CONTENTS

WEEK IN REVIEW

Ø ENERGY: 2014: Start New Conversations on Energy

Ø POWER: Moment of Cheer for Delhi Electricity Consumers?

DATA INSIGHT

Ø Delhi Distribution Utilities: Cost of Electricity Supply & Revenue Realisation

Oil & Gas: India’s Milestones

NEWS HEADLINES AT A GLANCE

· Aker may submit report in Apr on ONGC-RIL tie-up prospect

· BHEL renovates power plant unit in Uttar Pradesh

· Adani Power generates highest 4644 MW at Mundra Project

· Bagasse-based power plant to come up in Gujarat

· Indian company to set up power project in Pakistani Punjab

· NTPC plans to add 19 GW to capacity

· Adani Power approves demerger of transmission business

· Jaypee may sell hydro power assets

· Haryana discom UHBVN proposes no power tariff hike for 2014-15

· OVL completes acquisition of 12 pc stake in Brazil oil field

· Azerbaijan announces O&G production volumes

· Libya says oil production reaches 250k bopd

· Syria, Russia sign major offshore O&G exploration deal

· Russian gas exports to Europe hit record high in 2013

· Sterling completes purchase of 24 MW coal-fired power plant in Indiana

· Marubeni Corp. wins $1 bn contract to build power plant in Vietnam

· ABB wins $37 mn power transmission order in Poland

· NGCP, China research facility ink pact to boost PH power transmission

· Higher quota of cheap gas may cut CNG price in Delhi

· Baby steps in price decontrol defined oil economy in 2013

· Users may get to keep both LPG, PNG connections

· Govt’s direct gas subsidy transfer programme costs IOC ` 6 bn

· Higher winter demand drives up LNG prices

· Proposed Haryana nuke plant gets environment ministry's conditional nod

· GAIL gets environment nod for 220 MW power plant

· ONGC gets nod to offer 10 pc stake in Tripura Power Company to Bangladesh

· CCEA may take up Mega Power Policy proposal

· Almost every Delhi household has access to electricity, says NSSO

· Arvind Kejriwal may announce power tariff cut after taking oath as Delhi CM

· Egypt auctions 22 oil, gas exploration concessions

· Greenpeace activists say Putin’s amnesty isn’t Christmas gift

· Lakhra power plant will be re-privatised

· Spain approves new power transmission, distribution laws

· China commits $6.5 bn for Pakistan's nuclear project

· Uttar Pradesh signs contracts for solar plants

· Odisha to float tenders soon for 48 MW solar power

· Solar power a lucrative new opportunity for Punjab SMEs

· India renewable credit demand rises for fourth month

· Uttarakhand’s action plan to minimize effects of climate change

· JinkoSolar connects four solar PV projects totaling 80 MW to national grid in China

· Japan eyes smart meters, fuel cells to tackle climate change

· Japan to submit climate change measures to UN, NHK reports

· China’s Tianjin starts carbon trading at Half Guangdong’s price

· Saudis budget $4.4 bn for water desalination works

· US EPA’s fracking probe of range resources met rules

· Pakistan's govt deflates dream of gas-powered cars

WEEK IN REVIEW

2014: Start New Conversations on Energy

Lydia Powell, Observer Research Foundation

here is a need to start new conversations on energy that go beyond the stale dialogues over scarcity and security. These conversations over energy scarcity and energy security are not necessarily about interests of the country or its people. Nor are these conversations about basic scientific and economic principles that underpin the supply and use of energy. These conversations are about securing the interests of a narrow group of stakeholders.

The scarcity dialogue serves the interests of the suppliers of energy. As the resource they are supplying or aim to supply is scarce, they claim exclusive privileges from the State to search for and produce these resources. The scarcity conversation has almost always begun with the observation that India is not well endowed with primary energy resources such as oil and gas and that even its abundant resources of coal are of poor quality and in inaccessible places. The emphasis on ‘scarcity’ within the nation that underpins these conversations is used to allocate and justify special powers to entities that would supposedly use these powers to search for and produce energy.

As energy is seen to be vital for the nation’s economic survival, the security dialogue serves the interests of the State. Energy is portrayed primarily as a means of economic production and consequently the argument is made that without energy a nation cannot compete in the global economy or protect itself against external threats. This argument justifies State control over the production and flow of energy.

If six decades of exclusive privileges appropriated by the State and its agents supposedly on account of scarcity and security of energy, has only managed to produce more scarcity and more insecurity, something is definitely wrong in the conversations we are having. While scarcity and security are issues that are important in the context of energy, the context in which they are discussed needs to be reviewed through new conversations in the New Year.

One of the most important conversations we need to have must be about what we actually want and for whom when it comes to energy. To kick off the conversation let us look back into the history of energy and what it has meant for mankind. For most of human history sources of energy for human activity was limited. Food was the primary source of energy for human and animal labour and for four thousand years preceding the industrial revolution, the average quality of life for humankind changed very little. But in the last few hundred years, the use of energy, initially in the form of kinetic energy from flowing water and later in the form of fossil fuels, has enhanced quality of life by exponential proportions. It has been estimated that from 1500-1750, wealth measured as gross domestic product (a proxy for quality of life) grew by 0.4% annually with total wealth created in the 250 year period being $ 21 trillion. Large scale use of fossil fuels in the subsequent period increased wealth considerably between 1750 and 1950 with $139 trillion being generated between 1900 and 1950. In the 50 year period between 1950 and 2000, the wealth generated was a staggering $847 trillion which is estimated to be 3 times the wealth generated in the preceding 10,000 years. While these figures are interesting, we must turn to figures that are closer to every day energy use. As per calculations by David Hughes, a Canadian energy analyst, a man peddling constantly for 8 hours a day for five days a week, would need 8.6 years to produce the energy equivalent of 1 barrel of oil (which contains 1700 kilo watt hour of energy).

The message conveyed in these illuminating observations is that energy, particularly the energy stored in fossil fuels, has released human beings from the bondage of hard labour and it has improved his quality of life by heaps and bounds. We can now return to the question posed for our new conversation: what do we want from energy and for whom? We can answer it now without much thought: energy is a means to release human beings from the tyranny of hard labour and enhance their quality of life.

This does not mean that we must overlook conversations on scarcity or security. Energy, particularly energy that is stored in fossil fuels is not unlimited. When the world consumes 89 million barrels of oil a day it essentially consumes 14,000 years fossilised sunshine each day. Fossilised sunshine is not going to last forever. If the 89 million barrels of oil that the world consumes in a day is to be replaced by human labour the world would need 66 billion people peddling away to produce energy. We need to use these concepts of scarcity and security to convey messages on productivity, conservation and efficiency. We need to ask what the nation loses when it keeps most of its population energy-poor?

The idea of scarcity must be invoked in our conversations to highlight the value of energy and the small price we are paying for it. An average North American who consumes roughly 24 barrels of oil in a year will need over 200 people to replace the energy content of a barrel of oil. An average Indian who consumes about two barrels a day will need about 20 people. Now imagine paying just $100 each to two persons peddling 8 hours a day five days a week for 8.6 years to produce energy equivalent to those two barrels? It is evident that we actually do not pay much for energy.

We need to have conversations on the small price we pay for energy and ponder over why this is unlikely to continue forever. We need to have a new conversation on the geology of energy and the physics of energy to understand that energy will not last forever. We need to have a new conversation on the price of energy to understand that we do not pay enough for energy. These conversations are not about the interests of the State or the interests of its agents. It is about the interest of mankind and his survival. As David Huges has observed:

‘Rethinking energy at the end of the era of cheap energy is crucial and is not optional – the laws of thermodynamics cannot be repealed and mother nature has a way of settling such issues for those who choose to ignore them’

Views are those of the author

Author can be contacted at [email protected]

Moment of Cheer for Delhi Electricity Consumers?

Ashish Gupta, Observer Research Foundation

olitics and electricity have always gone side by side and this was quite visible in the recent elections in Delhi. Each party had its own formula for the power tariffs. Initially electricity was not the issue but rather it was the survival of the new party in the elections which was the issue. The manifestoes were made and both the leading parties did not bother about the presence of the AAP. The tone of the media was very different towards AAP as they devoted more attention to the ruling and the main opposition party. Once elections were concluded, the tone of the media changed and an ordinary man from an extraordinary party became the Chief Minister of the Delhi state.

Now that this is a reality we need to ask if the promises made by the party can be achieved? Power tariff was a major concern for common consumers and this was more acute for consumers in Delhi. There are allegations on the party as well as the discoms. It is felt that the party will not be able to fulfil its promises and also that discoms are involved in unscrupulous practices. Well, it is difficult to ascertain the validity of the allegation but the common man’s party took a step forward by announcing the audit of the Discoms by the Comptroller and Auditor General of India.

Interestingly when the election drama was at its peak, there was news in the media that the consumers must be prepared for another tariff hike in Delhi. All three discoms filed petitions for 3% - 6% tariff hike with Delhi Electricity Regulatory Commission (DERC) to cover additional power purchase cost. It was decided that the Power Purchase Additional Cost Adjustment (PPAC) will have to be borne by consumers for the next three months. This was the case when the outcome of the elections was uncertain. Surprisingly after the new CM took oath, DERC discarded the demand of the discoms and put forth the view that discoms have not incurred any additional cost. Then there was an allegation that discoms were showing fictitious costs and overcharging consumers. There appears to be some foul play and it is difficult to put the finger on the culprit now. We will have to wait for the journalists and investigating agencies to find out.

There is growing pressure on the new party to fulfil its promises. As a result, the party slashed power tariffs by 50% before proving its majority. The reduced tariff will be applicable from the New Year. Though it is a moment of cheer for the residential power consumers, it is coming at the cost of the subsidy and therefore it cannot be considered a sustainable move. Honest consumers have to bear the additional cost. However if allegations on the discoms prove to be true then it will be a win-win situation for the Delhi.

The discoms on the other hand are crying foul as they say that they are incurring huge losses and the tariff in the capital is not cost reflective. This is a genuine concern but if they are incurring huge losses then why are they shying away from the CAG audit? They do not have to worry if they are actually incurring a huge loss. Interestingly all the discoms kept mum on the issue and now it is being revealed that they do not have any reservation against an audit by the CAG, as long as it is conducted as per the law. The question which lingers in the mind of the common man is whether the CAG can perform the Audit? Yes the audit is possible with the consent of the CAG. Now that the party has got the consent of the auditor, we can be assured that it will be conducted as per the law. The CAG audit is in favour of accountability and so it will be inadequate if they come out with the conclusions based only on the accounting methodology used by discoms. The audit must also take into account the genuine problems of the discoms as they are under continued obligation to provide power at any cost. Well the audit is yet to be done and the wish is that a cushion is provided to the victims (discoms or consumers).

Though power tariff is a major issue, politics is a major spoiler for the power sector. Political masters should not be allowed to interfere with the regulatory function unless it is genuinely required. Unfortunately this is not happening and the political grip on the power sector is increasing. This will hinder reforms and become suicidal for any state. This is what is happening in many states in the country. Taking the cue from Delhi which has slashed tariff, Haryana is looking to reduce its residential electricity tariff structure. Maharashtra is not far behind as political parties are seeking to provide subsidized electricity to residential consumers up to 400 units. Reducing tariffs is a good thing but punishing the taxpayer for the same is not rational. All this is happening in the name of the consumers but this is not true in reality. Political parties are more interested in elections and not in consumer’s welfare. On the contrary consumers must be encouraged to pay for what they are using and welfare schemes must be limited to the needy.

One cannot equate the Delhi model with the Maharashtra model as they are both different in structure. In Delhi there is a government stake whereas in Maharashtra it is not the case. Most importantly, consumers in Maharashtra are quite satisfied with their discoms performance. Therefore when consumers are not complaining there is no justification for tariff reduction just before the elections. This demonstrates how desperate political parties are to win the Lok Sabha elections. The advice for the power consumers is that they should not seek free electricity and be sensible enough to pay for electricity services. If power utilities become more financially stable, they would not look out for any bailout package from the government. When they are financially strong, they become more independent and more importantly more accountable. Delhi has followed a different model and it cannot be made a benchmark for other states. Hope the New Year will be cheerful for Delhi electricity consumers but other states must look for other ways to reduce tariffs. Happy 2014 with lower tariff!

Views are those of the author

Author can be contacted at [email protected]

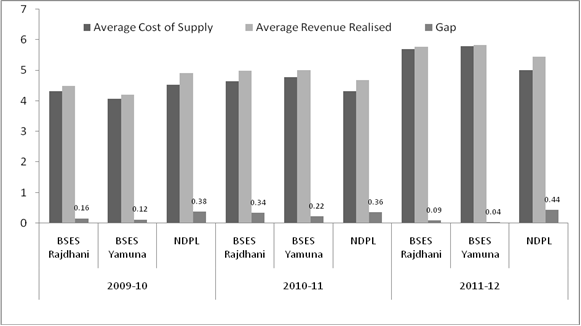

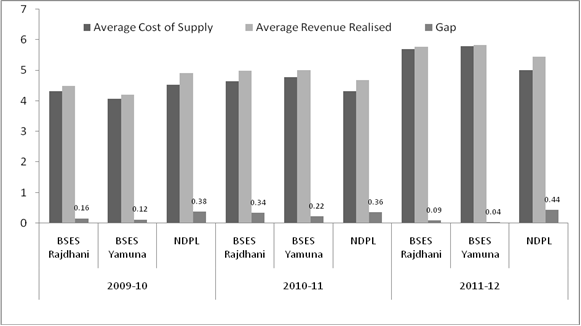

Delhi Distribution Utilities: Cost of Electricity Supply & Revenue Realisation

Akhilesh Sati, Observer Research Foundation

` per Unit (KWh)

|

Year

|

Utility Name

|

Average Cost of Supply

|

Average Revenue Realised

|

|

2009-10

|

BSES Rajdhani

|

4.33

|

4.49

|

|

BSES Yamuna

|

4.08

|

4.2

|

|

NDPL

|

4.54

|

4.92

|

|

2010-11

|

BSES Rajdhani

|

4.65

|

5.00

|

|

BSES Yamuna

|

4.79

|

5.01

|

|

NDPL

|

4.32

|

4.69

|

|

2011-12

|

BSES Rajdhani

|

5.69

|

5.78

|

|

BSES Yamuna

|

5.79

|

5.84

|

|

NDPL

|

5.02

|

5.46

|

Trends in Average Revenue Realisation in INR per Unit

Note: Gap = Average Revenue Realised - Average Cost of Supply

NDPL is now known as Tata Power Delhi Distribution Limited (TPDDL).

Source: Lok Sabha, Un-starred Question no. 1325.

Oil & Gas: India’s Milestones

Dinesh Kumar Madhrey, Observer Research Foundation

Continued from Volume X, Issue 28......

1990:

IOC’s 1st LPG bottling plant of Assam Oil Division was commissioned at Silchar and Kandla-Bhatinda product pipeline project was approved.

1991:

IOC’s Digboi Refinery modernisation project was initiated. Bunkering facility at Paradip was commissioned.

1992:

Punj Llyod became a Public Limited and won its first overseas pipeline contract in Indonesia.

1993:

A new concept of Computer Remote Operational Automatic LPG Filling System (RALFS) was developed and commissioned by IOC at the Calcutta bottling plant resulting in substantial increase in productivity. 6 new bottling plants were commissioned at Delhi, Amhedabad, Belgaum, Trichy, Farrukhadia and Guwahati.

1994:

India's first Hydrocracker commissioned at Gujarat Refinery (IOC). Gail’s 1st JV Mahanagar Gas Limited was formed with British Gas incorporated to implement Mumbai City Gas Distribution project.

1995:

IOC entered into a collaboration with Tata Chemicals Ltd for setting up a 6 million tonnes grassroots refinery at village Baholl in Karnal district of Haryana. The ultimate equity participation in the Joint Venture Company was IOC-26%, Tata Chemicals Ltd-16% and the balance 48% issued to the public including NRI. The joint venture company was incorporated as Tata Indian Oil Refineries Limited.

Punj Llyod got its 1st EPC (Engineering, Procurement & Construction) contract in Oil & Gas sector in India. IndianOil Institute of Petroleum Management was inaugurated at Gurgaon. IOC’s, Digboi refinery of the division achieved a capacity utilisation of 112% by processing 0.559 MMT of crude oil.

1996 (IOC):

Indian Oiltanking Ltd was incorporated as a JV company with M/s Oiltanking GmbH, Germany and IBP Co. Ltd. Kandla-Bhatinda product pipeline was inaugurated State-of-the-art LPG import terminal was commissioned at Kandla, Modernisation of vintage Digboi Refinery to state-of-the-art was completed.

to be continued…

NEWS BRIEF

OIL & GAS

Aker may submit report in Apr on ONGC-RIL tie-up prospect

December 30, 2013. Aker Solutions, appointed by state-owned ONGC to explore possibility of sharing Reliance Industries Ltd (RIL) infrastructural facilities on East coast of the country, is expected to submit its report by April next year. Based on Aker's report, ONGC will decide whether to enter into an agreement with RIL or not and modalities if it decides to go with the RIL. In July, ONGC had inked a Memorandum of Understanding (MoU) with RIL to explore the possibility of sharing the latter's infrastructural facility in the east coast. The MoU aims at working out the modalities for sharing of infrastructure, identifying additional requirements as well as firming up the commercial terms. This shall not only minimise ONGC's initial Capex but also expedite its field development resulting in early monetisation of its deep water fields adjacent to the fields of RIL, ONGC had said. Aker Solutions provides oilfield products, systems and services for customers in the oil and gas industry worldwide. ONGC has made nine gas discoveries in its KG block KG- DWN-98/2, which sits next to RIL's flagging KG-DWN-98/3 or KG-D6 block. The state-owned firm plans to club these finds with discoveries in another neighbouring block to begin gas production from 2016-17, ONGC had said. (www.business-standard.com)

LPG dealers to protest policy changes of oil companies

December 31, 2013. All India LPG Dealers' Federation (AILDF) representing 12,600 cooking gas cylinder dealers would take out a march, protesting the policy changes with respect to 'Marketing Discipline Guidelines (MDG)' of oil companies, which they said is making their "life hell". LPG dealers are hassled over the continuous changes and loopholes in the software for maintaining customer database which is affecting their work efficiency. Oil companies shifted from KYC database to Aadhar-linked software to implement direct benefit transfer of LPG. MDG ensures strict adherence to regulations on timed delivery, regular checks and proper maintenance of accounts. Severe penal action has also been suggested on account of any irregularity. Last revised in 2001, MDG underwent review this year and was implemented in November 2013. Changes in the marketing scenario, increased awareness in the customer and launch of the 'Direct Benefit Transfer of LPG (DBTL)' scheme led to the recent MDG being harsher than earlier versions. LPG distributors have alleged that their business has come down drastically post the launch of DBTL scheme and they are not able to meet expenses. (economictimes.indiatimes.com)

Congress poll push may lead to gas cylinder cap being raised

December 31, 2013. The government is set to relax the limit on subsidized cooking gas for homes as the Congress party looks for ways in which it can retrieve ground ahead of the general election after heavy defeats in recent assembly polls, a move that will mean a further retreat from the few reforms that the United Progressive Alliance put in place in its second term. Households may be entitled to 12 gas cylinders per year at subsidized prices, up from nine now, if the government allows itself to be persuaded by Congress party leaders including chief ministers. Such a move may help the UPA recoup some of the political capital it has lost due to the rise in prices amid a slump in growth. The UPA government had, in the face of economic difficulties brought on by sluggish growth and rising fuel prices, imposed a limit of six subsidized cylinders per household last year that was revised to nine early this year. The move aimed at slashing the subsidy burden was criticized by political parties and consumers, who said it would add to the burden of rising inflation. The move to raise the cylinder limit fits in with what party president Sonia Gandhi identified as a key reason for the state poll debacle - rising prices. (timesofindia.indiatimes.com)

Reliance Industries, BP to give $1.2 bn bank guarantee for higher gas price

December 29, 2013. Reliance Industries and its partners BP Plc of UK and Canada's Niko Resources may have to provide a maximum of USD 1.2 billion in bank guarantees over three years to get nearly double the rate for natural gas being produced from the main fields in KG-D6 block. The Cabinet Committee on Economic Affairs (CCEA) had decided to allow RIL to almost double the price of natural gas from April, 2014 provided the firm gave a bank guarantee to cover its liability if gas-hoarding charges are proved. The bank guarantee, which will be equivalent to the incremental revenue that RIL will get from the new gas price, will be encashed if it is proved that the company hoarded gas or deliberately suppressed production at the main Dhirubhai-1 and 3 (D1&D3) fields in the eastern offshore KG-D6 block since 2010-11. Considering gas prices will rise from USD 4.2 per million British thermal unit to USD 8.2-8.4 after the Rangarajan pricing formula comes into effect from next fiscal, the bank guarantee - being the difference of current and new price - for every trillion cubic feet (Tcf) of gas production will come to USD 4 billion. The bank guarantee for the entire remaining recoverable gas reserves of about 0.75 Tcf in D1&D3 fields comes to USD 3 billion. At current rate of production of about 8 million standard cubic meters per day, D1&D3 will produce about 0.3 Tcf in the next three years - the time that may be needed to settle the issue of gas hoarding charges. (economictimes.indiatimes.com)

Higher quota of cheap gas may cut CNG price in Delhi

December 28, 2013. The oil ministry may raise Delhi's quota of cheap natural gas that would not only help reverse a recent increase in auto and cooking gas prices, but may even lead to a fall in the fuel's cost in the Capital city. Once this quota of Indraprastha Gas, the monopoly gas distributor in Delhi, is raised to 80% from the current 73%, prices will go down. Imported gas is several times more expensive than the locally produced fuel, and reducing the share of imported gas in the total supply would help lower overall cost. Delhi's chief minister-designate Arvind Kejriwal criticised the government for raising the price of compressed natural gas, used as an automobile fuel, and piped natural gas, used by households, just before the swearing-in ceremony of his government. The Delhi government has a 5% stake in Indraprastha Gas. Bharat Petroleum Corp and Gail India hold 22.5% each in the distributor. His assurance came even as autorickshaw drivers, one of the biggest support groups for Kejriwal's Aam Aadmi Party, threatened to go on a strike over the fuel price increase. According to the oil ministry and Indraprastha Gas, gas prices were raised in Delhi because the government was forced to reduce the Capital's quota of domestic gas supply as city distribution companies in Mumbai and Pune insisted on getting cheaper gas to meet their entire requirement. Most of the domestically produced gas is sold at $4.20 a unit while imported gas costs about $20 in the spot market. The oil ministry issued a directive on the Supreme Court's instruction to distribute cheaper domestic gas to all cities equitably. This means the quota of Mumbai and Pune will fall to 80% from 100% while that of Delhi will rise to 80%. The high court has deferred the hearing till January 9. (articles.economictimes.indiatimes.com)

Baby steps in price decontrol defined oil economy in 2013

December 26, 2013. Partial deregulation of diesel prices and the government's nod for doubling natural gas prices from April 2014 were the highlights of India's oil economy in 2013, as the sector seeks a new thrust in the new year for the production of hydrocarbons. In a fresh round of bidding for hydrocarbon blocks under the New Exploration Licensing Policy (NELP), the 10th thus far slated for Jan 15, 2014, some 86 oil blocks will be up for auction in an effort to attract more investments into the exploration and production sector. The year began with a major decision that authorised state-run oil marketing companies to hike diesel prices from time to time, translating, in effect, to partial deregulation of the fuel. Since then, the cumulative hike in diesel prices has been ` .6.62 per litre in Delhi. This coincided with both a rise in international prices and a steep fall in the value of the rupee against the US dollar, leading to a spiraling current account deficit to which India's oil and gold imports were the biggest contributors. The situation improved somewhat toward the end of the year. But the government's target of fiscal deficit of 5.3 percent of the country's gross domestic product (GDP) is a performance that is being closely tracked by markets, foreign funds and ratings agencies. The partial deregulation in diesel appeared to yield dividends when Indian Oil Corp said that demand for the fuel this fiscal had dropped for first time in over a decade, with sales growth falling between 0.8 percent to one percent. However, oil marketing companies, effective Dec 16, continued to incur combined daily under-recovery, or losses, of ` 434 crore (around $70 million) on the sale of diesel, kerosene and domestic LPG below cost. In a bid to boost domestic production of natural gas, the government in June approved the doubling of natural gas prices from the present $4.2 per million British thermal unit to $8.4 mbtu from April 1, 2014, going along with the formula suggested by a panel headed by C. Rangarajan, chairman of the Prime Minister's Economic Advisory Council. Though the increase is likely to lead to a hike in power and fertilizer costs, the union cabinet, in the interest of exploration, acceded to the demand of leading players like Reliance Industries, bringing liquefied natural gas on a par with global prices. (economictimes.indiatimes.com)

Users may get to keep both LPG, PNG connections

December 26, 2013. Customers of cooking gas cylinders will soon be able to get legitimate piped natural gas connections in their kitchens, with the government readying to reverse the order that prohibits sale of cylinders to those who opt for piped gas and vice versa. The move will particularly ease problems of tenants in metros such as Mumbai and Delhi who were forced to surrender their subsidised liquefied petroleum gas (LPG) connections because their landlords opted for piped natural gas (PNG). The law prohibits a PNG customer to keep an LPG connection, executives of city gas distribution firms such as Mahanagar Gas Ltd (MGL) and Indraprastha Gas Ltd (IGL) said. More than 22 lakh customers have PNG connections while LPG users number more than 14 crore. IGL gives piped gas connection to a consumer only after taking written assurance that the person will surrender any LPG connection taken in the name of any family member. The family members are defined as husband, wife, unmarried children and dependent parents living together in a dwelling unit having common kitchen, IGL said. IGL supplies gas to more than 4.2 lakh households in Delhi and neighbouring Noida, Greater Noida and Ghaziabad. This relaxation is possible because of successful implementation of direct transfer of cooking gas subsidies in beneficiaries' accounts, which has stopped diversion for commercial use, the oil ministry said. The direct transfer of cash subsidy for cooking gas will cover another 291 districts next month, increasing the total to 9.22 crore consumers, oil minister Veerappa Moily said. The scheme has already covered 6.57 crore customers in 184 districts since June. (economictimes.indiatimes.com)

Govt’s direct gas subsidy transfer programme costs IOC ` 6 bn

December 25, 2013. Indian Oil Corporation (IOC) has taken a hit of ` 600 crore within months of the government introducing its ambitious programme to pay cooking gas subsidy directly to consumers in cash, the company said. IOC and the other state-run retailers, Bharat Petroleum and Hindustan Petroleum, need to deposit the difference between the market rate of LPG and its subsidised price to the accounts of consumers in places where the direct subsidy programme is introduced. In places where the programme isn't introduced yet, consumers can buy up to nine cooking gas cylinders a fiscal year at subsidised rates. The price difference between the market rate and subsidised price of a 14.2-kilogram LPG cylinder is about ` 650. The direct subsidy-transfer programme was first launched in 18 districts on June 1. As of December, it covered 49 districts and the government wants to extend it to 107 districts in January. (economictimes.indiatimes.com)

Higher winter demand drives up LNG prices

December 25, 2013. Higher global demand for liquefied natural gas (LNG) in winter has made it a non-viable fuel for a majority of Indian industries that were banking on imported supplies to bridge a fall in domestic natural gas production. The country's largest natural gas marketing and transmission company, state-run GAIL India, has raised the price of regassified LNG to $19.25 per million metric British thermal units in December from $18 in the previous month, and is considering increasing the price further. According to a Mumbai based trading company, LNG prices in the spot market will continue to remain firm until the end of February. Natural gas traders have already started quoting LNG at $20 a unit for spot cargoes since demand from Japan and China continues to drive the fuel's prices upwards. Due to its old contracts, GAIL is able to offer LNG at $15.75 per unit to some customers. LNG usually costs four to five times more than domestic natural gas, which is sold at a state-set price of $4.25 a unit. Indian consumers are compelled to buy expensive LNG due to lower domestic production of natural gas, primarily because of a fall in output from Reliance Industries' field off the eastern coast. India imported close to 11 million tonnes of LNG in 2012-13, and another six million tonnes during the first seven months of the current financial year that stated on April 1. (economictimes.indiatimes.com)

POWER

BHEL renovates power plant unit in Uttar Pradesh

December 31, 2013. Bharat Heavy Electricals Ltd (BHEL) has modernised a 200 MW unit at a thermal power plant in Uttar Pradesh. Besides renovation and modernisation, the rated output of the thermal unit has been enhanced to 216 MW. The work has been carried out at Obra thermal power station, an Uttar Pradesh government enterprise. BHEL said the working life of the machine has also been extended by another 15-20 years. BHEL is a leading power equipment maker in the country. (www.business-standard.com)

Adani Power generates highest 4644 MW at Mundra Project

December 31, 2013. Country's largest thermal private power producer Adani Power Ltd announced that its 4620 MW project at Mundra has set a record by attaining the highest generation of 4,644 MW, making it the only power station of such a gigantic size to reach a significant milestone in electricity production. Adani Power has a thermal power generating capacity of 7,920 MW, consisting of 4620 MW at Mundra, 1980 MW at Tiroda and 1320 at Kawai. The Mundra plant, which is one of the world's largest private coal based power station at a single location, has five units of 660 MW and four units of 330 MW each. All the 660 MW units are based on environment friendly. The company is evacuating the electricity from the Mundra power plant via a 400 kV transmission line from Mundra to Dehgam in Gujarat covering 430 KM and a 500 kV high voltage direct current line from Mundra to Mohindergarh in Haryana, covering over 1000 Km. The Mundra plant is also the world's first coal fired power project to receive carbon credits. It is generating about 1.8 million Certified Emission Reductions each year. (economictimes.indiatimes.com)

Bagasse-based power plant to come up in Gujarat

December 30, 2013. Shree Ganesh Sugar Mill has inked an MoU with a Singapore-based company Kara International for setting up Bagasse co-generation plant for power generation in neighbouring Bharuch district. According to Mill, the 28 MW capacity plant will come up at Vatariya village and will be first of its kind in the country with an FDI investment. As per the MoU, the Singapore company will hold 76 per cent equity and remaining 24 per cent will be owned by the mill. The Mill is expected to earn an annual revenue of about ` 15 crore after the agreement and will fetch ` 160 per tonne for crushing of sugarcane. The Gujarat Electricity Regulatory Commission (GERC) has been declaring attractive tariff for co-generation power projects from time to time. And whenever it revises its power tariff rates in future it will benefit our sugar mill. Ganesh Sugar is a co-operative factory with 14,000 members in six talukas comprising Bharuch and Surat districts. Bagasse is a by product of sugarcane that is used as fuel in boilers to produce process steam. The consumption of Bagasse depends upon the pressure at which steam is produced in the boiler. Co-generation projects with higher boiler pressure results in low computation of Bagasse, resulting in increased operating days. (economictimes.indiatimes.com)

Highly volatile Indonesian coal caused fire at Mundra UMPP

December 29, 2013. Tata Power has said the susceptibility of Indonesian coal to spontaneous combustion was the main reason for last month's fire incident at its 4,000 MW Mundra plant, where operations have been normalised. The fire had broken out at the site of the Mundra ultra mega power project (UMPP), temporarily affecting electricity generation. The plant is operated by Coastal Gujarat Power Ltd (CGPL), a wholly owned subsidiary of Tata Power, and is fired with coal imported from Indonesia. The Mundra project, located in Gujarat, has five units, each with 800 MW of generation capacity. Electricity from the plant is supplied to Gujarat, Rajasthan, Maharashtra, Haryana and Punjab. (www.business-standard.com)

Indian company to set up power project in Pakistani Punjab

December 28, 2013. Pakistan has signed an agreement with an Indian firm for setting up a 15 MW biomass power plant in Punjab province. Provincial agriculture minister Farrukh Javed said India would provide technical assistance for the power plant. He said the project would generate 15 MW of electricity. According to the MoU, the plant would be handed over to Pakistani authorities after successful installation and working within two years. The energy generated by it would be linked with a 132-KVA supply line. More similar projects will be completed with the assistance of India to help Pakistan overcome an energy crisis, the MoU said. (timesofindia.indiatimes.com)

NTPC plans to add 19 GW to capacity

December 26, 2013. Country's largest power producing firm NTPC has lined up new projects of 19,000 MW capacity, nearly half of that would be commissioned by 2017. Ten coal-based thermal power projects totalling 13,290 MW are under construction. These include 2,400 MW Kudgi (Karnataka), 1,980 MW Barh-I (Bihar), 1,600 MW Lara-I (Chhattisgarh), 1,600 MW Gadarwara-I (Madhya Pradesh) and 1,320 MW Mouda-II (Maharashtra) thermal power projects. NTPC is also executing over 5,000 MW capacity plants in joint venture with different firms in Bihar, Uttar Pradesh and Tamil Nadu. This list also includes 800 MW Koldam-I hydro power project in Himachal Pradesh, 520 MW Tapovan Vishnugad-I and 171 MW Lata Tapovan-I in Uttarakhand. NTPC is also developing many solar power projects, including a 50 MW Rajgarh Solar photo voltaic in Madhya Pradesh. At present, NTPC generates 42,454 MW of electricity from various sources of energy. The company is also hopeful of commissioning its very first hydro power project Koldam in Himachal Pradesh in the next six months. The public sector firm tied up a loan facility for 55 million euro with German developmental financial institution KfW to part finance the capital expenditure of its Mouda thermal power project in Maharashtra. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

Adani Power approves demerger of transmission business

December 30, 2013. Adani Power approved the demerger of its transmission lines business to its wholly owned subsidiary company besides appointing Vinod Bhandawat as the chief financial officer of the generation company. The transmission unit of Adani Power will compete with the likes of JSW Energy, Torrent Power and Reliance Infrastructure apart from the state-run Power Grid Corporation of India. Adani Power currently operates four transmission lines including one between the company's Mundra plant and Dehgam near Ahmedabad, another 1,000 km long line between Mundra and Mohindragarh in Haryana apart from two in the state of Maharashtra. The estimated investments on these lines is around ` 10,000 crore. Adani Power got its first transmission license in July 2013 and thereafter it had filed a petition for tariff determination at the Central Electricity Regulatory Commission (CERC). (www.business-standard.com)

State boards to ink long-term power pacts with firms

December 30, 2013. After much delay, some state electricity boards (SEBs) have decided to buy from power generation companies on a long-term basis. The boards of Jharkhand, Punjab and Maharashtra might sign deals with JSW Energy, Jindal Power and Essar Power, which have been looking for such opportunities, to get supply for 10-12 years. According to experts, such long-term agreements would bring stability to generators, helping them keep average sales constant. SEBs have been under pressure due to their own credit crunch. Unable to raise retail power rates, they had piled up huge loans. In the past year, many sick SEBs have progressively increased rates, and are now able to buy power. (www.business-standard.com)

Jaypee may sell hydro power assets

December 30, 2013. Abu Dhabi National Energy Company, IDFC and a Canadian pension fund are likely to walk away with some of the hydro power assets that the Jaypee Group is planning to hive off to cut debt. The deal could happen within a month. The Abu Dhabi firm would have a larger role. The projects likely to be put on the block include the 400 MW Vishnuprayag and the 1,000 MW Karcham-Wangtoo, the country's largest private sector hydro-power producer. The hydro-power business is run under Jaiprakash Power Ventures. It operates three plants, including the 300 MW Baspa project apart from the Vishnuprayag and Karcham-Wangtoo units. The company is developing a 2,700 MW hydroelectric project (the Lower Siang project), which is expected to commence operations in 2016 (1,500 MW Phase I) and a 500 MW hydroelectric project (the Hirong project), expected to start in 2018 in Arunachal Pradesh. The company has also entered into an implementation agreement with the Meghalaya government to set up the 270 MW Umngot and 450 MW Kynshi Stage II hydropower projects. (timesofindia.indiatimes.com)

Haryana discom UHBVN proposes no power tariff hike for 2014-15

December 26, 2013. Haryana's power distribution company UHBVN has not proposed any hike in power tariff for next financial year 2014-15 even as it has projected revenue gap of ` 2,246 crore for next financial year. Uttar Haryana Bijli Vitran Nigam Limited (UHBVN) undertakes power distribution and retail supply business in 11 districts of Haryana including Panchkula, Ambala, Yamunanagar, Kurukshetra, Kaithal, Karnal, Panipat, Sonepat, Rohtak, Jhajjar and Jind. UHBVN has submitted multi-year tariff petition for the period 2014-15 till 2016-17 for the first time with power regulator Haryana Electricity Regulatory Commission, giving projections of power purchase cost and other significant expenditures. In the Aggregate Revenue Requirement (ARR) submitted with state power regulator, UHBVN has not proposed any hike in power tariff, saying that it expected to fund its gap through available funding under Financial Restructuring Plan (FRP). Under the FRP scheme, the banks will fund operational deficit of the Discoms to the extent of 100 per cent in 2012-13, 75 per cent in 2013-14 and 50 per cent in 2014-15. (economictimes.indiatimes.com)

Policy / Performance

Proposed Haryana nuke plant gets environment ministry's conditional nod

December 30, 2013. A nuclear power plant proposed to be set up in Haryana is one step short of getting the green clearance with a high-level panel of the environment ministry giving conditional nod. The decision to recommend green clearance to the Nuclear Power Corporation of India Ltd (NPCIL) proposal for setting up a ` 23,502 crore nuclear power plant in Fatehabad district was taken at a recent meeting of expert appraisal committee on environmental appraisal of nuclear power projects. The environment minister is the final authority to grant the clearance to the project to be set up around 200 km away from the national capital. The NPCIL proposal seeks setting up a nuclear power park, known as Gorakhpur Haryana Anu Vidyut Pariyojna (4x700 MWe), at Fatehabad's Gorakhpur village. The project, for which the ministry accorded terms of references (ToR) three years ago, would be implemented in phases. The first phase would comprise two units of 700 MWe each. (timesofindia.indiatimes.com)

GAIL gets environment nod for 220 MW power plant

December 30, 2013. GAIL India Ltd, the nation's biggest gas marketing company, has received environmental clearance for setting up a 220 MW gas-based power plant at Raigad in Maharashtra at a cost of ` 1,028 crore. The state-owned firm plans to use 1 million standard cubic meters per day of natural gas to generated 220 MW of electricity at the proposed combined cycle power plant. GAIL plans to set up the combined cycle gas based power plant within the existing LPG plant boundary. Electricity generated at the plant will be sold to Maharashtra.

The project, which will use natural gas or imported liquefied natural gas (LNG) as fuel, is proposed to be located within GAIL's existing LPG recovery plant at Raigad. GAIL has appointed Tractebel Engineering Pvt Ltd as consultant for preparation of Detail Feasibility Report (DFR). According to the company's proposal, natural gas requirement for use in the proposed project would be about 1 million standard cubic meters per day. The supply of fuel is proposed to be available from GAIL pipeline network. A new pipeline of about 400 meters is to be laid to connect the power plant. (www.business-standard.com)

Any power tariff review will take 3 months: DERC Chief

December 30, 2013. The Delhi Electricity Regulatory Commission (DERC) which decides power tariff in the city has not yet received any request from the city government to cut power rates and it may take at least three months for reviewing the existing charges if such a proposal is made. The Aam Aadmi Party (AAP) in its manifesto had promised to cut tariff by 50 per cent and Chief Minister Arvind Kejriwal had said a decision on the issue will be made in four-five days. DERC chairman P D Sudhakar said government has not yet contacted the regulator on the issue of power tariff. He said it may take at least three months for the DERC, a quasi-judicial body, to review the existing tariff as the regulator will have to undertake the set procedure which includes calling all stakeholders for public hearing before deciding the rates. Power experts said government will have to take the subsidy route to implement the promise of slashing tariff as that will be an executive decision. As per estimates, government will have to incur an annual expenditure of around ` 5,000 crore if it decides to halve the power rates for around 40 lakh domestic consumers.

According to DERC figures, the three private discoms operating in the city have a revenue gap of whopping ` 19,500 crore. Power experts said any move to cut tariff will adversely impact the operation of the discoms in the city. As per official figures, around 80-90 per cent of total revenue of discoms goes into purchasing power from central and state government owned entities through long term power purchase agreement, at rates determined by the central and state regulators. The experts said discoms' cost of buying power from generating companies has increased by around 300 per cent in the last two years while the power tariff, in the corresponding period, has risen by around 70 per cent. Power tariff for domestic consumers was hiked by five per cent in August. Immediately after tariff was announced, the then Chief Minister Sheila Dikshit had announced subsidy for the consumers whose consumption does not go beyond 400 units. The power tariff in the city was hiked by 22 per cent in 2011 followed by five per cent hike in February last year. The tariff was hiked by up to two per cent in May last year and again by 26 per cent for domestic consumers in July last year. The tariff was hiked by up to three per cent in February. (news.outlookindia.com)

ONGC gets nod to offer 10 pc stake in Tripura Power Company to Bangladesh

December 30, 2013. The government has given an in-principle approval to state-run Oil & Natural Gas Corporation's (ONGC) proposal to offer 10% equity stake to Bangladesh in ONGC Tripura Power Company and supply 250 MW electricity to the energy-deficient neighbour. ONGC can supply energy to the neighbouring country after meeting the requirements of the northeast.

The 726.6 MW project is currently producing just 180 MW because the company has been unable to lay transmission lines between the Palatana plant and Bongaigaon to connect to the national grid for want of green clearance. The second phase of the project, which was expected to be commissioned by July this year, has, therefore, been delayed until March 2014. The Tripura government, which has a stake in the power plant, has already agreed to sell its share of surplus power across the border. ONGC, IL&FS and the government of Tripura promote ONGC Tripura Power Company.

Palatana power plant could be commissioned after generous help provided by the government of Bangladesh, which allowed the company to use its territory to move 90 cargos of huge equipment. ONGC has to its credit several natural gas finds in Tripura and it is confident of meeting the power plant's fuel requirement of 3 million standard cubic metres per day from its fields for more than two decades. (articles.economictimes.indiatimes.com)

Govt has no authority to reduce power tariffs: DERC

December 30, 2013. Delhi Electricity Regulatory Commission (DERC) has said the government cannot interfere in fixing tariff though it can subsidise consumers, highlighting the potential difficulties facing Arvind Kejriwal, the new Delhi CM, whose party has promised to halve electricity prices in the Capital. The meteoric rise of Aam Aadmi Party (AAP), which eventually led to Kejriwal becoming the chief minister of Delhi, was fuelled, at least in part, by promises which many economists would term populist. These include providing 700 litres of free water, the promise to cut electricity rates in the city and conducting audit of power distribution companies (discoms). While many Delhi residents were enthused by the prospects of cheaper power, the power distribution companies have said it will be "nearly impossible" to lower the rates, given that their accumulated losses amount to ` 11,000 crore. Discoms argue that in the past 10 years, cost of power has increased 300%, mainly because of higher coal prices and a rise in the financing charges due to higher interest rates, while the rate at which it is sold to retail consumers has increased by only 70% during the period. Delhi has three power discoms, two controlled by Reliance Infrastructure and one by Tata Power. The state government owns a 49% stake in each discom. The total annual revenue of the three discoms in Delhi is around ` 15,000 crore. If the government offers to lower tariff by 50%, it may result in an additional annual burden of ` 7,500 crore on the state, experts tracking the sector said. (articles.economictimes.indiatimes.com)

CCEA may take up Mega Power Policy proposal

December 29, 2013. The Cabinet Committee on Economic Affairs (CCEA) is likely to take up the Power Ministry's proposal to amend the Mega Power Policy. The issue was supposed to be discussed CCEA meeting but was not taken up as Power Minister Jyotiraditya Scindia was not present. The Mega Power Policy was introduced in November 1995 to provide impetus for the development of large-size power projects and derive benefits from economies of scale. Thermal power projects of 1,000 MW or more and hydel power plants of 500 MW or more are eligible for benefits under the Mega Power Policy.

These guidelines were modified in 1998 and 2002 and last amended in April 2006 to encourage power development in Jammu & Kashmir and the North Eastern region. Mega Power Projects can tie up electricity sales to distribution utilities through long-term power purchase agreements. They can also sell power outside these agreements, in accordance with the National Electricity Policy 2005 and the Tariff Policy 2006, as amended from time to time. The benefits of the Mega Power Policy also apply to energy-efficient supercritical projects that are awarded through international competitive bidding with the mandatory condition of setting up indigenous manufacturing facilities. (www.business-standard.com)

Cabinet coal nod to push 'standing power projects'

December 27, 2013. Adani Power's Tiroda power project in Maharashtra which was earlier using imported coal, will now get a new lease of life. The Cabinet cleared coal mines to nine power units, including that of Adani's, which were earlier stuck in evironmental clearances. The 3,300 project is yet to commission two more units of 1,320 MW. The plant load factor (PLF) or capacity utilisation of the 1,980 megawatt power project is currently at around 85%. This could go up to 90% or higher if cheaper domestic coal is available. Over 80% of the cost of producing power is over fuel purchase, any reduction in this, analysts say will have a huge impact on its profitability as well. As many as 24 units in which the development of coal blocks was delayed due to Go-No-Go policy of the Ministry of Environment and Forests. Until now, they were getting coal only by tapering linkages where only 65% coal will be received for the first two years. Apart from Adani, power plants of Vedanta group's Sterlite Energy at Jharsuguda, two power projects of GMR and that of Hyderabad-based KSK Power Ventures were also amongst those which were cleared. (www.business-standard.com)

Delhi's power economics not so simple

December 26, 2013. Only a proper cost audit by an independent agency, like the office of the Comptroller and Auditor General of India, can ascertain if there is, indeed, scope for a large cut in the capital's power tariff - which the Aam Aadmi Party promises to halve. The power utilities in the capital which distribute electricity in the city as also the Aam Aadmi Party have put forth their arguments in detailed letters to the administration, copies of which are with IANS. Not surprisingly, they all sound equally convincing. (www.business-standard.com)

CERC to hear WRLDC plea on Sasan unit commissioning on Jan 7

December 26, 2013. Electricity regulator CERC will hear next month a petition by Western Region Load Despatch Centre challenging Reliance Power's claim of commissioning the first unit of its Sasan ultra mega power project. The CERC (Central Electricity Regulatory Commission) gave January 7, 2014 as the next hearing date for the Western Regional Load Despatch Centre (WRLDC) petition. WRLDC, which operates the power grid in the region, had questioned the start date of commercial operations at the Sasan plant, where the first 660 MW unit was commissioned in March.

Based on a petition filed by the WRLDC, the CERC had set aside a certificate issued by the independent engineer for declaration of commercial operations at the Sasan plant. Reliance Power filed an appeal with the Appellate Tribunal for Electricity (APTEL) on the grounds that CERC's order is violative of principles of natural justice and is not tenable in law.

APTEL set aside CERC's order and directed it to decide afresh on the matter of commercial operation date. While referring to the judgement of APTEL, WRLDC in its petition with the CERC said that since the issue of maintainability is linked with the main issue on merits, the commission can consider all issues and then come to a conclusion. Sasan Power Ltd (SPL) is the wholly owned subsidiary of Reliance Power which is executing the 4,000 ultra mega power project in Madhya Pradesh. The first unit started producing power on March 30. The company is executing UMPPs in Sasan, Krishnapatnam (Andhra Pradesh) and Tilaiya (Jharkhand). (www.business-standard.com)

CAG all set to audit three discoms in Delhi

December 25, 2013. The Comptroller and Auditor General (CAG) is ready to start audits of three joint venture power distribution companies (discoms), supplying power in the national Capital, with top officials in the federal auditor's office citing examples of similar exercises of private firms and public private partnership (PPP) ventures in the past. Delhi has three discoms — BSES Rajdhani Power Limited (BRPL); BSES Yamuna Power Limited (BYPL) and North Delhi Power Limited (NDPL) - and in each the state government holds 49% share and the rest with private firms (51%). CAG expressed hope that with the Aam Aadmi Party (AAP) chief and CM-designate Arvind Kejriwal regime willing to ask the federal auditor to examine the books of these companies, the state government may be able to convince the Delhi High Court to permit scrutiny of their accounts on the grounds that similar audits of private companies such as Reliance Industry Ltd's KG D-6 basin had been done in the recent past while another one is in progress. Besides RIL and other oil and gas companies, the CAG had audited several PPP projects in highways and infrastructure sector, including the Delhi airport. One of the two private companies having majority share in discoms in Delhi have stopped paying the National Capital Territory (NCT) government share in the revenue it has been collecting . The arrears, on account of the government's share in the revenue with one such private company, have mounted to ` 1,200 crore. Audit is likely to reveal other discrepancies like total cash collection and how much it has been shown in the account books of these firms; billing cycle and if customers have been charged as per the actual tariff slabs applicable on monthly basis. (economictimes.indiatimes.com)

Almost every Delhi household has access to electricity, says NSSO

December 25, 2013. The previous Delhi government might have been criticised for high power rates, but almost every household in this Union Territory had access to electricity in 2012. According to a report by the 69th round of the National Sample Survey Officer (NSSO), 99 per cent of households in urban Delhi had electricity in 2012. At an all-India level, 97.9 per cent of urban households had access to electricity. However, Delhi lagged Goa, Mizoram, Sikkim, Dadra & Nagar Haveli, Daman & Diu, and Lakshadweep, where every household in urban parts had access to electricity. The data, however, do not specify the number of hours a day electricity is supplied. (www.business-standard.com)

Arvind Kejriwal may announce power tariff cut after taking oath as Delhi CM

December 25, 2013. All set to become Delhi Chief Minister, Arvind Kejriwal has held discussions with Chief Secretary D M Spolia on a range of issues like financial health of private power distribution companies and the city government, leading to speculation that there could be a power tariff cut in the offing. Spolia provided an update about status of Delhi Government's financial resources besides some other details about a number of departments. Arvind Kejriwal also sought to know specifically about the financial position of the private power distribution companies to which the Chief Secretary provided certain details. Arvind Kejriwal may make an announcement on power tariff after taking oath as Chief Minister.

In its manifesto, AAP had promised to slash power tariff by 50 per cent besides carrying out scrutiny of the accounts of the private power distribution companies. Arvind Kejriwal had launched an agitation in the city earlier in the year accusing the Sheila Dikshit dispensation of siding with the private distribution companies. The power tariff in Delhi is decided by the Delhi Electricity Regulatory Commission and it will be interesting to see whether Arvind Kejriwal will be able to fulfil the promise. The power tariff in the city was hiked by 22 per cent in 2011 followed by a 5 per cent increase in February last year. The tariff was hiked by 26 per cent for domestic consumers in July 2012. The tariff was hiked again by up to 3 per cent in February and further by 5 per cent in July. Congress has been attacking AAP accusing it of misleading the citizens on the issue, saying it was impossible to slash tariff by 50 per cent. (www.financialexpress.com)

Odisha targets 129 MW hydro power in 12th Plan

December 25, 2013. Odisha aims to add 129 MW of hydro power by the end of the 12th Plan (2012-17). The capacity addition in hydro power will be taken up at a cost of ` 903 crore and the investments will flow from the private players. During the 11th Plan (2007-12), only three state hydroelectric power projects (SHEPs) with a combined capacity of 57 MW were completed. For setting up small and hydro power projects at different locations, the state government has entered into memorandum of understanding (MoU) with 33 developers. The government has prioritized nine proposals for implementation with a combined generation capacity of 129 MW. The proposals contemplated on Kolab river will be allowed to be executed and operated for 20 years. Water and Power Consultancy Services (WAPCOS), a premier consultancy organization and Indian Institute of technology (IIT), Roorkee have been chosen to approve the design and drawings of these projects. Presently, three SHEPs in the state are operational- Meenakshi Power Ltd, Middle Kolab-Koraput (25 MW), Meenakshi PowerLtd, Lower Kolab-Malkangiri (12 MW) and Odisha Power Consortium Ltd, Samal barrage-Angul (20 MW). (www.business-standard.com)

OIL & GAS

OVL completes acquisition of 12 pc stake in Brazil oil field

December 31, 2013. ONGC Videsh Ltd (OVL), the overseas arm of state-owned Oil & Natural Gas Corp (ONGC), has completed acquisition of an additional 12 per cent stake in a Brazilian oilfield for USD 561 million after blocking a Chinese entry. The flagship Indian firm had along with Royal Dutch Shell exercised a pre-emption right to block China's Sinochem Group from buying their partner Brazilian national oil firm Petrobras' 35 per cent interest in the BC-10 oilfield.

OVL and Shell bought the 35 per cent interest of Petroleo Brasileiro SA's share for USD 1.636 billion. This stake was split between OVL and Shell - the Indian firm picked up 12 per cent while the remaining 13 per cent went to Shell. Shell increased its stake to 73 per cent from 50 per cent, while OVL's stake climbed to 27 per cent from 15 per cent in the Parque das Conchas project, also known as BC-10, OVL said. The heavy-oil BC-10 block, about 110 kilometres off southeast Brazil, started production in 2009 and is currently producing 50,000 barrels of oil equivalent a day. Shell is the operator of the project.

OVL said the transaction has received approval of the Brazilian regulatory authorities and the acquisition was completed. Block BC-10, also known as Parque das Conchas, is in the Campos Basin of Brazil and includes four offshore deep-water fields - Ostra, Abalone, Argonauta and Nautilus - and a few identified exploration prospects. The water depth in the block ranges from 1,500 to 1,950 metres and it is located about 120 km from Vitoria town. The licence for the fields expires in December 2032. (www.business-standard.com)

Britain's Breagh gas field back up after 7 week closure

December 30, 2013. Gas production at the Breagh field, one of the biggest new sites in the North Sea, resumed on Dec. 27 following a shutdown in November just one month after it started operating, project stakeholder Sterling Resources said. The start-up of the field, majority owned by Germany's RWE Dea, was plagued by delays and equipment issues have added to the series of problems since it opened for production in mid-October.

The field is expected to produce at a rate of 112 million cubic feet per day in 2014 and pumps gas to Britain's Teesside onshore gas processing terminal. Sterling Resources also said that Breagh would undergo two planned shutdowns scheduled for the first week of January. (www.rigzone.com)

Azerbaijan announces O&G production volumes

December 29, 2013. Azerbaijan produced 43.5 million tons of oil in 2013, head of Azerbaijan's energy giant SOCAR Rovnag Abdullayev said. Abdullayev further said the country also produced 29.5 billion cubic meters of gas. The State Oil Company produced 8.34 million tons of oil and 7.15 billion cubic meters of gas.

Oil is produced independently by SOCAR as well as through joint ventures. In addition, oil and gas production is carried out under the contract on the development of the Azeri-Chirag-Guneshli field block. Gas and condensate are produced within the Shah Deniz field development project. In both contracts SOCAR operates within a consortium with foreign companies. (www.azernews.az)

Libya says oil production reaches 250k bopd

December 26, 2013. Libya's oil production was at 250,000 barrels per day as of December 25, according to an oil ministry, and while that is up slightly from 224,000 at the end of November it is down sharply from July. Gas output was at 1.928 million cubic feet on December 25, the oil ministry said. A mix of militias, tribesmen and political minorities, which are demanding a greater share of Libya's oil wealth and more political power, have shut most oilfields and ports, cutting oil output from the 1.4 million bpd in July. The seizures have also cut Libya's oil exports to 110,000 barrels a day from more than one million in July. Libya's oil and gas industry association said it was optimistic the government would soon reach an agreement with protesters occupying major oil export ports for months. (www.rigzone.com)

Syria, Russia sign major offshore O&G exploration deal

December 26, 2013. The government of Syria has signed a major deal with a Russian company for oil and gas exploration in Syrian waters. Suleiman Abbas, oil minister of Syria and head of its General Petroleum Company, signed the 25 year development agreement with Russian oil and gas firm Soyuzneftegaz in Damascus.

The contract for offshore exploration in Syria will cover up to a depth of 43 miles and an area of 845 square miles between the Syrian cities of Tartous and Banyas. Projects are slated for development in several phases with total costs tentatively estimated at $90 million.

Under terms of the contract, Soyuzneftegaz will begin with surveys and studies in the area to pinpoint potential drilling sites, with this stage having an estimated cost of over $15 million. The second stage will involve drilling at least one test well, with costs estimated at over $75 million. If operations are successful, Soyuzneftegaz will carry out further drilling, development and production operations. (www.pennenergy.com)

Nigerian oil unions defer strikes over refinery sales

December 31, 2013. Nigeria’s two main oil unions deferred plans to start an indefinite national strike on Jan. 1 until they meet with government officials to discuss proposals to privatize the nation’s four state-owned oil refineries. The manager-level Petroleum and Natural Gas Senior Staff Association of Nigeria, or Pengassan, with 15,000 members has scheduled talks with petroleum and labor ministry officials for Jan. 7, said its President Babatunde Ogun. The blue-collar National Union of Petroleum and Natural Gas Workers, or Nupeng, hasn’t set a date for discussions, though it will “engage” with government before deciding on strike action, Elijah Okougbo, secretary general for the union representing over 30,000 workers, said.

Nigeria, while ranking as Africa’s largest oil producer, relies on fuel imports to meet more than 70 percent of its needs, as its 445,000 barrels a day of refining capacity operates at minimal rates because of poor maintenance and aging equipment. Petroleum Minister Diezani Alison-Madueke said that the government will pursue its plan to begin selling the refineries before the end of the first quarter.

The West African nation exchanges 60,000 barrels a day of crude for products with Trafigura Beheer BV and a similar amount with Societe Ivoirienne de Raffinage’s refinery in Ivory Coast, according to Nigeria National Petroleum Corp. The government’s privatization plans come as Africa’s richest man, Aliko Dangote, seeks to construct a $9 billion oil refinery, petrochemical and fertilizer complex in Nigeria’s southwest by 2016. Dangote says the plant will reduce Nigerian fuel imports. (www.bloomberg.com)

Total’s five French oil refineries resuming work as strikes end

December 27, 2013. All five of Total SA’s refineries in France are resuming operations after employees at Gonfreville voted to return to work, the last to come back after a strike that began two weeks ago, the CGT union said. All facilities are resuming activity, Eric Sellini, a CGT union representative, said.

The 247,000 barrel-a-day refinery at Gonfreville in northern France, Total’s largest in the country, is the third site where staff have ended industrial action. European diesel traded near the highest in two months, boosted by the strikes, which began on Dec. 13. The premium for benchmark diesel barges in the Amsterdam, Rotterdam, Antwerp oil hub was much as $15 a ton more than benchmark ICE gasoil futures on Dec. 24, up from $12.50 on Dec. 13, according to a survey of traders and brokers monitoring the Platts pricing window. Staff at the La Mede refinery voted overnight to resume work, and the Feyzin site ended industrial action, according to CGT.

Total’s refineries in France also include the Donges plant, where a strike ended last weekend, and the Grandpuits facility where workers went back to work on Dec. 17. The sites can collectively process about 800,000 barrels of crude a day, or 60 percent of the nation’s output. Demand for oil products in France averaged 1.76 million barrels a day in the third quarter.

At least two unions representing Total’s refining workers, CFDT and CGC-CFE, agreed to a pay deal with the company. CGT, which called for the industrial action, didn’t sign the accord, pressing for further benefits. Total’s crude-processing and petrochemicals business in France may lose as much as 500 million euros ($690 million) this year, the company said. (www.bloomberg.com)

Japan's JX to refine 2 pc less crude in Jan from year ago

December 26, 2013. Japan's top oil refiner, JX Nippon Oil & Energy Corp, said it plans to refine 2 percent less crude oil in January for domestic consumption from a year earlier. The lower runs in the face of sluggish kerosene sales due to much warmer-than-usual weather in northern Hokkaido island are offset somewhat by bumper exports, the company said.

JX Nippon's planned crude refining for local market is estimated at 1.22 million barrels per day, or 5.99 million kilolitres in January. Its December crude refining for domestic consumption was estimated at 1.27 million bpd, or 6.28 million kl, up 1 percent from the year-earlier period, compared with the original plan of 1.28 million bpd, or 6.31 million kl, as bad weather delayed the arrival of crude vessels. JX, which operates eight refineries in Japan with a total capacity of 1.61 million bpd, planned no refinery maintenance in December and January. The refining volumes exclude condensate but include crude processed at the company's 51 percent-owned venture with PetroChina, Osaka International Refining Co, an export-oriented 115,000-bpd refinery. (www.downstreamtoday.com)

Bashneft says halts poduction unit at Ufaneftekhim oil refinery after fire

December 26, 2013. Russian mid-sized oil producer Bashneft said it stopped production at a crude distillation unit (CDU-3) at its 190,000 barrels-per-day Ufaneftekhim refinery in the Urals region late after a fire. The company said a pipeline at the unit caught fire, which was put out by the emergencies service. No one was hurt. (www.downstreamtoday.com)

Russian gas exports to Europe hit record high in 2013

December 30, 2013. Russian gas exports to Europe in 2013 jumped 16 percent year on year to reach a record high of 161.5 billion cubic metres (bcm), preliminary data from Gazprom Export showed, as shipments from Norway and other sources decreased. The data from the export arm of Gazprom covers supplies to the European Union and Turkey under long-term contracts and excludes Gazprom's trading activity. Gazprom Export said the average Russian gas price in Europe stood at slightly above $380 per 1,000 cubic metres, which was below the $400 registered in 2012, when exports slumped by 7 percent to 138.8 bcm. Europe, where the Kremlin-controlled company meets a quarter of gas demand, is a source of over 50 percent of Gazprom's revenues, which stood at almost $56 billion in 2012.

Gazprom's previous record high for exports to Europe was 159 bcm hit in 2008, just before a global financial crisis hit. Gazprom was able to capitalise on a decrease in gas exports from Norway and troubled North Africa. It also gave in to pressure from clients in Europe, such as Germany's E.ON, to review its contract terms and pay hundreds of millions of dollars in rebates.

Europe's hopes for a higher intake of seaborne liquefied natural gas to substitute for pipeline gas exports from Russia - from which it has long sought to diminish its dependence - did not play out. LNG suppliers, such as Qatar, preferred to sell to more profitable Asian markets rather than to Europe. Gazprom was also dealt a blow this year when the Russian government scrapped its monopoly for LNG exports, giving rivals Novatek and Rosneft a chance to compete for the global gas market. (www.rigzone.com)

WTI trades above $100 for second day as oil stockpiles decline

December 30, 2013. West Texas Intermediate (WTI) oil traded above $100 a barrel for a second day after government data showed U.S. crude stockpiles fell more than forecast to the lowest level since September. Futures were little changed near the highest settlement, and the first above $100 a barrel, since Oct. 18. Crude inventories dropped by 4.73 million barrels amid an increase in refinery operations, the Energy Information Administration (EIA) said. WTI has increased 8.2 percent in December amid reduced crude stockpiles in the U.S., the world’s biggest oil consumer. The country will account for about 21 percent of global demand this year, according to the International Energy Agency. (www.bloomberg.com)

Worst fuel oil loss since 2011 seen easing on import cut

December 28, 2013. Refining losses from producing fuel oil in Asia are poised to narrow as imports from western countries and Iran decline while global economic growth boosts demand for transportation fuels. Cargoes of the ship and power-station fuel cost an average $10.20 a barrel below Dubai crude this month, the largest monthly discount since April 2011. That gap, known as the crack spread, will narrow to minus $8 a barrel in the first quarter of 2014, according to the median estimate in a survey of five analysts and traders.

A recovery in fuel oil, which refiners typically produce at a loss after making gasoline and diesel, will help boost margins at companies including South Korea’s S-Oil Corp. and Royal Dutch Shell Plc. Iran, once the second-biggest supplier to China, has cut exports by 67 percent compared with earlier this year. At the same time, global demand for shipping fuel is forecast to rebound amid economic growth from the U.S. to China.

Iran has cut exports to about 200,000 tons a month since October from 600,000 tons earlier this year, the National Iranian Oil Co. said. China’s fuel oil imports from Iran fell to 30,000 tons in November, from as much as 526,203 tons in May, the most in almost nine years, according to customs data. The Persian Gulf country was China’s biggest source of fuel oil in May after Russia, accounting for about 19 percent of overseas supplies. The nation’s total fuel oil purchases fell to 1.47 million tons last month from 2.83 million in May. (www.bloomberg.com)

Egypt auctions 22 oil, gas exploration concessions

December 30, 2013. Egypt’s General Petroleum Corporation (EGPC) and Natural Gas Holding Company (EGAS) announced an international auction for 22 concessions for oil and gas exploration in accordance with production-sharing agreements. The concessions are for areas in the Suez Canal, Egypt’s western desert, the Mediterranean sea and the Nile Delta, the state-owned firms said. Exploration companies have been hesitant to develop untapped gas finds in Egyptian waters partly because the amount the government pays them barely covers their investment costs. Egypt pays offshore gas producers on average around $2-$3 per million British thermal units. Comparable payments for gas in Britain are currently above $10 and for Asian supply above $17. (www.dailynewsegypt.com)

BP loses bid to require proof of losses in spill accord

December 26, 2013. British Petroleum (BP) lost a bid to require businesses to provide proof their economic losses were caused by the 2010 Gulf of Mexico oil spill under a $9.2 billion settlement over the disaster. US District Judge Carl Barbier in New Orleans, overseeing the settlement of lawsuits spawned by the blowout of BP's Macondo well, found the London-based oil company would have to live with its agreement to pay billions of dollars in business losses tied to the disaster. An appeals court ordered Barbier in October to re-examine the accord's terms to ensure claimants weren't receiving improper payouts.

In the settlement, BP agreed businesses in certain geographical regions were presumed to have been harmed by the oil spill if their losses followed a specific pattern, Barbier concluded in ruling. As part of the accord, BP agreed these claimants wouldn't have to prove a link to the spill to recover, the judge said. The company now contends claimants can only recover if they have damages directly linked to the spill. BP officials said they plan to appeal Barbier's ruling that claimants don't have to show their damages were directly tied to the spill. (www.business-standard.com)

Greenpeace activists say Putin’s amnesty isn’t Christmas gift