-

CENTRES

Progammes & Centres

Location

Quick Notes

The renewable electricity roadmap for 2030 prepared by Niti Aayog in 2015 for accelerated renewable energy (RE) deployment in India repeats a quote from an unnamed member of the erstwhile Planning Commission several times : “We should not get into the mindset that RE is the intruder and conventional energy is the main player. Why not consider RE to be the main occupant of the “house” and then work out the rest of the system around RE, essentially, because RE is the future?” To make RE the main occupant of the “house”, Niti Aayog called for rethinking and reengineering of institutions, redefinition of policies, re-tuning of power grids and systems, and replacement of old habits with new ones. The government followed up by redefining policies, re-engineering institutions and by forcing consumers to replace old habits with new ones. The result is that RE is now one of the main occupants of the “house”, though not yet the dominant one.

In 1982, the department of non-conventional energy (DNES) sources was constituted under the Ministry of Energy. This was the period when extending access to modern energy sources to the vast rural areas was a priority. Towards achieving this goal, the integrated rural energy programme (IREP) was announced during the 7th plan period (1985-1990). Commenting on the progress of IREP the 8th plan document noted that grave damage being done to the ecosystem through depletion of the biomass cover (used as firewood) must be arrested by incorporating the environmental aspect in the micro and macro level rural energy planning framework. The 8th plan document provided financial outlay for improved cookstoves and rural fuelwood plantations. In 1992, DNES was upgraded as the Ministry of Non-conventional Energy Sources (MNES). International funds flowed in for wind and solar (mostly solar thermal) demonstration projects. The government offered subsidies to set up wind turbines, distribute biomass gasifiers, improved cookstoves, solar water heaters and solar cookers. These initiatives did not result in mass adoption by rural households. Among many reasons cited are poor maintenance for these devices installed or distributed by central government programmes and inadequate buy-in from rural areas partly because these devices were imposed on them and partly because they were subsidised which reduced a sense of ownership.

In 1987, the Renewable Energy Development Agency (IREDA) was established to act as a dedicated public sector financing arm for RE projects. In 1993, IREDA launched a solar photovoltaic (PV) programme to commercialise the technology that included manufacture and assembly of solar modules. From the end of the 1990s to the mid-2000s, India was a net exporter of solar modules. In 2005, 60 percent of solar module production was exported. Overall, until 2000, RE sources were seen as low-quality energy sources that could replace even lower quality energy sources such as firewood in rural households. The result was that RE languished as an intruder in the margins of India’s energy sector.

In the 2000s concern over climate change started gathering momentum across the rich world. In 2005, the first meeting of the Parties to the Kyoto Protocol, was held in Montreal in conjunction with the eleventh session of the Conference of Parties (COP 11) to the United Nations Climate Change Convention. It was the largest intergovernmental conference since the Kyoto Protocol was adopted in 1997. COP 11 operationalised the clean development mechanism (CDM) that allowed developed countries to invest in carbon emission reduction programmes in developing countries. This presented a huge commercial opportunity for India and other developing countries. India grasped the significance of these international developments. It rechristened MNES as the “Ministry of New and Renewable Energy Sources (MNRE)” in 2006. In 2008 India launched the National Action Plan on Climate Change (NAPCC) in which solar energy was to occupy the centre stage in the shift away from fossil fuels. In 2010, the Government of India hosted the Delhi International Renewable Energy Conference (DIREC), the fourth in the series of global ministerial-level conferences on RE. That year the federal government launched the Jawaharlal Nehru National Solar Mission (JNNSM), under the brand name “solar India”. It was modelled on the success of wind power generation in the 2000s where the private sector capitalised on state level incentives to install wind power generators and also invest in the domestic manufacture of wind turbines. JNNSM set a target of installing 20 GW (gigawatt) of solar power generation capacity and achieving grid parity of solar power by 2022. MNRE also had a target of 60 GW of wind power generation capacity by 2022.

In 2014, the target for RE power generation capacity was increased to 175 GW with solar contributing 100 GW, wind 60 GW, biomass 10 GW small hydropower (SHP) 5 GW. Though the target is likely to be missed, RE installed capacity has increased substantially in the last decade. As of September 2022, RE installed power generation capacity was about 118 GW. Biomass has met the target with over 10 GW capacity and SHP is very close to the target with 4899 MW (megawatt) capacity. Wind has achieved about 70 percent of the target with a capacity of over 41 GW and solar has achieved 60 percent of the target with an installed capacity of over 60 GW.

Apart from setting ambitious targets for RE capacity addition, a host of financial incentives that include but are not limited to access to low-cost finance, capital subsidies, viability gap funding, attractive generation based incentives and must run status are behind the substantial RE capacity addition. Favourable legislation from the Ministry of Power (MOP) also played a significant role in increasing the installed capacity of RE. The Electricity Act 2003, provided for adequate grid connectivity for RE project developers and mandated minimum purchase of RE power through renewable purchase obligation (RPO) to be enforced by state electricity regulators. The National Electricity Policy 2005, emphasised the need for specific power purchase agreements and tariff mechanisms to promote RE. The National Tariff Policy 2006 introduced preferential feed-in-tariff to promote RE.

The Planning Commission was one of the institutions that promoted RE before the MNRE and MOP. The 7th plan (1985-90) introduced (i) “wheeling” that offered transfer of power from a generation site to a consumption site using state-owned transmission infrastructure for a captive generation project (ii) banking, that facilitated storage of power with the state-owned utility and (iii) open access/third-party sale that enabled a power provider and power user to enter into a contract and use the state infrastructure to transfer power or buy power from open markets/third-party supply contracts.

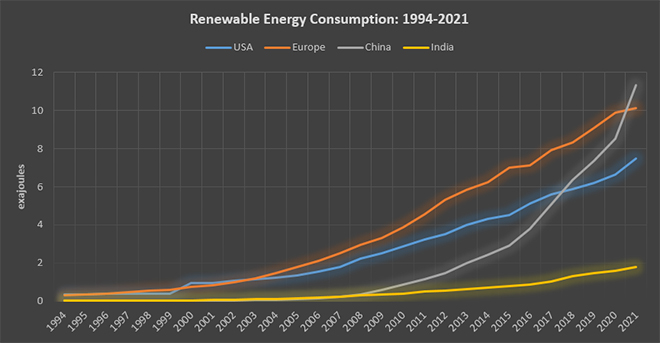

The key differences in approach over RE between the pre-2000 and post-2000 periods were (i) the shift in narrative of RE as energy for the poor to one of RE as key to strategic transformation (ii) shift from public sector as driver of change to the private sector as driver of change. The share of RE in India’s primary energy basket was less than 1 percent (0.2 percent) in 2010 and in 2022 the share had increased to about 3 percent. RE accounts for over 12 percent of power generation in India that makes India the 8th largest RE power generator in the world. Increase in the share of RE from less than 1 percent to about 3 percent in India’s primary energy basket in roughly 10 years would not have materialised but for the progress in policies to promote RE production and adoption in the last two decades. RE is now one of the dominant occupants of India’s energy house that could displace other occupants.

India’s top oil and gas producer ONGC (Oil and Natural Gas Corporation) wants the government to scrap windfall profit tax on domestically produced crude oil and instead use the dividend route to tap into bumper earnings resulting from surge in global energy prices. The company has also favoured a floor price for natural gas at US$10 per million British thermal unit (mmBtu)- the current government-dictated rate- to help bring deposits in challenging areas to production. ONGC management during discussions with government officials stated that levying windfall profit tax on domestic oil producers, while at the same time reaping rich savings from buying discounted oil from Russia was unfair.

Ruby, a floating production storage and offloading vessel destined for Reliance Industries Limited (RIL)’s MJ deep-water oil and gas development project in KG-D6 block, has set sail from South Korea, partner BP plc’s CEO (Chief Executive Officer) Bernard Looney said. MJ is the third and last of a set of discoveries that RIL and its partner BP of UK are developing in the eastern offshore block. The two will use a floating production system at high-sea in the Bay of Bengal to bring to production the deepest gas discovery in the KG-D6 block. The MJ-1 gas find is located about 2,000 metres directly below the Dhirubhai-1 and 3 (D1 and D3) fields — the first and the largest fields in KG-D6 block. MJ-1 is estimated to hold a minimum of 0.988 trillion cubic feet (Tcf) of contingent resources. The field also has oil deposits which would be produced using a floating system, called FPSO. RIL and BP are spending about US$ 5 bn (billion) on further development of KG-D6 through three different projects in block KG-D6 — R Cluster, Satellite Cluster and MJ — which together are expected to produce around 30 mmscmd (million metric standard cubic meter per day) of natural gas by 2023. R-Cluster started production in December 2020 and the Satellite Cluster came onstream in April last year. MJ is expected to come on stream before the end of the year. While R-Cluster has a plateau gas production of about 12.9 mmscmd, Satellite Cluster will have a peak output of 6 mmscmd. The MJ field will have a peak output of 12 mmscmd. Combined gas output from the R-Cluster and Satellite Cluster stood at more than 19 mmscmd during April-June quarter, according to RIL.

Seeking to capitalise on the rise in energy prices, ONGC has relaunched its tender for sale of KG field gas. The idea behind the rebidding is to get a higher price of US$15 per mmBtu. As per the tender papers, bids have been sought for sale of 0.75 mmscmd of gas for one year from the KG-DWN-98/2 (KG-D5) fields in the Bay of Bengal. At current Brent rates (US$101 a barrel), the reserve price comes to over US$15 per mmBtu. The price of locally produced natural gas is set twice a year by the government. The going rate for gas from deepsea fields stands at US$9.92 per mmBtu for the current six-month period (starting 1 April). For the next six-month period (starting 1 October), the prices are expected to be revised upwards for them to be in sync with global energy prices surge. The KG-D5 block is seen as having a peak production rate of 15.25 mmscmd of natural gas and 80,000 barrels of oil a day. ONGC has plans in the making for another tender later this year for sale of 5 mmscmd of gas beginning 2023.

India purchased some of the nation’s most expensive LNG shipments ever after vital Russian deliveries were cancelled. GAIL (India) Limited bought several LNG cargoes for delivery between October and November at more than double the price it paid around this time last year. The New Delhi-based company is struggling to replace supply from the former trading arm of Gazprom PJSC, which was nationalised by Germany earlier this year and is paying contractual fines rather than delivering fuel. GAIL bought three LNG shipments for October to November delivery above US$40 per mmBtu, among the most expensive cargoes ever for delivery to India, according to traders.

According to the Oil Ministry, India has set a target to provide 60 mn (million) piped natural gas (PNG) connections to households, commercial establishments, and industries in the next eight years in India. Virtually inaugurating a private gas supplier (LCNG) in Mysuru, Minister for petroleum and natural gas Hardeep S Puri said in proportion to that, about 9,500 CNG stations would be set up in the country in the said period. Briefing the growth of the industry, the minister said India has managed—in a short period of time—to increase the gas connections from 25 lakh connections in 2014 to 97 lakh connections—almost a four-fold increase. Even the number of city gas distribution (CGD) districts has increased nine times—from 66 in 2014 to 630 in 2022. The number of CNG stations too has gone up from 938 in 2014 to 4,629 at present

LNG imports by India likely hovered near multi-year lows in August while natural gas inflows so far this year are estimated to have declined more than 10 percent on year. India’s August LNG imports were only around 1.45 million tonnes (MT), the lowest since at least 2018, compared with 1.84 MT in July, according to shipping data from S&P Global Commodity Insights. Indian buyers attributed their unwillingness to purchase expensive LNG spot cargoes to their inability to pass on costs to industrial and residential customers, as well as lower domestic gas prices due to existing price ceilings. The PPAC (Petroleum Planning and Analysis Cell) data for the April-July period showed LNG imports fell 7.9 percent on the year to 9.97 bcm (billion cubic metres).

India has set up a panel to review the pricing formula for locally produced gas to ensure “fair price to the end consumer”, according to a government order, a move aimed at lowering inflation and boosting use of the cleaner fuel. India links local gas prices to a formula tied to global benchmarks, including Henry Hub, Alberta gas, NBP and Russian gas with a lag of one quarter. Local gas prices are at a record high and are expected to rise further due to a sharp increase in global gas prices triggered by the Ukraine-Russia conflict. The panel has to submit its report by the end of this month, it said. The panel’s recommendations will not be reflected in the next six-month revision of local gas prices from October, as Cabinet approval is required for implementation. The committee, headed by energy expert Kirit Parikh, will include members from the fertiliser ministry, gas producers, and buyers.

The committee will recommend ways to keep domestic natural gas prices stable and affordable for consumers while offering decent returns to producers. The ministry has also asked producers and consumers such as fertiliser, power and city gas companies to nominate representatives to the committee. The committee’s recommendations will help frame a new policy to replace the gas guidelines of 2014, under which volume-weighted average prices of gas in the US (United States), Canada, Europe and Russia are used to determine domestic prices every six months. Spiralling prices have shaken local gas consumers and spurred the government to relook at the pricing policy. A sharp economic recovery from the Covid-led slump and the Russian supply curbs following the invasion of Ukraine have driven up gas prices to record-high levels. Before the recent surge, domestic formula prices have mostly remained benign, in line with global rates, which were affected by the LNG glut or COVID in the last few years. Consumers have often sought affordable rates, while city gas companies–a key consumer segment–have recently demanded a ceiling on domestic prices to keep CNG fuel attractive with respect to petrol. For years, city gas companies have made big profits by obtaining traditionally cheaper domestic gas and selling CNG to drivers at market rates.

Bulgaria’s state gas company, Bulgargaz, is launching three tenders for liquefied natural gas (LNG) to avoid winter shortages and ensure long-term energy security, Chief Executive Officer (CEO) Denitsa Zlateva said. The Balkan country was almost totally reliant on Russian gas before Moscow cut deliveries in August and is now struggling to secure sufficient supplies at affordable prices for businesses in the European Union’s poorest member state. Bulgaria is also considering opening tenders for pipeline gas from neighbouring Turkey, interim Energy Minister Rossen Hristov said. Bulgaria has asked Gazprom to deliver what was due under its contract in rescheduled shipments until the end of the heating season next spring. Bulgargaz will open a tender for LNG deliveries for the last two months of the year, Zlateva said. Bulgargaz will seek about 142 million cubic metres (mcm) of gas for November and about 190 mcm for December. The company will also seek offers for supplies of LNG throughout 2023 for a total of 1.5 bcm and will launch a six-month process for LNG deliveries of 1 bcm a year from 2024 through 2034. Bulgaria consumes about 3 bcm of gas a year. It receives about 1 bcm a year from Azerbaijan under a long-term contract.

Portugal’s Prime Minister (PM) Antonio Costa has urged France to stop blocking the proposed MidCat gas pipeline across the Pyrenees noting it would help central and eastern Europe wean themselves off of Russian gas. Spain and Portugal have seven liquefied natural gas terminals that could supply central Europe via additional pipelines such as the proposed Spain-to-France Midcat pipeline. According to Costa, the European Commission has identified a subsea pipeline between Spain and Italy as an alternative to MidCat if France continues to block the project.

Norway and the European Union (EU) have agreed to a closer dialogue on proposals to resolve Europe’s energy crisis, Norwegian Prime Minister (PM) Jonas Gahr Støre said. EU energy ministers asked the European Commission to propose broad gas price caps, even as the EU executive itself poured cold water on the feasibility of such an idea. Norway, which is not an EU member, has become the union’s largest supplier of gas after Russia cut back exports in the wake of the Ukraine war, giving the Nordic nation record income from its petroleum industry as prices soared. While Norway aims to be a reliable supplier of gas to Europe, the terms of trade should be determined by negotiations between companies that pump the hydrocarbons and the firms that buy it, the Nordic country has said.

Hungary will have enough gas this winter to supply its households and economy, Tamas Menczer, state secretary of the Hungarian Ministry of Foreign Affairs and Trade, has said. He said the deal with Russian Gazprom, which had been brokered by Foreign Minister Peter Szijjarto, provides an additional 5.8 million cubic metres of natural gas per day for Hungary in September and October. While improving energy security in Hungary, the deal with Gazprom also marks a deviation from the strategy currently implemented by the European Union, which has been seeking to rid itself of Russian gas dependence as soon as possible. According to Menczer, about half of Europe’s annual gas consumption of 400 bcm traditionally comes from Russia.

Portugal said gas supplies to central European countries require a closer interconnection with the Iberian peninsula that, if impossible through France, should go through Italy. Spain and Portugal have large gas import capacities through their LNG terminals, which could be used to supply central Europe with additional pipeline connections such as the one planned crossing the Pyrenees between Spain and France, dubbed Midcat. However, French President Emmanuel Macron said he opposed the Midcat project, arguing that capacity on the two existing cross-Pyrenees gas pipelines was underutilised and gas flows were going mainly in the direction of Spain.

Spain will extend a gas price cap to power plants linked to heavy industry amid fears Russia could cut off all gas supply to Europe by land or sea, Spanish Prime Minister Pedro Sanchez said. Sanchez said the government will temporarily change power market regulations relating to the use of heat from industrial processes such as producing tiles, concrete, or fertilisers. Sanchez said the cap on gas prices used for electricity generation had already saved Spanish households two billion euros since mid-June.

Centrica’s Rough gas storage site off England’s east coast has received all the regulatory approvals to start storing gas again, Britain’s oil and gas regulator said. Countries across Europe have been building gas stocks ahead of winter to prepare for disruptions to supply of Russian gas, but Britain has had very little storage capacity since Rough’s closure in 2018. Britain’s North Sea Transition Authority (NSTA) said it had granted the required approvals and consents to Centrica Offshore UK Limited for Phase 1 of the Rough gas storage site.

Bulgaria has reached an agreement in principle to double its reserved capacity at a new LNG facility to be built off the northern Greek port of Alexandroupolis, the interim Energy Minister Rossen Hristov said. Rossen Hristov said that raising the reserved capacity to 1 bcm of gas per year at the LNG terminal, expected to become operational at the end of 2023, will help the Balkan country ensure diversified and stable gas supplies. The interim government, which has come under fire at home for seeking to renew gas supplies from Russia’s Gazprom, has said it plans to open tenders for mid to long-term gas deliveries and wants to import more LNG gas through Greece. The Alexandroupolis terminal is due to be built by a consortium of Greece’s Copelouzos family, Greek gas companies DEPA and DESFA, Bulgaria’s Bulgartransgaz and Cyprus’s Gaslog. It will be able to process 5.5 bcm of LNG annually and store 153,500 cubic metres. Bulgaria is struggling to secure natural gas at optimal prices for the coming winter after Russia halted its gas supplies in April over Sofia’s refusal to pay in roubles amid European sanctions on Moscow over its invasion of Ukraine. The interim government has sought talks with Gazprom to renew supplies under the current contract that expires at the end of 2022 and reschedule gas shipments the country has not taken until next April or June.

Gas production in the United Kingdom (UK) rose 26 percent in the first half of this year compared to the same period last year, an industry body said, as Britain cuts Russian energy imports in response to Moscow’s invasion of Ukraine. The 3.5 bcm increase in locally-produced gas is enough to heat almost 3.5 million UK homes for a year, Offshore Energies UK (OEUK) said. The increases were driven by the start-up of new gas fields in the southern North Sea, including Harbour Energy’s Tolmount field and IOG’s Saturn Banks project, OEUK said. British wholesale gas prices have hit record highs this year following Russia’s invasion of Ukraine, increasing pressure on household budgets as bills soar.

Israel’s Prime Minister (PM) Yair Lapid vowed to begin production at a contested Mediterranean natural gas field “as soon as it is possible,” threatening to raise tensions with Lebanon’s Hezbollah militant group. Lapid said it is “both possible and necessary” to reach an agreement with Lebanon, which he said would benefit both countries and “strengthen regional stability.” But he said that production from the Karish gas field is not connected to the negotiations and “will commence without delay, as soon as it is possible.”

Mexico’s oil regulator and state company Pemex are at odds over how to develop a deepwater natural gas project, eight people close to the matter said, threatening to stall a US$1.5 bn energy venture. The Lakach field holds up to 937 billion cubic feet of reserves but rising costs have hindered development. Now, a Pemex proposal to revive development with US liquefied gas company New Fortress Energy is at issue. The project’s fate could depend on the replacement for CNH chief Rogelio Hernandez, who resigned. In July, Pemex and New Fortress announced a “long-term strategic partnership” for Lakach that would supply gas for domestic use and produce liquefied natural gas for exports. Lakach, a Gulf of Mexico field with the potential to supply up to 1.8 billion cubic feet of gas per day, could become the country’s first commercial deepwater gas project and provide a huge boost for a country importing over 80 percent of the fuel.

Argentina’s state oil company YPF and its Malaysian counterpart, Petronas, inked a deal to build a major LNG plant and a pipeline to transport the fuel, as demand for the fossil fuel spikes globally. The fallout from Russia’s invasion of Ukraine on world energy markets has spurred growing interest in LNG shipments as major European economies that for decades have depended on Russian natural gas scramble for alternative supplies. The YPF-Petronas project calls for an initial investment of around US$10 bn, which the companies said will power output of 5 MT of LNG during the first year of operation, but they did not specify when the plant is expected to come online. The companies also said the project will take a decade to complete, and at that point will likely produce and export up to 25 MT of LNG annually.

Australia’s Santos Ltd said it would spend an additional US$311 mn to build a new pipeline to transport gas from its offshore Barossa field to its Darwin LNG plant in the Northern Territory. First gas production at the Darwin LNG plant using Barossa gas is targeted for the first half of 2025. Gas from Barossa will replace gas from the Bayu-Undan field, which is set to stop producing later this year. The new pipeline for Barossa gas will free up an existing pipeline from Bayu-Undan to transport carbon dioxide from Darwin into the depleted oil and gas field.

Military-ruled Myanmar earned US$800 mn from natural gas exports mainly to China and Thailand between April and July. Income from gas exports was US$60.7 mn higher than the same period last year, the ministry said. Thailand’s PTT Exploration and Production Pcl produces and exports natural gas from the Yadana, Yetagun and Zawtika fields. Myanmar accounts for about 14 percent of Thailand’s natural gas needs.

26 September: Oil and Natural Gas Corp (ONGC) said there is no clarity on the resumption of its oil and gas project Sakhalin-1. Production at Sakhalin-1 was “minimised” shortly after the Ukraine war started and there is no clarity or timeline yet when it could be resumed, ONGC said. The project was hit due to force majeure declared by the operator Exxon Mobile Corporation after sanctions against Russia had made it difficult to ship crude to customers.

24 September: Bharat Petroleum Corporation Limited (BPCL) said it has signed an agreement with Brazilian national oil company Petrobras for sourcing crude oil from the Latin American nation as part of plans to diversify its sourcing needs. BPCL imports a large volume of crude oil which is turned into fuel such as petrol and diesel at its three oil refineries at Mumbai, Bina in Madhya Pradesh and Kochi in Kerala. The firm, which gets majority of its supplies from west Asian nations such as Iraq and Saudi Arabia, is looking to diversify its sources of supply in an attempt to cut down reliance on any particular region. Bharat PetroResources Limited (BPRL), the upstream oil and gas exploration and production subsidiary of BPCL, plans to invest US$1.6 billion to develop an oil block in Brazil. BPRL holds a stake in an ultra-deep water hydrocarbon block in Brazil, owned and operated by Petrobras. The field development plan and final investment decision is expected to be declared soon. On 27 July, the Union Cabinet gave approval to the firm to invest an additional US$1.6 billion in the Brazilian oil block BM-SEAL-11. The block is to start production from 2026-27.

22 September: It is now officially confirmed that there is an oil spill off the Sindhudurg coast due to the sunken tanker. The oil spill has been spreading from the MT Parth tanker off Vijaydurg coast. The Indian Coast Guard (ICG) has confirmed to the Sindhudurg district administration that the oil spill has covered around 8 square km area in the deep sea, and warned that Devgad, Vengurla, Malvan and Goa coastal areas may be hit. About 250 litres of oil spill dispersants have been sprayed over the area from a helicopter. The 101-metre-long MT Parth vessel, loaded with 3,911 MT bitumen, was navigating from Khor Fakkan port, UAE, to New Mangalore port but sank on September 16 evening due to engine failure. Apart from the bitumen, the vessel had 140 kilolitre (kl) fuel oil and 30 kl diesel. The ICG had rescued 19 crew members.

27 September: The government-appointed panel for reviewing the pricing of natural gas has sought more time to submit its report as it does a tightrope walk of striking a balance between the expectations of producers and consumers. The panel headed by former planning commission member Kirit S Parikh was tasked to suggest a “fair price to the end-consumer” by the end of September. Given the enormity of the task, the committee wanted 30 more days to finish the report but the government wants it to wrap up the work by mid-October. To keep rates under check so that they do not add fire to already high inflation, the government formed a committee to review the way prices of gas produced in India are fixed. The Modi government had in 2014 used prices in gas surplus countries to arrive at a formula for locally produced gas. Rates, according to this, are set every six months — on 1 April and 1 October — each year based on rates prevalent in gas surplus nations such as the US (United States), Canada and Russia in one year with a lag of one quarter.

23 September: India plans to expand its coal power fleet by about a quarter through the end of the decade as it continues to lean on the fuel to meet growing demand until energy storage costs fall. The world’s third-biggest emitter of greenhouse gases will add nearly 56 gigawatt (GW) of coal power capacity unless there’s a substantial drop in the cost of storing electricity, Power Minister Raj Kumar Singh said. India is also planning major investments in renewable energy, but it has to prioritise providing reliable power to spur economic growth, he said. The plan underscores how energy security concerns are vying with climate targets as countries map out energy transition paths. Coal is enjoying a revival in Europe after Russian gas supplies fell in the fall-out from the invasion of Ukraine. India, which saw power demand surge this summer as temperatures rose to a record, is also delaying shutting older coal plants and increasing mining output.

22 September: India’s thermal coal imports from Russia are expected to fall for the first time in four months in September, two research consultancies said, potentially resulting in lower revenues for Moscow at a time it is mobilising more troops to fight in Ukraine. Indian consultancy Coalmint expects September thermal coal imports from Russia to decline 30 percent from August to 1.4 million tonnes (MT), it said. The value of India’s coal imports from Russia since troops marched into Ukraine on 24 February rose to about US$2.4 billion. Traders and analysts said logistical issues have resulted in lower imports in September by India from Russia. Coal shipments from Russia had risen in July and August despite a decline in overall Indian imports of the fuel, making Russia India’s third largest coal supplier. DBX expects India’s total thermal coal imports to fall to about 13 MT from 15 MT in August.

22 September: The average demand for power in UP (Uttar Pradesh) almost doubled between 2012-17 and April-September 2022 (Yogi 2.0) with the peak demand touching an all-time high of 26,589 megawatt (MW) on 9 September, the state government informed the UP assembly. Energy Minister Arvind Kumar Sharma said that during 2012-17 – when Samajwadi Party was in power – the average peak demand for power was around 13,598 MW. Likewise, the average minimum demand was 5,685MW. This rose to 24,969MW between April-September 2022, a rise of around 83 percent in comparison to 2012-17. The minimum demand, too, rose to 11,017 MW, an increase of around 94 percent. He said that while the state government tried its best to meet the demand, the outages occurred because of inclement weather conditions and dilapidated electricity infrastructure. He said that for better management and maintenance of electrical equipment, the rate of variable damage has been reduced by 0.42 percent this year. Also, around 1.6 lakh converters were changed between 18 April-September 2022, he said. He said the unprecedented rise in electricity demand was not just due to delayed rains and less than average rainfall but also because of extreme heat that prevailed this summer. He said that to meet the historic demand for power, the coal-fired thermal power plants were run at 73.31 per cent Plant Load Factor (PLF) against a PLF of 55.51 percent a year ago.

27 September: Multi-national solar energy solutions provider Goldi Solar has announced it plans to infuse over INR50 bn as a part of its business expansion plans, particularly in modules, cells and raw material manufacturing capabilities. It plans to commence production at its cell manufacturing unit in Gujarat. Goldi Solar is one of the leading Indian solar brands. The company manufactures panels, provides EPC services, and is an independent power producer. It has two facilities of 2.5 GW at Pipodara and Navsari in Gujarat. Subsequently, it will expand its capacity to 5 GW. Goldi Solar plans to recruit over 4,500 people across various functions, increasing its workforce to over 5,500, including the existing workforce. Goldi Solar will conduct three-month certification programmes at a skill development centre that it plans to open in collaboration with the NSDC (National Skill Development Council) in Navsari to train recruits for a career in renewables in Gujarat. Terming renewables as the future of energy, the firm’s plans of launching a new product line and expanding capacity for module manufacturing are designed to increase the supply of clean energy and motivate its large-scale replacement of fossil fuel. In India, the country’s goal toward 500 GW of non-fossil-fuel energy sources by 2030 could create 3.4 million new job opportunities (of short or long duration), or about 1 million direct full-time equivalents, International Renewable Energy Agency and the International Labour Organization joint report said. In 2020-21, India created 863,000 green jobs, of which 217,000 were in solar photovoltaic vertical and 414,000 in hydropower, the joint report said recently. Jobs in solar photovoltaic (PV) in 2021, the fastest-growing sector, accounted for more than a third of the total renewable energy workforce. India added 10.3 GW of solar PV capacity in 2021, up from 4.2 GW installed in 2020, the joint report said. India also aims to reduce the emissions intensity of GDP (Gross Domestic Product) by 45 percent. Finally, India commits to net-zero emissions by 2070.

23 September: The pieces to develop end-to-end solar panel manufacturing capabilities are all coming together in the Reliance Industries Limited (RIL) announcement to acquire a stake in solar glass coatings provider, Caelux. RIL announced to acquire a 20 percent stake in US-based solar-tech firm, Caelux, for US$12 million as it expands its value chain to improve capabilities in solar panel manufacturing and related materials. Caelux is testing its coating solutions for solar glass with nano materials – Perovskites (Calcium Titanium oxide – a combination of metals and non-metals) which when arranged in a certain way under the right conditions, produce materials that can help improve efficiency of the panels by up to 20 percent over the 25 year life of the solar panel, Morgan Stanley said in a report. RIL had announced that it would be manufacturing its own glass panels and we believe Caelux technology helps RIL in improving the panel efficiency towards the targeted 28 percent.

21 September: The Union Cabinet approved the Production Linked Incentive (PLI) Scheme on ‘National programme on High Efficiency Solar PV Modules’ for achieving manufacturing capacity of gigawatt (GW) scale in high efficiency Solar PV modules. The decision is aimed towards building an ecosystem for manufacturing high efficiency Solar PV modules, Union Minister Anurag Thakur said. A grant worth Rs 195 billion has been passed by the government for the manufacturing project. About 65,000 MW per year manufacturing capacity of fully and partially integrated, solar PV modules will be installed under the project.

25 September: The cost of Nigeria’s fuel subsidies rose to 525.714 billion naira (US$1.22 billion) in August, bringing the total spent this year to 2.568 trillion naira, according to state oil company NNPC (Nigerian National Petroleum Corporation). The ballooning costs of keeping petrol prices low in Africa’s most populous nation are straining the budget and draining revenue from the NNPC. NNPC has not submitted any money to the federal government this year due largely to subsidy costs. August’s bill compared with 448.782 billion naira in July, according to NNPC. Part of the increased cost was down to a bigger daily supply of petrol, which rose to 71.8 million litres, up nearly 10 percent from July, according to Nigerian Midstream and Downstream Petroleum Regulatory Authority. Oil production in August averaged 1.18 million barrels per day (bpd), well below the nation’s OPEC quota of 1.8 million bpd, due in large part to theft from pipelines that has curtailed production.

22 September: Oil prices edged lower in early Asian trade after the US (United States) Federal Reserve raised interest rates significantly to curb inflation, with fears for the global economy casting a shadow over future fuel demand. Brent crude futures fell 16 cents, or 0.2 percent, to US$89.67 per barrel, while US West Texas Intermediate (WTI) crude dropped 15 cents to US$82.79 per barrel. Meanwhile, US gasoline demand over the past four weeks fell to 8.5 million barrels per day (bpd), its lowest since February, the US Energy Information Administration said.

21 September: Indonesia will launch a second auction of oil and gas blocks this year as it seeks to cash in on high energy prices and boost output after decades of decline due to a lack of exploration and investment. Southeast Asia’s biggest economy is committed to reaching a lifting target of 1 million barrels per day (bpd) in 2030, Energy Minister Arifin Tasrif said. The once-OPEC member reached peak crude oil production in 1995, producing more than 1.6 million bpd. But output has declined steadily ever since due to a lack of exploration, an absence of discovery of large reserves, and shifting investment into renewable energy. Oil lifting in the January-June period was 614,500 bpd, upstream regulator SKK Migas said.

21 September: At least three Chinese state oil refineries and a privately run mega refiner are considering increasing runs by up to 10 percent in October from September, eyeing stronger demand and a possible surge in fourth-quarter fuel exports. Chinese refiners are expecting Beijing to release up to 15 million tonnes (MT) worth of oil products export quotas for the rest of the year to support the no. 2 economy’s sagging exports. Such a move would signal a reversal in China’s oil products export policy, add to global supplies and depress fuel prices. After a recent slide in benchmark Brent crude prices to below US$100 a barrel, Chinese refiners have taken arbitrage opportunities to boost stockpiles, traders said, booking supertankers to haul crude oil to China from the Americas and Middle East. China’s single largest refinery Zhejiang Petrochemical Corporation, which is capable of processing 800,000 barrels per day (bpd) of crude, is aiming to ramp up runs in the coming months from the current levels of 700,000-750,000 bpd, according to two sources familiar with its operations.

27 September: Three government-approved liquefied natural gas (LNG) import terminal projects in the Philippines are expected to begin commercial operations in early 2023, marking the birth of the country’s liquefied natural gas (LNG) industry. The projects are those of Singapore-based Atlantic, Gulf and Pacific (AG&P), First Gen Corporation, and Australia-listed Energy World Corporation, the Department of Energy (DOE)’s natural gas management division head Laura Saguin said. The three terminals are among six such projects that the DOE has approved. Three others are expected to come online within the next three years, including a project proposed by Shell. The Philippines will need to import LNG to fuel gas-fired power plants with a combined capacity of more than 3,000 megawatt (MW), as output from its Malampaya gas field in the South China Sea is expected to start declining this year and to be depleted by 2027.

27 September: Papua New Guinea (PNG) offered Japanese companies favoured access to new gas field development opportunities and liquefied natural gas (LNG) processing projects in trade talks that focused on energy security, PNG Prime Minister (PM) James Marape said. Japanese PM Fumio Kishida met with his PNG counterpart ahead of the funeral of former Prime Minister Shinzo Abe, at a time when Japan is seeking LNG supplies to replace gas from Russia. Marape said Kishida highlighted Japan’s need for energy security and sought to increase trade between the two countries. Marape said he had also invited those companies to get involved in processing LNG resources in PNG. Japan participates in several major projects in PNG, including an airport, Marape said.

27 September: Polish oil and gas company producer PGNiG will import at least 6.5 billion cubic metres (bcm) of natural gas from Norway in 2023, the company said. These deliveries will run via the Baltic Pipe pipeline, it said. PGNiG said that in 2023 it will use 80 percent of the pipeline’s capacity reserved by the company, which will rise to 90 percent in 2024, equal to about 7.7 bcm. The pipeline, with a capacity of 10 bcm, opens. It will provide Poland with alternative sources of gas which it has been seeking since April when it was cut off from Russian supplies. PGNiG said it had reserved about 8 bcm of the pipeline’s capacity for its deliveries. Following talks with gas suppliers from the Norwegian Continental Shelf, PGNiG has enough resources to fully utilise the pipeline’s capacity available for 2022.

21 September: Argentine President Alberto Fernandez said his government plans in the coming days to submit legislation to the national congress that “would give certainty” to energy producers and help advance Argentina’s liquefied natural gas (LNG) agenda. The Vaca Muerta shale basin, the world’s second largest unconventional gas reserve and the fourth largest oil reserve, gives the country strong advantages in oil and gas markets, he said. The South American country will have an energy trade deficit again this year, he said, but the government expects that rising output in Vaca Muerta and the construction of a key domestic gas pipeline will reverse that deficit. By 2026 Argentina would register a US$13 billion energy trade surplus, he said. Energy companies operating in Argentina hope the gas line will be ready soon, executives in the meeting said, noting that a lack of sufficient capacity has delayed some gas production increase plans and held back output of oil and associated-gas.

21 September: Algeria expects its natural gas exports to Italy will climb by a fifth this year, as European nations race to reduce their reliance on Russian supplies. Gas shipments to Italy from the north African country will total about 25.2 billion cubic metres (bcm) in 2022, state energy firm Sonatrach CEO (Chief Executive Officer) Toufik Hakkar, said. Italy received 20.9 billion cubic metres from Algeria last year, data from Italy’s gas network show. Countries are rushing to find alternative energy providers like Algeria to make up for the loss of supply from Russia, which cut gas flows to Europe in reaction to the continent’s support for Ukraine. For its part, Italy struck a deal with Algeria in April to increase imports through the Trans-Med pipeline, which was followed by ex-President Mario Draghi’s visit in July in a bid to secure more gas. The volume of gas pumped to Italy under long-term contracts will be about 21.6 bcm this year, while the amount sold under spot transactions is likely to total 3.6 billion cubic metres, he said. Algeria also has two pipeline links with Spain. However, Spanish grid data show Algerian gas imports slumped 40 percent in the first half from a year earlier after the Maghreb-Europe link, which crosses Morocco, halted in November 2021 in a rift between Algiers and Rabat over the status of Western Sahara. Spain has received 6.9 bcm of gas so far this year, Hakkar said.

21 September: Due diligence of PGE’s coal-fired power generation assets is underway as part of a carve-out process under a government plan, the Polish company’s chief executive Wojciech Dabrowski said. Poland plans to take over coal assets excluding hard coal mines owned by its utilities by the end of 2022, and then transfer them to a new state-owned company. The new model aims to help state-controlled utilities fund green projects as banks avoid backing coal-dependant companies. Dabrowski said that while margins on power generated from coal are “tempting”, the company is sticking to the government’s plan to complete the operation on time. PGE plans to import 10 million tonnes (MT) of coal from Columbia, Indonesia and Australia by the end of April next year, to make up for a shortfall due to a ban on the fuel from Russia in place since April. Poland is coping with a massive increase in coal prices and shortages of the fuel after banning imports from Russia in response to its invasion of Ukraine.

27 September: Ireland will likely extend a grant scheme to help businesses pay for soaring energy bills beyond its initial expiry date at the end of February if energy prices are not falling, Deputy Prime Minister Leo Varadkar said. The government introduced the €1.25 billion temporary scheme in the budget, providing most businesses with up to 40 percent of the increase in electricity or gas bills up to €10,000 per month.

26 September: Puerto Rican government workers tried to restore power amid growing frustration over the slow response from the main energy provider, with about 40 percent of the island still without electricity more than a week after Hurricane Fiona hit services. Puerto Rico grid operator LUMA Energy said power had been restored to 59 percent of its roughly 1.5 million customers following the 18 September arrival of Fiona, at the time a Category 1 hurricane that caused almost all the island’s roughly 3.3 million residents to lose power.

26 September: Saudi Arabia has announced five new projects to produce electricity using renewable energy. The Saudi Power Procurement Company said the projects are the fourth phase of the kingdom’s National Renewable Energy Program of the Energy Ministry. These projects, whose total capacity reaches 3,300 megawatt (MW), include three wind energy projects and two solar energy projects, it said. The total production of wind energy projects stands at 1,800 MW, which are distributed for a project in Yanbu with a capacity of 700 MW, another in Al-Ghat with 600 MW and a third in Waad Al-Shamal with 500 MW. The total capacity of solar projects reaches 1,500 MW, distributed to a project in Al-Henakiyah with 1,100 MW and another in Tubarjal with 400 MW. The Kingdom targets to reach the best energy mix to produce electricity from renewable energy resources and using gas with 50 percent for each of them and replace the fuel used to produce electricity by 2030.

21 September: Portugal has raised the target for its debut offshore wind power auction to 10 gigawatt (GW), Environment Minister Duarte Cordeiro said, aiming to “move faster” on the country’s energy transition. In June, Cordeiro put the capacity on offer at the auction due next year at 6-8 GW, which was already double the government’s target at the start of 2022. The energy crisis caused by Russia’s invasion of Ukraine is forcing countries to bet more on new technologies to boost renewable energy generation, such as wind and solar, which was already happening as part of a global shift from fossil fuels. Floating wind technology, seen as the final frontier in the offshore wind industry, has gained traction in countries such as Britain, France and parts of south-east Asia. Portugal has a small, 25 megawatt (MW) floating wind project off its Atlantic coast. Portugal has 7.3 GW of hydroelectric capacity and 5.6 GW of onshore wind, which together represents 83 percent of its total installed capacity.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of Newspaper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.