-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY/COAL: India Coal Outlook 2035

Ø POWER/RENEWABLE ENERGY: Who needs to be subsidised and who needs to be green in Delhi

DATA INSIGHT

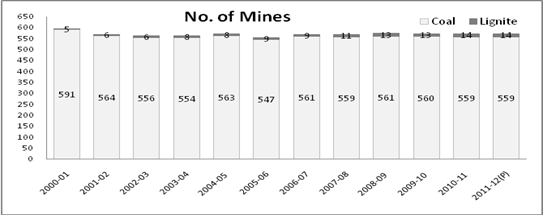

Ø Mines in India: Coal & Lignite

Oil & Gas: India’s Milestones

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· ONGC to invest $9 bn in KG basin

· RIL to increase KG-D6 gas output

· ONGC to drill more wells in Cambay to explore shale gas

· GAIL asked to use Indian ships for importing LNG from US

· Gujarat Gas signs agreement to buy gas from GSPC for 12 years

· Adani Power fully commissions 1.3 GW Kawai project in Rajasthan

· ONGC's Tripura power plant starts commercial generation

· CCI may consider land compensation exemption for Reliance Power plant

· L&T bags power transmission contract in Saudi Arabia

· BHEL completes power transmission sub-station at Raichur

· Indian cabinet approves 220kV Alusteng to Leh transmission system construction

· Statoil finds oil, gas at Askja

· Iraq awards $6 bn refinery contract to Hyundai Engineering Consortium

· Woodside says Japan's MIMI terminates browse LNG sales agreement

· APR Energy secure 70 MW contract extension in Botswana

· China $50 bn power goal leads to Australia

POLICY & PRICE

· SC to hear plea against RIL gas price on March 4

· Govt to offer 56 O&G blocks under NELP-X

· Reconsider price hike in non-subsidised LPG cylinder: Vasan

· PM urges LNG buyers in Asia to demand fair prices for gas imported from outside Asia

· CNG price may rise due to Centre's guidelines: Delhi govt to HC

· No increase in LPG price effected: Kerala CM

· ATF price hiked by over 2.7 pc

· CERC hearing on draft power tariff rules for 2014-19 on Jan 15

· GMR, JSPL, Sterlite to benefit from mega power policy relief

· DERC proposes new power regulations to help fix tariff

· Rajasthan Govt to ensure 24-hour power supply this year: Khimsar

· Cabinet approves PSDF

· Environmental panel clears Simang I & II hydel projects in Arunachal Pradesh

· AAP effect: Demand for audit of discoms rises in UP

· Tata Power welcomes move to provide power subsidy

· EIA increases US gasoline demand, price estimates for 2014

· Canada PM confident Keystone XL pipeline will be approved

· Oman to review fuel subsidies

· Indonesia 2014 LNG output to rise nearly 6 pc, exports steady

· German power costs seen dropping for fourth year

· Pakistan plans to produce 8.9 GW electricity by 2030

· NHPC to set up 82 MW wind farm in Kerala

· India’s $960 mn drinking water project gets World Bank aid

· China aims to curb water use in cities with progressive pricing

· Chile debates bill making mines use desalinated seawater

· China to assign some credit ratings on environmental protection

· Saudi Arabia seeks bids for integrated gas, solar plant

WEEK IN REVIEW

ENERGY/COAL

India Coal Outlook 2035

Lydia Powell, Observer Research Foundation

|

W |

hen we read the section on coal in the world energy outlook 2013 (WEO 2013), what strikes us most is the fact that coal is likely to hold its ground despite the competition from gas and the criminalisation of coal use by climate evangelists. The WEO 2013 predicts that coal is expected to remain the leading source of electricity generation by 2035 even though its share in the primary energy basket is expected to fall from 41% to 33%. Global coal use is expected to overtake oil use after 2020 and coal is expected to remain the leading fuel until 2035. The reasons appear to be fairly straightforward and simple. Coal meets the ‘three A’ criterion for energy security: availability, access and affordability. The fourth A of acceptability from the perspective of climate change seems to have fallen off the list, at least for the time being.

Coal passes the availability test effortlessly. Coal is the most abundantly available fossil fuels worldwide accounting for 55% of fossil fuels reserves. As per WEO 2013, coal resources are more than 20 times larger than reserves and this makes up 90% of global remaining fossil fuel resources. Coal is far more accessible than oil and gas because coal resources are widely distributed around the world. According to WEO 2013, 32 countries have reserves of more than 1 billion tonnes (bt) and 26 countries have resources of over 10 bt. In all major producing countries, proven reserves exceed projected cumulative production even by 2035 and in theory cumulative production in several of these countries can be met by drawing solely on the reserves of existing mines. The third attribute of affordability makes coal attractive for poor countries such as India. A significant share of coal resources can be, in theory, exploited at modest cost with existing technology.

While coal passes tests of availability, access and affordability that does not automatically imply that coal will be available, accessible and affordable for India. Governance of the Indian energy sector in general and coal sector in particular has to radically change if India wants to take advantage of the ‘three As’ of coal.

China and India are likely to remain the two most important countries to watch as far as coal is concerned between now and 2035 but India’s role is expected to become more important than that of China after 2020. China, India and Indonesia are expected to account for 90% of incremental coal output. Among these, China is likely to remain the world’s largest producer and user of coal but China’s coal imports are expected to peak in 2020 (subject to price arbitrage advantages). China’s rate of growth in coal demand including imports is expected to slow down on account of the substantial improvements in the efficiency of its coal plants, diversification in primary fuel sources in power generation and stagnation in industrial demand for coal as output from its steel and cement industries have peaked. Though some of these developments are beginning to unfold in India as well, the pace, scope and scale of these developments are unlikely to match that of China. These factors would make India the second largest coal market after China by 2025 and also the largest importer of coal by 2020 on account of constraints in ramping up domestic production.

According to WEO 2013, coal demand from the Indian power sector is expected grow at a CAGR of 3.1% to touch 972 million tonnes of coal equivalent (mtce) by 2035 while coal production in India is expected to grow at 2.3% and touch 624 mtce by 2035. As per assumptions made for the 11th plan (8% growth in GDP and about 5.4% growth in coal demand), demand for coal from the power sector is expected to touch 1290 mt by 2024 and coal supply is expected to grow at average of 4.4% and touch 1087 by 2024. India’s Coal Vision 2025 has slightly less optimistic projections with demand for coal from the power sector touching 950 mt under the 8% growth scenario and production touching 814 mt by 2024. Historically projections from international agencies such as the IEA have tended to be on the conservative side while those from domestic agencies on the optimistic side and this holds true in the case of coal. Reality may be somewhere in-between. A close reading of 12th plan targets may hold some clues on India’s current coal trajectory.

As per the optimistic scenario in the 12th plan about 596 mt of coal will be available for power generation by the end of the plan period with roughly 138 mt of incremental production. This level of incremental production would require a cumulative annual growth rate of 8%. This is almost double that of the 4.6% rate achieved during the 11th plan period. Even of optimistic levels of incremental production are achieved, thermal coal imports are expected to exceed 200 mt by the end of the plan period.

Unprecedented growth in coal imports is likely to be reality irrespective of which of the long term projections are accurate and this has serious implications for the Indian economy. According to WEO 2013, prospects for steam coal trade are bright as export mines have a cost advantage over domestic production subject to evolution of mining costs and seaborne freight rates. Numerous comments on India’s energy security have expressed concerns over availability of coal in the international market and used constraints in the coal export market to make the case for a shift towards nuclear power (or even renewable power). But developments in exporting countries seem to tell a different story. Australia and Indonesia are expected to expand their export capacity by 57% and 54% respectively by 2035. Furthermore Indonesian steam coal exports which are India’s primary source are expected to exceed combined steam coal exports of Australia and Colombia, the second and the third largest coal exporters by 2035.

The key issue for India is therefore not constraints in the export market but its economic ability to access those exports. First, India’s entry into the global market will have a significant impact on prices in the global market. Globally 85% of steam coal is produced and used domestically which means that only 10-15% (about 1 billion tonnes) is traded. If India enters the market with a demand for 200 mt (or one fifth of the global market) it will push up global prices. It happened in the case of China in 2012. Second, India’s coal imports are seen to be less sensitive to price than that of China but the conclusion here is not that India is actually less sensitive to increase in price of imported coal. Price arbitrage (between domestic and internally traded coal) decides China’s import volumes but India’s import volumes are decided by compulsion. India’s choice is having or not having coal for power generation which makes price relatively less important. Third, when coal is imported in US dollars and sold as electricity in Indian rupees an increase in the value of the dollar increases procurement cost compared to the value of the electricity prices in Indian rupees. This has serious financial ramifications for power generating and distributing companies. More importantly it has electoral ramifications for political parties that have made power tariff their selling point.

Views are those of the author

Author can be contacted at [email protected]

POWER/RENEWABLE ENERGY

Who needs to be subsidised and who needs to be green in Delhi

Ashish Gupta, Observer Research Foundation

|

T |

he Delhi government is in no mood for sparing the discoms and discoms on the other hand do not want to give up their inertia. The AAP promised tariff reduction and slashed the same by 50% after coming to power. The poor consumers are satisfied but the green opportunists are more than happy. These green opportunists are the ones who are benefiting twice, once through reduced tariffs and second through vested business interest. They are also the ones who want India to do away with the subsidies but when it comes to availing subsidies they are first in line.

This is just the case when it comes to producers of power through renewable sources. Interestingly in the name of making Delhi energy independent, they are seeking a surrogate route for pushing renewable energy by increasing subsidy on solar panels and associated equipment. This is a clear case of artificially creating a demand for the renewable energy at the cost of tax payer’s money. These opportunists always focus on the green aspect but shy away when it comes to funding the renewable programme and finding ways to earn revenue for the government. They do not want subsidy on coal fired power but would like to avail huge subsidies on green sources.

Indeed Delhi can become green at the cost of tax payer money. Certainly it could be a moment of cheer for the green fraternity as it is a step towards reforms that favour their interests. But reforms must take place in a genuine manner and therefore this column will offer some suggestions for the new government as to what they should do for greening the power sector and who needs to be green.

As already mentioned, the government has already slashed the tariffs by 50% which has cheered Delhi consumers. But bringing happiness must be complemented with financial viability. This is important not only for the power sector per se but for the whole State. The government must also think that whether offering benefits to all class of consumers irrespective of their need is sustainable. Instead the government must classify consumers in to different categories. Though this is difficult to do in a short time because of the leakages but it will be fruitful exercise in the long run. The following suggestion may be considered:

Needy and poor electricity consumers: This class certainly is in need and should be given intended befits through subsidy. They are the ones who pay more for the services availed by them from the grey market. Therefore the government must keep its commitment by providing electricity at the reduced 50% tariff. The poor who are yet to be metered must be metered at the earliest and they must be encouraged to pay for the services (at reduced tariffs). Very importantly, they must not be overburdened with green energy as they are already green. It must also be ensured that this class comes under no power cut zone as they have only necessary electricity gadgets and their electricity consumption is very low. The intended benefits should be given to the people who earn ` 5000/ month – ` 20,000/ month. The benefit must be provided through government budget or through wise cross-subsidisation. There are some miscreants in this group who must be identified and dealt with as necessary.

Middle class electricity consumers: This is the most loyal class of consumers as they pay the electricity bills on time. They are also under continues threat that their electricity connection will be cut in case of default. Yet they are the ones who are bullied every time and have to run around electricity utility offices for no fault of theirs. This class generally consists of service personnel and self employed small businessmen earning above ` 20,000/ month – ` 80,000/ month. The major chunk of their income goes towards rent and electricity bills. They must get some benefit of the reduced tariffs but not at the rate of 50%. Instead they could be offered a 30% reduction. Abusers of the scheme may be found in this class as well as many are found to be indulging in meter tampering which can be stopped through periodic checks and penalties. Importantly, they must also be kept out of the green ambit because that will become a surrogate route for burning their pockets. But some percentage of green cess (like 2% of the total electricity bill) can be charged from the consumers earning above ` 50,000/ month – ` 80,000/ month.

Upper middle class electricity consumers: For this class electricity tariff is not an issue. They can afford the electricity at high prices. They live in high rise buildings, drive SUVs and have all sorts of luxuries in their homes. Their lifestyles are expensive and they crave for every new electricity/ electronic gadget that is launched in the market. This class earns ` 80,000/ month – ` 1,50,000/ month. Their electricity bills are usually high in spite of having energy efficient Air conditioners (AC) and other electric gadgets. This class is not in need of any benefits. They do not care about electricity tariff as they are already paying ` 12– 15/unit for diesel generated power. If the government wants to give some benefits then it must be limited to 10%. The green energy obligation must be enforced on them and they must be encouraged to go for solar roof tops. Here too presence of miscreants cannot be ruled out. They work in cahoots with lower level employees of power utilities to reduce their electricity bill artificially. The same can be stopped through hefty penalty on the consumer and the employee.

Rich electricity consumers: This class is really stubborn and do not like any reduction in quality of their life style. They have everything and yet they want more. Subsidising them is certainly not acceptable. The class falls under incomes above ` 1,50,000/ month – ` 2,50,000/ month. Their electricity bills are very high and are hardly noticed as it is handled by their servants. They do not require any reduced tariff benefits. Any subsidy benefit availed by this class is nothing but a huge revenue loss for the government. Apart from that they must be made accountable to green obligations. They must procure power through renewable sources and in case of default a green penalty must be enforced upon them. There are miscreants in this class as well and they generally sort out their billing misdeeds by directly dealing with higher level employees of power utilities. The misdeeds can be stopped through adopting stick approach on the consumer and the employee.

Super-rich electricity consumers: This category falls under criteria earning above ` 2,50,000/ month. They are the real beneficiaries of the reduced tariff prices as they consume more electricity through more gadgets. They are not entitled to any government benefit. They are dedicated to consumption of high energy products such as packaged food, AC cars and AC homes! Their bill runs into several thousand to lakhs and they do have any problem in paying that. There is no need to subsidise them at the cost of the exchequer. Many in this class pretend to be green but yet they are not. They come in big cars and yet they talk about diesel subsidy. Their power tariff must be increased and since they are talking about being green, they must be forced to follow all green obligations or a hefty penalty must be imposed upon them. There must be clear directives from the government that this class must avail of renewable power for 5 – 8 hours a day. They must be made green! The miscreants of this class are very powerful and most of their misdeeds go unnoticed. Neither the power utilities nor the police have the guts to punish them. They can only be stopped through naming and shaming them.

Note: The above classification is only intended to make a point and not intended to offend anyone falling under the specific income category.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT

Mines in India: Coal & Lignite

Akhilesh Sati, Observer Research Foundation

|

STATE |

Coal |

Lignite |

Total |

||||||

|

2009-10 |

2010-11 |

2011-12(P) |

2009-10 |

2010-11 |

2011-12(P) |

2009-10 |

2010-11 |

2011-12(P) |

|

|

Andhra Pradesh |

49 |

50 |

50 |

0 |

0 |

0 |

49 |

50 |

50 |

|

Arunachal Pradesh |

1 |

1 |

1 |

0 |

0 |

0 |

1 |

1 |

1 |

|

Assam |

7 |

7 |

7 |

0 |

0 |

0 |

7 |

7 |

7 |

|

Bihar |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Chhattisgarh |

60 |

62 |

61 |

0 |

0 |

0 |

60 |

62 |

61 |

|

Goa |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Gujarat |

0 |

0 |

0 |

7 |

7 |

7 |

7 |

7 |

7 |

|

Haryana |

0 |

0 |

|

0 |

0 |

0 |

0 |

0 |

0 |

|

Himachal Pradesh |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Jammu & Kashmir |

7 |

7 |

7 |

0 |

0 |

0 |

7 |

7 |

7 |

|

Jharkhand |

174 |

174 |

172 |

0 |

0 |

0 |

174 |

174 |

172 |

|

Karnataka |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Kerala |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Madhya Pradesh |

75 |

71 |

71 |

0 |

0 |

0 |

75 |

71 |

71 |

|

Maharashtra |

55 |

55 |

57 |

0 |

0 |

0 |

55 |

55 |

57 |

|

Manipur |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Meghalaya |

1 |

1 |

1 |

0 |

0 |

0 |

1 |

1 |

1 |

|

Odisha |

26 |

28 |

28 |

0 |

0 |

0 |

26 |

28 |

28 |

|

Rajasthan |

0 |

0 |

0 |

3 |

4 |

4 |

3 |

4 |

4 |

|

Sikkim |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Tamil Nadu |

0 |

0 |

0 |

3 |

3 |

3 |

3 |

3 |

3 |

|

Uttar Pradesh |

5 |

5 |

4 |

0 |

0 |

0 |

5 |

5 |

4 |

|

Uttarakhand |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

West Bengal |

100 |

98 |

100 |

0 |

0 |

0 |

100 |

98 |

100 |

|

Total |

560 |

559 |

559 |

13 |

14 |

14 |

573 |

573 |

573 |

Trends in Coal Mines P: Provisional

Source: Indian Bureau of Mines, Ministry of Mines

Oil & Gas: India’s Milestones

Dinesh Kumar Madhrey, Observer Research Foundation

Continued from Volume X, Issue 29......

1996-97:

Reliance became the first private sector company to be rated by international credit rating agencies. S&P rated BB+, stable outlook, constrained by the Sovereign Ceiling. Moody's rated Baa3, Investment grade, constrained by the Sovereign Ceilings. Reliance was the 1st corporate in Asia to issue 50 and 100 year bond in US debt market.

1997:

Government of India granted Navratna status to GAIL. Petronet India Ltd was incorporated as a JV company with BPC, HPC and others.

1998:

Indian Oil Corporation (IOC) entered into an MoU with Reliance Petroleum for marketing and distribution of petroleum products of the latter. With this agreement, IOC had the sole rights to market Reliance's products manufactured at its 15 million tonne refinery at Jamnagar, Gujarat. Indian Oil is the largest commercial organisation in India, the only Indian company to feature in the Fortune Global 500 list, is ranked 30th in terms of sales and profits among the world's petroleum companies. Reliance completed phase-II expansion of Hazira Petrochemicals Complex including world's largest multifeed cracker, PET plant, MEG plant, PTA plant, PE plant.

Punj Llyod was awarded a project for the construction of India’s first LNG and regasification terminal at Dabhol, India. And It got its first Refinery project, De-sulphurisation unit of IOCL’s Mathura Refinery. IndianOil Board was reconstituted under the Navaratna concept, with the induction of five part-time non-official independent Directors. IOC’s Panipat Refinery and Haldia-Barauni crude oil pipeline were commissioned. Indraprastha Gas Limited (IGL) was incorporated for supply of gas to household sector, transport sector & commercial consumers in Delhi.

1999:

The Indian Oil's Mathura and Gujarat refineries were presented the Golden peacock Environment Management Award by Union minister of environment and forest Suresh Prabhu. Indian Oil Corporation Ltd (IOC) commissioned a crude pipeline from Haldia to its Barauni refinery enabling the latter to achieve total capacity utilisation, and eventually meet the crude deficit in Bongaigaon Refinery and Petrochemicals Ltd (BRPL) and Numaligarh Refinery Ltd (NRL).

1999-2000:

Reliance started commercial production of 27 million tpa refinery, the 5th largest in the world. Reliance started the World's largest PP plant of 0.6 million tpa, the World's largest PX Plant of 1.4 million tpa, India's largest port with capacity of 50 million tpa and the World's largest grassroots refinery.

to be continued…

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

ONGC to invest $9 bn in KG basin

January 6, 2014. Oil and Natural Gas Corp (ONGC) will invest around $9 billion in bringing to production an array of oil and gas discoveries in its prolific Krishna-Godavari basin block off the east coast by 2017-18. ONGC has made 11 oil and gas discoveries in the Block KG-DWN-98/2, which sits next to Reliance Industries Ltd (RIL)’s KG-D6 block and Gujarat State Petroleum Corp’s Deendayal gas field. The block is divided into a Northern Discovery Area (NDA) and Southern Discovery Area (SDA). ONGC plans to make that investment in producing from discoveries in NDA. NDA holds an estimated 92.3 million tonnes (mt) of oil reserves and 97.6 billion cubic metres of inplace gas reserves spread over seven fields. ONGC had submitted to the Directorate General of Hydrocarbons (DGH) a declaration of commerciality (DoC) for the oil find in NDA and a detailed field development plan would be submitted in a year. ONGC bought 90 per cent interest in Block KG-DWN-98/2 from Cairn Energy India in 2005. Cairn still holds 10 per cent in the block. Before selling most of its stake and giving away operatorship of the block, Cairn made four discoveries in the area — Padmavati, Kanakdurga, N-1 and R-1 (Annapurna). Subsequently, ONGC made six significant discoveries — E-1, A1, U1, W1, D-1 and KT-1 in NDA — and the first ultra-deepwater discovery UD-1 at a record 2,841 metres. NDA comprises discoveries such as Padmawati, Kanadurga, D, E, U, A, while the ultra deepsea UD find lies in SDA. ONGC was looking at producing oil and gas from NDA using a floating production, storage and offloading (FPSO) unit. (www.business-standard.com)

RIL to increase KG-D6 gas output

January 4, 2014. Reliance Industries Ltd (RIL) will add about 1-3 million standard cubic meters per day (mmscmd) of gas production at its eastern offshore KG-D6 fields this month as it begins the process of reversing the trend of falling output. RIL and its partners BP plc of UK and Canada's Niko Resources have spud the seventh well on the MA oil and gas field in the KG-D6 block in Krishna Godavari basin. The well, MA-8, is likely to be put on production this month. MA-8 is projected to produce a minimum of 1 mmscmd and a maximum of 3 mmscmd. At 3 mmscmd, MA-8 will be RIL's biggest gas producer well on KG-D6 currently. Production at KG-D6 has dropped to just about 12 mmscmd and MA-8 will help reverse the falling trend of last three years. The current output is made up of about 8.5 mmscmd from D1&D3 gas field and about 3.3 mmscmd from the MA field in the same block. RIL is also repairing a third of the wells shut at its main D1&D3 gas field to boost output by March. RIL had to shut 10 out of the 18 producing wells on D1&D3 due to sand and water flooding. It had also shut two of the six wells at the MA field due to high water and sand ingress. MA-8 will be the seventh well on the field. The KG-D6 fields, which began gas production in April 2009, hit a peak output of 69.43 mmscmd in March 2010 before water and sand ingress shut down well after well. D1&D3, the largest of the 18 gas discoveries in the KG-D6 block, produced 66.35 mmscmd, while 3.07 mmscmd was the output from the MA field, the only oil discovery on the block. Besides the fall in output from D1&D3, gas production from the MA field, which had hit a peak of 6.78 mmscmd in January 2012, has dropped. Of the current gas production from KG-D6, 11.7 mmscmd was sold to urea manufacturing fertiliser plants and the remaining consumed by the pipeline that transports the KG-D6 gas. The company has so far made 18 gas and one oil discovery in the Krishna Godavari basin block in Bay of Bengal. While the lone oil find, MA went on stream in September 2008, D1&D3 were put on production in April 2009. (articles.economictimes.indiatimes.com)

ONGC to drill more wells in Cambay to explore shale gas

January 1, 2014. Following the successful drilling of the country's first shale gas exploratory well near Jambusar, Oil and Natural Gas Corporation (ONGC) has decided to drill more wells in Cambay region of Gujarat. The data from the first well near Jambusar has given ONGC more leads for further exploration that will help the company ascertain parameters in taking up commercial productions. The results of the first exploratory well will open a new chapter in shale-gas exploration in the country. ONGC has been spending ` 2,000 crore per annum on the exploration of oil and gas in Gujarat and Rajasthan. ONGC said, India has recoverable shale gas reserves of around 90 TCF, which can satiate India's energy demand for 26 years. Shale gas is natural gas trapped within layers of shale rock and can be utilised as cooking gas and for other commercial purposes. ONGC estimates India's shale gas reserve in the range of 500 to 2000 trillion cubic meters. The corporation has already planned to dig 30 shale gas exploratory wells across the country at the cost of ` 600 crore by 2014-15 These explorations are expected to be carried out in alliance with Conoco Philips, a US-based oil company that is leader in shale gas and deep-water exploration. (economictimes.indiatimes.com)

Transportation / Trade

GAIL asked to use Indian ships for importing LNG from US

January 7, 2014. The government has directed GAIL India to use Indian ships for importing gas worth $2.5 billion annually from the US, a model that is practiced by Chinese oil firms to encourage domestic shipping industry. GAIL will require at least five ship to bring about 5.8 million tonnes of gas every year from the US starting September 2017 and there is a strong possibility of involving Indian shipyards in building liquefied natural gas (LNG) carriers. However, GAIL is reluctant to take any risk because of huge exposure in the deal. Any delay in delivery of ship would force the company to pay billions of dollar liabilities to the seller in the US as well as gas buyers back home, the oil ministry and the company said. Petroleum Secretary Vivek Rae also said India should have capacity to build LNG tankers. GAIL wants to sign charter agreements with companies supplying LNG carriers by September this year to meet the delivery deadline, the company said. LNG tankers require sophisticated technology as natural gas is stored below -162 degree Celsius to keep it in liquid state. The liquefaction shrinks storage space by 600 times compared to the gaseous state. Shipyards of South Korea lead the market for LNG tanker building while Japan and China are catching up fast. (economictimes.indiatimes.com)

Gujarat Gas signs agreement to buy gas from GSPC for 12 years

January 1, 2014. Gujarat Gas Company Ltd (GGCL) said it has signed an agreement to buy 0.65 million standard cubic meters per day of gas from Gujarat State Petroleum Corporation Ltd (GSPC) for almost 12 years. Gujarat Gas, which retails CNG to automobiles and piped cooking gas to households in some cities of Gujarat, will buy the fuel from GSPC on a long-term basis, the company said. It will buy "0.574 mmscmd (of gas) between period March 1, 2014 up to July 1, 2025, and, purchase 0.076 mmscmd between period January 01, 2014 upto July 01, 2025," the company said. Ahmedabad-headquartered Gujarat Gas was set up by BG Group of UK in 1980. But last year, the British firm sold its stake in the company to Gujarat government owned GSPC Group in June 2012 for ` 2,464 crore. GGCL and GSPC on September 3, 2013 entered into a Memorandum of Understanding (MoU) for a long-term gas supply deal. As per the MoU, GSPC agreed to supply 0.85 mmscmd of gas to GGCL from January 1, 2014 to June 30, 2025. (economictimes.indiatimes.com)

Policy / Performance

SC to hear plea against RIL gas price on March 4

January 7, 2014. The Supreme Court (SC) will hear the petitions against the government's decision to allow Reliance Industries to raise natural gas prices on March 4. The top court also made observations which were interpreted differently by the parties involved in the matter. Former Cabinet Secretary TSR Subramanian, one of the litigants, claimed that the court had taken a "very serious note" of the decision taken by the government as there were allegations of hoarding gas and inflating costs. However, Reliance executives claimed that the court had not issued any order reversing the cabinet's latest decision on gas prices. (economictimes.indiatimes.com)

Govt to offer 56 O&G blocks under NELP-X

January 7, 2014. The government plans to offer exploration blocks for bidding after a long delay, with a new revenue sharing model that will end the controversial system in which companies first recover their costs before the state gets revenue. The oil ministry will profile at least 56 oil and gas blocks, which will be offered in the 10th round of bidding, oil secretary Vivek Rae said. Rae also said the ministry was firm on its policy to curb diversion of cooking gas subsidies and it is not considering any proposal to raise the annual limit of subsidised cylinders from nine to 12. Finance minister P Chidambaram had said that chief ministers of several states were demanding raising quota of subsidised cylinders and the government would consider it. The government had capped the annual supply of subsidised cooking gas cylinders to six per household in September 2012 when Jaipal Reddy was the oil minister. Later, oil minister Veerappa Moily had raised the quota to nine cylinders per household in January last year. Commenting on the 10th auction round of exploration blocks, Rae said that the bids would be invited in February. (economictimes.indiatimes.com)

Govt taking lightly hardship caused by LPG price hike: LDF

January 6, 2014. CPI(M)-led LDF opposition staged a walkout in the Kerala Assembly accusing the UDF government of taking lightly the severe hardship caused to people by hike in LPG prices and insistence on Aadhaar-linkage of subsidised cooking gas for household consumers. Leading his colleagues out after Speaker G Karthikeyan turned down the demand for an adjournment on the issue, Opposition Leader V S Achuthanandan accused the state and central governments of colluding with petroleum companies to "plunder common man." Countering the opposition charge, Chief Minister Oommen Chandy said the state was against frequent hike in subsidised LPG and sought suspension of direct subsidy transfer for another six months as only 57% of domestic consumers had achieved 'Aadhaar-linkage' of their bank accounts. This demand had been directly conveyed to Prime Minister Manmohan Singh during his visit to the state the other day, he said. Civil supplies Minister Anoop Jacob said the disruption in delivery of LPG to domestic consumers over confusion in price had been resolved and the supply had regained normalcy.

Seeking leave for the motion at the outset, former Finance Minister T M Thomas Isaac (CPI-M) said the steep increase in non-subsidised LPG would hit common man also as hoteliers would be increasing price of eatables and autorickshaws running on LPG forced to hike fares. Isaac said frequent hike being effected in LPG and petroleum prices was part of a "clandestine strategy" of the Centre to take away the subsidy step by step. The state government was turning a blind eye to this move ignoring its adverse fallout on common man, he said. (www.business-standard.com)

Reconsider price hike in non-subsidised LPG cylinder: Vasan

January 4, 2014. Union Shipping Minister GK Vasan requested the Petroleum Ministry to 'reconsider' the hike effected in the price of non-subsidised LPG cylinders. Recently, the Centre had increased the price of non-subsidised LPG, which customers buy after consuming their quota of subsidised cylinders, was hiked by ` 220 per cylinder due to firming up of international rates. Tamil Nadu Chief Minister J Jayalalithaa had slammed the hike and demanded its roll-back saying it would add to miseries of the people. (economictimes.indiatimes.com)

PM urges LNG buyers in Asia to demand fair prices for gas imported from outside Asia

January 4, 2014. Prime Minister (PM) Dr Manmohan Singh said the major buyers of LNG in Asia should come together to demand a fair pricing mechanism for gas being imported from outside Asia. Dedicating the ` 4500 crore Petronet LNG terminal at Kochi to the nation, Dr Manmohan Singh said Asia has been the driver of the global LNG demand in the recent times. To make full use of the large investment in this project, there is a need to focus on increasing the penetration of natural gas in Kerala by augmenting the pipeline network in a manner similar to what has been done in northern and western parts of the country, according to PM. (economictimes.indiatimes.com)

No proposal to increase number of subsidised LPG cylinders: Moily

January 4, 2014. Union Petroleum Minister Veerappa Moily said there was no proposal before the government to increase the number of subsidised LPG cylinders from the present nine a year to 12. People will appreciate the government stand, he said. Finance Minister P Chidambaram had said in New Delhi that the government will "take a look" at the demand to raise the quota of subsidised LPG cylinders to 12 per household in a year from the current limit of nine. (economictimes.indiatimes.com)

CNG price may rise due to Centre's guidelines: Delhi govt to HC

January 2, 2014. The city government told the Delhi High Court (HC) that it apprehended rise in price of CNG due to reduction in allocation following new guidelines by Ministry of Petroleum and Natural Gas even as the Centre said that any shortfall will be met by import of the fuel. The price of CNG or compressed natural gas in the national capital was just hiked by a steep ` 4.50 per kg, the second increase in rates in three months. The guidelines, which may cause reduction in supply of CNG to Delhi, were issued by the Ministry in pursuance of a Gujarat High Court order that Ahmedabad should also get the fuel for domestic and vehicular usage at the same rate applicable to Delhi and Mumbai to enforce the right of equality. The supply of CNG is not affected in Delhi as the shortfall in domestic supply is being offset by import of CNG, the counsel for the Ministry said. (economictimes.indiatimes.com)

Oil Ministry forms panel to codify discovery-recognition norms

January 2, 2014. Amid disputes over recognition of oil and gas finds, the oil ministry has formed a panel headed by the Director General of Hydrocarbons (DGH) to codify globally recognised industry practices for adoption in India. Though Production Sharing Contracts prescribe the adoption of generally accepted international petroleum practices or standards, there have been disputes between the DGH and operators such as Reliance Industries over tests that should be carried out to confirm discoveries. Many gas finds have not been recognised and could not be put into production because the DGH insists on a test that companies such as RIL and BP Plc of UK did not conduct because it is considered unsafe globally and no longer practised. (economictimes.indiatimes.com)

