-

CENTRES

Progammes & Centres

Location

Not many will associate Karl Marx with energy but a close reading of his ‘Capital: A Critique of Political Economy’ which was first published in 1867 shows that Marx understood energy better than many do today. He observed that the energy sources powering industrialisation had to be ‘dependable, urban and completely under the control of man’. Dismissing the ‘horse’ as the worst form of energy he observed that the horse had a head of its own, was costly to maintain and was limited in factory applications. He also dismissed wind because it was ‘inconsistent and uncontrollable’. He had more charitable views on the kinetic energy of flowing water but he noted that ‘it could not be controlled at will, failed at certain seasons and was essentially local’.

Marx’s vote was for coal (with water in the steam turbine of Watt) which he said was ‘entirely under the control of man, mobile and a means of locomotion, and also urban unlike wind and water that were scattered up and down the countryside’. Marx did not dwell on the nature of energy but his observations on characteristics of energy such as ‘certainty’ ‘mobility’ and ‘controllability’ that would make certain sources of energy indispensable for industrialisation were accurate. Energy sources now have to be clean and green apart from being urban, mobile and completely under the control of man. The pursuit of ‘clean and green’ values in energy sources has taken us back to wind and sun that were dismissed by Marx as ‘uncontrollable and undependable’.

Powerwall battery system developed by Elon Musk’s Tesla is expected to overcome the ‘undependable and uncontrollable’ characterises of wind and solar power and ‘fundamentally change the way the world uses energy’ as Musk put it at the launch of Powerwall in January 2015. Solar energy is already urban (as opposed to being scattered up and down the countryside) because photovoltaic panels can convert sunlight into electricity from urban roof tops. The hope is that Musk’s lithium-ion battery (LIB) will take care of not just the ‘uncertain and uncontrollable’ nature of solar energy but also make it mobile. Uncertain solar energy will be stored in Musk’s efficient batteries and allow people to draw energy whenever they want for whatever they want to do (use electrical appliances or move around in a vehicle) even when the sun is not shining.

Gordon Moore, co-founder of Intel famously said in 1965 that the circuit density of semiconductors (made of high-grade silicon) will double every eighteen months. Moore’s law as it has come to be known has proved to be true in the micro chip industry. The number of transistors on a circuit has doubled almost every two years and the cost has fallen dramatically. If Moore’s law holds for PV (photovoltaic) panels (made from solar-grade silicon) and storage batteries that dependable and controllable electricity from these systems will be cheaper than grid-based electricity (derived from fossil fuels) in a matter of few years.

PV modules and the inverters required to convert the DC power output from PV systems to AC power are commodity products that are traded internationally. The cost of PV modules has fallen from about US$105/watt (w) in 1975 to about US$D 0.20/watt in 2020 which is over 12 percent annual average fall over the 45-year period. This is impressive but nowhere near a Moore-scale decline. Most of the cost declines are traced to lower input material cost (solar grade silicon), increased the scale of production (economies of scale), lower labour costs through manufacturing automation and lower waste from efficient processing. In other words, the cost declines of PV modules are the result of production experience and not changes in fundamental physics that is required for Moore’s law to work.

In the last fifty years, the power of a given-sized microchip has increased by a factor of over a billion but the power output of a solar panel has merely doubled. This is not because of insufficient investment in research and development of solar technology. The United States poured money into solar technology in the late 1940s when domestic reserves of oil began to decline. It increased support for research on alternative energy technologies after the oil crises of the 1970s. Though the enthusiasm for alternative energy sources generally waned when oil prices fell, ideas such as peak oil, the oil weapon (in the hands of oil producers) etc have kept up the support for alternative energy sources. Despite this, solar has not managed to make a breakthrough on the scale of microchips because of fundamental technical limitations of crystalline silicon.

In pure materials, electrons can only reside in certain discrete energy bands. The electronic properties of materials are dependent on the profile of these energy bands and gaps between these energy bands. In semiconductors such as crystalline silicon, the band gap is somewhere between the high band gap of insulators (materials that do not conduct electricity) and overlapping bands of conductors (materials that conduct electricity). To be precise, the band gap of semiconductors such as silicon is too large for it to conduct electricity (allow movement of electrons from one band to another) in their normal state (in the absence of additional energy in the form of light/heat) but small enough for it to conduct electricity when additional energy from sunlight is available for absorption. A solar cell can only absorb photons (light) with an energy gap greater than the band gap. The band gap energy is the maximum energy that can be extracted as electrical energy from each photon that is absorbed by the solar cell. One fundamental limitation of crystalline silicon is its indirect band gap (which involves a change in energy and a change in momentum) which leads to weak light absorption and consequently makes thick wafers a necessity. This translates into higher capital costs, low power-to-weight ratios and constraints on module flexibility and design.

Alternatives to silicon wafers such as gallium arsenide, a compound with a direct band the gap (only involves a change in energy) are being investigated but those in the field do not see commercially viable alternatives to silicon emerging within the next decade. Thin film PV technologies that are made by additive fabrication process reduce material usage and capital expenditure accounting for 10 percent of global PV production capacity. Commercial thin films use hydrogenated amorphous silicon (non-crystalline silicon), cadmium telluride and copper indium gallium Diselenide. These materials absorb light 10-100 times more efficiently than silicon. This property reduces the thickness of material required for light absorption to just a layer of film coated on a support material such as glass. Cadmium telluride is the leading thin PV technology on account of its ability to harvest solar energy with a direct band gap of 1.45 electron volt (eV) compared to the indirect band gap of 1.12 eV for crystalline silicon. Thin film PV technologies use 10 to 1000 times less material than crystalline silicon, reducing cell weight per unit area and increasing power output per unit weight. Perovskite solar cells are thin-film devices that have demonstrated higher efficiencies with potential for further improvement, but their stability is limited compared to leading PV technologies. A key disadvantage of commercial thin-film technologies is their low average efficiency compared to crystalline silicon. Another key problem with thin film technologies is that they often require scarce elements that cannot be replaced easily. This puts a limit on scaling up solar capacity that is dependent on thin films. Irrespective of which material is used, improvements in the efficiency of industrial processes are likely to bring down costs significantly in the future.

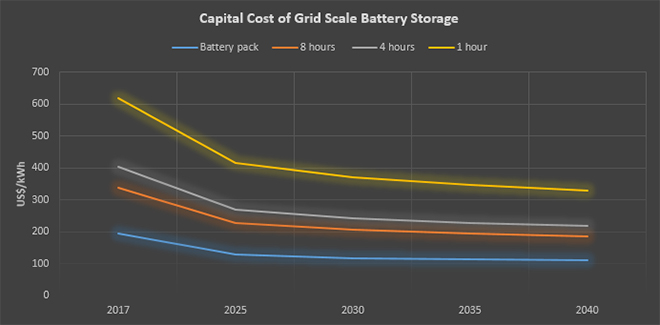

Variability and imperfect predictability of solar PV systems, qualities that allowed energy sources such as wind and water to be displaced by coal-based steam generation during the first industrial revolution is a challenge that battery storage is expected to address. The higher energy density and specific energy of Lithium-ion batteries (LIBs) have allowed the technology to replace nickel cadmium and nickel metal hydride batteries in grid storage applications. LIBs can maintain cell voltage levels approximately 3 times greater than alternatives. Coulombic efficiency (faradaic efficiency or current efficiency), the ratio of the total charge extracted from the battery to the total charge put into the battery over a full cycle which measures the efficiency of batteries is highest for LIBs among rechargeable batteries. It offers an efficiency that exceeds 99 percent when charged at a moderate current and at cool temperatures. Most improvements in the efficiency of LIBs can be traced to engineering gains in active material capacity and cell or electrode optimization. These improvements have slowed in recent years, posing a significant challenge for battery storage. The cost can increase two to four times when LIB cells are assembled into battery packs along with an increase in safety risks. If the industry manages to achieve US$200/kWh (kilowatt hour) battery cost, then US$200 trillion worth of batteries (10 times US GDP in 2020) can only provide 2 weeks’ worth of storage, which is not sufficient to heat homes in the winter. In 2022, the levelized cost of storage (LCOS) in Musk’s Powerwall was put at US$0.30/kWh which at current exchange rates is over INR 24/kWh. This is nowhere close to the tariff of grid-based electricity but the hope is that the cost of power from solar panels and batteries will decline rapidly and out-compete grid-based electricity.

Fire safety and recycling of batteries are emerging challenges that require greater attention. Besides safety and economic concerns, the mineral intensity of producing solar panels and LIBs creates a tough problem for climate strategies. Mineral mining, solar panel and LIB production produce substantial amounts of CO2, and are discarded in landfills or oceans upon retirement, generating large amounts of waste plastic and heavy metals that pose serious threats to the environment.

Like Marx’s ‘horse’, solar energy continues to have a head of its own, is costly to maintain and limited in applications even when saddled with battery storage. As there are doubts over making solar energy consistent and controllable, policy effort is also being devoted to making consumers consistent and controllable through incentives and penalties (price) for using energy at the right and wrong times. Likewise, if expected cost declines in solar PV plus battery storage do not materialise, the price for carbon or a tax on carbon will make fossil-fuel derived energy more expensive which in turn will make solar plus battery relatively inexpensive. Either way, life as we know it will come to an end.

Source: International Energy Agency

Source: International Energy Agency

Production

India plans to stop building new coal-fired power plants, apart from those already in the pipeline, by removing a key clause from the final draft of its National Electricity Policy (NEP), in a major boost to fight climate change. The draft, if approved by the federal cabinet chaired by Prime Minister Narendra Modi, would make China the only major economy open to fresh requests to add significant new coal-fired capacity. India and China account for about 80 percent of all active coal projects as most developing nations wind down capacity to meet climate targets. As of January 2023, only 20 countries have more than one coal project planned, according to E3G, an independent climate think tank. The new policy, if approved, would not impact the 28.2 GW of coal-based power in various stages of construction. India, whose proposed coal power capacity is the highest after China, had repeatedly refused to set a timeline to phase out coal, citing low per-capita emissions, surging renewable energy capacity and demand for inexpensive fuel sources. Coal is expected to be the dominant fuel in generating electricity in India for decades, but activists have pressed for a halt to new coal-fired plants, arguing this would at least help to reduce the share of the polluting fuel in overall power output.

Coal mining in Meghalaya, banned since April 2014, is likely to be resumed legally by July. At an election rally on 1 May, Meghalaya Chief Minister (CM) Conrad K Sangma said the Centre had approved mining leases for four persons, thus paving the way for scientific mining in the State. Despite the ban on rat-hole coal mining, the fossil fuel has been extracted and transported illegally for years in Meghalaya. More than a fortnight ago, the High Court of Meghalaya declined to exonerate the State government from complicity in the export of illegally mined coal to the adjoining Bangladesh.

The West Bengal cabinet has decided to give land to the Eastern Coalfields Limited (ECL) for the construction of new pits and expansion of non-operational coal mines. The cabinet of Chief Minister Mamata Banerjee decided to allot around 30 acres of land in the Asansol industrial area in Paschim Bardhaman district to ECL.

The coal ministry invited proposals for research and development (R&D) in the coal sector, aimed at improving production, productivity, safety, quality, and environmental protection. The ministry has been undertaking R&D activities for coal and lignite since 1975, with a total of 330 projects completed for INR 3.3 billion (bn) (US$44.7 million (mn) .

Coal Block Auctions

The central government extended the last date to submit bids under the seventh round of commercial coal auctions till 27 June 2023. The government had earlier fixed 30 May as the last date to submit bids for the 106 coal mines that were put on the block in the latest round of auctions. On 29 March, the government launched the seventh round of commercial coal auctions in a bid to increase the availability of the fuel in the country. The ministry said that so far 133 mines with cumulative peak rated capacity (PRC) of 540 million tonnes per annum (MTPA) have been allocated/auctioned. In order to facilitate the private players for early development of coal mines, the ministry is providing necessary support in terms of land availability, environment/forest clearances, assistance from financial institutions, and inter-agencies coordination, it said. The ministry said it has targeted 162 million tonnes (MT) of production from captive/commercial mines during the ongoing financial year.

Imports

Imports of non-coking coal could be cut drastically by fiscal 2025-26 on the back of increased output of dry fuel in the country. The world’s largest coal miner, Coal India Ltd (CIL), would be able to produce one billion tonnes by FY26. India’s overall coal production has witnessed a quantum jump to 893.08 MT in FY 2022-23 as compared to 728.72 MT in FY 2018-2019 with a growth of about 22.6 percent. Apart from CIL, NTPC, DVC, SCCL and other entities are also making endeavours for increased coal output that is bound to reduce imports. Non coking coal is mainly used as thermal coal for power generation. Efforts are also on to increase coking coal production by CIL arms - BCCL and CCL- to reduce dependence on coking coal imports. The production of coking coal by CIL rose by 17.2 percent year-on-year to 54.6 MT in 2022-23. Under 'Mission Coking Coal', the government has set a target of enhancing coking coal production from 52 MT in FY 2022 to 140 MT in FY 2030 besides enhancing coking coal washing capacity from 23 MT in FY 2022 to 61 MT in FY 2023.

Transport

The coal ministry said that it will complete 67 first- mile connectivity projects with a capacity of handling 885 MTPA by 2027. In order to eliminate road transportation of coal in mines, the ministry has developed a plan to improve the mechanised coal transportation and loading system under FMC projects. Crushing, coal size and quick computer-assisted loadings are advantages of coal handling plants (CHPs) and silios with rapid loading systems, it said. The ministry has set a target to generate 1.3 billion tonnes (bt) coal in FY25 and 1.5 bt in FY30 to increase India’s energy security and realise Atma Nirbhar Bharat by substituting domestically mined coal for imported coal. A key objective is the development of environmentally friendly, quick, and cost-effective coal transportation. India’s coal production hit a milestone of 892 MT during FY23, which is a y-o-y (year-on-year) growth of 14.7 percent. The power sector continued to be the largest consumer of domestic coal, accounting for the total despatches of 737.9 MT during FY23, an increase of 9.1 percent y-o-y. According to CareEdge, total coal imports surged by 26.18 percent y-o-y to 227.93 MT during April 2022 to February 2023 with non-coking coal accounting for 65 percent of the imports.

Prices

CIL is expecting to conclude the wage agreement (NCWA-XI) within a month, which would benefit its 2.38 lakh strong non-executive workers. Wages of the non-executive workers, which account for 94 percent of CIL’s workforce, are revised every five years. The hike is due from July 2021. In 2017, CIL signed a wage agreement with worker unions proposing a 20 percent hike in salaries for five years.

Rest of the World

World

Global thermal coal prices are stabilising this year in a range near US$200 a tonnes which is less than half of 2022’s record highs, with rising supplies providing respite to consumers roiled by last year’s volatility. Analysts expect the benchmark Newcastle coal index to average US$175-US$212 a tonne this year, a steep premium to the US$86 average for the ten years preceding Russia’s 2022 invasion of Ukraine, but down more than 50 percent from September’s highs at US$440. Last year, punitive Western sanctions on Russia pushed European buyers to pay top dollar for fuel to fire power plants, pushing up global prices. Russia was Europe's biggest supplier of coal and natural gas before the war. Coal prices in the tighter range expected this year, though, will help utilities and other users better plan fuel purchases, easing pressure on economies battling high inflation. Fuel prices typically account for more than half the total cost of generating electricity. Argus Consulting expects global coal exports to rise 4.4 percent this year, with imports set to increase 5 percent. China is seen ramping up imports by 11 percent, with Australian exports rising 9.4 percent after declining for three straight years. July Ndlovu, chairman of the World Coal Association (WCA) and chief executive of South Africa’s Thungela Resources (TGAJ.J), said Europe's "disproportionate" role in deciding coal prices was over.

China

China’s coal imports fell in April from a 15-month high in the prior month, government data showed, as weak power demand, high inventories and sliding domestic prices curbed overseas purchases. The world’s top coal consumer brought in 40.68 MT of the fossil fuel last month, down from 41.17 MT in March, according to data from the General Administration of Customs. For the first four months of the year, China imported a total of 142.48 MT of coal, up 89 percent year-on-year, customs data showed. Daily coal consumption at utilities in eight coastal regions fell to around 1.74 million tonnes in late April from 1.87 MT earlier, according to data from the China Coal Transportation and Distribution Association (CCTD). Coal inventory at utilities rose to around 32.6 MT as of the end of April, sufficient for 19 days of use, according to the CCTD data. Domestic thermal coal prices fell in April, with 5,500 kilocalories (kcal) coal declining to about 1,000 yuan (US$144.67) a tonne in northern Chinese ports from 1,130 yuan a tonne in late March. An expectation of weak coal prices in the coming weeks and the dwindling price competitiveness of overseas purchases provided little incentive for utilities to increase imports. Coal demand is forecast to pick up in the summer season from June to August amid expectations that lower-than-usual rainfalls in southern Chinese regions could curb hydropower generation and boost utilisation of coal-fired power plants.

Rest of Asia and Asia Pacific

Vietnam will not develop new coal power plants after 2030, according to a long-delayed national power plan published. The US$135 bn (RM607 bn) plan for its energy policy until 2030, mapping how it will reach those targets, was delayed for more than two years, with more than one earlier draft pointing to renewed investment in coal. Coal will represent 20 percent of Vietnam’s energy mix by the end of the decade, down from 50 percent currently, the plan said. Vietnam has the world’s third-largest pipeline of new coal power projects after India and China.

Australia’s centre-left Labor government said it will approve a new coal mine for the first time since it won power a year ago, sparking an angry reaction from environmental groups. Prime Minister Anthony Albanese’s government said it would authorise Bowen Coking Coal’s Isaac River mine project in Queensland to extract metallurgical coal for making steel. A public consultation on the coal project had attracted no submissions, the government said. Australia’s economy is fuelled by mining and coal exports—and it is among the world’s biggest emitters of carbon dioxide per capita.

North & South America

The capacity of coal-fired power plants in the United States (US) by 2050 will decline by more than half from 2022 levels, as environmental regulations raise costs and new plants powered by natural gas and renewable energy displace the ageing fleet, the US Energy Information Administration (EIA) said. In the EIA’s Annual Energy Outlook 2023, three scenarios with varying costs of zero-carbon technology projected that coal-fired electric-generating capacity will decline by 52 percent to 88 percent to between 97 gigawatts (GW) and 23 GW by mid-century. The plan will require coal plants that run past 2040 to install carbon capture and storage (CCS) technology starting in 2030. The Environmental Protection Agency projects the plan would cut emissions from coal plants and new gas plants by 617 MT between 2028 and 2042, the equivalent of reducing the annual emissions of 137 million passenger vehicles.

5 June: Around 14 lakh families of Rajasthan will get subsidies worth INR 640 each under the Indira Gandhi Gas Cylinder Subsidy Scheme, Chief Minister (CM) Ashok Gehlot has said. The scheme comes under his announcement for giving LPG (liquefied petroleum gas) cylinders for INR 500 each. Every family will get INR 640 under the scheme. Around 80 lakh such families are eligible under the scheme in the state.

3 June: After holding a review meeting of the HPCL Rajasthan Refinery Limited (HRRL) project at Pachpadra in Barmer, Rajasthan Chief Minister (CM) Ashok Gehlot disclosed that the refinery will start commercial production by 31 December 2024. Presently, Barmer Oil production amounts to 25 percent of the country’s demand, making it the highest in the country, he said. He said that with the commencement of commercial production before 31 December 2024, the pace of development will increase. He said in order to speed up the refinery project, the Central government should construct a 6-lane road from Jodhpur to Pachpadra-Barmer, and connect it to Amritsar-Jamnagar (Bharatmala Project).

1 June: Sales of petrol, diesel and jet fuel rose 9-10 percent year-on-year in May as economic activity expanded and summer holidays spurred leisure travel. Petrol sales jumped 10.4 percent over the same month last year, according to the preliminary sales data gathered from state-run oil companies. The consumption of petrol was nearly a quarter higher than in May 2019. Increased holiday travel, robust car and motorbike sales, and overall expansion in economic activity have all contributed to strong sales growth for petrol. Diesel consumption rose 9.3 percent in May helped by increased industrial and mining activity and retail demand. Elections in Karnataka also helped boost diesel demand. Diesel sales in May were 7 percent higher than in May 2019. Jet fuel sales rose 8.7 percent year-on-year on holiday travellers’ rush. Domestic airlines are carrying a record number of passengers these days though international flying is yet to fully recover to pre-Covid highs. Jet fuel sales in May were 5.3% lower than in May 2019. Liquefied petroleum gas (LPG), used mainly as cooking fuel in the country, rose 9.8 percent in May over the corresponding period last year. LPG sales in May were 20 percent higher than in the same month of 2019.

1 June: The domestic natural gas price will remain steady at US$6.5 per mmBtu (million metric British thermal units) in June, according to an oil ministry notification. Domestic natural gas price is determined every month as 10 percent of the average price of the India basket crude for the previous month. The gas price, as per the formula, fell to US$7.58 per mmbtu for June from US$8.27 in May. But since the gas price must stay within a Cabinet-determined band of US$4-US$6.5 per mmBtu, the effective price for June will not change. This price band applies only to gas produced by the fields operated by Oil and Natural Gas Corporation (ONGC) and Oil India Limited (OIL).

6 June: India will not face any shortage of coal this year even during the monsoon, Coal Minister Pralhad Joshi said. No matter what is the demand this year, the government is prepared to meet the same, the Minister said. Joshi said while 35 million tonnes (MT) of coal is at thermal power plants, 65 MT is lying at pit heads of Coal India Limited (CIL) and private miners and another 10-12 MT is in various stages of transportation. On the movement of coal through rakes, the Minister said the ministry is working in close coordination with Railways for the movement of the dry fuel from pit heads to locations. Earlier, the minister also unveiled Coal India's 'UG Vision Plan', which is a roadmap for achieving 100 MT production from CIL's underground mines by FY 2028. At present, CIL produces around 28 MT of coal from underground mines. Its subsidiary South Eastern Coalfields Ltd (SECL) alone contributes 11.5 MT coal from its 45 underground mines, SECL said.

3 June: The Meghalaya High Court (HC) has pulled up the state for allowing the export of coal through land customs stations in the state without seeking to ascertain the source or origin of such coal. The HC said several letters were issued to the state by the central agencies and by the Union finance ministry before the proceedings pertaining to illegal coal mining and illegal transportation of the illegally-mined coal being instituted in this court.

1 June: Coal India Ltd (CIL) has reported a 9.5 percent year-on-year rise in monthly production to a record 60 million tonnes (MT) in May 2023. The miner, along with its subsidiaries, had produced 54.7 MT of coal in the same month last year, CIL said. Progressive production in April-May 2023 was 117.5 MT, 8.6 percent higher from 108.2 MT in the year-earlier period. In May 2023, the total supplies rose to a healthy level of 63.7 MT, posting a 4.1 percent rise compared to 61.2 MT in May 2022. For April-May 2023, the coal off-take was 126 MT, clocking 6.2 percent year-on-year growth compared to 118.6 MT of the same period last year. According to the coal ministry, in open-cast mines, coal can be extracted only after removing layers of soil, stone etc. The coal inventory at CIL’s pitheads is at 61 MT, the company said adding coal at private washeries, goods sheds, captive mines, ports and in transit accounts to the tune of 15 MT, there is sufficient coal buffer stock of around 111 MT.

6 June: The Karnataka government issued an order to implement the 'Gruha Jyoti' scheme, which guarantees to offer up to 200 units of electricity free of cost to domestic consumers, from 1 July. The government order mentioned that the scheme cannot be availed by commercial consumers. Besides the introduction of 'Gruha Jyoti', the government also issued orders to fulfi l the 'Shakti' free bus travel for women scheme from 11 June. 200 units of free power will be provided, not only to the owners, but even the tenants are eligible to avail the scheme. Under the scheme, the government will take into account the one-year average power consumption in the 2022-23 financial year and will give free electricity up to 10 percent more than the average usage. If a consumer uses about 150 units of electricity a month on an average, he can get free power, up to 165 units of power. If he exceeds the limit, then he will have to pay for the rest of the units consumed, which will be the net power consumption. However, if the usage exceeds 200 units of power, the consumer will have to pay the full amount of the electricity bill. Consumers have to pay the arrears till June 30 within three months. The electricity metre usage and the metre reading have been made mandatory. The total electricity consumption will be displayed in the monthly bill, the order said. Every beneficiary has to link the customer ID or account ID with an Aadhaar number. Any consumer cannot integrate more than one electricity metre with the scheme. Those who want to avail benefits will have to enroll themselves in the 'Seva Sindhu' portal of the state government. The government mentioned that the beneficiaries of ‘Bhagya Jyoti’, ‘Kuteera Jyoti’ and ‘Amruta Jyoti’ schemes, which are various existing schemes offering free electricity to economically and socially backward communities, will be merged with the 'Gruha Jyoti' scheme. The government said the cost of the free electricity provided to the consumers will be compensated to the electricity supply companies.

5 June: The total trade volume of the Indian Energy Exchange grew by 8 percent year-on-year to 8,251 million units (MU) in May. The average spot power price during May 2023 was 30 percent lower at INR 4.74 per unit against INR 6.76 per unit in May 2022, due to an improving supply-side scenario, leading to increased liquidity, and cooler weather conditions. While an increase in power demand is expected in the coming months, the supply-side liquidity is likely to further improve due to enhanced coal supply, reduction in e-auction coal prices and consistently declining imported coal and gas prices.

31 May: Sterlite Power said it has started aerial operations to expedite the construction of its flagship Mumbai Urja Marg Project (MUML). To fast-track the completion of 400 kilovolt (kV) transmission corridor connecting Padgha to Kharghar , which links Mumbai to the national grid, Sterlite Power has proactively deployed lightweight helicopters to overcome the challenges of terrain and speed up material transfer, the transmission infrastructure developer and solutions provider said.

5 June: Realty firm Gaurs Group has set up a 15 megawatt (MW) solar power plant near Gwalior in Madhya Pradesh with an investment of INR 800 million. The electricity produced by the plant will be integrated into the central grid and utilised for its real estate projects, the company said. Delhi-NCR-based Gaurs Group has established a 15 MW solar power plant at Mahoba near Gwalior. The project is spread over a 50-acre area. The company has completed the 15 MW Mahoba solar power project and dedicated it to the nation on World Environment Day. Gaurs Group said this will result in a reduction of 18,000 tonnes of CO2 (carbon dioxide) equivalent annually.

5 June: Tata Power Renewable Energy Limited (TPREL), a subsidiary of Tata Power, said it has commissioned a 110 MW solar power project in Bikaner, Rajasthan, which will supply power to the Kerala State Electricity Board (KSEB). The project is also expected to generate approximately 211 million units and reduce a 258,257 metric tonnes carbon footprint annually, the company said. It said that this project is one of the fastest-commissioned projects in Rajasthan and that it is backed by a skilled team, cutting-edge technology, and experienced leadership. With this new installation, the total renewable capacity of TPREL reaches 6,788 MW, with an installed capacity of 4,047 MW (solar- 3,106 MW and wind- 941 MW) and 2,741 MW under various stages of implementation.

5 June: Prime Minister (PM) Narendra Modi said the poor and developing countries are paying the price for the "wrong policies" of some developed nations and stressed that India has been strongly raising the issue of climate justice with all such advanced and big countries. Modi said that for the protection of the world climate it is important that all countries think, rising above selfish interests. Modi said India is focusing on the environment in a big way just like any other area for its growth. In the past nine years, India has focused a lot on 'green and clean energy', Modi said.

5 June: Suzlon Group announced that it has crossed the 20 gigawatt (GW) wind energy installations milestone through 12,467 wind turbines installed across 17 countries ning six continents solidifying the company's position as a significant player in the global wind energy landscape. According to the Ministry of New and Renewable Energy (MNRE), India currently has a total renewable energy capacity of 168.96 GW (as on 28th February 2023) with about 82 GW at various stages of implementation and about 41 GW under tendering stage. This includes 64.38 GW solar power, 51.79 GW hydro power, 42.02 GW wind power and 10.77 GW bio power.

5 June: Delhi Chief Minister Arvind Kejriwal said pollution levels have dipped in the city in the last eight years despite the swift pace of development and the construction of schools, hospitals and flyovers. He asserted that both PM 2.5 and PM 10 levels “fell by 30 percent" in 2022 compared to the figures in 2016. Whenever development happens, it is accompanied with pollution due to felling of trees, road construction, kicking of dust, among others, he said. He said in 2016, on 26 days, pollution level was ‘very bad’ when the city was “akin to a gas chamber" with grey skies and bad air. In 2022, only six such days were there, he said. In 2016, on 109 days, pollution level was ‘low with clear sky’ and ‘very good air outside’, but in 2022, the number of such days was 163, he said. He said that the tree cover percentage (of total land area) in the city has risen to 23 percent today from 20 percent in 2013.

4 June: In a move to mitigate climate change, the Army has planned to make Narengi Military Station in Guwahati a completely renewable-based military station. For this initiative, the Army has installed a green solar energy plant with a capacity of 1 megawatt (MW) at the military station to benefit the troops of the Army. According to the Army officials, they have planned to extend the solar energy plant up to 3 MW capacity. The Army officials said they have used ‘Make in India’ solar panels in its first green solar energy plant. Renewable energy sources are derived from water, wind or sun. The Army is looking for a durable power supply in high altitudes to enhance the living conditions of its personnel.

3 June: India will add 58 gigawatt (GW) of wind energy capacity over the next seven years at an investment of over 4k billion. This would take the cumulative installed capacity of onshore wind energy to 100 GW as part of the Centre’s plan to create 500 GW of non-fossil fuel based installed capacity by 2030. Currently, 42.8 GW of onshore wind energy has been installed. On the other hand, the Union ministry of new & renewable energy will float a tender for seabed licensing to set up 4 GW of India’s first offshore wind energy off Tamil Nadu coast before the end of CY2023. Indian Wind Turbine Manufacturers Association said out of the 58 GW of wind energy, five GW and three GW will be installed in 2023-24 and 2024-25, respectively. Wind energy is produced from nine states with Tamil Nadu, Gujarat, Karnataka, Maharashtra, Rajasthan and Andhra Pradesh leading the list.

1 June: NTPC Green Energy Ltd (NGEL), a subsidiary of NTPC Ltd, has entered into a partnership with Uttar Pradesh Rajya Vidyut Utpadan Nigam Limited (UPRVUNL) to develop renewable energy parks in Uttar Pradesh. The collaboration aims to support the government’s energy transition goals and facilitate the development of clean energy infrastructure in the state. NGEL and UPRVUNL signed a Memorandum of Understanding (MoU) on 31 May in Lucknow, solidifying their commitment to joint efforts in renewable energy development. As part of the agreement, the companies will collaborate on the establishment of ground-mounted and floating solar projects in various locations, including the Rihand reservoir and other suitable water bodies and land areas. In addition to the solar projects, the partnership aims to solarize Ayodhya city through the development of a dedicated solar photovoltaic project. This initiative underscores the commitment of both companies to promoting clean and sustainable energy solutions. At present UPRVUNL has four thermal power stations within Uttar Pradesh with an installed capacity of 5,820 megawatt (MW) and one thermal power station with installed capacity of 1,320 MW under JV with NTPC.

Kazakhstan presses ahead with US$16.5 bn claim against oil majors

6 June: Kazakhstan is pressing ahead with US$16.5 billion in claims against international oil majors over disputed project costs and has no plans for a possible out-of-court settlement, Energy Minister Almasadam Satkaliyev said. In April Kazakhstan started arbitration proceedings against companies developing its Kashagan and Karachaganak oil fields over US$13 billion and US$3.5 billion respectively in costs deducted as part of profit-sharing deals.

5 June: Oil prices rose after the world's top exporter Saudi Arabia pledged to cut production by a further 1 million barrels per day (bpd) from July to counter macroeconomic headwinds that have depressed markets. Brent crude futures settled up 58 cents at US$76.71 a barrel, after touching a session high of US$78.73. US West Texas Intermediate crude gained by 41 cents to US$72.15 after hitting an intraday high of US$75.06. The Saudi energy ministry said the kingdom’s output would drop to 9 million bpd in July from about 10 million bpd in May. The voluntary cut, Saudi Arabia’s biggest in years, is on top of a broader deal by the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia to limit supply into 2024 as OPEC+ seeks to boost flagging oil prices. Fatih Birol, head of the International Energy Agency (IEA), said that the chance of higher oil prices had increased sharply after the new OPEC+ deal. OPEC+ pumps about 40 percent of the world’s crude and has cut its output target by a total of 3.66 million bpd, amounting to 3.6 percent of global demand.

31 May: Chemical maker LyondellBasell Industries said that it plans to delay closing of its Houston, Texas, oil refining business to no later than the end of the first quarter in 2025. The company said it would close its 263,776 barrel-per-day Houston Refinery by the end of 2023, its only refinery, due to the cost of needed overhauls after two failed attempts to sell the plant. Analysts had estimated the facility would require about US$1 billion in upgrades to continue operations. LyondellBasell said last month that it plans to run the plant at 95 percent of capacity this quarter, up from 85 percent in the first quarter.

31 May: United Nations (UN) said it is ready to start salvage work on an oil tanker stranded off Yemen’s coast with more than one million barrels of crude that pose an acute risk to the environment. In an unprecedented salvage plan, the UN has purchased a super-tanker to remove the oil from the vessel in the Red Sea. The actual pumping will start in about 10 days to two weeks. Experts said the ship is at risk of breaking apart, exploding or catching fire. The Safer's 1.1 million barrels are four times as much oil as that which spilled in the 1989 Exxon Valdez disaster off Alaska, one of the world's worst ecological catastrophes, according to the UN. The salvage operation, which will cost an estimated more than US$140 million, has been assigned to a company called SMIT Salvage. It will pump the oil from the Safer to the now UN-owned ship called Nautica, and then tow away the empty tanker.

Chevron produces first gas from Gorgon Stage 2 development off Western Australia

6 June: Chevron said it has started producing gas from the Gorgon Stage 2 development project off the coast of Western Australia. The development expands the existing subsea gas gathering network of the Gorgon Project, which exports liquefied natural gas (LNG) to customers across Asia and produces domestic gas for the Western Australian market, Chevron said. Gorgon’s Stage 2 development involved the installation of 11 additional wells in the Gorgon and Jansz-Io fields and accompanying offshore production pipelines and subsea structures to maintain feed gas supply for the project’s gas processing facilities on Barrow Island. Chevron is a 47 percent owner and operator of the Gorgon LNG project. It is also co-owned by Exxon Mobil Corp, Shell and Japanese utilities Osaka Gas, Tokyo Gas and JERA.

1 June: QatarEnergy has signed a 15-year supply deal for liquefied natural gas (LNG) with Bangladesh’s PetroBangla for 1.8 million tonnes a year starting in 2026. The latest contract with an Asian customer by the world’s top LNG exporter comes when Western countries, including Germany, push to win a chunk of the Qatari gas as competition ramped up following the Ukraine war. It is also QatarEnergy’s second to Asia since it started selling the gas expected to come on stream from the North Field expansion project. The expansion will raise Qatar’s liquefaction capacity to 126 million tonnes per year by 2027, from 77 million currently.

1 June: Trinidad and Tobago is requesting the US (United States) government amend the terms of a licence authorising the joint development of a promising offshore gas field with Venezuela, the Caribbean nation’s energy ministry said. The US in January issued a 2-year authorization for Trinidad and a group of companies including Venezuelan state-run oil firm PDVSA and Anglo-Dutch Shell to revive a dormant project that could help Trinidad boost gas processing and exports to its neighbours. Trinidad this month plans to disclose winners of a bidding round for onshore and shallow-water blocks in the country, after evaluating the offers. Negotiations with BP and Shell on the terms for exploring and developing deepwater oil and gas blocks awarded in a separate auction also could finish soon.

5 June: Italy could shut down its coal-fired power stations in 2024, a year earlier than planned, if gas prices remain at current low levels, Environment Minister Gilberto Pichetto Fratin said. Italy, which had to find an alternative for the gas it used to import from Russia following Moscow's invasion of Ukraine, increased its production of energy from coal to 7.5 percent of the total last year, from 4.6 percent in 2021. Under its current plan for energy and climate (PNIEC), which is under review, the government targets an exit from coal in 2025.

Heatwave in Bangladesh leads to school closures, power cuts

6 June: A searing heatwave in Bangladesh spurred the closure of primary schools and triggered frequent power cuts, worsening conditions for residents unable to run fans to cool themselves as weather officials warned relief was not imminent. Bangladesh could face power cuts for two more weeks, Nasrul Hamid, minister of state for power, energy and mineral resources, said as a fuel shortage sparked shutdowns of several power-generating units, including its biggest coal-fired plant. The heatwave comes as the country already grapples with power cuts that have hurt its economy in recent months, including its crucial apparel sector that accounts for more than 80 percent of its exports.

6 June: In Cape Cod Bay, 10-year-old Pilgrim and her calf skim the water’s glassy surface alongside the Shearwater research vessel to feed on tiny crustaceans. The two are among the last surviving 340 or so North Atlantic right whales left migrating along the US (United States) East Coast— down from 480 right whales in 2010. Now, the whales face another threat as the US Department of Energy tries to boost clean energy production by ramping up research into seaweed, or kelp, as a potential source of biofuel, scientists said.

1 June: Global additions of renewable power capacity are expected to rise by a third this year, the International Energy Agency (IEA) said, as stronger government policies and energy security concerns drive more clean energy deployment. In its Renewable Energy Market update report, the IEA said additions of renewable capacity worldwide are set to jump by 107 gigawatts (GW), the largest absolute increase ever, to more than 440 GW in 2023. Next year, total global renewable electricity capacity is expected to rise to 4,500 GW, equivalent to the total power output of China and the US combined. In Europe, the growth of renewable energy is at the heart of the bloc’s response to the energy crisis in the wake of the Ukraine war. New policy measures are also helping to drive significant capacity increases in the US and India over the next two years. China is also expected to account for nearly 55 percent of global additions of renewable power capacity in both 2023 and 2024, IEA said.

1 June: A group of United States (US) congressmen have formally complained about what they call unfair ethanol trade practices by Brazil that includes a blockade of US companies seeking to take part in the Brazilian low-carbon biofuel program RenovaBio. The bipartisan group of 21 members of the US Congress are asking Trade Representative (USTR) Katherine Tai to address the Brazilian tariffs on US ethanol and the non-tariff barrier created by the biofuel program implemented in 2020. RenovaBio is a carbon market that gives Brazilian biofuel producers an additional revenue source. Companies such as ethanol makers generate carbon credits, called CBios, from the lower emissions of biofuels when compared to oil-derived fuels such as gasoline.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.