-

CENTRES

Progammes & Centres

Location

Network industries, including electricity, natural gas, rail transportation and telecommunications, consist of potentially competitive activities, such as electricity generation, with naturally monopolistic ones, such as transmission and distribution of electricity. This combination produces a unique set of challenges to competition law and policy in designing a market structure and regulatory framework which maximise the benefits of liberalisation while effectively controlling any tendencies to monopolistic abuse. Mumbai, India where parallel licencing in electricity retail was introduced unintentionally illustrates this challenge.

The Electricity Act 2003 (EA 2003) provides for opening up electricity distribution to the private sector. Section 14 of EA 2003 which allows parallel licencing states that “the appropriate commission may grant a licence to two or more persons for distribution of electricity through their own distribution system within the same area, subject to the conditions that the applicant for grant of licence. The grant of the licence within the same area, subject to the conditions that the applicant for grant of licence within the same area shall, without prejudice to the other conditions or requirements under this Act, comply with the additional requirements (including the capital adequacy, credit-worthiness, or code of conduct) as may be prescribed by the Central Government, and no such applicant who complies with all the requirements for grant of licence, shall be refused grant of licence on the ground that there already exists a licensee in the same area for the same purpose”.

Parallel licensing in Mumbai was initiated not through policy or a careful reading of Section 14 of EA 2003, but through litigation over power purchase agreements (PPAs) between existing players when EA 2003 was enacted. Analysis of the outcome may be seen both as a muddle or a model for delicencing electricity retail across India in the future.

The “muddle” lens of the electricity delicencing experiment in Mumbai exposes sub-optimal outcomes for customers and complex challenges for regulators, who need to balance the interests of the licensees and those of the consumers, and also for the judiciary that has to interpret Section 14 and related provisions of EA 2003. Despite multiple regulatory and judicial interventions since 2008, expected outcome of competitive tariff for consumers has not materialised. In addition, issues of cherry picking of consumers by one distribution licensee (DL) in the area served by the other, disputes over duplication of distribution networks, cherry picking of consumers, use of networks owned by one licensee by the other, and over cross subsidies over use of the distribution network, power purchase agreements (PPAs) continue to persist along with other challenges.

Since the introduction of parallel licencing in 2008, Tata Power Corporation—Distribution (TPCD) and Reliance Infrastructure Distribution (erstwhile Bombay Suburban Electric Supply Limited or BSES, later acquired by Reliance Infrastructure limited [Rinfra] which was taken over by Adani Electricity Mumbai Limited [AEML] in 2017), the Brihanmumbai Electric Supply & Transport [BEST] and Maharashtra State Electricity Distribution Corporation Limited [MSEDCL] have indulged in legal conflict over the interpretation of provisions in section 14 of EA 2003.

In 2008, the Supreme Court held that TPCD, that was a bulk supplier of electricity in Mumbai and was entitled to supply electricity in retail, directly to all consumers within its area of supply, as stipulated in its licences following provisions of EA 2003. Subsequently, the Maharashtra Electricity Regulatory Commission (MERC) confirmed TPCD as a DL for the entire city of Mumbai, covering the licence areas of both BEST and Rinfra. TPCD’s distribution licence was valid up to August 2014. In 2014, TPCD secured a licence to distribute electricity in the entire Mumbai district, part of the Mumbai suburban district and the entire municipal corporation area(legally contested). The distribution licence (DL) was granted for a period of 25 years effective from August 2014 till August 2039. The DL covered an area overlapping the entire licensed area of Rinfra, BEST and MSEDCL.

Historically, TPCD was a power generator and bulk supplier of power in Mumbai. One of the bulk power purchasers with whom TPCD had signed PPAs was Rinfra. This relationship created unique challenges when TPCD entered distribution. As TPCD had access to low-cost power, it was able to offer lower tariffs to consumers in areas where it was a parallel licensee. This facilitated bulk consumers and eventually also domestic consumers to switch suppliers from Rinfra to TPCD. This was an intended outcome. However, TPCD had no incentive to supply power to Rinfra at competitive rates. This imposed additional costs on Rinfra in securing PPAs with alternative suppliers. For its part, Rinfra could impose wheeling charges on TPCD for transporting electricity on behalf of TPCD on its distribution network. These issues were part of the legal conflict between the players in the arena. The prospect of TPCD building its own distribution network, thus duplicating the existing network controlled by Rinfra was another contested issue. The result was a patchwork of temporary solutions imposed by the regulatory and other institutions such as cost plus mechanism for tariff determination. The cost-plus mechanism allowed parallel distributers in Mumbai to source expensive power purchased through short-term power markets and pass on the costs to the consumer. Customer interest was compromised as the cost of power procured through short-term markets was typically higher than that of power purchased through long-term PPAs. Customers also had to bear the risk of uncertainty in tariffs when a large share of the power supplied was procured through short-term markets. Structural barriers such as limitation in transmission capacity limited low-cost power procurement from outside the Mumbai area through competitive bidding. This meant a higher average tariff for consumers. When regulated tariff did not permit full cost recovery, DLs transformed unrecovered costs into regulatory assets, essentially costs recoverable from customers in the future through regulated tariffs. This was not an intended outcome of competition in retail electricity. Seen through the “muddle” lens, parallel licensing in Mumbai highlights inequitable outcomes for consumers reflected in high and uncertain tariffs and sub-optimal consequences of regulatory inadequacy reflected in incessant litigation. This is not an outcome that one would expect in Mumbai which exhibits high household density (number of consumers per unit area), a distribution network that is mostly underground that reduces losses, few agricultural consumers and higher household incomes compared to most of the rest of India all of which contribute to lower distribution losses and greater tolerance for higher electricity tariff. And yet parallel licencing has not been a great success.

The “model” lens highlights the introduction of private players in electricity distribution and the consequent improvement in the financial and technical efficiency of their operations. Even small improvements in the economic and technical efficiency of operations of private licensees’ stands in contrast to the persistent underperformance of state-run distribution companies (discoms) that are forced to carry social burdens (sustaining employment and subsidies). The annual integrated rating and ranking of power sector utilities by power finance corporation (PFC) rates distribution companies on parameters based on (i) financial sustainability (average cost of supply[ACS]-annual revenue realised [ARR], days receivable, days payable to gencos and transcos, adjusted quick ratio, debt service coverage ratio, leverage [debt/earnings before interest, tax and amortization]) (ii) performance (distribution loss, billing efficiency, collection efficiency, corporate governance and (iii) external environment (subsidy realised, loss taken over by state government, government dues, tariff cycle timelines and auto pass-through of fuel costs). In the 12th annual rating and ranking of distribution companies for 2023, six out of the top ten ranks go to private companies and the top rank and rating goes to one of the parallel licensees in Mumbai, Adani Energy Mumbai Limited (AEML). AEML serves 7 divisions of Mumbai city and serves over 3 million retail customers. It has no agricultural consumers and over 14 percent of its customers are from the commercial & industrial segments. AEML had a billing efficiency of 93.7 percent and collection efficiency of 99.8 percent. Its days receivable was 17 and days payable was 38. The aggregate technical and commercial losses (AT&C) in the areas served by AEML fell from 11 percent to about 6 percent over 5 years. AEML also claims that it has increased the share of renewables from 3 percent to over 30 percent with 50,000 green tariff customers. In 2023, applications of Adani Electricity Navi Mumbai (AENML) and Torrent Power Ltd (TPL) were pending before MERC for parallel licences in the jurisdiction of the MSEDCL illustrating the attractiveness of the business for private players.

Since the implementation of parallel licencing in Mumbai, structural issues that contributed to the “muddle” have improved substantially. There are a number of options for retail distributers to source power as constraints in transmission have been resolved. This has eliminated the need for cost-plus regulation of tariff. Overall tariff and uncertainty over tariff have reduced for domestic retail consumers. Consumer experience with billing and exercise of choice has also improved substantially with introduction of new technology. Separation of carriage (wires) and content (electricity) is yet to materialise physically but it is functioning in practice with the use of distribution network common to all the DLs who pay wheeling charges. The two private parallel licensees TPCD and AEML have no regulatory assets as of 2022, and their financial sustainability is among the best in the country. However, this does not mean that the parallel licencing muddle is now a model for the rest of the country. Unique features of Mumbai city that include high density with no agricultural consumers, greater incomes that can accommodate higher tariff and a long history of private sector presence in generation and distribution that are critical to accommodating parallel licencing cannot be replicated across the country. In many states agricultural or subsidised consumption of electricity is dominant and incumbent distribution companies are saddled with high levels of debt. The Mumbai model demonstrates the tendency of DLs to “vertically integrate” with their own sister concerns that generate power. This has the potential to limit the benefits of competition in retail particularly in the context of reducing tariff. The fact that there is no fully evolved wholesale market for power procurement along with the fact that there is no market for fuels (coal, natural gas, hydro, nuclear, renewables) has limited reduction in tariff, one of the key benefits of competition.

Regulation is necessary, because in most cities or States in India, no more than two or three DLs are likely to compete. This would be oligopolistic competition with limited benefits. The complexities in sourcing power in the early stages of introducing parallel licencing in Mumbai clearly highlights that wholesale competition must be in place before retail competition is introduced across the nation. In the case of Mumbai, retail competitor Rinfra was dependent upon its retail rival TPCD for its electricity supply. This created a price squeeze situation. Judiciary and regulatory interventions were inadequate in addressing price squeeze. Competition continues to be limited to a struggle for customers between privately owned and publicly-owned DLs in Mumbai. The arena for competition should be expanded, as the wireless telecommunications industry illustrates, to offer benefits to consumers not obtainable from regulation alone. Studies have shown that the only successful regulation of electric utilities has been to introduce competition and competitive interaction that eliminates the need for regulation. In mature electricity markets, distribution utilities exposed to true competition have lowered prices and gained sales. More crucially, their finances have met the regulatory test of attracting capital for expansion. In a number of cases, rates of return have risen and exceeded those of comparable companies not under competition. The key lesson from the Mumbai muddle is for legislators, regulators, and courts to recognize that regulation is not a substitute for competition, but rather is an adjunct to competition.

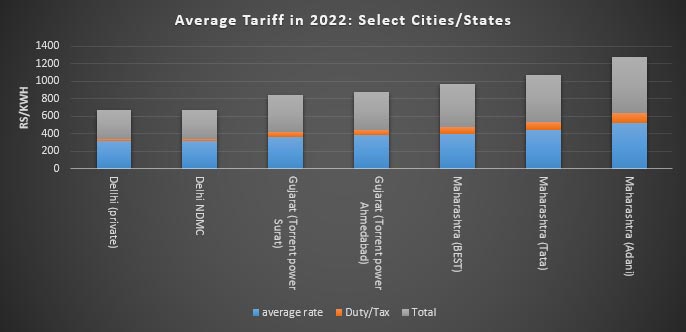

Source: Central Electricity Authority

Demand Growth

According to Union Ministry of Power, peak power demand in India is likely to cross 400 GW (gigawatt) by 2030 and more generation capacity is being set up to meet the rising demand. Electricity is the most important infrastructure which is a sine qua non for development, it said. One major distinguishing feature between a developing and a developed country is that in a developed country, there is no load shedding. It said that the nation will add enough capacity to meet this burgeoning demand.

The national capital’s peak power demand recorded an all-time high winter power demand, reaching 5,816 megawatt (MW) - the highest ever for the winter months, surpassing the previous record of 5,798 MW set on 19 January. Remarkably, this is the sixth instance in January when Delhi’s power demand exceeded last year’s peak winter demand of 5,526 MW, recorded on 6 January 2023. Barring 2 January, the city’s peak demand has consistently surpassed 5,000 MW every day this month so far. The surge in power demand comes on the back of a cold wave across northern India. In the areas served by BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Ltd (BYPL), peak demand reached 2,526 MW and 1,209 MW, respectively. As per the Tata Power Delhi Distribution Ltd, it met its highest winter peak power demand of 1,826 MW.

The 4,000 MW power project — Patratu Vidyut Utpadan Nigam Limited (PVUNL) — a joint venture of the NTPC Ltd and the Jharkhand Bijli Vitaran Nigam Limited (JBVNL) formed after scrapping the old Patratu Thermal Power Station (PTPS) will bring a revolutionary change in the power sector of Jharkhand, making it self-sufficient in terms of power requirement. According to the Memorandum of Understanding (MoU) signed between the NTPC and the JBVNL, 85 percent of the power produced from PVUNL will be supplied to Jharkhand. The mega power plant conceived in 2016 will comprise five units of 800 MW each and will be commissioned in two phases — 2,400 MWs (3x800 MW) in the first phase and 1,600 MWs (2x800) in the second phase.

Discom Reform

A roadmap to eliminating power cuts, which has eluded the Noida city (Uttar Pradesh) for decades even as it has grown manifold – both in terms of economy and population – is finally taking shape. The Noida Authority has allocated INR2 billion (bn) (US$24.1 million (mn)) for a pilot project to move power transmission lines under the ground in three sectors — 3, 15A and 47. Apart from these sectors, the Authority will shift 11 kV (kilovolt) and 33 kV lines underground in some other areas of the city where roads are undergoing a revamp. Occurring almost daily, power cuts have stood out as a sore point in Noida’s concerted push to promote the NCR city as a business destination.

Polaris Smart Metering has secured two smart meter projects totalling INR52 bn (US$627.4 mn) in Uttar Pradesh. Madhyanchal Vidyut Vitran Nigam Limited (MVVNL) has awarded the contracts for installing over 5.1 million smart meters in the important clusters of Lucknow and Ayodhya/Devipatan, which the company plans to install over the next 27 months. As per the agreement, Polaris Smart Metering will supply, commission, install and maintain smart meters for consumers and system metering across the consumer base in these clusters for the next 10 years.

Electric equipment maker HPL Electric and Power has bagged an order worth INR2.4 bn (29 mn) for smart meters from Advanced Metering Infrastructure Service Provider (AMISP). This accomplishment adds to HPL’s already existing significant order pipeline, reinforcing its ongoing upward momentum in the dynamic smart meter sector, the company said.

Generation

Prime Minister (PM) of India dedicated two power projects by NTPC and laid the foundation stone of another with a total investment of INR289.78 bn (US$3.5 bn) in Odisha on 3 February. Located in Sundergarh district, the Darlipali STPP is a pit-head power station with supercritical (highly efficient) technology and will supply low-cost power to its beneficiary states such as Odisha, Bihar, West Bengal, Jharkhand, Gujarat and Sikkim. The 250 MW project of NTPC-SAIL Power Company Ltd was established in Rourkela Steel Plant (RSP) to provide reliable power for the steel plant, which is vital for economic growth. NTPC is developing the Talcher Thermal Power Project, Stage-III, within the old TTPS plant premises in Angul district, was taken over by NTPC from Odisha State Electricity Board in 1995.

Regulation and Governance

According to Prime Minister (PM) Narendra Modi the Bharatiya Janata Party (BJP) government at the Centre is moving towards making the electricity bill of the households in the country zero. PM’s remarks came while addressing a gathering after inaugurating and laying the foundation stone of projects worth INR115.99 bn (US$1.4 bn) in Guwahati.

The Jaipur Vidyut Vitran Nigam Limited, a Rajasthan government-owned power discom (distribution company), vehemently opposed in the Supreme Court (SC) a plea of Adani Power seeking over INR13 bn (US$156.9 mn) as late payment surcharge (LPS) from the state discom. A bench comprising Justices Aniruddha Bose and PV Sanjay Kumar reserved its order on Adani Power Rajasthan Ltd (APRL)’s petition pertaining to its demand for late payment surcharge after hearing heated arguments by senior lawyers Abhishek Singhvi and Dushyant Dave.

According to Union Ministry of Power, the Union government is looking to set March 2025 as the deadline for 24x7 electricity supply across the country. After connecting all households with electricity supply through two flagship schemes in the past decade, the Bharatiya Janata Party (BJP)-led central government now plans to ensure uninterrupted reliable power supply by the end of 2024-25 (FY25).

North & South America

According to the US Energy Information Administration (EIA), United States (US) power consumption will rise to record highs in 2024 and 2025. EIA projected power demand will rise to 4,112 billion kilowatt hours (kWh) in 2024 and 4,123 billion kWh in 2025. That compares with 3,994 billion kWh in 2023 and a record 4,070 billion kWh in 2022. As homes and businesses use more electricity instead of fossil fuels for heat and transportation, EIA forecast 2024 power sales would rise to 1,530 billion kWh for residential consumers, 1,396 billion kWh for commercial customers and 1,035 billion kWh for industrial customers. That compares with all-time highs of 1,509 billion kWh for residential consumers in 2022, 1,391 billion kWh in 2022 for commercial customers and 1,064 billion kWh in 2000 for industrial customers.

According to the US EIA, wholesale electricity prices for 2024 in most areas of the US are seen to be close to or slightly lower than in 2023, because of relatively stable generation fuel costs. Periods of high demand or power market supply constraints, however, could lead to temporary spikes in wholesale prices, it said. EIA forecasts US wholesale prices to range between US$30 per megawatt hour (MWh) and US$40 per MWh outside of the Northeast, where the agency expects prices to increase and average US$48/MWh in New York and US$60/MWh in New England. The main source of electricity in the US is natural gas-fired generation, with EIA expecting natural gas prices for the production of electricity to average US$2.91 per million metric British thermal units (mmBtu) in 2024 compared with US$3.29 per mmBtu in 2023. In most areas, average wholesale electricity costs should remain lower than or comparable to those of the previous year due to lower natural gas prices, the report said. US wholesale power prices are typically calculated on an hourly or daily basis and are designed to reflect market conditions at a specific time.

A winter storm bringing snow, ice and high winds to parts of the US Midwest and Pacific Northwest knocked out power for hundreds of thousands of homes and businesses, with a brutal freeze expected to grip numerous states. The US Federal Aviation Administration (FAA) said storms continue to cause flight cancellations and delays. Some 150,000 homes and businesses were without power in Michigan. Power was out for another 200,000-plus customers in Oregon and Wisconsin.

The Alberta Electric System Operator (AESO) lifted the grid alert issued earlier in the day asking customers to reduce their consumption to avoid a power shortfall after a demand spike caused by extreme cold. The AESO earlier declared the grid alert and asked citizens to immediately reduce their electricity use to essential needs in response to ongoing extreme cold temperatures across western Canada, restricted imports and very high demand. The AESO had projected a shortfall of up to 200 megawatt (MW) of electricity during the peak evening hours and warned of potential rotating outages until demand declined or generation returned to the grid. The AESO said after the alert was issued, it almost immediately saw a 100 MW drop in electricity demand which rose to 200 MW within minutes.

Europe & Russia

Norwegian natural gas exports were curtailed due to an unplanned outage at the Nyhamna processing plant following a power cut at the weekend amid high winds, operator Shell, opens new tab said. The power line which tripped and caused the outage at Nyhamna was repaired late, transmission grid operator Statnett said.

Ukraine reported a surplus of electricity production and intends to export it to neighbouring Moldova and Poland, Ukrainian energy ministry said. Ukraine had produced more energy than it consumed before the Russian invasion in 2022, but that output has dropped since the Russian attacks on power facilities and the occupation of Europe’s largest Zaporizhzhia nuclear power plant. Ukraine’s Energy Minister German Galushchenko said that Ukraine could resume substantial energy exports as early as this spring due to lower consumption. Ukraine banned exports during the last heating season amid Russian attacks on Ukraine’s energy system and large-scale shutdowns.

Major German power utility EnBW, opens new tab, a likely bidder in auctions for building initially gas-fired generation capacity under a new government scheme, could draw on its existing plant sites, its Chief Executive Officer (CEO) Andreas Schell said. The company, alongside sector peers Uniper and RWE, opens new tab, is tipped to be among those responding to the long-awaited roadmap laying out details of a possibly €40 billion (US$43.6 billion) plan to avoid power shortages caused by volatile renewable generation, once coal is abandoned. The plan entails state-support for perhaps 20-25 GW of electricity-producing capacity by 2035, which will either be new stations or old ones that are converted, and which are made ready for clean hydrogen operations in the long term. Germany’s Economy Minister Robert Habeck said a much-anticipated roadmap for how a new generation of gas-fired power plants would be put out to tender was imminent, fuelling hopes of financial support for the construction of these stations. The plan, with an estimated cost of up to €40 bn (US$43.5 bn), aims to ensure enough electricity generation until renewable energy can overcome storage issues and inadequate grid technology to fully replace fossil fuels. German stakeholders were set to agree a deal on the power plant expansion strategy, which has drawn criticism from environmental campaigners keen to phase out coal and gas as soon as possible.

Sweden’s power demand could rise some 150 percent by 2045, transmission grid operator Svenska kraftnat said, driven by plans for new industrial developments and the conversion of fossil fuel-based industries to non-polluting energy sources. Overall demand could rise from 138 terawatt hours (TWh) in 2022 to just over 340 TWh in 2045 under two of the four scenarios the TSO presented in its latest long-term market analysis. The scenarios were deemed the most likely as they closely align with government projections of 300 TWh demand in 2045. To meet the higher demand, Sweden would need to add on average 7.5 TWh of new power generation per year over the next 20 years.

12 February: India’s demand for petroleum products is likely to increase by a mid-single-digit percentage in the financial year ending March 2024, following a 10 percent post-pandemic recovery in 2022-23, according to Fitch Ratings. Both petrol and diesel sales recorded robust 4-6 percent increases in the first nine months of 2023-24, fuelled by heightened economic activities in the agriculture and power sectors, coupled with a surge in holiday travel and auto sales. Fitch said it expects Indian refiners' gross refining margins (GRM) to moderate during 2024-25 from the strong levels expected in 2023-24, but remain above mid-cycle levels. By 2025-26, it foresees a shift closer to mid-cycle levels, but remaining resilient, bolstered by the escalating demand for end-products. In the upstream segment, domestic oil and gas production has modestly increased, driven by a 5 percent rise in gas production in the first nine months of 2023-24. Fitch forecasts the oil and gas sector’s high capex intensity to continue in the medium term, particularly with upstream companies investing in production enhancement.

8 February: India wants to sign a multi-year oil purchase deal with Guyana and acquire stakes in the South American nation’s exploration areas, the Guyanese minister for natural resources Vickram Bharrat said. He said any such deal with India would have to be approved by Guyana’s cabinet. India, the world’s third-biggest oil importer and consumer, wants to diversify its crude sources. India approved the signing of a five-year Memorandum of Understanding (MoU) with Guyana earlier this month for cooperation in energy. After a meeting with India’s Oil Minister, Hardeep Singh Puri, Bharat said Indian companies are interested in picking up stakes in Guyana’s exploration acreage through negotiation rather than a bidding process.

8 February: India’s fuel consumption rose 8.2 percent year-on-year in January, government data showed, helped by strong industrial activity in the world’s third largest oil consumer. Total consumption, a proxy for oil demand, totalled 20.04 million tonnes (MT) in January, up from 18.51 MT a year earlier, data from the Petroleum Planning and Analysis Cell (PPAC) of the oil ministry showed. Consumption held relatively steady month-on-month from December’s seven-month high of 20.05 MT.

8 February: At the India Energy Week 2024 in Goa, Bharat Petroleum Corporation Ltd (BPCL) took a significant step towards enhancing the efficiency of LPG cylinder delivery in India. The company has launched a ground-breaking initiative titled "Pure for Sure" that emphasizes quality and quantity assurance for LPG cylinders. The announcement was made by the Minister of Petroleum and Natural Gas, Hardeep Singh Puri, with the aim of improving customer satisfaction. The "Pure for Sure" initiative is a first-of-its-kind in the industry, designed to ensure the integrity of the product from the production plant to the customer’s doorstep. To do so, BPCL has introduced a tamper-proof seal with QR codes on the cylinders. When these QR codes are scanned, customers receive a pop-up and a signature tune that indicates the cylinder’s gross weight at the time of filling, enabling them to verify the cylinder before acceptance. In a progressive move, BPCL plans to include women in the LPG delivery process, acknowledging their understanding of the product. This shift not only promotes gender equality but also adds a unique perspective to the delivery process. With the launch of the "Pure for Sure" initiative, BPCL is poised to redefine the standard in LPG cylinder delivery, focusing on reliability, transparency, and excellence in customer service.

7 February: India is expected to be the largest driver of global oil demand growth between 2023 and 2030, narrowly taking the lead from top importer China, the International Energy Agency (IEA) said. The world’s third-largest oil importer and consumer is on track to post an oil demand increase of almost 1.2 million barrels per day (bpd) between 2023 and 2030, accounting for more than one-third of the projected 3.2 million bpd of global increases in the period, the IEA said in a report. The agency forecast India’s demand would reach 6.6 million bpd in 2030, up from 5.5 million bpd in 2023. The single largest basis of India’s oil consumption will be diesel fuel, accounting for almost half of the rise in the nation’s demand and more than one-sixth of total global oil demand growth through to 2030, the IEA said. Jet fuel is poised to grow 5.9 percent annually on average but this will be from a low base compared with other countries, it said. To meet this demand, India is expected to add 1 million bpd of new refining capacity over the seven-year period and this will increase its crude imports further to 5.8 million bpd by 2030, the IEA said.

7 February: Indian Strategic Petroleum Reserve Ltd (ISPRL) has signed a deal with Hindustan Petroleum Corporation Ltd (HPCL) to lease 300,000 metric tonnes of storage space for three years in a Strategic Petroleum Reserve (SPR) in Vizag in southern India. ISPRL operates three SPRs in southern India with combined capacity of about 5 million tonnes (MT). ISPRL said the contract with HPCL is for two years with a provision to extend it by one year. The 1.03 MT SPR at Vizag is half filled with Iraqi oil. And after leasing of space to HPCL, there is scope to rent out the remainder 200,000 tonnes space. ISPRL will soon invite bids to lease out half of the 1.5 MT SPR in Mangalore, where one of the two equally sized compartments has been leased to UAE’s ADNOC. ISPRL has been selling from the caverns to local refiners after a change in the government rules in 2021.

13 February: Clean fuel supply in Kolkata is set to receive a significant boost in the coming months with the completion of the main trunk GAIL gas transportation pipeline. Bengal Gas Company Ltd CEO (chief executive officer) Anupam Mukhopadhyay stated that the GAIL gas pipeline would be completed within the next three months, with the resolution of an 800-meter hurdle and the necessary statutory clearances.

8 February: India’s Petronet LNG plans to begin supplying liquefied natural gas (LNG) to neighbouring Sri Lanka for five years starting in 2025, its chief executive officer (CEO) Akshay Kumar Singh said. Petronet will ship 850 metric tonnes of gas daily to the island nation in 50 containers of 17 tonnes each, he said. The project will supply two gas-fired power plants in Sri Lanka, which has suffered from crippling power blackouts and fuel shortages. Petronet plans to commission a floating storage regasification unit (FSRU) in Sri Lanka and hopes to gain government approval by 2025 to build the facility by 2028. He said that Petronet, India’s top gas importer, is looking for more long-term gas deals. The company signed a deal for QatarEnergy to supply it with 7.5 million tonnes of LNG annually from 2028 to 2048, extending an existing agreement.

13 February: India’s coal import registered a rise of 27.2 percent to 23.35 million tonnes (MT) in December, over the corresponding month of the previous fiscal. The coal ministry is aiming for zero thermal coal import by FY26. The country’s coal import was 18.35 MT in the corresponding month of the previous fiscal, according to data compiled by mjunction services ltd. Of the total imports in December, non-coking coal imports stood at 15.47 MT, against 10.61 MT imported in December 2022. Coking coal import volume was 4.84 MT, against 4.71 MT imported in the same month of the previous financial year. The coal import in the April-December period of the current fiscal increased to 192.43 MT, over 191.82 MT in the year-ago period. During the April-December period of the current fiscal, non-coking coal import was at 124.37 MT, marginally lower than 126.89 MT imported during the same period in the previous financial year. Coking coal import was at 42.81 MT during April-December 2023-24, slightly up against 41.35 MT recorded for April-December 2022-23.

7 February: Chhattisgarh Chief Minister (CM) Vishnu Deo Sai announced in the Assembly scrapping of an order issued during the previous Congress government regarding the issuance of permits for coal transportation in the state through offline mode. The move will restore the old system of coal transportation by seeking transport permits online.

11 February: No subsidised power will be provided to any minister, officer or government employee in Assam, Chief Minister (CM) Himanta Biswa Sarma said. He has instructed the power department to install prepaid meters in government quarters, including residences in the ministerial colony. Sarma that he was informed by power department officials during a recent interaction that a very nominal amount on account of the monthly power bill is deducted from the salaries of ministers and senior officers.

7 February: The Jharkhand government decided to increase the limit of free electricity to 125 units from the existing 100 units per month for domestic consumers. In a review meeting with senior officials including the chief secretary, Chief Minister (CM) Champai Soren directed the energy department to prepare a proposal in this regard. The state government started the '100-unit free electricity' scheme in 2022 with an aim to reduce financial burden of the people. The scheme is applicable up to the consumption of 100 units of electricity per month for domestic connections.

11 February: Chhattisgarh has inaugurated the country’s biggest solar energy plant with a battery energy storage system located near the Dhaba village in the Rajnandgaon district. This solar facility established by the Solar Energy Corporation of India (SECI) and Chhattisgarh Power Distribution Company provides a capacity of 100 megawatt (MW). This solar plant ensures that there will be electricity even during the night generating over five lakh units per day. This will reduce 4.5 lakh metric tons of carbon emission and boost green energy. The on-grid solar power plant set-up by the Chhattisgarh Renewable Energy Development Agency (CREDA) is a significant step towards sustainable energy. The plant was established on 1 February 2024. The plant features a 100 MW solar plant equipped with 2,39,000 bifacial solar panels which is producing electricity from both the sides. The plant is expected to generate power for the next seven years using solar energy. The decision to establish the first solar park in the Bairam hill area of the Rajnandgaon district was taken by the Chhattisgarh government to maximize the use of these hilly terrains for solar power.

8 February: To propel the adoption of solar energy, the Uttar Pradesh (UP) government has unveiled plans to transform 17 major cities of the state into solar cities including revered cities of Ayodhya and Varanasi. Under the initiative, the development of solar cities will take place first and then the government will work towards building solar villages on the same pattern. Notably, the administration has already started its efforts to establish Ayodhya as the inaugural solar city. Recently, state’s Energy Minister A K Sharma underscored UP’s commitment to solar energy advancement and revealed that the state is poised to emerge as a leader in the solar energy domain, with initiatives already gaining momentum. Ayodhya’s solar city project encompasses the installation of over 2,500 solar-powered streetlights, enhancing the sacred city’s commitment to sustainability. CM (Chief Minister) Yogi Adityanath started a solar boat service in Ayodhya. The city already boasts solar-powered amenities such as ATMs and solar trees adorning its 40 intersections, epitomising the city’s embrace of renewable energy solutions. With Ayodhya spearheading the solar energy adoption, another major city Varanasi is making a foothold to install rooftop solar plants across government buildings. Under the project, Varanasi is slated to witness the installation of 25,000 rooftop solar plants, positioning it as a beacon of solar innovation.

7 February: SJVN Ltd said it has received a letter of intent (LoI) from Gujarat Urja Vias Nigam Ltd to set up a 200 megawatt (MW) solar power project. The tentative cost of construction and development of this project is INR11 billion, SJVN chairman and managing director (CMD) Geeta Kapur said. The ground-mounted solar project shall be developed by SJVN subsidiary SJVN Green Energy Ltd (SGEL) anywhere in India through an EPC contract. The Power Purchase Agreement (PPA) shall be executed with GUVNL after the adoption of the tariff by GERC (Gujarat Electricity Regulatory Commission), it said. The project is expected to generate 508.4 million units in the first year after commissioning and the projected cumulative energy generation over a period of 25 years is 11,836.28 million units.

13 February: OPEC (Organization of the Petroleum Exporting Countries) stuck to its forecast for relatively strong growth in global oil demand in 2024 and 2025 and raised its economic growth forecasts for both years saying there was further upside potential. The OPEC said world oil demand will rise by 2.25 million barrels per day (bpd) in 2024 and by 1.85 million bpd in 2025. A further boost to economic growth could give additional tailwind to oil demand. OPEC’s 2024 demand growth forecast is already higher than that of other forecasters such as the International Energy Agency (IEA), although the wider OPEC+ alliance is still cutting output to support the market. For this year, OPEC’s expectation of oil demand growth is much more than the expansion of 1.24 million bpd so far forecast by the IEA. The IEA, which represents industrialised countries, is scheduled to update its forecasts. OPEC and the IEA have clashed in recent years over issues such as long-term demand and the need for investment in new supply. The IEA sees oil demand peaking by 2030 as the world shifts to cleaner energy, a view OPEC dismisses.

12 February: United States (US) oil output from top shale-producing regions will rise in March to its highest in four months, the US Energy Information Administration (EIA) said. Production from the top basins will rise by nearly 20,000 barrels per day (bpd) to 9.7 million bpd, its highest since December, the EIA said. Oil output in the Permian basin, the largest US shale field spread across West Texas and New Mexico, was due to rise by about 14,000 bpd to 6.1 million bpd, the second highest monthly output on record after November, the EIA said. Production in the Eagle Ford in southeast Texas was due to rise nearly 4,700 bpd to 1.1 million bpd, the highest since September, the EIA said. In the Bakken, output was set to rise by about 3,000 bpd to 1.2 million bpd, the highest since December.

12 February: The International Monetary Fund (IMF) said Middle East economies were lagging below growth projections due to oil production cuts and the Israel-Gaza conflict, even as the global economic outlook remained resilient. In a regional economic report last month, the IMF revised its GDP growth forecast for the Middle East and North Africa down to 2.9 percent this year, lagging below October projections, due in part to short term oil production cuts and the conflict in Gaza.

8 February: French energy giant TotalEnergies is seeking to sell its minority share in a major Nigerian onshore oil joint venture, following Shell’s divestment, CEO (chief executive officer) Patrick Pouyanne said. The Shell Petroleum Development Company of Nigeria Limited (SPDC), in which TotalEnergies holds a 10 percent stake, has struggled with hundreds of onshore oil spills as a result of theft, sabotage and operational issues that led to costly repairs and high-profile lawsuits over the years. TotalEnergies is the latest international oil company seeking to withdraw from Nigeria’s onshore sector after decades of operations. But the French group, which produced a total of 219,000 barrels of oil equivalent per day in 2023 in Nigeria, remains a major operator of offshore fields in the West African country. It announced the start-up of the Akpo West oilfield located 135 kilometres off the coast.

12 February: Faced with stubbornly high Russian gas imports as the war in Ukraine rages on, Austria is seeking to take more radical steps, including ending energy company OMV’s long-term contract to buy gas from Gazprom, Austria’s Energy Minister Leonore Gewessler said. Having long sought to maintain close ties with nearby Russia, Austria sought to end its decades-long dependency on affordable Russian gas soon after Russia invaded Ukraine in 2022, scrambling to find alternative providers. Gewessler said the Russian share of Austria’s gas imports actually increased in December to a new record of 98 percent from 76 percent the month before, even if the total volume of imports fell slightly.

9 February: The Russian government has extended a permit for its Yamal LNG plant to supply liquefied natural gas (LNG) to German nationalised gas importer and trader SEFE until 31 December 2040. Russia banned trade with a number of companies including Gazprom Germania in 2022, but a year later the government made a special dispensation for the company to allow the LNG sales until the end of 2024. The decision to extend the permission was published as Russia’s largest liquefied natural gas producer Novatek is facing sanctions and delays at its new Arctic LNG 2 project.

8 February: Germany will receive its first supplies of pipeline natural gas from Algeria under a medium-term contract signed between a subsidiary of trader VNG AG and oil and gas firm Sonatrach, the companies said. This makes VNG the first German company to purchase pipeline gas from Algeria. Germany has been forced to seek new suppliers after Russia’s invasion of Ukraine in February 2022 ended Germany’s decades of reliance on Russian gas. Algeria’s gas production at 106 billion cubic meters per year, according to Sonatrach.

7 February: British energy supplier Centrica has agreed to purchase 1 million metric tonnes of liquefied natural gas (LNG) from Spain’s Repsol between 2025 and 2027, Centrica said. The cargoes will be delivered to the Isle of Grain terminal in Kent in the South of England.

13 February: Asia’s imports of seaborne thermal coal eased from record highs in January as top buyers China and India saw arrivals ease. However, there was strength in Japan and South Korea, which helped drive some divergence in prices between the high-energy coal preferred by the third- and fourth-biggest importers in Asia, and the lower quality fuel sought by China and India. Asia seaborne imports of thermal coal, used mainly to generate electricity, dropped to 77.65 million metric tonnes in January, according to commodity analysts Kpler data. China’s January imports of seaborne thermal coal slipped to 27.92 million tons from December’s all-time peak of 31.59 million, but were still 34 percent above the 20.86 million from January 2023. China’s appetite for imported coal has been fuelled by strong demand for thermal generation amid lower output from hydropower, as well as by a price advantage compared to domestic coal prices. The main grades imported by China are lower-energy coal from Indonesia and mid-rank fuel from Australia.

13 February: United States (US) energy regulators have launched a review of the performance of the bulk power system during recent winter storms in January that brought Arctic air across much of North America, the North American Electric Reliability Corporation (NERC) said. Elliott was the name given to the system that brought frigid cold and blowing winds, knocking out power for more than 1.5 million homes and businesses across the US in December 2022. In November 2023, the US energy regulators urged lawmakers to fill a regulatory blind spot to maintain reliable supply of natural gas during extreme cold weather that was highlighted by an inquiry into power outages during Elliott.

8 February: German gas-fired electricity generation jumped to its highest levels in two years in January as power firms dialled up output to compensate for the closure of the country's nuclear reactors and meet higher heating demand during a cold snap last month. The 8.74 terawatt hours (TWh) of electricity generated from gas-fired power stations was the highest since January 2022, according to think tank Ember, which was just before Russia’s invasion of Ukraine led to the severing of gas pipeline flows to Europe's largest gas consumer and economy. Gas-powered generation was 13 percent above January 2023 levels, and helped lift Germany’s total electricity generation to its highest level in a year. Higher gas generation also lifted natural gas' share of Germany’s electricity generation mix to 18.6 percent, the highest since early 2021, which indicates that German power firms remain reliant on fossil fuels for electricity production despite ongoing energy transition efforts. While German power producers lifted generation from gas power plants in January, use of coal-fired generation remains below previous levels. Coal-fired electricity production in January was 10.83 TWh, which was down 29 percent from January 2023 and around 22 percent below the average coal generation levels of 2022.

8 February: China’s National Development and Reform Council (NDRC) is moving to refine the pricing mechanisms for services essential to stabilising power supply in markets increasingly dependent on wind and solar power, in a fresh step toward creating a national electricity market by 2030. NDRC said it would focus on optimising pricing mechanisms for standby capacity, frequency modulation and so called peak shaving - which are ancillary services essential to maintaining reliable electricity supply. The peak shaving market allows power companies to buy power from quick-ramping sources such as energy storage and flexible coal plants, to help them meet spikes in demand. Frequency regulation helps maintain normal frequency on the grid, a function that can be performed by battery storage systems and generators such as coal- and gas-fired plants. The ancillary services rule is among a series of basic documents setting out the rules for a national electricity market by 2025, with the market’s start targeted for 2030.

9 February: European Union (EU) countries voted to pass a law to reduce emissions from trucks, after late demands by Germany had threatened to sink the policy. The move is the latest in a string of last-minute upsets to European Union (EU) laws, caused by disputes within Germany’s three-way coalition government. The law, which will enforce a 90 percent cut in CO2 (carbon dioxide) emissions from heavy-duty vehicles by 2040, still needs approval from the EU Parliament to enter into force. To win Germany’s backing, EU countries agreed to add a preamble to the law which said the European Commission would consider developing rules to register trucks running on CO2 neutral fuels, which could count towards the targets, diplomats said.

8 February: Britain’s biggest bank HSBC has partnered with Google to finance fast-growing climate technology firms behind some of the world’s most promising solutions to global climate change. Under terms of the partnership, HSBC will look to provide financing to companies cherry-picked by the US technology giant to join its Google Cloud Ready-Sustainability programme. Scaling technologies that can help the corporate world move more quickly to a low-carbon economy dominated the COP28 climate talks in Dubai in December, and is a crucial part of most banks' efforts to drive a global push to cut emissions.

8 February: Australia experienced its eighth-warmest year in 2023, with the influence of climate change pushing average temperatures almost 1 degree Celsius (1.8 degrees Fahrenheit) above the 1961-1990 average, the weather bureau said. Last year’s extreme weather swings took Australia from widespread flooding and the coolest January since 2002 through the hottest southern hemisphere winter and early spring and driest three months on record to end with heavy rainfall as summer got underway. Forecasters warn that climate change will make Australia hotter and increase the severity of weather extremes. The bureau said that globally 2023 was the warmest year on record, with ocean temperatures at their highest ever since April and the extent of Antarctic sea ice at a record low for much of the year. For most of 2023, Australia was in the grip of an El Nino weather phenomenon - a warming of the Pacific Ocean waters along the equator off the coast of South America that typically causes hot, dry weather in Australia and Southeast Asia.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.