Quick Notes

Decentralisation of energy supply in India: Energy in sachets

Background

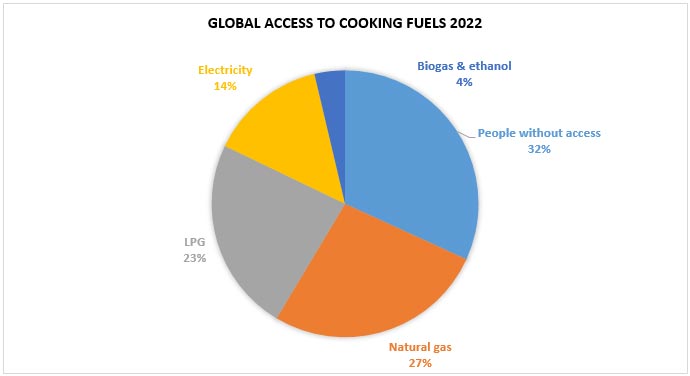

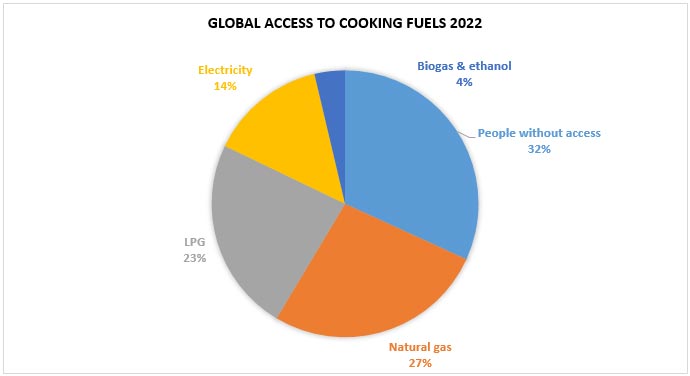

The energy problem in India is often framed as one of supply scarcity: India does not have adequate primary energy resources and insufficient energy production capacity which results in supply shortages; this in turn limits energy consumption. In reality, India’s key energy problem is one of inadequate effective demand for energy, especially from poor rural households in India and an underdeveloped market for energy. Globally India is the third largest market for energy but the “largeness” is derived from quantity and not quality. Millions of households consume small quantities of energy mostly for cooking and lighting that adds up to a large sum. India’s per person commercial energy consumption (not including unprocessed biomass consumption) estimated at 25.7 gigajoules (GJ) per year in 2022 is only about a third of the world average; it is the lowest among G20 countries and lower than the minimum required for decent living in tropical countries. India has the largest share of the population with an energy access deficit estimated at over 505 million. It is not difficult to see why.

Disposable incomes are low in rural households which means there is not enough money to spend on energy for cooking, lighting, heating, transport or communication. Poor family wage earners are paid weekly which limits energy and other essential purchases to small quantities. A South Indian entrepreneur took note of this trend and started marketing grooming products like soap and shampoo in small sachets in rural India in the 1980s. The availability of these products in tiny (3-4 grams) convenient packets opened a new market for hygiene and grooming products in rural areas. The small quantity purchased many times over meant that the poor paid more per unit of a given product than the rich who bought these products in larger volumes. Large multinational consumer goods companies were forced to adopt the sachet model as the sale of small shampoo sachets boomed in India. Labelled the Indian “sachet revolution”, this development is widely studied in business circles. Estimates of the share of shampoo sachets (single use) in total shampoo sales vary but by most accounts, it is far more than 50 percent. The “sachet revolution” can be replicated in the context of energy with modular energy forms such as LPG (liquid petroleum gas canisters) that can be packed and sold in canisters of many sizes and transported by road, sea or rail.

Energy in Sachets

The UN (United Nations) General Assembly has placed energy decentralisation central to the pursuit of SDG7. The role of decentralised energy solutions that were once considered the most suitable for rural India is now overlooked in the context of policy priorities to increase centralised energy solutions, especially for the supply of grid-based electricity. The infrastructure for countrywide electricity supply is already in place but the economics of electricity supply to the rural poor remains a challenge. The effective demand for electricity from rural households remains small as in the case of soaps and shampoos. This means that electricity distribution companies often lose money on every unit of energy supplied to rural households. Long distances increase technical losses that add to financial losses.

