-

CENTRES

Progammes & Centres

Location

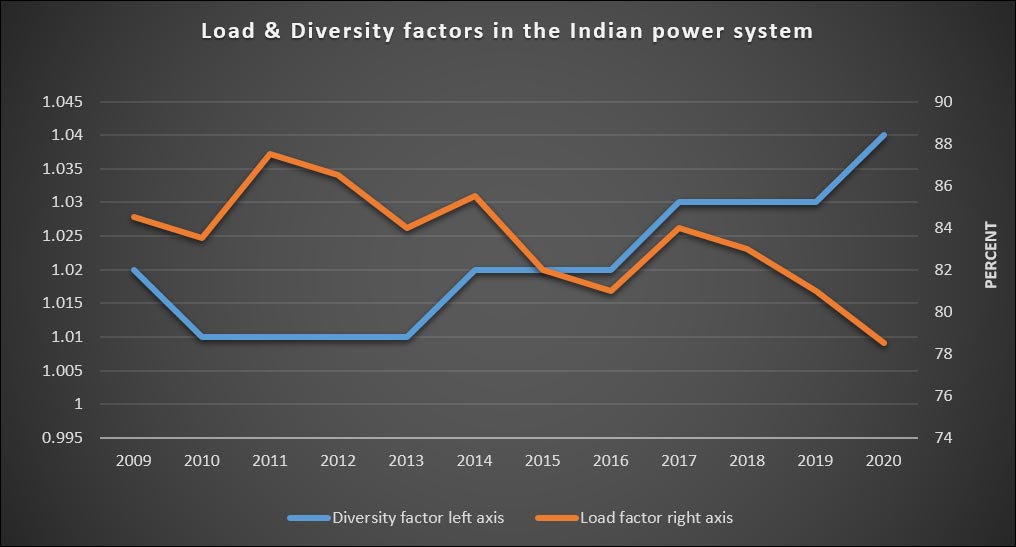

A distinguishing characteristic of the electricity demand is the timing or peak load nature of the demand. Electricity demand functions cannot thus be parameterised simply using prices and quantities, but must also include time. Since electric power is not easily stored, temporal variations in system load (instantaneous demand for kilowatts of electric power) means that capital (generation assets) is often idle, which creates cost minimisation problems and optimal pricing problems. If economic principles are followed, the distribution of a customer's demand for electricity throughout the day (or other time periods such as months or seasons) should influence the amount that the customer pays to the electricity distribution company (Discom). However, this is not the norm in tariff setting in India. The declining trend in load factor and increasing trend in diversity factor of the Indian power system make the case for tariff setting on the basis of economic principles stronger.

Load factor is a useful indicator for describing the consumption characteristics of electricity over a period. It is expressed as the ratio of average electricity demand to peak electricity demand and is always less than one. A high load factor (when the average demand is closer to peak demand) indicates consistent and predictable electricity consumption, which is better for Discoms. A low load factor indicates high demand on the grid for shorter periods. This increases investment in capacity and the cost of supplying electricity.

The diversity factor is the ratio of the sum of the maximum demand of the various subdivisions of the system (state or regional level in the case of India) to its connected load. This factor gives the time diversification of the load and is used to decide the installation of sufficient generating and transmission capacity. If all the demand for electricity came at the same time, (when diversity factor is one), the total installed capacity required would be much more. But not all demand comes at the same time and the factor is much higher than one, especially for domestic loads. In April 2023 the diversity factor for the Indian grid was 1.054 compared to 1.03 in April 2018.

According to an analysis of daily, monthly, and annual load factors using 5-minute instantaneous Supervisory Control and Data Acquisition (SCADA) data over the last twelve years (January 2009 to December 2020) by Power System Operation Corporation Limited (POSOCO), the all-India annual load factor remained in the narrow range of 83-86 percent in the last 12 years while the daily all India diversity factor of maximum demand was increasing.

The high load factor was attributed by POSOCO to demand side management in different States, the synchronous interconnection of regional grids to form the national grid for sharing of generation capacity, rapid augmentation in transmission capacity and transfer capability to facilitate exploitation of diversity in the state and regional power system. In addition, the fact that the rate of growth of energy and peak demand has been around the same also contributed to high load factors.

Other findings of the analysis are that maximum demand is increasing at a faster rate than the average demand and minimum demand. All India daily load factor was above 90 percent for 70 percent of the time, however, in 2019 & 2020, it was above 90 percent only 60 percent of the time. The analysis also found that the daily all-India load factor was gradually decreasing. POSOCO attributed this to a significant reduction in the peak and energy shortage consequent to rapid augmentation in the conventional as well as new and renewable energy (RE) generation capacity in the grid.

The data showed that the annual load factor for the northern region fell from 79 percent in 2009 to 63 percent in 2020. Variation in the daily load factor of the northern region between summer and winter was about 5-6 percent, which indicated a higher proportion of weather-sensitive and agricultural load within the region. The annual load factor of the western region reduced from 80 percent in 2009 to 72 percent in 2020. Variation in daily load factor between seasons was about 8-10 percent. The annual load factor of the southern region was between 69-84 percent. The variation in daily load factor between seasons was about 4-5 percent. Variation in load factor is more prominent in the southern region compared to other regions, and it demonstrated a decreasing trend over the last three years.

The annual load factor of the eastern region remained steady between 68 and 77 percent , and seasonal variation in daily load factor was about 7-9 percent. The annual load factor of the north-eastern region varied between 59-64 percent, and variation in daily load factor was about 8-10 percent. Daily Load factor hit maximum in July-August. Most of the states showed a decreasing trend in load factor except Kerala, Chhattisgarh, Madhya Pradesh, Odisha and West Bengal. There was minimal impact of seasonality on the load factor pattern of Jharkhand. In April, May, June, July and August, the load factor was relatively higher than in January, February, October, November and December.

System load and diversity factors affect the overall economics of the power system. While evaluating different policy trajectories, policymakers and regulators prefer the trajectory that increases the load and diversity factors to reduce the cost of supply and increase utilization of assets. The declining trend in the load factor in the Indian power system points towards the need for investments in flexible resources and energy storage technologies. It also underscores the need for regulatory interventions through market design (intra-day market, ancillary services) and tariff design (peaking tariff, peak hour capacity availability). Policies that encourage transnational interconnections to defer capital expenditure and increase load factor by exploiting regional diversity are also relevant. Demand elasticity could be enhanced by encouraging measures like demand response, demand side management and staggering of supply hours to bulk consumers. A higher diversity factor can be obtained by giving incentives to certain user categories (such as farmers and some industries) to use electricity in the night or light load periods. Discoms can also use time of the day (TOD) pricing of electricity supplied to consumers. Using day-light saving, staggering the office timings, having two-part tariff in which consumer must pay an amount dependent on the maximum demand he makes, plus a charge for each kilowatt hour (unit) of energy consumed are methods commonly used to increase diversity factor. The electrification of transportation and domestic cooking could also have a positive impact on the load factor. Enabling mechanisms to assess and harness the reserves available within the existing capacity could be considered.

The data from POSOCO also reveals that ramping has been increasing day by day during peak hours with difference in maximum and minimum demand of the order of 65 GW (gigawatt). Peak demand growth is surpassing the energy consumption growth possibly because of agriculture load shifting and rural electrification. In view of anticipated high ramping in the future due to higher peaks, it is envisaged that containing ramp during peak hours would be a challenge to keep all India frequency with in Indian electricity grid code (IEGC) band. This means that flexible ramp reserve requirement during morning and evening peak is more critical than base load requirement. High RE penetration and variability is also affecting the demand load factor profile significantly. In this environment, it is imperative that increasing diversity factor in the electricity system is leveraged to limit the effect of decreasing load factors on electricity tariff.

Source: GRID-INDIA

RE Policy and Market Trends

To propel the adoption of solar energy, the Uttar Pradesh (UP) government has unveiled plans to transform 17 major cities of the state into solar cities including revered cities of Ayodhya and Varanasi. Under the initiative, the development of solar cities will take place first and then the government will work towards building solar villages on the same pattern. Notably, the administration has already started its efforts to establish Ayodhya as the inaugural solar city. Ayodhya’s solar city project encompasses the installation of over 2,500 solar-powered streetlights, enhancing the sacred city’s commitment to sustainability. The city already boasts solar-powered amenities such as ATMs and solar trees adorning its 40 intersections, epitomising the city’s embrace of renewable energy solutions. With Ayodhya spearheading the solar energy adoption, another major city Varanasi is making a foothold to install rooftop solar plants across government buildings. Under the project, Varanasi is slated to witness the installation of 25,000 rooftop solar plants, positioning it as a beacon of solar innovation.

Power consumers in Delhi have a reason to cheer as the Delhi government has formulated the Delhi Solar Policy 2024 that will not only ensure zero electricity bills but also allow them to earn by installing solar panels on the rooftops of their houses. Making amendments to State Solar Policy 2016 that resulted in 1500 MW (megawatt) solar power installed capacity in Delhi government has come out with a more consumer-friendly Solar Policy 2024 that will provide 4500 MW of installed capacity of solar power in Delhi by 2027. As per the Delhi government, the Solar Policy 2016, announced in the first term of the AAP government after coming to power in 2015, laid the foundation for solar adoption in Delhi. The aims of Delhi Solar Policy 2024 are to reduce Delhi’s air pollution and help fight inflation by bringing the electricity bills of non-subsidized residential consumers to zero and for commercial/industrial consumers to 50 percent of their current bill.

Rajasthan will adopt the Maharashtra model to supply power to farmers during the day by promoting solar energy production and improving the power distribution system. An energy department team will soon visit Maharashtra to study the policy changes made there and will discuss ways about implementing them in Rajasthan.

To procure 100 percent renewable energy by the end of 2025, New Delhi Municipal Council (NDMC) has tied up with multiple PSUs in the sector. Last year, the total power consumption in NDMC’s jurisdiction was 400 MW and only 20 MW was supplied through solar plants. Likewise, NDMC has given consent to procure 100 MW from Solar Energy Corporation of India and a petition to finalise tariff has been filed to DERC. Its implementation period is 24 months from the date of signing agreement.

India requires a substantial investment of INR4.75 trillion (US$57.2 billion (bn)) by 2027 for developing its transmission infrastructure, including lines, substations, and reactive compensation, as per a draft plan floated by the Central Electricity Authority (CEA). This projection aligns with the Centre’s initiative to boost the national transmission system, facilitating integration of renewable energy capacities. The CEA has sought stakeholders' comments and recommendations on its draft National Electricity Plan (Volume II) for transmission by 26 March. As on 31 October 2023, India’s renewable energy capacity stood at 178.98 GW, including 46.85 GW from large hydro sources, accounting for approximately 42 percent of the country’s total power generation capacity. The cost projection is based on the expectation that by the year 2026-27, India's power generation capacity will reach 650.26 GW. This includes 235.13 GW from thermal sources and 206.14 GW from solar. India aims to increase its non-fossil fuel-based electricity generation capacity to 500 GW by 2030. To achieve this, regions with high solar and wind potential need to be connected to the Inter-State Transmission System (ISTS) for efficient power evacuation to demand centres.

According to Union Ministry of Finance, the government will mandate the phased blending of compressed biogas (CBG) in compressed natural gas (CNG) for transport and piped natural gas (PNG) for domestic purposes. These steps are taken towards meeting nation’s commitment for 'net-zero' by 2070. As per the ministry, the viability gap funding will be provided for harnessing offshore wind energy potential for initial capacity of 1 gigawatt (GW). The financial assistance will be provided for procurement of biomass aggregation machinery to support collection. According to the ministry to promote green growth, a new scheme of bio-manufacturing and bio-foundry will also be launched.

Renewable energy firm SAEL has secured US$1 billion funds from various financial institutions, including Norfund, DFC, ADB, and Tata Cleantech, to finance its renewable energy portfolio. As per the company, the investment will be used to expand the company’s solar and biomass projects, capitalising on the conducive market potential and government schemes in the renewable energy sector.

Roof Top /Distributed Solar Projects

According to Union Ministry for New and Renewable Energy, the government is set to increase the subsidy for rooftop solar installations to about 60 percent under the new Pradhan Mantri Suryoday Yojana. Currently, the government provides a 40 percent subsidy for rooftop solar installations. The enhanced subsidy aims to support consumers with electricity consumption below 300 units, typically belonging to economically weaker sections, by making solar installations more affordable without the need for loans. Post the 10 years when the loan is repaid, the rooftop solar infrastructure would be transferred to the household, which can then sell the excess power to the distribution companies (discoms). As per the Union Ministry of Finance, the 10 million beneficiaries of the new scheme would be able to get 300 units of free power through the rooftop solar installations, resulting in an annual saving of INR15,000-18,0000 per year.

All the government buildings in Jammu and Kashmir (J&K) are to be covered under the rooftop solar programme. In a meeting attended by the Principal Secretary of the Power Development Department (PDD); Principal Secretary of Finance; Commissioner Secretary of Science and Technology (S&T); Deputy Secretary of the Ministry of New and Renewable Energy (MNRE); Managing Directors of Kashmir Power Distribution Corporation Limited (KPDCL) and Jammu Power Distribution Corporation Limited (JPDCL); and representatives of National Hydroelectric Power Corporation (NHPC), Chief Secretary Atal Dulloo took note of the rooftop solar power plants. During this meeting, he asked the concerned to ensure the implementation of the scheme as per its guidelines. He asked them to identify all the buildings fit for installation of the solar rooftops. During the meeting, it was informed that it was envisaged that 100 percent of government buildings in J&K would be covered under the rooftop solar programme.

Prime Minister (PM) Narendra Modi, publicly announced a scheme to electrify 10 million (mn) households with solar electricity. Currently, there is no centrally compiled estimate of the number of households in India with rooftop solar installations. What is known is that despite increases in installed solar capacity, the growth in the number of rooftop solar installations has been muted. As of 31 July 2023, only 2.2 GW (1 GW is 1,000 MW) worth of rooftop installations were reportedly installed in Indian homes. To put that in perspective, the government, since 2010, has been claiming to install 100 GW by 2022 — 60 GW from utility project (mega concentrated solar parks) and 40 GW from rooftop solar. So far, about 56 GW has been installed in the utilities (July 2023) and 12 GW in rooftops. Rooftop solar installations include panels in offices and homes. Of the nearly 12 GW of rooftop solar installations as of July 2023, about 87 percent are “non-residential”, according to a report by JMK Research.

Utility Scale Solar Projects

MahaMetro Rail Corporation recently signed a power purchase agreement (PPA) with Delhi-based Ampin Energy Transition, a company engaged in renewable energy business. Ampin will be setting up a 6 MWp (megawatt peak) solar power plant at the premises of Nagpur Metro. The power generated through solar panels set up at metro stations and depots will be supplied to the corporation at INR4.15 a unit.

Chhattisgarh has inaugurated the country’s biggest solar energy plant with a battery energy storage system located near the Dhaba village in the Rajnandgaon district. This solar facility established by the Solar Energy Corporation of India (SECI) and Chhattisgarh Power Distribution Company provides a capacity of 100 MW. This solar plant ensures that there will be electricity even during the night generating over five lakh units per day. This will reduce 4.5 lakh metric tons of carbon emission and boost green energy. The on-grid solar power plant set-up by the Chhattisgarh Renewable Energy Development Agency (CREDA) is a significant step towards sustainable energy. The plant was established on 1 February 2024. The plant features a 100 MW solar plant equipped with 2,39,000 bifacial solar panels which is producing electricity from both the sides. The plant is expected to generate power for the next seven years using solar energy. The decision to establish the first solar park in the Bairam hill area of the Rajnandgaon district was taken by the Chhattisgarh government to maximize the use of these hilly terrains for solar power.

SJVN Ltd has received a letter of intent (LoI) from Gujarat Urja Vias Nigam Ltd to set up a 200 megawatt (MW) solar power project. The tentative cost of construction and development of this project is INR11 bn. The ground-mounted solar project shall be developed by SJVN subsidiary SJVN Green Energy Ltd (SGEL) anywhere in India through an EPC contract. The Power Purchase Agreement (PPA) shall be executed with GUVNL after the adoption of the tariff by GERC (Gujarat Electricity Regulatory Commission). The project is expected to generate 508.4 million units (MU) in the first year after commissioning and the projected cumulative energy generation over a period of 25 years is 11,836.28 MU.

SJVN Ltd has also bagged a 100 MW solar project under an e-reverse auction conducted by Gujarat Urja Vikas Nigam Ltd (GUVNL). SJVN bagged the 100 MW solar project at the rate of INR2.54 per unit on a build-own and operate basis through a tariff-based competitive bidding process of GUVNL Phase XXI. According to the company, SJVN has secured the full quoted capacity of a 100 MW solar power project through e-Reverse Auction conducted by GUVNL.

Waaree Renewable Technologies said it has bagged a order worth Rs 547.5 crore (US$66 mn) for 412 MWp solar energy project. The company's unexecuted order book now stands at 1.161GW, according to a BSE filing. The Waaree Renewable Technologies has received a Letter of Award (LoA) for the execution of Engineering, Procurement and Construction (EPC) work for Solar power plant on turnkey basis with an order value of INR5.47 bn. The LoA also includes operations and maintenance for a period of two years from the date of hand over, with an order value of INR67.98 million (US$0.82 mn). The projects are scheduled to be completed in December 2024 as per the term of the order. The company said that the order is awarded by one of the global leading biggest utility in the world in renewable energy. It has disclosed to the BSE that it is a domestic order.

Wind Power

The Government of India has invited bids for the development of off-shore wind energy of a total capacity of 4 GW. The bids invited are for four blocks of 1 GW each on open access basis, for development of offshore wind power projects off the coast of Tamil Nadu, through international competitive bidding. Under this arrangement, the developers who win the bid for each block will set up 1 GW off-shore wind energy capacity and sell electricity directly to consumers under the open access regime. No Viability Gap Funding (VGF) is given under the open access bids, and the Renewable Energy generated will be sold to entities such as industries which are currently in the high-tariff band. The off-shore wind energy bids have been invited through Solar Energy Corporation of India (SECI), a Government of India undertaking under the administrative control of the Ministry of New and Renewable Energy. The bids are being called after obtaining all necessary environmental clearances.

Biomass/Bio-Power/Waste to Energy

According to Union Petroleum and Natural Gas Minister Hardeep Singh Puri, 100 new biogas plants will soon be established in Uttar Pradesh (UP). Puri said that in the last seven years the state has shed the label 'BIMARU' (sick) state and has done excellent work in every sector. Puri said that the process of land selection for setting up 37 plants is complete. Puri said that the Budaun plant, developed on 50 acres with an investment of about INR1.35 billion, will produce about 14 tonne of compressed biogas every day, and will be instrumental in stubble management. Biogas is not only a solution to the problem of smog in NCR (National Capital Region) but also a means to increase the income of farmers, he said. According to Union Petroleum Secretary Pankaj Jain, under the biofuel policy of UP, there is a provision of a grant of up to INR200 million for the establishment of bioenergy plants.

North & South America

Colombia’s renewable energy sector could get investment of up to US$2.2 bn in 2024 across 66 projects that are soon to enter production or waiting to complete paperwork, renewable energy association SER Colombia said. Colombia has set its sights on developing renewable energy sources, such as solar, wind and geothermal, as part of President Gustavo Petro’s goal to wean the major regional coal and oil producer off its dependence on fossil fuels. However, some renewable projects have faced significant hurdles, including onshore and offshore wind farms in the north of the country, due to resistance from Indigenous communities and regulatory delays. Electricity capacity across Colombia’s offering of non-conventional renewable energy projects at the end of 2023 stood at 504 MW, SER Colombia said in a report. However, the Andean country is set to extend that capacity by 1,240 MW across 22 projects in 2024, with up to an additional 1,800 MW in 44 projects that are pending permissions and other administrative procedures, the report said. Sixty-five of the projects are for solar energy, while one is for a battery energy storage system, the report said. Colombia’s nascent renewable energy industry faces challenges in the form of lengthy execution times for projects to start entering the market, which in turn hampers financing and investment, the report said. The average time it takes a small renewable energy project to start operating in the country is between around three to six years, 70 percent of which is taken up by some 15 administrative processes, the report found.

New Jersey’s utility regulator approved two offshore wind power projects with a combined capacity of 3,742 MW and whose backers include Invenergy and TotalEnergies, opens new tab. The offshore wind industry is expected to play a major role in helping several states and US (United States) President Joe Biden meet goals to decarbonize the power grid and combat climate change. The latest approvals were part of New Jersey's third solicitation for offshore wind, which sought 1,200 to 4,000 MW of power capacity. In total, the state wants about 11,000 MW of offshore wind power by 2040. Specifically, the BPU approved the 1,342-MW Attentive Energy Two project and the 2,400-MW Leading Light project as qualified offshore wind projects to receive offshore wind renewable energy certificates.

Europe/UK

Snam, opens new tab is officially launching a market test for hydrogen demand in Italy and a collection of expressions of interest for carbon dioxide (CO2) transport and storage, the gas grid operator said. The two initiatives are part of Snam’s broader activities to support Italy's energy transition, the company said. According to the International Energy Agency (IEA), it can play a vital role in achieving global climate goals. However, critics said it risks prolonging the use of fossil fuels and question whether it is commercially viable. Snam and Italian energy group Eni announced a project last year to set up a carbon capture and storage hub offshore Ravenna to help decarbonise high-emitting industrial activities.

Prices of European power purchase agreements (PPAs) for green electricity fell 2 percent in the fourth quarter of 2023, making a case for buyers to strike new deals ahead of an expected rise in demand, price tracking platform LevelTen said. PPAs, bilateral long-term agreements between corporate power users and wind and solar project developers, give consumers supply security and developers a guaranteed income stream, making it easier to arrange financing. Corporate buyers are eager to lock in a carbon-free power supply to comply with a 2023 European renewable energy directive requiring 42.5 percent of EU (European Union) electricity be renewable by 2030.

Norway’s Equinor, opens new tab is sticking to its 2030 renewable energy capacity target despite dropping out of some offshore wind projects in New York. The company announced an asset swap with former partner BP, opens new tab for offshore wind projects in the US (United States) state of New York, leaving just the 0.8-GW Empire Wind 1 project to go forward at this time. Equinor is seeking better terms for Empire Wind 1 in New York's latest offshore wind auction, which closed, after a previous attempt to agree a better deal failed in October. It retains the 1.2 GW Empire Wind 2 project, for which it cancelled a power off-take agreement and will take more time to develop. The new bid has been submitted at a price level that was competitive but would restore profitability, albeit at the lower end of Equinor’s guided real base project return for renewables of 4-8 percent, Eitrheim said.

China has agreed to invest €2 bn (US$2.18 bn) in Serbia to build wind and solar power plants and a hydrogen production facility, the biggest investment in renewable energy in the Balkan country to date, Serbia’s mining and energy ministry said. A Memorandum of Understanding (MoU) between the ministry and China’s Shanghai Fengling Renewable Co Ltd and Serbia Zijin Copper, a local subsidiary of Zijin Mining, opens new tab, was signed. The MoU envisions the construction of a 1,500 MW wind farm, a 500 MW solar plant and a hydrogen plant with an annual capacity of about 30,000 metric tons by 2028, the statement said, with Shanghai Fengling Renewable as the principal investor.

China

China’s installed wind and solar capacity will overtake coal for the first time this year. The China Electricity Council (CEC) in a yearly report said grid-connected wind and solar would make up around 40 percent of installed power generation capacity by the end of 2024, compared with coal's expected 37 percent. By comparison, wind and solar together were around 36 percent of capacity at the end of 2023, and coal was just under 40 percent. China will have built around 1,300 GW of wind and solar capacity by the end of 2024, the CEC expects, meaning it will have already exceeded its official target of 1,200 GW by 2030. The CEC said that generating capacity from all non-fossil fuel sources - including nuclear and hydro - made up more than half of the total for the first time in 2023.

China plans to generate an increasing share of electricity from renewables as part of its pathway to net zero emissions, with coal-fired and gas-fired power plants acting in a reserve capacity to ensure reliability. The transformation is already well underway, though the extent of the changes was masked by drought in 2022/23 that temporarily reduced hydroelectric generation. Thermal power plants (mostly fuelled by coal) accounted for 2,853 GW of generation capacity or 48 percent of the total at the end of November 2023, according to the China Electricity Council. Remaining capacity came from zero-emission sources, including solar (558 GW, 20 percent), hydro (421 GW, 15 percent), wind (413 GW, 15 percent) and nuclear (57 GW, 2 percent). But thermal power plants still accounted for a far higher share of actual generation (70 percent in 2023), compared with lower shares from hydro (13 percent), wind (9 percent), nuclear (5 percent) and solar (3 percent). The average thermal plant generated for 4040 hours in the first eleven months of the year compared with 2927 hours for hydro plants, 2029 hours for wind farms and 1218 hours for solar. Thermal plants were able to generate on-demand thanks to plentiful coal supplies while hydro was hit by low water volumes on the southern river systems and wind and solar were limited by the normal intermittency.

Other Asia Pacific

Marine biofuel demand at the world’s largest bunker hub Singapore could potentially double by 2025 to almost 1 million metric tonnes from 2023 levels as shippers seek to cut emissions, TotalEnergies said. More shipping companies have been conducting refuelling trials using marine biofuel as an alternative to conventional fuel oil to reduce carbon emissions. Bio-blended marine fuel sales at Singapore more than tripled to over 500,000 tonnes last year, data from Singapore’s port authority showed. Total sales in 2023 surpassed initial estimates as regulations on carbon intensity indicator (CII) boosted growth. The International Maritime Organization approved interim guidelines on how certified sustainable biofuels could be used to improve a ship’s CII rating. However, the demand outlook is still contingent upon biofuels pricing and development of more infrastructure such as barging and tanking facilities. TotalEnergies Marine Fuels is among Singapore’s key marine biofuel suppliers in 2023, though it declined to comment on specific volumes. Its biofuel offerings are second-generation product and ISCC-certified. Demand for lower-carbon marine fuel is poised to increase from this year globally as the European Union Emissions Trading System kickstarts for the shipping industry.

17 February: Numaligarh Refinery Limited (NRL), a public sector oil company, has executed one of the longest horizontal directional drilling (HDD) in the Subansiri river for its ambitious crude oil pipeline project of laying a cross-country pipeline of 1,635 km from the Paradip Port in Odisha to Numaligarh in Assam’s Golaghat district. The refinery, jointly owned by Assam government, Oil India Limited and Engineers India Limited, is also carrying out an expansion of its refinery from 3.0 million metric tonnes per annum (mmtpa) to 9.0 mmtpa as part of ‘Numaligarh Refinery Expansion Project (NREP)’, which is the single largest investment in northeast India as part of the Centre’s ‘Hydrocarbon Vision 2030 for North East India’. NRL said the crude oil pipeline passes through five states, traversing numerous en route crossings, including all major rivers of east India, particularly the Ganges, Jia Bharali, Subansiri and Brahmaputra, through a technique called horizontal directional drilling (HDD) with intersection.

14 February: Union Minister Hardeep Singh Puri has reiterated Prime Minister (PM) Narendra Modi’s vision to increase the share of natural gas from 6 percent to 15 percent in India’s energy mix while addressing the inaugural edition of the International Conference of Petroleum and Natural Gas Regulators. The dialogue put spotlight on India’s natural gas regulatory and infrastructure development, especially for overall infrastructure development and city gas distribution sector to provide reliable and affordable clean energy.

14 February: Coal India Ltd plans to start operations at five new mines and expand capacity of at least 16 existing ones to address growing demand for the fuel, its Chairman P M Prasad said. India has increasingly relied on coal to address record power demand in recent months, with the rise in coal-fired power output outpacing renewable energy growth for the first time since at least 2019. A record output by Coal India - the world’s largest coal miner whose profits and share price have surged since early 2023 - is set to boost inventories at power plants running on domestic coal by 16.1 percent year-over-year to 40 million metric tonnes by end-March, Prasad said. Coal India aims to boost output by more than 7 percent to a record 838 million tonnes (MT) for the next fiscal year that starts 1 April, with initial stockpiles at 80 MT, over 15 percent higher from a year earlier. The miner plans to start operations at five new mines, with a combined annual capacity of 14.3 MT, in the next fiscal year, Prasad said. Last year’s decline in global coal prices from 2022’s historic highs prompted Indian traders and users to increase imports of thermal coal, which rose 9.4 percent to 176.3 MT in the year ended December 2023. Non-power users were avid buyers of imported coal, Prasad said. Meanwhile, lower seaborne coal prices have resulted in a decline in Coal India’s margins on what are usually lucrative spot auction sales, though volumes offered through auctions rose nearly 80 percent to 73 MT in the ten months ended January.

19 February: Tata Power Company advanced 1.61 percent to INR382.20 after the company announced the receipt of a letter of intent (LoI) from REC Power Development and Consultancy to acquire Jalpura Khurja Power Transmission for INR8.38 billion. The Jalpura Khurja Power Transmission is a project special purpose vehicle (SPV). It would be developed on build-own-operate transfer basis, to provide transmission service for 35 years from the schedule date of commercial operation (SCOD) which is 18 months from the date of SPV acquisition. Tata Power Company is one of India’s largest integrated power companies and together with its subsidiaries and jointly controlled entities. The company has a presence across the entire power value chain - generation of renewable as well as conventional power including hydro and thermal energy, transmission & distribution, coal & freight, logistics, and trading.

15 February: REC said its arm RECPDCL has handed over Pachora Power Transmission SPV (special purpose vehicle) to GR Infraprojects. The SPV was formed for the establishment of the Interstate Transmission Project for evacuation of power from renewable energy (RE) projects in Rajgarh (1,000 MW) SEZ in Madhya Pradesh-phase II through a tariff-based competitive bidding process, REC said. The SPV Pachora Power Transmission was handed over to the successful bidder GR Infraprojects in the presence of senior officials from RECPDCL. Additionally, representatives from the Central Transmission Utility of India Limited (CTUIL) and other key stakeholders attended the event, it said. RECPDCL, a wholly-owned subsidiary of REC Limited, has been acting as bid process coordinator (BPC) for tariff-based competitive bidding (TBCB) in transmission line projects and RE-bundling projects.

14 February: The Greater Noida Industrial Development Authority (GNIDA) has told power distribution firms PVVNL and NPCL – responsible for electricity supply in Greater Noida -- that power connections will not be given to the establishments that are illegally built in the notified area of the authority. According to the authority, the decision aims to tighten the noose against illegal encroachments that have come up in Greater Noida. The authority said the power connections will be granted by the power discoms (distribution companies) post-approval from the authority on the applications for power connections. The authority has geared up to stop the rampant illegal constructions and they are taking continuous efforts to stop these. The authority along with officials of Paschimanchal Vidyut Vitran Nigam Limited, NPCL and Gautam Budh Nagar district magistrate Manish Verma, had recently held a meeting to discuss the necessary steps that can be taken and implemented to curb the unauthorized construction activities in Greater Noida. The authority said that applications for electricity connections received will be sent to the authority by power discoms for approval, to ensure its proper implementation.

15 February: Adani Green Energy Limited (AGEL), the renewable energy (RE) arm of ports-to-power conglomerate, Adani Group, announced that it has operationalised 551 megawatt (MW) of solar power generation capacity at Khavda in Gujarat. AGEL, which has begun supplying power to the national grid from the said plant, is building the world’s largest solar park with a capacity of 30 gigawatt (GW) at Khavda. The planned capacity is expected to be operationalized in the next five years. When completed, the Khavda RE park will be the largest renewable energy installation in the world.

15 February: Prime Minister (PM) Narendra Modi has announced a scheme to encourage people to install solar panels on their roofs. According to the government’s PM Surya Ghar Muft Bijli Yojana, the government aims to light up over 10 million houses providing free 300 units of electricity every month by investing over INR750 billion in this project. This scheme was first announced by Finance Minister Nirmala Sitharaman during the interim budget 2024-25. Under this scheme, beneficiaries will be provided with substantive subsidies which will be transferred directly to their bank accounts.

20 February: Trinidad and Tobago has hired two remediation and salvage firms to help clean up an ongoing oil spill off Tobago and salvage the leaking barge, the energy ministry said. It has been almost two weeks since the oil spill was first discovered off Tobago’s Atlantic coast after a barge ran aground on a reef. The spill has entered the Caribbean Sea, threatening nearby Venezuela and Grenada. The barge, which was being towed by a tug boat when it went aground, carried as much as 35,000 barrels of fuel oil.

15 February: Global oil demand growth is losing momentum, the International Energy Agency (IEA) said as it trimmed its 2024 growth forecast, in sharp contrast to the view held by producer group OPEC (Organization of the Petroleum Exporting Countries). The IEA, which represents industrialised countries, has predicted that oil demand will peak by 2030 as the world shifts to cleaner energy. OPEC, meanwhile, expects oil use to keep rising for the next two decades. Monthly reports from the two forecasters underlined their starkly different estimates for 2024 oil demand. The IEA’s monthly report said it expects global oil demand to grow by 1.22 million barrels per day (bpd) this year, slightly down from last month’s estimate. OPEC stuck to its much steeper growth forecast at 2.25 million bpd.

14 February: A push to replenish depleted oil stocks notably in China, the United States (US) and Europe could buoy demand and prices in coming months, analysts and traders said, as tensions in the Middle East threaten key shipping lanes. Heavily depleted by supply disruptions wrought by sanctions on Russia in the middle of 2022, as well as protracted OPEC+ output cuts, global oil inventories have barely recovered with traders unable to justify the costs for storing oil. Shipping disruption in the Red Sea due to escalating attacks by Iran-aligned Houthi rebels has increased concerns about supply, spurring buyers to rebuild inventories. Consultants FGE said that available data so far this year has shown a large counter seasonal fall in crude and fuel stocks of almost 29 million barrels, compared with a typical average build of 20 million barrels during January in 2015-2019. The Chinese are buying heavily oil arriving this spring to replenish stocks while the US is gradually topping up its Strategic Petroleum Reserve after selling a record amount from the government oil stores in 2022.

15 February: Japan’s biggest city gas supplier Tokyo Gas Co Ltd expects that by 2030 its US (United States) shale gas and related businesses, including trading and marketing, will contribute around 50 percent to its targeted overseas profit. To achieve both decarbonisation and a stable energy supply, Tokyo Gas has been reshuffling its portfolio, broadening its US reach from upstream assets to mid- and downstream businesses, while divesting some minority stakes in gas projects in Australia. In Asia, Tokyo Gas is studying two LNG-to-power projects at Quang Ninh and Thai Binh in Vietnam and hopes to start commercial operations in late-2027 and in 2029, respectively. Tokyo Gas, an Asia’s major LNG buyer, has been diversifying its procurement sources, buying about 13 million metric tons of the super-chilled fuel a year from 13 projects in four countries.

15 February: United States (US) energy regulators approved a cross-border pipeline that would export about 2.8 billion cubic feet per day of natural gas from Texas to Mexico Pacific’s Saguaro LNG export plant on Mexico’s west coast. The approval is another step in the company's plan to build an about $15 billion liquefied natural gas (LNG) plant in Mexico that would export superchilled fuel processed from US natural gas. Mexico Pacific LNG has yet to give the financial greenlight for the construction of the 15 million metric tonne per annum plant.

14 February: Cyprus could start producing its first natural gas as soon as 2026, and plans to participate in a high-powered electricity cable project linking the eastern Mediterranean to continental Europe, Industry and Energy Minister George Papanastasiou said. Gas production, and a hook-up to power markets overseas, could be a game changer for the island and other countries in southern Europe keen to wean themselves off Russian supplies that were disrupted after Russia’s invasion of Ukraine. Cyprus reported its first offshore gas discovery in 2011, but it is one of the newer discoveries in 2022 - by a partnership of Italy’s Eni and France’s TotalEnergies - which is likely to be developed first, Commerce, Papanastasiou said. The project, known as Cronos, has an estimated 2.5 trillion cubic feet (tcf) of gas. When it comes online, that gas will likely be delivered to Eni’s Zohr facilities in Egypt, about 70 kilometers (43 miles) away.

14 February: Two explosions along Iran's main south-north gas pipeline network were caused by sabotage, the Iranian Oil Minister Javad Owji said. Authorities denied reports that the incident caused gas cuts to industries and offices in some provinces. Only villages near the damaged pipeline were experiencing gas outages, which will be fixed later, Owji said. Owji pointed to a similar incident which took place in 2011, which he said was an act of sabotage that caused temporary gas outages in four different regions in the country.

14 February: Global oil major BP and Abu Dhabi National Oil Company (ADNOC) will form a joint venture (JV) in Egypt that will initially focus on natural gas, they said. The JV, expected to be formed in the second half of this year, will be 51 percent owned by BP and 49 percent by ADNOC, the companies said. The BP-ADNOC Egyptian JV was originally planned to be the second phase of the two companies' cooperation in the Eastern Mediterranean after the planned acquisition of a 50 percent stake in Israeli gas producer NewMed. Negotiations on the proposed deal, first announced in March 2023, appear to have made little progress, in particular since the start of the Israel-Hamas war on 7 October. ADNOC, the UAE’s oil giant, is seeking to grow its gas business domestically and abroad and has called natural gas a transition fuel to renewable energy sources. BP aims to reduce its oil and gas output by 25 percent by 2030 from 2019 levels but continues to invest heavily in fossil fuels.

14 February: Global demand for liquefied natural gas (LNG) is estimated to rise by more than 50 percent by 2040, as China and countries in South and Southeast Asia use LNG to support their economic growth, Shell said. The market remains "structurally tight", with prices and price volatility remaining above historic averages, constraining growth, the world's largest LNG trader said. Demand for natural gas has peaked in some regions, including Europe, Japan and Australia in the 2010s, but continues to rise globally, and is expected to reach around 625-685 million metric tons per year in 2040, Shell said. That is slightly lower than Shell’s 2023 estimates of a global demand increase to 700 million tonnes (MT) by 2040. China’s 2024 LNG imports are expected to rebound to nearly 80 MT, from about 70 million tons in 2023, surpassing 2021’s record 78.79 MT. From 2030 to 2040, declining domestic gas production in parts of South Asia and Southeast Asia could drive a surge in demand for LNG as these economies need fuel for gas-fired power plants or industry.

19 February: The world’s top exporter of thermal coal is on track to smash last year’s record sales after projected shipments for the first two months of 2024 jumped nearly 25 percent from the same period in 2023. Indonesian exports of thermal and thermal bituminous coal - used in power generation - are on track to top 90 million metric tonnes for January and February, up 24 percent from the same two months in 2023, ship tracking data from Kpler shows. China, India, South Korea and the Philippines were the top markets for Indonesia coal so far this year, accounting for 33 percent, 15 percent, 5.8 percent and 5.1 percent respectively of the shipments so far. Along with Japan, those markets were the top five destinations for Indonesian coal in 2023. In volume terms, the 29.4 million tonnes (MT) shipped to China through February is nearly 9 percent less than shipped over the first two months of 2023. However, data has assessed over 21 MT of coal cargoes that have loaded or are being loaded but have yet to confirm their final destination on ship manifests. Many of those cargoes are likely bound for China, the world’s largest coal consumer, but may not be confirmed until after the Lunar New Year break is over. Indonesian coal shipments bound for Vietnam are already on track to rise by close to 600,000 tonnes from the January-February period in 2023, to a record 2.15 MT.

14 February: Global emissions from coal-fired power typically dip to their lowest point of the year during March and April as use of the fuel for heating drops off after the northern hemisphere winter. But this year China’s mammoth power and manufacturing systems may single-handedly reverse historical pollution trends if authorities unveil stimulus packages aimed at reviving industrial output in the spring. In turn, given the current delicate state of the economy, power producers will likely opt to use the cheapest fuel sources available when increasing baseload power generation, which in China’s case means more coal. And as China accounts for nearly 60 percent of worldwide coal use in power generation, more coal use in China means more global use of the world’s dirtiest power fuel. Coal generated a record 5,760 terawatt hours (TWh) of electricity in China in 2023, which was 6 percent up from 2022’s total, data from energy think tank Ember shows. In 2023, China’s total emissions of carbon dioxide (CO2) from coal-fired power generation hit 5.56 billion metric tonnes, an all-time high that was nearly 6 percent greater than 2022’s record. With coal use largely declining globally outside of China, China’s share of total coal emissions climbed to a record 64.4 percent in 2023 and could creep higher still in 2024 if the country's power sector supply growth remains coal-oriented.

20 February: Britain’s auction to ensure enough electricity capacity for 2024/25 cleared in a range of 35-40 pounds per kilowatt (kW) per year, National Grid said. Britain launched its power capacity market in 2014, offering to pay providers for making supplies available at short notice.

20 February: Guyana will delay until 2025 its biggest effort to capitalize on its energy bounty, a US$1.9 billion gas-to-power project that was to start this year, using untapped gas to slash electricity costs, a Ministry of Natural Resources consultant said. The rising oil producing nation relies on imported fuels in its shaky electric grid and has promised to use its oil wealth to construct a 140-mile (225 km) pipeline, gas processing facility and up to 300 megawatt (MW) power plant. Winston Brassington, a government consultant involved in the project, said the combined-cycle power plant is delayed and full operation will not be possible until the fourth quarter of 2025.

19 February: French utility Veolia has agreed to buy a 430 megawatt (MW), gas-fired power plant in Hungary from Uniper, the companies said, marking the German group’s latest asset disposal to meet EU (European Union) conditions imposed as part of its bailout in 2022. The gas-fired, combined-cycle power plant is in Gonyu, north-west Hungary, and was commissioned in 2011. Under the requirements, Uniper must sell 10 assets by the end of 2026, including its German coal-fired plant Datteln as well as an 18 percent stake in Latvian energy Latvijas Gaze. Gonyu helps to provide flexible electricity generation capacity, which is crucial as more intermittent renewable capacity comes online and European countries need flexible baseload capacity that can come on or offline quickly to balance their grids, Veolia said.

20 February: The United Arab Emirates (UAE), host of last year’s COP28 climate summit, called for governments to take action in transitioning away from fossil fuels. Intense negotiations last December saw countries agree to move away from fossil fuels in COP28’s UAE Consensus document, aiming to limit the worst impacts of climate change. Now, nations must lay out plans for how they'll get there. Countries must update their plans to tackle climate change, known as nationally determined contributions or NDCs, COP28 president Sultan Al Jaber said, who also leads the Abu Dhabi National Oil Company, at the Paris headquarters of the International Energy Agency.

16 February: Colombia’s government has awarded new licenses for electricity generating projects, to increase capacity by 4,489 megawatt (MW) in 2027 and 2028, the mines and energy ministry said. The auction assigned 99 percent of the new capacity to solar plants, the ministry said, while the remaining 1 percent went to thermal biomass plants, repairing a gas plant, building a biomass plant and expanding a smaller bio-gas plant. Solar power will overtake thermal in Colombia's energy matrix as a result of the auction, accounting for 26 percent of the country’s electricity, the ministry said.

15 February: Power generated by Texas wind farms dropped by 22 percent in January 2024 from the same month in 2023 as low wind speeds continue to stifle output across the main power system in Texas, the largest power market in the United States. Wind generation in January was 356,000 megawatt (MW), compared to 455,000 MW in January 2023, data from the Electric Reliability Council of Texas (ERCOT) compiled by LSEG shows. As wind power is the second largest source of electricity behind natural gas in Texas, the drop in wind output so far this year has forced utilities to sharply increase generation from fossil fuels to balance system needs.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.