so would have "profound economic consequences" and require emergency measures to curb demand. Escalating tensions between the West and Russia over Ukraine have raised concerns about Russian gas flows to Europe, prompting the European Commission and the US to investigate alternative supplies. Bruegel said that if Russia cuts off all gas, the EU would need to both hike imports of LNG and impose emergency measures to cut demand -- such as factory closures -- to avoid severe shortages. Soaring gas prices in recent months amidst lower-than-expected supplies Russian supply have already hiked Europeans' household bills, and forced some gas-reliant industries to curb production. Russia supplies around 40 percent of EU gas use, but reliance varies between countries. Central and Eastern European states with pipelines designed to import gas from the east, rather than Western Europe, could still suffer shortages if Moscow cut supply, Bruegel said. The analysis said spare infrastructure capacity could add 17 TWh of weekly imports from Norway, North Africa and LNG - nearly replacing levels Europe received from Russia in recent weeks. However, those countries may not be able to boost deliveries, and measures to curb demand would also be needed. In a scenario with very cold weather plus no Russian gas from February, the EU gas storage could be emptied by End-March, Bruegel said.

China

China’s National Development and Reform Commission (NDRC) has approved natural gas company Hanas Group’s plan to build a receiving terminal for LNG in the southeastern province of Fujian. The terminal, estimated to cost 5.26 bn yuan (US$829.8 mn), will have an annual receiving capacity of 5.65 mt of the super-chilled fuel, the NDRC said. The terminal, to be built in Meizhouwan port of Fujian province, will have one berth and two storage tanks each sized 200,000 cubic meters. Based in the city of Yinchuan in the northern region of Ningxia, Hanas Group is engaged in piped-gas distribution, natural gas liquefaction and power generation.

Rest of Asia-Pacific

Japan has decided to divert some LNG to Europe if the Ukraine crisis leads to a disruption of supplies after receiving a request from the US, national broadcaster NHK reported. The government is likely to announce the decision as early as, the report said. The report came after Japan has been considering how it could help after it received a request from the US.

Thailand’s state oil and gas explorer looks set to take over Myanmar’s biggest gas field, as TotalEnergies and Chevron Corp exit in the wake of last year’s military coup in the Southeast Asian state, analysts said. A move by PTT Exploration and Production Pcl (PTTEP) to become operator of Yadana field, in which it already has a 25.5 percent stake, would keep vital gas supplies flowing to Thailand and Myanmar, and could contribute revenues for Myanmar’s ruling junta amidst the tighter US and other sanctions. France’s TotalEnergies and the US firm Chevron said they were leaving, citing the worsening humanitarian situation following the coup. The French and the US firms were part of a group operating the Yadana gas project off Myanmar’s southwest coast and the Moattama Gas Transportation Company (MGTC) that runs a pipeline carrying gas from the field to Myanmar's border with Thailand.

News Highlights: 23 February – 1 March 2022

National: Oil

Commercial LPG cylinder rates increase by INR105 in Delhi & INR108 in Kolkata

1 March: In a significant update, prices of 19kg commercial LPG cylinders increased by INR105 in Delhi and by INR108 in Kolkata. Additionally, the price of 5kg commercial LPG cylinders also rises by INR27. Earlier the price was INR1,907. This has led to the price of 19kg commercial gas in Delhi to INR2,012 while in Kolkata it has spiked to INR2,095.

IOC no longer accepts Russian, Kazakh crude on FOB basis

28 February: India’s top refiner Indian Oil Corp (IOC) will no longer accept cargoes of Russian crude oil and Kazakh CPC Blend cargoes on a free-on-board (FOB) basis due to insurance risk, according to a tender notice. The letter was sent to traders who submit cargo offers into IOC's regular crude oil buy tenders. IOC bought 2 million barrels of Russian Urals for the first time in two years. Bharat Petroleum Corp Ltd (BPCL), said his firm mostly buys Urals on delivered basis, whereby freight and insurance are included, unlike in FOB. Traders were not offering Russian barrels. Russia and Kazakhstan are small suppliers to India. In December, the two countries accounted for 64,000 barrels per day (bpd) out of 4.7 million bpd.

Higher oil prices pose further risk to India’s growth momentum: Economists

28 February: Rising crude oil prices and supply disruptions following Russia's invasion of Ukraine could further sap an Indian economy already slowed by COVID-19, posing risks to household spending and private investments, economists said. India, which meets nearly 80 percent of its oil needs through imports, could be hit by a widening trade deficit, weakening rupee and higher inflation after Brent crude prices shot above US$105 a barrel, the economists said.

IOC to ramp up LPG output in NE by 53 percent to 80 mn cylinders by 2030

27 February: PSU major Indian Oil Corp (IOC) is planning three new plants in the Northeast to increase its LPG bottling capacity by nearly 53 percent to 80 million cylinders annually by 2030 to meet the growing demand in the region. IOC Executive Director (IndianOil-AOD) G Ramesh said the proposed new LPG bottling plants will come up in Mizoram, Meghalaya and Arunachal Pradesh at a total investment of INR3.25-3.50 bn in a combination of wholly-owned and public-private-partnership (PPP) models. IndianOil-AOD, the company’s Northeast division, at present has an annual capacity to bottle 52.3 mn LPG cylinders at its nine plants, and the capacity utilization stands at 51.1 mn units, Ramesh said. The Mizoram plant, which is still at the estimation stage as adjoining lands are being acquired, will have a daily capacity of 30,000 cylinders and it is likely to cost INR1.50 bn, he said. At present, Assam has six operational units and one each is located in Manipur, Nagaland and Tripura. Out of these facilities, one in Assam and the one in Tripura were recently set up. These two plants have started trial production, but are yet to be officially commissioned, Ramesh said. He said the new plant in Assam’s Nagaon is the IOC’s first ever private bottling unit in the country and can refill 7,000 cylinders every day. Besides, the IOC-AOD is expanding the existing capacity of its Bongaigaon LPG plant in Assam to 120,000 metric tonnes per annum (TMTPA) from 60 TMTPA for INR400 mn, and it will be completed by March 2023. When asked if the company plans to export LPG from the Northeast to the neighbouring countries, he said the 12 facilities will cater mainly to the demand in the region.

India watching global energy markets, supports release of oil from strategic storage

26 February: India, the world’s third largest energy importing and consuming nation, said it is closely monitoring the global energy markets to track any supply disruptions following the Russia-Ukraine conflict, and will support the release of oil from strategic storage to cool prices. While supply routes remain open, prices are likely to pinch. Petrol, diesel and cooking gas (LPG) rates continue to be on the election-related freeze for nearly four months now, but PSU oil firms are expected to pass on the elevated global oil prices to consumers soon after elections in Uttar Pradesh end next month. Asia’s third largest economy had in November last year agreed to release about 5 million barrels of crude oil from its emergency stockpile in tandem with the US (United States), Japan and other major economies to cool international oil prices.

National: Coal

Rajasthan-Chhattisgarh coal row likely to be resolved soon

28 February: The tussle between Congress governments of Rajasthan and Chhattisgarh over coal block allocation is likely to be resolved in the next few days with Rahul Gandhi meeting Chief Ministers of the two states. Gandhi met Ashok Gehlot and Bhupesh Baghel at his residence and held discussions to find an amicable resolution to the issue. Rajasthan is seeking allocation of Parsa coal block in Chhattisgarh for supply of coal, to which Chhattisgarh has raised certain concerns of tribals in the area. Gehlot has already written letters to Congress president Sonia Gandhi, seeking her intervention for speeding up clearances for coal mining for power plants in Rajasthan ahead of the summer season. Gehlot had said Rajasthan could face a severe power crisis due to non-availability of coal from the Chhattisgarh coal block and that may affect the party’s performance in upcoming elections, Rahul Gandhi is also learnt to have discussed the issue of implementation of the old pension scheme for government employees in Chhattisgarh on the pattern of that implemented in Rajasthan.

SECL coal dispatch at 139 MT so far in FY22

24 February: South Eastern Coalfields Limited (SECL), a flagship arm of Coal India Ltd (CIL), has surpassed the last year’s coal dispatch figure by transporting 139 million tonnes (MT) of the dry fuel so far in the current financial year. The largest coal-producing company had dispatched 138.8 MT in the last financial year 2020-21. The figure reported as on 23 February surpassed the last year’s cumulative dispatch, despite 36 days still remaining for the closure of the current fiscal 2021-22. Going by the stride, SECL is all set to record the highest-ever coal dispatch in the current financial year. The Bilaspur-headquartered miner had provided 14 percent more coal to the consumers as compared to last year. Compared to the previous year, the company had supplied 25 percent more coal to the power companies to facilitate sufficient stock, SECL said.

HC orders probe into illegal coal mining in Meghalaya

23 February: The Meghalaya High Court (HC) directed State Chief Secretary and Director General of police to file an independent report into the alleged illegal coal mining in the state. The HC took cognizance of reports and the complaint filed by the traditional village chief of Nengchigen in Garo Hills against certain persons, including the police, alleging widespread illegal mining of coal within the clan lands. It also threatened to appoint a special investigation team (SIT) to probe the alleged illegal coal racket in the state. Chief Minister Conrad K Sangma had said that a process is required to be followed for setting up a CBI inquiry into the alleged illegal coal trade in the state. He said that an FIR filed in connection with the alleged illegal coal mining and transportation in West Khasi Hills will be looked into and that police will hold the necessary inquiry.

National: Power

Power consumption grows 2.2 percent to 105.54 billion units in February

1 March: India’s power consumption growth has remained subdued at 2.2 percent year-on-year in February to 105.54 billion units (BU). The country’s power consumption in February 2021 was 103.25 BU, a tad lower than 103.81 BU in the same month of 2020, according to the data by the power ministry. The peak power demand met or highest supply in a day rose to 193.64 GW in the month under review compared to 187.97 GW in February 2021 and 176.38 GW in February 2020. As per the experts, the key reason behind the subdued power demand in February is because of the impact of local restrictions imposed by states to curb the spread of coronavirus. The local restriction had affected industrial and commercial demand, the experts said. The experts opined that the power demand and consumption would improve in the coming months as the states have started to lift local restrictions. Power consumption would surge with increased industrial and commercial activities due to the onset of summers in the coming months, according to the experts.

Rajasthan CM announces 50 free units for people consuming 100 power units

23 February: Rajasthan Chief Minister (CM) Ashok Gehlot announced that 50 units of electricity will be available free of cost to the people who use up to 100 units in the desert state. Domestic consumers spending up to 100 units of electricity will be given 50 units free, INR3 per unit grant for all domestic consumers spending up to 150 units and INR2 per unit grant for consumers spending 150 to 200 units. Around INR40 bn will be spent on this.

National: Non-Fossil Fuels/ Climate Change Trends

Assam tea industry eyes solar projects to augment revenue

27 February: Assam tea industry is looking at various ways and means to set up solar projects in the plantation areas and in the barren lands available inside the estates. The New and Renewable Energy (NRE) wing of the APDCL (Assam Power Distribution Company Limited) elaborated on several modes of execution of solar projects in the tea industry – rooftop solar power plant, setting up of solar power plant by leasing out uncultivated barren tea land, captive solar power plant and setting up solar parks by way of leasing out land to the power distribution company APDCL.

MNRE approves development of 400 MW solar project in Kinnaur by SJVN

25 February: SJVN said Ministry of New and Renewable Energy (MNRE) has approved development of 400 MW solar park by the company at Kinnaur in Himachal Pradesh. According to the company, an in-principle approval has been accorded by the Ministry for Development of this project under Ultra Mega Renewable Energy Power Parks of its solar park scheme. SJVN is the Solar Power Park Developer (SPPD) for all renewable energy projects in Himachal Pradesh. SJVN is gearing up for preparation and submission of Detailed Project Report (DPR) at the earliest in accordance with the timelines of the solar park scheme. SJVN is already preparing DPR for 880 MW Kaza Solar Park in Himachal Pradesh. Presently, SJVN has a portfolio of more than 16,400 MW and with this latest addition, the renewable energy portfolio is now 3054.5 MW.

Railways’ solar power plant in Madhya Pradesh shortlisted for international award

25 February: The Indian Railways’ solar power plant set up near Bina station in Sagar district of Madhya Pradesh has been shortlisted for an international award. The area where the plant operates falls under the West Central Railway (WCR). This solar power plant is the first of its kind initiative of the Indian Railways to promote the use of green energy. The International Union of Railways recently shortlisted this green initiative of the Indian Railways for an award in ‘Best Use of Zero-Carbon Technology Category’. The plant is going to generate 1.8 million units of power per year.

International: Oil

Canada to ban Russian crude oil import: Canadian PM

1 March: Canadian Prime Minister (PM) Justin Trudeau said the government plans to ban imports of Russian crude oil into the country, as part of efforts to ramp up pressure on President Vladimir Putin. Canada hasn’t imported any crude oil from Russia since 2019, Natural Resources Minister Jonathan Wilkinson said.

US, allies set oil reserves release as prices soar

1 March: The United States (US) and other member states of the International Energy Agency (IEA) agreed to release 60 million barrels of oil reserves to compensate for supply disruptions following Russia’s invasion of Ukraine. Russian oil trade is in disarray after many nations imposed sanctions on Russian companies, banks and individuals. Oil trade is exempt from sanctions but buyers are shunning Russian oil to avoid unwittingly violating sanctions. Brent crude rose US$7 per barrel to close at US$104.97, the highest since 2014. IEA Executive Director Fatih Birol said the current situation in energy markets is "very serious and demands our full attention". The precise share of member countries in the release will be determined in coming days, Japanese Industry Minister Koichi Hagiuda said, while some IEA members agreed to provide petrochemical products to Ukraine. Further disruption of exports from Russia could send prices even higher. Russia, which calls its actions in Ukraine a "special operation," is one of the world's top oil producers, exporting around 4-5 million barrels per day (bpd) of crude. Russia also exports 2 to 3 million bpd of fuel. The 60 million barrels represent 4 percent of the 1.5 billion barrels of emergency stockpiles held by IEA members, the agency said, and is equivalent to 2 million barrels a day for 30 days.

Petrol price expected to rise by INR10 per litre in Pakistan amid Russia-Ukraine crisis

27 February: The prices of petrol and high-speed diesel are expected to increase by about INR10 per litre amidst the soaring price of crude oil in the international market. The new petroleum prices will be applied for the next fortnight as crude oil rates have gone up in the international market following Moscow’s invasion. The prices of kerosene and light diesel oil (LDO) have been estimated to increase by about INR4 and INR3.70 per litre. Earlier this month, the crude oil price was hovered around US$94 a barrel which past US$100 a barrel for the first time since 2014 after development. Oil and Gas Regulatory Authority (OGRA) chairman Masroor Khan hinted at another hike in the prices of petroleum products from 1 March 2022.

International: Gas

Pakistan to penalise defaulting LNG supplier

24 February: Pakistan LNG Limited (PLL), which will now purchase one spot LNG cargo at a higher price of US$25.12 per mmBtu (million metric British thermal units), to be delivered on 10-11 March, has made up its mind to impose a monetary penalty on Italy based LNG term supplier ENI, which is the 30 percent of the term cargo. The PLL will impose the penalty on ENI under the provision of a 15-year term agreement for backing out of the cargoes, the Energy Ministry said. The latest default by both companies forced Pakistan to procure LNG from the spot market at a huge price of US$25.12 per mmBtu. Pakistan, in response to the emergency tender issued on 17 February for two LNG cargoes, one for 2-3 March and another one on 10-11 March, got two bids for spot LNG cargoes for only one-time window of 10-11 March. However, it got zero response from the LNG trading companies for providing a spot cargo for the window of 2-3 March. The Qatar Petroleum Trading submitted the lowest bid at US$25.12 per mmBtu for spot LNG cargo for 10-11 March while ENOC (Emirates National Oil Company), Singapore, submitted its bid at US$26.1625 per mmBtu for the same time slot.

International: Coal

China sees biggest growth in energy and coal use since 2011

28 February: China recorded its biggest increase in total energy consumption and coal use in a decade in 2021, as the economy recovered from COVID-19 slowdown a year earlier, the National Bureau of Statistics (NBS) data showed. China, the world’s biggest coal burner and greenhouse gas emitter, used 5.24 billion tonnes of standard coal equivalent of energy last year, up 5.2 percent from 2020, the NBS said. The NBS said coal consumption in China rose 4.6 percent in 2021, also the strongest rate of growth in a decade.

International: Power

Sri Lanka imposes power cuts as forex crisis deepens

23 February: Authorities in Sri Lanka are imposing power cuts on a staggered basis as the country continues to reel under the worst economic crisis in decades, which has led to fuel shortages and frequent power outages. Sri Lanka’s Public Utilities Commission said it will shut off the grid for four hours and 40 minutes due to a shortfall of 540 megawatts, power entity Ceylon Electricity Board (CEB) said. President Gotabaya Rajapaksa had summoned a special meeting of the Cabinet to discuss the power crisis and fuel shortages. Fuel shortages have stopped the functioning of at least three thermal power plants, CEB said.

International: Non-Fossil Fuels/ Climate Change Trends

Germany aims to get 100 percent of energy from renewable sources by 2035

28 February: Germany aims to fulfil all its electricity needs with supplies from renewable sources by 2035, compared to its previous target to abandon fossil fuels "well before 2040," according to a government draft paper. Europe’s top economy has been under pressure from other Western nations to become less dependent on Russian gas, but its plans to phase out coal-fired power plants by 2030 and to shut its nuclear power plants by end-2022 have left it with few options. Economy Minister Robert Habeck has described the accelerated capacity expansion for renewable energy as a key element in making the country less dependent on Russian fossil fuel supplies. According to the paper, the corresponding amendment to the country’s Renewable Energy Sources Act (EEG) is ready and the share of wind or solar power should reach 80 percent by 2030. By then, Germany’s onshore wind energy capacity should double to up to 110 gigawatts (GW), offshore wind energy should reach 30 GW - arithmetically the capacity of 10 nuclear plants - and solar energy would more than triple to 200 GW, the paper showed.

EDP Renewables to invest up to US$7.4 bn by 2030 for clean energy hub in Singapore

24 February: EDP Renewables (EDPR), the world’s fourth-largest renewable energy producer, said it plans to invest up to S$10 billion (US$7.4 billion) by 2030 to establish a clean energy hub in Singapore for the Asia Pacific region. Apart from solar and wind projects, EDPR and Sunseap intends to explore opportunities for co-operation in energy storage and green hydrogen, the companies said. EDPR said the recently closed deal allows the company to establish a headquarters for the Asia-Pacific region through Sunseap, which has a portfolio of close to 10 GW of renewable projects at different stages of development across nine markets including Singapore, Vietnam, Malaysia, Indonesia, Thailand, Cambodia, China, Japan, and Taiwan.

China’s solar power capacity set for record increase in 2022

23 February: China is expected to add 75 to 90 gigawatts (GW) of solar power in 2022, its solar manufacturing association said, far higher than a record increase in capacity last year. The world’s biggest solar products maker and solar power generator brought 54.88 GW of new solar power into operation in 2021, taking the total installed capacity to 306 GW despite a supply disruption of raw materials. China could add an average of 83 to 99 GW of new capacity each year during 2022 to 2025, the China Photovoltaic Industry Association (CPIA) chairman Wang Bohua said. China plans to boost rooftop solar power in central and eastern parts of the country that are close to consumers and offer easier access to the grid. Projects to build more large-scale solar stations in the Gobi and other desert regions in the west are also in the pipeline, with construction for about 100 GW of solar power capacity already under way in the area. Wang warned that the booming pace of solar manufacturing in the United States and certain European countries would challenge the industry in China. The US (United States) President Joe Biden in early February extended Trump-era tariffs on imported solar energy equipment by four years. Beijing’s energy consumption curbs on industrial plants that use more than 50,000 tonnes of standard coal equivalent could also slow China's solar manufacturing development, Wang said.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV