-

CENTRES

Progammes & Centres

Location

Quick Notes

India’s updated nationally determined contribution (NDC) contained two energy related quantitative commitments: (i) to reduce the emissions intensity of its GDP (gross domestic product) by 45 percent by 2030, from its 2005 level and (ii) to achieve about 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030, with the help of the transfer of technology and low-cost international finance, including from the Green Climate Fund (GCF). Increasing the share of non-fossil fuel based installed capacity by 50 percent by 2030 is within the scope of “business-as-usual” growth trajectory but will mean greater pressure on India’s meagre public finances.

As of October 2022, installed capacity for power generation was about 408,714 megawatts (MW) out of which coal accounted for 210,605 MW or just over 51 percent, renewable energy (RE) accounted for 119,092.59 MW or about 29 percent followed by 46,850 MW of hydro which accounted for about 11 percent of capacity. Natural gas accounted for 6 percent of installed capacity with 24,824 MW and nuclear accounted for 1.7 percent of capacity with 6780 MW. A total of about 172,723 MW of non-fossil fuel based installed capacity accounted for just over 42 percent of total installed capacity for power generation as of October 2022.

The report on India’s long-term low greenhouse gas (GHG) emission development strategies (LTLEDS) released at COP27 in 2022 does not mention any new quantitative target for RE (wind, solar etc) other than what it has already communicated but it clearly states that India’s installed capacity for nuclear power generation will be tripled by 2030. The existing nuclear power capacity of 6780 MW is projected to touch 22480 MW by the year 2031 on progressive completion of projects under construction and projects that have been sanctioned. In the case of hydro 79 hydro projects with an aggregate capacity of more than 30000 MW including 11 pumped storage schemes of 8700 MW are expected to come online by 2030. This includes just over 12,663 MW of hydro projects under construction and 5 projects with a capacity of 1023 MW that have been commissioned.

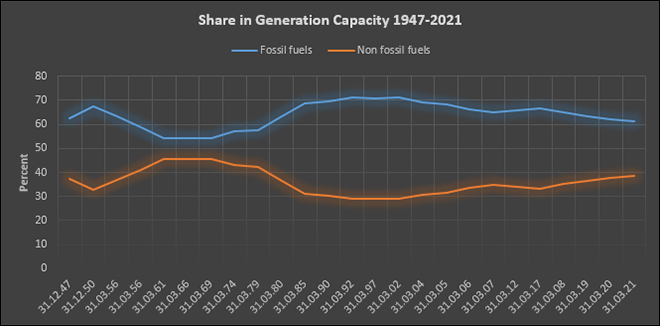

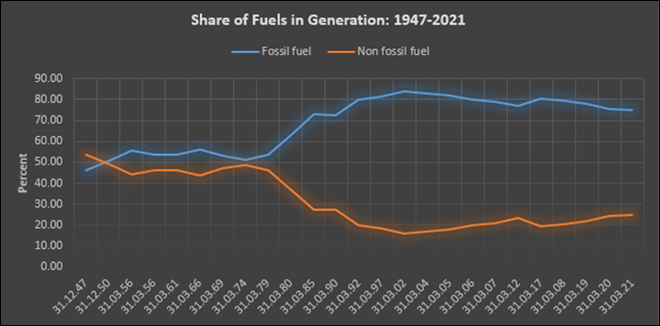

Fossil fuels, mainly coal, accounted for over 62.7 percent of the installed capacity of power generation in 1947 and hydro-power, the only non-fossil fuel accounted for 37.30 percent. The highest share of 71.16 percent for an installed capacity of fossil-fuel based power generation was in 2002 with non-fossil fuel-based power generation recording its lowest share of 28.84 percent. The lowest share for fossil fuel-based power generation capacity was in 1969 when it accounted for 54.36 percent of total generation capacity while non-fossil fuels (hydro and nuclear) accounted for the highest share of 45.64 percent. In terms of generation, the highest share of non-fossil fuel-based power generation was in 1947 when it accounted for over 53 percent of generation. The lowest was in 2002 when non-fossil fuel-based generation accounted for 16 percent of the generation. Since then, the share of non-fossil fuel-based generation is increasing primarily on account of RE. In 2022 non-fossil fuels accounted for just over 24 percent of generation.

The draft national electricity plan (NEP) expects installed capacity to increase to 865,941 MW by 2032. The largest capacity addition of 214,020 MW is expected from RE with about 69 percent contributed by solar photovoltaics (PV). Offshore wind power generation capacity of about 10,000 MW is expected to come on stream by 2032. Overall, RE is expected to account for about 60 percent of power generation capacity by 2032 estimated at 516,361 MW. The share of coal-based power generation capacity is expected to fall to 28.3 percent in 2032. No additional gas-based power generation capacity is expected after 2027 and the share of natural gas in power generation is expected to fall to just 2.9 percent by 2032. With 68,641.17 MW the share of hydropower is also expected to fall to 7.9 percent by 2032. Projections for nuclear power are optimistic with an additional capacity of 15,000 MW coming onstream by 2032. This will increase nuclear power generation capacity to 22,480 MW and its share in total power generation capacity is expected to increase to 2.5 percent. Total power generation is expected to increase to 865,941 TWh (terawatt hour) by 2032 in which coal is projected to account for the largest share of 1333.8 TWh or about 50 percent. Generation from RE is expected to touch 938 TWh equivalent to 34.8 percent of generation. Generation from hydropower of 231.8 TWh is expected to account for 8.7 percent of total generation in 2032. Generation of 134 TWh of power from nuclear generators is projected to increase to 5 percent of total generation.

In 1947, the share of non-fossil fuel-based capacity (only hydro) was about 37 percent but its share in generation was over 53 percent. As per projections by the draft NEP, the share of non-fossil fuel based installed capacity for power generation is expected to increase to over 71 percent by 2032 but the share of non-fossil fuels in power generation is expected to touch only 47 percent by 2032 even under optimistic assumptions. The share of RE (primarily wind and solar) alone is expected to account for over 60 percent of installed capacity but its share in generation is expected to touch only 34 percent. This underscores the challenge of low ‘capacity factors’ of new RE sources. This means greater investment in capacity is required to produce one unit of power from RE sources than from non-RE sources.

Public finance has so far played a key role in supporting broader finance flows towards increasing the shares of RE electricity and electrification. Policies that increase the costs of fossil fuels through high taxes to support RE investment would imply a higher cost of living, which may require either subsidies or recycling of public revenues back into the economy through various support schemes. In the case of power supply, the “must-run” status of RE has led to significantly increased costs for distribution companies. Public sector distribution companies bear the cost of policies that seek to increase electricity access to the poor and renewable purchase obligations (RPO) add to their costs. This excludes other socialisation of RE costs that are borne elsewhere in the system, including support like free inter-state transmission and other substantial system balancing costs.

Such support from public finance has increased since 2014 and is likely to increase further as new production linked incentives are announced for production of RE technologies. This is an issue that requires a place in the dominant narrative of RE power being cheaper than traditional fossil and non-fossil energy sources. Scarce public resources are being spent on increasing the production and consumption of RE. Mitigation or increasing the share of RE should not come at the cost of adaptation or development of the poor.

India is offering 26 blocks or areas for finding and producing oil and gas in a mega offshore bid round, upstream regulator DGH (Directorate General of Hydrocarbons) said. Simultaneously, 16 areas for prospecting for coal-bed methane (CBM) are also being offered in a separate round. Out of the 26 blocks, 15 areas are in ultra-deepwater, 8 in the shallow sea and 3 blocks are on land. The bid rounds are being held under the 2016 policy, called the Hydrocarbon Exploration and Licensing Policy (HELP), which was promulgated on 30 March 2016. DGH said the 16 CBM blocks being offered in the special bid round are spread over Madhya Pradesh (4), Chhattisgarh, Telangana (3 each), Maharashtra, Odisha (2 each), Jharkhand and West Bengal (1 each).

Reliance Industries Limited (RIL) will commission its deepwater MJ gas condensate field in Bay of Bengal block KG-D6 by year end, boosting natural gas output to 30 percent of India’s total. MJ is the third and last of a set of discoveries that RIL and its partner BP are developing in the eastern offshore block. The two will use a floating production system at the high sea in the Bay of Bengal to bring to production the deepest gas discovery in the KG-D6 block. RIL and BP are spending around US$5 billion (bn) on three separate development projects in the KG-D6 block — R-Cluster, Satellite Cluster, and MJ — which together are expected to produce around 30 million standard cubic metres per day (mmscmd) of natural gas by 2023. R-Cluster started production in December 2020 and the Satellite Cluster came onstream in April last year. While the R-Cluster has a plateau gas production of about 12.9 mmscmd, the Satellite Cluster will have a peak output of 6 mmscmd. The MJ field will have a peak output of 12 mmscmd. Combined gas output from R-Cluster and Satellite Cluster stood at more than 19 mmscmd during July-September. RIL has so far made 19 gas discoveries in the KG-D6 block. Of these, D-1 and D-3 — the largest two — were brought into production in April 2009, and MA, the only oilfield in the block, was put into production in September 2008. While the MA field stopped producing in 2019, the output from D-1 and D-3 ceased in February 2020. Other discoveries have either been surrendered or taken away by the government for not meeting timelines for beginning production. MJ’s reservoirs are about 2000 metres below the D1-D3 gas fields.

Indian Oil Corporation (IOC) is in talks with US (United States) energy firm Tellurian Inc for a long-term liquefied natural gas (LNG) supply deal as well as an equity investment in the latter’s Driftwood project. IOC has grand ambitions in the natural gas segment but turmoil in the international market has made it harder for it to source affordable LNG. Indian Oil, Petronet LNG and GAIL (India) Limited are all seeking long-term contracts but have been unable to lay their hands on any deal that can bring supplies ahead of 2026 when large global liquefaction capacity is expected to come onstream, easing the current crunch. IOC has begun discussions with Tellurian but is yet to agree on the volume or the equity investment in the Driftwood LNG project.

Indraprastha Gas Ltd, which retails compressed natural gas (CNG) and piped cooking gas in the national capital and adjoining cities, reported a 4 percent rise in its September quarter net profit as a rise in input natural gas prices hurt margins. The net profit stood at INR4.16 bn (US$50.98 mn) in July-September compared with INR4 bn in the same period a year back. Gas prices have doubled since Russia invaded Ukraine. IGL’s expense on the purchase of natural gas soared from INR9.29 bn (US$113.84 mn) in July-September 2021 to INR26.10 bn (US$319.84 mn) in the current year. The firm registered an overall sales volume growth of 12 percent over the corresponding quarter in the last fiscal, with the average daily sale going up from 7.24 mmscmd to 8.09 mmscmd. Product wise, CNG recorded sales volume growth of 15 percent, while piped natural gas (PNG) recorded sales volume growth of 3 percent in the quarter as compared to the corresponding quarter last year.

After a relief for a brief period, CNG has once again become more expensive than petrol in Lucknow, Uttar Pradesh. This happened for the second time but in total it was the fifth hike in the current financial year. Now the consumer must pay INR97 per kg (kilogram) for CNG in Lucknow, Agra and Unnao, which was INR95 per kg earlier. Similarly in Ayodhya, the vehicle owner has to pay INR 98.45 per kg, which is INR96.45 per kg. The current petrol price in Lucknow is INR 96.57 per litre, while diesel is sold in retail at INR 89.91 per litre. In April, CNG retail cost was INR 84.25 per kg.

Chief Minister (CM) M K Stalin inaugurated Tamil Nadu’s first liquefied, compressed natural gas (LCNG) station set up by AG & P Pratham near Manthangal village in Ranipet district. The new facility would transform Ranipet and Vellore districts and surrounding areas into a gas-based ecosystem and fuel industrial growth. The company is developing city gas distribution networks in six districts — Kancheepuram, Chengalpet, Vellore, Ranipet, Tirupattur and Ramanathapuram — besides South-East Chennai. The company has launched 27 CNG stations in Kancheepuram and Chengalpet districts and South-East Chennai, three in Ramanathapuram district and 14 in Vellore and Ranipet districts. The company plans to launch 22 more CNG stations in the state by March 2023. The company is working aggressively at the grassroots level to realize the government’s vision of migrating towards a gas-based economy. The company has authorizations to develop CGD networks across 12 geographical areas covering 34 districts across 8 percent of India and 64 million people in the states of Rajasthan, Andhra Pradesh, Tamil Nadu, Karnataka and Kerala. In its 12 geographical areas, the company is developing and operating CNG stations for vehicles, and piped natural gas to homes, industries and commercial establishments.

Punjab Director General of Police (DGP) Gaurav Yadav, who is also the chairman of the Onshore Security Coordination Committee (OSCC), assured complete assistance and support from the Punjab Police to the Oil and Gas Companies to ensure the security and safety of oil and gas, which are vital national assets. The DGP, chairing the third OSCC meeting organised by GAIL (India) Limited in Chandigarh, reviewed the safety measures in place for security of oil installations in the state. A number of issues such as the Standard Operating Procedures (SOPs), scaling up of security, keeping vigil via CCTVs and Drone Surveillance were discussed during the meeting, which was aimed at effective coordination between the stakeholders. DGP Yadav said that although Punjab has been secure so far, the Police and Oil-Gas Companies need to be alert and aware all the time and should work together for the safety of the oil and gas. He also stressed the need to hold district level security coordination meetings for greater synergy between oil-gas companies and district police.

A gas pipeline is to be built connecting Iberia to France and the rest of Europe, Spanish Prime Minister (PM) Pedro Sanchez has confirmed. Spain, France and Portugal have agreed to cooperate on the project. Sanchez said that the pipeline will hugely increase the volume of the two existing links between Spain and France. It will also help to transport green hydrogen and gas during the transition period Europe needs until it increases its capacity for renewables. Spain has spent several months pushing for the project, which is also supported by Germany. As well as its Algerian pipeline, Spain also has a high capacity for converting LNG, with 6 LNG terminals.

Germany has called for European Union (EU) states to work with countries that can develop new gas fields, prompting concern from campaigners over the climate change commitments of Europe’s biggest economy as it scrambles to replace Russian gas. EU leaders are meeting to debate new measures to tame high energy prices and plug the gap caused by plummeting deliveries of Russian gas – a response that Brussels has said should speed up, rather than slow, Europe’s shift to green energy. Germany is racing to find alternatives to Russian fossil fuels – both by expanding renewable energy faster and importing more non-Russian gas. Russia supplied more than half of Germany’s gas before Moscow invaded Ukraine.

Iberian wholesale market gas prices extended steep declines, with the day-ahead contract falling for the first time below the 40 euros per megawatt-hour (MWh) cap set in May for gas-fired power plants., after the national grid operator warned it may reject LNG shipments due to overcapacity. The price decline comes after Spain’s national gas operator Enagas warned it may have to reject shipments of LNG due to overcapacity at its six terminals. Dozens of ships carrying LNG are circling off the coasts of Spain and other countries in Europe, unable to secure slots to unload because of a lack of regasification capacity, with plants that convert the fuel back to gas operating at full capacity. Portugal has warned that recent floods there could affect the supply of LNG, while low levels of rainfall in Iberia could further stymie hydroelectric production and mount pressure on electricity suppliers to produce their energy using gas.

Damage to the Nord Stream gas pipeline from Russia to Europe was caused by powerful explosions, Danish police said, echoing earlier findings into leaks that erupted in the network under the Baltic Sea and that have been blamed on sabotage. Dwindling flows of gas from Russia, which once supplied 40 percent of Europe’s needs, have left the EU struggling to unite over how to respond to surging prices that have deepened a cost-of-living crisis for families and businesses. The European Commission proposed a package of emergency measures to tackle high energy prices, including for EU states to start jointly buying gas. But it avoided proposing an immediate price cap on gas amid splits over the idea.

The Czech Republic and Germany are close to reaching an agreement on sharing gas in times of emergency, Czech Industry Minister Jozef Sikela said, as the countries seek to bolster energy security amid dwindling supplies of Russian gas. Bilateral pacts are a part of the European Union’s plans to cope with any gas supply shock, although deals have been slow to materialise. As per the Minister, the two countries had defined conditions under which they would start sharing gas as well as what compensation the Czech Republic would pay Germany for use of the mechanism, without disclosing further details. Germany had been a large destination and transit country for Russian gas supplies before Moscow began reducing exports to the European Union in the wake of its invasion of Ukraine and subsequent sanctions from Brussels.

EU leaders meeting will explore a range of options for gas price caps, over which they have been divided for weeks, according to a new draft of conclusions for the 20-21 October summit. The EU’s 27 countries have been deadlocked for weeks over whether and how to cap gas prices as part of efforts to tame soaring energy prices, as Europe heads into a winter of scarce Russian gas, a cost of living crisis and a possible recession. Gas prices have soared as Russia slashed flows to Europe following its invasion of Ukraine and the Western sanctions imposed on it – prompting most EU countries to call for a gas price cap, although they disagree on its design.

According to French grid operator GRTgaz, Germany received the first direct gas deliveries from France through a pipeline link under a deal aimed at helping both countries cope with current energy supply problems. The operator mentioned that France, which is less exposed to Russian imports than its eastern neighbour as most of its needs are filled from Norway and through LNG deliveries, will at first deliver 31 gigawatt hours (GWh) per day, using a pipeline in the Moselle region. The maximum capacity of the new gas link is 100 GWh/d.

Spain’s cabinet approved a new energy-saving plan which aims to cut the country’s natural gas consumption by up to 13.5 percent by March as part of Europe’s efforts to reduce its dependence on Russian supplies. The plan also calls on Spain to increase its capacity to export gas to other European Union member states. It includes measures to increase by 18 percent Spain’s ability to send gas by pipeline to France across the Pyrenees mountain range, and an expansion in loading capacity for boats carrying gas to other EU countries, among them Italy. The EU has asked member states to cut gas use from August to March by up to 15 percent, although for some countries less exposed to Russian energy dependence the figure is lower, as in the case of Spain, which agreed to cut use by 7.0 percent. But under the new energy-saving plan approved, Spain aims to reduce its gas consumption by between 5.1 percent and up to 13.5 percent during this period.

According to Technology and Industry Minister Laszlo Palkovics, Hungary, one of the EU’s most-reliant members on Russian energy, aims to eliminate Russian gas imports by 2050 through a large-scale electrification driveUnder a 15-year deal signed last year, before the start of the war in neighbouring Ukraine, Hungary receives 4.5 billion cubic metres (bcm) of gas per year via Bulgaria and Serbia under a long-term deal with Russia. In July, nationalist Prime Minister Viktor Orban’s government scrapped a years-long cap on utility prices for higher-usage households, which Palkovics said would likely contribute to a decline in retail gas consumption. Palkovics said the government would review Hungary’s energy strategy in the first quarter of 2023, looking to curb gas reliance and boost electricity production relying on nuclear and solar energy as well as a possible move towards wind farms. As per the minister, households, which used 4 bcm of gas last year, would likely cut consumption by at least 800 million cubic metres after subsidies were curbed, with more savings coming from government measures to limit consumption. As a first step, Hungary aims to reduce the share of gas in its total energy consumption to 26 percent by 2030 from 35 percent last year, a decline of about 2.4 bcm, Palkovics said.

Romanian natural gas storage facilities have been filled above a targeted 80 percent capacity and could reach 90 percent by 1 November. Unlike other countries in the region, Romania relies less on Russian gas. It produces about 90 percent of its required gas locally through state producer Romgaz, oil and gas group OMV Petrom and Black Sea Oil & Gas. BSOG, controlled by private equity firm Carlyle Group, launched its offshore gas platform in Romanian waters of the Black Sea earlier this year. The potential for further gas discoveries in Romania’s Black Sea is huge, but the government needs to improve regulation to speed development, the country’s top gas producers said in September. Romania has also met its European Union-mandated storage target but could still need gas imports this winter.

According to Energy Minister Roberto Cingolani, Italy will be able to get through the winter with existing gas storage and flow levels unless there are “catastrophic events.” Energy group Eni, the biggest importer of Russian gas in Italy, said that it would not receive any of the gas it had ordered for delivery, and expected this situation to last. The disruption added to tensions caused by leaks found last week in the Nord Stream 1 and 2 pipelines linking Russia and Germany, which both the Kremlin and the West blamed on sabotage.

Greece and Bulgaria started a commercial operation of a long-delayed gas pipeline which will help decrease southeast Europe’s dependence on Russian gas and boost energy security. The 182-km pipeline will provide relief to Bulgaria, which has been struggling to secure gas supplies at affordable prices since the end of April, when Russia’s Gazprom cut off deliveries over Sofia’s refusal to pay in roubles. Russia has decreased its gas deliveries to Europe after the West imposed sanctions on Moscow over its invasion of Ukraine, leaving European Union countries scrambling to secure alternative supplies amid surging prices. The Interconnector Greece-Bulgaria (IGB) pipeline will transport 1 bcm of Azeri gas to Bulgaria. With an initial capacity of 3 bcm per year and plans to later raise this to 5 bcm, the pipeline could provide non-Russian gas to neighbouring Serbia, North Macedonia, Romania and further to Moldova and Ukraine. It will carry gas from the northern Greek city of Komotini to Stara Zagora in Bulgaria. IGB is linked to another pipeline, part of the Southern Gas Corridor that carries Azeri gas to Europe. Gas operators in Bulgaria, Romania, Hungary and Slovakia proposed to transport increased Azeri shipments through their networks to central Europe. The €240 million (US$235.18 million) pipeline is controlled by a joint venture between Bulgarian state energy company BEH, Greek gas utility DEPA and Italy’s Edison.

A rush to secure natural gas is resulting in an acute shortage of seaborne vessels, forcing companies to pay record-high rates to transport the fuel to Europe. The continent is racing to replace Russian pipeline flows with LNG from suppliers including in the US and Nigeria. But there are few ships available through the rest of the year, presenting a new risk to the global gas supply this winter. Buyers are snapping up all available vessels as demand for gas increases with winter approaching, and refraining from releasing any back into the market in case they’re needed for any supply at short notice. Shell Plc booked the Yiannis to load a US cargo at the end of October for delivery to Europe at a rate equivalent to US$400,000 per day on a round-trip basis, said traders. The deal is likely the most expensive ever for the Atlantic basin, according to traders and brokers.

Mozambique expects to ship its first liquefied natural gas exports to Europe from the Eni-operated Coral Sul floating plant later this month or early November, petroleum regulator INP said in a supply boost for the energy-starved region. BP’s LNG tanker, British Sponsor, has already arrived offshore northern Mozambique, said Welligence Energy Analytics in a note, with all of Coral Sul’s annual gas output of 3.4 million tonnes (MT) contracted to BP for 20 years on a free-on-board basis. The new LNG cargoes will help alleviate a tight global LNG market and gas shortages in Europe as winter looms following Moscow’s February invasion of Ukraine and Russia’s later decision to curb gas pipeline supplies into major European Union economies. As part of its exploration activity offshore Mozambique, Eni discovered the Coral South gas field in 2012 and took its final investment decision in 2017, pledging to start producing gas using a floating LNG plant after five years.

According to Portugal’s oil and gas company Galp Energia, it may face additional sourcing disruptions after Nigeria LNG declared force majeure due to widespread flooding. Galp Energia said it had received a notice from Nigeria LNG, its main natural gas supplier, about the force majeure but said “no information was provided to support an assessment of potential impacts”. The declaration of force majeure could worsen Nigeria’s cash crunch and will curtail global gas supplies as Europe and others struggle to replace Russian exports due to the invasion of Ukraine in February. Portugal’s Environment and Energy Minister Duarte Cordeiro said the southern European nation could face supply problems this winter if Nigeria does not deliver all the LNG it is due to. Last year, Portugal imported 2.8 bcm of LNG from Nigeria, or 49.5 percent of total imports, while the US was the second-largest supplier with a share of 33.3 percent.

Nigeria will award contracts for its flared gas by the end of December under an accelerated programme to harness gas that is released as a by-product of oil production, the country’s petroleum regulator said. President Muhammadu Buhari first launched the programme to auction rights to capture and sell flared gas in 2016. In 2020 the government approved 200 bidders but the process was stalled due to the outbreak of the coronavirus pandemic. The government has said that flaring costs roughly US$1 bn a year in lost revenue. The gas can be used in power plants, in industry or exported. Petroleum Minister Timipre Sylva said Nigeria’s plan to commercialise gas burned from its oil fields was at an advanced stage and would help cut 15 MT of carbon emissions from the atmosphere. Nigeria, which has Africa’s largest gas reserves of more than 190 trillion cubic feet, first targeted gas flaring in the late 1970s and, through various schemes and regulations, has more than halved it since 2001.

Egypt is aiming to take over the development of Gaza’s offshore natural gas field, in what would be a boost for the cash-strapped Palestinian economy. While Egypt and Israel have been producing gas in the eastern Mediterranean for years, the Gaza Marine field, about 30 km (20 miles) off the Gaza coast, has remained undeveloped due to political disputes and conflict with Israel, as well as economic factors. The project was last in the hands of oil major Shell, which gave up its stake in 2018. The Palestinians have been looking for a new foreign group to take over. Egypt’s gas company EGAS began talks last year with the Palestine Investment Fund PIF and the Consolidated Contractors Company CCC, a coalition of companies that are licensed to develop the field.

According to the Federal Energy Regulatory Commission (FERC), natural gas prices at major US trading hubs for the upcoming winter are expected to remain higher than in recent years. Freeport LNG, the second-largest US LNG (liquefied natural gas) export plant, idled for five months by fire, must receive full approvals before a planned November restart can begin, regulators said. FERC said it sees the Henry Hub natural gas futures contract price averaging US$6.82 per million metric British thermal units (mmBtu) for winter 2022-2023, up 30 percent from last winter’s settled price. US natural gas futures are currently trading just under US$5.3 per mmBtu, their lowest levels in about seven months.

US oil major Chevron Corporation expects high European prices for liquefied natural gas to attract a majority of US LNG exports in the short term. Europe is determined to wean itself off Russian gas imports following its invasion of Ukraine, a move that has thrown open the door to US suppliers. Its commitment to building import terminals and regasification facilities shows the region’s demand for US exports could last. Chevron is a large natural gas producer globally, last year pumping more than 7.5 billion cubic feet per day (bcfd) with more than half of its gas production in the US and Australia. The major producer produces LNG in Australia and Angola and recently carved out a foothold in US LNG through purchase agreements with LNG producers Cheniere Energy Inc and closely-held Venture Global LNG. The US is the world’s top gas producer with an output near 99 bcfd, but as consumption is lower, at about 89 bcfd, there is room for rising exports with expanding production. Chevron is also studying options to “commercialise” more gas from an Eastern Mediterranean field, off the coast of Israel, either through existing pipelines or some LNG alternatives.

China has asked its state-owned gas importers to stop reselling LNG to buyers in Europe and Asia as it seeks to ensure its own supply for the winter season. China’s National Development and Reform Commission (NDRC) has asked PetroChina Co, Sinopec and Cnooc Ltd to keep winter cargoes for domestic use. Chinese authorities said the country would greatly increase domestic energy supply capacity and its reserve capacity for key commodities, reiterating a policy of ensuring supplies and stabilising prices of raw materials.

Malaysia’s Petronas said it has declared force majeure on gas supply to one of its liquefaction terminals, Malaysia LNG Dua, due to a pipeline leak caused by soil movement at the Sabah-Sarawak Gas Pipeline. Japanese trading house Mitsubishi Corporation, which owns a stake in Malaysia LNG, said that Malaysia LNG, majority owned by Petronas, had declared force majeure on LNG supplies to its customers following the pipeline leak. Petronas said that the pipeline leak had affected its delivery commitments to some of its contracted LNG buyers, and the company was in discussions to “identify suitable mitigation efforts”. It was also conducting an evaluation of the Sabah-Sarawak Gas Pipeline to ensure its integrity and safety. With a total LNG capacity of 25.7 million tonnes per annum, the Malaysia LNG project is one of the largest LNG facilities in a single location in the world, according to Mitsubishi.

27 October: Vedanta has got a 10-year extension of the licence for its prolific Rajasthan oil block till 14 May 2030, the firm said. The initial licence to explore and produce oil and gas from the Barmer block expired on 14 May 2020. The government had agreed to a 10-year extension but it wanted a higher share of oil and gas from the block as well as a settlement of INR 56.51 bn dispute over cost recovery for the same. The government has agreed to sign the extension of the Production Sharing Contract (PSC) pending the settlement of the dispute. The company produced 1,20,805 barrels of oil equivalent per day (boepd) in the second quarter ended 30 September 2022. The block, with 38 discoveries, till date, has a total in place hydrocarbons of 5.9 billion barrels of oil equivalent (bboe). The block has cumulatively produced more than 700 million barrels of oil equivalent (mmboe) in the last decade. Vedanta believes it is eligible for an automatic extension of PSC for the Rajasthan (RJ) block on the same terms with effect from 15 May 2020. The government had in October 2018 agreed to extend by 10 years the contract for Barmer fields in Rajasthan after the expiry of the initial 25-year contract period on 14 May 2020.

27 October: India’s oil imports from the Middle East fell to a 19-month low in September while Russian imports rebounded although refining outages hit overall crude imports, trade and shipping data showed. India’s total oil imports in September fell to a 14-month low of 3.91 million barrels per day (bpd), down 5.6 percent from a year earlier, due to maintenance at refiners such as Reliance Industries Limited (RIL) and Indian Oil Corporation (IOC), the data showed. India’s imports from the Middle East fell to about 2.2 million bpd, down 16.2 percent from August, the data showed, while imports from Russia increased 4.6 percent to about 896,000 bpd after dipping in the previous two months. Russia’s share of India’s oil imports surged to an all-time high of 23 percent from 19 percent the previous month while that of the Middle East declined to 56.4 percent from 59 percent, the data showed. Imports for Saudi Arabia fell to a three-month low of about 758,000 bpd, down 12.3 percent from August, while imports from Iraq plunged to 948,400 bpd, their lowest level in a year, the data showed. In the first half of this fiscal year, Indian refiners also reduced purchases of African oil, mostly bought from the spot market. However, supply from the Middle East rose from a low base last year when the second wave of the coronavirus cut fuel demand.

28 October: The International Energy Agency (IEA) said that India’s import of natural gas will double and that of oil will rise 50 percent by 2030 due to soaring domestic demand while production remains subdued. The IEA stated that demand for natural gas in the country would nearly double to 115 billion cubic meters (bcm) in 2030 from 66 bcm in 2021, with most of the growth coming from manufacturing and other industry. The agency estimates domestic production of natural gas to rise 50 percent to 48 bcm in 2030, which would be lower than India’s output of 51 bcm in 2010. The global demand for natural gas rises at an average rate of 0.4 percent per year between 2021 and 2030, lower than the 2.2 percent growth rate between 2010 and 2021. The demand is expected to reach 4,400 bcm in 2030 and stay at that level until 2050.

1 November: The Chhattisgarh government has written to the Union environment ministry seeking cancellation of the forest approval given to Parsa coal block in Hasdeo Arand forest, citing the “law and order” problem and the overall benefit of the locals in the area. The coal from Parsa is meant for the thermal power plants in Rajasthan, another Congress ruled state. The Parsa coal block has been allocated to the Rajasthan Rajya Vidyut Utpadan Nigam Limited (RRVUNL) while coal mine developer-cum-operator (MDO) operations have been awarded to the Adani Enterprises through competitive bidding.

1 November: Coal India Limited (CIL) said its coal production increased by 17.4 percent to 351.9 million tonnes (MT) in the April-October period of the ongoing fiscal. The company’s coal output in the corresponding period of last fiscal was 299.6 MT, CIL said. However, in October the offtake dropped to 53.7 MT from 56.5 MT in the same month of last fiscal. The coal major did not give the reason for the drop in offtake. CIL accounts for over 80 percent of domestic coal output. CIL will achieve 1 billion tonnes of coal production target by 2025-26 as against the earlier timeline of 2023-24 in view of the COVID-19 pandemic, coal minister Pralhad Joshi had said. Coal output by CIL in the current financial year is expected to be 700 MT and there would be additional output of 200 MT from other sources.

1 November: India’s power consumption grew 1.64 percent to 114.64 billion units in October in contrast to the year-ago interval, according to authorities information. The energy consumption rose solely marginally in October, primarily due to incessant unseasonal rains which stored the mercury ranges low and decreased the usage of cooling home equipment. The farmers use electricity to run tube wells for irrigation for brand new crops. The peak power demand met, which is the very best provided in a day, in October rose to 186.90 gigawatt (GW). The peak energy supply stood at 174.44 GW in October 2021 and 169.89 GW in October 2020. The peak energy demand met was 164.25 GW in October 2019, which was the pre-pandemic interval. Electricity consumption in October 2019 stood at 97.84 billion units. Experts opined that the marginal development in power consumption in October doesn’t lead to sluggish restoration in the financial system because it has occurred simply due to unseasonal rains which affected demand of electrical energy quickly.

1 November: The five discoms (distribution companies) of Uttar Pradesh Power Corporation Limited (UPPCL) stated to the Electricity Regulatory Commission (ERC), that they have charged more than INR40.1 mn extra from power consumers for new connections. Earlier on 21 October, the discoms had presented a figure of merely INR22.7 mn. PVVNL (Paschimanchal Vidyut Vitran Nigam Limited) said that discom charged INR 37.49 lakh excessive from consumers and would complete the refund in next 15 days.

30 October: The Rajasthan government has approved a proposal to give exemption from electricity duty to industrial units under the Rajasthan Investment Promotion Scheme-2022. Chief Minister (CM) Ashok Gehlot has approved the proposal to give exemption in electricity duty to the beneficiaries of Rajasthan Investment Promotion Scheme-2022 (RIPS-2022). With this approval of CM, the units involved in RIPS-2022 will be able to get exemption in electricity duty on the electricity used by them. The units will be able to get the benefit of the said exemption as per the rules of the RIPS-2022 scheme. The RIPS-2022 scheme has been started recently by the CM to provide a better environment for proper development and investment of industries in the state.

28 October: Nearly 30 percent of the electricity consumers and subsidy beneficiaries are yet to apply for the power subsidy even as the last date of application, 31 October, inches closer, the government said. According to the government, over 33 lakh electricity consumers have so far applied for the power subsidy in the national capital. Delhi Chief Minister (CM) Arvind Kejriwal had announced 31 October as the deadline to apply for power subsidy for the month. He had said that those who do not apply for the subsidy will have to pay their non-subsidised bills but can apply next month. There are 58 lakh domestic power consumers in Delhi, of whom 47 lakh avail the subsidy. 33,14,488 lakh electricity consumers have applied for power subsidy, while the remaining 13.85 lakh consumers are yet to do it. He said people can give a missed call or send a WhatsApp message on 7011-3111-11 to opt for the subsidy. Out of 47 lakh electricity consumers who avail the subsidy, nearly 30 lakh are those who get zero bills and 16-17 lakh who get a 50 percent subsidy. At present, consumers with a power consumption of less than 200 units do not have to pay any charges and those with a consumption of up to 400 units get a 50 percent subsidy.

31 October: India will use the UN (United Nations) climate conference to urge rich countries to keep their promise to give US$100 billion a year in funding to help developing nations deal with climate change and switch to cleaner energy. New Delhi will also reiterate its commitment to do its best to help slow global warming at the COP27 event. India is the world’s third largest emitter of greenhouse gases after China and the US (United States) – though it is much lower down the rankings of emissions per capita, according to Our World Data. It has been ramping up its share of renewable energy, but coal continues to be India’s main fuel for power generation, as the country strives to provide energy for its 1.4 billion people using cheaper fuel. India had already initiated steps such as meeting half of its energy demand from non-fossil fuels and building 500 gigawatts (GW) of non-fossil energy capacity by 2030.

28 October: The state government must fast-track the PM Kusum scheme and sign power purchase agreements with landowners who are keen to set up solar plants on uncultivable land, the Confederation of Indian Industry (CII) said. CII said many local companies are ready to set up large solar plants on waste mines. CII Goa has recommended that instead of incurring high capital expenditure to set up solar power plants atop government buildings, the Goa government should ink long-term power purchase agreements with renewable energy service companies. CII asked the government to consider offering incentives to industries that install large scale rooftop solar plants. CII Goa is confident that if the government offers rates in the vicinity of INR4.5 per unit there would be sufficient interested parties that would meet Goa’s future renewable energy purchase obligation targets

26 October: Tata Power Solar Systems announced the launch of cost-efficient solar off-grid solutions in West Bengal, Bihar and Jharkhand. Tata Power Solar Systems Limited (TPSSL) is a wholly-owned subsidiary of Tata Power Renewable Energy Ltd (TPREL). The off-grid solutions provide a combination of high-efficient solar modules, inverters and batteries and are available in 11 variants ranging from 1 – 10 Kw with a 5-year warranty, the company said. These solar off-grid solutions are charged during the daytime and enable consumers to access sustainable electricity by reducing their reliance on costly and polluting alternatives like diesel generators during nighttime and outages.

1 November: Nigeria’s NNPC Ltd said Sinopec’s Addax Petroleum Development (Nigeria) Ltd had exited from its four major oil mining blocks in Nigeria and transferred them to the state-owned oil company. Addax began operations in Nigeria in 1998 by signing Production Sharing Contracts (PSCs) with NNPC. The oil leases were in April 2021 revoked by the petroleum regulator which accused Addax of failing to develop them sufficiently, but the decision was overturned by President Muhammadu Buhari. NNPC became a commercial entity in July and is bulking up assets ahead of a planned initial public offering in the second half of next year.

1 November: Libya’s National Oil Corporation (NOC) chief Farhat Bengdara said that oil output had risen to 1.2 million barrels per day (bpd) from 600,000 bpd three months ago and that NOC does not expect any disruption in oil production. Oil production has been repeatedly hit in Libya – an OPEC (Organization of the Petroleum Exporting Countries) member – by groups blockading facilities, sometimes to demand material benefits but also as a tactic to achieve wider political ends. Bengdara said that Libya, which is seeking investment to develop new supplies of oil and natural gas, is close to finalising a deal with Italy’s Eni worth up to US$8 billion.

31 October: Mexican state oil firm Pemex recorded a 30 percent monthly jump in crude exports in September from the prior month, boosted by soaring demand from Europe and Asia following Russia’s invasion of Ukraine. Pemex said in a weekend report it had exported 1.21 million barrels per day (bpd) of crude oil compared with 914,665 bpd in August. Exports were up 23 percent year-on-year, from the 983,000 bpd recorded last September. The Mexican government, which had said that this year it would move toward refining more oil at home, took advantage of the higher prices that followed Russia’s war in Ukraine. Pemex said shipments of crude destined for Europe – which is looking to wean itself off Russian oil – surged 85 percent in September from August to reach 149,734 bpd, while shipments to Asia were up 80 percent at 292,008 bpd.

28 October: Organization of the Petroleum Exporting Countries (OPEC) is likely to maintain its view world oil demand will rise for another decade, longer than many other forecasters predict, in a forthcoming major report, despite the growing role of renewables and electric cars. OPEC is scheduled to update its long-term oil demand forecasts in its 2022 World Oil Outlook on 31 October. The 2021 version sees oil demand reaching a plateau after 2035. Another decade or more of oil demand growth would be a boost for producers and OPEC, whose 13 members depend on oil income, and would justify continued investment in new supplies. Consumers and governments urging efforts to curb oil use to combat climate change would be less happy.

27 October: Colombia’s government may change its position on prohibiting new contracts for oil exploration, director of public credit Jose Roberto Acosta said. Granting new contracts for oil exploration would represent a major U-turn for the government of leftist President Gustavo Petro, who previously described oil and coal – as the country’s top exports – as poisons, while also pledging to move Colombia away from hydrocarbons. Petro’s decision to prevent new oil exploration contracts – alongside other comments on capital controls and criticism of the central bank’s raising the interest rate – has caused Colombia’s peso to depreciate sharply, falling to a record low. Petro’s government has agreed to modify a tax reform proposal to implement new duties on oil and coal more gradually.

26 October: Exxon Mobil Corporation has made two new discoveries at the Sailfin-1 and Yarrow-1 wells in the Stabroek block offshore Guyana, the oil major said, potentially adding more barrels to one of the most closely watched new oil discoveries. Exxon did not disclose how much crude oil or gas it estimates the new discoveries to contain. Guyana amounts for one third of the crude discovered in the world since Exxon first hit oil in the country in 2015, according to Rystad consultancy firm. The about 11 billion barrels of recoverable oil discovered prior to Wednesday’s finds, should make the country a global oil power in the coming years, Rystad said. Exxon and its partner Hess Corporation said that the Liza Phase 1 and Phase 2, the first projects sanctioned offshore Guyana by the two companies, are producing above capacity and achieved an average of nearly 360,000 barrels of oil per day (bopd) in the third quarter. The companies expect total production from Guyana to cross a million barrels per day by the end of this decade.

31 October: Russian President Vladimir Putin said a natural gas hub could be set up in Turkey fairly quickly and predicted many customers in Europe would want to sign contracts. Putin proposed Turkey as a base for gas supplies after the Nord Stream pipelines under the Baltic Sea were damaged in September by blasts. Turkish President Tayyip Erdogan says he agrees with the idea. Putin said it was very difficult to work directly with European commercial partners. The European Union, which previously turned to Russia for about 40 percent of its gas needs, is seeking to wean itself off Russian energy. Putin said Russia’s Gazprom had been allowed to inspect the damage done when blasts hit the Nord Stream gas pipelines.

30 October: QatarEnergy is in talks with the Lebanese government to take a 30 percent stake in an offshore exploration block and is also negotiating with TotalEnergies and Eni on this matter, CEO Saad al-Kaabi confirmed. TotalEnergies and the Lebanese government reached a deal handing the French oil major temporary majority control of the block and paving the way for negotiations with Qatar over a stake in the gas project. The initial exploration licence was held by a three-part consortium of TotalEnergies, Italy’s Eni, and Russia’s Novatek. Beirut announced in September that Novatek, which held a 20 percent stake, would exit. Offshore areas in the eastern Mediterranean and Levant have yielded major gas discoveries in the past decade. Interest in these has grown since Russia’s invasion of Ukraine disrupted gas supplies.

27 October: Algeria’s national petrochemicals firm Sonatrach announced it had signed deals worth US$600 million with Italian firms for the extraction and transport of liquefied petroleum gas (LPG). In recent months, the EU has been eyeing Algerian gas as a cheaper alternative to overpriced US gas. The Algerian company said it concluded a US$400 million deal with Italian company Tecnimont for the construction of an LPG plant scheduled to be completed in three years. It said that Algerian pipeline company ENAC will build a 65-kilometre (40-mile) conduit to link the plant to an existing transportation network in the country’s east. Sonatrach announced it concluded three other small-scale contracts for LPG-related infrastructure and equipment.

27 October: European Union (EU) Energy Commissioner Kadri Simson said she had informed Norwegian officials about planned “emergency measures” to address high energy prices, including a price cap on natural gas. EU energy ministers discussed proposals to contain and potentially cap gas prices that have soared in the wake of the war in Ukraine and Russian supplies have dwindled. Norway has become the most important natural gas supplier to the EU, accounting for 25 percent of all EU imports, after a drop in Russian gas flows. However, no decision had yet been made and work continued to address questions on how a price cap will secure supply and over its design, she said, speaking after meeting Norway’s Oil and Energy Minister Terje Aasland.

27 October: Italy plans to double its national gas production to 6 billion cubic metres (bcm) per year from the current 3 bcm, in a further effort to cut the country’s dependence on Russian supplies. The government will authorise new offshore drilling in the Adriatic sea, echoing the words of Italy’s new Prime Minister Giorgia Meloni, who said that Rome “has a duty to fully exploit” its offshore gas reserves to diversify energy sources.

26 October: Energean has begun production at the Karish offshore gas field and the first gas has been safely delivered, the company said. Israel granted Energean permission to start production at the Karish natural gas field. The London-listed energy group had begun pumping gas to its floating production facility on 9 October as part of reverse flow testing procedures. Energean said gas is being produced from the Karish Main-02 well and the flow of gas is being steadily increased. The Karish Main-01 and Karish Main-03 wells are expected to be opened up in approximately two and four weeks, respectively, it said. Karish has a capacity of 8 billion cubic metres (bcm). The initial capacity is up to 6.5 bcm/year, and commercial gas sales are expected to reach this level within six months. Energean said its growth projects including the Karish North development are on track for completion in late 2023. Then, it said, it would be able to produce the full 8 bcm year capacity.

31 October: Japan’s Electric Power Development Co Ltd (J-Power) raised its net profit forecast by 61 percent to a record 108 billion yen (US$727 million) for the year to 31 March as soaring coal prices boosted gains from its stake in thermal coal mines in Australia. Australia’s Newcastle thermal coal benchmark futures have more than doubled so far this year following sanctions by Western nations on Russia – the world’s third-largest exporter of coal – after its invasion of Ukraine. J-Power increased its annual net profit estimate to 108 billion yen, a record since its listing in 2004, from its May forecast of 67 billion yen, thanks to a stronger performance of three Australian coal mines in which it owns a stake. Spot prices for Australian standard thermal coal are now estimated at US$350 a tonne for 2022, up from its May assumption of US$200 a tonne and the actual US$100 a tonne in 2021, it said.

28 October: China’s strict COVID-19 policy is constraining coal supplies and pushing up prices, industry officials and traders say, just weeks before the country’s north switches on mostly coal-fired heating systems for winter and demand jumps. The world’s top coal consumer still relies on the fuel to heat homes across much of the colder north, and Beijing is determined to ensure sufficient supplies this year after shortages led to unprecedented power outages in 2021. But China’s top three coal production regions have reported hundreds of COVID cases in recent weeks, data from the country’s health commission showed, disrupting coal trade. The provinces introduced strict transport curbs this month, leaving some mines unable to ship coal out and forcing them to slow or halt production. In Zhungeer county, which contributes 27 percent of Inner Mongolia’s coal production, authorities ordered everyone in the area to stay home since 19 October after a solitary COVID case was reported at a coal mine, the local government showed. Two coal mines in Wuhai city in Inner Mongolia suspended production. Meanwhile, a month-long maintenance shutdown at the Daqin railway, China’s biggest coal transport line connecting the coal mining hubs with Qinhuangdao port, has also been extended for a week after dozens of railway staff contracted COVID in mid-October, coal traders said. Daqin typically transports about 1.3 million tonnes of coal in a normal day, but daily volumes have plunged to between 200,000 tonnes and 300,000 tonnes, according to traders. At major ports coal inventories have also fallen by 3 percent since late September, China Coal Transportation and Distribution (CCTD) agency data showed. Daily coal use at major coastal power plants has slid from over 2 million tonnes (MT) a month ago to below 1.8 MT, which is sufficient for 17 days of use, CCTD data showed.

1 November: Lebanon’s state power company Electricite du Liban (EDL) raised the price it charges for electricity for the first time since the 1990s, EDL said, in a move officials say will pave the way for an eventual increase in power supply. Lebanon has not had round-the-clock power since the 1990s and cash transfers to EDL to cover chronic losses have contributed tens of billions of dollars to the country’s huge public debt. Electricity-sector reform is a key demand of donor nations who have pledged to help Lebanon exit a financial crisis if it undertakes reforms. The Government said that increasing the price of power would allow the state to afford to purchase more fuel to fire power plants, thereby increasing supply from an hour or two per day to up to 10 hours per day.

31 October: A 40 percent cut in deliveries of Russian natural gas is hitting Moldova’s ability to provide sufficient electricity for its 2.5 million people, the Deputy Prime Minister of the small ex-Soviet state, Andrei Spinu, said. Spinu said Russian gas giant Gazprom had promised to supply only 5.7 million cubic metres of gas per day – well short of the 11.5 million needed to ensure enough power.

27 October: Illumination on Slovenia’s highways will be reduced onwards in a bid to save energy, the country’s state-owned company DARS has announced. The move will save 2,000 megawatt hours of electricity per year, which is equivalent to the average annual consumption of 600 households. From September, the government imposed a one-year price cap on electricity prices for households and small businesses, to ease the burden of rising energy prices on the population. Next month it plans to introduce a scheme to help medium and large companies overcome the energy crisis.

27 October: Singapore will import more electricity from the region and is on track to reach its import targets of up to 4 gigawatt (GW) of electricity by 2035, Tan See Leng, the manpower minister and second minister for trade and industry, said. The city-state’s Energy Market Authority (EMA) has launched requests for proposals for electricity import projects from the region, Tan said. The EMA has since received more than 20 proposals from Australia, Indonesia, Laos, Malaysia and Thailand, Tan said. About 95 percent of Singapore’s electricity is generated from natural gas, though the country plans to ramp up sources of renewable energy.

27 October: Ukrainian President Volodymyr Zelenskyy has publicly thanked the country’s power workers for maintaining the electricity supply as Russia continues to target energy infrastructure ahead of the winter. Authorities have ordered rolling blackouts in many parts of the country and urged households to limit consumption as electricity infrastructure is targeted by Russian attack drones. In a likely response to the Russian attacks on Ukrainian infrastructure, a power plant just outside the city had suffered minor damage in a drone attack. A drone hit a transformer and sparked a fire but did not affect its overall operation and did not interrupt the electricity supply.

1 November: Alphabet Inc’s Google said it would buy about three-quarters of the renewable power from SB Energy Global’s Texas facilities, as it aims to operate data centres on carbon-free energy by 2030. Companies are rapidly shifting toward clean energy and transportation as they look to meet environmental and sustainability goals. The US$430 billion Inflation Reduction Act signed by President Joe Biden signed in August also seeks to incentivise a shift to clean energy, by providing tax credits. Google will use the energy from the SoftBank Group Corp-backed company, which will have a capacity of about 3 GW by early next year, to power data centres in Texas, Alphabet said. SB Energy’s Orion 1, 2 and 3 and Eiffel solar projects which total nearly 1.2 gigawatt (GW) of capacity are expected to be ready to supply power by mid-2024.

31 October: Seoul and Warsaw signed outline agreements to develop nuclear power in Poland, as Poland strives to phase out coal and lower its carbon emissions and South Korea seeks to revive its nuclear industry. Poland’s ZE PAK and PGE) and Korea Hydro & Nuclear Power (KHNP) will assess the viability of building four 1,400 megawatt (MW) nuclear reactors in Patnow, central Poland, using South Korean technology, the South Korean Ministry of Trade, Industry and Energy said. Since the election this year of President Yoon Suk-yeol, who pledged to revive the country’s nuclear power industry, South Korea has stepped up efforts to win nuclear power plant export orders.

26 October: Singapore’s energy regulator will be introducing new emissions standards for new and repowered fossil fuel-fired power generation units in 2023, Low Yen Ling, the minister of state for the ministry of trade and industry, said. The Energy Market Authority (EMA) will consult with the industry in the coming months and will release details on the standards subsequently, the minister said. The new rules are part of the implementation of a law the city-state passed last year that allowed the EMA to set greenhouse gas emissions standards. The measure also follows Singapore announcing plans to reduce its emissions target for 2030 to 60 million tonnes of carbon dioxide (CO2).

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.