Air-conditioner use in India: The cause of or the solution to a warmer world?

Background

Staying warm in winter and cool in summer is not only a matter of comfort but also

essential for health. Heat stress is cited as the primary cause of death of at least 2000 people annually in India. Growth in the use of

air conditioners (ACs) in India driven by an increase in population number, increase in urbanization, increase in incomes, increase in average temperature, along with the affordability of ACs has limited heat stress-related casualties. However, ACs consume large quantities of electricity and use

hydrofluorocarbons (HFCs) that contribute to the emission of greenhouse gases (GHGs), the primary cause of climate change. This contradiction highlights the most fundamental and contentious climate challenge: Will the increase in energy consumption of the poor masses for cooling and other energy services help them

adapt to a warmer world or contribute to a warmer world? The response reiterated in

domestic and

international climate literature is that efficient cooling technology will allow for an increase in AC use without increasing GHG emissions.

Stylised facts

Global residential AC ownership is estimated to be about

2.2 billion units in 2021. Across the world, households with ACs increased from about 25 percent in 2010 to about

35 percent in 2021. Households account for 68 percent of total AC installations globally. In 2020-21 space cooling energy consumption (including energy consumption by ACs, fans, coolers, etc) increased by more than

6 percent which was greater than growth in any other building end-use energy. Space cooling energy consumption has tripled since 1990 and doubled since 2000.

Worldwide, ACs consume over

2000 terawatt hours (TWh) of electricity every year, which is more than the total electricity generated by India in 2021 and roughly

7 percent of global electricity generation that year. CO

2 (carbon-di-oxide) emissions from space cooling have tripled since 1990 to over

1 GtCO2 (giga tonnes of carbon dioxide), equivalent to the total CO

2 emissions of Japan. According to estimates, a

1°C increase in temperature in the future will increase electricity consumption for space cooling by around 15 percent.

China produced around

70 percent of the world’s room ACs and accounted for about 22 percent of installed cooling capacity worldwide. AC sales grew fivefold since 2000, representing nearly

40 percent of global sales. China saw the fastest growth worldwide in energy demand for space cooling in buildings over the last two decades, increasing by

13 percent a year since 2000 and reaching nearly 400 terawatt-hours (TWh) of electricity consumption prior to the pandemic. Though more than

500 million units were sold in China in the last decade, relative AC demand rose more quickly in India and Indonesia, with average yearly installations increasing at a rate of more than

15 percent in India and

13 percent in Indonesia. India along with China and Indonesia are projected to account for most of the growth in energy use for space cooling by 2050. However, India is still far behind China in protecting its people from heat stress. The population-weighted heat stress exposure is

100 percent for India compared to China where the exposure is less than

20 percent.

Researchers have concluded that room ACs alone are set to account for over

130 GtCO2 between now and 2050. That would account for

20-40 percent of the world’s remaining “

carbon budget” (the most CO

2 we can emit while keeping global warming to less than 2˚C above pre-industrial levels). Many parts of the world experienced record-high temperatures in the last few years, and the global average number of

cooling degree days (CDDs, the number of degrees that a day's average temperature is above 18°Celsius), in 2020 was 15 percent higher than in 2000.

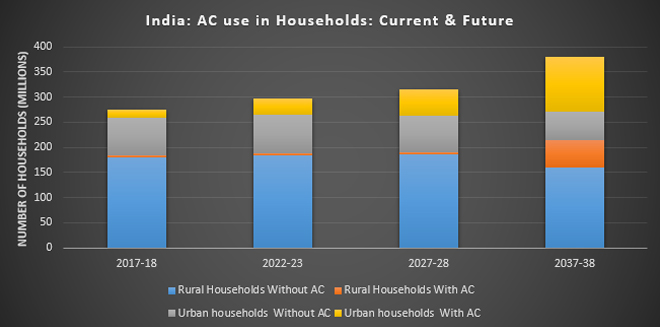

Source: MOEF&CC, 2018. India Cooling Action Plan (Draft)

Source: MOEF&CC, 2018. India Cooling Action Plan (Draft)

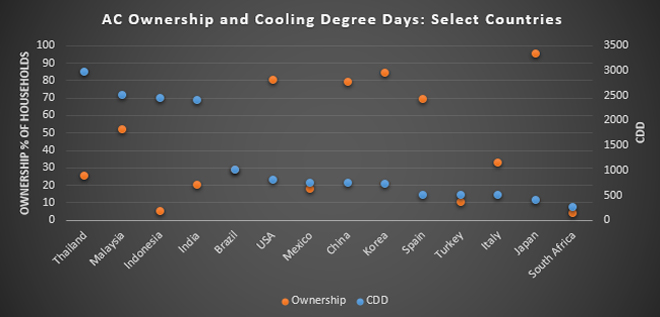

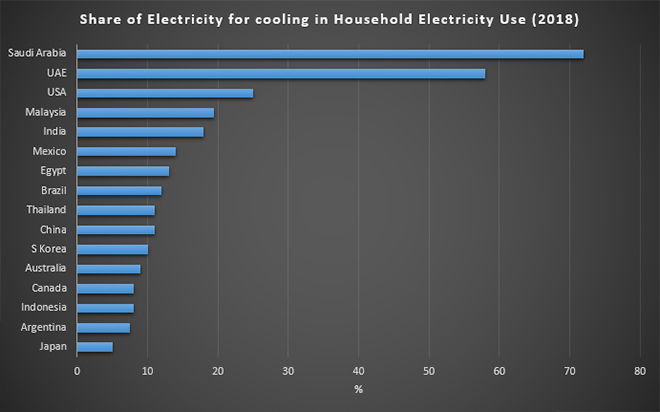

Disparities in Space Cooling

There are enormous disparities in access to space cooling across the world with the poorest countries located in tropical parts of the world having the lowest share of space cooling technologies. Out of the

35 percent of the world’s population living in countries where the average daily temperature is above 25°C, only

10 percent own an AC unit. India, which has more than

3,000 CDDs consumes

just 70 kilowatts hours (kWh) for space cooling compared to 800 kWh in South Korea which has only

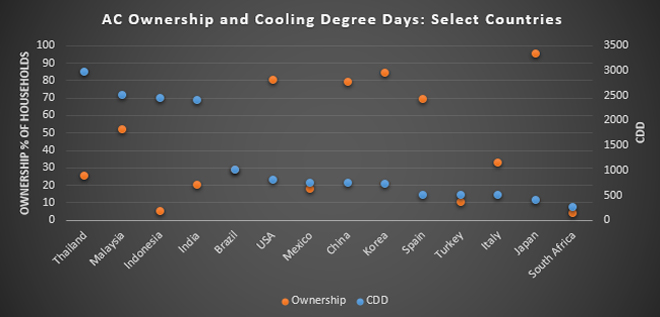

750 CDDs. This disparity is mainly on account of the low affordability of AC use in India. Currently, less than

10 percent of Indian households own ACs but the demand is growing rapidly. Studies show that the correlation between

wealth and AC-use is stronger than the correlation between climate and AC use.

Source: The Future of Air-Conditioning, Executive Briefing, Enerdata, 2019

Source: The Future of Air-Conditioning, Executive Briefing, Enerdata, 2019

Efficiency

As global average temperatures increase, AC use in India and elsewhere is likely to become more of a necessity than a luxury. Most of the detailed analysis of space cooling needs conclude that technology is the answer for improving the

efficiency of AC systems to substantially reduce electricity consumption and consequently GHG emissions. The average efficiency of ACs in India is relatively low given the cost-sensitive nature of the Indian market. Many of the suggestions from expert organisations propose stringent efficiency standards for ACs and incentives of the purchase of efficient ACs. Better building design,

increased renewables integration and smart controls are other measures that could reduce space cooling energy use and emissions and limit the power capacity additions required to meet peak electricity demand.

Other solutions that are commonly recommended are increasing

minimum energy performance standards closer to those of best-in-class ACs, which are typically

twice as efficient as the market norm. Government procurement agencies and large private-sector buyers (like real estate developers) leveraging their buying power in the form of advancing market commitments and

bulk procurement programs for super-efficient ACs is a workable solution. Simple financing solutions can encourage people to buy more efficient ACs. Forward-thinking distribution companies (discoms) can offer

‘on-bill’ financing, which allows consumers to pay for energy-efficient appliances on their electricity bills and in instalments - effectively enabling them to realise cash savings from the very first day.

Technology experts point out that the compressor technology at the heart of most AC units has barely reached

14 percent of its theoretical maximum efficiency (with most AC units in the six

-eight percent range). This is remarkably low compared to solar panels which have reached

40 percent of their theoretical efficiency potential and LED (light emitting diode) lighting which has reached 70 percent of its theoretical efficiency. Because consumers care about

price, brand, and appearance more than anything else, and regulators fail to apply much pressure on efficiency standards, AC manufacturers typically spend more on advertising and aesthetics than they do on research and development.

Issues

Even if all theoretically possible efficiency gains are achieved, AC-use is likely to remain the privilege of the affluent and aspiring classes. In India, the per person carbon emissions of the lowest 50 percent of the population is

0.9 tonnes of CO

2 equivalent (tCO

2eq) and 1.2 tCO

2eq for the middle 40 percent compared to

9.6 tCO2eq for the top 10 percent. The use of an air conditioner consumes more electricity as compared to other electrical equipment in a typical affluent household in India accounts for a large share of the CO

2 emissions of the top

10 percent. What this means is that the poor and middle-class households that make negligible contributions to CO

2 emissions (from ACs and other energy- intensive devices) are likely to suffer most from heat stress. This is a micro-reflection of the larger challenge of climate change: the rich consume and emit carbon and the poor suffer the discomfort and consequences.

As Homer Simpson put it in the context of alcohol (as both the cause and solution to life’s problems), AC-use is likely to remain both the cause and solution to a warming world. But the rich will continue to add to the problem and they will also produce and use the solutions.

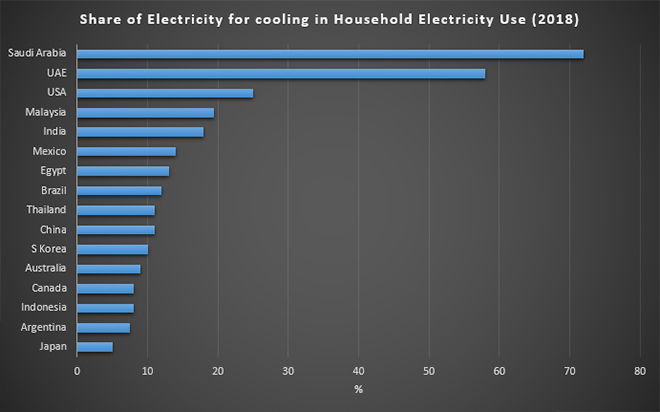

Source: The Future of Air-Conditioning, Executive Briefing, Enerdata, 2019

Source: The Future of Air-Conditioning, Executive Briefing, Enerdata, 2019

Monthly News Commentary: Natural Gas

New Gas Pricing Formula likely to reduce Risks for Producers

India

Policy & Governance

India’s new gas pricing regime will offer greater downside protection for earnings of gas companies such as Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL), S&P Ratings said. The new norms will not affect the pricing for gas produced from difficult fields that companies like Reliance Industries Ltd operate. Under the new guidelines announced on 6 April 2023, the government will set prices for domestically produced gas on a monthly basis; the rate will be 10 percent of the average price of the Indian crude basket in the preceding month. The price will have a floor of US$4 million metric British thermal unit (mmBtu) and a ceiling of US$6.5/mmBtu. The pricing mechanism for gas production from deep water, ultra-deep water, high-temperature, and high-pressure fields is unchanged. This means companies such as ONGC and RIL that operate in such fields will maintain marketing and pricing freedom, subject to a ceiling price that is revised semi-annually. The gas pricing reforms are intended to ensure more stable and affordable gas prices, and therefore fuel demand for natural gas. They also align with India’s ambitions of increasing the share of natural gas in the energy mix to 15 percent by 2030 from 6.5 percent. Gas accounts for almost 50 percent of ONGC’s production volume.

According to an order of the Oil Ministry’s Petroleum Planning and Analysis Cell,

the price of natural gas for the 8 April to 30 April period comes to US$7.92/mmBtu going by the new indexation of pricing it at 10 percent of the imported cost of crude oil. However, the Union Cabinet had while changing the pricing formula capped the rates at US$6.5/mmBtu for two years ending 31 March 2025. The capped rates, which are about a quarter less than the current prices, will lead to CNG and piped cooking gas prices being cut by up to 10 percent. Following the decision, the CNG price in Delhi is likely to be cut from INR 79.56/kg to INR 73.59/kg and that of PNG from INR 53.59/thousand cubic metres to INR 47.59. In Mumbai, CNG may cost INR79/kg instead of INR 87 and PNG may cost INR 49/SCM instead of INR 54. The Government accepted several key recommendations made by the Kirit Parikh Committee with respect to the pricing of natural gas produced from APM fields (that are legacy fields and largely held by PSUs like ONGC). Under the new pricing mechanism, the pricing of gas will be linked to 10 percent of India's average monthly crude import basket. There would also be a floor price of US$4/mmBtu and a ceiling price of US$6.5/mmBtu. This formula replaces the old one where the rates were fixed using four international gas benchmarks. The price of gas according to this formula was $8.57/mmBtu for six months ended 31 March. The government will monitor prices of CNG and PNG for household kitchens to ensure that the reduction in input gas price is passed on to the consumers.

In

dia is reportedly considering the creation of a strategic reserve of LNG to protect against potential supply shortages or price spikes in the future, following the country’s energy crisis last year. More governments are looking to set up emergency stockpiles of LNG, similar to the oil industry’s strategic reserves, as the super-chilled fuel becomes a more important element of the global energy mix. While no storage targets have yet been discussed, Petronet is adding more tanks at its LNG import terminals to store the imported fuel and is working on a floating import plant in the eastern state of Odisha. Petronet is in talks with Qatar to renegotiate its 7.5 million tonnes-a-year contract that expires in 2028. The New Delhi-based company is looking to expand the contract by as much as 1 MT.

The Union

Cabinet is likely to soon consider imposing caps or a ceiling on price for the majority of natural gas produced in the country to keep input costs for users ranging from CNG to fertilis er companies in check. The government bi-annually fixes prices of locally produced natural gas— which is converted into CNG for use in automobiles, piped to household kitchens for cooking and used to generate electricity and make fertilisers. Two different formulas govern rates paid for gas produced from legacy or old fields of national oil companies like ONGC and OIL, and that for newer fields lying in difficult- to- tap areas such as deepsea. The global spurt in energy prices post Russia’s invasion of Ukraine have led to rates of locally produced gas climbing to record levels – US$8.57/mmBtu for gas from legacy or old fields and US$12.46/mmBtu for gas from difficult fields. Going by the current formula, prices of gas from legacy fields are slated to climb to US$10.7/mmBtu with minor changes in rates for gas from difficult fields. The government had constituted a committee under Kirit Parikh to look at revision in gas prices that balances both local consumer and producer interest, while at the same time advances the country’s cause of becoming a gas-based economy. The committee has recommended changing the indexation for gas from legacy fields to 10 percent of prevailing Brent crude oil prices instead of the current practice of using rates of gas in surplus nations to decide their price. At current Brent crude oil price of US$75/barrel, the price of gas should be US$7.5/mmBtu but the fuel would be priced only at US$6.5 due to the cap. The committee recommended that gas should be brought under the Goods and Services Tax (GST) regime. Having common taxation such as GST for gas in lieu of state- level VATs, which vary from three percent to as high as 24 percent, will help develop the market.

CGD/CNG

Mahanagar Gas Ltd announced a steep reduction in the retail price of (CNG) by INR 8/kg and domestic PNG (piped natural gas) by INR 5/SCM (standard cubic unit) across its licenced area. The total CNG vehicular population has now gone over 900,000 which also includes commercial four-wheelers, taxis and auto rickshaws. Earlier this February, MGL reduced its CNG prices by INR 2.5/Kg. MGL said that they welcome the decision taken by the Government of India (GOI) for revising the pricing methodology of domestically produced natural gas to promote the usage of natural gas. This step of GOI will help to increase the consumption of natural gas in the domestic and transportation segment, which is an additional step towards making India cleaner and greener. The CNG will lead to savings of about 49 percent and 16 percent as compared to petrol and diesel respectively at current price levels in Mumbai. In future when the rationalisation of fares happens, there are chances of auto and taxi fares dropping.

LNG

GAIL (India) Ltd has issued a swap tender offering one liquefied natural gas (LNG) cargo for loading in the United States (US) in exchange for another cargo for delivery to India. India’s largest gas distributor is seeking the cargo for delivery on a delivery ex-ship (DES) basis at the Dhamra terminal between 16-25 May. It is offering the cargo for May loading from the Sabine Pass terminal, also on a DES basis. Adani Total, in which French oil and gas major TotalEnergies has a 50 percent stake, has a 20-year take-or-pay contract to provide regasification services to state-run Indian Oil Corp (IOC) for 3 million tonnes (MT) of LNG per year at the Dhamra terminal. GAIL has a similar deal for 1.5 MT per year. The terminal received its first LNG cargo on 1 April. In March IOC issued a tender seeking eight LNG cargoes to be delivered to the Dhamra terminal between June 2023 and May 2024. GAIL has 20-year deals to buy 5.8 MT a year of the US LNG split between Dominion Energy's Cove Point plant and Cheniere Energy’s Sabine Pass site in Louisiana.

Adani Group and French company TotalEnergies’ newly built INR 60 billion (bn) (US$729 million) LNG

import facility at Dhamra on the Odisha coast has received its first ever shipment of LNG - a fuel that will be used to make steel, produce fertilis ers and turned into compressed natural gas (CNG) and cooking gas, helping change the landscape of Eastern India. Qatari ship ‘Milaha Ras Laffan’ docked at Dhamra Port on 1 April morning, bringing in a 2.6 trillion British thermal units (Btu) of natural gas in its frozen form (LNG) which will be used to commission the facility.

Rest of the World

Global

Climate ministers of the Group of Seven (G7) countries have backtracked for now on earlier language touting growing future demand for LNG, instead noting there may be "considerable uncertainty" for consumption. A previous draft communique for the meeting of the G7 climate change and energy ministers had called for "necessary upstream investments in LNG and natural gas" amid the energy fallout from Russia's invasion of Ukraine and said, "demand for LNG will continue to grow". But, as negotiations over the communique resumed ahead of the ministerial meeting on 15-16 April in Sapporo, Japan, the wording was changed, the latest draft showed.

Japan plans to keep LNG as a transition fuel for at least 10-15 years, and many Japanese companies are exposed to super-chilled gas projects globally.

Europe

Finland is set to receive the first commercial delivery of LNG to the Inkoo floating terminal set up to replace the Russian gas supply after the start of the war in Ukraine. The Vivit Americas LNG tanker, carrying cargo loaded in the United States, is set to arrive at Inkoo, Refinitiv Eikon shipping data shows. It will be the first full delivery since the floating storage and regasification (FSRU) vessel Exemplar was installed at the end of last year. One other tanker, the Isabella, delivered partial cargo during the commissioning process. Finland has agreed on a 10-year charter for the vessel that will serve both its domestic and Baltic markets after Russia stopped all exports of gas over disputes sparked by its invasion of Ukraine. Operator Gasgrid initially offered 14 arrival slots for the second and third quarters but has since reduced that to 10, citing expected market demand and constraints on the gas pipeline connecting Finland and Estonia.

Seaborne exports of liquefied natural gas (LNG) from Barcelona to Italy rose 17-fold in 2022 from the prior year, while shipments in the first two months of 2023 alone accounted for 45 percent of last year’s traffic, Barcelona’s port data showed. The dramatic increase underscores how Spain has become a significant gas supplier in Europe as Russia’s invasion of Ukraine prompted countries to reduce their reliance on Russian gas. Italy was one of the most dependent countries, with gas from Russia making up 40 percent of its total prior to the war. Spain’s Energy Ministry announced last year the launch of a “virtual gas pipeline” to increase LNG shipments from Spain - mainly Barcelona - to Italy using small ships compatible with Italy’s western terminals of Panigaglia and Livorno. Spain does not produce natural gas but with six LNG terminals, the largest number in the European Union, has positioned itself as a supply hub for the rest of the bloc. Tankers unload LNG at the terminals and then part of it is re-exported by other vessels. Seaborne LNG exports from Barcelona totalled 316,831 tonnes in 2022, rising 36.5 percent from 2021, with Italy accounting for 61 percent of last year’s traffic. LNG exports to Italy evolved from zero in 2020 to 11,391 tonnes in 2021, and soared 1,608 percent to 194,574 tonnes in 2022. Elio Ruggeri, LNG chief at Italian gas grid operator Snam, said roughly 30 out of 80 LNG cargoes received at Panigaglia since January 2022 had been from Spain, with forward market price dynamics suggesting the trend would continue for the coming quarters. In 2022, Spain was Europe’s second-largest importer after France of LNG - totalling 29.5 billion cubic metres (bcm), mainly from the US, according to data compiled by the Institute for Energy Economics and Financial Analysis. Spain re-exported 1.76 bcm of LNG last year, with Italy (0.71 bcm) and the Netherlands (0.59 bcm) on top, the data showed.

North and South America

Berkeley, California, cannot ban natural gas hookups in new buildings because a US federal law preempts its rule, a federal appeals court said, siding with a challenge the state’s restaurant industry made. The 9

th US Circuit Court of Appeals in San Francisco said Berkeley’s 2019 ban on new gas hookups effectively barred appliances that use the fuel, and that the US Energy Policy Conservation Act preempts such a move. Gas ban supporters said switching from natural gas to electric heating and cooking is necessary to reduce carbon emissions that promote climate change and cut down on pollutants that can cause asthma and other health issues. At least 20 states with Republican-led state legislatures have enacted so-called preemptive laws to prohibit local governments from banning natural gas hookups, including Arizona, Ohio and Texas.

China

China’s LNG imports fell sharply in 2022 because of the disruption caused by lockdowns to control the coronavirus epidemic and the massive exit wave of infections when they were lifted. As the epidemic fades, resurgent manufacturing and service sector activity will increase gas consumption and is likely to tighten LNG supplies available to Europe ahead of winter 2023/24. But the import rebound could be smaller than some analysts anticipate because domestic gas production is rising strongly and the country has mostly completed its transition to natural gas for urban residents. China’s LNG imports fell by 16 MT (-20 percent) in 2022 compared with 2021, according to data from the General Administration of Customs. It was only the second time since 2006, when the country began importing LNG, that imports have fallen compared with the prior year. Reduced LNG arrivals were only partially replaced by an extra 4 million tonnes (+9 percent) of pipeline gas from Russia and Central Asia. Both LNG and pipeline imports remained subdued in the first two months of this year with any rebound delayed until later in 2023. China’s LNG purchasers have proved price-sensitive and will likely wait for prices to decline before increasing imports and refilling storage.

Rest of Asia-Pacific

Malaysia’s national oil company Petroliam Nasional Berhad

(Petronas) aims to restart a gas pipeline currently under force majeure by the first quarter of 2024. In October, Petronas declared a force majeure on gas supply to Malaysia LNG Dua due to a pipeline leak caused by soil movement at its Sabah-Sarawak Gas Pipeline. The company aims to complete an investigation into the gas supply disruption by mid-2023. The disruption had fuelled fears of a supply shortage to customers, including Japanese utilities, but Petronas has said it would continue efforts to provide alternative supplies. Petronas has long-term supply contracts with Japanese gas distributors such as Tokyo Gas and Osaka Gas, some of which are due to expire this year and next. Japan, Malaysia’s top client, imported 12 MT of LNG in 2022, up 19 percent from 2021, according to Japan’s trade data. The first phase of the project, set to be Canada’s first LNG export terminal, is expected to begin shipments around 2025.

News Highlights: 19 – 25 April 2023

National: Oil

Guyana rules out offering crude oil export discounts to India

21 April: South America’s fastest growing oil producer has turned down the

Indian government's request for discounted crude oil purchases during trade discussions, Guyana Vice President Bharrat Jagdeo said. Guyana’s oil production in total has tripled from a year ago to about 380,000 barrels of oil per day. The government has rights to about 12.5 percent of the barrels, which are marketed under a one-year contract reached with BP last November. India and Guyana have discussed a potential bilateral oil agreement for two years. Guyana has been also trying to attract Indian companies to take part in its first competitive oil auction, which will offer 14 offshore blocks to highest bidders. Indian companies have not confirmed participation. The auction, initially set for September last year, was postponed to July. Indian buyers have sought a discount to compensate for high freight costs to send its oil to the Asian country, Jagdeo said.

National: Gas

India’s GAIL to get 4 LNG cargoes from Germany’s Sefe in May

24 April: Indian gas firm

GAIL (India) Ltd will get 4 cargoes of liquefied natural gas (LNG) from Germany’s Sefe in May, equivalent to volumes it was getting under a deal with a former unit of Russia’s Gazprom, Chairman Sandeep Gupta said. Sefe supplied 2 LNG cargoes each in March and April. The resumption of supplies from Sefe is crucial for GAIL, which reported an almost 93 percent slump in its December quarter profit due to lower gas sales triggered by supply disruptions. GAIL agreed to a 20-year LNG purchase deal with Russian energy giant Gazprom in 2012. The deal was signed with Gazprom Marketing and Singapore (GMTS) for annual purchases of an average of 2.5 million tonnes of LNG. Sefe had stopped supplying LNG to the Indian company in May last year to meet its own demand.

RIL to start gas production from MJ field this quarter

22 April: Reliance Industries Ltd

(RIL) will commence natural gas production from its deepest discovery in the KG-D6 block this quarter, meeting 15 percent of India’s gas demand. KG-D6 off the Andhra coast is India’s only deepwater block under production. The block averaged 20 million metric standard cubic meters per day (mmscmd) of production in the January-March quarter, the company said. RIL and its partner, UK supermajor BP are now nearing the start of production from their giant MJ deep-water project, which will significantly boost gas output from the prized east coast asset. The company, which is the operator of the block, earlier planned to start production in the December quarter, but it was delayed by three months. RIL and BP are spending about US$5 billion on further developing KG-D6 through three different projects, aimed at rejuvenating gas production from the offshore asset. While the first two developments-R-cluster and Satellite Cluster-have started gas production, MJ is now nearing completion. Start of MJ will take KG-D6 gas production to 30 mmscmd in FY24, RIL said. The company has already sold 6 mmscmd of gas to companies in the city gas, power and fertiliser sectors. The two partners plan to use a floating production system at high-sea in the Bay of Bengal to bring to production the deepest gas discovery in the KG-D6 block.

Cairn Oil & Gas commences gas flow from Hazarigaon field in North-East

21 April: Cairn Oil & Gas, a unit of Vedanta Ltd, said it has commenced test production from its Hazarigaon field in Assam that it had won in a discovered small field (DSF) bid round. Additionally, the

gas cascading system will enable gas from Hazarigaon to be a prime contributor in fueling 100 CNG buses that will be plying in Guwahati as part of the clean energy initiative of the Government of Assam.

National: Coal

India’s coking coal imports from Russia to accelerate this year

24 April: India is set to step up its purchases of Russian coking coal this fiscal year to cash in on lower prices and diversify its imports, traders said. Indian firms are keen to capitalise on lower Russian coking coal prices and faster deliveries. Coking coal imports from Australia, New Delhi’s biggest supplier of the key raw material for steelmaking, have traditionally constituted 75 percent to 80 percent of India’s annual shipments. But during the first 11 months of the previous fiscal year to March 2023, Australia’s share dropped to 54 percent due to higher imports from the United States and Russia, government data showed. India’s coking coal demand is likely to jump 8 percent to 10 percent in 2023 thanks to rising steel demand from housing and infrastructure sectors, Fitch Ratings said.

National: Power

Kerala continues to face rising temperatures while power consumption goes up

20 April: Kerala continues to experience scorching heat with Palakkad district recording the highest maximum temperature of 38.4 degrees Celsius. Due to the rising mercury levels during the past few days, electricity consumption in Kerala has also gone up with 102.99 million units (mu) being consumed on 19 April which is an all-time record for the state, according to the data on the Kerala State Electricity Board (KSEB) website.

Electricity consumption has crossed the 100 million mark several times this month.

CM Adityanath directs UPPCL to ensure electricity supply amid increased demand in summer

19 April: Uttar Pradesh (UP) Chief Minister (CM) Yogi Adityanath has given necessary instructions to Uttar Pradesh Power Corporation and Production Corporation

(UPPCL) to ensure power supply in the state amid increased demand in summer. As per the instructions of the CM, UPPCL has also started the task of increasing power generation on a war footing, it said. UPPCL Chairman M Devraj inspected the Jawaharpur Super Thermal Power Project and took detailed information about the on-site construction works of the project under construction and directed the officials to start production of one unit (660 MW) of the project by 15 May 2023.

INR 1.5 bn plan to modernise power supply system in Himachal CM’s home district

19 April: The Himachal Pradesh Power Board said it will spend about INR 1.56 billion to

modernise and strengthen the electricity supply system in Hamirpur — the home district of Chief Minister (CM) Sukhvinder Singh Sukhu. The funds would be spent on the construction of new electrical sub-stations as well as modernisation of transformers and lines and many other works, he said. He said according to the power board’s estimate, about INR 966.4 million will be spent on the installation of new transformers, strengthening of old transformers, conversion of lines, modernisation of electric cable lines and other equipment. A separate detailed project report (DPR) estimating an investment of about INR 375 million has been prepared for the modernisation of the power supply system in Hamirpur city, he said. Residents of at least three dozen panchayats under Barsar and Bhoranj assembly constituencies are expected to be benefitted by this project, he said.

Power demand in Tamil Nadu hits all time high as mercury soars

19 April: With mercury rising, the

demand for power in Tamil Nadu has hit an all time high, state Power Minister V Senthil Balaji said. The Minister said that the state’s daily consumption of power has touched 413 million units and a peak demand of 18,882 MW on 18 April, but the government met the power demand without any interruption. He said that on 10 April, daily consumption was 400 million units which was the previous high. It had also said that the summer peak demand in the state was expected to rise to the range of 18,300-18,500 MW. The energy policy note for 2023-24 had also predicted a daily energy consumption of 390-395 million units in the period between April and May 2023. In 2022, the daily peak demand was 17, 563 MW and the maximum daily consumption was 388.078 million units on 29 April.

National: Non-Fossil Fuels/ Climate Change Trends

Gautam Solar supplies high efficiency solar panels to power Bhopal Airport

24 April: Gautam Solar said that it has successfully supplied 10BB mono half-cut

solar panels for a solar power plant at Raja Bhoj International Airport (Bhopal Airport) in the state of Madhya Pradesh. The project was completed within the designated timeline, showcasing Gautam Solar’s commitment to timely delivery of high-quality solar products. The Gautam Solar team collaborated with Newsol PV Power Pvt Ltd, the project developer, to ensure the panels‘ safe and timely delivery. The solar panels were installed on the airport’s parking area rooftops and other designated areas for the airport staff’s residence, making optimal use of the available space. Gautam Solar remains committed to supporting organis ations across India to adopt clean energy solutions and contribute to a greener future.

JSW Energy commissions 51 MW wind power capacity in Tamil Nadu

22 April: JSW Renew Energy Two, a step-down subsidiary of

JSW Energy, has commissioned 51 MW of wind power capacity in Tuticorin, Tamil Nadu, increasing its total installed capacity to 6,615 MW. The capacity was commissioned under phase-wise commissioning of 450 MW Inter State Transmission System-connected wind power project awarded under Solar Energy Corporation of India’s tranche X. With this, the cumulative wind capacity commissioned by the company under SECI X stands at 78 MW, JSW Energy said. The company’s under-construction capacity stands at 2,855 MW, which is likely to be commissioned in phases over the next 12-18 months. The company has set a target to 10 GW by 2025 and 20 GW capacity by 2030.

Himachal to set up two solar power projects in Pangi valley

21 April: Tribal areas of the state are ready to pioneer in the field of solar energy and contribute to achieving the goal of a green energy state

. Plans are underway to set up two solar power projects of 400 kW each in the Pangi subdivision of Chamba district for which land has been transferred to Himurja, the state-run nodal agency for renewable energy. Himurja has selected one hectare of land for each solar power project at Ph illaur and Dharwas of Pangi valley and the agency has initiated further action to complete the projects, which will cost approximately INR 100 million. Chief Minister Sukhvinder Singh Sukhu has instructed Himurja to complete the construction work of both solar power projects at the earliest. He said that apart from this, the government has made a provision in the budget for the year 2023-24 to set up a solar power-based battery energy storage system project in Pangi to strengthen its power supply system. The establishment of solar power projects in Pangi, along with the battery energy storage system project, will not only provide uninterrupted power supply to the people of the area but also contribute to the state’s overall goal of becoming a green energy state.

International: Oil

Pakistan makes its first purchase of discounted Russian oil

20 April: Pakistan has placed its first order for discounted Russian crude oil under a deal struck between Islamabad and Moscow, the country’s petroleum minister said, with one cargo to dock at the port of Karachi in May. Pakistan’s purchase gives Russia a new outlet, adding to Moscow’s growing sales to India and China, as it redirects oil from western markets because of the Ukraine conflict. As a long-standing Western ally and the arch-rival of neighbouring India, which historically is closer to Moscow, analysts say the crude deal would have been difficult for Pakistan to accept, but its financing needs are great. Major Russian oil companies have discussed the possible supply of oil to Pakistan over recent months, two trading sources familiar with the talks said, but declined to disclose the names of possible suppliers. One of the sources, speaking on condition of anonymity, said Russia plans to supply Urals crude to Pakistan.

International: Gas

Eni launches LNG production in Congo Republic

25 April: I

talian energy group Eni and Congo Republic’s government launched a US$5 billion gas liquefaction project expected to reach a production capacity of 3 million tonnes per year in 2025. The development of the liquefied natural gas (LNG) capacity is part of Italy’s strategy to cut dependence on Russia since it invaded Ukraine. In August, Eni acquired a floating liquefaction facility to produce and export LNG from Congo, and said it aimed for the facility to be operational in the second half of 2023. Congo’s hydrocarbons minister, Bruno Jean-Richard Itoua, said the project would make the West African country an exporter of LNG for the first time. Eni is the second largest oil operator in Congo Republic after France’s Total. It has been operating in the country for around 50 years, during which it built a gas-fired power plant that fuels nearly 70 percent of national electricity production.

Turkey starts delivery of natural gas from Black Sea field

21 April: Turkey has started the delivery of natural gas from its Black Sea field, as part of its flagship project aiming at reducing the country’s dependence on energy imports. The gas, shipped from a depth of 2,200 meters at the offshore Sakarya field via a 170-km-long subsea pipeline and through various compression plants, was delivered to the newly constructed Filyos land facility located in the northern Zonguldak province. The Turkish leader announced that the country will provide free natural gas for household consumption up to 25 cubic meters monthly for one year. The Sakarya field will initially produce 10 million cubic meters of natural gas per day, with an expected rise to 40 million cubic meters by around 2028 at the second stage, the Turkish presidency said. Turkey’s offshore gas reserves in the Black Sea are estimated at 710 billion cubic meters, which is enough to meet its domestic gas demand for 35 years. Currently, Turkey imports most of its gas from Russia and Azerbaijan. The Sakarya field is part of Turkey’s plan to reduce its dependence on energy imports and turn Filyos into a significant energy hub. Turkey, with its geographical advantage, has already served as a transit route for major gas pipelines. The presence of infrastructures such as the TurkStream in the Black Sea makes it easier for the country to re-export a mix of imported gas to European countries.

Japan’s Mitsui buys US gas asset in 'pragmatic solution' for energy transition

20 April: Japan’s Mitsui & Co Ltd has bought a 92 percent stake in an unconventional gas asset in Texas and plans to promote its gas business as a "pragmatic solution" for the energy transition, it said. Mitsui said it bought the stake from the operator of the asset, Silver Hill Eagle Ford E&P, for an undisclosed sum and aimed to produce over 200 million cubic feet of gas per day from the field. The field had access to the US. Gulf Coast with liquefied natural gas (LNG) export terminals and ammonia plants, it said. Energy-poor Japan wants to keep LNG as a transition fuel for at least 10 to 15 years. Germany and some other G7 members do not welcome new gas investments believing renewable energy development should be the priority.

International: Coal

China approved 20 GW of new coal power capacity in Q1: Greenpeace

24 April: China’s local governments approved at least 20.45 gigawatts (GW) of new coal power capacity in the first quarter (W!) of 2023, more than the whole of 2021, with energy security still outweighing climate concerns, environmental group Greenpeace said. Although China has promised to start cutting coal consumption in 2026, provincial authorities have rapidly accelerated new coal power project approvals since a wave of economically damaging blackouts in September 2021. China approved more than 90 GW of new coal-fired capacity last year, Greenpeace estimated after reviewing official project documents and environmental impact assessments. New coal approvals could have exceeded 100 GW last year, four times more than 2021 and the highest since 2015, according to a report by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM).

International: Power

Gilgit Baltistan to cut special power supply lines for government offices

25 April: As locals face up to 18-hour-long power outages, the Gilgit Baltistan

(GB) government has started an operation to remove illegal electricity connections and special transmission lines to government offices and official residences. The GB water and power department, in collaboration with district administrations, has started the action to overcome the power shortage. GB Chief Secretary Mohyuddin Ahmad Wani said government officers, including himself, have been provided with special power transmission lines to ensure 24-hour electricity supply to their offices and houses while the public was facing 18 to 20 hours of load shedding.

International: Non-Fossil Fuels/ Climate Change Trends

Western Balkans see boom in solar energy but grids unprepared

20 April: Western Balkan nations are seeing a boom in solar energy investment, which could help ease a power crisis that had threatened a shift away from coal. North Macedonia’s Economy Minister Kreshnik Bekteshi said investors have started to invest "quite furiously" in solar plants and that his country, which is a power importer, has become a regional hub for renewable energy sources. Since 2021, solar parks with 139 megawatt (MW) capacity have been built while up to 300 MW of new solar energy is planned to be produced by end-2023, which is enough to supply eight towns with electricity, North Macedonia’s Energy Regulatory Commission said.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: MOEF&CC, 2018. India Cooling Action Plan (Draft)

Source: MOEF&CC, 2018. India Cooling Action Plan (Draft) Source: The Future of Air-Conditioning, Executive Briefing, Enerdata, 2019

Source: The Future of Air-Conditioning, Executive Briefing, Enerdata, 2019 Source: The Future of Air-Conditioning, Executive Briefing, Enerdata, 2019

Source: The Future of Air-Conditioning, Executive Briefing, Enerdata, 2019