Quick Notes

Valuing Flexibility and Stability of Power Supply: Options for India

Status

As of May 2023, India’s non-fossil fuel power generating capacity of over

173,619 megawatts (MW) was about

41.5 percent of the total installed power generating capacity of about

417,668.2 MW. New renewable energy (RE) capacity (excluding nuclear and hydropower) accounted for over

30 percent of total power generation capacity, the second largest share after coal. Solar, wind, small hydropower, biomass and others accounted for over

73 percent of non-fossil fuel-based capacity while large hydropower accounted for

27 percent and nuclear just

3 percent.

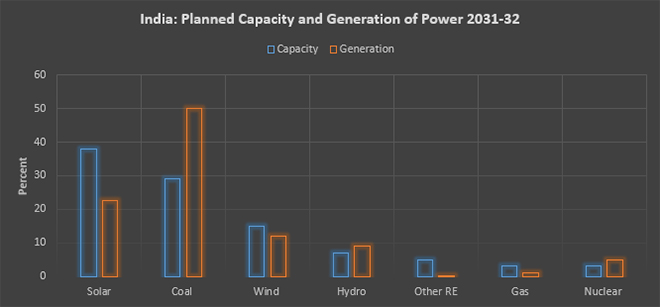

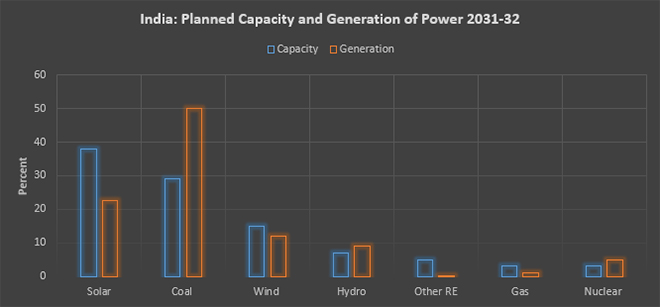

Stand-by Capacity

Though RE has the second largest capacity share, it accounted for less than

14 percent of power generation in 2022-23. Hydropower generation which has only about a third of renewable energy (RE) capacity accounted for over

10 percent of the power generation. Coal which accounted for about

50 percent of capacity contributed over

74 percent of generation in 2022-23. In terms of specific generation or power generated per unit of capacity that represents economic efficiency, nuclear power was the most efficient with a score of

over 7 while RE power was the least efficient with a score

less than 2 in 2022-23. This is because of low-capacity factors for RE which are in the range of

15-20 percent at best. Without stand-by capacity, a high RE power system can lead to compromise on the

security of supply in the form of frequent power outages. As RE cannot be relied upon to provide needed electricity at any moment, other tools such as making payments for maintaining

stand-by capacity (either in the form of batteries or in terms of gas or coal-based generation) or compensating consumers to

reduce demand, when necessary, must be employed. India often uses the latter option of reducing demand through

forced outages for rural consumers (or industrial consumers during elections when people are temporarily more valuable) who receive neither electricity nor payments for outages.

Consumers who are forced to

accommodate outages are India’s back-up system or more accurately, its demand management system which is perverse and should be eliminated. The other credible options for supply security include creating vibrant markets for

electricity, capacity, and ancillary services. India is technically an energy-only market but using the term market to describe India’s power sector is a stretch as the electricity tariff at one end and fuel supply at the other end do not respond to the

market signals.

Energy only and capacity markets

Capacity markets aim to ensure grid reliability by paying participants to commit generation for delivery years into the future. Energy-only markets, by contrast,

pay generators only when they provide power on a day-to-day basis. Capacity markets prevent generating capacity that only supplies

excess energy at high prices from being squeezed out of the wholesale electricity market in such quantities and at such speed that it may affect system reliability. Capacity markets that provide the opportunity to

secure revenue years in advance give generators added incentives to build new plants. But the model could be wasteful, since

financially challenged distribution companies (Discoms) in India will pay out the capacity costs for load events that may not materialise years down the line. Capacity markets also remain vulnerable to

price depression as a result of out-of-market subsidies. If these resources also enter as price takers without any checks and balances into the capacity market, the regulator can end up compromising the ability of the capacity market to balance

revenue flows. Capacity payments may also blur price signals on traded markets, preventing scarcity markets from functioning.

Capacity remuneration also risks double payments to the generator-for energy and capacity.

In mature

energy-only markets, regulators ensure reliability through a mechanism called scarcity pricing, which allows real-time electricity prices to increase on days of peak demand. Instead of guaranteeing

generation revenue through a capacity market, the promise of

high prices is supposed to incentivize generators to build new plants and keep them ready to operate. In an energy-only market, the grid’s

reserve margin is maintained at sufficiently high levels allowing for enough instances of scarcity that increase prices to such an extent that generators can recover their capital costs. This can be seen in Indian electricity exchanges that demonstrate

steep increases in electricity tariffs during summer months when the demand is high. The worry is that

energy-only markets could become increasingly unstable due to the low electricity prices (on account of subsidies for certain energy forms or on account of depressed demand) which could discourage generators from building new power plants without guaranteed revenue of a capacity market. Essentially, securing sufficient

flexibility in the system is a separate issue to stimulating investment in future capacity.

The critical difference is that in an energy-only market, generators must wait and hope for the day when

real-time prices increase substantially. With a capacity market, some of that revenue is

guaranteed. The capacity market is designed to provide a solution by balancing lower energy market prices with

higher revenues for generators in the capacity market. Capacity remuneration mechanisms can remove

investment incentives for demand-side response activity in the wholesale market and energy storage. They also impede

cross-border electricity trade by reducing the peak-prices that make trade profitable. Over the long term, the energy-only and capacity market constructs could end up delivering

similar cost results to consumers.

The third alternative, often confused with capacity markets, is to use

ancillary service markets, which procure short-term reserve generation and grid support products for everyday system stability. As the proportion of RE continues to increase the demand for

ancillary services to ensure daily operational stability is likely to increase. Ancillary services are traded in months, weeks, days and hours, not years like capacity. Ancillary service markets are for securing the right combination of resources for generation quality and not for generation adequacy. Competitive trading of these services is part of some, but not all,

wholesale electricity markets. If generators can generate revenue from selling ancillary services, the need for capacity payments to keep plants online can be reduced. A properly functioning

energy and services market can deliver all the capacity that the Indian grid requires.

India is slowly moving towards this system but there are significant challenges not only because it is an imperfect energy only market but also because India’s energy supply serves non-energy goals such as delivering development subsidies. However, keeping the future in mind, India’s

central electricity authority (CEA),

central electricity regulatory commission (CERC) and

Grid India have studied the prospect of developing an

ancillary services market. But it is too early to say whether a well-designed market that makes it profitable for generators to provide ancillary services (short term reserves and grid support products) would also stimulate investment in

future capacity in India. The worry is that continued

policy-supported RE additions may keep electricity prices low, thereby reducing the incentive for generators to build new plants. Most of the RE is “

aspirational capacity,” capacity directly contracted to meet commitments to multilateral climate treaties, not necessarily capacity needs. Reconciling

environmental goals that demand more RE additions with the need to preserve market incentives for new generations is a critical challenge.

If India’s electricity sector matures into a vibrant open market, it can, at least in theory,

value, reliability, and compensate investors for supplying fixed resources. A well-functioning wholesale electricity market in India should dynamically

value the energy, support services, and capacity in response to the changing forces of supply and demand. An ancillary services market that responds to scarcity of

flexible reserves by pushing up their price will make it profitable to operate peaking plants that can rapidly ramp up and down, giving generators a reason to keep plants online and invest in future capacity.

Another alternative is keeping

strategic reserves of power generating capacity where the capacity mechanism is procured completely outside the wholesale market so that it does not compromise the move towards developing an energy market in India. As in the case of strategic oil reserves, it should be owned and operated by the

government to provide national security (energy security), a public good. Strategic reserve for power generation is a

pragmatic and relatively simple solution to meet the demand for short periods of extreme system stress. But the risk with a peak strategic reserve is that over time it can become just as

expensive as a capacity market.

Creating a new system of benefits, or an entirely new market, to stimulate investment in enough future capacity without interfering with the ancillary market's valuation and procurement of reserve capacity is complicated even in the most mature market and much more so in India.

Source: Draft National Electricity Plan 2022

Source: Draft National Electricity Plan 2022

Monthly News Commentary: Power

Power Sector Prepared for Summer Demand Spurt

India

Demand Growth

India’s power consumption dipped 0.74 percent to 127.52 billion units (BU) in March this year for the first time in 31 months, according to government data. The contraction in power consumption is mainly because of widespread rains due to western disturbances in the country and low temperatures in March. The last contraction in power consumption was recorded in August 2020, when it declined by over two percent to 109.21 BU, compared to 111.52 BU in August 2019. Power consumption slumped in 2020 due to the impact of lockdown restrictions imposed to curb the spread of the deadly coronavirus. Experts are hopeful that power consumption and demand would grow from April onwards, due to further improvements in economic activities as well as rise in temperatures. In March 2022, power consumption stood at 128.47 BU, higher than 120.63 BU in the same month of 2021, the data showed.

With mercury rising, the

demand for power in Tamil Nadu has hit an all-time high. According to the state power ministry, the state’s daily consumption of power has touched 413 million units (MU) and a peak demand of 18,882 MW on 18 April, but the government met the power demand without any interruption. It said that on 10 April, daily consumption was 400 MU which was the previous high. It had also said that the summer peak demand in the state was expected to rise to the range of 18,300-18,500 MW. The energy policy note for 2023-24 also predicted a daily energy consumption of 390-395 MU in the period between April and May 2023. In 2022, the daily peak demand was 17, 563 MW and the maximum daily consumption was 388.078 MU on 29 April. Even as TANGEDCO (Tamil Nadu Generation and Distribution Corp Ltd)’s policy note for 2023-24 said the maximum electricity demand would range between 18,000 and 18,500 MW, the maximum demand recorded was 18,667 MW.

Uttar Pradesh (UP) Chief Minister (CM) Yogi Adityanath has given necessary instructions to Uttar Pradesh Power Corporation Limited

(UPPCL) to ensure power supply in the state amid increased demand in summer. As per the instructions of the CM, UPPCL has also started the task of increasing power generation on a war footing, it said. UPPCL Chairman M Devraj inspected the Jawaharpur Super Thermal Power Project and took detailed information about the on-site construction works of the project under construction and directed the officials to start production of one unit (660 MW) of the project by 15 May 2023.

Electricity Trade

Adani Power has begun supplying electricity from its plant in Godda in Jharkhand to Bangladesh. Adani Power Ltd (APL), a part of the diversified Adani Group, has commissioned the first 800 megawatts (MW) ultra-super-critical thermal power generation unit at Godda in Jharkhand. The plant has started supplying 748 MW of power to Bangladesh. The electricity supplied from Godda will significantly improve the situation in the neighbouring country as it will replace expensive power generated from liquid fuel, bringing down the average cost of power purchased.

Regulation and Governance

The

government has revised the framework for electricity supply to provide the cheapest power lot first to consumers and help state utilities to meet demand in a cost-effective manner. The power ministry has revised the structure of the Day-Ahead National level Merit Order Despatch Mechanism to lower the overall cost of electricity generation, which will translate into lower power prices for consumers. As per the revised mechanism, the cheapest generating resources (power) across the country will be dispatched (supplied) first to meet the system demand. The power ministry has been taking several measures to enhance the competition in the sector to lower the cost of electricity to consumers.

Kerala continues to experience scorching heat with Palakkad district recording the highest maximum temperature of 38.4 degrees Celsius. Due to the rising mercury levels during the past few days, electricity consumption in Kerala has also gone up with 102.99 MU being consumed on 19 April which is a record for the state, according to the data on the Kerala State Electricity Board (KSEB) website.

Electricity consumption has crossed the 100 million mark several times this month.

The Himachal Pradesh Power Board will spend about INR 1.56 billion (bn) (USD $18.9 million) to

modernise and strengthen the electricity supply system in Hamirpur. The funds would be spent on the construction of new electrical sub stations as well as the modernisation of transformers and lines and many other works. According to the power board’s estimate, about INR 966.4 million (mn) (US$11.71 mn) will be spent on the installation of new transformers, strengthening of old transformers, conversion of lines, modernisation of electric cable lines and other equipment. A separate detailed project report (DPR) estimating an investment of about INR 375 mn has been prepared for the modernisation of the power supply system in Hamirpur city. Residents of at least three dozen panchayats under Barsar and Bhoranj assembly constituencies are expected to be benefitted from this project.

Delhi's power subsidy scheme will continue as Lieutenant Governor (LG) VK Saxena approved its extension on 14 April, following accusations from Delhi Power Minister Atishi of stalling the move. The Delhi Cabinet had approved the extension for the year 2023-24, but the file was pending in the LG office. The development breeds a fresh tussle between the Arvind Kejriwal led- Delhi government and the Delhi L-G. Delhi Power Minister Atishi had earlier said power subsidy to nearly 4.6 million people in the city will cease. The AAP leader cited the reason for cessation to the LG not approving an extension of the subsidy to Delhi residents. However, the Lt Governor's office said the power subsidy extension for the year 2023-24 has been approved by Saxena and accused Atishi of levelling false allegations. Delhi Cabinet has approved the extension of power subsidy for the year 2023-24 but the file is still pending in the LG office. Atishi said that the file was sent a few days back and a response is still awaited. Saxena, in a note to the chief minister, has criticised the government for not conducting the audit of INR 135.49 bn (US$1.64 bn) given to the distribution companies (discoms) over the past six years. The LG has reiterated his stand that power subsidy should be provided to the poor, pointing that amounts being given to discoms be audited to ensure non-pilferage. The AAP government in Delhi provides free electricity to consumers with 200 units of monthly consumption. Those having 201 to 400 units of consumption per month get a 50 percent subsidy capped at INR 850. Last year, Chief Minister Arvind Kejriwal announced that a power subsidy would be provided to only those consumers who apply for it. According to official figures, over 4.8 million among more than 5.8 million domestic consumers have applied for power subsidies. The AAP government has allocated INR 32.5 bn (US$394 mn) for power subsidies in its budget for 2023-24. The

Delhi Cabinet approved extension of 200 units of free electricity under power subsidy scheme and also the continuation of 50 percent subsidy on consumption between 200 to 400 units. In a cabinet meeting, the proposal to give subsidy on electricity was approved unanimously under the leadership of CM (Chief Minister) Arvind Kejriwal. The free electricity scheme was introduced by the Kejriwal Government in 2019.

The Central Electricity Authority

(CEA) has released draft guidelines for utilities to prepare uniform power demand forecasts to improve infrastructure planning. CEA said the forecast should be prepared for the medium-term and long-term. According to the draft guidelines, forecasts for power utilities should be carried out for at least three scenarios: optimistic, business as usual and pessimistic. The forecast should be prepared in consultation with all stakeholders, including industrial, agricultural, municipal corporations, drinking water departments, captive power plant owners and other departments involved in planning and implementing electrical energy-intensive schemes, it suggested. These granular forecasts are expected to be more useful in power infrastructure planning, the regulator said in its guidelines. By 11 May, the power regulator wants feedback from the public about the draft guidelines.

Punjab Chief Minister Bhagwant

Mann said the state has cleared its entire electricity subsidy bill of INR 202 bn (USD $2.45 bn) for the last financial year and has witnessed a jump in excise and GST revenue. He said the state has registered a revenue of INR 88.41 bn (US$1.07 bn) for the financial year 2022-23, up by 41.41 percent when compared to 2021-22. He said the state has registered a rise of 78 percent in stamp duty and fee collection in March. The government earlier announced an exemption of 2.25 percent on stamp duty and fees on registration of properties.

Electricity from the central pool will not be allocated to states and Union territories (UTs) which will impose taxes on clean energy projects, impede the inter-state flow of power and have not cleared subsidy dues on electricity tariff, according to an official order. The power ministry said that the power from the central pool will not be allocated to those states which have regulatory assets. Regulatory assets come into existence when power regulators acknowledge that the tariffs imposed on electricity consumers do not adequately cover the power purchase costs of distribution companies (discoms). Certain aspects will be examined whenever a request will be received from any state/union territory for the allocation of power from the unallocated quota of Central Generating Stations, the ministry said. The ministry will take into account non-creation of regulatory assets and timely payment of subsidy declared, if any, in the consumer tariffs by the state government to distribution utilities.

Rest of the World

Other Asia Pacific

As locals face up to 18-hour-long power outages, the Gilgit Baltistan

(GB) government has started an operation to remove illegal electricity connections and special transmission lines to government offices and official residences. The GB water and power department, in collaboration with district administrations, has started the action to overcome the power shortage. GB Chief Secretary Mohyuddin Ahmad Wani said government officers, including himself, have been provided with special power transmission lines to ensure 24-hour electricity supply to their offices and houses while the public was facing 18 to 20 hours of load shedding.

Africa

South African President Cyril Ramaphosa said that the

country is implementing wide-ranging reforms in the electricity sector aimed at enabling private investment in power generation and accelerating the procurement of new generation capacity from solar, wind, gas and battery storage. The lack of reliability in electricity supply weakens business and consumer confidence, taints international perceptions about South Africa, and affects investment sentiment and decisions, Ramaphosa said.

North & South America

Mexico’s President Andrés Manuel López Obrador

announced a deal to buy 13 of the power plants operated by the Spanish company Iberdrola in the country for an estimated US$5.94 bn, calling it a "new nationalization" of the Mexican electricity sector. The deal could put an end to President Andrés Manuel López Obrador’s years of verbally sparring with the company, along with fines and limits on its plants in Mexico. López Obrador has long admired former President Adolfo López Mateos, who nationalized Mexico’s electrical industry in 1960. By the 2000s, decades of corruption, high domestic electricity rates and under-investment led López Obrador’s predecessors to invite foreign companies in to build new, cleaner power plants. López Obrador said the deal will give Mexico’s state-owned power company a 55.5 percent share of the electricity market. The utility, the Federal Electricity Commission, now produces just under 40 percent of Mexico's electricity. In 2022, Iberdrola was reportedly hit with fines amounting to nearly US$466 mn, after Mexican regulators claimed the company violated rules governing private electricity sales to companies. Those fines were later put on hold by a court. It is unclear if, under the terms of deal, they will be waived.

News Highlights: 3 – 9 May 2023

National: Oil

Nagaland not to explore oil in disputed areas

6 May: The

Nagaland government has decided not to go ahead with plans to facilitate resumption of oil exploration in the disputed areas with Assam without consulting all stakeholders and tribal bodies of the area. The Nagaland government consulted with tribal bodies and civil societies of the oil-bearing areas of Nagaland—Mon, Longleng, Mokokchung, Wokha, Nuiland, Dimapur and Peren. Patton did not specify the date for holding the consultative meeting. The Lotha Hoho, an apex body of Wokha district which has a rich depository of oil in Nagaland, had objected to taking the stand on Article 371(A) of the Constitution which gives special protection to the Nagas on land and other rights.

National: Gas

India’s top gas importer sees 'huge jump' in demand as prices ease

3 May: India’s top gas importer

Petronet LNG expects a 'huge jump' in local gas demand for at least six months due to a softening of global prices of liquefied natural gas (LNG), its chief executive A K Singh said. Indian gas demand is already showing signs of recovery after global LNG prices fell to about US$11 per million metric British thermal units in Asian markets. Petronet operated its 17.5 million tonnes (mt) a year Dahej LNG terminal on the west coast at 97 percent in April compared to 77 percent in the three months to March, Singh said. India wants to raise the share of gas in its energy mix to 15 percent by 2030 from 6.2 percent at present. Singh said Indian LNG imports could have risen to 30 mt a year had there not been abnormal situations such as the COVID pandemic and Russia’s war in Ukraine. In the fiscal year to March 2023, India imported 20.1 mt of LNG, down from 25.6 mt in 2019/20 according to the government data. Singh said that demand in the later part of the year would depend on the winter season in the West and its implication on LNG prices. Singh expects capacity use at its 5 mt a year Kochi terminal in southern India to rise beyond 20 percent as Mangalore Refinery and Petrochemicals Ltd and a petrochemical plant could turn to gas from liquid fuels, drawn to the lower prices of the cleaner fuel. Petronet is adding two LNG storage tanks at its Dahej plant and one at its Kochi facility, Singh said.

National: Coal

Coal ministry to complete 67 first mile connectivity projects by 2027

5 May: The

coal ministry said that it will complete 67 first mile connectivity projects with a capacity of handling 885 million tonnes per annum (mtpa) by 2027. In order to eliminate road transportation of coal in mines, the ministry has developed a plan to improve the mechanised coal transportation and loading system under FMC projects. Crushing, coal size and quick computer-assisted loading are advantages of coal handling plants (CHPs) and silios with rapid loading systems, it said. The ministry has set a target to generate 1.3 billion tonnes (bt) coal in FY25 and 1.5 bt in FY30 to increase India’s energy security and realise AatmaNirbhar Bharat by substituting domestically mined coal for imported coal. A key objective is the development of environmentally friendly, quick, and cost-effective coal transportation. India’s coal production hit a milestone of 892 million tonnes (mt) during FY23, which is a y-o-y (year-on-year) growth of 14.7 percent. The power sector continued to be the largest consumer of domestic coal, accounting for the total despatches of 737.9 mt during FY23, an increase of 9.1 percent y-o-y. According to CareEdge, total coal imports surged by 26.18 percent y-o-y to 227.93 mt during April 2022 to February 2023 with non-coking coal accounting for 65 percent of the imports.

India amends power policy draft to halt new coal-fired capacity

4 May: India plans to stop building new coal-fired power plants, apart from those already in the pipeline, by removing a key clause from the final draft of its National Electricity Policy (NEP), in a major boost to fight climate change. The draft, if approved by the federal cabinet chaired by Prime Minister Narendra Modi, would make China the only major economy open to fresh requests to add significant new coal-fired capacity. India and China account for about 80 percent of all active coal projects as most developing nations wind down capacity to meet climate targets. As of January 2023, only 20 countries have more than one coal project planned, according to E3G, an independent climate think tank. The new policy, if approved, would not impact the 28.2 GW of coal-based power in various stages of construction. India, whose proposed coal power capacity is the highest after China, had repeatedly refused to set a timeline to phase out coal, citing low per-capita emissions, surging renewable energy capacity and demand for inexpensive fuel sources. Coal is expected to be the dominant fuel in generating electricity in India for decades, but activists have pressed for a halt to new coal-fired plants, arguing this would at least help to reduce the share of the polluting fuel in overall power output.

Nine years after ban, coal mining to resume in Meghalaya: CM

3 May: Coal mining in Meghalaya, banned since April 2014, is likely to be resumed legally by July. At an election rally on 1 May, Meghalaya Chief Minister (CM) Conrad K Sangma said the Centre had approved mining leases for four persons, thus paving the way for scientific mining in the State. Despite the ban on rat-hole coal mining, the fossil fuel has been extracted and transported illegally for years in Meghalaya. More than a fortnight ago, the High Court of Meghalaya declined to exonerate the State government from complicity in the export of illegally mined coal to the adjoining Bangladesh.

National: Power

Power Minister lays a foundation for p owergrid’s substation to add capacity

9 May: Union Power Minister R K Singh

laid the foundation stone for Powergrid’s substation in Bihar to expand capacity. The augmentation of the 220/132 kV Ara sub-station will increase the total transformation capacity of the sub-station to 560 MVA. The scheme would facilitate meeting the demand for electricity for the next 10 years in Ara (Bihar). Uninterrupted power supply will lead to the industrial and commercial development of the area and also improve power availability in Bhojpur, Buxar and Rohtas districts.

PTC India inks pact for 115 MW power supply from VS Lignite Power

8 May: Power trading solution provider

PTC India has inked a long-term power purchase agreement with VS Lignite Power for 115 MW of electricity supply. PTC India executed a long-term power purchase agreement (PPA) for 115 MW with VS Lignite Power Pvt. Ltd. VS Lignite operates a 135 MW lignite-fired power plant in the Bikaner district of Rajasthan. The power plant sources fuel from a captive lignite mine near the project. PTC plans to explore various opportunities to sell this power to state utilities under long-term, medium-term and short-term power sale arrangements.

DERC seeks figures from discoms to fix 2023-24 power tariff

7 May: The Delhi Electricity Regulatory Commission (DERC) has asked power distribution companies (

discoms) and other electricity utilities to submit their annual revenue requirement (ARR) figures by 21 May to help it initiate the procedure to determine the power tariff for the 2023-24 fiscal year. Power discoms, generation companies and transmission licensees have already filed their petitions for approval of the true-up of expenses for financial year 2021-22. It is incumbent on the regulatory commission to prepare and upload an executive summary of these petitions and invite comments and suggestions from consumers and other stakeholders before conducting public hearings and finalising the tariff order for each financial year. It was probably for the first time in 2022-23 that the DERC completed the entire exercise but did not announce the tariff order. As per the direction of the Union power ministry in 2021, all state power regulators should issue tariff orders before 1 April of a financial year. The ministry also said that tariff orders should be cost reflective. The DERC issued the tariff order for FY 2021-22 in September 2021.

Government approves INR 6.8 bn to upgrade Ladakh’s power distribution infra

3 May: The

central government has given its approval for the implementation of Revamped Distribution Sector Scheme (RDSS) in the Union Territory of Ladakh with a sanctioned cost of INR 6.87 billion. The power ministry conveyed its approval to RDSS for implementation in Ladakh. The scheme includes the grid connectivity of the Changthang region, downline infrastructure in the Zanskar region along with other loss reduction works in the Leh and Kargil districts of Ladakh.

National: Non-Fossil Fuels/ Climate Change Trends

Avaada Energy bags 280 MW solar project in Rajasthan

9 May: Avaada Energy said it has

bagged a 280 megawatts (MW) solar project from Rajasthan Urja Vikas Nigam Limited (RUVNL). The project, bagged through a bidding process, will be commissioned within 18 months, the Avaada Group company said. As per the bid terms, the solar power generated from the project will be supplied to RUVNL for 25 years at a tariff of INR 2.62 per kWh (kilowatt hour), it said. The plant will generate about 500 million units per annum which will help to reduce 4,65,500 tonnes of CO

2 equivalent emissions annually. The solar project can potentially power 3.6 lakh households with green energy.

Maharashtra Pench to turn greener by going completely solar

8 May: Pench Tiger Reserve (PTR), Maharashtra, will completely do away with electricity soon by implementing a INR 25 million project to run the ecotourism complexes,

water holes, camp offices, guest houses, and staff quarters exclusively on solar energy. Apart from this, over INR 50 lakh has been spent on making borewells, which have solar-powered pumps under the corporate social responsibility (CSR) by ICICI Foundation.

K P Energy commissions 29 MW wind energy project in Gujarat

8 May: K P Energy Ltd announced the

commissioning of a 29.4 megawatts (MW) wind energy project in Gujarat. The capacity is a part of the 250.8 MW ISTS connected wind power project capacity awarded by Solar Energy Corporation of India Limited (SECI) under Tranche-VIII bidding, the company said. With the present phase-II commissioning the net cumulative capacity commissioned stands at 81.9 MW.

Kerala State Electricity Board proposes INR 2.54 a unit as ‘green energy’ tariff

6 May: The Kerala State Electricity Board

(KSEB) has proposed INR 2.54 a unit as green power tariff for consumers who have opted for it in the current financial year. A green power tariff for the supply of power from renewable energy sources is a first for the KSEB. It has requested the commission to consider the proposal alongside the petitions on general tariff revisions for the 2023-24 to 2026-27 period which will be up for public hearings this month. Growing consumer demand in Kerala has prompted it to place the proposals before the commission, the KSEB said. It would enable interested consumers to fulfil their green energy/zero carbon emission commitments, according to the power utility. The Central government had notified the Electricity (Promoting Renewable Energy through Green Energy Open Access) Rules in 2022 and an amendment in 2023. These rules were meant to promote the generation, purchase and consumption of green energy, including energy generated at waste-to-energy plants. They entitle consumers to demand the supply of green power from distribution companies (discoms). The KSEB has proposed a condition that the consumers should apply one year in advance for the green tariff. Further, the consumers opting for it should avail it for a minimum of one year.

India considering allowing foreign investment in nuclear power

5 May: India is considering overturning a ban on foreign investment in its nuclear power industry and allowing greater participation by domestic private firms, as part of a push for cleaner energy. The measures have been recommended by a government panel, set up by think-tank Niti Aayog which is headed by Prime Minister Narendra Modi. Under India's Atomic Energy Act 1962, the government plays a central role in developing and running nuclear power stations. Domestic private companies are allowed to participate as "junior equity partners" by supplying components and helping build them. The panel has recommended changes to the act and to India’s foreign investment policies so that both domestic and foreign private companies can complement nuclear power generation by public companies. The aim is to reduce carbon emissions and nuclear is in focus because it can supply energy 24/7, unlike solar energy. India’s current nuclear power capacity is 6,780 MW and it is adding 21 more units with a capacity of 7,000 MW by 2031.

Kerala government, BPCL agree in principle to set up a plant in Kochi to process waste 3 May: The Kerala government and the Bharat Petroleum Corporation Ltd (BPCL) reached an in-principle agreement to

set up a plant in Kochi to process waste and produce compressed biogas, nearly two months after the port city witnessed a massive fire at the Brahmapuram dump site, exposing an outdated waste management practice. The natural gas produced through waste treatment will be used for BPCL’s operations. However, BPCL came up with the new proposal after finding that a natural gas plant would be more suitable for Kochi’s climate.

SJVN bags 200 MW solar project worth INR 12 bn from GUVNL

3 May: SJVN Ltd said it has bagged a

200 MW solar project worth INR 12 billion from Gujarat Urja Vikas Nigam Ltd (GUVNL). Bagged at a tariff of INR 2.88 per unit, the project will be set on Build Own and Operate (BOO) basis. The project is expected to generate 505 million units in the first year of commissioning and cumulative energy generation over a period of 25 years would be around 11,756 million units.

International: Oil

China’s April crude oil imports fall to lowest since January

9 May: China’s crude oil imports fell in April to the lowest level since January, customs data showed, as the country’s post-COVID economic rebound slowed amid a weaker global macroeconomic backdrop. Crude imports in April totalled 42.41 million tonnes (mt), or 10.3 million barrels per day (bpd), according to data from the General Administration of Customs. That was down 1.45 percent from the 10.5 million bpd of crude imported in April last year. Slower economic activity has put the brakes on refined fuel demand, particularly for diesel.

UN fails to raise enough money for Yemen oil tanker operation

4 May: The United Nations

(UN) fell far short of raising the money it needs for an operation to salvage 1.1 million barrels of oil from a decaying vessel moored off Yemen's coast and avert an environmental disaster. The UN has said the clean-up of a spill could cost USD $20 billion, but yet it is struggling to raise the US$ 129 million needed to remove the oil from the Safer and transfer it to a tanker, the Nautica, the UN bought for USD $55 million. The salvage operation cannot be paid for by the sale of the oil because it is not clear who owns it, the UN has said.

Russian oil companies ramp up May exports to meet Asian demand

4 May: Russia is expected to increase seaborne oil exports from its western ports this month to a four-year high to meet Asian demand for low-priced oil, two sources familiar with the loading plans from the ports said. Weaker global prices mean Russian oil trades below USD $60 per barrel, the price cap level imposed by Western countries, making it more attractive to Asian buyers as they have fewer issues with banks and compliance. Oil exports from Russia's main western outlets, Primorsk, Ust-Luga and Novorossiysk, will reach a combined 2.42 million barrels per day (bpd) this month, slightly up from 2.38 million bpd. Oil loadings from Primorsk and Ust-Luga will reach 7.5 million tonnes (mt), including Urals and Kazakhstan’s transit sold as KEBCO oil grade, up from 7.2 mt in April. Apart from weaker oil prices that are facilitating trade, more oil is available for export as oil refineries in Russia are undergoing seasonal maintenance in May, which reduces domestic demand. Russian refineries are expected to increase run rates in June as they emerge from maintenance and volumes of crude available for export are likely to decrease.

International: Gas

Global gas markets rebalancing, to remain tight in 2023: IEA

4 May: Global gas markets are gradually rebalancing but are expected to remain tight in 2023 amid lower Russian pipeline gas deliveries to Europe, the International Energy Agency (IEA) said. The European and global gas markets suffered a major supply shock in 2022 when Russia reduced its pipeline gas deliveries to the European Union by 80 percent, triggering a global energy crisis. Mild weather, an increase in liquefied natural gas (LNG) exports and a strong decline in gas demand helped to cushion the shock leaving Europe’s storage 60 percent full. The risks, which include adverse weather, such as a dry summer, lower availability of LNG, and the possibility of a further decline in Russian deliveries to Europe, could renew market tensions and price volatility. In Europe, gas consumption fell by a record 16 percent, or 55 billion cubic metres (bcm), during the 2022/23 heating season. LNG accounts for two-thirds of Europe’s gas imports, meeting around one-third of its gas demand during the 2022/23 heating season. European LNG imports rose by 25 percent, or 20 bcm during the heating season, with the United States supplying over 45 percent of incremental supply. But global LNG supply is forecast to increase by just 4 percent (or over 20 bcm) in 2023, which would not be sufficient to offset the expected reduction in Russia’s piped gas supplies to Europe. Meanwhile, China’s LNG imports, which declined by 20 percent in 2022, enabling higher LNG flows to Europe, recovered in March, supported by higher domestic demand.

International: Coal

China’s April coal imports drop on high stocks, weak demand

9 May: China’s coal imports fell in April from a 15-month high in the prior month, government data showed, as weak power demand, high inventories and sliding domestic prices curbed overseas purchases. The world’s top coal consumer brought in 40.68 million tonnes (mt) of fossil fuel last month, down from 41.17 mt in March, according to data from the General Administration of Customs. For the first four months of the year, China imported a total of 142.48 mt of coal, up 89 percent year-on-year, customs data showed. Daily coal consumption at utilities in eight coastal regions fell to around 1.74 million tonnes in late April from 1.87 million tonnes a month earlier, according to data from the China Coal Transportation and Distribution Association (CCTD). Coal inventory at utilities rose to around 32.6 mt as of the end of April, sufficient for 19 days of use, according to the CCTD data. Domestic thermal coal prices fell in April, with 5,500 kilocalories (kcal) coal declining to about 1,000 yuan (US$144.67) a tonne in northern Chinese ports from 1,130 yuan a tonne in late March. An expectation of weak coal prices in the coming weeks and the dwindling price competitiveness of overseas purchases provided little incentive for utilities to increase imports. Coal demand is forecast to pick up in the summer season from June to August amid expectations that lower-than-usual rainfalls in southern Chinese regions could curb hydropower generation and boost utilisation of coal-fired power plants.

International: Non-Fossil Fuels/ Climate Change Trends

Malaysia to lift export ban on renewable energy in accelerated transition plans

9 May: Malaysia will lift a ban on exports of renewable energy as part of efforts to develop its clean power industry and boost generation from non-fossil fuel sources, its economic affairs ministry said. The Southeast Asian country, which currently generates just over 1 percent of its electricity annually from renewable sources, banned its exports in October 2021 in the hopes of developing the local industry. Malaysia has pledged to cut its greenhouse gas emissions dramatically by 2030 and reach net-zero emissions by 2050. The International Renewable Energy Agency (IRENA) said that Malaysia will need to double its investments in renewable power capacity, infrastructure and energy efficiency to at least $375 billion in order to achieve that ambitious target. The government aims to increase the proportion of renewable energy supply to 70 percent of its total capacity by 2050 in a bid to create new economic opportunities and attract foreign investment. The current installed capacity is 25 percent of the total.

Australia to invest US$1.4 bn to scale up renewable hydrogen industry

9 May: Australia will invest A$2 billion (US$1.4 billion) to scale up development of its renewable hydrogen industry, the government announced in its annual budget, as it looks to accelerate clean energy projects in the country. Funds will be allocated under a "Hydrogen Headstart" programme that provides revenue support for large-scale renewable hydrogen projects through competitive hydrogen production contracts, the announcement said. The government said the funds would help bridge the commercial gap for early projects and put Australia on course for up to a gigawatt of electrolyser capacity by 2030 through two to three flagship projects Prime Minister Anthony Albanese’s government has also allocated about A$4 billion to renewable energy projects in the budget. It brings the total investment into renewable energy to more than A$40 billion.

UAE signs nuclear energy cooperation agreements with China bodies

7 May: Emirates Nuclear Energy Corporation

(ENEC), the body responsible for developing the United Arab Emirates' nuclear energy sector, has signed three agreements with Chinese nuclear energy organisations as it looks to boost low-carbon nuclear power. The UAE, which is hosting the COP28 climate summit this year and wants to get 6 percent of its energy needs from nuclear as part of its 2050 net zero plan, has previously said China would be a key partner in its energy transition plan.

Vietnam to more than double power generation by 2030, lower offshore wind target

5 May: Vietnam aims to more than double its power generation capacity by 2030, but has slightly lowered its target for offshore wind and will heavily rely on coal until the end of the decade, according to a government document. Total installed power generation capacity in the

Southeast Asian country is projected to reach 158 gigawatt (GW) by 2030, more than previously estimated and up from 69 GW in 2020, according to the document which detailed THE government's plans discussed with foreign investors and diplomats. The 2030 target for offshore wind capacity, which is expected to attract billions of dollars of foreign investments, is set at 6 GW from zero now, the document said - slightly lower than the 7 GW target included in a December draft of the country’s power development plan, which was reviewed. The country made a commitment at the United Nations climate conference in Glasgow (COP26) in November 2021 to become carbon neutral by 2050.

Australia’s biggest hydropower project faces delay to 2028

3 May: Australia’s biggest hydropower project faces a delay of up to two years, likely pushing its start-up out to 2028, the company said, in the latest setback for the A$5 billion (US$3.33 billion) renewable energy project. The updated guidance meant the first power could be generated as late as December 2028. The setback comes as the federal government aims to get 82 percent of the east coast market’s power from renewables by 2030, up from 30 percent.

Colombia oil regulator to invest USD $135 mn in renewable energy

3 May: Colombia’s National Hydrocarbons Agency

(ANH) will invest more than US$135 million in growing its knowledge of renewable energy options, the agency’s new president Clara Guatame said. The government of leftist President Gustavo Petro has set its sights on weaning Colombia from its dependence on oil exports, a major source of income for the Andean country, as it moves to transition to cleaner energy sources.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Draft National Electricity Plan 2022

Source: Draft National Electricity Plan 2022