Quick Notes

Sustaining grid stability: Role of hydropower in India

Status

In 1947, hydropower capacity was about

37 percent of the total power generating capacity and over

53 percent of power generation. In the late 1960s, coal-based power generation started displacing hydropower in India and

hydropower’s share in both capacity and generation fell dramatically. In 2022-23, hydropower accounted for roughly

11.3 percent of power generation capacity with 46,850 MW (megawatt) and

9.9 percent of power generation in India. Small hydro power (below 25 MW) had an installed capacity of 4944 MW and

4745 MW of pumped hydro storage (PHS) capacity of which

3305 MW was used in pumped storage mode in 2022.

Globally, hydropower is the dominant renewable energy (RE) source to date, providing over

two-thirds of all renewable electricity. Hydropower accounted for about

18 percent of global installed power generating capacity and roughly

17 percent of power generation in 2020. Clean electricity generation from hydropower achieved a record

4,500 terawatt hours (TWh) in 2020 but fell to

4327 TWh in 2021 because of widespread droughts. Hydropower was the third largest source of electricity after coal and natural gas making the single largest contribution from an RE source in history; hydropower generation was

55 percent higher than nuclear power and higher than the electricity generated from all RE sources including wind and solar. Global growth in hydropower generation capacity was just over

1 percent in the last few years which is much lower than the

3 percent annual average growth required to meet net zero targets.

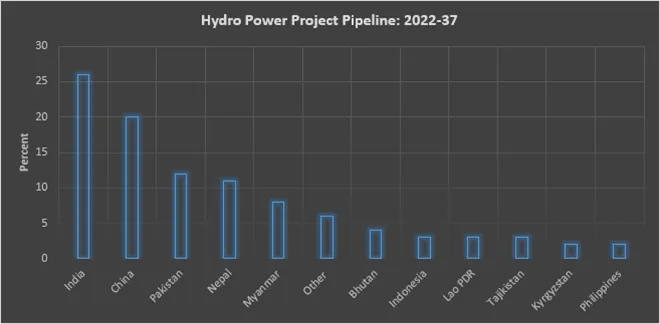

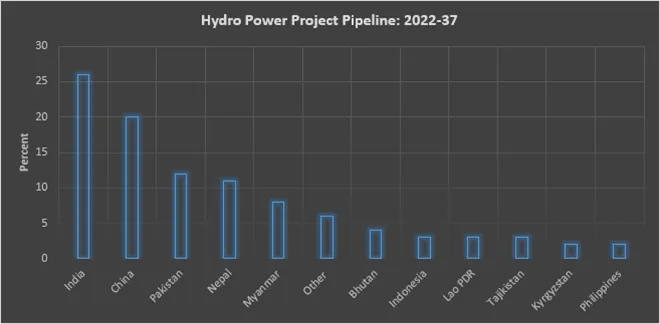

Source: The Changing Role of Hydropower: IRENA 2023

Source: The Changing Role of Hydropower: IRENA 2023

Challenges

Large storage hydro-power projects produce low-carbon electricity but they also impose huge

local environmental and social costs. They displace thousands of people, disrupt

river ecology, resulting in large-scale deforestation, initiate loss of aquatic and terrestrial

biodiversity, and negatively alter food systems, water quality and agriculture. These environmental and social costs have led to

dam removals in North America and Europe that used to be big dam builders until the 1970s. Now more dams are

being removed in North America and Europe than are being built. Even in developing countries where dam building continues, the pace is slowing down because most of the best sites have been taken and also because other sources of RE such as solar and wind are monopolising

policy attention and investment.

In the fragile Himalayan mountains where most of India’s new hydro-power projects are being developed, devastating floods and landslides have

raised risk levels for hydro-projects. Some of the incidents that illustrate this challenge include the sudden flooding in the

Dhauliganga,

Rishiganga and

Alaknanda rivers in Uttarakhand’s Chamoli district in early February 2021 that took more than 70 lives and severely damaged NTPC’s (National Thermal Power Corporation) 520 MW (megawatt)

Tapovan-Vishnugad hydel project, the Uttarakhand Jal Vidyut Nigam’s 13.5 MW

Rishiganga Hydel Project, THDC’s (Tehri Hydropower Development Corporation) 444 MW

Pipal Koti project (which received World Bank assistance) and Jaiprakash Power Ventures’s 400 MW

Vishnuprayag project. Though there is

disagreement over the cause (glacier crash, avalanche, landslide), there is general agreement that carrying out development projects including hydropower projects, highways, railway lines and mining without

adequate appraisals and the disregard for cumulative impact and disaster potential assessments contributed to the scale of the loss. Widespread indifference to

environmental concerns among project developers and the absence of credible monitoring and compliance from regulatory bodies have considerably increased exposure to risks. But this does not mean hydropower projects must be abandoned. There are examples of hydropower projects in India that have met the best international standards. The

Teesta-V hydropower station, located in Sikkim was rated as an example of international good practice in hydropower sustainability in 2019. The 510 MW power station, owned and operated by NHPC Limited (National Hydropower Corporation), met or exceeded international

good practice across all 20 performance criteria. For hydropower planning to become sustainable in India the government and industry must prioritise transparency by engaging the civil society, especially those who are directly affected by the project. Research suggests

modular solutions that combine wind, solar, and hydropower provide alternative energy sources that are environmentally, socially, and financially desirable. Instream

turbine parks are much less disruptive alternatives to dams and produce energy at a much lower cost. Large, ‘

smart’ hydropower projects may be developed, taking into account the economic, environmental and social concerns of local and downstream communities, in addition to national economic benefits. Technical provisions in

smart projects can minimise the impacts on aquatic life and terrestrial ecosystems. To support hydropower projects, the government of India has included large projects above 25 MW under the renewable energy category and has notified

hydropower purchase obligation (HPO) as a non-solar renewable purchase obligation (RPO). To facilitate viability, tariff rationalisation with backloading of tariff after increasing project life to 40 years, increasing debt repayment period to 18 years and introducing escalating tariff of 2 percent,

budgetary support to building enabling infrastructure such as roads and bridges and also for flood moderation services have been introduced.

Contribution to Grid Stability

The most important advantage of hydropower in contrast to other REsources, like wind and solar, is that it can be dispatched quickly at any time, enabling utilities to

balance load variations on the electric distribution system. In India, hydropower’s load-following ability was best demonstrated on 5 April 2020 when the country’s operators restored grid stability following a

31 GW (gigawatts) plunge in demand when most households switched off electrical lights for nine minutes from

21.00 hours to 21.09 hrs. As the event unfolded, generation from hydropower was decreased by over

68 percent and then restored in a short period without which grid stability would have been compromised.

Pumped hydro storage (PHS) facilities

store energy in the form of potential energy of water in an upper reservoir, pumped from another reservoir at a lower elevation. During periods of high electricity demand, power is generated by releasing the

stored water through turbines in the same manner as a conventional hydropower station. During periods of low demand, the upper reservoir is recharged by using

lower-cost electricity from the grid to pump the water back to the upper reservoir. PHS projects are unlike traditional hydroelectric stations in that they are a

net consumer of electricity, due to hydraulic and electrical losses incurred in the cycle of pumping from lower to upper reservoirs. However, these plants are typically

highly efficient and can prove very beneficial in terms of balancing load within the overall power system. Pumped-storage facilities can be very economical due to

peak and off-peak price differentials and their potential to provide critical ancillary grid services. Globally, about

190 GW of PHS acts as the world’s largest ‘water battery’ accounting for over

85 percent of installed global energy storage capacity. It supports grid stability, reduces overall system costs and sector emissions. India has eight PHS plants with a combined capacity of

4745 MW in 2022. Only six plants with a combined capacity of around

3305 MW, are being operated in pumping mode. India has ambitious plans for PHS projects.

63 sites have been identified for PHS with a total potential of about

96,500 MW. As of 2022, PHS projects of capacity

5280 MW are under various stages of construction, projects of total capacity

16,770 MW are under various stages of investigation and projects of capacity

8855 MW are under preliminary studies. In 2020 the Solar Energy Corporation of India (SECI) concluded the world’s largest renewable-cum-energy storage power purchase tender through a reverse auction method. Greenko Group

won the auction with a peak power tariff rate of INR 6.12/kWh (kilowatt hour) pairing solar power with PHS.

Economics of PHS

No energy solution can exist outside of the real and competitive pressures of the market. Though a market for electricity does not exist in India in the strictest sense, PHS cannot count on technical viability and environmental benefits to succeed in the longer term. The traditional revenue source for

PHS is arbitrage: making the most of generating when the price is high, and pumping when the price is low. But this relies on a certain level of

predictable variability in the electricity market, and for that variability to continue into the future. PHS provides network support services such as frequency control, inertia and fault level control that have increasing value in a grid with significant amounts of non-synchronous solar and wind generation. As of now, there are no markets for these

network support services but, in the future, the need for such services is likely to increase to the point where the market is willing to pay for it.

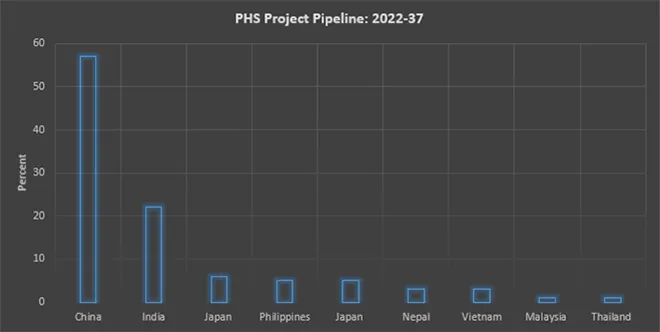

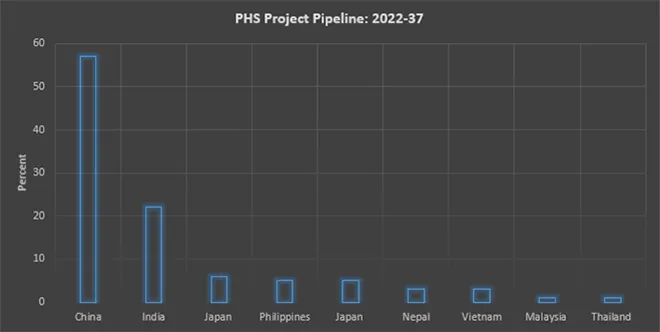

Source: The Changing Role of Hydropower: IRENA 2023

Source: The Changing Role of Hydropower: IRENA 2023

Monthly News Commentary: Coal

Commercial Mining to Increase Domestic Coal Production

India

Coal Block Auctions

Gujarat Mineral Development Corporation

(GMDC) had emerged as the highest bidder for two coal mines in Odisha in the recently concluded commercial coal block auction by the Ministry of Coal, Government of India. GMDC has won the bids for Odisha’s Burapahar Block in Sundargarh District, having a Geological Reserve of 548 million tonnes (MT) and the Baitarani (West) Block in Angul District a geological reserve of 1152 MT.

The

29 coal blocks which have been successfully bid out for commercial mining by the government are expected to enhance the average dry fuel output by an additional 7 percent in the next two years, as the combined peak rated capacity (PRC) of these reserves is around 91 MT. The 91 MT PRC of 29 coal blocks which have been bid out, would be an additional 7 percent of the present national average PRC of coal reserves. The coal ministry had put up 29 reserves on auction for commercial mining last month, all of which have been bid out. With all the 29 mines expected to begin production by 2024-25, i.e. by the next two years, the government is hoping that all these coal mines put together will enhance the overall national average output by an additional 7 percent. The ministry launched the auction of coal reserves for commercial mining in the sixth round and the second attempt of the fifth round on 3 November 2022. PRC pertains to the maximum production capacity of a coal mine, or in other words, the maximum quantity of coal which can be mined from it annually. Commercial mining allows the private sector to mine coal commercially without placing any end-use restrictions. Private firms will have the option of either gasification of the coal or exporting it.

The c

onsortium of Mahalakshmi and Satyam Group won the auction of the largest coal reserve in Northeast India at Nampuk Namchik in Arunachal Pradesh. The consortium stated in the recent auction of North East’s largest coal mine located at Nampuk Namchik in Arunachal Pradesh, two major industrial groups of eastern India, Satyam Group and Mahalakshmi Group won the auction. Last year the auction of most of the coal mines across the country was completed and coal mining had also started. But due to various technical reasons, the auction of Nampuk Namchik coal mine could not take place. The consortium stated that this time the auction rate of the mine here was kept 55 percent above the base price. The consortium of these two groups won the game by bidding 65 percent. Illegal coal mining and its transportation has been a major problem in the Northeast.

Most of the 10 coking coal blocks that have been auctioned to the private sector in the last two years are likely to start production by 2025, according to the Coal Ministry. To augment the output of raw coking coal, a key input in the production of iron and steel, in the country, the ministry has auctioned 10 coking coal blocks to the private sector. These mines have a PRC of 22.5 MT. Domestic raw coking coal production is likely to reach 140 MT by 2030. Coal India Ltd (CIL) which accounts for over 80 percent of domestic coal output has planned to increase raw coking coal production from existing mines up to 26 MT and has identified nine new mines with PRC of about 22 MT.

The Supreme Court

(SC) said it will hear on 14 March the pleas related to a coal block allocation in Chhattisgarh to the Rajasthan Rajya Vidyut Utpadan Nigam Limited (RRVUNL) and mining operations by Adani Enterprise Limited (AEL). The State firm had made a statement in October last year before the court that no coal will be extracted before the matter is heard.

Imports

Coal imports have seen a 25 percent fall in the last three years as India strives to increase domestic production and reduce dependence on imports, despite the fact that owing to global geopolitical turmoil which has put a strain on supply chains, it, along with other nations, has been forced to enhance its dependence on the dry fuel instead of moving to greener sources of energy. The government imported 248.54 MT of coal in 2019-20, which has come down by 25 percent to 186.06 MT in the current fiscal of 2022-23 (till December 2022), according to coal ministry data. In fact, coal imports have gradually come down since 2019-20, as in 2020-21, it was 215.25 MT while in 2021-22, it further came down to 208.93 MT. In 2022-23, it further slid below the 200 MT mark to 186 MT till December 2022. In 2018-19, India’s coal imports stood at 235.35 MT and had risen to 248.54 MT in 2019-20, a rise of 5.6 percent. Though India imports coal from several countries like Australia, Canada, China, Mozambique, Russia, South Africa, New Zealand and the US, its bulk of imports are from Indonesia. Mindful of the fact that due to the Russia-Ukraine war impacting supply chains of green fuels, it has to depend on coal, India is aiming to improve its domestic production of dry fuel and plans to produce 911 MT in the current fiscal, in order to reduce dependence on imported coal.

Demand

The Meghalaya High Court

(HC) has asked CISF to indicate its readiness to check illegal mining and transportation of coal in the north- eastern state. The direction was passed by the full bench of the HC headed by Chief Justice Sanjib Banerjee while hearing a public interest litigation. The respondent had indicated that a deposit of approximately 52,600 MT of coal was available at Gasuapara and that approximately 5060 trips by vehicles will be required to complete the export from the place. It cast doubts that such a huge quantity of coal is available to the person, the petitioner said and said that the source could not have been in Meghalaya. This is because pursuant to orders passed by the National Green Tribunal and Supreme Court there is a complete ban for about seven years on coal mining in Meghalaya and as of now no licenc e has been issued for scientific mining of the mineral.

A parliamentary panel has termed the opening of trapped underground coal reserves as a "right step" and said that the move will not only help in meeting the production of quality coal but will also reduce the import of dry fuel. The government has been taking several measures over the past to increase the domestic production of coal in a bid to reduce the country’s dependence on imports. While appreciating the government initiative to mine out trapped coal reserves, the committee also recommended the use of the latest technologies that will boost quality coal production from underground mines, the Standing Committee on coal mines and steel said in a report.

Adani Krishnapatnam Port Private Siding Limited of Vijayawada Division, South Central Railway

achieved a record coal loading of 12.95 MT by rail as on 18 March. This is the highest-ever coal volume dealt in a financial year since its inception, surpassing the previous benchmark of 12.94 MT during the 2014-15 corresponding period. During the current year, the port has loaded 17.40 MT of commodities, with coal occupying a majority share of 75 percent share in total loading and revenue. Adani Krishnapatnam Port commenced its operation in November 2009 and remained the major contributor to the Vijayawada Division’s share in freight loading and revenue. Coal and fertilis ers are the major commodities dealt with at this port.

NTPC Ltd has commissioned a first-of-its-kind commercial green coal project in Varanasi, which will make torrefied charcoal from municipal waste. Nearly three years ago NTPC had planned to make green coal (torrefied charcoal) from municipal waste. NTPC’s arm NTPC Vidyut Vyapar Nigam Ltd (NVVNL) had awarded the project on an EPC (engineering procurement construction) basis to Macawber Beekay, and recently the first reactor module of 200 tonnes per day (TPD) capacity green coal plant was installed and commissioned for NTPC’s Harit Koyla (Green Coal) Pariyojna plant at Ramana in Varanasi. The total capacity of this plant after installation of all three modules shall be 600 TPD of waste handling capacity. The plant is built on 20 acres of land. Torrefied charcoal (green coal) which is similar to natural coal can be successfully blended with fuel in thermal power plants to produce electricity. NTPC got 70 tonnes of green coal out of 200 tonnes of waste from this unit. After the successful experiment, more units of green coal from waste will be set up.

Industries in India, including metals producers and paper makers, are stockpiling coal to avert shortages during the summer when heat waves are expected to drive consumption of the country’s main power generation fuel. Although supplies to non-power industries have improved in recent months, companies remain wary of shipments thinning out when demand from power stations soars during the hot season starting in April. The fear of disruptions to mine output when monsoon rains begin a couple of months later is also a factor.

Amid the early onset of summer and a pick-up in industrial demand for electricity,

CIL is geared up to meet the demand of dry fuel from the power sector. The public sector coal producer also expressed hope to supply 156 MT of coal to the power sector during the April-June quarter of FY24. This would be 25.6 percent of the enhanced annual dispatch target of 610 MT slated for the sector in 2023-24. CIL, which accounts for over 80 percent of domestic coal output, is a major supplier of dry fuel to electricity generating plants. Factors in favour of CIL are a strong 68 MT coal stock build-up expected at its pitheads by the end of the current fiscal. The state-owned coal mining behemoth is confident of meeting the enhanced 610 MT coal supply target to the power sector in 2023-24. The target is 20 MT more than the initially projected 590 MT requirement by the power sector.

Chhattisgarh Chief Minister (CM) Bhupesh Baghel discussed issues like the coal royalty with the Prime Minister (PM) Narendra Modi. Baghel said he

demanded the due royalty of INR 41.70 billion (US$508.6 million) from the coal blocks.

Expecting a surge in demand for coal by power plants during the summer, the

railways increased its coal transportation by 11.92 percent in terms of tonnage by the end of February. In order to meet the projected demand for rakes by the power sector in the coming fiscal, the railways has taken various steps, including higher induction of coal carrying wagons.

India’s power generators and coal mines are being stretched to the limit to meet the surging demand for power stemming from a fast-growing economy and rapid electrification. Coal units increased generation by almost 16 billion kWh or 16 billion units (+18 percent) compared with a year earlier, in part to offset reduced output from expensive gas-fired units. Mine production and coal trains di spatched to power plants both increased last year by 12 percent, which was impressive but still below generators’ requirements. India’s railways loaded an average of 271 coal trains per day bound for power producers in February, well below the plan for 313 trains, and no higher than in February 2022. The rail system is becoming a binding constraint on the ability to move more coal to generators and ensure they have sufficient fuel.

Punjab Chief Minister (CM) Bhagwant Mann said the

Centre has agreed to waive the mandatory rail-sea-rail (RSR) mode condition for coal supply from Mahanadi Coalfields Limited (MCL) to Talwandi Sabo Power Limited (TSPL) in the State. Mann said the Union Power Minister R K Singh had apprised him that as far as transport of coal is concerned, the Government of India does not specify any particular route or port and transport is entirely the responsibility of the concerned States or generators, adding that additional coal can be allotted to Punjab from MCL and if Punjab can transport it through any other mode, it is welcome to do so. Punjab’s ruling party AAP had earlier slammed the Centre for asking the State Government to lift coal using rail-ship-rail (RSR) mode, claiming that it would put an additional financial burden on the State power utility. The power ministry had asked power utility Punjab State Power Corporation Limited to start lifting 15-20 percent of its domestic coal requirement through rail-ship-rail mode.

Coal production grew by 16 percent touching 698 MT during April-January period of the current fiscal, against 601 MT production recorded during the corresponding period of last year. According to the coal ministry, during the above mentioned period, Coal India Limited (CIL)’s production rose by 15.23 percent to 550.93 MT against 478.12 MT recorded during the corresponding period of last year. The increase in domestic coal production has helped the country curb import to a large extent in the face of the sharp increase in coal demand, arising due to a continuous rise in power consumption. The coal ministry has fixed the target of 1.31 billion tonnes (BT) for 2024-25, which it expects to go up to 1.5 BT by 2029-30. The ministry has been actively engaging with various state governments and central government agencies for starting new coal mines and enhancing coal production in the currently operational mines.

Nalco Coal Mine Utkal-D has been paralysed for the last three days due to an agitation by the affected tenants of Raijharan panchayat in Angul block. The villagers have vowed not to call off the strike until their demands are met. So far, no company or official has visited the strike spot.

Utkal-D coal block has been allocated to the public sector national Aluminium Company. Nalco, in turn, has outsourced the work of coal extraction, infrastructure development and dispatch of coal to its captive power plant to a private coal company - Mytri Company. The coal mine is a captive coal mine and all its coal will go to the Nalco power plant only.

Prices

CIL Chairman Pramod Agrawal said there is a "strong case" for increasing coal prices, and the hike could be effected "very soon" as discussions are underway with stakeholders. Agrawal said he is confident the mining behemoth will achieve its production target of 1 BT by 2025-26. Elaborating on the 1 BT production target, he said though CIL is on course to achieve this by 2025-26, it will depend on factors like the needs of the country and the growth of the private sector. The company is

aiming to raise underground coal production to 100 MT by 2030 from around 25-30 MT at present.

Rest of the World

China

China’s demand for Australian coking coal for steelmaking remains lacklustre even after Beijing removed import restrictions, as supplies from local mines, Mongolia and Russia are cheaper, traders said. Beijing in early January partially eased an unofficial ban on Australian coal imports by allowing three state-backed utilities and a steelmaker to resume procurement as the two countries sought to rebuild ties. The restrictions were further eased after China’s commerce ministry said coal trade is a "normal activity". Several key coal import regions, such as Guangdong, Fujian and Guangxi, have fully lifted the curbs, according to three people who deal in Australian coal, adding that customs authorities have granted permission to clear all cargoes. However, the policy change has not spurred much buying by Chinese coking coal traders as there is barely any profit to be made due to high Australian coking coal prices. Before the restrictions were imposed in late 2020, China bought more than 30 MT of coking coal annually from Australia, about 40 percent of its imports. Mongolian and Russian coking coal priced at about 2,030 yuan a tonne at China-Mongolian border and 2,240 yuan a tonne at northern Chinese ports, respectively, are also more competitive than Australian supplies, the traders said. In 2022, China’s imports of Russian coking coal doubled from 2021 and arrivals from Mongolia surged 82 percent year-on-year, Chinese customs data showed. Australian coking coal cargoes en-route to China could be resold if Chinese domestic prices fall further, traders said.

China’s state planner, National Development and Reform Commission (NDRC), underlined a greater role for coal in its power supply, saying the fossil fuel would be used to improve the reliability and security of its energy system. Soaring global energy prices following Russia’s invasion of Ukraine and domestic supply disruption have prompted Beijing to step up its focus on energy security in recent years. The world’s second-biggest economy relied on coal to generate 56.2 percent of its electricity last year, according to data from the National Bureau of Statistics, but has significantly boosted its use of natural gas and renewable energy in recent years to lower carbon emissions.

China approved the construction of another 106 gigawatts (GW) of coal-fired power capacity last year, four times higher than a year earlier and the highest since 2015, driven by energy security considerations, research showed. Over the year, 50 GW of coal power capacity went into construction across the country, up by more than half compared to the previous year, the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM) said. The amount of new capacity connected to the grid had slowed in recent years after a decline in new approvals over the 2017-2020 period, but it is set to rebound over the next few years, driven by concerns about power shortages. China suffered a wave of blackouts in September 2021 as a result of coal supply shortages, cutting off thousands of homes and factories. A long drought last year also saw a dramatic drop in hydropower generation and the rationing of electricity.

Rest of Asia and Asia Pacific

Indonesia launched the first phase of mandatory carbon trading for coal power plants, part of efforts by Southeast Asia’s biggest economy to boost renewable energy and achieve net zero emissions by 2060. Coal makes up more than half of Indonesia’s power generation. The first stage of a carbon trading mechanism will cover 99 power plants with a total installed capacity of 33.6 GW directly connected to power grids owned by state utility Perusahaan Listrik Negara (PLN). Under the mechanism, power plants that emitted more carbon than their quota can buy carbon credits from plants with below-quota emissions or from renewable power plants. Indonesia’s carbon trade applies to power plants with a capacity of at least 100 MW. Energy Minister Arifin Tasrif said, however, it would later be rolled out to smaller coal plants and other fossil-fuelled power plants, as well as power plants not connected to PLN’s grid. Indonesia initially planned to tax the remaining carbon emissions that had not been offset by carbon credits, but the implementation has been delayed.

North & South America

Nippon Steel Corporation could buy more stakes in coking coal and iron ore mines even after its recent decision to invest in a Canadian mine, as it sees a risk of commodity prices staying high, the world’s No.4 steelmaker said. Japan’s top steelmaker said it will spend around 1.15 billion Canadian dollars (US$844 million) to buy a 10 percent stake in Elk Valley Resources Ltd (EVR), the coking coal unit to be spun off from Canadian miner Teck Resources Ltd. Nippon Steel already owns stakes in several coking coal mines, procuring 20 percent of its annual 27 million tonne imports of the coal. The deal will boost that share to 30 percent.

News Highlights: 22 – 28 March 2023

National: Oil

India’s February crude oil imports jump to meet growing demand

23 March: India’s imports of crude oil in February rose about 8 percent from a year earlier, government data showed, as fuel demand hit over 2-decade highs in the world’s third-biggest oil importer and consumer. Rising crude demand and a strong Indian economy bodes well for higher refinery runs and imports, in addition to cheaper Russian crude, Refinitiv analysts said. Analysts expect refiners to boost runs and imports as temperatures rise and people travel more. Fuel demand in February hit its highest level in at least 24 years, data from the website of the Petroleum Planning and Analysis Cell (PPAC) showed. Russia tightened its grip on India’s oil market in February, leaving African crude oil imports in India at the lowest level in at least 22 years.

Government hikes windfall tax on diesel export to INR 1 per litre

22 March: The

government has hiked the windfall profit tax on export of diesel to INR1 per litre while the levy on domestically produced crude oil has been cut by a fifth, according to an order. The levy on crude oil produced by companies such as Oil and Natural Gas Corporation (ONGC) has been reduced to INR 3,500 per tonne from INR 4,400 per tonne, the order said. The government raised the tax on export of diesel to INR 1 per litre from INR 0.50, and the same on overseas shipments of ATF (aviation turbine fuel) remains at nil. The new tax rates come into effect from 21 March, the order said. Crude oil pumped out of the ground and from below the seabed is refined and converted into fuels like petrol, diesel and ATF. The tax rates are reviewed every fortnight based on average oil prices in the previous two weeks. India first imposed windfall profit taxes on 1 July last year, joining a growing number of nations that tax super normal profits of energy companies. At that time, export duties of INR6 per litre (US$12 per barrel) each were levied on petrol and ATF and INR 13 a litre (US$26 a barrel) on diesel. The export tax on petrol was scrapped in the very first review and that on ATF was done away with at the last review on 4 March. Reliance Industries Ltd (RIL), which operates the world’s largest single-location oil refinery complex at Jamnagar in Gujarat, and Rosneft-backed Nayara Energy are primary exporters of fuel in the country. The government levies tax on windfall profits made by oil producers on any price they get above a threshold of US$75 per barrel. The levy on fuel exports is based on cracks or margins that refiners earn on overseas shipments. These margins are primarily a difference between the international oil price realised and the cost.

Crude oil price decline should lead to lower petrol prices: Congress

22 March: The Congress has demanded that the

Centre transfer the benefits of declining crude oil prices to the consumers. Congress spokesperson Gourav Vallabh said that in March last year the price of crude oil was higher than what it is now, and the difference is INR 16.75 per litre. He said that as per the analysis, cheaper Russian Oil lowered the average price of imported crude oil by just US$2 per barrel during the nine months.

National: Gas

India mulls LNG reserve to avoid future shortages

27 March: In

dia is reportedly considering the creation of a strategic reserve of liquefied natural gas (LNG) to protect against potential supply shortages or price spikes in the future, following the country’s energy crisis last year. More governments are looking to set up emergency stockpiles of LNG, similar to the oil industry’s strategic reserves, as the super-chilled fuel becomes a more important element of the global energy mix. While no storage targets have yet been discussed, Petronet is adding more tanks at its LNG import terminals to store the imported fuel and is working on a floating import plant in the eastern state of Odisha. Petronet is in talks with Qatar to renegotiate its 7.5 million tonnes-a-year contract that expires in 2028. The New Delhi-based company is looking to expand the contract by as much as 1 million tonnes.

Cabinet to consider price caps on gas to stave off rates rising to US$10.7 per mmBtu

27 March: The Union

Cabinet is likely to soon consider imposing caps or a ceiling on price for the majority of natural gas produced in the country to keep input costs for users ranging from CNG (compressed natural gas) to fertilis er companies in check. The government bi-annually fixes prices of locally produced natural gas — which is converted into CNG for use in automobiles, piped to household kitchens for cooking and used to generate electricity and make fertilisers. Two different formulas govern rates paid for gas produced from legacy or old fields of national oil companies like Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL), and that for newer fields lying in difficult to tap areas such as deepsea. The global spurt in energy prices post Russia’s invasion of Ukraine have led to rates of locally produced gas climbing to record levels – US$8.57 million metric British thermal units (mmBtu) for gas from legacy or old fields and US$12.46 per mmBtu for gas from difficult fields. These rates are due to revision on 1 April. Going by the current formula, prices of gas from legacy fields are slated to climb to US$10.7 per mmBtu with minor changes in rates for gas from difficult fields. The government had constituted a committee under Kirit Parikh to look at revision in gas prices that balances both local consumer and producer interest, while at the same time advances the country’s cause of becoming a gas-based economy. The committee has recommended changing the indexation for gas from legacy fields to 10 percent of prevailing Brent crude oil prices instead of current practice of using rates of gas in surplus nations to decide their price. At current Brent crude oil price of US$75 per barrel, the price of gas should be US$7.5 per mmBtu but the fuel would be priced only at US$6.5 due to the cap. The committee recommended that gas should be brought under the Goods and Services Tax (GS) regime. Having a common taxation such as GST for gas in lieu of state level VATs, which vary from 3 percent to as high as 24 percent, will help develop the market.

National: Coal

Coal India’s supplies to non-regulated sectors seen up 16.6 percent during January-March

24 March: Coal India Limited

(CIL) will likely see its di spatches to non-regulated sectors increase 16.6 percent sequentially during January-March. Coal despatches to customers in non-regulated sectors, including cement, steel and aluminium industries, have been averaging 3.67 lakh tonne per day so far in Q4 FY23. CIL will likely close the current quarter with 33 million tonne (MT) supply to the sector, as per a company statement on Friday. It would lead to 4.7 MT more coal, or a jump of 16.6 percent, from the 28.3 MT supplied in the third quarter of fiscal 2022-23. Supplies to the non-regulated sector during January-March, expected at 33 MT, would be 3.1 MT more from the comparable quarter of FY22, representing a growth of 10.4 percent. CIL supplied 29.9 MT to the non-regulated sector (NRS) in the final quarter of FY22. Coal India’s pithead stock, which was at 32 MT as of 31 December, has doubled to a comfortable buffer of 63.8 MT as on 23 March. Stocks are expected to hit 68 MT by the end of FY23.

Chhattisgarh’s Gevra becomes India's first coal mine to produce 50 MT output

22 March: The Gevra project of the Chhattisgarh-based South Eastern Coalfield Limited (SECL), which is an undertaking of the Coal India Limited (CIL), has created a distinct niche for itself after attaining a

milestone achievement with the highest coal production in the country touching 50 million tonnes (MT). The SECL achieved the highest-ever annual production of 157.45 million tonnes (MT) of coal, surpassing its own previous high of 157.35 MT achieved in 2018-19.

National: Power

UJVNL achieves target, generates over 5k million units power in 2022-23

28 March: Uttarakhand Jal Vidyut Nigam Limited

(UJVNL) achieved its target of power generation for the financial year 2022-23 on 25 March, by generating 5,390 million units (mu) of electricity during this period. UJVNL has a total of 19 hydropower plants in the state among which the one named Maneri Bhali II in Dharasu generated the maximum power of 1,281.9 million units.

Gujarat government paid INR 169 bn in two years to Adani, Tata firms to buy electricity

27 March: The

Gujarat government has paid INR 169 bn to Adani Power and Tata Power for purchasing electricity during the last two years. As per the data tabled by Energy Minister Kanubhai Desai, the state government paid INR 81.60 bn to Adani Power Mundra Ltd while INR 8,784 was paid to Coastal Gujarat Power Ltd, a wholly owned subsidiary of Tata Power, in 2021 and 2022. Desai said the state government paid INR 27.60 bn to Adani Power in 2021 to buy 5,589 million units while INR 54 bn was paid to the firm in 2022 for nearly 6,000 million units. In 2021, the state government paid INR 27.51 bn to Tata Power to buy 7,315 million units, while the cost came to INR 60.33 bn for 10,446 million units in 2022. The data suggested per unit cost of INR 2.83 paid to Adani in January 2021 went up to INR 8.83 per unit in December 2022 (provisional). Similarly, Tata Power charged INR 4.92 per unit from the government in 2022 against INR 1.80 in January 2021. Desai said the per unit cost of electricity went up after 2018 due to "exponential rise" in the price of imported coal, which had forced such power generators to shut their plants in Gujarat. To ensure people of Gujarat get uninterrupted power, the state government had signed new supplementary agreements with Adani to pay as per the actual cost of fuel, Desai said.

Relief for consumers as no hike in Andhra Pradesh power tariff

26 March: There will be no hike in tariff of any category of electricity consumers for the year 2023-24. The state government has agreed to bridge the total revenue gap of INR 101.35 bn for 2023-24 as a subsidy. Andhra Pradesh State Electricity Regulatory Commission (APERC) issued the retail supply tariff (RST) order. The power distribution companies (discoms) proposed a

revenue gap of INR 140.28 bn, while APERC determined it as INR 101.35 bn. APERC chairman CV Nagarjuna Reddy said after talking to all stakeholders, the commission prepared the retail tariff order. The commission in its order stated that the subsidy given by the state government to fill the revenue gap is applicable for nine hours of free power supply to eligible farmers, concessions extended to various classes of consumers like SC, ST, MBC and aqua farmers. The subsidy will also help discoms to maintain uniform tariffs for domestic consumers.

Delhi saves 279 MW electricity during Earth Hour

25 March: Delhi saved 279 MW of electricity during ‘Earth Hour’ as electric appliances were switched off across the city from 8.30 pm to 9.30 pm, discom (distribution company) said. Discom said last year, 171 MW of power was saved as Delhi observed Earth Hour. In the areas covered by BSES discoms BRPL and BYPL, 178 MW of power was saved, said a company spokesperson. Tata Power Delhi Distribution Limited (TPDDL) consumers successfully managed to save 15 MW during the Earth Hour 2023, discom said.

Electricity regulatory commission allows 24 percent hike in power tariff in Bihar

23 March: In a major jolt to around 17.9 million power consumers in the state, Bihar Electricity Regulatory Commission

(BERC) has allowed 24.1 percent hike in power tariff (electricity charges). An announcement in this regard was made by the BERC in its annual tariff order for the two power distribution companies (discoms) of the state energy department for the fiscal 2023-24. However, a final tariff rate for calculating electricity charges will come out after the state government announces its subsidy. The power tariff order has been passed on zero- subsidy basis, which means that the tariff rate may come down, after the state government announces subsidy. The practice of zero-subsidy tariff petition was introduced from the fiscal 2016-17. The two discoms — North Bihar Power Distribution Company Limited (NBPDCL) and South Bihar Power Distribution Company Limited (SBPDCL) — had submitted their tariff petitions for the next fiscal to the BERC in November last year.

100 percent railway network in Odisha electrified

23 March: The

Indian Railways has completed electrification of the existing broad gauge network of Odisha that plays an important role in transportation of minerals, agricultural products and other goods from the state to other parts of the country. Railways said the existing broad gauge network of 2,822 km has been 100 percent electrified, resulting in savings on account of reduced line haul cost (around 2.5 times lower) and heavier haulage capacity. Odisha is the third state with its entire broad gauge railway network electrified after Uttar Pradesh and Chhattisgarh. Full electrification of tracks will facilitate elimination of diesel traction and significantly reduce carbon footprint and environmental pollution. As per an estimate, carbon footprint of 3.8 lakh tonne will be reduced and over INR12 bn saved every year due to electrification of the entire network.

National: Non-Fossil Fuels/ Climate Change Trends

All government buildings will be solar-powered by March 2024 in Panaji: Goa Power Minister

27 March: Power Minister Sudin Dhavalikar said that all state

government buildings in Panaji city will be solar-powered by March 2024. He said that 76 government buildings in Panaji will have solar panel installations, and the tender will be done by April end. The power ministry is also processing a proposal which involves setting up solar panels at the expansive state Assembly complex, but the approval of the Speaker, as well as members of the House, was necessary to kickstart the project, he said. He said that the Ministry of Renewable Energy and GEDA has decided to make Panaji a solar city. For this, we will need to generate around 80 megawatts (MW) of renewable energy power. Earlier, the state had said it was examining the possibility of setting up floating solar panels in abandoned mining pits as part of a push to ensure 50 percent power by renewable energy by 2030 and 100 percent by 2050. However, the uptake of rooftop solar installations has been low despite a 50 percent subsidy being offered.

Ahmednagar to soon have its first solar agri-feeder

24 March: The problem of irregular agriculture power supply to farmers in Ahmednagar district may be solved soon. The government has acquired 5.45 hectares to

set up the district’s first solar agriculture-feeder plant. The five MW feeder is being set up as a part of the Chief Minister Solar Agriculture project and will come up in two villages of Rahata taluk — Kelwad Budruk and Kelward Khurd. The solar feeder will generate power, which would be linked to the Maharashtra State Electricity Distribution Company Limited (MSEDCL) grid, thus enabling day time supply of electricity for agricultural purposes.

PM Modi to inaugurate two new solar power plants for Jal-Kal, Konia SPS

24 March: Apart from supplying potable water to city localities and lifting city’s sewerage, the Jal-Kal’s Bhelupur campus and Konia sewage pumping station

(SPS) will soon start generating power through the newly-installed solar power plants, to be inaugurated by Prime Minister Narendra Modi during his one-day visit to the city. The two solar power plants are among the 19 projects, which will be inaugurated by the PM on the day. At Jal-Kal campus, the solar power plant worth INR 172.4 bn has been built on 14,400 square metre area with installation of 3704 solar panels, including 10 solar trees. The PM laid the foundation stone of the project on 15 July 2021.

NDMC okays renewable power purchase to cover deficit

23 March: New Delhi Municipal Council

(NDMC) approved a proposal for procuring renewable non-solar power through a government enterprise to meet the nearly 200 MW power deficit till March. The contract may be extended later for a year to promote the use of green energy. NDMC’s peak demand is around 400 MW. It wants to fulfil the 200 MW deficit through renewable sources. The council also approved a proposal for augmenting the network for improving power supply to the Lodhi Colony area.

India eases biofuel export rules from SEZ, export oriented units

23 March: The government announced that if the biofuel is produced using imported feed stock, exports of biofuel from special economic zones (SEZ) and export-oriented units are permitted for both fuel and non-fuel purposes without any restrictions. Within days of placing limitations on their imports, the government on 28 August 2018, had restricted the export of biofuels as well in a bid to increase the domestic capacity. Biofuel imports and exports both call for a licence. Ethyl alcohol, petroleum oil, oils derived from bituminous materials, bio-diesel, and mixes are examples of biofuels. India has an ambitious biofuel roadmap under its national biofuel policy.

By 2025-26, the centre aims to achieve 20 percent ethanol blending in petrol. The initial target to achieve 20 percent blending was 2030. The target of petrol supplies with 10 percent ethanol blending was achieved in June last year, before the original schedule of November 2022.

India misses RE capacity target due to low solar rooftop

22 March: A parliamentary panel has attributed low installation of solar roof-top and wind energy projects as key reasons for the shortfall in achieving India’s renewable energy (RE) capacity target of 175 gigawatt (GW) by 2022.

India set an ambitious target of installing 175 GW of renewable energy capacity by the year 2022, which included 100 GW from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydro-power. However, a renewable energy capacity of 120.90 GW has been installed in the country as of 31 December 2022 which is about 69 percent of the overall target, the Standing Committee on Energy said in a report. Keeping in view India’s commitment to increase our non-fossil fuel based energy capacity to 500 GW by the year 2030, the Ministry of New and Renewable Energy (MNRE) must ramp up its pace for timely achievement of targets, it suggested.

By 2025, Delhi government aims to meet 25 percent of annual electricity demand through solar power

22 March: The Delhi government’s solar policy, which will be notified next month, aims to meet 25 percent of the

city’s annual electricity demand through clean energy by 2025, Delhi Finance Minister Kailash Gahlot announced. While presenting his maiden budget as Finance Minister, Gahlot in the assembly announced an allocation of INR 33.48 bn for the power sector, up from INR 33.40 bn last year, and highlighted that electricity rates have not been increased in the last eight years. Gahlot said the government’s Solar Policy will be notified by next month and it will establish Delhi as a leading example for the country in the field of solar energy.

International: Oil

US could buy back oil for strategic reserve late this year

28 March: US (United States

(US) could start buying back crude oil for the Strategic Petroleum Reserve late this year after President Joe Biden last year directed the largest ever sale from the stockpile, Energy Secretary Jennifer Granholm said. The administration intended to repurchase crude oil for the SPR when prices were at or below about US$67-US$72 a barrel, after last year's 180-million-barrel sale drove the level of the stockpile to its lowest since 1983, the White House said in October. Biden conducted the sale to relieve oil prices that shot up after Russia invaded Ukraine. US oil prices touched that range but no sales were announced.

Russia irked with Pakistan’s slow progress in importing crude oil

28 March: Pakistan plans to import crude oil from Russia has hit a critical roadblock due to slow processing by Islamabad, which has irked and disappointed Moscow. As per sources, Moscow has expressed serious concerns over Pakistan’s initiative to import crude oil from Russia and has communicated to Islamabad to import at least one crude oil cargo and establish its seriousness and intent. Russia has also expressed its disappointment over Pakistan after it was revealed that Islamabad did not even initiate the process to start the first shipment of crude oil. Pakistan had committed that it would set up a new Special Purpose Vehicle (SPV) company responsible for import of Russian crude oil to the refineries in Pakistan. It was also committed by Islamabad that the SPV would be responsible for handling all matters related to the import and its relevant payments for oil. Pakistan requires crude oil that produces higher diesel oil, in reference to which, importing crude oil from Russia will increase costs and erode incentives. If both Pakistan and Russia sign the deal, Moscow will become Islamabad's second-largest crude oil supplier after Saudi Arabia, exporting around 100, 000 barrels of crude oil per day.

Saudi Aramco boosts China investment with two refinery deals

27 March: Saudi Aramco raised its multi-billion-dollar investment in China by finalising and upgrading a planned joint venture in northeast China and acquiring an expanded stake in a privately controlled petrochemical group. The two deals, announced separately, would see

Aramco supplying the two Chinese companies with a combined 690,000 barrels a day of crude oil, bolstering its rank as China’s top provider of the commodity. The deal includes the supply of 480,000 bpd of crude oil to Rongsheng-controlled Zhejiang Petrochemical Corp (ZPC) for 20 years, Aramco said. The deals are the biggest to be announced since Chinese President Xi Jinping visited the kingdom in December where he called for oil trade in yuan, a move that would weaken the US (United States) dollar’s dominance in global trade.

Venezuela’s commercial oil exports nearly halted as reviews expand

23 March: Expanded oil export contract reviews at

Venezuela’s PDVSA have nearly halted all commercial crude and fuel releases. PDVSA, which accounts for most of the OPEC nation’s export revenue, delivered documents to prosecutors that revealed US$21.2 billion in commercial accounts receivable in the last three years, of which US$3.6 billion are potentially unrecoverable.

Brent plunge fails to displace Russian crude for Asian buyers

23 March: A plunge in Brent

crude prices has narrowed the spread between Atlantic Basin and Middle East benchmarks but has failed to spur interest from Asian refiners, which are instead buying up discounted Russian oil, leaving an overhang in African supply. Global oil benchmark Brent tumbled more than 10 percent over the past two weeks, touching a 15-month-low of US$70.12 a barrel, as investors have fretted over banking sector turmoil in the US and Europe and as strikes in France have dented oil demand. Middle East crude prices in Asia appear to be resilient as the market bets on robust demand from China, which is rebounding from zero-COVID restrictions that formerly squeezed its economy.

International: Coal

German utility EnBW speeds up coal exit as grid, renewables profits to soar

27 March: German utility EnBW expects its core profit to rise by as much as 58 percent in 2023 on the back of its energy networks, renewables and trading divisions, reason enough for the group to accelerate its coal power phase-out by seven years. EnBW, one of Germany’s largest utilities, operates 4.3 gigawatts (GW) of lignite- and hard coal-fired power plants, accounting for a third of its total installed capacity. This compares with 5.4 GW of renewable capacity.

EnBW moved forward its planned phase-out of coal-fired power generation to 2028 from 2035, a target already ahead of the 2038 deadline set by the government.

China’s new coal plants set to become a costly second fiddle to renewables

23 March: China’s plans for some 100 new coal-fired power plants to back up wind and solar capacity have sparked warnings that the world’s second-biggest economy is likely to end up lumbered with even more loss-making power assets. Analysts question the logic of policies that intend to reduce the role of the dirtiest fossil fuel but at the same time require more coal-fired power plants to be built - especially given that only a small number of older plants are typically retired each year. The construction of 106 gigawatt (GW) of coal-fired power was approved last year - four times more than in 2021 and the highest amount since 2015, according to research published last month by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM). China’s National Development and Reform Commission (NDRC) has also flagged that at least 200 GW of coal capacity is expected to be deployed to support renewable power. China’s big jump in coal power approvals has sparked fears that there will be backsliding on its climate goals. Coal accounted for 58.4 percent of China’s total power generation last year, but high prices have meant many plants have suffered losses for years. More than half of the country’s large coal power firms were loss-making in the first half of 2022, according to the China Electricity Council.

International: Power

Iowa SC blocks law favouring in-state electric grid developers

25 March: The Iowa Supreme Court (SC) temporarily blocked a

state law that it said would limit competition for electric transmission projects, just as bidding is set to begin on multi-million-dollar contracts to connect renewable energy projects to the Midwest’s power grid. Reversing lower court orders, the state’s high court said the 2020 law giving electric utilities already operating in Iowa the right of first refusal to build proposed transmission projects would stifle competition and harm business interests of out-of-state companies. The stakes are high, the court said. Regional planners have already approved billions of dollars for projects to connect wind, solar and other renewables to the Midwest grid, and billions more were allocated for electric transmission projects in the 2021 bipartisan infrastructure law and 2022 Inflation Reduction Act.

International: Non-Fossil Fuels/ Climate Change Trends

China Energy plans 1 GW floating solar plant in Zimbabwe

27 March: China Energy Engineering Corporation has proposed the construction of a 1,000 megawatt (MW)

floating solar plant on Zimbabwe’s Kariba dam at a cost of nearly US$1 billion. The southern African country is currently generating less than half of its 1,700 MW power demand, due to the underperformance of its ageing coal-fired plants and low water levels which impact generation from its 1,050 MW hydropower plant at Kariba. China Energy’s proposal, made to the state-owned Zimbabwe Power Company and a private consortium of the country’s industrial power consumers, would see about 1.8 million solar panels installed at a cost of US$987 million. China Energy has recently completed two floating solar projects in China’s Shandong Province and Thailand. Zimbabwe started generating power from the first of its two new China-funded 300 MW coal-fired plants at Hwange, but plans to shift to renewable energy sources for its long-term electricity supply.

Japan’s TEPCO to develop 1.9 GW of offshore wind power in Scotland

27 March: Tokyo Electric Power Company Holdings

(TEPCO) said that it had won the rights to develop up to 1.9 gigawatts (GW) of floating offshore wind capacity across two projects in Scotland together with Norway-based company Vargronn. The two Scotland projects, Green Volt and Cenos, will be developed by TEPCO’s UK unit, Flotation Energy, and Vargronn, TEPCO said. Commercial operation of Green Volt and Cenos should be launched in 2028 and 2030, respectively, TEPCO said. The Japanese company recently invested an undisclosed sum into Flotation Energy, a British floating offshore wind power company, its first equity investment in overseas wind power. TEPCO’s overseas investments are in line with its plan to develop 6-7 GW of new offshore wind and hydroelectric power assets by 2030.

China to launch rural pilot scheme for renewable energy

23 March: China will launch a pilot scheme to promote the development of renewable energy in rural areas, according to an action plan released by the National Energy Administration (NEA). Under the scheme, provincial-level government departments are to identify rural 'pilot counties' for the construction of renewable energy projects and submit development plans to the NEA for evaluation and approval by the end of May this year. The scheme proposed a target that renewable energy will account for over 30 percent of total primary energy consumption and over 60 percent of new capacity primary energy consumption in the pilot counties by 2025. The announcement comes amid an ambitious drive to increase the country’s renewable energy capacity. China installed 152 gigawatt (GW) of renewables capacity last year, representing 76.2% of all new energy capacity. China has said it aims for renewable power to account for more than 50 percent of its electricity generation capacity by 2025, with much of this to be installed in sparsely populated, largely rural regions such as Inner Mongolia and Gansu province.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: The Changing Role of Hydropower: IRENA 2023

Source: The Changing Role of Hydropower: IRENA 2023 Source: The Changing Role of Hydropower: IRENA 2023

Source: The Changing Role of Hydropower: IRENA 2023