-

CENTRES

Progammes & Centres

Location

Quick Notes

The Kirit Parikh panel report on natural gas pricing was submitted to the Ministry of Petroleum & Natural Gas (MOPNG) last week. The proposals correspond to domestically produced natural gas that comes under the administered price mechanism (APM). APM gas produced by state-owned companies accounted for 68 percent of net domestic production 2021-22. The rest of the domestic gas production contracted before 2019 has a degree of pricing freedom within an upper ceiling price. Natural gas production contracted after 2019 has total marketing and pricing freedom.

The mandate given to the panel was to recommend a solution for pricing APM gas that will (i) increase domestic production to meet the goal of increasing the share of natural gas from 6 percent to 15 percent of primary energy consumption by 2030 (ii) offers a fair price for consumers and (iii) decrease the subsidy burden on the government. These are competing interests that are difficult to reconcile but the Kirit Parikh report proposals have managed to strike a balance and also prepare the sector for market-based pricing of natural gas in the next few years.

The panel has recommended that the pricing of domestic gas production be linked to the price of crude oil with a floor price of US$4/mmBtu and an upper ceiling price of US$6.5/mmBtu. The floor price is based on the marginal cost of production for state-owned producers ONGC (Oil & Natural Gas Corporation) and OIL (Oil India Limited) and the ceiling price is based on the price that will keep household consumers of compressed natural gas (CNG) and vehicle fuel consumers of piped natural gas (PNG) happy. The report has recommended that the existing price mechanism should continue for gas produced from difficult and complex fields. The panel has also suggested that price controls (upper ceiling) for gas production from complex fields should be eliminated from 1 January 2026 and for APM gas on 1 January 2027. The time frame has been chosen keeping in mind the time needed to prepare for gas pricing freedom and more importantly avoid the prospect of legal challenges over ongoing contracts for gas trade most of which are expected to end by 2026. The panel also recommends that excise on CNG is reduced until natural gas is brought under the GST (goods and services tax) tax regime. Compensation of loss in value added tax (VAT) revenue from CNG sales for certain states by the central government is also among the suggestions.

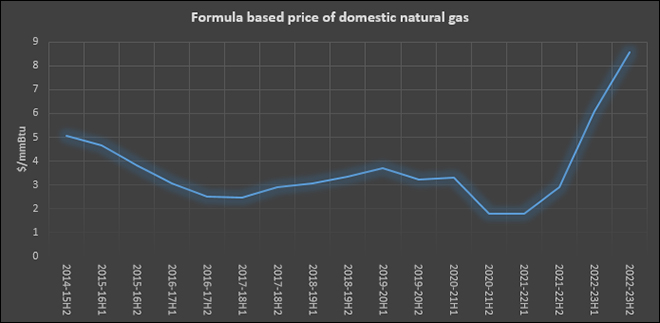

The current formula-based pricing of APM gas that links US, European, Russian and Japanese market prices has imposed considerable volatility with prices ranging from US$1.79/mmBtu (metric million British thermal units) from April to September 2021 to US$8.57/mmBtu in October 2022 to March 2023. The prices would have been much higher in the range of US$25/mmBtu but for the 15-month lag in incorporating prices in the various regional markets. In fact, without a revision in the basis of pricing APM gas, the government would have been cornered by its own formula with high subsidy bills, inflation and angry consumers of CNG and PNG in the price revision after March 2023.

The prospect of shifting APM gas to market-based pricing has been debated before. The nineteenth report of the standing committee on petroleum & natural gas (2013-14) of the Lok sabha (the lower house of the Indian parliament) indulged in critical analysis of the effort to introduce elements of the market in the natural gas sector. The report documented the opinions of different stakeholders on the formula that is the basis for deciding the price of natural gas that comes under APM. The formula averaged the price of natural gas in different regional markets and arrived at a domestic price. The formula was supported by the MOPNG while the Ministry of Finance (MOF) questioned every element in the formula. The opinion of the Ministry of Power (MOP) and the Department of Fertilisers were also not in favour of the formula with the MOP preferring a price below US$5/mmBtu and the Department of Fertilisers preferring a price of about US$11/mmBtu.

The formula averages price paid in American, European and Japanese markets which account for over 63 percent of world consumption as it was, according to the MOPNG, a good indicator of price expectations by Indian upstream companies. According to the MOPNG, The Japanese LNG (liquified natural gas) import price was included in the formula as it was the closest LNG import market to India and without the Japanese LNG price in the formula, the domestic price would be too low to keep domestic producers happy.

The MOF, which has to shoulder the burden of subsidies from gas consuming industries such as power and fertilisers, contested the claims of the MOPNG. The argument of the MOF was based on the clause in the production sharing contracts (PSC) signed with producing companies that state the price to be paid to the producers would be based on competitive arm’s length sales in the region with similar conditions and that the price would take into account domestic and international prices of comparable gas and the linkages with traded liquid fuels. It argued that the formula that links consumption volumes in USA, Japan and Europe cannot be justified in the context of the clause in the PSC. It recommended that the net back wellhead prices of suppliers in Qatar, Oman, Abu Dhabi and Malaysia that supply gas to India may be taken into account in arriving at a formula.

Countries and regions that have gas-to-gas competition and a mature gas trading hub have market determined prices. In these markets, producers are not protected from the downside of the market just as consumers are not protected from the upside of the market (at least until 2022 when European gas prices breached all records and states intervened to protect consumers). Other gas importing countries have a formula-based pricing system to mimic some trends in mature national and regional markets.

China moved towards deregulation of natural gas prices in a phased manner. In 2009, it raised domestic prices when global natural gas prices were low. This reduced the government’s subsidy burden but it also reduced gas consumption. 80 percent of natural gas consumption by households in China is in the lowest price slab. Historically China used the “cost-plus” method to price natural gas but in 2013 it shifted to netback pricing. City gate prices were linked to substitutes (fuel oil and liquified petroleum gas or LPG) through an oil linked formula-based pricing regime in Guangdong and Guangxi regions. By linking the price of gas with the international price of its competing fuels the formula aimed to reflect international market fundamentals. The formula also had a discount rate to give natural gas a competitive advantage over competing fuels. Heating value and import prices were included for price calculation. This shifted regulated price points from ex-plant to city gate. China’s natural gas pricing used to differentiate between old and new gas but these prices converged in 2015. China deregulated pricing of unconventional gas production and LNG as these fuels competed with diesel and petrol. In 2018, city gate prices for residential and non-residential consumers were unified. Overall, China is removing cross subsidies and is rapidly moving towards complete price deregulation.

In South Africa, the natural gas pricing formula is designed to recognise that no single fuel is a perfect substitute for natural gas and to reflect a balance between encouraging a new fuel and equitable sharing of economic surplus between consumers and producers.

In the optimistic scenario in 2026-27, India may have an adaptation of one of the above formula-based pricing models that is linked to the price of competing fuels. Reforms may be piecemeal but earnest across the gas value chain that tries to balance competing industry, political and social needs. In a less optimistic scenario, the efforts to deregulate upstream prices as recommended by the Kirit Parikh panel would not be coupled with downstream reforms and even if higher prices may boost domestic supply, shortages met partially by imports will continue as demand from fertiliser, CNG and PNG consumers may grow unchecked.

According to the Union Coal Ministry, India’s total coal production will touch 900 MT (million tonnes) during this financial year, and all efforts are being taken by Coal India Limited and its subsidiaries to attain this goal. It said mineral exploration norms have been relaxed recently, nine private exploration agencies got accredited so far, and the commercial coal mine auctioning process has been made totally transparent by the present government. As per the ministry, coal import has come down considerably and by 2024 import will be stopped.

A temporary coal shortage has emboldened the Indian government to press ahead with plans to develop 99 new coal projects with the production of 427 million tonnes per year (mtpa), a briefing by Global Energy Monitor (GEM) said. Land for new coal projects continues to be auctioned despite the government’s pledge to achieve net zero emissions by 2070 and despite the fact that 36 percent of capacity at operating mines goes unused. India’s 427 mtpa of planned new coal mine capacity places it second in the world after China with 596 mtpa. In some major mining regions, like Jharkhand and Odisha, the industry has over 100 MT in unused capacity at active mine sites, amounting to over 40 percent of unused mine capacity in those states. GEM said new mines would not open fast enough to meet coal demand in the short term and would be hampered by the same problems as existing mines, such as low labour productivity, competition from renewables, land acquisition issues, and infrastructure constraints. The 99 new coal projects threaten to displace at least 165 villages and affect 87,630 families, of which 41,508 families live in scheduled areas of India, which have a predominant population of tribal communities.

According to the Ministry of Coal, Coal India Ltd (CIL) will achieve 1 billion tonne coal production target by 2025-26 as against the earlier timeline of 2023-24 in view of the COVID-19 pandemic. CIL accounts for over 80 percent of the domestic coal output. CIL was earlier eying 1 billion tonne coal production by 2023-24. It said as far as thermal power plants are concerned, there is an average coal stock of 24 MT and day-to-day stock of fossil fuel. Coal output by CIL in the current financial year is expected to be 700 MT and there would be additional output of 200 MT from other sources. For setting up large-scale coal-to-chemical projects through the surface coal gasification route, CIL signed three separate MoUs with BHEL, Indian Oil Corporation Ltd (IOCL) and GAIL (India) Ltd. NLC India is signing a MoU with BHEL. The proposed surface coal gasification projects are planned to be set up in West Bengal, Odisha, Chhattisgarh, Maharashtra and Tamil Nadu.

Following the directions of the National Green Tribunal (NGT) earlier, the district administrations of East Jaintia Hills District in Meghalaya once again promulgated prohibitory orders banning rat-hole coal mining in the district. District administration said that the prohibitory order under Section 144 of CrPC was issued also against illegal transportation and dumping of coal in noncompliance with the directions issued by the NGT earlier. In April 2014, NGT banned the indiscriminate and hazardous rat hole coal mining in Meghalaya. Many workers got trapped in the illegal and unsafe mines and subsequently died – five in May/June last year but only three bodies were retrieved from the flooded coal mine after hectic efforts for over 27 days in East Jaintia Hills district; in December 2018, in a major tragedy in the same district, 15 migrant miners from Assam died inside in an abandoned coal mine. The 15 miners, whose bodies were never found, had been stuck in the coal mine at a depth of nearly 370 feet after a tunnel was flooded with water from the nearby Lytein river.

CIL has been directed by the government to scale up dispatch to thermal power plants. In a review meeting presided over by the Coal Ministry, coal companies were advised to enhance supplies to thermal power plants to help them meet the growing electricity demand. During the first half of 2022-23, CIL had dispatched 285.6 MT of dry fuel to the power sector, which is a growth of almost 17 percent over previous year. As a result, coal stock at thermal power plants is now three times more than last year’s stock. CIL’s production during the first half of the current fiscal year was 299 MT.

The country’s coal output rose a 12 percent to 57.93 MT in September. India’s coal output stood at 51.72 MT in the year-ago period. Of the top 37 mines, the output of 25 blocks has been more than 100 percent and another five mines’ production stood between 80 and 100 percent in the last month. The dispatch of coal also went up marginally by 1.95 percent to 61.18 MT in September, over 60.02 MT in the corresponding period last year. The dispatch of coal to power utilities also went up to 51.71 MT during last month as against 50.16 MT in the preceding year. Coal-based power generation registered a growth of 13.40 percent in September as compared to last year. The overall electricity generation in September has been 13.77 percent higher than the power generated in September 2021. CIL accounts for over 80 percent of domestic coal output. The PSU is eyeing one billion tonnes of coal output by FY24.

As 450-plus coal-based factories of Panipat stalled, the Commission for Air Quality Management (CAQM)’s guidelines about the use of industrial generators pressed the panic button among thousands of micro, small, and medium enterprises (MSMEs) in the National Capital Region (NCR). The commission has passed standing instructions to close the NCR industries if the region’s air quality index enters the red zone. Faridabad and Gurugram have mixed industries. These cities and Sonipat have Haryana State Industrial Development Corporation (HSIIDC)’s production zones along with heavy industry in Manesar, Barhi, Kundli, Rai, and Bahadurgarh. The state has 3,000 units in Sonipat, 8,000 in Faridabad, 7,500 in Gurgaon, and 2,000 in the government and private industrial parks of Rohtak and Jhajjar districts.

China’s strict COVID-19 policy is constraining coal supplies and pushing up prices, industry officials and traders say, just weeks before the country’s north switches on mostly coal-fired heating systems for winter and demand jumps. The world’s top coal consumer still relies on the fuel to heat homes across much of the colder north, and Beijing is determined to ensure sufficient supplies this year after shortages led to unprecedented power outages in 2021. But China’s top three coal production regions have reported hundreds of COVID cases in recent weeks, data from the country’s health commission showed, disrupting the coal trade. The provinces introduced strict transport curbs this month, leaving some mines unable to ship coal out and forcing them to slow or halt production. In Zhungeer county, which contributes 27 percent of Inner Mongolia’s coal production, authorities ordered everyone in the area to stay home since 19 October after a solitary COVID case was reported at a coal mine, the local government showed. Two coal mines in Wuhai city in Inner Mongolia suspended production. Meanwhile, a month-long maintenance shutdown at the Daqin railway, China’s biggest coal transport line connecting the coal mining hubs with Qinhuangdao port, has also been extended for a week after dozens of railway staff contracted COVID in mid-October, coal traders said. Daqin typically transports about 1.3 MT of coal in a normal day, but daily volumes have plunged to between 200,000 tonnes and 300,000 tonnes, according to traders. At major ports coal inventories have also fallen by 3 percent since late September, China Coal Transportation and Distribution (CCTD) agency data showed. Daily coal use at major coastal power plants has slid from over 2 MT a month ago to below 1.8 MT, which is sufficient for 17 days of use, CCTD data showed.

Metallurgical coal prices in top steel producer China rose to their highest in more than three months, shrugging off weakness in the broader ferrous market, as concerns grew over tightening supply. Coal companies in Shanxi, China’s top coal producing province, plan to suspend production ahead of the ruling Communist Party congress beginning 16 October, traders said. Flood warnings in key coal supplier Australia also added to the supply concerns, analysts said. The most-traded January coking coal on the Dalian Commodity Exchange DJMcv1 rose as much as 2.1 percent to 2,233 yuan (US$310.60) a tonne, its strongest since 30 June.

Russian coal exports to energy-hungry China have jumped by about a third this year but the supply boom is being constrained by transport infrastructure limitations. China is seeking coal supplies from overseas, in particular, after recent COVID-19 outbreaks in the major coal mining regions of Inner Mongolia and Shaanxi forced many mines to close, while coal demand for power generation and heating sectors will soon pick up with the coming of winter. Russia is the world’s sixth-largest coal producer and one of top coal exporters, along with Indonesia and Australia. Its share of global coal exports reached 17 percent last year with a supply of 223 MT. Some traders were simply told by sellers or miners that a coal shipment was cancelled due to the lack of rail capacity and could be delayed for weeks. Russian First Deputy Prime Minister Andrei Belousov has acknowledged the problem with infrastructure constraints, saying this month that the situation with coal exports and congestion on the rail system had not stabilised, though it was improving. China’s coal imports from Russia fell to 6.95 MT last month, down from a peak of 8.54 MT in August, according to China’s customs data. According to the Russian transport industry, Russia has increased coal supplies to China by railways by about a third this year, to 27.6 MT in the January-August period. Of Russia’s total of 223 MT of coal exports last year, 49 MT were delivered to Europe, according to the energy ministry. But Russia expects its coal exports to decline in coming years due to the Western sanctions over the Ukraine conflict, and US (United States), European Union (EU) and British embargos on Russian coal imports. According to Russian government expectations, coal exports may fall by 22 percent this year and by a further 31 percent in 2023.

Japan’s Electric Power Development Co Ltd (J-Power) raised its net profit forecast by 61 percent to a record 108 billion yen (US$727 million) for the year to 31 March as soaring coal prices boosted gains from its stake in thermal coal mines in Australia. Australia’s Newcastle thermal coal benchmark futures have more than doubled so far this year following sanctions by Western nations on Russia – the world’s third-largest exporter of coal – after its invasion of Ukraine. J-Power increased its annual net profit estimate to 108 billion yen, a record since its listing in 2004, from its May forecast of 67 billion yen, thanks to a stronger performance of three Australian coal mines in which it owns a stake. Spot prices for Australian standard thermal coal are now estimated at US$350 a tonne for 2022, up from its May assumption of US$200 a tonne and the actual US$100 a tonne in 2021, it said.

Indonesia’s state utility Perusahaan Listrik Negara (PLN) is in negotiations with US and European investors to help finance an acceleration scheme for its coal power plant retirement. PLN is targeting reaching net zero carbon emission by 2060 and planning the early retirement of coal plants with a collective capacity of 10 gigawatts (GW). As of 2020, PLN had 63.3 GW of installed power capacity with 50 percent coming from coal-fired plants. Some of PLN’s coal capacity would come to natural retirement in 2044, but the company could expedite the phasing out by a decade with affordable financing at a 2.5 percent to 3 percent rate.

Colombia coal miner Cerrejon, which is owned by Anglo-Swiss commodities giant Glencore, reported that production at its mine in the country’s La Guajira province was halted by some 13 illegal road blocks. According to the company, in September nearly week-long road blockades cut production at the mine by 70 percent. Cerrejon, which produced 23.4 MT of coal in 2021, was fully bought by a top global miner and trader Glencore last year. Colombia is a major global exporter of coal and royalties and taxes from the fuel are a top contributor to government coffers.

As the UN (United Nations) steps up calls to make the switch to renewable energy to fight the global climate emergency, Portugal is among the first European Union (EU) countries to abandon coal. It has been nearly a year now since the smoke has trailed up from the cooling towers of the coal plant in Pego, 120 kilometres (70 miles) northeast of the capital Lisbon. The lights are off at the station, and the dust gathering on the steel structure attests to the fact that the last coal plant in Portugal shut down in November last year after 30 years in service. The authorities in Lisbon shut down this fossil-fuel eight years sooner than planned — and just months after the Sines coal plant, some 90 kilometres south of Lisbon, closed at the start of 2021. Portugal is one of a handful of EU member states — along with Belgium and Sweden — to have renounced coal as an energy source. The energy crisis triggered by the war in Ukraine prompted Austria to reverse a previous decision to close coal-fired plants. The two coal plants recently closed accounted for nearly 20 percent of Portugal’s greenhouse gases. To replace coal’s contribution to electricity production, the government hopes to continue developing its green energy to provide 80 percent of its energy by 2026, up from 40 percent in 2017.

Germany’s largest power producer RWE is bringing forward its coal phase-out by eight years and is ready to end lignite-based electricity generation in 2030 as part of a deal reached with the government. However, faced with a Europe-wide energy crisis after Russia slashed gas deliveries following its invasion of Ukraine, RWE said it would temporarily boost its use of power plants fuelled by heavily polluting lignite, or brown coal. The German government in November agreed to “ideally” bring forward the country’s exit from coal-fired power generation to 2030, compared with a previous goal of 2038, but that plan still required negotiations with the individual operators.

3 November: PSU (Public Sector Undertaking) oil companies are losing a net INR4 per litre on diesel while their margins have turned positive on petrol, Oil Minister Hardeep Singh Puri said on talks of a price reduction in the offing as international rates have softened. Puri said his ministry will seek assistance for the three fuel retailers – Indian Oil Corporation (IOC), Bharat Petroleum Corporation Limited (BPCL) and Hindustan Petroleum Corporation Limited (HPCL) for the losses they incurred on holding petrol and diesel prices since the Ukraine war to help the government fight inflation. The three firms held prices despite international oil prices shooting up to more than a decade high. The under-recovery – difference between the retail selling price and the international rate – currently is about INR 27 per litre on diesel but the actual cash loss (the loss based on the actual cost of procurement of crude oil and turning it into fuel) is about INR3-4 per litre. Puri said oil companies moderated prices during extreme volatility to help consumers. The three fuel retailers suffered a net loss of over INR 190 bn in the April-June quarter and are expected to report losses for the following quarter as well. The government last month doled out INR 220 bn to the three firms as a one-time grant to make up for the losses they incurred on selling domestic cooking gas (LPG) in two years starting June 2020.

2 November: The price of a 19 kg (kilogram) commercial LPG (liquefied petroleum gas) cylinder has once again dropped in Mumbai-this time by INR115.50 a cylinder. The revised price of commercial cylinders from 1 November is INR 1,696, which has brought huge relief to hoteliers, caterers and among others. While prices of commercial LPG cylinders have been slashed drastically in the past few months, there has been no change in prices of domestic cylinders which cost INR 1,052 per cylinder. Mumbaikars are complaining about increasing prices of cooking gas. The price of LPG domestic cylinder witnessed five hikes in the past one year taking the price to over INR 1,000 for a 14.2kg cylinder while piped cooking gas or PNG also witnessed 10 hikes during the same period. The rate of piped cooking gas was INR 52.50 per unit. Commercial LPG rates are revised once every month. The rates differ from state to state depending on the local VAT, sources added. This April, the commercial LPG rates had witnessed a hike of INR250 and the rate had escalated to INR 2,205 per cylinder. As for piped cooking gas, prices were reduced by Mahanagar Gas on two occasions-in April and August-as the government cut taxes, but citizens said this wasn’t a great relief. Overall, there was over INR 20 hike in the past year.

3 November: Adani Total Gas Limited (ATGL), India’s leading City Gas Distribution company, announced its operational and financial performance for the half yearly and quarter ending on 30 September 2022. As per the results, compressed natural gas (CNG) Volume has increased by 40 percent Y-o-Y (year on year) on account of increased consumption along with network expansion of CNG stations. PNG (piped natural gas) Volume has decreased by 3 percent Y-o-Y due to the curtailment of gas supplies from suppliers and high gas prices. In spite of high gas prices, ATGL adopted a calibrated pass through pricing strategy and as a result sustained its overall volume growth and EBITDA of INR4.64 bn on Y-o-Y basis. ATGL continued its effort to have efficient gas sourcing to reduce the impact of volatility in gas price.

3 November: Shapoorji Pallonji Oil & Gas, the only domestic specialist firm in building floating production storage and offloading units (FPSO) in the hydrocarbon industry, has built a unit for ONGC (Oil and Natural Gas Corporation) to be deployed in the KG Basins. Named Armada Sterling V, the FPOS was built at the Sembcorp Shipyard in Singapore in association with Malaysia’s Bumi Armada group. The company has a 70:30 joint venture with the Malaysian group, Shapoorji Pallonji Oil & Gas said. Armada Sterling V will be deployed in Cluster 2 of ONGC’s KG98/2 Block off the Vizag coast, making it the national oil major’s first deep-water development where the oil and gas major is investing over USD 5 billion, which includes an FPSO, a process platform and other facilities. Production of Cluster 2 is expected to peak at around 16.5 million standard cubic metres of gas per day and 78,000 barrels of crude oil per day, which if achieved can reduce the country’s annual crude oil import bill by US$4.5 billion.

6 November: The dispatch of coal to the power sector registered a 5.5 percent decline at 56.49 MT (million tonnes) last month. The coal supply to the power sector was at 59.79 MT in October 2021. The overall dispatch of dry fuel to different sectors in October also dropped to 67.02 MT from 70.21 MT in the year-ago period. The supply to captive power plants also fell to 3.54 MT from 4.97 MT. Many states faced power outages due to a shortage of coal in the summer season this year. However, the coal ministry had said the “power crisis” happened mainly on account of the sharp decline in electricity generation from different fuel sources and not due to the non-availability of domestic coal. The government had attributed the low coal stocks at power plants to several factors such as heightened power demand due to the boom in the economy post-Covid, early arrival of summer, a rise in the price of gas and imported coal and sharp fall in electricity generation by coastal thermal power plants.

3 November: Finance Minister Nirmala Sitharaman said a fast-growing economy like India needs greater investment in coal production and gasification projects as globally, energy prices, especially that of gas, are going up. Launching the sixth round of coal mine auction of the Ministry of Coal the Finance Minister highlighted that India is at present the best investment destination in the world. She said that due to policy consistency and the transparent process of the present Government, coal imports for the power sector have come down by 41 percent. She said that 11 states are to benefit directly from the auctioning of 141 coal mines. Coal Minister Pralhad Joshi said that the coal ministry is exploring alternative methodologies for enhanced use of coal. Joshi said that previously auctioned mines have started production and hoped that 10 to 15 million tonnes of coal will be produced from new mines by next year.

7 November: Chief Minister (CM) M K Stalin inaugurated 14 new substations set up by TANGEDCO (Tamil Nadu Generation and Distribution Corporation Limited) in different parts of Tamil Nadu. The new substations set up at INR 3.73 bn are located at Millers Road, Kannammapet, Vadapalani, Kodambakkam in Chennai, Anakaputhur in Chengalpet district and in some in places in Tiruvallur and Kancheepuram districts. Also, the new transformers with additional capacity have been installed in 57 existing substations across the state at a cost of INR 915.7 mn. The chief minister virtually laid the foundation stones for another eight new substations to be set up in Karur, Cuddalore, Ariyalur and Thanjavur districts at a cost of INR 1.3 bn.

4 November: Kalpataru Power Transmission informed that it has bagged orders worth INR 12 bn. The new orders include work in overseas markets in the T&D (transmission and distribution business, oil and gas pipeline works and railway works in India. The company’s total order intake in this fiscal year is around INR 68.9 bn. The company said that the order intake reflects significant growth compared to the same period in the last fiscal year. KPTL is currently executing projects in over 30 countries and has a global footprint in 67 countries.

4 November: The total trade volume of Indian Energy Exchange (IEX) dipped 13 percent to 7,972 million units (MU) in October compared to a year ago. The IEX achieved 7,972 MU volume in October 2022, including Green Power trade of 403 MU, and 3.58 lac RECs (equivalent to 358 MU), the IEX said.

3 November: The government asked smart metre makers to bring down the cost of the device to make it more affordable. Power Secretary Alok Kumar said safety, quality and design should be the key parameters for manufacturing of smart metres. Besides, IEEMA should focus on capacity building of the utilities and finding opportunities to change conventional metres into smart metres with sustainable disposing options, he said. As per industry estimates, a smart metre costs around USD 50, including manufacturing and installation charges. Around 250 mn smart prepaid metres are to be installed by March 2025 under the Revamped Distribution Sector Scheme (RDSS) at an outlay of INR3.3k bn. Amit Kumar, Chairman of IEEMA Meter Division and Vice President of Schneider Electric India Private Limited, said the combined annual production capacity of the Indian metre industry is more than 100 million smart metres which is sufficient to meet the 2025 target.

7 November: India will need additional investment of around US$300 billion to complete the 500 gigawatt (GW) renewable energy capacity target by 2030, according to Arthur D Little (ADL) report. With 165 gigawatts (GW) generation capacity already in place, the country is on the right trajectory to meet its goal of having 50 percent of energy needs through the renewable portfolio, the report said. To further accelerate adoption, according to the ADL perspective, India should focus on developing solar and wind generation capacities. As the big conglomerates foray into green hydrogen and other renewable energy generation, associated industries such as transmission and distribution also need significant transformation. While government initiatives such as the rooftop solar program, national hydrogen mission and PM KUSUM have laid a strong foundation for transitioning towards renewables, India is still a long way from realising the targeted benefits of these schemes. The involvement of consumers with planned awareness campaigns along with leveraging global alliances to boost FDI and technology collaboration could be key focus areas. India is all set to be a big player in green energy generation and aspires to not only attain its energy security but to also start supplying power to neighbouring nations.

7 November: With 6,200 MW installed solar-power capacity, Tamil Nadu (TN) got fourth place in a national ranking prepared as of 30 September. The first three spots went to Rajasthan, Karnataka, and Gujarat, in that order. To achieve its “zero carbon” target by 2070, TN was encouraging green power generation. Between 31 March 2019 and 31 March 2022, TN’s solar-power capacity rose from 2,575 MW to 4.986.01 MW. After TANGEDCO (Tamil Nadu Generation and Distribution Corporation Limited) boosted the installation of rooftop solar panels, the State’s total installed capacity crossed 6,200 MW, the officer added. TN hopes to reach the top position among southern States by implementing new solar projects. TANGEDCO had set a target of 9,000 MW installed solar energy capacity by 2023. If this target is met, TN would have the largest solar energy capacity among southern States. On the future of solar power generation in Tamil Nadu, TANGEDCO has planned solar parks in every district, with a combined capacity of 4,000 MW. For this, all Collectors had been requested to identify land.

7 November: Goa Power Minister Ramkrishna Sudin Dhavalikar said that he expects Germany to bring in technical expertise and investment for renewable energy projects in the state, which is aiming for 100 percent renewable energy by 2045 in all sectors. Goa is in the forefront to encourage solar energy and other non-conventional renewable energy to cut carbon emissions to zero, he said, at the Indo-German core partnering meet on sustainable energy and environmental technologies held recently. The Minister asked private sector companies from Goa to explore opportunities for implementation of sustainable energy and technology projects in Goa.

8 November: Oman’s Energy Minister Salim al-Aufi said he saw oil prices coming down from the range of US$90 a barrel after the winter season. Aufi said Oman set the oil price for its budget at US$55 a barrel to create an extra cushion for debt payments but that he did not think prices would go down that much. Aufi said he had not seen any data yet and that OPEC+ could move either way, depending on whether the group believed the market was over-supplied. OPEC+ producers have rallied around top oil exporter and de facto OPEC leader Saudi Arabia after Washington accused it of pushing some members into the cut. Oman’s production capacity is currently at 1.2 million barrels per day, Aufi said.

8 November: The United States (US) Energy Information Administration (EIA) cut its forecast for next year’s crude output growth by 21 percent, days after heads of oil producers warned of persistent inflation and supply chain constraints. US crude production is expected to increase by about 480,000 barrels per day (bpd) to 12.31 million bpd, the EIA said, down from a prior 610,000 bpd growth forecast. Still, US oil production in 2023 will top 2019’s record 12.29 million bpd output. The lower outlook comes as US President Joe Biden has called on companies to ramp up their production to push down fuel prices that are stoking inflation and threatening shortages of heating oil and diesel this winter. The EIA cut its demand estimates for next year to a 100,000 bpd increase from the 190,000 bpd gain it had forecast last month.

8 November: The Oil Companies Advisory Council (OCAC) of Pakistan has said that the country is expected to face petrol and high-speed diesel shortage in the days ahead, calling for special measures to avert the looming fuel crisis. A deficit of 210,000 metric tons of high-speed diesel and 147,000 metric tons of petrol was worked out after extensive deliberation previously. However, it is alarming that petrol import corresponding to the anticipated sales volume and the stock cover has also not been booked yet, the OCAC noted. Considering the situation, the oil sector representative asked the country’s oil and gas regulators to issue necessary directives to the importing companies for strict adherence to the import plans to avoid a shortage.

2 November: Falling production knocked Venezuela’s October oil exports to the fourth lowest monthly average this year, according to vessel monitoring data and documents from state-run oil firm PDVSA. Oil production and exports by PDVSA and its joint ventures have fluctuated this year due to outages, a lack of sustained investment and a shrinking pool of partners willing to continue operating in the US-sanctioned South American nation. In October, a total of 25 cargoes departed Venezuelan waters carrying an average of 533,968 barrels per day (bpd) of crude and products, according to Refinitiv Eikon tanker tracking data and PDVSA’s internal exports reports. Declining crude output and insufficient inventories of the country’s flagship exportable grade Merey 16 knocked down Venezuela’s oil exports in October to the fourth-lowest monthly average so far this year. Venezuela reported to the Organization of the Petroleum Exporting Countries (OPEC) a 57,000-bpd fall in its crude output in September to 666,000 bpd, the second lowest monthly figure this year. Last December, PDVSA celebrated hitting 1 million bpd of oil output, but the increase was short-lived. Most oil cargoes shipped in October headed to Asian destinations, mainly Malaysia and China, through intermediaries. Another 52,000 bpd of crude, fuel oil, diesel and jet fuel were sent to political ally Cuba, which is struggling to meet domestic fuel demand amid increased consumption and insufficient imports after a large fire damaged its main oil terminal in August.

2 November: Iraq exported 104.83 million barrels of crude oil in October, generating US$9.25 billion in revenue, the country’s oil ministry has announced. A total of 102.7 million barrels were exported from oil fields in central and southern Iraq through the Port of Basra, while more than 2 million barrels were exported from the northern province of Kirkuk through the Turkish port of Ceyhan on the Mediterranean. Oil prices have risen in global markets since the outbreak of the Russia-Ukraine crisis in February, benefiting Iraq and other oil exporting countries. Iraq’s economy heavily relies on crude oil exports, which account for more than 90 percent of the country’s revenues.

8 November: The European Union (EU)’s executive body told its 27 member countries at a seminar that it was not possible to create a gas price cap that would not affect long-term contracts or supply security. After much wrangling at an all-night summit, EU leaders agreed to task the European Commission with proposing a temporary gas price cap in power generation and a temporary price corridor bring down costs for consumers. But a compromise between those like France, Spain and Belgium that want a cap and the German-led camp opposing it meant additional conditions were attached, namely that any cap could not affect long-term contracts, lead to an increase in gas consumption or provoke producers to reroute supplies elsewhere.

4 November: Germany’s largest gas importer Uniper announced that it recorded a net loss of €40 billion (US$39 billion) in the first nine months of this year due to record high gas prices. Gas prices in Europe have more than doubled since the start of the Russia-Ukraine war. After peaking at almost €350 per megawatt hour, European TTF (Title Transfer Facility) gas futures were trading at around €133. In September, the German government rescued Uniper from insolvency because of its key role in the country’s energy supply. It was impossible to give a more precise earnings outlook due to the “high degree of uncertainty” regarding delivered gas volumes and price levels, the company said.

3 November: Poland has complained to the European Court of Justice about EU (European Union) gas reduction rules agreed upon earlier this year. EU countries bracing for further cuts in Russian gas supplies approved an emergency plan to curb demand, after striking compromise deals to limit consumption reductions for some countries. Under the plan, the cuts could be made binding in a supply emergency, provided a majority of EU countries agree. Hungary was the only country that opposed the plan. Polish Prime Minister Mateusz Morawiecki at the time said that a possible decision on a compulsory reduction in gas consumption in the EU must be made unanimously, not by a qualified majority vote.

3 November: Europe must act immediately to prevent a shortage of natural gas next year as Russia slashes deliveries in the wake of the Ukraine war, the International Energy Agency (IEA) warned. The IEA said the shortfall would occur if Russia stops pipeline deliveries completely and China steps up its imports of liquefied natural gas, which Europe has relied upon to replace Russian supplies. Russia drastically cut supplies to Europe in suspected retaliation against Western sanctions over its invasion of Ukraine, but the region was able to fill storage sites for this upcoming winter. Moscow delivered 60 billion cubic metres of gas to Europe this year, but the IEA said in a report that it is “highly unlikely” that Russia will provide the same amount in 2023 and could cease deliveries entirely.

2 November: China has expanded long-term thermal coal supply contracts for 2023 to all coal mines and asked power utilities to source more of their demand through those contracts, as it aims to ensure market supply and stabilise prices. The world’s second biggest economy still relies on coal to generate 60 percent of its electricity, and its President, Xi Jinping, has repeatedly emphasised the vital role of fuel – a major contributor to global warming – in the country’s energy security strategy. All coal mining firms and coal-fired power and heating plants will be covered under the long-term contracts, the National Development and Reform Commission (NDRC) document showed, a wider range compared to 2022’s order of covering only mines with annual capacity bigger than 300,000 tonnes. The expanded coverage is expected to reduce coal supply in the spot market but better ensure supply to power utilities, avoiding a repeat of a nationwide coal shortage that led to unprecedented power outages in 2021. Coal mines should put at least 80 percent of their overall output and 75 percent of their thermal coal output under the long-term contracts, while all production capacity approved since September 2021 will have to be included.

2 November: Germany’s cabinet approved a draft law to phase out coal-fired power plants in the western state of North Rhine-Westphalia by 2030 instead of a previous date of 2038, part of Berlin’s efforts to speed up the cutting of greenhouse emissions. At the same time, the cabinet approved extending the lifespan of two coal-fired plants in the same state as a way of shoring up the country’s energy security as it copes with dwindling Russian gas and oil supplies since the war in Ukraine. Chancellor Olaf Scholz requested that the economy, finance and environment ministries write into law an agreement to phase out coal by 2030. The planned phase-out will take place despite Germany’s July decision to reactivate coal-fired power plants and to extend the lifespans of those already operating. RWE, Germany’s largest power producer, said it was bringing forward its own coal phase-out by eight years and was ready to end lignite-based electricity generation in 2030.

6 November: The Russian-installed administration in Ukraine’s Kherson region said that a number of settlements, including Kherson city had lost water and power supplies after what it said was an act of “sabotage”. The Russian-installed Kherson administration said that electricity and water supplies were “temporarily absent” after what it said was a “terrorist attack” damaged three power lines in the region. The city’s power supply was planned to be restored by the end of the day. 10 settlements, including Kherson city, which had a pre-war population of 280,000, had been left without electricity.

4 November: South Africa, one of the world’s largest greenhouse-gas emitters, has been granted financing of US$497 mn to decommission one of its largest coal-fired power plants and convert it to renewable energy, the World Bank said. The bank said the newly closed Komati power station about 170 kilometres (105 miles) northeast of Johannesburg will be repurposed using solar and wind sources, supported by batteries for storage. The project aims at easing carbon emissions and creating economic opportunities in the area, which has been home to one of Africa’s largest coal plants for more than 60 years. South Africa secured US$8.5 bn in loans and grants at the UN climate talks last year from a group of rich nations to finance its switch to greener energy. But it remains heavily dependent on coal, which generates 80 percent of its electricity. The power sector accounts for 41 percent of national CO2 (carbon dioxide) emissions. The funding comprises a US$439.5 mn World Bank loan, a US$47.5 mn concessional loan from the Canadian Clean Energy and Forests Climate Facility and a $10m grant from the Energy Sector Management Assistance Program (ESMAP), an initiative to help low and middle-income countries. The World Bank said South Africa would require at least US$500 bn to achieve carbon neutrality by 2050.

3 November: Gas emissions from the European Union (EU)’s energy sector have ended more than a year of post-pandemic rises thanks to cleaner power supplies and energy-saving efforts, the Centre for Research on Energy and Clean Air (CREA) said. The independent organisation, which studies trends, causes and health impacts of air pollution, said in a report that carbon-dioxide emissions fell 5 percent in the past three months from the same period last year, with an 8 percent fall in October, after rising steadily since March 2021. CREA lead analyst Lauri Myllyvirta said that boosting investments into clean energy and expanding related policies should lead to a sustained and accelerated fall in emissions in coming years. Europe’s emissions had risen from March 2021 as economies recovered from the pandemic, the report said, that an underperformance of nuclear and hydropower, together with electricity demand during heat waves in the summer, drove up demand for fossil fuel power. But the increase in power-sector emissions up to August cannot be attributed to policies favouring coal, as there was no shift from gas to coal in the fuel mix for thermal power generation in 2022, Myllyvirta said. France’s EDF expects to get most of its nuclear fleet back from maintenance in early 2023 while Germany has extended the operation of its three remaining reactors to April 2023. However, 2022 shows low investments in wind power generation, constrained by permitting and related issues, Myllyvirta said.

2 November: Poland’s first nuclear power station, which will be built by US (United States) firm Westinghouse Electric Co, will cost around US$20 billion, Prime Minister (PM) Mateusz Morawiecki said. Poland chose Westinghouse Electric Co for the project in a bid to reduce the country’s carbon emissions and phase out coal. Under the government’s nuclear program six reactors with up to 9 gigawatts (GW) capacity will be built in two locations. A partnership between Korea Hydro Nuclear Power (KHNP), Poland’s top utility PGE SA, ZE PAK aims for additional 3 reactors, Climate Minister Anna Moskwa said. Poland’s maximum potential is as much as 15 GW of nuclear capacity, Moskwa said.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.