-

CENTRES

Progammes & Centres

Location

Recent headlines show India's renewable energy, especially solar, is slowing despite optimism. The government's coal focus hints at a shift.

Recent headlines on India’s renewable energy (RE) sector are not encouraging. Even the solar sector, which was celebrated as the means to achieve India’s ambitious goal of increasing the installed capacity for power generation using RE, is showing signs of slowing down. The government’s plans to meet the expected summer peak demand for electricity in 2024 focus on coal rather than on RE. Slower growth rates in RE capacity addition could mean that the RE industry is entering a phase of maturity in its lifecycle, or input cost escalations are decelerating growth. It could also mean that regulations and resource constraints, especially land availability, are starting to bite. In the current geopolitical context where all countries are prioritising energy nationalism, the slowdown in the RE industry could also be the result of trade barriers.

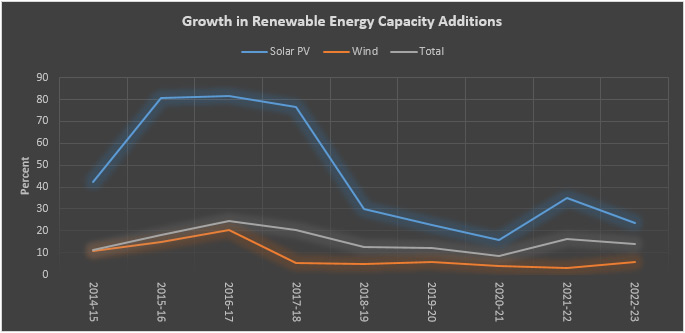

In the early 2010s, the nascent RE industry demonstrated double digit growth rates. The overall annualised growth rate of RE installations for power generation in India was close to 20 percent in 2013-18. Solar installations grew by 70-80 percent annually in this period while wind power installations grew by 15-20 percent. In 2018-23, annualised growth rate of RE installations slowed down to 10-15 percent. In this period, solar installations grew by 25-35 percent, while the growth of wind power installations slowed down to around 5 percent. In 2023-24 (up to February 2024), the annualised growth rate of RE installations grew by less than 10 percent. The annualised growth rate of wind power installations remained close to 5 percent while the growth of solar installations fell to around 11 percent.

The slowdown in the growth rate of solar and wind power installations which account for over 88 percent of total RE power generation installations is raising concerns over India meeting the target of 500 GW of RE installations by 2030.

In terms of annual capacity additions of RE since 2013, the highest values of over 15 GW were recorded in 2021-22 as well as in 2022-23. In the same two periods, annual solar installations also recorded their highest values of over 13 GW. The highest annual installation in the wind sector, of 5.5 GW was in 2016-17 while the annual capacity additions were 1.1 GW and 1.2 GW in 2021-22 and 2022-23.

As of 29 February 2024, solar installations accounted for 55 percent of total RE installed capacity while wind accounted for about 33 percent. Other RE sources, such as small hydropower, biomass and waste to energy accounted for the remaining 11.5 percent of total RE installations. The slowdown in the growth rate of solar and wind power installations which account for over 88 percent of total RE power generation installations is raising concerns over India meeting the target of 500 GW of RE installations by 2030. In 2023-24 (up to 29 February 2024), total RE installations were 11.2 GW and wind installations was 2.5 GW, an increase of 13 percent compared to 2022-23. Solar installations however fell by over 50 percent to 11.2 GW, the lowest annual capacity addition since 2013-14.

To achieve the goal of 500 GW of RE installed capacity by 2030, installations have to grow by an annual average of 20 percent and annual capacity additions have to increase from the current level of 11-12 GW to over 60 GW. If the current rate of capacity additions is the result of a secular trend rather than that of a cyclical flux, slowing growth of RE installations signals a serious challenge.

Project developers have cited inadequate transmission infrastructure and the new regulatory requirements as the prime causes of the slowdown in RE installations. One of the new regulations that influences RE installations is the general network access (GNA) rules. GNA rules, notified in June 2022 have been framed by the CERC (central electricity regulatory commission) to facilitate non-discriminatory open access to distribution licensees or generating companies or consumers for use of inter-state transmission system (ISTS).

According to the international energy agency (IEA) , global annual RE capacity additions increased by almost 50 percent to nearly 510 GW in 2023 (calendar year), the fastest growth rate in the past two decades. The factor behind the impressive number is China which commissioned as much solar photovoltaic (PV) as the entire world did in 2022 (calendar year). RE installations were also at an all-time high in Europe, the United States and Brazil in 2022. This suggests that the situation in India is an exception to the global trend. Solar module prices exported from China are at historic low of around US$0.14/watt indicating that input cost escalations are not driving the deceleration in solar PV installations in India.

Chinese industrial policies focusing on solar PV as a strategic sector and on growing domestic demand have enabled economies of scale and supported continuous innovation throughout the supply chain.

Restrictions on import of solar PV modules from China to promote domestic manufacturers could also be among the reasons for the slowdown. In 2023, solar PV module exports from China to Europe and other countries that added the most RE capacity increased substantially. Solar PV module exports to India fell by over 7 percent in the first half of 2023 while exports to the rest of the world increased by 35 percent in the same period. This suggests that trade restrictions could have inhibited growth in RE installations in India. Global solar PV manufacturing capacity is expected to reach almost 1,000 GW in 2024, adequate to meet annual IEA’s net zero 2050 demand of almost 650 GW in 2030. In 2022, global solar PV manufacturing capacity increased by over 70 percent to reach almost 450 GW, with China accounting for over 95 percent of new facilities throughout the supply chain. In 2023 and 2024, global solar PV manufacturing capacity is expected to double, with China again claiming over 90 percent of this increase. Chinese industrial policies focusing on solar PV as a strategic sector and on growing domestic demand have enabled economies of scale and supported continuous innovation throughout the supply chain. According to the IEA, these policies have contributed to a cost decline of more than 80 percent, helping solar PV to become the most affordable electricity generation technology in many parts of the world. Seen through the lens of climate risk, China’s continued dominance of the solar supply chain that reduces the cost of solar PV installations is a global public good. Industrial policies of the United States and India that prioritise energy nationalism and domestic solar PV manufacturing are on the other hand strategic national security goods. These produce domestic jobs, and add to manufacturing capacity but increase the cost of solar installations. If industrial policies of countries are accepted as necessary, then the underlying suggestion that China rather than climate change is a more significant threat must also be accepted.

Source: Central Electricity Authority

Lydia Powell is a Distinguished Fellow at the Observer Research Foundation.

Akhilesh Sati is a Program Manager at the Observer Research Foundation.

Vinod Kumar Tomar is a Assistant Manager at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +