-

CENTRES

Progammes & Centres

Location

Contemporary globalisation led to an expansion of economic activities that heightened the energy demand across the developing world. This was essentially to satiate the ‘growth-fetishism’ of the countries aiming for a ‘not-so-stable’ convergence with the advanced nations! As mankind continuously strives to find a tradeoff between present gains and inter-generational equity, the importance of energy is bound to rise. The big question that however remains is, what can drive efficient energy production and its optimal consumption?

According to many experts there are two contrasting views on the effect of financial development on energy efficiency. Firstly, it can be assumed that a rapid advancement in the financial sector of an economy would lead to an increase in the purchasing power of the people towards energy intensive commodities that leaves a high carbon footprint. On the contrary, it also has to be noted that a progressive financial system would not only allow for larger credits to the renewable energy sector, but also induce people to invest in higher priced, energy efficient commodities due to their higher incomes.

Moreover, FDI can lead to the market penetration of more energy efficient production technologies which enhances the competition among the domestic producers to invest and innovate in order to compete with foreign firms.

The premise of this article lies in the World Bank definition of Financial Inclusion which “means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way” and more importantly, the World Bank strongly acknowledging that financial inclusion is identified as the key enabler of the Goal 7 (Affordable and Clean Energy) of the UN Sustainable Development Goals 2015. In the context of application of energy efficient methods financial inclusion has a major role to play, both at the micro and macro level. At the scale of a rural Indian community for example, the key aspects of financial inclusion such as access to banking services, availability of credit, efficient insurance systems and the dissipation of FDI benefits via modernized financial machinery will induce the technologically backward classes to employ energy efficient techniques of production and consumption. Moreover, rural financial institutions also play a very important role in awareness of energy efficient campaigns.

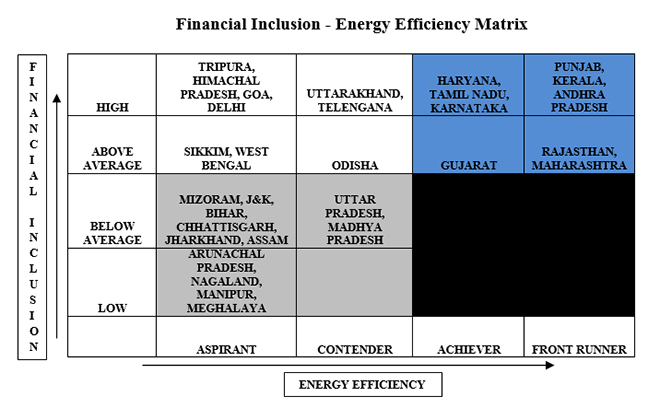

In this background we can devise a matrix analysis that decodes the current status of the Indian states in terms of an intersection between energy efficiency and financial inclusion. The vertical axis denotes the categories of Level of Financial Inclusion 2016 of the Indian states computed by CRISIL (CRISIL Inclusix) based on four critical dimensions of the financial system, namely, branch penetration, credit penetration, deposit penetration and insurance penetration. The horizontal axis denotes the categories of State Energy Efficiency Preparedness Index 2018 published by the Alliance for an Energy Efficient Economy (AEEE) under the leadership of Bureau of Energy Efficiency (BEE) and NITI AAYOG, which uses 59 indicators of energy efficiency across five sectors and four cross-sector indicators.

The absence of states in the black zone in the above matrix, affirms that financially inclusive development is important in attaining energy efficiency.

In other words, a state at a very low level (or below average level) of financial inclusion ceases to find a position at a high level of energy efficiency. However, the reverse is not true: the white zone represents states which are in a low level of energy efficiency but at a high level (or above average level) of financial inclusion. The grey zone denotes the states in worse situation while the blue zone represents states in the best situations in terms of both financial inclusion and energy efficiency. We see, the states of Punjab, Kerala and Andhra Pradesh are in advanced positions in terms of both energy efficiency and financial inclusion, while the states of Arunachal Pradesh, Nagaland, Meghalaya and Manipur are in the lowest category with much room for improvement. The road to a stage of high energy efficiency is from the grey region to the blue region via the white zone and not via the black zone, establishing the importance of a structural change with regard to financial systems to achieve energy efficiency. The latter states need to focus on their financial systems and institutional inclusiveness in order to stimulate better performance with regard to the energy sector.

The Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) is a benchmark scheme launched by the Government of India in 2015. It is an embodiment of the targets highlighted by SDG 7, that is, inclusivity and access in terms of clean and affordable energy. The causation of financial inclusion on energy efficiency can be further substantiated by a linear regression exercise on available state wise data in India. It is observed that the CRISIL Inclusix scores (2016) positively contributes to the percentage of households electrified under DDUGJY (2017) as highlighted by the positive sign of the slope coefficient (0.314). A time lag of one year is allowed to better understand the effect. At the same time, the slope coefficient is statistically significant at 1% level. Its robustness is reflected by the R2 (0.500) and the adjusted R2 (0.476) values. This further strengthens our stance that greater access to financial services essentially facilitates the growth in income, its efficient mobilization and effective policy implementation in terms of cleaner energy measures, especially at the rural scale.

The public-sector financial institutions are spearheading efforts to revolutionize energy efficiency in their institutions and to develop financial instruments for a particular range of energy efficiency projects.

This is essentially due to the instruction and resources provided by the Government that enable them to offer grant finance for technical services such as energy efficiency audits and lower interest rate credit. On the other hand, private-sector financial institutions too have sustainability commitments and renewable energy lending programmes. But it is still difficult for these institutions to get the level of scale and financing ability required to model these particular energy efficiency projects as commercially attractive. Apart from the US, there was little evidence of dedicated activities by private-sector financial institutions in this field.

Although, financial development is more correlated with the functioning of the capital markets and the FDI inflow of a nation, the aspect of financial inclusion is what will drive energy efficiency in rural India. A shift in policy focus may be needed in current times to develop financial systems at the grass root level in order to enhance access to cleaner energy.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +