Quick Notes

Certainty of Uncertainty in Oil Prices: India’s Challenges

Oil Price Projections

Following the crisis in Ukraine, self-sanctions against Russian oil by oil traders concerned about payment bottlenecks along with Russian oil import sanctions by Western economies increased the price of Brent crude from US

$90.81/barrel (b) on 17 February 2022 to US

$129.8/b on 8 March 2022. Anticipating a prolonged crisis, most forecasters have revised their oil price expectations for 2022. Prior to the crisis in January 2022, the Energy Information Administration (EIA) forecasted that Brent crude prices would average about US

$75/b in 2022 and US$68/b in 2023. Growth in oil supply that exceeded growth in demand and inventory increases were expected to exert a downward pressure on oil prices. Production of crude was expected to increase by

5.5 million barrels per day (mb/d) in 2022 with the USA, Russia, and the OPEC (Oil Producing and Exporting Countries) accounting for 84 percent

(4.6 mb/d) of the increase. Oil consumption was expected to increase by

3.6 mb/d with the USA and China accounting for 39 percent of consumption growth. Oil inventories were projected to increase by

0.5 mb/d in 2022. However, after the military intervention in Ukraine in March, the EIA revised its Brent crude price forecast for 2022 to US

$101/b (by more than US$30/b) and US$85/b for 2023. This forecast was made prior to the

import bans on the Russian crude by the USA and other European countries which leaves the possibility of another upward revision open. Goldman Sachs revised its Brent price expectation for

2022 to US$138/b from US$98/b with the possibility of 1.6 mb/d of the Russian crude removed from the market. JP Morgan revised expectations to a high of US

$125/b for 2022.

Macroeconomic Impact

Oil prices impact the Indian economy through various

channels. In the short term, high crude prices could increase inflation if the increase in crude prices are passed through to the retail consumers. At the extreme, inflation estimate of

4.5% for 2022-23 by the RBI (Reserve Bank of India) could increase by

about 1% if oil prices remain at about US$100/b. The impact could be lower if oil

price pass through is curtailed by reducing taxes on petrol and diesel, but this will translate into an increase of India’s fiscal deficit. It is estimated that an increase of the current excise of

INR27.9/litre (l) on petrol and

INR21.9/l on diesel is reduced by

INR7/l, the government could lose revenue of close to

INR1 trillion even if consumption of petrol and diesel increase by 8-10 percent in 2022-23. This is over 6 percent of the estimated fiscal deficit of over

INR16 trillion for 2022-23.

India’s current account deficit (CAD) could increase significantly if oil prices remain high for a longer period. Oil is a critical input to the Indian economy and in the short term, demand is inelastic to price which means that when oil price increases, the oil import bill increases proportionally. In 2020-21, oil accounted for over

20 percent of India’s total import bill. Oil imports alone contributed about

56 percent of the total trade deficit of over US

$102 billion. In 2020-21 the average price of crude (Indian basket) was US

$44.82/b. The price of the Indian basket of crude in the past 11 months is over US

$83/b (not including March 2022) and the oil import bill for March 2021-January 2022 is US

$114.141 billion compared to US

$82.684 billion in 2020-2021. Analysis of the past

oil price shocks suggest that the

nature of the oil shock matters in understanding the effects of oil price shocks. Oil shocks can be aggregate demand driven, oil-specific demand driven, or supply driven as in the current case. Supply-driven oil shocks contribute more to the increase in

current account imbalances than demand-driven shocks, and the impacts of supply-driven shocks are closely related to the degree of energy dependence. In a

demand-driven oil shock, the impact on current account imbalance is weak because an increase in oil price comes from an increase in global economic activity. The conclusion is that the

trade channel (rather than the asset valuation or exchange rate channels) represents the main adjustment mechanism to oil shocks. Increasing exports under current circumstances of geo-political turmoil, high commodity prices, and supply chain bottlenecks will be challenging for India.

Higher growth rate of GDP (gross domestic product), even if achieved, will not necessarily cushion the adverse effect of high oil prices. It is estimated that even a 1 percent increase in GDP growth rates will not change the ratio of

CAD to GDP significantly.

In the longer term,

sustained increase in oil prices could have an impact on economic activity and output. Decrease in the productivity of the economy because of an increase in the cost of production could also negatively impact wages, employment, and eventually the

purchasing power of households. Analysis of the correlation between

oil price shocks and macroeconomic outcomes show only a

weak correlation between oil price shock and economic output for India compared to other large oil importers. The possible explanation is that India’s industrial output is more dependent on domestic coal, but this cannot lead to complacency. In most of the past supply-driven oil shocks, India’s economy has slumped along with the rest of the world.

Higher for Longer?

Two factors contributed to India’s

1991 balance of payments crisis. One was the crisis in the Middle East and the consequent increase in oil prices which battered the current account. The second was the economic slow-down in India’s

trading partners which added to the current account crisis. In 1991, the value of petroleum imports increased by US

$2 billion to US$5.7 billion as a result of an increase in oil prices combined with an increase in the volume of oil imports. In comparison, non-oil imports increased only by 5 percent in value terms and 1 percent in volume terms. The rise in oil imports led to a sharp deterioration of the

trade account which was already under pressure on account of the fall of the Soviet Union which was India’s important trading partner. The rest was history.

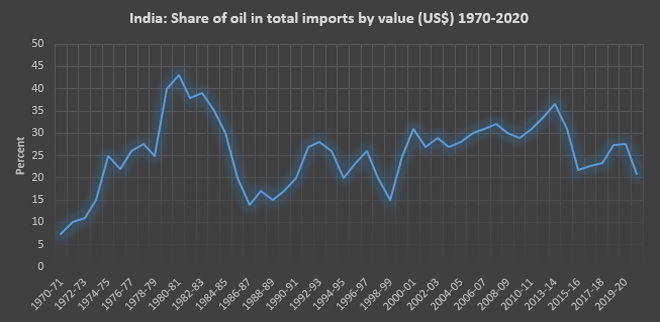

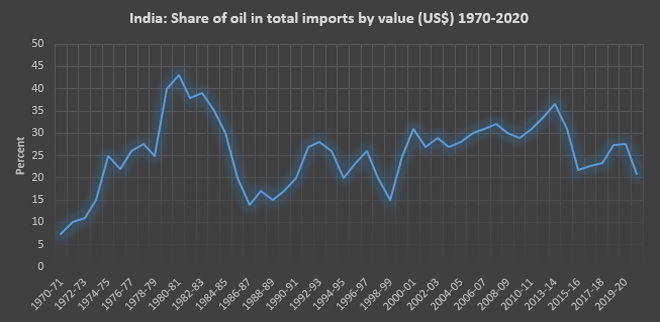

The share of crude in India’s total imports (in terms of value) has fluctuated in the last four decades reflecting changes in the global and domestic economy. In 1970, it was less than

10 percent but increased to more than

40 percent during the oil crises of the late 1970s. It has remained

above 25 percent over the last two decades. Though this partly reflects increase in consumption of oil, it also reflects higher oil prices (interrupted by the financial crisis in 2008 and the pandemic in 2019). In fact, during the pandemic the narrative on oil prices centred around the theme “

lower for longer”. In 2022, sanctions and uncertainty in the oil market appear to have changed the narrative to “higher for longer”. However, there is no certainty over this either. By 17 March 2022, oil prices fell to about US

$100/b from a high of over 130/b. This is attributed to a correction following

speculative overshoot rather than a change in fundamentals. If oil prices remain

higher for longer, it leads to demand destruction through an increase in efficiency of end use and a shift to alternatives that brings prices down. But this takes time. The share of fossil fuels in the global primary energy basket fell from over

95 percent in 1965 to about

84 percent only in 2020. The share of oil in the global primary energy basket fell from over

41 percent to 34 percent in the same period but the geo-politics around oil appears to have held its ground. In 1956 the USA used its financial and military dominance to stop

Anglo–French military action against nationalisation of the Suez Canal by Egypt. Oil tankers were prevented from using the Suez Canal through which

1.2 million barrels of crude was carried each day. A major pipeline carrying half a million barrels of crude from Iraq through Syria was also

sabotaged and exports of Middle Eastern oil to Britain and France were blocked. Surprised at their NATO (North Atlantic Treaty organisation) ally’s betrayal, several European countries turned to

oil from the Soviet Union and in the 1970s gas from the Soviet Union. The irony to be noted by oil importers today is that more than 60 years later, oil’s strategic significance and oil importers’ (Europe’s) vulnerability has endured though the roles of the perpetrator and saviour have reversed.

Source: Reserve Bank of India

Source: Reserve Bank of India

Monthly News Commentary: NON-FOSSIL FUELS

Solar Imports likely to Decline

India

Solar Manufacturing

India is pressing ahead with plans to curb reliance on China, the dominant producer of solar power equipment, even as it seeks to add huge volumes of renewable energy. A pair of measures in budget will help India’s Prime Minister’s efforts to extend his government’s ‘Made in India’ campaign to the clean power sector, in which about 80 percent of all solar hardware is imported from the nation’s northern neighbour. Grants of INR195 billion (bn) (US$2.6 bn) are being added to spur local equipment production, while there’ll also be a 40 percent tax on imports of solar modules and 25 percent on cells from the next fiscal year. India, the world’s third biggest emitter of greenhouse gases, plans to more than quadruple its renewable power generation capacity to 450 gigawatt (GW) by 2030, including 280 GW of solar. That total will continue to rise sharply as the nation seeks to zero out its emissions by 2070. Major local firms including Reliance Industries Ltd. and Adani Group have already outlined plans to add solar equipment production lines.

India’s solar module manufacturing capacity is set to rise by almost 400 percent by fiscal 2025, compared with fiscal 2021, ratings agency Crisil said. The trend will be supported via strong demand, favourable policies, likely improvement in energy efficiency, and price competitiveness, it said. The imposition of 40 percent custom duty on imported modules and the Production-Linked Incentive (PLI) scheme’s benefits will not only eliminate the existing price gap, but may even make domestic module competitive by 2-3 cents per watt at current prices, Crisil said. Consequently, India’s solar capacity implementation is expected to rise to 14 GW per annum between fiscals 2022 and 2024, and further beyond that given aggressive renewable energy plans.

RE Policy and Market Trends

Union Power and New & Renewable Energy Ministry said

India and ASEAN (Association of Southeast Asian Nations) together can develop the entire ecosystem for renewable energy (RE) and explore the joint initiative for building RE manufacturing hubs in the region. At the ASEAN-India High-Level Conference on Renewable Energy, the Ministry said India and ASEAN can work together to develop an entire ecosystem for renewables that promotes knowledge sharing, capacity building, and technical assistance; and also explore joint initiatives for the development of renewable energy manufacturing hubs in the region. The Ministry applauded ASEAN efforts to achieve the development of an ASEAN Power Grid and said India foresees opportunities to expand this grid integration beyond ASEAN to the Indian sub-continent in line with the 'One Sun-One World-One Grid' initiative.

India’s largest lender State Bank of India

(SBI) has launched a dedicated centralised processing cell - ‘Surya Shakti Cell’ after entering into an agreement with Tata Power Solar Systems Ltd (a Tata Power Company). SBI, with the launch of this centralised processing cell, aims to strengthen the existing financing arrangement for solar power projects. The Surya Shakti Cell, which is set up in the Mumbai’s Ballard Estate, will process all the loan applications for Solar Projects (capacity up to 1 MW) from across the country, for business entities as well as household installation. SBI aims to offer an end-to-end platform for digital and hassle-free loan applicants for financing Solar projects. The bank, with this digital initiative, plans to provide a complete solution at competitive rates for Solar projects.

According to the Economy Survey, the country needs a policy roadmap for clarity about the pace at which it wants

to make a shift from conventional fossil-fuel based sources to determine investments in the renewable energy generation sources. The two main pillars for mitigation action to achieve net-zero carbon ambition are transition to clean and renewable sources of energy and storage of this energy, it said. The survey quoted a World Bank report on ‘Minerals for Climate Action’ that this transition from conventional fossil fuel-based energy to clean energy as well as battery storage will be mineral intensive. Minerals and metals like copper, aluminum, iron, manganese, and nickel are critical for developing clean energy sources like solar PV, wind, and nuclear while minerals like lithium and graphite are important for energy storage, it said.

India’s renewable energy sector has the potential to employ around one million people by 2030, and most of the new jobs would be generated by small-scale renewable energy projects, according to the Council on Energy, Environment and Water (CEEW), Natural Resources Defense Council (NRDC), and Skill Council for Green Jobs (SCGJ) study. India’s renewable energy sector could potentially employ around one million people by 2030, which would be 10 times more than the existing workforce of an estimated 1.1 lakh employed by the sector, according to the study. In FY21, a majority of the new workers were employed in the rooftop solar segment where annual capacity additions grew by nine percent over FY20 and accounted for 1.4 GW capacity, it said. The study further noted that India has successfully trained 78,000 people under the Suryamitra training program, between 2015 and 2017, to improve the availability of skilled workers for clean energy projects.

Roof Top /Distributed Solar Projects

Indian Renewable Energy Development Agency (IREDA) inked a Memorandum of Understanding

(MoU) with Goa Shipyard to provide its techno-financial expertise to set up a rooftop solar power project. Under the MoU, IREDA will assist Goa Shipyard Ltd (GSL) to set up a rooftop solar power project at the headquarters of the company in Vasco da Gama, Goa. With this, GSL will be able to bring down the expenditure on electricity and reduce its carbon footprint as well, IREDA said.

The Ministry of New & Renewable Energy

(MNRE) said households are free to get rooftop solar panel installed by themselves or by any vendor of their choice and a photograph of the installed system for distribution utility is sufficient to avail benefits or subsidy under the government scheme. Earlier under the rooftop solar scheme, the households were required to get that from the listed vendors only to avail the benefits and subsidy under the scheme. As per the Ministry, the decision to simplify the rooftop solar scheme was taken in a review meeting on 19 January 2022. According to the Ministry, the households may also install the rooftop solar panel by themselves or get the rooftop solar panel installed by any vendor of their choice, and inform the distribution company about the installation along with a photograph of the system, which has been installed.

Indian Railways is working on an ambitious project to meet the

energy requirements of nearly 7000 railway stations with solar power. Railway authorities said they are already successfully generating around 121.47 MW of solar power through their existing solar rooftop capacity installed in 1,094 railway stations across the country. The 1,094 railway stations that have rooftop solar panel installations include major ones like Varanasi (redeveloped with all world-class facilities in UP), Katra in Jammu and Kashmir, New Delhi, Old Delhi, Jaipur, Secunderabad, Kolkata, Howrah, and Guwahati among others. A 3 MW solar power generating plant has already been set up at MCF in Raebareli while two pilot projects have been assigned to BHEL and the Railway Energy Management Company Limited (REMCL) at Bina in Madhya Pradesh and Diwana in Haryana, to generate 1.7 MW and 2 MW of solar energy respectively. Apart from all this, another 50 MW plant is being set up on railway land in Bhilai by the Railways to generate enough solar power to meet the energy requirement of railway stations. For the same purpose, the Railways has also already tied up with the Rewa Ultra Mega Solar—a joint venture of Solar Energy Corporation of India Limited (SECI) and the Madhya Pradesh government for obtaining solar energy to meet the energy requirement of railway stations.

Utility Scale Solar Projects

SJVN rose 2.33 percent to INR30.80 after the company has emerged as the

lowest bidder for 200 MW grid-connected solar project in the state of Bihar. Bihar Renewable Energy Development Agency (BREDA) has accepted the bid submitted by the company and issued a letter of intent (LoI) for supply of 200 MW power at the fixed quoted tariff of INR3.11 per Kilowatt hour (kWh) for sale of solar power. These projects will assist SJVN in achieving its ambitious shared vision of 5000 MW by 2023, 25000 MW by 2030 and 50000 MW by 2040 and simultaneously contribute towards RE capacity addition target of 500 GW by 2030 set by Government of India.

Tata Power Renewable Energy Limited

(TPREL) has commissioned two Solar Power projects of 50 MW each at Prayagraj, and Banda in Uttar Pradesh (UP). The projects have been completed by TPREL, 100 percent subsidiary of Tata Power. The plants are expected to generate more than 221.26 million units annually. The company said approximately 1,59,600 modules were used in the project at Prayagraj and the installation is expected to reduce 91,137 lakh tons of carbon emission every year.

Telecom operator

Bharti Airtel said it has commissioned a new 21 megawatt (MW) solar power plant in Buldhana district of Maharashtra as part of its commitment to reduce carbon footprint and contribute to the global efforts to curb the effects of climate change. The company expects the solar-powered unit to reduce 25,517 tonnes in carbon emissions annually. The captive power unit, spread over 80 acres, has been set up by Airtel in partnership with Avaada to supply clean energy to Airtel’s Nxtra data centres and switching centres in Maharashtra. Nxtra by Airtel has already commissioned two captive solar power units of 14 MW each in Uttar Pradesh. The company claims to have the largest network of data centres in India with 11 large and 120 edge data centres across the country and will invest over INR50 bn (US$660 mn) over the next four years to expand its capacity by three times. Airtel has committed to reducing absolute Scope 1 and 2 Green House Gas (GHG) emissions across its operations by 50.2% by the financial year 2031, considering FY 2021 as the base year. Airtel has committed to reducing absolute scope 3 GHG emissions by 42% over the same timeframe.

Hydro Power

According to

NHPC it’s 2,880 MW Dibang hydropower project in Arunachal Pradesh is expected to kick-off in the first quarter of 2022-23 "with in-hand forest and environment clearances". The company is waiting for the financial approval of the government which is expected soon. After the approval, NHPC will begin the execution of the ambitious project in Arunachal Pradesh at a cost of around INR300 bn (US$3. 96 bn).

India will have to add 18 GW of hydro power by 2030 to meet its hydro power purchase obligations (HPOs). However, the segment faces significant challenges such as long construction schedule, land acquisition issues, environmental clearances, among others, ratings agency ICRA said. India’s hydro power capacity addition has been slow in the past two decades largely on account of significant execution challenges. Between 2000 and 2021, hydro power capacity grew at a CAGR of 3% adding a capacity of 22 GW, ICRA said. The country’s hydro power generation stood at 1,18,046.85 gigawatt hour (GWh) during the April-November period this fiscal, ending March 2022, as against 1,18,486 GWh in the year-ago period. As of March 2020, India’s total hydro power installed capacity stood at 45,699.22 MW.

Wind Power

ReNew Power has set up Gujarat’s first wind-solar hybrid project at the Chlor-Alkali unit of Grasim Industries in Vilayat, Bharuch, in southern Gujarat. The first phase of the hybrid project, with 17.6 MW commercial-scale wind-solar, commenced operations and is expected to generate 80 million units of renewable energy every year. ReNew develops, builds, owns, and operates utility-scale wind and solar energy projects, hydro projects, and distributed solar energy projects. As of 31 December 2021, ReNew had a total capacity of approximately 10.2 GW of renewable energy projects across India, including commissioned and committed projects.

JSW Group is planning to raise

INR22 bn through bank loans to fund a 450 MW wind power unit in Tamil Nadu. The project is scheduled to be finished by 31 March 2023. India Ratings has assigned “A-” to proposed bank loans. The rating is anchored by the presence of a fixed-tariff power sale contract with a reasonably strong counterparty Solar Energy Corporation of India (SECI), a 100% Government of India-owned entity.

Rest of the World

China

The

US (United States) extension of tariffs on solar products distorts international trade and hinders the development of clean, low-emission energy, China’s Commerce Ministry said. President Joe Biden extended Trump-era tariffs on imported solar energy equipment for four years, though he eased the terms to exclude bifacial panels that generate power on both sides, which are dominant amongst the big US projects. Donald Trump imposed the tariffs on solar imports in 2018, using authority under section 201 of a 1974 trade law. Driven by growing protectionism abroad as well as rising domestic demand, China’s solar manufacturers have focused increasingly on the home market. China’s solar capacity rose by a record 54.9 GW last year to 306.6 GW. It aims to total wind and solar power capacity to a combined 1,200 GW by the end of the decade from 635 GW at the end of last year.

Non-fossil fuel energy sources such as wind, nuclear, solar, and hydropower may make up half of China's total power generation capacity by the end of 2022, for the first time ever, the country’s Electricity Council has forecast. China, the world’s biggest greenhouse gases emitter and coal consumer, is expected

to add 180 gigawatt (GW) of new power generation capacity from non-fossil fuel sources during 2022, driving total non-fossil fuel capacity to 1,300 GW, according to a report issued by the China Electricity Council (CEC). That equates to half of the CEC’s forecast of total installed power generation capacity in China of 2,600 GW by the end of 2022, of which 1,140 GW would be coal-fired power capacity. China has pledged to "control" coal consumption in the 2021-2025 period and bring total wind and solar capacity to at least 1,200 GW by the end of this decade in order to cap carbon emissions by around 2030 and reach a carbon neutrality by 2060. The CEC said that China’s power industry, which causes about 41% of the country’s total carbon emissions, could aim to cap its carbon emissions by 2028.

China connected a record 54.9 GW of solar power capacity to the grid in 2021, up 14 percent from a year earlier and accounting for 31 percent of its total capacity additions to the grid during the period, China’s energy authority said. China’s total solar power capacity had reached 306.56 GW by the end of 2021, the National Energy Administration (NEA) said. New wind installations reached 47.6 GW in 2021, down 34 percent from the previous year’s record high of 71.7 GW. Offshore wind installations hit a record high of 16.9 GW, driven by a rush to connect ahead of the phasing out of subsidies by the end of the year. Total accumulated wind and solar capacity now stands at 635 GW, or 26.7 percent of the national total. China aims to increase total wind and solar capacity to at least 1,200 GW by 2030.

USA / N America

California officials said they needed more time to consider whether to adopt a controversial

proposal that would reform the state’s key rooftop solar power incentive. The move is at least a temporary win for solar installation companies like Sunrun Inc, Tesla Inc, and SunPower Corp that warned of a sharp decline in installations which would harm California’s efforts to combat climate change, if the revisions were implemented. California is home to about 40 percent of the nation’s residential solar energy capacity. The commissioner, CPUC (California Public Utilities Commission) President Alice Reynolds, joined the regulator late last year and did not participate in the lengthy process to consider changes to the policy, known as net metering, that has underpinned the dramatic growth of residential solar in California. Under the proposal, which was unveiled by the CPUC in December, homeowners would receive a lower rate for the power their rooftop panels send to the grid and pay a monthly charge of US$8 per kilowatt to maintain electrical infrastructure.

The US Environmental Protection Agency (EPA) had

finalized a rule that would give oil refiners more time to comply with biofuel blending mandates, including those from previous years. The agency is working to finalize proposed biofuel blending requirements for 2020, 2021, and 2022. It said it would change the way in which future deadlines are determined to help ensure that each year’s deadline falls after the standards for the subsequent compliance year are known. Under the US Renewable Fuel Standard (RFS), oil refiners must blend billions of gallons of biofuels, or buy compliance credits from those that do. In 2021, several oil refiners slowed or stopped buying compliance credits in a bet the EPA would ease the blending requirements, putting them at risk of hundreds of millions of dollars in liabilities. The Renewable Fuels Association, a biofuels trade group, said it was disappointed by the action and was concerned by the new approach the agency is taking on future deadlines.

President Joe Biden’s administration would hold the US

government’s biggest ever offshore wind auction next month for areas in waters off the coast of New York and New Jersey, part of a range of measures it unveiled to speed growth of clean energy. The announcement, which seeks to advance Biden’s ambitious climate change agenda, comes as sweeping legislation to support those goals is stalled in Congress. In a wide-ranging memo, the administration unveiled actions by seven federal agencies designed to accelerate deployment of wind and solar projects while creating well-paying jobs, a cornerstone of Biden’s presidential campaign pledge. It would be the first offshore wind auction under Biden, who last year launched an aggressive push to install 30 GW of the technology by 2030 and approved the nation’s first two commercial-scale projects. The last government auction for wind leases was held in 2018. Onshore, the administration announced steps to slash the time it takes to permit clean energy projects on public lands through better coordination between five agencies and the creation of renewable energy coordination offices at the Department of Interior. The administration said it would ensure that the benefits of clean energy investment will reach rural communities through a new US$10 million grant program at the Agriculture Department to support projects in poor areas.

Mexican cement maker Cemex had achieved the first step in fully powering plants with solar energy, producing what is known as clinker via the sun’s rays. Cemex had teamed up with Swiss solar company Synhelion to produce clinker, a limestone and clay mix used to make cement, with "record-breaking" solar heat. The move to produce clinker via solar heat is part of Cemex’s push to go carbon neutral by 2050, as current clinker production uses fossil fuels to heat limestone and clay. Cemex and other cement makers have felt pressure in recent years from regulators and investors to reduce CO

2 (carbon dioxide) emissions. Cement, a key ingredient in concrete, contributes to about 8 percent of global CO

2 emissions.

Brazil’s installed power generation capacity is expected to rise by 37 percent to 275 GW over the next 10 years, the government said,

as both wind and solar generation increase at the expense of hydropower. The South American country currently has 200 GW of installed capacity, relying heavily in hydropower - which state-run energy research company EPE now sees accounting for less than half of the total capacity by 2031. According to a 10-year plan submitted by EPE for public consultation, the microgeneration segment - small-sized, mainly solar power generation for self-supply - will grow to 37 GW from the current 8 GW, reaching a 14 percent stake in the total installed capacity. The government also expects power supply from non-renewable thermoelectric plants, which can be moved by products such as coal, natural gas, and diesel, to grow by 12 GW and reach a total 35 GW by 2031.

Other Asia Pacific

Japan’s biggest power generator JERA will spend 160 bn yen (US$1.4 bn)

to develop one GW of solar power farms in Japan over the next five years by joining with local energy developer West Holdings Corp. The move marks JERA’s entry into a local solar power market and comes as part of its plan to expand its renewable energy capacity to 5 GW by 2025 from about 1.5 GW now to help combat climate change. Under the collaboration, JERA will ask West Holdings to build solar power farms at about 7,000 sites, including former JERA power plant sites, and will sell the electricity to corporate customers seeking clean energy. West Holdings has developed about 65,000 solar power projects of around 2 GW in capacity in Japan and Thailand.

Vietnam’s leading renewables firm Trung Nam Group has launched its first offshore wind farm amidst the South-East Asian country's drive for clean energy. The 5 trillion dong (US$220.17 mn) farm in the southern province of Tra Vinh has 25 turbines with installed capacity of 100 MW. Trung Nam would raise the total capacity of its renewable power plants to 3.8 GW and LNG-to-power plants to 1.5 GW by 2025. Vietnam is finalising a master power development plan with a focus on renewables to meet its target to achieve carbon emission neutrality by 2050. The country aimed to double its installed wind and solar power generation capacity to 31-38 GW by 2030.

EU & UK

Enel Green Power built a record 5,120 MW of new renewable energy capacity worldwide in 2021, or 64.8 percent more compared to 2020 installations, the renewables multinational and part of Italian utility Enel SpA said. The latest capacity figure includes the company’s first battery energy storage systems (BESS), totalling 220 MW, which Enel Green Power added to its Lily and Azure Sky Solar plants and the Azure Sky wind farm in the US. The new capacity is divided between around 70 plants, mostly wind and solar farms, Enel Green Power said. Most of it was installed in Latin America, mainly Brazil and Chile, followed by North America, Europe, and in Africa, Asia and Oceania markets.

The European Union

(EU) tapped renewables for 22 percent of its energy consumption in 2020, beating its 20 percent target, the EU statistics office said. The bloc’s 27 countries are increasingly turning to wind, solar and other renewable energy sources as part of efforts to meet the EU-wide ambition of net-zero greenhouse gas emissions by 2050. Sweden has raced ahead of other EU nations, with over 60 percent of its energy consumption derived from renewable sources, surpassing Finland at 44 percent and Latvia at 42 percent. Eurostat found that Malta, Luxembourg and Belgium had the lowest proportions of renewable energy consumption in 2020, at between 11 percent and 13 percent. Sweden outperformed its own national renewables target of 49 percent by 11 percentage points alongside Croatia, which had aimed for a 20 percent share, while Bulgaria exceeded its own goal of 16 percent by 7 percentage points. Fuelled by hydropower and bioenergy, Sweden has long topped international environmental rankings, cutting back on greenhouse gases while preserving its economic growth as it moves towards its 2045 net-zero target. However, Norway and Iceland - which are not part of the EU - far exceeded any country within the bloc, with respective shares of renewable consumption of 77 percent and 84 percent, largely thanks to their extensive use of hydro-electricity. France, which is expanding its nuclear reactor fleet, was the only country that fell short of its national goal for renewables of 23 percent, missing it by 3.9 percentage points.

Renewables investor

Econergy Renewable Energy plans to develop a portfolio of 800 MW of renewable energy storage and 900 MW of solar photovoltaic (PV) capacity in Britain over the next three years. The firm plans to develop 350 MW of energy storage capacity for operation in 2023, 300 MW for 2024 and 150 MW for 2025. It also aims to develop 900 MW of solar PV projects by early 2025. As a first step, Econergy has acquired a 50 MW storage project in Yorkshire, northern England, from UK renewables developer Yoo Energy, for an undisclosed sum. Econergy is listed on the Tel Aviv stock exchange and develops solar PV, wind and storage projects in Europe, including Britain, Italy, Spain, Romania and Poland. It currently has 6 GW of projects under development across Europe.

EDF Renewables UK (United Kingdom) has created a joint venture with project developer DP Energy to generate up to

1 GW of wind power from floating turbines in the Celtic Sea. The floating offshore wind project, ‘Gwynt Glas’, will likely English and Welsh waters south of Ireland. The wind farm could create enough electricity to provide power for some 927,400 homes. It could also contribute a significant part to ambitions for 4 GW of capacity in the Celtic Sea announced last year by the Crown Estate, which manages the seabed and half the foreshore around England, Wales, and Northern Ireland. Floating wind farms are an emerging technology with far higher costs than projects fixed to the seabed, but costs are expected to fall as more projects are brought online. Britain is also offering funding for developing the technology to help meet its target of generating 40 GW of electricity from offshore wind by 2030, up from around 10 GW currently.

Africa

South Africa’s state power provider Eskom will carry out a staggered shutdown of both units of its Koeberg nuclear power station for scheduled refuelling and maintenance, putting an already overburdened power system under additional strain.

Russia & Central Asia

South Korea and the UAE held a high-level meeting and agreed

to establish a joint bidding team for nuclear energy projects in third-party countries. Both sides also agreed to conduct joint research on aging of concrete structures, taking into consideration the UAE’s climate conditions, and begin separate performance analysis research on accident tolerant fuel (ATF), which prevents hydrogen from exploding in a nuclear accident. In addition, the two sides consulted on conducting a joint survey on small module reactors (SMR) and also agreed to expand cooperation in nuclear security training. In 2009, a KEPCO-led consortium won a US $20 bn contract to build four nuclear reactors in Barakah, 270 kilo meters west of Abu Dhabi, marking South Korea’s first export of its homegrown commercial atomic power plant.

News Highlights: 9 – 15 February 2022

National: Oil

Diversion of domestic LPG cylinders for commercial use on the rise

12 February: Large price gap between domestic LPG (liquefied petroleum gas) cylinders and commercial gas cylinders are resulting in rise in diversion of domestic cylinders for commercial purposes.

The 14.2 kg domestic gas cylinders are being heavily diverted to commercial use due to the huge pricing gap between 14.2 kg domestic gas cylinders and 19 kg commercial gas cylinders. A 14.2 kg domestic gas cylinder in Delhi is priced at INR899.50, while 19 kg commercial gas cylinder is priced at INR1,907. The large price gap of INR 1,007.5 is being exploited by unscrupulous marketers who are using it as an opportunity to earn money by diverting domestic cylinders for commercial use. Distributors are selling the domestic cylinders with a profit of INR200-250 to unauthorised agents, who in turn refill commercial cylinders and sell these directly to restaurants, eateries, and tea stalls between INR 1,300-1,550, which is much below the authorised rate of INR 1,907 for a commercial gas cylinder.

India headed for steep fuel price hike in March: Deloitte

9 February: Deloitte Touche Tohmatsu India expects the nation’s biggest fuel retailers to sharply raise pump prices after state elections end next month, adding pressure on the government and the central bank to take steps to contain inflation. Debasish Mishra, partner at Deloitte, expects companies to increase prices by INR8-9 (11-12 cents) a litre to make up for a shortfall in sale price by 10 March when the election process winds down. Despite a surge in international prices, Indian Oil Corporation (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL)—which together control more than 90% of the domestic market—have frozen gasoline and diesel rates for over three months, coinciding with elections in five states. While state-run fuel retailers are technically free to align prices with global rates, they often freeze rates in the run-up to polls fearing public backlash over higher prices. When the increase eventually happens, the government is likely to absorb some of it by cutting taxes and let the consumers bear the rest, Mishra said. Increase in oil prices pose a problem for the government by impacting disposable incomes in a nation where private consumption accounts for some 60 percent of gross domestic product.

National: Gas

Delhi HC stays notices to declare Adani Total CGD network as common carrier

14 February: The Delhi High Court (HC) stayed the notices issued by Petroleum and Natural Gas Regulatory Board (PNGRB) in connection with declaring Adani Total Gas Limited’s City Gas Distribution Network for Ahmedabad city, Daskroi, and Khurja as a common carrier or contract carrier. The company explained that while city gas distribution (

CGD) Network refers to the infrastructure laid down by a company for supplying gas, a common carrier is a pipeline that is used by more than one entity for gas transportation by paying tariff for such transportation

Restructuring of gasification assets to unlock value for RIL

12 February: The restructuring of gasification assets will unlock value, provide flexibility for Reliance Industries Limited (RIL). Gasification Undertaking is proposed to be transferred, as a going concern on Slump Sale basis, by way of a Scheme of Arrangement. The Appointed Date for the Scheme is 31 March 2022 or such other date as may be approved by the Board. The Scheme has been filed with both Mumbai and Ahmedabad NCLTs and will require approvals of Shareholders, Creditors and NCLT.

Gasification assets are proposed to be transferred to a subsidiary which will provide flexibility to induct suitable strategic partners and distinct sets of investors, RIL said. Collaborative and asset-light approach to unlock value of syngas, specifically induction of investors in gasifier subsidiary and capturing value of upgradation in RIL through partnerships and investments in different chemical streams.

GAIL bets on US gas for arbitrage as prices spike

10 February: GAIL (India) Ltd is playing smart by advancing LNG (liquefied natural gas) shipments from the US (United States), using the flexibility in its contract to make a killing from arbitrage created by runaway demand and skyrocketing prices in Europe. Simultaneously, the utility is looking at short-term contracts of 3-5 years for 1-2 cargos a month from early next 2023 to meet an anticipated domestic demand on growing pace of economic activities, commissioning of new fertiliser manufacturing capacities and expansion of city gas networks. Company chairman Manoj Jain said GAIL intends to use 4-5 US cargoes for arbitrage. GAIL’s long-term US LNG contract for nearly 6 million tonnes LNG a year is benchmarked to Henry Hub and costs US$5.45 per unit. Gas prices in Europe are linked to Brent crude, which has spiked to US$90/barrel. Whilst flaring Brent alone jacked up gas prices in Europe and other crude-linked markets such as Japan and South Korea, the harsh winter drove them to three times the Henry Hub as demand spurted. Prices in the spot market shot up to US$27-30 per unit. In addition to the US, GAIL has a 2.5 million tonnes LNG contract with Russia’s Gazprom, 4.8 million tonnes (mt) deal through Petronet LNG, in which it is a promoter, with Qatar and 0.4 mt with the Gorgon project in Australia. GAIL had first signed time-swap deals for its US LNG in 2017-18. Under three deals signed that year, the company bought LNG from international companies and sold an equivalent amount of Henry Hub-indexed volumes during 2018-19. That time-swap was done as it did not find buyers for imported LNG. Jain said gas is the transition fuel towards the goal of reaching net-zero by 2070.

National: Coal

India targets 1.2 bn tonnes coal production by 2023-24: Coal Ministry

10 February: The Coal Ministry said that a target of all India coal production of 1.2 billion tonnes upto the year 2023-24 has been fixed. The Union government has launched Single Window Clearance portal on 11 January 2021 for the coal sector to speed up the operationalisation of coal mines. It is a unified platform that facilitates grant of clearances and approvals required for starting a coal mine in India. Now, the complete process shall be facilitated through Single Window Clearance Portal, which will map not only the relevant application formats, but also process flow for grant of approvals or clearances.

National: Non-Fossil Fuels/ Climate Change Trends

India to be self-dependent in coal production for thermal power generation by 2024: Coal Secretary

15 February: Coal Secretary Anil Kumar Jain said

the import of coal for thermal power generation will end in India by 2024 and the domestic production of the dry-fuel is expected to rise by 10%. Jain said the coal import for thermal power generation will end in India by 2024. He said 90 million tonnes (mt) of coal for thermal power plants used to be imported. There is a possibility that this year, 60-70 mt of this will be achieved domestically. In 2023, there will be limited requirement of imported coal.

India hopes to replace diesel with green energy in its farms by 2024

11 February: India is hoping to cut diesel use by farms to zero and migrate the agriculture sector to renewable energy as early as 2024, the Power Ministry said, as a part of its broader plan to transition to cleaner energy sources. The Ministry did not say how it planned to achieve the ambitious target. In February 2020 it launched a scheme to provide financial incentives to farmers to use solar instead of diesel-fired irrigation pumps.

Nuclear energy share in power generation to be increased: Government

10 February: The share of nuclear energy in the total electricity generation in the country has remained around 3 to 3.5 % since 2014, the Parliament was told.

The share of nuclear power in the total electricity generation is planned to be increased by adding more nuclear power capacity in the country, Union Atomic Energy, and Space Minister Jitendra Singh said. The Minister said that the share of nuclear power in total electricity generation depends on the generation by nuclear power units compared to that by all electricity generating technologies. India is pursuing an indigenous three-stage nuclear power programme to provide the country long term energy security in a sustainable manner, he said.

International: Oil

OPEC sees upside to 2022 oil demand forecast on strong pandemic recovery

10 February: OPEC (Organization of the Petroleum Exporting Countries) said

world oil demand might rise even more steeply this year as the global economy posts a strong recovery from the pandemic, a development that would underpin prices already at a seven-year high. Tight oil supply has also given impetus to booming energy markets, and the report from the Organization of the Petroleum Exporting Countries also showed the group undershot a pledged oil-output rise in January under its pact with allies. In the report, OPEC said it expected world oil demand to rise by 4.15 million barrels per day (bpd) this year, unchanged from its forecast last month, following a steep rise of 5.7 million bpd in 2021. OPEC took an early view that the effect of the Omicron Coronavirus variant would be mild, and the report said it has not had as negative an economic impact as previous COVID-19 waves. The report also showed higher output from OPEC as the group and allied non-members, known as OPEC+, gradually unwind record output cuts put in place in 2020. OPEC+ has aimed to raise output by 400,000 bpd a month, with about 254,000 bpd of that due from 10 participating OPEC members, but production has increased by less than this as some producers struggle to pump more. The report showed OPEC output in January rose by just 64,000 bpd to 27.98 million bpd. Seven of the 13 OPEC members had a drop in output, amongst them Venezuela, Libya, and Iraq. Top exporter Saudi Arabia boosted output by 54,000 bpd according to the report, but Saudi Arabia told OPEC it made a larger increase of 123,000 bpd that brought its production to 10.145 million bpd.

Japanese government to hold meeting on crude oil prices

9 February: T

he Japanese government is planning to hold a meeting regarding rising crude oil prices, Chief Cabinet Secretary Hirokazu Matsuno said. The Ministers are expected to discuss the effectiveness of the government's measures it has implemented so far and possible further actions to curb soaring prices, Matsuno said. The Japanese government has provided a gasoline subsidy for oil distributors.

Brazil’s Petrobras oil production slightly rises in Q4

9 February: Brazilian state-run oil company Petroleo Brasileiro SA

(Petrobras) produced 2.704 million barrels per day of oil equivalent in the fourth quarter (Q4), up 0.8% from the same period the previous year, it said. Petrobras' crude production came in at 2.151 million barrels per day (bpd), up 0.7% from the fourth quarter of 2020. The company attributed the mostly flat performance to scheduled stoppages on high-production platforms and the start of the Buzios field production-sharing agreement, although these factors were partially offset by the ramp-up of the Carioca floating production storage and offloading platform (FPSO). Petrobras lowered its 2022-2026 production outlook to reflect production-sharing agreements involving the Atapu and Sepia oilfields. Exports of oil and derivatives showed a decrease of 17.7% year-on-year to 701 barrels of oil equivalent per day. The oil company sold 463 million bpd of gasoline domestically in the fourth quarter, up 20.1% in annual terms. Domestic diesel sales came in at 790 million bpd, 16.7% higher than the previous year.

International: Gas

Europe remains top destination for US LNG for the third month

15 February: Europe’s call for US (United States) liquefied natural gas (LNG) continues to run hot in February and is poised to remain the top destination for the US shipments for the third month in a row, according to mid-month Refinitiv vessel tracking data. About three quarters of US LNG volumes went to Europe in January as skyrocketing demand lifted prices and the US LNG exports. The US LNG exports overall last month hit 7.3 million tonnes (mt). So far this month, the US has exported 3.56 mt of LNG, similar to the half-way market in December, which was the second highest on record, data showed. At least half of the US LNG shipped this month has gone to Europe, the Refinitiv data showed, as companies look to secure new supplies. Worries over a cutoff of Russian gas, which accounts for about 35% of European consumption, have contributed to the exports, analysts have said. The European LNG benchmark on the Dutch exchange traded at $23.35 per mmBtu (million metric British thermal units), below the Asia spot gas at $24.70 per mmBtu and below November's about $31 per mmBtu, data showed. The Panama Canal said it was seeing increased seasonal demand for passage, but there were fewer LNG vessels crossing the canal due to warmer temperatures in Asia.

Japan to divert some LNG to Europe in the event of Ukraine disruption

9 February: Japan has decided to

divert some LNG (liquefied natural gas) to Europe if the Ukraine crisis leads to a disruption of supplies after receiving a request from the United States, national broadcaster NHK reported. The government is likely to announce the decision as early as, the report said. The report came after sources told Reuters that Japan has been considering how it could help after it received a request from the United States.

International: Coal

Indonesia January exports grow below expectation after coal shipment ban

15 February: Indonesia’s export growth slowed more than expected in January, after authorities in the world’s top thermal coal exporter banned coal shipments, a move that shocked the global energy market. The January trade surplus was bigger than expected at US$930 million, however, compared with a US$190 million surplus seen in a poll, as imports rose more slowly than predicted.

Indonesia on 1 January suspended coal exports due to low inventory at power plants. Shipments resumed gradually from 10 January, but the ban still applies to miners not compliant with domestic sales requirements. The resource-rich country has recorded a trade surplus every month since May 2020 due to an upward trend in commodity prices as countries lift COVID-19 restrictions. Exports of products classified as mineral fuel - much of which is coal - dropped by US$2 billion from December, with shipments to China, India, and the Philippines most affected.

Banks gave more than US$1.5 trillion to coal sector in 2019-2021: NGOs

15 February: Financial institutions channelled more than US$1.5 trillion into the coal industry in loans and underwriting from January 2019 to November 2021, despite many having made net-zero pledges, a report by a group of 28 non-government organisations (NGOs) showed. Cutting coal use is a key part of global efforts to slash climate-warming greenhouse gases and bring emissions down to net zero by the middle of the century, and governments, firms and financial institutions worldwide have pledged to take action. However, banks continue to fund 1,032 firms involved in the mining, trading, transportation and utilisation of coal, the research showed. Banks like to argue that they want to help their coal clients transition, but the reality is that almost none of these companies are transitioning, Katrin Ganswind, head of financial research at German environmental group Urgewald, said. The study said banks from six countries - China, the United States, Japan, India, Britain, and Canada - were responsible for 86% of global coal financing over the period. Direct loans amounted to US$373 billion, with Japanese banks Mizuho Financial and Mitsubishi UFJ Financial - both members of the Net Zero Banking Alliance - identified as the two biggest lenders. Another US$1.2 trillion was channelled to coal firms via underwriting. The top 10 underwriters were Chinese, led by the Industrial and Commercial Bank of China (ICBC) with US$57 billion. Institutional investments in companies still developing coal assets amounted to US$469 billion, led by BlackRock with US$34 billion. BlackRock’s total coal-related share and bond holdings over the period stood at US$109 billion, the NGO report said. Comparative coal funding figures for previous years were not immediately available. Other research studies however have shown that coal investment is on the decline. The coal sector is responsible for nearly half of global greenhouse gas emissions. More than 40 countries pledged to end coal use following climate talks in Glasgow in November, though major consumers such as China, India, and the United States did not sign up.

International: Power

Jordan to begin exporting electricity to Lebanon in March: Energy Minister

14 February: Jordan will begin exporting electricity to Lebanon in March after finalising a funding agreement with the World Bank, Jordan’s Energy Minister Saleh Kharabsheh said. The US (United States)-backed funding deal aims to ease crippling power shortages in Lebanon by transmitting electricity across neighbouring Syria.

International: Non-Fossil Fuels/ Climate Change Trends

Sweden sets plan for up to 120 TWh of offshore wind power capacity

15 February: Sweden presented plans to build offshore wind power plants that will generate 20-30 terawatt hours (TWh) per year, with an aim to reach 120 TWh at a later stage. Sweden currently consumes about 140 TWh per year, and power consumption is expected to rise considerably in the coming years as the country's industries and transport sector are phasing out fossil fuels, the government said. Offshore wind power is in high demand, Climate Minister Annika Strandhaell said.

UK’s National Grid to get grid stability services from renewables for first time

14 February: Britain’s National Grid said it will be able to obtain grid stability services from renewable power generators for the first time, in the path to decarbonising the power sector and as more fossil fuel generators go offline. Britain has a target to reach net zero emissions by 2050 which will require a huge increase in the amount of renewable energy as it moves away from fossil fuels such as natural gas and coal. The UK government has a target to generate 40 gigawatts (GW) of electricity from offshore wind by 2030 - up from around 10 GW currently - which it says would be enough to power every home. It said it has changed the GB Grid Code, a rulebook for what connects to the grid, so that renewable generators and power interconnectors will be able to compete to provide grid stability services, alongside fossil fuel generators which are directly connected to the transmission system.

Poland’s new gas plans would put net zero target out of reach

10 February: Poland’s plans for a new generation of

gas-fired power plants would make it impossible for it to meet net zero emissions by 2050 and cost taxpayers US$4.4 billion, research by thinktank Carbon Tracker showed. Poland, mainly reliant on coal, plans to more than double its existing gas-fired power generation capacity to over 8 gigawatts (GW) by 2030, viewing gas as a transition fuel before switching to nuclear and renewables. Carbon Tracker analysed the financial viability of five planned gas plants with combined capacity of 3.7 GW due to begin operation between 2023 and 2027, which would more than double Poland’s current gas-fired capacity. It calculated the levelised cost of energy - the average cost of each unit of energy generated over the lifetime of each plant – for new renewables and for the five gas projects. The report said that all five projects will be costlier investments than either new onshore wind, offshore wind or solar farms. Renewables supported by battery storage will be able to respond to peaks and troughs of demand, providing flexibility comparable to new gas plants. Solar with storage will be cheaper than gas from 2024 and onshore wind with storage from 2025.

US solar producer asks Biden administration for new tariff probe

9 February: A US

(United States) solar panel maker is asking federal trade officials to investigate whether to impose tariffs on imports from four Asian countries, arguing that Chinese manufacturers had shifted production to those nations to avoid paying duties. The petition, filed by San Jose, California-based Auxin Solar with the Department of Commerce, came days after the administration of President Joe Biden extended but eased tariffs on overseas-made solar products, disappointing the small US solar manufacturing industry. Domestic solar producers in recent years have sought trade remedies repeatedly, saying their products cannot compete with cheaper Asian panels that dominate the market. However, the US solar trade groups have opposed tariffs because their members - facility developers and panel installers - rely on cheap imports to compete with fossil fuels.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV