Quick Notes

Discom Reform: Equalising the Unequal?

Background

In the last three decades, the governance of the electricity sector has been subject to slow but steady centralisation notwithstanding the fact that electricity is a

concurrent subject under the Indian Constitution. One of the forces behind the centralisation drive is the introduction of

market-oriented reform influenced by developments in industrialised countries. The first step in the reform initiative was the vertical

separation of competitive segments, i.e., generation, transmission and distribution. This was followed by efforts to deregulate each segment. In the 2000s power generation was

opened up for competition and now the private sector dominates ownership of generating capacity. Transmission that has monopoly characteristics is

subject to price, network access, service quality and entry regulation. So far, State governments that control electricity distribution have resisted “reform” but in the last decade, they have been subject to pressure from markets, mandates, regulations, executive action and legislation (

draft Electricity Amendment Act 2022) that has eroded their control. It is only a matter of time before State government control over distribution companies (Discoms) is replaced by

Central regulation and control with a large role for the private sector. Though private sector participation does not automatically translate into a market environment, markets and their ability to enforce financial and technological discipline through competition will provide the justification for deregulation and delicencing with Discoms framed as inefficient entities.

Discom Differences

The

Power Finance Corporation (PFC) brings out annual reports on the performance of power sector utilities that covers 47 Discoms, 9 private Discoms and 12 power departments. The measures that determine the performance of Discoms such as

revenue, cost, profitability, debt, transmission losses etc., are entirely financial and technical. Under this framework, Discoms that serve industrialised States with a large share of electricity supplied to industrialised consumers are able to achieve

higher ratings than Discoms that serve less industrialised States with a large share of agricultural and domestic consumers.

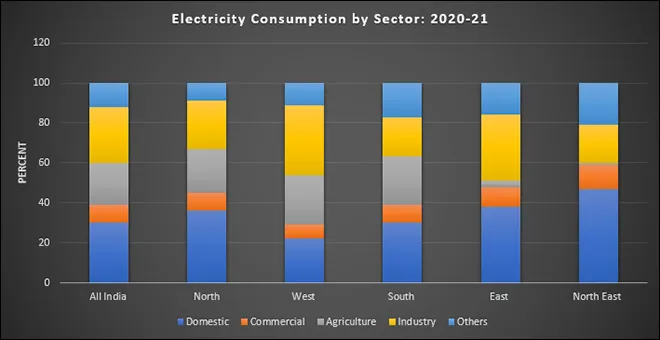

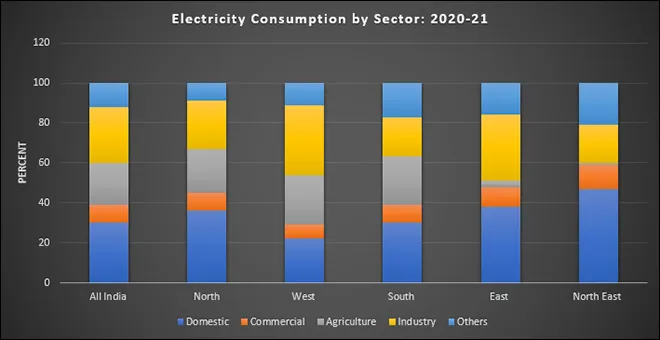

Regionally

22 percent of the electricity supply in the Western grid is to domestic consumers, the lowest among all regions and 35 percent to industrial consumers. On average only

3 percent of the electricity supply goes to agricultural consumers in the Eastern grid while agricultural consumption is over 20 percent in most other regions. In the North Eastern region,

47 percent of the electricity supply goes to domestic consumers while only

1 percent of the electricity supply goes to agricultural consumers.

There are also significant differences among States in terms of electricity consumption profiles. For example, in Delhi, nearly

60 percent of the electricity supply is to households. Delhi has no agricultural consumers, an attribute shared with Himachal Pradesh where industrial consumption accounts for over 58 percent of the electricity supply.

Domestic consumers dominate electricity supply by Discoms in Jammu & Kashmir and Uttar Pradesh while

irrigation dominates the electricity supply by Discoms in Rajasthan.

Discoms in Gujarat, Haryana and Punjab are the only ones that have

made a profit after tax (PAT) in 2020-21, with tariff subsidy excluding regulatory income and UDAY (Ujjwal DISCOM Assurance Yojana) grant. Discoms in Gujarat were the most profitable with a PAT of over

INR 11 billion in 2020-21. Discoms in Tamil Nadu recorded the largest losses of over

INR 179 billion in the same period. In Gujarat, industrial consumption accounted for over

50 percent of the electricity supply in 2020-21, agriculture accounted for

20 percent of the supply, domestic consumption accounted

for 17 percent of supply, commercial consumption accounted for 4 percent and other consumption accounted for 9 percent of supply. The large share of industrial consumers with higher tariffs allows Discoms in Gujarat to recover the cost of supply. In Tamil Nadu, also an industrialised state, industry accounts for only

18 percent of the electricity consumption while agriculture accounts

for 16 percent. Domestic consumption has the largest share of

34 percent. Commercial consumption accounts for 8 percent of electricity supply and others

24 percent. The lower share of industrial electricity consumption in Tamil Nadu along with the fact that industries in Tamil Nadu are mostly small and medium-sized enterprises (SMEs) contributes to the low-cost recovery of Discoms in Tamil Nadu.

Tamil Nadu’s

gross domestic product is higher than that of Gujarat primarily because of the higher share of economic value added in the service sector. In 2020-21, the average tariff of electricity supplied to households was

INR 5.46/kWh (Kilowatt hour) in Gujarat compared to

INR 2.26/kWh in Tamil Nadu. The Industrial tariff in Gujarat was

INR 8.04/kWh in 2020-21 compared to

INR 6.21/kWh in Tamil Nadu. Agricultural consumption is free in Tamil Nadu while it is

INR 0.63/kWh in Gujarat. The tariff for commercial consumption is

INR 0.40/kWh in Gujarat while it is a staggering

INR 9.58/kWh in Tamil Nadu. Overall, the average electricity tariff in Gujarat is

INR 5.06/kWh in Gujarat while it is about

INR 3.95/kWh in Tamil Nadu. The large share of industrial electricity consumption arises from the fact that Gujarat has to

employ a higher share of India’s fixed capital to generate a lower share of India’s factory jobs. In contrast Tamil Nadu can employ a

lower share of India’s fixed capital to generate a higher share of factory jobs. This is not a rigorous comparison but it highlights the trade-off between equity and efficiency in the provision of electricity. Comparisons can be made for other States with significantly

different economic profiles. Some States are major

agricultural producers that offer subsidised electricity for irrigation which is, in the larger context, a subsidy for the food security of the country. Some of the less industrialised States have a

large number of economically challenged consumers.

When electricity distribution is centralised and private players are introduced as licensees or franchisees along with some elements of market characteristics, it is very likely that it will have an impact on the socio-economic profile of States. Markets do not like borders. Borders create a fragmented field with different rules and different prices that increase the cost of doing business.Centralisation will systematically dismantle these State level barriers to make the field attractive for market participants, particularly those from the private sector. Markets also do not bother about issues of equity. Markets will ignore or marginalise economically challenged consumers who are unable to consume large quantities of electricity and have limited ability to pay for the electricity that they consume. Economic efficiency of Discoms that is achieved at the cost of equity under the “one-size fits all” approach to Discom reform will be celebrated by the affluent who believe, like Bentham, that in the highest form of social prosperity, the great mass of civilization will always be near economic (energy) destitution.

Source: Central Electricity Authority

Source: Central Electricity Authority

Monthly News Commentary: Power

Electricity Trade Gathers Momentum

India

Electricity Trade

While distribution companies

(discoms) in Madhya Pradesh are seeking a tariff hike of 3.2 percent citing a revenue difference between their income and expenses of around INR 15 billion (bn), more than 8,600 million units of power worth INR 30 bn (US$364.6 million (mn)) are estimated to be backed down this year. Simply put, this extra power produced is not likely to be used at all. The extra power is less than half of the total surplus energy as discoms estimate to sell more than 11,000 million units (MU) of surplus energy which is apart from more than 8,600 MU of backed down energy in the upcoming financial year, ie, 2023-24, as per the ARR submitted before Madhya Pradesh Electricity Regulatory Commission (MPERC).

Adani Electricity Mumbai

Limited (AEML) recently issued a tender to buy 1,500 megawatts (MW) of electricity from the open markets. Out of this, 750 MW – 51 percent – will come from renewable sources. Currently, the AEML supplies power to suburbs (except Bhandup and Mulund) and also the satellite township of Mira Bhayander. The procurement of 1,500 MW of power will also help them to meet rising demand in the licensed area. The city’s power demand has grown at an average of 4 percent over the last few years due to the rise in gadget usage and redevelopment projects.

India’s power regulator retained a price cap of INR12 (US$0.1450) per unit/kilowatt hour (kWh) on electricity traded on its spot power exchanges ahead of expected record energy demand in the coming summer months. The Central Electricity Regulatory Commission (CERC) issued the order for extended retention of the ceiling "until further orders", citing consumer interests. The move could effectively keep costlier imported coal and gas-based power generation out of the spot market. The CERC had lowered the price ceiling on power exchanges in April, from INR20 a unit, in light of desperate buying by state electricity companies to meet surging summer demand. The order was extended twice and was to expire on 31 December. The Indian Energy Exchange (IEX) and unlisted PXIL are the two main power exchanges in India.

Discom Reform

Even as the discoms (distribution companies) have failed to meet the target of replacing old electricity metres with smart metres across Haryana, consumers are being pursued to shift to pre-paid electricity connections. Notably, smart metres enable distribution companies to offer app-based or generally operated pre-paid electricity connections to consumers. Once a consumer opts for pre-paid electricity connection, he/she becomes eligible for 5 percent discount on the normal electricity billed tariff of regular connections. As of now, the discoms are focussing to introduce prepaid connections in Gurugram, Faridabad, Sonipat and Panchkula cities. In-charge of circles or sub-divisions are targeting special groups, especially the opinion makers or professionals and group housing societies or apartments used for rental purposes to popularise the scheme. The move comes after the two electricity distribution companies -- UHBVN (Uttar Haryana Bijli Vitran Nigam) and Dakshin Haryana Bijli Vitran Nigam (DHBVN) – of the state drew flak from the Haryana State Electricity Regulatory Commission (HERC). Energy Efficient Services Limited (EESL) – the company engaged by the two discoms for the replacement of old metres with smart metres has also faced the HERC ire. As per information,

the Haryana power department had given the target of installation of 3 million metres by the end of December 2024. The target till December 2022 was 1 million metres, but only 624,000 were installed. In a hearing on 3 January, HERC had advised the discoms and EESL officials to conduct monthly meetings.

A big initiative is being

launched by Smart City Kanpur to ensure an uninterrupted quality power supply in order to save electricity and provide better services to consumers of the city. As per the communique issued by the divisional commissioner’s office, this initiative is a joint effort of the Central and state governments. It will ensure better services and uninterrupted quality supply of electricity by using automation and new technologies in the power sector.

A Parliamentary panel has expressed disappointment over the

poor utilisation of budgetary allocation of the Centre’s National Smart Grid Mission (NSGM) called for expeditious augmentation of smart metres' manufacturing capacity under it, to match their increasing demand. The panel has also recommended that the quality and reliability of the smart metres should be ensured through their mandatory quality check by independent institutions like the CPRI. The NSGM was unveiled by the government in 2015 to plan and monitor the implementation of policies and programmes related to smart grid activities in India.

Demand Growth

The

nation’s electricity consumption is projected to increase by 9–10 percent y-o-y (year-on-year) in the current fiscal year, which would be a decadal high, according to Crisil Market Intelligence and Analytics report. Due to increased heating needs with the arrival of winter and ongoing momentum in manufacturing activity, which rose to a 25-month high during the month, peak demand in December increased by a sharp 12 percent y-o-y and 9 percent month-on-month to 206 GW. Peak power demand in India reached a new high of 216 gigawatts (GW) in April 2022, up 6 percent year on year, as several regions in the North suffered from a severe heatwave. Industrial and manufacturing activities also contributed to the increase in demand. Seasonally lower renewable output impacted generation in the third quarter of the financial year 2023, leaving costly thermal power to service incremental demand. In April 2023, the government anticipates a peak demand of 230 GW.

Electricity consumption by industries across various industrial belts in Indore and nearby areas jumped about 10 percent in the calendar year 2022 on a year-on-year basis due to an increase in new industrial connections and a rise in demand from units. Industries in Indore and adjoining areas consumed around 6.61 bn kilowatt hour (kWh) in the year 2022 as against 5.91 bn kWh in 2021, according to discom (distribution company). Industries of Pithampur, Indore and Dewas are the major industrial belts of this region and these areas consume over 70 percent of the total electricity supplied to industrial belts. Total HT connections in industrial areas have increased to 4130 of which 3000 connections are near Indore. As per the initial demand estimates from industries for the new financial year submitted to discom, a major jump in electricity consumption is likely to be witnessed in Indore, Dhar, Dewas, Ujjain and Ratlam. Industrialists expect a rise of another 10-12 percent in electricity demand in the ongoing year in industrial belts due to the functioning of new factories in industrial belts.

The cold conditions in December – January pushed

Delhi’s peak power demand to a record high of 5,247 MW, more than the peaks during winters in the past two years. According to the State Load Dispatch Centre (SLDC) Delhi data, peak power demand of the city clocked 5,247 MW at 10.56 am. The peak demand had crossed the 5,000 MW-mark (5,126 MW) this winter. The peak demand of 5,247 is the highest so far this winter. It is more than the peak power demand clocked during the winters of 2022 (5,104 MW) and 2021 (5,021 MW) yet lower than 5,343 MW in the winters of 2020. The surge in power demand was mainly due to increased heating needs of the people that normally formed 50 percent of the total demand. BSES discoms are using avenues such as "banking" and "power exchange" and ensuring sufficient "spinning reserves" to dispose of surplus power as well as ensuring reliable power supply and making arrangements to get power during the summer months.

India’s power consumption logged a double-digit growth of over 11 percent to 121.19 Bn kWh in December 2022 compared to the year-ago period, according to government data. The robust growth of power consumption indicates sustained momentum of economic activities in December. Experts said power consumption and demand will further increase in January due to use of heating appliances, especially in the northern parts of the country, and further improvement in economic activities. In December 2021, power consumption stood at 109.17 Bn kWh higher than the 105.62 Bn kWh in the same month of 2020, the data showed. The peak power demand met, which is the highest supply in a day, rose to 205.03 GW in December 2022. The peak power supply stood at 183.24 GW December 2021 and 182.78 GW in December 2020. The peak power demand was 170.49 GW in pre-pandemic December 2019. Electricity consumption in December 2019 stood at 101.08 Bn kWh.

Generation

NTPC Ltd power generation grew 11.6 percent year-on-year to 295.4 BU in April-December this fiscal. This assumes significance as NTPC supplies one-fourth of the electricity in the country. NTPC recorded a generation of 295.4 billion kWh during April-December 2022, registering a growth of 11.6 percent compared to the same period the previous year. On a standalone basis, NTPC generated 254.6 bn kWh during April-December 2022, a 16.1 percent year-on-year rise. NTPC group’s installed capacity is 7,0824 MW.

NTPC Ltd

North Karanpura power plant will start power generation after a long wait of 23 years. The trial of 660 MW power generation and transmission at full load from the first unit of this plant was successful. The electricity was generated and sent to the National Grid. The plant, located at Tandwa in Jharkhand consists of three units and has a total capacity of 1980 MW.

Regulation and Governance

Hoteliers as well as

residents are worried about the high power tariffs in Uttarakhand which they point out are significantly higher than other states, including adjoining Himachal Pradesh. For small domestic consumers in Himachal Pradesh (HP), the tariff for using up to 100 kWh per month is INR 1.85/kWh, while in Uttarakhand, it is INR 2.95/kWh. In fact, the tariff for small domestic consumers in Mumbai is even lesser at INR 1.72/kWh. Similarly, for domestic consumption above 400 units per month, HP charges INR5/kWh while Uttarakhand charges INR 6.90/kWh. An analysis of power tariffs revealed that for domestic consumers, the Himachal government offers a subsidy that ranges between 55 percent to 11 percent of the total tariff, but consumers lament that there is no such respite in Uttarakhand.

The Uttar Pradesh Electricity Regulatory Commission

(UPERC) has severely reprimanded two power distribution companies (discoms), Paschimanchal Vidyut Vitran Nigam Ltd (PVVNL) and Madhyanchal Vidyut Vitran Nigam Ltd (MVVNL) for poor progress of power metre conversion. The Commission feels that it is due to some 'nefarious interest or goblin mode' that the two discoms are not putting their best efforts to convert single-point metre connections to multi-point in group housing societies.

Karnataka Chief Minister (CM) Basavaraj Bommai dismissed as “irresponsible and irrational” the election promise made by the opposition Congress to provide

200 kWh of free power to all households every month if voted to power in the state. He said the announcement showed “how low they are in the electoral race.

Under a centrally-sponsored scheme, residents of a tribal area in Tethan in Dooru block,

Anantnag district of south Kashmir received an electricity connection after almost 75 years. The electricity has reached this remote village with a population of just 200 people under the centrally sponsored PM Development Package scheme. Residents of Tethan located on the hills of Anantnag were delighted when the first bulb lit in the village for the first time after almost 75 years. For 75 years, the people of this village relied on traditional wood for their energy needs and used lamps and candlelight. The Electricity department said electricity had been brought to the village through a fast-track process.

The UP Power Corporation Limited (UPPCL) submitted a proposal to the UP Electricity Regulatory Commission

(UPERC), suggesting a hike of around 18 percent in power tariff for urban domestic consumers. Confirming the development, highly placed sources in UPERC said that the proposed tariffs would be subjected to rigorous scrutiny before the new power tariff is announced after two months. The Power tariff in UP was last increased in 2018-19. According to the proposal submitted by the UPPCL, an average hike of around 16 percent has been proposed for various categories of consumers. For industries, the rate has been proposed to be increased by 16 percent, while in case of agricultural consumers, a hike of 12 percent has been proposed. The increase in power tariff for industries has been proposed even as the state seeks to attract investments through the Global Investor Summit. A hike of around 17 percent has also been proposed for the lifeline category consumers -- rural/ urban poor who are provided power at a low rate.

Deputy Chief Minister (CM) Devendra Fadnavis said the state government was formulating

a new power subsidy policy for the industries in Marathwada and Vidarbha regions. Fadnavis said that concerns related to the power at Aurangabad Industrial City (AURIC) would be addressed by considering the differential tariff system, which he said would be less than the prevalent tariff system. Fadnavis said Aurangabad and Jalna are the future of industries in Maharashtra by virtue of the edge these cities have because of the Samruddhi expressway and the upcoming dry-port.

The UJALA (Unnat Jyoti by Affordable LEDs for All) scheme is aimed at promoting the efficient usage of energy at the residential level by using energy-efficient appliances and aggregating demand to reduce the high initial costs. Also known as the LED-based Domestic Efficient Lighting Programme (DELP), it is considered the world’s largest programme. With the rising energy bills and resulting crisis due to the war in Europe, it becomes even more important for a nation like India which is dependent on many other countries for its fuel and energy to establish itself as a self-sufficient player at the global stage. As part of the Saubhagya Yojana to provide electricity to every household in the country, the

Government of India decided to arrange for low-energy consumption through the UJALA scheme. Given the importance of lighting in any manufacturing setup, educational institution, security and connectivity sectors, the scheme was launched in the year 2015 recognising the cost and sustainability benefits of energy-efficient lighting. In eight years, nearly 37 crore LED bulbs, 7.2 million tube lights and 23.5 lakh energy-efficient fans have been distributed, saving approximately INR200 bn (US$2.43 bn) per year. Prior to 2014-2015, the electricity bill used to be higher due to the use of outdated bulbs despite the lower demand for electricity. Requiring a solution that would reduce power consumption, and improve lighting but still reduce overall costs, the UJALA scheme has been successful in achieving these objectives.

In a major relief to residential, commercial, agricultural, and industrial consumers, four state-run power distribution companies (discoms) have not proposed any hike in power tariffs for the upcoming fiscal year. To revise tariffs, discoms are required to file petitions with the Gujarat Electricity Regulatory Commission (GERC). All the state-run discoms the Madhya Gujarat Vij Company Limited, Paschim Gujarat Vij Company Limited, Dakshin Gujarat Vij Company Limited, and Uttar Gujarat Vij Company Limited refrained from revising tariffs for the fiscal year 2023-24, according to the petitions. The last time that

GERC approved a power tariff hike for discoms was in 2015-16

Uttar Pradesh (UP) Chief Minister,

Yogi Adityanath said that power subsidy should be provided to the 250,000 weavers in the state for improving their productivity and economic well-being. He said that the power corporation should start taking preparatory measures to offer the subsidy to weavers which, in turn, would also help in preventing electricity theft. The Minister reviewed a presentation regarding the MSME Weaver Scheme and discussed issues related to the consumption of electricity and the subsidy provided to the sector with the officials.

Given the growing population and rising demand during peak summers, the Uttar Pradesh Power Transmission Corporation Limited

(UPPTCL) is working on constructing three new substations for Noida which are expected to come up by 2023 and 2024. These include two 132 kilovolts (kV) substations in Sector 115 and Bhangel near Sector 110 and another 220kV substation in Sector 45. While the Sector 115 and Sector 45 substations are expected to be ready by August and September respectively, the substation at Bhangel will be ready by March 2024. A third substation of 220 kV is under construction in sector 45. Built at a cost of about INR 800 mn (US$9.72 mn), this substation is expected to be ready by September this year. Meanwhile, UPPTCL has completed work on two more substations of 132 kV capacity in sectors 63 and 67.

The Asian Development Bank (ADB) and the government of India have signed a US$220 mn loan agreement to improve energy security, quality of supply, efficiency, and

resilience of the power sector in Tripura. After signing the loan an agreement, the project would support the government of Tripura’s efforts to strengthen its power sector through replacement of inefficient power plants, strengthening of the distribution network and installation of smart metres that would help increase generation capacity, reduce distribution losses and meet the increasing electricity demand to boost the state economy.

The Aam Aadmi Party (AAP) accused the Maharashtra government of conspiring to

hand over electricity distribution company Mahavitaran to the private conglomerate Adani group. In November last year, an Adani group company had sought a licence for expanding its power distribution business into more areas of Mumbai. In an advertisement published in several newspapers then, Adani Electricity Navi Mumbai (AENM) had said it has approached the Maharashtra Electricity Regulatory Commission (MERC) for a distribution licence in some pockets of the Mumbai Metropolitan Region (MMR) along with its listed parent Adani Transmission. After airports, ports, BSES (a power firm taken over by the group) and Dharavi redevelopment projects, Mahavitaran, which distributes electricity to villages in Maharashtra, is also being handed over to the Adani group by the Bharatiya Janata Party (BJP) government, Mumbai unit president and AAP national executive member Preeti Sharma Menon said.

Punjab’s power subsidy burden will mount by nearly INR 25 bn by the next financial year, 2023-24 compared to the current year. A big factor behind this is subsidy attributable to the domestic sector consumers, which has shot up by 300 percent in a year -- 2021-22 to 2022-23. The previous Congress government subsidised power for all consumers up to 7 kW load with INR 3/kWh subsidy and AAP (Aam Aadmi Party) regime’s zero bill scheme in July this year further added to the load of Punjab State Power Corporation Limited (PSPCL). According to the ARR (Annual Revenue Requirement) report filed by PSPCL, uploaded, before Punjab State Electricity Regulatory Commission (PSERC), the power subsidy payable to PSPCL for 2022-23 has been calculated to be INR 165.15 bn (US$2.01 bn). It includes INR 73.75 bn on free power for agriculture, INR 26.69 bn for the industrial sector and INR64.71 bn for domestic sector consumers. In the last financial year (2021-22), a total of INR 11,278 crores (US$1.37 bn) of power subsidy was given -- INR 70.85 bn to agriculture sector consumers, INR 21.55 bn to domestic sector consumers, and INR 20.38 bn for the industrial sector comprising small power, medium and large supply industry.

Rest of the World

Asia Pacific

Sri Lanka’s cabinet approved new electricity tariffs to reflect the cost of coal and power generation to take effect this month, Power Minister Kanchana Wijesekera said, without saying how much higher they would be. Sri Lanka raised electricity tariffs by 75 percent last August and a cabinet proposal to raise them by a further 25 percent had been under consideration. The 25 percent proposal had sparked widespread criticism from opposition political parties, unions and Sri Lanka’s power regulator. Sri Lanka has a state-run power monopoly, the Ceylon Electricity Board, which has incurred massive losses. The government has committed to increasing power prices to reduce losses and put public finances on a sounder footing.

North & South America

An inquiry will be opened into the power outages caused by extreme weather during historic winter storm Elliott, the US (United States) Federal Energy Regulatory Commission (FERC) and other North American regulatory authorities said. Elliott was the name given to the system that brought frigid cold and blowing winds, knocking out power for more than 1.5 million homes and businesses across the United States.

FERC will probe operations of the bulk power system to identify performance issues and recommend solutions alongside the North American Electric Reliability Corporation (NERC) and its six regional entities which encompass nearly 400 million customers, mainly in the US and Canada. While most of the outages were caused by weather impacts on electric distribution facilities, some local utilities in the US southeast resorted to rolling blackouts and the bulk-power system elsewhere came under pressure, the regulators said. In November, NERC warned that a large portion of North America was at risk of insufficient electricity supplies during peak winter conditions, due to higher demand projections, generator retirements, vulnerability to extreme weather and fuel supply and natural gas infrastructure limitations.

The US Energy Department

declared a power emergency in the country’s second-largest state Texas amid an Arctic winter blast that was feared to cause a shortage of electricity in the state. The Electric Reliability Council of Texas (ERCOT), the state grid operator which serves 90 percent of electric customers in Texas, requested the order, allowing it to exceed certain air pollution limits to boost generation amid record power demand in the state. The Energy Department said in the order that units that produce about 11,000 MW of coal and gas-fired power, 4,000 MW of wind and 1,700 MW of solar power were down or scaled back due to the winter storm. However, ERCOT said that the state’s power grid has withstood freezing temperatures through much of the state, expecting the power supply to keep up with demand. According to the Energy Department, power demand in Texas reached an all-time winter peak of over 74,000 MW.

Africa & Middle East

South African President Cyril Ramaphosa has cancelled his trip to the World Economic Forum in Davos in order to deal with his country’s worsening power blackouts. He had been scheduled to lead a delegation from South Africa to the Swiss resort town to promote the country as an investment destination. But public outrage over the electricity crisis has forced him to hold urgent meetings at home. The power utility

Eskom is currently implementing a high level of power blackouts, with households and businesses going without electricity for up to 10 hours daily until further notice. Compulsory maintenance, the breakdown of generating units at its ageing power stations and years of corruption have been blamed for Eskom’s failure to meet electricity demand. South Africa’s electricity regulator approved an electricity price increase for consumers of more than 18 percent for this year and a further increase in 2024, despite the power utility’s failure to provide a reliable supply. South Africa is looking to add additional electricity capacity through emergency procurement of renewable energy sources like wind and solar, but that is unlikely to happen in the short term.

The Nigerian government said it

plans to sell some electricity-generation companies in the country, six months after it announced the restructuring of power distribution companies and privatisation of five power projects. The government said the sale will take place in the first quarter of 2023 and the proceeds will be used to fund 2023 budget. The generating companies of Gencos for sale are Geregu power plant, a 562 MW facility in Calabar, Cross River State, and the Olorunsogo power plant. The power plants are part of the power projects that were shortlisted for privatisation in July. Since the government handed over authority in 2013, privately owned businesses have had difficulty supplying electricity. Nigeria’s power system has mostly remained dysfunctional, producing and distributing an average of 4,000 MW to around 200 million people. The government urged the private sector to invest in electricity to end shortages.

News Highlights: 18 – 24 January 2023

National: Oil

India’s crude imports hit 5-month high in December on cheap Russian supply

23 January: India’s crude oil imports rose to a five-month high in December, government data showed, as refiners stocked up discounted Russian fuel amid a steady increase in consumption in the country. Crude imports for the month were up 2.7 percent from November at 19.52 million tonnes (MT), according to data from the Petroleum Planning and Analysis Cell. On a yearly basis, imports were down 0.7 percent in December. Russia continued to be the top oil supplier to India in December, shipping a record 1.25 million barrels per day (bpd). Oil product imports rose to 4.12 million tonnes (MT) in December from 3.74 MT in November. Exports rose to 5.83 MT, with diesel accounting for 2.41 MT. Meanwhile, India’s fuel demand reached a nine-month high in December, helped by strong industrial activity and a rise in gasoline consumption. India has cut its windfall tax on crude oil and exports of aviation turbine fuel (ATF) and diesel, according to a government notification. India, Asia’s third-biggest economy, holds surplus refining capacity and exports refined fuels as well.

BPCL to shut Bina refinery in June for maintenance

23 January: Bharat Petroleum Corporation Ltd

(BPCL) plans to shut its 156,000 barrels per day (bpd) Bina refinery in central India for about a month in June for maintenance. The refiner plans to shut half of its 240,000 bpd Mumbai refinery in western India for three to four weeks in September-October for maintenance. Indian refiners have to shut units at refineries once every four years for maintenance and inspection. Numaligarh Refinery Ltd plans to shut its 60,000 bpd plant in the northeast for about 40 days up to the end of April for maintenance.

HPCL’s Vizag oil refinery to expand by June: Chairman

22 January: Hindustan Petroleum Corporation Ltd

(HPCL) will complete the expansion of its Vizag oil refinery in Andhra Pradesh to 15 million tonnes per annum (MTPA) by June, its Chairman Pushp Joshi said. HPCL is expanding the 8.33 MTPA refinery and building a new one at Barmer in Rajasthan to bridge the gap between the fuel it produces and sells. HPCL sells 50 percent more petrol, diesel and LPG than it produces. The Vizag expansion as well as the 9 MTPA units in Rajasthan expected by 2024-end would bridge the gap. Joshi said HPCL’s residue upgradation project at Vizag refinery will improve its distillate yield and will be ready by the end of 2023.

Oil Minister hopes for cut in petrol prices no sooner oil cos recoup past losses

22 January: Oil Minister Hardeep Singh

Puri hopes petrol prices will be reduced no sooner state-owned oil companies recoup past losses. Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL) have for the past 15 months not revised petrol and diesel prices in line with the cost. The losses incurred are now being recouped after oil prices slid. Softening of international prices from a multi-year peak hit last year had led to companies making a profit on petrol but they continue to incur losses on diesel. Puri said oil companies acted as responsible corporate citizens by not burdening consumers of the rally in global energy prices in the aftermath of Russia’s invasion of Ukraine. The oil ministry is pushing for compensation for the three retailers to make up for the losses they incurred.

National: Gas

India gas imports to rise on lower global prices: Petronet

20 January: India’s liquefied natural gas (LNG) imports are set to recover as global prices ease, the chief executive of the country's top gas importer Petronet LNG Ltd said. Asian spot LNG prices have fallen due to mild weather in Europe and ample inventories, from an average of US$30-$35 per million metric British thermal units (mmBtu) in the December quarter to around US$17 per mmBtus, A K Singh said. India wants to raise the share of gas in its energy mix to 15 percent by 2030 from 6.2 percent at present. However, a spike in the global gas prices last year, triggered by the Russia-Ukraine conflict, cuts demand for cleaner fuel from price-sensitive Indian customers. India’s gas imports in October and November declined by about a fifth to about 1.8 million tonnes from this fiscal year’s peak of 2.2 million tonnes (MT) in May, according to the government data. Due to low local demand, Petronet operated its 17.5 MT a year Dahej LNG terminal on the west coast at 68 percent capacity in the December quarter. The capacity use has improved to 81 percent and is expected to rise further as global prices ease, Singh said. Petronet supplies gas, mostly procured under long-term deals with Qatar and Australia, to Indian energy companies for sale to end-users. These companies have also booked capacity at Dahej to import gas directly. In the previous quarter, Petronet levied an INR 8.5 billion (US$104.80 million) penalty on Indian companies for not taking the committed volumes of gas from its Dahej import facility, Singh said.

National: Coal

Mahanadi Coalfields expects 13 percent production rise to 190 MT in FY23

23 January: Mahanadi Coalfields Ltd (MCL), a subsidiary of Coal India Ltd (CIL), aims to achieve approximately 190 million tonnes (MT) of dry fuel production in the current fiscal. This will be 13.09 percent more than 168 MT production recorded in 2021-22 by MCL. MCL Chairman-cum-Managing Director O P Singh said that the production target for 2022-23 was 176 MT, however the company is 21 percent ahead of the target, and expects to reach 190 MT by end of this fiscal.

MCL has kept a target of 190 MT for coal despatch for 2022-23. In the next financial year (2023-24), MCL has kept a projection of 200 MT for coal despatch. Out of this, 80 percent is expected to be for the power sector. With the government aiming to encourage commercial coal mining, Singh said that it would enhance MCL’s supplies.

CAQM asks Coal India to stop the supply, sale to industries in Delhi-NCR

19 January: The Commission for Air Quality Management (CAQM) has asked the Centre-run Coal India Ltd

(CIL) to stop the supply and sale of coal to industrial units and other commercial organisations, except thermal power plants, in the National Capital Region. The direction comes in view of the ban on the use of coal and other unapproved fuels in Delhi-NCR which came into effect on 1 January. However, the use of low-sulphur coal in thermal power plants is allowed. Haryana and Uttar Pradesh have been asked to ensure that companies of CIL do not supply or allot coal to the suppliers, stockists and agents of the Centre-owned coal producer, the CAQM said. The commission has also asked industries and entities, including stockists, traders and dealers, to discontinue coal supply, except for thermal power plants, in Delhi-NCR. It said that 84 industrial units not operating on approved fuels in the NCR areas of Haryana, Uttar Pradesh and Rajasthan closed down their operations temporarily or permanently on their own. Since 1 October, only 21 industrial units have been found using highly-polluting unapproved fuels like coal and furnace oil and have subsequently been shut down.

State to face brunt of imported coal, shipping detour: AIPEF

19 January: Punjab is all set to face a double whammy — of blending imported coal with Indian coal, and transportation of coal from Odisha via rail-ship-rail (R-S-R) mode — leading to a 20 percent escalation in a generation cost, said All India Power Engineers’ Federation (AIPEF). The Union government had decided that Indian coal required blending with imported coal by 6 percent by weight, in view of a likely coal shortage in summer, and use of R-S-R mode for transporting coal from Mahanadi and Talcher coalfields in Odisha to Punjab via Mundra in Gujarat.

India’s coal production target at more than one billion tonnes for FY24: Government

18 January: The government said that it has set a coal production target of more than one billion tonnes for the next financial year. Of the said target, Coal India Ltd (CIL) has been given the task to produce 780 MT of coal, followed by 75 MT for Singareni Collieries Company Ltd (SCCL) and 162 MT for captive and commercial mines. A total of 290 mines are operational in CIL out of which 97 mines produce more than one MT per year. For all 97 such coal mines, issues of land acquisition, forest clearance, environment clearance, rail connectivity and road connectivity have been discussed and timelines fixed.

CIL produced 622 MT of coal during FY22 and 513 MT have been produced so far in the current financial year. It is expected that CIL will surpass the target of 700 MT fixed for current fiscal and accordingly will achieve 780 MT for the year 2023-24. CIL accounts for over 80 percent of domestic coal production.

National: Power

DERC withdraws advisory on power subsidy through DBT

24 January: The Delhi Electricity Regulatory Commission

(DERC) has withdrawn its 2018 advisory to the Delhi government that power subsidy should be granted to the eligible beneficiaries through direct benefit transfer (DBT) mode, as done in the case of LPG cylinders. The advisory was withdrawn on 24 December, just a day after deputy Chief Minister (CM) Manish Sisodia wrote to DERC saying he had received a file from the power department suggesting that the government should shift to the DBT mode on power tariff subsidy and wanted the commission to re-examine the issue. Interestingly, DERC re-examined the issue and withdrew its earlier advisory of switching to the DBT mode of February 2018 just a fortnight before the term of the former chairman of the commission was ending. The commission said that the adjoining states of Haryana, Uttar Pradesh, Rajasthan and Himachal Pradesh were not using the DBT model for providing the electricity subsidy.

Punjab’s maximum power demand rises by 800 MW

19 January: Punjab’s maximum power demand has increased by about 800 megawatts (MW) or 26 percent from last year’s corresponding period till 12 January. The consumption has risen by almost 30 percent. Punjab State Power Corporation Ltd (PSPCL) has supplied 1,821 million units of power in the first 12 days of 2023, compared with 1,396 mn units in last year’s corresponding period. Power demand increased to 8,852 MW from 7,051 MW. Even in the current financial year, from April to December 2022, the PSPCL has supplied 9 percent more power to the state.

National: Non-Fossil Fuels/ Climate Change Trends

BPCL to set up 1 GW renewable energy plant in Rajasthan

24 January: Bharat Petroleum Corporation Ltd (BPCL) said it has signed a Memorandum of Understanding

(MoU) with Rajasthan to set up a 1 gigawatt (GW) renewable energy (RE) plant in the state. BPCL has set the goal of net zero in Scope 1 and 2 emissions by the year 2040. The company plans to expand the renewables portfolio and reach 1 GW of renewable energy by 2025 and 10 GW by 2040. Rajasthan Chief Minister Ashok Gehlot expressed Rajasthan’s vision to create a positive space for investment in Rajasthan with a Green Imprint on it. He congratulated the working teams and encouraged them to further augment this collaboration for sustainable economic development in the state. BPCL’s ‘Renewables’ business unit is steering this voyage to help the global efforts to curb global warming, in line with the national climate commitments, and renewable energy has a pivotal role to play in this endeavour.

Chandigarh gets North India’s largest floating solar power project

24 January: UT Administrator Banwari Lal Purohit

inaugurated northern India’s largest floating solar power project of 2000 kWp (kilowatt peak) worth INR 117 mn at waterworks, Sector 39. He inaugurated a 500 kWp floating solar project with fountains at Dhanas Lake. Adviser Dharam Pal, director (environment) Debendra Dalai and Mayor Anoop Gupta were present on the occasion. These projects have been designed and executed by CREST (Chandigarh Renewable Energy and Science & Technology Promotion Society) and will generate a minimum of 35 lakh units (kWh) of solar energy per year with 20 percent module efficiency.

Adani Green Energy posts 9 percent surge in solar, 47 percent jump in wind energy sale in Q3

23 January: Adani Green Energy posted a surge of 9 percent in the sale of its solar energy portfolio to 2,507 million units for the quarter ended December 2022, against 2,300 million units. The renewable energy company said this increase in the sale of energy was backed by 150 MW commissioned in Rajasthan in November 2022 and 140 basis points improvement in capacity utilisation factor (CUF). Under the solar portfolio, plant availability was at 99.8 percent in the reviewed quarter against 99.4 percent in the year-ago period. Grid availability was at 99.6 percent while it was 99.3 percent in the year-ago period. It also said the capacity utilisation factor was at 23.3 percent in the reviewed quarter while it was 21.9 percent in the year-ago period. Under the wind portfolio, the company posted a jump of 47 percent in its sale of energy to 300 million units for the reviewed quarter, against 204 million units in the corresponding quarter the previous year. The company in a statement shared with exchanges said its sale of energy went up on the back of its capacity increase from 497 MW to 971 MW in the year-ago period. Under wind energy, its plant availability was at 92.7 percent in the reviewed quarter while it was 96.9 percent in the corresponding quarter the previous year. Its grid availability was 88.2 percent, against 99.9 percent in the year-ago period. The company said the reduction in CUF is primarily due to a one-off disruption in the transmission line for a 150 MW plant at Gujarat, which has now been restored fully.

UP receives INR2k bn investment commitments in solar sector: Energy Minister

18 January: Uttar Pradesh

(UP) has received investment commitments of about INR 2k billion in solar energy and related sectors, State Energy Minister A K Sharma said. UP has launched ‘Uttar Pradesh Solar Energy Policy 2022’ which aims to set up 22 gigawatts (GW) of green energy projects by 2027 in the state, Sharma said. Rooftop solar projects along with ground-mounted projects in agriculture fields will be the growth drivers of the green energy demand in the state, he said. Besides, the government aims to set up utility scale projects, ultra mega solar parks, distributed solar systems and development of model solar cities etc, Sharma said. The state has also launched a Bio Energy Policy 2022 to help the country meet its net-zero goals, Sharma said. Sharma said there are immense business opportunities in the clean energy sector in the state and investors must tap these areas for good returns. The demand for clean energy is growing in the state on the back of various government initiatives and programmes, he said.

International: Oil

Uganda unveils first commercial oil production drilling programme

24 January: Uganda commissioned the first of its four planned oil rigs and the start of drilling the first production well, a key milestone as the country races to meet its target of first oil output in 2025 after a long delay. The East African country discovered commercial reserves of petroleum nearly two decades ago but production has been repeatedly postponed over a lack of infrastructure such as a pipeline.

Biden would veto House Republican bill on an oil reserve: US energy chief

23 January: President Joe Biden will veto a bill by US (United States) House of Representatives Republicans on the Strategic Petroleum Reserve (SPR) if it passes Congress, Energy Secretary Jennifer Granholm said. Granholm warned Republicans that limiting the Democratic president’s authority to tap the nation’s oil reserves would undermine national security, cause crude oil shortages, and raise gasoline prices.

Biden tapped the SPR repeatedly last year in response to oil prices that jumped due to Russia's invasion of Ukraine and as travel increased while the COVID-19 pandemic eased. The Energy Department this month rejected the first batch of bids from oil companies to resupply a small amount of crude to the SPR.

Uganda to announce oil blocks licensing round in May

20 January: Uganda said it plans to announce a third oil licensing round in May in an effort to further develop a sector on track to produce its first oil in 2025. Energy Minister Ruth Nankabirwa Ssentamu said detailing developments in the sector that the next licensing round would be announced at a regional petroleum conference due to take place in Uganda’s capital Kampala in May. The East African country discovered commercial hydrocarbon deposits near its western border with Democratic Republic of Congo in 2006. Production is projected to begin in 2025. Uganda is also developing a crude export pipeline and a domestic crude refinery that will help to commercialise the country’s oil resources.

China’s COVID-19 reopening set to push 2023 oil demand to new high: IEA

18 January: The lifting of COVID-19 restrictions in

China is set to boost global oil demand this year to a new record high, the International Energy Agency (IEA) said, while price cap sanctions on Russia could dent supply. Weak industrial activity and mild weather helped cut oil demand by nearly a million barrels per day in the OECD developed countries in the last quarter of 2022. But despite possible but likely mild recessions in Europe and the United States, China’s expected reopening is set to fuel rebounds in nearby Asian economies and watch it take the lead from India as the world’s leader in oil demand growth. Meanwhile the main growth in oil supply is set to come from the United States as output from the OPEC+ producer group will decline by 870,000 barrels per day (bpd), led by Russia. The Russian oil output was dented by only 200,000 barrels per day (bpd) in December after the European Union banned imports of its seaborne crude and a coalition of countries imposed a price cap on its crude, the IEA said.

Indonesia’s 2022 oil lifting miss target, hopes stalled projects to resume

18 January: Indonesia said it missed oil and gas production targets last year but expects long-stalled gas projects, the Indonesia Deepwater Development (IDD) and Masela gas blocks, to resume development soon. The Southeast Asian country, which aims to boost its crude oil lifting to 1 million barrel per day (bpd) and gas to 12,000 million standard cubic feet per day (mmscfd) by 2030, and is ramping up efforts to attract investment and to get stalled projects going. US (United States) oil giant Chevron is close to reaching a deal with an investor to transfer its stake and operatorship of IDD, Dwi Soetjipto, head of upstream oil and gas regulator (SKK Migas), said. Chevron announced in early 2020 its intention to exit its 62 percent stake in the project as it makes sweeping changes to its global portfolio. Indonesia’s upstream production in 2022 came below target amid unplanned shutdowns and due to maturing blocks.

International: Gas

Santos faces new delay on Barossa gas pipeline due to heritage assessment

24 January: Santos Ltd faces a new delay in developing the Barossa gas project off northern Australia after a regulator ordered it to evaluate the environmental risks to underwater indigenous cultural heritage before starting pipeline construction. Pipeline construction for the US$3.6 billion gas project had been due to begin at the end of January, with the company aiming to start producing gas in the first half of 2025.

EU gas price cap risks curbing market liquidity, regulators warn

23 January: The European Union (EU)’s gas price cap, which launches next month, could impact financial stability and potentially curb liquidity in Europe’s exchange-traded gas markets, the bloc’s financial and energy market regulators said.

EU countries agreed in December to a gas price cap that, from 15 February, will kick in if a benchmark Title Transfer Facility (TTF) gas hub prices spike - a long-debated policy designed to avoid the record-high prices Europe faced last year after Russia slashed gas deliveries. The European Securities and Markets Authority (ESMA) said that if the gas prices edge towards the level that would trigger the cap, the market participants are likely to change their behaviour to avoid triggering it, or to prepare for it.

Nigeria seeks to overturn US$11 bn damages bill over failed gas project

23 January: Nigeria was the victim of "a campaign of bribery and deception" over a collapsed gas processing project, its lawyers told London’s High Court, as the country’s appeal against an US$11 billion damages bill got underway. A London arbitration tribunal in 2017 awarded US$6.6 billion in damages to Process & Industrial Developments (P&ID), a little-known British Virgin Islands-based company, for lost profits related to the failed project.

Russia reduces gas transit to Europe via Ukraine

19 January: Russian energy giant Gazprom will ship 25.1 million cubic metres (mcm) of gas to Europe via Ukraine, it said, further reducing its supplies to the European Union. At the same time, data from Ukraine indicates a possible partial recovery in supplies. Russian gas exports to Europe via pipelines plummeted to a post-Soviet low in 2022 as deliveries to its largest customer plunged because of the conflict in Ukraine and suspected sabotage that damaged a major pipeline. Gazprom had already reduced flows to 32.6 mcm via the Sudzha metering point, down almost 8 percent from the previous several days. The company had shipped gas via Ukraine at between 35.4 mcm and 35.5 mcm over Jan. 6-16, having exported more than 40 mcm per day for most of the second half of last year and the first three days of 2023. Ukraine’s state gas transit company said that Russian gas nominations, or requests from customers, were seen at 35.2 mcm via the Sudzha metering point, signalling a possible partial recovery in supplies.

International: Coal

South Africa’s Sasol H1 coal exports down 25 percent due to rail, mining problems

24 January: South Africa’s Sasol reported a 25 percent decline in coal exports during the first half of its financial year due to rail logistics problems as well as safety and operational stoppages at its mines. In a production update, Sasol reported a 4 percent decline in coal output to 15.2 million tonnes (MT) for the six months to 31 December, with only 900,000 tonnes being shipped for export, compared to 1.2 MT in its first half the previous year.

North Asia cranks coal imports to fuel industrial reboot

24 January: Thermal coal imports into China, Japan and South Korea - three of the world’s largest coal users - hit their highest combined total in 16 months in December as the North Asian manufacturing powerhouses primed their economies for growth in 2023. Economic momentum in these countries - which collectively accounted for nearly half of all thermal coal imports in 2021 - was subdued in 2022 as China's strict zero-COVID measures stifled industrial activity across the world's largest manufacturing base. Combined thermal coal imports by the three countries totalled 43 million tonnes (MT) in December 2022, the highest monthly tally since August 2021, ship-tracking data from Kpler shows. In turn, that collective climb in

coal use is set to generate a swell in combined coal emissions from China, Japan and South Korea, which together accounted for 36 percent of global carbon dioxide emissions from the energy use in 2021, according to the BP Statistical Review of World Energy.

Coal miners must keep up to 10 percent for local needs: Australian state

19 January: Australia’s most populous state is set to require coal miners to reserve up to 10 percent of production for the domestic market, as part of a national move to cap soaring energy prices. Australia’s Labor government led by Prime Minister Anthony Albanese in December passed legislation to cap natural gas prices for one year, and secured agreements from the coal producing states of New South Wales (NSW) and Queensland to cap the price of coal sold to power plants. NSW Treasurer Matt Kean said the state would require those coal miners that do not currently sell into the domestic market to reserve between 7 percent and 10 percent of their output for domestic use. The new arrangement would ensure a fairer sharing of the burden among coal companies as part of the federal government’s push to drive down energy prices, he said. Thai firm Banpu’s Centennial Coal and Peabody Corp are the main suppliers of coal to power plants in the state. Other major coal miners in the state include BHP Group, Glencore Plc, Whitehaven Coal, Yancoal and New Hope Corp, which concentrate on exports.

International: Power

Japan power company seeks to raise the household electricity prices by 30 percent

24 January: The Tokyo Electric Power Company Holdings Inc.

(TEPCO) said that it has applied to the government to raise its regulated electricity rates for households by around 30 percent from June in response to surging energy prices and the yen’s weakening. The rate hike application, following five other major power companies which have already filed for the government's approval to raise prices by between 28 percent and 46 percent from April, reflects a deteriorating business performance due to soaring prices of fossil fuels such as liquefied natural gas (LNG) and thermal coal for power generation. Japan’s industry ministry will examine details of TEPCO’s cost reduction measures and decide on the actual rate increase. TEPCO president Tomoaki Kobayakawa said that the company would have problems ensuring stable supplies of electricity if it leaves the situation as it is. The hike in the regulated rates would be the first for TEPCO since 2012 when it raised the rates in the aftermath of the 2011 Fukushima nuclear disaster.

PM orders inquiry into 16-hour power outage in Pakistan

24 January: Pakistan Prime (PM) Minister Shehbaz

Sharif has ordered an inquiry into the power outage in Pakistan. According to Pakistan’s energy ministry, the national grid’s frequency dropped around 7:34 am, leading to a "widespread breakdown" in the electricity system. Additionally, it stated that Warsak was the starting point for the repair of grid stations. However, electricity has still not been fully restored nationwide, which is hindering companies and the daily lives of more than 220 million people. The outage lasted for more than 16 hours, especially when temperatures were forecasted to fall to around 4 degrees Celsius (39°F) in Islamabad and 8 degrees Celsius (46°F) in Karachi. The blackout, which Energy Minister Khurram Dastagir claimed was caused by a power surge, is the second significant grid breakdown in three months and adds to the nearly daily blackouts Pakistan's population experiences. Islamabad Electricity Supply Company (IESCO), which provides electricity to Islamabad, Rawalpindi, Attock, Jhelum, Chakwal and parts of Pakistan-occupied Kashmir (PoK) said that the power supply to 117 grid stations of its company has been suspended.

Lebanon to take out US$116 mn in loans for ailing electric grid

18 January: Lebanon’s caretaker government approved opening credit lines totaling

$116 million to help fix its crippled state electricity grid. The cash-strapped country for over two years has struggled with rampant power cuts that have crippled much of public life, worsening a broader economic crisis that has pulled over three-quarters of the country’s population into poverty. Today, households only receive about an hour of state electricity per day, with millions now relying on expensive private generator suppliers to power their homes. Lebanon’s state electricity company has bled state coffers dry for decades, costing the government over $40 billion with annual losses of up to US$1.5 billion. The country’s two main power plants have occasionally broken down and require heavy maintenance. The World Bank and International Monetary Fund says restructuring the country’s energy sector is a key reform for the country to pull itself from the mire.

International: Non-Fossil Fuels/ Climate Change Trends

France’s renewables growth falling below targets

24 January: France is falling behind in its plans to boost onshore wind and solar power, the country’s annual renewable electricity report showed. The share of renewables in France’s electricity mix last year was estimated at about 26 percent, a slight rise from 25 percent in 2021. The country’s onshore wind installed capacity had risen to nearly 20 gigawatts (GW) as of September, the report said, but added that a goal of some 24 GW in 2023 appeared out of reach. By 2028, France’s multi-annual energy program (PPE) law calls for between 33 GW and 35 GW of onshore wind capacity installed, yet at the current pace France is on track to fall short at some 29.4 GW, the report said. As of September, France had 15.8 GW of installed solar photovoltaic capacity. At the current pace, that would mean achieving 31.4 GW by 2028, short of its legislative goal of between 35 GW and 44 GW.

Grenergy aims to sell minority stake in Spanish solar assets

24 January: Spain’s Grenergy aims to sell a minority stake in photovoltaic projects in the country, the renewable power generation company said. Such a deal would follow the path of larger rival Iberdrola, which

sold a 49 percent stake in a portfolio of solar plants and onshore wind farms in Spain to Norway’s sovereign wealth fund. With its sunny plains, fast-flowing rivers and windy hillsides, Spain aims to produce two thirds of its electricity from renewables by 2026. Power companies from all over the world are investing in the country to build infrastructure to reach that goal. Swiss renewable power group, Smartenergy plans to sell a portfolio of solar power projects in Spain.

Portugal to launch first offshore wind auction, eyes 10 GW by 2030

23 January: Portugal expects to launch its first offshore wind power auction by the last quarter of this year, aiming to reach 10 gigawatts (GW) of installed capacity by 2030, Prime Minister Antonio Costa said. As a precondition to the auction, the government will launch a public hearing regarding proposals for the delimitation of areas to allow the deployment of wind farms off the country’s Atlantic coast, he said. Portugal has 7.3 GW of hydroelectric capacity and 5.6 GW of onshore wind, which together represents 83 percent of its total installed capacity. The energy crisis caused by Russia’s invasion of Ukraine is forcing countries to bet more on renewable energy generation, such as wind and solar. Portugal has a small, 25 megawatts (MW) floating wind project off its Atlantic coast. The country aims to have 80 percent of its electricity usage coming from renewable sources by 2026, up from around 60 percent, which is already one of the highest ratios in Europe.

Ethiopia signs deal with UAE’s Masdar for 500 MW solar plant

18 January: United Arab Emirates (UAE) renewable energy company

Masdar and Ethiopia have signed an agreement for the joint development of a solar project with a capacity of 500 megawatts, Ethiopia’s prime minister Abiy Ahmed said. The move could potentially allow Ethiopia to significantly expand its energy capacity and also diversify its energy mix, a key part of the PM’s industrialisation drive. At present, Ethiopia has a total installed power generating capacity of about 4,898 MW, with 91 percent of it coming from hydroelectric power, based on data from Ethiopian Electric Power. Ethiopia is eager to expand its energy capacity and last year began generating power from its giant Grand Ethiopian Renaissance Dam (GERD), a multi-billion-dollar hydropower plant on the River Nile that neighbours Sudan and Egypt have opposed. Masdar has been pushing into renewable energy in Africa and elsewhere. The company signed an agreement with Zambia's state-owned power utility Zesco to develop solar projects worth US$2 billion.

China sets another solar record despite supply chain disruptions

18 January: China set another record for solar power capacity last year as the country sped up renewable installations to reach its ambitious climate targets. The nation installed 87.4 gigawatts (GW) of solar last year, beating 2021’s record of 54.9 GW, the National Energy Administration said. Additions fell short of bullish industry forecasts in the middle of last year for as much as 100 GW as supply chain disruptions boosted prices and slowed installations.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Central Electricity Authority

Source: Central Electricity Authority