-

CENTRES

Progammes & Centres

Location

[Renewable Forced Obligation]

“Renewable Energy Certificates have been introduced to enable resource poor states to comply with their RPO targets. But neither the resource rich states nor resource poor states have complied with their RPO targets because they do not find any incentive in fulfilling obligation. RPO which was once cited as a major force driving renewable energy in the country has failed to make any impact on national level…”

Energy News

[GOOD]

Improving efficiency to reduce power tariff is the right road even if it is the road less travelled!

Growing oil imports is a problem when foreign exchange earnings from exports are falling!

[UGLY]

Natural gas will flow into India when pricing regulations are ‘bypassed’ and not when Pakistan is bypassed!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Renewable Forced Obligation

ANALYSIS / ISSUES…………

· High GDP growth centered paradigm and GHG emissions

DATA INSIGHT………………

· Country-wise Electricity and Total Energy Consumption

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC, partners to invest $24 bn in Mozambique

· ONGC gets one-year extension for Vietnam block

· ONGC submits draft field development plan for KG discoveries

Downstream……………………………

· IOC said to plan $3 bn petrochemicals plant in Iran

Transportation / Trade………………

· RIL allowed to sell LPG to private marketers

· India's oil imports to be 90 percent by 2020

· Assocham wants India to bypass Pakistan for gas pipeline with Iran

· RIL July oil imports rise nearly 25 percent from June

· IOC raises oil import from Latin America to cut costs

· Kakinada Seaports moves Hyderabad HC against GAIL, HPCL

· BPCL September exports highest in a year

Policy / Performance…………………

· Oil companies slash Jet fuel price by 11.7 percent

· Govt mulls 2 kg LPG cylinders

· Govt to fix formula for premium on gas pricing soon: Oil Minister

· CCEA nod for royalty to states on crude output

· IOC ratings unaffected by govt stake sale: Moody's

[NATIONAL: POWER]

Generation………………

· CIL misses August output target by 3.8 percent

· TN govt to set up a ` 240 bn thermal power project

· Meenvallam power project's revenue touches ` 32.4 mn

Transmission / Distribution / Trade……

· Bengaluru will face 2 hr power cuts every day

· Jindal Steel coal mine in Australia to shut

· Govt may cut power price to boost rural supply: Goyal

· Over ` 40 bn plan for augmenting power supply in Haryana

· NDMC's 'Smart Grid' project to improve power distribution

· GMR plans to export power from its Nepal plants to Bangladesh

· Don't distort tariff, use DBT to provide aid directly to poor: NTPC to states

Policy / Performance…………………

· Power producers allowed to source fuel from Coal India via e-auction

· Three coal mines in MP to start soon: Goyal

· Delhi CM launches scheme to penalise electricity companies over complaints

· Govt to rationalise coal prices: Goyal

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· UK approves development of $4.5 bn Culzean gas field in North Sea

· New US oil data shows lower 2015 production: EIA

· Eni discovers massive gas field in the Mediterranean

· Denmark expects to maintain present O&G production

Downstream……………………

· Oman commissions first crude oil floating storage facility

· Amec Foster to support Vietnam’s Dung Quat refinery $1.8 bn expansion plan

· Petrobras says to cost $4.3 bn to finish Comperj refinery

Transportation / Trade…………

· Sasol seeks contractors for Mozambique oil project, gas pipeline

· Petronas said to consider buying Statoil’s stake in TAP project

· Big Rail's little cousins find boon in US oil-by-rail bust

· South Korea may hike Iran oil imports once sanctions lifted

· Lithuania LNG imports could fall to 320-350 mn cubic metres in 2016

· ExxonMobil, BHP to spend A$400 mn to replace Australian pipeline

· Shell says gas supplies to Nigeria LNG reduced due oil pipeline issues

· Rosneft will supply LNG to Egypt

· Total sells North Sea gas pipelines for $907 mn

· China oil giants seek to join spree of global energy deals

Policy / Performance………………

· Russia says oil output could decline if prices stay low

· South Korea will increase domestic gas tariffs by 4.4 percent

· Alberta regulator orders 95 Nexen pipelines shut down after leak

· Oman said to consider importing LNG as domestic gas use surges

[INTERNATIONAL: POWER]

Generation…………………

· UN body to aid Africa with nuclear power generation

· Construction of the 2 GW Batang coal-fired power plant launched in Indonesia

· South Africa inaugurates coal-fired power plant

· Consortium awarded Oman deal for 445 MW power plant

· South Korean firms to invest in power generation

· Nigeria’s electricity generation hits new peak

Transmission / Distribution / Trade……

· Zimbabwe electricity cuts to worsen on power plants maintenance

· TEPCO secures purchase of 1.5 GW of coal-fired power capacity

· Kyrgyzstan hails epoch-making power line

· Abengoa to build power transmission lines in South Africa

Policy / Performance………………

· China plans to invest $313 bn to boost power grid infrastructure by 2020

· Electricity tariffs dropped in Mexico in 2015

· Indonesia signed MoU for 140 MW tidal power project

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Inox Wind bags 100 MW power project from Ostro Energy

· Kolkata parks to have India's first carbon-neutral lighting

· Adani Group wins 50 MW solar power plant in UP

· NTPC eyes dollar bidding to make solar power cheap

· India seeks SoftBank push for Modi's solar goal

· Delhi govt plans to install solar panels at DTC bus shelters

· Rise in solar cells' production to bring ` 300 bn investment & create 25k jobs in India

· 'Climate change will lead to rise in malaria, dengue cases'

· Punjab govt to offer 66 percent subsidy to SCs on solar inverters

· Delhi Dialogue Commission presents draft solar policy to all

· Vestas gets 40 MW order in India

GLOBAL………………

· MidAmerican Energy will add 522 MW of wind park by end 2016

· Taiwan rises its renewable target by 25 percent to 17.3 GW in 2030

· Enel secures right to sign 20 year solar power supply contracts in Brazil

· UN said to summon leaders to closed-door climate change meeting

· Fossil fuels losing cost advantage over solar, wind: IEA

· Brazil grants contracts to develop 30 new solar parks

· Work starts on Vietnam's first solar power plant

· UK to end small-scale renewables aid in blow to solar

· US needs to expand clean power plan to meet carbon cut targets

[WEEK IN REVIEW]

COMMENTS………………

Renewable Forced Obligation

Ashish Gupta, Observer Research Foundation

|

T |

he government has introduced various polices to increase renewable energy generation and Renewable Purchase Obligation (RPO) is one of them. As per Section 86 (1) (e) of Electricity Act, 2003, states are required to specify purchase of electricity from renewable sources, a percentage of the total consumption of the electricity in the area of the distribution licensee. Consequently, Renewable Energy Certificates have been introduced to enable resource poor states to comply with their RPO targets. But neither the resource rich states nor resource poor states have complied with their RPO targets because they do not find any incentive in fulfilling obligation. RPO which was once cited as a major force driving renewable energy in the country has failed to make any impact on national level. One of the reasons being that most of the state discoms are not convinced about the commercial viability of such obligation.

|

State |

RPO Regulation |

|

Assam |

|

|

Chhattisgarh |

|

|

Delhi |

|

|

Gujarat |

|

|

Haryana |

|

|

Himachal Pradesh |

|

|

Jammu & Kashmir |

|

|

Jharkhand |

|

|

Goa & UT |

· There is no long term trajectory of RPO target. |

|

Manipur & Mizoram |

|

|

Karnataka |

|

|

Meghalaya |

|

|

Odisha |

|

|

Punjab |

|

|

Rajasthan |

|

|

Uttarakhand |

|

|

Uttar Pradesh |

|

|

Tripura |

|

|

West Bengal |

|

It is quite evident from the table above that most of the States have allowed the flexibility to carry forward their RPO targets either through non – reporting or by having short term RPO trajectory or by not specifying minimum capacity for captive consumers for applicability of RPO. Why? The answer is simple and straight forward, that renewable energy is costly.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

High GDP growth centered paradigm and GHG emissions

Shankar Sharma, Power Policy Analyst

|

W |

hereas many conventional economic analysts argue that in order to have adequate human development index the country’s economy has to grow continuously at an appreciable rate, a densely populated and resource constrained society such as ours cannot afford to ignore the implications of high energy / material consumption (which will be a consequence of high growth of the economy). As the table below indicates, whereas the economy will grow by 300% in 36 years at Compounded Annual Growth Rate (CAGR) of 4%, it takes only 18 years to grow the economy by 400% at 10% CAGR. In this context it is essential to address the question how much energy / material consumption increase is considered acceptable?

Time taken for economy to get multiplied at constant CAGR

|

CAGR Growth Percentage |

Increase by 100% |

Increase by 200% |

Increase by 300% |

Increase by 400% |

|

@ 4% |

19 Years |

29 Years |

36 Years |

40 Years |

|

@ 6% |

13 Years |

20 Years |

25 Years |

29 Years |

|

@ 8% |

10 Years |

15 Years |

19 Years |

22 Years |

|

@ 10% |

8 Years |

13 Years |

16 Years |

18 Years |

The consequences of high GDP growth rate year after year need to be kept in mind w.r.t the true welfare needs of the communities in the state, which is possible only if the GHG emissions and all the associated problems are targeted to be contained within the manageable limits. A question arises whether this ultimate objective can be compromised for any reason, since it involves the existential threat to the man kind in the form of Climate Change. Successive governments have proceeded with the assumption that India needs to sustain a high economic growth over next 20 / 30 years (and possibly beyond) to eradicate poverty and to meet its human development goals. It appears that the social, economic and environmental impacts associated with such high GDP growth on the vulnerable sections of our society were not considered objectively. It is a fact that a sustained high GDP growth rate will mean the manufacture of products and provision of services at an unprecedented pace leading to: setting up of more factories/manufacturing facilities; consumption of large quantities of raw materials; unsustainably increasing demand for natural resources such as land, water, minerals, timber etc.; acute pressure on the govt. to divert agricultural/forest lands for other purposes; huge demand for energy; accelerated urban migration; clamor for more of airports, air lines, hotels, shopping malls, private vehicles, express highways etc. Vast increase in each of these activities, while increasing the total GHG emissions, will also add up to reduce the overall ability of natural carbon sinks such as forests to absorb GHG emissions. There will also be increased air and water pollution along with huge issues of managing the solid /liquid wastes.

These consequences, such as shrinking forests and agricultural lands, will result in depriving the weaker sections of the society even the access to natural resources, while driving the fragile environment to a point of no return. Does our society need such an eventuality? Is this what we want from Global Warming perspective?

Since the primary objective of high GDP growth centered policy is to create jobs, it is worth repeating what Tamil Nadu State Action Plan on Climate Change (TNSAPCC) has said about the importance of agriculture to TN’s economy. “Global development experience reveals that one percent growth in agriculture is at least two or three times more effective in reducing poverty than the type of same growth emanating from non-agricultural sector.”

Most states in the Union, being traditionally agrarian economies, should consider the role of agriculture and allied sectors, such as animal husbandry, horticulture, floriculture, beekeeping, social forestry etc. in providing vast employment opportunities in parts of the country. The perspective that good agricultural practices will lead to much reduced overall GHG emissions than the best set of industrial practices becomes highly relevant.

The net effect associated with high GDP growth target will be that the total GHG emissions will increase by considerable margin, even if we adopt most energy efficient processes, and even if reduced emission intensity of the state’s GDP is feasible. The desirability of such high GDP growth rate scenario to our society needs to be questioned in the context that the increase in total GHG emissions will be closely associated with the increased pollution of air, land and water; and the increased denial of access to natural resources to the vulnerable sections of the society. Reduced area and density of forests, dammed rivers, polluted air, forced displacements which will all be the consequences of a high GDP growth are bound to impact the vulnerable sections of our society. Since the vulnerable sections of the society are also the most impacted lot due to climate change, the larger civil society has a crucial role to ensure that their legitimate interests are protected adequately.

A quick look at the possible impact of sustained high GDP growth on the critical sectors of the Indian economy can reveal a disturbing trend. The transport sector will demand much higher consumption of energy such as diesel, petroleum and LNG. These products which already have about 80% import content can only increase with disastrous consequences on energy security. The pollution loading of vastly increased consumption of petroleum products, which has given rise to concerns in urban areas already, is likely to reach extremely unhealthy levels. Along with increased GHG emissions and much higher levels of suspended particulate matter, the pressure on the transportation infrastructure can become unmanageable. Increased use of private passenger vehicles, which is already a huge concern, will escalate to choke our roads and lungs.

Industrial activities, as a consequence of high GDP growth rate, will put unbearable demand on land, fresh water, energy and other raw materials. Such a demand on land (such as in SEZs, coastal industrial corridors, large size coal power plants, nuclear power parks, IT&BT parks etc.) have already given rise to a lot of concerns to social scientists, and already has witnessed social upheavals as in Narmada valley, Singur in West Bengal, Niyamgiri Hills in Orissa etc. The industrial sector, which is already responsible for about 21% of GHG emissions, will contribute hugely to the increase in total GHG emissions. Similarly, high GDP growth rate will lead to steep increase in demand for building activities in the form of factories, transportation infrastructure, offices, hotels, airports etc. which in turn will put huge demand for construction materials and energy. In this scenario can the increase in GHG emissions be contained adequately?

The most telling impact of frenetic economic growth over the next 20 / 30 years will be on forests, rivers and other natural resources, which in turn will lead to reduced capacity of nature’s carbon sinks. As against National Forest Policy target of 33% of forests & tree cover, the country (and most of the states) has less than 20% of the same, whereas these are considered to be the most important sinks of CO2. The demand for additional lands and minerals for the increased activities in all the above mentioned sectors will further reduce the forest & tree cover, which in turn will severely impact the availability of fresh water. The impact of vastly reduced forest & tree cover on human health and on all aspects of our society is well known, and hence requires no detailed elaboration. Whereas the increased economic activities associated with high GDP growth rate will certainly result in vastly increased GHG emissions, the same will also reduce the ability of forest & tree cover to absorb GHG emissions from the atmosphere. In this scenario it is anybody’s guess as to how the net GHG emissions can be reduced to an acceptable level.

The base line assumption (in Integrated Energy Policy of the erstwhile Planning Commission, 2006) that the country needs to sustain an economic growth of 8 - 9 % over next 20 years to eradicate poverty and to meet its human development goals will lead to very many intractable problems for the society from social and environmental perspectives. Such a high growth rate has never been found in developed economies, where even at the highest growth period they are reported to have registered only 3-4 % growth. The so called “trickle down” benefits to vulnerable sections of our society through 8-9 % growth will be negligible as compared to the all round benefits associated with inclusive growth of a much reduced rate, say 3-4%, if we harness our natural resources responsibly and equitably. Hence the obsession with target GDP growth rate of 8-9 % should be replaced by a paradigm shift in our developmental objective, which will give priority for inclusive growth aimed at sustainable and responsible use of natural resources.

All sections of our society need to appreciate the fact that there is a limit to the nature’s ability to support human activities / desire. Such a demand on the nature must be carefully managed, which is not possible if we set a target of 8-9 % GDSP growth rate year after year for a huge population.

A World Bank report of June 5, 2013 has highlighted how the environment has suffered in India consequent to past decade of rapid economic growth. The report with the title “Diagnostic Assessment of Select Environmental Challenges, Economic Growth and Environmental Sustainability: What Are the Tradeoffs?” has many revelations of critical importance to the future of our communities; provided our leaders take cognizance of it.

Salient features of the report are as follows:

Ø Although the past decade of rapid economic growth has brought many benefits to India, the environment has suffered, exposing the population to serious air and water pollution.

Ø Environmental degradation costs India $80 billion per year or 5.7% of its economy.

Ø Green growth strategies are needed to promote sustainable growth and to break the pattern of environmental degradation and natural resource depletion. Emission reductions can be achieved with minimal cost to GDP.

Ø Simultaneously, poverty remains both a cause and consequence of resource degradation: agricultural yields are lower on degraded lands, and forests and grasslands are depleted as livelihood resources decline. To subsist, the poor are compelled to mine and overuse the limited resources available to them, creating a downward spiral of impoverishment and environmental degradation.

Ø Environmental sustainability could become the next major challenge as India surges along its projected growth trajectory.

Ø For an environmentally sustainable future, India needs to correctly value its natural resources, and ecosystem services to better inform policy and decision-making.

In this context it can be added that in the medium to long term such emission reduction measures can even add to GDP through positive feedback impact.

The report also says that Green growth is eminently feasible: Green growth is necessary; Green growth is affordable; Green growth is desirable; Green growth is measurable. It can be argued that without green growth, India’s future development however measured will be at great risk.

Ø A low-emission, resource-efficient greening of the economy should be possible at a very low cost in terms of GDP growth. A more aggressive low-emission strategy comes at a slightly higher price tag for the economy while delivering greater benefits.

Ø Emissions reduction would have a minimal impact on GDP which would be offset by savings through improving health while substantially reducing carbon emissions.

Ø A 10% particulate emission reduction will lower GDP only modestly. GDP will be about $46 billion lower in 2030 due to interventions, representing a loss of 0.3 % compared to business as usual.

Ø A 30% particulate emission on the other hand reduction will lower GDP by about $97 billion, or 0.7 %.

Ø GDP growth rate will be negligibly reduced by about 0.02 to 0.04% in both scenarios. There will be significant health benefits under both scenarios which will compensate for the projected GDP loss.

Ø The savings from reduced health damages will range from $105 billion in the 30% case and by $24 billion with a 10% reduction.

Ø Under both the scenarios, another important benefit would be a substantial reduction in CO2 as a co-benefit which has a potential of being monetized.

Ø Taken together the CO2 reduction and the health benefits are greater than the loss of GDP in both cases.

UN’s Cocoyoc Declaration (Mexico, 1974); and the report “Prosperity without growth? - The transition to a sustainable economy” by the Sustainable Development Commission (SDC), which was the UK Government's independent adviser on sustainable development have come to the similar conclusions. The fact that high GDP growth rate cannot be pursued indefinitely and hence cannot be sustainable is being acknowledged widely.

Keeping in view the dire need to contain the GHG emissions and the vastly increasing pollution loading, the relevance of a high GDP growth rate paradigm for the state/country need to be effectively discussed at the societal level from the perspective of overall welfare of every section of our society.

Views are those of the author

Author can be contacted at [email protected]

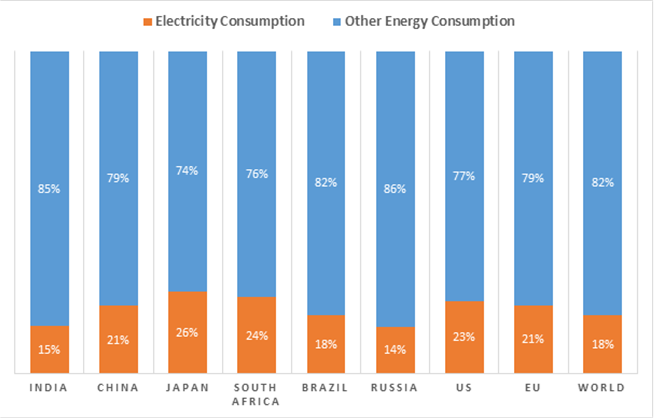

DATA INSIGHT……………

Country-wise Electricity and Total Energy Consumption

Akhilesh Sati, Observer Research Foundation

|

Country/Region |

Total Energy Consumption (MTOE) |

Electricity Consumption (MTOE) |

|

India |

510 |

75 |

|

China |

1714 |

359 |

|

Japan |

309 |

79 |

|

South Africa |

72 |

17 |

|

Brazil |

225 |

41 |

|

Russia |

442 |

64 |

|

US |

1426 |

321 |

|

EU |

1141 |

241 |

|

World |

8943 |

1628 |

Share of Electricity in Total Energy Consumption

Note: The above statistics are given for year 2012.

Source: World Energy Outlook 2014.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC, partners to invest $24 bn in Mozambique

August 31, 2015. Oil and Natural Gas Corp (ONGC) and its partners will invest about $24 billion (` 1.59 lakh crore) to produce natural gas from a giant field off Mozambique and converting it into liquid fuel (LNG) for export by ships to consumers like India. ONGC Videsh Ltd (OVL), the overseas investment arm of the state-run explorer ONGC, holds 16% stake in Rovuma Area 1 where recoverable resources in excess of 75 trillion cubic feet have been established. BPCL holds another 10% and Oil India Ltd 4% stake in the field and all three together hold more stake than operator Anadarko of the US (26.5%). The partners have so far committed $16 billion (` 1.06 lakh crore) and hope to achieve financial closure of the remaining by December or early January. They are planning to produce first gas from first quarter of 2020. The gas will be turned into liquefied natural gas (LNG) at an onshore liquefication plant and exported in cryogenic ships to consumption centres like India. (www.dnaindia.com)

ONGC gets one-year extension for Vietnam block

August 27, 2015. Oil and Natural Gas Corp. Ltd (ONGC) said it has received a one-year extension to explore in a Vietnam oil block in the contested waters of the South China Sea. It had in May applied to the Vietnamese authorities for a third extension of the exploration licence for deep sea Block 128 to maintain India’s strategic interest in the South China Sea. ONGC said its overseas investment arm, ONGC Videsh Ltd (OVL) had applied for extension of block to PetroVietnam, Vietnam’s national oil company, on 28 May 2015. OVL had signed Production Sharing Contract (PSC) for the 7,058 square km Block 128 in offshore PhuKhanh Basin, Vietnam on 24 May 2006. The ministry of planning and investment (MPI), Vietnam issued investment licence for the Block on 16 June 2006, being effective date of the PSC, ONGC said. The company has not found any hydrocarbon in the block but is continuing to stay invested. ONGC termed the extension as “routine” saying such an exercise is carried out in all the exploration blocks where extensions are required for further studies. OVL first took a two-year extension of the exploration period till June 2014 and then another one year. That extended licence expired on 15 June 2015. The company has so far invested $50.88 million in the block. The block lies in the part of South China Sea over which China claims sovereignty. In 2011, Beijing had warned OVL that its exploration activities off the Vietnam coast were illegal and violated China’s sovereignty, but the company continued exploring for oil and gas. OVL entered into Vietnam as early as 1988, when it bagged the exploration licence for Block 06.1. The company got two exploration blocks—Block 127 and Block 128, in 2006. However, Block 127 was relinquished due to poor prospectivity but the other Block 128 was retained. The first extension followed China putting the area under Block 128 for global bidding. OVL holds 100% interest in Block 128. China claims sovereignty over most of the South China Sea where Block 127 and 128 are located and had warned the Indian arm from drilling in the region. OVL continues to own 45% stake in Vietnam’s offshore block 6.1 and its share of production was 2.023 billion cubic metres of gas and 0.036 million tonnes of condensate. (www.livemint.com)

ONGC submits draft field development plan for KG discoveries

August 26, 2015. Oil and Natural Gas Corp (ONGC) has submitted to oil regulator DGH a draft field development plan (FDP) for beginning oil and gas production from its Krishna-Godavari (KG) basin D5 block by 2018-19. ONGC approved submission of the draft FDP for one set of oil and gas discoveries made in the eastern offshore Block KG-DWN-98/2 or KG-D5, which sits next to Reliance Industries' flagging KG-D6 area. The 7,294.6 sq km deepsea KG-D5 block has been broadly categorised into Northern Discovery Area (NDA - 3,800.6 sq km) and Southern Discovery Area (SDA - 3,494 sq km). ONGC has divided 12 oil and gas discoveries in KG-D5 and gas discovery in an adjacent G-4 block in the Bay of Bengal into three clusters to quickly bring them to production. Cluster-1 comprises D&E discoveries as also G-4 find in the neighbouring area which ONGC estimates can produce 14.5 million metric standard cubic metres per day (mmscmd) of gas for 15 years. Cluster - 2A mainly comprises oil finds of A2, P1, M3, M1 and G-2-2 in NDA which can produce 77,000 barrels per day (3.75 million tonnes per annum). Cluster-2B, which is made up of four gas finds - R1, U3, U1, and A1 in NDA, envisages a peak output of 14 mmscmd of gas with cumulative production of 32.5 bcm of gas in 14 years. ONGC is presently focused on developing Cluster-2A and 2B and a draft FDP for these has been submitted to the Directorate General of Hydrocarbons (DGH). (www.businesstoday.in)

Downstream………….

IOC said to plan $3 bn petrochemicals plant in Iran

August 31, 2015. Indian Oil Corporation (IOC) is seeking to build a $3 billion petrochemicals plant in Iran. The plan hinges on assurances from Iran that the 1 million-ton-a-year project will have access to cheap natural gas as feedstock. Indian Prime Minister Narendra Modi’s government is eyeing energy and infrastructure investments totaling billions of dollars in Iran, including upstream gas production and port developments. India has sought to secure ties with Iran and ensure access to its abundant hydrocarbons as years of sanctions on the Persian Gulf nation may be nearing an end. IOC is betting on petrochemicals to drive growth. The company plans to spend $4.5 billion in the next few years to expand the business. A natural gas-fed petrochemicals plant will allow IOC to diversify from its existing projects that use oil products from its own refineries. Petrochemicals accounted for 4.4 percent of the company’s revenues in the year ended March 31, while accounting for almost 39 percent of its operating income. Iran and India are planning mutual energy investments, Iranian Foreign Minister Mohammad Javad Zarif said. (www.bloomberg.com)

Transportation / Trade…………

RIL allowed to sell LPG to private marketers

August 31, 2015. Reliance Industries Ltd (RIL) has been permitted to sell up to 120,000 tonnes of its LPG (cooking gas) output to private cooking gas marketers as per a government order. The petroleum ministry order, valid from April 1, 2015 to March 31, 2016, is, however, subject to RIL importing an equivalent quality for supplying to state-run oil marketing companies (OMCs). According to the order, RIL will have to import an equivalent quantity and deliver it to state-run OMCs at a cost-neutral or cheaper price. The ministry's LPG control order mandates that all domestically-produced cooking gas must be supplied to state-run companies. However, under the Parallel Marketing Scheme (PMS), private companies are allowed to import and market cooking gas to bulk consumers. RIL has been permitted to sell up to 10,000 tonnes per month to private marketers, while arrangement would be valid till the LPG import facility at Kandla Port in Gujarat is re-commissioned or March 31, 2016 or till further orders, whichever is earlier. The government had, in February 2014, asked RIL to stop retailing cooking gas produced in its Jamnagar, Hazira and Patalganga plants. The company supplies cooking gas to 1 million, mostly rural, customers, and to 134 auto LPG outlets. RIL had contested the order, saying it was selling domestic LPG in the market because state-run OMCs were not willing to pay market rates. The company said the move to prohibit the company from marketing gas would deprive its rural customers, mostly in Gujarat, Maharashtra, Rajasthan and Madhya Pradesh. Following the RIL representation, the petroleum ministry in August last year permitted the company to sell up to 10,000 tonnes per month of cooking gas to parallel marketers till March 31, 2015, which period has now been extended till March 2016. (www.business-standard.com)

India's oil imports to be 90 percent by 2020

August 30, 2015. India's import dependence on oil is likely to touch 90 percent by 2020 due to widening supply-demand gap on growing appetite for the fossil fuel, the report titled "Let's energise -- Meeting India's growing fuel demand" by India-Tech Foundation and PricewatersCooperhouse Ltd (PwC) said. If the trend of importing more oil continues, India's dependence is likely to reach 90 percent by 2020 from 79 percent last fiscal (2014-15) on widening supply-demand gap, accentuated by growing appetite for fossil fuels, the report said. Noting that the country had to diversify its energy basket through use of alternative fuels, the report said otherwise higher percentage of GDP (gross domestic product) would have to be spent on imports, increasing vulnerability to price shocks. Admitting that the country's economy could not be insulated against external shocks, the report, however, said their impact could be limited by boosting domestic production, increasing use of alternative fuels and reducing oil imports. Dwelling on the impact of oil on the economy and its significance in the country's coal-dominant energy basket, the report said as major oil suppliers were in the unstable regions of West Asian and North Africa, the nation faces host of risks ranging from geopolitics to volatile price. The report also favoured shoring up oil reserves by encouraging state-run and private Indian oil firms to scout for potential reserves overseas. (www.sify.com)

Assocham wants India to bypass Pakistan for gas pipeline with Iran

August 30, 2015. India must fully exploit the economic opportunities from lifting of western sanctions on Iran and bypass Pakistan for import of natural gas from Iran, according to the industry body Assocham. The industry body also suggested that it enhance its merchandise trade with the key West Asian strategic nation through signing of a preferential trade agreement (PTA). Lifting of the sanctions holds the promise of starting an undersea pipeline project that could bring Iranian gas to India via the Arabian Sea, bypassing Pakistan. India is increasingly looking for opportunities overseas for natural gas. India, according to Assocham, needs to resurrect Iranian oil and gas projects stalled due to the international sanctions. The consortium of Indian public sector companies - ONGC Videsh Ltd (OVL), Oil India Ltd (OIL) and India Oil Corporation (IOC) - had discovered gas in the Farzad-B block in Iran in 2008 and subsequently, prepared a field development plan to recover about 12.8 trillion cubic feet of gas. The plan had to be abandoned following sanctions on Iran. India has already spent US$ 90 million on exploration, Assocham said. The association pushed for a PTA with Iran, citing the example of one with Pakistan that has boosted its exports to Iran and increased bilateral trade as well. The Pak-Iran trade saw considerable progress during the first three years of the PTA i.e. from 2006-07 to 2008-09 in which bilateral trade rose to an unprecedented level of US$ 1,321.32 million from US$ 573.76 million. (economictimes.indiatimes.com)

RIL July oil imports rise nearly 25 percent from June

August 27, 2015. Reliance Industries Ltd (RIL) imported nearly 25 percent more oil in July compared with the previous month, when it had slowed purchases due to a planned maintenance shutdown at one of its two plants, according to tanker arrival data. Reliance had shut half of its crude processing capabilities at its 580,000-barrel-per-day export focussed plant in the Jamnagar complex for 10 days in July. The company, which has a diversified crude slate and shifts purchases to maximise revenue, bought about 1.37 million bpd last month, marginally higher than a year earlier. The share of Latin American oil in RIL's overall imports declined from a year earlier to about 44 percent in July, while that of the Middle East rose marginally to about 36 percent from about 35 percent, the data showed. (in.reuters.com)

IOC raises oil import from Latin America to cut costs

August 27, 2015. Indian Oil Corp (IOC) is increasing crude oil imports from as far as Latin America and raising proportion of purchase from spot or cash market to cut costs. IOC spent ` 1.65 lakh crore on import of 43.9 million tons of crude oil in 2014-15. IOC is also optimising the proportion of term and spot crudes to gain price advantage. IOC’s refining capacity will rise to 80 million tons this fiscal after a 15 million tons per year new refinery is commissioned at Pradip in Odisha. Also, the company is implementing in-house ideas to enhance profitability and margins, and improve systems and procedures in its refineries. IOC shall be focussing more on pipeline transport, which is both economical and environment-friendly compared to other modes. Its pipelines network currently spans over 11,220 km, and has a throughput capacity of over 80 million tonnes per annum. (www.livemint.com)

Kakinada Seaports moves Hyderabad HC against GAIL, HPCL

August 27, 2015. Private seaport owner Kakinada Seaports has moved Hyderabad High Court (HC) against PSU oil and gas giants GAIL and HPCL, alleging that it was deprived of the promised equity holding in the city gas distribution firm Bhagyanagar Gas. Kakinada Seaports has accused GAIL and HPCL, which held 25% equity stake each in Bhagyanagar Gas, of managing to increase stakes to 44.98% each and shrinking the seaport's stake to 0.05% from a high of 50% by dishonouring promised stake. The court has admitted the petition. (expresstv.in)

BPCL September exports highest in a year

August 27, 2015. Bharat Petroleum Corp Ltd (BPCL) has sold two naphtha cargoes, bringing its total sales for next-month lifting to 140,000 tonnes, its highest monthly export volume since September 2014. BPCL had sold two 35,000-tonne cargoes for Sept. 7-9 loading from Mumbai and Sept. 27-29 loading from Kochi to oil major BP at a premium of about $15 and $20 a tonne to Middle East quotes on a free-on-board (FOB) basis respectively. The state-owned refiner had previously sold two September cargoes of 35,000 tonnes each to Unipec and Marubeni. It was unclear what led to higher exports from BPCL, but naphtha sentiment among sellers has been weak due to off-peak gasoline demand and run cuts at crackers operated by Taiwan’s Formosa, Asia’s top naphtha importer. (www.diligentia.net.in)

Policy / Performance………

Oil companies slash Jet fuel price by 11.7 percent

September 1, 2015. Aviation Turbine Fuel (ATF) or jet fuel price was slashed by a steep 11.7 percent while rates of non-subsidised cooking gas LPG were reduced by ` 25.5 per cylinder in line with dip in international prices. ATF price in Delhi was cut by ` 5,469.12 per kilolitre (kl), or 11.7 percent, to ` 40,938.24 per kl, oil companies announced. This is one of the steepest reductions, the biggest being a cut of ` 7,520 per kl, or 12.5 percent, on January 1. Prior to reduction, jet fuel rate was cut by 9.4 percent to ` 46,407.36 on August 1 and by ` 2,086.56 per kl to ` 51,267.36 on July 1. ATF, just as fuel in aeroplanes, costs 33 percent less than petrol that drives two-wheelers and cars. After a ` 2 per litre cut effected, petrol in Delhi costs ` 61.20 per litre as compared to jet fuel rate of ` 40.93 a litre. Higher rates of petrol are primarily due to central and local sales taxes — ` 17.46 — on account of excise duty and ` 12.25 because of sales tax or VAT. Rates vary at different airports because of differential in local sales tax or value-added tax (VAT). Jet fuel constitutes over 40 percent of an airline’s operating costs and the price cut will reduce the financial burden on cash-strapped carriers. The oil firms have also cut prices of non-subsidised LPG, which consumers buy after exhausting their quota of subsidised cooking fuel, by ` 25.50 per 14.2-kg bottle. Non-subsidised cooking gas (LPG) price in Delhi has been cut to ` 559.50 per cylinder as compared to ` 585 previously. This is the third reduction in rates in as many months. Non-subsidised LPG rates were last cut by ` 23.50 on August 1. Prior to that, rates were cut by ` 18 per cylinder to ` 608.50 on July 1. Non-subsidised or market-priced LPG is one that consumers buy after exhausting their quota of 12 bottles of 14.2-kg each at subsidised rates in a year. Subsidised LPG costs ` 417.82 per 14.2-kg cylinder in Delhi. (www.thehindubusinessline.com)

Govt mulls 2 kg LPG cylinders

August 30, 2015. The government is planning to launch 2-kg LPG bottles at kirana stores even as it introduced online booking of new connections for subsidised cooking fuel. New subsidised connections of 5-kg cylinders in rural as well as far flung areas will be issued in first place. Consumers can now book a new connection online. It will be verified within 48 hours and a person from the nearest LPG agency will deliver a new connection at the doorstep in next 3-4 days, Oil Minister Dharmendra Pradhan said. (www.thehindu.com)

Govt to fix formula for premium on gas pricing soon: Oil Minister

August 28, 2015. Oil Minister Dharmendra Pradhan said the government would soon finalise a formula to calculate premium on gas pricing for difficult blocks. The premium will be given in new gas discovery, he said. The government had earlier said all new discoveries in ultra-deep water areas, deep water areas, high pressure and high temperature areas would be given a premium price over the price to be determined as per gas pricing formula. The government is also considering new bidding rounds for oil and gas discoveries, he said.

The Modi government's Make in India policy will take manufacturing to new heights and there will be a huge requirement of energy, Pradhan said. As per the estimates in the next 15 years there will be huge demand for petroleum products. Foreign direct investment (FDI) in the petroleum and natural gas sector witnessed an almost ten-fold jump in financial year 2014-15 as compared to the preceding fiscal year, touching ` 6,473.22 crore. The government is encouraging foreign investment to supplement domestic investment and technological capabilities. Over the last three financial years, the sector attracted FDI worth more than ` 8,375 crore, he said. (economictimes.indiatimes.com)

CCEA nod for royalty to states on crude output

August 27, 2015. The Cabinet Committee on Economic Affairs (CCEA) approved the proposal for payment of differential royalty to state governments concerned in respect of 28 discovered fields. These blocks were awarded to different exploration companies during the years 1994-95, 2001 and 2004 by the government. Differential royalty refers to the difference between the rates of royalty as per provisions contained in respective Production Sharing Contracts (PSCs) and the notified rate of royalty on crude oil production. The payment shall be through budgetary allocation instead of through Oil Industry Development Board (OIDB) fund from the year 2015-16 onwards. The proposal will have a financial implication on government budgetary allocation, while the outflow from OIDB will be reduced accordingly. (www.newindianexpress.com)

IOC ratings unaffected by govt stake sale: Moody's

August 26, 2015. The government's sale of its 10% stake in Indian Oil Corporation (IOC) has no impact on the company's ratings, Moody's Investors Service has said. After the stake sale, the government will continue to hold a majority stake of 58.57% in IOC. The stake sale in IOC is part of the government's disinvestment programme by which it targets to raise ` 69,500 crore in the fiscal year ending March 31, 2016 (FY2016). IOC's issuer rating could however come under downward pressure if the sovereign rating is downgraded, Moody's said. (timesofindia.indiatimes.com)

[NATIONAL: POWER]

Generation……………

CIL misses August output target by 3.8 percent

September 1, 2015. Coal India Ltd (CIL) recorded an output of 36.21 million tonnes in August, missing the target by 3.82 percent. The company's production target for August was 37.65 million tonnes, CIL said. The government has set an ambitious one billion tonnes coal production target for CIL by 2020. CIL's achieved an output of 192.37 million tonnes in the first five months of the current fiscal, missing its target of 196.73 million tonnes. Coal India's output target for the current fiscal is 550 million tonnes. CIL missed the production target for the financial year 2014-15 by 3 percent recording an output of 494.23 million tonnes. The government had earlier said that it is hopeful that CIL will surpass its one billion tonne excavation target by 2020. CIL accounts for over 80 percent of the domestic coal production. (economictimes.indiatimes.com)

TN govt to set up a ` 240 bn thermal power project

September 1, 2015. In order to add 20,000 MW more electricity generation facility as part of Vision 2023, Tamil Nadu Government announced setting up a new 4,000 MW thermal power plant at a cost of ` 24,000 crore. Besides, to strengthen the power distribution capacity the state administration has announced projects worth ` 6,791 crore. Tamil Nadu Chief Minister J Jayalalithaa announced this project at Ramanathapuram district, around 550 kms from Chennai. She said around 3,000 acres of land for the project has been identified and work would start after getting necessary approvals. To address the growing demand and future requirements of households and industries in the state, government has commenced construction of a 660 MW Ennore Thermal Power Plant, 2X200 MW Ennore Special Economic Zone thermal project, a 800 MW North Chennai Thermal Power Project Phase-III, 2X800 MW Upper Thermal Power project, 2X660 MW Udangudi Project and another 660 MW project at Ennore. One of the big challenges in the state is evacuation of power.

To strengthen the same, the state government is planning to set up new substations with 400 KW and 230 KW capacity. Jayalalithaa said, in North Chennai 765/400 KW 3X1500 MVA capacity will be set up at a cost of ` 2,335 crore and the power produced in North Chennai will be transmitted to Ariyalur and Puliyanthoppe in Southern Tamil Nadu. She also announced 765/400 KW 2X1500 MVA project worth ` 2121.45 crore at Ariyalur, 765/400 KW 2X1500 MVA project worth ` 2,335 crore at Coimbatore. These project will cater to the power demand of Coimbatore, Salem and Mettur.

Detailed Project Report for a 2000 MW hydro electric project in Sillahalla, Nilgiris, is getting prepared, she said. By implementing these projects, Tamil Nadu will not only have excess power capacity, it will also boost industrial growth, which in turn will create new jobs in the state, she said. The State currently has an installed capacity of 20,714 MW including the non-conventional power, which is the second largest in India. Around 40 percent of the power requirement is met by renewable energy sources. (www.business-standard.com)

Meenvallam power project's revenue touches ` 32.4 mn

September 1, 2015. The revenue from the 3 MW Meenvallam mini-hydel project, set up in Karimba panchayat by Palakkad district panchayat has touched ` 3.24 crore. The project was first in the country to be implemented by a local body. District panchayat T N Kandamuthan said that the power was sold at ` 4.88 per unit to the Kerala State Electricity Board (KSEB). The project, commissioned in June 2014, has so far produced 66.34 lakh units.

The Meenvallam mini-hydel scheme was implemented by the Palakkad Small Hydro company, registered under the Companies Act of 1956 on January 20, 1999 at an outlay of ` 22 crore. He said the success of the Meenvallam project, implemented by the LDF-ruled district panchayat, has prompted the State Government to entrust two more mini-hydel projects to the local body. The district panchayat will take up two mini-hydel projects -- the 4.5 MW Koodamhydro electric project in Agali and 6.5 MW mini-hydel project in Kottopadam. He said that panchayat will soon prepare a detailed project report and will submit it to the Government. He said that the district panchayat, apart from the above two projects, has identified the Chindillam waterfalls in Palakuzhi of Kizhakkencherrypanchayat to tap power, which would be able to generate 1 MW. (www.newindianexpress.com)

Transmission / Distribution / Trade…

Bengaluru will face 2 hr power cuts every day

September 1, 2015. As Karnataka reels under drought, the cabinet decided to impose scheduled power cuts, from two to eight hours on a rotational basis across the state, possibly from next week. While the power cuts are likely to be restricted to two hours daily in Bengaluru, it will be four hours in the district headquarters and as much as six to eight hours in the towns and rural areas. Added to this will be unscheduled power cuts. Reeling out statistics, the law and parliamentary affairs minister TB Jayachandra said the peak demand in Karnataka currently is 10,188 MW but production from various sources ranged between 6,600 MW and 7,300 MW, causing a shortfall of over 3,000 MW. The state had requested the Centre to allocate 1,500 MW of power additionally to the state to tide over the shortage, and efforts were on to purchase power from neighbouring states. Earlier in the day, energy minister DK Shiva Kumar said power situation in the state has reached a precarious situation due to drought and they are doing their best to tide over the crisis. (timesofindia.indiatimes.com)

Jindal Steel coal mine in Australia to shut

September 1, 2015. One of Australia's oldest coal mines said it was being shut by its Indian owner Jindal Steel and Power as market conditions in the sector continue to deteriorate and financial pressures on producers mount. The closing of the Russell Vale colliery 100 kms (62 miles) south of Sydney comes amid widening losses reported by operator Wollongong Coal Ltd, majority-owned by Jindal. Idling of the colliery, which started operating in 1887, will result in 80 job losses and follows unsuccessful efforts by Jindal to turn Wollongong Coal around, the operating firm said. Wollongong Coal reported a A$199.2 million ($142 million) loss in the financial year to March 31, following a A$169.4 million loss the previous year. Jindal Steel acquired a majority stake and management control of Wollongong Coal in 2013. Most of the coal was being exported to make steel for Jindal in India. Global metallurgical coal prices have dropped from more than $300 a tonne in 2011 to around $85 in step with weakening steel prices. Chinese-controlled coal miner Yancoal Australia in July announced it was cutting close to half the jobs at two of its collieries after losses climbed to more than A$1 billion ($730 million) over two years. Brazil's Vale sold a mothballed coal mine in Australia to a local operator for A$1. At peak coal prices, the mine was worth around A$500 million. A small number of employees at the Russell Vale Colliery will be retained for care and maintenance activities, according to Wollongong Coal. (in.reuters.com)

Govt may cut power price to boost rural supply: Goyal

August 31, 2015. The Centre plans to supply affordable electricity to rural households by creating huge demand for setting up solar and thermal power capacities, and cutting aggregate transmission and commercial losses. It does not plan to come up with any bailout package for power utilities, but instead help bring down power prices and reduce aggregate technical and commercial losses so that affordable power can be supplied to rural India. By 2020, the government aims to supply electricity to the entire 200 million rural population that does not have access to power. It intends to expand power generation capacity to 800 GW by 2030 and to fuel this it is aiming at a coal production of 1.5 billion tonnes by 2020. Coal and Power Minister Piyush Goyal said at present some villages do have power connection but not all houses in a village have connection. (economictimes.indiatimes.com)

Over ` 40 bn plan for augmenting power supply in Haryana

August 31, 2015. Haryana's State Level Standing Committee has recommended preparation of detailed project reports for implementing Integrated Power Development Scheme (IPDS) and Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) with an outlay of ` 4,044.31 crore. The decision was taken to strengthen the transmission and distribution network and metering of distribution transformers /feeders throughout the state, Uttar Haryana Bijli Vitran Nigam (UHBVN) said. The Ministry of Power has appointed Power Finance Corporation (PFC) as the nodal agency for IPDS and Rural Electrification Corporation (REC) for DDUGJY, respectively for overall monitoring and ensuring timely completion of both the projects. With an objective to provide round-the-clock power to rural households and adequate power to agricultural consumers, DDUGJY would also benefit further reduction in AT and C losses of Haryana Discoms. A total of ` 2,753.64 crore would be spent for these activities. The IPDS scheme, with an aim to provide electricity access to all households in the urban areas having population of more than 5,000, would help in achieving the reduction of AT and C losses of the Discoms of the state. A total of ` 1,290.67 crore has been recommended under the scheme for erection of new 33/11 kV substation, augmentation of existing substation, bifurcation/ reconductoring of 11 kV feeders, construction/augmentation of distribution transformers and LT lines, among other things. (thefirstmail.in)

NDMC's 'Smart Grid' project to improve power distribution

August 30, 2015. New Delhi Municipal Council (NDMC) is coming up with a ` 500-crore Smart Grid project aimed at reducing losses through better power distribution and checking thefts and faults in transmission. The project, a part of the smart city initiative, will enable us to accurately judge power requirements of each locality, cut down on outages and sell off the surplus, NDMC said. The Union Power Ministry has, in-principle, approved the project and the Council gave nod to it in a meeting last week. The project with an estimated cost of ` 500 crore has been divided into three phases -replacing old equipment and cables, installing smart metres in households and institutions under NDMC jurisdiction, and developing a software to improve the efficiency of electricity distribution, NDMC said. At present, the civic body meets a peak demand of 380 MW of electricity during summers but in winters, it comes down to 90 MW. So, during winters when less electricity is required, we will sell off the surplus electricity beforehand as the software will help us to give accurate figures regarding consumption and demand, NDMC said. (www.businesstoday.in)

GMR plans to export power from its Nepal plants to Bangladesh

August 30, 2015. Infra major GMR Group, which is setting up two hydel power projects in Nepal, is in discussions with Bangladesh government among others to export power from the Himalayan country. The company is in the process of setting up 600 MW Upper Marsyangdi-2 Hydroelectric Power Project on river Marsyangdi in Lamjung and Manang districts and 900 MW Upper Karnali Hydroelectric project located on river Karnali in Dailekh, Surkhet and Achham districts of Nepal. Joint Development Agreement (JDA) was executed with International Finance Corporation (IFC) for the transmission line project on December 22, 2014 and another JDA with IFC is already in place for Upper Marsyangdi-2 project, it said. With regard to GMR Upper Karnali Hydro Power Public Limited (GUKPL) - (900 MW), it said Project Development Agreement (PDA) negotiations were completed and executed on September 19, 2014 for generation and transmission line projects with Nepal government. Post execution of PDA, the project land has been identified and joint verification for government and forest land and cadastral mapping among others are under progress, it said. (www.business-standard.com)

Don't distort tariff, use DBT to provide aid directly to poor: NTPC to states

August 26, 2015. Issuing bonds and writing off debt will not help power distribution firms, and states should use technology to provide direct subsidy to weaker sections without affecting tariff, NTPC said. NTPC said that states should use Direct Benefit Transfer (DBT) for providing financial aid or subsidy to poor using power. Under the DBT, the government transfers the subsidy on cooking gas or cereals or other benefits like pension or scholarships, directly into beneficiary's bank account. In the present scenario, the power distribution companies' cumulative debt is over rupees three lakh crore and Centre has given clear indication that it will not act like a bailout bank for them. The tripartite agreement among NTPC, states and Centre provides security regarding payment of dues by states to NTPC. In the event of non-payment of dues, the money is deducted from the central allocations to them and paid to NTPC. (economictimes.indiatimes.com)

Policy / Performance………….

Power producers allowed to source fuel from Coal India via e-auction

August 31, 2015. With pithead stock piling up at Coal India’s mines due to lack of demand from contracted power sector buyers, the Centre has further relaxed norms for the power sector to source the domestic fuel. By a notification issued, the Coal Ministry allowed Coal India Ltd (CIL) to open a dedicated window for e-auction of fuel to the power sector. A total of 10 million tonnes of coal, capable of generating nearly 2,000 MW, will be sold through the window this fiscal. Any generation utility — including those having a fuel supply pact (FSA) with the coal major and the awardees of the recent auction of coal blocks — can buy the fuel through e-auction backed by sales contracts of varying tenure to either discoms or traders or power exchanges. Coal India currently offers to supply up to 75 percent of the fuel required (annual contracted quantity) by a utility to run the power station at 80 percent plant-load factor (PLF) for a 15-year period. This is for utilities commissioned after March 2009. The FSA is given effect only against long-term power purchase agreement (PPA) entered by the generation company. And, since discoms are not showing much interest in entering long-term PPAs, many such plants are denied access to domestic coal. Discoms are, however, showing interest in term buying to capitalise on low tariff opportunity in the open market. With huge capacities idling due to lack of demand, many private producers are ready to sell electricity at rates that merely recovers the fuel cost. However, non-availability of domestic fuel is further squeezing their survival opportunity. The new coal e-auction window hopes to address the demands of both these segments. The auction will create an opportunity for CIL to boost profits that have been declining due to increasing quantities of low-margin sales through FSAs to the power sector. A back-of-the-envelope calculation suggests 10 million tonne sales at an average premium of 30 percent over the average CIL price of ₹ 1,295 a tonne (June 2015), will fetch the company an additional ₹ 300-crore revenue. The actual profits would vary depending on the quality of fuel sold. (www.thehindubusinessline.com)

Three coal mines in MP to start soon: Goyal

August 31, 2015. Coal and Power Minister Piyush Goyal said that South, North Mandla and Siyal Ghoghri coal mines in Madhya Pradesh (MP) would start soon, adding a revenue of ` 27,204 crore to the state kitty. He said that former Union Minister and senior Congress leader Kamal Nath - who represents Chhindwara in the Lok Sabha - has'nt done any developmental work in the area. Congress was upset because of the developmental schemes introduced and implemented by Prime Minister Narendra Modi, he said. The Prime Minister has introduced a scheme under which a loan of ` 10 lakh will be provided to youths for starting their own ventures, he informed. (economictimes.indiatimes.com)

Delhi CM launches scheme to penalise electricity companies over complaints

August 30, 2015. Delhi Chief Minister (CM) and Aam Aadmi Party (AAP) Arvind Kejriwal, launched the electricity bill disputes redressal scheme. Kejriwal also lashed out at previous governments of Delhi for signing a 30 year long deal with the current electricity providers. Kejriwal appealed to the central government to help the Delhi Government in cancelling these contracts. (www.financialexpress.com)

Govt to rationalise coal prices: Goyal

August 29, 2015. The Coal Ministry will rationalise coal prices aligning it with gross calorific value (GCV), so that the price disparity is eliminated across various grades of coal. Coal and Power Minister Piyush Goyal said that certain grades were not being priced properly. He made it clear that rationalising coal prices didn’t mean downward revision of coal prices to bring parity with falling international prices. Coal India Ltd (CIL) shifted from useful heat value-based (UHV) pricing to GCV-based pricing prior to its maiden IPO, to price coal on international parity prices. Since CIL offered coal at a deep discount of up to 50%, the company advised the government to change the pricing mechanism so that Indian coal prices were worked out on the basis of market forces and on the basis of international standards. There were even suggestions of a regulator, which would determine Indian coal prices. With international prices falling, coal imports have already increased. While Goyal has been saying that the country was aiming at not importing a single tonne of thermal coal, it has imposed a zero duty on imported coal. He said since 70% of the country’s coal requirement was produced by the government-owned CIL and the government more or less regulated the price, there was no need for a separate regulator in the coal sector. West Bengal Power Minister Manish Gupta said that a regulator was necessary since CIL has a monopoly over the commodity in India and it often drove prices keeping profitability in its mind. Goyal said profitability has to be resolved by efficiency and benefits should not come to CIL through pricing only. (www.financialexpress.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

UK approves development of $4.5 bn Culzean gas field in North Sea

September 1, 2015. The UK Oil & Gas Authority has approved a plan by Maersk Oil and its joint venture partners to develop £3bn ($4.5 bn) Culzean gas field in North Sea. According to estimate, the field contains 250-300 million barrels of oil equivalent and can be operational for over 13 years. According to WoodMac research, the Culzean is claimed to be the largest field discovered in the last decade in the North Sea and also is the largest gas field sanctioned since 1990. The field is scheduled to commence production in 2019 and is expected to reach peak production of 60,000-90,000 barrels of oil equivalent per day, which is about 5% of total demand in the UK, in 2020/21. (explorationanddevelopment.energy-business-review.com)

New US oil data shows lower 2015 production: EIA

August 31, 2015. The United States (US) oil industry pumped less crude than initially estimated this year, according to new government data that offered the clearest look yet at the impact of drillers' retrenchment in response to collapsing prices. The Energy Information Administration (EIA) said its new survey-based output data showed the United States pumped a hair below 9.3 million barrels per day (bpd) in June, down by 100,000 bpd from a revised May figure. The June figure was also nearly 250,000 bpd below what the EIA had estimated a few weeks ago, highlighting the steep reversal in output as a five-year boom sours and suggesting to some analysts that a global glut might ease sooner than expected. (www.reuters.com)

Eni discovers massive gas field in the Mediterranean

August 30, 2015. Eni SpA discovered a “super giant” natural gas field offshore Egypt in what the Italian oil company said is the largest find in the Mediterranean Sea. The deep-water deposit in the Zohr Prospect in the Shorouk block may hold 30 trillion cubic feet of gas, equivalent to 5.5 billion barrels of oil, Eni said. Eni, which wholly owns the license for Shorouk, said the discovery validates its strategy of exploring mature areas. International oil and gas companies are seeking new deposits as existing fields become depleted. Egypt’s energy demand is rising as the Arab world’s largest population grows, making the country more reliant on imports provided by Persian Gulf states. The latest discovery will contribute to Egyptian supply for decades, Eni said. (www.bloomberg.com)

Denmark expects to maintain present O&G production

August 28, 2015. Denmark expects to maintain its current production of oil and gas (O&G) for the next two and a half years according to new estimates from the Danish Energy Agency. This year the production of crude oil is seen at 9.6 million cubic metres, equivalent to 60.4 million barrels, a marginal increase from estimates made a year ago. Next year the new forecast is 9.5 million cubic metres and for 2017 the agency expects 9.6 million, slightly below its previous estimates. The production of gas is now estimated at 4.1 billion cubic metres in 2015, 3.6 billion in 2016 and 3.7 billion cubic metres in 2017, largely in line with estimates made last year. It is now expected that Denmark will continue to be self-sufficient with oil until 2021 and with gas to 2023. (www.rigzone.com)

Downstream…………

Oman commissions first crude oil floating storage facility

September 1, 2015. Oman Tank Terminal Company (OTTCO), a subsidiary of Oman Oil Company, has opened a new floating storage facility with a 2.1 mbl capacity at Mina Al Fahal port in Oman capital city Muscat. The facility will provide Oman Export Blend Crude Oil (OEBCO) to China Oil, Glencore and Oman Trading International that will access the unit via a very large crude carrier (VLCC). Scheduling and loading of the oil will be managed by Petroleum Development Oman (PDO). The project is an interim storage solution for some of OTTCO’s customers ahead of the commissioning of the Ras Markaz Crude Oil Park, which is being built in Oman’s Al Wusta region. (www.enerdata.net)

Amec Foster to support Vietnam’s Dung Quat refinery $1.8 bn expansion plan

August 28, 2015. Vietnam National Oil & Gas Group’s (PetroVietnam) subsidiary Binh Son Refining and Petrochemical (BSR) has awarded a front end engineering design (FEED) contract to Amec Foster Wheeler for the Dung Quat oil refinery in Quang Ngai province. Under the two-year contract, Amec Foster will be responsible for the optimization of the refinery configuration, coordination of licensors, design new units and upgrade the existing units. Amec will also support contracting activities of BSR for the next phase of the project. The contract is part of the $1.8 bn expansion to boost the annual processing capacity of the refiner by 30% to 10 million tons from current 6.5 million tons. Upon completion of the expansion project by 2017, the refinery will have capacity to process Middle East sour crude oil and sweet crude oil. (refiningandpetrochemicals.energy-business-review.com)

Petrobras says to cost $4.3 bn to finish Comperj refinery

August 27, 2015. Brazil's state-run oil company Petroleo Brasileiro SA (Petrobras) said it would cost an additional $4.3 billion to complete the first 165,000 barrel-a-day operating unit at its stalled Comperj refinery project outside Rio de Janeiro. Petrobras expects to complete the first unit or "train" at the plant in Itaboraí, Brazil in 2020, its refining chief Jorge Celestino Ramos said. The work could be finished sooner if Petrobras can find a partner to help complete the refinery, Ramos said. The refinery, located in Itaboraí, Brazil is more than 80 percent complete. It was supposed to enter operation in August 2016, according to the Petrobras. With Petrobras already having spent $11 billion on the first unit, the cost of completion will rise to $15.3 billion, according to the Petrobras. At an estimated cost of about $93,000 for each barrel of refining capacity added, Comperj will be one of the most expensive oil refineries ever built. (www.reuters.com)

Transportation / Trade……….

Sasol seeks contractors for Mozambique oil project, gas pipeline

September 1, 2015. Sasol Ltd., the world’s biggest maker of liquid fuels from coal, is looking for contractors to help it become the first commercial oil producer in Mozambique and to extend a gas pipeline that will increase exports to neighbouring South Africa. Johannesburg-based Sasol is waiting for the Mozambican government to approve plans for the oil venture submitted in February. The company, which has produced gas in Mozambique since 2004, proposes building a 127 kilometer pipeline across the provinces of Gaza and Inhambane that will feed into supplies to Sasol’s plants over the border. (www.bloomberg.com)

Petronas said to consider buying Statoil’s stake in TAP project

September 1, 2015. Malaysia’s state-owned energy company is considering acquiring Statoil ASA’s stake in a gas pipeline into Europe from the Caspian basin. Petroliam Nasional Bhd (Petronas) may buy the Norwegian company’s 20 percent stake in the project. Statoil plans to exit the Trans Adriatic Pipeline (TAP) project, the State Oil Company of Azerbaijan said. From 2018 the 870-kilometer (541-mile) TAP project will initially deliver 10 billion cubic meters of gas annually from the Shah Deniz fields through Greece and Albania to Italy. The pipeline, which should eventually be able to deliver 20 billion cubic meters (bcm) of gas a year, will connect to Tanap, a pipeline that will stretch 1,841 kilometers into Turkey. (www.bloomberg.com)

Big Rail's little cousins find boon in US oil-by-rail bust

September 1, 2015. Amid the rolling mountains surrounding this quiet town in southwest New York state, tucked away on miles-long stretches of underused rail tracks, hundreds of idle oil tank cars attest to the extent of fallout from oil's rout. The oil tank cars - a year ago sought-after to haul crude from North Dakota to New Jersey - now stand idle as a result of two converging trends: the reversal in U.S. shale oil production and the completion of new pipelines. They show how the pain from the slump in the oil-by-rail industry has spread far and wide. Crude shipments by rail soared to 1.1 million barrels per day (bpd) in December 2014, or more than a tenth of total U.S. production, from 20,000 bpd in 2009, but volumes have been falling since the start of this year, according to the data from the U.S. Energy Information Administration. In addition, construction of several new pipelines from North Dakota to a major storage facility in Cushing, Oklahoma, has been completed, providing a cheaper alternative for shippers and further reducing demand for tank cars. (www.reuters.com)

South Korea may hike Iran oil imports once sanctions lifted

August 30, 2015. South Korea will consider increasing its imports of Iranian crude oil and condensate when sanctions on Tehran are lifted. Woo Tae-hee, deputy minister for trade, who was part of a recent South Korean delegation to Iran seeking possible deals in the oil, gas and construction sectors noted there had been a sharp fall in imports of Iranian oil since the sanctions were imposed. Additional oil imports would be discussed later, he said.

Iran's Oil Minister Bijan Zanganeh said after the delegation's visit that Seoul agreed to increase its purchases of Iranian oil once a nuclear deal with world powers cleared the way for an easing of international sanctions on Tehran. South Korea's Iranian oil imports fell 11 percent to 111,665 barrels per day in the first seven months of this year from the same period of last year, according to calculation based upon industry data from Korea National Oil Corp (KNOC). (www.reuters.com)

Lithuania LNG imports could fall to 320-350 mn cubic metres in 2016

August 28, 2015. Lithuania is planning to import 35-40 percent less liquefied natural gas (LNG) via its terminal at the Klaipeda port next year due to falling demand. The volumes could decline from a planned 540 million cubic metres (mcm) this year to 320-350 mcm in 2016. Lithuanian LNG importer Litgas has a five-year contract with Norway's Statoil to buy 540 mcm per year, but it has an option to resell cargoes it doesn't need. Next year's surplus may be sold on the European spot market. The Baltic state opened a floating LNG import terminal last year, seeking to reduce its dependence on imports of Russian gas. Its gas consumption has fallen in recent years due to warm weather and biomass replacing gas for central heating. Last year's consumption was 2.6 billion cubic metres. (af.reuters.com)

ExxonMobil, BHP to spend A$400 mn to replace Australian pipeline

August 28, 2015. ExxonMobil Corp and BHP Billiton have agreed to spend about A$400 million (188 million pounds) to replace a pipeline that transports crude oil and condensate between two of their sites in Australia's Victoria state, ExxonMobil said. The project comes at a time when Australia is counting on infrastructure investment to help offset a bust in mining and energy projects. ExxonMobil and BHP Billiton, 50-50 joint venture partners in the Gippsland Basin, will be replacing a 187 km (116 mile) pipeline, with construction expected to generate around 500 jobs at its peak. Construction is expected to begin in late 2015, pending regulatory approval. (uk.reuters.com)

Shell says gas supplies to Nigeria LNG reduced due oil pipeline issues

August 28, 2015. Shell said gas supplies to Nigeria's LNG export terminal on Bonny Island had been reduced due to the shutdown of a major oil pipeline in the country caused by a leak and theft. The reduction may impact liquefied natural gas exports from the facility. Shell's Nigerian unit, Shell Petroleum Development Company (SPDC), declared force majeure on crude oil exports via two major pipelines, including the Trans Nigera Pipeline (TNP). The shutdown has led to a cut in gas being fed into the LNG export plant. SPDC is a joint venture with state oil company Nigerian National Petroleum Corp. They supply gas into the LNG plant. (af.reuters.com)

Rosneft will supply LNG to Egypt

August 28, 2015. Rosneft Trading, a subsidiary of Rosneft Group, and the Egyptian Natural Gas Holding Company (EGAS) signed a master LNG supply and purchase agreement. Accordingly, Rosneft and EGAS plan to organize the supply of LNG to Egypt. With this first supply contract, Rosneft, which does produce LNG, marks its entry into the world LNG trading market. The deal is estimated to include the delivery of 24 cargoes of LNG to Egypt, equivalent to between 3.5 Mt and 3.7 Mt of LNG over a two-year period starting in the last quarter of 2015. (www.enerdata.net)

Total sells North Sea gas pipelines for $907 mn

August 27, 2015. French oil major Total has agreed to sell some of its gas pipeline assets in the UK's North Sea to North Sea Midstream Partners, an affiliate of U.S.-based private equity firm ArcLight Capital, for 585 million pounds ($907 million). The sale includes the Frigg UK and SIRGE gas pipelines and the St. Fergus gas terminal, Total said.

Europe's second-largest oil company, Total unveiled a plan to cut investments and jobs, and accelerate its asset sale programme after oil prices more than halved in the past year. Total expects to become the largest oil and gas producer in the UK by the end of the year, it said. The start-up of its third hub in British waters, the Laggan-Tormore project in the Shetlands, is expected later this year. (in.reuters.com)

China oil giants seek to join spree of global energy deals

August 27, 2015. PetroChina Co., the country’s biggest oil and gas producer, signaled it’s looking to join a wave of global energy deals as crude’s collapse makes it the right time to buy and sell assets. Oil’s collapse to a six-year low has prompted a wave of acquisitions across the energy industry. Three of the last five quarters have exceeded $160 billion in deal volume, surpassing even the late 1990s, a period when many of the world’s largest energy corporations were formed, according to data. While China’s big three oil companies have sat out this latest round, China Petroleum & Chemical Corp. said it’s seeking overseas assets, signaling that at least two of them are now ready to join the spree. PetroChina is in talks with some international oil companies to swap assets, especially in North America, the company said. The act would save transaction fees and allow the explorers to achieve better economies of scales in a low crude price environment. PetroChina plans to produce more than 120 billion cubic meters of natural gas from conventional and unconventional sources annually in China by 2020, the company said. Conventional gas output in 2020 will reach as much as 90 billion cubic meters, while shale output from Sichuan will reach 10 billion cubic meters, the company said. Tight gas output, also considered an unconventional resource, will stabilize at 30 billion cubic meters a year by 2020. Natural gas will be a major profit contributor for PetroChina in the five years to 2020 as crude languishes, the company said. (www.bloomberg.com)

Policy / Performance…………

Russia says oil output could decline if prices stay low

September 1, 2015. Russia will not deliberately cut oil production to prop up prices, however its output may decline if prices remain low, Deputy Prime Minister Arkady Dvorkovich said. He said that Russia was ready to discuss measures aimed at oil price stabilization with the Organization of the Petroleum Exporting Countries (OPEC) and other key producers. Oil prices almost halved from last year mainly due to oversupply. OPEC kingpin Saudi Arabia, in a strategy designed to squeeze out rivals, such as U.S. shale oil firms, has been reluctant to cut oil output in order to support prices. Russian President Vladimir Putin and his Venezuelan counterpart Nicolas Maduro will discuss "possible mutual steps" to stabilize global oil prices when both visit China. OPEC and Russia, one of the world's biggest oil producers, have held regular meetings but have not agreed on any coordinated action to prop up falling prices. Dvorkovich reiterated that it would be technically difficult to restore oil production in Russia if output is cut artificially. Russia has been pumping oil at a post-Soviet high of more than 10.7 million barrels per day and expects to maintain high levels of output next year. (www.reuters.com)

South Korea will increase domestic gas tariffs by 4.4 percent