-

CENTRES

Progammes & Centres

Location

Quick Notes

According to article 4.19 of the Paris Agreement (PA) all parties are expected to formulate and communicate their long-term low greenhouse gas (GHG) emission development strategies (LTLEDS), mindful of article 2, taking into account their common but differentiated responsibilities and respective capabilities in the light of different national circumstances. The deadline for submitting the plan for long term action was 2020 but so far only 56 countries have submitted their strategies. India joined the list as the 57th country when it released LTLEDS report at COP27 in 2022. India’s LTLEDS is in line with its historic positions in multilateral climate negotiating platforms. It reiterates ambitions for reducing carbon emissions that are cautiously hedged to provide for a range of energy options and also to provide space for development.

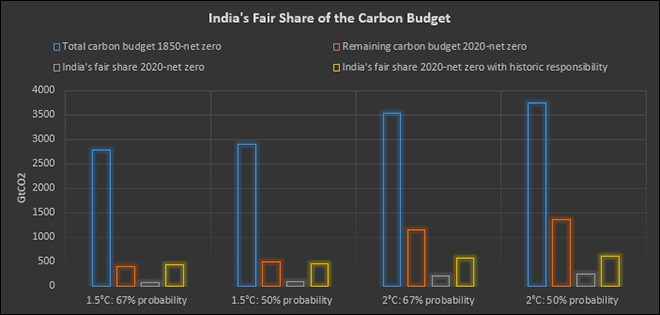

The title of India’s LTLEDS uses the term “low carbon development strategy” rather than “low GHG emission development strategy” specified in the PA. It is possible that this was done intentionally from a legal standpoint, to avoid commitments for reduction in emission being applied not just to carbon but to other GHGs. It is equally possible that this was unintentional. The key principle that informs India’s climate policy is to pursue its development goals according to national circumstances while keeping within its fair share of the global carbon budget. As stated in the report, India is committed to addressing the challenge of climate change with firm adherence to multilateralism based on equity and the principle of common but differentiated responsibilities and respective capabilities (CBDR-RC), enshrined in the United Nations framework convention on climate change (UNFCCC). India maintains that operationalizing the principle of equity and climate justice requires that the remaining carbon budget be equitably shared among all countries and used responsibly. Most importantly India wants historical and future responsibility of countries to be framed in terms of limiting their cumulative emissions within their fair share of this budget. The key word here is “cumulative” as it includes historic emissions from developed countries. Developed countries have so far resisted the idea of cumulative emissions and historic responsibility and have instead attempted to introduce categories such as “major emitters with capabilities” at COP27 to assign liability on developing countries for future emissions.

India reiterates its updated nationally determined contribution (NDC) in the LTLEDS with emphasis on initiating a mass movement for LiFE, lifestyle for environment through moderation and conservation as key to combating climate change. Unfortunately, India’s meagre per person consumption of energy and most other minerals and natural resources is not the result of a lifestyle choice but rather economic compulsion.

India offers four basic principles that underscore its approach to low carbon development articulated in the LTLEDS. The first is that India has contributed little to climate change. The observation in the summary for policy makers (SPM) of the working group III contribution to the sixth assessment report (AR6) of the intergovernmental panel on climate change (IPCC) that the contribution of entire Southern Asia is only about 4 percent of historical cumulative net anthropogenic emissions between 1850 and 2019, even though the region includes almost 24 percent of the global population justifies this statement. North America and Europe alone have contributed almost 10 times more to global cumulative emissions in this period, though they have only about 13 percent of the global population.

The second is about India’s energy needs for development. India’s energy consumption per person is lower than developed countries and also many of its developing country peers. India’s person energy consumption of 25.4 giga joules per person in 2021 is a third of world average and a fourth of China’s energy consumption per person. India is the only country in the G20 group to have per person energy consumption lower than the world average. The report brings out issues that India would not be proud of as one of the world’s largest and fastest growing economies, to make the case for its energy needs. It points out that India is well short of the threshold of per person energy consumption required to reach an acceptable level of human development index (HDI). The report argues that more energy must be made available for post pandemic efforts for economic revival focussed on persons below poverty line and the large section of the population employed in the informal sector. The report also points out that India is undergoing multiple transitions (i) a demographic transition with large number people entering the workforce requiring job creation in manufacturing that requires abundant energy availability (ii) an agrarian to urban transition that requires more energy for better lifestyles (iii) a deficit infrastructure environment to sufficient infrastructure environment that cannot be built without energy.

The third principle of India’s long term low carbon strategy is that India’s carbon reduction strategies are designed to address the twin challenges of climate change and development. Low carbon energy sources that will increase access to energy, provide affordable energy for all sectors of the economy and increase energy security. Acknowledging the relatively high social and transaction costs of making the transition to low carbon energy sources, India points out that its per person coal consumption adjusted for coal quality is half the world average in 2019 and that its per person natural gas consumption is 30 to 50 times lower than many OECD (organisation for economic cooperation and development) countries. Low per person gas consumption is partly because the share of natural gas in India’s primary energy basket is much lower than that of most OECD countries. The report does not mention per person oil consumption which is also very low: a third of world average, a fourth of China’s and almost one sixteenth of that of USA. India highlights the fact that global emissions from oil & gas are 25 percent higher than that from coal which is probably behind India’s call for phasing down oil and gas, not just coal at COP27.

The fourth is the need for building resilience or adapting to changes in the climate. India argues that building resilience and adaptation capabilities is critical to sustaining the gains it has made in development. The report gives a long list of programs designed to increase resilience of ecosystems and communities including long running development programmes such as the Mahatma Gandhi national rural employment guarantee scheme and state level action plans.

Overall, India’s LTLEDS does not deviate from its historic conceptual position based on equity and the principle of CBDR-RC, enshrined in UNFCCC. India’s approach maintains that operationalizing the principle of equity and climate justice requires that the remaining carbon budget be equitably shared among all countries and used responsibly. This may not be easy. For example, for limiting average global temperature increases to 1.5°C with a 67 percent probability of success, India alone will need the entire remaining carbon budget if historical responsibility of developed countries is taken into account. The report therefore calls for net zero achievement by developed countries before 2050 and recommends the use of negative emission technologies. The developed world is not likely to agree barring miracles on all fronts: social, political, technological and economic.

According to the Union Petroleum and Urban Affairs Minister Hardeep Singh Puri, Indian petroleum industry is at the cusp of opportunity and will be able to produce 25 percent of its crude oil demand by 2030. At present, five million barrels of petroleum is being consumed in our country every day and it is also increasing by three percent, which is higher than the global average of nearly one percent. Ethanol-blending percentage in petrol increased to 10 percent in nine years. The ethanol-blend percentage in petrol has increased from 0.67 percent in 2013 to 10 percent in May 2022, i.e., five months ahead of schedule. It is reducing 2.7 million tonne of CO2 emissions which is good for the environment. As per the International Energy Agency estimates, India will contribute a quarter (25 per cent) of the growth in global energy consumption in the coming two decades. As per the Petroleum Secretary Pankaj Jain, the geology experts should utilise this opportunity to elevate their contribution in the context of increasing demand and scarcity of energy sources.

According to the data from the Petroleum Planning and Analysis Cell (PPAC) of the oil ministry, India’s monthly fuel demand in September was at the lowest since November 2021. Total monthly fuel demand in September fell 3.6 percent from August, although it was up 8.1 percent when compared with September 2021. Consumption of fuel, a proxy for oil demand, totalled 17.18 million tonnes (MT) in September, up from 15.89 MT a year earlier. Sales of diesel, or gasoil, rose about 13.4 percent year-on-year to 6.26 MT, but dropped 1.4 percent month-on-month to a one-year low. Sales of gasoline, or petrol, were 8.8 percent higher from a year earlier at 2.83 MT. Preliminary sales data showed gasoline and gasoil sales by Indian state refiners rose sharply in September from a year earlier, signaling a pick-up in industrial activity ahead of the festive season from October. Cooking gas or liquefied petroleum gas (LPG) sales increased 3.5 percent to 2.45 MT, while naphtha sales fell 6.4 percent to 1.08 MT. Indian state refiners plan to lock-in more of their crude supplies in term deals, worried that tighter Western sanctions on Russia, including from the EU, could curb future supplies in already tight markets.

The Gujarat government decided to give free LPG cylinders twice a year to beneficiaries of the Pradhan Mantri Ujjwala Yojana. According to Education Minister Jitu Vaghani, there are 38 lakh beneficiaries under the scheme and the decision will save INR6.5 billion (bn) (US$79.5 million) for poor families. The moment a consumer gets one’s cylinder refilled, immediately, the money will be transferred to the account.

The Cabinet approved a one-time grant of INR220 bn (US$2.69 bn) to three state-owned fuel The three firms – Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL) and Hindustan companies to cover their losses incurred over selling cooking gas or LPG below cost over the past two years. Petroleum Corporation Ltd (HPCL) – sell domestic LPG at government-regulated prices to consumers. The grant will be for the losses they incurred on selling LPG below cost to consumers from June 2020 to June 2022. International prices of LPG rose by around 300 percent from June 2020 to June 2022.

LPG cylinder blast incident has turned out to be a bad turn of fate for the auto-rickshaw drivers. With tightening of noose against the illegal but flourishing trade of filling up of LPG gas in auto-rickshaws by the enforcement agencies, their business has been badly affected. In the past two days, almost all the illegal gas filling outlets have shut down fearing backlash by the police and administration, which has forced these auto-rickshaw drivers to take to the LPG filling stations. Jodhpur has two LPG fuel stations, of which one falls out of the city area. In these two days, the entire onus of supplying gas has fallen on the remaining filling station, which on normal days has only 700 liters of average demand per day. The city has about 5,000 auto-rickshaws running on LPG and there are also some LPG four-wheelers also. This sudden turn of events has pointed to the flourishing illegal LPG filling trade, with these auto-rickshaws being their potential customers. Sharing the economics behind this illegal trade, a rickshaw driver said that the gas is available at INR111.50 (US$1.36) per litre at the filling station while the illegal gas fillers charge them somewhere between INR90-100 depending upon the price of the cylinder.

According to Union Civil Aviation Minister Jyotiraditya Scindia, there is a huge demand for air travel after the pandemic and urged eight states and Union Territories (UTs) to reduce the tax on jet fuel. Air traffic growth will be driven by smaller cities, he said. Domestic air traffic is inching closer to pre-Covid level and in recent times, the daily passenger numbers crossed the four lakh mark twice. Value Added Tax (VAT) on jet fuel is still high in eight states and Union Territories in the range of 20-30 percent. Jet fuel cost accounts for a significant part of an airline’s operational costs. The Minister requested Goa, Assam, Delhi, Maharashtra, West Bengal, Rajashthan, Bihar and Tamil Nadu to reduce the VAT on Aviation Turbine Fuel (ATF). Currently, 28 states and UTs have VAT on jet fuel in the range of 1-4 percent.

According to Moody’s Investors Service, a INR220 bn (US$2.69 bn) one-time grant to the three oil marketing companies (OMCs) by the Centre would cover their losses on sales of domestic LPG if they still incur losses on the sale of petrol and diesel. The central government approved the grant to IOC, BPCL and HPCL to cover losses on sales of domestic LPG between June 2020 and June 2022.

Petrol and diesel sales in India jumped in September as economic activity picked up with the nearing festival season and the ending of the monsoon raised the demand. Petrol sales soared 13.2 percent to 2.65 MT in September when compared to 2.34 MT of consumption in the same month last year. Sales were 20.7 percent higher than Covid-marred September 2020 and 23.3 percent more than pre-pandemic September 2019. Demand was, however, 1.9 percent lower than the previous month of August 2022. Diesel, the most used fuel in the country, posted a handsome 22.6 percent rise in sales in September to 5.99 MT when compared to the same month last year. Consumption was up 23.7 percent over September 2020 and nearly 15 percent higher than pre-Covid 2019. The fuel, which had seen a near 5 percent drop in sales in August when compared to the previous month of July, saw demand rise 1.3 percent month-on-month. Accordingly, jet fuel (ATF) demand jumped 41.7 percent to 5,44,700 tonnes during September when compared to the same month last year.

India said it will speed up its diversification of oil imports to hedge against any surprise output cuts by the Organization of the Petroleum Exporting Countries (OPEC) and its allies. As the world’s third largest consumer and importer of oil, India buys about 85 percent of its needs from overseas, while its energy demands are set to rise to power its economic expansion. According to India’s Oil Ministry, output cuts could temporarily maximise revenue for OPEC+ producers, but could tip the world into recession. As per the ministry, Indian state fuel retailers have not raised pump prices since April and the country will be able to navigate the terrain “with confidence”. Indian companies have signed new oil supply deals with Colombia and Brazil and are scouting to buy stakes in oil producing assets overseas. India is also upset with Saudi Arabia for charging an Asian premium on oil supplies and Indian state refiners last year briefly cut oil imports from the kingdom after output cuts by OPEC+, led by the Saudis. The share of Middle Eastern and OPEC’s oil in India’s overall imports has been declining for some years. India’s oil imports from Russia are driven by discounts offered on sales.

Indian state refiners plan to lock-in more of their crude supplies in term deals, worried that tighter Western sanctions on Russia, including from the EU (European Union), could curb future supplies in already tight markets, sources at state refiners said. IOC and BPCL are seeking term deals with countries, including the United States (US). The move towards term deals marks a shift in refiners’ purchasing strategy, which had been geared towards maximising spot purchases in past years when supplies were abundant. India’s dependence on spot purchases allowed Indian refiners to snap up discounted Russian oil shunned by some Western buyers over Moscow’s Ukraine invasion in February. India, which rarely used to buy Russian oil, has emerged as Moscow’s second-largest oil customer after China. To secure supplies, IOC last month signed its first six-month oil import deals with Brazil’s Petrobras for 12 million barrels and Colombia’s Ecopetrol for 6 million barrels. BPCL has signed an initial deal with Petrobras as it seeks to diversify oil sources. Supplies for IOC under the two deals will begin from October. IOC is also looking for more short-term supplies, including a contract for US oil. IOC already has an annual deal that provides an option to buy 18 million barrels of US oil. Of these, IOC has already bought about 12 million barrels so far this year. BPCL, which has already ramped up US oil purchases, is looking for more term contracts.

ONGC said there is no clarity on the resumption of its oil and gas project Sakhalin-1. As per the ONGC, production at Sakhalin-1 was “minimized” shortly after the Ukraine war started and there is no clarity or timeline yet when it could be resumed. The project was hit due to force majeure declared by the operator Exxon Mobile Corporation after sanctions against Russia had made it difficult to ship crude to customers.

India’s first unloading single point mooring (SPM) facility, commissioned by IOC in 1978 at Vadinar in Gujarat, achieved a significant milestone with the berthing of the 6,000th oil tanker. Oil tanker MT Yio, a Liberian very large crude carrier carrying Basrah crude oil from Iraq, berthed at the Vadinar SPM. The 3 lakh kilo litres of crude oil that MT Yio is carrying is adequate to meet about 40 percent of the daily fuel requirement of the entire nation. IOC currently operates two SPM terminals at Vadinar, in the south of the Gulf of Kutch, for unloading of crude oil brought in tankers for transportation to shore tanks through pipelines, of which around 14 km is subsea. Subsequently, the crude is transported through cross-country pipelines to IOC’s mega refineries at Vadodara in Gujarat, Mathura in Uttar Pradesh and Panipat in Haryana.

BPCL has signed an agreement with Brazilian national oil company Petrobras for sourcing crude oil from the Latin American nation as part of plans to diversify its sourcing needs. BPCL imports a large volume of crude oil which is turned into fuel such as petrol and diesel at its three oil refineries at Mumbai, Bina in Madhya Pradesh and Kochi in Kerala. The firm, which gets majority of its supplies from west Asian nations such as Iraq and Saudi Arabia, is looking to diversify its sources of supply in an attempt to cut down reliance on any particular region. Bharat PetroResources Limited (BPRL), the upstream oil and gas exploration and production subsidiary of BPCL, plans to invest US$1.6 bn (US$19.6 million) to develop an oil block in Brazil. BPRL holds a stake in an ultra-deep water hydrocarbon block in Brazil, owned and operated by Petrobras. The field development plan and final investment decision is expected to be declared soon. On 27 July, the Union Cabinet gave approval to the firm to invest an additional US$1.6 bn in the Brazilian oil block BM-SEAL-11. The block is to start production from 2026-27.

It is now officially confirmed that there is oil spill off the Sindhudurg coast due to the sunken tanker. The oil spill has been spreading from the MT Parth tanker off Vijaydurg coast. The Indian Coast Guard (ICG) has confirmed to the Sindhudurg district administration that the oil spill has covered around 8 square km area in the deep sea, and warned that Devgad, Vengurla, Malvan and Goa coastal areas may be hit. About 250 litres of oil spill dispersants have been sprayed over the area from a helicopter. The 101-metre-long MT Parth vessel, loaded with 3,911 MT bitumen, was navigating from Khor Fakkan port, UAE, to New Mangalore port but sank on September 16 evening due to engine failure. Apart from the bitumen, the vessel had 140 kilolitre (kl) fuel oil and 30 kl diesel. The ICG had rescued 19 crew members.

Oil prices fell, snapping five days of gains, as investors took profits after a report on slowing economic activity in China, the world’s biggest crude importer, re-ignited concerns about falling global fuel demand. Brent crude futures for December settlement fell by as much as 1.1 percent, and was last down 39 cents, or 0.4 percent, at US$97.53 a barrel. West Texas Intermediate crude for November delivery declined by as much as 1.1 percent and was last at US$92.27 a barrel, down 37 cents, or 0.4 percent. Services activity in China during September contracted for the first time in four months as COVID-19 restrictions hit demand and business confidence, data showed.

Iranian Petroleum Minister Javad Owji has said that Iran has started refining its crude oil in Venezuela. Iran had started processing nearly 100,000 barrels per day (bd) of its crude in Venezuela’s El Palito refinery, Owji said. Jalil Salari, Head of NIORDC (National Iranian Oil Refining and Distribution Company), said that efforts are underway to expand Iran’s refinery operation in overseas projects. Iran signed a US$116 million (mn) contract with Venezuelan state oil firm PDVSA in May to repair and expand the refinery.

Saudi Aramco has told at least seven customers in Asia they will receive full contract volumes of crude oil in November ahead of the peak winter season. The producer is keeping supplies to Asia steady despite likely production cuts by tapping on inventories. The full supply allocation comes despite a decision by the OPEC and allies including Russia, known as OPEC+, to lower their output target by 2 million bpd. Saudi Energy Minister Abdulaziz bin Salman had said the real supply cut would be about 1 million to 1.1 million bpd. Analysts expect Saudi Arabia, the United Arab Emirates and Kuwait to shoulder much of the production cuts because other OPEC+ members are falling behind output targets. Consultancy FGE expects the Saudi oil production target to fall by around 550,000 bpd in November from the previous month.

The head of QatarEnergy, who is also Qatar’s Energy Minister, Saad al-Kaabi said the company wants to speed up the development of two oil wells it discovered off the Namibian coast with joint venture partners earlier this year. Saad al-Kaabi said drilling work is expected for 2023 to get a better understanding of deliverability and capacity, but did not indicate when the two oil finds will be brought into production. The discoveries could make Namibia, the southern neighbour of OPEC member Angola, another oil producer along the African Atlantic coast.

The OPEC+ alliance looks set to make deep cuts in the amount of oil it ships to the global economy, which would reduce supply in an already tight market, despite pressure from the US and other countries to pump more. Energy Ministers from the OPEC cartel, whose leading member is Saudi Arabia, and allied non-members, including Russia, are meeting in person at the group’s Vienna headquarters for the first time since the start of the COVID-19 pandemic in early 2020. The potential cuts could help Russia weather a looming European ban on its oil exports by forcing oil prices up. They’ve dropped to about US$90 a barrel from US$120 three months ago due to fears of a global recession. OPEC+ is considering cuts of one million to two million barrels per day, with several sources saying cuts could be closer to two million.

Afreximbank has approved US$200 mn toward financing of a contested oil pipeline to export Uganda’s crude, and is willing to finance construction of a refinery in the east African country, Uganda’s presidency said. The US$3.5 bn pipeline will run from landlocked Uganda’s oilfields in the country’s west to a port on Tanzania’s Indian Ocean coast, but has drawn criticism from environmentalists and European Union lawmakers. France’s TotalEnergies, the lead developer of the pipeline, is facing mounting pressure to drop the project or re-route it because of protests over potential harm to the environment and livelihoods of local communities.

The cost of Nigeria’s fuel subsidies rose to 525.714 bn naira (US$1.22 bn) in August, bringing the total spent this year to 2.568 trillion naira, according to state oil company NNPC (Nigerian National Petroleum Corporation). The ballooning costs of keeping petrol prices low in Africa’s most populous nation are straining the budget and draining revenue from the NNPC. NNPC has not submitted any money to the federal government this year due largely to subsidy costs. August’s bill compared with 448.782 bn naira in July, according to NNPC. Part of the increased cost was down to a bigger daily supply of petrol, which rose to 71.8 million litres, up nearly 10 percent from July, according to Nigerian Midstream and Downstream Petroleum Regulatory Authority. Oil production in August averaged 1.18 million bpd, well below the nation’s OPEC quota of 1.8 million bpd, due in large part to theft from pipelines that has curtailed production.

Kazakhstan’s Energy Minister Bolat Akchulakov said that the giant offshore Kashagan oilfield will resume production of 400,000 bpd by the end of October after maintenance. He said that all three mooring points at the Black Sea terminal of the Caspian Pipeline Consortium (CPC) will likely resume operations before the end of this month. Production at Kashagan, one of the world’s largest oil fields, sharply declined on 3 August due to a gas release. Kashagan had planned to boost output to 500,000 bpd after upgrades. The Kashagan consortium includes Eni, ExxonMobil, CNPC, Shell, TotalEnergies, Inpex and Kazakh state energy firm KazMunayGaz. He said that Kazakhstan currently exports some 11-11.5 MT of oil per year to China, with pipeline capacity of 20 million.

Guyana has called for proposals to design, finance and build a 30,000 bpd oil refinery, the first for the South American country as it becomes a force in crude oil production. Construction work on the facility, to be located on public land near the Berbice river, is expected to begin by the first half of 2023 with project completion two years after. Requests are due in mid-December. An Exxon Mobil-led consortium has ramped up oil and gas output to almost 400,000 bpd this year, a rapid increase for a country that only inaugurated crude production in 2019. All output is currently exported.

Chinese refiners are likely to boost refined oil products exports in the last two months of 2022 and into early 2023 after receiving the biggest allocation from Beijing this year, traders and analysts said. The increase in Chinese exports is likely to help stabilise global oil markets and partly replace supplies from Russia which will be hit by EU embargoes in coming months. It also allows the world’s No. 2 refiner to tap excess refining capacity and boost exports when its economy is struggling for growth after narrowly avoiding a contraction in the second quarter and the decline in the yuan to a 14-year low. Between January and August, China exported about 16.4 MT of refined fuel, which included 7.56 MT of gasoline, 5.54 MT of jet fuel and 3.25 MT of diesel, customs data showed. Chinese refiners are also expected to ramp up diesel exports by the most because it has the highest profit compared with gasoline and jet fuel which could tighten domestic supplies, analysts said.

Indonesia will launch a second auction of oil and gas blocks this year as it seeks to cash in on high energy prices and boost output after decades of decline due to a lack of exploration and investment. Southeast Asia’s biggest economy is committed to reaching a lifting target of 1 million bpd in 2030, Energy Minister Arifin Tasrif said. The once-OPEC member reached peak crude oil production in 1995, producing more than 1.6 million bpd. But output has declined steadily ever since due to a lack of exploration, an absence of discovery of large reserves, and shifting investment into renewable energy. Oil lifting in the January-June period was 614,500 bpd, upstream regulator SKK Migas said.

At least three Chinese state oil refineries and a privately run mega refiner are considering increasing runs by up to 10 percent in October from September, eyeing stronger demand and a possible surge in fourth-quarter fuel exports. Chinese refiners are expecting Beijing to release up to 15 MT worth of oil products export quotas for the rest of the year to support the no. 2 economy’s sagging exports. Such a move would signal a reversal in China’s oil products export policy, add to global supplies and depress fuel prices. After a recent slide in benchmark Brent crude prices to below US$100 a barrel, Chinese refiners have taken arbitrage opportunities to boost stockpiles, traders said, booking supertankers to haul crude oil to China from the Americas and Middle East. China’s single largest refinery Zhejiang Petrochemical Corporation, which is capable of processing 800,000 bpd of crude, is aiming to ramp up runs in the coming months from the current levels of 700,000-750,000 bpd, according to two sources familiar with its operations.

Norway’s Equinor is considering buying oilfields in the British North Sea from China’s CNOOC, including a big stake in the huge Buzzard oilfield. The deal is valued at between 20 bn and 30 bn Norwegian crowns (US$1.9 bn-US$2.8 bn), and might close as swiftly as the end of this year.

Hungary and Serbia have agreed to build a pipeline to supply Serbia with Russian Urals crude via the Druzhba oil pipeline as Belgrade’s shipments via Croatia fall under EU sanctions, the Hungarian government said. The EU agreed on new restrictions against Russia over its war against Ukraine, which include an oil price cap for Russian seaborne crude deliveries to third countries. Serbia gets its oil via the JANAF oil pipeline from Croatia. Hungary, which is largely reliant on Russian oil and gas, has been the most vocal critic of sanctions against Russia in the EU, saying the measures drove up energy prices.

22 October: In order to decrease the rising burden of oil imports, India recently opened up bidding for 26 blocks for oil exploration in India. India currently imports 85 percent of country’s oil requirements, and plans to reduce its dependence on imported crude oil by at least 10 percent in the coming years. India recently launched a sizable offering for oil and gas exploration, with most of the blocks on offer lying offshore and in deeper waters. The government awarded another 31 contracts for oil and gas developments last month through the DSF-3 competitive bidding round, in what was the country’s largest-ever offering of areas with known oil and gas accumulations. India has tried to carry out several biddings for oil exploration in the past decade, however, it has failed to attract the big international energy companies, despite lucrative incentives. India wants to attract companies from Western nations who can bring in technical capabilities to get the most out of domestic offshore assets. Global oil exploration companies are also eager to gain a foothold in India, where fuel demand is expected to keep rising with the country’s economic growth. India’s oil consumption or demand is expected to rise to almost 3.3 billion barrels annually by 2040 from about 1.6 billion barrels this year 2022.

24 October: Reliance Industries Limited (RIL) will commission its deepwater MJ gas condensate field in Bay of Bengal block KG-D6 by year end, boosting natural gas output to 30 percent of India’s total. MJ is the third and last of a set of discoveries that RIL and its partner BP are developing in the eastern offshore block. The two will use a floating production system at the high sea in the Bay of Bengal to bring to production the deepest gas discovery in the KG-D6 block. RIL and BP are spending around US$5 billion on three separate development projects in the KG-D6 block — R-Cluster, Satellite Cluster, and MJ — which together are expected to produce around 30 million standard cubic meters per day of natural gas by 2023. R-Cluster started production in December 2020 and the Satellite Cluster came onstream in April last year. While the R-Cluster has a plateau gas production of about 12.9 million metric standard cubic meter per day (mmscmd), the Satellite Cluster will have a peak output of 6 mmscmd. The MJ field will have a peak output of 12 mmscmd. Combined gas output from R-Cluster and Satellite Cluster stood at more than 19 mmscmd during July-September. RIL has so far made 19 gas discoveries in the KG-D6 block. Of these, D-1 and D-3 — the largest two — were brought into production in April 2009, and MA, the only oilfield in the block, was put into production in September 2008. While the MA field stopped producing in 2019, the output from D-1 and D-3 ceased in February 2020. Other discoveries have either been surrendered or taken away by the government for not meeting timelines for beginning production. MJ’s reservoirs are about 2000 metres below the D1-D3 gas fields.

23 October: Indraprastha Gas Ltd, which retails compressed natural gas (CNG) and piped cooking gas in the national capital and adjoining cities, reported a 4 percent rise in its September quarter net profit as rise in input natural gas prices hurt margins. The net profit stood at INR4.16 bn in July-September compared with INR4 bn in the same period a year back, the company said. Gas prices have doubled since Russia invaded Ukraine. IGL’s expense on purchase of natural gas soared from INR9.29 bn in July-September 2021 to INR26.10 bn in the current year. The firm registered an overall sales volume growth of 12 percent over the corresponding quarter in the last fiscal, with the average daily sale going up from 7.24 million metric standard cubic meter per day (mmscmd) to 8.09 mmscmd. Product wise, CNG recorded sales volume growth of 15 percent, while piped natural gas (PNG) recorded sales volume growth of 3 percent in the quarter as compared to corresponding quarter last year.

19 October: Indian Oil Corporation (IOC) is in talks with US (United States) energy firm Tellurian Inc for a long-term liquefied natural gas (LNG) supply deal as well as an equity investment in the latter’s Driftwood project. IOC has grand ambitions in the natural gas segment but a turmoil in the international market has made it harder for it to source affordable LNG. Indian Oil, Petronet LNG and GAIL (India) Limited are all seeking long-term contracts but have been unable to lay their hands on any deal that can bring supplies ahead of 2026 when large global liquefaction capacity is expected to come onstream, easing the current crunch. IOC has begun discussions with Tellurian but is yet to agree on volume or the equity investment in Driftwood LNG project.

20 October: Coal Minister Pralhad Joshi said India’s total coal production will touch 900 million tonnes (MT) during this financial year, and all efforts are being taken by Coal India Limited and its subsidiaries to attain this goal. He said mineral exploration norms have been relaxed recently, nine private exploration agencies got accredited so far, and commercial coal mine auctioning process has been made totally transparent by the present government. Coal import has come down considerably and by 2024 import will be stopped, he said.

19 October: Vedanta Limited said that its arm Balco has won the bid for a coal block in Chhattisgarh. The company emerged as successful bidder for the mine during the fourth round of commercial coal mine auction conducted by the government. Once operational, the mine will provide fuel security, enhance power availability, and further strengthen Balco’s operations and performance. The block has estimated reserves of 900 million tonnes (MT).

24 October: The first unit of the 1980 MW North Karanpura power plant underwent a trial run and generated power from its 660 MW unit. NTPC Limited, which took almost 22 years to reach this stage, described the development as “big”. Foundation stone of the plant was laid on 6 March 1999, by then Prime Minister Atal Bihari Vajpayee at Tandwa. With efforts on to invite Prime Minister Narendra Modi to the inaugural function, NTPC officials hope that the first unit will start commissioning in December.

25 October: The state-run power player said it will commission a 75 MW solar project at Kalpi in Uttar Pradesh (UP) by month-end. SJVN’s renewable portfolio stands at 4007.5 MW out of which 179.5 MW is under operation, 1370 MW is under construction and 2458 MW are at different stages of implementation. With the commissioning of this 75 MW Solar project, cumulative operational capacity will increase from 2016.5 MW to 2091.5 MW. The company has aligned its Shared Vision of 5000 MW by 2023, 25000 MW by 2030 & 50000 MW capacity by 2040 with that of Government of India’s target of achieving 50 percent energy from non-fossil fuel sources by 2030.

25 October: The Meghalaya government signed an agreement with the North Eastern Electric Power Corporation Limited (NEEPCO) for commissioning of three hydroelectric projects with a total generation capacity of 235 MW. Deputy Chief Minister Prestone Tynsong, also in charge of the Power department, after the agreement signing ceremon y, said the NEEPCO under the agreement would set up the Umiam stage 1, stage 2 and stage 3 hydro power plants. The Umiam stage 3 is in the final stage and NEEPCO is expected to start the implementation process soon. Both Stage-I and Stage-II would cost around INR17.50 bn with 70 percent loan.

24 October: Goa Energy Development Agency (GEDA) will install a concentrated solar cooking system with patented solar grade mirror technology, AGNi 69, at the Central Reserve Police Force (CRPF) camp at Latur in Maharashtra. GEDA will install three concentric solar systems on a trial basis, which will be used to cook food for about 1,000 people. Like a sunflower, AGNi69 automatically tracks the sun from sunrise to sunset to catch maximum sunlight. Each dish reflects the solar radiation onto a receiver that is placed at its focal area. GEDA will need 90 working days to test the system by studying the local solar radiation.

23 October: Andhra Pradesh Chief Minister (CM) Y S Jagan Mohan Reddy will launch the 800 MW third unit of the AP-Genco’s supercritical thermal power plant at Krishnapatnam on 27 October. The Sri Damodaram Sanjeevaiah Thermal Power Station (SDSTPS) at Nelaturu of Muthukur mandal of Nellore district already generates 1,600 MW of power. After the launch, the power generation capacity will go up to 2,400 MW, according to Agriculture Minister Kakani Govardhan Reddy.

22 October: Punjab will soon come up with an energy action plan aimed at reducing greenhouse gas emissions by adopting new and innovative clean energy technologies. Punjab Energy Development Agency (PEDA) said the state-owned agency is striving hard to achieve the target of 2,500 MW renewable energy capacity in Punjab and the energy action plan will facilitate all stakeholder departments to implement energy efficiency and renewable energy in their institution at the state level.

21 October: Somalia has signed a petroleum exploration agreement for seven offshore blocks with United States-based Coastline Exploration, the company said. Petroleum Minister Abdirizak Omar Mohamed said the agreement signed with Coastline was the finalisation of an earlier deal signed in February. Coastline, an upstream oil and gas company focused on East Africa, said it had paid a US$7 million signature bonus to the government and would now proceed with exploration. In 2019, Somalia passed a petroleum sector law paving the way for exploration, especially off its coast.

20 October: Uganda’s national oil company (UNOC) expects to secure the funding for a US$5 billion crude pipeline that the European Union is opposed to, by early next year, UNOC’s chief executive Proscovia Nabbanja said. In February, TotalEnergies and its partner China National Offshore Oil Corporation signed a final investment decision with Uganda and Tanzania to kick-start investments worth more than US$10 billion to produce and export Uganda’s crude. Part of that investment will involve a US$5 billion pipeline, criticized by the EU which has passed a parliamentary resolution seeking to delay the project, that will help ship landlocked Uganda’s crude to world markets via a port on Tanzania’s Indian Ocean coast.

21 October: A gas pipeline is to be built connecting Iberia to France and the rest of Europe, Spanish Prime Minister (PM) Pedro Sanchez has confirmed. Spain, France and Portugal have agreed to cooperate on the project. Sanchez said that the pipeline will hugely increase the volume of the two existing links between Spain and France. It will also help to transport green hydrogen and gas during the transition period Europe needs until it increases its capacity for renewables. Spain has spent several months pushing for the project, which is also supported by Germany. As well as its Algerian pipeline, Spain also has a high capacity for converting liquid natural gas (LNG), with 6 LNG terminals.

21 October: Mozambique expects to ship its first liquefied natural gas (LNG) exports to Europe from the Eni-operated Coral Sul floating plant later this month or early November, petroleum regulator INP said in a supply boost for the energy-starved region. BP’s LNG tanker, British Sponsor, has already arrived offshore northern Mozambique, said Welligence Energy Analytics in a note, with all of Coral Sul’s annual gas output of 3.4 million tonnes (MT) contracted to BP for 20 years on a free-on-board basis. The new LNG cargoes will help alleviate a tight global LNG market and gas shortages in Europe as winter looms following Moscow’s February invasion of Ukraine and Russia’s later decision to curb gas pipeline supplies into major European Union economies. As part of its exploration activity offshore Mozambique, Eni discovered Coral South gas field in 2012 and took its final investment decision in 2017, pledging to start producing gas using a floating LNG plant after five years.

20 October: Germany has called for European Union (EU) states to work with countries that can develop new gas fields, prompting concern from campaigners over the climate change commitments of Europe’s biggest economy as it scrambles to replace Russian gas. EU leaders are meeting to debate new measures to tame high energy prices and plug the gap caused by plummeting deliveries of Russian gas – a response that Brussels has said should speed up, rather than slow, Europe’s shift to green energy. Germany is racing to find alternatives to Russian fossil fuels – both by expanding renewable energy faster, and importing more non-Russian gas. Russia supplied more than half of Germany’s gas before Moscow invaded Ukraine.

20 October: Natural gas prices at major US (United States) trading hubs for the upcoming winter are expected to remain higher than in recent years, the Federal Energy Regulatory Commission (FERC) said. Freeport LNG, the second-largest US LNG (liquefied natural gas) export plant, idled for five months by a fire, must receive full approvals before a planned November restart can begin, regulators said. FERC said it sees the Henry Hub natural gas futures contract price averaging US$6.82 per million metric British thermal units (mmBtu) for winter 2022-2023, up 30 percent from last winter’s settled price. US natural gas futures are currently trading just under US$5.3 per mmBtu, their lowest levels in about seven months.

19 October: Iberian wholesale market gas prices extended steep declines, with the day-ahead contract falling for the first time below the 40 euros per megawatt-hour (MWh) cap set in May for gas-fired power plants, official data showed, after the national grid operator warned it may reject LNG shipments due to overcapacity. The price decline comes after Spain’s national gas operator Enagas warned it may have to reject shipments of liquefied natural gas (LNG) due to overcapacity at its six terminals. Dozens of ships carrying liquefied natural gas (LNG) are circling off the coasts of Spain and other countries in Europe, unable to secure slots to unload because of a lack of regasification capacity, with plants that convert the fuel back to gas operating at full capacity. Portugal has warned that recent floods there could affect supply of LNG, while low levels of rainfall in Iberia could further stymie hydroelectric production and mount pressure on electricity suppliers to produce their energy using gas.

25 October: Colombia coal miner Cerrejon, which is owned by Anglo-Swiss commodities giant Glencore, reported that production at its mine in the country’s La Guajira province was halted by some 13 illegal road blocks. In September nearly week-long road blockades cut production at the mine by 70 percent, the company said. Cerrejon, which produced 23.4 million tonnes (MT) of coal in 2021, was fully bought by top global miner and trader Glencore last year. Colombia is a major global exporter of coal and royalties and taxes from the fuel are a top contributor to government coffers.

25 October: Russian coal exports to energy-hungry China have jumped by about a third this year but the supply boom is being constrained by transport infrastructure limitations. China is seeking coal supplies from overseas, in particular after recent COVID-19 outbreaks in the major coal mining regions of Inner Mongolia and Shaanxi forced many mines to close, while coal demand at power generation and heating sectors will soon pick up with the coming of winter. Russia is the world’s sixth-largest coal producer and one of top coal exporters, along with Indonesia and Australia. Its share of global coal exports reached 17 percent last year with supply of 223 million tonnes (MT). Some traders were simply told by sellers or miners that a coal shipment was cancelled due to the lack of rail capacity and could be delayed for weeks. Russian First Deputy Prime Minister Andrei Belousov has acknowledged the problem with infrastructure constraints, saying this month that the situation with coal exports and congestion on the rail system had not stabilised, though it was improving. China’s coal imports from Russia fell to 6.95 million tonnes last month, down from a peak of 8.54 MT in August, according to China’s customs data. According to Russian transport industry, Russia has increased coal supplies to China by railways by about a third this year, to 27.6 MT in the January-August period. Of Russia’s total of 223 MT of coal exports last year, 49 MT were delivered to Europe, according to the energy ministry. But Russia expects its coal exports to decline in coming years due to the Western sanctions over the Ukraine conflict, and US (United States), European Union and British embargos on Russian coal imports. According to Russian government expectations, coal exports may fall by 22 percent this year and by a further 31 percent in 2023.

25 October: Nepal’s electricity consumption reached the highest level at about 1,700 MW during Laxmi Puja — the first day of the five day festival of light Deepavali. More than 1,300 MW of electricity was consumed domestically during the Laxmi Puja and 385 MW was exported to India, according to Pradeep Thike, the Deputy Managing Director of Nepal Electricity Authority (NEA). Nepal started celebrating the festival of light in its real sense in 2016 when the load shedding of electricity ended as power produced within the country became surplus. Prior to this, Nepal was witnessing up to 16 hours of load shedding mainly due to mismanagement of electricity and shortage of power. This year, the consumption of electricity during Tihar, or the festival of light, increased by 100 MW. The maximum electricity consumption during Tihar last year was around 1,200 MW. Nepal is currently witnessing a surplus of electricity and exporting power to India since June. The Himalayan nation is exporting 385 MW of electricity to India.

19 October: Germany’s government plans to introduce a cap on electricity prices for households and industry to ease the impact of soaring energy costs. To help finance the cap and pay for the stabilisation of power transmission grids, Berlin is considering skimming off some electricity companies’ profits. The cap, which the draft did not quantify, would be based on historical annual electricity consumption. As part of the plan, Berlin may skim off 90 percent of the power profits that electricity companies make above production costs. Germany’s economy ministry paper showed that power production from hard coal, gas and biomethane would not be included in the measures, due to their higher production costs.

25 October: Canada will provide C$970 million (US$708 million) in financing to develop a grid-scale small modular reactor (SMR), a new nuclear technology touted as a key part of the country’s plans to reduce emissions, Natural Resources Minister Jonathan Wilkinson said. The project, which is being developed by utility Ontario Power Generation (OPG) in Darlington, Ontario, will be the first commercial grid-scale SMR in the Group of Seven wealthy nations (G7), according to the Minister. Canada, like the rest of the G7, is targeting net-zero emissions by 2050. The government has an intermediate goal to cut emissions 40 percent to 45 percent below 2005 levels by 2030. About 15 percent of Canada’s electricity comes from nuclear power, according to the World Nuclear Association.

25 October: Ivory Coast has started construction on its first biomass-fired power generation plant, a 46 megawatt (MW) project backed by France’s EDF, the company building it said. Ivory Coast’s power capacity is about 2,369 MW, mainly from oil and gas, and the country hopes to increase that to 4,000 MW by 2025. Ivory Coast also exports power to several of its West African neighbours.

19 October: Australia announced plans to build renewable energy zones, wind projects and underwater electricity interconnectors, as it looks to build its renewable power capabilities and bring more clean energy into its national grid. The state of Victoria, which will have an election next month, will get A$1.5 billion (US$947.85 million) of concessional financing for Renewable Energy Zones (REZ) and offshore wind development projects, the government said. The government announced a US$1 billion loan for Tasmania’s Tarraleah Power Station redevelopment and Lake Cethana Pumped Hydro project.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.