-

CENTRES

Progammes & Centres

Location

Recent headlines on India’s renewable energy (RE) sector are not encouraging. Even the solar sector, which was celebrated as the means to achieve India’s ambitious goal of increasing the installed capacity for power generation using RE, is showing signs of slowing down. The government’s plans to meet the expected summer peak demand for electricity in 2024 focus on coal rather than on RE. Slower growth rates in RE capacity addition could mean that the RE industry is entering a phase of maturity in its lifecycle, or input cost escalations are decelerating growth. It could also mean that regulations and resource constraints, especially land availability, are starting to bite. In the current geopolitical context where all countries are prioritising energy nationalism, the slowdown in the RE industry could also be the result of trade barriers.

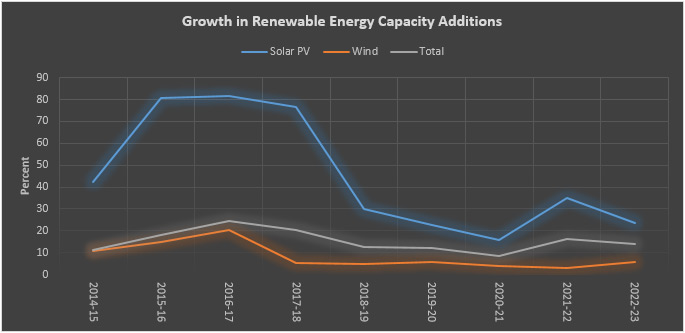

In the early 2010s, the nascent RE industry demonstrated double digit growth rates. The overall annualised growth rate of RE installations for power generation in India was close to 20 percent in 2013-18. Solar installations grew by 70-80 percent annually in this period while wind power installations grew by 15-20 percent. In 2018-23, annualised growth rate of RE installations slowed down to 10-15 percent. In this period, solar installations grew by 25-35 percent, while the growth of wind power installations slowed down to around 5 percent. In 2023-24 (up to February 2024), the annualised growth rate of RE installations grew by less than 10 percent. The annualised growth rate of wind power installations remained close to 5 percent while the growth of solar installations fell to around 11 percent.

In terms of annual capacity additions of RE since 2013, the highest values of over 15 GW were recorded in 2021-22 as well as in 2022-23. In the same two periods, annual solar installations also recorded their highest values of over 13 GW. The highest annual installation in the wind sector, of 5.5 GW was in 2016-17 while the annual capacity additions were 1.1 GW and 1.2 GW in 2021-22 and 2022-23.

As of 29 February 2024, solar installations accounted for 55 percent of total RE installed capacity while wind accounted for about 33 percent. Other RE sources, such as small hydropower, biomass and waste to energy accounted for the remaining 11.5 percent of total RE installations. The slowdown in the growth rate of solar and wind power installations which account for over 88 percent of total RE power generation installations is raising concerns over India meeting the target of 500 GW of RE installations by 2030. In 2023-24 (up to 29 February 2024), total RE installations were 11.2 GW and wind installations was 2.5 GW, an increase of 13 percent compared to 2022-23. Solar installations however fell by over 50 percent to 11.2 GW, the lowest annual capacity addition since 2013-14.

To achieve the goal of 500 GW of RE installed capacity by 2030, installations have to grow by an annual average of 20 percent and annual capacity additions have to increase from the current level of 11-12 GW to over 60 GW. If the current rate of capacity additions is the result of a secular trend rather than that of a cyclical flux, slowing growth of RE installations signals a serious challenge.

Project developers have cited inadequate transmission infrastructure and the new regulatory requirements as the prime causes of the slowdown in RE installations. One of the new regulations that influences RE installations is the general network access (GNA) rules. GNA rules, notified in June 2022 have been framed by the CERC (central electricity regulatory commission) to facilitate non-discriminatory open access to distribution licensees or generating companies or consumers for use of inter-state transmission system (ISTS).

According to the international energy agency (IEA) , global annual RE capacity additions increased by almost 50 percent to nearly 510 GW in 2023 (calendar year), the fastest growth rate in the past two decades. The factor behind the impressive number is China which commissioned as much solar photovoltaic (PV) as the entire world did in 2022 (calendar year). RE installations were also at an all-time high in Europe, the United States and Brazil in 2022. This suggests that the situation in India is an exception to the global trend. Solar module prices exported from China are at historic low of around US$0.14/watt indicating that input cost escalations are not driving the deceleration in solar PV installations in India.

Restrictions on import of solar PV modules from China to promote domestic manufacturers could also be among the reasons for the slowdown. In 2023, solar PV module exports from China to Europe and other countries that added the most RE capacity increased substantially. Solar PV module exports to India fell by over 7 percent in the first half of 2023 while exports to the rest of the world increased by 35 percent in the same period. This suggests that trade restrictions could have inhibited growth in RE installations in India. Global solar PV manufacturing capacity is expected to reach almost 1,000 GW in 2024, adequate to meet annual IEA’s net zero 2050 demand of almost 650 GW in 2030. In 2022, global solar PV manufacturing capacity increased by over 70 percent to reach almost 450 GW, with China accounting for over 95 percent of new facilities throughout the supply chain. In 2023 and 2024, global solar PV manufacturing capacity is expected to double, with China again claiming over 90 percent of this increase. Chinese industrial policies focusing on solar PV as a strategic sector and on growing domestic demand have enabled economies of scale and supported continuous innovation throughout the supply chain. According to the IEA, these policies have contributed to a cost decline of more than 80 percent, helping solar PV to become the most affordable electricity generation technology in many parts of the world. Seen through the lens of climate risk, China’s continued dominance of the solar supply chain that reduces the cost of solar PV installations is a global public good. Industrial policies of the United States and India that prioritise energy nationalism and domestic solar PV manufacturing are on the other hand strategic national security goods. These produce domestic jobs, and add to manufacturing capacity but increase the cost of solar installations. If industrial policies of countries are accepted as necessary, then the underlying suggestion that China rather than climate change is a more significant threat must also be accepted.

Source: Central Electricity Authority

Coal Gasification

According to Union Minister Nitin Gadkari, those coal mines in Maharashtra’s Vidarbha region and WCL (Western Coalfields Ltd) areas which are economically not viable, produce low-quality coal, and where mining is almost stopped can be used for coal gasification projects. The Minister pitched for the use of non-viable coal blocks and low-quality ones under WCL areas for coal gasificationand backed public-private partnerships in coal gasification projects, coal extractions and power projects on coal pitheads. As per the minister, nano urea introduced by the Centre should be used instead of extracting the urea from coal. He said coal is available in huge quantities in Yavatmal, Chandrapur, and Nagpur districts in the Vidarbha region besides in Madhya Pradesh and Chhattisgarh where WCL is working.

Coal Block Auctions

The coal ministry will organise a roadshow in Ranchi to increase participation of investors in the commercial coal mine auction. The government launched the process for sale of 39 coal mines under eight rounds of commercial auctions and 31 under the ninth. These 70 coal mines are from the coal-bearing states of Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Maharashtra, Odisha, Telangana, and West Bengal. Of the said mines, 27 are fully explored ones and 43 are partially explored.

Coking Coal Imports

Association of producers and suppliers of metallurgical coal expressed concerns over the "influx of met coke at prices below the domestic cost of production" and sought the government's intervention to resolve the issue. Metallurgical coal is a grade of coal that can be used to produce good-quality coke. The prevailing import rate for metallurgical coke in India is US$395 per tonne, while the production cost for domestic met coke manufacturers is around US$460 per tonne. According to the Indian Metallurgical Coke Manufacturers' Association (IMCOM), this significant pricing gap has led to an influx of over 3.6 million tonnes (MT) of inexpensive met coke imports during 2022-23, posing a substantial challenge to India’s merchant met coke sector.

India plans to form a consortium of state-owned companies to facilitate coking coal imports to help domestic steel companies tide over shortages. Stung by lower supplies and higher prices of coking coal, leading Indian steel companies have petitioned the government to help boost supplies of the key steel-making raw material. Indian steel companies consume around 70 MT of coking coal annually, and imports constitute around 85 percent of the country’s total requirement. Steel mills in India, the world’s second-biggest crude steel producer, have struggled with volatile supplies of coking coal from Australia, which normally accounts for more than half of India’s annual imports. Other than Australia, India imports coking coal from the United States, Indonesia and Canada, among others.

Coal Production

According to Union Minister for Coal and Mines Pralhad Joshi, for the first time, the country’s coal production is going to cross 1 billion tonnes (1000 MT). The minister is of the view that India is going to stop the import of substitutable coal from next year. On the occasion, Madhya Pradesh was also given the 'Award of Appreciation' for securing first place in the mineral block auction in the country during 2022-23.

According to Singareni Collieries Company Limited (SCCL), optimum utilisation of heavy machinery, increase in production and decrease in production cost are key to spurring productivity and facing market competition. As per the company, about 160 lakh tonnes (16 MT) of coal has to be produced in the remaining period of this fiscal to achieve the annual coal production target of 70 MT. It implies that at least 227,000 tonnes of coal need to be produced daily.

Jindal Power has proposed to top a bid by Adani Power, opens new tab, for a thermal power plant, as India looks to drum up investment in coal-fired power. The tussle for the 1,980 megawatt (MW) plant in central India, ensnared in insolvency proceedings, comes after the power minister called last November for more private investment to meet a dramatic rise in electricity demand. Private investments in coal-based power in India started dwindling after 2018, hit by lower demand and an ambitious national thrust in renewable energy.

Prices

Indicating sufficient coal availability in the market, the National Coal Index (NCI) dropped 17.54 percent to 155.09 points in November 2023. As per the coal ministry, the NCI was at 188.08 points in November 2022. This shows a strong supply of coal in the market, with sufficient availability to meet the growing demand. NCI is a price index that combines coal prices from all sales channels, including notified prices, auction prices and import prices. The peak of NCI was observed in June 2022 when the index reached 238.83 points, but subsequent months have experienced a decline, indicative of abundant coal in the Indian market.

China

China’s imports of Mongolian coking coal may rise to a record in 2024, after more than doubling in 2023, on improving transport links and its lower price versus domestic and international supplies, traders and miners said. China is the world’s biggest steel producer and coal importer and a shift to abundant Mongolian supplies could come at the expense of Australian imports of the steelmaking ingredient. Australia, the world’s second-biggest coking coal miner, was China’s largest supplier until a 2020 diplomatic dispute. This year’s coking coal imports from landlocked Mongolia may rise more than 10 percent as newly expanded road links enable more truck traffic, a Beijing-based coal trading executive estimated. China imports Mongolian coal mostly by truck through seven ports along a border that stretches more than 4,600 km (2,858 miles). Beijing and Ulaanbaatar have simplified customs clearances to bolster coal imports, which have been hindered by transport bottlenecks, several Chinese coal traders said. Australian coking coal imports plunged when Beijing slapped an unofficial ban on several commodities after Canberra called for an investigation into the origins of the COVID-19 pandemic, although trade resumed last year as relations warmed.

Rest of Asia and Asia Pacific

Asia’s imports of seaborne thermal coal rose to a record high in December as top buyer China sucked up cargoes amid peak winter demand. Asia’s imports of seaborne thermal coal reached 83.69 MT in December, up from 78.87 MT in November and the highest in records compiled by commodity analysts Kpler going back to January 2017. The strength was led by China, with seaborne thermal coal imports of 32.08 MT, another record high according to Kpler data, and up from 29.57 MT in November. China’s appetite for imported thermal coal soared in 2023 as coal-fired power generation rose amid lower hydropower output and rising electricity demand as the economy posted a modest recovery from the weakness caused by Beijing's previous strict zero-COVID policy. It’s also worth noting that China’s domestic coal production has also been rising, with November output hitting a record high on a daily basis of 13.8 MT, besting the previous peak of 13.5 MT from March last year.

Bangladesh nearly tripled its coal-fired power output in 2023, an analysis of government data showed, helping it tide over the worst power shortages in over a decade and slash rising generation costs. Power generation from coal surged to a record 21 billion kilowatt-hours (kWh) in 2023, up from the 7.9 billion kWh of electricity produced from coal in 2022, an analysis of daily operational reports by the Power Grid Company of Bangladesh (PGCB) showed. Coal’s share of the power generation fuel mix rose to 14.2 percent in 2023, from 8.9 percent in 2022, the PGCB data showed, while the share of natural gas rose to 55.2 percent in 2023, the first increase in four years and up from 51 percent in 2022. Overall shortages surged nearly 40 percent year-on-year to 2.7 billion kWh in 2023, or 2.8 percent of demand, PGCB data showed, with shortages easing in the second half of the year because of higher coal-fired output. Along with other major Asian economies India and Vietnam, Bangladesh boosted its use of relatively inexpensive coal to meet it surging power demand growth, which rose over 5 percent in 2023. Higher coal-fired generation also put the south Asian nation on track to cut average generation costs for the first time in four years.

Africa

South Africa’s Sasol, opens new tab reported lower output at its coal mining division in the October-December quarter citing safety-related incidents, tough geological conditions and delays in sourcing spares for maintenance. According to Sasol, the world's biggest producer of fuels and chemicals from coal and gas, as a result, output in the quarter was cut by 5 percent or 394,000 metric tonnes (0.39 MT).

South African freight rail operator Transnet resumed partial service on the line connecting to the country’s main coal export terminal, four days after two trains collided and blocked the tracks. The first line leading to the Richards Bay coal terminal was declared safe for the passage of trains, Transnet said. Coal miners Thungela Resources, and Exxaro Resources, said they did not expect the derailment to significantly impact their exports of the fossil fuel.

Europe/ Middle East

Turkey is on track to surpass Germany as Europe’s largest coal-fired electricity generator in 2024 as high inflation causes power producers to cut purchases of expensive natural gas and boost the use of cheaper coal in electricity generation. Turkey generated a record 117.6 terawatt hours (TWh) of electricity from coal which yielded a record 118 MT of carbon dioxide and related gases in 2023, data from environmental think tank Ember shows. That generation tally compared to 117.9 TWh by Europe’s largest coal-fired electricity generator, Germany, and handily exceeded the 97 TWh by generated in Europe's most coal-reliant power system, Poland. Both Germany and Poland recorded steep annual decreases in coal generation in 2023, and have pledged further reductions in coal use alongside rapid increases in renewable energy deployment for electricity generation going forward. In contrast, 2023 marked the second straight annual climb in Turkey's coal-fired electricity output, and Turkish power producers look set to continue favouring cheap coal over other forms of electricity generation as the country grapples with one of the highest inflation rates in the world.

German importers of coal for power generation, heating and steelmaking have found new suppliers in the United States (US) and Australia, enabling them to end their reliance on Russia, industry body VDKi said. Between January and October 2023, Russia accounted for 2 percent of all German imported coal volumes - mainly supplies that had reached Germany and other European countries before a European Union ban in August 2022 under sanctions against Russia over its invasion of Ukraine. In 2021, Russia supplied 53 percent of Germany’s coal imports. The US accounted for 28 percent of the 28 MT imported in total in the first ten months of 2023 by Europe’s largest economy, followed by 27 percent from Australia and 15 percent from Colombia. Overall, German hard coal imports in the whole of 2023 may have fallen by 26.3 percent year-on-year to around 33 MT, VDKi said.

6 February: Indian Oil Corporation (IOC) expects its gasoline sales to rise 4.5-5 percent in the financial year ending on 31 March 2025, the company’s head of marketing Satish Kumar Vaduguri said. The company’s diesel sales are expected to climb 3 percent over the same financial year, he said.

6 February: Mining conglomerate Vedanta Ltd will invest US$4 billion over the next three years to double oil production, its chairman Anil Agarwal said as he pushed ahead with an aggressive oil and gas expansion programme. Vedanta, which more than a decade back acquired Scottish explorer Cairn Energy’s (now Capricorn Energy) India assets, is targeting 300,000 barrels per day (15 million tonnes a year) oil output in 3 years from aggressive exploration campaign, he said.

31 January: Liquefied Petroleum Gas (LPG) cylinder transporters of Indian Oil Corporation (IOC) went on an indefinite strike for the second time in less than two months, alleging pending dues and low rates in recently floated tenders. The decision to go for the shutdown was taken after a meeting called by the Food, Public Distribution & Consumer Affairs Department of Assam between IOC and the North East Packed LPG Transporter Association (NEPLTA) failed to yield any solution to the prolonged stalemate. The association had also written to the chief secretary on 5 January, raising the same issues and urged him to take necessary steps, NEPLTA chief adviser Kumud Nath said. Hundreds of trucks were seen lining up outside the bottling plants across Assam, but the vehicles did not enter the factories and load the cylinders, meant for distribution among the dealers. On the low rate issue, he asserted that the company is moving ahead as per its tripartite discussions with the state government and the NEPLTA.

6 February: Adani Total Pvt Ltd’s Dhamra terminal has received 15 commercial LNG (liquefied natural gas) cargoes since commissioning in May 2023 and is operating at a utilisation rate of 55 percent, CEO (chief executive officer) Satinder Pal Singh said. Singh said the capacity of the terminal on India’s east coast could be doubled and the company is in the early stages of planning its expansion. The 5 million tonnes per annum (mtpa) LNG terminal, in which French energy giant TotalEnergies SE, opens new tab has a 50 percent stake, has a 20-year take-or-pay contract to provide regasification services to state-run Indian Oil Corporation (IOC), opens new tab and GAIL (India) Ltd, opens new tab.

5 February: The government is making constant efforts to bring the prices of CNG (compressed natural gas) under control and has delinked Indian gas prices from four international hubs based in US, Canada, UK and Russia, and aligned them to the Indian crude basket, Oil Minister Hardeep Puri said. He said the government is encouraging consumption of compressed natural gas as it is relatively a cleaner fuel. On the matter of encouraging people to switch to CNG vehicles, Puri said there is an autonomous process of transition taking place. He said in April 2023, the government took some far-reaching reforms by deciding to delink the Indian gas prices from four international hubs based in the US (United States), Canada, the UK and Russia, and we aligned them to the Indian crude basket, in other words, 10 percent of the Indian crude basket.

1 February: India has proposed to supply liquefied natural gas (LNG) to Sri Lanka to help the island nation produce power from its Yughadhanavi and Sobhadabavi power plants, Sri Lanka's Energy Minister Kanchana Wijesekera said. In the efforts to expedite the process to generate power from LNG the Government of India has proposed an interim solution from Petronet LNG, opens new tab, he said.

5 February: The government said 10 companies, including Nalco, Gujarat Mineral Development Corporation, and NLC India, submitted bids for coal mines put up for sale under the eighth round of commercial mines auction. A total of 10 companies have submitted bids in the auction process, the coal ministry said. Other companies from which the bids were received are TANGEDCO, OCL Iron, and Steel Ltd, JMS Mining Pvt Ltd, Shyam SEL & Power Ltd, SMN Tradecomm Pvt Ltd, Maa Durga Coal & Minerals Pvt Ltd, and Nilkanth Infra Mining Ltd. The bids will be evaluated by a multi-disciplinary technical evaluation committee and technically qualified bidders will be shortlisted for participating in the auction, to be conducted on MSTC portal. Prime Minister Narendra Modi had in 2020 launched the auction of 41 coal blocks for commercial mining, a move that opened India’s coal sector to private players.

1 February: India will start operating new coal-fired power plants with a combined capacity of 13.9 gigawatt (GW) this year, its power ministry said, the highest annual increase in at least six years. Modi’s government has cited energy security concerns amid surging power demand and low per-capita emissions to defend India’s high dependence on coal. The 2024 capacity increase will be more than four times the annual average in the last five years. India added 4 GW of coal-fired power capacity in 2023, the most in a year since 2019. Coal-fired output surged 14.7 percent during the year, outpacing renewable energy output growth for the first time since at least 2019. Green energy output rose 12.2 percent in 2023, an analysis of daily load dispatch data from the federal grid regulator showed.

31 January: India’s electricity supply is much more comfortable at the start of 2024 than in either 2023 or 2022 as coal production has ramped up and the huge deployment of renewables has relieved pressure on fuel inventories. After a weak monsoon curtailed hydro generation and forced the country to rely heavily on coal-fired generation in the summer and autumn of 2023, fuel inventories fell to critically low levels in October. But they recovered strongly in November, December and January, with record volumes of coal dug and despatched by rail to generators over the last three months. Generators are currently storing 38 million tonnes (MT) of coal on site, up from 33 MT at the same point in 2023 and 25 MT in 2022, according to data from the Central Electricity Authority. The number of unit coal trains despatched to power producers averaged 279 per day in December 2023, a new monthly record and up from 269 per day in December 2022.

4 February: Prime Minister (PM) Narendra Modi said that the Bharatiya Janata Party (BJP) government at the Centre is moving towards making the electricity bill of the households in the country zero. PM’s remarks came while addressing a gathering after inaugurating and laying the foundation stone of projects worth INR115.99 billion in Guwahati.

1 February: Prime Minister (PM) Narendra Modi is scheduled to dedicate two power projects by NTPC and lay the foundation stone of another with a total investment of INR289.78 billion during his daylong visit to Odisha on 3 February. Located in Sundergarh district, the Darlipali STPP is a pit-head power station with supercritical (highly efficient) technology and will supply low-cost power to its beneficiary states such as Odisha, Bihar, West Bengal, Jharkhand, Gujarat and Sikkim. The 250 MW project of NTPC-SAIL Power Company Ltd was established in Rourkela Steel Plant (RSP) to provide reliable power for the steel plant, which is vital for economic growth, he said. NTPC is developing the Talcher Thermal Power Project, Stage-III, within the old TTPS plant premises in Angul district, was taken over by NTPC from Odisha State Electricity Board in 1995.

5 February: The Waaree Renewable Technologies has received a Letter of Award (LoA) for the execution of Engineering, Procurement and Construction (EPC) work for Solar power plant on turnkey basis with an order value of INR5.47 billion. The LoA also includes operations and maintenance for a period of two years from the date of hand over, with an order value of INR67.98 million. The projects are scheduled to be completed in December 2024 as per the term of the order. The company said that the order is awarded by one of the global leading biggest utility in the world in renewable energy.

2 February: The government is set to increase the subsidy for rooftop solar installations to about 60 percent under the new Pradhan Mantri Suryoday Yojana, Union Minister for New and Renewable Energy R K Singh said. Currently, the government provides a 40 percent subsidy for rooftop solar installations. The enhanced subsidy aims to support consumers with electricity consumption below 300 units, typically belonging to economically weaker sections, by making solar installations more affordable without the need for loans. Post the 10 years when the loan is repaid, the rooftop solar infrastructure would be transferred to the household, which can then sell the excess power to the distribution companies (discoms), said Singh, who also holds the power portfolio. Union Finance Minister Nirmala Sitharaman had said that the 10 million beneficiaries of the new scheme would be able to get 300 units of free power through the rooftop solar installations, resulting in an annual saving of INR15,000-18,0000 per year.

2 February: The Government of India has invited bids for the development of off-shore wind energy of a total capacity of 4 GW (gigawatt). The bids invited are for four blocks of 1 GW each on open access basis, for development of offshore wind power projects off the coast of Tamil Nadu, through international competitive bidding. Under this arrangement, the developers who win the bid for each block will set up 1 GW off-shore wind energy capacity and sell electricity directly to consumers under the open access regime. No Viability Gap Funding (VGF) is given under the open access bids, and the Renewable Energy generated will be sold to entities such as industries which are currently in the high-tariff band. The off-shore wind energy bids have been invited through Solar Energy Corporation of India (SECI), a Government of India undertaking under the administrative control of the Ministry of New and Renewable Energy. The bids are being called after obtaining all necessary environmental clearances.

1 February: Finance Minister (FM) Nirmala Sitharaman said that the government will mandate the phased blending of compressed biogas (CBG) in compressed natural gas (CNG) for transport and piped natural gas (PNG) for domestic purposes. 'These steps are taken towards meeting our commitment for 'net-zero' by 2070,' She said. She said that the viability gap funding will be provided for harnessing offshore wind energy potential for initial capacity of 1 gigawatt (GW). She said that the financial assistance will be provided for procurement of biomass aggregation machinery to support collection. She said that to promote green growth, a new scheme of bio-manufacturing and bio-foundry will also be launched.

31 January: Russia has reduced gasoline exports to non-CIS countries to compensate for unplanned repairs at refineries, the energy ministry said, as the country grappled with the impact of fires and drone attacks on its energy infrastructure. It said gasoline and diesel exports have been reduced in January by 37 percent and 23 percent respectively from the same month in 2023. Russia is voluntarily cutting its oil and fuel exports by 500,000 barrels per day (bpd) in the first quarter as part of efforts by the Organization of the Petroleum Exporting Countries (OPEC) and allies (OPEC+) to support the energy markets. Russia will likely cut exports of naphtha by some 127,500-136,000 bpd, or around a third of its total exports, after fires disrupted operations at refineries on the Baltic and Black Seas, according to traders and LSEG ship-tracking data. The ministry said that major Russian oil companies had boosted gasoline production, which resulted in an increase of gasoline supplies to the domestic market in first 25 days of January by 7 percent, or 150,000 metric tonnes, year-on-year, and diesel supplies by almost 17 percent, or 490,000 tonnes. The country’s inventories for ensuring stable supply of the domestic market amount to 1.9 million tonnes (MT) for gasoline and 3.9 MT for diesel fuel, up 16 percent and 7 percent from January 2023, it said.

31 January: United States (US) crude production in November rose 0.6 percent to a new monthly record of 13.31 million barrels per day (bpd), as output in Texas and New Mexico notched records as well, the Energy Information Administration (EIA) said. Crude production in Texas rose by 1.4 percent to 5.66 million bpd, a monthly record, while crude output in New Mexico gained by 2.4 percent to 1.88 million bpd, also a record, the EIA said. Output in both of those states recorded the steepest growths since May 2023 and December 2022, respectively. US product supplied of crude and petroleum products rose in November to 20.71 million bpd, the highest since August, the EIA said. Product supplied of finished motor gasoline fell in November to 8.85 million bpd, the lowest since September, the EIA said.

31 January: Nigeria wants to resolve outstanding issues around the disputed OPL 245 oil block as it seeks to attract investment to its oil and gas industry and has held talks with Shell and Eni to discuss the matter, Oil Minister Heineken Lokpobiri said. Lokpobiri reiterated the government’s position that there was no criminal liability on its part, or by the other parties, in the oil block deal, which has been embroiled in litigation for years. Nigeria in November, withdrew a US$1.1 billion civil claim against Shell, opens new tab and Eni, opens new tab related to allegations of corruption in the deal, ending all litigation around the oil asset.

5 February: The spot price of liquefied natural gas (LNG) is continuing to meander at low levels amid ample supply from major exporters and signs that winter demand is easing in the top-importing regions of Asia and Europe. The spot price for LNG delivered to north Asia ended at US$9.60 per mmBtu (million metric British thermal units) in the week to Feb. 2, up slightly from the seven-month low of US$9.50 the previous week. Spot LNG prices have broken their usual seasonal pattern of rising during the northern winter and again in summer, but declining in the shoulder periods between peak demand.

5 February: Shell Plc has made a final investment decision to build a gas supply facility in Nigeria to feed a fertiliser plant owned by Africa's richest man Aliko Dangote, the company said. The new facility will supply 100 million standard cubic feet of gas per day from the Iseni field to the Dangote Fertiliser and Petrochemical plant for 10 years, according to the deal agreed by Shell, opens new tab and its joint venture partners TotalEnergies, opens new tab, Eni, opens new tab and the state oil firm NNPC Ltd. Nigeria holds Africa’s largest gas reserves of more than 200 trillion cubic feet and is seeking to develop the reserves to boost supply to industries, power plants, and for exports. Shell’s Nigeria chief, Osagie Okunbor, said the project will increase the delivery of gas to the domestic market and help stimulate economic growth.

3 February: Tanzania Petroleum Development Corporation (TPDC) has paid US$23.6 million to double its shareholding in the Mnazi Bay natural gas field under an agreement with French energy company Maurel & Prom, opens new tab. The Mnazi Bay gas field, in the Mtwara region of the country’s south, has an estimated 641 billion cubic feet of recoverable natural gas reserves and contributes nearly half of the gas used to generate electricity in the East African country. TPDC and Maurel & Prom signed a joint operating agreement under which TPDC will have decision-making power in the development and operation of the gas field, including sending its staff on long-term secondments.

31 January: Japan’s top power generator JERA expects the temporary suspension of US (United States) liquefied natural gas (LNG) export permits may affect Japan’s fuel security, and even the world's, if the issue persists. JERA is one of the world’s biggest LNG buyers and Japan is the world’s second-biggest buyer of the super-chilled fuel after China. US President Joe Biden paused approvals for pending and future applications to export LNG from new projects, a move cheered by climate activists that could delay decisions on new plants until after the Nov. 5 election. JERA, which has signed 20-year agreement to buy 1 million metric tons per annum of LNG from Venture Global LNG’s Calcasieu Pass (CP2) plant in Louisiana, will work together with the public and private sectors to address the issue while keeping a close eye on the situation, JERA’s head of global investor relations Tetsuo Yoshida said. Japan’s Industry Minister Ken Saito raised concerns over the US suspension of LNG export permits and said the Japanese government will take necessary steps to ensure that Japan's stable energy supply is not compromised.

31 January: Grain LNG said it had signed a 10-year deal with Sonatrach to extend the Algerian company’s long-term storage and redelivery capacity at Europe’s largest liquefied natural gas (LNG) import terminal beyond January 2029. The agreement is for 125 gigawatt hours per day (GWh/d) of import capacity, equivalent to 3 million metric tonnes per annum (mtpa) of LNG, and is the first to be announced under Grain LNG’s competitive auction process which was launched in September for 9 mtpa of existing capacity. Located on the Isle of Grain in Kent, National Grid’s Grain terminal is currently being expanded to store and deliver enough gas to meet up to 33 percent of British gas demand.

6 February: United States (US) power consumption will rise to record highs in 2024 and 2025, the US Energy Information Administration (EIA) said. EIA projected power demand will rise to 4,112 billion kilowatt hours (kWh) in 2024 and 4,123 billion kWh in 2025. That compares with 3,994 billion kWh in 2023 and a record 4,070 billion kWh in 2022. As homes and businesses use more electricity instead of fossil fuels for heat and transportation, EIA forecast 2024 power sales would rise to 1,530 billion kWh for residential consumers, 1,396 billion kWh for commercial customers and 1,035 billion kWh for industrial customers. That compares with all-time highs of 1,509 billion kWh for residential consumers in 2022, 1,391 billion kWh in 2022 for commercial customers and 1,064 billion kWh in 2000 for industrial customers.

5 February: Norwegian natural gas exports were curtailed due to an unplanned outage at the Nyhamna processing plant following a power cut at the weekend amid high winds, operator Shell, opens new tab said. The power line which tripped and caused the outage at Nyhamna was repaired late, transmission grid operator Statnett said.

5 February: Ukraine reported a surplus of electricity production and intends to export it to neighbouring Moldova and Poland, Ukrainian energy ministry said. Ukraine had produced more energy than it consumed before the Russian invasion in 2022, but that output has dropped since the Russian attacks on power facilities and the occupation of Europe’s largest Zaporizhzhia nuclear power plant. Ukraine’s Energy Minister German Galushchenko said that Ukraine could resume substantial energy exports as early as this spring due to lower consumption. Ukraine banned exports during the last heating season amid Russian attacks on Ukraine’s energy system and large-scale shutdowns.

5 February: Snam, opens new tab is officially launching a market test for hydrogen demand in Italy and a collection of expressions of interest for carbon dioxide (CO2) transport and storage, the gas grid operator said. The two initiatives are part of Snam’s broader activities to support Italy's energy transition, the company said. The International Energy Agency (IEA) said it can play a vital role in achieving global climate goals. However, critics said it risks prolonging the use of fossil fuels and question whether it is commercially viable. Snam and Italian energy group Eni announced a project last year to set up a carbon capture and storage hub offshore Ravenna to help decarbonise high-emitting industrial activities.

1 February: Prices of European power purchase agreements (PPAs) for green electricity fell 2 percent in the fourth quarter of 2023, making a case for buyers to strike new deals ahead of an expected rise in demand, price tracking platform LevelTen said. PPAs, bilateral long-term agreements between corporate power users and wind and solar project developers, give consumers supply security and developers a guaranteed income stream, making it easier to arrange financing. Corporate buyers are eager to lock in a carbon-free power supply to comply with a 2023 European renewable energy directive requiring 42.5 percent of EU (European Union) electricity be renewable by 2030.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.