PATHOGEN TRUMPS POLICY IN REDUCING POLLUTION

Monthly Non-Fossil Fuels News Commentary: April - May 2020

India

Virus Impact

For the first time in four decades, emissions of toxic carbon dioxide have declined in the country — thanks to an economic slowdown, growth of clean energy and the ongoing lockdown. CO

2 emissions in the country fell by around 15 percent in March, and are likely to have fallen by 30 percent last month, year-on-year. Using the latest consumption data for coal, oil and gas, the analysts concluded that CO

2 emissions fell by 30 mt in the financial year 2019-20 compared to the previous fiscal. Power and transportation sectors are the major contributors of CO

2 pollution in the country. The thermal sector spewed out nearly 929 mt of CO

2 in a year. Power generated from coal-fired plants fell by 15 percent in March, and 31 percent in the first three weeks of April.

The MNRE has announced the extension of the off-grid and decentralised solar PV applications programme phase-III till 31 March 2021. During the extended period, the sanction of new projects under the Scheme will be available only in the northeastern region. Off-grid and decentralised solar PV applications programme phase-III was launched by the ministry on 7 August 2018, and the scheme was valid for FY19 and FY20.

Renewable energy capacity addition progress in the second quarter and third quarter of financial year 2019-20 (FY20) would continue to be affected by the coronavirus disruption. Though project construction activities were allowed to commence from 20 April 2020 onwards a further two to three months were expected to be lost in remobilisation effort and resolving shipment blockages. India has 37 GW of solar and wind projects currently in the pipeline, excluding 3 GW capacity in the manufacturing-linked tender, the remaining 34 GW is due for completion in the next two years. India added a total utility scale solar and wind capacity of 715 MW and 328 MW, respectively, in the quarter ending March.

The supply disruption from China due to the Covid-19 pandemic and subsequent decline in domestic solar capacity addition offer a golden opportunity to ramp up local manufacturing of solar modules and cells, according to industry experts. However, the industry feels there is an urgent need for a national vision policy for local solar modules manufacturing as well as ancillary products, in line of solar power generation target of 100 GW by 2022 under National Solar Mission. Till 2011, India controlled 70-80 percent of global supplies of solar modules, but the opposite is the case, as 80-90 percent of modules are imported, as domestic modules are not cost-effective.

Policy Developments

India’s power sector regulator CERC has released draft regulations for determination of tariff from renewable energy sources. The last date for submission of comments on the draft is 28 May 2020. The regulations will come into force from July 2020 and unless reviewed earlier will remain in force upto March 2023. The control period under these regulations will be from July 2020 to March 2023. The regulations will apply to cases where tariff for a grid-connected generating station or a unit commissioned during the control period is to be determined by the commissions. The draft regulations will not apply to the bid out projects through SECI it is primarily meant for laying out certain guidelines for SERCs for state sector projects and for certain state RE projects which have not still transitioned into competitive bidding mode. The generic tariff will be determined by the commission on an annual basis in accordance with the regulations for various types of renewable energy projects based on small hydro, biomass, non-fossil fuel based cogeneration, biomass gasifier and biogas based power projects. The other tariff which is project specific will be determined by the commission on a case to case basis for solar power projects, wind power projects, renewable hybrid energy projects and renewable energy storage projects.

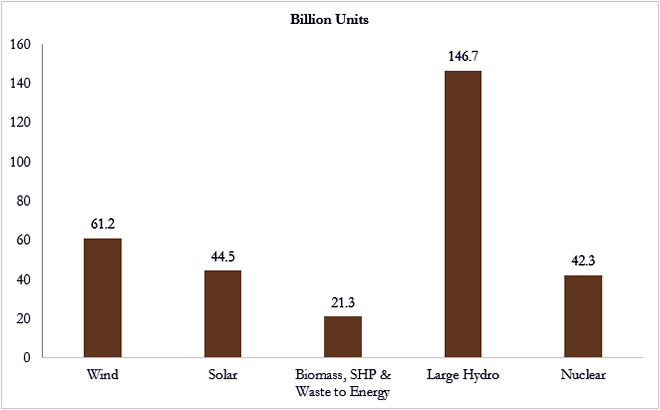

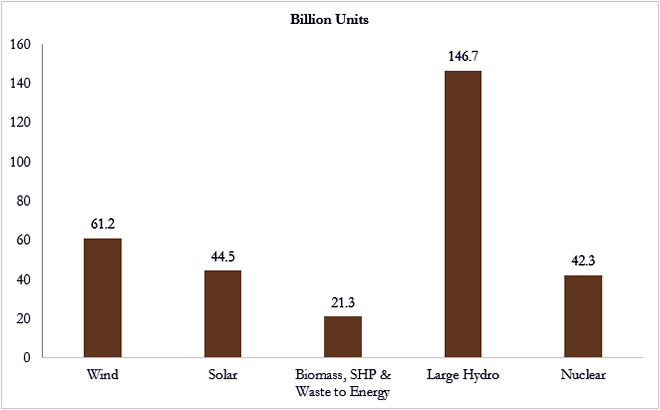

The lessons learnt by countries using significant amounts of renewable energy are important for India, which is set to announce a bailout package for the power sector shortly. Faced with the herculean task of restarting and reviving their economies, many major countries are going backwards on their promises to promote renewable energy. Some energy-rich economies are even relaxing environmental restrictions. Coal mining and coal-power are getting renewed support in countries where it is a prominent source of energy or export revenue. In India, the renewable sector, including large hydro, accounted for 15.6 percent of the generation in January, which is a lean season for hydro. Solar, wind, small hydro, biomass ― officially referred as renewable energy in India ― contributed 9.11 percent, up from 8.55 percent in the same period last year. Currently, the RPO varies from state to state for distribution utilities. The Electricity (Amendment) Bill, 2020, proposes to harmonise the standard and put up a steeper target. The proposal came at a time when many or most state governments, starting with Punjab, are demanding relaxation in the RPO obligation. Though renewable energy comes cheaper on a per kWh basis, it creates a techno-economic problem for the base coal-based power.

The SECI asked all bidders for the 15 MW floating solar plant at the SCCL to send their pre-bid queries online, as a result of the extended nationwide lockdown due to the Covid-19 outbreak. SECI had issued the tender inviting bids for setting up of 15 MW floating solar PV power plant at different sites at the SCCL in Telangana.

The MNRE has urged Haryana to honour signed renewable energy contracts and provide them the connectivity they need to start transmitting power. In the past few months, Haryana has been reluctant to give connectivity to 1000 MW of ‘open access’ solar projects whose construction it had earlier okayed. As a result, these projects are being denied formal approval. The Distributed Solar Power Association is likely to file a petition on the issue before the Haryana Electricity Regulatory Commission.

Tamil Nadu Generation and Distribution Corp Ltd has ruled out the possibility of rolling over the banking facility for captive solar power produced by industries during the lockdown. Most industries in the State generate captive wind or solar power to meet their energy requirements. Banking facility allows the captive power user to sell the excess power after own use to the grid and also draw the power which is needed. The own consumption and the surplus power provided to the grid is adjusted in the power bills. Association of Indian Forging Industry said that 1 MW of solar plant would have generated 5,000 units every day during the 50-day lockdown period and the cost worked out to ₹1.6 mn.

Utility Scale Solar Projects

India added about 5.7 GW of new utility-scale solar capacity in the financial year 2019-20 (FY20), which is 24 percent less than the 7.5 GW target set for this year. In FY20, Rajasthan added a maximum capacity of 1.8 GW, followed by Tamil Nadu with 1.3 GW addition, and Karnataka with 1.1 GW addition. About 2.1 GW of new wind capacity was added in FY20, which is about 30 percent less than the target of 3 GW set for this fiscal year. Compared to previous year installations, FY20 wind installations were about 31 percent higher. Gujarat led the installations with the commissioning of 1.4 GW of new wind projects, followed by Tamil Nadu with 335 MW, and Maharashtra with 206 MW.

According to the IEEFA, India’s ultra-mega solar parks have attracted foreign capital, top global developers, and provided investors with an opportunity to join a $500-700 bn renewable energy and grid infrastructure investment boom in the coming decade. India now houses multiple ultra-mega solar parks with capacity of more than 1 GW, with two of them being the largest commissioned in the world. The Bhadla solar park in Rajasthan is the world’s largest such installation to date, covering more than 14,000 acres with the total capacity of 2,245 MW. In 2016, the MNRE had set a target for 40 industrial solar parks with a combined capacity of 20 GW, and in 2017 doubled this target to 40 GW by 2022. The Indian government has set a target to install 175 GW of renewable energy by the financial year 2021-22 (FY22) and 275 GW by FY27.

SECI extended the bid submission deadline for setting up 14 MW solar with a battery storage capacity of 42 MWh in Leh and Kargil to 30 June 2020. The earlier deadline for submission of bids was 1 June 2020. SECI had issued a tender for the solar power project in February this year. The government was planning for two solar plants each of 7 MW capacity with 21 MWh battery energy storage system at Leh and Kargil. The total peak power demand of the union territory of Ladakh was 50 MW, with an estimated solar and wind energy potential of about 60 GW and 100 GW, respectively. The government has set an installation target of 175 GW of grid-connected renewable power capacity by 2020. Of this, 100 GW will come from solar, 60 GW from wind, 5 GW from small hydro and 10 GW from bioenergy.

As part of supplying reliable power to agriculture sector on a permanent basis, the power utilities have laid special focus on taking up works of 10,050 MW mega solar plants to supply free power to all the agricultural feeders. The mega solar project will be implemented in two phases and the project is estimated to cost ₹48.55 bn. In the first phase, works related to 4,550 MW power plants would be taken up, followed by 5,500 MW in the second phase. Nine locations have been identified in Anantapur (2), Kadapa (3), Kurnool (10 and Prakasam (3) districts. While the first phase is expected to cost ₹12.55 bn, an estimated ₹36 bn would be required to take up works related to 5,500 MW (phase 2) works.

Rajasthan and Maharashtra added maximum utility-scale solar installations in first quarter of 2020 with 250 MW and 135 MW capacity additions, respectively. Whereas, Gujarat saw maximum wind installations with 132 MW in the same period. Renewable energy installations in first quarter of 2020 dropped by 60-70 percent as compared to the previous quarters. In March 2020, only 222 MW of solar capacity and 25 MW of wind capacity was installed as a result of the Covid-19 lockdown, which led to falling power demand, poor health of discoms, supply chain disruption for under construction projects, and shortfall of labour. Because of the current crisis, about 3 GW of solar and 2.5 GW of wind projects whose scheduled commissioning timeline was 2020 are likely to be delayed. 2021 is expected to have 1 GW of new rooftop solar installations which would grow to 1.5 GW by the end of FY2021. In first quarter 2020, $1.8 bn of investments were done in India’s renewable energy sector.

Gurugram-based independent power producer JBM Solar, part of the JBM Group, is planning to set-up 100 MW of solar power projects by next year. More than 95 percent of these projects would be ground-mounted. In these difficult times the relief measures the industry seeks is a reduction in the GST on some goods in the energy sector from the government. Payment support to industry through ESI or other government funds should be provided for the energy sector to sustain in the long-term. JBM is also active in the waste-to-energy sector where it is setting up a 10 MW project. The firm currently has an installed solar capacity of 175 MW spread across Maharashtra, Gujarat, Haryana, Uttar Pradesh, and Delhi.

Wind Power

According the Global Wind Energy Council and MEC+ report India, the world’s fourth-largest onshore wind market by installations, is likely to fall short of its ambitious wind energy target for 2022 by up to 10 GW if urgent regulatory challenges are not addressed. The country’s total wind energy capacity would only reach 50 GW by 2022 as existing the pipeline and new auctions face multiple challenges. In 2020, supply chain disruptions due to the Covid-19 impact would further compound existing challenges to delay about 0.7 GW to 1.1 GW in new volume to 2021 and also possible cancellation of some planned auctions. Challenges such as grid and land availability, off-taker risks, onerous tender conditions, and low tariff caps have led to the past three Central tenders and all state wind tenders to be unsubscribed, retendered or even cancelled, while 80 percent of awarded projects have been delayed by 6-12 months. India is the world’s fourth-largest onshore wind market by installations, with 37.5 GW of capacity as of 2019, and has the potential for more than 695 GW at 120 metres. The government has set a target to reach a total wind capacity of 140 GW by 2030.

Only about one-third of 6,000 MW wind power capacity auctioned by the SECI in four tranches between 2017 and 2018 have been commissioned so far despite their deadlines ending. SECI, the nodal agency through which the MNRE conducts wind and solar auctions, has commissioned only 1961 MW of wind capacity. SECI has commissioned 1,000 MW out of 1,049 MW in the first auction held in February 2017 while 685 MW out of 1,000 MW have been commissioned in tranche 2 held in October 2017. The scheduled commissioning date for tranche 2 was May 2019. In the tranche 3 auctioned in February 2018, 277MW out of 2000 MW have been commissioned while not a single megawatt has been commissioned amongst the 2000 MW auctioned in tranche 4 in April 2018. The scheduled commissioning deadline for tranche 3 projects was November 2019, and March this year for tranche 4. The winning tariffs in tranche 3 auctions were “too low”. The winning tariffs in that auctions were in the range of ₹2.44-2.45/kWh only one paisa higher than the record low reached so far.

Wind energy solutions provider Inox Wind has begun executing the first phase of 250 MW wind power projects in Gujarat following the receipt of certain advances. The first phase of the projects is scheduled to be commissioned in the third quarter of the ongoing. Common infrastructure such as 220 kV pooling substation at Dayapar, 220 kV bay at PGCIL Nirona End, 220 kV transmission line for 72 km is already ready and the project will be executed on a plug and play basis.

Hybrid Solutions

The renewable energy sector will see a shift to grid-independent systems in the coming months and storage systems such as solar-plus-storage will see a major boost in the market. The government has a policy focus towards solar-plus-storage systems as also seen through hybrid policy in place and the recent award of the renewable project-cum-storage capacity. One of the reasons why the government’s focus is shifting to solar-plus storage systems is that the overall weighted average bid tariff discovery in such tenders has been relatively cost competitive with ₹4/kWh. Viability of such storage-based systems in the long run, availability of peaking tariff policy, which is absent currently, remains a key. In 2019, India’s first and biggest battery-storage system of 10 MW was commissioned in Delhi at the Rohini substation of Tata Power Delhi Distribution, And in October last year, SECI had issued a 400-MW tender for round-the-clock supply of renewable power along with energy storage to New Delhi Municipal Council and Dadra and Nagar Haveli.

Adani Green Energy plans to complete 1,300 MW of hybrid projects by calendar year 2021. These hybrid projects where they mix wind and solar were currently being executed in Gujarat and Rajasthan. Adani Green had won the 700 MW wind-solar hybrid project in January 2020 and had bagged the 600 MW projects in June 2019. Adani Green is building 1,280 MW of wind, 475 MW solar and 1,690 MW hybrid plants. The firm has a current project portfolio of 6 GW including under-construction capacity.

Hydro Power

Lockdown has put final clearance from National Company Law Tribunal for NHPC Ltd to take over insolvency hit 120 MW Rangit Stage IV hydro project in Himalayan state Sikkim to a halt. But the Mini Ratna PSU has started its homework on the project to minimize cost and time overrun. After emerging out as the highest bidder under a resolution plan for insolvency bound Hydropower Company Jal Power Corporation’s 'Rangit stage IV' HE Project, with its bid of ₹1.65 bn. Escalation of project cost due to all these factors pushes up project output tariff making it less competitive. As the system goes, tariff of power is regulated by CERC. It allows tariff structure based upon applications made by the generation company mainly depending upon project cost. Final estimated cost for Rangit IV is yet to be finalized and approved at different levels. But by rough average expense pattern of ₹100-120/MW installed capacity, the project cost may go somewhere around ₹15 bn.

Activists and locals in Kinnaur have asked the MoEFCC to not extend environment clearance to the integrated Kashang Hydro Power Project. Around 1,000 environmental activists from across the world and local residents have written to the ministry raising concern over the ecological damage the will be caused due to the project. The MoEFCC had granted an Environment Clearance to the four-stage project back in April 2010 with the condition of 10-year validity. Only stage I of the project has been completed within the deadline by the Himachal Pradesh Hydropower Corp Ltd, which now is seeking an extension. The Expert Appraisal Committee of the ministry is due to discuss the matter.

Rest of the World

Europe and UK

The French government wants the EU to impose policies to underpin fossil fuel prices to protect the bloc’s climate ambitions during its recovery from the coronavirus pandemic. Most EU countries believe the bloc’s recovery plan must uphold its Green Deal policy to decarbonise by 2050. France called for the EU to use taxes or its carbon market to prevent “extremely low prices” seen during the pandemic from thwarting climate ambitions. Countries such as Poland backed other parts of the proposal, including a call to quickly impose carbon charges for imports into the bloc. The Polish government warned last month that the economic hit from the pandemic will make EU climate policies harder to achieve. The European Commission plans next year to review EU energy taxation rules and the ETS, a carbon market policy that forces industry to pay for the carbon dioxide emissions. But France called on the EU to take steps “without delay” to bolster the ETS market stability reserve, which removes surplus carbon permits from the system to avoid a build-up of supply. With Europe headed for a steep recession, the fear is that the ETS could suffer the same fate after the 2008-2009 financial crisis when lower prices for carbon permits provided little incentive for firms to curb their pollution.

French power producer Neoen SA will build Australia’s largest solar farm for A$570 mn ($367 mn), after lining up a contract to sell most of the power to an electricity company. The state of Queensland’s CleanCo has agreed to buy 320 MW of capacity from the Western Downs solar farm in southeast Queensland, which will help the state make progress on its target of 50 percent renewable energy by 2030. Neoen, which sees Australia as one of its key growth markets expects to begin construction on the Western Downs solar farm in July, with generation from the project due to start in the first quarter of 2022. Neoen already has six solar farms, three wind farms and the world’s biggest lithium-ion battery in Australia. French energy major Total was awarded several solar power generation projects with a total capacity of around 135 MW in France’s latest round of tenders awarded by energy market regulator CRE. The projects will be operated through its Total Quadran subsidiary. The largest project in the lot is a 50 MW ground-mounted solar project at the site of the company’s former refinery in Valenciennes in northeast France. It is expected to be completed in 2022. Another 25 MW capacity project, also expected to be completed in 2022, will be constructed near its Grandpuits refinery in the Paris region.

Germany’s ruling coalition reached a compromise deal in a row over the minimum distance onshore wind turbines should have from dwellings, leaving the final decision to regional governments and lifting a cap on solar energy. Wind power is one of the most important drivers of Germany’s transition to renewable energy, but Europe’s largest economy saw a sharp fall in the number of new onshore wind turbines installed last year. Business groups have warned that the government’s target for green energy to reach 65 percent of electricity production by 2030 could be missed if the current rate of turbine growth continues. The existing national cap of 52 GW on the capacity of solar energy installations stemmed from a time when solar panels were much more expensive. German utility E.ON has sold forward 65 percent of its nuclear power generation in 2021 and 34 percent of its 2022 output at prices well above the current wholesale market, raising earnings prospects from that segment. The company has to date also sold some 86 percent of output in the current year from reactors at its Preussen Elektra unit, it showed in presentation slides on reporting financial results for first quarter 2020. Production in 2020 was sold at €46 ($49.72)/MWh after 2019’s locked in price had been €33.

Poland sees its capacity in solar energy rising to 2 GW this summer, which will help it respond to the demand for power when some of its coal-fuelled power plants may face issues with water cooling due to expected drought. Poland generates most of its electricity from burning coal in power stations, some of which use river waters for cooling. The country’s total installed electrical capacity is almost 47 GW. Poland’s capacities in solar energy rose by 180 percent year on year to almost 1.7 GW as of 1 April.

The Czech government approved agreements with majority state-owned electricity producer CEZ setting out the framework for building a new nuclear power block to come online in 2036. The Czech state has long been in talks with CEZ, in which it owns a 70 percent stake, about expanding its nuclear power fleet to replace blocks that will expire in the coming decades as well as lignite power plants to be retired in the 2030s as Europe weans itself off coal. Costs and financing have been major sticking points in light of delays and cost overruns at other projects, Germany’s decision to abandon nuclear energy and CEZ’s unwillingness to take on risks of a project favoured by politicians that may never pay for itself. The government wants to propose a financing model by the end of May, before the state goes into talks with the European Commission over the project. It has been pushing for nuclear to be seen as a green or low-emission source under European Union rules, which would help reduce funding costs. The government has estimated a new 1,200 MW block, set to be built at CEZ’s Dukovany nuclear power plant and enough to cover a tenth of annual consumption, would cost 140-160 bn Czech crowns ($5.6-$6.4 bn).

BP Plc has won Australian government backing for a feasibility study into producing hydrogen using wind and solar power to split water and converting the hydrogen to ammonia in Western Australia. The Australian Renewable Energy Agency would provide A$1.7 mn ($1.1 mn) toward the A$4.4 mn feasibility study, part of a push by the government to make the country a major producer of hydrogen by 2030. At commercial scale, BP would produce green ammonia for domestic and export markets and the plant would require around 1.5 GW of power capacity. Western Australia is already a big producer of ammonia, but made from natural gas. Producing ammonia instead from hydrogen made from electrolysing water would cut carbon emissions sharply and help BP meet its new goal of becoming a net zero carbon emitter by 2050. BP is working on other hydrogen projects at its refineries in Europe, and for renewable energy has a partnership with solar firm Lightsource, which is working on two solar farm projects in Australia.

USA

The US has overtaken China as the most attractive country in the world for renewables investment and the global clean energy sector is expected to bounce back quickly despite the coronavirus pandemic, research showed. In an annual ranking of the top 40 renewable energy markets worldwide by consultancy EY, the United States was ranked first for the first time since 2016, followed by China. US growth was largely due to a short-term extension of a production tax credit for wind projects and plans to invest $57 bn to install up to 30 GW of offshore wind by 2030. China’s growth in renewables has slowed, as the government looks to wean the market off subsidies. France was ranked third, followed by Austria, Germany and Britain. India slumped to seventh place, having been third last year, due to warnings it might miss its 175 GW installation target by 2022.

The Trump administration has ended a two-year rent holiday for solar and wind projects operating on federal lands, handing them whopping retroactive bills at a time the industry is struggling with the fallout of the coronavirus outbreak, according to the company. US power plant owner Avangrid Inc, majority owned by Spain’s Iberdrola, received a bill for more than $3 mn for two years of rent on its 131 MW Tule wind project on federal land near San Diego. Some 96 utility-scale solar, wind and geothermal projects operate on lands run by the Interior Department’s Bureau of Land Management. The Trump administration also approved what it said would one day be the largest solar project in US history, to be located on federal land in the Nevada desert. The Gemini Solar project is expected to generate enough electricity to power 260,000 homes in the Las Vegas area and will include a battery system to store energy for use after the sun goes down.

A group of Republican lawmakers from energy-producing states called on the US President to prevent banks from halting loans and investments with companies that produce oil and other fossil fuels while they have access to federal assistance programs during the Covid-19 pandemic. Democratic lawmakers who want an economic recovery featuring investments in conservation and alternative energy to fight climate change, have been calling on Treasury Secretary to bar oil and gas companies from accessing loans through the Main Street facility. For years, environmental activists have pressured banks and financial firms to drop support of fossil fuel companies.

The Nuclear Regulatory Commission, meanwhile, recently agreed to a 90-day fee deferral for nuclear power plant owners due to economic disruptions caused by the pandemic. Renewable companies are also facing significant headwinds from the coronavirus. Project delays have threatened their ability to tap lucrative federal subsidies needed to compete with fossil fuels and cut the growth outlook for US wind and solar installations by 5 percent and 10 percent, respectively, this year.

South America

The Mexican government has cited the coronavirus pandemic as a justification for new rules that will reduce the role of renewable energies like solar and wind power, granting a reprieve to the government’s own ageing, fossil-fuel power plants. The decree over the weekend has sparked outrage among Mexican and foreign investors who had been allowed to sell their power into the government-operated grid. According to industry associations it will affect 28 solar and wind projects that were ready to go online, and 16 more under construction, with a total of dollar 6.4 bn in investments, much of it from foreign firms. Mexico also has been slow to build supplementary plants for the times when wind or sun power naturally decreases.

Japan

The Tokyo Olympic Games will be powered by electricity from 100 percent renewable energy according to the Tokyo Organising Committee of the Olympic and Paralympic Games (Tokyo 2020). The renewable energy mix will be from clearly identified power sources and will include electricity from the areas affected by the Great East Japan Earthquake and Tsunami nine years ago. The Tokyo government will also use hydrogen energy in some of the Olympic Village facilities. Tokyo 2020 will also promote proper waste sorting to achieve its target of reusing and recycling 65 percent of Games-time waste.

China

China will cut subsidies on NEVs such as electric cars by 10 percent this year, following a decision to continue providing incentives to buy cleaner cars. The government had announced plans in 2015 to end the subsidies this year, but said in March it would extend them. China has set a target for NEVs, which also include plug-in hybrids and hydrogen fuel cell vehicles, to account for a fifth of auto sales by 2025, compared with the current 5 percent, as it seeks to cut pollution and cultivate home-grown auto sector champions. Under the new plan, China will extend subsidies for buying NEVs to 2022, and tax exemptions on purchases for two years. However, the subsidies will apply only to passenger cars costing less than 300,000 yuan ($42,376). That is likely to exclude premium electric vehicles such as those built by Germany’s BMW and Daimler.

Africa

South Africa will soon start developing a plan for a new 2,500 MW nuclear power plant. Africa’s most industrialised economy, which operates the continent’s only nuclear power plant near Cape Town, was considering adding more nuclear capacity in the long term, after abandoning in 2018 a massive nuclear expansion championed by the former president. Analysts had expressed serious concern about Zuma’s project for a fleet of nuclear plants totalling 9,600 MW because it would have put massive additional strain on public finances at a time of credit rating downgrades. Its current nuclear plant, Koeberg, has a capacity of around 1,900 MW and was synchronised to the grid in the 1980s.

Central Asia

Uzbekistan plans to more than double its power generating capacity over the next 10 years, with half of new capacity coming from solar plants and wind farms. The former Soviet republic of 34 mn aims to increase its capacity to 29.3 GW from the current 12.9 GW, and rely less on natural gas, which dominates its power mix at present. Out of the added capacity, 5 GW is set to come from solar power plants and 3 GW from wind farms. Renewables will thus account for more than a quarter of the country’s capacity by 2030. Uzbekistan has already launched a handful of projects, including with Saudi Arabia’s Acwa Power and United Arab Emirates’ Masdar, for the construction of solar and wind facilities with long-term power purchase agreements.

| MNRE: Ministry of New and Renewable Energy, CO2: carbon dioxide, mt: million tonnes, PV: photovoltaic, mn: million, bn: billion, tn: trillion, kWh: kilowatt hour, FY: Financial Year, MW: megawatt, GW: gigawatt, CERC: Central Electricity Regulatory Commission, SECI: Solar Energy Corp of India, SERC: State Electricity Regulatory Commission, RPO: renewable purchase obligation, SCCL: Singareni Collieries Company Ltd, IEEFA: Institute for Energy Economics and Financial Analysis, discoms: distribution companies, GST: Goods and Services Tax, PGCIL: Power Grid Corp of India Ltd, kV: kilovolt, km: kilometre, PSU: Public Sector Undertaking, MoEFCC: Ministry of Environment, Forest and Climate Change, EU: European Union, ETS: emissions trading system, NEVs: new energy vehicles, UK: United Kingdom, US: United States |

NATIONAL: OIL

Modi government denying people benefit of low oil prices, no other nation doing so: Moily

26 May. When nations around the world have passed on the benefit of plunging oil prices to consumers, the Modi government has irrationally kept petrol and diesel prices at levels prevalent when crude prices had touched an all-time high of $107 few years back, former Petroleum Minister M Veerappa Moily said. Moily said petrol was priced at ₹71.41 per litre and diesel at ₹55.49 a litre when during the UPA-2 regime international oil prices touched an all-time high of $107.09 per barrel. Currently, the cost of crude is $36.29, but diesel is priced at ₹65.39 and petrol at ₹71.26 in Delhi, he said. Excise duty on petrol was ₹9.48 per litre when the Modi government took office in 2014 and that on diesel was ₹3.56. At present, this incidence is ₹32.98 a litre on petrol and ₹31.83 on diesel - a result of successive duty hikes. Moily said the Congress-led UPA II had taken a conscious decision to do away with the administered price regime and to fix the prices of diesel and petrol in accordance with the benchmark international price.

Source: The Economic Times

India looks to store cheap oil in US: Oil Minister

25 May. India is looking at storing some low priced US (United States) oil in facilities there as its local storage is full, Oil Minister Dharmendra Pradhan said. India’s plan could be similar to a move by Australia, which said it would build up an emergency oil stockpile initially by buying crude to store in the US Strategic Petroleum Reserve to take advantage of low oil prices. Pradhan said India, which is the world’s third biggest oil consumer and importer, had already filled its 5.33 million tonnes (mt) of strategic storage and parked about 8.5-9 mt of oil on ships in different parts of the world, primarily in the Gulf. Indian refiners have also filled their commercial tanks and pipelines with refined fuel and oil. Pradhan said stored oil and products amounted to about 20 percent of India’s annual needs. India imports more than 80 percent of its oil requirements. India plans to build new strategic storage to expand capacity by 6.5 mt. Pradhan said India was keen to have participation from global investors in building these facilities. India’s fuel demand nearly halved in April to its lowest level since 2007 as a nationwide lockdown and travel curbs to combat the spread of novel coronavirus eroded economic activity. So far in May India’s petrol and diesel demand is about 60-65 percent of what it was in the same month last year and in June fuel consumption will return to the same level as June 2019, he said.

Source: Livemint

Government working on relief measures for oil producers

25 May. The government is stitching together a package of measures to help domestic oil producers pull through the price crash and the uncertainty in the global oil market as heavy losses on each barrel they pump threaten the commercial viability of projects. A relief package has become crucial for the survival of companies such as ONGC (Oil and Natural Gas Corp) as the price crash since March has turned oil production into a loss-making proposition. For example, the total cost of a barrel of oil produced by ONGC works out to $45 after including royalty, cess and other levies. So at $35/barrel closing price of global benchmark Brent, ONGC actually loses $10/barrel. Brent had on April 22 crashed to 21-year low of $16/barrel. ONGC pays 10-12.5 percent royalty to the Centre on oil produced from offshore areas. State governments charge 20 percent royalty on the price of oil produced from onland fields. Then there is 20 percent ad-valorem oil industry development (OID) cess on the price that producers get. OID cess has increased from $3 to $13 over the years and causing a financial stress to current and new projects. The cess is levied as excise duty under the Oil Industries (Development) Act of 1974. The cess is being levied on crude oil from nominated blocks and pre-NELP (New Exploration Licensing Policy) exploratory blocks only. The OID cess was raised from ₹2,500 per tonne to ₹4,500 per tonne in March 2012. The price of the Indian basket of crude oil stood at around $110 per barrel then. With the fall in global crude oil prices in mid-2014, companies asked for reduced levy and converting it into 8-10 percent ad-valorem. The government had changed the cess to 20 percent ad-valorem in March 2016.

Source: The Economic Times

Pune’s Repos Energy plans producing over 3k mobile petrol pumps in FY21

25 May. Pune-based energy distribution startup, Repos Energy plans to manufacture and sell around 3,200 mobile petrol pumps in the current financial year. The company said it also plans to get on board over 1,200 operators from across the country during FY 2020-21. The startup is backed by Ratan Tata, Chairman Emeritus of Tata Group, who came on board as a mentor along with Tata Motors who have helped in making these Repos Mobile Petrol Pumps safe and efficient.

Source: The Economic Times

Oil Minister sees fuel demand reaching pre-Corona level next month as India gets back to work

24 May. India has regained 65 percent of its appetite for fuel and demand will reach nearly pre-pandemic levels next month as economic activities pick up pace after the government’s announcement of a stimulus package and staggered easing of Corona restrictions, Oil Minister Dharmendra Pradhan said. This compares well with fuel consumption in China, the world’s second-largest oil consumer and the pandemic’s epicentre, reaching 90 percent of the pre-Corona level after losing 40 percent of the demand in February, as per an IHS Markit report. A rebound in fuel demand indicates India is getting back to work and the world’s third-largest energy market is poised to regain its position as the global demand centre. Latest industry data show petrol sales rising 7.5 percent and diesel sales jumping 72 percent in May following the government’s move to ease lockdown curbs to allow from 20 April. Jet fuel sales grew 6-7 percent and LPG 4 percent during this period as only select cargo and repatriation flights took to the skies and domestic cooking fuel demand tapered off after the initial panic-buying triggered by the lockdown and commercial consumption was yet to return. Asked about current pump prices corresponding to $100 oil price and consumers not getting the benefit of historically low oil prices because of the government raising fuel taxes by ₹13 and ₹16 a litre of petrol and diesel, respectively, Pradhan said it did not put the burden on consumers and will raise resources for welfare schemes, stimulus package and infrastructure.

Source: The Economic Times

India’s petroleum product demand to fall 8 percent in 2020: IEA

22 May. India’s petroleum product demand is expected to fall by eight percent to 4,597 thousand barrels per day (bpd) in 2020, International Energy Agency (IEA) said as part of its May oil market report. The country’s petrol demand is projected to fall by 350 thousand barrels per day in the second quarter of 2020, primarily due to mobility restrictions. The agency has projected petrol demand to fall 60 percent year-on-year in April as well as May, as compared to the year ago period. Diesel demand is projected to contract by 690 thousand barrels per day in the second quarter of 2020 and demand for aviation turbine fuel (ATF) and kerosene is projected to decline by almost 40 percent in April-May, as roughly half of the kerosene demand is used as jet fuel and will be severely impacted by airline restrictions, IEA said. Overall, India’s oil demand is expected to fall to 4.60 mn bpd in 2020, as compared to 5.01 mn bpd recorded in 2019. The agency expects domestic crude oil production to continue to decline in 2020. According to the report, crude oil production will remain subdued in the coming months and is projected to decline to 0.75 mn bpd in 2020, as compared to 0.80 mn bpd recorded in 2019.

Source: The Economic Times

India’s LPG penetration reaches 97.5 percent

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Claims on LPG penetration can be established only by household level surveys!

< style="color: #ffffff">Ugly! |

21 May. India’s liquefied petroleum gas (LPG) or cooking gas penetration reached 97.5 percent as on 1 April 2020, as compared to 94.3 percent recorded in the same month last year, according to PPAC (Petroleum Planning and Analysis Cell) report. LPG penetration, the share of population with LPG connections, stood at 56 percent in April 2015. The country’s active LPG domestic consumers have almost doubled in the last five years, from 148.6 mn in April 2015 to 278.7 mn in April 2020. The number of non-domestic LPG consumers increased from 21.1 lakh in 2015 to 32.4 lakh on 1 April 2020. Of the 278.7 mn active LPG consumers, 29 percent or 80.1 mn LPG consumers are beneficiaries of Pradhan Mantri Ujjwala Yojana (PMUY). PMUY, launched in May 2016, is aimed at safeguarding the health of women and children by providing free LPG connections to the woman beneficiary of poor families. The scheme was initially started for families below the poverty line, but was later extended to families above the poverty line and certain other categories. According to region-wise data by the report, northern states including Chandigarh, Delhi, Haryana, Himachal Pradesh, Jammu and Kashmir, Punjab, Rajashtan, Uttar Pradesh and Uttarakhand reported the highest LPG penetration, with all states posting more than 100 percent LPG coverage. While, eastern states including Bihar, Jharkhand, Odisha, West Bengal and Andaman and Nicobar islands collectively posted the lowest LPG coverage at 84 percent as on 1 April 2020. Oil Marketing Companies (OMCs) sold nearly 23.1 million tonnes (mt) of LPG in 2019-2020.

Source: The Economic Times

NATIONAL: GAS

RIL estimates $200-400 mn liability in KG-D6 cost recovery dispute

25 May. Reliance Industries Ltd (RIL) has estimated a maximum liability of $400 mn (₹30 bn) in its nine-year old dispute with the government over alleged under-utilisation of capacity at the KG-D6 field due to failure to comply with an approved investment plan. Natural gas output from Dhirubhai-1 and 3 gas fields in the KG-D6 block in the Bay of Bengal started to lag company projections from the second year of production itself in 2010 and the field ceased to produce in February this year much ahead of its projected life. The government blamed the phenomenon to the company not sticking to the approved development plan and disallowed over $3 bn costs. The company disputed this and dragged the government to arbitration. The Production Sharing Contract (PSC) allows contractors to recovery all their capital and operating cost from the sale of oil and gas discovered and produced from a block before sharing profits with the government. Disallowing certain costs for recovery leads to the government claiming higher profit share. While the two sides have filed their respective pleadings before the three-member arbitration tribunal, final hearings are tentatively scheduled from September to December 2021. Gas output from D1 and D3 fields in KG-D6 block was supposed to be 80 mmscmd (million metric standard cubic meter per day) but actual production was only 35.33 mmscmd in 2011-12, 20.88 mmscmd in 2012-13 and 9.77 mmscmd in 2013-14. The output continued to drop in the subsequent years and the fields ceased to produce in February this year.

Source: The Economic Times

City gas operators seek tax relief, loan restructuring to deal with lockdown impact

25 May. Pummeled by evaporating demand and fall in business due to the lockdown, city gas operators such as Adani Gas, GAIL (India) Ltd and Torrent Gas have sought tax relief and loan restructuring to tide over difficult times. Natural Gas Society (NGS), which represents CNG (compressed natural gas) and piped natural gas (PNG) retailers in the country, has written to the Oil Secretary Tarun Kapoor seeking government support in expansion of the city gas distribution (CGD) business and the share of natural gas in the country's energy basket. Barring supply of piped natural gas to households kitchens, all segments under the CGD have shown a sharp fall in gas offtake. Slowdown in the overall economic activity, it said, can be a dampener for infrastructure capex plans especially under the newly awarded city gas licenses. The association sought exemption of the CGD sector from excise duty (14 percent) and a deferment of statutory tax compliances at least till September-December, 2020. NGS wanted government-priced controlled gas to be allocated to CGD operators.

Source: The Economic Times

Spot LNG price crash set to make life harder for Indian suppliers of long-term gas

23 May. Spot prices of liquefied natural gas (LNG) have fallen sharply to $1.3 per unit, which has serious implications for India because it will be difficult to sell the fuel to factories as supplies under long-term contracts have a much higher rate of $5-7. LNG rates have been under pressure for more than a year due to a supply glut but the extraordinary demand destruction by the coronavirus pandemic and the difficulty in storing the super-cooled liquid has hammered global gas prices like never before. With LNG rates under long-term contracts being several times the spot prices, industry executives say it would be difficult to sell gas to Indian factories, which want to cut energy costs as the economy reopens amid general demand uncertainties. Gas marketers like GAIL (India) Ltd, Indian Oil Corp (IOC), GSPC (Gujarat State Petroleum Corp) and Bharat Petroleum Corp Ltd (BPCL) procure LNG via one or more long-term contracts with suppliers in Qatar, Russia, Australia and the US (United States). They make this supply available to city gas distributors or industrial customers under a contract that requires customers to pay even if they can’t take gas during the contract period.

Source: The Economic Times

GAIL issues tender to buy and sell LNG cargoes

22 May. Gail (India) has issued a tender offering two liquefied natural gas (LNG) cargoes for loading in the United States, and is seeking a cargo for delivery into India. It offered two cargoes to load from the Cove Point plant in the US (United States) on a free-on-board (FOB) basis loading in late-June and July. It is also seeking a cargo for delivery into India, in May or August 2021, on a delivered ex-ship (DES) basis. The tender closes on 27 May.

Source: Reuters

NATIONAL: COAL

Telangana coal unions want private players barred

23 May. Five employees unions demanded that the Central government immediately withdraw the proposed commercial coal mining by private players, as it is detrimental to the interests of coal employees. The SCMLU-INTUC, SCWU-AITUC, SCE&W-HMS, SCEU-CITU and GLBKS-IFTU submitted a memorandum to the Director (PA&W) of SCCL (Singareni Collieries Company Ltd) in Kothagudem to this effect. SCMLU-INTUC activists staged a one-day dharna in Kothagudem against the privatisation of CIL (Coal India Ltd) and SCCL. Coal produced by private players to whom the new coal blocks would be allocated through auction would engage contact labour for coal exploration and the price of coal per tonne would be cheaper than CIL and SCCL, they explained.

Source: The New Indian Express

HC declines to stay conviction of former Jharkhand CM Koda in coal scam case

23 May. The Delhi High Court (HC) declined to stay the conviction of former Jharkhand Chief Minister (CM) Madhu Koda in a coal scam saying it will not be apt to facilitate him to contest polls for any public office, till he is finally acquitted. Justice Vibhu Bakhru said the wider opinion was that persons charged with crimes ought to be disqualified from contesting elections to public offices and therefore, it would not be apt to stay Koda’s conviction to overcome the disqualification incurred by him. Koda had moved the plea for stay of conviction to contest in the 2019 Jharkhand state assembly polls and the high court had reserved its verdict on his application on 19 March. Koda was held guilty of corruption and conspiracy, by a trial court in 2017, in allocation of a Jharkhand-based coal block to Kolkata-based company Vini Iron and Steel Udyog Ltd (VISUL).

Source: The Economic Times

Commercial coal mining to cut India’s import bill by half: Crisil

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Commercial coal mining will introduce efficiency in the sector!

< style="color: #ffffff">Good! |

21 May. The government’s move to open up commercial coal mining can halve the annual expenditure incurred on importing non-coking coal to as much as ₹450 bn because of substitution through domestic production, rating agency Crisil said. In fiscal 2020, India imported an estimated 180-190 million tonnes (mt) of non-coking coal costing over ₹900 bn. On 20 May, the Cabinet approved liberalisation of coal mining by eliminating eligibility conditions for private sector participation. India has one of the largest coal reserves in the world at 300 billion tonnes (bt), yet it imports a fifth of its annual requirement. At present, two government-owned miners, Coal India Ltd and Singareni Collieries Company, produce over 90 percent of the coal. Last fiscal, the government had allowed 100 percent foreign direct investment in coal mining, enabling global miners to join the fray. According to Crisil, sectors such as power, cement and steel will gain the most as they are the largest consumers of non-coking coal.

Source: Business Standard

NATIONAL: POWER

Power back in 60k more Kolkata households

26 May. Power supply to 60,000 homes on the CESC grid along the city’s southern periphery was restored. The development came after a prod by West Bengal CM (Chief Minister) Mamata Banerjee who visited power utility CESC’s headquarters at Victoria House in Esplanade to drive home the urgency to step up restoration of power lines. Also, acute water crisis in several localities was resolved after booster pumping stations that had suffered power outage resumed operations by either reconnecting to the network or providing temporary connections through generators. Of the 33 lakh consumers on its network, nearly 10 lakh have overhead power lines that bore the brunt of the cyclone that tore through the city.

Source: The Economic Times

Real-time trading on power bourses likely soon

26 May. India is set to start real time trading on power exchanges, enabling electricity purchase to be as quick as placing an online meal. State power distribution companies (discoms) and industrial consumers will be able to meet emergency short-term power needs through the new real time market (RTM). Power can now be bought an hour before its requirement in real time market, unlike the popular day-ahead market by discoms on spot exchanges where trade happens a day in advance. In the same manner, power generating stations with excess power capacity or discoms with more than required contracted capacities can sell at a short notice in the real time market. Electricity RTM launch has not been deferred amid the nationwide lockdown and will start operations as per the schedule on 1 June, multiple sources in the government and Central Electricity Regulatory Commission (CERC) said. The auctions in RTM will be held every half-hour. The bidding criteria will be similar to that of day-ahead where market clearing price is determined through demand and supply. Currently, there are intra-day markets on power bourses where electricity delivery can take place after 2.5 hours of the auctions but they are less popular since their bidding criteria requires the traders to match winning bids. CERC has disabled last minute changes in power schedule by discoms to let power generators sell excess in RTM. Power plants with long-term power tie-ups will be required to share half of their gains with the discoms.

Source: The Economic Times

₹900 bn package to provide only temporary relief to discoms: IndRa

26 May. The ₹900 bn package would provide only a temporary relief to power distribution companies but not long-term stability, India Ratings and Research (Ind-Ra) said. Finance Minister Nirmala Sitharaman announced ₹900 bn liquidity infusion for discoms (distribution companies), saying that they owe ₹940 bn to power generation companies. As a result, despite the transfer of a major portion of debt from the books of discoms to state governments, the finances of several discoms have remained in reds and weak, even prior to Covid-19 related lockdown. The lockdown has only aggravated the stress of discoms.

Source: The Economic Times

Delhi’s peak power demand picks up, may touch record high in July

25 May. With the mercury rising and many establishments being allowed to operate in Lockdown 4.0, the city discoms (distribution companies) are expecting the peak power demand to surpass last year’s record high in the coming months. While the demand may reach 7,380 MW in June, it is expected to cross 7,500 MW in July. In the past two decades, Delhi’s peak power demand has increased by over 250 percent — from 2,879 MW in 2002 to an all-time high of 7,409 MW on 2 July 2019. In the first half of the lockdown, the capital saw up to 49 percent slump in the peak demand. The commercial demand has already started to increase with the easing of restrictions and the increase in temperature is resulting in night peaks. The first 19 days of May has also seen more demand — over 24 percent — than the same period this April. While the highest peak power demand was 3,362 on 1 April, the same was 4,195 MW on 19 May. According to the city discoms, arrangements have been made to source adequate electricity to meet the demand.

Source: The Economic Times

KMC, Bengal government shouldn’t be blamed for power supply disruption: Hakim

25 May. Kolkata Municipal Corp (KMC) chief Firhad Hakim said that the West Bengal government or the civic body cannot be held responsible for the continued disruption in power supply in several parts of the city after Cyclone Amphan. Hakim said private power utility CESC Ltd itself clarified that they did not have the required staff to carry on restoration work.

Source: The Economic Times

No plan to scrap free power scheme: Tamil Nadu Electricity Minister

25 May. The scheme of free power supply for farmers will not be scrapped at any cost, Tamil Nadu Electricity Minister P Thangamani said. Thangamani said the State government had introduced a tatkal scheme to obtain agriculture power connections and the metres were fixed for only tatkal connections.

Source: The Economic Times

Rebate to discoms only for 40 day complete lockdown: Power ministry

25 May. The rebate that state-owned power generators and transmission companies have offered to state discoms (distribution companies) is only a one-time contribution to support business continuity in an unprecedented situation and prevent litigations, the power ministry has said. The rebate was on fixed charges for power drawn by discoms during the 40 days of complete nationwide lockdown period, the ministry said. Almost all states have been drawing lesser electricity than normal during the lockdown period. Now, if the contracted capacity of a discom is 500 MW and it normally drew 400 MW but because of the lockdown it drew only 300 MW, then the discom will get a rebate of about 20 percent on the 300 MW for 40 days from concerned central public sector enterprises. But it will have to pay fixed charges for the remaining 200 MW. For the 100 MW that it usually drew but did not draw during the lockdown period, the discom can pay the fixed charges in three monthly instalments. The ministry had issued a revised advisory to central undertakings such as NTPC Ltd, NHPC Ltd, Power Grid Corp of India, and Damodar Valley Corp to forego up to a fourth of fixed charges they collect from state discoms for the lockdown period.

Source: The Economic Times

Three bids for Anil Ambani’s Delhi power distribution business

25 May. Italy’s biggest utility Enel Group is competing with homegrown private power producer-distributors Greenko and Torrent Power to acquire Reliance Infrastructure’s Delhi electricity distribution business. The Anil Ambani-led Reliance Group is looking to sell assets to pay off lenders. The unit is India’s largest in terms of consumers. Reliance Infrastructure had hired KPMG to find buyers for the 51 percent stake each it holds in BSES Rajdhani Power (BRPL) and BSES Yamuna Power (BYPL). The Delhi government owns the remaining 49 percent in both. The three submitted bids to comply with the deadline. Ambani sold the Mumbai city power distribution business to Adani Transmission Ltd for ₹188 bn in August 2018. Reliance Group and Tata Power supply power to about 93 percent of Delhi. The two BSES companies cater to 4.4 mn customers in the national capital, handling peak power demand of 4.8 GW. Last July, New Delhi touched an all-time high electricity demand of 7.4 GW.

Source: The Economic Times

Gujarat: Power consumption at 78 percent of normal, signals revival

21 May. Power consumption by industries and other users has touched 78.7 percent of the normal power consumption in the state, signalling the resumption of economic activity on a large scale in the state even as Lockdown 4.0 is being enforced. Going by the trend, in two or three days, the state government expects an increase in power consumption across the state as compared to the same period last year. With permission granted to industries in Ahmedabad and other cities which are out of containment zones to function, power consumption will further increase. On May 19 last year, Gujarat’s total power consumption was 16,176 MW, while on 19 May 2020, the total power consumption stood at 14,242 MW, which is 1,934 MW lesser.

Source: The Economic Times

Uttar Pradesh: Self-generate your power bill in lockdown

20 May. With hand held billing suspended during the lockdown, the energy department pitched for trust billing, that is, self-generation of electricity bill. Power Minister Shrikant Sharma said UPPCL (Uttar Pradesh Power Corp Ltd) has been receiving complaints that consumers are not getting bills because of the lockdown. For this, he said, the only solution would be trust billing wherein a consumer could generate electricity bill by logging on to UP energy department website www.upenergy.in. Under the process, a consumer has to create an ID and generate bill. The facility will be applicable for consumer having a load up to 9 kW. Sharma also emphasised on constitution of a helpdesk at the billing counters. Sharma said the department was also receiving complaints of consumers not being given electricity connections under Saubhagya scheme. Also, many applications under Jhatpat connection and Nivesh Mitr portal are pending. Sharma directed UPPCL chairman Arvind Kumar to get the applications disposed of under a set of guidelines.

Source: The Economic Times

India Inc powers up in a healthy sign

20 May. Power consumption in India is on the rise, reflecting a gradual improvement in economic activities after the government relaxed lockdown restrictions in regions with lower impact from the Covid-19 pandemic. According to the data from Power System Operation Corp (POSOCO), consumption rose by 11.6 percent to 3,297 mn units per day between 11 May and 17 May compared to the last seven days of the previous month. Northern and southern states showed visible improvements in business activity. Nearly two-thirds of the manufacturing companies in the BSE-200 index have restarted production at utilisation rates of 25-40 percent of their capacities. The plant utilisation of some of the consumer companies has improved to 80-85 percent compared with below 40 percent in the last week of March. The gap between regular and peak power consumption during 11-17 May narrowed to 12-15 percent year on year after companies restarted factories. The maximum demand for power rose by 14.7 percent to 1,46,657 MW during the period. Maximum power demand in the northern states of Punjab, Rajasthan, Delhi and Uttar Pradesh increased by 11-22 percent over the past seven days. The share of these four states to the total maximum demand rose to 25 percent compared with 20 percent in the pre-lockdown period.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Coal washing not mandatory for supply to thermal plants: MoEFCC

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Removal of mandatory coal washing will decrease efficiency and increase local pollution!

< style="color: #ffffff">Bad! |

23 May. Five years after the government, in laying down its climate-change targets, committed to have mandatory coal washing, the Ministry of Environment, Forests and Climate Change (MoEFCC) has done away with it. In a gazette notification, the ministry amended the Environment Protection Act to drop mandatorily washing coal for supply to thermal power plants. In 2015, as part of its climate-change commitments, the government had made coal washing mandatory for supply to all thermal units more than 500 kilometre (km) from the coal mine. The ministry in a separate policy proposal has asked the thermal power sector to source coal domestically. The ministry has instead directed thermal power plants to install the technology for handling ash content.

Source: Business Standard

ONGC, NTPC sign MoU to set up joint venture for renewable energy business

22 May. ONGC (Oil and Natural Gas Corp) and NTPC Ltd have signed a preliminary agreement to set up a joint venture company for renewable energy projects. ONGC and NTPC "entered into a Memorandum of Understanding (MoU) on 21 May 2020 in New Delhi to formalize this arrangement," ONGC said. The MoU will enable both companies to achieve their respective targets in renewable energy business. ONGC has a renewable portfolio of 176 MW comprising of 153 MW wind power and 23 MW of solar plants. Through this collaboration with NTPC, ONGC envisages significant growth in its presence in the renewable power sector. ONGC’s Energy Strategy 2040 document calls for the company to invest in renewable energy sources with a target to create 5-10 GW portfolio with a focus on offshore wind power. NTPC, with a 920 MW of installed renewable power capacity in its portfolio with about 2,300 MW of renewable energy projects under construction and aspiring to reach 32 GW by 2032, will benefit from this tie up by expanding its footprint in offshore wind and overseas renewable energy projects as well.

Source: Livemint

India’s solar tariff stabilises, lower than thermal power

22 May. The current tariffs in the Indian solar sector, hovering at ₹2.50-2.87 per kWh (kilowatt hour), have stabilised at rates 20 to 30 percent below the cost of existing thermal power in India, and up to half the price of new coal-fired power, a new study said. It concludes that the lucrative prices provide enormous opportunities to invest in clean, zero emissions solar industry. The study undertaken by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics compared domestic tariffs and the conditions enabling project returns, with the results juxtaposed against solar developer expectations.

Source: The Economic Times

Haryana gets its first grid connection biogas plant

22 May. Haryana’s first grid-connected 1.2 MW biogas-based power plant has been commissioned at a cost of about ₹140 mn rore in Morkhi village of Jind district in Haryana. The plant will have an annual power generation of 85 lakh units. The plant has been set up by Mor Bio Energy Private Limited and entire power will be purchased by the Haryana Power Purchase Centre at the tariff to be decided by Haryana Electricity Regulatory Commission (HERC). Ranjit Singh, Minister of Power and New and Renewable Energy, said a three-day trial run from March 11to 15 was done at 80 percent capacity by the joint team of power and new and renewable energy department. The main feed material of this plant is poultry litter and cow dung. It consumes nearly 180 tonne biodegradable waste per day and apart from electricity it produces nearly 15 tonne organic fertilizer per day, he said. He said the waste slurry of this plant contains f nitrogen and other nutrients and can be used as organic fertilizer for crop. Additionally, these projects will avoid release of methane gas in environment and mitigate the problem of pollution created by the poultry farms in the state.

Source: The Economic Times

India to have 70 GW of hydropower capacity by 2030

21 May. India will have an installed hydropower generation capacity of 70,000 MW by 2030, the MNRE (Ministry of New and Renewable Energy) joint secretary Aniruddha Kumar said. During the 5 April the team led by POSOCO (Power System Operation Corp) managed the fluctuation of 32,000 MW power demand with no hassles. Kumar said hydropower is required to meet the flexibility in case of increasing penetration of renewable energy into the grid. The country has around 13,000 MW of hydropower plants under various stages of construction and another 8,000 MW projects are in the pipeline which will commence construction in the next six to eight months. The current installed capacity of hydropower in the country stands at around 45,700 MW. India has an estimated hydropower potential of 145,000 MW at 60 percent plant load factor. The power ministry in its draft amendment of the Electricity Act has proposed to include hydropower within the renewable purchase obligation (RPO) targets set for the state power distribution companies.

Source: The Economic Times

Centre launches scheme to solarise entire Konark Temple, Konark town

20 May. The Ministry of New and Renewable Energy (MNRE) said the central government has launched a scheme for solarisation of Konark Sun Temple and Konark town in Odisha. The scheme envisages a 10 MW grid-connected solar project and various solar off-grid applications such as solar trees and solar drinking water kiosks. The MNRE has taken up the complete solarisation of Konark Sun Temple and Konark town in Odisha. The scheme envisages setting up of the 10 MW grid connected solar project and various solar off-grid applications such as solar trees, solar drinking water kiosks and off-grid solar power plants with battery storage, with a 100 percent central financial assistance (CFA) support of around ₹250 mn from the Government of India through the MNRE. Implementation of this project will be done by the Odisha Renewable Energy Development Agency (OREDA). The scheme will meet all the energy requirements of Konark town with solar energy.

Source: The Economic Times

MNRE issues draft guidelines for off-grid solar power plants scheme

20 May. The Ministry of New and Renewable Energy (MNRE) issued draft guidelines for implementation of off-grid solar power plants under the renewable energy service company (RESCO) model. In April 2020, the ministry had extended the off-grid and decentralised solar photovoltaic (PV) applications programme phase-III scheme till 31 March 2021. It said that under the extended scheme, off-grid solar power packs would be installed only under RESCO. According to the guidelines, off-grid solar power plants of individual size up to 25 kW can be installed in areas where grid power has not reached or is not reliable. Such plants are mainly aimed at providing electricity to government schools, hostels, panchayats, police stations and other public service institutions. The guidelines stated that under the RESCO model the vendor would install and operate the solar power plant of capacity up to 10 kW for at least 10 years and solar PV plants of capacity above 10 kW for at least 15 years. Solar power plants would be installed by the RESCO on a build, own, operate, transfer basis.

Source: The Economic Times

INTERNATIONAL: OIL

Russia sees global oil market balancing in June-July

25 May. Russia’s energy ministry sees global oil demand and supply balancing in the next two months, it said. Leading oil producers are due to hold an online conference in around two weeks on how to further police joint efforts to steady a global oil market hammered by overproduction and a demand drop linked to the coronavirus pandemic. The ministry said supply has already dropped by 14 mn to 15 mn barrels per day (bpd) thanks to the OPEC+ deal and output cuts in other countries. Russian oil production volumes were near the country’s target of 8.5 mn bpd for May and June.

Source: Reuters

Hard to predict oil prices as demand unclear: Iran’s Oil Minister

25 May. Iran’s Oil Minister Bijan Zanganeh said it was difficult to forecast crude prices amid uncertainties over prospects for demand, Iranian state radio reported. Oil prices rose, reversing earlier losses, as countries around the world continued to ease lockdown measures imposed to combat the coronavirus pandemic.

Source: Reuters

China’s 'hermit' investors fill doubled oil storage with crude bet

25 May. Chinese financial investors betting on a rebound in oil prices are filling commercial storage tanks held by the Shanghai futures exchange just as fast as the exchange can find them. Despite a more than doubling of storage capacity over the past six weeks to 57 mn barrels, with tanks sourced from state and private refiners, nearly all existing storage is set to be filled by end-June. The flood of purchases has come from companies little-known to the oil industry which have been bidding up Shanghai futures, China’s only oil futures contract, since early April when global oil prices slumped as Covid-19 hammered demand.

Source: Reuters

UK court throws out Nigerian oil corruption case against Shell, Eni

22 May. An English court threw out a $1.1 bn case Nigeria had brought against Royal Dutch Shell and Eni related to a dispute over the OPL 245 oilfield, saying it had no jurisdiction, a court document showed. The Nigerian government filed the case in 2018 at a commercial court in London alleging payments made by the companies to get the OPL 245 oilfield licence in 2011 were used for kickbacks and bribes.

Source: Reuters

Asian, European jet fuel margins rise on supply cuts, more flights

20 May. Asian refining margins for jet fuel turned positive for the first time in a month and European margins rose to the highest level in three weeks, bolstered by deep supply cuts and an uptick in flights in regional markets. The jet fuel refining margin in Singapore flipped to $1.83 per barrel above Dubai crude, in positive territory for the first time since 20 April. Measures imposed to curb the spread of the coronavirus have caused jet fuel demand to plunge since February, leading to refining losses of as much as $7.23 a barrel on 5 May. China Aviation Oil (CAO) has been bidding for jet fuel cargoes in the Singapore physical trade window this month, scooping 245,000 barrels, which represents half of the traded volumes in an otherwise subdued market.

Source: Reuters

INTERNATIONAL: GAS

Saudi to invest in Iraq’s Akkas gas field

23 May. Iraq’s Finance Minister Ali Allawi, who is acting oil minister, said the country had agreed to allow Saudi companies to invest in its western Akkas gas field. The Akkas field in western Anbar province and bordering Syria is Iraq’s largest.

Source: Reuters

INTERNATIONAL: COAL

German power utility Uniper’s Datteln coal plant set for 30 May start-up

26 May. German power utility Uniper’s new Datteln 4 coal-fired power station will begin operating on 30 May, it said. The 1,050 MW plant that has cost Uniper €1.5 bn ($1.65 bn) was granted an exemption from Germany’s plan to exit coal power by 2038 after the company argued that it made more sense to shut old capacity with high CO

2 (carbon dioxide) emissions to clear the way for state-of-the-art Datteln to operate into the 2030s. Environmentalists have criticised the compromise, saying the government lacked ambition and allowed coal operators to get off lightly.

Source: Reuters

Czech coal mine stops work after outbreak

26 May. A coal mine in northeastern Czech Republic near the border with Poland has halted work after a major Covid-19 outbreak among the miners. In recent days, tests of some 2,400 people revealed a total of 212 positive for coronavirus, mostly miners from the Darkov mine in the town of Karvina and their family members.

Source: The Economic Times

China to slash H2 coal imports to back domestic miners

20 May. China is expected to tighten coal import rules in the second half of 2020 to shore up its struggling domestic industry, after record arrivals in the first four months, just as demand tanked because of the coronavirus outbreak. Imports could drop as much as a quarter in the second half from the corresponding 2019 period, analysts estimate, which is likely to boost pressure on major coal exporters, such as Australia, Indonesia and Russia, which are already battling weak demand because of the virus. China’s total thermal coal consumption may reach 1.9 billion tonnes (bt) from July through December, Wood Mackenzie said. IHS Markit estimates China’s full-year coal imports could fall to 275 million tonnes (mt), with thermal coal plunging about 20 percent on the year, but seaborne metallurgical coal arrivals seeing a slight pick-up. China’s National Coal Association expects demand to decline in the second quarter on the year, after a fall of 6.8 percent in the first quarter as the virus shut industrial plants. Chinese coal miners have cranked out record output in 2020 in response to Beijing’s call to ensure energy supplies, but the flood of imports, coupled with lower consumption, slashed profit margins by 30 percent in the first quarter.

Source: Reuters

INTERNATIONAL: POWER

Thousands without power in Western Australia after once in a decade storm

25 May. Wild weather downed trees and left tens of thousands of people without power in Western Australia, as emergency services began cleaning up in Perth after some of the worst weather in a decade. Around 50,000 customers were without power due to storm-related outages, utility Western Power said, as the remnants of Cyclone Mangga hit a cold front and brought squalling rain and emergency level storm warnings to the south of the state.

Source: Reuters

Mexico ready to negotiate over power market shake-up

22 May. Mexico’s President Andres Manuel Lopez Obrador said he was ready to negotiate over changes to the electricity market that angered firms and foreign allies, opening the door to a potential compromise that could ease tensions over energy policy. President has vowed to strengthen the state’s role in energy production, saying previous “neo-liberal” governments handed too much control to the private sector at the expense of consumers. The President has pledged to revive state oil firm Petroleos Mexicanos (Pemex) and national power company the Comision Federal de Electricidad (CFE). The electricity dispute follows a spat last year over several natural gas pipeline contracts the government said were costing Mexico too much. After weeks of talks, the dispute was resolved under revised terms the government said would benefit taxpayers.

Source: Reuters

Lebanon seeks foreign government-backed financing for power plants after default

20 May. Lebanon has turned to global power plant manufacturers including General Electric to arrange financing to build badly needed electricity capacity, hoping favourable terms can be agreed with help from their governments. Energy Minister Raymond Ghajar said that Lebanon had modified its approach to the process since it defaulted on its sovereign debt in March, meaning it was unable to offer the kind of sovereign guarantee sought by investors. Fixing the loss-making power sector is seen as critical for the country which is mired in a financial crisis seen as the biggest threat to its stability since the 1975-90 civil war. The country has failed to provide 24-hour power since the war, leaving households reliant on expensive private generators.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

German luxury automaker Daimler aims for worldwide carbon-neutral production by 2022

25 May. German luxury automaker Daimler announced tougher carbon emissions targets, saying it aimed to reach carbon dioxide-neutral production of passenger cars worldwide by 2022. The carbon goal previously had just applied to Europe.

Source: Reuters

Australia shows how policy can stifle renewable energy future

25 May. One of the themes emerging as the world looks to recover from the coronavirus pandemic is that this is a once-in-a-lifetime opportunity to reboot the global energy system and embrace a future of renewables. But the current debate in Australia over energy policy and emissions shows that in the absence of supportive, or even neutral, government policies, achieving the goal may be difficult. In theory it’s hard to find a country more suited to switching to renewable power than Australia, given its long hours of sunshine for solar power and extensive coastline suitable for wind power developments. Two recent developments have underscored just how deeply enamoured the conservative Liberal-National coalition of Prime Minister Scott Morrison is of the fossil fuel industry.

Source: Reuters

China to allocate $57 bn to environment protection

22 May. China’s finance ministry will allocate a total of 407.3 bn yuan ($57.22 bn) to ecology and environment protection in 2020, up from 390.6 bn yuan last year. From this total, 25 bn yuan will be allocated to air pollution prevention and control, 31.7 bn yuan to water and 4 bn yuan to soil protection. China will also promote the official launch of the national green development fund, and step up efforts to establish trans-regional compensation mechanisms for ecological conservation in the Yangtze and Yellow river basins, the ministry said.

Source: Reuters

OPEC producer Algeria aims to build $3.6 bn solar power projects