Quick Notes

Beating discoms with the same stick

Outline of the Revised Scheme

In June 2021, the ‘reforms-based and results-linked, revamped distribution sector’ (RRRD) scheme was approved by the government for revival of distribution companies’ (discoms) finances. The scheme seeks to improve the operational efficiencies and financial sustainability of all discoms (excluding private sector discoms) through conditional financial assistance for strengthening of supply infrastructure. Several financial criteria and basic minimum benchmarks provide the framework that will qualify discoms for assistance. According to the government, implementation of the scheme will be based on the action plan worked out for each state rather than a “one-size-fits-all” approach.

The scheme has an outlay of over INR 3.03 trillion with an estimated gross budgetary support (GBS) of over INR 976 billion from the central government over a period of five years from FY 2021–22 to FY 2025–26. The ongoing projects under Integrated Power Development Scheme (IPDS), Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), Prime Minister’s Development Package (PMDP-2015) for the union territories of Jammu & Kashmir (J&K) and Ladakh and Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan (PM-KUSUM) Scheme would be subsumed into this umbrella programme. Rural Energy Corporation (REC) and Power Finance Corporation (PFC) have been nominated as nodal agencies for facilitating implementation of the scheme. Objectives of the scheme are:

- Reduction of aggregate technical & commercial losses (AT&C) to pan-India levels of 12–15 percent by 2024–25.

- Reduction of average cost of supply-average realisable revenue (ACS-ARR) gap to zero by 2024–25.

- Developing institutional capabilities as modern discoms

- Improvement in the quality, reliability, and affordability of power supply to consumers through a financially sustainable and operationally efficient distribution sector.

Under the scheme, eligible discoms would be provided financial support for upgradation of the distribution infrastructure and smart metering systems for the network as well as prepaid smart metering systems for consumers. The funding for works other than prepaid smart metering and system metering would be contingent upon discoms meeting the criteria and achieving at least 60 percent marks on the result evaluation matrix formulated based on action plans for loss reduction and work plans of discoms agreed upon by the centre.

The scheme relies heavily on technology to address financial problems of discoms. Implementation of prepaid smart metering will use public-private-partnerships (PPP) mode. Artificial intelligence (AI) will be leveraged to analyse data generated through IT/OT (information technology/operational technology) devices including system meters and prepaid smart meters to prepare system generated energy accounting reports every month. This is expected to enable discoms to take informed decisions on loss reduction, demand forecasting, time of day (ToD) tariff, renewable energy (RE) integration, and for other predictive analysis. As part of system strengthening, supervisory control and data acquisition (SCADA) would be set up in all urban areas and distribution management systems in urban centres. The scheme will focus on improving electricity supply for the farmers through separation of agriculture feeders and for providing daytime electricity to them by convergence with the PM-KUSUM scheme for solarisation of agriculture feeders.

Issues

RRRD is the latest amongst a long list of programmes launched for financial revival of discoms over several decades. Concern over SEB (State Electricity Boards now called discoms) finances started with the fourth five-year plan (1969-74) that called for interventions to limit losses. Since then, every plan document discussed the issue of deteriorating SEB finances. A series of SEB reconstruction and revival plans were implemented by various governments but almost all failed. The recent bailout packages from the union government, FRP (financial restructuring plan) in 2013 and UDAY I & II (Ujawal Discom Assurance Yojana) in 2017 and 2020 also failed to bail out discoms. Under UDAY, some progress was reported on parameters such as AT&C losses and revenue gap but broader structural issues that undermined commercial viability of discoms remained unchallenged. As pointed out by the Reserve Bank of India (RBI) , transfer of discom liabilities to the state budget under UDAY contributed to fiscal slippages that undermined both distribution reforms and energy access policies in the long term.

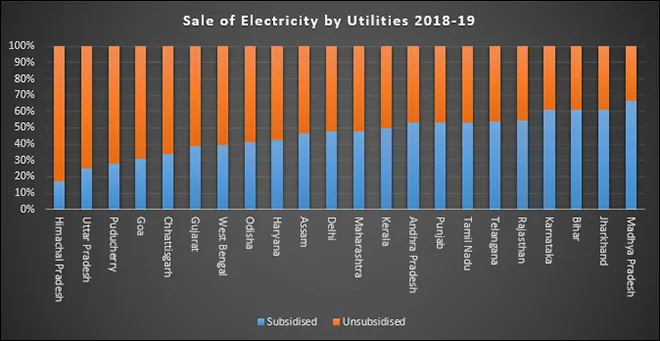

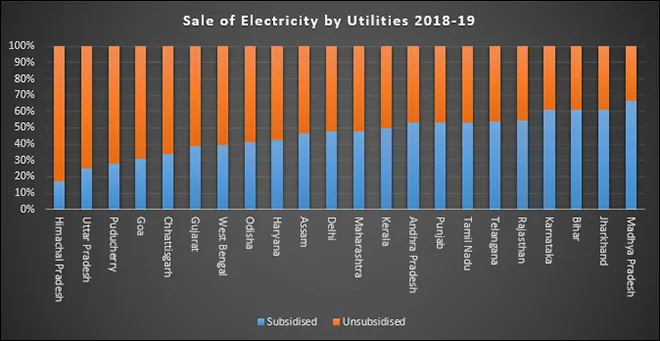

The likelihood of RRRD succeeding where others failed is low primarily because the scheme is very similar to the earlier schemes that offered financial incentives to discoms that made efficiency gains. Though designers of the scheme have stated that it shuns the ‘one-size fits all approach’ it does use the same parameters to measure progress of all discoms. Unfortunately, all discoms are not the same. Discoms that are rated as good performers based on financial and technical efficiency parameters such as those chosen for RRRD have more commercial and industrial consumers than agricultural and household consumers. Gujarat discoms are rated with A+ indicating very high operational and performance capability and the Tamil Nadu discom is rated with C indicating very low operational and performance capability. But this does not capture differences in demand profile. Domestic load is less than 15 percent in Gujarat compared to nearly 40 percent in Tamil Nadu. Industrial load that carries the highest tariff is nearly 60 percent in Gujarat and just 15 percent in Bihar whose discoms are rated with C+, just a notch above C.

With exclusive focus on technical and financial parameters the RRRD does not address consumer concerns such as quality of service. It also does not consider imbalances between discoms such as the burden of renewable energy purchase obligations (RPO) falling heavily on southern discoms with about 50 percent renewable energy generation capacity is concentrated in the region. The provision that installation of smart and pre-paid meters will depend on discom performance may delay the or postpone the installation of this equipment that can substantially improve billing and collection efficiency. Efficiency gains are reported where electricity distribution is handled by private companies under a licence such as in Delhi or under a franchise such as in Odhisa and Maharashtra. But these operate primarily in urban areas with substantial state assistance and the possibility of replicating this model in large states with significant rural and agricultural load is limited. There is also the possibility of centrally monitored schemes favouring discoms in states that are ruled by the same party as that in the centre and discrediting discoms that are ruled by regional and other parties.

A recent report from Niti Aayog on distribution reforms recommends creation of regional electricity regulatory commissions with participation from the central government above state electricity regulatory authorities to limit political interference on regulatory functions. It is not clear how this additional layer of bureaucracy will address the key issue of political influence on regulatory functions. It is well known that even the party ruling at the centre does not resist the temptation to limit electricity tariff increases when it faces elections at the state level. This is the key issue that undermines all efforts to “reform” discoms. The upside of tariff concessions announced by political parties accrues to the party in the form of electoral gains while the downside is passed on to discoms that grapple with mounting losses and a C rating. Unless this fundamental reality is addressed, reform of discoms may become a routine exercise that no one takes seriously.

Sources: Power Finance Corporation, Report on the Performance of State Power Utilities, 2018-19; Note: Subsidised category includes household and agricultural load, unsubsidised category includes commercial, industrial and other load

Sources: Power Finance Corporation, Report on the Performance of State Power Utilities, 2018-19; Note: Subsidised category includes household and agricultural load, unsubsidised category includes commercial, industrial and other load

Monthly News Commentary: Natural Gas

Domestic Gas Production Perks Up

India

Production

India’s natural gas production jumped 19.5 percent in June, as Reliance Industries Ltd (RIL) and its partner BP Plc ramped up output from their eastern offshore KG-D6 block. India produced 2.77 billion cubic meters (bcm) of natural gas in June, up from 2.32 bcm in the same month last year. RIL is the operator of block KG-DWN-98/3 or KG-D6 in the Krishna Godavari basin, off the east coast. The firm started producing from the second wave of discoveries in the block in December. D-34 or R-Series was the first field to start, followed by Satellite Cluster. Peak production from R-Cluster will be 12.9 million metric standard cubic meter per day (mmscmd), according to the operators. Satellite fields would produce a maximum of 7 mmscmd. MJ field in the same block will start production in the third quarter of 2022 and will have a peak output of 12 mmscmd. The production from KG-D6 more than made up for a fall in the output from fields operated by Oil and Natural Gas Corporation (ONGC)’s. ONGC produced 5.6 percent less gas at 1.68 bcm.

Demand

India’s natural gas consumption will rise 4.5 percent while global demand will rebound by 3.6 percent in 2021, the International Energy Agency (IEA) has forecast. By 2024, the global gas demand is forecast to be up 7 percent from 2019’s pre-COVID levels, according to the IEA’s latest report. Global demand dropped by 1.9 percent in 2020 due to an exceptionally mild winter in the northern hemisphere and the impact of the COVID-19 pandemic. COVID-linked lockdowns and high LNG (liquefied natural gas) prices hurt demand also in the second quarter.

LNG

Makers of Ayurvedic medicines from the city, Shree Baidyanath, has diversified into LNG sale. The company will be inaugurating the country’s first commercial LNG filling station in the Nagpur city in Maharashtra. Located at the outer ring road towards Dighori, it has a capacity of 23 tons and will be catering to LNG driven vehicles along the national highways around Nagpur. At present, the only dispensation station is at Dahej in Gujarat.

CGD/CNG

For the second time in six months, the Mahanagar Gas Ltd (MGL) announced hike in prices of Compressed Natural Gas (CNG) and Domestic Piped Natural Gas (PNG) for Mumbai and surrounding areas, with effect from midnight 13–14 July. The rate of CNG—used in over 800,000 vehicles—has been hiked by INR 2.58/kg, taking it up to INR 51.98/kg, raising fresh fears of a corresponding increase in the fares for public transport vehicles. The price of domestic PNG has been increased by INR 0.55/Standard Cubic Metre (SCM) and the new rates will be INR 30.40/SCM in Slab 1 and INR 36/SCM in Slab 2, for the 800,000-plus customers in the Mumbai Metropolitan Region. However, as per the MGL despite the fresh revision in prices of CNG—to offset operational costs and increase in gas pipeline transportation costs, it is around 67 percent and 47 percent cheaper than petrol and diesel, respectively.

Policy & Governance

The former Chief Minister of Tamil Nadu urged the current Chief Minister to prevent GAIL (India) Ltd from laying gas pipelines through farm lands. GAIL is laying its gas pipeline on farm lands in Krishnagiri district, much against the wishes of the farmers. Projects are for people and not people for projects. GAIL is laying a pipeline to carry gas from Kochi in Kerala to Bengaluru via several western districts in Tamil Nadu (Coimbatore, Tirupur, Erode, Namakkal, Salem, Dharmapuri, and Krishnagiri). While the pipelines are laid along the highways in Kerala, the company wants to lay the pipes through the farm lands in Tamil Nadu.

Rest of the World

USA

Global Infrastructure Partners (GIP) has put up for sale its 26 percent stake in the limited partnership behind Freeport LNG, the second-largest export facility for LNG in the United States (US). It paid US $850 (INR 63,000) million (million) for the stake in 2014, before the Freeport LNG site began exporting gas and generating revenue. Originally envisioned as an import terminal, Freeport LNG was converted into an export facility once the US shale gas boom took off. Situated on Quintana Island off the Texas coast, exports began in 2019, with its three production units providing 15 million metric tonnes per year of liquefaction capacity. A fourth unit is planned, according to Freeport LNG.

US and Germany failed to settle their dispute over Russia’s Nord Stream 2 natural gas pipeline but agreed that Moscow must not be allowed to use energy as a weapon to coerce its neighbours. US expressed its long-standing concerns to Germany about the US $11 (INR815) billion (billion) pipeline, which would deliver gas from the Arctic to Germany via the Baltic Sea, bypassing Ukraine and depriving it of valuable transit fees. Washington is pressing Germany to find ways to ensure that Russia could not use the pipeline to harm Ukraine or other allies in Eastern Europe. The US recently waived sanctions against German companies involved in the project, raising hopes in Berlin that an agreement acceptable to all sides can be found. Germany is keen to increase its use of natural gas as it completes the shutdown of its nuclear power plants next year and phases out the use of heavily polluting coal by 2038.

Royal Dutch Shell Plc plans to leave Aera, its California-based oil and gas-producing joint venture (JV) with Exxon Mobil Corp. Shell has divested numerous carbon intensive assets this year, selling its refinery in Washington state to Holly Frontier Corp and its stake in a Houston-area refining joint venture to Petroleos Mexicanos as it shifts new investments to renewables and power. Aera produces about 125,000 barrels of oil and 32 milion cubic feet (mcf) of natural gas each day, accounting for about 25 percent of the state’s oil and gas production. California still produces roughly 360,000 barrels of oil per day (bopd) even as it has introduced the most stringent state-level rules on greenhouse gas emissions.

Russia & the Far East

Mongolia, land-locked between two countries—Russia and China, could soon serve as an important transit country for Russian natural gas and its related supply chains. Once completed, the Soyuz Vostok gas pipeline will become an extension of Russia's Power of Siberia 2 natural gas pipeline in Mongolian territory. In other words, this ambitious project is meant to provide supplies of Russian gas across Mongolia and into China.

Kremlin-controlled gas giant Gazprom has held off from booking additional capacity for gas supplies via Ukraine to meet surging demand in recent months, sending a clear sign it is waiting for the Nord Stream 2 pipeline to be commissioned. Nord Stream 2, which runs on the bed of the Baltic Sea from Russia to Germany, bypassing Ukraine, has faced criticism from the United States, will increase European reliance on Russian gas. Washington imposed sanctions on the project in 2019, slowing its progress. The project is set to double the annual capacity of the existing Nord Stream pipeline to 110 bcm, more than Russia’s total gas exports to Europe for half a year. The first line of the double-lined pipeline is completed and the project is expected to be commissioned this year. According to Ukraine’s gas pipelines operators gas prices have exceeded US $400 per 1,000 cubic metres on the European gas hubs, reflecting Gazprom's decision not to use additional capacity. Natural gas prices have shot to multi-year highs, with high temperatures driving up demand for power generation in the northern hemisphere for air conditioning and as traders in some regions replenish stocks ahead of winter.

China

China has begun building a US $1 billion natural gas import and storage base in the southern coastal province of Guangdong, a project in which US energy major ExxonMobil is advancing discussion with partners for a joint investment. ExxonMobil entered in September 2018 a preliminary deal with Guangdong province to invest billions of dollars worth of projects in the manufacturing hub, including a petrochemical complex and an LNG terminal in Huizhou. The new terminal, situated at Huidong county of Huizhou city, has a designed annual receiving capacity of 4 million tonnes (mt) under phase-one investment estimated to cost 6.636 billion yuan (US $1.02 billion). China’s state economic planner, the National Development and Reform Commission, gave the greenlight for the project in early-July. The Huizhou terminal includes a berth that can dock up to 266,000 cubic-meter tankers of LNG and three storage tanks each sized 200,000 cubic meters.

Taiwan’s state-owned refiner CPC Corp had signed a 15-year LNG supply agreement with Qatar Petroleum. From next year, it will buy 1.25 mt of LNG annually from Qatar, for domestic consumption. Australia and the United States are Taiwan’s other main sources of LNG. The government is trying to generate more electricity from LNG as it shifts away from both coal-powered and nuclear plants.

Rest of Asia

Russia has expressed its concerns over reports that Pakistan is considering working out an alternate plan to construct the $2.5 billion Pakistan Stream Gas Pipeline (PSGP) project from Port Qasim to Kasur, formerly known as North-South Gas Pipeline. Pakistan and the Russian Federation had signed the amended Inter-Governmental Agreement (IGA) in Moscow on Pakistan Stream Gas Pipeline Project (PSGP), both the countries have to sign the share-holders Agreement (SHA) within 60 days from the signing of the protocol scheduled for 27 July. Petroleum Division, which earlier agreed to a 56-diameters pipeline with Russia, is considering using 42 diameter, which is more expensive. The Petroleum Division carved out an alternate plan under which the Petroleum Division wants to build the LNG-III pipeline under the consortium of Sui Southern, Sui Northern and PAPCO—the company of PARCO. The Petroleum Division favours the alternate project in case talks with Russia fail on the PSGP/also known as North-South Gas Pipeline. The Petroleum Division's proposal is based on Economic Coordination Committee (ECC) decision, of 5 January 2018, under which financing was approved for the 1.2 billion cubic feet (bcf) per day gas capacity RLNG-III pipeline of 1,150 km from Karachi to Lahore through a 42-inch diameter pipeline.

Malaysia’s state oil firm Petronas has signed a 10-year LNG supply agreement with a subsidiary of China's offshore oil and gas major CNOOC Ltd valued at about US $7 (INR519) billion. The deal with CNOOC Gas and Power Trading & Marketing Limited is for 2.2 million tonnes per annum (mtpa) over a 10-year period. The deal is indexed to a combination of the Brent and Alberta Energy Company (AECO) indices. AECO is a Canadian natural gas price benchmark, similar to the Henry Hub index in the United States, but is not typically used as a pricing basis for LNG spot contracts. In Asia, the S&P Global Platts' Japan-Korea-Marker (JKM) has been increasingly used as a pricing basis in spot contracts. Petronas signed its first LNG cargo using the AECO index to a buyer in the Far East in May. The deal with CNOOC reflects the markets' receptiveness and recognition of AECO indexed LNG into the world's largest LNG market.

News Highlights: 28 July – 3 August 2021

National: Oil

IOC may sell some petrol pumps to JV with Petronas

2 August: Indian Oil Corporation (IOC), the nation’s biggest oil firm, may sell some of its over 32,300 petrol pumps to a joint venture (JV) with Malaysia’s Petronas with a view to monetising the firm’s vast fuel marketing network, its Director (Finance) S K Gupta said. IOC has an over two-decade-old 50:50 JV with Petronas for the import of LPG. The scope of this joint venture, Indian Oil Petronas Pvt Ltd (IPPL), is being expanded to include fuel and natural gas marketing. For one, IPPL will not be governed by the tedious petrol pump allotment rules that require public sector oil marketing companies to appoint dealers through a draw of a lottery. The JV can choose a site and operator quickly and on commercial terms. IPPL can set up petrol pumps that will not just sell petrol and diesel but also have EV charging and battery swapping points as well as CNG/LPG and LNG dispensing stations. Gupta said fuel marketing business is opening up that requires agility in operations. State-owned fuel retailers such as IOC have to allot dealerships through a lottery of all eligible candidates. IPPL currently sells LPG to commercial customers who are not allowed to use subsidised cooking gas sold to households by state energy firms. IOC owns 32,303 out of 77,709 petrol pumps in the country.

Source: The Economic Times

India’s top refiner IOC eyes 100 percent crude processing within a quarter

31 July: Indian Oil Corp (IOC) said it was operating its refineries at 90 percent capacity as diesel sales were yet to reach pre-COVID-19 levels, but it expects to ramp up refining to full capacity within a quarter as demand picks up. Indian state fuel retailers' gasoline sales exceeded pre-pandemic levels in the first fortnight of July, as motorists took back to the roads after states eased COVID-19-related lockdowns. Even as a second wave of COVID-19 infections battered the country during April and May, this year’s lockdown restrictions were not as severe as compared to last year, with most states allowing some vehicular movement. Still, Indian refiners had reduced crude processing during the quarter and curtailed oil purchases amidst higher fuel inventories. Diesel sales are still at around 85-90 percent of pre-COVID-19 levels and are expected recover by the festival of Diwali in November, Chairman S M Vaidya said. The refinery runs are also expected to be at 100 percent capacity by then. Higher fuel prices also sapped consumption, with India’s tax-heavy retail prices of gasoline and gasoil touching record highs due to a surge in global crude oil prices. International Brent prices jumped about 18 percent during the June quarter.

Source: The Economic Times

National: Coal

APMDC set to start coal mining in MP, a first in another state

3 August: In a major move, Andhra Pradesh Mineral Development Corporation (APMDC) has set the stage to launch coal mining at Suliyari coal block in Singrauli district of Madhya Pradesh (MP). Mines and Geology Minister Peddireddy Ramachandra Reddy said that this was the first time APMDC has begun coal exploration in other states. He said APMDC won Suliyari coal block spread over 1,298 hectors through an open bidding conducted by the Centre.

Source: The Economic Times

CIL records new high for July output, off-take and overburden removal

2 August: Coal India Limited (CIL) achieved highest ever coal off-take, production, and over burden removal (OBR), posting growths of 16.7 percent, 14.1 percent and 3.6 percent respectively in these performance parameters in July 2021. The company said it clocked 30.7 percent growth in supplies to the power sector during April- July period with a whopping 39 million tonnes (mt) increase, over the same period a year ago. Off-take to the power sector for July 2021 at 39 mt registered 17 percent growth compared to 33.3 mt that the company supplied during July 2020. CIL’s total coal off-take also increased by a staggering 46.7 mt during the first four months of the current fiscal, registering a 28.4 percent growth. CIL’s efforts to liquidate its pithead stock resulted in a reduction of 43.4 mt ending July, backed by increased appetite for coal.

Source: The Economic Times

National: Power

Quality 24X7 power supply key for accelerated economic growth: Singh

30 July: Power Minister R K Singh said that providing quality and reliable power supply round-the-clock is a key factor for accelerated growth of the economy. Singh said the power sector has witnessed tremendous growth over the past few years in the areas of generation, transmission and distribution. With a total installed generation capacity of 384 GW, the country has transformed from a power deficit to a power surplus country. Transmission network has been expanded to connect the whole country into one integrated grid with inter-regional transfer capacity of over 1 lakh MW, he noted. Under the Deen Dayal Upadhyaya Gram Jyoti Yojana and Integrated Power Development Scheme for strengthening the distribution system, 2,798 new substations have been set up, 3,930 substations have been upgraded and 2.5 crore meters had been provided, amongst others. Singh said the revamped distribution sector scheme was the largest of its kind in the power sector and that there are enough funds to meet the requirements of the states/discoms (distribution companies) for distribution system strengthening and modernisation. While calling for a major technological push by discoms, Singh said the scheme envisages extensive use of Artificial Intelligence (AI) and Information Technology (IT) for system generated energy accounting to enable energy audit and modernisation of distribution infrastructure for loss reduction as well as improvement in reliable power supply. Amongst others, the scheme provides for separation of agricultural feeders and discoms should also take advantage of KUSUM Scheme for separation and solarisation of the agricultural feeders, Singh said. The target of the scheme is to bring down the Aggregate Technical and Commercial (AT&C) losses to 12–15 percent at the all India level as well as to reduce the gap between Average Cost of Supply (ACS) and Average Revenue Realised (ARR) to zero by 2024–25.

Source: Business Standard

National: Non-Fossil Fuels/ Climate Change Trends

Solar power pumps ensure daily irrigation for 86k farmers in Maharashtra

3 August: To achieve the aim of installing one lakh solar agricultural pumps, an impetus has been given to the Chief Minister’s Solar Agricultural Pump Scheme to provide day-time power supply to farmers for irrigation. According to MSEDCL (Maharashtra State Electricity Distribution Company Ltd), a total of 85,963 farmers in the state have been given 3, 5 and 7.5 horse power solar agricultural pumps. As the warranty period of installed solar pumps and panels is five and 10 years respectively, the cost of maintenance for farmers is zero.

Source: The Economic Times

Torrent Power to acquire 50 MW solar power plant from Lightsource

31 July: Torrent Power said it has inked an agreement with Lightsource India Ltd and Lightsource Renewable Energy (India) Ltd for acquisition of a 50 MW solar plant. The enterprise value for the deal is around INR 3.17 billion. The SPV (special purpose vehicle) operates a 50 MW solar power plant, commissioned in April 2018, situated in Maharashtra. It has a long-term power purchase agreement with Solar Energy Corporation of India Ltd for full capacity for a period of 25 years. Torrent Power currently has an aggregate installed generation capacity of 3,879 MW comprising 2,730 MW gas-based capacity, 787 MW renewable and 362 MW coal-based capacity. Further, renewable power projects of 815 MW are under development. With the acquisition of the 50 MW solar power plant, Torrent’s total generation capacity, including under construction portfolio, will exceed 4.7 GW with renewable portfolio of more than 1.6 GW.

Source: The Economic Times

First Solar plans to set up 3.3 GW manufacturing facility in India

30 July: First Solar, a US (United States)-based solar panel manufacturer, said it plans to invest US $684 million in a fully vertically-integrated photovoltaic (PV) thin-film solar module manufacturing facility of 3.3 GW capacity in Tamil Nadu, India. It said that upon permissions and pending approval of Indian government, the facility is expected to commence operations in the second half of 2023.

Source: The Economic Times

Environmental clearance exemptions to industrial units in NCR

28 July: The exemption been given by the Union environment ministry to industrial units running in as many as eight district areas of Haryana coming under National Capital Region (NCR), where there is no access to pipe supply of CNG, PNG, and LPG, in getting environmental clearance will now continue. This was shared by Haryana Chief Minister Manohar Lal Khattar after meeting with Union Minister of Environment, Forest and Climate Change Bhupender Yadav in New Delhi to discuss various issues regarding environmental and ESI hospital of Haryana. Environmental clearance would also be given to 15 long-established formaldehyde industrial units so that those industrial units could uninterruptedly run their operations.

Source: The Economic Times

International: Oil

Brazil’s Petrobras undecided on LPG program

3 August: Brazilian state-controlled oil company Petrobras said it has not decided to participate in social programs to fund free LPG (liquefied petroleum gas) bottles to families in need. Brazilian President Jair Bolsonaro said Petroleo Brasileiro SA (Petrobras) would spend 3 billion reais (US $575.5 million) to pay for free LPG bottles to the low-income population. The company also said a decision will be taken according to its governance rules. Petrobras also said it has paid the Brazilian government 3 billion reais in dividends so far this year.

Source: The Economic Times

International: Gas

US LNG exports in first half up 42 percent from a year ago: EIA

28 July: US (United States) liquefied natural gas (LNG) exports accelerated in the first half of 2021, as colder weather drove LNG spot prices in Asia and Europe higher, the US Energy Information Administration (EIA) said in a report. The EIA said exports averaged 9.6 billion cubic feet per day (bcf/d) in the first six months of the year, up 42 percent from the same period a year ago. The price difference between the US Henry Hub natural gas benchmark and international natural gas prices have supported record volumes of LNG exports, the EIA said. US natural gas futures surged to a 31-month peak earlier, while European and Asian gas contracts are trading over US $12 and US $14 per mmBtu (million metric British thermal units) respectively. In July, the EIA projected exports would rise to 9.56 bcfd in 2021 and 10.15 bcfd in 2022 from a record 6.53 bcfd in 2020.

Source: The Economic Times

International: Coal

Australian coal miner TerraCom reports fatality at South African mine

30 July: Australian coal miner TerraCom said a contractor had died at its South African mine on 6 May, leading to an 11-day halt in operations at the time. The company in its production report disclosed that the fatality occurred at its 49 percent-owned New Clydesdale Colliery mine, but did not give details on how it happened. TerraCom said that coal sale deliveries were delayed in early July due to the political unrest in South Africa. Earlier this month, the country witnessed its worst violence in years after protests broke out after the jailing of ex-president Jacob Zuma. The miner also did not update the market about a US $215 million debt refinancing facility, which it previously had said should be finalised by August. Coal miners are finding it increasingly difficult to secure financing and insurance as pressure grows on their backers to break away from fossil fuels. The biggest banks in Australia, the world’s biggest coal exporter, are working to phase out exposure to thermal coal by 2030.

Source: The Economic Times

International: Non-Fossil Fuels/ Climate Change Trends

Indonesia begins construction on region’s largest floating solar plant

3 August: Indonesia will begin work on a 145 MW floating solar power project, the largest in Southeast Asia, after state power utility Perusahaan Listrik Negara (PLN) and Masdar of United Arab Emirates agreed financing for the project. Indonesia aims to have 23 percent of its energy from renewable sources by 2025 and the government has said the country will try to reach net zero emissions by 2060 by moving away from coal. A joint venture between a unit of PLN and Masdar in West Java, the Cirata floating photovoltaic power plant is expected to be the largest of its kind in Southeast Asia and is scheduled to begin commercial operation in November 2022.

Source: The Economic Times

Korea Southern Power to start commercial operation of wind power plant in Jordan

3 August: Korea Southern Power announced that it started commercial operation of the Jordan Tafila Wind Power Project. Jordan Tafila Wind Power Project is the first overseas wind power project conducted by Korea Southern Power. It is a project that Korea Southern Power and DL Energy invested 50 percent of shares each to build and operate 15 wind power generators, which have a generation capacity of 3.45 MW each, in Tafila, Jordan. A total of 120 billion won was invested in this project. The company will supply electrical power to more than 50,000 households in Tafila through the wind farm. Korea Southern Power predicted that it will generate a total of 360 billion won in sales through an electricity supply contract with Jordanian National Electric Power Company (NEPCO) for 20 years after the completion of the wind power plant.

Source: The Economic Times

Biden mileage rule to exceed Obama climate goal

28 July: In a major step against climate change, President Joe Biden is proposing a return to aggressive Obama-era vehicle mileage standards over five years. He's then aiming for even tougher anti-pollution rules after that to forcefully reduce greenhouse gas emissions and nudge 40 percent of US (United States) drivers into electric vehicles by decade’s end. The proposed rules from the Environmental Protection Agency and Department of Transportation are expected to be released as early as. Acknowledging Biden’s goal of cutting US greenhouse gas emissions by at least half by 2030, the rules would begin with the 2023 car model year and start by applying California's 2019 framework agreement on emissions standards reached between Ford, Volkswagen, Honda, BMW and Volvo. The California deal increases the mileage standard and cuts greenhouse gas emissions by 3.7 percent per year. Requirements ramp up in 2025 to Obama-era levels of a 5 percent annual increase in the mileage standard and a similar cut in emissions. In the proposed rule, the EPA is likely to make a nonbinding statement that the requirements will ramp up even faster starting in 2027, forcing the industry to sell more zero-emissions electric vehicles, the industry and government officials said. For now, the agency was seeking to ask that 40 percent of all new car sales to be electric vehicles by 2030.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV