India has the second largest urban population in the world and this is expected to double by 2050, with the addition of 416 million people. Concurrently with 70 percent (IFC estimates) of the buildings (housing, retail, commercial, hospitality and health) needed by 2030 still to be constructed, India’s construction sector is at an inflection point – an opportunity for energy efficiency expansion by building green.. Residential and commercial buildings in India account for 30 percent of the energy consumption. This is expected to increase to 48% by 2042. Given that certified green buildings can deliver energy savings between 20-30 percent and water savings of up to 30-50 percent, India should attach greater importance to high-performing green buildings, as it strives to reduce green house emissions by 33-35% (from 2005 levels).

The regulatory framework for green buildings is evolving.The National Building Code 2016, which regulates construction activity, now incorporates the Energy Conservation Building Code (ECBC) developed by the Bureau of Energy Efficiency (BEE). The 2017 development on the ECBC prescribes a minimum standard for energy use in new commercial buildings. For existing buildings, BEE has taken up the task of institutionalizing energy efficiency services and energy efficiency delivery mechanisms, such as a market for Energy Service Companies (ESCOs). Design guidelines for Energy Efficient multi-storey residential buildings have been launched as well.

Certification and rating system for green buildings have also taken root. The BEE Buildings Star Rating System rates buildings on a five-star scale based on actual performance in terms of energy usage (in kWh/sqm/year). Beyond this, two other rating systems are operating: (i) Green Rating for Integrated Habitat Assessment or GRIHA, and (ii) Leadership in Energy & Environmental Design or (LEED). GRIHA is India’s own rating system, jointly developed by TERI and the Ministry of New and Renewable Energy, whereas LEED is developed by the U.S. Green Building Council (USGBC).

As per Anarock properties, approximately 5% of the buildings in India are green.. Maharashtra, Tamil Nadu and Karnataka take the top spots in the number of green (LEED certified) building in their state. States including Andhra Pradesh, Bihar, Haryana, Maharashtra, Punjab and Uttar Pradesh provide incentives such as increased Floor Area Ratio (FAR), subsidy on fixed capital (excluding cost of land, land development, preliminary and preoperative expenses and consultancy fees) and discounts on municipal taxes for buildings which classify as green. In terms of financing green buildings, limited products (green home loans offered by a few banks) and programs (IFC’s EDGE program) operate in India.

Green architecture, whichis currently a trillion dollar market, presents an important opportunity for India. The IFC estimates a $1.4 trillion opportunity for India (residential sector: $1.25 trillion, commercial: $228 billion). Second, The World Green Building Council estimates that green buildings could generate higher returns: additional costs could be lower by 0.5 percent to 12 percent, operational costs can go up to 37%, green buildings could achieve sales premiums of upto 31 percent and faster sales times, occupancy rates could be higher by 23%, and rental income by up to 8 percent. Finally, green buildings may help mitigate the risks associated with a transition to a lower carbon economy.

Despite this, green real estate has not received the warranted attention by investors. This is due to several market barriers which include: (i) information asymmetry (degree assurance of the green component), and (ii) limited financial products and instruments.

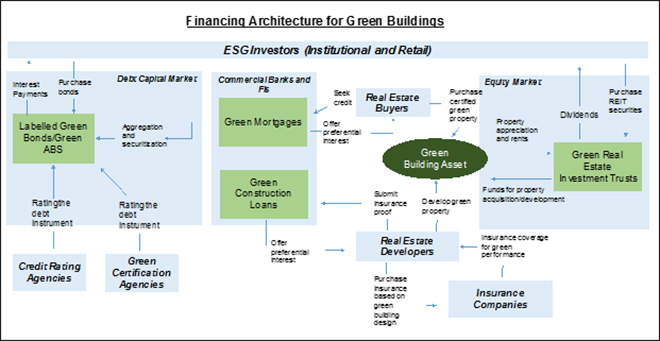

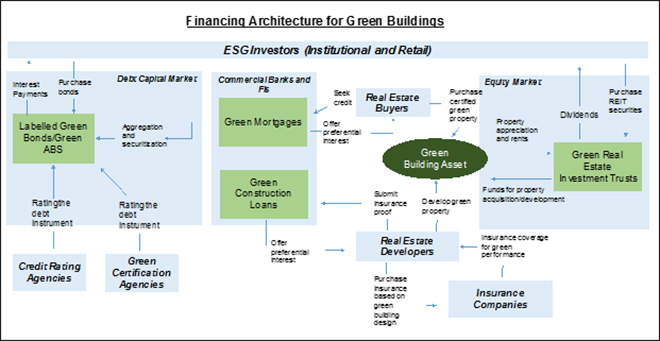

ESG investments (an investment class that places due importance to Environmental, Social and Governance aspects) are on the anvil in India, and products including ESG mutual funds, exchange traded and index funds are already operating. As the ESG investment class gains momentum, a well diversified financial ecosystem that brings together all players (investors, debt and equity markets, credit rating agencies, green rating/certification agencies, developers and end users) supported by an array of innovative and market based financial modalities, can catalyze ESG investment flows (both institutional and retail) in the area of green realestate. An illustrative financial architecture for financing green buildings is shown below:

Green Mortgages and Green Construction Loans from Commercial Banks and NBFC’s

As financiers to both developers and end users, commercial banks and Non Banking Finance Companies (NBFCs) could be the lynch-pin of the green building financial architecture. Some Indian banks already support green mortgages: these provide a money-saving discount or a bigger loan than normally permitted as a reward for green retrofits, or for buying a home a certified green home. Housing loans are already covered under the priority sector lending (PSL) guidelines of the RBI and the possibility of including green mortgage as a sub category under PSL norms could be explored. To incentivize property buyers, banks could explore linking home loan interest rate to the star rating/certification of the property. The higher the star rating the lower the interest rate.

As important sources of funds for developers, banks and NBFC’s can incentivize green construction by offering concessional construction finance based on the green rating of the building design. The challenge here is twofold: (i) the performance mismatch between the building design and operation (green design performance estimates and actual could vary) and (ii) the term mismatch between the credit issuance and performance verification. To mitigate this anomaly, China has tested an insurance model where the property developer buys an insurance policy before construction to ensure a building’s green performance after construction. The banker issues green credits based on the insurance policy. Once the building is constructed and occupied, the insurance company is liable to repair or pay if performance ratings do not meet the original promise. The government also subsidizes the insurance cost.

Green Bond/Mortgage Backed Securities to tap scale credit for green buildings

To scale up the credit for green buildings the green bond market can be tapped by issuing asset back securities where the underlying assets are the green mortgages and green construction loans. To make the product sufficiently attractive for ESG investors, the ABS or the green bond could have a credit rating and a green certification. The Federal National Mortgage Association or US-based Fannie Mae, is a leading provider of Mortgage Backed Securities (MBS). Fannie Mae’s Green MBS (backed by green certified properties) issuances have increased 12 percent to $22.8 billion in 2019, totaling $75 billion since the program's inception in 2010.

Green Real Estate Investment Trusts to tap equity investments

A Real Estate Investment Trust (REIT) is a company that owns and typically operates an income generating real estate asset. The securities of REITs are traded on stock exchanges. A green REIT that invests in green property could be a viable option for ESG equity investors. India’s first REIT, backed by Embassy Office Parks and The Blackstone Group, came out in March 2019. By December 2019, the REIT had gained 50% from its listing price, signifying a notable appetite for REIT’s.

Conclusion

It is clear that green buildings should play a greater role in India’s climate change discourse. For mainstreaming green real estate in the built environment, finance will play a catalytic role. To support green buildings, a few research priorities and objectives could be:

- the development of a robust regulatory and policy framework with incentives and guidelines for both the green construction and the financial sector.

- the identifcation and improvement of green credit for real estate.

- the assessment of various financial modalities for suitability to the Indian market; this should be followed by a study of international best practices.

- the strengthening and adaption of the rating and green certification mechanism for application in the financial sector.

- the development of a mechanism to track financial flows in green construction.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV