Quick Notes

Climate narratives: Reading between the lines

Background

Reports of working groups I, I,I and III to the

sixth assessment report (AR6) of the intergovernmental panel on climate change (IPCC) that assesses the scientific basis and impact of climate change to offer solutions were widely covered by the media in the last six months. The dominant reporting flavour was that of ‘

climate doom’ with a focus on climate impacts in the

worst-case. The key message conveyed was that unless sweeping technological, economic, and social

transformations are made immediately climate catastrophe is assured. The coverage of the report of

working group III on mitigation of climate change was slightly more optimistic as it reflected

technological optimism with the message that

carbon emissions can be halved by 2030. The blame was assigned to countries and their

leaders who were failing to act even though technology offered solutions.

Carbon emissions

Recent studies show that developed countries have made significant gains in decarbonisation, but this information was lost in the noise of climate catastrophe. One notable observation in AR6 that failed to grab media attention is that the rate of growth of net

anthropogenic GHG (greenhouse gas) between 2010 and 2019 was lower than that between 2000 and 2009. This does not mean that total emissions are lower. Total emissions have continued to rise during the period 2010–2019, as have cumulative net CO

2 (carbon dioxide) emissions since 1850. Average

annual GHG emissions during 2010-2019 were higher than in any previous decade. But a slowdown in the growth rate of emissions is progress.

At least

18 countries have sustained production-based GHG and consumption-based CO

2 emission reductions for longer than 10 years. Reductions were linked to

energy supply decarbonisation, energy efficiency gains, and energy demand reduction, which resulted from both policies and changes in economic structure. Some countries have reduced production-based

GHG emissions by a third (that ignore embedded GHGs in their imports) or more since peaking, and some have achieved several years of consecutive reduction rates of around

4 percent per year comparable to global reductions in scenarios limiting warming to 2°C or lower.

The slowdown in emission rates is recorded in the studies of the

global carbon project (GCP). A 2021 paper by GCP nearly halved the estimate of net

emissions from land-use change over 2019 and 2020, and by an average of 25 percent over the past decade. These changes come from an update to underlying

land-use datasets that lower estimates of cropland expansion, particularly in tropical regions. Emissions from land-use change in the new GCP dataset have been decreasing by around 4 percent per year over the past decade, compared to an increase of

1.8 percent per year in the prior version.

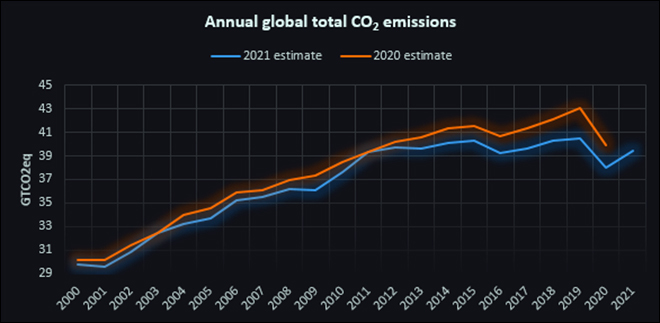

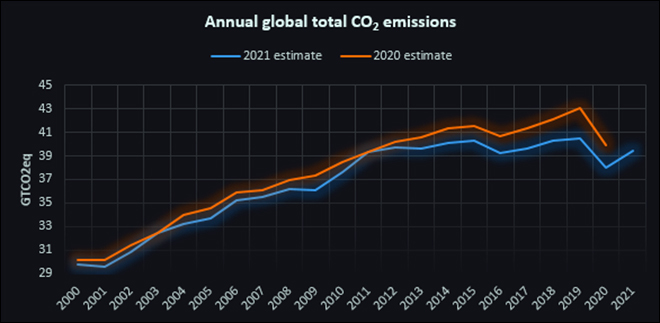

The

earlier dataset showed global CO

2 emissions increasing by an average of 1.4 GtCO

2eq/y (giga tonnes of CO

2 equivalent per year) between 2011 and 2019 prior to COVID-related emissions declines. The new revised dataset shows that global CO

2 emissions were essentially flat—increasing by only

0.1GtCO2eq/y from 2011 and 2019. When 2020 and 2021 are included, the new GCP data actually shows slightly

declining global emissions over the past decade, though this is because of the dramatic decline in emissions due to pandemic related lockdowns in 2020 and 2021. The new GCP dataset also puts historical (1750-2020) cumulative emissions around

19 GtCO2eq lower than in the prior 2020 version, roughly equal to half a year of current global emissions. Falling

land-use emissions have counterbalanced rising fossil

CO2 emissions keeping emissions flat in the last decade. The GCP authors caution that there is no guarantee these trends will continue in the future and that

uncertainties in land-use change emissions remain large.

The GCP also observes that the global slowdown in fossil CO

2 emissions growth is due to the

emergence of climate policy and emission declines in OECD countries (organisation for economic cooperation and development). Consumption-based emissions are also falling significantly in

15 out of the 23 OECD countries. Lower economic growth and

declines in energy use per GDP (gross domestic product) also made smaller contribution to the slowdown in CO

2 emissions growth rate. Despite the slowing growth in global fossil CO

2 emissions,

emissions are still growing and are far from the reductions needed to meet the ambitious climate goals.

Equity

Another key issue highlighted in AR6 reports that was not sufficiently covered in the wider media is that of inequality in responsibility for climate change, inequality in vulnerability to climate change and inequality in the ability to address climate change. AR6 notes that since AR5, the average global per person net anthropogenic GHG emissions increased from

7.7 to 7.8 tCO2eq, ranging from

2.6 tCO2eq to 19 tCO2eq across regions. Least developed countries (LDCs) and small island developing states (SIDS) have much lower per capita emissions (1.7 tCO

2eq, 4.6 tCO

2eq, respectively) than the global average (

6.9 tCO2eq), excluding CO

2 from land use, land-use change and forestry (LULUCF). India with per person emission of about

1.8tCO2eq is in the group of LDCs though it qualifies as a developing country on the whole.

As pointed out by working group III, in 2019, around

48 percent of the global population lived in countries emitting on average more than 6t CO

2eq per person, excluding CO

2 LULUCF. The share of the population emitting more than 6tCO

2eq per person is high because China with per person CO

2 emission of

7.35tCO2eq is included in this group. 35 percent live in countries emitting more than

9 tCO2eq per person. Another 41 percent live in countries emitting less than

3 tCO2eq per person. India is part of this group. A substantial share of the population in these low emitting countries lack access to modern energy services. Globally, the 10 percent of households with the highest per capita emissions contribute

34-45 percent of global consumption-based household GHG emissions, while the middle 40 percent contribute 40-53 percent, and the bottom 50 percent

contribute 13-15 percent.

Taking note of these inequalities, the report of working group III recommends market-based solutions such as

carbon taxes and

carbon pricing, stating that equity and distributional impacts of such instruments can be addressed using revenue from carbon taxes or

emissions trading to support low-income households. This is easier said than done. The substantial revenue that the Indian government collects by heavily taxing fossil fuels (implicit carbon tax) does not

necessarily support low-income households. The AR6 report makes circular arguments effectively stating that “attention to equity in policy design can address inequity” or that “pathways towards sustainability will address unsustainability” which probably reflects the insignificance of equity in climate narratives. As pointed out by

observers of the line-by-line approval of the SPM of working group III, reference in the original draft to ‘developed countries’ and ‘developing countries’ that lead to the issue of equity was removed on

insistence of the US. Equalising unequal countries is among the worst forms of injustice in the context of climate change, but this effort has progressed relentlessly since the

21st conference of parties (COP21) in Paris in 2015.

Climate Finance

The issue of inadequate flows of climate finance was also not given the attention that it deserved by the media. The SPM of working group II on climate change impacts and mitigation note that losses and damages are

unequally distributed across systems, regions and sectors and are not comprehensively addressed by current financial, governance and institutional arrangements, particularly in vulnerable developing countries. It adds that with increasing global warming, losses and damages increase and become

increasingly difficult to avoid, while strongly concentrated among the poorest vulnerable populations. It also points out that current global financial flows for adaptation, including from

public and private finance sources, are insufficient for and constrain implementation of adaptation options especially in developing countries. The report notes that overwhelming majority of global

tracked climate finance was targeted to mitigation while a small proportion was targeted to adaptation. The report acknowledges that adaptation finance has come predominantly from public sources. The SPM of working group III observes that

accelerated international financial cooperation is a critical enabler of low-GHG and just transitions and can address inequities in access to finance and the costs of, and vulnerability to, the impacts of climate change. But a

footnote in the same page states that model quantifications help to identify high priority areas for cost-effective investments, but do not provide any indication on who would finance the regional investments.

In the line-by-line approval process of the SPM,

developed countries led by the US questioned the classification of developed and developing countries to undermine climate finance obligations to the developing countries. The distinction between developed and developing countries is firmly embedded in the UN Framework Convention on Climate Change (UNFCCC) and its Paris Agreement (PA). Though developed countries resisted reference of the unfulfilled

US$100 billion-a-year finance goal (by 2020 which was committed by developed countries under the UNFCCC), it is mentioned in the SPM of working group III on the insistence of developing countries.

Issues

The narratives of climate doom and technological optimism facilitate the side-lining of key issues of equity and climate finance that are critical for developing countries. Climate doom that likens the problem to that of an

asteroid approaching the earth provides a sense of urgency that pushes equity and finance down the list of priorities. Technological optimism facilitates framing countries as offenders who supposedly refuse to act despite the promise of technology. As the energy crisis initiated by the invasion of Ukraine by Russia shows, the

real world is far more complicated than these simplistic narratives suggest. OECD countries that have reduced carbon emissions have stable or declining energy use implying complete industrialisation with declining or stable population growth rates. This has allowed them to implement decarbonisation policies with a surplus generated from industrialisation to replace existing fossil fuel infrastructure. Developing countries cannot bypass this path without

obligatory finance flows from developed countries justified by concerns of equity.

Source: Global Carbon Project

Source: Global Carbon Project

Monthly News Commentary: Power

Electricity Generation increases to meet Summer Demand

India

Generation

NTPC Ltd surpassed the maximum annual electricity generation of 314 (BU) achieved in 2020-21 on 18 February. Last year, the generation was 270.0 (BU) till 18

th February, indicating improved performance and an increase in demand for power in the current year. NTPC Korba (2600 MW plant) in Chattisgarh is the top performing thermal power plant in India with 94.32 percent plant load factor (PLF or capacity utilisation) between April 2021 and January 2022, according to the CEA (Central Electricity Authority) data. The total installed capacity of the company is 67,832.30 MW having 23 coal-based, 7 gas-based, 1 hydro, 19 renewable energy projects. Under JV, NTPC has 9 coal-based, 4 gas-based, 8 hydro and 5 renewable energy projects.

Discom Reform

Tamil Nadu Generation and Distribution Corporation (TANGEDCO) will be seeking the State government’s

approval to link power connections to Aadhaar cards. As per TANGEDCO, this will help identify those taking advantage of the electricity subsidy by taking multiple connections for a single residence. TANGEDCO is of the view that if the power connections are linked with Aadhaar, then it would be easy to identify those having multiple connections for a single premise and enjoying undue subsidy.

Demand Growth

As per estimates of the 19

th Electric Power Survey (EPS),

Power requirement in the country is estimated to be 1,650.59 billion units (BU) in 2022-23 while it was 1,141.94 (BU) till January of the ongoing fiscal year. In financial year 2020-21, power requirement was 1,275.53 (BU). The peak power demand was 2,03,014 Megawatt (MW) till January 2021-22 and it is estimated to touch 2,38,899 MW in the next financial year. India has robust transmission grid capacity. Power from one state to another state can be transmitted through Electricity Grids. The cumulative inter regional transmission capacity of the National Grid as on 31 January 2022 was 1,12,250 MW, which has ensured seamless transfer of power in Electricity Grids.

Regulation and Governance

Union Home Minister said in Dibiyapur, in Auraiya district (80 km from Kanpur) in Uttar Pradesh, that if the

BJP was re-elected to power, farmers in UP (Uttar Pradesh) would not have to pay electricity bills for the next five years.

Rajasthan Chief Minister (CM) announced that

50 units of electricity will be available free of cost to the people who use up to 100 units in the desert state. Domestic consumers spending up to 100 units of electricity will be given 50 units free, INR3 per unit grant for all domestic consumers spending up to 150 units and INR2 per unit grant for consumers spending 150 to 200 units. Around INR40 billion (US$526 million) will be spent on this.

Rest of the World

Asia Pacific

Authorities in Sri Lanka are imposing power cuts on a staggered basis as the country continues to reel under the worst economic crisis in decades, which has led to fuel shortages and frequent power outages. Sri Lanka’s Public Utilities Commission will shut off the grid for four hours and 40 minutes due to a shortfall of 540 MW, power entity Ceylon Electricity Board (CEB) said. President Gotabaya Rajapaksa had summoned a special meeting of the Cabinet to discuss the power crisis and fuel shortages. Fuel shortages have stopped the functioning of at least three thermal power plants.

Africa & Middle East

Jordan will begin exporting electricity to Lebanon in March after finalising a funding agreement with the World Bank. The US (United States)-backed funding deal aims to ease crippling power shortages in Lebanon by transmitting electricity across neighbouring Syria.

Europe & Russia

Statkraft, Norway’s largest power producer and one of Europe’s largest producers of renewable energy, posted booming core earnings in the fourth quarter on the back of surging power prices.

The increase was driven by substantially higher Nordic power prices and high Norwegian hydropower generation, offsetting losses at its trading unit because of market volatility. The benchmark Nordic system power price soared after a cold, dry winter and surging fuel and carbon markets last year, averaging 96.26 euros per megawatt hour in the fourth quarter of last year, up from €13.76/MWh for the same period of 2020. The Norwegian government is subsidising record-high power bills this winter, though much of it will be financed from the state’s revenue from petroleum and power production, including its Statkraft dividend.

Britain’s auction to ensure enough electricity capacity for 2022/23 cleared at a record high of 75 pounds (US$101.70) per kilowatt (kW) per year. Britain launched its power capacity market in 2014, offering to pay providers for making supplies available at short notice. Britain usually holds auctions for power capacity about four years in advance of the delivery date and another auction for a smaller amount of capacity around a year before delivery. In early 2020, the power capacity auction for 2020/21 cleared at just 1 pound/kW/year when UK wholesale power prices were a lot lower. A total of nearly 5 gigawatts (GW) of capacity was procured in this auction, with nearly 3.4 GW from gas-fired plants, a provisional auction document showed. Some 516 MW was procured from demand-side response providers, or firms that guarantee to cut industrial demand, 411 MW from coal, 385 MW from battery storage and the rest from other sources. About 65 percent of the capacity procured in the auction was from existing power assets, the auction results showed, including one coal unit at Uniper’s Ratcliffe plant in Nottinghamshire. Utilities such as Centrica, SSE, E.ON were among other winners of agreements.

A rushed transition away from fossil fuels risks driving electricity prices higher, responding to German government comments that an EU carbon tax may make renewables more attractive in Russia. Russian Deputy Energy Minister Pavel Snikkars said Russia was ready to support global efforts against the negative consequences of climate change but said any push to renewables should be gradual.

Russia’s exports of commodities and power to Europe have been in the spotlight because of winter price rises and disputes about supply, at a time when relations between Moscow and the West are at their worst since the Cold War over Ukraine. Russian state power utility Inter RAO expects its electricity exports to double in 2021 to more than 21 billion kilowatt hours.

News Highlights: 9 – 15 March 2022

National: Oil

Government to take measures to provide relief to consumers from high fuel prices

15 March: Amid skyrocketing oil prices, Union Minister Hardeep Singh Puri said the government will take all required measures in the coming months to ensure that consumers get relief from high fuel prices.

India relies on overseas purchases to meet about 85 percent of its oil requirement, making it one of the most vulnerable in Asia to higher oil prices. Observing that oil prices had shot up from US$19.56 cents a barrel to US$130 a barrel at one stage and are currently hovering around US$109 a barrel, the minister said it is emanating from a war-like situation, apparently referring to the ongoing Russia-Ukraine conflict. Though the government has deregulated petrol and diesel prices, rate changes have been in the past put on hold by public sector oil companies Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) for reasons that appear to be non-commercial.

India indicates readiness to release more oil reserves

14 March: India will take "appropriate" steps to calm the rise in oil prices, triggered by Russia’s invasion of Ukraine, the junior Oil Minister Rameswar Teli said, indicating the country could release more oil from national stocks if required. India, the world’s third biggest oil consumer and importer, imports about 85 percent of its oil needs. India said it was prepared to release additional crude from its national stocks in support of efforts by other major oil importers to mitigate surging global prices. Teli said in November the federal government had joined other major consumers to release 5 million barrels of oil from its strategic petroleum reserves to contain inflationary pressures. India buys only a fraction of its oil from Russia but has been hit hard by a spike in global oil prices due to Western sanctions against Moscow, the world’s second largest crude exporter. The Indian basket of crude oil had jumped to US$112.59/barrel by 11 March, after averaging US$84.67/barrel in January and US$94.07 in February. Indian oil companies have not raised fuel prices since 4 November to shield the customers from higher costs. However, to ease the import cost for companies, India is considering a Russian offer to sell its crude oil and other commodities at a discount.

India’s ONGC fails to get bids in its tender to sell Russian oil

10 March: India’s ONGC Videsh Limited

(OVL) failed to get bids in its tender to sell 700,000 barrels of Russian Sokol crude in a growing backlash against Moscow for its invasion of Ukraine. This was the first tender by OVL, since the war in Ukraine began on 24 February. OVL, the overseas investment arm of India’s top explorer Oil and Natural Gas Crop (ONGC), has a 20 percent stake in Russia’s Sakhalin-1 project and sells its share of oil through tenders. The tender for the sale of May loading cargo closed. OVL has an option to bring the cargo to India for processing at refineries owned by its subsidiary Hindustan Petroleum Corp (HPCL) and Mangalore Refinery and Petrochemicals Ltd (MRPL). No Indian company has publicly withdrawn from Russia and New Delhi has declined to condemn Moscow’s invasion of Ukraine despite pressure from the United States to do so.

National: Gas

Soaring LNG prices likely to drive up India’s INR1 tn fertiliser subsidy

14 March: By shifting away from expensive LNG imports for fertiliser production and using domestic supplies instead,

India could reduce its vulnerability to high and volatile global gas prices and ease the subsidy burden, Institute for Energy Economics and Financial Analysis (IEEFA) report said. Natural gas is the main input (70 percent) for urea production, and even as global gas prices increased 200 percent from $8.21/mmBtu (metric million British thermal unit) in January 2021 to $24.71/mmBtu in January 2022, urea continued to be provided to the agriculture sector at a uniform statutory notified price, which led to an increased subsidy. The budget allocation for the fertiliser subsidy is about US$14 billion or INR1.05 trillion, the report said. The prices of domestic gas and imported LNG are pooled to supply gas to urea manufacturers at a uniform price. With domestic supplies being diverted to the government’s city gas distribution network, the use of expensive imported LNG in fertiliser production has been rising rapidly. In FY2020/21 the use of regasified LNG was as high as 63 percent of the total gas consumption in the fertiliser sector, according to the report.

Maharashtra Budget proposes cutting VAT on CNG to 3 percent from 13.5 percent

11 March: In a relief for consumers of domestic piped CNG (compressed natural gas) as well as vehicle owners, Maharashtra Finance Minister Ajit Pawar

proposed a drastic cut in the Value Added Tax (VAT) on natural gas from 13.5 percent to 3 percent. Pawar, who presented the state Budget in the Assembly, said this reduction will cause a revenue loss of INR8 bn annually. Natural gas is "environment-friendly" and is largely used for domestic piped gas supply and for CNG-powered motor vehicles, auto-rickshaws, taxis and private vehicles, Pawar said.

RIL sells CBM gas for over US$23 to GAIL, GSPC and Shell, HOEC gets US$25

10 March: Reliance Industries Ltd

(RIL) has sold natural gas produced from a coalfield in Madhya Pradesh for over US$23 to firms, including GAIL (India) Ltd, GSPC and Shell, but its price discovery was beaten by smaller explorer HOEC, which sold half of its sales volume for over US$25. RIL sold 0.65 million metric standard cubic metre per day (mmscmd) of gas from its coal-bed methane (CBM) block SP-(West)-CBM-2001/1 at a US$8.28 per metric million British thermal unit (mmBtu) premium over prevailing Brent crude oil prices. The firm had sought bids at a premium over the base of 13.2 percent of Brent crude oil prices. At the current Brent crude oil price of US$115 per barrel, the base comes to US$15.18 per mmBtu and adding US$8.28 premium bid by state-owned gas utility GAIL and other firms, the final price comes to US$23.46 per mmBtu. This rate compares to US$2.9 that state-owned producer ONGC and Oil India Ltd get gas from fields given to them on a nomination basis. A higher capped rate of $6.13 is available for discoveries made in difficult areas, such as the deep sea. However, no cap is imposed on gas from CBM blocks or areas like B-80 in Mumbai Offshore that was bid out under-discovered field round. RIL gets US$6.13 for gas from its KG basin fields. Hindustan Oil Exploration Company (HOEC) sold 0.3 mmscmd of gas to Gujarat State Petroleum Corp (GSPC) at a price of around 22 percent of Brent. At the current Brent price, this translates into a price of US$25.3. As per the government mandate, gas producers are obligated to tender the available quantities, seeking bids from users on a formula. The sources said e-auctions of both RIL and HOEC intense competition with participation from multiple companies, including GAIL, GSPC, Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL), Hindustan Petroleum Corporation Ltd (HPCL), Shell and Adani-Total Gas Ltd. In the RIL tender, GAIL and GSPC picked up 0.28 mmscmd each while Shell took 0.04 mmscmd. City gas distributor Think Gas took 0.02 mmscmd and an affiliate of RIL bought a similar volume. GSPC bought the entire 0.3 mmscmd of the gas bid out by HOEC.

National: Coal

MCL becomes largest coal producing company in India

14 March: Coal India Limited unit, the Mahanadi Coalfields Limited

(MCL) said it has become the largest coal-producing company in the country. The company said it has crossed 157 million tonnes (MT) in coal production in the financial year 2021-22. And, on 12 March, the company produced 7.62 lakh tonne of dry fuel. The company claimed that it is the highest production in a day during the current financial year, the company said.

Tata Steel seeks alternative to Russian coal

12 March: Tata Steel Ltd is looking at alternative markets for imports of coal as it faces uncertainties with its Russian suppliers and bankers, amid the Russia-Ukraine conflict. The geopolitical situation after Russia’s invasion of Ukraine has also opened up steel export opportunities in Europe, following a supply vacuum of 45 million tonne (MT) of the metal left by Russia and Ukraine in the continent, Tata Steel Managing Director T V Narendran said. Tata Steel will look at alternative markets for coal imports to de-risk. There is a lot of uncertainties with Russian suppliers and bankers at present, he said. The steelmaker used to buy 10-15 percent of its coal requirements from Russia for use in pulverised coal injection, he said.

Present plan to phase out use of coal in industry: Gujarat HC

12 March: The Gujarat high court

(HC) asked the state government what are the modalities and its plans to phase out the use of coal and lignite in industrial units to curb air pollution in the state, and how can it reduce their use. The court asked what are the government’s plans to persuade industry to switch to CNG and PNG from coal. The court asked the state government for its stance on how the use of coal as a fuel can be done away with. The government submitted that it cannot be phased out all of a sudden, but over a long period. The Union government has come up with the National Coal Gasification Mission for use of coal. The court asked if coal is an approved fuel and if it is a policy, to what extent can the court use its writ jurisdiction to direct the government to delete coal as a fuel from its notification and stop its use. The court questioned why the government does not promote the use of gas in place of coal. It sought details on production and consumption of CNG and commented that its order to Morbi’s ceramic units to shift from coal to gas yielded good results in the area. The court inquired about the use of lignite, of which 1.19 lakh million tonnes (MT) is used every day in Gujarat. The state submitted that lignite causes more pollution than coal, but is the cheapest fuel available. It was also submitted that the government plans to stop the use of lignite in a phased manner. Seeking the government’s response to its plan to phase out coal and lignite, the court recorded the government’s submission that lignite is worse than coal. It questioned while coal is creating so much problem for the ecology, why the government permits the use of lignite and why it should not be done away with at the earliest.

India’s Russian coal imports could be highest in over two years in March

10 March: India’s coal imports from Russia in March could be the highest in more than two years, data from research consultancies showed, as Indian buyers continue buying the fuel from a market that is now increasingly isolated by sanctions. Vessels carrying at least 1.06 million tonnes (MT) of coking coal, mainly used for steelmaking, and thermal coal, used primarily for electricity generation, are set to deliver the fuel at Indian ports in March, the highest since January 2020, consultancy Kpler data showed. Russia, usually India’s sixth largest supplier of coking and thermal coal, could start offering more competitive prices to Chinese and Indian buyers as European and other customers spurn Russia because of sanctions, traders said. About 870,000 tonnes of Russian coal have already delivered or are expected to be delivered at Indian shores until March 20, the highest since April 2020, Indian consultancy Coalmint said.

National: Power

Gujarat paid INR8 bn excess to CGPL for power procurement from October-December 2021

15 March: The Gujarat state government procured power from a private player by paying INR8.28 bn in excess to the agreed rate. Responding to questions asked by Congress legislators about the details of power procured from the Coastal Gujarat Power Limited (CGPL) — a subsidiary of Tata Power — by the state, Energy Minister Kanu Desai said that the state government had carried out the purchase of power with the company according to the Power Purchase Agreement (PPA) of buying each unit at the rate INR 2.26 for a period of 25 years. However, as per the figures provided by the minister, the state government had procured power from the company at the rate ranging from INR2.71 per unit to INR3.16 per unit between January 2020 and September 2021.

No power crisis in India, generation capacity greater than peak demand: Power Minister

15 March: India is not facing any power crisis as the installed electricity generation capacity stood at 395.6 GW (gigawatt) against the peak demand of 203 GW recorded in 2021-22, Parliament was informed. Power Minister R K Singh said that as per the information compiled by the Central Electricity Authority (CEA), the import of coal reduced to 22.7 MT (million tonnes) during 2021-22 (April-January) as against 39 MT during the same period last year, mainly due to high imported coal price in the international market. He said that there was a decrease in the coal-fired electricity produced in the country during the financial year 2020-21 as compared to the previous year 2019-2020 due to the COVID-19 pandemic. As on March 6, 2022, coal-based generation capacity is 2,03,889.5 MW out of the total capacity of 395,592.86 MW i.e. about 52 percent. As per optimal generation capacity mix projections for 2029-30 prepared by the CEA, the capacity for coal-based thermal projects will be about 267 GW in 2030. This is out of the total projected capacity of 817 GW i.e. about 32 percent, due to the corresponding increase in non-fossil fuel-based electricity generation capacity. He said 1,16,766 MW of power generation capacity is under construction, including 72,606 MW renewable (including large hydro projects), 15,700 MW nuclear and 28,460 MW thermal. The increasing demand for power in the country is being met with a commensurate increase in power generation. A generation capacity of 15,978.84 MW has been added during the year 2021-22 (up to 28 February 2022), which includes 3,825 MW of thermal, 213 MW of hydro (above 25 MW capacity) and 11,940.84 MW from other renewable energy sources.

Haryana power regulator bats for SLDC autonomy

14 March: The Haryana Electricity Regulatory Commission

(HERC) has strongly advocated autonomy for the state load dispatch centre (SLDC) for the purpose of transmission of electricity within the state. The HERC sanctioned an annual revenue requirement (ARR) worth INR224.2 mn for SLDC for the year 2022-23. The regulator has asked Haryana Vidyut Prasaran Nigam Limited (HVPNL) to take up the issue of autonomy to SLDC with the state government and revert with the communication received from Haryana government. The HERC has sanctioned the ARR worth INR22.08 bn for the HVPNL for the year 2022-23. It has also asked the electricity transmission distribution company to ensure further reduction in the pilferage of electricity while bringing the same through state or private agencies. The commission has observed that HVPNL has improved the target for intra-state transmission losses fixed for the FY 2020-21, with the reported actual loss touching 2.115 percent against the target of 2.15 percent. HVPN has efficiently managed the transmission system including ‘Opex’ and ‘Capex’ during the year under review, it said. The commission said it expected HVPNL to go an extra mile to improve the benchmarks set, so as to ensure that the backbone of the power system in the state is among the best performing power utilities in the country. HERC has given directives to HVPNL to identify projects that could be taken up for utilization of the surplus fund in the reactive energy pool account, in addition to the projects already approved by the commission.

National: Non-Fossil Fuels/ Climate Change Trends

Tamil Nadu plans INR700 bn worth 20 GW solar plants by 2030

12 March: In a bid to increase renewable energy resources, reduce the quantum of power being purchased from private companies, and cut the State’s carbon footprint, the Tamil Nadu Generation and Distribution Corporation

(TANGEDCO) is planning to install a total of 20,000 megawatt (MW) capacity of solar plants at an approximate cost of INR700 bn across Tamil Nadu by 2030. TANGEDCO has floated a tender inviting consultants for the project. TANGEDCO said that for generating 1 MW of solar power, at least five acres of land is required and the corporation had already requested collectors to identify land parcels.

India needs US$20 bn annual investments to achieve climate targets

12 March: India needs US$20 billion worth of investments each year to achieve its climate targets and fund its green transition, according to a report. The white paper by Ficci and Trilegal highlights that the country needs a large budget allocation, international finance from bilateral and multilateral sources and green private investments. The report also spotlights reforms in the power sector for encouraging environmental, social and governance-led investment in India’s climate transition. Focussing on redefining corporate citizenship -- the road to sustainability, the report details how corporates can contribute to the sustainability agenda, non-financial metrics and management of environmental, social and governance (ESG) risks. As regulators actively incorporate ESG and sustainability factors into the legal framework, the ways in which companies operate will change, it said.

Maharashtra ranks 5th in renewable energy power

11 March: The economic survey report mentioned that

Maharashtra ranked fifth in India when it came to electricity generation from renewable energy. Meanwhile, electricity distribution losses for Tata Power have gone up by 5 percent in 2021-22 while those of MSEDCL (Maharashtra State Electricity Distribution Company Ltd), Adani Electricity and BEST saw a drop in the past one year, the report showed.

International: Oil

British PM to visit Saudi Arabia for oil supply talks

15 March: British Prime Minister (PM) Boris Johnson is set to visit Saudi Arabia and meet with its crown prince for talks on oil supplies, as he stressed that the West must end its dependence on Russian energy. Johnson’s government announced that the UK

(United Kingdom) will phase out the import of Russian oil and oil products by the end of the year.

Norway’s Equinor confirms trading halt in Russian oil

14 March: Norwegian state oil company

Equinor said it will stop trading in Russian oil as the company shuts down operations in Russia following its invasion of Ukraine. Equinor said that it had contractual commitments which it struck prior to Russia’s invasion of Ukraine, under which it was to receive four oil cargoes in March. Equinor joins oil and gas majors, including Shell, BP, France’s TotalEnergies and Italian energy group ENI, in stopping purchases of oil from Russia.

International: Gas

Global LNG demand growth shifts from Asia to Europe on Russia sanctions

9 March: Asia’s liquefied natural gas (LNG) demand growth may cool this year as buyers baulk at record-high spot prices pushed even higher by Europe’s shift to the super-chilled fuel amid the Ukraine crisis, analysts said. High spot prices since late last year have already slowed trade and are likely to crimp demand growth of the fuel in Asia - the largest consuming region - even as some countries see widening gas supply deficits as domestic production falls. This comes just as new LNG buyers in Asia, the Philippines and Vietnam, are set to enter the market later this year. Asia’s spot LNG benchmark price assessed by S&P Global Platts, known as Platts JKM, jumped to a record US$84.762 per metric million British thermal units (mmBtu) on the back of strong prices in Europe as buyers scour global markets for LNG cargoes to replace Russian gas and LNG. Consultancy Wood Mackenzie expects Asian LNG demand growth to slow to 2 percent year-on-year in 2022, from 8 percent in 2021.

International: Coal

China’s January-February coal output jumps 10.3 percent for winter heating

15 March: China’s coal output rose 10.3 percent in the first two months of 2022 from a year earlier, after Beijing encouraged miners to ramp up production for the winter heating season, with demand also receiving a boost from Indonesia’s export ban. The world’s biggest coal miner and consumer produced 686.6 million tonnes of the dirty fossil fuel during January-February period, up from 617.59 million tonnes in the same period in 2021, the National Bureau of Statistics said. China urged state-owned coal miners to increase output ahead of the festival and ordered them to operate normally during the holidays to ensure market supply and cool prices. Indonesia, China’s largest overseas coal supplier, imposed a shock ban on shipments on 1 January. This boosted demand for China’s domestic coal as seaborne shipments were delayed and regional benchmark prices surged. China’s output is expected to stay at a level of more than 12 million tonnes (MT) a day in the near-term, as Beijing strives to ensure sufficient energy supply amid a global price surge and supply disruption in the wake of Russia’s invasion of Ukraine. However, surging domestic cases of COVID-19, especially in the top mining region of Inner Mongolia, are challenging coal production and transportation. The major coal shipping railway connecting Datong and Qinhuangdao, with annual transportation volume at 421 MT, is expected to carry out annual maintenance in April. China’s most-active thermal coal contract for May delivery rose more than 4 percent in early trade before easing to 2.8 percent.

Coal prices likely to cross US$500 per tonne in 2022: Rystad Energy

10 March: Coal prices could cross US$500 per tonne in 2022, underpinned by soaring gas prices which may lead European countries to turn to coal, Rystad Energy said. European Union leaders gathered to forge a joint response to Russia’s invasion of Ukraine, with differing views on how far to go with economic sanctions, how quickly to cut Russian energy imports and whether or not to let Ukraine join their bloc swiftly. Adding to supply concerns, Australia declared a national emergency in response to devastating floods along its east coast which affected coal producing regions of the country.

International: Power

Myanmar ministry blames gas prices for worsening power cuts

11 March: Many parts of Myanmar are suffering worsening power cuts that are affecting water supplies and halting online classes, compounding the misery for residents following the economic turmoil since the military seized power last year. The Southeast Asian country typically suffers more frequent electricity outages in summer due to lower supplies from hydro-power plants, but the electricity ministry has warned people to brace for worse-than-usual blackouts. The military-controlled ministry blamed outages on higher gas prices as well as damaged power lines and said to expect more disruption in coming days. Some liquefied natural gas (LNG) power plants had paused operations due to higher fuel costs. Most of Myanmar’s electricity is generated from hydroelectric projects, but LNG has been seen as increasingly important for a country whose economy had boomed during a decade of democratic reforms, leading to erratic power supplies.

Spain’s electric steel mills cut output amid soaring power prices

10 March: Spanish steel makers have cut output at their electric-powered mills after power prices skyrocketed to record highs following Russia’s invasion of Ukraine. The steel mills halted production on the afternoon of 8 March. Since then, many have been producing at a reduced rate to lower costs, UNESID and some local steel producers said. Electricity costs have surged in tandem with gas prices following Russia's invasion of Ukraine, creating a headache for power-intensive industries like steel, as producers are unable to transfer all the increase in costs to their customers. Wary of signing long-term contracts with utilities, which would lock in current high prices, steel makers have resorted to buying electricity on the spot market where prices are at record highs. The company will also extend a scheduled closure of another plant in nearby Sestao for 10 days until 23 March, and plans to close a third plant in Gijon, in Asturias, between 24 and 28 March. To protect steel makers, UNESID has asked the government to change regulations to decouple electricity from international gas prices.

International: Non-Fossil Fuels/ Climate Change Trends

Denmark takes first steps towards green hydrogen economy

15 March: Denmark pledged to build up to six gigawatts (GW) of electrolysis capacity to

convert renewable power into green hydrogen as it looks to wean itself off fossil fuels and boost its energy security. Hydrogen is categorised 'green' when it is made with renewable power and is seen as key to help decarbonise industry, though the technology remains immature and costly. Danish lawmakers agreed subsidies worth 1.25 billion Danish crowns (US$184.83 million) through one tender aimed at supporting production and making green hydrogen more commercially viable. Denmark’s target hinges on massive development of solar and wind energy but Jorgensen declined to say if the new agreement would trigger new renewable tenders and referred to political negotiations due later this year.

Swedish wind power generation to rise 70 percent by 2024

14 March: Wind power generation in Sweden is expected to increase by some 70 percent by 2024 compared with last year's level amid a boom in capacity additions, the Swedish Energy Agency said. Wind power generation is expected to rise from 27.4 terawatt hours (TWh) in 2021 to 46.9 TWh in 2024, driven by a strong expansion of installed capacity. In 2021, Sweden installed 2.1 gigawatt (GW) of new wind power capacity, equating 6.8 TWh of normal annual production. Total net electricity production will rise from 165.7 TWh to 183.5 TWh over the same period, which will also see a tripling of solar output from 1.1 TWh to 3 TWh, the Swedish Energy Agency data showed. Hydropower and nuclear power will remain Sweden's largest and second-largest sources of electricity generation, at a steady 66 TWh and 52 TWh over the period.

Czech ministry to order launch of nuclear power plant tender

13 March: The Czech industry ministry will order the

launch of a tender for a new unit at the Dukovany nuclear power plant, the ministry said. The previous government last year sent security questionnaires to three potential bidders - Westinghouse of the United States, France’s EDF and South Korea’s KHNP - after candidates from China and Russia were excluded on security grounds. Czech state-controlled electricity producer CEZ operates four units of 510 MW (megawatt) each at the Dukovany plant, built from 1985 to 1987. The new unit is meant to replace facilities set to retire in the coming decades. Prime Minister Petr Fiala said that under the tender plans, a supplier for the new Dukovany unit could be picked in 2024 and construction permits obtained by 2029. He has said it was necessary to launch the unit by 2036. Nuclear power is an important energy source in the Czech Republic, accounting for 40 percent of its energy mix.

South Korea’s nuclear power at inflection point as advocate wins presidency

11 March: South Korea’s nuclear power industry is at an inflection point after Yoon Suk-yeol triumphed in the nation’s presidential vote, as a platform pledge to revive the fortunes of a once-dominant sector faces stiff business hurdles. It's the second U-turn in less than a decade for the industry, which has been left in tatters with major talent and business losses during liberal President Moon Jae-in's policy to "exit" nuclear energy. Yoon has rejected the idea of phasing out nuclear energy and made it a key pledge of his campaign to boost investment in the industry and restore its earlier pre-eminence as an exporter of lean and safe reactors. The rethink of the country’s energy mix comes at a time the crisis in Ukraine has highlighted the risks of over-reliance on imports of oil and gas and the EU (European Union)’s inclusion of nuclear power in sustainable carbon neutrality goals. But policy uncertainty caused by a constitutional limit of a single five-year presidential term has magnified the business risks in an industry that relies on long-term investment and commitment. Yoon has promised to lift nuclear power’s contribution to 30 percent by restarting construction and extending reactors' lives, and export 10 nuclear power plants by 2030.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Global Carbon Project

Source: Global Carbon Project