-

CENTRES

Progammes & Centres

Location

According to the World Health Organisation (WHO), clean fuels and technologies are those that attain the fine particulate matter (PM2.5) and carbon monoxide (CO) levels recommended in the WHO global air quality guidelines (2021). Fuel and technology combinations are classified as clean if they achieve either the annual average air quality guideline level (AQG, 5 µg/m3 [micrograms per cubic meter]) or the interim target- 1 level (IT1, 35 µg/m3) for PM2.5; and either the 24-hour average air quality guideline level (AQG, 4 mg/m3) or the interim target-1 level (IT-1, 7 mg/m3) for CO. Under this definition, the WHO categorizes solar, electric, biogas, natural gas, liquefied petroleum gas (LPG), and alcohol fuels including ethanol as clean cooking fuels for PM and CO household emissions.

The report on tracking Sustainable Development Goal 7 (SDG 7), improving access to clean cooking fuels) notes that in 2021, 71 percent of the global population had access to clean cooking fuels and technologies. This means that about 2.3 billion people still use polluting fuels and technologies for most of their cooking. Even by 2030, which is the target year for attaining SDG goals, only 77 percent of the global population is expected to have access to clean cooking fuels, leaving 1.9 billion people to the mercy of solid fuels (biomass, wood, charcoal, crop and animal waste) and kerosene.

Not surprisingly, most of those who do not have access to modern cooking fuels are in the world’s poor and developing countries in Africa and Asia. While countries in Asia, particularly India, have substantially improved access to cooking fuels since the 2000s, the trend in Africa is one of stagnation or an increase in the number of people without access to cooking fuels. The key driver behind the improvement in access to modern cooking fuels in Asia, particularly India is subsidised access to gaseous fuels, particularly LPG.

Household wealth and socio-economic status (primarily higher education) are known drivers of access to and adoption of clean cooking fuels. For example, developed countries in Western Europe and North America have per person GDP (gross domestic product) above US$20,000 and 100 percent of their households have access to clean cooking fuels. Some developed countries, such as India, have followed a different approach to providing access to clean cooking fuels. Rather than have millions of households wait for incomes and socio-economic status to rise to a level that makes clean cooking fuels accessible and affordable, access to clean cooking fuels, such as LPG, is subsidised through policy. As a result, India has increased access to LPG to about 60 percent of households notwithstanding the fact that its per person GDP is just US$ 2410 in 2022 (current US$). In Côte d’Ivoire, West Africa, the share of households with access to clean cooking fuels is just 32 percent, though its GDP per person is comparable to that of India. Policy interventions explain the divergence in access to clean cooking fuels between the two countries.

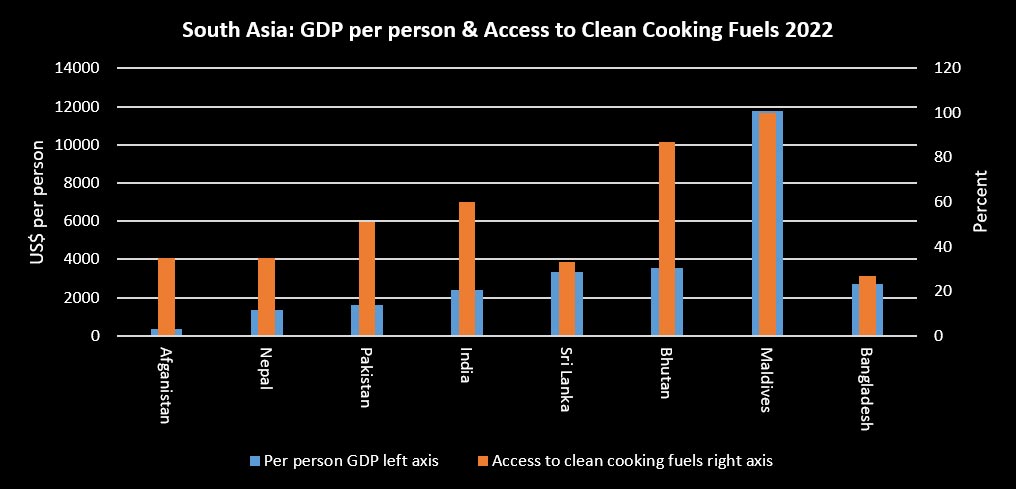

The divergence in the share of households with access to clean cooking fuels and per person GDP in South Asia provides a clear illustration of how policy can make up for the shortcomings of the market in providing equitable access to energy. Among South Asian countries, Maldives had the highest per person GDP of US$ 11,780 (current US$) in 2022 and 100 percent access to clean cooking fuels. Bhutan which had a per person GDP of US$ 3560, the second largest in South Asia, covered 87 percent of households with access to clean cooking fuels. However, Sri Lanka that had a comparable GDP of US$ 3354 covered only 33 percent households with access to clean cooking fuels. Sri Lanka’s per person GDP was nearly 10 times the per person GDP of Afghanistan, and yet Afghanistan had a higher share of households with access to clean cooking fuels at 35 percent. Bangladesh surpassed India’s per person GDP in 2020 and in 2022, Bangladesh’s per-person GDP was US$ 2688, higher than that of India which was US$ 2410. But Bangladesh had the lowest share of households with access to clean cooking fuels among South Asian countries at 27 percent while India’s share of households with access to LPG and piped natural gas was close to 60 percent. The wide difference in the share of households with access to clean cooking fuels among South Asian countries may be explained not only by household wealth but also by policy interventions.

Interventions in improving access to clean cooking fuels in India initially began at the state level when the LPG shortage eased in the late 1990s. Several southern state governments launched dedicated programmes for the distribution of subsidised or free LPG connections to households ‘below poverty line’ (BPL). This model was successful in galvanising political support for governments dispensing LPG programmes at the state level and was adopted by the centre in the form of the Rajiv Gandhi Gramin LPG Vitran (RGGLV) scheme in 2009. RGGLV more than doubled LPG dealers in rural areas and contributed to increasing LPG access in rural areas. Later in 2014 this programme was relaunched with some modifications as the Pradhan Mantri Ujjwala Yojana programme that provided subsidised access to LPG. While the political payout of the LPG access programmes that target private voters cannot be denied, they also substantially improve the welfare of poor households.

Subsidising LPG access is controversial. The liberal economic school categorically states that energy subsidies particularly fossil fuel subsidies (including LPG even though it is a clean fuel) have a net negative effect: they artificially lower fossil fuel prices, leading to market distortions that have environmental, economic and social consequences; they increase energy consumption and greenhouse gas (GHG) emissions, strain government budgets, divert funding that could otherwise be spent on social priorities such as healthcare or education and reduce the profitability of alternative energy sources.

However, there is a less studied welfare argument for subsiding access to clean cooking fuels. The benefits of access justify some form of subsidy. For cooking, the poor often pay more for wood or other biomass-based fuels than they would for LPG, once the end-use efficiencies of the fuels are taken into account. Subsidising access assists the poor in lowering their expenditures on energy for cooking, making finances available for other essentials like food and medicine and avoiding all the problems of indoor air pollution.

The LPG subsidy in India, assessed by their relative efficacy, welfare benefits and cost-effectiveness is not necessarily net negative. In terms of efficacy, the subsidy reaches those for whom it is intended, the poor, through the direct benefit transfer model minimizing errors of inclusion and exclusion. The welfare gains in providing energy access for cooking (increase of female literacy and engagement in productive activity, improvement in health particularly respiratory health of women and children in a household) are often much higher than the long-term costs involved in providing the subsidy. The subsidy is structured in such a way that it encourages provision of service at least cost as LPG does not involve elaborate infrastructure such as pipelines or transmission lines. This is one aspect that makes LPG subsidies more cost-effective in remote rural areas than gas pipelines or electricity distribution infrastructure (and service provision). Cost-effectiveness means that the subsidy achieves social goals at the lowest programme cost while providing incentives to LPG distributers to serve poor and rural populations.

Dependence on the invisible hand of the market for distribution of goods and services results in economic efficiency at the cost of equity. The visible hand of policy provides access to clean cooking fuels without having poor households wait for decades for economic benefits of the market logic to trickle through to them. The line of causality between economic growth and energy consumption runs both ways. This means that welfare benefits that accrue to poor households on account of higher energy consumption contribute to economic growth (education and employment of women). Energy subsidies and energy poverty are linked, and energy subsidies improve social wellbeing by mediating effects of energy poverty. What is required is not elimination of subsidy but innovation in energy subsidy for combating energy poverty and ensuring clean, sustainable, and affordable energy for all in line with the aims of the SDG 7.

Source: World Bank

Production

Oil and Natural Gas Corporation (ONGC) will in May next year start commercial production of crude oil from its much-delayed flagship deep-sea project in Krishna Godavari basin. Minister of State for Petroleum and Natural Gas Rameswar Teli said ONGC’s KG basin project, KG-DWN-98/2, is in "challenging geology". Delays have occurred due to multiple challenges and issues in actual project implementation such as subsurface geological issues, shifting of well locations and surface facilities/processing platform, delays and disruption in project supply chain for vendors spread across multiple countries due to Covid-19 pandemic and challenging weather conditions.

Deregulation of the sale of domestically-produced crude oil appeared to be in favour of ONGC as the firm will charge a premium over Brent in oil deals with Bharat Petroleum Corporation Ltd (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL). The ONGC has signed deals to sell about 4.5 MT of crude oil each to BPCL and HPCL in which it will sell crude oil it produces from Mumbai offshore fields at a premium to international benchmark Brent. The oil has been priced at the prevailing Brent crude oil price plus 1 percent. Brent, which is trading at US$80, after the oil contract the ONGC would get US$80 plus US$0.8. ONGC produces 13-14 million tonnes per annum (MTPA) of crude oil from its fields in the Arabian Sea, off the Mumbai coast. In June last year, the government of India allowed firms like ONGC and Vedanta to sell locally produced crude oil to any Indian refinery for turning it into fuel, such as petrol and diesel, as it deregulated one of the last few avenues that were still under its control. While contracts for oilfields awarded since 1999 gave producers the freedom to sell oil, the government fixed buyers for crude produced from older fields, such as Mumbai High of ONGC and Ravva of Vedanta.

According to Petroleum Planning & Analysis Cell (PPAC), India produced a total of 2.5 MT of crude oil in October 2023 - registering a growth of 1.3 percent compared to the year-ago period. Out of 2.5 MT, ONGC produced 1.6 MT of crude oil while Oil India Limited (OIL) and private sector producers contributed 0.3 MT and 0.6 MT. India’s crude oil imports rose in October, after falling in the previous four months, as the world's third biggest oil importer and consumer shipped in more fuel to meet winter demand. According to PPAC data, crude oil imports increased by 2.2 percent and by 0.6 percent during October 2023 and April-October 2023 respectively, compared to the corresponding period of the previous year. The net import bill for oil and gas was US$11.8 bn in October 2023 compared to US$11.9 bn in October 2022. Out of this, crude oil imports constitutes US$11.7 bn, liquefied natural gas (LNG) imports were US$1.2 bn and the exports were $3.6 bn during October 2023. The production of petroleum products was 21.8 MT during October 2023 which is 4.2 percent higher than October 2022. Out of above 21.5 MT, 21.5 MT was from refinery production and 0.3 MT was from fractionator.

Demand

India’s fuel consumption in November fell after hitting a four month peak in the previous month, hit by reduced travel in the world’s third biggest oil consumer as a festive boost fizzled out. Total consumption in November, a proxy for oil demand, fell by 2.8 percent to 18.72 million tonnes (MT) from 19.26 MT in October. Sales of diesel, mainly used by trucks and commercially-run passenger vehicles, decreased by 1.4 percent month-on-month to 7.53 MT. Sales of gasoline in November were 0.4 percent lower than the previous month at 3.13 MT. India’s diesel consumption slumped by 7.5 percent in November on a fall in demand in the transportation sector where some took Diwali break, preliminary data of state-owned firms showed. Diesel consumption dropped to 6.78 MT in November from 7.33 MT a year back. Diesel is India’s most consumed fuel, accounting for almost 40 percent of all petroleum product consumption. Transport sector accounts for 70 percent of all diesel sales in the country. Petrol sales by three state-owned fuel retailers rose 7.5 percent to 2.86 MT on increased personal vehicle movement during the festive season. Petrol demand had fallen 9 percent year-on-year in the first half of October and diesel sales by 3.2 percent but the start of Navratri/Durga Puja celebration helped reverse the trend. Diesel demand fell 12.1 percent in the first half of November and recovered a bit in the second half. Diesel sales typically fall in monsoon months as rains lower demand in the agriculture sector which uses the fuel for irrigation, harvesting and transportation. Also, rains slow vehicular movements.

According to S&P Global Commodity Insights, the global demand for crude oil is expected to see its peak in 2030 at 112 million barrels a day (bpd) mark with India and Africa to be major contributors,. The current global demand of crude oil is at 103 million bpd. The global demand for crude oil will peak to stay in the range of 112 milion bpd in 2030 from the present level of 103 million bpd. India and Africa will be the major contributors to the 8.73 percent increase in demand by 2030 as industrial activities will pick up in the region. There will be increased use of clean cooking, automotives and setting up of refineries by various economies. However, the demand for crude oil in India will see its peak in 2040 to reach 7.2 million bpd from 5.2 million bpd at present.

With crude oil prices falling to a 4-month low in the international market, the Indian economy is expected to get a shot in the arm. The country’s current account deficit had started to spiral out of control due to the huge oil import bill and the rupee had been weakening due to the higher demand for dollars to buy expensive oil. The price of the global benchmark Brent crude fell by 4.63 percent to close at US$77.42 per barrel, while the US’s West Texas Intermediate crude oil futures fell 4.9 percent to settle at US$72.90 per barrel. An increase in US crude oil inventories, a rebound in US Treasury yields, and the easing of oil demand due to the global economic slowdown have contributed to the decline in crude prices. Prices have in fact been gradually declining over the last four weeks. India’s merchandise trade deficit rose to a record high in October and the decline in oil prices would bring respite in November. The country imports over 80 percent of its crude oil requirement and any increase in prices leads to a sharp increase in the current account deficit.

LPG

The price of domestic cooking gas or liquefied petroleum gas (LPG) at INR603 for a 14.2 kilogramme cylinder for beneficiaries under Pradhan Mantri Ujjwala Yojana (PMUY) is the cheapest in India when compared to rates in neighbouring countries, Petroleum Minister Hardeep Singh Puri said. He said India imports 60 percent of its LPG requirement. Despite volatile and high global prices of LPG, the government absorbed it and kept the prices lower for the Ujjwala beneficiaries. He said that the consumption under PMUY has gone up to 2.8 cylinders per household annually now. The number of connections under the scheme has also increased to 96 million and utilization has increased. He said the total number of cooking gas connections in the country, which stood at 140 million in 2014, has increased to 330 million at present. Out of which, the connections under the PMUY are 96 million. The government has decided to provide additional 7.5 million gas connections under the scheme, out of which 3.4 million has already been accomplished, he said

Indian Oil Corporation (IOC)’s LPG cylinder transporters have withheld their agitation for a month after the company agreed to several of their demands. Members of the North East Packed LPG Transporter Association (NEPLTA) had on December 4 stopped plying their trucks, alleging pending dues and low rates in recently floated tenders, thereby affecting supply of LPG in several states of the region. According to the NEPLTA, in the tender floated, the distributor-wise RTKM (round trip kilometre) is missing and it should be incorporated.

The central government has informed the Parliament that it has distributed 141.7 million free LPG refills nationwide as part of the PMUY. Rameswar Teli, the Minister of State in the Ministry of Petroleum and Natural Gas, shared this information during a written reply in the Rajya Sabha. According to Teli, there are currently 96.7 million active LPG connections under the PMUY, with 6.926 million connections in Rajasthan as of October 2023. The PMUY, initiated in May 2016, aims to provide clean cooking fuel to impoverished households nationwide. Adult women from economically disadvantaged households are eligible for a deposit-free LPG connection under this program. Furthermore, Teli informed the Parliament that the government had also granted up to three free refills to PMUY beneficiaries under the Pradhan Mantri Garib Kalyan Package from April 2020 to December 2020, resulting in the distribution of 141.7 million free refills across the country.

Refining

IOC has revised the estimates of cost of expanding the Panipat refinery in Haryana by 10 percent to INR362.25 billion (bn) (US$4.36 bn) and pushed back completion deadline by more than a year to December 2025. IOC is expanding its 15 MT a year refinery, about 100-km north of New Delhi, to 25 MT. IOC owns and operates nine of the country’s nearly two-dozen refineries. The total capacity under its operations is 70.1 MT per annum.

Imports

Indian refiners have resumed Venezuelan oil purchases through intermediaries, with Reliance Industries Ltd (RIL) set to meet executives from state firm PDVSA to discuss direct sales following the easing of US sanctions on the South American country. India last imported Venezuelan crude in 2020. Access to Venezuela’s heavy oil could cap import costs for India, which has become a major Russian oil buyer, and further reduce its reliance on the Middle East. Three Indian refiners have bought some 4 million barrels of Venezuelan crude for February delivery at between US$7.50 and US$8 per barrel below dated Brent on a delivered ex-ship basis, traders said. RIL had previously received an offer for a prompt cargo at US$16 a barrel below dated Brent on a free-on-board basis, but it was unclear if the deal had gone through.

India’s Russian oil imports rebounded in November after several plants came back online from planned maintenance and as fuel consumption rose during the Diwali festive season, preliminary data from ship-tracking firms Kpler and Vortexa showed. The world’s third-biggest importer and consumer of oil has boosted purchases of Russian oil sold at a discount after imports from Russia were shunned by some Western countries following its invasion of Ukraine last year. Data from Kpler and Vortexa showed a 9 percent and 5 percent rise in India’s monthly intake of Russian oil in November from the previous month to 1.73 million bpd and 1.68 million bpd, respectively. Indian refiners mostly have annual contracts with key Middle East producers such as Saudi Arabia. Both agencies noted a more than 25 percent decline in India’s intake of Saudi oil in November versus October.

World

Saudi Arabia and Russia, the world’s two biggest oil exporters, called for all OPEC+ members to join an agreement on output cuts for the good of the global economy only days after a fractious meeting of the producers' club. Hours after Russian President Vladimir Putin went to Riyadh in a hastily arranged visit to meet Saudi Crown Prince Mohammed bin Salman, the Kremlin released a joint Russian-Saudi statement about the conclusion of their discussions. The Organization of the Petroleum Exporting Countries (OPEC), Russia and other allies agreed last week to new voluntary cuts of about 2.2 million bpd, led by Saudi Arabia and Russia rolling over their voluntary cuts of 1.3 million bpd.

The global oil market will see a slight surplus of supply in 2024 even if the OPEC+ nations extend their cuts into next year, the head of the International Energy Agency (IEA)’s oil markets and industry division Toril Bosoni said. At the moment, however, the oil market is in a deficit and stocks are declining "at a fast rate", Toril Bosoni said. OPEC+ is set to consider whether to make additional oil supply cuts when the group meets later this month, three OPEC+ sources have told Reuters after prices dropped by some 16 percent since late September. Oil has slid to around US$82 a barrel for Brent crude from a 2023 high in September of near $98. Concern about demand and a possible surplus next year has pressured prices, despite support from the OPEC+ cuts and conflict in the Middle East. Saudi Arabia, Russia and other members of OPEC+ have already pledged total oil output cuts of 5.16 million bpd, or about 5 percent of daily global demand, in a series of steps that started in late 2022.

Global oil markets are expected to be fairly balanced, with a slight surplus next year as demand and non-OPEC supply growth are exceeding expectations, the global head of research at Vitol, the world’s largest independent oil trader, said. Oil demand globally has exceeded 2019 levels and is expected to continue growing as oil intensity - the volume of oil consumed per unit of GDP - for most economies has returned to pre-pandemic levels except in the United States. Global crude price Brent has weakened to just above US$82 a barrel from a 2023 high in September near US$98. Concern about economic growth and demand has pressured prices, despite support from supply cuts by OPEC and its allies, and conflict in the Middle East. The IEA raised its oil demand growth forecasts for this year and next despite slower economic growth in nearly all major economies.

Africa & Middle East / OPEC+

The Dangote oil refinery in Nigeria received its first cargo of 1 million barrels of crude oil from Shell International Trading and Shipping Co (STASCO), bringing the start of operations closer after years of delays. Once fully running, the 650,000 bpd refinery funded by Africa’s richest man Aliko Dangote will turn oil powerhouse Nigeria into a net exporter of fuels, a long-sought goal for the OPEC member that almost totally relies on imports. Dangote Group said that the cargo of 1 million barrels of crude from Agbami - a deep water field run by Chevron - was the first of 6 million barrels that would enable an initial run of the refinery. Dangote Group said the STASCO cargo arrived on a chartered vessel and was discharged into the refinery’s crude oil tanks. Nigeria’s state oil firm NNPC Ltd signed an agreement in November to supply the Dangote refinery with up to six cargoes of crude starting this month. NNPC has a 20 percent stake in the refinery. Despite being Africa’s biggest oil producer, Nigeria experiences repeated fuel shortages. It spent US$23.3 bn last year on petroleum product imports and consumes around 33 million litres of petrol a day. Nigeria commissioned the refinery in May, after it ran years behind schedule. At a cost of US$19 bn, the massive petrochemical complex is one of Nigeria’s single largest investments.

OPEC+ handed Nigeria a 2024 oil output target lower than Africa’s largest oil producer had hoped for while lowering Angola’s target, according to the group of oil-producing countries. The move follows a meeting in June where OPEC+ agreed a complex deal that revised production targets for several members. OPEC had tasked three consultancies - IHS, Rystad Energy and Wood Mackenzie - with verifying production figures for Nigeria, Angola and Congo. Based on that it has given Nigeria a 2024 target of 1.5 million bpd, Angola one of 1.11 million bpd and Congo a target of 277,000 bpd, OPEC+ said. In June it had been agreed, pending the assessments by the consultancies, that Angola could produce 1.28 million bpd and Nigeria 1.38 million bpd and possibly as much as 1.58 million bpd.

The United Arab Emirates (UAE) will ramp up exports of Abu Dhabi’s flagship Murban crude early in 2024 as a new OPEC+ mandate kicks in and barrels are diverted to the international market owing to refinery maintenance, according to traders. That will add to increased output of other light sweet crude grades, including from fellow OPEC members Nigeria and Angola and non-OPEC countries such as the United States (US) and Brazil. The UAE production baseline under OPEC+ agreements is set to rise 200,000 bpd to 3.219 million bpd in January. At the same time, maintenance work at Abu Dhabi’s 837,000 bpd Ruwais refinery means less crude demand domestically.

Ghana plans to introduce a more flexible oil royalties regime as soon as next year to spur investment and reduce risk for energy companies, the head of the state oil sector regulator said. Ghana’s current royalty regime is a fixed 4 percent-12.5 percent of gross oil production, and 3 percent-10 percent of the volume of gas exported. Ghana, the world’s second biggest cocoa producer, became an oil producer in 2010. Output is currently at around 160,000-170,000 bpd of crude oil and about 325 million standard cubic feet per day of natural gas.

Russia/Central Asia

A severe storm in the Black Sea region has disrupted up to 2 million barrels per day (bpd) of oil exports from Kazakhtsan and Russia, according to port agent data. Oil loadings from Novorossiysk and the Caspian Pipeline Consortium (CPC) terminal in nearby Yuzhnaya Ozereyevka have been suspended. Kazakhstan’s largest oilfields - Tengiz, Kashagan and Karachaganak - are cutting combined daily oil output by 56 percent from 27 November as the storm disrupts loadings at CPC, the main export terminal for Kazakh oil, the Kazakh energy ministry said. The disruption is expected to lower Kazakhstan’s oil production by 631,700 metric tons, it said. Russia’s Black Sea port of Novorossiysk, the largest Black Sea outlet for oil and products, remained closed for loadings on Tuesday, according to port agent data.

Russia has lifted restrictions on gasoline exports, the energy ministry said, after scrapping most restrictions on exports of diesel last month, saying there was a surplus of supply while wholesale prices had declined. Russia, the world’s top seaborne exporter of diesel, introduced a ban on fuel exports in order to tackle high domestic prices and shortages. Only four ex-Soviet states - Belarus, Kazakhstan, Armenia and Kyrgyzstan - were exempt. The government eased restrictions, allowing the export of diesel by pipeline, but kept measures on gasoline exports in place. Overseas supplies of diesel and other fuels by truck and railway also remained prohibited at the time. The scrapping of the ban might complicate Russia’s efforts to reduce its oil and petroleum product exports by 300,000 bpd until the end of the year, compared with the average level seen in May and June.

BP has started drilling the first oil production well from the new Azeri Central East (ACE) platform in the Azeri sector of the Caspian Sea, the company said. The well will be up to 3,188 metres deep and drilling will take about three months, it said. The US$6 bn ACE project is the next stage of development of the giant Azeri-Chirag-Gunashli field in the Caspian Sea.

North & South America

The US Department of Energy said it wants to buy up to 3 million barrels of crude oil for the Strategic Petroleum Reserve (SPR) for delivery in March 2024, as it takes advantage of lower prices to start to replenish the stockpile. The administration of President Joe Biden last year conducted the largest sale to date from the SPR of 180 million barrels to try to limit an oil price rally after Russia's war on Ukraine began in February 2022. The Energy Department in October said it would buy back oil for the reserve at US$79 per barrel or lower, after it had received an average of about US$95 a barrel from last year’s emergency sales. The new solicitation is for sour crude and the delivery will be received by the Big Hill SPR site in Texas.

Canadian oil and gas producers will drill 8 percent more wells in 2024 to take advantage of greater access to pipelines, with the Trans Mountain oil pipeline expansion due to open, an industry group said. Conventional oil production accounts for a small portion – 14 percent on average this year - of Canada’s overall crude output, which comes mainly from oil sands. Canada is the world’s fourth-largest oil producer. Producers will drill 6,229 wells next year, up 481 from 2023, the Canadian Association of Energy Contractors predicted. The Trans Mountain expansion is scheduled to start shipping crude late in the first quarter of 2024, while the Coastal GasLink is approaching mechanical completion.

The US Coast Guard said it was still looking for the source of a leak from an underwater pipeline off the Louisiana coast in the Gulf of Mexico that it estimated had released more than a million gallons of crude oil. The 67-mile long pipeline was closed by Main Pass Oil Gathering Co (MPOG), after crude oil was spotted around 19 miles offshore of the Mississippi River Delta, near Plaquemines Parish, southeast of New Orleans.

US pipeline operator Energy Transfer said it has signed a non-binding agreement to supply crude oil to French energy major TotalEnergies from its upcoming Blue Marlin oil export project. Under the agreement, Energy Transfer would supply 4 million barrels per month of crude oil from the terminal in the Gulf of Mexico, amid a boom in shale oil production in the US. The company submitted an application for approval in late 2020 for the project, which converts an existing offshore platform in federal waters in the US Gulf of Mexico so that it could load large crude tankers with up to 2 million barrels of oil piped from Texas daily.

Asia Pacific

Bangladesh started in recent days a large crude oil receiving and offloading facility built by China that allows the south Asian oil importer to significantly reduce the cost of shipping in crude oil. The single-point mooring facility at Chattogram port offloaded 82,000 tonnes (about 600,000 barrels) of crude oil from a 100,000-tonne tanker, Bangladesh Petroleum Corporation (BPC) said. Bangladesh, which imports most of its oil needs, does not have a deepwater port and has relied on small vessels to ship crude oil from large tankers parked outside ports.

Key Asian refiners are set to seal 2024 diesel export deals at lower premiums than last year as global supply is poised to rise next year amid slower global demand growth, traders said. South Korea’s top refiners, GS Caltex and SK Energy, a subsidiary of SK Innovation, are likely to close deals for 10ppm sulphur diesel with end-users at premiums between 50 cents and 60 a barrel to Singapore quotes, they added, down from premiums of US$1 to US$1.50 a barrel for this year’s supply. This comes after Taiwan’s Formosa Petrochemical Corp (FPCC) sold at least one 750,000-barrel cargo per month to Western trading house Vitol at a premium of between 80 cents and US$1 a barrel last month. The fall in diesel premiums could weigh on refining profits for such major fuel exporters. The industrial fuel roughly accounts for 45 percent to 60 percent of refined fuel exports from Taiwan and South Korea, consultancy firm FGE said.

Sri Lanka will likely approve a proposal from Chinese state refiner Sinopec to build a US$4.5 bn refinery, the South Asian island nation’s Energy Minister Kanchana Wijesekera Said. Sri Lanka, trying to recover from its worst economic crisis in more than 70 years, is hungry for new investment and local fuel supplies. For Sinopec, the world’s top refinery by capacity and one of the largest petrochemical makers, the investment would mark a breakthrough in a long effort to expand beyond China’s borders. It owns refinery assets in Saudi Arabia and petrochemicals production in Russia. Sinopec will start basic engineering design, including finalising the size of the refinery and technical configuration, after getting official approval. The investment will add to Sinopec’s recently started fuel retailing business, the third international company with a foothold in Sri Lanka, with a license to operates 150 petrol stations. In August Sinopec and commodities trader Vitol were shortlisted by the Sri Lankan government to bid for the refinery. The refinery may target markets beyond Sri Lanka, where local fuel consumption is low, and use its partnership with China Merchants Port to expand bunker fuel supply at Hambantota, a deep-sea port near busy shipping lanes between Europe and Asia, analysts said. Sinopec’s fuel oil division, which runs the retail business there, began in 2019 supplying marine bunker fuel at Hambantota. Sri Lanka’s refinery at Sapugaskanda, commissioned in 1969, can process 38,000 barrels of oil a day.

China’s oil demand growth is likely to ease in the first half of 2024 to around 4 percent, according to consultancies, with resurgent consumption from the aviation and petrochemical sectors offset by weaker diesel usage due to an ongoing property sector crunch. Slowing demand growth for the world’s biggest oil importer comes amid what remains an uncertain outlook for the Chinese economy and as travel patterns normalise following the post-COVID rebound earlier in the year. The OPEC foresees Chinese demand averaging 16.41 million bpd in the first half of 2024, up 3.2 percent on 2023 levels, while the IEA forecasts demand averaging 17.1 million bpd for the full year, to show 3.9 percent growth. Even though China’s economy has made a faltering recovery this year, oil consumption was still on course to set record highs, having been subdued between 2020-2022 by strict COVID curbs. OPEC and the IEA expect China’s oil demand to show growth in 2023 of 7.6 percent and 12.1 percent, respectively.

China’s oil refinery throughput in October eased from the previous month’s highs amid weakening industrial fuel demand and narrowing refining margins. Total refinery throughput in the world's second-largest oil consumer was 63.93 million metric tons, data from the National Bureau of Statistics (NBS) showed. That was equivalent to 15.05 million bpd, a slight slowdown on September’s record 15.48 million bpd. China’s crude imports were up 13.5 percent year-on-year in October at 11.53 million bpd, though growth from September was relatively muted at 3.6 percent.

EU & UK

Czech Prime Minister Petr Fiala said he supported Slovakia’s request to continue exports of fuel produced from Russian oil to the Czech Republic beyond a 5 December deadline. Slovnaft, Slovakia’s sole refiner, owned by Hungary’s MOL, has sought to cut the share of Russian oil in its processing activities this year to about 60 percent, from about 95 percent. The European Union (EU) has imposed sanctions on Russian crude, although Slovakia, the Czech Republic and Hungary have exemptions while they shift to new sources.

17 December: India’s diesel consumption in the first half of December recovered from the steep fall seen last month on transporters taking a Diwali break, but sales were still lower than last year, preliminary data of state-owned firms showed. Diesel consumption at 3.15 million tonnes (MT) during December 1 to 15 was 0.7 percent higher than 3.13 MT demand in the first half of November. The demand was 8.1 percent lower than 3.43 MT consumption in 1-15 December 2022. The November dip in sales was largely on account of some truckers taking Diwali break to visit their homes. Diesel is India’s most consumed fuel, accounting for almost 40 percent of all petroleum product consumption. The transport sector accounts for 70 percent of all diesel sales in the country. Petrol sales by three state-owned fuel retailers rose 0.7 percent to 1.22 MT in the first fortnight of December on increased personal vehicle movement. Petrol demand had fallen 9 percent year-on-year in the first half of October and diesel sales by 3.2 percent but the start of Navratri/Durga Puja celebration helped reverse the trend. Diesel demand fell 12.1 percent in the first half of November and recovered a bit in the second half.

