-

CENTRES

Progammes & Centres

Location

The Covid-19 pandemic has dented the demand of petroleum products in India and also reduced the demand for natural gas, forcing E&P companies to scale down production in March 2020. India’s production of natural gas in March declined 14 percent to 2,411 mmscm as compared to the corresponding month a year ago. According to a report by the oil ministry, natural gas production by Indian E&P players had been impacted in March on account of decreased production in response to less off take by gas power plants, fertilizer plants, industrial customers as well as operational issues faced by E&P companies. The country’s natural gas production during 2019-2020 declined 5 percent to 31,180 mmscm, the lowest recorded output in at least 18 years. The record low production of natural gas comes at a time the country’s crude oil production is also at a multi-year low. Production by ONGC the country’s largest E&P company, in March declined 11 percent to 1,906 mmscm, as compared to the corresponding month a year ago. Also, cumulative production during financial year 2019-2020 declined 4 percent to 23,746 mmscm, as compared to the year ago period. Other reasons included less gas production from Vasistha wells, non-realization of gas production planned from WO-16 cluster and less than planned gas production from Bassein field, Daman Tapti Block and marginal fields. Oil India Ltd, India’s second government-owned oil and producer, posted a 10 percent decline in gas production at 212 mmscm in March 2020, as compared to the corresponding month a year ago. Cumulative natural gas production during financial year 2019-2020 declined 2 percent to 2,668 mmscm, as compared to the year ago period. According to the ministry, lower production during the month was attributed to decline in production potential of gas wells consequent to shut-in during protest and bandhs, controlled production because of low market demand from the tea sector during lockdown due to Covid-19, shut-down of Brahmaputra Valley Fertilizer Corp, low off-take from Numaligarh Refinery besides other reasons. Natural gas production from fields operated by private players and joint ventures declined 34 percent to 294 mmscm in March 2020, as compared to the corresponding month a year ago.

ONGC has been forced to cut natural gas production by over 15 percent as factories shut down following the unprecedented nationwide lockdown have refused to take supplies. ONGC which produced 64.3 mmscmd prior to the lockdown imposed on 25 March, has reduced the flow to 53.4 mmscmd. Gas sales are down to 40 mmscmd against 50 mmscmd previously. The difference between production and sales is due to the fact that some of the gas is also used by ONGC for internal consumption purposes such as power generation and re-injection into wells. The company received requests from customers for a reduction in gas supplies while some supply reduction requests have been lodged with the gas transporter GAIL (India) Ltd. The customers refusing gas supplies are mostly small companies whose business has been completely shut because of the lockdown, and city gas distributors who have seen volumes vanish after CNG vehicles went off the road. The demand for gas has also been hit as all vehicles, barring the ones used by law enforcement agencies and those used in maintaining essential supplies, have gone off the road. This meant vehicles run on CNG too have gone off the road in cities ranging from Delhi to Mumbai to Ahmedabad. IGL, the company that retails CNG to automobiles and piped cooking gas to households in the national capital and adjoining cities, has already shut two-thirds of its CNG dispensing pumps in view of the demand constraints.

Gas production from RIL-BP’s new fields in the KG basin may not begin in May, as was widely expected, because of the pandemic that has brought in lockdown and triggered an oil price collapse, which can reduce deep-sea gas price to less than $2/mmBtu. In November, the joint venture of RIL and BP had auctioned its planned output of 5 mmscmd of gas from R-cluster field in its KG-D6 block. Customers were told that supply would begin between 15 May and 10 November. By 1 April, the supplier was supposed to give buyers a 45-day window in which output would start. No such notice was given to customers.

The government has extended the last date to bid for 11 oil and gas blocks to 10 June as it extended till 3 May a lockdown of the country to contain the coronavirus. The fifth bid round under OALP opened in January and it was to first close on 18 March. However, the bid date was first extended to 16 April and then late last month, it was extended again but no closing deadline was given. In view of the nationwide lockdown, the OALP bid Round-V last date for bid submission will be extended according to the DGH. The revised date was to be notified later. Under OALP, companies are allowed to carve out areas they want to explore oil and gas in. Companies can put in an expression of interest for any area throughout the year but such interests are accumulated thrice in a year. The last bid round, OALP-IV, saw just eight bids coming in for seven blocks on offer. ONGC walked away with all the seven oil and gas blocks on offer. Of the 94 blocks awarded in the first four rounds of OALP, Vedanta has won the maximum at 51. Oil India Ltd has got 21 blocks and ONGC another 17.

In a move that may help at least 41 companies, which were part of the ninth and tenth rounds of CGD bids, the PNGRB is likely to extend the deadline for completing the committed works by at least three months. This comes after several companies had approached the downstream regulator to invoke the force majeure clause. A total of 136 geographical areas (GAs) were on offer in the ninth and tenth rounds of CGD bids. Companies had committed around 42.3 mn piped natural gas connections, 8,181 CNG and 174,000 km of steel pipeline network by 2029 under the two rounds. The deadlines are likely to be extended for those companies, which were part of the seventh and the eighth rounds. Other reliefs for the industry will be based on policy initiatives taken by the government. With the completion of the tenth round, the CGD network will be available in 228 GAs, comprising 402 districts spread over 27 states and Union Territories covering approximately 70 percent of India’s population and 53 percent of its geographical area. The regulator was also in the process of coming up with bids for the eleventh round, covering 44 GAs with the majority coming under Tamil Nadu (eight), Maharashtra (seven), and Madhya Pradesh (six). With the extension of the lockdown, the eleventh round of CGD bidding is expected to get delayed. Companies, which fail to meet the deadline, are supposed to pay a penalty. At present, India has 5.63 mn domestic, commercial and industrial PNG connections, 1,758 CNG stations and 50,216 km of steel pipeline infrastructure. Of the total consumption of natural gas in India, around 30 percent is consumed by the fertiliser sector; 19 percent comes under the CGD. Other major consumers include power firms (18 percent), refineries (15 percent), and petrochemical companies (6 percent).

IGL, the city gas distributor in Delhi and NCR announced a cut of ₹3.20 per kg in the consumer prices of CNG in Delhi and ₹3.60 cut per kg in Noida, Greater Noida and Ghaziabad. It also announced a cut in PNG prices with effect from 1 April 2020. The consumer price of PNG in Delhi has been cut by ₹1.55/scm from ₹30.10/scm to ₹28.55/scm, while the price of domestic PNG in Noida, Greater Noida and Ghaziabad would be ₹28.45/scm, which has been reduced by ₹1.65/scm from ₹30.10/scm. In Rewari, the applicable price of domestic PNG would now be ₹28.60/scm, which has been decreased by ₹1.55/scm. IGL supplies PNG to over 900,000 households in Delhi and over 450,000 households in Noida, Greater Noida, Ghaziabad and Rewari. With the revised price, CNG would offer over 56 percent savings towards the running cost when compared to petrol driven vehicles at the current level of prices. When compared to diesel driven vehicles, the economics in favour of CNG at revised price would be over 32 percent.

GAIL, whose natural gas sales have dropped 30 percent since the lockdown began, expects demand for the fuel to pick up soon as fertiliser plants increase production ahead of the sowing season and electricity generation expands to meet increasing air-conditioning needs with rising temperature. GAIL and its customers are also seeking to cautiously manage their cash flows to avoid any future financial turbulence due to economic uncertainties induced by the lockdown. For GAIL, the biggest demand hit came from city gas companies that mainly supply to small industries and CNG vehicles. CNG vehicles receive cheap domestic gas supply and as they went off the roads during lockdown, domestic production of gas too had to be reduced. Domestic and imported natural gas are currently available at record-low rates, an inducement for gas-based power plants to increase utilisation.

India’s LNG imports jumped 68 percent to 3,453 mmscm in February this year compared to the corresponding month a year ago, as gas-based power plants, oil refineries and gas marketing companies take advantage of low spot LNG prices, according to the oil ministry data. The overall increase in LNG imports during FY20 has not come at the cost of inflating the country’s trade deficit, data showed. The value of India’s LNG imports during the April-February period last financial year decreased 7.36 percent to $8.8 bn, as compared to $9.5 bn recorded in the corresponding period a year ago. India’s LNG imports during the April-February period of financial year 2019-2020 increased 17 percent to 30,812 mmscm, as compared to the corresponding period a year ago. Gas marketing companies and LNG terminal operators would have procured bulk LNG cargoes as spot LNG prices fell substantially, adding that the demand for natural gas had been robust in 2019-2020 prompting companies to lock-in more shipments in anticipation of healthy demand. According to the sector-wise imported LNG consumption published by the oil ministry, India’s power sector witnessed the highest growth in 2019-20. Imported LNG consumed by the power sector jumped 32 percent to 3,446 mmscm in the April-February period last financial year, as compared the corresponding period a year ago. According to analysts, the decline in domestic natural gas production in the last couple of quarters may have pushed gas-based power plants to increase buying of spot LNG cargoes.

GAIL has sold an LNG cargo for loading from the Cove Point terminal in Maryland in the US in May. It sold the cargo on FOB basis at around $1.50 to $2/mmBtu. The Indian importer has 20-year deals to buy 5.8 mtpa of US LNG, split between Dominion Energy’s Cove Point plant and Cheniere Energy's Sabine Pass site in Louisiana.

ONGC will lose about ₹40 bn in revenue and start making cash losses after the government slashed the natural gas prices by a steep 26 percent by benchmarking it against rates prevalent in gas-surplus nations. Prices of natural gas, which is used to produce fertilizer, generate electricity and gets converted into CNG for use in automobiles and piped natural gas for household cooking, was from 1 April cut to ₹2.39/mmBtu, a rate about 37 percent lower than the cost of production. The government had in October 2014 evolved a new pricing formula using rates prevalent in gas surplus nations like the US, Canada, and Russia to determine the price in a net importing country. Prices using this formula are calculated semi-annually. The cost of production of natural gas in the prolific Krishna Godavari basin is between $4.99 -7.30/mmBtu. The same for other basins is in the range of $3.80-6.59/mmBtu. For ONGC, which produces most of its 64 mmscmd of gas from western offshore, the breakeven is around $3.8/mmBtu. On 1 April, the gas price was reduced from $3.23/mmBtu to $2.39 - an 84 cent reduction which translates into annual ₹40 bn of revenue loss. The price of gas produced from difficult fields such as deepsea too has been cut to $5.61 from $8.43/mmBtu. This would just about breakeven ONGC’s new production from KG basin.

While the coronavirus-led plunge in crude oil prices has grabbed the bulk of the headlines, the collapse in spot LNG prices in Asia has been just as dramatic, and just as likely to have lasting consequences. Spot LNG prices for delivery to North Asia LNG-AS slipped to $1.95/mmBtu, the lowest on record and also the first time they have closed below the $2 mark. That means a slump of 71.3 percent since their pre-winter peak of $6.80/mmBtu in October last year, worse than the 70.1 percent fall in Brent crude oil futures from their 8 January peak this year - $71.75/bbl - to the 24 April close of $21.44. One of the almost bizarre consequences of the decline in Asian spot LNG prices is that they are now almost as low as natural gas futures in the US. This may to some extent be comparing apples with oranges, but it does serve to underline that the first casualty of the weakness in LNG will be US exports to Asia. US natural gas closed at $1.75/mmBtu, above recent lows around $1.50 but also well below the $2.91 peak reached just ahead of the northern hemisphere winter on 5 November. The US price is for delivery to the Henry Hub pipeline in the state of Louisiana, and thus is quite different to spot Asian LNG prices. The most obvious difference is US natural gas excludes to cost of transport to a liquefaction plant, the process of liquefaction and the shipping from the US Gulf coast to Asia.

Britain has become the world’s cheapest natural gas market as the front-month contract fell below its US counterpart in a rare event caused by falling energy demand owing to the coronavirus outbreak. The US Henry Hub gas price is usually considered the floor for European gas prices. The drop in UK gas below the US price has made it not only the cheapest in Europe but globally. The May contract on the UK’s NBP hub closed at $1.72/mmBtu $0.20 below US Henry Hub May futures, Refinitiv price data showed.

Qatar Petroleum will postpone the start of production from its new gas facilities to 2025 due to a delay in the bidding process, but is not downsizing the world’s largest LNG project despite concerns of a mounting glut. The company is not scaling back a plan to build six new LNG production facilities, known as trains, needed for an ambitious domestic scale-up, though commercial bids from contractors and the start of output will be delayed. QP had wanted to lift its output to around 110 mtpa by 2024 from 77 mtpa, as the first phase of its expansion. The company had been expecting to receive final bids from contractors for the first phase - the North Field East project, which will involve the construction of four trains - this month. However, that was delayed as firms asked for more time to submit bids due to the global lockdown linked to coronavirus. The second phase, known as the North Field South project, will boost Qatar’s LNG production capacity to 126 mtpa by 2027 through the construction of two more trains. Global LNG demand has crumbled due to the coronavirus pandemic that has disrupted Daily gas production at Iran’s South Pars field reached more than 700 mcm/day in the last Iranian calendar year. South Pars, which Qatar calls North Field, is the world’s largest gas field and is shared between Iran and Qatar.

Washington granted Iraq a 30-day extension to a waiver allowing it to import Iranian gas for its dilapidated power grids despite American sanctions. Iraq relies on gas and electricity imports from its neighbour Tehran to supply about a third of its power grid, crippled by years of conflict and poor maintenance. The US blacklisted the Iranian energy sector in late 2018 and has granted Baghdad a series of waivers, usually for 45, 90 or 120 days. The US has pressured Iraq to use the waivers to become independent from Iranian energy, but progress has been slow.

GCL Oil & Natural Gas Co Ltd a private company in China has signed a framework agreement with Royal Dutch Shell to explore setting up a JV based in eastern China to market and trade LNG. The proposed JV would secure LNG supplies from Shell and market the fuel to a receiving terminal which GCL is planning in Jiangsu province, GCL said. GCL, a subsidiary of private energy and power firm GCL (Group) Holding, is one of over a dozen Chinese gas terminal developers outside state giants China National Offshore Oil Company, PetroChina and Sinopec Corp that have so far dominated the LNG sector. China is the world’s No.2 LNG importer. GCL is planning three receiving terminals along China’s east coast - Yantai in Shandong province, Rudong in Jiangsu and Maoming in Guangdong - with a total annual handling capacity of 14.5 mt. Among them, the 5 mtpa Yantai project was first to have won state regulatory approval, in January, and GCL aims to start constructing the facility this year. The Yantai terminal, at an estimated cost of $1.1 bn, would start up in 2023.

Pipeline gas flows from Norway to Britain fell 44 percent from the start of the week as the summer gas season starts and coronavirus lockdowns continue to hit demand, according to data from Norway’s gas system operator Gassco. Pipeline gas flows to Britain fell to 49.7 mcm/day, down from 88.6 mcm, according to data. Deliveries to continental Europe remained broadly steady at over 240 mcm/day. Gas traders said UK demand was partly reduced by temperatures rising to above normal levels over the weekend and most of the following week, and the beginning of April also marks the end of the heating season when importers adjust volumes. But the market is expecting production reductions due to the unprecedented slump in energy demand in Europe and stoppages in most power-intensive manufacturing due to lockdowns in several European countries.

Golar LNG Ltd said that it received a force majeure notice from a BP Plc unit seeking to delay taking delivery of a floating liquefied natural gas facility by a year. The notice is the latest force majeure claim issued in the LNG sector that is struggling with a seasonal plunge in demand as well as the spread of the coronavirus outbreak, which has further hammered the consumption of the super-chilled fuel globally. BP is expecting a one-year delay due to the pandemic and currently sees no possibility in reducing the duration of the new timing, according to Golar’s unit Gimi MS Corp. The plant is designed to produce an average of about 2.5 mtpa. The construction of the floating facility was expected to cost about $1.3 bn, excluding financing costs.

The Australian unit of Royal Dutch Shell and joint venture partners have decided to delay an FID on the Crux gas project in offshore Australia that was initially planned for 2020. The Crux project is one of several globally that have been delayed in recent months following the collapse in energy prices. LNG demand had been hitting record highs until recently thanks to appetite from China and India as they diversify away from dirtier coal power generation, but the crash in oil and gas prices has caused major LNG exporters to put off gigantic new facilities or expansions of existing projects. Crux, owned by Shell, Osaka Gas and a unit of Seven Group Holdings, is one of several gas fields that have been awaiting development off northwestern Australia. The project will be developed to supply backfill gas to the Prelude floating LNG facility off northwest Australia. Cargo liftings from Shell’s Prelude facility, which is the world’s largest floating LNG facility, has been suspended since February following an electrical trip.

| FY: Financial Year, mn: million, bn: billion, E&P: Exploration and Production, mmscm: million metric standard cubic meter, ONGC: Oil and Natural Gas Corp, mmscmd: million metric standard cubic meter per day, CNG: compressed natural gas, RIL: Reliance Industries Ltd, KG: Krishna-Godavari, mmBtu: million metric British thermal units, OALP: Open Acreage Licensing Policy, DGH: Directorate General of Hydrocarbons, PNG: piped natural gas, CGD: city gas distribution, PNGRB: Petroleum and Natural Gas Regulatory Board, GAs: geographical areas, km: kilometre, IGL: Indraprastha Gas Ltd, kg: kilogram, scm: standard cubic meter, LNG: liquefied natural gas, US: United States, FOB: free-on-board, bbl: barrel, UK: United Kingdom, mtpa: million tonnes per annum, mcm: million cubic meters, JV: joint venture |

5 May. Petrol and diesel prices in New Delhi were hiked by ₹1.67 and ₹7.10 per litre as the state government implemented a steep hike in Value Added Tax (VAT) on both the fuels. Price of diesel witnessed the steepest hike with the state government increasing the VAT on the fuel to 30 percent from 16.75 percent earlier. Diesel prices in New Delhi increased to ₹69.39 per litre from ₹62.29 per litre. While, VAT on petrol was hiked to 30 percent from 27 percent earlier, leading to an increase in the retail price of the fuel to ₹71.26 per litre. Fuel prices across other major cities including Mumbai, Chennai and Kolkata remained unchanged, continuing a 50-day freeze on petrol, diesel prices across the country.

Source: The Economic Times

5 May. Tamil Nadu government will be beefing up its revenue with the increase in Value Added Tax (VAT) on petrol and diesel by ₹25 bn. According to the state government the VAT increase has resulted in a retail price hike of ₹3.25 per litre of petrol and ₹2.50 per litre of diesel. The government said the VAT was increased so that the state revenue is protected as and when the global oil prices come down and the interests of consumers would be protected when there is a hike in the global oil prices. The CIPD (Consortium of Indian Petroleum Dealers) has demanded a financial stimulus package from the oil marketing companies (OMCs) as their members are incurring losses due to the Covid-19 induced lockdown.

Source: The Economic Times

5 May. Indian Oil Corp (IOC)’s mountain of debt, which has grown a third in a year to ₹1,160 bn, will start diminishing on an expected revival of fuel demand after the easing of lockdown and as benefits of cheaper crude start flowing in. Gross debt at IOC, the nation’s largest refiner and fossil fuel retailer, has risen from ₹864 bn at the beginning of 2019-20 to ₹1,160 bn at the start of 2020-21, the company said. The debt had actually fallen at the end of December 2019 to ₹757 bn, according to the oil ministry data. About 50 percent jump in debt in the January-March quarter came following the weakening of demand due to the coronavirus pandemic, dividend outflow and delay in fuel subsidy transfer by the government. In April too, IOC and other refiners borrowed heavily to meet their expanded working capital needs. Just on 30 April, IOC sold commercial papers worth ₹70 bn. Besides, the government has begun transferring fuel subsidies to state refiners, which would further improve cash position. In April, the government paid IOC about ₹17 bn of the ₹130 bn due on account of cooking gas and kerosene subsidy for the year 2019-20. The pandemic hasn’t altered IOC’s capital spending plan of ₹260 bn for the current fiscal year. The government has eased nationwide lockdown in much of the country, which is expected to recover demand that had fallen by a record 61 percent and 56 percent for petrol and diesel, respectively, in April from a year earlier.

Source: The Economic Times

4 May. Indian refiners have stored about 32 million tonnes (mt) of oil in tanks, pipelines and on ships, taking advantage of low oil prices to help the nation cut its import bill, Oil Minister Dharmendra Pradhan said. India, the world’s third biggest oil importer, buys over 80 percent of its oil needs from overseas markets. The nation has annual refining capacity of about 250 mt. However, travel restrictions and curbs on industrial activity to stem the spread of Covid-19 have hit fuel consumption and crude processing in the country. India has also diverted some of the state refiners’ excess oil to fill the 5.03 mt strategic petroleum reserves (SPRs), helping companies which are struggling to find storage avoid charges for delays in offloading fresh cargo deliveries. The companies have parked 7 mt of oil in floating storage and 25 mt in pipelines and storage tanks as oil prices plunged, he said. The nationwide lockdown, among the world’s strictest, is being relaxed in some areas with fewer infections, although it will last until 17 May, the government said.

Source: Reuters

4 May. The lockdown measures in place to combat the Covid-19 pandemic in the country are expected to significantly impact India’s oil demand in April, research and consultancy firm Wood Mackenzie (WoodMac) said. According to projections made by the agency, in 2020 India’s oil demand is expected to decline seven percent to 350,000 barrels per day (bpd) on a year-on-year basis. Diesel, which accounts for the largest share of India’s oil demand, has been impacted more in terms of volumes during the period and the demand for the fuel is expected to decline by 1.2 mn bpd in April. Private refiners like Nayara Energy and Reliance Industries Ltd will have to reckon with low demand from international export destinations as global stockpiles of crude and petroleum products are very high, according to WoodMac.

Source: The Economic Times

3 May. Around 4,000 free LPG cylinders were distributed among beneficiaries under the centrally-run Ujjwala scheme in Doda district of Jammu and Kashmir (J&K). However, some Below Poverty Line (BPL) families claimed that they have not received the free refills till date, a charge denied by the concerned agency. The free cooking gas cylinder distribution is part of the special relief measure announced by the Central government under Pradhan Mantri Garib Kalyan Yojana to mitigate against the economic losses suffered by the poor due to the coronavirus pandemic outbreak. Indane gas, a subsidiary of Indian Oil Corp, said it has reached a large section of the Ujjwala subscribers with free refills despite the lockdown.

Source: Business Standard

1 May. The Goa government has decided that people not wearing masks will not be given fuel at petrol pumps or ration at fair price shops in the state. The decision was taken during a meeting of the State Executive Committee (SEC) chaired by chief secretary Parimal Rai. The SEC decided that the use of masks or face cover needs to be implemented strictly in view of the coronavirus pandemic. No petrol pump will fill fuel in a vehicle or no ration or other grocery items would be sold in fair price shops if a customer does not wear a mask. During the meeting, state Inspector General of Police, Jaspal Singh, said that the police have collected fine from about 1,000 people for not wearing masks.

Source: The Economic Times

1 May. The price of non-subsidised LPG (liquefied petroleum gas) or market-price cooking gas was cut by over ₹160 per cylinder. Non-subsidised LPG price was cut by a record ₹162.50 per cylinder in the wake of a slump in benchmark international rates due to falling oil demand. A 14.2 kg (kilogram) LPG cylinder will now cost ₹581.50 in Delhi, down from ₹744, as per the price notification issued by state-owned oil firms. In Mumbai, it will now be available for ₹579 per cylinder, compared to ₹714.50 earlier.

Source: India Today

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Loss of oil tax revenue will affect public spending! < style="color: #ffffff">Bad! |

30 April. India’s 40-day lockdown to contain the spread of the coronavirus is curbing oil demand and reducing the government’s tax income from the petroleum industry, which contributes about a fifth of budget revenue. Consumption of fuel products probably declined at least 80 percent in April, which would lead to a revenue loss of as much as ₹400 bn ($5.3 bn), according to Care Ratings Ltd. That means the lockdown has cost the government about $175 mn a day in lost oil revenue this month. Demand in the world’s third-biggest consumer of fuel plummeted this month as the government imposed a lockdown on 1.3 bn people, restricting their mobility and shutting down most businesses. At the same time, oil prices have collapsed, further reducing tax receipts from fuel products and crude production from local fields. In India, taxes on key petroleum fuels such as petrol and diesel make up more than 50 percent of pump prices.

Source: The Economic Times

30 April. Russia’s largest petrochemical company Sibur will supply two cargoes of liquefied petroleum gas (LPG) to India in May for the first time ever as it looks for new markets after demand in Europe fell sharply due to the coronavirus outbreak, according to traders and shipping data. In India, though, LPG demand is seen rising this year despite the coronavirus as it is mostly used by private households as cooking gas and therefore in demand during the lockdown. In March, LPG sales in India rose about 1.9 percent from February to 2.31 million tonnes (mt), according to the Petroleum Planning and Analysis Cell (PPAC) data. Moreover, Indian authorities announced at the end of March that the state would provide free cooking gas cylinders to poorer citizens for three months, under a scheme meant to nudge them to adopt the cleaner fuel.

Source: Reuters

3 May. Reliance Industries Ltd (RIL) and its partner BP Plc of UK (United Kingdom) have pushed back the start of production from the second wave of discoveries in their eastern offshore KG-D6 block to end June because of restrictions on movement of people and material the nationwide lockdown has imposed. At current Brent oil price of around $26 per barrel, the gas from R-Series field in KG-D6 block will cost about $2.2 per mn metric British thermal unit (mmBtu) -- lower than even the government mandated rate of $2.39 for gas from ONGC (Oil and Natural Gas Corp) fields. RIL said it is working on three projects in the KG-D6 block, where production from older fields stopped in February this year. Gas production from R-Cluster was to start by mid-May but the coronavirus lockdown has delayed it. RIL and BP are developing three sets of discoveries in KG-D6 block -- R-Cluster, Satellites, and MJ by 2022. RIL has so far made 19 gas discoveries in the KG-D6 block. Of these, D-1 and D-3 -- the largest among the lot -- were brought into production from April 2009 and MA, the only oilfield in the block was put to production in September 2008.

Source: Business Standard

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Flexible spot e-auction of coal will help consumers adjust to slowing demand! < style="color: #ffffff">Good! |

5 May. Western Coalfields Ltd (WCL), a subsidiary of Coal India Ltd (CIL), has offered a flexible route of spot e-auction of coal to provide immediate financial relief to consumers and give them an opportunity to plan their post-lockdown coal requirement. WCL said the volume of coal offered is 3.5 million tonnes (mt) which are higher in comparison to normal spot auction. Normally, spot auction is being done with coal lifting period of 45 days only and coal offered is below 1 mt. Also, the payment has to be made within 10 days. Currently, all auctions are being done at the notified price to provide substantial financial relief to consumers. Moreover, the successful bidder and the coal company will have the option of mutually deciding the monthly lifting schedule.

Source: The Economic Times

4 May. Chhattisgarh East West Rail Ltd (CEWRL) has entered into a pact with a consortium of banks led by State Bank of India (SBI) for a sanctioned loan of ₹39.76 bn to develop a 135 kilometre (km) double rail line for coal evacuation. CEWRL is a joint venture company formed by Coal India Ltd (CIL) arm South Eastern Coalfields Ltd (SECL), IRCON and the Chhattisgarh government. The loan will be utilised by CEWRL for a 135 km double line connectivity from Gevra Road to Pendra Road (both existing stations) to evacuate coal from Gevra, Dipka and Kusmunda -- the mega mines of SECL. When completed, it will help SECL evacuate about 65 million tonnes (mt) of coal every year from its mines. CIL eyeing 1 billion tonnes of output target amid slump in fuel demand in the wake of lockdown. CIL accounts for over 80 percent of domestic coal output.

Source: Business Standard

2 May. Amidst two-week extension of the nationwide lockdown, the Meghalaya government has decided to allow mining activities to resume from 4 May for domestic purpose and barred the export outside the country. Meghalaya’s Commerce and Industries Department said the state government has issued a notification allowing the mining of limestone and boulder by licence and lease-holders companies for domestic sale within the country. Meghalaya exports around 5 to 8 lakh million tonnes (mt) of coal extracted from underground pits and bowels to Bangladesh every year at a cost of $52 per mt. The Bangladesh government had on a number of occasions citing high sulphur content in coal mined from Meghalaya which causes pollution. Subsequently, the ban was lifted by that country as the users, mostly the brick kilns, preferred Meghalaya coal due to its low ash content.

Source: The Economic Times

4 May. With tepid electricity demand lowering utilisation levels of power plants, private power producers want Coal India Ltd (CIL) to defer the special auctions planned for plants without sufficient fuel supply contracts. With tepid electricity demand lowering utilisation levels of power plants, private power producers want CIL to defer the special auctions planned for plants without sufficient fuel supply contracts. These auctions are conducted under the Scheme for Harnessing and Allocating Koyala (coal) Transparently in India (Shakti), which was implemented to ease supply constraints faced by power producers. As many as 10 plants with 8,346 MW capacity are eligible to participate in upcoming auctions. These include plants of Adani Power, KSK Energy, Bajaj Energy, GMR Energy.

Source: The Financial Express

3 May. Coal India Ltd (CIL) has shifted its focus to overburden removal -- the process of removing the top soil and rock to expose coal seams in its open cast mines --as the power sector, a major consumer of the dry fuel, has witnessed almost 30 percent drop in fuel consumption amid the lockdown, a company official said. The enhancement in overburden removal will enable Coal India Ltd (CIL) to accelerate coal production whenever the demand picks up and coal can be supplied to its customers at short notice. A Central Electricity Authority (CEA) report said that as on 30 April 2020, there were 50.89 million tonnes (mt) of coal stocked up at the power houses in India, enough to last for 31 days. CIL itself has a pit-head stock of about 76 mt as on 30 April.

Source: Hindustan Times

30 April. Prime Minister (PM) Narendra Modi held a "detailed" meeting to discuss the potential economic reforms in the mines and coal sectors to give a boost to the economy in the backdrop of the Covid-19 pandemic. The discussions involved ensuring easy and abundant availability of mineral resources from domestic sources, upscaling exploration, attracting investment and modern technology to generate large-scale employment through transparent and efficient processes. In the meeting, the PM laid special focus on improving the country's self-reliance in production of minerals and their in-country processing.

Source: Business Standard

5 May. Electricity trade on Indian Energy Exchange (IEX) shrunk 6.6 percent in April this year to 4052 mn units while the national peak demand at 133 GW declined 25 percent. This was mainly due to contraction in commercial and industrial demand in lieu of the Covid-19 related preventive lockdown. The day-ahead mark volume was at 3692 mn units while the term-ahead volume was at 360 mn units. The term-ahead segment recorded a significant 8 percent yoy (year-over-year) growth due to increased preference for term- ahead contracts amongst Southern, Western and Northern utilities. Power procurement by distribution utilities from southern, western and northern states such as Andhra Pradesh, Telangana, Tamil Nadu, Maharashtra, Gujarat, Uttar Pradesh, Bihar and Punjab amongst others increased by over 10 percent in April owing to ample power availability and very attractive prices.

Source: The Economic Times

5 May. Gujarat Urja Vikas Nigam Ltd (GUVNL)’s consumers will have to pay less for electricity as the power utility has reduced Fuel Price and Power Purchase Adjustment (FPPPA) charge or fuel surcharge for the first quarter of the current fiscal. A power distribution company (discom) levies a fuel surcharge or FPPPA from consumers to offset changes in fuel (coal and gas) cost. GUVNL, the apex electricity company in Gujarat, has cut FPPPA from ₹2.06 per unit to ₹1.90 per unit. GUVNL, which supplies electricity to most of the state, barring Ahmedabad, Gandhinagar and Surat, has asked its four distribution companies to levy ₹1.90/unit from April to June 2020. The reduced surcharge is applicable to all categories of consumers except agricultural consumers because state government provides a subsidy to discoms for agricultural use. Meanwhile, power demand across Gujarat is down by nearly 30 percent due to the lockdown to control the spread of Covid-19.

Source: The Times of India

4 May. Kalpataru Power Transmission (KPTL) said it had terminated the deal with CLP India to sell its transmission project ALP for not fulfilling certain conditions. The deal was inked in July last year. In July last year, the KPTL had entered into binding agreements with CLP India to sell its stake in three power transmission assets for an estimated enterprise value of ₹32.75 bn.

Source: Business Standard

3 May. Power sector employees and engineers jointly decided to oppose the Electricity Amendment Bill 2020 at every front. National Co-ordination Committee of Electricity Employees and Engineers (NCCOEEE) expressed its agony over the astonishing hurry shown by the Government of India in bringing the proposed Electricity Amendment Bill 2000 in the ambience of nationwide lockdown. Further, the prime minister has given consent to go ahead keeping priority over the struggle of India against Covid-19. NCCOEEE said that National Protest Day will be observed after the lockdown period through wearing Black Badges by the electricity employees and engineers across the country. The date will be announced immediately after the lockdown period is over. AIPEF (All India Power Engineers Federation) said that all other participants of various Federations demanded that the Government should extend the date of submission of their objections on Bill 2020 to 30 September instead of 5 June. It was also decided that all National Federations and NCCOEEE will write letters to all chief ministers & MPs requesting them to take the

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Falling PLF will lead to less optimal technological and economic outcomes! < style="color: #ffffff">Ugly! |

initiative to drop the enactment of the draft Electricity (Amendment) Bill, 2020

Source: The Times of India

1 May. Electricity bills generated between 1 March and 30 April can be paid by 15 May. The energy department has also announced 1 percent rebate on electricity bill and waiver of late payment charge on the electricity bill. Energy Minister Shrikant Sharma announced extension of Easy Instalment Scheme for farmers till 31 May. Under the scheme, a farmer can pay the arrears up to January 2020 in six installments without any surcharge over delayed payment. Sharma said the extension has been given to farmers who could not get benefited by the scheme because of corona pandemic.

Source: The Times of India

1 May. Amid the coronavirus crisis, Prime Minister (PM) Narendra Modi asked officials to work towards ensuring round-the-clock supply of power to all consumers. At a meeting on the power sector and the impact of Covid-19 on it, he discussed various long-term reforms for enhancing sustainability, resilience, and efficiency of the sector. PM Modi underlined the significance of the power sector in propelling the economy, and the need for effective enforcement of contracts for attracting private investments was also discussed at the meeting. Measures for improving viability of distribution companies, including tariff rationalization and timely release of subsidies along with improved governance were discussed as well.

Source: Business Standard

30 April. India’s electricity sector is likely to register a decline in power demand by 1 percent and a drop in plant load factor (PLF) to 54 percent for the whole year in financial year 20-21, considering the full lockdown till 3 May 2020 and resumption of full operations by industrial and commercial establishments from July 2020 as a base case scenario, credit rating agency ICRA said. The electricity demand growth was subdued at 1.2 percent in FY 2020, mainly because of unseasonal rains in August and September 2019 and lower demand from the industrial segment, given the overall slowdown in the economy during this period. ICRA noted that the lockdown has also adversely impacted the revenues and cash collections for the power distribution companies (discoms), especially given the consumption decline from the high tariff paying industrial and commercial consumers and the likely delays in cash collections from other consumer segments.

Source: The Economic Times

29 April. The Asian Development Bank (ADB) said it has approved a $346 mn (₹26.16 bn) loan to Indian government to provide reliable power connection in rural areas of Maharashtra. Maharashtra is the second-most populous state in India, and about half of the state's labour force is engaged in agriculture and related activities in the rural areas, ADB said. The loan will support the state government’s high voltage distribution system program for new grid-connected rural agricultural customers across the state.

Source: The Economic Times

5 May. Adani Green Energy, a renewable energy firm of the Adani Group, plans to complete 1,300 MW of hybrid projects by calendar year 2021, its Chief Executive Officer (CEO) Jayant Parimal said. He said that these hybrid projects where they mix wind and solar were currently being executed in Gujarat and Rajasthan. Adani Green had won the 700 MW wind-solar hybrid project in January 2020 and had bagged the 600 MW projects in June 2019. Adani Green is building 1,280 MW of wind, 475 MW solar and 1,690 MW hybrid plants. The firm has a current project portfolio of 6 GW including under-construction capacity.

Source: The Economic Times

4 May. Lockdown has put final clearance from National Company Law Tribunal (NCLT) for NHPC Ltd to take over insolvency hit 120 MW Rangit Stage IV hydro project in Himalayan state Sikkim to a halt. But the Mini Ratna PSU (Public Sector Undertaking) has started its homework on the project to minimize cost and time overrun. After emerging out as the highest bidder under a resolution plan for insolvency bound Hydropower Company Jal Power Corporation’s 'Rangit stage IV' HE Project, with its bid of ₹1.65 bn. Escalation of project cost due to all these factors pushes up project output tariff making it less competitive. As the system goes, tariff of power is regulated by CERC (Central Electricity Regulatory Commission). It allows tariff structure based upon applications made by the generation company mainly depending upon project cost. Final estimated cost for Rangit IV is yet to be finalized and approved at different levels. But by rough average expense pattern of ₹100-120 mn per MW installed capacity, the project cost may go somewhere around ₹15 bn.

Source: The Economic Times

4 May. The renewable energy sector will see a shift to grid-independent systems in the coming months and storage systems such as solar-plus-storage will see a major boost in the market. The government has a policy focus towards solar-plus-storage systems as also seen through hybrid policy in place and the recent award of the renewable project-cum-storage capacity. According to Girishkumar Kadam, vice-president, sector head-corporate ratings, ICRA, one of the reasons why the government’s focus is shifting to solar-plus storage systems is that the overall weighted average bid tariff discovery in such tenders has been relatively cost competitive with ₹4 per unit. He said that for the viability of such storage-based systems in the long run, availability of peaking tariff policy, which is absent currently, remains a key. In 2019, India’s first and biggest battery-storage system of 10 MW was commissioned in Delhi at the Rohini substation of Tata Power Delhi Distribution, And in October last year, SECI (Solar Energy Corp of India) had issued a 400-MW tender for round-the-clock supply of renewable power along with energy storage to New Delhi Municipal Council and Dadra and Nagar Haveli.

Source: The Economic Times

4 May. The Ministry of New and Renewable Energy (MNRE) has announced the extension of the off-grid and decentralised solar photovoltaic (PV) applications programme phase-III till 31 March 2021. The MNRE said that during the extended period, the sanction of new projects under the Scheme will be available only in the northeastern region. Off-grid and decentralised solar PV applications programme phase-III was launched by the ministry on 7 August 2018, and the scheme was valid for FY19 and FY20.

Source: The Economic Times

30 April. India’s power sector regulator Central Electricity Regulatory Commission (CERC) has released draft regulations for determination of tariff from renewable energy (RE) sources. The last date for submission of comments on the draft is 28 May 2020. The regulations will come into force from July 2020 and unless reviewed earlier will remain in force upto March 2023. The control period under these regulations will be from July 2020 to March 2023. The regulations will apply to cases where tariff for a grid-connected generating station or a unit commissioned during the control period is to be determined by the commissions. The draft regulations will not apply to the bid out projects through Solar Energy Corp of India (SECI) it is primarily meant for laying out certain guidelines for State Electricity Regulatory Commissions (SERCs) for state sector projects and for certain state RE projects which have not still transitioned into competitive bidding mode. The generic tariff will be determined by the commission on an annual basis in accordance with the regulations for various types of renewable energy projects based on small hydro, biomass, non-fossil fuel based cogeneration, biomass gasifier and biogas based power projects. The other tariff which is project specific will be determined by the commission on a case to case basis for solar power projects, wind power projects, renewable hybrid energy projects and renewable energy storage projects.

Source: The Economic Times

30 April. Nearly 20 leaders from think tanks, research groups, renewable energy companies, sustainable development organisations and industry associations said India’s weak healthcare infrastructure in rural areas are being exposed due to the ongoing Covid-19 pandemic. In a letter to the government of India, they called for action, making the case for solarising all unelectrified sub-centres in rural India.

Source: The Economic Times

5 May. Saudi Arabia’s crude oil exports in May are expected to drop to about 6 mn barrels per day (bpd), the lowest in almost a decade, and domestic refining output is likely to fall as the coronavirus crisis hits demand. The world’s top oil exporter will cut crude production by 23 percent to about 8.5 mn bpd in May and June, under a supply reduction pact with OPEC+ alliance to shore up prices hammered by demand destruction due to the coronavirus-related lockdowns. Saudi crude oil exports for May are expected to be about 6 mn bpd, with Asia taking about 4 mn bpd.

Source: Reuters

4 May. A consortium led by Spain’s Repsol including Germany’s Wintershall DEA and Thailand’s PTTEP have discovered two deepwater oil fields in the Gulf of Mexico, the companies said. Mexican President Andres Manuel Lopez Obrador has slammed the breaks on the energy market liberalization put in place by his predecessor, and has pursued a more nationalist energy agenda that limits the participation of the private sector. The consortium said that the find was in the Polok-1 and Chinwol-1 wells, located in Block 29 of the Salina Basin, off the southeastern states Veracruz and Tabasco.

Source: Reuters

3 May. Brooge Petroleum and Gas Investment Company (BPGIC) has leased oil storage facilities in the United Arab Emirates (UAE) to France’s Total, industry sources familiar with the matter said, as global crude storage rapidly fills up. The company is leasing six storage tanks in the UAE emirate of Fujairah for six months and this could be renewed for another six months. The tanks, which store oil products, have already received initial cargoes. Global oil storage is filling swiftly as lockdowns to halt the spread of the coronavirus pandemic hammer consumption, driving down global demand for crude and its products, such as gasoline, diesel and jet fuel, by as much as 30 percent. UAE-based BPGIC, established in 2013, plans to expand its storage capacity for crude and oil products to around 3.5 million cubic meters (mcm), from 1 mcm.

Source: Reuters

2 May. Russia raised oil and gas condensate output in April to 46.45 million tonnes (mt), or 11.35 mn barrels per day (bpd), from 11.29 mn bpd in March, before it makes cuts this month under a global supply pact. The Organization of the Petroleum Exporting Countries (OPEC), Russia and other allied producers, a group known as OPEC+, agreed to cut their combined oil output by about almost 10 mn bpd, or 10 percent of global supply in May and June to tackle the economic fallout from the new coronavirus.

Source: Reuters

30 April. Oman has notified all its crude oil term customers of a cut of about 30 percent in their allocations for July loading and delivery, Oman’s oil and gas ministry said. OPEC (Organization of the Petroleum Exporting Countries) and its allies led by Russia, a group known as OPEC+, agreed to a new supply pact from 1 May to shore up the market, following a slide in demand caused by lockdowns to contain the new coronavirus.

Source: Reuters

30 April. With oil still gushing from its fields and no immediate plans for substantial output cuts, Mexico’s state company Petroleos Mexicanos (Pemex) is considering storing crude in salt caverns and depleted wells. The plan could double state company Petroleos Mexicanos’ 11 mn barrels of crude storage capacity, according to a former company executive. But it could take more than a month to prepare the new storage sites, and available space could run out within days. Mexico has resisted serious output cuts, agreeing at OPEC+ meetings a few weeks ago to keep back 100,000 barrels per day (bpd) for two months from the 1.75 mn bpd it pumps. That was far less than the 25 percent reduction accepted by other members. Mexico’s current 11 mn barrel storage capacity is equivalent to about six days of output.

Source: Reuters

30 April. Norway, Western Europe’s largest oil producer, will slash its output from June to December of 2020, the oil ministry said, the first time in 18 years it has joined other major producers to shore up prices. Oilfields that were supposed to start output later this year, but which must now wait until 2021, represent 166,000 barrels per day (bpd) of the overall 300,000 bpd December cuts, the ministry said. The Norwegian cuts are made from a reference point of 1.859 mn bpd, and the upper limit of output in June will thus be 1.609 mn bpd, while the upper limit in the second half of the year will be 1.725 mn bpd, the ministry said. The OPEC+ group, comprising the OPEC, Russia and other countries, agreed to cut output by 9.7 mn bpd in May and June, or about 10 percent of global supply.

Source: Reuters

30 April. Cheniere Energy Inc, the largest US (United States) liquefied natural gas (LNG) company, said it expects investment in new projects worldwide to slump this year and next as the industry grapples with the coronavirus-led economic slump that has sliced 30 percent off worldwide fuel demand. Cheniere said demand for the super-cooled fuel could potentially fall in coming quarters, a reversal from years of record-setting growth, as slower economic activity and high storage inventory levels reduce the need for imports. Before the pandemic, demand for LNG had grown sharply as nations like China and India shift from dirtier coal to cleaner gas for power generation and home heating. Major LNG exporters like Qatar, Australia and the US have been investing heavily in export capacity to feed that demand. The global recession is expected to cause investment to fall, cutting the expected growth in new projects worldwide in 2020 and 2021 to 65 million tonnes (mt) of LNG capacity, compared with its previous forecast of about 130 mt. Cheniere said robust LNG supply growth over the past several years, along with warmer winters and strict virus containment measures, have caused global gas prices to drop. Gas contracts in Europe and Asia have plunged to record lows over the past week or so. Separately, Cheniere said it still expects to complete the third liquefaction train at its Corpus Christi LNG export plant in Texas in the first half of 2021 and the sixth train at its Sabine Pass LNG export plant in Louisiana in the first half of 2023.

Source: Reuters

30 April. In a historic shock amid Covid-19 pandemic, coal is set for the largest decline since World War II alongside sharp reductions for oil and gas, the International Energy Agency (IEA) said in a report. The report provides an almost real-time view of the Covid-19 pandemic's extraordinary impact across all major fuels. After overtaking coal for the first time ever in 2019, low-carbon sources are set to extend their lead this year to reach 40 percent of global electricity generation - six percentage points ahead of coal. As a result, the combined share of gas and coal in the global power mix is set to drop by three percentage points in 2020 to a level not seen since 2001. Coal is particularly hard hit, with global demand projected to fall by eight percent in 2020, the largest decline since the Second World War. Following its 2018 peak, coal-fired power generation is set to fall by more than 10 percent this year.

Source: The Economic Times

29 April. Poland’s Tauron will cut hours and pay by 20 percent in its three coal mines for three months from May, making it eligible for government help during the new coronavirus crisis, the state-run utility said. Poland relies on coal for almost 80 percent of its electricity production, but lockdown measures, which have shut schools, restaurants, cinemas, some factories and reduced railway transportation, have led to a fall in demand for coal and power. Tauron said daily coal output in its mines stood at 20,000 tonnes in the first quarter. Poland’s biggest coal producer PGG said that it also needs to cut pay and working hours, but the management proposal was rejected by trade unions.

Source: Reuters

5 May. Pakistan deferred for two months an inquiry into suspected contract violations by independent power producers which may have cost the national exchequer billions of dollars. Hobbled by decades of energy shortages, successive Pakistani governments have pursued private sector investment in power production, offering lucrative returns backed by sovereign guarantees. Around 40 independent power producers operate in Pakistan. Company representatives have consistently rejected allegations of wrongdoing. Some of Prime Minister Imran Khan’s powerful cabinet ministers have stakes in the private power sector business. Up until 2017, prolonged power outages hit the country’s industrial production.

Source: Reuters

4 May. Germany’s energy regulator, the Bundesnetzagentur, raised its planned power reserve capacity for the 2020/21 winter to 6,596 MW, saying it needed to make up for insufficient grid expansion to plug possible gaps. A year ago, the Bonn-based authority required 5,126 MW of reserve capacity for the 2019/20 winter. To ensure there are no supply bottlenecks the authority signs up power plants on standby which are able to quickly provide electricity, with the costs recovered through consumers’ bills.

Source: Reuters

4 May. France’s Total SA is seeking to expand its power retailing business in Australia from the middle of this year as part of a global plan to sell electricity to 9 mn sites by 2023. Total already sells power to the Gladstone liquefied natural gas (LNG) project, in which it is a stakeholder, and wants to supply electricity to other large customers across Australia’s eastern states, it said in an application to the Australian Energy Regulator. As of 2018, Total said it sold 37 terrawatt hour (TWh) of electricity to more than 5 mn customers and traded 250 TWh of electricity in 11 countries.

Source: Reuters

1 May. US (United States) President Donald Trump signed an executive order that seeks to protect the US electricity system from cyber and other attacks in a move that could eventually put barriers on some imports from China and Russia. Trump declared in the order that the threat to the US power system represents a national emergency, which allows the government to put in place measures such as the creation of a task force on procurement policies for energy infrastructure. Energy Department said that the order was not directed at any new threat, but the result of a process to bolster the power system. The power system not only delivers electricity to homes and businesses, but supports the military and emergency systems. The order authorizes Brouillette to work with Trump’s Cabinet and the energy industry on protecting the electricity system.

Source: Reuters

4 May. Greenhouse gas emissions regulated under Europe’s carbon market fell by 8.7 percent last year, with a large fall from the power industry helping to offset a small increase from aviation, the European Commission said. Around 45 percent of the European Union (EU)’s output of greenhouse gases is regulated by the Emissions Trading System (ETS), the bloc’s flagship policy to tackle global warming by charging for the right to emit carbon dioxide (CO2). An increase in renewable power generation such as wind and solar led to a 15 percent fall in power industry emissions covered by the scheme, the Commission said, while industrial emissions were down 2 percent compared with 2018. Aviation industry emissions covered by the scheme rose by 1 percent. Total verified greenhouse gas emissions from stationary installations, such as power plants and factories, were 1.527 billion tonnes of carbon dioxide equivalent (CO2e) in 2019. Emissions from the aviation industry were 68.14 million tonnes (mt) CO2e, the Commission said.

Source: Reuters

4 May. Environmental activists delivered a petition to a special session of the Swiss parliament demanding that a government aid package should promote a “green recovery” from the coronavirus crisis. With some lawmakers wearing protective face masks, parliament convened at an exhibition centre rather than its normal building so members had extra space to maintain social distancing rules. Campaigners said the 62 bn Swiss francs ($64 bn) in emergency economic aid should be used in an environmentally friendly way. More than 22,000 people signed the petition demanding that support for companies in sectors with large greenhouse gas emissions like aviation be tied to reducing their environmental impact. The government to back measures to eliminate the use of fossil fuels and promote renewable energy, and called on the financial industry to fund sustainable solutions. Many environmentalists see efforts to minimise the economic fallout from the coronavirus pandemic as a chance to scale up the technologies needed to speed a transition to cleaner energy. International Energy Agency head Fatih Birol has said support from governments could drive rapid growth in battery and hydrogen technology to help the world to reduce its reliance on fossil fuels.

Source: Reuters

4 May. Uzbekistan plans to more than double its power generating capacity over the next 10 years, with half of new capacity coming from solar plants and wind farms, the Central Asian nation’s government said. The former Soviet republic of 34 mn aims to increase its capacity to 29.3 GW from the current 12.9 GW, and rely less on natural gas, which dominates its power mix at present, it said in a strategic plan. Out of the added capacity, 5 GW is set to come from solar power plants and 3 GW from wind farms, the government said.

Source: Reuters

1 May. The Tokyo Olympic Games will be powered by electricity from 100 percent renewable energy. The Tokyo Organising Committee of the Olympic and Paralympic Games (Tokyo 2020) said in the report that the renewable energy mix will be from clearly identified power sources and will include electricity from the areas affected by the Great East Japan Earthquake and Tsunami nine years ago. The Tokyo government will also use hydrogen energy in some of the Olympic Village facilities. Tokyo 2020 will also promote proper waste sorting to achieve its target of reusing and recycling 65 percent of Games-time waste.

Source: The Economic Times

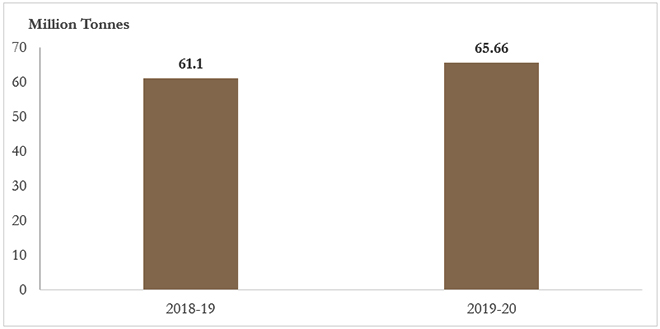

Million Tonnes

| Petroleum Products | Petroleum Products Exports | |

| 2019-20 | % Increase/Decrease in 2019-20 w.r. to previous year | |

| LPG | 0.46 | 9.5% |

| Petrol | 12.71 | -1.4% |

| Naphtha | 8.9 | 27.9% |

| ATF | 6.91 | -6.5% |

| Kerosene | 0.16 | 700% |

| Diesel | 31.65 | 13.7% |

| Others Products | 4.87 | -12.9% |

Total Exports of Petroleum Products in FY20

Source: PPAC, Ministry of Petroleum and Natural Gas

Source: PPAC, Ministry of Petroleum and Natural GasThis is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.