Quick Notes

India as a gas-based economy: Insights from Gujarat

Background

The share of natural gas in Gujarat’s primary energy mix is about

23 percent, close to the global average of

24 percent and four times the share of gas in India’s primary energy basket. Gujarat has the most extensive gas pipeline network in the country with over

3370 kilometres (km) of main lines that accounts for about 20 percent of gas pipelines of length

21,102 km in the country. Gujarat’s per capita natural gas consumption at

191 kgoe (kilogram oil equivalent) is 400 percent higher than the national average of

39 kgoe. Consumption of natural gas of

11,667,095 SCMD (standard cubic metres per day) through CGD (city gas distribution) by Gujarat in the first half of 2023 accounted for roughly

34 percent of total CGD consumption, the highest in the country. In 2022, Gujarat had the highest number of CNG (compressed natural gas) stations accounting for over

19 percent of total CNG stations in the country, the highest number of domestic PNG (piped natural gas) connections accounting for about

27 percent of the total, the highest number of commercial PNG connections accounting for

59 percent of the total and the highest number of industrial PNG connections accounting for

39 percent of the total. Gujarat has the second largest number of CNG vehicles with over

27 percent of the total at the national level after Delhi NCR which had a share of

37 percent.

The success of Gujarat’s gas industry can be traced to the discovery of gas in Gujarat in the 1960s. This geographic proximity to gas supplies along with the enthusiasm of the Government of Gujarat to enlist industrial consumers with favourable prices which in turn led to investment in an extensive gas pipeline network was critical for the success of the gas industry in Gujarat.

Proximity to Supplies

The Oil and Natural Gas Commission (ONGC) discovered oil in the Cambay basin,

Gujarat in 1958 and in Ankleshwar, Gujarat in 1960, just a few years after ONGC was set up. In fact, ONGC began exploration in Gujarat only after Oil India Limited (OIL) which was developing oil discoveries in Digboi in

Assam in 1889 refused to work in Gujarat. Since ONGC’s front-end activity was exploration, the discipline of

geology enjoyed great prestige in the early years and was central to strategic planning in the company. This led to discoveries in regions that were not thought to be attractive petroleum prospects by mature oil companies. The first major oil-find of ONGC in

Ankleshwar located about 80 km south of Vadodara and nearly 160 km south of Khambhat was so productive that, the Prime Minister of India Jawaharlal Nehru called it a ‘

fountain of prosperity’. With Ankleshwar, Gujarat became one of the earliest

oil & gas producing states in the country. Many oil & gas discoveries followed and now Gujarat receives natural gas from

six gas producing areas in Ahmedabad, Mehsana, Kadi, Kalol, Ankleshwar and Gandhar. Besides, Gujarat also receives offshore gas from Bassein field off the Mumbai coast and other satellite gas fields amounting to

40 percent of gas produced in India. The LNG (liquified natural gas) import capacity of

42.7 million tonnes per annum (MTPA) in Gujarat accounts for more than

64 percent of total LNG import capacity in India but in terms of actual imports LNG terminals in Gujarat account for over

95 percent of total gas imports into India.

Investment in Infrastructure

All countrywide

major gas pipelines originate from the coastal locations of Gujarat. Besides, gas companies developed smaller pipelines from gas producing fields to specific consumers in Gujarat. Gujarat is the only state where the gas pipeline network is operated by more than

one player, GAIL (Gas Authority of India Ltd), GSPL (Gujarat State Petronet Limited) and Gujarat Gas Limited (GGL). GAIL primarily serves consumers who have been

allocated natural gas by the Ministry of Petroleum & Natural Gas (MOPNG) with several customers connected on HVJ (Hazira-Vijaipur-Jagdishpur) Pipeline, DVPL (Dahej-Vijaipur) and DUPL (Dahej-Uran-Panvel) pipelines.

GSPL is the nodal pipeline agency in Gujarat with the mandate to set up a gas grid operating on a common carriage basis. GSPL pipelines serve

consumers in the Hazira, Vapi, Halol, Bharuch, Vadodara, Ahmedabad, Morbi, Rajkot, Jamnagar, Mehsana, Himmatnagar & Kutch regions. The pipeline obtains gas from the

GSPC (Gujarat State Petroleum Corporation) owned onshore gas fields in Hazira. The network also obtains gas from

Cairn at Mora from its Suvali gas complex, imported gas from Petronet and Hazira LNG terminals and domestic gas from fields such as the Panna-Mukta and Tapti (PMT) and

ONGC Olpad fields.

GSPL pipeline network is connected to the East West Pipeline that transports gas from KG D6 field in Andhra Pradesh to Gujarat at Attapardi (Vapi) and Bhadbhutt (Bharuch).

Consumer Friendly Pricing

One of the earliest consumers of natural gas produced in and around Gujarat was the Gujarat state electricity board, whose

Dhuvaran Project used the gas for power generation. Though this was seen by experts as a gross misuse of the gas and waste of a valuable natural resource (as opposed to using the gas that was rich in

higher hydrocarbons for fertiliser production in the Baroda fertiliser plant which was burning naphtha from the Koyali refinery) burning gas for electricity generation continued as it was thought to be a cost-effective substitute for coal which had to be transported across thousands of kilometres. It was the 1960s and gas was a relatively new form of energy which initiated a debate over

how to price natural gas for consumers such as the Gujarat state electricity board. Speaking on behalf of the electricity board, the state fertiliser company and smaller private companies that were potential users of gas, the Gujarat government demanded a price of

INR 0.02-0.03 per cubic metre (m3) much lower than of the

INR 0.08-0.10/m3 that ONGC wanted. The argument made by the government was that Gujarat had suffered on account of its great distance from

coal mines and that it should be allowed to benefit from a new local source of energy. The price should, the government demanded, be fixed on a

cost-plus basis. The government of Gujarat also cited the far lower price of

INR 0.009/m3 charged by OIL (Oil India Ltd) in Assam and challenged the substitution principle that pegged the gas price to the prices of naphtha and fuel oil. The government of Gujarat also noted that being

associated with gas (produced along with more valuable oil) the cost of gas production was negligible for ONGC. The dispute between ONGC & the government of Gujarat ended in arbitration and the price of

INR 0.05/m3 awarded was closer to the price demanded by the Gujarat government on behalf of consumers. This price was questioned by economists who argued that ONGC must be run on a

commercial basis and the development of Gujarat need not be subsidised by ONGC, a public corporation. In the absence of direct competition between fuels, the economists pointed out, the rational price of a fuel must bear some relation not only to the investment made on it but to the price of the next most easily

available fuels (which were naphtha and fuel oil). But gas pricing settled at a level that

favoured consumers at the expense of the producer, ONGC. Lack of competitive parity, in relation to other fuels and alternative end-uses, has for long distorted fuel policy in India. The error was compounded in natural gas and it continues till today. Domestic gas production (ONGC and other private sector producers) is penalised with

regulated low prices. But in the early years, low prices relative to substitutes such as coal and fuel oil boosted consumption of natural gas in Gujarat. It is very unlikely that competitive pricing of natural gas comparable to substitutes would have created a vibrant gas market in Gujarat.

Expansion of Distribution

Gujarat Gas Limited (GGL) was incorporated under the name of Gujarat Amico Chem Limited by promoters Mafatlal Fine Spinning & Manufacturing Company Limited and Gujarat Industrial Investment Corporation (GIIC) in the 1980s to distribute

gas production by ONGC from fields in Gujarat. GGL was so optimistic about the prospects for gas distribution that it signed an agreement with a Qatar based

subsidiary of Enron for importing and transporting LNG for a power plant. In the 1990s,

British Gas acquired a stake in GGL which was divested in the 2010s. Today, GGL is India's

largest city gas distribution (CGD) player with presence spread across 22 districts in Gujarat and union territory of Dadra Nagar Haveli and Thane which includes Palghar district of Maharashtra. The company has India's

largest customer base in major user segments. In 2015, GGL executed a gas purchase contract for

regasified LNG with GSPC (Gujarat State Petroleum Corporation). In 2016, the PNGRB (Petroleum and Natural Gas Regulatory Board) granted authorisation to the company to lay, build, operate or

expand CGD networks for the geographical area of Amreli, Baruch, Dahod Panchmahal, Anand and Ahmedabad districts in Gujarat. As per the provisions of the PNGRB, GGL was granted 300 months of infrastructure exclusivity valid up to

May 2041 and 60 months of marketing exclusivity valid up to

26 May 2021 for the CGD network. GGL’s projects are almost entirely based on its own know-how and technology and indigenously available plant and equipment. This has minimised project cost and consequently reduced the cost of distribution to a level lower than that of other existing and planned gas distribution projects.

Issues

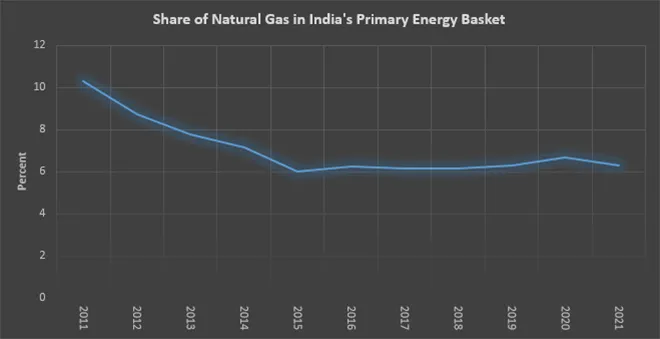

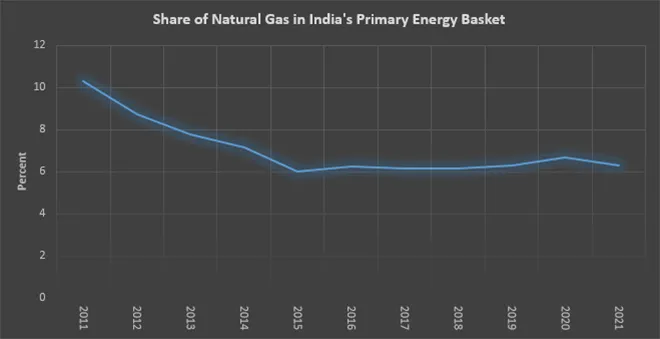

The share of natural gas in India’s primary energy basket (not including biomass) has fallen from about

10.3 percent in 2011 to

6.3 percent in 2021, roughly the same level as in 2019 which was last pre-pandemic year. The goal of making India a “

gas-based economy” by increasing the share of natural gas in India’s primary energy basket to 15 percent is likely to remain a challenge. Even when critical drivers such as security of supply, low prices relative to alternatives and investment in pipeline infrastructure were in place, the development of a gas market in Gujarat took nearly five decades. This was the case even in much larger and more transparent gas markets in the USA and Europe. In the case of India, security of domestic supplies is uncertain. Though there is a liquid global market for LNG, there is uncertainty over price especially in comparison to alternatives such as domestic coal. Investment in infrastructure is progressing but there is much ground to cover. Overall, replicating the success of Gujarat’s gas market across the country will be difficult but not impossible.

Source: BP Statistical Review of World Energy, 2011 to 2022

Source: BP Statistical Review of World Energy, 2011 to 2022

Monthly News Commentary: Oil

LPG Subsidies Decline Substantially

India

LPG

While a recent hike of

INR 50 in the price of the 14.2 kg domestic liquefied petroleum gas (LPG) cylinder led to the cost of the cylinder touching INR 1,103, the price has registered a rise of nearly 56 percent in the last four years. The retail selling price (RSP) of a domestic LPG cylinder (14.2 Kg) on 1 April 2019 was INR 706.50 which increased to INR 744 in 2020, INR 809 in 2021 and INR 949.50 in 2022. The price increased to INR 1,103 from INR 1053 on 1 March this year. While the price of the domestic LPG cylinder has recorded a substantial rise over the last few years, government data disclosed that the total subsidy on LPG has come down significantly over the last few years. Details of the subsidy on LPG given by the government during each of the last four years showed that it was INR 372.09 billion (bn) (US$4.53 bn) in 2018-19 and came down to INR 241.72 bn in 2019-20, INR 118.96 bn in 2020-21 and INR18.11 bn (US$220.3 mn) in 2021-22. As per the information from the Ministry of Petroleum, the prices of petroleum products including LPG in the country are linked to the price of respective products in the international market. The Pradhan Mantri Ujjwala Yojana (PMUY) was launched in 2016 to provide deposit free LPG connections to women members of poor households under which 80 million (mn) connections were given. Under Ujjwala 2.0, all PMUY beneficiaries are provided a free first refill and stove as well, in addition to deposit free LPG connections. As on 1 February 2023, 16 mn connections have been given under Ujjwala 2.0. During the COVID-19 pandemic, as a pro-poor initiative, the government announced a scheme for providing up to three free of cost LPG refills to Ujjwala beneficiaries from 1 April 2020 under the Pradhan Mantri Garib Kalyan Package (PMGKP).

If the international price of fuel comes down from its current price of US$750 per metric tonne,

domestic LPG can then be sold at "even more economical rates," the Centre told Lok Sabha. Union Minister for Petroleum and Natural Gas Hardeep Singh Puri was replying to questions of the members who wanted to know why the cost of the domestic gas cylinders is not being reduced. He said the government is "sensitive" to the requirements of the consumers, particularly the most vulnerable.

Demand

India’s fuel demand witnessed the sharpest rebound in February as petrol and diesel consumption rose by double digits after a winter lull in the previous month, preliminary industry data showed. Petrol sales of state-owned fuel retailers jumped 12 percent to 2.57 million tonnes (MT) in February, as compared to 2.29 MT of consumption in the same period of last year. Sales were 1.57 percent higher than in COVID-marred February 2021 and 20 percent more than in the same period of 2020. Month-on-month, the demand was up 13.5 percent, reversing the dip in the previous month. Sales had fallen 5.1 percent month-on-month in January as cold conditions cut vehicular movement. Diesel, the most used fuel in the country, posted a 13 percent rise in sales during February to 6.52 MT, as compared to the same period last year.

India's fuel demand slipped in January after hitting a nine-month peak in December, hit by lower mobility due to cold weather in parts of the country and a slowdown in industrial activity. Consumption of fuel, a proxy for oil demand, was about 4.6 percent lower than the previous month at 18.7 MT in January, the oil ministry’s Petroleum Planning and Analysis Cell (PPAC) data showed. Sales of diesel fell 7.6 percent in January from a month ago to 7.18 MT, while sales of gasoline, or petrol, fell 5.3 percent to 2.82 MT.

Retail Prices

Maharashtra’s opposition Maha Vikas Aghadi

(MVA) staged a noisy protest against the steep hike in cooking gas prices for domestic and commercial users and demanded a rollback. A majority of the MVA legislators from Congress-Nationalist Congress Party-Shiv Sena- UBT demonstrated with banners and placards on the footsteps of the Maharashtra Legislature. They raised slogans against the government for inflicting yet another hike on gas prices which have made life miserable for poor and middle-classes in the country. The Centre announced a hike of INR 50 on a domestic LPG cylinder of 14.2 kg, and INR 350.50 (US$4.26) on a commercial cylinder of 19 kg. Accordingly, the prices of cooking gas cylinders have now shot up from INR1,053 to INR1,103, and of the commercial cylinders prices from INR1,769 to INR 2,119.50 (US$25.8).

Refining

Hindustan Petroleum Corp Ltd

(HPCL) plans to start its 9 MT a year Barmer refinery and petrochemical project in Rajasthan state by January 2024, Oil Minister Hardeep Singh Puri said. India, the third biggest oil importer, is expanding refining capacity to meet rising demand for fuel and petrochemicals to power economic expansion. India's per capita petrochemical consumption is about a third of the global average. He said the project, which covers 4,800 acres, would produce 2.4 MT a year of petrochemicals and cut the annual petrochemical import bill by INR260 bn (US$3.14 bn). The Barmer refinery and petrochemical project will produce gasoline and gasoil for retail sales and will use naphtha, liquefied petroleum gas and kerosene as feedstock to make petrochemicals. The company would look at importing oil from the Middle East to start the project, which will also process 1.5 MT a year of locally produced oil. The Barmer complex, executed by HPCL Rajasthan Refinery Ltd, could double capacity to 18 MT a year, he said.

Production

Oil and Natural Gas Corp

(ONGC) said that it will put in over US$2 bn in drilling 103 wells in Arabian Sea as it works on a turnaround plan that is aimed at adding 100 MT to production. ONGC has three main assets off the west coast: Mumbai High, Heera and Neelam, and Bassein and Satellite, which contributed the bulk of 21.7 MT of oil and 21.68 billion cubic metres (bcm) of gas is produced in 2021-22. The development is estimated to enhance production by over 100 MT of oil and oil equivalent gas over the life of the field and the investment involved in drilling and facilities will be over US$2 bn. ONGC produces two-third of the total oil and gas produced in India, and the incremental production from the development will help the country cut dependence on imports to meet its energy needs. India imports over 85 percent of the crude oil, which is later converted into fuels such as petrol and diesel; and imports almost half of the natural gas that produces electricity, makes fertilisers and provides CNG.

Exploration for crude oil and natural gas in the northern bank of Brahmaputra in Assam will commence soon with the state government entering into an agreement with Oil India Ltd (OIL). The Assam government signed petroleum exploration licence (PEL) deeds of two open acreage licensing policy (OALP) blocks with the PSU. It is for the first time that exploration for crude oil and natural gas will be done on the northern bank of Brahmaputra in the lower Assam region. OIL will invest around INR 120 mn (US$1.46 mn) in the projects, and will start the seismic survey this month itself.

Transport

Workers of Chennai Petroleum Corporation Limited

(CPCL) plugged the leak of crude oil from a crack in the underwater pipeline that resulted in an oil spill a few kilometres off the Nagapattinam coast. The leak occurred in the nine-km long pipeline used to carry crude from the Oil and Natural Gas Corporation (ONGC)’s Narimanam oil wells to the CPCL’s, now defunct, second refinery at Nagapattinam. CPCL said the leak in the 20-inch dia pipeline was detected. Oil dispersants had been deployed to clear the oil and a recovery system was deployed to clear the area in totality. This activity will be continued till the area is clear of hydrocarbons. The pipeline will also be flushed to make it free of hydrocarbons.

India has withdrawn trading licences for oil tankers and bulk carriers that are more than 25 years old, its shipping regulator said, as the world’s third-largest greenhouse gas emitter looks to cut emissions and reduce the average age of its fleet. The order bans acquisition of such vessels that are more than two decades old. Under current guidelines, vessels that are less than 25 years old can be acquired without any technical clearance. The average age of the Indian fleet has been increasing in recent years, bucking a global declining trend. The regulation requires oil tankers older than 15 years to improve their working condition and subjects bulk carriers to additional checks to ensure adherence to high international standards. The new norms would also apply to foreign vessels discharging in India, the regulator said, adding that existing vessels affected by the new cap on lifetime of operating vessels shall be allowed to sail for three more years, regardless of their current age.

More Indian firms are attracted to buying Russian naphtha as low-cost feedstock for their refineries and petrochemical plants after price caps imposed by Western nations. Prices for refined products such as naphtha and fuel oil are capped at US$45 a barrel by the Group of Seven nations, the European Union, and Australia in a scheme aimed at curbing Moscow funding its war against Ukraine. India’s interest in ramping up Russian oil products imports comes after the world's third largest crude importer became Moscow’s top oil client after China as the West shunned supplies from Moscow. Cheap Russian crude has shaved costs at Indian refiners and boosted margins. Reliance Industries Ltd (RIL), the owner of the largest refining complex in the world, boosted its imports of Russian naphtha imports in February to about 222,000 tonnes, ship tracking data from Refinitiv showed. RIL began importing Russian naphtha in September and by the end of January had shipped in about 217,000 tonnes, the data showed. RIL, already India’s largest buyer of Russian naphtha and fuel oil, would consider increasing imports further. State-owned refiners Bharat Petroleum Corporation Ltd (BPCL) and Indian Oil Corporation (IOC), which have petrochemical facilities, are also looking for opportunities to buy Russian naphtha. Haldia Petrochemicals Ltd would also consider buying Russian naphtha if the quality and cost are suitable for its plants. However, Indian refiners are unlikely to purchase Russian diesel as import costs are high after adding US$10–US$15 per barrel in freight and insurance costs to the US$100 price cap for the fuel.

Rest of the World

Africa & Middle East/ OPEC+

A French court has dismissed a landmark lawsuit against controversial TotalEnergies projects in east Africa, which was filed by six French and Ugandan activist groups in 2018, using a 2017 law on multinationals operating outside France. This was the first time that NGOs tried to halt an oil project through a Paris courthouse.

As Uganda looks to drill its first of more than 400 oil wells and build a 1,400-kilometre pipeline, part of the massive Tilenga project in Uganda, critics have said the government and its French and Chinese partners are damaging the environment and impeding wildlife migration. The court’s ruling rejected the case against oil giant Total Energies that was accused of failing to protect people and the environment as it pursues oil projects in Uganda and Tanzania. The world’s longest heated oil pipeline will pass through forest reserves and game parks before running alongside Lake Victoria, a source of fresh water for 40 million people.

Strong pick-up in fuel demand in China and flattish supply from other producers will push the

oil market into deficit in the second half of this year, leading OPEC (Organization of the Petroleum Exporting Countries) to reverse its production cut at the June meeting, analysts at Goldman Sachs said. OPEC+, comprising the OPEC and allies such as Russia, agreed in October to cut oil production targets by 2 million barrels per day (bpd) until the end of 2023. The bank said in a note that it expects oil prices to rise gradually to US$100 per barrel by December, assuming OPEC increases output by 1 million bpd in the second half. However, if OPEC were to stay put, then Brent would likely reach US$107 per barrel in December, and keep grinding higher thereafter, it said. Saudi Energy Minister Prince Abdulaziz bin Salman said the current OPEC+ deal on oil output would be locked in until the end of the year, adding he remained cautious on Chinese demand forecasts. Russia plans to reduce its crude oil production in March by 500,000 bpd, or about 5 percent of output. Goldman Sachs lowered its Brent price forecast for the second quarter to US$90 per barrel from US$105 per barrel.

Russia/Central Asia

A 500,000 bpd cut to Russian oil production announced will apply only to March output for now, Deputy Prime Minister (PM) Alexander Novak said. The cut will be made from January output levels, he said. He has said production stood at 9.8 million-9.9 million bpd. A European Union ban on purchases of Russian oil products from 5 February and price caps on oil and oil products are complicating Moscow’s efforts to sell its oil globally.

Moscow’s trade partners have increasingly paid more for Russian crude than quoted prices suggest, Goldman Sachs said in a note, cushioning Russia from the impact of Western sanctions. The bank in a note estimated that the gap between the average effective price paid and the quoted price has widened since last March, and reached around US$25 per barrel in December. In response to the latest Western sanctions, including price caps designed to limit Moscow’s revenues, Russia said it would cut oil production by 500,000 bpd, in March this year. International Brent crude spiked to levels close to all time highs following Russia's invasion of Ukraine nearly a year ago, but later eased and Russia’s benchmark Urals blend has traded at deep discounts as European buyers have shunned it. Russia's State Duma introduced a bill setting discounts for Russian oil exports, which typically trade at a discount to dated Brent. Goldman Sachs lowered its oil price forecasts for this year and next but said it still expects prices by December to rise gradually to US$100 a barrel.

North & South America

Guyana’s coming auction of offshore oil exploration blocks has lured at least 10 companies including Shell, Petrobras and Chevron, to consider the decade’s hottest oil region. The South American country is offering 14 offshore blocks in an attempt to speed economic development and reduce an Exxon Mobil-led consortium's dominance of its oil sector. Winning bidders are expected to be picked next month. Guyana Vice President Bharrat Jagdeo spoke at the CERAWeek energy conference in Houston to drum up support for the country's first competitive bidding round. Guyana is considering a state investment firm that would hold stakes with partners in offshore blocks offered through government-to-government talks, Guyana Vice President Bharrat Jagdeo said. Guyana estimates it has up to 25 billion barrels of oil and gas in place off its coast. A consortium that includes Exxon Mobil, Hess and CNOOC operates the country’s most important area, the 6.6-million-acre (26,800 sq km) Stabroek block, with more than 30 discoveries to date. Exxon, QatarEnergy, Shell PLC, Chevron Corp and Petrobras are among the oil giants that have paid US$20,000 for the geologic information available on the 11 shallow water and three deep-water blocks.

United States (US) President Biden administration is weighing

approval of a major oil project on Alaska’s petroleum-rich North Slope that supporters say represents an economic lifeline for Indigenous communities in the region but environmentalists say is counter to President Joe Biden’s climate goals. A decision on ConocoPhillips Alaska’s Willow project, in a federal oil reserve roughly the size of Indiana, could come by early March. On average, about 499,700 barrels of oil a day flow through the trans-Alaska pipeline, well below the late-1980s peak of 2.1 million barrels.

US oil drilling activity has begun to decline in response to the downturn in prices since the middle of 2022 - which will translate into slower production growth throughout the rest of 2023 and into 2024. The number of rigs drilling for oil fell to 600 in the week ending on 24 February, down from a recent peak of 627 in the week ending on 2 December, oilfield services company Baker Hughes found. When prices rise, delays reflect the time needed to confirm a change in price level is persistent rather than temporary, contract extra rigs, move them to the drill site, erect the equipment, and begin boring. When prices fall, the lag reflects time needed to confirm the trend, finish part-drilled wells, drill wells already under contract, and idle unneeded rigs. Prices are roughly 15 percent below year-ago levels and still trending lower, implying drilling is likely to continue falling through the end of June 2023. The current slowdown in drilling is therefore likely to reduce production growth through the end of 2023 and probably into 2024. The Energy Information Administration (EIA) forecasts US production will be only 340,000 bpd (2.7 percent) higher in December 2023 than it was in December 2022.

Guyana Vice President Bharrat Jagdeo said the

country plans to take back 20 percent of the giant Stabroek oil block that has been responsible for a series of massive discoveries from a consortium led by Exxon Mobil Corp, and remarket it by next year. More than 11 billion barrels of oil and gas have been found to date in the 6.6 million acre (26,800 sq km) block. The group’s contract allows Guyana to reclaim unexplored portions this year, he said. Guyana is pursuing a multi-pronged strategy to lessen the consortium’s grip on the country’s oil resources, he said, and spur new oil production. The US-Chinese group produces 380,000 barrels of oil and gas per day from two projects within the Stabroek block, and expects to increase output to 1.2 million barrels by 2027. The least-developed country in South America expects to collect US$1.63 bn in oil royalties and fees this year. One year ago, he said Guyana wanted to recruit state-controlled oil companies to develop new fields. The decision to reclaim existing Exxon blocks signals urgency to speed development.

The country is also considering allocating extra blocks to countries including Brazil, Qatar and India through bilateral agreements, he said.

Asia Pacific

China’s seaborne imports of Russian oil are set to hit a record after refiners took advantage of cheap prices as domestic fuel demand rebounded, but Russia’s plan to cut exports will likely cap buying in coming months. Hefty Chinese buying, alongside robust Indian demand, has been spurred by steep price discounts but is providing Moscow much-needed revenue after the Group of Seven imposed a US$60 price cap on Russian crude. Tanker tracking consultancies Vortexa and Kpler estimated nearly 43 million barrels of Russian crude oil, comprising about at least 20 million barrels of ESPO Blend and 11 million barrels of Urals, are set to reach China in March. The previous high for Russian seaborne crude imports was 42.48 million barrels in June 2020, ship tracking data showed. China, Russia’s largest oil buyer including via pipelines, has been taking steady volumes of ESPO crude as refiners - mostly its independent plants - favour the oil’s high quality and proximity. ESPO Blend is a light, low sulphur grade exported from Far East ports. State refiners, however, scaled back buying Urals crude in late 2022 due to worries about sanction risks after Western governments imposed a price cap on Russian oil imports and implemented embargoes over Moscow’s invasion of Ukraine. State-owned PetroChina and Sinopec recently resumed buying Urals - a medium heavy, high sulphur crude loaded from Russia’s European ports - after receiving permission from their headquarters, looking to boost refining margins.

China’s Yulong Petrochemical said it had signed Memorandum of Understanding (MoU) agreements with

BP and Chevron to supply its 400,000 bpd greenfield refinery in northern China. Yulong Petrochemical, which is building the refinery and a 1.5 million tonnes per year ethylene complex in Shandong province, is aiming to start commercial operation of the whole complex by December 2024. The new refinery in Longkou county in Shandong province is aiming to carry out test runs late this year. The US$20 billion Yulong project will add to two large similar-sized refinery and petrochemical complexes started late last year, in China’s latest wave of refining expansion focused on petrochemical products such as plastics and chemical fibre rather than transportation fuel. The Yulong refinery will help Shandong, China’s No.3 provincial economy, scale up its fragmented refining sector, made up of some 60 small refiners, in line with Beijing's push to close inefficient plants and build large, competitive manufacturers. The province was expected to have closed down 10 smaller refineries with combined refining capacity of more than 500,000 bpd by the end of last year to make way for the Yulong plant.

Companies in Singapore will have to consider and manage any potential impact on their business activities, transactions, and customer relationships when dealing with Russian crude oil and refined products.

Russia’s oil trade faces multiple restrictions imposed by the West and Moscow in the wake of the Ukraine war. The European Union (EU) has imposed bans on Russian crude and oil products imports while the Group of Seven nations, EU and Australia agreed to ban the use of Western-supplied maritime insurance, finance and brokering for seaborne Russian oil priced above pre-set levels. In turn, Russia has banned any deals that involve applying the price cap mechanism.

EU & UK

Norway’s Equinor is close to reaching

a deal to buy Suncor Energy’s British North Sea oil and gas assets for around US$1 billion. The deal includes Suncor’s 40 percent stake in the Equinor-operated offshore Rosebank oil and gas project, located some 130 km (80 miles) northwest of Shetland Islands, and one of the largest developments in the ageing basin. The deal follows the British government’s decision late last year to increase a windfall tax on North Sea oil and gas producers to 35 percent from 25 percent, bringing the total tax rate to 75 percent, one of the highest in the world. Suncor flagged plans to divest its upstream assets in Britain last August as the company aims to focus on its core oil sands operations in northeast Alberta. The deal also includes a 29.9 percent stake in the Buzzard oilfield, the largest supplier to Forties, one of North Sea crude oil grades underpinning the Brent crude benchmark, delivering more than 20,000 barrels of oil equivalent (boe) net to Suncor, according to the company.

Equinor has agreed to sell its South Riding Point oil terminal in the Bahamas to Estonian logistics and investment company Liwathon Group, the Norwegian oil and gas producer said. A 2019 hurricane damaged the 6.8 million barrels capacity terminal, causing an oil spill that affected a nearby forest as well as the site. Equinor said testing of the groundwater outside the terminal, following clean-up operations, had shown no sign of hydrocarbon deposits. Liwathon, formerly called AS Vopak, operates four oil liquid terminals in Estonia with a total storage capacity of 6.7 million barrels.

News Highlights: 8 – 14 March 2023

National: Oil

SC directs CPCB to ensure VRS installation at retail petroleum outlets

14 March: The Supreme Court (SC) directed the Central Pollution Control Board

(CPCB) to ensure all retail petroleum outlets located in different cities having a population of more than 10 lakh and a turnover of over 300 kilolitres a month install Vapour Recovery System (VRS) mechanism within the fresh timeline prescribed by the CPCB. VRS is a process which can arrest the release of harmful organic compounds from petroleum products. The top court said it has taken notice of the fact that the CPCB, in consultation with the Ministry of Petroleum and Natural Gas, has issued circulars/guidelines from time to time for installation of VRS.

Western countries 'not unhappy' that India is buying Russian oil: Puri

14 March: Petroleum Minister Hardeep Singh

Puri said Western countries are "not unhappy" that India is buying Russian oil, and pointed out that had India bought more oil from Gulf countries , it would have pushed up crude prices. India shunned western pressures to raise imports from Russia last year. Russia, whose oil is available at a discount due to some western nations slapping sanctions, is now India’s top oil supplier. Puri said that India as a sovereign country has always exercised the right to source its energy from wherever it can at the most affordable prices. In the last few years, India, the world’s third-largest energy consumer, has diversified the source of energy from 27 countries to 39 countries, he said. From just 0.2 percent of all oil imported by India, Russia in January supplied 28 percent.

Puducherry CM announces monthly LPG subsidy of INR300

13 March: The

Puducherry government announced a INR300 monthly LPG subsidy for the people of the Union Territory (UT), earmarking INR 1.26 bn for the scheme. Chief Minister (CM) N Rangasamy made the announcement in the UT budget presented for the year 2023-24. He presented a INR 116 bn tax free budget. The LPG subsidy initiative would benefit all families possessing family ration cards. Meanwhile, Lt Governor Tamilisai Soundararajan welcomed the CM’s announcements on LPG subsidy and assistance to girl children.

VAT on jet fuel cut to 18 percent in Mumbai, Pune and Raigad

10 March: In a major relief to commercial airlines, the state government in its budget announced a reduction in Value Added Tax (VAT) levied on aviation turbine fuel

(ATF) to 18 percent from 25 percent in the city, Pune and Raigad. Now, VAT on ATF has been brought down to 18 percent in two of the top three airports in the country. As the airport here is the second busiest in the country, the drop in VAT is expected to bring considerable savings to airlines. In Delhi, the busiest airport in the country, VAT on ATF continues to be high at 25 percent. In December 2021, VAT on ATF charged at the third busiest airport in the country, Bengaluru, was brought down to 18 percent from 28 percent. Civil Aviation Minister Jyotiraditya Scindia tweeted that with the cut, the state had joined the group of 19 states and union territories that had rationalised VAT rates in the past year and a half. ATF is heavily taxed in the country and typically accounts for about 45 percent of the operating cost of an airline. When ATF prices hit a high in June, the fuel was costing airlines INR 120 per litre in the city. Following efforts by the civil aviation ministry, VAT on the jet fuel was brought down to 5 percent in Gujarat and 18 percent in Karnataka.

India’s February fuel demand hits at least 24-year high

9 March: India’s fuel demand hit its highest level in at least 24 years in February, data showed, with industrial activity in Asia’s third biggest economy boosted by cheap Russian oil. Consumption of fuel, a proxy for oil demand, rose by more than 5 percent to 4.82 million barrels per day (18.5 million tonnes) in February, its 15

th consecutive year-on-year rise, data showed. Demand was the highest recorded in data compiled by the Indian oil ministry’s Petroleum Planning and Analysis Cell (PPAC) going back to 1998. The strength highlights a combination of profitable refining from record Russian crude imports in February, total utilisation for primary distillation across India and still-robust domestic consumption, Viktor Katona, lead crude analyst at Kpler said. Katona forecasts demand in March at 5.17 million barrels per day (bpd) and then the seasonal monsoon-driven slowdown will lead to it to drop to 5 million bpd in April-May. Sales of gasoline, or petrol, rose 8.9 percent year-on-year to 2.8 million tonnes (MT) in February, while diesel consumption climbed 7.5 percent to 6.98 MT. Sales of jet fuel jumped more than 43 percent to 0.62 MT, the data showed.

National: Gas

Oil India denies reports of gas leak at Baghjan oil well

13 March: Oil India Limited

(OIL) has denied reports about a gas leak at its Baghjan plant in Tinsukia district on 8 March. In May 2020, a high-intensity blowout had occurred at OIL’s Baghjan well no. 5 that lasted for 173 days.

National: Coal

Coal India ready to meet dry fuel demand from power sector

14 March: Amid early onset of summer and a pick-up in industrial demand for electricity, Coal India Limited

(CIL) said it is geared up to meet the demand of dry fuel from the power sector. The public sector coal producer also expressed hope to supply 156 million tonnes (MT) of coal to the power sector during April-June quarter of FY24. This would be 25.6 percent of the enhanced annual dispatch target of 610 million tonnes (MT) slated for the sector in 2023-24. CIL, which accounts for over 80 percent of domestic coal output, is a major supplier of dry fuel to the electricity generating plants. Factors in favour of CIL are a strong 68 MT coal stock build-up expected at its pitheads by the end of current fiscal, which as of Monday was 57.3 MT. The state-owned coal mining behemoth is confident of meeting the enhanced 610 million tonnes (MT) coal supply target to power sector in 2023-24. The target is 20 MT more than the initially projected 590 MT requirement by the power sector.

GMDC successfully bids for two coal mines in Odisha

13 March: Gujarat Mineral Development Corporation

(GMDC) announced that it had emerged as the highest bidder for two coal mines in Odisha in the recently concluded commercial coal block auction by the Ministry of Coal, Government of India. GMDC has won the bids for Odisha’s Burapahar Block in Sundargarh District, having a Geological Reserve of 548 million tonnes (MT) and the Baitarani (West) Block in Angul District a geological reserve of 1152 MT.

Coal imports fall by 25 percent in 3 years as India aims to up domestic production

13 March: Coal imports have seen a 25 percent fall in the last three years as India strives to increase domestic production and reduce dependence on imports, despite the fact that owing to global geopolitical turmoil which has put a strain on supply chains, it, along with other nations, has been forced to enhance its dependence on the dry fuel instead of moving to greener sources of energy. The government imported 248.54 million tonnes (MT) of coal in 2019-20, which has come down by 25 percent to 186.06 MT in the current fiscal of 2022-23 (till December 2022), according to coal ministry data. In fact, coal imports have gradually come down since 2019-20, as in 2020-21, it was 215.25 MT while in 2021-22, it further came down to 208.93 MT. In 2022-23, it further slid below the 200 MT mark to 186 MT till December 2022. In 2018-19, India’s coal imports stood at 235.35 MT and had risen to 248.54 MT in 2019-20, a rise of 5.6 percent. Though India imports coal from several countries like Australia, Canada, China, Mozambique, Russia, South Africa, New Zealand and the US, its bulk of imports are from Indonesia. Mindful of the fact that due to the Russia-Ukraine war impacting supply chains of green fuels, it has to depend on coal, India is aiming to improve its domestic production of dry fuel and plans to produce 911 MT in the current fiscal, in order to reduce dependence on imported coal.

Chhattisgarh CM meets PM Modi, discusses coal royalty, GST dues

10 March: Chhattisgarh Chief Minister (CM) Bhupesh Baghel discussed issues like the conduct of an early census, GST (Goods and Services Tax) dues, and coal royalty with the Prime Minister (PM) Narendra Modi. Baghel said he

demanded the due royalty of INR 41.70 bn from the coal blocks.

Railways increases coal transportation for power sector ahead of summer

9 March: Expecting a surge in demand for coal by power plants during the summer, the

railways increased its coal transportation by 11.92 percent in terms of tonnage by the end of February, the national transporter said. In order to meet the projected demand for rakes by the power sector in the coming fiscal, the railways has taken various steps, including higher induction of coal carrying wagons.

Government successfully bids out 29 coal blocks for commercial mining

9 March: The

29 coal blocks which have been successfully bid out for commercial mining by the government are expected to enhance the average dry fuel output by an additional 7 percent in the next two years, as the combined peak rated capacity (PRC) of these reserves is around 91 million tonnes (MT). The 91 MT PRC of 29 coal blocks which have been bid out, would be an additional 7 percent of the present national average PRC of coal reserves. The coal ministry had put up 29 reserves on auction for commercial mining last month, all of which have been bid out, sources informed. The last of the 29 mines was bid out successfully earlier in the day. With all the 29 mines expected to begin production by 2024-25, i.e. by the next two years, the government is hoping that all these coal mines put together will enhance the overall national average output by an additional 7 percent. The ministry launched the auction of coal reserves for commercial mining in the sixth round and second attempt of the fifth round on 3 November 2022. PRC pertains to the maximum production capacity of a coal mine, or in other words, the maximum quantity of coal which can be mined from it annually. Commercial mining allows the private sector to mine coal commercially without placing any end-use restrictions. Private firms will have the option of either gasification of the coal or exporting it.

National: Power

No plans to change Delhi power subsidy scheme: Atishi

14 March: Newly appointed minister Atishi said the Delhi government has no plan to put any cap on sanctioned load and that everyone will continue to get power subsidies . Atishi said Manish Sisodia, who was the former power minister, had written to the DERC chairman requesting him to re-examine the issue and give fresh opinion on the matter. Following which, the commission carried out a detailed legal examination and placed its fresh opinion through an order on 6 January, retracting its prior ‘statutory advice’ on legal grounds. The

government is working on renewing the voluntary subsidy scheme which will expire on 31 March. The scheme will be relaunched in April and the people have to opt for the subsidy again.

India taking steps to ensure adequate power supply during summer

9 March: India’s power ministry said it has taken several steps to ensure adequate power availability during the upcoming summer months, in an attempt to allay fears of power cuts due to surging demand in the country. India faces a high risk of night-time power cuts this summer and in coming years, as delays in adding new coal-fired and hydropower capacity could limit the country’s ability to address surging electricity demand when solar energy is not available. Power utilities have been directed to undertake maintenance for coal-based power plants well in advance to avoid disruptions during the peak summer months of April and May. Power companies have also been asked to avoid load shedding during the summer months. Adequate coal stocks would be made available at the coal-based power plants, while the Railway Board has assured availability of enough rakes for transporting the commodity, the power ministry said.

India will raise power price cap to let factories keep humming

8 March: India’s major power users will soon be able to access higher-priced electricity rather than being forced to scale down operations if another sweltering summer leads to a repeat of last year’s shortages. Indian Energy Exchange Ltd will offer a new type of electricity with a price cap of INR 50 (US$0.61) a kilowatt-hour for power generated from batteries, gas and imported coal, according to Rohit Bajaj, the head of business development at the nation’s largest electricity platform. That’s more than quadruple the limit on other types of power. Unusually high temperatures for this time of year are fueling predictions that electricity demand might rise to a record this summer, overwhelming domestic coal supplies and transportation networks and resulting in a repeat of last year’s blackouts. The shortfalls last year exposed citizens to blistering heat waves and forced some industries to scale down factory output. The high-price window could help narrow the gap by bringing back tens of gigawatts of under-utilis ed generation capacity. The power ministry last month invoked an emergency rule that would force some plants running on imported coal to run at capacity for three months starting 16 March. The exchange plans to start the high-price spot trade window from 15 March and has the regulator’s approval, Bajaj said. The price cap for all other trades on the exchange will remain at INR 12 a kilowatt-hour, Bajaj said.

National: Non-Fossil Fuels/ Climate Change Trends

Onix Group signs MoU with government of UP for 2000 MW Renewable Energy Projects

14 March: Onix Structures Private Limited (Onix Group), a leading turnkey electrical and civil projects developer, announced signing a Memorandum of Understanding (MoU) with the Government of Uttar Pradesh (UP) during the recently concluded UP Investors Summit 2023. Pursuant to the MoU,

Onix aims to develop a 1000 MW solar power project in Prayagraj and a 1000 MW wind power generation plant in Baghpat. The proposed projects, set to commence this year, will require a proposed investment of INR120 bn and are expected to generate employment opportunities for over 1500 people. The development of these projects will further strengthen UP’s position as a leading state in renewable energy and will also contribute to the state’s intent to invest in this sector.

Maharashtra government plans solar-powered agricultural feeders for 12-hour supply

13 March: The state

government will bring all agricultural electricity feeders under solar energy to meet the pending demand of farmers to provide 12-hour daytime power supply to their farms, deputy Chief Minister (CM) Devendra Fadnavis said. At present, farmers are forced to take up farm operations at night due to the unavailability of a regular uninterrupted daytime power supply. The deputy CM said that 30 percent of all agricultural feeders would be brought under solar energy this year, for which they will use government land as well as lease the unused or infertile farmland from farmers for 30 years at INR75,000 per year rent which will be increased by 2 percent every year.

In Goa, homes can soon pay EMIs to install rooftop solar plants

13 March: Given domestic households’ reluctance to install rooftop solar power systems, Goa Energy Development Agency (GEDA) plans to introduce a new scheme under which the government will foot the bill to install the rooftop plants. Instead of a lump sum amount, a monthly fee will be collected from residents till the installation cost is recovered. Currently, the Union Ministry for New and Renewable Energy

(MNRE) and the state government offer subsidies for the installation of rooftop solar plants with a capacity of up to 10 kilowatt hour (kW). However, the steep initial cost and the delay in disbursement of the subsidies have deterred many from signing up. At present, the MNRE gives 40 percent subsidy for domestic consumers who install 1 kW to 3 kW rooftop solar power plants with the state government providing an additional 10 percent subsidy. Rooftop solar plants with a capacity between 4kW and 10 kW attract 20 percent subsidy from MNRE with Goa providing an additional 30 percent subsidy. The Union ministry is now shifting to a fixed subsidy which GEDA will also adopt.

IREDA will be an integral part in achieving 500 GW from non-fossil fuel by 2030: CMD

13 March: Indian Renewable Energy Development Agency Limited (IREDA) Chairman and Managing Director (CMD) Pradip Kumar Das said the Miniratna company stands fully committed towards achieving Prime Minister Narendra Modi’s

‘Panchamrita’ targets and would be an integral part in achieving the 500 GW of non-fossil fuel-based capacity by 2030. Ministry of New and Renewable Energy Secretary Bhupinder Singh Bhalla complimented IREDA for spearheading the development of clean and renewable energy (RE) in India for the last 36 years.

India fastest in renewable energy capacity addition among major economies

9 March: Since time immemorial,

India has remained the hub of climate protection and environmental sustainability. A substantial chunk of folklore literature and practices geared at taking a holistic view of the natural resources remain the solid foundation on which the mainstream narrative of Indian society is built. However, there has been a renewed focus over climate protection in the recent past. India’s international image has been on the path of widening its reach and clout of late, and now India has assumed the G20 Presidency. India is emerging as an inspiration for countries across the globe, particularly on the fact that economic development and conservation of the environment can go hand in hand. India has become the fastest in renewable energy capacity addition among major economies that have added over 100 gigawatt (GW) of renewable energy capacity by the end of 2021 with the vision of 500 GW by 2030. India has the lowest cost for large-scale solar power in the world-another spectacular achievement of its traditional skill at supply-side process innovation. India has tremendous potential to lead the world in green energy and she will forward the cause of global good apart from generating green jobs. In that context, the Ministry of Power recently led the first post-budget webinar on green growth with discussions taking place in six parallel sessions on the 12 announcements made under the Union Budget this year.

Jindal Stainless to invest in two rooftop solar projects

8 March: Jindal Stainless (JSL) will invest INR 1.2 bn to set up rooftop solar power projects at its Jajpur and Hisar facilities. A 21 megawatt peak (MWp) capacity solar power plant will be set up in Jajpur, while another 6 MWp rooftop solar power capacity is to be installed at its unit in Hisar. The two rooftop solar power plants will generate about 795 million units of electricity, with a carbon abatement potential of 5,64,450 tonnes over a period of 25 years. Both the projects are scheduled to be completed by March 2024. The energy generated will be for the company’s captive consumption and will be part of responsible business practices to reduce its carbon footprint, as it pursues the net-zero target. The company’s Hisar unit has already commissioned rooftop solar power projects of 4.1 MWp, which is capable of generating 110.7 million units of electricity, with the potential for reducing 78,597 tonnes of CO

2 emissions. In FY22, the company managed to reduce its carbon emissions by 1.4 lakh tonne.

Gujarat’s power from renewables less than 2 GW this March

8 March: In the first six days of March,

renewable energy generation in Gujarat remained at just 14 percent of installed capacity. According to data from Gujarat Urja Vikas Nigam Ltd (GUVNL), renewable energy sources accounted for just about 2,000 megawatt (MW) of power generation in the first six days of March. Experts said unusual weather has reduced renewable power generation. Gujarat has 6,835 MW of installed wind power and 6,325 MW of solar power as of December 31, 2022. Thus, GUVNL has a renewable energy installed capacity of 13,160MW. In the last April to June quarter, renewable energy generation was higher, at 4,700 MW, but that number also implies a plant load factor (PLF) of just 36 percent.

Renewable subsidies, higher tariffs on coal to result in lower emissions in India by 2030

8 March: Combining renewable subsidies and higher tariffs on coal would lower the

emissions by nearly one-third in India by 2030 compared to the current policies, according to a study carried out by two IMF economists. The study, conducted by Margaux MacDonald and John Spray, notes that the two steps would also decrease coal imports by 14 percent by 2030, thus increasing resilience to global changes in energy prices and improving energy security. The study observes that India has made significant progress towards meeting its emissions reduction targets under the Paris Agreement, but with current policies total greenhouse gas (GHG) emissions would nonetheless increase by more than 40 percent by 2030. While a modest increase in short-term emissions may be necessary to meet poverty reduction and energy security goals, a more rapid scaling up of current policies could help lower emissions considerably over the medium term and bring India closer to a path to net zero by 2070, it said. The two economists said that their research shows an alternative emissions trajectory could be achieved by scaling up current policies.

International: Oil

OPEC raises Chinese oil demand growth view, flags econ risks

14 March: Organization of the Petroleum Exporting Countries

(OPEC) further raised its forecast for Chinese oil demand growth in 2023 due to the relaxation of the country’s COVID-19 curbs, although it left the global total steady citing potential downside risks for world growth. World oil demand in 2023 will rise by 2.32 million barrels per day (bpd), or 2.3 percent, the OPEC s said. While faster Chinese demand could support the oil market, crude prices have fallen as the collapse of Silicon Valley Bank has sparked fears about a fresh financial crisis. OPEC flagged potential downside risks for the world economy from rising interest rates. OPEC expects Chinese oil demand to grow by 710,000 bpd in 2023, up from last month's forecast of 590,000 bpd and a contraction in 2022. OPEC said its crude oil output in February rose by 117,000 bpd to 28.92 million bpd, helped by a further recovery in Nigeria which has boosted supply due to improved security in its oil-producing Delta region.

Malaysia’s Petronas posts higher Q4 profit, sees lower oil prices in 2023

13 March: Malaysia’s state oil firm Petroliam Nasional Berhad

(Petronas) posted a 55 percent jump in quarterly profit on higher energy prices and bigger sales volume, but warned of moderating prices for this year due to an expected slowdown in the global economy. Energy prices rose in 2022 after Russia’s invasion of Ukraine, boosting oil companies' profits.

Pakistan plans to procure Russian crude oil at US$50 per barrel

12 March: Cash-strapped

Pakistan is making concerted efforts to procure Russian crude oil at US$50 per barrel, at least US$10 per barrel less than the price cap imposed by the G7 countries due to Moscow’s invasion of Ukraine. Crude oil is currently being sold globally at US$82.78 per barrel. Pakistan, which is currently grappling with high external debt and a weak local currency, is desperate to purchase cheap crude at discounted rates from Russia. Moscow will respond to Pakistan’s request for discounted crude oil only after it completes formalities such as mode of payment, shipping cost with premium and insurance. The first consignment of crude oil from Moscow is scheduled to arrive in Pakistan by the end of next month, paving the way for a bigger deal in the future. Pakistan will first import one Russian crude oil ship to test landed cost. In December last year, Russia refused to provide Pakistan with a 30 percent discount on its crude oil after the Pakistani delegation asked for a reduction in price. Energy accounts for the biggest share of Pakistan’s imports, and cheaper oil from Russia will help Pakistan in containing the ballooning trade deficit and balance-of-payments crisis.

Barclays cuts 2023 oil price forecasts on resilient Russian output

8 March: Barclays cut its 2023 oil price forecasts, due in part to more resilient output from Russia than expected, and said the market could flip into a deficit in the second half of the year due to growing demand in China. The bank cut its average forecasts for the Brent and West Texas Intermediate (WTI) benchmarks by US$6 per barrel (/b) and US$7/b, respectively, to US$92/b and US$87/b. It also forecast Brent would average US$97/b next year and WTI US$92/b.The market could flip into a deficit of 500,000 barrels per day (bpd) in the second half of this year as China’s reopening from pandemic restrictions "matures" and as supply growth from outside the OPEC+ producer group slows, the analysts said. China’s oil demand could increase by 500,000 to 600,000 bpd in 2023, Organization of the Petroleum Exporting Countries (OPEC) secretary general Haitham Al Ghais said, with global oil demand seen rising by 2.3 million bpd in 2023. Barclays, meanwhile, revised its 2023 demand estimate 150,000 bpd higher due in part to a somewhat improved growth outlook for the United States and Europe. It sees a 900,000 bpd increase in Chinese demand this year.

International: Gas

Ukraine to jointly buy gas with European Union countries

9 March: Ukraine will take part in the European Union (EU) scheme to jointly buy gas in global markets, to procure 2 billion cubic metres of the fuel ahead of next winter. EU countries plan to pool demand and sign their first joint gas contracts in the coming months, to help fill storage caverns ahead of peak winter demand as Europe replaces Russian gas. European Commission Vice President Maros Sefcovic, who leads the EU’s joint gas-buying, held a video call with international gas suppliers. Sefcovic said Europe was on track to expand its capacity to regasified liquefied natural gas (LNG) to 227 billion cubic metres (bcm) by 2024, up from 178 bcm, as countries swap Russian gas for other supplies. Participating in the EU scheme could help Ukraine to stave off gas shortages. Of the 27.3 bcm of gas Ukraine used in 2021, domestic production accounted for about 19.8 bcm, imports were 2.6 bcm and 4.9 bcm of gas was taken from underground storage. Initial estimates from state-owned energy firm Naftogaz suggest Ukrainian gas production was around 18 bcm in 2022.

Trinidad has begun substantive negotiations with Venezuela on gas project

9 March: Trinidad and Tobago has held substantive talks with

Venezuela on developing the promising Dragon offshore gas field following a US (United States) authorization to begin the long-stalled project, Energy Minister Stuart Young said. The US in January green-lighted the project after lengthy appeals by Trinidad and its Caribbean neighbours. The authorization came among several decisions by President Joe Biden’s administration that have eased some sanctions on Venezuela.

Bahrain explores constructing LNG export facility

8 March: Bahrain aims to slash domestic natural gas consumption under a plan to decarbonize its economy and is exploring ways to export the fuel to international markets, Bahrain’s energy investment and development arm Nogaholding chairman Nasser bin Hamad Al Khalifa said. The Gulf Arab state plans to build solar farms to power its homes and industries, replacing the gas now used, Khalifa said. The plan comes as Europe is hunting for new fuel supplies and major gas discoveries in the Mediterranean have led to proposals for new offshore LNG (liquefied natural gas) and gas pipelines to Europe.

Bahrain produces around 2 billion cubic feet per day of gas which is used to generate electricity and power its refinery and industry.

Green light for Argentina’s gas project with Petronas to come in 2024: YPF CEO

8 March: Argentina's state-controlled energy firm YPF and Malaysia’s Petronas expect to make a final decision next year on whether to

invest in the first phase of a massive US$60 billion natural gas project in Argentina, YPF Chief Executive Officer (CEO) Pablo Iuliano said. The five-phase project to integrate gas production, storage, pipeline transportation and liquefaction is key for the South American country to monetize its vast reserves and become an exporter of liquefied natural gas (LNG). A delegation of technicians from Petronas travelled to Argentina in February to plan for the project. Its first phase is expected to require US$5-6 billion in investment to build facilities capable of producing up to 5 million metric tonnes per year of LNG. Drilling rigs could be imported for the upstream portion of the gas project as Argentina struggles to secure specialis ed equipment, CEO said. The gas project with Petronas, the oil terminal and a two-phase gas pipeline connecting Vaca Muerta to the country's Northern region are needed to boost the country’s oil and gas output and exports. Argentina sits on one of the world’s largest shale gas reserves, but the cash-strapped nation still must import fuel to generate electricity. The proposed gas law, which had been expected to be debated by lawmakers, would encourage construction of LNG plants and related infrastructure.

International: Power

Pakistan, Iran to increase electricity exchange

14 March: Pakistan and Iran have signed a contract to increase their electricity exchange. Under the deal, the electricity exchange capacity between the two countries via the newly built 132 kilovolt transmission lines will increase by 100 megawatt (MW) to reach 200 MW in the first phase. In the second phase, the two countries will install 70 kilometres of 230 kilovolt electricity transmission lines in Pakistan to raise the electricity exchange capacity to 400 MW. Iran’s electricity network is currently linked with several neighbouring states, which improved the sustainability of the country’s power network, the Iranian energy ministry said.

EU to revamp power market, aiming to blunt price spikes

14 March: The

European Commission is set to propose a revamp of Europe’s electricity market rules, aimed at expanding the use of fixed-price power contracts to shield consumers from severe price spikes like those experienced last year. The European Union (EU) vowed to overhaul its electricity market after cuts to Russian gas after its invasion of Ukraine last year sent European power prices soaring to record highs, forcing industries to close and hiking households' bills. Draft versions of the EU proposal outline measures designed to make consumers less exposed to short-term swings in fossil fuel prices - by nudging countries to use more contracts that lock in stable, long-term electricity prices. Future state support for new investments in wind, solar, geothermal, hydropower and nuclear electricity, for example, must be done through a two-way contract for difference (CfD).

World Bank sets conditions for Lebanon to access electricity funding

14 March: Lebanon has to audit its state electricity company among other reforms the World Bank has required before it will consider funding Lebanon’s worn-down electricity sector, the bank’s regional vice president Ferid Belhaj said. Public provision of electricity in Lebanon has been poor since the country’s 1975-90 civil war but has deteriorated further over the last three years as the financial crisis has debilitated the government's ability to secure fuel. The country has signed deals to receive electricity from Jordan and natural gas from Egypt, both via Syria, which would add up to 700 megawatt (MW) of power to the country’s grid, increasing power supply by several hours. The World Bank agreed to finance the agreements if Lebanon enacts long-awaited power sector reforms. State power stations are almost entirely offline and fuel subsidy cuts have caused operating costs for private generators to skyrocket.

UK lacks strategy to meet decarbonised power target

9 March: Britain has no clear strategy on how it plans to meet

a target of decarbonising its electricity system by 2035, threatening efforts to boost energy security, the country’s climate change advisers said. Britain has a target to reach net zero emissions by 2050 and is also seeking to improve its energy independence after Russia’s invasion of Ukraine sent energy prices to record highs. As part of this goal, which requires a huge scaling up of renewable power generation such as wind and solar, Britain has set a target to decarbonise electricity supplies by 2035 to reduce reliance on imported gas.

International: Non-Fossil Fuels/ Climate Change Trends

Renewable energy accounts for over 62 percent of Cambodia’s energy supply: PM

14 March: Cambodian Prime Minister (PM) Hun Sen said that

renewable energy has made up over 62 percent of the Southeast Asian country’s installed electricity capacity. Renewable energy is energy that comes from sources such as hydropower, solar energy and biomass energy. Most renewable energy in Cambodia comes from hydropower dams. According to the Electricity Authority of Cambodia (EAC), energy supply in Cambodia rose to 4,495 megawatt (MW) in 2022, an increase of 12.6 percent from 3,990 MW a year earlier. As of last year, 98.27 percent of the total 14,168 villages in the kingdom have access to electricity, the EAC said.

Britain’s tax take risks blowing green energy off target

13 March: A cap on revenue and the lack of the kind of incentives offered to oil explorers are blocking the development of renewable energy in Britain. The

British government has set targets for major increases in wind generation, for instance, as it seeks to meet a goal of net zero emissions by 2050 and to become more independent of imported energy following the supply disruption caused by Russia’s invasion of Ukraine. Representatives of the renewable energy sector said those goals could be missed without policy changes, especially as other countries are doing more to attract investment in green power. British government targets include increasing offshore wind capacity to 50 gigawatt (GW) from around 14 GW.

Ivory Coast signs deal for 50-70 MW solar plant with UAE’s Masdar

10 March: Ivory Coast has signed an agreement with UAE renewable energy company

Masdar to explore the development of a 50-70 megawatt (MW) solar power plant, Masdar said. The West African cocoa-producing nation has committed to reducing its greenhouse gas emissions by 32 percent and increase the share of renewable energy in its energy mix to over 40 percent by 2030. Masdar aims to deliver 100 gigawatt (GW) of green energy around the world by 2030 and sees "enormous potential" for this sector in Africa. In January, it signed an agreement with Ethiopia for the joint development of a 500-MW solar project. It also signed agreements with Angola, Uganda and Zambia to develop renewable energy projects.

Malaysia needs to invest US$375 bn in renewables to reach 2050 climate goals

9 March: Malaysia will need to double its investments in renewable energy transition to at least US$375 billion in order to achieve its ambitious goal of carbon neutrality by 2050, the International Renewable Energy Agency (IRENA) said. The Southeast Asian nation has pledged to cut its greenhouse gas emissions dramatically by 2030 and reach net-zero emissions by 2050. Due to rising population and energy consumption, Malaysia’s emissions are expected to rise to 280 million tonnes of carbon dioxide per year by 2050, according to IRENA. IRENA said Malaysia needs to increase its total investment to between US$375 billion and US$415 billion, from the current US$159 billion, to expand renewables capacity, infrastructure and energy efficiency.

EU agrees to push for fossil fuel phase out ahead of COP28

9 March: European Union

(EU) countries agreed to promote a global fossil fuel phase out ahead of the United Nation s COP28 climate summit this year, attempting to boost a global deal that failed at last year’s summit. Ministers from the 27 EU member states approved a text on their diplomatic priorities ahead of the COP28 summit, which begins on 30 November in Dubai, where nearly 200 countries will attempt to strengthen efforts to rein in climate change. Europe is in the midst of transforming its energy system to meet climate targets and end decades of reliance on Russian fossil fuels.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: BP Statistical Review of World Energy, 2011 to 2022

Source: BP Statistical Review of World Energy, 2011 to 2022