-

CENTRES

Progammes & Centres

Location

The Union Finance Minister surprised many with his social sector-centric budget. No one expected the Modi government to go for enhancing the MNREGA by Rs 5000 crore or to have a huge kitty of subsidies ($37 billion) aimed at the poor. There seems to be a vision towards giving India a universal social security system for all and especially the poor.

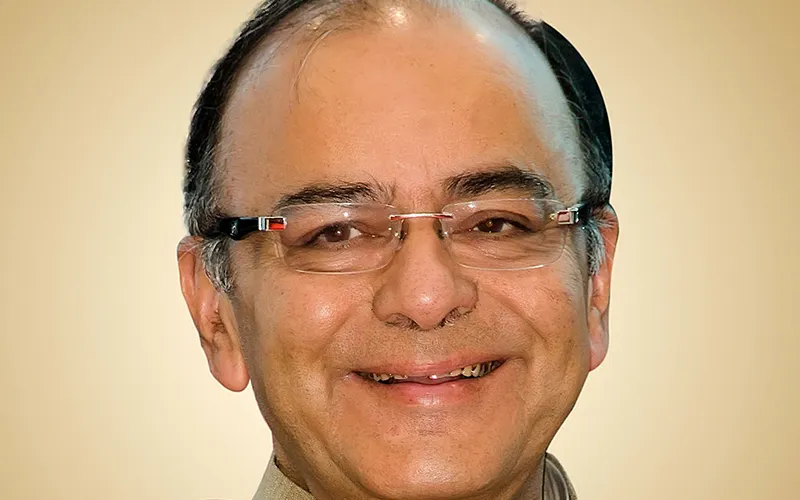

Finance Minister Arun Jaitley surprised many with his social sector-centric budget. No one expected the NDA government to go for enhancing the MNREGA by Rs 5000 crore or to have a huge kitty of subsidies ($37 billion) aimed at the poor. He is still going to meet the fiscal deficit requirement of 3.9 per cent next year. There seems to be a vision towards giving India a universal social security system for all and especially the poor. For a corporate friendly Prime Minister, this has been somewhat unusual.

Mr. Jaitley has focused on rural infrastructure and rightly so because 60 per cent of India's population lives in villages. Villageroads, electricity, access to irrigation are of great importance to the rural population. He has allocated Rs 25, 000 crore for village infrastructure. There will be 4 crore new houses in rural India. Moreover 20,000 villages remain unconnected to electricity. These habitations are going to be connected with roads and solar power by 2020. Also, he has promised medical facility in each village, skill training of youth, upgrading of village schools. Agro industries and irrigation facilities in rural India will be enhanced.

The previous government also focused on many of these things but we do not know how much was achieved because the state of the villages is still quite dismal. It is heartening to note that the Modi government has renewed the focus on rural India. Mr. Jaitley has looked at rural infrastructure afresh, giving it more funds in areas where it is most needed.

Along with his words about the plight of the poor in India who are without any kind of pension or insurance, Mr. Jaitley announced pension and insurance schemes that are quite new and can have universal coverage in the future.

People from low income groups can now have insurance cover of Rs 2 lakhs on death due to natural causes or accident by just paying Rs 12 a year. There is also Atal Pension Yojna which will provide a defined pension depending on the contribution and the period of contribution. The government will contribute 50 per cent of the beneficiaries' premium limited to Rs 1000 each year for five years. Yet another scheme is about insurance cover of Rs 2 lakhs for people of working age, between 18 and 50, with a premium of Rs 330 a year which is less than a rupee a day.

With unclaimed PPF and EPF, the FM has proposed the creation of Senior Citizen Welfare fund. Also there is tax exemption for health insurance up to Rs 30,000 for senior citizens.

There will be 6 crore new toilets in rural and urban areas. It is a good preventive health measure. The mid-day meal scheme has also got a boost as it is now quite clear that such meals often are the only meal a child has in the day.

Welfare schemes for SCs, STs and women have got more funds. For SCs, Rs 30,851 crore, ST, Rs.19,980 crore, for women Rs 72,258 crore. For education and livelihood scheme for minority youth, there will be Nai Manzil to find better employment.

There are of course various things to make corporate sector happy - the corporate tax has been reduced from 30 per cent to 25 per cent which will be done over four years but along with it there will an end to all the exemptions by which companies try to reduce their tax burden.

He has also focused on improving the 'Ease of doing Business'. Various changes are going to help companies wanting to establish base in India. Also he is going to establish an 'Alternative Investment Fund' where foreign investors can invest thus doing away with the distinction between FII and FDI.

Business expectations are determined by the inflation outlook. Jaitley has promised to keep inflation low (below 6 Per cent) and also pointed out that the rupee had stabilized and India had a huge foreign exchange reserve of $340 billion. He has reduced custom duty on 22 items and hopes GST will be in place on April 1, 2016. He also wants to bring in a new bankruptcy code. The disinvestment program is to be continued and Rs. 41,000 crore is the target though with strategic sales it will be Rs 69,000 crore.

For Make in India programme to take off the FM has reduced the custom duties on 22 items.

For medium and small enterprises, credit access has been increased which will take care of overcoming their biggest hurdle. His emphasis on developing infrastructure will benefit all business, big and small. He has allocated Rs. 70,000 crore for infrastructure. He has also proposed 5 ultra mega power projects for 4000 MW each. Ports in public sector will be encouraged to corporatize under the companies Act.

The money for the budget will come from borrowings and increase in revenue from indirect taxes because with higher growth, revenue generation will be bigger. The fiscal deficit target for next year at 3.9 per cent will be met but for the next four years, the target of 3 per cent will be phased out so that there is fiscal space to increase investment in infrastructure. The revenue deficit has been reduced to 2.8 per cent.

The middle class is unhappy because Mr. Jaitley did not change the income tax slabs. He has, however, abolished the Wealth Tax and replaced it with a 2 per cent surcharge on the super-rich. The middle class will also not be happy when they find that all services (except Yoga) will be costing more. The service tax rate and education cess has been raised from 12.30 per cent to 14 per cent. He did not suggest steps to widen the tax base especially when the tax GDP ratio is a dismal 17 percent. Quite surprisingly, petrol and diesel prices have been hiked on the next day after the Budget.

The 2015-16 Budget has tried to introduce harsh penalty for black money. It has also laid a road map for double digit growth. Mr Jaitley is lucky because the Indian economy is on an upswing. On the whole he has tried to be development oriented rather than purely growth oriented.

(The writer is a Senior Fellow at Observer Research Foundation, Delhi)

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

David Rusnok Researcher Strengthening National Climate Policy Implementation (SNAPFI) project DIW Germany

Read More +