-

CENTRES

Progammes & Centres

Location

The Ministry of Power (MoP) had projected a peak of 229 GW (gigawatt) during the summer of 2023. Though peak demand exceeded projections, it occurred much later than expected. Speaking at a meeting in October 2023, the Minister for Power observed that power demand had increased by 20 percent in August, September, and October 2023 compared to demand in the same months in 2022. The minister attributed the surge in power demand mostly to a increase in economic activity but demand is highly corelated with summer temperature. An increase in temperature not only increases electricity demand but also increases carbon emissions posing a challenge to India’s energy transition.

In September 2023, coal with an installed capacity of 214,254 megawatt (MW) accounted for just over 50 percent of total power generation capacity of 425,406 MW in India followed by renewable energy (RE) with 131,783 MW that accounted for about 31 percent of installed capacity. 46,850 MW of installed capacity for hydro accounted for about 11 percent of total power generation capacity while natural gas with installed capacity of 25,038 MW accounted for about 6 percent. Nuclear power with installed capacity of 7480 MW accounted for just under 2 percent of total installed capacity.

Source: Central Electricity Authority

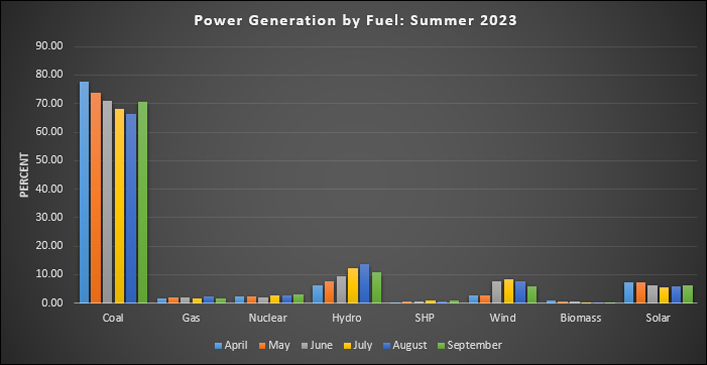

Coal continued to dominate power generation in 2023 contributing 71 percent of electricity generation from April to September 2023. Hydro made the second largest contribution with over 10 percent of generation in the 6-month period. Solar power generation contributed 6.45 percent followed by wind that contributed 5.92 percent of generation. Nuclear contributed about 2.58 percent of generation and natural gas about 1.87 percent. Renewables like biomass and small hydro power (SHP) contributed less than 1 percent each.

In the same period in 2022 (April-September 2022) the fuel shares were roughly the same with coal accounting for about 70.54 percent of generation followed by hydro with 12.34 percent. The third largest contribution came from wind with about 5.87 percent closely followed by solar with about 5.71 percent of electricity generation. The contribution of nuclear power was 2.57 percent closely followed by natural gas-based generation that contributed 1.67 percent of generation. Renewables like biomass and SHP contributed less than 1 percent each.

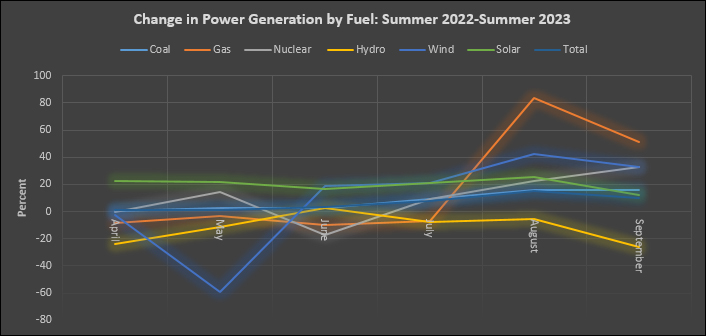

Peak energy generation was in May 2022 with a generation of 145.79-terawatt hour (TWh) while peak energy generation occurred in August 2023 with a generation of 159.97 TWh, an increase of over 9.7 percent over peak generation in 2022. The increase in monthly generation in 2023 compared to monthly generation in 2022 was 1.5 percent in April, 0.95 percent in May. In June 2023, generation increased by over 3.4 percent compared to generation in June 2022. The increase was 7.89 percent in July, 15.3 percent in August and 10.34 percent in September. The overall increase in generation in 2023 summer over 2022 summer was about 6.56 percent.

In terms of generation growth, solar led with an average growth of over 20 percent in April-September 2023 compared to generation in the same period in 2022 followed by natural gas that demonstrated an increase of 17.76 percent. Nuclear ramped up by 10.23 percent while wind generation increased by 9.05 percent but generation from hydro fell by 11 percent. During August and September 2023 when electricity generation touched new highs, generation from natural gas increased by over 83 percent in August and 51 percent in September compared to generation in the same months in 2022. Overall, coal provided7.29 TWh of additional electricity generation, the largest during the summer of 2023 compared to generation in the summer of 2022.

The summer surge in electricity demand poses challenges to India’s energy transition. It favours generation that can be ramped up quickly in response to demand. This invariably means fossil fuel-based generation which increases carbon emissions. In the context of summer electricity demand, the power minister said that thermal generators were asked to run at full capacity and opt for 6 percent blending with imported coal to make up for any shortfall in domestic coal availability. He also said that phasing out coal was not an option for India and that capacity of coal-based power generation under construction would have to be increased by 80 GW to meet the surge in power demand in the future. India had also sought additional volumes of natural gas to meet summer demand and had asked utilities to expedite completion of gas-based power plant maintenance, as part of emergency steps to stop electricity outages in summer.

According to research by the International Energy Agency (IEA), extreme heat drives higher air conditioner demand, with sustained average daily temperatures of 30°C typically boosting weekly sales by around 16 percent. Demand is found to be rising fastest in emerging and developing economies where fewer households own air conditioners. In the United States and Japan, more than 90 percent of households have an air conditioner, while in Southeast Asia, only 15 percent do. That number drops to 5 percent in India and Africa.

While the need for cooling is growing, greater usage of air conditioners is straining the grid. Cooling represents around 10 percent of global electricity demand. In hotter countries, such as India cooling can drive a rise in electricity demand of more than 50 percent in summer. In the hottest regions, the capacity of the grid needs to cover a doubling of electricity demand compared with milder months and cooling can account for over 70 percent of electricity peak demand. In Texas, USA for example, every 1°C increase in the average daily temperature above 24°C drives a rise of about 4 percent in electricity demand. In India, where air conditioner ownership is lower, the same temperature increase drives a 2 percent rise. Swings in demand as a result of changing cooling needs mean grid operators need to ramp up fossil fuel-based firm (dispatchable) electricity supply. One power plant in China is recorded to have burnt around 800 tonnes of coal in just one hour in June 2023 to help keep Shanghai residents cool.

In many markets short term peak demand which is expensive to serve is reduced through financial and other incentives. For example, in Texas, when electricity demand hit an all-time high in June 2023, the operator provided financial incentives to energy consumers to reduce demand during times of electricity grid stress or shift consumption to times of day when grid pressures and power prices are lower. Demand response payments in Texas were 20 times higher in 2023. Korea launched a new pilot programme in December 2022 in which intelligent appliances automatically respond to demand reduction requests based on grid conditions instead of relying on consumers’ manual adjustments to controls, resulting in a 24 percent improvement in electricity savings.

Given the stress on power grids during summer, distribution companies in India need to adopt similar demand response mechanisms to reduce peak demand. Households, industries and other consumers should be offered the option of reducing the use of electrical equipment based on real-time electricity demand, helping to balance the grid during periods of peak demand. Distribution companies must offer financial compensation to consumers for this service. This is likely to benefit financially stressed distribution companies as paying consumers to reduce demand will be far cheaper than investment in peaking capacity.

Source: Central Electricity Authority

Ministry of New & Renewable Energy expressed confidence that India will achieve its target of producing 500 gigawatt (GW) renewable energy well ahead of the 2030 deadline. The Ministry further stated if the country had not lost two years due to the COVID-19 pandemic, it would have achieved the goal of setting up 50 percent of its power generation capacity based on non-fossil fuels, by now. India has 424 GW of power generation capacity in place which includes around 180 GW from non-fossil fuels and another 88 GW is in the process of being set up.

India’s renewable sector is booming but just not fast enough to become 1.5-degree Celsius compatible, and the country is heading in the opposite direction entirely when it comes to phasing out coal power, a new report by Climate Action Tracker claimed. The report by the independent research group that tracks government climate action and measures it against Paris Agreement goals comes on the eve of the United Nations' Climate Ambition Summit. It analyses whether the plans of 16 countries to decarbonise their power sector align with the goal of keeping global warming below 1.5 degrees Celsius. India and China have 1.5-degree Celsius compatible levels of fossil gas power now, but both need to develop their longer-term phase-out strategies. It said India is a world leader in new renewable energy (excluding hydro) for both total capacity and generation. By mid-2023, the country had installed more than 130 GW of new RE (renewable energy) capacity, 30 percent of its total capacity. The country plans to add around 300 GW of solar and 80 GW of wind by the end of the decade.

The Indian Renewable Energy Development Agency (IREDA) has signed a Memorandum of Understanding (MoU) with the Bank of Maharashtra to fund a diverse spectrum of renewable energy projects. Under this agreement, the Bank of Maharashtra can invest in the Bonds issued by IREDA. India aims to meet its 50 percent energy needs through renewable sources by 2030. At the COP26 summit in Glasgow in 2021, India committed to an ambitious five-part "Panchamrit" pledge, including reaching 500 GW of non-fossil electricity capacity, to generate half of all energy requirements from renewables, to reduce emissions by 1 billion tonnes by 2030. India aims to reduce the emissions intensity of GDP by 45 percent. Finally, India commits to net-zero emissions by 2070.

Bharti Airtel will purchase 23 GWh gigawatt hour (GWh) of renewable energy for its data centre company Nxtra by the fourth quarter (Q4) of FY23-24. With this addition, the total contracted renewable energy capacity for Nxtra data centre is likely to exceed 274 GWh, the company said. Airtel said it will acquire stakes in the renewable energy project companies established by Continuum Green India Pvt. Ltd. and Vibrant Energy Holdings Pte Ltd to power six of Nxtra's Edge data centre facilities. The purchase will be made through an open access route where Airtel will acquire stake in the project company of Continuum Green, which will supply green power from solar and wind power projects to its Edge data centers in Madhya Pradesh. Airtel has also entered into a similar stake purchase agreement with the project company Vibrant Energy to supply solar power to its Edge data centre in Vijaywada. Nxtra by Airtel has committed to reducing absolute scope 1 and 2 greenhouse gas (GHG) emissions across its operations by 100 percent.

Oriana Power Ltd announced securing two fresh orders totalling INR1.34 billion (bn) (US$16.1 million (mn)) to set up solar capacities in Karnataka and Rajasthan. It has secured an engineering, procurement and construction (EPC) contract worth INR1 bn from a steel company for construction of a 29 megawatt (MW) captive open access solar power plant in Karnataka. The second order worth INR 344 mn is for setting up a 7 MW DC solar plant in Rajasthan. The project was awarded by a cement player in last week of August. The company would be responsible for supply of the auxiliary panel with metering and supply and laying of cables. Oriana Power is one of India’s leading solar energy solution providers that finances, constructs and operates solar projects for its industrial and commercial customers.

Satluj Jal Vidyut Nigam (SJVN) signed a power purchase agreement (PPA) of 18 MW solar power with Bhakra Beas Management Board (BBMB). SJVN, through its wholly-owned subsidiary SJVN Green Energy Limited (SGEL), signed a PPA with BBMB for 18 MW solar power. The project will be developed on land parcels of BBMB in Himachal Pradesh and Punjab. The project is scheduled to be commissioned by August 2024. The project involving investment of INR 900 mn (US$10.81 mn) will come up within a year. The project has been secured through open competitive bidding at a tariff of INR 2.63/kWh in the e-reverse auction organised by Punjab Energy Development Agency. The project will generate 39.42 million units (MU) of energy in the first year of operation and the cumulative energy generation over a period of 25 years would be about 917 MU. The agreement will be effective for 25 years and its commissioning of the project would reduce 44,923 tonnes of carbon emission.

Tata Motors Limited and Tata Power Renewable Energy Limited (TPREL), a subsidiary of Tata Power, have entered into a Power Purchase Agreement (PPA) to develop a new 12 megawatt peak (MWp)on-site solar project. The solar project will come up at Tata Motors' commercial vehicle manufacturing facility in Pune, Maharashtra. The solar installation is expected to collectively generate 17.5 MU of electricity annually, meeting approximately 17.2 percent of the annualised energy requirement of the company. As per the company, with the boost in solar power capacity after the setting up of the new project it will potentially reduce carbon emissions by over 12,400 tonnes per year. The solar project is scheduled to be commissioned within six months following the signing of the PPA and will play a vital role in Tata Motors' long-term sustainability goals. The agreement encompasses rooftop installations. With this addition, Tata Motors' total solar capacity in its Commercial Vehicle Business Unit (CVBU) in Pune will reach 20.73 MWp, including the existing 8.73 MWp capacity. The company plans to further expand its solar capacity at the Pune plant in the coming years to cater to the growing demand for renewable energy.

AmpIn Energy Transition announced its partnership with the Allana Group to provide 4.5 MW of solar power to their Aligarh plant. This power supply agreement will significantly increase the utilisation of renewable energy, accounting for approximately 50 percent of the total energy mix at the Aligarh facility in Uttar Pradesh. The solar power will be sourced from AmpIn Energy Transition’s Mishrikh Solar Project, which boasts a capacity of 30 MW.

In four years from now, Ghaziabad may draw 10 percent of its total energy needs from solar power with the Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA) planning to develop it as the second ‘solar city’ of the state after Ayodhya. The state government, through UPNEDA, will disburse INR 200 mn (US$2.40 mn) over the next five years for installation of rooftop solar panels at all residential, industrial, commercial and government establishments. The per unit cost of solar energy is nearly 30 percent less than conventional energy sources and to promote it both the central and state governments are offering subsidies. The estimated cost of installing solar panels for a 3BHK or 4BHK apartment comes to around INR200,000.

Suzlon Group has secured a new order for the development of a 29.4 MW of wind installed capacity for BrightNight. The global renewable power producer’s 100 MW co-located wind-solar hybrid project is located at Osmanabad in Maharashtra. Suzlon will install 14 units of S120-140m wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 2.1 MW each. Suzlon will undertake the supply, installation, and commissioning, as part of the scope. Additionally, it will also provide post-commissioning operation and maintenance (O&M) services. The project is expected to be commissioned in phases, starting April 2024. Electricity generated from the project will be supplied to Commercial and Industrial (C&I) customers in the state. The plant is specially designed to meet energy savings requirements, the wind-solar configuration is optimised, enabling consumers to achieve up to 80 percent of greening of their overall consumption.

With an aim to ensure availability of affordable, clean and green energy in the state, Punjab Government is all set to establish a compressed bio-gas (CBG) project worth INR1.4 bn (US$16.82 mn) in Hoshiarpur district. Punjab New and Renewable Energy Sources Minister Aman Arora said that Punjab Energy Development Agency (PEDA) would set up the CBG project, having a total capacity of over 20 ton of CBG per day, at Baroti village in Hoshiarpur district. This project is likely to be operational by December.

Biofuel alliance can generate opportunities worth US$500 bn in the next three years for G20 countries, according to Indian Biogas Association (IBA). Biofuel alliance can be a win-win situation for G20 countries and the environment, IBA said. According to a study by the IBA, the biofuel alliance can generate opportunities worth US$500 bn in the next three years for G20 countries. The findings of the study assume significance as India is currently hosting the G20 leaders' Summit in New Delhi. Biogas can generate an opportunity of US$200 bn, considering the least investment required, compared to other energy generation options and easy availability of raw materials, it said. Bioenergy/Biogas, in principle, has the potential to replace fossil fuels completely, especially to decarbonize the transport sector, it said. In 2016, the G20 adopted a voluntary action plan on renewable energy, which committed members to increase the share of renewable energy in their energy mix. India significantly increased its share of renewable energy in the overall energy mix and grew at a CAGR of roughly 22 percent in the last six years. India has ramped-up solar energy 20-fold in the last decade. During this period, solar energy and wind energy roughly grew at a CAGR of 38 percent and 30 percent, respectively. The G20 is a powerful forum that can play a major role in promoting Bio energy. As per Ministry of New & Renewable Energy, current biogas and CBG production in the country is 1151 million tonnes (MT) per day, and with the push to the sector, even with conservative estimates, it can go up to 1750 MT per day by 2025 in the next few years. The average cost for each biogas plant is US$4.25 mn, and with the government's target of 5,000 biogas plants, this is a huge opportunity of over US$ 200 bn, it said.

G20 leaders agreed to pursue tripling renewable energy capacity globally by 2030 and accepted the need to phase-down unabated coal power, but stopped short of setting major climate goals. The world’s 20 major economies have had disagreements on commitments to reduce fossil fuel use, cut greenhouse gas emissions and increase renewable energy targets. One such sticking point was a proposal by Western countries to triple renewable energy capacity by 2030 and cut greenhouse gas emissions by 60 percent by 2035, which was opposed by Russia, China, Saudi Arabia and India during sherpa level meetings. The declaration adopted by G20 leaders on the first day of the two-day summit in New Delhi did not mention cutting greenhouse emissions. The G20 member countries together account for over 80 percent of global emissions and a cumulative effort by the group to decarbonise is crucial in the global fight against climate change. Climate talks at the bloc’s summit will be keenly watched by the world ahead of the COP28 UN climate summit in the United Arab Emirates later this year.

Minnesota approved plans for the expansion of a solar energy project that a utility says will be one of the largest in the country with the capability of powering more than 150,000 homes. The state Public Utilities Commission approved Xcel Energy’s expansion of the Sherco Solar project, adding a 250 MW array to a 460 MW array now under construction. The utility says all phases of the project will be finished by 2025. The solar generation will be near an existing coal-fired plant in Becker, Minnesota, northwest of Minneapolis.

Canada’s Silfab Solar will invest $150 mn in a new solar cell manufacturing plant in South Carolina, expanding its United States (US) operations to the East Coast. The announcement makes Silfab the latest solar equipment maker to commit to new US production since the passage of President Joe Biden’s Inflation Reduction Act (IRA) last year. The law offers incentives for domestic manufacturing of clean energy components with tax credits for both producers and buyers. As per the Silfab the new facility in Fort Mill, South Carolina, will create 800 jobs and begin operations in the third quarter of 2024. It will initially produce 1 GW of cells and 1.2 GW of modules annually, a company spokesperson said, representing a large expansion of its operations. The building can accommodate a doubling of cell capacity in the future.

United States regulators are ready to review and license the next generation of nuclear reactors while staying committed to safety, the Nuclear Regulatory Commission (NRC) said. The NRC is under pressure to show it can move fast on a new generation of nuclear technology, including small modular reactors (SMRs) and other previously untested designs, as many in the industry call for deep reforms of the regulator. The regulator must be willing to remove operational and organizational barriers that are in the way of rapid and efficient licensing and understand that time is of the essence to reduce emissions and solve energy security issues. The government agrees that more work needs to be done to enable the NRC to meet the coming challenges.

Poland has issued an environmental permit for the country’s first nuclear power plant. According to Poland’s General Directorate for Environmental Protection (GDOS), the building and operation of the plant will not adversely affect the environment, and its impact will be monitored. Warsaw plans to build its first nuclear power plant on the Baltic coast by 2033. Construction is set to begin in 2026.

Europe’s solar power industry warned of a "precarious" situation for European solar photovoltaic (PV) manufacturers as solar PV prices reached record lows. Industry trade group SolarPower Europe said in a letter sent to the European Commission that European companies risk bankruptcies, which they said would hurt the EUs (European Union) goal of reshoring 30 GW of the solar PV supply chain. Prices of PV modules have dropped by more than a quarter since the beginning of the year, according to SolarPower. The industry calls on the European Commission to buy up European companies' solar module stockpiles, to set up a Solar Manufacturing Bank at EU level and to boost demand for solar PV in Europe among others.

Germany’s wind power expansion is facing an unexpected roadblock: builders need permits to transport the heavy turbines down the country’s roads, and they are waiting months to get them. With a backlog of more than 15,000 applications for approvals, companies say their projects are heavily delayed, with the costs of prolonged warehousing for steel tower segments, generators and blades running into the millions. Germany aims to obtain 80 percent of its electricity from renewable sources by 2030, 115 GW of which should come from onshore wind, but a lack of transport permits endanger that goal.

According to the Organization of the Petroleum Exporting Countries (OPEC), data-based forecasts do not support the International Energy Agency (IEA)’s projection that demand for fossil fuels would peak in 2030. OPEC said the projections do not factor ongoing technological progress by the oil and gas industry to cut emissions and that 80 percent of the world's energy mix comes from fossil fuels, the same as three decades ago.

The renewables unit of Portugal's largest utility, EDP, will start building its largest solar power plant in land-scarce Japan this year to sell power directly to a company. With the majority of its projects in Europe and North America, EDP Renovaveis SA (EDPR), is betting on power deals with companies to expand in the Asia-Pacific as it shifts focus from distributed solar installations to large projects. Major investments in renewable power projects in Singapore and Vietnam helped boost the firm’s installed capacity in Asia Pacific to 1 GW this month, doubling from February 2022, when EDPR took over solar firm Sunseap.

1 October: Jet fuel or Aviation Turbine fuel (ATF) price was hiked by 5 percent -- the fourth straight monthly increase since July, and commercial cooking gas (LPG) rates were raised by a steep INR209 per 19-kg cylinder, in line with the firming up seen in international benchmarks. However, the price of domestic LPG - the one used in household kitchens for cooking purposes - remained unchanged at INR 903 per 14.2-kg cylinder. ATF price was increased by INR 5,779.84 per kilolitre, or 5.1 percent, in the national capital to INR 118,199.17 per kl from INR 112,419.33, according to a price notification of state-owned fuel retailers.

29 September: The Indian government increased windfall tax on petroleum crude, while reduced it on aviation turbine fuel and diesel, according to a government notification. The windfall tax on petroleum crude will be raised to INR 12,100 (US$145.65) per ton from INR 10,000 (US$120.37), effective 30 September. The levy has been cut on aviation turbine fuel to INR 2.50 per litre from INR 3.50 per litre, while on diesel to 5 rupees per litre from INR 5.50. On 16 September, the government had raised the windfall tax on petroleum crude to INR 10,000 per ton from INR 6,700. India imposed the windfall tax on crude oil producers in July last year and extended the levy on exports of gasoline, diesel and aviation fuel after private refiners wanted to make gains from robust refining margins in overseas markets, instead of selling at home.

1 October: The price of natural gas produced from difficult areas like deep sea KG-D6 block of Reliance Industries Ltd (RIL) was cut by a steep 18 percent, in line with softening of benchmark international gas prices. However, the price of gas that is largely used for making CNG for fueling automobiles or piping to households kitchens for cooking purposes will remain unchanged due to a price cap that is set at 30 percent less than market rates such as that paid to RIL. For the six-month period starting 1 October, the price of gas from deepsea and high-pressure, high-temperature (HPTP) areas has been cut to US$9.96 per million British thermal unit from US$12.12, oil ministry’s Petroleum Planning and Analysis Cell (PPAC) said. The government bi-annually fixes prices of the locally-produced natural gas -- which is converted into CNG for use in automobiles, piped to household kitchens for cooking and used to generate electricity and make fertilisers. Two different formulas govern rates paid for gas produced from legacy or old fields of national oil companies like Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL), and for newer fields lying in difficult-to-tap areas, such as deep sea. India is aiming to become a gas-based economy with the share of natural gas in its primary energy mix targeted to rise to 15 percent by 2030 from the existing level of around 6.3 percent.

2 October: Supply of coal to the power sector by Coal India Ltd (CIL) increased 3.4 percent to 294.8 million tonnes (MT) in the first six months of the current fiscal even as the demand for electricity touched record highs in the past two months, the Maharatna firm said. The total amount of coal supplied was 1.8 MT more than the 293 MT demand projected for this period, Coal India Ltd (CIL) said. Coal is the largest source of electricity in the country and CIL produces over 80 percent of coal in India. CIL’s total supplies shot up to 360.7 MT during the April-September period as against 332 MT in the year-ago period. Coal supplies by CIL to the non-power sector during the first six months of FY24 peaked at 65.7 MT, registering a growth of 40 percent. As of September-end, the coal stock at CIL’s pitheads was 41.6 MT.

28 September: Steel Authority of India Ltd (SAIL) is expecting four ships of coking coal from Russia in the September quarter, each with a capacity of 75,000 tonnes, Chairman Amarendu Prakash said. The country’s largest state-owned steel producer said the company was working on doubling coking coal production capacity in International Coal Ventures Private Limited (ICVL) at Mozambique. At present, ICVL has a 2 million tonne per annum capacity, Prakash said.

27 September: India’s electricity transmission system smashed previous records for generation and consumption in August, according to the latest monthly data from the Grid Controller of India. Nonetheless, network stability improved as surging output from coal-fired generators made up for a shortfall from hydroelectric sources impacted by a patchy monsoon. The grid boosted coal-fired generation to a near-record 104 billion kWh (kilowatt hour) in August. Improved fuel availability ensured coal-fired units were able to start up when called on – averting the severe power shortages and blackouts that plagued the network in October 2021 and again in April 2022. To ensure sufficient fuel on hand, India’s domestic mines boosted coal production by almost 65 million tonnes (+11 percent) in the first eight months of 2023 compared with the same period in 2022. And the rail network hauled an extra 24 million tonnes (+5%) to power producers over the same period, according to the coal ministry. India’s railways despatched an average of 248 coal trains to generators every day in August 2023, up from 233 in August 2022 and 211 in August 2021.

3 October: Adani Energy Solutions Ltds shares were up by 0.12 percent after the company commissioned the Kharghar-Vikhroli Transmission Ltd (KVTL) project. The project addresses the need for additional power in Mumbai, given the city’s burgeoning electricity demand. In the wake of recent grid failures in Mumbai, the Kharghar-Vikhroli line will ensure an additional 1,000 megawatt (MW) of power supply. The project grants Mumbai a 400 kilovolt (kV) grid within its municipal boundaries. KVTL encompasses approximately 74 circuit km of 400 kV and 220 kV transmission lines, along with a pioneering 1,500 MVA (megavolt-ampere) 400 kV Gas Insulated Substation (GIS) at Vikhroli.

1 October: India has allowed Nepal to sell electricity generated through two hydropower projects in its real-time energy market starting, according to the Nepal Electricity Authority (NEA). It is for the first time that India granted project-wise approval ensuring that Nepal could sell hydroelectricity in India’s Real-Time Market (RTM). The Central Electricity Authority of India has allowed the trading of 44 MW of electricity generated from the 19.4 MW Lower Modi and 24.25 MW Kabeli B-1 hydropower projects in the real-time market in the first phase, according to NEA. Nepal is currently selling 13,000 MW of electricity to India on a daily basis. India has been allowing Nepal to sell its power in its day-ahead market since November 2021.

3 October: India must boost its solar energy capacity by 36 percent annually for at least the ensuing five years in order to achieve its energy mix objectives, according to the analysis by UK-based energy think group Ember. It urgently requires infrastructure upgrades and greater storage space to handle the intermittent nature of renewable energy sources, according to Ember. According to Ember, investments in the renewables sector are rising, and this year, India put into service a record amount of solar power. The document, covering the decade to 2032, projects India will continue to rely on coal, but with renewables making up an ever-greater share of its power generation mix. While solar accounted for just five percent of India’s total electricity generation in financial year 2022, the National Electricity Plan (NEP) projects it will make up 25 percent within a decade. And India needs better storage solutions to address the variable supply of sources like solar and wind.

3 October: Prime Minister Modi dedicated the first 800 megawatt (MW) unit of the Telangana Super Thermal Power Project of NTPC to the nation through virtual mode from Nizamabad. PM said that the second unit of the project would start operations soon. Once the second phase was completed, the total installed capacity of the project would be increased to 4000 MW. This project was the most modern power plant of NTPC in India, he said.

2 October: Adani Group plans to build 10 gigawatt (GW) of integrated solar manufacturing by 2027, more than double its current capacity. The conglomerate owned by Indian billionaire Gautam Adani produces solar photovoltaic cells or solar PVs through Adani Solar, with a manufacturing capacity of 4 GW. Adani Solar has confirmed orders worth over 3,000 megawatt (MW). India's current annual solar panel manufacturing capacity of 32 GW per annum falls short of the required 52 GW. Though solar currently makes up over half of India’s renewable energy capacity, domestic component supplies have been slow to pick up, and the industry was also spooked by higher import taxes. The country is considering cutting import tax on solar panels by half and seeking a rollback in goods and services taxes on the devices to make up a shortfall in local output.

1 October: The Graded Response Action Plan -- a set of anti-air pollution measures implemented in Delhi-NCR during the winter -- came into effect. The Commission for Air Quality Management (CAQM), an autonomous body tasked with improving the air quality in Delhi and its adjoining areas, made crucial changes to the Graded Response Action Plan (GRAP) last year and again in July. The new changes include strict restrictions on the plying of overage vehicles and a complete ban on the use of coal and firewood in eateries, restaurants and hotels when the Air Quality Index (AQI) breaches the 200-mark.

29 September: Renewables solution provider Sterling and Wilson Renewable Energy (SWRE) said it has bagged an order worth INR15.35 billion from NTPC Renewable Energy. SWRE has received the notification of award for the EPC project of 300 MWac of NTPC Renewable Energy Limited (NTPC REL) at Khavda RE Power Park, Rann of Kutch, in Gujarat, the company said. The company has got the third order from NTPC REL in just over a year.

29 September: United States (US) crude oil output grew in July to near its pre-COVID peak in 2019, fueled by a record level of production from Texas, the top US shale oil producer, the US Energy Information Administration (EIA) said. US crude production grew 0.7 percent to 12.99 million barrels per day (bpd) in July, its highest since November 2019, when production hit a peak of 13 million bpd. Oil output from Texas, New Mexico and North Dakota all rose. Texas grew 1.3 percent to 5.6 million bpd in July, its highest on record, North Dakota’s output rose 1.2 percent to 1.2 million bpd, and New Mexico's oil climbed 0.6 percent to 1.8 million bpd. The additional supplies come as Saudi Arabia and Russia extended their voluntary oil cuts to the end of the year, pushing up global oil prices as supplies tightened.

29 September: Russia may introduce quotas on overseas fuel exports if a complete export ban imposed does not succeed in bringing down persistently high gasoline and diesel prices, Deputy Prime Minister Alexander Novak said. The government said that Novak told a meeting of senior managers at Russian oil companies that the ban on the export of gasoline and diesel had initially led to a fall in prices on the commodity exchange. The Kremlin and Russia’s energy ministry have said the current fuel export ban, announced on 21 September, will remain in place until the domestic fuel market stabilises. Analysts expect it to last until the Russian harvest, and peak fuel demand, is over in a few weeks. Any fuel export quotas are likely to be put in place after the lifting of the export ban and would be similar to Russian restrictions on cross-border fertilizer sales. Novak told the meeting with oil producers to take urgent measures to reduce fuel prices at filling stations of oil producers and the independent companies.

27 September: Britain has given the go-ahead for one of its biggest new oil and gas projects in years, Equinor’s North Sea Rosebank field, saying energy security was the priority despite opposition from environmentalists. Norwegian energy group Equinor said the earliest the field, located west of the Shetland Islands and due to start output in 2026/27, would be electrified is 2030. The Rosebank field, relatively small in the global context, is expected to produce 300 million barrels of oil in its lifetime. Equinor said the type of light, sweet oil contained in Rosebank can be used in most refineries, including in Britain, and that the country can obtain the crude via the open market. Equinor, which holds a majority stake in Rosebank will invest US$3.8 billion alongside its partner Ithaca Energy to develop the first phase of the field. It expects to spend around US$9.8 billion over the lifetime of the field through 2051, including operations and decommissioning, with the bulk going to British firms.

2 October: Italian energy group Eni announced a big gas discovery in Indonesia, opening the door to a strengthening of its position in the Asian country, where it has been present since 2001 with a portfolio of exploration and production assets. The group said the discovery was from the Geng North-1 exploration well drilled in the North Ganal PSC, about 85 kilometres (53 miles) off the coast of East Kalimantan. Preliminary estimates indicated a total discovered volume of 5 trillion cubic feet (tcf) of gas, equal to about 140 billion cubic meters, with an estimated condensate content up to 400 million barrels. The ongoing exploration campaign is in line with Eni’s strategy to shift its portfolio mix towards gas and liquefied natural gas (LNG), targeting 60 percent in 2030, and to increase its LNG equity portfolio. The discovery opens the door to the creation of a new production hub to be tied to the Bontang LNG facilities on the coast of East Kalimantan, Eni said. It is estimated that, in addition to Geng North, more than 5 tcf of gas in place are present in undeveloped discoveries within the area of interest, the Italian group said.

29 September: Cyprus and international energy companies led by Chevron have agreed to extend talks on how to develop its Aphrodite offshore gas field amid progress in negotiations, Energy Minister George Papanastasiou said. Nicosia disagreed with modifications proposed by Chevron and its partners earlier this year to a 2019 agreement to develop the estimated 3.5 trillion cubic feet (tcf) gas field, particularly a proposal to remove what Cyprus considers essential processing infrastructure on the sea surface. The modifications removed a floating gas processing plant, which Nicosia believes is necessary in its exclusive economic zone, and cut the number of production wells to three from an initial five.

28 September: A joint venture is developing the first dedicated liquefied natural gas (LNG) bunkering facility for ships in the US (United States) Gulf amid efforts by the maritime industry to find cleaner fuel solutions. Seapath, a subsidiary of global business group Libra, and Houston-based energy infrastructure company Pilot LNG have formed a joint venture to develop, construct, and operate the LNG bunkering facility in the greater Houston/Galveston area of Texas, with operations set to begin in early 2026, the companies said. The facility, as currently planned, will produce 300,000 gpd (gallons per day) of LNG, rising by an additional 150,000 gpd as needed. There will be a storage capacity of 2 million gallons on site, with the ability to raise capacity with a second 2 million gallon storage tank, Seapath said.

28 September: Ukrainian oil and gas firm Naftogaz, aiming to cover the country’s needs with domestic production, has brought five new gas wells into operation, the company said. Ukraine has not imported natural gas directly from Russia since 2015, buying gas from the European Union instead and stepping up efforts to increase domestic production. Naftogaz said the five wells would increase overall production by about 500,000 cubic meters per day. The company traditionally has not disclosed the location of the wells, but most of Ukraine’s gas fields are in the Kharkiv and Poltava regions that have come under frequent missile fire since the full-scale Russian invasion in February 2022. Naftogaz is Ukraine’s largest gas producer, with output of 12.5 billion cubic meters (bcm) in 2022. It plans to increase output to 13.5 bcm in 2023 and to 14 bcm in 2014.

27 September: Turkey’s state gas grid operator BOTAS signed a deal to supply up to 1.5 billion cubic meters (bcm) of natural gas to Romania’s OMV Petrom as Ankara expands its gas export reach. Turkey, with meagre gas sources of its own but with extensive liquefied gas import infrastructure, aims to be an alternate supplier to smaller gas markets in southeastern Europe. Gas exports to Romania will begin on 1 October, at up to 4 million cubic meters per day, or around 1.5 bcm of gas per year. The agreement runs until the first quarter of 2025. Turkey signed supply deals with Bulgaria and Hungary this year.

27 September: China will extend a resource tax concession for shale gas development to end-2027 to help boost domestic natural gas supplies, according to a joint statement from the Ministry of Finance and the State Administration of Taxation. The government will continue a 30 percent concession to the 6 percent resource tax for developing shale gas, the ministries said, extending a policy that began in 2018. China, the world’s top energy consumer and the largest greenhouse gases emitter, is looking to boost the use of natural gas as a key bridge fuel to achieve its 2060 carbon-neutral goal. In 2022, the country produced 24 billion cubic meters of shale gas, mostly from southwestern Sichuan basin, accounting for 11 percent of total domestic gas output.

27 September: QatarEnergy said it had signed a 14.2 billion riyal (US$3.90 billion) deal with HD Hyundai Heavy Industries (HHI) for the South Korean firm to supply it with 17 liquefied natural gas (LNG) carriers. Qatar’s North Field Expansion plan will boost its position as the world’s top LNG exporter. It includes six LNG trains that will ramp up Qatar’s liquefaction capacity from 77 million tonnes per annum (mtpa) to 126 mtpa by 2027. QatarEnergy had already contracted for 60 ships to be built at Korean and Chinese shipyards in a first phase of its LNG ship acquisition programme, and the 17 ships with HHI mark the start of the programme's second phase, it said.

27 September: Norwegian energy group Equinor has signed a five-year agreement to supply gas to Austria’s OMV as part of the latter’s supply diversification strategy, the companies said. Equinor will deliver 12 terawatt hours (TWh) of natural gas starting on 1 October, the beginning of the European gas winter season, adding to volumes under existing contracts, the companies said. The Austrian company is already purchasing gas from its own production sources in Norway and Austria, via long-term liquefied natural gas (LNG) deliveries at the Dutch Gate terminal and the European Union’s Joint Gas Purchasing Platform, it said. OMV still has long-term supply contracts with Russia’s Gazprom running until 2040. Norway has become Europe’s single biggest gas supplier, overtaking Russia, whose deliveries to Europe have dwindled in the wake of the war in Ukraine and damage to the Nord Stream pipelines. Landlocked Austria still receives around 66 percent of its natural gas imports from Russia via pipelines into eastern Europe, according to government data, and the country is looking to join new supply routes.

29 September: Pakistan’s largest coal miner Sindh Engro Coal Mining Company (SECMC) expects to boost its output by 51.3 percent in 2024, its Chief Executive Officer (CEO) Amir Iqbal said, as the south Asian economy seeks to reduce imports, cut fuel costs and shore up its finances. SECMC aims to help by boosting coal production to 11.5 million tonnes (MT) in 2024, from an expected 7.6 MT this year, Iqbal said. The company will seek to push power plants currently operating fully on imported coal to use 20-25 percent domestically mined coal, Iqbal said. SECMC has funds to finance the expansion of mining for 2024, but faces challenges in boosting output after that as Chinese lenders have stopped funding coal projects, Iqbal said.

29 September: A new financing tool that allows Asian governments to force coal plants into early retirement is set to launch its first project in Indonesia "soon" following months of negotiations, the Asia Development Bank’s climate envoy said. ADB's senior climate advisor Warren Evans said negotiations on the Cirebon One project in Indonesia were now on schedule, and talks were also underway to launch similar projects in the Philippines and Vietnam. Developed nations have not yet fulfilled a pledge to make US$100 billion in annual funding available by 2020, but even when they do, it would not be enough, Evans said.

29 September: Rapid electrification poses risks to power grids across the US (United States) that are straddling the twin goals of decarbonizing the sector and maintaining reliable supply, grid operators told US lawmakers. Appearing before the Energy, Climate, and Grid Security Subcommittee of the US House of Representatives, officials from all seven of the country’s grid operators said multiplying electricity demand will strain the power supply as the sector shifts from burning fossil fuels towards renewable sources. While new technologies like battery storage develop to become commercially viable and scalable, electric grids will need to keep relying on conventional sources like coal and natural gas. The Federal Energy Regulatory Commission recommended revising reliability standards for power grid and natural gas infrastructure to avoid issues during extreme weather.

28 September: Britain’s electricity and gas grid operators said they expect to have sufficient supplies this winter, with more power generation available than last year and brimming gas stores across Europe, but cautioned geopolitical risks remain. Last year, National Grid’s Electricity System Operator (ESO) warned Britain could face three-hour planned power cuts if the country was unable to import enough gas as Europe grappled with reduced supply from Russia and low gas storage levels. ESO said its base case for de-rated margin, which is a measure of the amount of excess capacity expected above peak electricity demand, is currently 4.4 gigawatts (GW) for winter 2023/24, or 7.4 percent of capacity, up from 3.7 GW, or 6.3 percent last winter. ESO will again use its demand flexibility service (DFS) which pays people, usually via money off their bills, for turning off appliances such as ovens and dishwashers during a specific periods when electricity demand is high. Last winter, the scheme saved over 3,300 megawatt hours of electricity or enough to power 10 million homes, but Dyke said it expects to treble the amount of capacity available under the mechanism this year.

29 September: German power grid operator 50Hertz said it had signed a €4.6 billion (US$4.88 billion) contract with Denmark's NKT and Italy's Prysmian Group as it expands high-capacity submarine and land cables for Germany’s renewables switch. The contracts are for cables covering at least 3,500 kilometres which could be later extended by an additional 2,700 kilometres, the company said. The project is part of Germany’s 2045 ambitions to generate 100 percent electricity from renewables, of which onshore and offshore wind power in the north would have to be transmitted to the industry-heavy south. The projects include 525 kilovolt (kV) cable systems with a capacity of 2 gigawatt (GW) each, a technology that is ideal for large amounts of power transportation over long distances, Denmark’s NKT said. The cables will have a lifespan of 40 to 60 years and would be manufactured in Germany and Sweden.

28 September: Brazil’s state oil firm Petrobras said it will sign a Memorandum of Understanding (MoU) with mining giant Vale to study potential joint ventures in renewable energy, even as looks to new suppliers for diesel. The partnership would come at a time when Petrobras is pushing to move into renewable energy.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.