COAL ABUNDANCE REVITALISES SELF-RELIANCE NARRATIVE

Monthly Coal News Commentary: April 2020

India

Domestic Production & Demand

A meeting was organised by the government to discuss the potential economic reforms in the mines and coal sectors to give a boost to the economy in the backdrop of the Covid-19 pandemic. The discussions involved ensuring easy and abundant availability of mineral resources from domestic sources, upscaling exploration, attracting investment and modern technology to generate large-scale employment through transparent and efficient processes. Special focus was given to improving the country’s self-reliance in production of minerals and their in-country processing. India is planning to bring 'avoidable coal imports' to zero by 2023-24 amid abundance of fuel stock due to subdued demand by the power sector in the wake of the coronavirus-driven lockdown. This comes at a time when the country’s coal imports increased marginally by 3.2 percent to 242.97 mt in the just-concluded financial year 2019-20. Of the total, 110 mt of fuel was unavoidable import, while the remaining nearly 130 mt is avoidable import. This unavoidable coal import consisted of coking coal and coal with low-ash content. India does not have much coking coal, which steel plants use to mix into iron to produce steel, and so has to import. State governments were asked not to import dry fuel and take domestic supply of fuel from CIL which has the fossil fuel in abundance. To give a boost to coal demand hit by the ongoing lockdown, the government has also announced a slew of measures like increased dry fuel supply for linkage consumers. It announced that no performance incentive shall be levied on power consumers if CIL supplies more than the upper limit of FSA. About 80 percent of India’s domestic coal production comes from CIL. CIL recorded an all-time high coal output of 84.36 mt during March 2020, registering 6.5 percent growth compared to 79.19 mt it produced in March 2019.

The government has no plans to scale down CIL’s output target of 710 mt for the ongoing fiscal even though the country has more than enough stock of the dry fuel amid subdued power demand due to the coronavirus lockdown. CIL’s pithead stock was at 74 mt as on 31 March, the highest ever. In spite of abundance of fuel stock and subdued demand by the power sector, the company will keep producing coal as the government feels the electricity demand will pick up in the days ahead with the onset of summer. Moreover, during monsoons there is less production of coal, so this is the time when the maximum production can happen. In a bid to spur coal demand hit by the ongoing lockdown, the government had recently announced a slew of measures like increased dry fuel supply for linkage consumers. Several relief measures were announced for CIL consumers, including the power sector, in the wake of the situation arising from the pandemic. The coal ministry announced that no performance incentive shall be levied on power consumers if CIL supplies more than the upper limit of FSA. About 80 percent of India’s domestic coal production comes from CIL. The company closed fiscal 2019-20 with coal production of 602.14 mt, against the target of 660 mt.

CIL has moderated its production in April keeping in mind the demand and fire hazard threats at mine pitheads and power plant stockyards in summer months. In the first 11 days of April, the average daily production stood at 1.3 mt as against 2.7 mt for the month of March. Cumulative production in this month was 14.50 mt and an offtake of 14.70 mt indicated that the miner was producing in line with demand. For FY21 the company had earlier set a production target of 710 mt based on previous goals. Coal stocks in the country stand at 120 mt. The company has extended the time limit for payment of coal, booked by its customers, by two more weeks till 21 April from 7 April announced earlier. CIL has extended the validity period for lifting of coal under all auctions without any penalty. Earlier, failure to lift the ordered quantity of coal within a stipulated time attracted forfeiture of earnest money deposit under auction schemes. Now, this clause has been done away with till the closure of the lockdown period to non- regulated sector as well. The company closed fiscal 2019-20 with annual coal production of 602.14 mt achieving 91 percent of the target. It had recorded an all-time high of 84.36 mt coal output during March the last month of FY20.

CIL plans to auction 60 percent of its inventory by May to liquidate stocks that touched a record 75 mt in March. The company has decided to reduce floor price for bidding, from 20 percent-30 percent above notified price, to the notified prices and bulk of the offer would be for auctions allowing consumers to lift booked quantities over several months. CIL’s demand outlook is not promising for at least the first half of this fiscal. CIL is expecting increased competition from imports as global coal prices have started to soften. Coal auctions are expected to help prevent the market from being swayed away towards import segment due to a possible drop in global prices.

CIL’s daily average production in April has halved from March and is down 11.3 percent versus April 2019. The world’s largest coal miner produced an average of 1.34 mt during the first 22 days of April, down from 1.51 mt per day April 2019. It produced 2.72 mt per day on average in March. CIL is targeting production of 710 mt, or 1.94 mt per day, during the year ending in March 2021. The company’s annual production fell in 2019/20 for the first time since 1998/99 as the heaviest rainfall in 25 years battered coal mining regions and a broad economic slowdown stifled demand. Lower demand due to a nationwide lockdown has created record high fuel stocks at utilities, CIL’s biggest clients, prompting many power plants to avoid buying more coal. Electricity consumption has fallen 24.3 percent compared with last year during the nationwide shutdown India started on 25 March.

Amid nationwide coronavirus lockdown, CIL has extended the deadline for submission of Expression of Interest from power gencos for rationalising coal linkages. The linkage rationalisation refers to transfer of coal supply source of a power plant from a far-end mine to the nearer one. Earlier, CIL had invited expression of interest from the desired state/central gencos proposing for rationalising their existing linkages. Earlier, the coal ministry had written to CIL stating that as per the methodology, linkage rationalisation for two IPPs have been done by the PSU for a quantity of 2 mt. It had asked the PSU to commence the next round of linkage rationalisation and apprise the Centre about the final result of the linkage rationalisation by 30 June. Under coal linkage rationalisation, the fuel linkage of a thermal power plant of an independent power producer is transferred from one coal company to another based on the fuel availability and future coal production plan of the coal company. The linkage rationalisation is considered only for IPPs having linkages through allotment route. The IPPs which have obtained linkages through auction process are not eligible for rationalisation under this scheme. CIL which accounts for over 80 percent of the domestic coal producer is a major supplier of dry fuel to the power sector. Aiming to lower the payment burden on its consumers amid the ongoing lockdown, CIL has further extended the time limit for payment of coal booked by its customers, by two more weeks till 21 April from the earlier deadline of 7 April. The long-pending demand for Deferred Payment Letter of Credit has now been implemented as an additional mode of payment along with Irrevocable Revolving L/C for the coal supplied to power producers, especially independent power plants. This will help cash-strapped power producers avail credit facility through their banks to tackle the liquidity crunch. As a concentrated effort, CIL has decided to continue with coal supplies despite payment defaults. According to provisions of contracts signed between gencos and CIL, the power producers make monthly payment for the coal purchase in three instalments. CIL said that despite payment defaults, coal supplies to gencos are assured although dues from gencos stand at around ₹140 bn. The rest 45 mt of coal stock is at thermal power plants sufficient for 28 days consumption. CIL has seen a 10 percent fall in dispatches in March 2020 due to a sharp fall in demand from the power sector, leading to an increase in inventories both at power plants and coal mines. This comes amid production rising up 6.5 percent to 84.4 mt. CIL’s dispatches declined 10.3 percent yoy to 53.5 mt in March 2020 as demand for power plummeted. For FY20, CIL’s dispatches dropped 4 percent yoy to 582 mt, while production declined about 1 percent yoy to 602 mt. India’s nationwide lockdown came at a time when power demand had largely remained muted and production at CIL’s mines ramped up following a heavy monsoon season. Hence, inventories at coal mines and power plants have risen, a general trend seen at the onset of summer but now higher than usual.

WCL, a subsidiary of CIL has slashed the coal auction floor price of specific mines by 10 percent. With an effort to provide coal at cheaper price to consumers during the current Covid-19 pandemic, the reduced auction price will be applicable for coal from 'mine specific source' for all auctions to be conducted by WCL in April 2020. WCL had identified 11 out of its total 66 mines in November 2019 as 'mine specific source' especially for use of power plants at an additional add-on price of ₹450/tonne over the notified price. These 11 mines, including eight greenfield ones -- Dinesh, Makardhokra I, Gokul Bhanegaon, Singhori, Penganga, Yekona, Pauni II & 3 Brownfield- Mungoli, Niljai, and Gondegaon -- were opened during the last five years to provide coal to power consumers in central, western and southern India at their doorstep at cheaper landed price. Earlier, these power plants were getting coal from mines located in eastern India which was costly due to extra railway freight, it said. With opening of new projects by WCL, coal became cheaper for these plants to the tune of ₹1,000/tonne on an average. All linked power plants, including state gencos of Maharashtra, Madhya Pradesh, Gujarat, Karnataka and other private sector power plants are getting coal at specific add on price from these 11 mines. WCL has launched a roadmap to achieve beyond 75 mt of output by FY its contribution towards the ambitious 1 bt target of parent firm CIL. WCL achieved an output of 57.64 mt in FY2019-20, surpassing the target of 56 mt. The company registered highest ever single day production of 5.02 lakh tonne on 31 March 2020. WCL registered a growth of 8.4 percent, which is highest among all subsidiaries of CIL. The company has a target of 62 mt for the year 2020-21.

NLC India Ltd has commenced operations to mine coal at Talabira mines in Odisha. NLC has established a facility to mine 20 mt of coal per annum. The coal mined in the region will be used to meet the requirement of the company’s existing and future coal-fired power plants. By launching the project during the difficult time of Covid-19 lockdown the company has contributed for the energy security of the country especially when avoiding import of coal is the topmost priority. This coal block has been developed through mine developer and operator model, which is developed and successfully implemented by the NLC team.

NALCO said it is considering operationalising Utkal-D coal block in Odisha in the current financial year. The company said it is in the process of obtaining mining lease of Utkal-E coal block, which was allocated to the government-owned firm along with Utkal-D coal block in May 2016. The lease for Utkal-D has been granted for a period of 30 years. The initial capacity of Utkal-D coal block is 2 mtpa with a total mineable reserve of 101.68 mt. Utkal-D coal block was allocated to NALCO in May 2016.

Imports

India’s coal import in March stood at 15.74 mt down 27.5 percent over last year, due to restrictions imposed at various ports in the wake of coronavirus outbreak in the country. The country had imported 21.72 mt of coal in March last year, according to a provisional compilation by mjunction services based on monitoring of vessels' positions and data received from shipping companies. However, the country’s coal import registered an increase of 3.2 percent to 242.97 mt in 2019-20. Of the total imports in March 2020, non-coking coal was at 11.73 mt, against 16.94 mt imported in February 2020.

Covid Concerns

INTUC-affiliated trade body INMF has put forth a demand before CIL that all workers irrespective of activities they are involved in, should have an insurance cover of ₹50 lakh in case of death due to Covid-19. The INMF further said that it supports and endorses contribution of one-day salary to combat Covid-19 pandemic. CIL which accounts for over 80 percent of domestic coal output produced 602.14 mt of dry fuel during 2019- 20 fiscal against the target of 660 mt.

Rest of the World

Global Trends

In a historic shock amid Covid-19 pandemic, coal is set for the largest decline since World War II alongside sharp reductions for oil and gas according to the IEA that provides an almost real-time view of the Covid-19 pandemic's extraordinary impact across all major fuels. After overtaking coal for the first time ever in 2019, low-carbon sources are set to extend their lead this year to reach 40 percent of global electricity generation - six percentage points ahead of coal. As a result, the combined share of gas and coal in the global power mix is set to drop by three percentage points in 2020 to a level not seen since 2001. Coal is particularly hard hit, with global demand projected to fall by eight percent in 2020, the largest decline since the Second World War. Following its 2018 peak, coal-fired power generation is set to fall by more than 10 percent this year.

China

China and other countries could be planning to build more coal plants to stimulate their economies in the wake of the novel coronavirus pandemic but nearly half of global coal plants will run at a loss this year, research showed. China has over 1,000 GW of coal-fired power, accounting for about 60 percent of the country’s total installed generation capacity and around 100 GW under construction. London-based environmental think tank Carbon Tracker analysed the profitability of 95 percent of coal plants in operation or planned around the world. China, which produces and consumes about half the world’s coal, might be considering building more coal plants to stimulate its economy in the wake of Covid-19, after the National Energy Administration announced it was ready to relax rules on coal power investment. Nearly 60 percent of China’s existing coal plant fleet is running at an underlying loss. Governments and investors building new coal may never recoup their investment because coal plants typically take 15 to 20 years to cover their costs.

Poland

Poland’s JSW, EU’s biggest coking coal producer, reported a 40 percent drop in output after it reduced the number of shifts and many miners remained at home because of the coronavirus outbreak. Rising coal stockpiles have been an issue raised by coal trade unions, which said they pose a threat to mining operations. However, the current high stocks and falling demand for coal-fired power could make it easier for Poland to reduce output to ensure miner safety during the coronavirus crisis.

According to Poland’s biggest coal producer, PGG has asked unions to accept a cut in hours and pay of up to 20 percent for three months, which would make the state-run company eligible for government help during the new coronavirus crisis. Poland relies on coal for almost 80 percent of its electricity production, but lockdown measures, have led to a decrease in electricity usage that the company puts at 10-12 percent. Trade unions at Poland’s biggest coal group PGG warned that the industry would collapse because of falling demand if the government did not help. Poland, which is heavily reliant on coal-fuelled power stations for its energy, is the only EU member state not to have pledged to achieve zero carbon emissions by 2050. The increasing share of clean energy in power generation, falling demand for electricity since the start of the coronavirus lockdown and coal imports have heightened problems for the coal industry.

Poland’s Tauron will cut hours and pay by 20 percent in its three coal mines for three months from May, making it eligible for government help during the new coronavirus crisis. Poland relies on coal for almost 80 percent of its electricity production, but lockdown measures have led to a fall in demand for coal and power. Tauron’s daily coal output in its mines stood at 20,000 tonnes in the first quarter. Poland’s biggest coal producer PGG said that it also needs to cut pay and working hours, but the management proposal was rejected by trade unions.

Russia

Russian steel and coal producer Mechel has sold its stake in the Elga coal mine in Russia, which was its main asset for future growth, to a local businessman to reduce debt. After the deal to sell one of the world’s largest coking coal deposits was agreed, two state-controlled Russian banks - Gazprombank and VTB - agreed to restructure part of Mechel’s debt by 7 years with an optional extra 3 years. The reduced debt will help Mechel to focus on investment in its coal mining and processing at assets in Russia’s Kuzbass and Yakutia regions and increasing output of high-margin steel products.

Australia

Australia’s Testing laboratory ALS Ltd said an investigation found that about half the certificates it provided for export coal samples over the past decade had been manually altered to improve the quality of the commodity. The assay reports, going back to 2007, had been amended at four laboratories of the coal superintending and certification unit of ALS’s Coal business in New South Wales and Queensland states. Australia, which is known for its high quality coal, is the world’s biggest exporter of the fuel to markets like Japan, South Korea, China, Taiwan and India. The ALS unit has about 40 percent of the market for testing coal samples to ensure shipments meet quality standards agreed with buyers. The issue came to light after allegations in an unfair dismissal case that Australian miner TerraCom Ltd had worked with ALS’s Brisbane-based testing laboratory to falsely upgrade the quality of its coal in export documentation.

Indonesia

The Indonesian government set its coal benchmark price (HBA) for April at $65.77 per tonne, down from $67.08 per tonne last month. The benchmark price COAL-HBA-ID dropped from a month earlier due to lower electricity consumption in importing countries, as the global coronavirus outbreak disrupts economic activity. The HBA is a monthly average of the Argus-Indonesia Coal Index (ICI-1), the Platts Kalimantan 5,900 assessment, the Newcastle Export Index and the globalCOAL Newcastle index from the previous month.

S Africa

South Africa’s struggling utility Eskom said it had sent letters to its coal suppliers warning that it could declare force majeure if demand continued to drop during the nationwide lockdown. The government has imposed a nationwide lockdown, which started on 27 March and has been extended until the end of April, as it battles to curb the spread of the virus in Africa’s most industrialised economy. Exxaro Resources’ subsidiary Exxaro Coal has received letters calling force majeure on the coal supply agreements for the supply of coal to Eskom’s Medupi and Matimba power stations for the period starting on 16 April until one month after national lockdown has been completely lifted. However according to Exxaro, which is one of Eskom’s main coal suppliers this did not constitute force majeure as stipulated in the coal supply agreements, as the power stations were still capable of supplying power and it planned to “vigorously defend” its position in the matter.

Japan

Investors with nearly $200 bn in assets holding shares in Japan’s Mizuho Financial Group said they plan to back a shareholder motion urging the bank to cut its lending for coal and other fossil fuels. Similar shareholder resolutions have succeeded in getting banks to stop financing coal and other fossil fuels. Kiko Network and other non-profit organisations describe Mizuho as the world’s biggest lender to coal power plant developers. Japan is the only major industrialised economy that is expanding use of coal, hit by the Fukushima nuclear disaster in 2011 which led to the shutdown of most of the country’s reactors that once supplied about a third of the electricity in the world’s third-biggest economy. Japan’s Sumitomo Mitsui Financial Group Inc said it would no longer lend to new coal-fired power plants from 1 May, a day after peer Mizuho Financial Group Inc said it would stop financing new coal power projects. Japanese banks are among the few major lenders who have stuck to backing coal projects even as other banks worldwide have cut their exposure to coal.

| CIL: Coal India Ltd, mt: million tonnes, FSA: Fuel Supply Agreement, FY: Financial Year, gencos: generation companies, IPPs: independent power producers, PSU: Public Sector Undertaking, yoy: year-over-year, WCL: Western Coalfields Ltd, NALCO: National Aluminium Company Ltd, INMF: Indian National Mineworkers' Federation, EU: European Union |

NATIONAL: OIL

Oil refiners step up operations as fuel demand rises after lockdown relaxation

12 May. With the rising consumption of petrol and diesel, state-run refiners Indian Oil Corp (IOC) and Bharat Petroleum Corp Ltd (BPCL) have ramped up capacity utilisation at their refineries — the former to 60 percent and the latter to 52 percent. Petrol and diesel usage in the first 10 days May was up 68 percent and 74 percent, respectively, from the corresponding period in April. Domestic consumption of petroleum products in April, when the lockdown to contain the spread of coronavirus was implemented throughout the month, fell 46 percent year-on-year to 18.3 million tonnes (mt). Throughout the lockdown period, the company had kept all its refinery units on ‘hot standby’, which means the units were ready for scale-up whenever petrol and diesel demand picks up. The total refining capacity of the country is 249.4 million tonnes per annum (mtpa), and of this 69.2 mtpa is run by IOC. According to provisional data by the government’s petroleum planning and analysis cell (PPAC), diesel usage fell 54.8 percent y-o-y to 3.3 mt in April, while demand for the aviation turbine fuel (ATF) fell 91.3 percent to 56 thousand tonne in the month. Petrol consumption fell 60.4 percent to 973 thousand tonne in April. Consumption of bitumen, mostly used in road construction, dropped 72 percent y-o-y to 196 thousand tonne. Rising consumption in May is a positive development for the Union government, which has sharply increased auto fuel taxes by ₹10/litre on petrol and ₹13/litre on diesel earlier this month. In mid-February, the Centre had hiked the tax on both these fuel by ₹3/litre. To shore up more revenues, at least 14 states have also hiked their own taxes on fuels since the start of Covid-19 lockdown.

Source: The Financial Express

Not cancelled any long-term contract for LNG or crude oil: Oil Minister

12 May. Indian energy companies have deferred some cargoes and spot bookings but not cancelled any long-term contracts for procuring liquefied natural gas (LNG) or crude oil supplies, Oil Minister Dharmendra Pradhan said. In a conversation with Daniel Yergin, vice chairman of research and consultancy firm IHS Markit, Pradhan said India has 5.3 million tonnes (mt) of strategic storage capacity. Talking about the impact of Covid-19 on India’s oil and gas industry, the Minister said Indian refiners are currently grappling with reduced demand and inventory losses. The Minister expressed confidence domestic production will gain priority as demand picks up and the government expects investments to come in the country’s upstream sector due to the recent policy reforms. The Minister highlighted that low oil prices is not a solution for achieving energy security and while India is one of the largest consumers of crude oil the current market situation requires oil prices to be reasonable and sustainable for both oil producing and consuming countries.

Source: The Economic Times

IOC plans to operate refineries at 80 percent capacity by May end

11 May. Indian Oil Corp (IOC), the country’s largest fuel retailer, intends to operate its oil refineries at 80 percent capacity by end of May in anticipation of increased demand during the month, the company said. With the demand for petroleum products gradually picking up, IOC has re-started several process units at its refineries that were down due to the lockdown. The refineries were operating at full capacity before the lockdown but had to curtail throughput and bring operations down to nearly 45 percent of capacity by the first week of April in response to a steep decline in demand.

Source: The Economic Times

Higher risks to Indian oil marketing firms' standalone profiles: Fitch Ratings

11 May. Standalone credit profiles of India’s oil marketing companies are at greater risk of downward revision due to the coronavirus-induced drop in demand and refining margins, and their continued investments, Fitch Ratings said. However, the Issuer Default Ratings (IDRs) of Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL), which are driven by sovereign linkages through the state’s direct or indirect ownership, will remain stable. Fitch said the FY20 financial profiles of the three companies were likely to have been affected by large inventory losses due to the steep fall in crude oil prices in the last fortnight of March 2020 and by weakened demand during the period. Fitch cut its FY2021 forecast for industry-wide gross refining margin (GRM) by around 35 percent as it expects product cracks (or margins) to remain weak until global economic growth recovers materially from the coronavirus crisis. It expected FY2021 GRMs to remain at around FY2020 levels excluding inventory losses in March 2020, due to weak product spreads, which are expected to improve gradually from the second half of FY2021 as demand gradually recovers.

Source: The Economic Times

New hikes on petrol, diesel to earn ₹3 bn revenue: Delhi government

7 May. The current hike in VAT (Value Added Tax) on petrol and diesel along with the corona cess on liquor will earn ₹3 bn revenue in a month for the Delhi government. During normal circumstances, the Delhi government generates revenue of ₹50 bn from excise and ₹300 bn in VAT and Goods and Services Tax (GST) every year. In order to make up for the lost revenue due to lockdown, the AAP (Aam Aadmi Party) government has announced steep hike in auto fuels, increasing the VAT by almost double on diesel and similar for petrol. Petrol in the national capital now costs ₹71.26 a litre as compared to ₹69.59 previously and diesel cost ₹69.39 per litre from ₹62.29 earlier. The new fee will be levied 70 percent of the maximum retail price which means if a bottle of liquor is ₹1000, ₹700 will be the special corona fee amounting to ₹1,700 in total. Chief Minister (CM) Arvind Kejriwal had said that if the national capital continues to be in the red zone, the government will cease to function due to lack of capital eventually leading to unpaid staff. Hence, to prevent such a scenario, the government has decided to put a special corona virus tax on liquor and almost 30 percent increase in VAT on petrol and diesel.

Source: The New Indian Express

Petrol, diesel prices raised by nearly ₹3 a litre in Chandigarh

7 May. Petrol and diesel prices in Chandigarh will go up by nearly ₹3 per litre with the Union Territory (UT) administration announcing a hike in VAT (Value Added Tax) on fuel by 5 percent. The tax hike will generate an additional revenue of ₹1 bn for the UT administration in 2020-21. After the revision in prices, petrol in the city now costs ₹68.62 a litre, a hike of ₹2.8, and diesel ₹62.02 per litre, an increase of ₹2.72. Before the increase in the tax, the price of petrol and diesel in Chandigarh was ₹65.82 and ₹59.30 a litre, respectively. According to the government, VAT on petrol has been hiked from 17.45 percent to 22.45 percent. Similarly, the tax on diesel has been raised from 9.02 percent to 14.02 percent. Despite an increase in VAT, the fuel prices in Chandigarh continue to be lower than that of Punjab. Prices of petrol and diesel in Mohali stood at ₹72.58 a litre and ₹64.05 a litre, respectively.

Source: The Economic Times

Vedanta’s plans to sell minority stake of $1 bn oil unit stalls

7 May. Vedanta Ltd’s plans to sell a minority stake in its Indian oil unit have stalled after a collapse in crude prices. The Mumbai-listed company, backed by tycoon Anil Agarwal, was seeking to raise more than $1 bn by selling at least 20 percent of its Cairn Oil & Gas business. The crash in energy prices and the Covid-19 pandemic have made it difficult for potential investors to gauge Cairn’s business outlook. While the stake sale talks could resume when oil prices stabilize, Vedanta may also explore other fundraising options to reduce its debt.

Source: Livemint

93k Ujjwala beneficiaries in Uttarakhand get money in their accounts for free LPG refills

6 May. Bharat Petroleum Corp Ltd (BPCL) has transferred money directly to the accounts of 93,000 PMUY (Pradhan Mantri Ujjwala Yojana) beneficiaries in Uttarakhand to help them get three free refills of LPG (liquefied petroleum gas) under the Pradhan Mantri Gharib Kalyan package. PMUY beneficiaries are to be given three free LPG refills between April-June under the package announced by Prime Minister (PM) Narendra Modi after the outbreak of the Covid-19 pandemic. Money was transferred directly to the accounts of 93,000 out of a total of 98,759 active PMUY customers in Uttarakhand during the month of April, BPCL state head Vineet Singh said. Free LPG refills have also been provided to 79.5 percent of these customers already and the process to reach out to the rest is on, he said. He gave the credit for it to the BPCL’s contractual workers like delivery boys and drivers of utility vehicles engaged in distribution of LPG cylinders, who took their job in such critical times in mission mode. Despite the threat of the pandemic, they never shied away from going to the remotest corners of the state to reach PMUY customers, he said. The delivery men who are always wearing masks have strict instructions to deliver the LPGs at a distance of 1.5 metres from the doorstep of a customer, he said.

Source: The Economic Times

Petrol, diesel under GST unlikely in near future: BJP, Congress leaders

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Keeping petrol, diesel out of GST will keep low carbon fuels competitive!

< style="color: #ffffff">Good! |

6 May. Indian industry is raising the pitch to bring petrol and diesel under the GST (Goods and Services Tax) for sure, but BJP and Congress leaders indicated that it is unlikely to be fructified in the near future with states not willing to get on board. Senior Congress leader M Veerappa Moily said his party held the view that the fuels have to be brought under the ambit of GST but added that now is not the time to do so as state finances are collapsing due to the adverse impact of the Covid-19-induced lockdown. BJP Spokesperson and Rajya Sabha member G V L Narasimha Rao said the Union Government had on many occasions proposed bringing petroleum and liquor under GST but the states were reluctant contending that they were their major source of revenue and they cannot allow these two items. Industry body ASSOCHAM said sooner petrol and diesel are brought under the GST, better it would be for the Indian economy. According to ASSOCHAM secretary general Deepak Sood, governments, both at the Centre and States have been over- dependent on petrol and diesel for revenue. In any case, the crude oil prices have crashed to unprecedented lows, without the pump prices being reduced, against the spirit of the market-driven pricing policy, the ASSOCHAM said.

Source: The Economic Times

Uttar Pradesh hikes petrol price by ₹2 per litre, diesel by ₹1 per litre

6 May. The Uttar Pradesh (UP) government approved a hike in the prices of petrol and diesel, UP Finance Minister Suresh Khanna said. The UP government has increased the price of petrol by ₹2 per litre, and that of diesel by ₹1 per litre, he said. The move follows the Centre’s decision to increase excise duty on petrol by a record ₹10 per litre and ₹13 per litre for diesel. The hike, however, did not push up fuel prices as global oil prices have dropped to a nearly two-decade low.

Source: The Economic Times

NATIONAL: GAS

Gas production to remain a loss-making proposition for upstream producers: ICRA

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Gas production as loss-making proposition is not good news for the domestic industry!

< style="color: #ffffff">Bad! |

12 May. Domestic gas production is expected to remain a loss-making proposition for most Indian upstream producers in financial year 2020-2021 as prices are expected to remain subdued, rating and research firm ICRA said. ICRA senior vice-president K Ravichandran said the recent sharp drop in crude oil prices is a credit negative for the upstream sector as their realisations and cash accruals will decline. According to ICRA, the credit metrics of Indian upstream players will further weaken materially in the near-term unless the government provides some relief on fiscal levies like royalty, cess and profit petroleum, along with changes in domestic gas pricing formula. India sets the price of domestically produced natural gas based on a formula that is revised bi-annually. As per the formula, the price is the weighted average of four global benchmarks — Henry Hub, Alberta gas, NBP and Russian gas. Price of domestically produced natural gas fell 26 percent to $2.39 per million metric British thermal units (mmBtu) for the period between 1 April 2020 to 30 September 2020, the lowest recorded price of domestically produced natural gas under the Administered Price Mechanism (APM).

Source: The Economic Times

ONGC losses on gas business to widen to ₹60 bn in FY21

11 May. India’s top oil and gas producer ONGC (Oil and Natural Gas Corp) is likely to see its loss on natural gas sales widen by nearly 50 percent to ₹60 bn in the current fiscal after the government-mandated rates for the fuel dropped to a decade low. ONGC had posted ₹42.72 bn loss on gas business in 2017-18, which is likely to widen to over ₹60 bn in the current fiscal (April 2020 to March 2021). The accounts for 2019-20 are yet to be finalised but the loss on gas business should be around ₹45 bn. ONGC has seen incurring losses on the 65 million standard cubic meters per day of gas it produces from domestic fields shortly after the government in November 2014 introduced a new gas pricing formula that had “inherent limitations” as it was based on pricing hubs of gas surplus countries such as the United States, Canada, and Russia. In previous years, loss from the gas segment was getting offset from the gain from the oil business. In May 2010, the Cabinet had approved an oil ministry proposal to raise the rate of gas sold to power and fertilizer firms from $1.79 per mmBtu (million metric British thermal units) to ₹4.20. ONGC and Oil India Ltd got ₹3.818 per mmBtu price for the gas they produced from fields given to them on nomination basis and after adding 10 percent royalty, the fuel cost $4.20 per mmBtu for consumers.

Source: The Financial Express

India’s LNG imports jumped 18 percent in 2019-2020

8 May. In an indication of increasing demand for natural gas in the country, India’s import of liquefied natural gas (LNG) jumped 18 percent to 33,680 million metric standard cubic meter (mmscm) in 2019-2020, as weaker global prices of LNG prompted the local industry to consume more. Despite higher volumes, the LNG import bill witnessed a decline last fiscal indicating a sustained weakness in global LNG prices. According to data published by Petroleum Planning and Analysis Cell (PPAC), the country’s LNG import declined 8 percent to $9.5 bn in 2019-2020. According to analysts many refiners, gas marketing companies and gas-based power plant operators aggressively grabbed distressed LNG cargoes during the first quarter of 2020 in anticipation of robust natural gas demand. All the major sectors which consume imported LNG witnessed a major jump in demand last financial year. Data showed LNG imports by the power sector increased 26 percent to 3,595 mmscm. LNG imports by city gas distribution (CGD) companies increased 19 percent to 4,746 mmscm in 2019-2020. Similarly, the petrochemical industry witnessed a 15 percent increase in LNG imports at 3,016 mmscm. LNG imports by refiners jumped 13.40 percent to 6,727 mmscm last financial year. India’s fertilizer industry, which is the largest consumer of imported LNG, witnessed a 10 percent increase in LNG imports at 9,539 mmscm in 2019-2020. While India remained one of the few strong LNG demand centres in Asia up to March this year, the lockdown measures deployed to arrest the outbreak of Covid-19 have severely impacted LNG demand from power plants, CGD companies as well as the refinery and petrochemical sector.

Source: The Economic Times

NATIONAL: COAL

Unions oppose Coal India’s move to shift marketing offices from Kolkata

12 May. Workers’ unions are opposing Coal India’s move to shift subsidiary marketing offices from Kolkata to their respective headquarters since it will disrupt jobs of some 130 employees and some 29 contract workers. The decision was to shift subsidiary desk offices along with respective marketing and sales offices of subsidiaries, Eastern Coalfields, Bharat Coking Coal, Central Coalfields, South Eastern Coalfields and Mahanadi Coalfields from Kolkata to their respective subsidiary headquarters. Most of the marketing and sales offices are currently located at a building in Kolkata which used to house the company’s headquarters. Some offices are at other locations in the city.

Source: The Economic Times

India’s coal production to clock record 700 mt in FY21: Coal Secretary

10 May. India will produce a record 700 million tonnes (mt) of coal in the current fiscal ending March 2021, helping cut down on imports, Coal Secretary Anil Jain said. India produced 602.14 mt of coal in 2019-20 fiscal, marginally lower than 606 mt output in the previous year. India imports 235 mt of coal annually. About half of this is non-substitutable as they are tied to the power plant or user factories, but the rest can be cut down, he said. To meet the import reduction goal, state miner Coal India Ltd (CIL) is targeting to raise its annual output to 1 billion tonnes by fiscal year 2024. He said FY20 coal production was lower than the target of 660 mt because of flooding of a key coal mine. Power plants, which are key coal users, have stocks as high as 30-days due to the coronavirus lockdown, he said. The lockdown shut factories and offices, slashing electricity demand by about a quarter, thus affecting the use of coal and causing inventories to swell to record levels. CIL has stocked up a record 75 mt at its mines while power station inventories have surged to 44.7 mt, the highest in data going back to 2008. He said coal production in April was about 40 mt, down from 45 mt a year back. Coal’s share in India’s electricity generation is estimated to come down to 50 percent by 2030 from about 72 percent now.

Source: Business Standard

Chhattisgarh demands ₹41.4 bn coal levy back from Centre

10 May. Chhattisgarh has demanded that the Centre transfer the additional levy of ₹41.4 bn collected from coal mines to the state. The state had written a similar letter to the coal ministry at the Centre in January this year seeking what it believes is rightful due to Chhattisgarh. Chief Minister Bhupesh Baghel’s Congress government had recently also demanded that the steel ministry undertaking, NMDC, pay up its remaining ₹10 bn due. The Centre was collecting this levy under Section 14 (5) of the Coal Mines (Special Provision) Act 2014 read with Rule 18 of the Coal Mines (Special Provision) Rule 2014 which mandates that the additional levy on coal extracted from any Schedule II coal mine shall be deposited by the prior allottee with the central government.

Source: The Economic Times

Covid-19 lockdown delays commercial coal mining auction to July, Centre finalises bid document

9 May. After more than five-year wait, the government may finally throw open the doors of the regulated coal sector for commercial mining by the private sector comprising both Indian and overseas miners in July. Government said that draft rules, bid documents and agreements for commercial mining has been prepared and finalised and it would be approved by Cabinet soon before auctions start. In the first phase a total of about 80 large and small mines would be put up auction for commercial mining. Government was looking to start auctions in April but lockdown due to Covid-19 outbreak has delayed the process. The decision to permit commercial coal mining would allow domestic mining firms like Essel Mining, Sesa Goa, JSW Energy, Vedanta, Adani and global giants like Rio Tinto, BHP Billiton, PesBody, Glencore and Vale to mine and sell and help ramp up output from the country’s huge reserves -- the world’s fifth biggest. It will also offer an additional source of fuel for power producers, some of whom often face low coal stocks at their plants. In order to address the concerns of the potential bidders, the coal ministry conducted pre-bid consultations stakeholders in Kolkata and Mumbai in February. Based on the suggestions received, the government has now agreed to ease bidding conditions that would form part of the document that would go for cabinet approval. The government is considering allowing composite route for potential bidders of commercial coal mine and offer simultaneous prospecting and mining lease to bidders to ensure certainty on the investments made by the bidders. Also, the bid document may incentivise companies who also offer to undertake coal gasification from mines won by them. The revenue share for coal gasification would be kept low to active participation of companies. The success of the first bidding round for commercial mines would have to be weighted against lack of investor interest in some of the recent coal auctions for end user plants. The commercial mining auctions could see in all 15 large coal blocks with annual production potential of 5-10 million tonnes being put up for bidding in phases. The reserves in five of these mines could be in excess of 500 million tonnes. These could fetch anywhere between ₹50 and 60 bn to the state government. However, in all 80 blocks would be put under the hammer in phases that would also include smaller mines. As of now, power, steel and cement companies can mine coal but for their own consumption after getting blocks through auction. Coal India Ltd (CIL) dominates commercial mining in India. Government in January issued ordinance that lifted end use restrictions and opens coal sector for commercial mining. A legislation relating to opening up of coal mining has already been passed by Parliament.

Source: The New Indian Express

India’s coal import declines 29 percent in April

7 May. The country’s coal import dropped by 29.1 percent to 18.65 million tonnes (mt) in April due to the lockdown to contain the spread of coronavirus infection. The government had recently asked power generating companies to reduce coal import for blending purpose and replace it with domestic coal. The comported 26.34 mt of coal in April 2019, according to a provisional compilation by mjunction services based on monitoring of vessels' positions and data received from shipping companies. Coal import through ports is estimated to have decreased by 6.18 percent in April 2020 over the previous month, mjunction services said. Of the total imports in April 2020, the volume of non-coking coal was at 13.05 mt against 13.16 mt in March 2020. Coking coal imports stood at 3.3 mt in April 2020, lower than 4 mt a month ago. Coal import in 2019-20 was at 247.1 mt, about 5 percent higher than 235.35 mt fuel imported during FY2018-19. Coal Minister Pralhad Joshi had earlier written to state chief ministers asking them not to import dry-fuel and take the domestic supply of fuel from Coal India Ltd (CIL), which has the fossil fuel in abundance.

Source: The Economic Times

NATIONAL: POWER

Discoms generate 95 percent billing efficiency due to smart meters

12 May. EESL (Energy Efficiency Services Ltd) said that its smart metering programme (SMP) is helping distribution companies (discoms) generate 95 percent of billing efficiency during the lockdown. The discoms using smart meters have seen 15-20 per cent average increase in monthly revenue per consumer, EESL said. The power ministry PSU (Public Sector Undertaking) is the designated agency to implement the SMP in India. The EESL has enabled discoms to generate around 95 percent of billing efficiency by using smart meters amid this lockdown and 15-20 percent average increase in monthly revenue per consumer. States like Uttar Pradesh, Haryana, NDMC New Delhi and Bihar have installed around 9.84 lakh, 1.23 lakh, 57,000 and 28,000 smart meters, respectively, it said. The discoms in these states, with the help of smart meters, have been able to handle their operations smoothly in the time of crisis, it said. Smart meters deployed by the EESL have the capability to switch to prepaid mode with a remote button click from the IT system. Wherein the general populace has to adhere to the social distancing norms by the government, electricity distribution companies have not been able to physically collect electricity bills from consumers, leading to dip in the cash flow. However, it said that few discoms are enjoying the perks of using the prepaid smart meters. Bihar is the first state in India to use about 28,000 Smart prepaid meters. The consumers on an average are recharging their prepaid smart meters with a credit balance of ₹20 daily, it said.

Source: The Economic Times

Indian power sector adds more new capacity in FY20 vis-à-vis FY19

11 May. The Indian power sector (includes both conventional and renewables) managed to add more new capacity in FY20 than the previous fiscal amid some challenges. The total capacity addition of conventional and renewable segments stood at 15,776 MW in 2019-20 when compared with 14,204 MW in 2018-19. The power sector in the country has been affected by the prevailing slowdown in the Indian economy. The emerging economic disruption caused by the coronavirus pandemic would add to the weakness in the sector. As a result, India’s power sector performance is expected to see a significant decline in 2020-21, pointed out CARE Ratings’ analysts.

Source: The Hindu Business L ine

April power bills can be paid by 30 May in Gujarat

10 May. The deadline for payment of electricity bills for March-April has been extended till 30 May, the state government took the decision. This is for power customers of all electricity distribution companies in the state. Gujarat Chief minister (CM) Vijay Rupani has decided to provide financial relief to small and middle class traders, shopkeepers and industries in the state by exempting all such LT customers from fixed charge on their April electricity bills. Earlier, the state government had decided to exempt only closed units from fixed charge exemption. It has been decided not to charge the fixed charge from HT customers in the state whose power consumption during lockdown was less than 50 percent of the average consumption of the previous three months. This exemption will not apply to bank, telecom companies, petrochemical complex refineries and dairy as well as hospitals. Hospitals whose power consumption is 50 percent less than the average of the previous three months of lockdown are also exempted from fixed charge, the state government has decided.

Source: The Times of India

Tamil Nadu CM urges PM Modi to put Electricity Bill on hold

10 May. Tamil Nadu Chief Minister (CM) Edappadi K Palaniswami has urged Prime Minister (PM) Narendra Modi to keep the new Electricity (Amendment) Bill in abeyance till the proposed changes are thoroughly discussed with state governments. In a letter, he said the Bill goes against the rights of states and was detrimental to public interest. The Centre has introduced the Bill, the fourth draft since 2014, to help private players enter generation, distribution and transmission of electricity, which, by and large, remains state-owned discoms’ monopoly as of now. The Bill seeks to make discoms levy power charges from all types of consumers. The government will have to directly transfer the subsidy component to the beneficiaries’ bank accounts. The electricity regulatory commission will have to fix tariffs without accounting for subsidies. In simpler terms, cross subsidising some sectors – agriculture, huts and domestic connections - by levying higher tariffs on other sectors – commercial and industrial connections - will stop. In an election year, Palaniswami’s concern is that the bill would antagonise a large section of consumers as it would put ner in the works of free power distribution to agriculture sector and hutments. The state has not been able to even meter agriculture power consumption. If unlimited use of power by agriculture sector ends, it could become a major political issue for the government. The state has also been providing 100 units of free power to all domestic consumers. However, the concerns raised by Palaniswami in the letter is that there would be serious difficulties in implementing direct benefit transfer in the electricity sector. It would work against the interest of farmers and domestic consumers, he claimed. The proposed amendment Bill also seeks to take away the power of the state government in deciding the constitution of the state electricity regulatory commission.

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Steepest plunge for power demand will add to power sector woes!

< style="color: #ffffff">Ugly! |

Source: The Times of India

Madhya Pradesh government mulls company to supply cheap power to industries

9 May. Madhya Pradesh (MP) government plans to set up a separate company to provide cheap electricity to industries. This plan came about in a meeting chaired by Chief Minister (CM) Shivraj Singh Chouhan on industrial land and policy. In the meeting, Chouhan said with land pooling policy, sufficient land was available for industries in the state.

Source: Business Standard

Assam CM invites power companies to set up their businesses in Assam

9 May. Assam Chief Minister (CM) Sarbananda Sonowal made an open invitation to companies to set up their business ventures in Assam as the state has a power surplus of 350 MW to cater to their electricity need. Chairing a meeting to assess the impact of Covid-19 on Assam Power Distribution Company Ltd (APDCL), Assam Power Generation Corp Ltd (APGCL) and Assam Electricity Grid Corp Ltd (AEGCL), Sonowal said that though the state has been hit hard by the coronavirus pandemic, the unrelenting endeavour of the government’s power companies has yielded into a power surplus of 350 MW. Sonowal hailed the role of every personnel of power department and the power companies in maintaining their high standard of professionalism and providing un-interrupted supply to the state which is battling the coronavirus infection for quite sometime now. Sonowal asked the companies to sustain their professionalism and ensure uninterrupted power supply to all the consumers during the forthcoming monsoon season also when the different parts of the state will be reeling under flood.

Source: The Economic Times

Power demand falls 22.6 percent in April, steepest plunge in recent history

9 May. The April electricity consumption recorded was also the lowest in corresponding months since 2016. The April electricity consumption recorded was also the lowest in corresponding months since 2016. Electricity demand in April, when the lockdown to contain the outspread of the coronavirus was implemented throughout the month, fell 22.6 percent year-on-year to 85.2 bn units, owing to muted industrial and commercial activities. This is the lowest growth in electricity demand in the country in any month in recent years. The April electricity consumption recorded was also the lowest in corresponding months since 2016. Power consumed by highly industrialised states like Gujarat, Maharashtra and Tamil Nadu in April was lower by 26.1 percent, 17.9 percent and 28.6 percent, respectively than the volume of electricity supplied to these states in the same month in 2019. The three states are among the top five electricity users (other two being Uttar Pradesh and Rajasthan) and fall in power consumption in these places had already dragged down the country’s annual demand growth to a six-year low of 1.3 percent in FY20. Electricity consumption in Uttar Pradesh declined by 20.3 percent in April while Rajasthan recorded an annual fall of 21.3 percent in the same month.

Source: The Financial Express

Power demand up as manufacturers resume production in Tamil Nadu

8 May. As people begin to return to work across Tamil Nadu after more than one-and-a-half months, power demand has started to increase. The peak demand, which was less than 11,000 MW since 25 March when the lockdown came into effect, went up as manufacturing plants gradually resumed work. Power Minister P Thangamani reviewed preparation of TANGEDCO (Tamil Nadu Generation and Distribution Corp Ltd)’s thermal units and other power generation sources to meet the demand. Meanwhile, TANGEDCO like other discoms (distribution companies) is also hoping to get a financial package from the Centre.

Source: The Times of India

Firms spared fixed electricity charges for 2 months, no penalty for others on late payment: Karnataka CM

7 May. Karnataka Chief minister (CM) B S Yediyurappa announced waiver of fixed electricity charges for micro, small and medium enterprises (MSMEs) for two months, bringing some relief to the struggling sector. The government’s relief is expected to help about 6.5 lakh MSME units in the state that employ about 70 lakh people. The CM announced a special relief package of ₹16.1 bn to assist people from various affected sectors, which was welcomed by his political opponents. Besides waiver of fixed power costs for MSMEs, the CM announced some relief for electricity consumers across categories. These include the utilities accepting delayed payments without a penalty. The government has decided to give a one-time compensation of ₹5,000 to autorickshaw and taxi drivers who have lost their income during the lockdown.

Source: The Economic Time

Power consumption in Patna up 13 percent despite lockdown

6 May. Electricity consumption in the state capital increased by up to 13.6 percent in the last couple of days owing to rise in temperature, the energy department said. The rise in power consumption during the lockdown period, though, has surprised many. The maximum power demand was 334 MW at 8pm, the highest in the last 40 days since the lockdown was announced by the Centre. The power demand had dipped in the initial days of lockdown as all commercial establishments, malls, restaurants, hotels, coaching classes, hostels, educational institutions and industrial units were closed. Interestingly, the peak power demand is still low when compared to last year’s figures of above 400 MW per day in April and May. Patna Electric Supply Undertaking (PESU) general manager Dilip Kumar Singh said the electricity demand would further increase as temperature has started to rise. The state recorded peak power demand of 4,100 MW, he said.

Source: The Times of India

High power bills give consumers a shock in Bengaluru

6 May. Many residents had the shock of their lives when they got their electricity bill for May. Even after deducting the last payment made in April, the bills have been ‘unusually high’, they alleged. Over the past five days, BESCOM (Bangalore Electricity Supply Company) officials have been getting frantic calls, messages and emails from consumers crying foul over high electricity bills. With meter readings being put off due to the Covid-19 situation, BESCOM had decided to bill domestic consumers for April based on their average consumption over the past three months. BESCOM claims the bills are high due to increased usage of home appliances. From May, meter readings have once again commenced within BESCOM limits.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Only one-third SECI wind projects commissioned so far

12 May. Only about one-third of 6,000 MW wind power capacity auctioned by the Solar Energy Corp of India (SECI) in four tranches between 2017 and 2018 have been commissioned so far despite their deadlines ending. SECI, the nodal agency through which the Ministry of New and Renewable Energy (MNRE) conducts wind and solar auctions, has commissioned only 1961 MW of wind capacity. SECI has commissioned 1,000 MW out of 1,049 MW in the first auction held in February 2017 while 685 MW out of 1,000 MW have been commissioned in tranche 2 held in October 2017. The scheduled commissioning date for tranche 2 was May 2019. In the tranche 3 auctioned in February 2018, 277MW out of 2000 MW have been commissioned while not a single megawatt has been commissioned amongst the 2000 MW auctioned in tranche 4 in April 2018. The scheduled commissioning deadline for tranche 3 projects was November 2019, and March this year for tranche 4. According to a wind power developer, the winning tariffs in tranche 3 auctions were “too low”. The winning tariffs in that auctions were in the range of ₹2.44-2.45 per unit, only one paisa higher than the record low reached so far.

Source: The Economic Times

10 GW mega solar power plants to come up in two phases in Andhra Pradesh

11 May. As part of supplying reliable power to agriculture sector on a permanent basis, the power utilities have laid special focus on taking up works of 10,050 MW mega solar plants to supply free power to all the agricultural feeders. The mega solar project will be implemented in two phases and the project is estimated to cost ₹48.55 bn. In the first phase, works related to 4,550 MW power plants would be taken up, followed by 5,500 MW in the second phase. Nine locations have been identified in Anantapur (2), Kadapa (3), Kurnool (10 and Prakasam (3) districts. While the first phase is expected to cost ₹12.55 bn, an estimated ₹36 bn would be required to take up works related to 5,500 MW (phase-2) works.

Source: The New Indian Express

Inox Wind begins execution of 1st phase of wind power projects in Gujarat

11 May. Wind energy solutions provider Inox Wind said it has begun executing the first phase of 250 MW wind power projects in Gujarat following the receipt of certain advances. The first phase of the projects is scheduled to be commissioned in the third quarter of the ongoing fiscal, Inox Wind said. Common infrastructure such as 220 kilovolt (kV) pooling substation at Dayapar, 220 kV bay at Power Grid Corporation of India Ltd (PGCIL) Nirona End, 220 kV transmission line for 72 kilometre (km) is already ready and the project will be executed on a plug and play basis, it said.

Source: The Economic Times

Covid-19 provides opportunities for domestic solar module manufacturing

10 May. The supply disruption from China due to the Covid-19 pandemic and subsequent decline in domestic solar capacity addition offer a golden opportunity to ramp up local manufacturing of solar modules and cells, according to industry experts. However, the industry feels there is an urgent need for a national vision policy for local solar modules manufacturing as well as ancillary products, in line of solar power generation target of 100 GW by 2022 under National Solar Mission. Till 2011, India controlled 70-80 percent of global supplies of solar modules, but the opposite is the case, as 80-90 percent of modules are imported, as domestic modules are not cost-effective

Source: The Economic Times

INTERNATIONAL: OIL

Oil prices rise as Saudi Arabia pledges further supply cut

12 May. Oil futures climbed in early trade, boosted by an unexpected commitment from Saudi Arabia to deepen production cuts in June to help drain the glut in the global market that has grown as the coronavirus pandemic crushed fuel demand. Saudi Arabia said overnight it would cut production by a further 1 mn barrels per day (bpd) in June, slashing its total production to 7.5 mn bpd, down nearly 40 percent from April. The United Arab Emirates and Kuwait committed to cut production further, promising to cut another 180,000 bpd altogether.

Source: Reuters

Norway’s oil income plunges with weak crude prices, tax relief

12 May. The Norwegian government has sharply cut its crude oil price forecast and the expected cash flow it will receive from the oil and gas industry after global demand plunged, its revised 2020 fiscal budget showed. Norway is Western Europe’s largest oil and gas producer, with the industry accounting for about 40 percent of its exports and about a fifth of the state’s revenues. Brent crude fell below $16 a barrel on 22 April, its lowest level in more than two-decades, although it has started to rebound amid production cuts and some signs of demand picking up as countries ease Covid-19 related lockdowns. Norway expects net cash flow from the oil industry to the government of 97.8 bn crowns ($9.53 bn) this year, down from the 245 bn predicted in the original draft budget in October. The Norwegian Oil and Gas Association, an industry lobby group, said the government’s proposal was not sufficient to spur investment in new projects however, and called on parliament to do more. The government cut its oil price assumption for 2020 to 331 Norwegian crowns ($32.17) per barrel from a forecast of 476 crowns last October. It assumes the oil price will be only slightly higher at 353 crowns per barrel in 2021. Norway has agreed to cut its oil output from June until December, following the cuts agreed by the OPEC+ group of oil producing nations, which also affects the state’s income.

Source: Reuters

Mexican oil company Pemex’s oil reserves replacement rate jumps in 2019

11 May. The replacement rate of proven oil and gas reserves estimated by Mexican national oil company Pemex soared in 2019 compared to the previous year, according to the firm’s annual filing with the US (United States) Securities and Exchange Commission (SEC). Pemex’s 2019 replacement rate, a measure of new discoveries compared to ongoing production, jumped to 120.1 percent due to new discoveries and revisions. Loss-making and heavily-indebted Pemex has been dealt a further blow in recent months by the drastic drop in oil prices. But its replacement rate was helped by discoveries of six new fields, four of them in shallow water in the Gulf of Mexico, both with gas and crude. As of March, the most recent figures available, Pemex’s crude production averaged 1,992 mn barrels per day (bpd), including with partnerships. But 1,745 mn bpd without partners. The oil company expects to produce an average of 1,867 mn bpd of crude in 2020, according to the document sent to the SEC. Pemex announced first-quarter losses of $23.6 bn (562.13 bn peso), likely the company’s biggest ever quarterly loss as the Covid-19 pandemic cratered demand for crude oil globally.

Source: Reuters

Russian oil output falls near to OPEC+ target

6 May. Russia’s oil output in the first five days of May fell to 8.75 mn barrels per day (bpd), close to its production target of 8.5 mn bpd for May and June under a global deal to cut crude supplies. Russia’s Deputy Energy Minister Pavel Sorokin said that domestic oil producers are striving to reach the target as soon as possible. He said that the global oil demand declined by around 30 percent and the fall has eased since then. However recovery to pre-crisis levels would not be achieved quickly. He said that some countries, where international majors work, may have difficulties with sticking to targets under a global oil output cuts deal. A group of leading oil producers known as OPEC+ including Russia and Saudi Arabia agreed to cut crude supplies to combat the fallout from the coronavirus, which has hit economic activity and demand for fuel around the world. Under the global pact, Russia has pledged to reduce its crude oil output in May and June by 2.5 mn bpd from a baseline of 11 mn bpd. In April, the month before the deal came into force, Russia produced an average 11.35 mn bpd.

Source: Reuters

INTERNATIONAL: GAS

Qatar faces tough choices as coronavirus guts natural gas demand

12 May. Qatar began in February redirecting LNG (liquefied natural gas) cargoes away from Asia, where the coronavirus was hobbling sales, and sending them instead to northwestern Europe. That quick fix didn’t last, as the pandemic soon engulfed Europe’s biggest economies and left Qatar struggling for places to park unsold cargoes. The Persian Gulf state led by Emir Sheikh Tamim bin Hamad Al Thani has a key decision to make with far-reaching consequences. Cutting production of its main export would squeeze government revenue at a time when crude’s collapse is adding to pressure on LNG prices, some of which are linked to oil. An output cut might also enable Australia to strike a blow to Qatar’s national pride by snatching its crown as the world’s top exporter. Deliveries of Qatari LNG to northwestern Europe peaked in April. A convoy of four tankers arrived over the last three weeks at Belgium’s Zeebrugge import terminal, where Qatar Petroleum has booked all the import capacity until 2044.

Source: Aljazeera

INTERNATIONAL: COAL

Asia’s pandemic stimulus may slow the demise of coal

12 May. Coal power plant construction will push ahead in Asia despite falling electricity demand and environmental concerns as policymakers prioritise boosting economies crippled by the coronavirus pandemic, analysts said. The European Union, International Monetary Fund and the United Nations have said that marks a once-in-a-generation opportunity to launch a ‘green recovery’, which includes Asia joining the global trend of ending support for coal power. China, which produces and consumes about half of the world’s coal, has in recent weeks said it would allow more provinces to start building coal power plants starting in 2023. China’s coal imports in April surged 22 percent from a year earlier, as traders jumped on low prices to build stockpiles and prepare for a recovery in domestic demand. Coal power infrastructure in Asia relies heavily on state-backed financing from China, South Korea and Japan. Japan and South Korea are expected to continue to fund coal plants in developing countries like Vietnam and Indonesia to support state-backed industries hurt as domestic coal operations wind down to meet carbon-emission commitments, analysts said. Many planned coal-fired plants are not economically viable and will burden governments with stranded assets and billions of dollars of debt, analysts said.

Source: Reuters

BNP Paribas accelerates its exit from coal in OECD countries

11 May. French bank BNP Paribas is expanding to all OECD (Organization for Economic Cooperation and Development) countries its target to end relationships with customers that use coal to generate electricity by end 2030, it said. It said it will continue its commitment to sever links with all customers developing new coal-based production capacity in the near future, and will no longer accept any new customers that generate more than 25 percent of their revenue from coal-related activities. This policy will cut by half the number of BNP Paribas corporate customers using coal to generate electricity, it said.

Source: Reuters

South Africa’s Eskom to fix design flaws at mammoth coal plants

11 May. South African state utility Eskom plans to correct design defects at all units of its mammoth Medupi and Kusile coal-fired power stations, it said, after completing modifications on one of the plants’ units. Medupi and Kusile have been beset by faults and delays and are a major reason why Eskom is struggling with around 450 bn rand ($24.5 bn) of debt. Eskom said that modifications at Medupi Unit 3 had gone smoothly, with the unit reaching its full generation capacity of roughly 800 MW after returning to service. With a capacity of 4,800 MW each, Medupi and Kusile will be among the largest coal power stations in the world when complete.

Source: Reuters

Polish coal producer to cut pay and hours by 20 percent in May

8 May. Trade unions at Poland’s biggest coal producer, PGG, have agreed to the company reducing hours and pay by 20 percent in May, which would make PGG eligible for government help. Poland generates most of its electricity from coal but demand for power has slumped due to the new coronavirus epidemic and more of it is being generated from cleaner sources. PGG is struggling with the rapid spread of coronavirus cases among its miners.

Source: Reuters

Anglo American considers spinning off South African coal operations

7 May. Diversified miner Anglo American said it prefers unbundling and listing its thermal coal operations in South Africa in the next two to three years over other options for exiting the business. Anglo said it had halved production of thermal coal since 2015 after it sold some mines in South Africa and Australia. In February, Anglo said it had received interest from potential buyers for the coal assets. The miner, which produces copper, diamonds and platinum group metals, said its increasing focus on commodities with a greener slant, such as those used for electrification, meant the coal assets would be better served under different owners.

Source: Reuters

China coal imports in April increase 35 percent from a year earlier

7 May. China’s coal imports in April surged 35 percent from a year earlier, as traders scrambled to snap up low-cost coal from the seaborne market amid plunging demand for the fuel worldwide because of the coronavirus pandemic. The world’s largest coal buyer imported about 34.22 million tonnes (mt) of coal, according to the General Administration of Customs data. That compares to 27.83 mt imported in March and 25.3 mt in April 2019. Imports over the period of January to April jumped 26.9 percent to 130 mt. Prices for Chinese domestic thermal coal with same quality were around 475 yuan ($66.94) a tonne as of 4 May, according to data from China Coal Market.

Source: Reuters

INTERNATIONAL: POWER

Turkey to start power generation in huge Tigris dam: Erdogan

11 May. Turkey will launch the first turbine in Ilisu Dam in southeast Turkey, President Tayyip Erdogan said. The dam, approved by the Turkish government in 1997 to generate electricity for the region, uproots some 80,000 people from 199 villages and has alarmed authorities in neighbouring Iraq, who fear the impact on their water supplies from the Tigris river. The Ilisu Dam will generate 1,200 MW of electricity, making it Turkey’s fourth-largest dam in terms of energy production.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Shell, Eni lead oil majors' climate ambitions but still fall short: Investors

12 May. None of the big oil companies currently meet UN (United Nations) targets to limit global warming despite the most ambitious targets set by Royal Dutch Shell and Eni, investors managing $19 tn said. Burning of oil and gas accounts for the vast majority of the world’s carbon emissions. TPI (Transition Pathway Initiative), in a study of Europe’s biggest oil producers, singled out Shell and Italy’s Eni for making the broadest commitments to reduce greenhouse gases from all fuel products they sell, also known as Scope 3 emissions. All European majors have committed to varying degrees of carbon reductions by 2050 to make their companies fit for a transition to a lower carbon economy. In marked contrast, US (United States) oil giants lag far behind in terms of climate aims. Shell has pledged to bring down its overall carbon intensity by 65 percent, Eni by 55 percent and BP by 50 percent by 2050. Intensity targets mean that absolute emissions can rise with increasing production. Eni has also set itself a target to bring down its absolute emissions by 2050 by 80 percent. Scope 3 emissions dwarf, typically by a factor of about six, direct emissions from operations and from the electricity a company uses, known as Scope 1 and 2 emissions. BP and Spain’s Repsol have pledged to bring down their overall emissions to net zero by 2050, but this target does not cover fuel initially acquired from other producers and sold through their marketing businesses. Most companies use the phrase ‘net zero’ carbon in some way to describe their ambitions, despite the varying pathways. None of the companies had done enough to align with plans to keep global warming to below 2 degrees Celsius, TPI said.

Source: Reuters

E.ON sold ahead German nuclear power at above market prices

12 May. German utility E.ON said it has sold forward 65 percent of its nuclear power generation in 2021 and 34 percent of its 2022 output at prices well above the current wholesale market, raising earnings prospects from that segment. The company has to date also sold some 86 percent of output in the current year from reactors at its Preussen Elektra unit, it showed in presentation slides on reporting financial results for first quarter 2020. Production in 2020 was sold at €46 ($49.72) per megawatt hour (MWh) after 2019’s locked in price had been €33.

Source: Reuters

US approves massive solar power project on public land

11 May. The Trump administration approved what it said would one day be the largest solar project in US (United States) history, to be located on federal land in the Nevada desert. The Gemini Solar project is expected to generate enough electricity to power 260,000 homes in the Las Vegas area and will include a battery system to store energy for use after the sun goes down, the US Department of Interior said.

Source: Reuters

Republicans urge US President to bar banks from shunning fossil fuel loans

9 May. A group of Republican lawmakers from energy-producing states called on US (United States) President Donald Trump to prevent banks from halting loans and investments with companies that produce oil and other fossil fuels while they have access to federal assistance programs during the Covid-19 pandemic. Democratic lawmakers like Senator Elizabeth Warren, who want an economic recovery featuring investments in conservation and alternative energy to fight climate change, have been calling on Treasury Secretary Steve Mnuchin to bar oil and gas companies from accessing loans through the Main Street facility. For years, environmental activists have pressured banks and financial firms to drop support of fossil fuel companies.

Source: Reuters

Australia backs BP’s study to produce hydrogen from wind, solar

8 May. BP Plc has won Australian government backing for a feasibility study into producing hydrogen using wind and solar power to split water and converting the hydrogen to ammonia in Western Australia. The Australian Renewable Energy Agency said it would provide A$1.7 mn ($1.1 mn) toward the A$4.4 mn feasibility study, part of a push by the government to make the country a major producer of hydrogen by 2030. At commercial scale, BP would produce green ammonia for domestic and export markets and the plant would require around 1.5 GW of power capacity, the company said. Western Australia is already a big producer of ammonia, but made from natural gas. Producing ammonia instead from hydrogen made from electrolysing water would cut carbon emissions sharply and help BP meet its new goal of becoming a net zero carbon emitter by 2050. BP is working on other hydrogen projects at its refineries in Europe, and for renewable energy has a partnership with solar firm Lightsource, which is working on two solar farm projects in Australia.

Source: Reuters

South Africa to develop plan for new 2.5 GW nuclear plant

7 May. South Africa will soon start developing a plan for a new 2,500 MW nuclear power plant, the energy ministry said. Africa’s most industrialised economy, which operates the continent’s only nuclear power plant near Cape Town, said that it was considering adding more nuclear capacity in the long term, after abandoning in 2018 a massive nuclear expansion championed by former president Jacob Zuma. Analysts had expressed serious concern about Zuma’s project for a fleet of nuclear plants totalling 9,600 MW because it would have put massive additional strain on public finances at a time of credit rating downgrades. Its current nuclear plant, Koeberg, has a capacity of around 1,900 MW and was synchronised to the grid in the 1980s.

Source: Reuters

French power producer Neoen to build Australia’s biggest solar farm

6 May. French power producer Neoen SA said it will build Australia’s largest solar farm for A$570 mn ($367 mn), after lining up a contract to sell most of the power to an electricity company. The state of Queensland’s CleanCo has agreed to buy 320 MW of capacity from the Western Downs solar farm in southeast Queensland, which will help the state make progress on its target of 50 percent renewable energy by 2030, the government said. Neoen, which sees Australia as one of its key growth markets, said it expects to begin construction on the Western Downs solar farm in July, with generation from the project due to start in the first quarter of 2022. Neoen already has six solar farms, three wind farms and the world’s biggest lithium-ion battery in Australia.

Source: Reuters

DATA INSIGHT

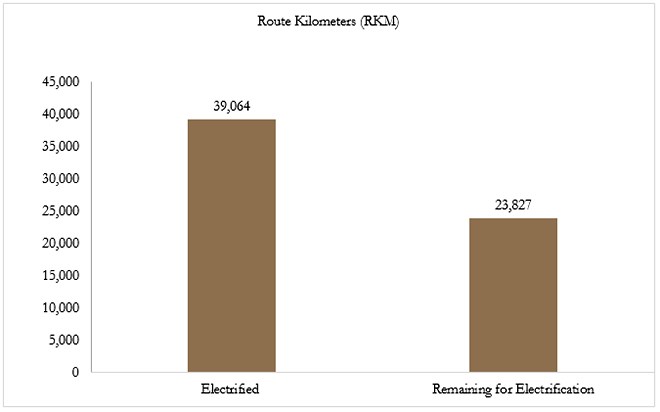

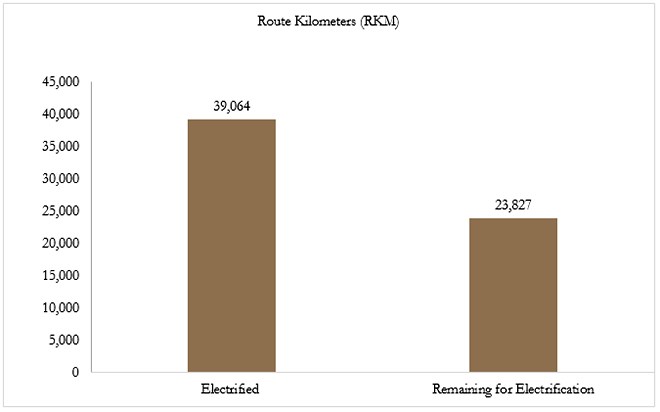

Scenario of Electricity Consumption in Indian Railways

| Year(s) |

Electricity Consumption by Indian Railways

(Million Units) |

| 2014-15 |

18,246 |

| 2015-16 |

18,208 |

| 2016-17 |

18,061 |

| 2017-18 |

18,987 |

| 2018-19 |

20,439 |