-

CENTRES

Progammes & Centres

Location

If consumers can choose their retail electricity supplier in India, will they choose and pay for electricity derived from renewable energy (RE) supplied by a private distribution licensee (DL) or distribution franchisee (DF)? Currently, there are provisions for consumers to opt for RE electricity through monopoly distribution companies (discoms) or DFs. The results so far are not encouraging, as the uptake of RE power and the number of consumers signing up for RE power are small. However, if distribution is delicensed, there is potential for dedicated suppliers of green electricity to emerge, offering RE energy products and services that are tailored to meet consumer preferences. DFs and DLs dedicated to providing RE power can use the green tariff route to offer clean power to commercial and industrial consumers (C&I) who must purchase RE power, and also to domestic consumers who want to contribute towards decarbonising the electricity sector. The green tariff option carries lower transaction costs compared to purchasing RE power through green power exchange or opting for procuring RE power directly from RE generators using the open access (OA) provision or setting up captive rooftop solar generators.

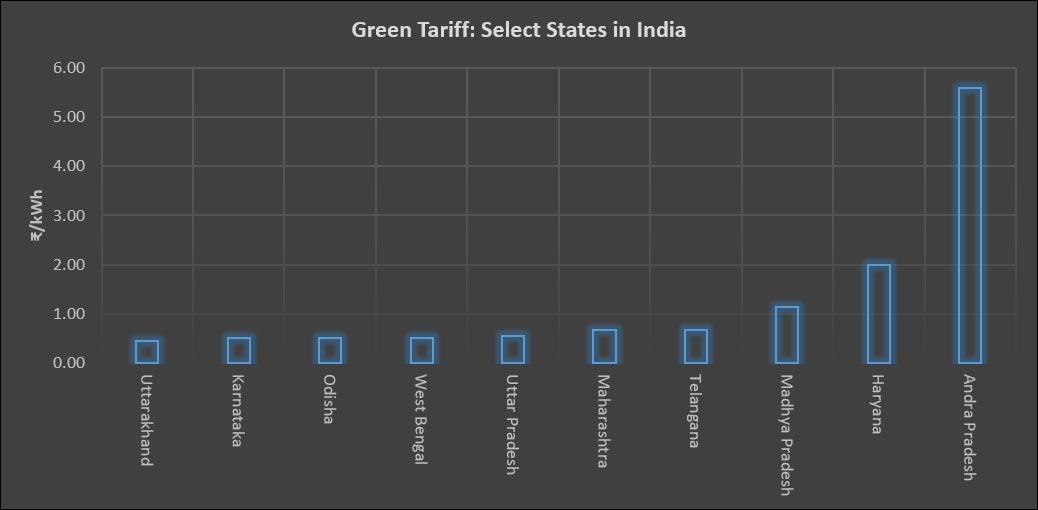

Green premium tariff is not new, as states like Andra Pradesh introduced it almost 15 years ago. Karnataka, Maharashtra, Gujarat and Uttar Pradesh also offer green tariff, but the offtake of RE power facilitated by green tariff remains less than 0.5 percent. In all states that have green tariffs, the tariff is higher than the average retail tariff of electricity which is probably among the key reasons for limited interest in RE power offtake.

In 2022, the Ministry of Power (MoP) introduced the ‘electricity (promoting RE through green energy open access rules [GEOAR]), 2022’. As per the new rule, any consumer with a contract demand of 100 kW (kilowatt) or more can purchase “green” energy from their discom upon payment of a pre-determined tariff. For determining the green tariff rate, states must, in line with the GEOAR 2022 rules, take into account only (i) average pooled power purchase cost of the RE (ii) the cross-subsidy surcharges at 20 percent of average cost of supply and (iii) service charges (reasonable margin of INR0.25/kWh [kilowatt hour]). The MOP is directing all state electricity regulatory commissions (SERCs) to adopt the rules. If GEOAR 2022 proves to be a driver of RE power adoption, it may facilitate private distribution companies to offer RE power to consumers when competition is introduced in electricity retail.

Two private electricity suppliers, Tata Power and Adani Electric in Mumbai offer consumers the option of using 100 percent RE power facilitated through green tariff. According to Tata Power, 27,000 consumers have switched to green power, and in November 2023, a special festival drive enlisted 6274 consumers to opt for RE power. Of the total, 3576 consumers are said to be in the 1-100 kWh category. Tata Power claims that the supply of 270 million kWh of green electricity reduced carbon emissions by 200,000 tonnes annually. The green premium charged was INR0.66/kWh over and above the normal tariff. This is half of INR1.33/kWh green tariff calculated as per regulations. Tata Power has 762,000 consumers in Mumbai and those who have opted for RE power account for just over 3 percent of the total. This is not an encouraging number, but it may be too early to come to a conclusion.

On 12 November 2023, Adani Electricity Mumbai claimed that 3 million households and establishments, comprising over 12 million entities were powered entirely by “clean” renewable energy sources for 4 hours. In 2023, Adani Electricity said that it met up to 38 per cent of its consumers’ electricity requirements from RE power. The RE power was sourced from Adani’s own generation assets. This is a slightly different model of RE power adoption compared to that of Tata Power, as the decision to switch to RE power happened at the supply end rather than the demand end. Adani Electricity offers green tariff to its customers in Mumbai, but details on how many consumers have switched is not readily available.

Green pricing programmes are likely to attract C&I customers (compliance market) as well as affluent urban households (voluntary market). Green pricing provides an independent option that is voluntary and market-based to complement the carbon compliance market, including renewable purchase obligations (RPOs). In the absence of green tariff, customers that are willing to pay for RE power may lack the means to buy RE power. Opting for green tariff signals economic validation of consumers’ ideological and emotional preference for RE power.

It is likely that in a delicenced electricity market green pricing programs will be adopted by some of the DFs and DLs to differentiate their service offering of a commodity like electricity. Green tariff is likely to remain the simplest among the many ways available for electricity customers to access RE power without investing in roof-top solar systems that carry prohibitive up-front costs, or directly buying unbundled RE power through OA provisions which carries high transaction costs.

In a delicensed downstream electricity market, DFs and DLs are likely to indulge in green power marketing through instruments like green tariff partly to increase offtake of their own RE generation assets (as in the case of Adani Electricity Mumbai), or to meet their RPO. Green power marketing by DFs and DLs will effectively seek to develop a customer-driven market for RE power. Demand for green power is equivalent to the voluntary provision of public goods (clean air, lower carbon emissions). The experience of the DLs in Mumbai suggests that green marketing in a competitive environment is not likely, on its own, to provide a large market for RE power. This is especially true if green power commands a premium price in an extremely price-sensitive market like India. Though customers respond positively to survey questions on their preference for RE power, they are likely to hesitate when they are asked to pay for RE power. Even affluent consumers are likely to have strong incentives to `free-ride' and therefore will not contribute siginificantly to the provision of public goods.

There are a number of studies on consumers' willingness to pay (WTP) for green power in mature electricity markets in North America and Europe. Many of the surveys conclude that even when 80-90 percent of those surveyed respond that they care about the environment only about 20 percent confirm WTP for green power. Most of those who demonstrate WTP for green electricity are well educated and have high incomes. When applied to India, the share of those who demonstrate WTP in surveys among residential consumers may be much lower and those who actually pay for green power may be even lower. From a policy perspective, the delicencing of the retail electricity sector is not likely to drive adoption of green power but it could be one of the many options for promoting RE power adoption.

Source: Mercom India Research; Note: only the green premium energy charge that is over and above regular electricity tariff is shown; final green tariff may be higher when fixed charges are included.

Solar Manufacturing

According to All India Solar Manufacturers Association (AISMA), India has achieved a milestone of 60 gigawatt (GW) of installed solar module manufacturing capacity. In line with a target to achieve net zero carbon emission by 2070, India aims to build 500 GW of renewable energy capacity by 2030, with solar energy expected to contribute to 300 GW of this capacity even as solar power installations in the country is growing at 30 percent per annum. High-quality India-manufactured solar modules have gained demand across global markets such as North America and Europe. In 2023 alone, Indian solar manufacturers have exported 3,900 MW of solar modules with the potential to expand this to 30 GW per annum, earning US$7-8 billion (bn) in foreign exchange, and reversing the trend of heavy reliance on fossil fuel imports.

RE Policy and Market Trends

According to a report released by global energy think tank Ember, India’s 14th National Electricity Plan (NEP) sets it on a path to more than triple its renewable energy capacity by 2030, but the country needs a whopping US$293 bn to achieve this.. Ember’s analysis reveals that India requires an additional financing of US$101 bn to further expand its renewable energy capacity and align with the IEA (International Energy Agency)’s proposed net-zero scenario. The Ember report suggests that India is already planning a substantial increase in renewable energy, making it feasible to achieve the goal of tripling renewable energy capacity. However, if the country aims to follow the IEA’s plan and achieve "net-zero" status (where it doesn't produce more greenhouse gases than it removes), it needs to set even higher goals. This implies that India would need to generate around 32 percent of its energy from solar and 12 percent from wind by 2030. To achieve this, India will need to add an additional capacity of 115 GW of solar and 9 GW of wind by 2030, on top of the targets set in its NEP14 plan. This will increase India’s total renewable capacity to 448 GW of solar and 122 GW of wind by 2030.

Roof Top /Distributed Solar Projects

Over 250 million households across India have the potential to deploy 637 GW of solar energy capacity on rooftops, according to a new independent report by the Council on Energy, Environment and Water (CEEW). As per the CEEW report deploying just one-third of this total solar technical potential could support the entire electricity demand of India’s residential sector (about 310 TWh). Currently, India has installed 11 GW of rooftop solar capacity, of which only 2.7 GW is in the residential sector. India’s rooftop solar potential is spread geographically across states in contrast to other renewable technologies like utility-scale solar and wind projects, and could be critical to the energy transition ambitions of states.

Utility Scale Solar Projects

The Uttar Pradesh (UP) government is gearing up to set up solar plants on a 1,700-hectare land along the Bundelkhand Expressway, aiming to develop it as the state’s first solar expressway to generate 550 megawatt (MW) of solar power. With this solar plant, the state government aims to supply electricity to one lakh houses along the expressway. The estimated lifespan of the project is 25 years. According to the state government, eight leading solar power developers gave presentations before government authorities on the project. These companies include Tusco Ltd, Torrent Power Ltd, Somaya Solar Solutions Pvt Ltd, 3R Management Ltd, Avaada Energy Ltd, Atria Brindavan Power Ltd, Erisha E Mobility, and Mahapreit.

Hindustan Unilever Ltd (HUL) announced a partnership with Brookfield to set up a solar energy park with 45 MW capacity in Rajasthan which would help it in its journey towards net zero. The project will be developed at the site of Brookfield’s solar park, being undertaken as a part of Brookfield Global Transition Fund. As per the HUL, the project is aligned with the Indian Government’s commitment in COP26 (Conference of Parties) to reach 500 GW of non-fossil energy capacity by 2030; and will leverage group captive models for renewable energy procurement.

French power utility Engie SA has launched the construction of a 400 MW solar park in the Indian state of Gujarat after securing the US$200 mn (182.3 million euros) project in a local tender. According to the Paris-based company, it expects to bring the photovoltaic (PV) farm online by the second quarter of 2024. Its commissioning will expand its Indian fleet of renewable power plants to 1.5 GW, coming from 18 assets across seven states. The 400 MW complex will be run under a 25-year power purchase agreement (PPA) with regional utility Gujarat Urja Vikas Nigam (GUVNL). Engie was awarded the deal after being successful in the 750-MW Phase XVI auction for solar power projects held by GUVNL last year. Once up and running, the park will be capable of generating around 907 GWh of electricity annually and mitigate 774,112 tonnes of carbon dioxide (CO2) emissions. In Gujarat, the company already operates a 200 MW solar park in Raghanesda and a 29.9 MW wind farm in Tithva.

Biomass/Bio-Power/Waste to Energy

According to the Indian Biogas Association (IBA) study proposed 5 percent blending of biogas with natural gas supplies in the country can cut LNG imports worth US$1.17 bn annually. The study comes against the backdrop of the government’s recent mandate to blend one percent biogas with piped natural gas (PNG) supplies in the country from 1 April 2025 under the compressed biogas blending obligation (CBO) scheme. The biogas blending is proposed to be further increased to 5 percent by fiscal year 2028-29. According to the study, this blending initiative gels well with the government’s macro-level move to make India a gas-based economy, with a target to increase the current share of gas in the energy mix from 6 percent currently to 15 percent by 2030. The IBA estimates show that 5 percent blending of biogas with natural gas can reduce LNG imports worth US$1.17 bn. This can also bring down per capita CO2 emissions by two percent, benchmarked to the 2019 figure, which was 1.9 metric tonne of CO2 per person in India.

According to the government of India, India will start blending compressed biogas with natural gas to boost domestic demand and cut reliance on natural gas imports. The mandatory phased introduction will start at 1 percent for use in automobiles and households from April 2025, it said. The share of mandatory blending will then be increased to around 5 percent by 2028. India, which is one of the world’s largest importers of oil and gas, ships in about half of its overall gas consumption and wants to cut its imports cost. The government also aims to have 1 percent sustainable aviation fuel (SAF) in aircraft turbine fuel by 2027, doubling to 2 percent in 2028. The SAF targets will initially apply to international flights. The steps are aimed at helping India achieve net zero emissions targets by 2070.

Punjab Energy Development Agency (PEDA) has signed an agreement with GAIL (India) Limited to set up 10 compressed biogas projects and other new and renewable energy projects in the state. According to the Punjab New and Renewable Energy Sources (NRES) Minister, the pact will help the state to manage five lakh tonnes of paddy straw per annum and generate clean energy out of it. As per the Minister, Punjab is an agrarian state, and it has immense potential for crop residue-based CBG plants.

Global

Spanish renewable energy giant Iberdrola and UAE clean energy developer Masdar have formed a €15 bn (US$16.2 bn) alliance to invest in offshore wind and green hydrogen in countries including Germany, Britain and the United States. The agreement announced follows a pledge by 118 countries at the COP28 climate summit in Dubai to triple the world’s renewable energy capacity by the end of the decade as they seek to wean themselves off fossil fuels. As per the Spanish company, the first step of the partnership will be for Masdar to take a stake of up to 49 percent in Iberdrola’s 1.4 GW offshore wind project off Britain’s eastern coast, known as East Anglia 3.

World governments agreed at the COP26 climate summit in Glasgow two years ago to phase out "inefficient" fossil fuel subsidies to help fight global warming. Since then, however, global fossil fuel subsidies have risen US$2 trillion to US$7 trillion, according to the International Monetary Fund, as governments around the world moved to protect consumers from rising energy prices. EU governments were among those that have increased support for fossil fuels since Glasgow, mainly as a response to energy security concerns following Russia’s invasion of Ukraine.

BP is seeking partners for offshore wind projects in Japan and may invest in hydrogen technology companies to tackle inflation and equipment bottlenecks that have battered the renewables sector. The oil major plans to expand in low carbon energy in the coming decades as it seeks a long-term business model that can survive the global transition from fossil fuels. Some investors have criticised the strategy for taking BP's focus from higher returns on oil and gas businesses. Globally, the renewables sector has been undermined by slow permitting, technological challenges, rising raw material costs and higher costs of capital. BP’s renewable partner Norway's Equinor, also took a related US$300 mn impairment, while Denmark’s Orsted, the world’s No.1 offshore wind project company, scrapped two local projects and suffered billions of euros of writedowns. As BP seeks to guarantee it can meet its internal returns target of 6 percent to 8 percent on renewables projects, Dotzenrath said BP was working out how to reduce costs globally.

Governments are making insufficient progress in slashing greenhouse gas emissions to avert the worst impacts of global warming, according to a United Nations (UN) report. Under current national climate plans, known as Nationally Determined Contributions (NDCs), emissions can be expected to rise 9 percent above 2010 levels by the end of this decade even if NDCs are fully implemented, the report found. Greenhouse gas emissions would fall to 2 percent below 2019 levels by 2030, the report added, indicating the world will see emissions peak this decade.

North & South America

Brazil has signed onto an agreement to triple renewable energy globally by 2030 and shift away from using coal, the country’s foreign ministry said, joining a prospective deal backed by the European Union, US (United States) and United Arab Emirates. Brazil is already a major player in renewable energy. More than 80 percent of the country’s electricity comes from renewable sources, led by hydropower with solar and wind energy expanding rapidly. While Brazil supports tripling renewables globally, mathematically it is not possible domestically, the ministry said.

Work on a US$10 bn project that will funnel renewable energy across the West has come to a halt in southwestern Arizona, with Native American tribes saying the federal government has ignored concerns about effects that the SunZia transmission line will have on religious and cultural sites. Renewable energy advocates have said the SunZia project will be a key artery in the Biden administration’s plan for boosting renewables and improving reliability among the nation’s power grids. It will stretch about 550 miles (885 kilometres) from central New Mexico, transporting electricity from massive wind farms to more populated areas as far away as California.

EU

More than 400 companies involved in Europe’s solar power sector urged policymakers not to launch a trade investigation that could lead to EU (European Union) tariffs on imported solar products. The call comes ahead of a meeting of solar industry chiefs, national ministers and the EU commissioner for the internal market, Thierry Breton, to assess measures to bring production back to Europe. SolarPower Europe, which coordinated the call, said signatories included 18 manufacturers and 28 national associations and research institutes. All agreed that tariffs should not apply to imported PV products. The EU has a target to reach 600 GW of EU solar installations by 2030, about triple the level of 2022, requiring a significant acceleration of deployment. Tariffs, the group said, would only slow this down. The EU set limits on imports of Chinese solar panels, cells and wafers from 2013 to 2018. Now, more than 90 percent of PV wafers and other components come from China.

According to Sweden’s government, it aimed to build the equivalent of two new conventional nuclear reactors by 2035 to meet surging demand for clean power from industry and transport and was prepared to take on some of the costs. By 2045 the government wants to have the equivalent of 10 new reactors, some of which are likely to be small modular reactors (SMRs), smaller than conventional reactors. Energy Minister Ebba Busch said the government was planning a "massive build out" of new nuclear power by 2045. Countries like Poland, the Czech Republic, and Britain are looking at expanding nuclear power as societies transition to a fossil-fuel free future. Sweden’s government has already offered 400 billion crowns (US$37.71 bn) of loan guarantees to support new nuclear power, which it says is needed to power developments like fossil-fuel free steel production, but said it was now willing to shoulder more of the burden.

Britain will increase the guaranteed price offered for offshore wind projects in its next renewables auction by 66 percent, the government said, as it seeks to spur more projects after its last auction failed to attract any offshore wind investment. Britain, which is already the world’s second largest offshore wind market after China, is seeking to ramp up its capacity to 50 GW by 2030 from around 14 GW now, to help meet its climate targets and boost energy security. The offshore wind sector has been hit by surging supply chain and interest rate costs over the past year with some developers cancelling projects, while Britain’s last auction yielded no offshore wind projects when the results were announced in September with developer saying the price offered was too low. The government said despite the absence of offshore wind, the last auction had succeeded in supporting other technologies such as solar, tidal and onshore wind projects capable of generating 3.7 GW, the equivalent to powering some 2 million homes. Britain’s contract-for-difference (CfD) scheme, offers renewable power developers a guaranteed price for their electricity.

Africa & Middle East

The African Development Bank (AfDB) is drawing up plans for US$1 bn of upgrades to a dozen hydropower plants in Africa. Ranging from Nigeria’s largest 760 MW Kainji plant, to South Africa’s 2.7 MW Sol Plaatje, the refurbishments are expected to yield an extra 570 MW across the 12 projects. Work on the first plants is expected to start by June next year. Although only a fraction of its potential is harnessed, hydropower is a cornerstone of renewable energy and water management in Africa, where climate change is worsening droughts and floods and hundreds of millions of people lack access to electricity. An AfDB-commissioned study in August by the International Hydropower Association (IHA) found that out of 87 plants across Africa, 21 with a total capacity of 4,600 MW needed urgent rehabilitation worth US$2 bn. Another 31, totalling 10,000 MW, would need work in the next decade. More than 60 percent of Africa’s hydropower capacity came from plants more than 20 years old that need upgrades as longer-term projects were pursued. The plan seeks to raise output at Nigeria’s 600 MW Shiroro hydropower station close to Abuja, with an extra 100 MW using floating solar photovoltaics.

Asia Pacific

International energy companies, from Germany’s RWE to Spain’s Iberdrola, are urging Japan to beef up offshore wind power auctions and make investments more attractive, amid soaring installation costs as competition for suppliers grows worldwide. Although desperate to ease its heavy dependence on energy imports from the Middle East and Russia, Japan is coming late to offshore wind, but some industry players say it is taking a more cautious approach that puts it at a disadvantage. With less than 500 MW of installed offshore wind capacity, Japan aims for projects of 10 GW by 2030. So far, it has auctioned 1.7 GW of offshore wind capacity contracts, all won by Mitsubishi-led consortiums in 2021, and will choose winners for four more wind farms with total capacity of 1.8 GW by the end of March.

Indonesia’s state utility Perusahaan Listrik Negara (PLN) plans to build an additional 31.6 GW of renewable power capacity between 2024 and 2033, Chief Executive Darmawan Prasodjo said. In the 2021-2030 plan, PLN had proposed building 20.9 GW renewable capacity and nearly 20 GW of gas and coal power capacity. Out of the total additional capacity planned for 2021-2030, 8.6 GW has been built as of September. The new plan is aimed at accelerating adoption of cleaner energy as Indonesia aims to reach net-zero emissions before 2060. The company will also build transmissions to connect hydropower and other renewable energy sources to Java where demand for power is high and Sulawesi where consumption is expected to surge in the future.

Indonesia’s President Joko Widodo inaugurated a 192 megawatt peak (MWp) floating solar power plant on a reservoir in West Java province as part of a drive to increase renewable energy sources and switch away from coal. The 1.7 trillion-rupiah (US$108.70 mn) project was developed by PLN Nusantara Power, a unit of Indonesia’s state utility company Perusahaan Listrik Negara (PLN) and United Arab Emirates renewable energy company Masdar, a unit of Mubadala Investment Company. The solar power infrastructure was built on Cirata reservoir, 108 kilometres (67.11 miles) southeast of Indonesia capital Jakarta. A hydropower plant at the dam has an installed capacity of about 1,008 MW.

11 December: The price of domestic cooking gas or liquefied petroleum gas (LPG) at INR603 for a 14.2 kilogramme cylinder for beneficiaries under Pradhan Mantri Ujjwala Yojana (PMUY) is the cheapest in India when compared to rates in neighbouring countries, Petroleum Minister Hardeep Singh Puri said. He said India imports 60 percent of its LPG requirement. Despite volatile and high global prices of LPG, the government absorbed it and kept the prices lower for the Ujjwala beneficiaries. He said that the consumption under PMUY has gone up to 2.8 cylinders per household annually now. The number of connections under the scheme has also increased to 96 million and utilization has increased. He said the total number of cooking gas connections in the country, which stood at 140 million in 2014, has increased to 330 million at present. Out of which, the connections under the PMUY are 96 million. The government has decided to provide additional 75 lakh gas connections under the scheme, out of which 34 lakh has already been accomplished, he said

11 December: Indian Oil Corporation (IOC)’s LPG cylinder transporters have withheld their agitation for a month after the company agreed to several of their demands. Members of the North East Packed LPG Transporter Association (NEPLTA) had on December 4 stopped plying their trucks, alleging pending dues and low rates in recently floated tenders, thereby affecting supply of LPG in several states of the region. The NEPLTA said that in the tender floated, the distributor-wise RTKM (round trip kilometre) is missing and it should be incorporated.

8 December: India’s fuel consumption in November fell after hitting a four month peak in the previous month, hit by reduced travel in the world’s third biggest oil consumer as a festive boost fizzled out. Total consumption in November, a proxy for oil demand, fell by 2.8 percent to 18.72 million tonnes (MT) from 19.26 MT in October, the data from the Indian oil ministry’s Petroleum Planning and Analysis Cell (PPAC) showed. Sales of diesel, mainly used by trucks and commercially-run passenger vehicles, decreased by 1.4 percent month-on-month to 7.53 MT. Sales of gasoline in November were 0.4 percent lower than the previous month at 3.13 MT.

7 December: Mumbai’s CNG (compressed natural gas) distributor Mahanagar Gas Limited (MGL) has signed a Memorandum of Understanding (MoU) with fuel aggregator startup Nawgati in a bid to make CNG services more convenient, accessible and efficient for commercial vehicles in the city. As a part of the collaboration, the services provided through the MGL Tez app has now been integrated with Nawgati’s Fuel Discovery app. The collaboration will help commercial CNG vehicle owners to bypass long queues, preschedule their slots at BEST depots and make digital payments. Do note that this service is currently available at Goregaon-Oshiwara and Ghatkopar BEST Depots, while there are plans in place to add 13 more depots across Mumbai soon.

6 December: In Q3 2023, India’s average LNG (liquefied natural gas) imports reached 91 million cubic meters per day (MMcm/d), marking a notable increase of approximately 20 MMcm/d compared with the same period last year. This surge in imports can be attributed to increased gas consumption in the fertilizer and power sectors. Higher gas generation in the power sector was driven by higher peak thermal demand amid reduced hydropower generation. Additionally, as India plans to phase out urea imports by 2025, the dependence on domestically produced urea will increase, supporting the rise in gas consumption in India’s fertilizer sector. Since this sector is subsidized by the government, spot LNG prices will have a limited impact on its growth.

12 December: Coal India Limited (CIL) reported a 7.6 percent year-on-year increase in its capital expenditure (capex) for the April-November period to INR104.92 billion, reflecting its intensified efforts to bridge the investment gap. CIL accounts for more than 80 percent of domestic coal output.

10 December: India’s coal imports dropped 4.2 percent to 148.13 million tonnes (MT) in the April-October period of the ongoing financial year. The country’s coal imports were 154.72 MT in the corresponding period of the previous fiscal. During the April-October period, non-coking coal imports were 94.53 MT, lower than 104.41 MT imported during the same period last year, according to the data of mjunction services ltd. Coking coal imports were at 33.74 MT during the first seven months of the ongoing financial year, slightly up against 32.74 MT in the year-ago period. Of the total imports in October, inbound shipments of non-coking coal stood at 16.88 MT, against 11.69 MT imported in October last year. Coking coal imports stood at 4.31 MT, against 4.69 MT imported in October last financial year.

10 December: India’s Power consumption has increased by nearly 9 percent to 1,099.90 billion unit (BU) in the country during April-November this fiscal compared to the same period a year ago, showing a surge in economic activities. The power consumption in the country was 1,010.20 BU in April-November 2022-23, higher than 916.52 BU recorded in the same period of 2021-22. Power consumption in the entire fiscal 2022-23 was 1,504.26 BU, higher than 1,374.02 BU witnessed in 2021-22 financial year. Industry experts said that around 9 percent growth in power consumption in the first eight months of this fiscal year shows buoyancy in the economy. The power ministry had estimated the country’s electricity demand to touch 229 GW (gigawatt) during summer. The demand did not reach the projected level in April-July due to unseasonal rain. The peak demand, however, touched a new high of 224.1 GW in June before dropping to 209.03 GW in July. Peak demand touched 238.82 GW in August. In September this year, it was at a record high of 243.27 GW. The peak demand was 222.16 GW in October and 204.86 GW in November this year. According to experts, power consumption was affected in March, April, May, and June this year due to widespread rainfall. Union Power Minister R K Singh had said that the power demand has gone up by 50.8 percent in energy terms from 2013-14 to 2022-23.

8 December: The central government has allocated 1,972 MW (megawatt) additional power to Jammu & Kashmir (J&K) to meet winter electricity demand. Lieutenant Governor (LG) of Jammu & Kashmir Manoj Sinha met Union Power Minister R K Singh in New Delhi in the wake of rising power demand in UT (Union Territory), as a result of economic growth and increasing electrification, during the ongoing winter season, the power ministry said. According to the ministry, the LG informed that the current demand of UT of Jammu & Kashmir has touched around 2,800 MW with a deficit of approximately 1,400 MW in the current winter season. Sinha requested the Union Power Minister for allocating more power to the UT. Singh apprised LG that the ministry has already allocated 1,500 MW from central pool to meet the winter requirements of J&K. Further, 472 MW is also allocated under Shakti policy, for which, power purchase agreement with Power department of J&K is proposed to be signed by the end of December 2023.

8 December: The rejection rate of photos in electricity bills of Maharashtra State Electricity Distribution Company Limited (MSEDCL) has come down from 45 percent to 1.3 percent since January this year, increasing the accuracy of power bills, Maharashtra Deputy Chief Minister (CM) Devendra Fadnavis said. To reduce disputes, employees of the MSEDCL take pictures of the electricity meters to print them on the bill. However, the photos are rejected at times for reasons including poor quality. In such a case, an estimated bill is generated without the image of the meter reading. But it also frustrates consumers as they are kept in the dark about the actual usage of power. Bills become more reliable when photo rejections are brought down. Fadnavis said the ratio of photo rejections in electricity bills has come down to 1.3 percent. The state government is also implementing a revamped distribution sector scheme (RDSS) under which aerial bunched cables are used, Fadnavis said.

11 December: Oil and Natural Gas Corporation (ONGC) is planning to invest INR300 billion to INR350 billion for 5 GW capacity of solar and wind energy projects in the first phase by 2030. The investment will be executed in phases with respect to 2030, 2035, and 2038, till it achieves the net-zero Scope-1 and Scope-2. The company is exploring different options such as pumped storage with 2 gigawatt (GW) capacity, solar and onshore wind capacity of about five GW, and offshore wind with one GW capacity by 2035. Further, it intends to invest in all technological areas. Moreover, the company has been preparing a strategy to address climate change through the transition to RE and a roadmap to achieve net-zero status for Scope-1 and Scope-2 emission by 2038. As on 31 March 2023, ONGC’s total installed capacity of RE was 189.52 megawatt (MW) comprising 36.52 MW of solar energy and 153 MW of wind energy. With this initiatives, the company is making efforts towards reducing carbon emissions to provide sustainable and low-carbon products.

8 December: Adani Group Chairman Gautam Adani announced that all its port operations will be carbon neutral by 2025. The target for net-zero port operations is 2040, the group chairman said. Adani said his conglomerate is pledging mangrove plantations in about 5,000 hectares by the financial year 2024-25. Mangroves are critical to the coastal ecosystem as they provide a natural shield against soil erosion and support various flora and fauna. Adani said his conglomerate is setting up the world’s largest green energy park in the Rann of Kutch desert area in Gujarat, covering a vast 726 sq km land mass. Adani said it will generate 30 gigawatt (GW) to power over 20 million homes. This Adani Group project is expected to add to India's green energy capacity, besides helping in reaching its climate action pledges it made at COP. India committed to an ambitious five-part "Panchamrit" pledge at COP26, held in 2021. They included reaching 500 GW of non-fossil electricity capacity, generating half of all energy requirements from renewables, to reducing emissions by 1 billion tonnes by 2030. India also aims to reduce the emissions intensity of GDP by 45 percent. Finally, India commits to net-zero emissions by 2070.

7 December: India will add another 38 gigawatt (GW) of renewable energy capacity by March 2025 to touch 170 GW-mark, aided by moderation in solar module prices, ICRA analyst said. The country’s installed renewable energy capacity was at 130 GW as of October 2023, ICRA said. Indian Renewable Energy (RE) capacity is expected to reach 170 GW by March 2025, led by strong policy support and moderation in solar module prices, ICRA said. The capacity addition thereafter is likely to be supported by the significant improvement in tendering activity in the current fiscal with over 16 GW projects bid out so far and another 17 GW bids underway by the central nodal agencies, ICRA said.

8 December: Bangladesh started in recent days a large crude oil receiving and offloading facility built by China that allows the south Asian oil importer to significantly reduce the cost of shipping in crude oil. The single-point mooring facility at Chattogram port offloaded 82,000 tonnes (about 600,000 barrels) of crude oil from a 100,000-tonne tanker, Bangladesh Petroleum Corporation (BPC) said. Bangladesh, which imports most of its oil needs, does not have a deepwater port and has relied on small vessels to ship crude oil from large tankers parked outside ports.

8 December: The United States (US) Department of Energy said it wants to buy up to 3 million barrels of crude oil for the Strategic Petroleum Reserve (SPR) for delivery in March 2024, as it takes advantage of lower prices to start to replenish the stockpile. The administration of President Joe Biden last year conducted the largest sale to date from the SPR of 180 million barrels to try to limit an oil price rally after Russia's war on Ukraine began in February 2022. The Energy Department in October said it would buy back oil for the reserve at US$79 per barrel or lower, after it had received an average of about US$95 a barrel from last year’s emergency sales. The new solicitation is for sour crude and the delivery will be received by the Big Hill SPR site in Texas.

8 December: The Dangote oil refinery in Nigeria received its first cargo of 1 million barrels of crude oil from Shell International Trading and Shipping Co (STASCO), bringing the start of operations closer after years of delays. Once fully running, the 650,000 barrel per day (bpd) refinery funded by Africa’s richest man Aliko Dangote will turn oil powerhouse Nigeria into a net exporter of fuels, a long-sought goal for the OPEC member that almost totally relies on imports. Dangote Group said that the cargo of 1 million barrels of crude from Agbami—a deep water field run by Chevron—was the first of 6 million barrels that would enable an initial run of the refinery. Dangote Group said the STASCO cargo arrived on a chartered vessel and was discharged into the refinery’s crude oil tanks. Nigeria’s state oil firm NNPC Ltd signed an agreement in November to supply the Dangote refinery with up to six cargoes of crude starting this month. NNPC has a 20 percent stake in the refinery. Despite being Africa’s biggest oil producer, Nigeria experiences repeated fuel shortages. It spent US$23.3 billion last year on petroleum product imports and consumes around 33 million litres of petrol a day. Nigeria commissioned the refinery in May, after it ran years behind schedule. At a cost of US$19 billion, the massive petrochemical complex is one of Nigeria’s single largest investments.

8 December: Key Asian refiners are set to seal 2024 diesel export deals at lower premiums than last year as global supply is poised to rise next year amid slower global demand growth, traders said. South Korea’s top refiners, GS Caltex and SK Energy, a subsidiary of SK Innovation, are likely to close deals for 10ppm sulphur diesel with end-users at premiums between 50 cents and 60 a barrel to Singapore quotes, they added, down from premiums of US$1 to US$1.50 a barrel for this year’s supply. This comes after Taiwan’s Formosa Petrochemical Corp (FPCC) sold at least one 750,000-barrel cargo per month to Western trading house Vitol at a premium of between 80 cents and US$1 a barrel last month. The fall in diesel premiums could weigh on refining profits for such major fuel exporters. The industrial fuel roughly accounts for 45 percent to 60 percent of refined fuel exports from Taiwan and South Korea, consultancy firm FGE said.

7 December: Saudi Arabia and Russia, the world’s two biggest oil exporters, called for all OPEC+ members to join an agreement on output cuts for the good of the global economy only days after a fractious meeting of the producers' club. Hours after Russian President Vladimir Putin went to Riyadh in a hastily arranged visit to meet Saudi Crown Prince Mohammed bin Salman, the Kremlin released a joint Russian-Saudi statement about the conclusion of their discussions. The Organization of the Petroleum Exporting Countries (OPEC), Russia and other allies agreed last week to new voluntary cuts of about 2.2 million barrels per day (bpd), led by Saudi Arabia and Russia rolling over their voluntary cuts of 1.3 million bpd.

10 December: Serbia completed the interconnector to a pipeline in Bulgaria which would allow the Balkan country to diversify its gas supplies and reduce its dependence on Russia. The launch of the interconnector will make operational the pipeline from the town of Novi Iskar in Bulgaria to the Serbian city of Nis, allowing Belgrade to access gas from Azerbaijan and LNG terminal in the Greek port of Alexandroupolis. The capacity of the pipeline on the Serbian side is 1.8 cubic meters a year, which accounts for 60 percent of the country’s annual gas needs.

8 December: The European Union (EU) is poised to give its member states the power to halt gas imports from Russia and Belarus. Any member state will be able to block companies from Russia and Belarus from obtaining space in their gas pipelines and liquefied natural gas terminals. EU member states could have the authority to "partially or, where justified, completely limit" access to infrastructure to gas operators from Russia and Belarus, in order to protect their vital security interests. The EU previously implemented a collaborative gas procurement initiative in order to replenish gas reserves ahead of winter and avoid a repeat of last year’s record-high energy prices and concerns about deficits in Europe resulting from Russia's reduction of gas supplies.

8 December: Two Japanese energy companies, oil and gas producer Inpex Corporation and power utility JERA, urged a US energy regulator to give prompt approvals for Venture Global to begin construction on its CP2 LNG project in Louisiana. JERA’s letter to the US Federal Energy Regulatory Commission (FERC) dated Friday, which followed Inpex's letter, reiterated the role of the CP2 LNG project in securing Japan’s energy supply. Both companies have signed 20-year agreements to each buy 1 million metric tons per annum (MTPA) of liquefied natural gas (LNG) from CP2 LNG, and JERA said it had also bought spot cargoes from Venture Global's first project, Calcasieu Pass LNG.

6 December: Australia’s Woodside Energy said it has signed a deal with energy company Mexico Pacific to purchase 1.3 million tonnes of liquefied natural gas (LNG) per annum for two decades to beef up production and optimise operations. Under the deal, the Australian oil and gas producer will buy the LNG from Mexico Pacific’s Saguaro Energia LNG project, located in Sonora, Mexico on a free-on-board basis with pricing linked to US (United States) gas indices. Commercial operations at the project are targeted to start in 2029, Woodside said.

8 December: RWE AG will receive €2.6 billion (US$2.79 billion) in compensation from the German government for its accelerated phase-out of coal from its energy systems, with European Union (EU) regulators set to approve the state aid support. The multi billion euro package will be paid out over 15 years and covers costs for RWE’s mine rehabilitations and closures. The EU’s approval of the German support could come as soon as.

11 December: Energy trader Gunvor has agreed to acquire a 75 percent stake in 785 megawatt (MW) power plant in Bilbao, Spain, from BP gas marketing. The facility will be the Geneva trader’s first power plant acquisition. The deal is expected to complete in the first quarter of 2024.

8 December: Ukrainian energy consumption hovered near record highs, increasing strains on the fragile power sector as nearly 500 settlements faced blackouts due to Russian shelling, air strikes and bad weather. Ukraine, an exporter of electricity before Russia’s invasion in February 2022, has been forced to turn to emergency power imports from neighbouring Romania and Poland to meet demand, grid operator Ukrenergo said. Russia has so far kept up its strikes on the energy system this winter, sending dozens of drones on an almost nightly basis to hit power-generating facilities and distribution networks across the country. Ukrenergo said a thermal power plant in the east had again and again been damaged by systematic and prolonged shelling. The energy ministry said a total of three power units did not work at the plant in a frontline region, which affected the power system.

7 December: Brazil’s largest-ever power transmission auction by expected investment volume may see little competition, experts said, as the need for billions of dollars in investments and tech expertise may dissuade potential bidders. In the last five years, Brazil’s transmission lines auctions have had on average at least six bidders for each allotment, according to national energy regulator Aneel, but the trend could change if the current outlook is confirmed. Brazil is expected to sell three power transmission projects at auction, scheduled for 15 December, totaling 4,470 kilometers (2,778 miles) across more than five states. Chinese company State Grid and Brazil’s largest power utility Eletrobras are considered the top candidates to take the auction’s darling, an 18 billion real line requiring expertise on high-voltage direct current (HVDC), a system both have experience operating.

12 December: Sri Lanka’s government announced it had tapped an Australian company to build the island nation’s largest solar energy plant at an expected price tag of US$1.7 billion. An unprecedented economic crisis last year saw Sri Lanka hit with blackouts of up to 13 hours each day as power generators ran out of funds to pay for fossil fuel imports. The government has since fast-tracked a number of renewable energy proposals to diversify the island’s grid. Energy Minister Kanchana Wijesekera said the government had approved plans to buy electricity from a proposed 700 megawatt (MW) plant to be built by Australia’s United Solar Energy. Colombo approved in February a US$442 million investment by India’s scandal-hit Adani Group to build a 350 MW wind power plant, also in the island’s north.

12 December: Growth of European Union (EU) solar power installations may slow by 24 percent in 2024 and 23 percent in 2025 in the face of weaker wholesale electricity prices and problems getting permits and grid connections. The EU has a target of 600 gigawatt (GW) of solar installations by 2030, needing a significant acceleration in deployment for its transition to non-fossil energy. The 27-member bloc raised the size of its solar fleet by 27 percent to 263 GW in 2023, SolarPower Europe said. EU capacity additions in 2023 totalled 56 GW, representing a 40 percent increase over the additions seen in 2022 and a new record number for the third year running, SolarPower Europe said.

12 December: The Brazilian government approved measures to raise import taxes on photovoltaic modules and wind turbines, in a move that should give a boost to local production of equipment used to generate renewable energy. The government revoked an import tax subsidy on assembled solar panels, as the country manufactures similar products, the industry and trade ministry said. The government also revoked more than 300 temporary tax reductions on solar modules, effective in 60 days. Brazil produces some of the equipment used to generate solar energy, which has already become the second-largest source of electricity in the country. However, the panels are mostly imported from China. From 2025, all imports of wind turbines will be subject to an 11.2 percent import tax.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.