15 December: The International Energy Agency (IEA) said the "explosive growth" in Indian oil product consumption may be coming to an end. In a report, the IEA projected that India’s oil product demand growth would slow to 2.5 percent next year from 4.1 percent in 2023. Indian oil product deliveries edged higher in November but were underwhelming compared to the usual seasonal rise, the agency noted. Deliveries in November increased by 40,000 barrels per day (bpd), compared with the typical seasonal upswing of 170,000 bpd. Data from the Indian oil ministry’s Petroleum Planning and Analysis Cell (PPAC) showed that India’s fuel consumption in November fell after hitting a four-month peak in the previous month, hit by reduced travel in the world’s third biggest oil consumer as a festive boost fizzled out.

15 December: India will buy Venezuelan oil as some refiners in the country have the capability to process heavy crude oil, Oil Minister Hardeep Singh Puri said. Indian refiners have already resumed Venezuelan oil purchases, with Reliance Industries, Indian Oil Corp and HPCL-Mittal Energy securing cargoes of Venezuelan oil after the United States (US) lifted sanctions in October. India last imported Venezuelan crude in 2020. India is the world’s third-biggest oil importer and consumer, shipping over 80 percent of its oil needs from overseas. It wants to cut its crude import bill and is looking to expand its refining. India is willing to buy oil from any country that is not sanctioned, he said. He said some Indian money is locked up in Venezuela, referring to India’s Oil and Natural Gas Corporation (ONGC), which has more than US$500 million in dividends pending since 2014 for its stake in Venezuelan projects.

14 December: Oil demand growth in the key Asian market of India is set to slow next year as the spurt in consumption that followed the pandemic fades, echoing a slowdown in China and presenting a fresh headwind for prices. Consumption will expand 150,000 barrels a day in 2024, down from about 290,000 barrels a day seen from 2021 to 2023, according to Rystad Energy Head of Oil Trading Mukesh Sahdev. The drop will return growth near the pace seen from 2011 to 2019, he said. India is the third-biggest crude consumer, and a vital market for producers from the Middle East as well as from Russia, with Moscow boosting flows after the 2022 invasion of Ukraine. India’s economy has been expanding at a rapid clip — the economy grew 7.6 percent in the third quarter — lifting demand for gasoline, diesel and other products. While overall oil consumption is at record, the rate of expansion will ease as the one-off lift following the pandemic passes.

14 December: India’s Russian oil imports in November rose to a 4-month high of 1.6 million barrels per day (bpd), up 3.1 percent from October, making up about 36 percent of the nation’s overall imports last month. India, the world’s third biggest oil importer and consumer, has traditionally relied on Middle Eastern producers for meeting the bulk of its oil needs and rarely made purchases from Russia in the past due to high transportation costs. Last month, India overall imported about 4.5 million bpd oil, a decline of about 4.5 percent from October and a growth of 13 percent over the same month last year. Iraq and Saudi Arabia were the next top oil suppliers to India after Russia in November.

15 December: For the first time after piped natural gas (PNG) project was launched in the city as well as the country in 1972, the gas lines of the area where the project kicked off will be changed finally. The pipelines in the walled city of Vadodara and surrounding areas had not been changed since they were laid when the project began. Vadodara had become the first city in the country where PNG was provided to households. The Vadodara Municipal Corporation (VMC) had established a gas project department and taken up the project. In 2013, the civic body entered into a joint venture with Gail Gas Ltd and floated Vadodara Gas Ltd (VGL) that has taken over PNG network and has also set up CNG stations for automobiles. Despite the new corporate structure, the condition of the gas lines in the old city had not changed. The old city areas of Vadodara have around 7,000 connections and a network of gas pipelines totaling to 73 kilometre (km). VGL will spend around INR55 million on replacing the pipelines for domestic connections. Another INR40 million will be spent on the gas pipelines that carry gas in the area. The areas that will be covered include Mandvi, Wadi, Gajrawadi, Dandiabazaar, Kharivav Road, Panigate, Bavamanpura, Chhipwad, Bhutdi Jhampa and Karelibaug.

15 December: The Centre has formally allocated a coal block in Jharkhand to NLC India Ltd, the state-owned entity said. The PSU had emerged as successful bidder for North Dhadu (Western Part) mine in Latehar district of Jharkhand under commercial auctions held in August. This coal mine has reserves of 434.65 million tonnes (MT) and its peak rated capacity is 3 MT per annum.

14 December: Indian Railways’ plan to raise the quantum of coal to be transported by rail by at least 400 million tonnes (MT) in the next eight years face congestion and logistical challenges, the Institute for Energy Economics and Financial Analysis (IEEFA) said in a report. Coal India Ltd (CIL) is likely to be the largest contributor to new coal production and is floating plans to move an additional 400 MT by rail in just four years. The report states that this timeline appears unrealistic since almost all the extra 91 million tonne that CIL has mined in the last two years moved by trucks on roads and not rail. CIL reports 6 lakh truck movements each month. While Indian Railways devotes planning and engineering resources to coal evacuation projects, on major routes track renewal activities take a hit.

14 December: Coal Secretary Amrit Lal Meena asked successful bidders to fast-track operationalisation of coal blocks. The secretary further assured the bidders of full support of the Centre in getting the necessary clearances. The coal ministry has issued vesting orders for six commercial coal mines and signed pacts for two mines. Of the six coal mines, two are fully explored.

19 December: NTPC Group said it has produced 300 billion units of power so far this fiscal. It is the fastest ever 300 BU generation, NTPC said. In 2022-23, the group had crossed 300 billion units generation on 5 January 2023, it said. NTPC Ltd, under the power ministry, is India’s largest integrated power utility, contributing 1/4th of the power requirement of the country.

15 December: Peak power demand in India will increase to 366 gigawatt (GW) by 2032 and 693 GW by 2047. This assumes significance in view of rising electricity consumption in the country as peak power demand touched a record high of 243.27 GW in September 2023. Considering the projected electricity demand and energy requirement in the country, which is expected to grow in terms of peak demand to 277 GW by 2027; to 366 GW by 2032 and 693 GW by 2047, Central Electricity Authority said.

13 December: Himachal Pradesh Chief Minister (CM) Sukhvinder Singh Sukhu has said that INR650 million has been sanctioned for the ducting of overhead electricity and other cables. He said that besides, INR200 million each had been proposed for the laying and termination of underground cables in Nadaun and Hamirpur. The CM directed Himachal Pradesh State Electricity Board Limited (HPSEBL) to ensure the completion of the works in a time-bound manner.

19 December: A total of 50 solar parks with a combined capacity of 37,490 megawatt (MW) have been approved in 12 states till 30 November, Parliament was informed. The government is implementing a scheme — Development of Solar Parks and Ultra Mega Solar Power Projects — with a target capacity of 40 gigawatt (GW), Minister of New and Renewable Energy R K Singh said. Under the said scheme of the Ministry of New and Renewable Energy (MNRE), 50 solar parks with an aggregate capacity of 37,490 MW have been sanctioned in 12 states in India as on 30 November, he said. An aggregate capacity of 10,401 MW of solar projects have been commissioned in 19 solar parks so far, he said. He said two solar parks — Kadaladi Solar Park and Ramanathapuram Solar Park — of 500 MW each were earlier sanctioned in Tamil Nadu, but were subsequently cancelled due to slow progress and land constraints.

17 December: India’s second home-built 700 megawatt (MW) nuclear power reactor at Kakrapar in Gujarat achieved its first criticality, the start of the controlled fission reaction, setting the stage for its gradual move towards producing electricity for commercial purposes. The first criticality was achieved at 1.17 am in the presence of Nuclear Power Corporation of India Limited (NPCIL) Chairman-cum-Managing Director B C Pathak. Kakrapar Atomic Power Project (KAPP) Unit-4 is the second in the series of 16 indigenous Pressurised Heavy Water Reactors (PHWR) of 700 MW each being set up in the country.

15 December: Renewable energy solutions provider Suzlon has secured a 100.8 megawatt (MW) wind energy project from a leading global company. The company will execute the project with a scope of supply, supervision, and commissioning. Additionally, Suzlon will undertake post-commissioning operation and maintenance services. Suzlon will install 32 wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 3.15 MW each. Electricity generated from the project will be supplied to Gujarat Urja Vikas Nigam Ltd (GUVNL). A project of this size can provide electricity to about 77,000 households and curb 3.02 lakh tonne of CO2 (carbon dioxide) emissions every year.

14 December: Singapore’s Sembcorp Industries said its renewables unit was awarded a 300 megawatt (MW) solar power project by Indian government-run hydropower producer NHPC Ltd. NHPC in its letter of award confirmed Sembcorp’s unit, Green Infra Wind Energy Ltd (GIWEL)’s final offer, and committed to buying power output from the project for 25 years under a long-term power purchase agreement, Sembcorp said. The project will be funded by internal funds and debt, and is expected to be ready for commercial operation in 2026, the energy and urban solutions provider said. The award comes weeks after GIWEL signed an agreement with an India-based power producer, Leap Green Energy, to buy two special purpose vehicles owning 228 MW of operational wind assets in the Indian states of Madhya Pradesh, Maharashtra and Rajasthan.

14 December: President Droupadi Murmu said the dependence on fossil fuels is definitely decreasing, but fossil fuel-based energy is also essential for India. India has always worked as a responsible country in the field of clean energy, Murmu said.

13 December: Prime Minister (PM) Narendra Modi is determined to triple the nuclear installed capacity in India within the next decade, the IAEA (International Atomic Energy Agency) chief Rafael Mariano Grossi said. He said that India’s decisions regarding nuclear power will make a significant impact on the path ahead. Nuclear Power Corporation said India will have an addition of 14,500 megawatt (MW) in the nuclear power sector over the next nine years.

18 December: Saudi Arabia’s crude oil exports in October hit their highest level in four months, data from the Joint Organizations Data Initiative (JODI) showed. Crude exports from the world’s largest oil exporter rose 9.6 percent rose to 6.30 million barrels per day (bpd) from September, while the country's crude oil production, decreased 0.4 percent to 8.94 million bpd. In November, OPEC+ oil producers agreed to voluntary output cuts totaling about 2.2 million barrels per day (bpd) for early next year led by Saudi Arabia rolling over its current voluntary cut. Domestic refineries' crude throughput fell to 2.116 million bpd from 2.866 million bpd in September and direct crude burn fell to 531,000 bpd from 606,000 bpd.

17 December: Philippine President Ferdinand Marcos Jr said his country is working to resolve "exploration issues" in the South China Sea so it could start new energy exploration projects in the resource-rich waterway to meet his nation’s energy needs. The Philippines and China have resumed discussions about jointly exploring oil and gas resources in the South China Sea, where the two nations have sparred for decades over sovereign rights to develop natural resources in the strategic waterway.

14 December: World oil demand will rise faster than expected next year, the International Energy Agency (IEA) said, a sign that the outlook for near-term oil use remains robust despite COP28 agreement to transition away from fossil fuels. Despite the upgrade, there is still a sizeable gap between the IEA, which represents industrialised countries, and producer group OPEC (Organization of the Petroleum Exporting Countries) over 2024 demand prospects. The two have clashed in recent years over issues such as long-term demand and the need for investment in new supplies. World consumption will rise by 1.1 million barrels per day(bpd) in 2024, the Paris-based IEA said in a report, up 130,000 bpd from its previous forecast, citing an improvement in the outlook for the United States and lower oil prices.

19 December: German energy firm Sefe secured a €50 billion (US$55 billion) gas deal with Norway’s Equinor that will cover one-third of the industrial gas needs of Europe’s largest economy, the companies said. It also strengthens Norway’s position as Germany’s top supplier of natural gas, a position it has held since Gazprom suspended direct deliveries via the Nord Stream pipeline. Currently, Norway already accounts for roughly 40-50 percent of Germany’s gas imports. The supply deal covers around 10 billion cubic meters (bcm) of natural gas per year from 1 January 2024 until 2034 and carries an option for another five years covering 29 bcm, the companies said.

19 December: The European Union (EU) is set to extend its emergency cap on gas prices for another 12 months to serve as a safeguard against possible energy price shocks, after energy ministers backed the plan. The EU first agreed the gas price limit in December 2022, after months of cripplingly high energy prices caused by Russia slashing gas supplies to Europe after its invasion of Ukraine. Europe’s energy security situation is more comfortable than during last winter - energy prices are far lower, countries have secured new sources of non-Russian gas, and gas storage is near-full.

18 December: Australian oil and gas major Santos said it had received approval for a revised drilling plan at its US$4.3 billion Barossa gas project, although the fate of a pipeline to take gas to shore remains locked in a legal dispute. Santos was forced to stop drilling at the field roughly 285 km off northern Australia in September 2022 after the Federal Court ruled it had failed to sufficiently consult Indigenous people on the nearby Tiwi Islands. Separately, Santos is awaiting a ruling on whether it can resume work on a key section of pipeline that will take gas to Darwin for processing. Despite the various challenges, Santos affirmed last month it still expects to start producing Barossa gas in the first half of 2025.

14 December: The German state-owned Securing Energy for Europe GmbH (SEFE) has become the third company to seek approval from the US (United States) energy regulator for liquefied natural gas (LNG) developer Venture Global to begin construction on its CP2 LNG project in Louisiana. In June, SEFE, via its unit Wingas, signed a 20-year deal to buy 2.25 million tonnes per annum of LNG from Venture Global’s proposed 20 MTPA CP2 project in Louisiana.

13 December: United States (US) natural gas futures edged up about 1 percent from a six-month low in the prior session on raised demand forecasts for this week, and as record amounts of gas flowed to liquefied natural gas (LNG) export plants. Front-month gas futures for January delivery on the New York Mercantile Exchange rose 2.4 cents, or 1.0 percent, to settle at US$2.335 per million metric British thermal units (mmBtu). With record production and ample gas in storage, futures have been sending bearish signals for weeks that prices this winter (November-March) likely already peaked in November. Analysts have said they expect prices to climb in coming years as demand for the fuel grows as new LNG export plants enter service in the US, Canada and Mexico. But for 2024, some analysts have reduced their US demand forecasts after Exxon Mobil delayed the start of first LNG production at its 2.3 billion cubic feet per day (bcfd) Golden Pass export plant under construction in Texas to the first half of 2025 from the second half of 2024.

15 December: Global coal demand is expected to decline by 2026, according to the International Energy Agency (IEA)’s annual coal market report—Coal 2023 — released. Though global coal demand is rising by about 1.4 percent in 2023, IEA expects global coal demand to fall by 2.3 percent by 2026 compared with 2023 levels, even in the absence of governments announcing and implementing stronger clean energy and climate policies. This decline is set to be driven by the major expansion of renewable energy capacity in the three years to 2026, the IEA has projected.

19 December: The Texas electric grid is too dependent on natural gas-fired backup power generators after blackouts, US (United States) regulators found in a study that also called for gas suppliers and electric utilities to sync their plans to recover from outages. The joint study by the Federal Energy Regulatory Commission (FERC), North American Electric Reliability Corporation (NERC), and six regional entities which encompass nearly 400 million customers, looked at outages in Texas during the 2021 Winter Storm Uri. The freeze left more than 4.5 million people without power, some for days, as the Electric Reliability Council of Texas (ERCOT) sought to prevent a grid collapse due to the suspension of an unusually high amount of generation. As per a 2021 report on Uri by regulators, all 28 of ERCOT's "blackstart" resources, which can start up without drawing power from the grid, use natural gas as their primary fuel, and during Uri, over 80 percent of them failed or faced issues in starting.

14 December: The European Union (EU) agreed on an overhaul of the bloc’s power market to accelerate the rollout of renewables and curb volatility in electricity prices during the energy transition. The tentative deal between representatives of the European Parliament and member states in the EU Council would enable state support for existing nuclear facilities using so-called contracts for difference to help provide price certainty for generators. It would also pave the way for coal-fired plants to receive subsidies to provide backup power during the move to clean sources.

17 December: Germany’s Economy Minister Robert Habeck said he aimed to replace a subsidy to makers of solar panels that fell victim to a court ruling last month that scrapped swathes of the budget, arguing support was needed to compete with Chinese manufacturers. While solar energy is booming, most of the panels are imported from China.

15 December: TotalEnergies is ready to start construction of a 216 megawatt (MW) solar plant with battery storage in South Africa that should be operational in 2025, the company said. Africa’s most advanced economy is battling to end crippling power cuts blamed on its ageing fleet of coal-fired plants, while seeking to transition away from the polluting fossil fuel. The France-based energy company owns 35 percent of the consortium developing the project, with its partners Hydra Storage Holding and Reatile Renewables controlling 35 percent and 30 percent, respectively. South Africa launched three bidding rounds for 7,615 MW of new power generation from renewable energy, natural gas and battery storage, as part of its drive to overcome the electricity crisis that has hit its economy.

14 December: China’s cost to produce solar panels has plummeted 42 percent in the last year, giving manufacturers there an enormous advantage over rivals in places like the United States and Europe. The dramatic decline comes as the world’s largest solar panel producer has ratcheted up production capacity this year while the United States is incentivizing its own small industry to take on China. US (United States) producers are concerned the wave of new factories could make their own uneconomical. China accounts for 80 percent of the world’s solar manufacturing capacity, according to the analysis by energy research firm Wood Mackenzie. Wood Mackenzie said China was expected to dominate the global solar supply chain for much of the next decade. China’s panel production cost has dropped to 15 cents per watt this year, more than 60 percent below the US price of 40 cents per watt. A year ago, Chinese panels cost 26 cents per watt.

14 December: Portugal sourced a record 72 percent of its electricity from clean power sources over the first 11 months of 2023, up from 56 percent over the same period in 2022, thanks to a more than doubling in electricity generation from hydro sources. The surge in hydro output, along with a 40 percent climb in solar power generation, in turn helped Portugal’s power producers slash generation from fossil fuels to their lowest levels since at least 2015, data from think thank Ember shows. That mix of high volumes of clean power and low fossil-fuel use cemented Portugal’s status as the third-cleanest major power system in Europe behind Spain and France. Of the roughly 36 terawatt hours (TWh) of electricity generated by Portugal’s power system through November, 8.34 TWh (23.4 percent) came from hydropower sources, according to Ember. During the same period in 2022, hydro power generated only 3.78 TWh of electricity, as extensive droughts across much of Europe reduced reservoir and river levels.

14 December: South Africa launched three bidding rounds for 7,615 megawatt (MW) of new power generation from renewable energy, natural gas and battery storage, part of efforts to overcome record power outages crippling economic output. The Department of Mineral Resources and Energy said it had issued three requests for proposals (RFPs) for independent power producers to generate 5,000 MW of renewable energy, 2,000 MW from gas and 615 MW from battery storage.

13 December: Japan’s industry and land ministries picked three consortia, including one featuring Germany’s RWE and its partners, to operate offshore wind farms in the second round of a public auction. Japan’s offshore wind power market is set to grow as the government aims to have 10 gigawatt (GW) of offshore wind farm deals by 2030, and up to 45 GW by 2040, as part of its decarbonisation push.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.