-

CENTRES

Progammes & Centres

Location

In India, liquefied petroleum gas (LPG) is perceived primarily as household cooking fuel. But LPG supports a wide range of industrial processes and services that require a high degree of precision and flexibility in process temperatures, as well as a strong flame. Space, process and water heating, metal processing, drying, food production, petrochemical production as well as powering industrial ovens, kilns and furnaces are among industrial activities that use LPG. It is valued by industry for its highly controllable temperatures, homogeneous content, low emission of pollutants (negligible NOx

Chlorofluorocarbons (CFC’s) are the most common refrigerants used but CFCs are known to destroy the ozone layer that limit the passage of ultraviolet radiation from the Sun. LPG, with zero ozone depletion potential (ODP) is emerging as a credible replacement for CFCs in industrial and household refrigeration. Although various LPG classifications have refrigeration applications, isobutane is most frequently found in domestic fridges and freezers, whilst propane is common in commercial heat pumps, air conditioning, refrigeration and freezer applications. The cooling capacity of LPG is 10 percent higher than alternatives and its excellent thermodynamic properties lead to energy efficiency gains of 10-20 percent. LPG operates at slightly lower pressures than other main refrigerants whilst maintaining a similar volumetric refrigerating effect to them. LPG does not form acids and thereby eliminates the problem of blocked capillaries.

Despite these benefits, consumption of LPG by the service and industrial sectors accounts for less than 10 percent of total LPG consumption in India. Strong policy support for LPG use as fuel for cooking in households driven by political and environmental goals has marginalised LPG consumption in other segments. Promoting industrial use of LPG, a relatively clean, alternative fuel with modular packaging and transportation features can serve India’s economic and environmental goals.

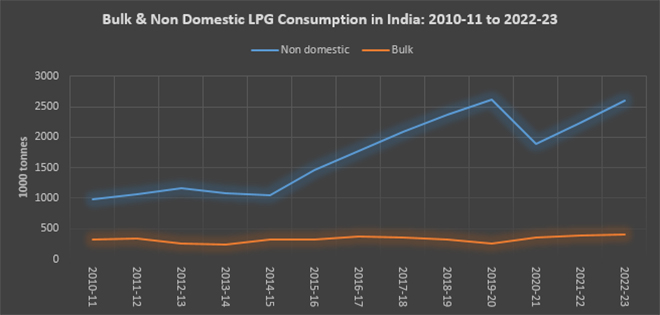

In India, bulk consumption of LPG accounted for about 1.4 percent and non-domestic consumption of LPG accounted for about 9.1 percent of total LPG consumption in 2022-23. Bulk and non-domestic LPG consumption is growing though consumption growth has started declining in the domestic and transportation sectors. Between 2010-11 and 2022-23, non-domestic consumption of LPG has grown by an annual average of over 8.4 percent while bulk consumption has grown by about 1.8 percent. Overall LPG consumption grew by about 6.1 percent in the same period. The share of bulk consumption of LPG fell from about 2.3 percent in 2010-11 to about 1.4 percent in 2022-23 while the share of non-domestic consumption increased marginally from about 7 percent in 2010-11 to about 9 percent in 2022-23. In 2022-23, India imported 18.3 million tonnes (MT) of LPG accounting for about 64 percent of consumption which is a substantial increase in import dependency that stood at 49 percent in 2016-17. Despite growth in consumption since 2009-10, Indian refiners have not ramped-up LPG production capability. LPG produced by Indian refineries was only 4.2 percent of total crude processing capacity in 2022-23. Indian refineries are more optimally designed to produce petrol and diesel and have lower LPG yields, which in turn limits domestic LPG production.

One of the key factors inhibiting widespread adoption of LPG by industries is the competition from natural gas. In all three LPG consuming sectors (household, transport and industries) availability of piped natural gas at regulated prices makes LPG a more expensive option. Policy support to increase natural gas consumption to about 15 percent of India’s primary energy basket has increased investment in transport infrastructure for natural gas such as pipelines. In addition, accommodative pricing incentivises domestic production of natural gas from complex and difficult offshore fields.

Historically natural gas has traded at a discount to oil and oil products. However, the current volatility in imported natural gas prices opens the possibility of substituting oil products including LPG for natural gas to contain costs. Refineries can increase internal consumption of propane as process fuel to reduce the need for expensive natural gas. Industries can also substitute LPG for natural gas but this depends on regulatory restrictions. Many industrial plants in China used LPG as their primary fuel source for local power generation and/or process fuel in the past. As natural gas supply expanded, many of these facilities were linked to gas distribution networks but still retained LPG storage tanks and the ability to switch back if needed. As in the case of India, most of China’s state-owned industrial plants are connected to domestic gas supply, which is subject to price controls while most of the private sector gas users were buying imported re-gasified LNG (liquefied natural gas). Private sector gas users were thus exposed to the price volatility in LNG-based natural gas which is not subject to price regulation. When the price of globally traded natural gas increased, LPG became competitive compared to imported LNG and this led to "reverse switching" from gas to LPG and contributed to Chinese LPG import demand. As per current regulations in China, fuel switching is not permitted. Once an industrial user gets connected to the natural gas grid, LPG has to be eliminated in the system.

Domestic consumption of LPG in India declined from 25,502,000 tonnes in 2021-11 to 25,382,000 tonnes in 2022-23. Consumption of LPG by the transportation segment also declined from 122,000 tonnes in 2021-11 to 107 tonnes in 2022-23. However, non-domestic and bulk consumption of LPG increased from 2,630,000 tonnes in 2021-22 to 3,015,000 tonnes in 2022-23. For industries that are not connected to the gas grid, LPG may be promoted as a source of power generation and process heat. Decentralised nature of LPG as fuel can facilitate industrialisation of rural areas. For industries that are connected to the natural gas grid, policy provision to switch between LPG and natural gas by industries in India will not only sustain the momentum in consumption growth but also alleviate the cost pressure on industries by reducing exposure to volatility in natural gas prices.

Source: Petroleum Planning & Analysis Cell (PPAC)

Source: Petroleum Planning & Analysis Cell (PPAC)

Indian Oil Corporation (IOC) has walked away with half of the natural gas that Reliance Industries Ltd (RIL) and its partner BP of the UK offered in the latest auction of the fuel used to generate power, produce fertilizer, turned into compressed natural gas (CNG) and used for cooking purposes. IOC got 2.5 million standard cubic meters per day (mmscmd) out of the 5 mmscmd of gas auctioned last month. The oil refining and marketing company, which was the top bidder even in the previous auction of gas from the eastern offshore KG-D6 block of RIL-BP, bid the volumes on behalf of seven fertilizer plants. City gas companies including GAIL Gas Ltd, Mahanagar Gas Ltd, Torrent Gas, Indian Oil Adani Gas Ltd, and Haryana City Gas secured a total of 0.5 mmscmd of gas for turning into CNG for sale to automobiles and piped to household kitchens for cooking purposes. GAIL (India) Ltd and refiner Hindustan Petroleum Corporation Ltd (HPCL) got 0.6 mmscmd each while Gujarat State Petroleum Corp (GSPC) walked away with 0.5 mmscmd and Shell another 0.2 mmscmd. RIL-BP, which two years back reversed the declining trend in domestic gas output by bringing to production their second wave of discoveries in the KG-D6 block lying in deepsea of the Bay of Bengal, are now ramping up supplies. Natural gas, a cleaner-burning, efficient fuel, is being seen as a transition fuel for nations to move from polluting hydrocarbons to zero-emission fuels. RIL-BP in the latest tender offered 5 mmscmd of gas for a period of 3 years starting June 1. Bidders were asked to quote a variable 'v' over and above the JKM price, the spot market benchmark for liquefied natural gas (LNG) delivered to Japan and South Korea. The e-auction started on 19 May and ended on 23 May - the longest duration of an auction since the time operators were allowed to sell fuel through open tender. At the end of the e-auction, gas was sold to 16 buyers at a price of JKM + (plus) USD 0.75 per million metric British thermal units (mmBtu) for 3 years. The current JKM price of US$9.2 per mmBtu, the price for KG-D6 gas comes to around US$10. This rate compares with the capped price of US$6.5 per mmBtu that Oil and Natural Gas Corporation (ONGC), the state-owned behemoth, gas for fuel produced from legacy or old fields. RIL-BP had in April sold 6 mmscmd of gas. IOC had walked away with almost half of the 6 mmscmd of gas sold in an e-auction on April 12 while GAIL bought 0.7 mmscmd, Adani-Total Gas Ltd 0.4 mmscmd, Shell 0.5 mmscmd, GSPC 0.25 mmscmd and IGS another 0.5 mmscmd. Reliance has so far made 19 gas discoveries in the KG-D6 block. Of these, D-1 and D-3 -- the largest among the lot -- were brought into production in April 2009, and MA, the only oilfield in the block, was put into production in September 2008. While the MA field stopped producing in September 2018, output from D-1 and D-3 ceased in February 2020. Since then, RIL-BP is investing US$5 billion (bn) in bringing to production three deepwater gas projects in block KG-D6 -- R-Cluster, Satellites Cluster, and MJ -- which together are expected to meet about 15 percent of India’s gas demand by 2023.

GAIL (India) Ltd won the license to build the 2 mmscmd Gurdaspur-Jammu natural gas pipeline. India’s Petroleum and Natural Gas Regulatory Board awarded the project to GAIL over IOC, the only other qualified bidder. The 175-km pipeline will carry gas from Punjab to Indian-administered Jammu and Kashmir. PNGRB is also preparing for its twelfth bidding round to build out India’s natural gas pipelines and city gas distribution network, releasing a list of eight geographical areas for which it is beginning public consultation. These areas are Arunachal Pradesh, Meghalaya, Manipur, Mizoram, Nagaland, Sikkim, Jammu and Kashmir, and Ladakh. The Government of India has said it is prioritizing a shift towards a natural gas-based economy.

HPCL has secured a long-term contract from ONGC Petro additions (OPaL) for supply of natural gas to their mega petrochemical complex at Dahej. OPaL, a joint venture of ONGC, GAIL (India) Ltd and GSPC, requires the gas to operate its own captive power plant (CPP) to support its power and steam requirements.

The domestic natural gas price remained steady at US$6.5 per mmBtu in June. Domestic natural gas price is determined every month as 10 percent of the average price of the India basket crude for the previous month. The gas price, as per the formula, fell to US$7.58 per mmbtu for June from US$8.27 in May. But since the gas price must stay within a Cabinet-determined band of US$4-US$6.5 per mmBtu, the effective price for June will not change. This price band applies only to gas produced by the fields operated by ONGC and Oil India Limited (OIL).

Gas production at the Netherlands' Groningen field will end by 1 October, the government said, as it kept its promise to rapidly cease already minimal extraction to limit seismic risks in the region. The field, operated by a joint venture of Shell and Exxon Mobil, still holds massive reserves of natural gas, but production has been almost completely wound down in the past years as tremors related to drilling caused widespread damage and mental anguish for people living nearby. Production facilities will be closed permanently in 2024, the government said, but there will be an option to extract limited amounts of gas in extreme circumstances in the coming year. Extraction at what once was one of Europe’s largest natural gas fields, was limited to the minimum needed to keep it operational (around 3 billion cubic meters per year) in October last year, with the aim of shutting the field a year later or by 2024 at the latest. Extraction was even increased to nearly 54 billion cubic metres (bcm) of gas in 2013 even though Groningen had been hit by the region's heaviest tremor on record a year before. Discovered in 1959, production hit a peak of 88 bcm in 1976 and was still close to 30 bcm only six years ago. Gas from the Groningen field is estimated to have delivered €363 bn (US$395 bn) to the Dutch treasury since production started in the 1960s, laying the foundation for the country’s welfare state.

United States (US) liquefied natural gas (LNG) developer Venture Global LNG had signed a 20-year deal to provide Germany's Securing Energy for Europe GmbH (SEFE) with 2.25 million tonnes per annum (MTPA) of LNG. With this deal, Venture Global would become Germany’s largest LNG supplier, with a combined 4.25 MTPA of LNG.

Israel should urgently examine how much natural gas the country should export to make sure it keeps enough for itself, the Israel's finance ministry said. The country is expected to roughly double its gas output over the coming years and is weeks away from a highly-anticipated licensing round for new oil and gas exploration blocks offshore Israel.

US LNG developers are on track to approve three export projects capable of processing 5.1 billion cubic feet per day (bcfd) of gas in the first half of the year, a record volume for new LNG projects in any year. The US became the world's largest LNG producer by installed capacity in 2022 driven by the boom in LNG plant construction and a decade of surging shale gas discoveries. US LNG exports are poised to reach 12.1 bcfd this year and 12.7 bcfd next year. US LNG developers this year have already approved the construction of two projects: the second 1.2-bcfd phase of Venture Global LNG’s Plaquemines in Louisiana and Sempra Energy’s 1.8-bcfd Port Arthur in Texas. NextDecade Corporation said it expects to greenlight the first 2.1-bcfd phase of its Rio Grande LNG project in Brownsville, Texas by month’s end. First production could take place in 2027, it said.

TotalEnergies will buy a 17.5 percent stake in US LNG developer NextDecade for US$219 million (mn), the French group said, part of a broader deal to enable the Texas company’s Rio Grande LNG export project to proceed. NextDecade said it had entered into framework agreements with Global Infrastructure Partners (GIP) and TotalEnergies to facilitate the final investment decision for the Rio Grande LNG project, expected to be confirmed by the end of June. Record LNG exports from the United States helped soften the blow to Europe from sharply lower Russian pipeline natural gas supplies in 2022, and will remain a key energy source for the continent, prompting a race to bring more US export terminals online. The 5.4 million tonnes (MT) commitment is the complete production from one of the first of three liquefaction units, and is by far the largest supply contract NextDecade has secured so far. The French firm has an option to take additional LNG from the Rio Grande project's second phase. TotalEnergies is the world’s third largest LNG player, with a roughly 12 percent market share and global portfolio of about 50 MT of LNG per year. It has said that it aims to grow its LNG business by 3 percent annually, and expects natural gas to account for half of all its energy sales by 2030. British rival Shell has also announced plans to grow its natural gas business and defend its position as the top global LNG player. NextDecade plans for it to produce up to 27 MT of LNG annually, with a carbon sequestration component to the project to reduce greenhouse gas emissions.

Trinidad and Tobago is requesting the US government amend the terms of a license authorizing the joint development of a promising offshore gas field with Venezuela, the Caribbean nation’s energy ministry said. The US in January issued a 2-year authorization for Trinidad and a group of companies including Venezuelan state-run oil firm PDVSA and Anglo-Dutch Shell to revive a dormant project that could help Trinidad boost gas processing and exports to its neighbours. Trinidad this month plans to disclose winners of a bidding round for onshore and shallow-water blocks in the country, after evaluating the offers. Negotiations with BP and Shell on the terms for exploring and developing deepwater oil and gas blocks awarded in a separate auction also could finish soon.

Cheniere Energy will supply 1.8 MT of LNG per annum to China’s ENN Natural Gas for over 20 years. The US has emerged as the world’s largest LNG exporter after Western sanctions on major supplier Russia left Europe scrambling to find alternate sources for the commodity. In 2021, ENN had signed a 13-year deal to buy LNG from Cheniere beginning in July 2022. Cheniere said deliveries will start in mid-2026, ramping up to 0.9 million tonnes per annum (MTPA) in 2027. Delivery of the remaining 0.9 MTPA is subject to Cheniere's positive final investment decision with respect to the Sabine Pass Liquefaction Expansion Project in Louisiana.

QatarEnergy will sign a 27-year deal to supply China National Petroleum Corporation (CNPC) with 4 MT of LNG per year. CNPC will also take a 5 percent equity stake of one LNG train of QatarEnergy’s north field gas expansion.

Bangladesh’s Petrobangla has signed a long-term deal to buy LNG from Oman’s OQ Trading. Under the SPA signed, OQT, previously known as Oman Trading International, will supply 0.25-1.5 MT per year of LNG to Bangladesh over 10 years, starting in 2026, according to a statement by Bangladesh’s ministry of power and energy. OQT will deliver four cargoes of LNG in 2026, 16 cargoes per year from 2027 to 2028, and 24 cargoes per year from 2029 to 2035. This is the second LNG supply deal as the two firms have already signed a 10-year deal back in 2018. Under that SPA which started in 2019, OQT is supplying about 1 MT per year to Bangladesh. OQT works with Omani state-owned producer Oman LNG, the operator of three LNG trains in Qalhat with a nameplate capacity of 10.4 MT per year. Besides these deals, Petrobangla has a 15-year deal with QatarEnergy’s unit Qatargas for 2.5 MT of LNG and this deal started in 2018. The firm recently signed another deal with QatarEnergy’s LNG trading arm for about 1.8 MT of LNG per year, starting in 2026. Bangladesh currently imports LNG via its first LNG import facility, Moheshkhali Floating LNG or MLNG, operated by Petrobangla, and via Summit’s FSRU-based LNG import terminal located offshore Moheshkhali Island in the Bay of Bengal with a daily regasification capacity of 500 million cubic feet. QatarEnergy has signed a 15-year supply deal for LNG with Bangladesh’s PetroBangla for 1.8 MTPAstarting in 2026. The latest contract with an Asian customer by the world’s top LNG exporter comes when Western countries, including Germany, push to win a chunk of the Qatari gas as competition ramped up following the Ukraine war. It is also QatarEnergy’s second to Asia since it started selling the gas expected to come on stream from the North Field expansion project. The expansion will raise Qatar’s liquefaction capacity to 126 MTPA by 2027, from 77 million currently.

In an effort to speed up work on Turkmenistan, Afghanistan, Pakistan, and India (TAPI) gas pipeline project and finish the feasibility study as soon as possible, Pakistan and Turkmenistan signed a Joint Implementation Plan (JIP). In the meeting with the Turkmenistan delegation, Pakistan Prime Minister Shehbaz Sharif said that being a critical component of his government’s vision, the TAPI gas pipeline project would ensure energy security, economic growth and prosperity in Pakistan as well as the entire region. The PM renewed the commitment to early implementation of the project and hoped that the TAPI gas pipeline would be completed at the earliest by optimising all available resources by all relevant parties. The government of Pakistan invited Turkmenistan to explore gas connectivity from the Chaman border to Gwadar and building LNG terminals at Gwadar, which would expand supplies to Europe and global LNG markets. The TAPI gas pipeline project aims to bring natural gas from the Galkynysh gas field in Turkmenistan to Pakistan through Afghanistan. The pipeline will transport up to 33 bcm (average 3.2 bcfd) of natural gas per year over a 30-year period. The supply source is the Galkynysh gas field in the eastern region of Turkmenistan whereas Pakistan’s off-take will be 1.3 bcfd with a pipeline diameter of 56 inches. Pakistan continues to attach great importance to the TAPI gas pipeline project to meet emerging energy challenges for the country and as a manifestation of meaningful commercial, energy cooperation between Pakistan and Central Asia.

Chevron has started producing gas from the Gorgon Stage 2 development project off the coast of Western Australia. The development expands the existing subsea gas gathering network of the Gorgon Project, which exports LNG to customers across Asia and produces domestic gas for the Western Australian market. Gorgon’s Stage 2 development involved the installation of 11 additional wells in the Gorgon and Jansz-Io fields and accompanying offshore production pipelines and subsea structures to maintain feed gas supply for the project’s gas processing facilities on Barrow Island. Chevron is a 47 percent owner and operator of the Gorgon LNG project. It is also co-owned by Exxon Mobil Corp, Shell and Japanese utilities Osaka Gas, Tokyo Gas and JERA.

4 July: Oil Marketing Companies (OMCs) have increased the price of commercial 19 kilogram (kg) LPG (liquefied petroleum gas) gas cylinders by INR7. The new 19 kg commercial LPG gas cylinder will now cost INR1780 in Delhi. Earlier in Delhi, a commercial LPG cylinder used to cost INR1773, and now with a revised rate, the commercial LPG cylinder will cost INR1780. The prices of the commercial LPG gas cylinder increased in other states as well. The prices of LPG cylinders increased to INR1902 in Kolkata, INR1740 in Mumbai, and INR1952 in Chennai. Last month, the price of commercial LPG cylinders was reduced significantly by INR83.50. After the revised price, the LPG cylinder cost INR1773 in Delhi. The price of a domestic LPG gas cylinder of 14.2 kg remains the same. In March 2023, the price of domestic LPG gas cylinders increased by INR50, taking the price of 14.2 kg gas cylinders to INR1103 in Delhi, 1129 in Kolkata, INR1102.50 in Mumbai, and INR1118.50 in Chennai.

3 July: India’s imports of Russian oil hit another record last month as the South Asian nation potentially nears the limit of its buying splurge from the major OPEC+ producer. Daily volumes climbed to 2.2 million barrels a day in June, rising for a 10th month, according to Viktor Katona, the head of crude analysis at Kpler. Russian purchases again exceeded the combined shipments of Saudi Arabia and Iraq, data from the analytics firm show. India emerged as a key consumer of Russian oil following the invasion of Ukraine, but the nation’s buying could be near its limit due to infrastructure issues and the need to maintain good relations with other suppliers. Kpler said imports may dip next month because of lower Russian supply. Indian Oil Corporation (IOC) has been the biggest buyer of Russian crude over the past two months, followed by Reliance Industries Ltd., according to Kpler. Overall, India’s imports of Urals hit another record of 1.5 million barrels a day in June, the analytics firm said.

30 June: The Petroleum and Natural Gas Regulatory Board (PNGRB) is planning to auction city gas distribution licences for north-eastern states and the union territories of Ladakh, and Jammu & Kashmir (J&K). The PNGRB is in the process of finalising the areas for the 12th city gas bidding round. It has drawn up a tentative list of areas for which licenses will be auctioned and has sought views from the stakeholders, according to a notification on the website of the regulator. The proposed list of areas includes Arunachal, Meghalaya, Manipur, Mizoram, Nagaland, Sikkim, J&K and Ladakh.

30 June: Reliance Industries Limited (RIL) and BP said they had commenced production from the MJ field, following testing and commissioning activities. The MJ field represents the last of three major new deepwater developments the RIL-BP consortium have brought into production in block KG D6 off the east coast of India, the companies said. Together, the three fields are expected to produce around 30 million standard cubic metres of gas a day (1 billion cubic feet a day) when MJ field reaches peak production. This is expected to account for around one third of India’s current domestic gas production and meet approximately 15 percent of India’s demand, the companies said.

29 June: Adani Total Gas Limited (ATGL), the joint venture between Adani Group and TotalEnergies of France, said that it will invest INR180 billion to INR200 billion in the next 8 to 10 years. According to ATGL, the investment will be made to expand infrastructure for retailing CNG (compressed natural gas) to automobiles and piping gas to households and industries. The company has over 460 CNG stations in the country and retails CNG to automobiles and pipes gas to household kitchens for cooking purposes in 124 districts of India. ATGL has about 7 lakh consumers for its piped cooking gas. The statement comes as the company is looking to expand its network of CNG stations as well as pipeline network in order to successfully tap into the country’s growing appetite for cleaner fuel. ATGL is not only looking forward to scaling core business of gas distribution, but also on diversifying its bouquet of choice and tap into newer opportunities- CNG, compressed biogas (CBG) and EV charging. Meanwhile, the government has pledged to increase the share of natural gas in the economy to 15 percent of its energy mix by 2030 from the current 6 percent as it is less polluting than liquid fuels.

4 July: NTPC Limited witnessed a surge of 99 percent in coal production from its captive mines and an increase of 112 percent in coal despatching in the first quarter of 2023-24, compared to the same period the preceding fiscal year. The company received 4.27 million metric tonne (MMT) coal in the first quarter of 2022-23 whereas 8.48 MMT coal was produced during the same period in 2023-24, an increase of 99 percent. The company achieved 8.82 MMT of coal despatch in the first quarter of the current financial year, marking a 112 percent increase.

3 July: The coal ministry has achieved an increase in coal production at a growth rate of 8.40 percent during the first quarter of the financial year (FY) 2023-24. The cumulative coal production surged from 205.65 million tonnes (MT) (same period last year) to 222.93 MT this year. In FY 2023-24, national miner Coal India Limited (CIL) produced 175.35 MT of coal, compared to 159.63 mt produced during the previous year’s corresponding period, recording a 9.85 percent increase in production which contributed to overall growth. Captive mines and other coal producers also witnessed a growth of 4.74 percent, reaching 30.48 MT in FY 2023-24, compared to 29.10 MT in FY 2022-23. The dispatch of coal has also shown a positive trend, with a 6.97 percent growth in the first quarter of FY2023-24. The cumulative coal dispatch reached 239.69 MT (provisional) in Q1, compared to 224.08 MT in Q1 of FY 2022-23. Here as well, CIL achieved a production of 186.21 MT in Q1 of FY 2023-24, showing a growth of 5.32 percent from the 176.81 MT produced in Q1 of FY 2022-23. The increase in coal production and dispatch has led to a comfortable coal stock position, reported the coal ministry. As of 30 June 2023, the total coal stock reached 107.15 MT (provisional), a significant rise from 77.86 mt on 30 June 2022. This growth of 37.62 percent indicates the concerted efforts to meet the rising demand for coal. These developments setting the coal ministry up to not only meet India’s energy need but also reach its one billion tonne coal production target by the end of this year.

29 June: Coal India Limited (CIL) Chairman Pramod Agrawal said that the company should continue to remain as a "government entity" in the future to maintain "price stability" of the dry fuel in the country and suggested an alternative methodology for coal pricing in future. He said unlocking value cannot be the "sole" purpose of all enterprises. As a government-owned entity, CIL holds the responsibility of ensuring that the benefits of coal production are distributed to the public, he said. He said that the miner’s identity is synonymous with the country’s energy sector, and the present structure with CIL as the apex holding company is "strong and stable". Coal prices of the Kolkata-based PSU are heavily discounted as compared to imported fuel. Under the leadership of Agrawal over three years from FY20, production and off-take for CIL surged by an additional 101 million tonnes (MT) and 113 MT respectively, while supplies to the power sector were higher by 121 MT during the same period. The use of coal in the country is set to peak by the early to mid-2030s, amid the highest addition in renewable energy capacity among many global economies.

28 June: India has received bids from 22 companies, including Jindal Steel and Power and Hindalco Industries, for the commercial extraction of coal from 18 thermal and coking coal mines, the coal ministry said. Most of the mines have reserves of thermal coal used in power generation, while one has the variety used in the process of making steel. Half of the mines are fully explored and the others partially, the ministry said. The total capacity of the fully explored mines is 47.8 million tonnes per year. The government wants private players to boost coal production in the country as power demand surges. Coal India Limited dominates coal mining in the country.

4 July: The energy infrastructure of Bhopal is likely to get a face lift with major investment of INR2.88 billion. This is being done under the RDSS (revamped distribution sector scheme) scheme of the government aimed at strengthening supply infrastructure of the discoms (distribution companies). State Energy Minister Pradhyumn Singh Tomar said that the development works done under the scheme will benefit the entire population of around 24 lakh of the city and it will strengthen the energy infrastructure of the city for the next 10 years. Works that will be carried out with these funds in the city include installation of additional 220/132 kV (kilovolt) high tension power transformers, apart from the up gradation of the existing ones, he said. A total of 12 kilometers in length of new 220 KV high tension line will be built, and 132 KV high tension line of length 8 kilometer will also be built, he said.

1 July: Uttar Pradesh (UP) Chief Minister Yogi Adityanath held a review of the state’s power generation, transmission and distribution system and stressed on the need for comprehensive reforms in the Electricity department. Under the PM’s guidance, every village, town and district in UP has been illuminated in the last six years. There is uninterrupted power supply, he said. The biggest challenge for the Electricity department and discoms (distribution companies) is to provide correct bills on time and to collect the amount from the consumers, he said and directed the power supply corporations to ensure that not even a single consumer gets the incorrect bill. The department and power supply corporations will have to make concerted efforts for timely collection of payments, he said. He directed that there should not be any unnecessary power cuts anywhere and problems resolved without delay. Feeder wise accountability should be fixed. There should be better communication between all the discoms, he said. Strict legal action should be taken against those who steal electricity but consumers should not be harassed in the name of investigations, he said. He also called for action against officers against whom complaints are lodged. Necessary steps should be taken to keep line losses to a minimum, he said and sought the implementation of a one-time settlement scheme for defaulters.

29 June: The state government has received INR27.25 billion in financial incentive for 2021-22 and 2022-23 for power sector reforms. The department of expenditure, finance ministry, released INR664.13 billion to 12 states for reforms in the power sector to encourage and support states to increase efficiency and performance of the power sector. An initiative was taken by the Centre in the Union Budget 2021-22 to provide this financial incentive after implementation of specific reforms in the power sector by the states. Based on the recommendations of the ministry of power, the finance ministry has granted permission for reforms undertaken in 2021-22 and 2022-23 to 12 state governments. To get this facility, the states must undertake a set of mandatory reforms and meet stipulated performance benchmarks, including transparency in the reporting of financial affairs of the power sector, timely rendition of financial and energy accounts and timely audit and compliance with legal and regulatory requirements. The power ministry is the nodal ministry to assess the performance of states and determining their eligibility for granting additional borrowing permission.

29 June: The government has issued guidelines to ensure that sufficient electricity is made available to power the country’s growth. A framework for advance procurement of resources will be put in place by discoms (distribution companies) to meet the electricity demand in a cost-effective manner. The guidelines provide for an institutional mechanism for Resource Adequacy ranging from National level to discom level such that the availability of resources to meet the demand is ensured at each level. The new generation capacities, energy storage and other flexible resources, needed to reliably meet future demand growth at optimal cost, will be assessed well in advance.

30 June: India’s first indigenously developed 700 MW nuclear power reactor at the KAPP (Kakrapar Atomic Power Project) in Gujarat started commercial operations. Presently, the unit is operating at 90 percent of its total power, KAPP said. The Nuclear Power Corporation of India Limited (NPCIL) is building two 700 MW pressurised heavy water reactors (PHWRs) at Kakrapar, which is also home to two 220 MW power plants. Various commissioning activities were underway at KAPP 4, which had achieved 96.92 percent progress by May end. The NPCIL plans to build sixteen 700 MW PHWRs across the country and has granted financial and administrative sanction for the same.

29 June: ReNew said it is setting up two hybrid projects of 70.2 MW (megawatt) in Karnataka. The two solar and wind energy projects will help reduce 150 kilotonne of CO2 (carbon dioxide) emissions per year. The projects are part of ReNew’s 200 MW energy park to supply clean power to companies in Karnataka’s Vijaynagara region. According to industry estimates, to set up every 1 MW of renewable energy project, an investment of INR50-60 million is required.

4 July: Italy’s Eni aims to reduce its exposure to oil in favour of natural gas and non-fossil fuels in part through asset sales, the energy group’s CEO (Chief Executive Officer) Claudio Descalzi said. Eni plans to generate €1 billion (US$1.1 billion) of net proceeds from the balance between asset sales and acquisitions between 2023 and 2026, the company said in its business plan. Eni announced the sale of some of its oil assets in Congo, just a few days after saying it had agreed to buy Neptune Energy.

3 July: Russia will cut oil exports by 500,000 barrels per day (bpd) in August, President Vladimir Putin’s point man on oil said, as Moscow seeks to nudge up global oil prices in concert with Saudia Arabia. Brent crude oil spiked as much as 1.6 percent to US$76.60 a barrel after the Russian announcement and a statement from Saudi Arabia that it would extend its voluntary output cut of 1 million bpd for another month to include August. Russia’s exports have stayed strong despite Western sanctions. It has already pledged to reduce its output by 500,000 barrels per day (bpd) to 9.5 million bpd from March until year-end. Both Riyadh and Moscow have been trying to keep the price of oil high. Brent has dropped from US$113 per barrel a year ago because of concerns of an economic slowdown and ample supplies from major producers.

3 July: Asian refiners expect Saudi Arabia to lower prices for its crude supply to the region in August, a survey showed, even as the top oil exporter pledged to deepen production cuts in July as part of a broader OPEC+ deal. Saudi Arabia in June unexpectedly raised prices for July-loading cargoes, eating into Asian refiners' margins. To support global prices depressed by rising interest rates and recessionary fears, the producer volunteered to cut output by 1 million barrels per day (bpd) in July on top of a broader OPEC+ deal to limit supply into 2024. State oil company Saudi Aramco is expected to cut the official selling price (OSP) for Arab Light crude in August by about 50 cents a barrel from the prior month, according to a Reuters survey of six refining sources. The July OSP for the flagship grade hit a six-month high of US$3 a barrel above the average of Dubai and Oman quotes. Profits at a typical Singapore refinery processing Dubai crude fell to an average of US$3.44 a barrel in June, from US$4.78 a barrel last month. Also, demand for August-loading cargoes, which would arrive at Asian refineries in September, could fall as some plants are set to shut for maintenance, survey said. Saudi crude prices typically closely track changes in benchmark Dubai monthly price spreads, but the two have disconnected in recent months.

28 June: Uganda National Oil Company (UNOC) expects to start oil production from the Tilenga project in the first half of 2025, CEO (Chief Executive Officer) Proscovia Nabbanja said. The Tilenga project, in the Buliisa and Nwoya districts in Uganda’s Lake Albert oilfields, is operated by French energy major TotalEnergies in partnership with China’s CNOOC Ltd and UNOC. Oil from the Tilenga project will be transported via the US$3.5 billion East African Crude Oil Pipeline (EACOP) to the port of Tanga in Tanzania for export. The EACOP has the capacity to send up to 246,000 barrels of crude per day out to world markets by as early as 2025.

28 June: Three Norwegian labour unions have agreed to a wage deal with the owners of floating offshore oil drilling rigs, preventing the outbreak of strike action that would have disrupted exploration, the unions said. The deal between the Norwegian Shipowners' Association and the Industri Energi, Safe and DSO labour unions comprises 7,500 workers. Unions had said that 1,644 workers on 12 rigs would go on strike initially if the talks failed, but would not disrupt the current production of oil and gas.

4 July: Egypt has begun a US$1.8 billion programme to drill natural gas exploration wells in the Mediterranean Sea and Nile Delta, Petroleum Minister Tarek El Molla said. The programme is in cooperation with Eni, Chevron, ExxonMobil, Shell and BP. The aim is to drill 35 exploration wells within two years, 21 in the current 2023/2024 financial year and 14 in the next year, El Molla said.

3 July: Russia’s total exports of liquefied natural gas (LNG) have declined by 9.4 percent in the first half of the year to around 14.4 million tonnes (MT), while supplies to Europe have remained steady at some 9 MT, Refinitiv Eikon data showed. Europe has been ramping up purchases of sea-borne LNG in a move to compensate significant decline in Russian gas flows, supplied via the network of pipelines. According to Refinitiv Eikon, Russian exports of LNG to Europe in the first half of the year reached around 9 million tonnes, while supplies to Asia were at some 5.2 MT, comparing to 8.9 MT and 7 MT respectively in the year-earlier period. Russia’s total LNG exports rose by a fifth in 2022.

2 July: Partners in the Israeli offshore gas project Leviathan said they would invest US$568 million to build a third pipeline that will allow increased natural gas production and exports. Leviathan, a deep-sea field with huge deposits, came online at the end of 2019 and produces 12 billion cubic meters (bcm) of gas per year for sale to Israel, Egypt and Jordan. The idea is to boost capacity to include sizeable volumes for Europe as it seeks to reduce dependence on Russian energy. The new pipeline will connect the well with a production facility some 10 km off Israel’s Mediterranean shore. It is due to come online in the second half of 2025, when production at Leviathan will jump to 14 bcm a year, the companies said. In the longer-term, Leviathan production is expected to reach about 21 bcm a year. The group has announced plans for a floating liquefied natural gas (LNG) terminal off the Israeli coast with an annual LNG capacity of about 4.6 million tons, or 6.5 bcm.

2 July: South Africa’s Electricity Minister Kgosientsho Ramokgopa said the country was closer to ending daily power cuts as warmer weather returns towards the end of the year, but declined to give a specific date. South Africa is on course to see its most blackout days in history this year with daily power cuts extending to almost 10 hours a day, affecting businesses and households in an economy already hobbled by high interest rates and inflation. The power cuts, called loadshedding locally, is expected to shave off 2 percentage points from GDP this year, the central bank said. Blackouts have eased in the past few weeks but there is a fear that as the southern hemisphere winter takes deeper hold in July and August, higher heating demand could trip many power plants. By September, the temperature starts to climb once more. Due to interventions on system maintenance and availability and efforts from businesses and households, the worst case scenario of peak winter demand of 34,000 megawatt (MW) has not materialised, he said. The capacity available is plateauing around 29,000 MW, giving enough room to bring the power cuts down to Stage 3, where 3,000 MW are taken off the grid, leading to between two and four hours of daily power cuts, he said. South Africa implements power cuts in stages from one to eight with eight being the highest and translating into over 10 hours of daily power cuts. He said the country was reaching a stage where power generation was beginning to keep up with demand, with blackouts coming down from Stage 6 to Stage 3 in the space of six weeks. South Africa could soon have no blackouts for 24 hours, he said.

30 June: Japan plans to become one of the world's top offshore wind energy producers, joining the likes of China and the United Kingdom (UK), as it makes the transition to a zero-emission economy while also seeking greater energy security. Japanese companies have offshore wind assets from Taiwan to Belgium and UK but are yet to build large-scale farms at home. Japan’s Ministry of Economy, Trade and Industry (METI) and Ministry of Land, Infrastructure, Transport and Tourism (MLIT) finished accepting proposals for the second major round of offshore wind tenders to build 1.8 gigawatt (GW) capacity in four areas. Japan had 136 megawatt (MW) of offshore wind capacity installed as of 2022, a fraction compared to nearly 14 GW in UK and 31 GW in China, according to Global Wind Energy Council. It aims to have 10 GW by 2030 and up to 45 GW operational by 2040 as it wants renewables to provide 36 percent to 38 percent of its electricity mix by the end of this decade from around 20 percent now and has targeted becoming carbon neutral by 2050. A Marubeni-led consortium launched Japan’s first large-scale commercial offshore wind operations at Noshiro Port (84 MW) and Akita Port (55 MW) in late 2022 and early 2023. Marubeni won these projects with the feed-in tariff program for renewable energy, before the government enforced a new law in 2019 to enhance development of offshore wind farms outside of port areas, introducing a public auction scheme.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.