LPG, a modular energy form whose distribution is independent from the transmission grid and gas pipelines needs to be considered as a decentralised bridge fuel until RE with storage options becomes dependable and affordable. Small canisters of LPG (propane and butane) can provide decentralised fuel for cooking, lighting and small-scale industrialisation and also facilitate a gradual move away from subsidised LPG among the rural poor. LPG is not a greenhouse gas (GHG) as per the classification of the IPCC (Intergovernmental Panel on Climate Change) and it is among the clean cooking fuels listed by the WHO (World Health Organisation). LPG can go in where natural gas and electricity cannot: small canisters of LPG can be safely carried by men and women, and larger canisters can be transported by trucks, trains and boats. When LPG replaces other fuel technologies such as heating oil, solid fuel and even grid-based electricity in India, there are significant carbon savings.

In terms of security of supply, LPG is among the most secure among conventional forms of energy. LPG is an inevitable byproduct of the oil refining and natural gas extraction processes. It will exist as long as society demands that these two processes happen. LPG is freely traded around the world and scores twice as highly as both petrol and diesel on the OECD’s (Organisation of Economic Cooperation and Development) trade openness index. It is also a fuel that is less susceptible to political instability due to its dual-source origins and variety of transportation options—ships, trains, boats, and trucks. Unlike natural gas and crude oil which are exposed to high price volatility, the price of LPG is relatively stable and predictable.

The argument that rural India should leapfrog into RE (renewable energy) solutions rather than use fossil fuels like LPG is premature from an economic perspective and inequitable from a social justice perspective. Decentralised (off-grid) RE solutions with storage are unaffordable even for affluent urban households. Most urban households use LPG or PNG (piped natural gas), petrol & diesel and grid-based electricity as key sources of household energy which together carry a large carbon footprint. Mandating that the rural poor should use RE-based solutions will not only take away their right to choose but also impose undue costs on them. Effectively RE solutions imposed on the rural poor would be a climate subsidy extracted from the poor by the rich.

Challenges

Even at a subsidised price of INR 603 for a 14.2 kg canister in 2023, LPG remains unaffordable for many poor households in India. As per information conveyed in the upper house of the Indian Parliament in December 2023, the consumption of subsidised LPG cylinders is on average just 2.8 cylinders per household per year. The method used to arrive at this figure is not clear but in general procurement of a tradable subsidised good (such as LPG) does not necessarily confirm use and the actual consumption of LPG by poor households may be lower. In urban households, the average number of 14.2 kg LPG canisters used is over 9 per year. Among the reasons for the low consumption of subsidised LPG by the poor are low incomes that make even subsidised LPG unaffordable, cooking limited to one or two times a day and the availability of biomass-based fuels at low or no cost (except of course the opportunity cost of female labour). Smaller canisters may improve adoption and use of LPG in rural areas but the experience of 5kg LPG canisters introduced by public sector oil marketing companies in the early 2010s is not very encouraging. Among the reasons are the fact that the number of dealers and retail outlets for 5kg “free trade” LPG canisters is limited and the price of the 5kg LPG canister is too high for a typical single-income poor household. The small LPG canisters target populations with no proof of address in urban areas and not the poor in rural areas. If the 5kg LPG canisters are sold primarily in rural markets at reasonable (not subsidised) prices, it is likely to be adopted in rural kitchens. Applications of LPG in lighting and power generation can also be introduced in rural areas which may initiate investment in small-scale industries and create demand for LPG. LPG can also serve as a robust and affordable backup source for off-grid RE solutions. As LPG supply does not require specialised infrastructure, LPG can be replaced with renewable LPG (rLPG) when it becomes affordable and available. This will necessarily mean a focused policy for the promotion of small LPG canisters to improve access to cooking fuels, reduce carbon emissions and to prepare for the energy transition.

Source: International Energy Agency

Monthly News Commentary: Natural Gas

Power and Fertiliser Sector Demand Drive LNG Imports

India

LNG

In Q3 2023, India’s average LNG (liquefied natural gas) imports reached 91 mmscmd, marking a notable increase of approximately 20 mmscmd compared with the same period last year. This surge in imports can be attributed to increased gas consumption in the fertilizer and power sectors. Higher gas generation in the power sector was driven by higher peak thermal demand amid reduced hydropower generation. Additionally, as India plans to phase out urea imports by 2025, the dependence on domestically produced urea will increase, supporting the rise in gas consumption in India’s fertilizer sector. Since this sector is subsidized by the government, spot LNG prices will have a limited impact on its growth.

Hindustan Petroleum Corporation Ltd (HPCL) plans to start operations at the 5 million tonne a year (MTPA) Chhara LNG import terminal in Gujarat in the coming months and got offers from 6-7 parties to hire capacity. While the terminal was mechanically completed in March, the commissioning was delayed since a 40-kilometre pipeline connecting it to an existing network was not ready. HPCL, the oil refining and fuel marketing company, has been a late entrant into the gas business. It built the facility at Chhara in Gir-Somnath district of Gujarat to receive natural gas that has been supercooled to a liquid state in cryogenic ships.

Indian Oil Corporation (IOC) aims to double the capacity of its LNG import terminal at Ennore in Southern India. The company plans to expand capacity to 10MTPA amid the growing demand for gas in the country. India wants to raise the share of gas in its energy mix to 15 percent by 2030, up from the current 6.2 percent, as part of an effort to cut emissions. IOC hopes to boost local sales of gas to 20 MTPA by 2030, a substantial increase from the current 6.3 MTPA. Aside from the Ennore terminal, IOC has leased capacity in at least two local projects operated by other companies to import gas. India needs to sign more long-term LNG import contracts to ensure price stability, the company said. IOC recently signed two agreements for 14-year LNG import contracts worth US$11 billion (bn).

Demand

Indian Oil Corporation (IOC) has cornered more than a third of natural gas that Reliance Industries Ltd (RIL) and its partner BP of the UK (United Kingdom) offered in the latest auction of the KG-D6 gas. IOC got 1.45 million metric standard cubic meter per day (mmscmd) out of the 4 mmscmd of gas auctioned last week. The oil refining and marketing company, which was the top bidder even in the previous two auctions of gas from the eastern offshore KG-D6 block of RIL-BP, bid the volumes as an aggregator on behalf of fertiliser plants. City gas companies including Torrent Gas and Gujarat Gas secured a total of 2.21 mmscmd of gas for turning into CNG for sale to automobiles and piped to household kitchens for cooking purposes. Gujarat Gas won the tender to buy 0.5 mmscmd, Torrent Gas 0.45 mmscmd, Adani Total Gas Ltd 0.29 mmscmd, IndianOil-Adani Gas Pvt Ltd 0.17 mmscmd and Indraprastha Gas Ltd and Mahanagar Gas Ltd 0.30 mmscmd each. RIL and BP auctioned 4 mmscmd of gas from the Krishna Godavari basin block starting 1 December 2023.

CGD/CNG

For the first time after piped natural gas (PNG) project was launched in the Vadodara city as well as the country in 1972, the gas lines of the area where the project kicked off will be changed finally. The pipelines in the walled city of Vadodara and surrounding areas had not been changed since they were laid when the project began. Vadodara had become the first city in the country where PNG was provided to households. The Vadodara Municipal Corporation (VMC) had established a gas project department and taken up the project. In 2013, the civic body entered into a joint venture with Gail Gas Ltd and floated Vadodara Gas Ltd (VGL) that has taken over PNG network and has also set up CNG stations for automobiles. Despite the new corporate structure, the condition of the gas lines in the old city had not changed. The old city areas of Vadodara have around 7,000 connections and a network of gas pipelines totaling to 73 kilometre (km). VGL will spend around INR55 million (mn) (US$0.66 mn) on replacing the pipelines for domestic connections. Another INR40 mn will be spent on the gas pipelines that carry gas in the area. The areas that will be covered include Mandvi, Wadi, Gajrawadi, Dandiabazaar, Kharivav Road, Panigate, Bavamanpura, Chhipwad, Bhutdi Jhampa and Karelibaug.

Mumbai’s CNG (compressed natural gas) distributor Mahanagar Gas Limited (MGL) has signed a Memorandum of Understanding (MoU) with fuel aggregator startup Nawgati in a bid to make CNG services more convenient, accessible and efficient for commercial vehicles in the city. As a part of the collaboration, the services provided through the MGL Tez app has now been integrated with Nawgati’s Fuel Discovery app. The collaboration will help commercial CNG vehicle owners to bypass long queues, preschedule their slots at BEST depots and make digital payments. This service is currently available at Goregaon-Oshiwara and Ghatkopar BEST Depots, while there are plans in place to add 13 more depots across Mumbai soon.

Policy & Governance

Petroleum and Natural Gas Regulatory Board has added Mizoram to the areas it has offered for bidding for a licence to retail CNG and piped cooking gas in the latest city gas bid round. In a notice, PNGRB said in continuation of the bids invited on 13 October for the development of the city gas distribution network for seven geographical areas, electronic bids are invited for the same in the state of Mizoram.

According to GAIL (India) Ltd, India is looking at building its first strategic natural gas reserves by using old, depleted hydrocarbon wells to store the fuel and hedge against global supply disruption. The strategic facilities would be built in phases in India's western and northeastern regions with an initial capacity to store three to four billion cubic meters (bcm) of gas. India has five million tonnes (MT) of strategic petroleum reserves but no storage facilities for natural gas. Indian companies together currently hold two billion cubic meters (bcm) of gas in pipelines and LNG tanks for commercial use. As per the company, the first strategic gas storage facility would take three to four years to build after government approval. India aims to raise the share of natural gas in its energy mix to 15 percent by 2030 from about 6.2 percent. The nation consumes around 60 bcm gas annually.

Rest of the World

Europe

German energy firm Sefe secured a €50 bn (US$55 bn) gas deal with Norway’s Equinor that will cover one-third of the industrial gas needs of Europe’s largest economy. It also strengthens Norway’s position as Germany’s top supplier of natural gas, a position it has held since Gazprom suspended direct deliveries via the Nord Stream pipeline. Currently, Norway already accounts for roughly 40-50 percent of Germany’s gas imports. The supply deal covers around 10 bcm of natural gas per year from 1 January 2024 until 2034 and carries an option for another five years covering 29 bcm.

The European Union (EU) is set to extend its emergency cap on gas prices for another 12 months to serve as a safeguard against possible energy price shocks, after energy ministers backed the plan. The EU first agreed the gas price limit in December 2022, after months of cripplingly high energy prices caused by Russia slashing gas supplies to Europe after its invasion of Ukraine. Europe’s energy security situation is more comfortable than during last winter - energy prices are far lower, countries have secured new sources of non-Russian gas, and gas storage is near-full.

Serbia completed the interconnector to a pipeline in Bulgaria which would allow the Balkan country to diversify its gas supplies and reduce its dependence on Russia. The launch of the interconnector will make operational the pipeline from the town of Novi Iskar in Bulgaria to the Serbian city of Nis, allowing Belgrade to access gas from Azerbaijan and LNG terminal in the Greek port of Alexandroupolis. The capacity of the pipeline on the Serbian side is 1.8 cubic meters a year, which accounts for 60 percent of the country’s annual gas needs.

The EU is poised to give its member states the power to halt gas imports from Russia and Belarus. Any member state will be able to block companies from Russia and Belarus from obtaining space in their gas pipelines and LNG terminals. EU member states could have the authority to "partially or, where justified, completely limit" access to infrastructure to gas operators from Russia and Belarus, in order to protect their vital security interests. The EU previously implemented a collaborative gas procurement initiative in order to replenish gas reserves ahead of winter and avoid a repeat of last year’s record-high energy prices and concerns about deficits in Europe resulting from Russia's reduction of gas supplies.

Czech utility CEZ has booked 2 bcm of annual capacity at a yet-to-be build land-based terminal for LNG imported into Germany’s Stade from 2027, spurring the build-up of transport infrastructure and securing itself future energy supplies. Germany’s quest to increase LNG import capacity has intensified as it seeks to end reliance on Russian pipeline gas, on which the European region relied heavily prior to Moscow's invasion of Ukraine last year. Pending the provision of fixed terminals, Germany is using floating storage and regasification terminals (FSRUs) to help to replace piped Russian gas supplies. Three FSRUs are working at the Wilhelmshaven, Brunsbuettel and Lubmin ports after Germany arranged their charter and onshore connections.

Africa

Libya’s National Oil Corporation (NOC) expects to achieve close to zero gas flaring by 2030, Chairman Farhat Bengdara said. Bengdara said that NOC is aiming for an 83 percent reduction in gas flaring by 2030.

North and South America

The German state-owned Securing Energy for Europe GmbH (SEFE) has become the third company to seek approval from the US (United States) energy regulator for LNG developer Venture Global to begin construction on its CP2 LNG project in Louisiana. In June, SEFE, via its unit Wingas, signed a 20-year deal to buy 2.25 million tonnes per annum (MTPA) of LNG from Venture Global’s proposed 20 MTPA CP2 project in Louisiana.

United States natural gas futures edged up about 1 percent from a six-month low in the prior session on raised demand forecasts for this week, and as record amounts of gas flowed to LNG export plants. Front-month gas futures for January delivery on the New York Mercantile Exchange rose 2.4 cents, or 1.0 percent, to settle at US$2.335 per million metric British thermal units (mmBtu). With record production and ample gas in storage, futures have been sending bearish signals for weeks that prices this winter (November-March) likely already peaked in November. Analysts have said they expect prices to climb in coming years as demand for the fuel grows as new LNG export plants enter service in the US, Canada and Mexico. But for 2024, some analysts have reduced their US demand forecasts after Exxon Mobil delayed the start of first LNG production at its 2.3 billion cubic feet per day (bcfd) Golden Pass export plant under construction in Texas to the first half of 2025 from the second half of 2024.

Two Japanese energy companies, oil and gas producer Inpex Corporation and power utility JERA, urged a US energy regulator to give prompt approvals for Venture Global to begin construction on its CP2 LNG project in Louisiana. JERA’s letter to the US Federal Energy Regulatory Commission (FERC), which followed Inpex's letter, reiterated the role of the CP2 LNG project in securing Japan’s energy supply. Both companies have signed 20-year agreements to each buy 1 MTPA of LNG from CP2 LNG, and JERA said it had also bought spot cargoes from Venture Global's first project, Calcasieu Pass LNG.

US LNG exports in November rose to the second highest monthly production level on record, 7.99 MT of the superchilled gas, according to tanker tracking data. The US was the world’s largest exporter of LNG in the first half of this year, according to the Energy Information Agency (EIA), ahead of Qatar and Australia. November’s volumes were just shy of April’s record 8.01 MT and above the 7.92 MT shipped in October, according to trade flows and tanker tracking data published by financial firm LSEG. US LNG producers continued to focus exports on Europe as winter begins in the northern hemisphere, with greater shipments delivered to customers in that region. In November, about 68 percent of all US LNG was exported to Europe, an increase from October’s 65 percent, the data showed.

Delfin Midstream Inc had entered into a long-term LNG supply agreement with global commodity trader Gunvor. Delfin said in a news release its LNG plant in Louisiana will supply between 500,000 to 1 million tonnes of LNG per annum to Gunvor on a free-on-board basis at Delfin Deepwater Port for at least 15 years. Delfin has been developing the Delfin LNG Deepwater Port project supporting up to four floating LNG vessels with a combined export capacity of about 13.3 MTPA. The company secured commercial agreements for LNG sales, liquefaction services and is in the final phase towards final investment decisions (FID) on its first three floating LNG vessels.

Russia & the Far East

Exports of gas condensate, a kind of light oil, from Russia’s Yamal LNG field were up by 15.8 percent year-on-year in January-November at 880,000 metric tonnes, according to LSEG ship-tracking data and traders. In November, gas condensate shipment from Yamal’s port of Sabetta reached 80,000 tonnes, down from 120,000 tonnes in October. Two tankers, Boris Sokolov and Yuriy Kuchiev, export gas condensate from Sabetta in the Arctic. Each of them is able to carry 40,000 tonnes of the product, mainly intended for Rotterdam and Terneuzen.

Moscow and Ankara are set to reach agreement on the creation of a natural gas hub in Turkey in the nearest future, Russian Deputy Prime Minister (PM) Alexander Novak said. He said Russia’s Gazprom and Turkey’s Botas were cooperating closely and had been discussing the project road map. Russia last year proposed setting up a gas hub in Turkey to replace lost sales to Europe, playing into Ankara’s long-held desire to function as an exchange for energy-starved countries.

Asia-Pacific

Australian oil and gas major Santos had received approval for a revised drilling plan at its US$4.3 billion Barossa gas project, although the fate of a pipeline to take gas to shore remains locked in a legal dispute. Santos was forced to stop drilling at the field roughly 285 km off northern Australia in September 2022 after the Federal Court ruled it had failed to sufficiently consult Indigenous people on the nearby Tiwi Islands. Separately, Santos is awaiting a ruling on whether it can resume work on a key section of pipeline that will take gas to Darwin for processing. Despite the various challenges, Santos affirmed last month it still expects to start producing Barossa gas in the first half of 2025.

Australia’s Woodside Energy said it has signed a deal with energy company Mexico Pacific to purchase 1.3 million tonnes of LNG per annum for two decades to beef up production and optimise operations. Under the deal, the Australian oil and gas producer will buy the LNG from Mexico Pacific’s Saguaro Energia LNG project, located in Sonora, Mexico on a free-on-board basis with pricing linked to US gas indices. Commercial operations at the project are targeted to start in 2029, Woodside said.

Japan’s power utilities called for an increase in the volume of the country’s strategic LNG buffer (SBL) to ensure a stable fuel supply amid lingering risk of supply disruptions due to heightened geopolitical risks. The world’s second biggest LNG buyer after China, Japan has introduced the new SBL scheme for this winter to provide cover for any shortfalls in the event of an emergency, after last year’s energy crunch. As an accredited provider of the SBL, Japan’s top power generator, JERA, will secure one cargo of LNG, about 70,000 metric tonnes, each month from December to February in preparation for the heating season.

Shipments of LNG from Australia Pacific LNG (APLNG) have come to a halt after a loaded tanker docked at the site lost power, operator ConocoPhillips and co-owner Origin Energy said. APLNG, which has a capacity of 9 MTPA of LNG, can only take one vessel at a time and on average loads one tanker every three days.

News Highlights: 20 – 26 December 2023

National: Oil

Commercial LPG rate cut by INR39.50 per 19-kg cylinder

22 December: Commercial cooking gas (LPG) prices were cut by INR39.50 per 19-kg (kilogram) cylinder in line with softening international benchmarks. However, the price of domestic LPG — used in household kitchens for cooking purposes — remained unchanged at INR903 per 14.2-kg cylinder. Commercial LPG — used in various establishments such as hotels and restaurants — will cost INR1,757 per 19-kg cylinder in the national capital as against INR1,796.50, oil firms said in a price notification. State-owned oil firms last hiked the price of commercial LPG by INR21 on 1 December.

National: Gas

Haryana to roll out gas distribution policy

22 December: The Haryana government is set to introduce a comprehensive city gas distribution policy to expedite the approval process for the installation of piped natural gas (PNG) and compressed natural gas (CNG) pipelines within a specified time frame. Chief Secretary Sanjeev Kaushal said the upcoming policy is a step towards streamlining procedures, ensuring efficient and timely permissions for advancing the development of gas infrastructure in the state. The Chief Secretary said the city gas distribution network is being developed to expand gas demand and utilisation across domestic households, commercial establishments, industrial facilities and the transport sector. The state government has been strategically planning for extensive city gas infrastructure implementation, which will reduce state’s dependence on crude oil imports. This policy specifically focuses on granting necessary approvals for laying PNG and CNG pipelines. The proposed policy will primarily concentrate on granting authorisation for pipeline installations.

National: Coal

Congress gave nod for coal mining in Hasdeo Aranya: Chhattisgarh CM

25 December: Amidst uproar over felling trees in Parsa East and Kanta Basan (PEKB) extension coal mines in Hasdeo forest region of north Chhattisgarh, Chief Minister Vishnu Deo Sai said that the decision for coal mining and tree felling was taken during the Congress regime and the work is an extension to the decision taken earlier. Opposition Congress has condemned the act of deforestation and formed a human chain as part of protest in state capital. Deforestation drive in Hasdeo Aranya for coal mining is being widely criticized, condemned and protested by local tribals, women in large, on social media, environmentalists and activists.

India aims to reduce coal import for power sector to 2 percent by 2025: Joshi

21 December: Union Minister of Coal, Mines, and Parliamentary Affairs, Pralhad Joshi, said that India’s coal import for the power sector is projected to decrease to 2 percent by 2025, owing to a significant rise in domestic coal production. Joshi indicated that the overall coal production this year is expected to surpass one billion tonnes. Emphasizing the coal sector’s continuous contribution to the nation’s energy security and economic growth, Joshi highlighted India’s sustainable coal mining practices, positioning the country as a global leader in emissions containment. He said that INR60 billion have been given as incentive for coal gasification and mentioned that coal public sector undertakings (PSUs) have planted 100 million saplings in recent years to promote sustainable mining. As part of the 9th round of commercial coal mine auctions, a total of 31 coal mines, including 26 from the 9th round and 5 from the 2nd attempt of the 7th round, are being offered. These mines are located in coal/lignite-bearing states like Jharkhand, Chhattisgarh, Madhya Pradesh, and Telangana. India, with a total coal reserve of 344.02 billion tonnes, ranks as the second-largest coal producer globally. Given that 72 percent of electricity in India is generated from coal, the coal sector plays a crucial role in the nation’s development. The ongoing commercial coal mining efforts are anticipated to attract new investments, creating both direct and indirect employment opportunities. The revenue generated from these auctions will be allocated to coal-bearing state governments, benefiting states such as Jharkhand, Chhattisgarh, Odisha, Madhya Pradesh, Maharashtra, West Bengal, Andhra Pradesh, Telangana, Arunachal Pradesh, Bihar, and Assam.

West Bengal’s first commercial coal mine to begin production in 6 months: Rashmi Group

20 December: Rashmi Group, a Kolkata-based player in the iron and steel sector, has secured the first-ever private coal mining rights in West Bengal and the company expects to start extracting coal within six months. The company has announced an investment of around INR20 billion in mining activities. The group has been allotted three coal mines in the state: Kagra Joydev Coal Block and Kasta East Coal Block in Birbhum district, and Jagannathpur B in Paschim Bardhaman.

National: Power

Telangana CM orders judicial probe into power deals of BRS regime

21 December: Telangana Chief Minister (CM) A Revanth Reddy ordered a judicial probe into the irregularities in the execution of the power purchase agreement (PPA) with Chhattisgarh by the previous BRS government. The CM said a judicial probe will cover irregularities in two more projects, including the use of expired sub critical technology for the Yadadri Power Project and the delay and escalation of costs in the construction of Bhadradri thermal power station. The BRS government had entered into an agreement with Chhattisgarh for the supply of 1000 MW (megawatt) power supply without going for tender process.

National: Non-Fossil Fuels/ Climate Change Trends

JSW Renew Energy commissions 51 MW wind energy capacity in Tamil Nadu

26 December: JSW Renew Energy has commissioned the first phase of 51 MW (megawatt) capacity of its 810 MW wind energy project in Tamil Nadu, the company said. The project has a power purchase agreement with Solar Energy Corporation of India (SECI) for 25 years, the company said. JSW Renew Energy Ltd, a wholly owned step-down subsidiary of JSW Energy, has started phase-wise commissioning of the 810 MW (Inter State Transmission System) ISTS-connected wind power project awarded under SECI tranche IX in Tamil Nadu with commissioning of the first phase of 51 MW, as per the company. With a total capacity of 9.8 GW (gigawatt), the company is well placed to achieve its near-term target of 10 GW by 2025, the company said. JSW Energy said it has set a target for a 50 percent reduction in carbon footprint by 2030, and is aiming to achieve carbon neutrality by 2050.

International: Oil

US buys 3 mn barrels of oil for strategic reserve

26 December: The United States (US) has finalized contracts to purchase three million barrels of oil to help replenish the Strategic Petroleum Reserve (SPR) after the largest sale in history last year, the US Department of Energy said. The department said it bought the oil, for delivery to a site in Big Spring, Texas, for an average of US$77.31 a barrel, below the average of US$95 a barrel that oil sold for in 2022. The administration of President Joe Biden had conducted sales last year, including a record one of 180 million barrels, to help control oil prices after Russia, a large crude exporter, invaded Ukraine. The US has purchased about 14 million barrels for replenishment after last year’s sales. About 4 million barrels are also coming back to the SPR by February as oil companies return oil that had been loaned to them through a swap.

Angola leaves OPEC in blow to oil producer group

21 December: Angola said it would leave OPEC (Organization of the Petroleum Exporting Countries) in a blow to the Saudi-led oil producer group that has sought in recent months to rally support for further output cuts to prop up oil prices. Angola’s Oil Minister Diamantino Azevedo said the OPEC no longer served the country’s interests. It joins other mid-sized producers Ecuador and Qatar that have left OPEC in the last decade. Angola’s announced departure follows a protest from Angola about OPEC+’s decision to cut its output quota for 2024. The dispute helped to delay OPEC+'s last policy meeting in November and its agreement on new output curbs. Angola, which joined OPEC in 2007, produces about 1.1 million barrels of oil per day, compared with 28 million bpd for the whole group. Angola’s departure will leave OPEC with 12 members and crude oil production of about 27 million barrels per day (bpd), some 27 percent of the 102 million bpd world oil market.

Russia oil price cap coalition toughens shipping rules: US Treasury Department

20 December: The US (United States)-led coalition imposing a price cap on seaborne Russian oil announced changes to its compliance regime, the Treasury Department said will make it harder for Russian exporters to bypass the cap. The Treasury imposed fresh sanctions on a ship manager owned by the Russian government and three oil traders involved in Russian oil trade. The Group of Seven (G7) industrialized countries last year imposed a price cap of US$60 per barrel on Russian oil shipments in response to Russia’s invasion of Ukraine. The coalition will soon require Western maritime service providers to get declarations from their counterparties that the Russian oil was sold under the cap each time they lift or load the oil, the Department said. The price cap mechanism bans Western companies from providing maritime services, including financing, insurance, and shipping for oil sold above the cap.

US Gulf of Mexico oil auction is largest since 2015

20 December: A Biden administration auction of Gulf of Mexico drilling rights raised US$382 million as oil companies claimed offshore acreage for what is set to be the last time until 2025. The auction total was the highest of any federal offshore oil and gas lease sale since 2015. Anadarko had the auction’s highest bid of more than US$25 million for a block in the deepwater Mississippi Canyon area, according to an online broadcast of the sale by the US (United States) Bureau of Ocean Energy Management (BOEM). The sale will likely be the last opportunity for oil and gas companies to bid on Gulf of Mexico acreage until 2025, according to the administration’s five-year schedule, which includes a historically low number of planned lease auctions.

International: Gas

China seeks exemption from US sanctions on Russian LNG plant

22 December: China’s state oil majors CNPC and CNOOC have both asked the US (United States) government for exemptions from sanctions on a new Russian liquefied natural gas (LNG) export plant. CNOOC Ltd and China National Petroleum Corporation (CNPC) each have a 10 percent stake in the Arctic LNG 2 project controlled by Novatek, Russia's largest LNG producer, which holds a 60 percent stake in the project. LNG vessels could fall foul of US sanctions if they pick up fuel from Arctic LNG 2, the Bloomberg report said, adding that CNOOC and CNPC also purchase LNG from the United States, and don’t want to endanger their supply from American projects. The project is a key element of Russia’s drive to increase its share of the global LNG market to a fifth by 2030 from around 8 percent now. The first LNG tankers from the project were expected to set sail in the first quarter of next year.

Shell, Trinidad’s NGC get 30-year license to produce gas in Venezuela

22 December: A license extended by Venezuela to Shell and Trinidad and Tobago’s National Gas Company (NGC) will allow the companies to produce natural gas off the South American country’s coast for 30 years, state oil company PDVSA said. Venezuela, Shell and NGC signed the license in Caracas for the Dragon project following a US (United States) authorization granted in January, which could mark the OPEC country's first exports of its vast offshore gas reserves. The license provides for an initial output of 185 million cubic feet per day of gas to be sent to Trinidad for producing liquefied natural gas (LNG) and petrochemicals, PDVSA said.

TotalEnergies to restart its delayed Mozambique LNG project in early 2024

22 December: French energy firm TotalEnergies plans to restart its long-delayed US$20 billion Mozambique liquefied natural gas (LNG) project in the first quarter of next year. The ongoing violence in the northern Mozambican province has claimed thousands of lives since it broke out in 2017, disrupting multibillion-dollar investments including the US$20 billion LNG project in which TotalEnergies has a 26.5 percent stake. The project, which will help transform the economic fortunes of the impoverished southern African country, has faced criticism from environmental activists who last month urged funders to withdraw their financial support.

Germany swaps Russia for Norway in gas supply dependence

21 December: Germany’s decision to make Norway its biggest gas supplier, culminating in a deal that will cover a major chunk of its industrial needs, means it has replaced the formerly dominant Russia with another equally dominant supplier. The risk of deliberate supply disruption of gas from a friendly country may be much lower, but Germany could find itself at the mercy of technical issues, analysts said. German energy firm Sefe and Norway’s Equinor announced a €50 billion (US$55 billion) gas deal that will provide a third of the industrial gas Germany needs.

ADNOC signs 15-year LNG supply deal with unit of China’s ENN

20 December: Abu Dhabi’s state oil giant ADNOC said it signed a 15-year agreement to deliver at least 1 million metric tons a year of liquefied natural gas (LNG) to a subsidiary of China’s ENN Natural Gas. The agreement with ENN LNG, a Singapore-based subsidiary of China’s ENN Natural Gas, is subject to a final investment decision including regulatory approvals and reaching a definitive sale and purchase agreement. ADNOC plans to more than double its LNG production capacity to meet rising global demand through its new project. Demand for natural gas soared as Europe scrambled to secure supplies to replace Russian gas in the wake of Moscow's invasion of Ukraine last year.

International: Power

China’s power generators well prepared for surging winter demand

21 December: Ample heating fuel stocks from bumper production mean China may not need to ramp up imports of coal and natural gas to meet record power loads as a result of freezing weather which continues to grip the country. Peak electricity loads were up by 100 million kilowatts on last year’s high. This equated to an increase of around 8.6 percent, data from China’s state planner showed. China’s State Council urged state-owned enterprises to boost energy supplies to cope with the elevated household demand.

International: Non-Fossil Fuels/ Climate Change Trends

China’s power sector emissions to surpass 4 billion metric tons in 2023

21 December: China’s power sector emissions of carbon dioxide (CO2) and equivalent gases will surpass 4 billion metric tons for the first time in a calendar year in 2023, as the country cranks up coal-fired electricity output to new highs. China’s total emissions from fossil fuel-powered electricity generation hit 3.99 billion tons through October, marking a 5.5 percent rise from the same period in 2022 and a 22 percent jump from five years ago, data from think tank Ember shows. Emissions from coal-fired power hit 3.87 billion tons through October, accounting for just under 95 percent of the country’s total fossil fuel pollution from electricity production. As China’s coal-fired power output often peaks in December due to higher demand for heating in winter, the country's power generation emissions can be expected to climb further before the end of the year to ensure a new emissions record. China's share of global power sector emissions from fossil fuel use also looks set to hit new highs in 2023, after averaging over 41 percent through the first nine months of the year, Ember data shows.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV