-

CENTRES

Progammes & Centres

Location

[August 2015: Living with Low Oil Prices]

“If we take into account that one of the causes for lower oil prices is slowing global growth and the consequent decline in demand for oil in emerging markets (including India), expectation that lower oil prices will result in growth becomes a flawed circular argument. In the last decade India’s growth has coincided with growth in oil demand and high oil prices which imply a fairly high degree of correlation between global economic and energy market conditions…”

Energy News

[GOOD]

The oil product pipeline to Nepal may be a small step for the region but a giant step for the two countries!

The revival of conflict over hydro-projects on the Indus is a worrying sign in the relationship between India and Pakistan!

[UGLY]

How can thermal coal imports show double digit growth rates when electricity demand growth is stagnant?

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· August 2015: Living with Low Oil Prices

· Delhi must think twice before going solar

DATA INSIGHT………………

· Growth Scenario of Key Energy Sectors

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC identifies six projects to propel its next phase of growth

Downstream……………………………

· IOC says fire-hit CDU at Koyali plant shut for maintenance

· India to raise $1.4 bn from top oil refiner stake sale

· India's thirst for gasoline supports Asian petrol margins

Transportation / Trade………………

· GAIL in talks with Iran to revive decade-old $22 bn LNG deal

· India signs pact to lay oil pipeline to Nepal

· Iran asks India to clear oil dues within two months

Policy / Performance…………………

· India submits gas field plan to Iran

· 30k LPG consumers giving up subsidy daily: Modi's magic

· Govt puts 10 percentage stake in IOC on the block

· Global producers must price oil 'reasonably': Oil Minister

[NATIONAL: POWER]

Generation………………

· India’s talks offer on power plants rejected

· NHPC restores Unit-4 of its power plant in Kargil

· NTPC to set up 4 GW thermal power plant at Ramagundam

· Deficit monsoon hits hydel power output in Karnataka

Transmission / Distribution / Trade……

· Rajasthan to set up company for power purchase, sale

· Thermal coal imports soar 24 percent to 33 mn tonnes at 12 major ports

· HC restrains action against Delhi discoms

· Australia could be reliable supplier of uranium: Kakodkar

Policy / Performance…………………

· Reopen 1.2 GW unit at UPCL: Karnataka Energy Minister

· Govt proposes loan swap for discoms

· Adani to invest $3.7 bn in coal gasification project

· Power Ministry’s expert committee divided on Subansiri

· Bihar cabinet nod to 16 power projects

· Odisha to get ` 456.3 bn from first round of coal auctions

· South Korea keen to invest in Punjab

· World Bank to look into investment opportunities in Haryana

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Iran expects new South Pars gas production to start in October

· Argentine oil output up 0.7 percent in June, natural gas up 3.1 percent

· Eni will start oil production from Norwegian Arctic in September 2015

· POGC says phases 15 & 16 of South Pars gas project to startup in October

· PPL finds gas, condensate at Kabir X-1 well in Gambat South block in Sindh

Transportation / Trade…………

· Jemena weighs bid for $720 mn EnergyAustralia gas plant

· Putin hopes for Chinese gift as oil slump sours second gas deal

· Shell lifts force majeure on gas supplies to Nigeria's NLNG

· Mnazi Bay gas wells deliver 1st gas to Tanzania pipeline

· Sinopec buys Kazakhstan oil assets from Lukoil for $1 bn

· Kazakh gas pipeline operator gets $2.5 bn loan from Chinese banks

Policy / Performance………………

· Norway's Oil Minister says crude price at $40 can't last

· Iraqi Oil Minister says $9 bn in arrears paid to foreign oil companies

· Norway approves Statoil's giant Johan Sverdrup oil project

· Kuwait says oil rout heightens need for domestic investments

· Iran plans ‘any cost’ oil output rise to defend market share

· Average US gas price steady over past two weeks

· Australia approves Woodside's Browse LNG project

· Mexico wraps $1.1 bn oil options hedge to lock in $49 floor

· Feels like 1986: Oil on track for longest weekly losing streak in 29 yrs

· Algeria oil, gas export volumes down 8.9 percent in Q1

· UK to offer licenses for 27 onshore O&G blocks

[INTERNATIONAL: POWER]

Generation…………………

· NERC raises hope of 6 GW power generation this year

· Denham and Nexif Energy to jointly invest in Southeast Asia power projects

· New $600 mn power plant to be built in Woodbridge

· China to build $10 bn nuclear plant in Pakistan

· TEPCO and Mitsubishi partnering on Fukushima coal-fired plants

· ScottishPower to decommission 2.4 GW Longannet power plant in March 2016

Transmission / Distribution / Trade……

· CFE selects builder for power transmission project

· Power plant payments jump as PJM seeks to avoid grid blackouts

· Ichor Coal offers to buy remaining stake in Universal Coal

Policy / Performance………………

· Nigeria gets World Bank guarantee for 450 MW power plant

· ENEC awards $2.5 bn contracts to develop nuclear power plants

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Suzlon commissions 6.25 MW wind power project for NSE

· How India can cut short-term carbon emissions 70 percent

· India says rich world has responsibility to curb climate change

· RERC orders reducing transmission charges for solar projects

· India has potential to achieve 100 GW solar target: Bosch

· World's largest solar power plant to come up in MP

· Master plans approved for 50 solar cities

· Targets to tackle climate change will remain a dream without affordable technology: PM Modi

· India, US invest $8 mn for off-grid clean energy fund

· Clean energy switch helps SMC cut carbon emission

· Adani in talks with Softbank, Foxconn on $3 bn solar plan

· Indian railways plans to set up first-of-its-kind waste plants in Delhi, Jaipur

· Govt seek comments on reframing National Biofuel Policy

GLOBAL………………

· German renewables investors to fund Iranian wind farm

· Indonesia considers create State company to boost geothermal energy

· Obama adds $1 bn in loan guarantees for clean energy

· SolarReserve gets green light for 260 MW CSP project in Chile

· Brazil approves construction of 669.5 MW of clean energy projects

· Germany and Brazil to collaborate on renewable energy projects

· Duke Energy seeks bids to develop 53 MW of solar power plants in South Carolina

· California can blame climate change for fifth of its drought

· Siemens wins turbine order for $182 mn Australian wind farm

· EU slams top economies on climate summit targets

· South Africa’s renewable benefits seen at $310 mn

· Greenskies secures $165 mn financing for 127 solar power projects in US

· Asia Green Capital to build 62.5 MW Jeneponto 1 wind project in Indonesia

· Taiwan will promote offshore wind power generation

· China’s global warming pollution estimates cut in Harvard study

[WEEK IN REVIEW]

COMMENTS………………

India monthly energy briefing

August 2015: Living with Low Oil Prices

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

G |

lobal energy news in the month of August was dominated by the fall in oil prices. Around the third week of August WTI prices breached the floor of $ 40/bbl and continued to stay around that level till the end of the month leading to predictions of $ 20/bbl in the future. Many observers said that low oil prices were a great opportunity for India as it can use the savings on imports and subsidies to boost growth. But reality is not likely to be that simple, especially when the drop in crude prices is put in the context of impending gloom in the global economy.

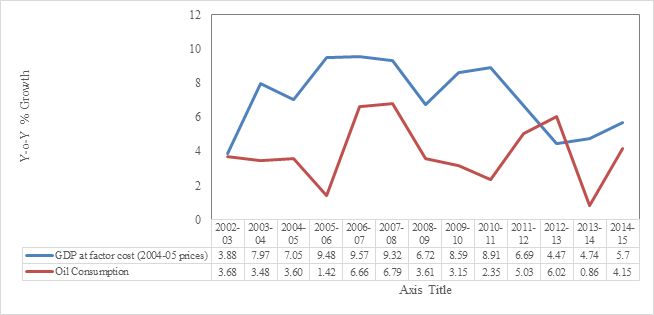

The Governor of the Reserve Bank of India and the Ministers handling economic affairs rushed to assure that India is protected from global economic turmoil and that India can take the place of China in driving global growth. The probability of this materialising is low. When the world is awash with capital, labour and commodities (including oil) as the Wall Street Journal put it, what special offer can India make to the World to facilitate growth? If we take into account that one of the causes for lower oil prices is slowing global growth and the consequent decline in demand for oil in emerging markets (including India), expectation that lower oil prices will result in growth becomes a flawed circular argument. In the last decade India’s growth has coincided with growth in oil demand and high oil prices which imply a fairly high degree of correlation between global economic and energy market conditions (Chart 1)

Chart 1: Economic growth and Oil Consumption Growth Rates (2002-2014)

Sources: RBI (from 2002-03 to 2013-14), CSO (2014-15, data point in graph is for Q1 of 2014-15) & PPAC for Oil Consumption.

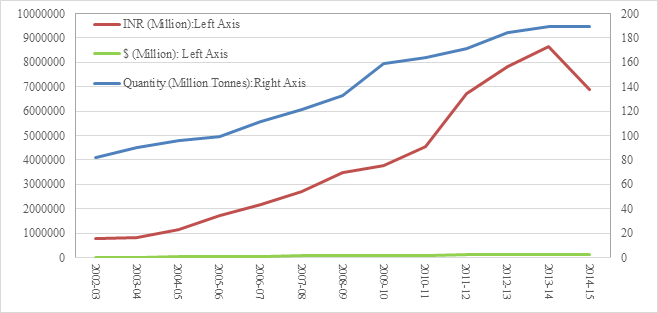

The price of the Indian crude basket fell by about 4 percent from $ 59.07/bbl in April to $ 56.30/bbl in July. The price in July 2015 represents a 50 percent fall from the average price of $ 111.89/bbl of the Indian crude basket recorded in the year 2011-12. In 2011-12, the import of 171.7 Million Tonnes (1.26 billion bbls) of oil cost around $139.7 billion. The import of 189.4 Million Tonnes (1.39 billion bbls) of oil in 2014-15 cost only $112.7 billion. However the depreciation of the rupee shaved off a large share of the wind fall savings from lower import bills (Chart 2)

Chart 2: Oil Import volume and cost in Dollars and Rupees

The other significant oil related development in August was the impact of the change in Iran’s position in the geo-political context. There was plenty of news on increasing oil investments in Iran, settling pending payments of over $ 6.5 billion towards oil imports from Iran and so on. There was even talk of reviving the decade old $22 billion long LNG deal. The oil deals with Iran may materialise but the prospects of an LNG deal materialising look remote at this point. There was even talk of reviving the Oman-India underwater pipeline. The fall in the price of natural gas and oil may be driving the revival talks but ironically it is generally the case that high prices for oil and gas rather than low prices that make capital intensive projects such as the Oman-India project viable. On the domestic front, we can probably expect yet another formula for difficult gas soon. This may add to complexity of multiple pricing schemes that co-exist in the country rather than facilitate increase in production and consumption of gas.

Low oil prices also led to talk of filling up strategic reserves at the cost of ` 11.5 billion. The reduction in subsidies for petroleum products and the growth in the number of people giving up subsidised LPG were all hailed as achievements of what is called ‘Modi Magic’ by the media. Whether the magic will work when oil prices increase is an open question.

Another issue that came up in August in the context of oil was the need for a single regulatory authority for ensuring the safety of oil and gas installations and infrastructure. This is a welcome move as multiple authorities have given rise to turf wars as well as ‘not my problem’ syndromes. There was also news on mandatory 10 percent blending of ethanol and the setting up of bio-diesel retailing stations. Whether this policy was motivated by the need to create an outlet for the products of the sugar industry or if it was motivated by the need to reduce dependence on oil was not clear.

Some promising news on under-ground coal gasification (UCG) and coal bed methane (CBM) also emerged in August. A product-pipeline to Nepal was proposed. Though a small step in the context of South Asian regional integration in the energy context, it could become a giant step in the bilateral relationship between India and Nepal.

On the power sector, the news was mixed. There was little or no news of power outages and coal shortages which dominated summer news last year. However the news that thermal coal imports increased by 24 percent to 33 MT is very surprising given that demand for power is not growing at the same pace. It is likely that there is more to this development than just supply and demand fundamentals. The historic problem with distribution companies continued to grab the headlines with the Delhi discoms topping the table. As pointed out in the article last week, efficiency has not automatically trickled down to the entire system with the entry of the private sector in distribution. One troubling piece of power sector news that hardly anyone would have noticed is the revival of conflict between India and Pakistan over constriction of power projects on the western tributaries of the Indus by India. While there is nothing new in the positions taken by both countries the prospect of a storm gathering after a relatively long period of calm on this front is troubling.

On the renewable energy front there was no shortage of positive news as it has been the case since the magic of Modi took over. Companies ranging from Adani to ACME were committing investment in solar projects. The World Bank, for its part said that it would no longer fund coal projects. This is unlikely to hurt coal investments in India as it capable of funding its own projects. Overall energy news coverage by the Indian media in August did not reflect the serious energy implications of the growth challenge that the World including India faces. The media appears to remain hypnotised by the power of magic to transform the energy sector. We hope they are right but if they are wrong we may have to brace ourselves for trouble.

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

Delhi must think twice before going solar

Ashish Gupta, Observer Research Foundation

|

T |

he Delhi Dialogue Commission recently presented the draft solar policy for Delhi in a meeting with Non Government Organisations (NGO’s), discoms, power department officials and others. The highlights of the policy included developing Delhi as a solar city and generating about 1,000 MW between 2015 and 2020 when the policy will be implemented.

The draft policy is also proposing various incentives for making the proposed policy a success. But unfortunately the stakeholders who participated in the meeting expressed concern over the viability of such policy on a large scale. Even the discom officials were not sure whether the proposed policy will be a boon or bane for them. The NGOs who participated in large numbers are of the view that without government support the proposed policy will not take off. The proposed policy is based on the pattern of Haryana Solar Policy.

On September 3, 2014, Haryana government released order no. 22/52/2005-Spower making solar power mandatory for all industries, schools, hospitals and commercial institutions. Even after having a coherent and straight forward policy the solar power deployment did not take off in a big way. From 2011 – 2015, Haryana has added only 18.8 MW solar power capacity. This simply gives an indication that there are no consumer groups, be it commercial institutions, malls, office spaces, rich bungalows, schools, hospitals etc who are seriously interested in deploying solar rooftops. Though many are of the view that this is because of the lethargic implementation of the policy in the State ground reality suggests otherwise. This is quite evident from the data on solar power capacity in the state showing clear preference for the cheap (coal) as a source of power generation. This also means that poor deployment is not due to policy lacuna but is due to commercial concerns.

India has been making a strong push for solar energy since 2010, but installing solar panel kits to meet residential electricity still remains a distant dream because of the high initial costs involved. Coming to Delhi the net metering scheme that would have facilitated excess energy generated through rooftop solar systems to be sold to the power grid has not taken off. Even with net metering the scheme may not have taken off. The government needs to learn from its past mistakes and find out why the policy failed.

Apart from that, the Delhi government must differentiate between myth and the reality. It is believed that solar power is comparable to coal based electricity as the tariff bids have come down sharply. The big question is how did the tariffs came down? That is because of the huge subsidy extended by the government to the developers including but not limited to 30% viability gap funding, accelerated depreciation, 30% capital subsidy etc. Added to this is the reduction in global price of solar equipment on account of subsidies extended to manufacturers in China as well as the tariff subsidies offered in countries like Germany which has created artificial demand. Surprisingly even after getting such a huge subsidy, solar power tariffs still do not match coal electricity prices. Even the few installations that have been made are due to huge subsidy/ incentives given by the government.

The situation has changed for the Ministry of New & renewable Energy (MNRE) as it has stated via order no. 5/34/2013-14/RT, that due to limited budgetary provisions, it may not be possible to provide central assistance / capital subsidy to all categories of beneficiaries. Therefore all State Nodal Agencies, State Departments, Commercial Establishments, Channel Partners, System Integrators etc. are advised to set up grid connected rooftop projects without waiting for the subsidies of MNRE.

Therefore if the Delhi government implements the policy in haste by making it mandatory for all the government institutions, commercial establishments etc to install solar rooftop, it is going to be huge burden not only on the utility but also on the government. Whether Central or State assistance it ultimately means taxpayers money. Why should the common man be penalised for policies that are not viable? The Delhi government must weigh the pros and cons of the proposed policy and only then try to implement it on large scale.

Views are those of the author

Author can be contacted at [email protected]

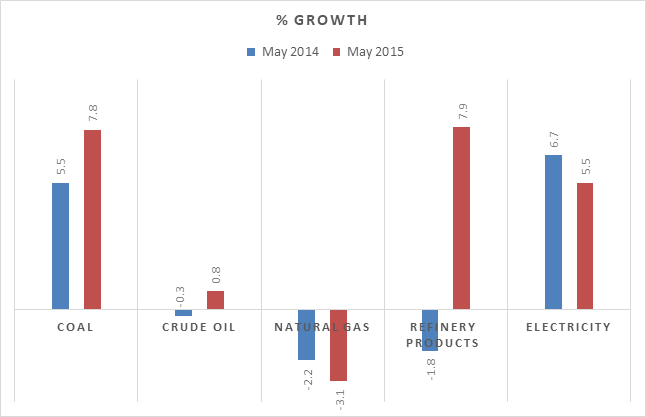

DATA INSIGHT……………

Growth Scenario of Key Energy Sectors

Akhilesh Sati, Observer Research Foundation

|

Core Energy Sectors |

Growth Rate (in %) |

||||||

|

2008-09 |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

|

|

Coal |

8 |

8.1 |

-0.2 |

1.3 |

4.6 |

1.3 |

8.4 |

|

Crude Oil |

-1.8 |

0.5 |

11.9 |

1 |

-0.6 |

-0.2 |

-0.9 |

|

Natural Gas |

1.3 |

44.6 |

10 |

-8.9 |

-14.5 |

-13 |

-5.2 |

|

Refinery Products |

3 |

-0.4 |

3 |

3.1 |

29 |

1.5 |

0.4 |

|

Electricity |

2.7 |

6.2 |

5.6 |

8.1 |

4 |

6 |

8.1 |

Source: Office of the Economic Adviser, DIPP, MoC&I.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC identifies six projects to propel its next phase of growth

August 19, 2015. Oil and Natural Gas Corporation (ONGC) has identified six projects over and above its flagship development project in the Krishna-Godavari (KG) basin to power the next phase of its growth. These projects, entailing an investment of ` 24,000 crore, are expected to help the state-owned company in maintaining its growth rate in the production of oil and natural gas and contribute almost 14% of its domestic crude oil and 15% of its domestic gas output in the coming years. These new and marginal fields have already yielded positive results and contributed close to 14% of domestic crude oil and 15% of gas output in the financial year 2014-15. It aims to maintain this share in the coming years. Stuck with ageing fields as old as 40 years, ONGC has often been criticized for failing to significantly boost production in the past 10 years. Over the past decade, the company has seen a steady decline in production from a high of 47.15 million tonnes of oil equivalent (Mtoe) in fiscal 2005. In fiscal 2014, the company’s domestic oil and gas production was 44.28 Mtoe, its lowest in a decade. But in the past financial year, the company reversed the trend in crude oil for the first time by posting a marginal jump in production. This raised hopes that the years of subdued production are over and that ONGC would play a more prominent role in reducing the country’s crude oil and natural gas import bill. ONGC said that production at the much-delayed and highly-anticipated KG basin block would start from fiscal 2019, helping to sustain the rise in production. At its peak, the block is expected to produce up to 20 million metric standard cubic metres per day (mmscmd) of gas and up to 90,000 barrels per day of crude oil. The peak is expected by mid-2021. For the year ended March 2015, ONCG produced 24.946 million tonnes of crude, down 0.18% and 23.519 billion cubic metres (bcm) of natural gas, down 5.35% from a year ago. (www.livemint.com)

Downstream………….

IOC says fire-hit CDU at Koyali plant shut for maintenance

August 24, 2015. Indian Oil Corporation (IOC) said all units at its 274,000 barrels per day (bpd) Koyali refinery in western Gujarat are running normally except the 44,000 bpd crude distillation unit (CDU), where a minor fire occurred during a planned maintenance shutdown. IOC had shut the 44,000 bpd crude unit 2-3 days ago for routine maintenance, the company said. The shutdown will last for about 25 days. Koyali refinery has five CDUs. (in.reuters.com)

India to raise $1.4 bn from top oil refiner stake sale

August 24, 2015. India will raise about ` 93.79 billion ($1.4 billion) from selling a stake in state-run refiner and fuel retailer Indian Oil Corporation, the government said, even as a global stock market rout raised concerns about future offerings. New Delhi is seeking to raise as much as $11 billion by selling stakes in state-run companies this fiscal year, crucial to narrowing the fiscal deficit to a planned 3.9 percent of gross domestic product in 2015/16. The sale of a 10 percent stake in IOC came on the day India's stock market plunged nearly 6 percent, its biggest daily slide in 6-1/2 years, as steep falls in Chinese equities sparked widespread panic in global markets. The Indian Oil sale was the fourth government stake sale this fiscal year, which began in April. Indian Oil's stock is still up 13.8 percent on the year, outperforming a 5.7 percent fall in the broader market, helped by cheaper global crude oil prices and improved product prices. (uk.reuters.com)

India's thirst for gasoline supports Asian petrol margins

August 19, 2015. Strong Indian imports of gasoline, boosted by a shift towards petrol car sales, are expected to underpin Asian margins for the fuel at least for the rest of the fiscal year to next March, industry sources say. India has surplus refining capacity, but there has been maintenance at some plants and gasoline demand has risen after a cut in diesel subsidies increased the attractiveness of petrol cars. Gasoline imports from April to June were the highest in more than four years, data showed. As a result, Asia's average gasoline profit margin for refiners, or the crack, in the first seven months of 2015 was$12.60 a barrel, the highest for the period since 2009, based on data going back to the second half of 2008. In the first six months of the year, India's gasoline demand grew 14.17 percent, data showed, and trade sources expect growth this year to reach 17 percent. Although India still exports more gasoline than it buys, the government said state refiners would continue importing at least until the end of this fiscal year to March 31 2016. Higher domestic demand meant that total gasoline exports for January-June 2015 fell about 5.2 percent to 7.2 million tonnes or 337,400 barrels per day (bpd), while imports have spiked to about 23,400 bpd from about 2,850 bpd. For all of 2015, consultancy JBC Energy expects India's gasoline surplus to fall to around 310,000 bpd and drop below 300,000 bpd in the next few years, versus 345,000 bpd in 2014. IOC, the key importer of gasoline, has sought almost 700,000 tonnes for March-September delivery. IOC's Panipat refinery is only able to meet 75 percent of demand for Euro IV, IOC said. India's strong gasoline demand comes as major consumers Japan and Australia shut refining capacity and switch instead to imports. (uk.reuters.com)

Transportation / Trade…………

GAIL in talks with Iran to revive decade-old $22 bn LNG deal

August 24, 2015. State-run gas utility GAIL India Ltd has begun talks with Iran to revive a decade-old $22-billion LNG supply contract, the cheapest deal ever struck by an Indian firm. Indian state firms had on June 13, 2005, signed a sale and purchase agreement (SPA) with National Iranian Gas Export Company (NIGEC) for buying 5 million tonnes (mt) a year of LNG on a long-term contract at very attractive price of $3.215 per million British thermal unit. But Tehran never honoured the deal. With prospects of sanctions against Iran being lifted after a nuclear accord it stuck with the US and other world powers, India has reopened dialogue on buying LNG from the Persian Gulf nation. In the contract, GAIL had signed to buy 2 million tonnes per annum (mtpa) of LNG from NIGEC while refiner Indian Oil Corporation (IOC) had signed for 1.75 mt. Bharat Petroleum Corp Ltd (BPCL) was to take another 1.25 mt. (economictimes.indiatimes.com)

India signs pact to lay oil pipeline to Nepal

August 24, 2015. India signed an agreement to lay an oil pipeline from Raxaul in Bihar to Amlekhgunj in Nepal to supply petrol, diesel and aviation turbine fuel (ATF) or jet fuel to the land-locked Himalayan Kingdom. Oil Minister Dharmendra Pradhan, who is on a three-day visit to Kathmandu, and Nepalese Minister of Commerce and Supplies Sunil Bahadur Thapa signed an MoU for the petroleum product pipeline. This will be the first trans-national petroleum pipeline in South Asia. Nepal depends on India for meeting all of its fuel requirements. Petrol, diesel, domestic LPG and jet fuel (ATF) are currently trucked from Indian Oil Corporation's (IOC) depot at Raxaul to Nepal. The 41 kilometre pipeline -- 2 km in India and 39 km in Nepal -- will initially supply petrol, diesel and kerosene. It will be built by IOC at a cost of ` 200 crore. IOC will take 30 months to complete the project after receipt of necessary statutory clearances from the Government of Nepal. IOC will also do re-engineering of the Amlekhgunj petroleum depot to make it compatible to receive petroleum products by pipeline. India exports about $1.1 billion worth of petroleum products per annum to Nepal. Bulk of this volume will be transported through this pipeline. The pipeline was first proposed in 2006 for transportation of fuel from Raxaul to Amlekhgunj. The pipeline was to be funded 50:50 by IOC and Nepal Oil Corporation (NOC). The project, however, never took off as Nepal refused to fund its share of cost. IOC has agreed to foot the ` 200 crore cost in exchange for Nepal committing to buy products for at least 15 years. (www.ndtv.com)

Iran asks India to clear oil dues within two months

August 20, 2015. Iran has asked India to pay, within the next two months, the dues on account of oil supplies that have accumulated since 2013 with sanctions on the country blocking payment routes. This follows the world powers signing the historic nuclear deal with Iran last month that has opened the door to the easing of sanctions. The cumulative dues worth $6.5 billion (` 41,000 crore) could be discharged partly in rupees, and the balance in dollars or euros. Iran will open a fresh account with one of the Indian banks for receipt of the rupee payment, which it will use to pay for its imports from India.

Since February 2013, Indian state-run and private refiners have paid around 45 percent of the payment due in rupees, through the Kolkata branch of the state-run UCO Bank. The balance has been accumulating, pending finalization of a payment route and mechanism. The new account will be different from the UCO Bank account, which is non-interest bearing. Iranian foreign minister Javad Zarif said that Iran's central bank and government officials are working with their Indian counterparts on the technicalities of the settlement of India's oil import dues that have grown to over $6.5 billion. (timesofindia.indiatimes.com)

Policy / Performance………

India submits gas field plan to Iran

August 24, 2015. India's ONGC Videsh Ltd (OVL) says it has submitted Iran a revised plan for development of the giant Farzad-B gas field in the Persian Gulf. The company is rigorously pushing for development rights to the offshore field after losing them due to dawdling under US pressures. The Farzad-B field in the offshore Farsi block is estimated to hold 12.8 trillion cubic feet of gas reserves. A consortium of three Indian companies discovered the field in 2008, winning the right to its development. But Iran had to put Farzad-B in the list of projects for tender last year after the Indians dragged their feet on its development. Oil India Ltd, a member of the consortium, said that it had been given assurances by Iranian energy officials to be allowed back to the field. India has discussed reviving a deal signed in 2005 to buy 5 million metric tons of liquefied natural gas (LNG) from Iran, Oil Minister Dharmendra Pradhan said. (www.presstv.ir)

30k LPG consumers giving up subsidy daily: Modi's magic

August 24, 2015. Prime Minister (PM) Narendra Modi's magic appears to be working well among cooking gas consumers. With a little assistance from state-run fuel retailers. Between 30,000 and 40,000 households are giving up LPG subsidy daily in response to a countrywide door-to-door campaign launched by the oil marketers to capitalize on the PM's call to 'Give It Up'. The result is nothing but magical in a country used to government freebies. The number of households surrendering subsidy has already topped 20 lakh mentioned in the PM's Independence Day speech. What is more striking is that within a day of the PM's speech, the number rose by more than a lakh to 21.26 lakh and has further gone up to 22.57 lakh, oil ministry data shows. And the number keeps growing by leaps and bounds. Oil company executives say the pace of households giving up subsidy is rising as the door-to door campaign gathers steam.

Oil Minister Dharmendra Pradhan said that nearly 13.87 lakh consumers had given up subsidy as of July 28. Modi first made the give it up call in April. The door-to-door campaign was launched in May-end and picked up momentum from June. The campaign is focused on affluent localities. All this is happening in times of low international oil and gas prices. The real test will be when prices rise and the subsidy gap widens to ` 400-600 per cylinder. The subsidy had risen to ` 800 during oil's peak run in the 2008-09 period. There are 15.3 crore LPG-consuming households registered with the three oil marketing companies. Nearly 14 crore have joined Pahal, the programme for transferring cash subsidy directly into the bank account of consumers. So far, ` 23,848.32 crore has been transferred by way of subsidy. The government has set a target of getting a crore households to give up subsidy. (timesofindia.indiatimes.com)

Govt puts 10 percentage stake in IOC on the block

August 22, 2015. The government will put 10 percent stake sale of Indian Oil Corporation (IOC) through an offer for sale (OFS) that can fetch about ` 9,500 crore to the exchequer. The floor price for the share sale will be announced and the stake sale will take place, IOC said. The government has so far been able to collect only ` 3,200 crore from stake sale of Power Finance Corporation, Rural Electrification Corporation and Dredging Corporation. Stake sale in IOC will be the fourth disinvestment this fiscal and the biggest so far. The government, currently holds 68.6 percent interest in IOC, will sell 24.28 crore equity shares through an OFC. At least 20 percent of the offer size has been reserved for retail investors, who will also get a 5 percent discount to the cut-off price, the government said in a regulatory filing. (www.newindianexpress.com)

Global producers must price oil 'reasonably': Oil Minister

August 19, 2015. Reiterating New Delhi's decade-old demand, he said the Organisation of Petroleum Exporting Countries (OPEC) is not justified in asking Asian buyers to pay more so that transportation cost to distant consumers particularly in the West can be subsidised.

Oil Minister Dharmendra Pradhan said producers need to be "reasonable and responsible" in pricing of oil. The world's fourth-largest petroleum consumer wants OPEC to revisit its policy of seeking letter of credit as payment guarantee from regular and bulk buyers and demanded that it consider extending the credit time for crude import. Pradhan said he will continue to press for a favourable oil pricing at international forums, including the OPEC summit in Vienna in June. He said like consumers of petrol and diesel who benefited from a fall in international oil prices, users will gain if gas prices remain soft and come down from October. (www.ndtv.com)

[NATIONAL: POWER]

Generation……………

India’s talks offer on power plants rejected

August 24, 2015. Pakistan rejected an Indian offer to hold talks on the controversial hydro power projects, calling it a trap by New Delhi to buy time for completing the projects. The offer, made through a letter, comes just a day after New Delhi sabotaged the broader peace talks between the two countries. India is building Kishanganga Hydroelectric Project (with 330 MW power production capacity) and Ratle Hydroelectric Plant (850 MW) in Occupied Kashmir on the rivers flowing into Pakistan. Islamabad had raised objection on the design of these projects, saying they will obstruct the flow of water to a degree that violates the Indus Water Treaty, signed between the two countries on sharing the water of Indus River tributaries. Kishanganga project is designed to divert water from river Kishanganga to a power plant on Jhelum River basin. It is located 5 km north of Bandipore in occupied Kashmir. Ratle project is located at Chenab River in the Indian-held valley. The government had written a letter to India and proposed appointment of an international expert to decide the issue. India was bound to reply the Pakistan’s offer within 30 days under the agreement. However, New Delhi did not show seriousness on Pakistan’s objections rather it speeded up work on both the projects. The acceptance of India’s offer of talks would mean restart of the whole process from the beginning which Pakistan could not afford at the time when the neighbouring country has already speeded up construction work on the projects. Besides the two projects, Pakistan had raised concern on design of three other projects being built by India on River Chenab. These projects are: 1,000 MW Pakal Dul, 120 MW Miyar and 48 MW Lower Kalnai. However, it is yet to be unknown that either Indus Water Commissions of both the countries will continue talk on the three projects and resolve the issue or the cases will move in the World Bank too. (nation.com.pk)

NHPC restores Unit-4 of its power plant in Kargil

August 20, 2015. NHPC said it has restored Unit-4 of its Chutak power station in Jammu and Kashmir, which was shut down due to sudden increase in the water level in June. Chutak power station is run-of-the-river scheme with an installed capacity of 44 MW (4X11 MW) and harnesses the Hydropower potential of river Suru in Kargil district of Jammu & Kashmir. The barrage of the power station is located near village Sarzhe and the power house is located on right bank of river Suru near village Chutak. (www.business-standard.com)

NTPC to set up 4 GW thermal power plant at Ramagundam

August 20, 2015. National Thermal Power Corporation (NTPC) has decided to set up the 4,000 MW thermal power plant completely dedicated to meet the needs of Telangana State at Ramagundam in Karimnagar district, where it already has a 2,600 MW Inter-State Generating Station (ISGS). It was initially planned that the NTPC too would set up the 4,000 MW project at Damaracherla in Nalgonda district, where Telangana State Power Generation Corporation (TS-Genco) is setting up a major power plant.

NTPC is planning to set up two plants comprising two units of 800 MW each in the first and eight units of 300 MW capacity each in the second at Ramagundam as part of the 4,000 MW project, promised to Telangana by the Centre in the Andhra Pradesh Reorganisation Act. The proposal to set up 2,400 MW plant in the second-phase was likely to be taken up by the Executive Board of NTPC soon. The existing ISGS project of NTPC at Ramagundam has three units of 600 MW each and four units of 500 MW each. (www.thehindu.com)

Deficit monsoon hits hydel power output in Karnataka

August 19, 2015. Deficit southwest monsoon over a month in the catchment areas of Karnataka has hit power generation from hydel sources in the state. Though the state has a combined installed capacity of 10,189 MW from conventional resources like hydel and thermal stations, generation is around 6,600-7,300 MW due to lower hydro output and breakdown in state and central power generating units. Karnataka Power Corporation Ltd (KPCL) generates most energy in partnership with private producers from Raichur Thermal Power Station (RTPS), Ballari Thermal Power Station (BTPS) and Udupi Power Corporation Ltd (UPCL), an independent private producer Lanco-Infratech. (www.newkerala.com)

Transmission / Distribution / Trade…

Rajasthan to set up company for power purchase, sale

August 25, 2015. The Rajasthan government decided to set up a company for purchase and sale of power in the state, which so far was being done by separate companies. The decision to form the fully government-owned company was taken in a cabinet meeting chaired by Chief Minister Vasundhara Raje, parliamentary affairs minister Rajendra Rathore said. He said that the move was aimed at bringing more transparency in the sale and purchase of electricity units, a work which was so far being done by three power distribution companies (DISCOM). (thefirstmail.in)

Thermal coal imports soar 24 percent to 33 mn tonnes at 12 major ports

August 24, 2015. Imports of thermal coal jumped 24 percent at the country’s top 12 major ports to 32.54 million tonnes (MT) during the April-July period this year even as the government continues to announce its commitment to boost domestic output, mainly by monolith Coal India Ltd (CIL). These 12 ports had handled 26.29 MT of coal during the same period of the last fiscal. Thermal coal is the mainstay of India’s energy programme as 70 percent of power generation is dependent on the dry fuel, while Coal Minister Piyush Goyal has been emphasising the need to increase the production by CIL. Handling of coking coal, which is used mainly for steel-making, however remained flat at 10.56 MT, as per the data released by the Indian Ports Authority. The ports had handled 10.74 MT of coking coal in April-July period of 2013-14. Together, they handled 43.10 MT coal during the April-July period of the current fiscal as against 37.03 MT in the same period of the previous fiscal. India is the third-largest producer of coal, after China and the US, and has 299 billion tonnes of resources and 123 billion tonnes of proven reserves, which may last for over 100 years. India has 12 major ports - Kandla, Mumbai, JNPT, Marmugao, New Mangalore, Cochin, Chennai, Ennore, V.O. Chidambarnar, Visakhapatnam, Paradip and Kolkata (including Haldia) — which handle approximately 61 percent of the country’s total cargo traffic. (www.thehindu.com)

HC restrains action against Delhi discoms

August 22, 2015. The Delhi High Court (HC) restrained the city government from taking any action on the basis of a draft Comptroller and Auditor General (CAG) report on the functioning of power distribution companies. The report alleged inflation of dues and passing on the “dead cost” of power to consumers without supplying equivalent electricity.

The court order came on a petition filed by Reliance Infrastructure-promoted power distribution companies in Delhi, BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd, which moved court on August 20. Tata Power Delhi Distribution Company Ltd is the city’s third power distribution company. The Delhi High Court also sought replies from the Aam Aadmi Party-ruled Delhi government and the CAG. The court will hear the case next on September 11. (www.business-standard.com)

Australia could be reliable supplier of uranium: Kakodkar

August 20, 2015. Former Atomic Energy Commission of India chairman Anil Kakodkar has said the country should accelerate its nuclear energy production programme by taking advantage of the civil nuclear deal it has struck with Australia last year. India and Australia had last year signed a landmark civil nuclear deal, clearing the way for Canberra to sell uranium to the energy-starved country for power generation. Kakodkar said the importance of nuclear energy will grow with time and it will form an inevitable part of the energy mix for the country. (zeenews.india.com)

Policy / Performance………….

Reopen 1.2 GW unit at UPCL: Karnataka Energy Minister

August 25, 2015. Karnataka Energy Minister D K Shivakumar directed the Udupi Power Corporation Ltd (UPCL) to ensure that the 1,200 MW coal-based thermal power plant reopens its first unit at the earliest. The minister was addressing officials during his visit to UPCL at Nandikoor.

The minister’s visit gained importance as both the units of UPCL had stopped functioning for 10 days. Power generation from wind has come down in the state, he said. Raichur Thermal Power Station (RTPS) and Bellary Thermal Power Station have not able to generate a sufficient power, the minister said. (www.newindianexpress.com)

Govt proposes loan swap for discoms

August 24, 2015. While refusing a fresh bailout to electricity distribution companies, the Centre has asked state governments to issue bonds for raising funds at 8.5-9 percent and help the power firms swap their high-cost loans, raised at 13-14 percent, to improve their financial health. The move will take care of the legacy issues. For future funding, the power ministry is reading the riot act and has clearly told state governments with weak discoms to cut the aggregate technical & commercial (AT&C) losses to 15 percent, which in Jharkhand was estimated at close to 42 percent and at around 32 percent in parts of Uttar Pradesh. During consultations with the states, the power ministry has clearly said that they need to undertake 100 percent metering and keep the farm sector on a separate grid. In fact, funding from schemes such as Integrated Power Development System and Deen Dayal Upadhyaya Gram Jyoti Yojana is also linked to reforms. Discoms in Rajasthan, UP, Tamil Nadu and Jharkhand are seen to be under maximum stress with high amount of debt as well as accumulated losses. The poor health is also putting pressure on banks, which at the behest of the Centre had extended a financial restructuring plan without any asset backing. Although the discoms are backed by state governments, any delay in repayment of loans will increase the headache for the state-run lenders, grappling with mounting bad debt. (timesofindia.indiatimes.com)

Adani to invest $3.7 bn in coal gasification project

August 24, 2015. Adani Group said it would invest ` 250 billion ($3.75 billion) in a coal gasification project. Adani said the project would be launched in Chhattisgarh, one of India's poorest, where there is an abundant supply of poorer quality coal containing high ash. It said it would also invest ` 2 billion in a rice bran solvent extraction plant and a physical refinery packing plant in Chhattisgarh. Headed by billionaire Gautam Adani, the Adani Group's operations include coal mining, power plants, ports and logistics. (in.reuters.com)

Power Ministry’s expert committee divided on Subansiri

August 24, 2015. Cracks have appeared in an expert Committee formed by the power ministry to study safety issues of the beleaguered 2,000 MW Subansiri hydro project, with one faction likely to submit the final report. The eight-member Committee, which includes four members from Assam and four from outside the state, was set up by the Ministry in December 2014 to review all aspects of NHPC’s Subansiri Lower Hydro Electric Project. Construction work of the project has been stalled for over three and half years due to protests. According to sources in the power ministry, there has been a divided opinion between the groups from Assam and outside. (www.theshillongtimes.com)

Bihar cabinet nod to 16 power projects

August 22, 2015. In an effort to boost power sector in Bihar, the state cabinet approved 16 schemes aimed at ensuring electricity supply in rural areas, renovation and expansion of thermal power stations and better power transmission network. Many of these schemes are sponsored by the Centre, with the state government sharing the cost of manpower engaged in those works. The approved schemes included ` 1,699 crore project of Bihar Grid Company Ltd (BGCL), a joint venture of Bihar State Power (Holding) Company Limited (BSPHCL) and Power Grid Corporation, to expand and strengthen power transmission network in the state. The BSPHCL's share in the project will be about Rs 170 crore. The cabinet also approved allotment of the first instalment of ` 57.50 crore for the project. A sum of ` 5,827 crore would be spent for better power supply in both north and south Bihar. Of this, 60% would be spent by the Centre and the rest by the state government. The state government has provided ` 10 crore, while the rest of its share would be made available by financial institutions as loan. During its meeting chaired by CM Nitish Kumar, the cabinet accorded administrative approval for over ` 333 crore for the projects of North Bihar Power Distribution Company Limited and South Bihar Power Distribution Company Limited to replace faulty and burnt transformers with high-capacity ones in rural areas under Rajiv Gandhi Rural Electrification Scheme. The cabinet approved a project of ` 71.35 crore for protection and upgradation of control systems of six grid sub-centres of the Bihar State Power Transmission Company Limited (BSPTCL) in the state (timesofindia.indiatimes.com)

Odisha to get ` 456.3 bn from first round of coal auctions

August 21, 2015. The first round of coal auctions is likely to fetch the Odisha government a revenue of ` 45630 crore. The projected amount would accrue to the state government by way of e-auction proceeds, royalty fees and fixed reserve price, the ministry for steel & mines said. The projected revenue is set to flow to the state coffers in a span of 25-30 years. In the first tranche, the central government has agreed to pay ` 12.52 crore to Odisha. So far, nine coal blocks from the state have been put to auctions. All blocks have been earmarked for the power sector. The Coal ministry has notified 10 more coal blocks for auctions in the third tranche including the Jamkhani coal block in Odisha. All these blocks are for unregulated sectors. (www.business-standard.com)

South Korea keen to invest in Punjab

August 20, 2015. A high-level business delegation from Republic of Korea (South Korea) expressed willingness to invest in Punjab and Chandigarh. South Korea also evinced interest in investing in joint- venture partnership with industrialists from northern region and in developing infrastructure projects, including smart cities, transportation and power generation. (www.newindianexpress.com)

World Bank to look into investment opportunities in Haryana

August 20, 2015. The World Bank will look into investment opportunities in Haryana's key infrastructure sectors like smart cities, energy and mass rapid transit systems. The international financial institution, during a meeting with visiting Haryana's principal secretary of industries Devender Singh, also agreed to examine the scope for technical and financial assistance through Global Infrastructure Fund and International Finance Corporation for a public-private participation project to set up a multi-modal logistics hub. It also evinced keen interest in deepening the engagement with the state government in the field of cutting down losses in transmission and distribution of power, and in bringing efficiency in demand management. (www.moneycontrol.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Iran expects new South Pars gas production to start in October

August 25, 2015. Iran plans to bring online two new gas operations in October after the OPEC member completes development of another section of the world's largest gas field, its Oil Minister Bijan Zangeneh, said. Iran and Qatar share the field, which Iran calls South Pars and Qatar calls the North Field. It straddles their offshore Gulf border and accounts for nearly all of Qatar's gas production and about 35 percent of Iran's. Development phases 15 and 16 of the South Pars field are close to starting production and will be inaugurated by President Hassan Rouhani in October, Bijan Zangeneh said. Iran has huge gas reserves. It exports small quantities to Turkey but has been unable to increase production quickly enough to meet its own demand and northern Iran relies heavily on gas imports from Turkmenistan, especially for heating in winter. Iran's gas production, excluding flared and re-injected gas, more than doubled to 160.5 billion cubic meters (bcm) by 2012 from 75 bcm in 2002. (in.reuters.com)

Argentine oil output up 0.7 percent in June, natural gas up 3.1 percent

August 24, 2015. Argentine oil production crept 0.7 percent higher in June versus the same month last year, despite a fall in international crude prices, while the country's natural gas output grew 3.1 percent. June oil production was 2.55 million cubic meters, boosted by an increase in output from state-controlled energy company YPF.

YPF itself increased crude output by 4.7 percent in June, year-on-year, to 1.08 million cubic meters. In 2012, Argentina's government seized control of the company from its former parent, Spain's Repsol. Argentina produced 3.54 billion cubic meters of gas in June. Of that, YPF, Argentina's No. 1 energy company, pumped 1.07 billion cubic meters, or 11.4 percent more than in June 2014. (af.reuters.com)

Eni will start oil production from Norwegian Arctic in September 2015

August 20, 2015. Italian energy group Eni plans to start producing oil from its Goliat field in Barents Sea (Norwegian Arctic), after years of delays and large costs overruns. The field, located 50 km south-east of the Snøhvit field, is estimated to hold 174 mbl of oil and is operated by Eni with a 65% stake in partnership with Statoil (35%). Partners took the final investment decision in June 2009 to develop the field with a floating production and storage vessel (FPSO) and first production was scheduled in 2013.

However, challenges in the engineering and construction processes delayed operations and raised costs by more than 50%, from around NOK 30bn (2009) to NOK 46.7bn (US$5.6 bn). The project is expected to peak at 34 mb/d during the second year of production. (www.enerdata.net)

POGC says phases 15 & 16 of South Pars gas project to startup in October

August 19, 2015. Iran's Pars Oil and Gas Company (POGC) reported that Phases 15 & 16 of the massive offshore South Pars gas field located on the Iranian border with Qatar in the Persian Gulf are close to starting production. POGC Project Manager Reza Forouzesh said the phases are expected to come online by mid-October. He said that the first desalting train of the refinery was launched in 2013. Production from Phases 15 & 16 of the offshore South Pars, jointly operated by Iran and Qatar, is forecast to reach 1.7 billion cubic feet per day (Bcf/d) in a month. The two phases are currently producing 1.0946 million cubic feet per day (MMcf/d) or 31 thousand cubic meters per day (Mcm/d) of gas, he said. (www.rigzone.com)

PPL finds gas, condensate at Kabir X-1 well in Gambat South block in Sindh

August 19, 2015. Pakistan Petroleum Ltd. (PPL) made a petroleum discovery at Kabir X-1 exploration well in the Gambat South exploration license in Sanghar district in Pakistan's Sindh province. The company, which has a 65 percent working interest in Gambat South block, drilled the Kabir X-1 well, to test the hydrocarbon potential of the Lower Goru and Sembar formations. Kabir X-1 well is the seventh discovery made by Pakistan Petroleum in the Gambar South. In December, Pakistan Petroleum reported a gas and condensate discovery at the Faiz X-1 exploration well in the same block. (www.rigzone.com)

Transportation / Trade……….

Jemena weighs bid for $720 mn EnergyAustralia gas plant

August 25, 2015. Jemena Ltd., the energy distributor controlled by State Grid Corp. of China, is weighing a final bid for EnergyAustralia Pty’s Iona gas storage plant. Jemena is looking for opportunities to expand its business and is examining the Iona facility, as well as other options in the energy industry. The gas storage plant, which may fetch more than A$1 billion ($720 million), has also drawn interest from other suitors including Australian pipeline owner APA Group and fund manager QIC Ltd. Final bids are due around the end of next month. (www.bloomberg.com)

Putin hopes for Chinese gift as oil slump sours second gas deal

August 24, 2015. Russia’s energy pivot toward Asia faces its sternest test early next month when President Vladimir Putin visits Beijing amid slumping oil prices and concerns over China’s economic slowdown. While Gazprom PJSC said that talks over a second natural gas supply contract with China in less than 18 months are “showing good dynamics,” the Beijing government has damped Russian hopes that a deal will be signed on Putin’s two-day trip set to start on Sept. 2. Last year, Putin reached his first deal to supply gas to China from East Siberia after almost a decade of talks, marking a milestone in relations between the world’s largest energy exporter and the biggest importer. The accord followed a deterioration of Russia’s relations with the U.S. and Europe over the conflict in Ukraine. In November, Russia and China signed a framework agreement for a second 30-year gas contract, which would involve building a pipeline from West Siberia. It would deliver as much as 30 billion cubic meters of gas a year, adding to the 38 billion cubic meters from the first contract and making China Gazprom’s largest customer. (www.bloomberg.com)

Shell lifts force majeure on gas supplies to Nigeria's NLNG

August 21, 2015. Shell said that its Nigerian joint venture lifted its force majeure on natural gas supplies to the Nigeria Liquefied Natural Gas Co (NLNG) after repairing a pipeline. The force majeure was put in place on Aug. 4 after the company discovered a leak on the Eastern Gas Gathering System (EGGS-1). (af.reuters.com)

Mnazi Bay gas wells deliver 1st gas to Tanzania pipeline

August 21, 2015. East Africa-focused junior producer Wentworth Resources announced the first gas delivery from its Mnazi Bay Concession in southern Tanzania to the country's new transnational pipeline. Wentworth said that two wells are now producing, with the three remaining wells expected to be put on production in the coming months. Initial production volumes will be used for commissioning purposes and to fill the pipeline, with production rates expected to increase to 70 million cubic feet per day by October this year and 80 MMcf/d by the end of 2015. Wentworth said that the Mnazi Bay joint venture partners have agreed payment security terms with Tanzania Petroleum Development Corporation, the buyer of the gas, and various other parties. (www.rigzone.com)

Sinopec buys Kazakhstan oil assets from Lukoil for $1 bn

August 20, 2015. China Petroleum & Chemical Corp. completed the purchase of a 50 percent stake in a Kazakh oil producer from Lukoil PJSC for $1.09 billion, gaining full control of a venture with stakes in five oil and gas fields. The sale of Caspian Investments Resources Ltd. received the required permits from the state authorities of the Kazakhstan in late July, Lukoil said. The deal concluded after more than a year of talks and the price is less than the $1.2 billion agreed on in April 2014. State-owned Sinopec, as the Chinese producer is known, signed the initial accord with Lukoil as the government in Beijing pushed to diversify energy assets abroad to meet rising demand at home. Sinopec and its parent company already own the other half of Caspian Investments Resources, which holds stakes in fields with more than 200 million barrels of proved oil and gas reserves, according to a Moody’s Corp. report published when the deal was announced last year. The Chinese joint venture bought its stake in Caspian Investments Resources in 2010. (www.bloomberg.com)

Kazakh gas pipeline operator gets $2.5 bn loan from Chinese banks

August 19, 2015. Kazakhstan's gas pipeline monopoly KazTransGas has signed an agreement with a group of Chinese banks for a syndicated loan worth a total of $2.5 billion to help fund a natural gas project, the company said. The loan, to be repaid in 2028, was arranged by China Development Bank Corp and Bank of China, KazTransGas said. The funds will be used to complete construction of the Beineu-Bozoi-Shymkent pipeline in southern Kazakhstan, the first stretch of which was built in September 2013. This pipeline is part of a network carrying gas from post-Soviet central Asia, mainly from Turkmenistan, to China. (www.reuters.com)

Policy / Performance…………

Norway's Oil Minister says crude price at $40 can't last

August 25, 2015. Crude at $40 a barrel is unsustainable and prices will have to rise as supply drops out of the market, according to Norway’s Oil Minister. Falling investments combined with a slump in oil prices are proving painful for Norway’s economy, with almost half its exports related to petroleum. Crude producers and service companies such as state-controlled Statoil ASA have cut more than 20,000 jobs, sending ripples through an economy where one in nine jobs depends on oil. Brent crude has slumped more than 56 percent over the past 12 months to the lowest level since 2009 on signs a global oversupply will persist. Leading members of the Organization of Petroleum Exporting Countries (OPEC) are sustaining production while U.S. stockpiles are almost 100 million barrels above the five-year seasonal average. The government, which has pledged to support the economy with stimulus, is unlikely to come with any special measures for the oil industry. (www.bloomberg.com)

Iraqi Oil Minister says $9 bn in arrears paid to foreign oil companies

August 25, 2015. Iraq's Oil Minister Adel Abdel Mehdi said his country had paid foreign oil companies $9 billion in remaining arrears for 2014 and was paying 2015 arrears in stages until the beginning of 2016. Adel Abdel Mehdi said that the ministry would study with foreign oil companies ways to reduce costs and link them to oil prices. Service contracts with Western oil companies are currently based on a fixed dollar fee for additional volumes produced, meaning that with the drop in oil prices over the past year, the amount of crude needed to pay the companies has roughly doubled. (in.reuters.com)

Norway approves Statoil's giant Johan Sverdrup oil project

August 24, 2015. The Norwegian Ministry of Petroleum and Energy has approved Statoil's plan for development and operation (PDO) for Johan Sverdrup oil field - phase one on the Utsira High in the North Sea. The Johan Sverdrup oil field is planned to be developed in several phases. The development of phase-1 has an expected production capacity in the range of 315,000 - 380,000 bbl/d with first oil planned to be produced for late 2019. The second phase is scheduled for 2022. Full production is estimated at 550,000 - 650,000 bbl/d. Statoil and its partners aim at a recovery rate of 70%. The capital expenditures for Phase-1 are estimated at NOK 117bn (€13.4 bn) and the expected recoverable resources are projected at between 1.4-2.4 Gboe. For the full field development, capital expenditures are estimated at some NOK 170-220bn (€19.5-25.3 bn) with recoverable resources of between 1.7-3.0 Gboe over 50 years. (www.enerdata.net)

Kuwait says oil rout heightens need for domestic investments

August 24, 2015. OPEC member Kuwait said the global plunge in oil and financial markets heightens the need for the country to press ahead with investment spending and diversify revenue sources. Finance Minister Anas Al-Saleh briefed the cabinet on the market turmoil. The plunge in oil prices has sent stock markets in the six-nation Gulf Cooperation Council, which includes Kuwait and Saudi Arabia, tumbling. The government has cut spending on energy subsidies and officials have repeatedly said that other forms of handouts to citizens were unsustainable. The fourth-largest producer in OPEC, Kuwait pumps about 2.8 million barrels of oil per day and oil income has contributed to more than 90 percent of public revenues. (www.bloomberg.com)

Iran plans ‘any cost’ oil output rise to defend market share

August 23, 2015. Iran plans to raise oil production “at any cost” to defend the country’s market share and backs calls for an emergency OPEC meeting to help shore up crude prices. Iran had the second-biggest output in the Organization of Petroleum Exporting Countries (OPEC) before U.S.-led sanctions banning the purchase, transport, finance and insuring of its crude began July 2012. Oil producers such as BP Plc and Royal Dutch Shell Plc have expressed interest in developing the country’s reserves, the world’s fourth-biggest, once sanctions are removed. Iran backed calls for an emergency OPEC meeting to be held earlier than the oil producing group’s next session on Dec. 4. OPEC is pumping at near record levels, even amid a global glut of crude. Algeria wrote to others in the 12-member group saying they should consider measures for reviving oil prices and stabilizing the market. (www.bloomberg.com)

Average US gas price steady over past two weeks

August 23, 2015. The average price of a gallon of gasoline in the United States remained steady in the past two weeks, as price rises in several Midwest cities offset cuts in the West, according to the Lundberg survey. Regular grade gasoline dropped just one-third of a cent to average $2.71 per gallon, according to the survey. While a rebound in gasoline supply has helped lower prices in California, motorists elsewhere in the country reeled from increases as the largest crude distillation unit of BP PLC's Whiting, Indiana refinery remained closed for repairs. The average price of gasoline is down 77 cents a gallon from the same year-ago period, according to the survey. Lundberg said the lower U.S. crude price may cause refiners and gasoline retailers to slash selling prices - spoiling their currently wide margins - as they try to gain a leg up on their competition. (www.reuters.com)

Australia approves Woodside's Browse LNG project

August 21, 2015. The Federal Department of Environment of Australia has granted its approval to Woodside's Browse gas liquefaction project in the Browse basin in Western Australia. The approvals (granted until 2070) include 26 conditions and requirements to minimise impacts on the Scott Reef. The project has been approved for up to three floating LNG (FLNG) vessels with a capacity of 3.9-4 Mt/year each. Woodside will make a final investment decision by the end of 2016. The company initially planned to develop a 12 Mt/year onshore LNG terminal but that project was cancelled in April 2013 due to cost escalations. (www.enerdata.net)

Mexico wraps $1.1 bn oil options hedge to lock in $49 floor

August 20, 2015. Mexico has concluded its vast oil hedging program for next year, paying more than $1 billion to guarantee it will get at least $49 a barrel for about half of its exported crude in 2016. Mexico's finance ministry said it had bought options based on Maya and Brent crude oil prices that will cover 212 million barrels of oil, at a cost of $1.09 billion. The program, a longstanding part of the country's strategy for safeguarding oil revenues from market volatility, the ministry said, suggesting it had purchased most of the options as oil prices entered a second deep slump. In its hedge program for 2015, Mexico ensured an average oil price of $76.40 per barrel, covering 228 mn barrels of crude oil at a cost of $773 million. Mexico has long been one of the few major oil producing nations that uses derivative markets to hedge, a policy that paid off handsomely after the 2008 oil price crash and has also helped protect this year's budget revenues. Oil sales have traditionally made up about a third of Mexico's budget. The current price of crude oil is $38.15 per barrel, the ministry said, significantly below the $79 per barrel that the government had estimated for its 2015 budget. Mexico, the world's 10th biggest crude producer, pumps about 2.3 million barrels per day (bpd) and exports around half of that. The 2016 hedge is equivalent to around 580,000 bpd. Mexico announced that it would cut 2016 spending by 4.3 percent because of lower crude production and a drop in oil prices. The finance ministry said that Mexico will need to make additional cuts to the 2016 budget amid lower crude output. (www.reuters.com)

Feels like 1986: Oil on track for longest weekly losing streak in 29 yrs

August 20, 2015. Oil prices resumed their downward trend pulled lower by weaker global stock markets and a sharp contraction in China's manufacturing activity, with the U.S. benchmark on track for its longest weekly losing streak since 1986. Activity in China's factory sector shrank at its fastest pace in almost 6-1/2 years in August as domestic and export demand dwindled, adding to worries about lower demand for crude in the world's second biggest oil consumer. Key oil benchmarks were trading near 6-1/2 year lows, with the U.S benchmark headed for its eighth straight weekly decline, the longest weekly losing streak since 1986. In late 1985, oil prices slumped to $10 from around $30 over five months as OPEC raised output to regain market share following an increase in non-OPEC production. Despite the rout in oil prices, some mutual funds keep plowing money into oil exploration and production companies in the United States in a bet that production will retreat sharply over the next 12 months, setting the stage for a rebound towards $65-70 per barrel. (www.reuters.com)

Algeria oil, gas export volumes down 8.9 percent in Q1

August 19, 2015. Algeria's oil and gas export volumes are continuing to decline, dropping 8.9 percent in the first quarter of 2015 from a year earlier, weakened by stagnant output and a sharp rise in domestic demand, the energy ministry said. The trend adds to problems Algeria is facing from a fall in global oil prices that has already cut into the North African OPEC member's state finances. Algeria's government expects energy earnings, which make up 60 percent of its budget, will drop by 50 percent to $34 billion this year, mainly due to the slide in global crude prices. Overall oil and gas exports reached 23.4 million tonnes of oil equivalent in the first three months of 2015, a decrease of 8.9 percent from a year earlier, the energy ministry said. Algeria's National Statistics Bureau said natural gas exports dropped 17 percent to 27.44 billion cubic metres last year, while crude oil and condensate volumes fell 16 percent to 28.355 million tonnes in 2014. (af.reuters.com)

UK to offer licenses for 27 onshore O&G blocks

August 19, 2015. The UK Oil & Gas Authority (OGA) is preparing to award 27 licenses to companies, to explore for potential oil and gas, as part of the 14th onshore oil and gas (O&G) licensing round. Selected firms include IGas Energy, Cirque Energy (UK), Ineos Upstream, Cuadrilla Resources, Egdon Resources UK, Hutton Energy, Aurora Energy Resources, Blackland Park Exploration, GDF Suez E&P UK, Osprey Petroleum and Warwick Energy Exploration. The decision comes after the government unveiled plans to fast-track applications for shale gas. Launched on 28 July 2014, the first round of the 14th licensing round received bids from 47 companies for areas covering 295 ordnance survey blocks. Upon finalization of terms and conditions, the selected firms will receive licenses for their respective blocks offered. The oil and gas regulator is planning to complete environmental assessment prior to allocating a further 132 blocks under the second round, later this year. The second round will covers parts of north-west England, North Yorkshire, Lincolnshire, Dorset and the Isle of Wight. The UK shale gas industry is expected to attract investments worth around £33bn, which will support the region with 64,000 jobs, UK Energy Minister Lord Bourne said. In July, the UK Government proposed new regulations for underground shale fracking in protected areas. (explorationanddevelopment.energy-business-review.com)

[INTERNATIONAL: POWER]

Generation……………

NERC raises hope of 6 GW power generation this year

August 25, 2015. Nigeria Electricity Regulatory Commission (NERC) has raised hope that the nation can witness the generation of over 6,000 MW by the end of this year. NERC said that the meeting would provide the opportunity to present the performance management officials a template designed by NERC in collaboration with a consultant. NERC lamented that the electricity market would have been generating about 9000 MW if all the National Integrated Power Projects (NIPPs) were completed and the capacities of existing electricity generation companies recovered. (worldstagegroup.com)

Denham and Nexif Energy to jointly invest in Southeast Asia power projects

August 25, 2015. Global energy-focused private equity firm Denham Capital and Singapore-based independent power management company Nexif have partnered to form a new south-east Asia power investment platform. Supported by $200 mn financing from Denham Capital, the entity will initially focus on power generation projects in south-east Asia and Bangladesh and significantly expand operations across other regional markets in the future. The platform will develop, finance, construct and acquire conventional and renewable power generation projects across Asia. Nexif is an independent power management firm that has developed, financed, constructed or exited more than 4 GW of projects, worth around $4.3 bn, across Asia, Australia and the Middle East. (biofuelsandbiomass.energy-business-review.com)

New $600 mn power plant to be built in Woodbridge

August 24, 2015. PSEG will spend $600 million to build a state-of-the art power plant in Sewaren, creating hundreds of jobs and supplying electricity to about 500,000 New Jersey homes, the power company announced. PSEG said workers will tear down a generations-old power plant after buil the new plant at 751 Cliff Road. The 540 MW plant will use combined-cycle technology, producing electricity and capturing waste from the gas turbine to increase efficiency and output, PSEG said. Construction will begin in early 2016 and the plant will go online in the summer of 2018, PSEG said. The company said that the power plant is a major investment in the local economy and should bring significant tax revenue and other economic benefits to the area. (www.nj.com)

China to build $10 bn nuclear plant in Pakistan

August 20, 2015. Prime Minister Nawaz Sharif inaugurated construction work on a China-backed $10 billion nuclear power plant near Karachi to add 1,100 MW to the energy-starved country's electric grid. The Karachi Nuclear Power Plant II (Kanupp II) or K-2 with the capacity to produce 1,100 MW electricity is being built with the assistance of China, which has become the biggest investor in energy and infrastructure projects in Pakistan. The groundbreaking of K-2 and K-3 power plants was performed by the Prime Minister in November last year. He also congratulated the Pakistan Atomic Energy Commission on the timely start of the project after its foundation was laid in November 2013. The start of work on Kanupp II will pave the way for the construction of Kanupp III, also with a planned capacity to produce 1,100 MW, to be built with Chinese help. (www.ndtv.com)

TEPCO and Mitsubishi partnering on Fukushima coal-fired plants

August 19, 2015. Tokyo Electric Power Co. (TEPCO) will work with Mitsubishi Heavy Industries Ltd. and a group of other companies to bolster the development of coal-fired power projects with emissions-reducing technology slated for Fukushima, site of the 2011 nuclear disaster.

Mitsubishi Heavy, Mitsubishi Corp., Mitsubishi Electric Corp., and Joban Joint Power Co. will join TEPCO to promote the development of two 540 MW units, the companies said. One unit will be set up at TEPCO’s Hirono station, with the other located at the Nakoso power plant operated by Joban. The new generators will use a process called integrated coal gasification combined cycle. The Nakoso station already has one IGCC generator, which has capacity of 250 MW. The five companies are aiming to start operating the plants in the early 2020’s. (www.bloomberg.com)

ScottishPower to decommission 2.4 GW Longannet power plant in March 2016

August 19, 2015. ScottishPower has announced plans to decommission the 2,400 MW Longannet coal fired power plant located in Fife, Scotland, on 31 March 2016. The decision to close the power station after 46 years of its operations life comes as the company failed to secure approval from the National Grid for the grid balancing services contract. The company plans to continue to invest around £8bn primarily in renewables and networks, over the next five years in the UK, including £1.3bn this year. (fossilfuel.energy-business-review.co)

Transmission / Distribution / Trade…

CFE selects builder for power transmission project

August 24, 2015. The Mexican national power utility, Federal Electricity Commission (CFE), has selected the winner of the tender process for the construction of a 426-km-long electricity transmission project in the north-western state of Sonora. The winner is a consortium of companies led by Exclusive High Tech, and including Castco of Mexico, DINA Camiones, Obras Especializadas del Pacífico, Construcciones y Adaptaciones, and Actividades de Construccion y Servicios El Roble. The consortium will build seven transmission lines of 400 kV and 230 kV which will connect the future Empalme-1 CCGT power plant to the existing grid. Construction is expected to take 24 months and the project is scheduled to be commissioned in August 2017. (www.enerdata.net)

Power plant payments jump as PJM seeks to avoid grid blackouts

August 24, 2015. The largest U.S. grid will boost payments to electricity suppliers by 37 percent to avoid blackouts from heat waves or cold snaps. PJM Interconnection LLC said that payments to generators for the year starting June 2018 will be $164.77 a megawatt per day, based on results of a capacity auction held. That’s up from $120 for the previous 12 months reached in an auction last year and the highest in eight years. The payments rose after federal regulators approved a plan allowing PJM to penalize generators that fail to supply the power they’d promised. The rules are aimed at preventing a repeat of the unplanned plant shutdowns and fuel shortages that sent prices soaring during the frigid winter of 2014. Under the new rules the grid operator can impose penalties of about $2,800 per megawatt-hour on generators that fail to deliver promised megawatts during emergency hours, Goldman Sachs Group Inc. said. Suppliers that are exempt from the rules because of physical limitations that keep them from meeting the performance standards, representing about 20 percent of the supplies in the auction, saw capacity payments clear at $149.98. The cost of securing the supply commitments rose to $10.9 billion from $7.5 billion in last year’s auction. The grid manager secured 166,837 MW of power supplies in the auction, down from 167,004 MW in last year’s auction, in part because the grid operator cut its demand forecast. The grid’s reserve margin, or supply in excess of projected needs, widened to 19.8 percent from 19.7 percent in last year’s auction, higher than the target of 15.7 percent. New power plants accounted for 2,919 MW, comprised mostly of natural gas-fired generation, falling short of last year’s 5,927 MW, PJM said. (www.bloomberg.com)

Ichor Coal offers to buy remaining stake in Universal Coal

August 21, 2015. Ichor Coal is planning to acquire all of the shares in Universal Coal for A$80mn ($58.6 mn) in an all cash transaction. Ichor Coal presently has 400 million tons of coal on 16 properties, and the company plans to increase its current production of around 2.1 million tons per annum to 15 million tons per annum by 2017. (coal.energy-business-review.com)

Policy / Performance…………

Nigeria gets World Bank guarantee for 450 MW power plant