No increase in LPG price effected: Kerala CM

January 1, 2014. Kerala Chief Minister (CM) Oommen Chandy rejected reports of hike in the prices of LPG after Petroleum Minister Veerappa Moily clarified that no increase had been effected. Moily said the Centre had only decided to implement the direct transfer of the subsidy component on the domestic LPG to bank accounts of the beneficiaries. He also said his ministry would be issuing a statement to clarify on this, Chandy said. In case of direct cash transfer, Kerala had been given a grace period of two months since the Aadhaar-linking of the bank accounts of the LPG customers had not exceeded 50 per cent, the Chandy said. (economictimes.indiatimes.com)

ATF price hiked by over 2.7 pc

January 1, 2014. Jet fuel or Aviation Turbine Fuel (ATF) prices were hiked by over 2.7 per cent, the second increase in rates in one month. ATF, price at Delhi was hiked by ` 2,036.59 per kilolitre, or 2.74 per cent, to ` 76,241.33 per kl, according to Bharat Petroleum Corp Ltd (BPCL). The increase follows a marginal ` 597.48 per kl or 0.8 per cent hike in rates effected from December 1. ATF prices had touched a life time high of ` 77,089.42 per kl in October following five consecutive increases since June as rupee depreciated against the US dollar, making oil imports costlier. However, the rupee's appreciating thereafter helped trim cost, leading to a steep 4.5 per cent cut in prices in November. However, rates have been increased in subsequent month as rupee value has dipped marginally. (economictimes.indiatimes.com)

POWER

Generation

Kudankulam n-plant has foolproof safety systems: Russian developer

January 6, 2014. The Kudankulam nuclear power plant in Tamil Nadu, whose first 1,000 MW unit is currently in the testing stage, is equipped with state-of-the-art safety mechanisms with unique features that make them foolproof, its Russian developer says, addressing current concerns on nuclear safety issues. Denis Kolchinskiy, chief project engineer of SPbAEP, the developers of the AES 92 nuclear reactor installed at Kudankulam, said modern Russian designs have an optimised balance of active and passive safety systems that have been developed over a decade. According to Kolchinskiy, the Kudankulam plant is built with "active" and "passive" safety systems to provide two layers of protection. While the active layer requires an electrical actuator, or starter, the passive one uses natural force, like that of gravity. (economictimes.indiatimes.com)

Adani Power fully commissions 1.3 GW Kawai project in Rajasthan

January 5, 2014. Adani Power has fully commissioned the 1,320 MW coal-fired power project in Rajasthan taking its overall electricity generation capacity to 7,920 MW. Adani Power, part of diversified Adani Group, aims to increase its total generation capacity to 9,240 MW by end of this fiscal. The Kawai project has two super critical units, each having a generation capacity of 660 MW. While the first unit is operational since last year, the second one was commissioned this month. According to the company, Kawai project is the largest private power plant in Rajasthan and its work was completed in three years. Adani Power, the country's largest private thermal electricity producer, plans to add another 1,320 MW generation capacity in the current financial year ending March 2014. Its current capacity is 7,920 MW. (www.business-standard.com)

Lanco says it got favourable APTEL ruling in Amarkantak issue

January 3, 2014. Lanco Infratech's received a favourable verdict on its year-long dispute with Haryana Power Generation Corporation (HPGCL) over the second unit of its Amarkantak power plant. The 300 MW second unit which was commissioned, could not start generating due to the dispute, can now start generation. The first unit of coal-based Amarkantak power, which is located in Chhattisgarh, has been generating power and earning revenues, unlike the second unit. Lanco's ` 7,700 crore debt recast was approved by its lenders. Amongst other developments, Lanco said that it has two cases pending verdicts with Appellate Tribunal for Electricity (APTEL) and that they were expecting favourable judgments. (www.business-standard.com)

ONGC's Tripura power plant starts commercial generation

January 1, 2014. ONGC Tripura Power Corporation (OTPC) has formally announced the launch of commercial operations of its first unit of the 3 MW Palatana power plant. After completion of 15 days trial run and necessary tests, the first unit was put on operation. The Ministry of Power has allocated more than 58 per cent of power from the project to the Northeast states with Assam (240 MW), Tripura (196 MW), Meghalaya (79 MW), Manipur (42 MW), Nagaland (27 MW), Arunachal Pradesh & Mizoram (22 MW each), while 98 MW is allocated to OTPC for merchant sales. (economictimes.indiatimes.com)

CCI may consider land compensation exemption for Reliance Power plant

January 1, 2014. The Cabinet Committee on Investment (CCI) may decide whether Reliance Power's ultra mega power project at Tilaiya in Jharkhand should be exempted from providing non-forest land to compensate for the loss of forest land to be acquired for the project. At present, only the central government or public sector undertakings are exempted from the obligation to provide non-forest land. Reliance Power has won contracts to set up two other ultra mega power projects (UMPPs) - at Sasan in Madhya Pradesh and at Krishnapatnam in Andhra Pradesh. A UMPP is coal-based power plant with a capacity of about 4,000 MW built at an approximate cost of ` 20,000 crore. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

L&T bags power transmission contract in Saudi Arabia

January 7, 2014. Infrastructure major Larsen & Toubro (L&T) has secured an engineering, procurement and construction (EPC) order from a Saudi Arabian Oil Company - Saudi Aramco. The purpose of this project is to replace the existing electrical power supply system at the Abu Ali Plants and overcome existing deficiencies to meet future energy demand of Berri oil field. The project will be completed in 26 months. (www.business-standard.com)

BHEL completes power transmission sub-station at Raichur

January 6, 2014. BHEL has completed building a transmission sub-station in Karnataka, a link that connects the southern and national electricity grids. The government said that the southern grid had been linked with the national grid following the commissioning of the Raichur-Solapur transmission line. The line had been commissioned five months ahead of the May 31, 2014, deadline at a cost of about ` 815 crore. (www.business-standard.com)

Power prices touched ` 3.22 per unit on IEX in Dec

January 6, 2014. The average price of electricity sold on the Indian Energy Exchange (IEX) rose to ` 3.22 per unit in December even as volumes remained mostly flat in the same month. The day-ahead market saw trading of 2,409 million units of electricity last month almost similar to that witnessed in November 2013, according to IEX. In December, the total purchase bids stood at 3,800 million units while the sale bids touched 3,812 million units. In November, the price stood at ` 2.78 per unit of electricity. Last month, on an average 1,091 participants traded in the day ahead spot market. (economictimes.indiatimes.com)

Southern grid connectivity to help NTPC utilise idle capacity

January 6, 2014. NTPC plans to activate its idle capacity to generate some 7,000 MW of electricity to make the most of a new grid that connects power transmission systems in south India to the rest of the country. NTPC said at least 5,000 MW of power capacity was lying idle at the country's largest power company entire last year due to lack of demand from state utilities. The connection of the southern grid to the national network with effect from January 1 will help NTPC utilise this capacity as power demand from southern states have always remained high, they said. So long the southern grid was a standalone power distribution system and NTPC could not route power from its plants to the region. (economictimes.indiatimes.com)

Indian cabinet approves 220kV Alusteng to Leh transmission system construction

January 6, 2014. The Indian Cabinet Committee on Economic Affairs (CCEA) has approved the proposal for construction of a 220kV transmission system from Alusteng, Srinagar, to Leh, and 66kV interconnection system for Drass, Kargil, Khalsti and Leh substations in Jammu & Kashmir (J&K), at an estimated cost of INR17.8bn ($286 mn). Implemented through Power Grid Corporation of India Limited (PGCIL) within 42 months from the date of release of the first installment of funds, the transmission project is expected to provide grid connectivity and reliable power supply to Ladakh region. (utilitiesnetwork.energy-business-review.com)

Grid integration will give another 1.5 GW to South

January 5, 2014. Power-starved South is set to get some succour with the region expected to gain access to additional electricity flow of about 1,500 MW once the all India national power grid becomes fully operational. In a major step, the Southern power grid was synchronised with the rest of the national grid on December 31, 2013, and it is expected to be fully-operational in a few months. In the absence of grid connectivity, the Southern region was unable to utilise excess power available in other regions. The south witnessed peak power deficit of 6.8 per cent in November last year, the highest amongst the regions. Peak power deficit refers to the shortage of electricity when demand is at the maximum. During November last, while the Southern region’s electricity demand touched 34,118 MW, the availability was only around 31,786 MW. Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, Puducherry and Lakshwadeep make up the Southern region as per power sector’s planning body Central Electricity Authority (CEA). The country’s power system is operating through five regional grids. Till December 31, the Northern, Eastern, Western and North-eastern regions’ grids were connected synchronously while southern grid was connected through HVDC (High Voltage Direct Current) links. Out of the country’s total installed generation capacity of 232,164 MW, the Southern region accounted for 57,529 MW at the end of November, 2013. (www.business-standard.com)

CBI raids Bhilai power plant officials, pvt firm

January 5, 2014. A Central Bureau of Investigation (CBI) team from Gandhinagar in Gujarat raided premises of M/s Bhatia International Limited Indore in connection with supply of poor quality coal to NTPC-SAIL Power Corporation Ltd. (NSPCL) by the private company in connivance with some officials of the concerned power plants. Officials of NSPCL, Bhilai Power Plant are among those named in the case. The poor quality coal supply to the thermal plants had resulted in a total loss of ` 92.91 crore to the government. The CBI has registered two FIRs in this connection. (articles.timesofindia.indiatimes.com)

Inadequate transmission network troubles power producers in Chhattisgarh

January 3, 2014. Power project developers in Chhattisgarh fear lower profits because of a lack of adequate transmission network that limits their ability to sell surplus electricity out of the state. Besides state utilities, private power producers such as KSK Energy, Jindal Steel & Power, RKM Powergen and Bhaskar Group are commissioning new projects in Chhattisgarh which will more than double the state's electricity generation capacity in the next couple of years from close to 9,500 MW now. Transmission network in the state, however, is not expanding at the same pace. Power Grid Corporation was to provide grid connectivity to power projects based in the state. By March 2014, Chhattisgarh will add 3,200 MW, which will increase the state's total generation capacity to more than 12,500 MW, but the capacity of transmission networks in the state by then will be just about 9,000 MW. It is projected to have 21,500 MW of generation capacity by March 2015. The lack of adequate transmission network is already hurting the state's ability to sell power on the spot market to outside consumers. According to power-trading platform Indian Energy Exchange, Chhattisgarh witnessed power price going down to ` 2.30 a unit in November from ` 2.41 in October. (economictimes.indiatimes.com)

Alstom T&D India bags ` 544 mn contract from Bihar Transco

January 2, 2014. Alstom T&D India said it has bagged an order worth ` 54.4 crore for supplying equipment to Bihar State Power Transmission Company. The state government of Bihar plans to add a number of new voltage level substations at various locations in the state in near future. The substation at Bihta is important as it is the first in the series in energy expansion plan of the state. (www.business-standard.com)

Power trading set to get a boost as India gets a national grid

January 2, 2014. In what may give a big boost to power trading business in the country, India has finally connected the southern region with rest of the country for unhindered electricity flow, achieving the goal of a national grid after a long wait. The central transmission utility, Power Grid, has successfully commissioned the Raichur-Solapur 765-KV single-circuit transmission line, interconnecting the southern grid synchronously with the rest of the national power grid –- a move that would facilitate bulk transfer of power across regional boundaries. With this, the mission of ‘One Nation – One Grid – One Frequency’ has been successfully accomplished, the power ministry said. The national grid will help southern states, especially Andhra Pradesh, Tamil Nadu and Kerala, which are facing huge shortages, lift surplus power from other regions. In the absence of a national grid, these states were paying exorbitantly high prices for buying electricity from the open market because of uncertainty about power evacuation due to congestion in the transmission network. The Indian power system is operating through five regional grids and a Pan-India synchronous grid was envisaged for optimal utilisation of the generation resources in the country. Till now, four regional grids -- northern, eastern, western and north-eastern -- were connected synchronously and the southern region was connected to the other four grids via HVDC links. The 208-circuit-km-long transmission line and 765- and 400-KV substations at Raichur and Sholapur have been commissioned five months ahead of the contracted schedule. The project has been completed at the cost of ` 815 crore, Power Grid said. (www.financialexpress.com)

IPPs asked not to use PGCIL line for power supply to Odisha grid

January 1, 2014. The Odisha government has directed the independent power producers (IPPs) to deliver its share of power at its own substations and transmission lines, instead of transmission network of Power Grid Corporation of India Ltd (PGCIL). As per existing practice, IPPs had plans to connect to PGCIL transmission system for sale of power throughout the country and would have used the same line to provide power to Odisha. But the state government’s new norm is likely to affect the business prospects of the private power producers to some extent, said experts. The Odisha government has signed agreements with 29 private developers with combined generation capacity of 38,000 MW power. As per the agreements, the IPPs have to sell 14 per cent of total generated power to the state network at a subsidised rate. The state government aims to get around 2,000 MW power from private power stations by 2015 and hence, has come up with large transmission network plan. The Odisha Power Transmission Corporation Limited (OTPCL) is in the process of setting up three high capacity substations with an estimated investment of ` 1,000 crore for sale of surplus power. (www.business-standard.com)

Delhi govt cannot afford power subsidy: Ex-CERC chief

January 7, 2014. It is increasingly becoming clear that the Arvind Kejriwal-led Aam Aadmi Party (AAP) put little thought in announcing its freebies, especially in the power sector. Former Chairperson of Central Electricity Regulatory Commission (CERC) of India and the longest serving electricity regulator in the country, Dr Pramod Deo, said Delhi cannot afford to meet the subsidy burden announced by AAP. The way the Kejriwal government has managed it is by giving only Tata Power the subsidy amount and adjusting the amount due from Reliance Infra. This is contestable as the law is clear that any subsidy amount announced by a political party has to be paid upfront. The section 65 of the Electricity Act 2003 is clear on this part that if the state government announces subsidy, then they have to pay the amount upfront, says Deo. If the state government wants to give benefit to any consumer, they are free to do that but they have to pay the difference to the distribution company. The idea being that whatever the political decisions are taken they should not affect the performance/commercial operations of distribution companies, Deo pointed out. The former CERC chief made it very clear that if the state government does not give subsidy, tariff cannot be reduced. Kejriwal had said that Tata Power will be given a ` 61 crore subsidy while the amount due to Reliance will adjusted against payment dues to government owned generating and transmission companies. The Delhi government will have to pay much more than what was announced by the chief minister, Deo said, if Reliance contests the mode of subsidy payment. (www.business-standard.com)

Allow CAG audit or lose licence, AAP govt warns power discoms

January 7, 2014. Lieutenant-Governor Najeeb Jung on warned power distribution companies that their licences may be cancelled if they didn’t abide by rules and cooperate with the CAG audit. The Lt-Governor said the government planned to monitor financial transactions made by the discoms to check for violations. The L-G was reiterating Chief Minister Arvind Kejriwal’s decision to have the CAG audit the finances of three private power discoms. The CAG audit comes in wake of the AAP’s poll promise to reduce the power tariff by 50 per cent. However, after forming the government, Delhi Chief Minister Arvind Kejriwal put a rider on the poll promise, which allows only those up to 400 units to avail of the benefits of the scheme. Under the scheme, those who consume more than 400 units will have to pay the entire bill, without a subsidy. The announcement of subsidy on power tariff has come under criticism, especially from the Opposition BJP. The party claims that the promise to cut power tariff will fall through in the summers. (www.financialexpress.com)

Power surcharge for discom open access

January 6, 2014. Around the time Arvind Kejriwal was cobbling support to form an Aam Aadmi Party (AAP)-led government in the capital, the Delhi electricity regulator issued guidelines with a steep surcharge that virtually ends the possibility of any competition for customers seeking better services. DERC has issued an order that will require any consumer to pay an additional surcharge of up to ` 3 a unit for power sourced from another distributor under the open access regime, a key issue being pushed to improve the plight of consumers, a key AAP poll plank. While the average cost of power sold on the power exchange during the last three years is estimated at around ` 3.50 a unit, with the additional surcharge, the per unit cost of power will nearly double as wheeling and other charges will also be added. Through open access, consumers can look forward to using the services of another power distributor in case they are unhappy with the existing service provider. Discoms are seen as the biggest beneficiaries of the move, which is being seen to be against consumer interest. Currently, the open access facility is available only to large consumers, as the DERC turned down the plea for extending to facility to others. DERC's order, which follows a consultation process started a few months ago, has come under criticism with experts accusing the regulator of jumping the gun when other states are still to firm up their views on the move. So far only one state, Uttarakhand, has levied an additional surcharge. (economictimes.indiatimes.com)

No electricity tariff hike in Haryana

January 6, 2014. Haryana discoms Dakshin Haryana Bijli Vitran Nigam (DHBVN) and Uttar Haryana Bijli Vitran Nigam (UHBVN) have not proposed any tariff hike in the state for the 2014-15 financial year. The present tariff has been revised downward by reviving the old telescopic system of tariff for the domestic sector, giving a benefit of about ` 200 per bi-monthly bill. The tariff in Haryana for domestic consumers is a minimum of ` 2.98 per unit, and a maximum ` 5.98. Now, consumers recording consumption of nil to 40 units per month in their meters will be charged a tariff of ` 2.98 per unit. The tariff for 41 to 100 units per month consumption will be ` 4.75 per unit. On consumption of units from 101 to 250, the tariff will be ` 4.90 per unit. For units between 251 to 500, the tariff will be ` 5.60 per unit. And, for units from 501 to 800 per month, the tariff will be ` 5.98 per unit. For monthly consumption above 800 units, the consumers will have to pay at the rate of 5.98 per unit for the entire consumption. (economictimes.indiatimes.com)

CERC hearing on draft power tariff rules for 2014-19 on Jan 15

January 5, 2014. Electricity regulator Central Electricity Regulatory Commission (CERC) will hold a public hearing on the draft tariff regulations it has prepared for central government-owned power generation utilities on January 15. The draft regulations had stated that generation incentives should be linked to actual power produced instead of a plant's installed capacity. It proposed that incentives for thermal power projects should be based on plant load factor (PLF) and not plant availability factor (PAF). PAF, the declared generation capacity of a plant, remains the same. PLF is the actual generation and may vary depending on demand. State-run power producers had said that under normal circumstances, PAF is generally higher than PLF and therefore incentives should not be linked to PLF. NTPC, the country's largest generator of electricity, is likely to respond to the draft regulations. The CERC revises tariff regulations every five years. The existing regulations expire on March 31, 2014. (www.business-standard.com)

Power tariff for industry in Maharashtra to come down: Rane

January 4, 2014. The industrial power tariff in Maharashtra would be reduced in two phases to bring it on a par with rates in the neighbouring states, Maharashtra Industry Minister Narayan Rane said. The revised tariff would come into effect from May this year, he said. (www.business-standard.com)

GMR, JSPL, Sterlite to benefit from mega power policy relief

January 4, 2014. Power generators such as GMR, Essar Power, Jindal Steel and Power and Sterlite Energy are likely to benefit from the relaxations in mega power policy announced. A number of coal-fired power projects have been under stress due to non-availability of fuel and reduction in off-take and lack of payments. The mega power status allows projects to claim tax benefits that would net 10 per cent savings on carriage charge of tariffs. The power policy, which was amended in 2009, covers coal-based power projects of 1,000 MW and hydro power projects of 500 MW, above to claim tax benefits. They can import equipment duty free but to avail benefits they had to supply around 75 per cent power that they produced through competitive bidding. However, projects based in states like Chhattisgarh, Jharkhand, Madhya Pradesh and Odisha could not avail this due to host state obligations. (www.business-standard.com)

DERC proposes new power regulations to help fix tariff

January 4, 2014. Delhi Electricity Regulatory Commission (DERC) has proposed to adopt new power regulations from next fiscal to help fix tariff. The new regulations will replace the current average revenue requirement (ARR) petitions that discoms file every year. The new accounting format has been prepared by the forum of regulators and is being slowly adopted by electricity regulators across the nation. DERC is keen to have the new regulations in place at the earliest. (economictimes.indiatimes.com)

Rajasthan Govt to ensure 24-hour power supply this year: Khimsar

January 3, 2014. The Rajasthan government said that 24-hour power supply would be ensured for all in the state this year, as promised in the BJP's election manifesto, Rajasthan Energy Minister Gajendra Khimsar said. Once the state achieves self-reliance in electricity generation, power would be supplied for all for 24 hours during this year, Khimsar said. (www.business-standard.com)

Goa's power scenario gets a boost after decrease in losses

January 3, 2014. Constant check on electricity pilferage and upgradation of infrastructure in the state has helped Goa to drastically reduce its power losses, government said. The measures have helped the Goa government to drastically reduce its power losses since last year at 11 per cent compared to the national average of 35 per cent, State Power Minister Milind Naik claimed. The upgradation of infrastructure and constant check on the electricity pilferage has helped the department to curb power losses making Goa one of the best managed state in terms of electricity, Naik said. (www.business-standard.com)

Cabinet approves PSDF

January 2, 2014. The government approved the proposal of the Ministry of Power for operationalisation of the Power System Development Fund (PSDF). The fund will also be utilised towards installation of shunt capacitors, series compensators and other reactive energy generators for improvement of voltage profile in the grid. Installation of standard and special protection schemes, pilot and demonstrative projects, and for setting right discrepancies identified in protection audits on regional basis. Renovation and Modernisation (R&M) of transmission and distribution systems for relieving congestion and any other scheme or project in furtherance of the above objectives, such as, conducting technical studies and capacity building, etc. PSDF will be operationalised within three months. (economictimes.indiatimes.com)

Environmental panel clears Simang I & II hydel projects in Arunachal Pradesh

January 2, 2014. A key environmental panel has recommended clearance for two hydel power projects in the Siang river valley in Arunachal Pradesh. The two projects—Simang I and II totalling 133 MW—are located on the Simang, the right bank tributary of the Siang River. Projects in the Siang river basin are viewed as strategically important on account of the border with China. Adishankar Power Pvt Ltd is the project developer. The Expert Appraisal Committee on River Valley and Hydroelectric Power Projects decided to recommend to the environment ministry that the two projects be cleared subject to requisite clearances from the National Wildlife Board, since Simang II is 6.4 km away from the Mouling National Park. (economictimes.indiatimes.com)

AAP effect: Demand for audit of discoms rises in UP

January 2, 2014. Close on the heels of the Aam Aadmi Party (AAP) led Delhi government's decision seeking audit of power distribution companies' (discoms) accounts by Comptroller and Auditor General (CAG), a similar demand has been raised in Uttar Pradesh (UP). A prominent state power consumers' forum filed a public interest petition before the UP Electricity Regulatory Commission (UPERC) seeking directive to power companies to get their accounts audited by CAG. The forum demanded that the Commission should also scrap the Annual Revenue Requirement (ARR) recently filed by these companies. ARR contains proposal for upward power tariff revision. UP Rajya Vidyut Upbhokta Parishad president Avadhesh Kumar Verma claimed that the power companies had been submitting ARR without audit. He claimed that these companies later 'true up' their accounts and submit audited figures to impose regulatory surcharge on consumers. Meanwhile, the Parishad also submitted a formula before UP Planning Commission for decreasing power tariff in the state. Avadhesh Kumar Verma demanded that the proposal should be put before state chief minister Akhilesh Yadav for approval, so that consumers get relief in tariff like other states, such as Delhi and Haryana. In June 2013, the state power tariffs were hiked by over 30 per cent. The fixed charge on power consumption load was also increased by ` 10 from ` 65 per kilowatt (Kw) to ` 75 per Kw for domestic consumers. The power tariff was hiked from ` 3.45 per unit to ` 4 per unit for the first 200 units of consumption. Between 201 to 500 units of consumption, the tariff was hiked from ` 3.80 per unit to ` 4.50 per unit. Beyond that, the tariff had been hiked to ` 5 per unit of consumption. (www.business-standard.com)

Tata Power welcomes move to provide power subsidy

January 1, 2014. Tata Power welcomed Delhi Government's announcement of providing 50 per cent subsidy on power consumption up to 400 units, saying it was a "good move" which will provide relief to majority of the consumers in the city. Delivering on yet another poll promise, the Aam Aadmi government announced a 50 per cent subsidy on power consumption upto 400 units in Delhi, which will benefit around 28 lakh of the total 35 lakh consumers in the city. When asked about Government's move to order CAG scrutiny of the finances of the three private power distribution companies, TPDDL CEO Pravir Sinha chose not to comment but said Tata Power Delhi Distribution Ltd (TPDDL) will comply with the law. He, however, said TPDDL was responding to government's directive of making their stand clear on the CAG scrutiny of the companies. (economictimes.indiatimes.com)

CCI may take up three hydro power projects at next meeting

January 1, 2014. The Cabinet Committee on Investment (CCI) at its next meeting may take up three hydro power projects that have been held up on account of environmental and forest clearances. The three hydel projects -- Tawang (800 MW) and Tato (700 MW) and Teesta (520 MW) --have been awaiting environmental clearances for a very long time. (economictimes.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

Libya oil flow rebounds from 10-month slide; field starts

January 6, 2014. Libya’s oil production is rising for the first time in 10 months after the North African country started a field in the south and smaller deposits elsewhere resumed after months of disruption. Flows from Sharara are set to reach 340,000 barrels a day. The field, near Ubari in the south, had been closed for about 90 days because of protests. Libya’s total daily output will rise to 600,000 barrels. Output from the nation, once North Africa’s biggest producer, slumped to 210,000 barrels a day in December amid protests across the country. Sharara restarting is a “good sign” and will help Libya’s government in its negotiations with rebels holding eastern ports. Libyan production rose to 1.6 million barrels in July 2012 as the country restored output following the 2011 revolt. It climbed as high as 1.8 million barrels a day in 2008. The country’s oil output will probably average 650,000 barrels a day or more this year, Goldman Sachs Group Inc. said. Protests halted oil fields and four out of nine export facilities. (www.bloomberg.com)

Exxon Russia ambitions show oil trumps Obama-Putin spats

January 2, 2014. As Barack Obama and Vladimir Putin argue over human rights in Russia and the fate of fugitive U.S. intelligence analyst Edward Snowden, the countries’ biggest oil companies are preparing to drill for giant oil discoveries together in the Arctic Ocean. Exxon Mobil Corp. and OAO Rosneft are set to start their first Arctic well this year, targeting a deposit that may hold more oil than Norway’s North Sea. It will kick off a series of landmark projects and cement an alliance begun in 2011. They also plan to frack shale fields in Siberia, sink a deep-water well in the Black Sea and build a natural gas-export terminal in Russia’s Far East. The deepening alliance shows the two governments’ fractious relationship is no bar to America’s most valuable energy company investing billions in Russia. For Rosneft Chief Executive Officer Igor Sechin, the Irving, Texas-based company brings financial heft and the expertise needed to drill offshore in some of the world’s harshest conditions for rigs. Exxon CEO Rex Tillerson has said his company’s output will drop 1 percent this year, a third straight annual drop, putting pressure on to find new reserves. Tillerson’s decision to expand work in Russia is a switch from his predecessor’s policy. (www.bloomberg.com)

Statoil finds oil, gas at Askja

January 2, 2014. Statoil and its partner Det norske oljeselskap reported that they have made gas and oil discoveries on their Askja prospects in the North Sea. Two exploration wells – 30/11-9S and 30/11-9A – were drilled by the Ocean Vanguard (mid-water semisub) rig between the Oseberg and Frigg fields. The main wellbore (30/11-9S) tested the Askja West prospect and proved a net gas column of 295 feet in Late and Middle Jurassic rocks. The side-track well (30/11-9A) tested the Askja East prospect and proved a net oil column of 131 feet in the same geological formations. Statoil said that it estimated the total volumes in Askja West And Askja East to be in the range of 19 to 44 million barrels of recoverable oil equivalent. (www.rigzone.com)

Downstream

Iraq awards $6 bn refinery contract to Hyundai Engineering Consortium

January 7, 2014. Iraq awarded a $6.04 billion oil refinery contract to a consortium of South Korean firms led by Hyundai Engineering & Construction. The refinery will be located in Kerbala with a capacity of 140,000 barrels per day and the contract has a duration of 54 months. (www.downstreamtoday.com)

Nigeria Govt says has no plan to privatise refineries

January 3, 2014. Nigeria's President Goodluck Jonathan has no plans to privatise the country's oil refineries, contradicting a government pledge to do so last month. The Bureau of Public Enterprises said that Jonathan had approved a plan to sell the refineries, which have a combined capacity of 445,000 barrels per day (bpd), but run far below capacity due to decades of mismanagement in Africa's top oil producer. Oil Minister Diezani Alison-Madueke had also suggested the government was looking into the idea, which is part of the Petroleum Industry Bill being debated in parliament since 2012. (www.downstreamtoday.com)

Transportation / Trade

Crude tankers to China seen signaling pre-holiday imports gain

January 6, 2014. A surge in the number of crude tankers bound for China may signal that the second-largest importing nation is buying more cargoes before New Year holidays begin later this month, the biggest oil-tanker company said. There were 80 of the industry’s biggest tankers sailing to Chinese ports. Chinese traders may be booking more shipments in anticipation of Chinese New Year holidays, which start on Jan. 31 this year, the Frontline Management AS, said. There’s been a “definite increase” in bookings to the country in the past 12 months. Frontline is the world’s largest tanker company. (www.bloomberg.com)

US crude imports fall to lowest level since 1998

January 4, 2014. U.S. crude-oil imports fell to the lowest level in almost 16 years as domestic output rose, the Energy Information Administration (EIA) reported. Shipments of foreign crude fell 1.1 percent to 7.41 million barrels a day, the fewest since January 1998, based on the four-week average through Dec. 27, according to data released by the EIA.

U.S. crude output surged to a 25-year high on rising production from shale formations. Fracking and horizontal drilling have boosted shale oil output from the Bakken formation in North Dakota and the Eagle Ford in Texas. Domestic production increased to 8.12 million barrels a day, the most since September 1988. Output surpassed imports in October for the first time since 1995, according to the EIA. (www.bloomberg.com)

Draining Indonesia oil fields raise import need: Southeast Asia

January 2, 2014. Bekapai, which pumped more than 50,000 barrels a day in 1978, now flows at just 7,000 barrels, a symbol of the decline in Indonesia’s oil and gas production. Aging fields, rising exploration costs and increased fuel demand will force Southeast Asia’s most populous nation to import 90 percent of the oil it needs by 2030, according to the Agency for the Assessment and Application of Technology. Domestic consumption is the biggest factor turning the region’s largest oil producer into a net importer, said Unggul Priyanto, the deputy head of the agency known by its local acronym, BPPT. The nation withdrew from the Organization of the Petroleum Exporting Countries in December 2008. Production is forecast to drop by more than half to 124 million barrels in 2030, from 329 million in 2011, BPPT said in a report. Imports will rise almost four times to 532 million barrels, from 134 million, as output from maturing fields slows. (www.bloomberg.com)

Woodside says Japan's MIMI terminates browse LNG sales agreement

January 2, 2014. Japan Australia LNG (MIMI) Pty. Ltd, a 50-50 joint venture between Mitsui & Co and Mitsubishi Corp, has terminated a long term sales and purchase agreement with Woodside Petroleum for liquefied natural gas (LNG) from its Browse LNG project, Woodside said. The termination of the agreement follows Woodside's decision to scrap plans for an onshore Browse LNG plant in favor of a floating LNG plant. The sales agreement, which would have supplied MIMI with 1.5 million tonnes of LNG a year, was conditional on Woodside making a final investment decision on the Browse project by the end of 2013. (www.downstreamtoday.com)

North Dakota train fire adds fuel to Keystone XL debate

January 1, 2014. The derailment and fire that led to the evacuation of a North Dakota town has renewed the debate over whether it’s safer to ship oil by rail or pipeline as the U.S. completes a review of the Keystone XL project. Public safety officials urged more than 2,000 North Dakota residents to flee fumes from the fire that engulfed BNSF Railway Co. cars carrying oil after a collision Dec. 30 with another train about 25 miles (40 kilometers) west of Fargo. BNSF is owned by Berkshire Hathaway Inc. of Omaha. While climate change has been the focus of the fight over TransCanada Corp.’s proposed Keystone XL pipeline from Canada to the U.S. Gulf Coast, a subset in the debate has been the relative safety of pipes versus trains. The U.S. State Department, reviewing the $5.4 billion project because it would cross the U.S. border, is weighing whether the pipeline would be in the national interest. Keystone would allow about 100,000 barrels a day of crude from the Bakken formation in Montana and North Dakota onto the pipeline through a link in Baker, Montana. (www.bloomberg.com)

Policy / Performance

EIA increases US gasoline demand, price estimates for 2014