-

CENTRES

Progammes & Centres

Location

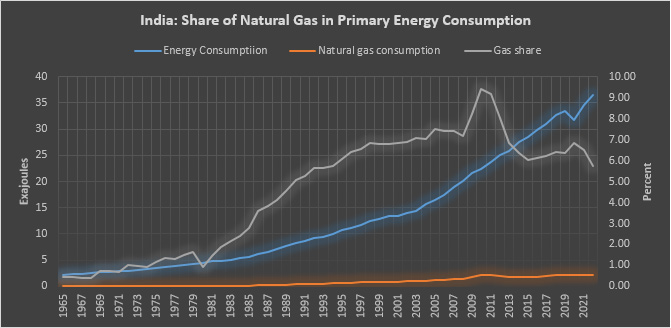

In 2016, the Government of India (GOI) announced that India would increase the share of natural gas in its primary energy basket from 6.14 percent in 2016 to 15 percent by 2030 and become a “gas-based economy”. Since the announcement, the share of natural gas in India’s primary energy basket (commercial energy, not including energy derived from unprocessed biomass) increased marginally to 6.83 percent in 2020 but has since fallen to 5.7 percent in 2022. The share of natural gas in India’s primary energy basket was 9.43 percent in 2010 when domestic gas production substantially increased. If the current trend continues, the probability of India becoming a gas-based economy by 2030 is low.

India’s natural gas consumption in 2022-23 was about 164.3 million metric standard cubic meters per day (mmscmd) . To increase consumption to 600 mmscmd by 2030, the annual growth rate in consumption has to be more than 10.5 percent, which is not an impossible target. In the period 2008-2018, natural gas consumption in China grew by over 13 percent. Behind this double-digit growth rate for natural gas consumption in China was an annual average economic growth rate of over 8 percent, regulatory reform for transparency and flexibility along with focussed policy mandates. India has implemented progressive policies in the gas sector, but production and consumption trends in the last decade are not very encouraging.

In India, net domestic production of natural gas declined from 108.94 mmscmd to 92.23 mmscmd, demonstrating an annual average decline of about 1.6 percent in 2012-13 to 2022-23. Import of LNG (liquified petroleum gas) increased from 39.24 mmscmd in 2012-13 to 72.07 mmscmd in 2022-23, representing an annual average growth of about 6.2 percent. In the same period, consumption of natural gas increased from 148.18 mmcsmd to 164.30 mmscmd, showing an annual average growth of about 1.3 percent. Peak domestic production of 143.61 mmscmd was in 2010-11 while peak consumption of 175.74 mmscmd as well as peak LNG import of 92.84 mmscmd were in 2019-20 prior to the pandemic.

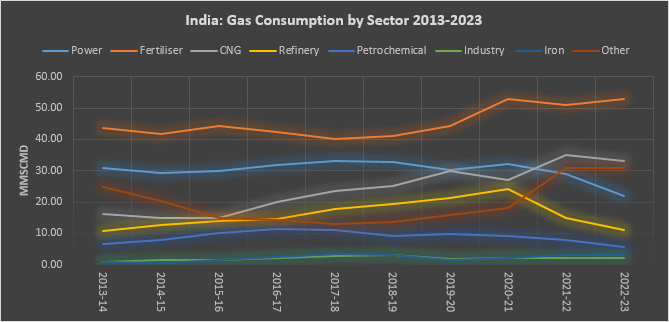

In the 70s and 80s, natural gas consumption grew at double-digit rates annually, typical of a new consumption segment, starting from a small base. In the 1990s and 2000s growth in consumption of natural gas slowed down to an annual average of 6-7 percent. In the 2010s and 20s, consumption growth fell to an annual average of around 1 percent. In the decade ending in March 2023, natural gas consumption by the power sector fell by an annual average of 3.7 percent from 30.92 mmscmd in 2012-13 to 22 mmscmd in 2022-23. Consumption of compressed natural gas (CNG) supplied to domestic and transportation segments made-up for the decline in consumption by the power sector, recording an annualised growth of 8.2 percent in the same period. While consumption growth in the industrial and sponge iron segments remained robust at 12 percent and 16 percent respectively, consumption in the refining segment grew only by an annual average of just 0.1 percent in the decade ending in March 2023 and consumption growth in the petrochemical segment fell by an annualised rate of 1.9 percent in the same period.

In 2013-14, the power sector accounted for 23 percent of natural gas consumption, but by 2022-23, its share had fallen to about 13 percent. If natural gas is promoted as a fuel for providing power at short notice with costs reflected in tariff, offtake of gas for power generation may increase. However, decline in the cost of battery storage solutions that can also provide power at short notice to make up for intermittency in renewable power generation is likely to reduce the attractiveness of gas as fuel for power generation. The share of the fertiliser segment in natural gas consumption increased marginally from 32 percent in 201-14 to 33 percent in 2022-23. India plans to stop import of urea by 2025 which means demand will shift to natural gas (feedstock for urea production). This could potentially increase consumption of imported liquefied natural gas (LNG) by the fertiliser segment.

Source: Petroleum Planning & Analysis Cell (PPAC)

The share of CNG in natural gas consumption increased from just over 16 percent in 2013-14 to 33 percent in 2022-23. CNG consumption has potential for growth in the future but it is dependent on availability domestic gas and at regulated prices and investment in infrastructure. The unified tariff (UFT) policy introduced by the Petroleum and Natural Gas Regulatory Board (PNGRB) in April 2023 could facilitate growth in CNG consumption as it aims to create a single, consistent and fair tariff structure for natural gas transport across the country. The UFT policy will apply to a network of 21 pipelines, representing around 90 percent of pipelines in operation or under construction. The unified tariff is a fixed charge determined by the PNGRB and based on the levelized cost of service of the entire pipeline network, and is revised periodically to reflect the changes in pipeline costs and utilisation. The zonal factor is variable and depends on the tariff zone. There are three tariff zones: the first up to 300 kilometres (km) from the gas entry point, the second between 300 km and 1,200 km and the third beyond 1,200 km. The zonal factors for the three zones are 0.25, 0.5 and 1.0 respectively. The zonal tariff, corresponding to the fee paid by the shipper to the pipeline operator for the transport of gas, is calculated by multiplying the unified tariff by the zonal factor. A stable, competitive and transparent pricing regime enabled by UTF will benefit domestic production and demand and in addition attract investment in gas infrastructure. The suggestion from the Energy Transition Advisory Committee (ETAC) to develop strategic gas storage could also strengthen the country’s energy supply security and reduce price volatility both of which could potentially boost demand for natural gas. The government is reported to be studying the prospect of developing gas storage with a capacity of 3-4 bcm (billion cubic meters). The share of petrochemicals and refining segments in natural gas consumption in 2022-23 was lower than that in 2013-14. The sector is dependent on imported LNG and high volatility in the price of imported LNG contributed to the decline in natural gas by these sectors. The availability of substitutes at more certain price prospects also contributed to the reduction in natural gas consumption by the refining and petrochemicals segments.

Notwithstanding the attractiveness of natural gas as a bridge fuel for India, gas faces stiff competition from coal in terms of affordability and energy security (availability of domestic coal) and from solar and wind in terms of environmental acceptability. In the context of emissions, it is well established that natural gas scores over coal and oil. Coal-to-gas switching is generally seen as the means to rapid reduction in CO2 emissions. Typically, natural gas emits 50-60 percent less CO2 when combusted in an efficient power plant compared to emissions from a typical coal plant. Considering only tail-pipe emissions, natural gas used as fuel for transportation emits 15-20 percent less emissions than petrol when burned in a modern vehicle.

But there is the environmentalist argument that gas is not necessarily carbon-free and investment in gas supply chains would lock in emissions and create new path dependencies that would only extend the life of fossil fuels. The conclusion is that facilitating natural gas use is inconsistent with the goal of decarbonisation and it would potentially create stranded assets. The fact that LNG supply chains produce more emissions per unit of gas than pipeline gas because of the additional energy required for liquefaction is used to strengthen the case against gas.

Despite these shortcomings, gas has contributed to emission reduction. Prior to the pandemic, natural gas contributed to a 1.7 percent fall in global emissions on account of coal-to-gas switching in the United States and Europe. In the US, coal to gas switching was driven by the price competitiveness of gas over coal and in Europe coal to gas switching was driven by high carbon prices. In India, coal’s cost competitiveness is not likely to be eroded by natural gas, especially when most of it is imported. Carbon prices, even if implemented are not likely to be high, as India already imposes excessive taxes on fossil fuel consumption. It appears that India will need more than six months to become a gas-based economy.

Source: Statistical Review of World Energy 2023

Utility Scale Solar Projects

A total of 50 solar parks with a combined capacity of 37,490 megawatt (MW) have been approved in 12 states till 30 November. The government is implementing a scheme — Development of Solar Parks and Ultra Mega Solar Power Projects — with a target capacity of 40 gigawatt (GW). Under the said scheme of the Ministry of New and Renewable Energy (MNRE), 50 solar parks with an aggregate capacity of 37,490 MW have been sanctioned in 12 states in India as on 30 November. An aggregate capacity of 10,401 MW of solar projects have been commissioned in 19 solar parks so far. Two solar parks — Kadaladi Solar Park and Ramanathapuram Solar Park — of 500 MW each were earlier sanctioned in Tamil Nadu, but were subsequently cancelled due to slow progress and land constraints.

Hinduja Renewables Energy Private Limited, an independent power producer, has won a bid to set up a 140 MW solar power capacity project in a tender issued by the Gujarat Urja Vikas Nigam Limited (GUVNL) at a tariff rate of INR2.64/kWh. This has a potential to 280 MW as the GUVNL may allow an additional capacity of 140 MW by exercising the Greenshoe option. The award is part of the Solar Tender Phase -XXII issued by GUVNL for the selection of solar power developers for setting up 500 MW Solar Power Projects anywhere in India.

Singapore’s Sembcorp Industries renewables unit was awarded a 300 MW solar power project by Indian government-run hydropower producer NHPC Ltd. NHPC in its letter of award confirmed Sembcorp’s unit, Green Infra Wind Energy Ltd (GIWEL)’s final offer, and committed to buying power output from the project for 25 years under a long-term power purchase agreement. The project will be funded by internal funds and debt, and is expected to be ready for commercial operation in 2026. The award comes weeks after GIWEL signed an agreement with an India-based power producer, Leap Green Energy, to buy two special purpose vehicles owning 228 MW of operational wind assets in the Indian states of Madhya Pradesh, Maharashtra and Rajasthan.

Roof Top /Distributed Solar Projects

The Jammu and Kashmir (J&K) administration has approved solarisation of 4,000 agri water pumps, in a move aimed at harnessing solar energy for agricultural purposes. The administrative council of the UT gave its approval to solarisation of 4,000 existing individual grid-connected agriculture pumps under Component–C of Pradhan Mantri Kissan Urja Suraksha Evam Uthaan Mahaabhiyan (PM-KUSUM) scheme having the grid connected solar power plant capacity in the range of 1 kW to 15 kW. Under this scheme the farmers will be able to use the generated solar power to meet the irrigation needs and the excess solar power will be sold to distribution companies.

Nuclear Power

Prime Minister (PM) Narendra Modi is determined to triple the nuclear installed capacity in India within the next decade, the IAEA (International Atomic Energy Agency) chief Rafael Mariano Grossi said. He said that India’s decisions regarding nuclear power will make a significant impact on the path ahead. Nuclear Power Corporation said India will have an addition of 14,500 MW in the nuclear power sector over the next nine years.

India’s second home-built 700 MW nuclear power reactor at Kakrapar in Gujarat achieved its first criticality, the start of the controlled fission reaction, setting the stage for its gradual move towards producing electricity for commercial purposes. The first criticality was achieved at 1.17 am. Kakrapar Atomic Power Project (KAPP) Unit-4 is the second in the series of 16 indigenous Pressurised Heavy Water Reactors (PHWR) of 700 MW each being set up in the country.

Hydro Power

Nepal and India signed a power trade agreement for Kathmandu to export 10,000 MW of hydroelectricity to India over the next 10 years, in a deal they hope will draw investment to the cash-strapped Himalayan nation. India, which has a short term electricity trading deal with Nepal, is investing billions of dollars in infrastructure including hydropower plants, as New Delhi looks to grow its influence among its smaller neighbours, where China is also increasingly active. Indian Prime Minister Narendra Modi and his Nepali counterpart Pushpa Kamal Dahal agreed the long-term power trade agreement last year which, would be key to attracting investment in Nepal’s hydroelectric sector. Indian companies are at various stages of constructing, or negotiating with the Nepalese government to construct, power plants that could produce a total of 8,250 MW, attracting billions of dollars.

Wind Power

Integrated energy solutions provider Apraava Energy has secured a 300 MW wind energy project in Aski, Karnataka. The project is part of the 1,200 MW auction capacity of Inter-State Transmission System (ISTS)-connected wind power projects (Tranche-XIV) from the Solar Energy Corporation of India (SECI). As part of the agreement, Apraava Energy will be responsible for acquiring the land, developing the wind farm, and establishing the grid infrastructure up to the metering point at the ISTS grid substation. The company’s current RE portfolio (Solar and Wind) stands at 1,176 MW, with projects spread across the states of Rajasthan, Gujarat, Maharashtra, Madhya Pradesh, Tamil Nadu, Telangana and Karnataka.

JSW Renew Energy has commissioned the first phase of 51 MW capacity of its 810 MW wind energy project in Tamil Nadu. The project has a power purchase agreement with Solar Energy Corporation of India (SECI) for 25 years, JSW Renew Energy Ltd, a wholly owned step-down subsidiary of JSW Energy, has started phase-wise commissioning of the 810 MW (Inter State Transmission System) ISTS-connected wind power project awarded under SECI tranche IX in Tamil Nadu with commissioning of the first phase of 51 MW. With a total capacity of 9.8 GW, the company is well placed to achieve its near-term target of 10 GW by 2025. JSW Energy has set a target for a 50 percent reduction in carbon footprint by 2030, and is aiming to achieve carbon neutrality by 2050.

Renewable energy solutions provider Suzlon has secured a 100.8 MW wind energy project from a leading global company. The company will execute the project with a scope of supply, supervision, and commissioning. Additionally, Suzlon will undertake post-commissioning operation and maintenance services. Suzlon will install 32 wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 3.15 MW each. Electricity generated from the project will be supplied to Gujarat Urja Vikas Nigam Ltd (GUVNL). A project of this size can provide electricity to about 77,000 households and curb 3.02 lakh tonne of CO2 (carbon dioxide) emissions every year.

North & South America

The United States (US) solar industry will experience modest growth in 2024, as electricity prices decline and support from the Inflation Reduction Act (IRA) rolls in, SolarEdge Chief Financial Officer Ronen Faier said. The solar product manufacturer sees demand improving with expectations for lower interest rates this year. Incentives from the IRA in top solar markets like California are also beginning to improve the economics and prices of solar products and components, Faier said. The US Department of the Treasury in December unveiled proposed guidelines for manufacturers of clean-energy products seeking to claim a tax credit, created under the IRA, in a bid to power the energy transition with American-made products.

EU

Britain plans to spend 300 million pounds (US$380 mn) on a new programme to produce advanced nuclear fuel suitable for the next generation of power-generating reactors, seeking to dislodge Russia as the main international supplier. Britain was one of over 20 countries - including the United States, France and South Korea - that recently signed a pledge to triple global nuclear capacity by 2050 as part of international efforts to cut climate-damaging carbon emissions.

The United Kingdom (UK) experienced a notable reduction in electricity generated from fossil fuels in 2023, marking the lowest level since 1957. That’s according to Carbon Brief analysis, which suggests the 22 percent year-on-year decline brought the total to 104 terawatt hour (TWh), reflecting a broader trend of a two-thirds drop since the peak in 2008. This shift is attributed to the increased use of renewable energy and decreased electricity demand. According to the report, fossil fuels comprised 33 percent of the UK’s electricity supplies in 2023, with gas at 31 percent, coal just over 1 percent, and oil just below 1 percent. Low carbon sources accounted for 56 percent, with renewables contributing 43 percent and nuclear 13 percent. According to the Power Tracker analysis by the Energy and Climate Intelligence Unit (ECIU), renewable generation experienced a significant increase of over 10 percent in 2023 compared to 2019, while gas generation saw a decline of approximately 25 percent. The ECIU analysis found that in 2023, renewable electricity generation in the UK achieved a notable milestone, surpassing 90 TWh from wind, hydro, and solar sources.

Germany’s solar and wind power installations hit a record in 2023 but only photovoltaic energy reached the government’s targets, expecting continued growth this year with further reduced bureaucracy. Germany aims to cover 80 percent of its electricity needs from renewables by 2030, up from 52 percent in 2023. More than a million new solar power systems generating 14 GW of energy were installed in Germany last year, up 85 percent year-on-year, thanks to a boom in residential solar demand, putting it on track to reach Berlin’s 2030 goal, the BSW solar power association said.

Renewable power sources supplied 61 percent of Portugal’s electricity in 2023, up from 49 percent a year earlier, hitting a new record thanks to periods of heavy rains, strong winds and good doses of sunshine, grid operator REN said. The country aims to generate 85 percent of its annual electricity from renewable sources by 2030 but it already has one of the highest ratios in Europe. European nations are increasingly betting on renewable energy, especially after gas prices hit record highs following the invasion of Ukraine by Russia, which was Europe’s top gas supplier. Last year, wind energy accounted for a quarter of all electricity usage in the southern European nation, while hydropower made up 23 percent, solar 7 percent and biomass 6 percent, according to REN.

Spain confirmed plans to close the country’s nuclear plants by 2035 as it presented energy measures including extended deadlines for renewable projects and adjusted renewable auctions. The management of radioactive waste and dismantling of the plants, whose shut down will begin in 2027, will cost about €20.2 billion (US$22.4 bn) and will be paid for by a fund supported by the plants' operators, the government said. The future of the country’s nuclear plants, which generate about a fifth of Spain’s electricity, was a hot issue during the recent electoral campaign, with the conservative opposition People’s Party (PP) pledging to reverse the planned phase-out.

Germany’s Economy Minister Robert Habeck said he aimed to replace a subsidy to makers of solar panels that fell victim to a court ruling last month that scrapped swathes of the budget, arguing support was needed to compete with Chinese manufacturers. While solar energy is booming, most of the panels are imported from China.

Africa & Middle East

TotalEnergies is ready to start construction of a 216 MW solar plant with battery storage in South Africa that should be operational in 2025, the company said. Africa’s most advanced economy is battling to end crippling power cuts blamed on its ageing fleet of coal-fired plants, while seeking to transition away from the polluting fossil fuel. The France-based energy company owns 35 percent of the consortium developing the project, with its partners Hydra Storage Holding and Reatile Renewables controlling 35 percent and 30 percent, respectively. South Africa launched three bidding rounds for 7,615 MW of new power generation from renewable energy, natural gas and battery storage, as part of its drive to overcome the electricity crisis that has hit its economy.

South Africa launched three bidding rounds for 7,615 MW of new power generation from renewable energy, natural gas and battery storage, part of efforts to overcome record power outages crippling economic output. The Department of Mineral Resources and Energy said it had issued three requests for proposals (RFPs) for independent power producers to generate 5,000 MW of renewable energy, 2,000 MW from gas and 615 MW from battery storage.

China

China’s cost to produce solar panels has plummeted 42 percent in the last year, giving manufacturers there an enormous advantage over rivals in places like the United States and Europe. The dramatic decline comes as the world’s largest solar panel producer has ratcheted up production capacity this year while the United States is incentivizing its own small industry to take on China. US producers are concerned the wave of new factories could make their own uneconomical. China accounts for 80 percent of the world’s solar manufacturing capacity, according to the analysis by energy research firm Wood Mackenzie. Wood Mackenzie said China was expected to dominate the global solar supply chain for much of the next decade. China’s panel production cost has dropped to 15 cents per watt this year, more than 60 percent below the US price of 40 cents per watt. A year ago, Chinese panels cost 26 cents per watt.

Other Asia Pacific

Japan’s industry and land ministries picked three consortia, including one featuring Germany’s RWE and its partners, to operate offshore wind farms in the second round of a public auction. Japan’s offshore wind power market is set to grow as the government aims to have 10 GW of offshore wind farm deals by 2030, and up to 45 GW by 2040, as part of its decarbonisation push.

10 January: India’s finance ministry has scrapped a INR50 billion (US$602 million) plan to top up the nation’s strategic crude oil reserves, given market volatility and the prospect of a further decline in prices. Instead of buying at current levels — Brent crude has already slumped about a fifth from a September peak, and could fall further if supply remains plentiful — the ministry is asking state-owned Indian Strategic Petroleum Reserves Ltd to lease out empty underground storage to refiners and global oil majors. India has limited oil storage capacity, with space for only 39 million barrels of crude — barely enough for eight days of the country’s consumption — to use in the event of an emergency. It filled the storage in 2020, when Brent crude prices crashed, but has since released about a third of that oil to local refiners. The ministry’s decision not to refill its reserves, at odds with other large consumers, comes as New Delhi seeks to lower its fiscal deficit to 5.9 percent of its gross domestic product in the fiscal year to March, from 6.4 percent a year earlier. It has instead sought to lease out space, but refiners have expressed limited appetite so far. The South Asian nation keeps its strategic oil stockpiles at three sites. A combined 13.5 million barrels of storage space at Visakhapatnam and Mangalore are currently empty.

14 January: Oil and Natural Gas Corporation (ONGC) has made two significant back-to-back natural gas discoveries in a Mahanadi basin deepwater block in the Bay of Bengal as its calculated game plan of venturing into high-risk deep water exploration starts yielding results. The firm made the discoveries in the block MN-DWHP-2018/1, which it had won in the third round of auction under the open acreage licensing policy in 2019. The first discovery, named Uktal, is in 714 metres of water depth and flowed more than 3 lakh cubic metres per day of gas during initial testing, they said, adding the other find is at a water depth of 1,110 metres. ONGC has notified the discoveries to upstream regulator Directorate General of Hydrocarbons (DGH) and is doing pool size and commercial viability assessments. For a nation that imports roughly half of its gas needs, finding new reserves augurs well for its energy security. India is targeting raising the share of natural gas in its energy basket to 15 percent by 2030 from the current 6.3 percent and more domestic production will aid that. Gas is being seen as a transition fuel in India’s journey towards net zero carbon emission by 2070. As the country pivots away from polluting fossil fuels, natural gas with a lower carbon footprint is seen as a bridge fuel.

12 January: Mahanagar Gas Limited (MGL), the city utility arm of GAIL (India) Limited, announced a joint venture with Baidyanath LNG, the first domestic firm to set up LNG (liquefied natural gas) retailing outlets, to form Mahanagar LNG. The joint venture will focus on developing LNG infrastructure to cater to the increasing demand for clean and sustainable energy solutions for the long-haul and close-loop transportation segments, MGL said. The joint venture aims to set up six LNG stations in Maharashtra in the first phase and subsequently expand its footprint across the country, MGL said.

15 January: Association of producers and suppliers of metallurgical coal expressed concerns over the "influx of met coke at prices below the domestic cost of production" and sought the government's intervention to resolve the issue. Metallurgical coal is a grade of coal that can be used to produce good-quality coke. The prevailing import rate for metallurgical coke in India is US$395 per tonne, while the production cost for domestic met coke manufacturers is around US$460 per tonne. This significant pricing gap has led to an influx of over 3.6 million tonnes of inexpensive met coke imports during 2022-23, posing a substantial challenge to India’s merchant met coke sector, The Indian Metallurgical Coke Manufacturers' Association (IMCOM) said.

12 January: The coal ministry will organise a roadshow in Ranchi to increase participation of investors in the commercial coal mine auction. Coal Secretary Shri Amrit Lal Meena will be the chief guest for the event while additional secretary M Nagaraju will be the guest of honour, the coal ministry said. The government launched the process for sale of 39 coal mines under eight rounds of commercial auctions and 31 under the ninth. These 70 coal mines are from the coal-bearing states of Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Maharashtra, Odisha, Telangana, and West Bengal. Of the said mines, 27 are fully explored ones and 43 are partially explored.

12 January: Jindal Power has proposed to top a bid by Adani Power, opens new tab, for a thermal power plant, as India looks to drum up investment in coal-fired power. The tussle for the 1,980 megawatt (MW) plant in central India, ensnared in insolvency proceedings, comes after the power minister called last November for more private investment to meet a dramatic rise in electricity demand. Private investments in coal-based power in India started dwindling after 2018, hit by lower demand and an ambitious national thrust in renewable energy.

10 January: Indicating sufficient coal availability in the market, the National Coal Index (NCI) dropped 17.54 percent to 155.09 points in November 2023. The NCI was at 188.08 points in November 2022, the coal ministry said. This shows a strong supply of coal in the market, with sufficient availability to meet the growing demand. NCI is a price index that combines coal prices from all sales channels, including notified prices, auction prices and import prices. The peak of NCI was observed in June 2022 when the index reached 238.83 points, but subsequent months have experienced a decline, indicative of abundant coal in the Indian market.

15 January: Electric equipment maker HPL Electric and Power has bagged an order worth INR2.4 billion for smart meters from Advanced Metering Infrastructure Service Provider (AMISP). This accomplishment adds to HPL’s already existing significant order pipeline, reinforcing its ongoing upward momentum in the dynamic smart meter sector, the company said.

14 January: The Union government is looking to set March 2025 as the deadline for 24x7 electricity supply across the country. After connecting all households with electricity supply through two flagship schemes in the past decade, the Bharatiya Janata Party (BJP)-led central government now plans to ensure uninterrupted reliable power supply by the end of 2024-25 (FY25). After achieving universal connectivity, the power ministry said, the next step was to ensure round-the-clock power supply.

15 January: Avaada Group said it has committed investments worth INR400 billion for development of 6,000 MW (megawatt) hybrid wind-solar projects in Gujarat. The agreement was signed in the presence of Gujarat Chief Minister Bhupendrabhai Patel on the sidelines of the Vibrant Gujarat Global Summit 2024 on January 10-12 at Gandhinagar, the company said. According to the company, Avaada Group has signed a Memorandum of Understanding (MoU) with the Gujarat government. This strategic alliance aims to set up hybrid wind-solar projects with an aggregate 6,000 MW (6 GW) capacity in the state with an investment of about INR400 billion. The group’s commitment to green initiatives in Gujarat is underscored by substantial investments in the development of a robust renewable energy ecosystem.

15 January: Mormugao Port Authority (MPA) and Goa Energy Development Authority (GEDA) are in the process of setting up a 3 megawatt (MW) solar energy plant at Sada. On completion, it will cater to the port’s complete electricity needs. The excess energy generated will be supplied to the state grid through net-metering. The project, which is estimated to cost INR169 million, has garnered interest from at least 10 companies. The MPA and GEDA-funded solar power plant will be set up on 7 acres of land within the port premises. The port currently requires 2.6 MW of power to meet operational requirements.

13 January: Nigeria’s Dangote oil refinery has begun producing diesel and aviation fuel, the company said, after years of construction delays at the 650,000 barrel per day (bpd) plant. The refinery, Africa’s largest, was built on a peninsula on the outskirts of the commercial capital Lagos at a cost of US$20 billion by the continent's richest man Aliko Dangote. Although Nigeria is Africa’s top energy producer, it has relied on imports for most of the fuel it consumes. The Dangote refinery is expected to not only make it self-sufficient but also allow it to export fuel to neighbouring West African countries, potentially transforming oil trading in the Atlantic Basin. The plant received 1 million barrels of Nigeria’s Agbami crude, taking the total volume received since December to 6 million barrels. Nigeria’s NNPC Ltd is expected to supply four crude cargoes to the refinery from its February programme. Dangote has said it will start by refining 350,000 bpd, hoping to ramp up to full production later this year.

13 January: The OPEC+ group of oil producers is working to limit the challenges affecting the stability of the global oil market, Iraq’s Oil Minister Hayan Abdel-Ghani said. Voluntary output cuts by OPEC+ since November have allowed members states like Iraq to achieve the highest rates of balance between supply and demand, helping them achieve stability in the global oil market, its oil ministry has said.

12 January: Bulgaria is replacing Russian oil imports with crude from Kazakhstan, Iraq and Tunisia in January, according to traders and LSEG data. Bulgaria has a waiver from a European Union embargo that allows it to continue seaborne imports of Russian oil in 2024. But the country has restricted exports of all refined products produced from Russian crude from this month, which makes it almost impossible for its sole refinery to run on Russian oil, and has decided to stop all Russian crude imports from March. Bulgaria purchases oil to feed its Burgas refinery, which has a capacity of 190,000 barrels per day (bpd) and is operated by Russia’s Lukoil. Bulgaria was the fourth largest buyer of seaborne Russian oil in 2023, purchasing over 100,000 bpd.

12 January: Protesters who have threatened to shut down two oil and gas facilities near the Libyan capital Tripoli have extended the deadline by 24 hours for talks with mediators. Protesters have threatened to shut down the facilities, with one group campaigning against corruption issuing a 72-hour ultimatum that ended. The two facilities are the Mellitah complex and the Zawiya refinery. Mellitah is a joint venture between Libya’s National Oil Corporation (NOC) and Italy’s Eni, opens new tab. If the complex is closed, that would disrupt the supply of gas through the Greenstream pipeline between Libya and Italy. Libya’s oil sector, the country's major source of income, has been a target for local and broader political protests since the toppling of Muammar Gaddafi in a NATO-backed uprising in 2011. The Zawiya refinery, with a capacity of 120,000 barrels per day (bpd), is connected to the country's 3000,000 bpd Sharara oilfield.

11 January: Global oil demand is expected to increase by almost 2 million barrels a day in 2024, with China accounting for more than 25 percent of the increase, consultancy Wood Mackenzie said in a report. WoodMac projected total oil demand of 103.5 million barrels per day for this year. The consultancy said oil supply is expected to lag demand growth as OPEC+ supply cuts slow production growth across 2024, although it said could move into oversupply without output restraint, especially if demand growth is lower than expectations. Some analysts have predicted weak economic growth will weigh on oil markets and curb demand, keeping prices around US$80 a barrel this year, according to a poll.

15 January: Enagas, opens new tab has awarded has awarded 2,231 slots, about half of the total capacity, for vessels to unload liquefied natural gas (LNG) at six of Spain's terminals over the next 15 years, according to the company data. Spain is a key European hub for LNG imports, thanks to its large fleet of regasification terminals. Spanish plants held almost a third of the LNG stored in Europe as of 14 January, data from Gas Infrastructure Europe showed. Enagas said that 588 slots were also booked to allow smaller vessels to load LNG stored at the terminals.

15 January: Australia’s Santos, opens new tab can proceed with construction of an undersea pipeline vital to its US$4.3 billion Barossa gas project after a court ruled in favour of the oil and gas firm in a dispute with an Indigenous man looking to pause the work. Work on the pipeline, which will connect the Barossa gas field to a processing plant in the northern Australian city of Darwin, was paused by court order in November after a suit by a member of an Indigenous group regarded as traditional land owners from the nearby Tiwi Islands.

10 January: Norway’s export of natural gas via pipelines to Europe hit an all-time high in December but still declined by 6.7 percent overall in 2023 following lengthy maintenance outages, pipeline system operator Gassco said. Norway in 2022 overtook Russia as Europe’s biggest source of gas as Moscow cut supplies amid the war in Ukraine, increasing the focus on the security and reliability of the Norwegian energy industry. In total, Gassco delivered 109.1 billion cubic meters (bcm) of gas through its 8,800 km (5,468-mile) pipeline network in 2023, down from 116.9 bcm a year prior, it said. Pipeline gas supply to Europe between January and August had dropped 6.4% it said previously, and Norway’s natural gas output hit a four-year low in September.

10 January: Finnish energy firm Gasum said it is delivering a US (United States) cargo of liquefied natural gas (LNG) it procured from Germany’s SEFE LNG to the Inkoo floating storage regasification unit (FSRU). The LNG cargo is approximately 800 gigawatt hour (GWh), and the fourth large shipment Gasum has delivered to Inkoo since the Balticconnector gas pipeline between Finland and Estonia suffered a rupture and was shut down in early October, it said. While the pipeline is being repaired, all Finnish natural gas demand must be met through imports of LNG, it said. Gasgrid had ordered a rapid extra LNG delivery of liquefied natural gas (LNG) amid a prolonged cold snap engulfing the Nordic country.

10 January: South Africa has selected a Vopak, opens new tab consortium as the preferred bidder to develop and operate a liquefied natural gas (LNG) terminal at the Port of Richards Bay for 25 years, Transnet National Ports Authority said. Vopak, a Dutch company which operates terminals and storage facilities worldwide, partnered with Transnet Pipelines during the bidding round as South Africa pushes to raise gas consumption in Africa's most industrialised economy. South Africa is increasingly turning towards gas, as well as renewable energy sources such as wind and solar, as it looks to overcome its worst energy crisis on record and break its reliance on coal-fired plants that power its economy.

12 January: China’s imports of Mongolian coking coal may rise to a record in 2024, after more than doubling in 2023, on improving transport links and its lower price versus domestic and international supplies, traders and miners said. China is the world’s biggest steel producer and coal importer and a shift to abundant Mongolian supplies could come at the expense of Australian imports of the steelmaking ingredient. Australia, the world’s second-biggest coking coal miner, was China’s largest supplier until a 2020 diplomatic dispute. This year’s coking coal imports from landlocked Mongolia may rise more than 10 percent as newly expanded road links enable more truck traffic, a Beijing-based coal trading executive estimated. China imports Mongolian coal mostly by truck through seven ports along a border that stretches more than 4,600 km (2,858 miles). Beijing and Ulaanbaatar have simplified customs clearances to bolster coal imports, which have been hindered by transport bottlenecks, several Chinese coal traders said. Australian coking coal imports plunged when Beijing slapped an unofficial ban on several commodities after Canberra called for an investigation into the origins of the COVID-19 pandemic, although trade resumed last year as relations warmed.

13 January: A winter storm bringing snow, ice and high winds to parts of the US (United States) Midwest and Pacific Northwest knocked out power for hundreds of thousands of homes and businesses, with a brutal freeze expected to grip numerous states. The US Federal Aviation Administration (FAA) said storms continue to cause flight cancellations and delays. Some 150,000 homes and businesses were without power in Michigan. Power was out for another 200,000-plus customers in Oregon and Wisconsin.

13 January: The Alberta Electric System Operator (AESO) lifted the grid alert issued earlier in the day asking customers to reduce their consumption to avoid a power shortfall after a demand spike caused by extreme cold. The AESO earlier declared the grid alert and asked citizens to immediately reduce their electricity use to essential needs in response to ongoing extreme cold temperatures across western Canada, restricted imports and very high demand. The AESO had projected a shortfall of up to 200 megawatt (MW) of electricity during the peak evening hours and warned of potential rotating outages until demand declined or generation returned to the grid. The AESO said after the alert was issued, it almost immediately saw a 100 MW drop in electricity demand which rose to 200 MW within minutes.

12 January: China said it plans to take an annual inventory of its greenhouse gas emissions as it tries to boost its carbon trading capability and ensure it meets its climate targets. The government aims to "compile a year-by-year national greenhouse gas inventory" as part of efforts to halt the rise in emissions before 2030 and achieve carbon neutrality by 2060, China’s cabinet said. The world’s biggest carbon polluter has not previously published annual updates about how much greenhouse gas it produces, but it has been obliged to submit figures to the United Nations (UN) every five years. China said in its UN submission that it had been working to improve the integrity of its statistics and bring them in line with international standards. It highlighted "uncertainties" in its estimates of greenhouse gas from road traffic as well as methane emissions from rice cultivation.

11 January: Global renewable energy capacity is expected to grow by two and a half times by 2030 but governments need to go further to achieve a goal of tripling it by then agreed at United Nations' climate talks, the International Energy Agency (IEA) said. In its annual renewable energy outlook report, the IEA said new capacity added last year increased by 50 percent from the previous year to 510 gigawatt (GW). That takes installed capacity to 3,700 GW. Under current policies and market conditions, global renewables capacity is forecast to grow to a total of 7,300 GW by 2028. To reach the 2030 goal agreed last year, it will require reaching at least 11,000 GW. World governments agreed to triple renewable energy generation capacity by 2030 and move away from fossil fuels at the COP28 UN climate conference in Dubai last December. But no mechanism was agreed to finance the shift to clean energy in developing countries.

11 January: Brazil’s state run oil firm Petrobras, opens new tab has ruled out investing in wind and solar power abroad, deciding instead to focus on building a portfolio of local greenfield projects, energy transition head Mauricio Tolmasquim said. Last year, Petrobras Chief Executive Officer (CEO) Jean Paul Prates said the company was analyzing the potential purchase of a minority stake in offshore wind farms outside Brazil. The shift to local renewable projects meets the ideas President Luiz Inacio Lula da Silva has for the company, with a focus on creating local jobs and enhancing the energy transition in Brazil. By 2028, the firm will invest US$5.2 billion in solar and wind power with an initial focus on onshore plants, while researching the development of offshore wind in Brazil, CEO said when they unveiled Petrobras' new business plan in November.

10 January: Nuclear power production in France jumped to its highest levels in three years over the first nine days of January, marking an 18 percent jump in nuclear generation from the same period in 2023, according to power generation data compiled by LSEG. Higher French output comes just as a cold snap extending from the Nordic countries has lifted regional demand for heating, and has allowed Europe’s largest electricity exporter to boost clean power flows to neighbouring nations so far this year, data from the International Energy Agency shows (IEA). If France’s main power provider EDF can sustain high levels of clean power output and exports, utilities elsewhere may be able to limit fossil fuel use in power generation this winter, and potentially avert the traditional surge in power pollution tied to greater heating-related generation. Extended maintenance issues at key but aging reactors curbed France's nuclear generation to 34-year lows in 2022, forcing power firms to increase fossil fuel use in electricity generation in Europe's most nuclear-dependent power system. Nuclear output shortages also forced French power firms to sporadically reverse traditional power flows within Europe by becoming net importers, worsening the regional power price crisis in the wake of Russia's invasion of Ukraine. Engineers worked to restore output through 2023 and managed to lift total nuclear generation by nearly 15 percent by the end of the year from 2022’s stunted total, LSEG data shows.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +