-

CENTRES

Progammes & Centres

Location

[Will Solar Energy defy Marx and yield to Musk using Moore?]

“The western world that has completed the process of industrialisation using dependable and mobile fossil fuels has moved up the hierarchy of characteristics that it wants in its energy sources. Energy sources now have to be ‘clean and green’ apart from being ‘urban, mobile and completely under the control of man’. The pursuit of ‘clean and green’ values in energy sources takes us back to energy sources such as wind and sun that were dismissed by Marx as ‘uncontrollable and undependable’…”

Energy News

[GOOD]

Oil companies from the Middle East hiring oil storage in India is commercially more attractive than strategic storage!

India’s mega power plants are grinding to a halt because no one thought about load development!

[UGLY]

Why build solar plants if coal power is needed to subsidise them?

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Will Solar Energy defy Marx and yield to Musk using Moore? (Part I)

ANALYSIS / ISSUES…………

· India’s Leadership Challenge in the Climate Negotiations

DATA INSIGHT………………

· State-wise Per Capita Electricity Consumption

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC acquires 15 percent in 2nd-largest oil field in Russia for US$1.3 bn

· RIL successfully tests presence of natural gas in contentious discoveries

· ONGC counts benefits of crude oil's drop

· Not exploring shale gas, ONGC promises TN farmers

Downstream……………………………

· Netoil starts due diligence to acquire NORL

· NRL eyes expansion after stellar show

· Essar Oil to more than triple petrol pump count to 5k

· National oil companies in Middle East keen to hire storage in India

Transportation / Trade………………

· IGL takes to marketing aiming to add 3 lakh households in FY16

· India's Iran oil imports fall to five-month low in August

Policy / Performance…………………

· O&G auction policy shifts risks to developers: India Ratings

· Govt floats proposal to appoint consultant for oil CPSEs

· Govt to auction small oil fields to private companies

[NATIONAL: POWER]

Generation………………

· Kudankulam Unit-I maintenance work to be completed this month

· India's mega power projects grind to a slow halt

Transmission / Distribution / Trade……

· JSW Energy set to buy Jaiprakash Power thermal power plant

· BSES discoms sells 16 lakh LED bulbs

· Gangavaram Port sets a record on steam coal handling

· KSEB buys power from NTPC unit

· Haryana discoms losses shoot up to ` 293.6 bn in FY15

· Adani loses key customer for Carmichael mine in Australia

· Strike would not impact coal production: Goyal

Policy / Performance…………………

· 11 hydropower projects can be executed in Tawang basin: Govt

· Odisha to seek Baitarani West coal block for OTPCL

· HP govt approves refund of ` 2.8 bn to Adani Power

· 2nd auction on subsidy to gas-based power projects on Sep 15

· Power to all households of Odisha in 18 months: Goyal

· Railway infrastructure upgrade needed for more coal from Talcher: Goyal

· India pushes for early implementation of nuke deal with Australia

· CIL to hire retired govt officials to increase production

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· CNPC adds 163 bcm of shale gas reserves in the Sichuan basin

· Woodside Petroleum seeks to acquire Oil Search for $8 bn

· Lekoil achieves first oil from Otakikpo in Niger Delta

· Sahara plans to dual list O&G unit in London, Lagos

· Rosneft and Japan Drilling partner to drill offshore exploration wells in Vietnam

· YPF, Gazprom sign pact to develop gas projects in Argentina

· Inpex submits revised plan for Abadi FLNG project in Indonesia to triple production

· Statoil hits oil in northern North Sea

· PPL makes gas, condensate find in Hala Block in Pakistan's Sindh province

· ConocoPhillips begins production at Surmont 2 oil sands facility in Canada

· Atlantic Petroleum continues to increase production

Downstream……………………

· European oil refiners' good times are not over yet

· Total Port Arthur refinery operating at 50 percent capacity

Transportation / Trade…………

· Asia's slowing economies and oversupply weigh on oil markets

· Nigeria's state oil company to receive military help to curb oil theft

· Iran hopes to export gas to EU through Spain

· Gazprom, European partners sign Nord Stream-2 deal

· China's CNOOC launches 1st ever LNG sell tender as oversupply grows

· Canada oil industry says price drop makes new pipelines essential

· Egypt picks winners in tender for 4 LNG cargoes via Jordan

Policy / Performance………………

· Indonesia approves $3.6 bn investments in 18 oil, gas projects

· Israel approves pipeline for exporting natural gas to Jordan

· Genel Energy receives $16.5 mn from KRG

· Gas policy vacuum endangers Israel power flow: IEC

· Thailand to raise retail NGV prices to reflect costs

· Defiant Netanyahu withdraws vote on gas plan lacking support

· Norway approves Wintershall's Maria oil field development

· Russia bows to cheap oil as Putin aide sees $50 price for budget

· China's gas-demand growth rate below GDP hinders Russian deals

· Bulgaria proposes O&G projects cooperation to Azerbaijan

· Mozambique govt allows development of Rovuma Area-1 gas field

[INTERNATIONAL: POWER]

Generation…………………

· Iran’s 2nd power plant construction by March

· Dalia Power commissions 835 MW Haruvit combined-cycle power plant in Israel

· Bangladesh launches 1.2 GW coal-fired power plant project

· Iran's first pumped-storage hydroelectric power plant comes on stream

· UK's coal-fired Eggborough power plant may close in March 2016

Transmission / Distribution / Trade……

· Alstom delivers e-terramarket software to support single European electricity market

Policy / Performance………………

· China to build new nuclear reactor in UK

· California Assembly passes coal divestment bill

· South Africa looks to gas power generation to ease electricity crunch

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· 'Need to lower capital cost for renewable energy projects'

· PM Modi tells coal power plants to subsidize solar

· Gujarat to run battery operated buses between Ahmedabad and Gandhinagar

· NTPC nod to use recycled waste water for power plants: Maharashtra CM

· Govt calls for utilising rooftop space for solar projects

· Solar power plant inaugurated at VOC Port

· ABB surpasses 2 GW solar inverter milestone in India

· Adani Group keen on setting up 1 GW solar plant

· Ujaas Energy gains on ` 880 mn contract from Oil India

· Govt has equal focus on all renewable power sources: Goyal

GLOBAL………………

· French President sees risk of failure in global climate deal

· Net metering law comes into effect in Pakistan for solar up to 1 MW

· Finland to get less wind power as govt overhauls subsidies

· Canadian Solar to build 185 MW of solar power projects in Brazil

· Israel will review support schemes for PV

· Harvard seen forgoing $108 mn a year divesting fossil fuels

· Tri-State to purchase power from juwi’s 30 MW Solar power plant in US

· International efforts to cut carbon pollution won't be enough

· Drax, Infinis challenge UK move on tax status for renewables

· Indonesia pledges to cut carbon emissions 29 percent by 2030

[WEEK IN REVIEW]

COMMENTS………………

Will Solar Energy defy Marx and yield to Musk using Moore? (Part I)

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

N |

ot many will associate Karl Marx with energy but a close reading of his ‘Capital: A Critique of Political Economy’ that was first published in 1867 shows that Marx understood energy better than many do today. He observed that the energy sources powering industrialisation had to be ‘dependable, urban and completely under the control of man’. Dismissing the ‘horse’ as the worst form of energy he observed that the horse had a head of its own, was costly to maintain and was limited in factory applications’. He also dismissed wind because it was ‘inconsistent and uncontrollable’. He had more charitable views on the kinetic energy of flowing water but he noted that ‘it could not be controlled at will, failed at certain seasons and was essentially local’. Marx’s vote was for coal (with water in the steam turbine of Watt) which he said was ‘entirely under the control of man, mobile and a means of locomotion, and also urban unlike wind and water that were scattered up and down the countryside’. Marx did not dwell on the nature of energy because his mission different (to show how capital would use energy to marginalise labour) but his observations on characteristics of energy such as ‘certainty’ ‘mobility’ and ‘controllability’ that would make certain sources of energy indispensible for industrialisation were accurate.

The western world that has completed the process of industrialisation using dependable and mobile fossil fuels has moved up the hierarchy of characteristics that it wants in its energy sources. Energy sources now have to be ‘clean and green’ apart from being ‘urban, mobile and completely under the control of man’. The pursuit of ‘clean and green’ values in energy sources takes us back to energy sources such as wind and sun that were dismissed by Marx as ‘uncontrollable and undependable’.

This brings us to Elon Musk, the CEO of Tesla Motors who is hailed as the messiah of modern energy sources. Tesla’s Powerwall battery system launched recently is expected to overcome the ‘undependable and uncontrollable’ characterises of wind and solar power and ‘fundamentally change the way the world uses energy’ as Musk put it at the launch of Powerwall in January 2015. Though the euphoria that surrounded the launch of Powerwall has subdued as many have understood that the fundamental change that Musk was talking about would come only at a cost, it has sparked the hope that the day the world will be running on solar energy is much closer than we think.

Solar energy is already urban (as opposed to being scattered up and down the countryside) because photovoltaic panels can convert sunlight into electricity from urban roof tops. The hope is that Musk’s lithium-ion battery will take care of not just the ‘uncertain and uncontrollable’ nature of solar energy but also make it mobile. Uncertain solar energy will be stored in Musk’s efficient batteries and allow people to draw energy whenever they want for whatever they want to do (use electrical appliances or move around in a vehicle) even when the sun is not shining. The question now is ‘at what cost?’

The figures available for the cost of power from Musk’s Powerwall varies but it is nowhere close to the tariff of grid based electricity. The hope is that the cost of power from solar panels and batteries will decline rapidly and out-compete grid based electricity. This brings us to Gorden Moore, co-founder of Intel who famously said in 1965 that the circuit density of semiconductors (made of high grade silicon) will double every eighteen months. Moore’s law as it has come to be known has proved to be true in the micro-chip industry. The number of transistors on a circuit has doubled almost every two years and the cost has fallen dramatically. Many of those who are betting on solar energy believe that Moore’s law is applicable to PV panels (made from solar grade silicon) and storage batteries and that dependable and controllable electricity from these systems will be cheaper than grid based electricity (derived from fossil fuels) in a matter of few years.

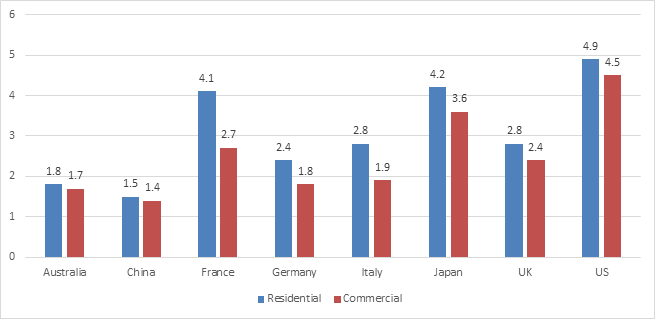

PV System Prices for 2013 (US$/W)- Selected Countries

Source: IRENA, Renewable Power Gen. Costs in 2014

Solar photovoltaic (PV) modules and the inverters required to convert the DC power output from PV systems to AC power are commodity products that are traded internationally. The price of PV modules has fallen from about $76/watt in 1977 to about $0.30/watt in 2015 according to Bloomberg new energy finance which amounts to a 13% compounded annual average fall over the 38 year period. This is nowhere near a Moore scale decline but impressive. As pointed out by a recent report on solar energy by MIT, most of the cost declines are on account of lower input material cost (solar grade silicon) and on account of increased scale of production (economies of scale), lower labour costs through manufacturing automation and lower waste from efficient processing. In other words the cost declines of PV modules are the result of production experience and not the result of better grasp of fundamental physics that is required if we want Moore’s law to work.

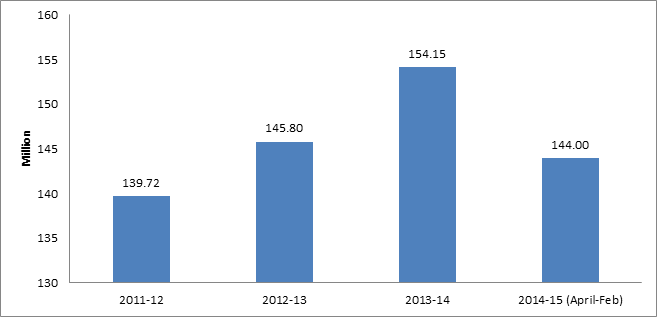

Indian Imports of Solar Panels

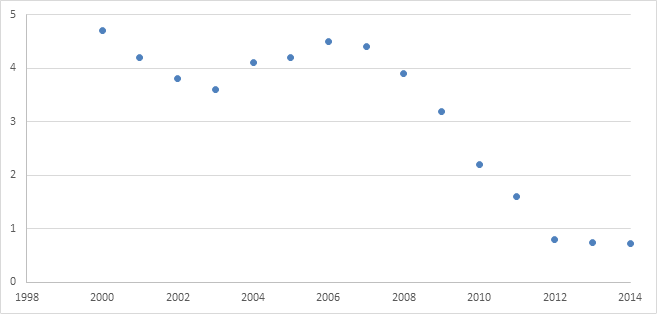

Trends in Global Average Solar PV Module (c-Si) Selling Price US$/W

Source: IEA 2014, Technology Roadmap-Solar Photovoltaic Energy.

In the last fifty years, the power of a given sized microchip has increased by a factor of over a billion but the power output of a solar panel has merely doubled. This is not because of insufficient investment in research and development of solar technology. The United States poured money into solar technology in the late 1940s when domestic reserves of oil began to decline. It increased support for research on alternative energy technologies after the oil crises of the 1970s. Though the enthusiasm for alternative energy sources generally waned when oil prices fell, ideas such as peak oil, the oil weapon (in the hands of Arab nations) etc have kept up the support for alternative energy sources. Despite this solar has not managed to make a break-through on the scale of micro-chips because of fundamental technical limitations of crystalline silicon.

to be continued.......

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

ANALYSIS / ISSUES……………

India’s Leadership Challenge in the Climate Negotiations

Mukul Sanwal*

|

T |

he just concluded tenth round of preparatory meetings at Bonn, an 83 page compilation document yet to become a negotiation text, 193 countries seeking to secure their national interest and only one more formal meeting before the Climate Summit in Paris in December has been described by the Secretary-General of the United Nations as “snail pace”. Veteran negotiations will point out that it is at the extended hours on the last day, or rather night, that trade-offs are made. The strategic issue before India is the strategy to shape those options.

The universal global deal must stress new international cooperation goals rather than the old burden sharing obligations. In 1992 the major concern was the impact of human activity on nature. The Intergovernmental Panel on Climate Change has now focused on the remaining global climate budget and stressed the importance of ethics and justice in sharing it. How best to incorporate this new element in the universal regime is the subject of the current negotiations.

The initiative to host a meeting of 107 “sunshine” countries prior to Paris to forge a common platform on exchanging experiences, sharing research and looking for common financial solutions can be the game changer. Prime Minister (PM) Modi made a proposal at the G20 meeting, in Brisbane in November 2014, to set up a global virtual centre for clean energy development and fund collaborative projects to make solar energy competitive with conventional energy, in order to manage the sustainability transformation. Too often, our discussion is reduced to an argument about emission cuts. But, we are more likely to succeed if we offer affordable solutions, not simply impose choices. Chairing the first meeting of India’s reconstituted high-level climate panel, on January 19, 2015, PM called for a paradigm shift away from focusing on emissions and cuts to reviewing what the country has done for clean energy generation, energy conservation and energy efficiency. Speaking at UNESCO in April 2015 he was more emphatic – “we are more likely to succeed if we offer affordable solutions, not simply impose choices”, and he called “for a change in lifestyle, because the emission reduction that we seek will be a natural outcome of how we live”.

Over the last 20 years the national response of all countries to climate change has evolved. The Intended Nationally Determined Contributions (INDCs) submitted so far reflect national circumstances, stages of development (or, urbanization) and capacities as well as the world-view of the respective countries. Developed countries, which have to cap emissions, have focused on absolute reductions of greenhouse gases. China has based its vision on a peaking year when it will have completed its infrastructure development and urbanisation process – 2030 – and expressed actions in terms of 60-65 percent reduction in carbon dioxide emissions per unit of GDP; 20 per cent share of non-fossil fuels in primary energy consumption; and 4.5 billion cubic metres increase in forest stock from 2005, while differentiating itself by not directly referring to emissions reductions in absolute terms. The common factor is that all countries are basing emissions reductions from the year their emissions will have peaked as a part of their growth process; the United States has chosen 2005 and China 2030.

India’s climate policy is evolving on the lines of this differentiation, based on the global carbon budget rather than on international environmental law. First, per-capita emissions of the United States are twice those of the European Union, six times those of China and thirteen times those of India; per-capita emissions should be among the central parameters in assessment and review of national actions. Second, China’s industrial production is eight times, consumption of primary energy five times, metals eleven times and GDP four times higher than India’s. Climate variability will affect India much more than China. Therefore, India, rather than be defensive on why it is not following China and capping its emissions in 2030, should take a strategic decision that it will “aim” to cap its emissions in 2050.With two-third of its population below 30 years of age India will continue to urbanize and grow till at least 2050. Third, India should not shy away from arguing that countries that have used two-third of the global carbon budget to raise levels of wellbeing cannot expect citizens of late developers to bear the burden.

India is rightly shifting the focus on use and distribution, rather than scarcity, of natural resources and must demonstrate that it is contributing its “fair” share. As urbanization spreads, and if current trends continue, three ‘basic’ human needs – housing, food, mobility – will account for 80% of resource use, 60 % of household spending, 40% of energy demand and 36% of carbon dioxide emissions, in 2050. Construction is one of the largest economic sectors; housing is the largest direct expenditure of households, automobile emissions are expected to be 50% of global emissions of greenhouse gases and current lifestyles in developed countries lead to 30% of the food being wasted at the end of the value chain.

We know that modular construction reduces building costs by 50% and energy consumption in buildings can be reduced by 60%.It has been estimated that fast-urbanizing cities in Asia could potentially reduce total global energy use in cities by more than 25% from business as usual. This is the area where India’s national contribution is rightly focusing instead of absolute emissions reduction. In an urbanized world, where three-quarter of the population are consumers, and in the middle class, decoupling economic growth from resource use requires creating new consumer choices and innovative technology will be critical.

As climate policy transitions towards integrating longer-term transformations in national policy the defining feature of the new climate regime should be recognition of renewable energy and agriculture technology innovation as global ‘public goods’ to speed this process. Securing a global consensus on sharing prosperity, or innovative technology, and not only responsibility, will be the biggest leadership challenge for India.

*Ex Director UNFCCC and author of ‘The World’s Search for Sustainable Development’, Cambridge University Press, July 2015).

Views are those of the author

Courtesy: India Environment Portal (http://www.indiaenvironmentportal.org.in/content/418392/indias-leadership-challenge-in-the-climate-negotiations/)

DATA INSIGHT……………

State-wise Per Capita Electricity Consumption

Akhilesh Sati, Observer Research Foundation

|

State/UTs |

Consumption in kWh 2014-15 (P) |

% increase/decrease |

|

Chandigarh |

1052 |

-7 |

|

Delhi |

1561 |

8 |

|

Haryana |

1909 |

8 |

|

Himachal Pradesh |

1336 |

-1 |

|

Jammu & Kashmir |

1169 |

10 |

|

Punjab |

1858 |

3 |

|

Rajasthan |

1123 |

11 |

|

Uttar Pradesh |

502 |

6 |

|

Uttarakhand |

1358 |

6 |

|

Chhattisgarh |

1719 |

7 |

|

Gujarat |

2105 |

7 |

|

Madhya Pradesh |

813 |

6 |

|

Maharashtra |

1257 |

6 |

|

Daman & Diu |

6960 |

-13 |

|

Dadra & Nagar Haveli |

13769 |

-5 |

|

Goa |

1803 |

-18 |

|

Andhra Pradesh |

1040 |

-13 |

|

Telangana |

1356 |

- |

|

Karnataka |

1211 |

3 |

|

Kerala |

672 |

4 |

|

Tamil Nadu |

1616 |

5 |

|

Puducherry |

1655 |

-2 |

|

Lakshadweep |

657 |

-1 |

|

Bihar |

203 |

27 |

|

Jharkhand |

835 |

3 |

|

Odisha |

1419 |

5 |

|

West Bengal |

647 |

6 |

|

Sikkim |

685 |

-2 |

|

Andaman- Nicobar Island |

361 |

-2 |

|

Arunachal Pradesh |

525 |

4 |

|

Assam |

314 |

12 |

|

Manipur |

295 |

11 |

|

Meghalaya |

704 |

3 |

|

Mizoram |

449 |

1 |

|

Nagaland |

311 |

20 |

|

Tripura |

303 |

-8 |

|

All India |

1010 |

6 |

P- Provisional

Source: Rajya Sabha -Unstarred Question No. 363 (Ministry of Power).

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC acquires 15 percent in 2nd-largest oil field in Russia for US$1.3 bn

September 7, 2015. Rosneft and ONGC Videsh Ltd (OVL), the foreign arm of Indian state-owned petroleum explorer Oil and Natural Gas Corporation (ONGC), signed the agreement of sale and purchase of 15% in Vankorneft. Vankorneft is a subsidiary of Rosneft established in 2004 to develop the Vankor oil and gas condensate field that is Russia's second-largest oil field. The Vankor field has recoverable reserves estimated at 476 million tonnes of oil and condensate and 173 billion cubic meters of gas. In 2014 Vankor produced 22 million tonnes of oil. The transaction will enhance OVL's presence in Russia. In 2009, the company acquired 20% in the Sakhalin-I oil and gas field in eastern Russia for US$2.1 bn. Parties intend to complete the transaction, estimated at US$1.35 bn, upon getting necessary regulatory and other approvals. (www.enerdata.net)

RIL successfully tests presence of natural gas in contentious discoveries

September 6, 2015. Reliance Industries Ltd (RIL) has successfully tested presence of natural gas in one of the two KG-D6 block natural gas discoveries which the sector regulator DGH had previously refused to recognise. RIL completed Drill Stem Test (DST) on the Dhirubhai-29 (D-29) gas discovery that established presence of hydrocarbon. A rig used to conduct the DST will be moved to the other find, D-30 in the Bay of Bengal for conducting similar test. The Directorate General of Hydrocarbons (DGH) had refused to recognise the 2007 gas discoveries of D-29, 30 and 31 in the eastern offshore KG-D6 block in absence of its prescribed conformity test, DST. RIL had done its own conformity tests but in absence of surface flow that could be established through DST, the DGH refused to recognise them and the company could not bring them to production. After protracted wrangling, the Government in April made an offer to RIL and other operators who faced similar derecognition of discoveries, to conduct DST under limited cost to retain the finds. RIL opted to do confirmatory test on two of the three contentious gas finds in the KG-D6 block and one of the two discoveries in question in NEC-25 block. It along with its partners BP plc of the UK and Canada's Niko Resources decided to relinquish discoveries D-40 in NEC-25 block off the Odisha coast and D-31 in KG D6 block. After DST on D-29 and D-30, similar test will be conducted on D-32 in block NEC-25. The cabinet committee on economic affairs (CCEA) had in April approved a policy to allow operators to develop a dozen contentious natural gas discoveries worth about ` 1 lakh crore at current prices. The new policy gives companies options to either develop the finds at their own risk or perform upstream regulator DGH-prescribed conformity tests before developing them and recouping the entire cost. The policy approved by CCEA settled long pending issue with regards to 12 discoveries in five blocks pertaining to Oil and Natural Gas Corp (six discoveries) and RIL (six discoveries). The 12 finds hold reserves of around 90 billion cubic meters of gas. The CCEA allowed companies to either relinquish the blocks or develop the discoveries after conducting DST with 50 percent cost of DST being disallowed as penalty for not conducting the test on time. (economictimes.indiatimes.com)

ONGC counts benefits of crude oil's drop

September 3, 2015. Oil and Natural Gas Corporation (ONGC) is making the most of the drop in crude oil prices by renegotiating service contracts with drillers and others. ONGC says the drop in crude oil prices has helped reduce operating expenditure for exploration in shallow waters by 30 percent. Since last August, crude oil prices are down by about 50 percent. ONGC saw a 41 percent drop in its gross realisation to $63.8 a barrel in the June quarter. On the other hand, there was a 91 percent fall in its portion of subsidy burder share, to ` 1,100 crore. This resulted in a net realisation of $58.9 a barrel from $47.2 a barrel in the same quarter last year. With the drop in crude oil prices, rig prices have come down by 30 percent. ONGC mainly uses conventional and premium rigs. The cost of conventional jack-up rigs was $80,000 a day till January 2015. It is now below $60,000 a day. (www.business-standard.com)

Not exploring shale gas, ONGC promises TN farmers

September 3, 2015. Oil and Natural Gas Corporation (ONGC) made it clear that it was not carrying out any coal bed methane (CBM) or shale gas exploration in Tamil Nadu (TN). ONGC Director, Exploration, A K Dwivedi said that exploratory efforts in Tamil Nadu have resulted in setting up of 31 oil and gas fields which were generating over 700 tonnes of oil per day and about 3.2 million cubic metres of natural gas per day. He also claimed that during the last five years, ONGC has contributed to Tamil Nadu State’s exchequer a total of ` 1,768 crore of royalty and VAT/sales tax. According to him, ONGC has been given only the task of carrying out research and development efforts for exploring and assessing the potential of shale gas in sedimentary basins. Dwivedi said exploration of shale gas can be done only after the government drafts a policy. (www.deccanherald.com)

Downstream………….

Netoil starts due diligence to acquire NORL

September 8, 2015. Singapore-based oil firm Netoil Limited has started confirmatory due diligence to acquire the entire equity capital in Nagarjuna Oil Corporation Ltd (NOCL), which is setting up a refinery of six million tonnes per annum capacity at Cuddalore, Tamil Nadu. Nagarjuna Oil Refinery Ltd (NORL) holds 46.78 percent of the equity share capital. According to NOCL, the ` 11,500-crore refinery project is the single largest private sector investment in Tamil Nadu and it has been declared an anchor unit for the proposed Petroleum Chemical and Petrochemical Investment Region in the state. The six-million tonne refinery is the first phase of a ` 25,000-crore project in which the total capacity is expected to be 12 million tonnes. The project was delayed due to damages caused by a cyclone some years ago as well as the global economic slowdown. Around 15 lenders have reportedly invested in the project. Phase-I of the project, according to the company, is expected to be around 1,25,000 barrels per stream day, and will primarily meet the growing energy needs of southern India. The project site is spread over an area of 2,100 acres, including 300 acres of greenbelt. (www.business-standard.com)

NRL eyes expansion after stellar show

September 5, 2015. Numaligarh Refinery Ltd (NRL), which generated its highest revenue in the 2014-15 fiscal, is planning to expand overall production from 3 MMTPA (million metric tonnes per annum) to 9 MMTPA. In the 2014-2015 fiscal, the company recorded a net profit of ` 718.31 crore and registered a growth of 93.57% over last year's net profit of ` 371.09 crore. The Gross Refining Margin (GRM) at $16.67 per barrel was the highest among the country's PSU refineries. The company is pursuing its ambitious refinery expansion at an estimated cost of ` 20,000 crore. (timesofindia.indiatimes.com)

Essar Oil to more than triple petrol pump count to 5k

September 5, 2015. Essar Oil Ltd plans to more than triple its petrol pumps to 5,000 by the end of next year, Chairman Prashant Ruia said. Essar currently has 1,550 petrol pumps, the highest owned by any private company, and another 1,600 are in various stages of implementation. The gradual increase of ` 0.50 per litre per month in diesel prices initiated by the previous UPA government in January 2013 and reduction in crude oil prices during the NDA regime in 2014-15 led to full de-regulation of diesel prices. Essar Oil Ltd and Reliance Industries Ltd (RIL) had together captured about 17 percent of domestic retail market for diesel and 10 percent of petrol by 2006 before heavily subsidised sales by state-run firms drove them out of business. While RIL had shut down all of its 1,432 petrol pumps around March 2008, Essar Oil continued to operate its near equal number of outputs on limited scale, mostly selling petrol. Petrol price was deregulated or linked to market price in June 2010. Essar Oil said during 2014-15, retail sales contributed 4 percent to company's revenues, against 2 percent in the previous year. Essar Oil said its sales from retail operations have grown 175 percent from 214,000 tons in 2013-14 to 590,000 tons in 2014-15. To capture higher petrol sales volumes, it is now planning to enter into mini-metro's and Tier II cities. 30 of its petrol pumps also offer Compressed Natural Gas (CNG) besides petrol and diesel, while 6 others also sell Auto Liquid Petroleum Gas (ALPG). (energy.economictimes.indiatimes.com)

National oil companies in Middle East keen to hire storage in India

September 3, 2015. National oil companies of Saudi Arabia, Iran, Kuwait and UAE have evinced interest in hiring a part of the under-construction strategic oil storages being built on the west coast but first want India to liberalise policy by allowing export of crude oil. India, which is 79 percent dependent on imports to meet its crude oil needs, recently built a 1.33 million tonne underground oil storage at Visakhapatnam in Andhra Pradesh. Caverns totalling 4 million tons at Mangalore and nearby Padur in Karnataka will be built by December to guard against crude price shocks and supply disruptions. UAE's Abu Dhabi National Oil Company (ADNOC) and Kuwait Petroleum Corp (KPC) as well as Saudi Aramco of Saudi Arabia have expressed interest in storing about 2 million tonne of crude oil in the caverns on the west coast. While the Mangalore strategic storage is at in a SEZ that allows duty free import of oil, Padur caverns are in domestic tariff area (DTA) where oil can be imported by paying applicable import duty which currently is zero. But rules currently do not permit export of crude oil from either DTA or SEZ. The Middle East national oil firms want India to amend rules so that they can store oil at the caverns and export it when they get customers or good price for it. The oil companies want to use the caverns on the west coast for commercial storage of oil which they can use to supply to refiners like Mangalore Refinery and Petrochemcials Ltd (MRPL) or to a third country. MRPL buys large quantity of crude oil from Iran and Kuwait. The storages at Visakhapatnam, Mangalore and Padur will be enough to meet nation's oil requirement of about 10 days. Visakhapatnam facility, which has already started being filled, has capacity to store 1.33 million tonnes of crude oil in underground rock caverns. Huge underground cavities, almost ten storey tall and approximately 3.3 km long are being built. The 1.5 million tonnes Mangalore facility and 2.5 million tonnes unit at Padur will be commissioned by December when a pipeline bringing crude from high-sea is completed. India join nations like the US, Japan and China that have strategic reserves. These nations use the stockpiles not only as insurance against supply disruptions but also to buy and store oil when prices are low and release them to refiners when there is a spike in global rates. (www.newindianexpress.com)

Transportation / Trade…………

IGL takes to marketing aiming to add 3 lakh households in FY16

September 7, 2015. Indraprastha Gas Limited (IGL) has unleashed an intensive marketing campaign to chase a government-set target of adding three lakh households in the current fiscal, more than half of what it has achieved in 16 years of existence, but it is up against a messy urban planning and a sluggish property market. Prime Minister Narendra Modi wants one crore households across India to have access to piped natural gas (PNG), a safer and more convenient fuel for cooking, in four years. This means almost quadrupling from the current level, leading the government to set targets for city gas distributors such as IGL. IGL — a joint venture between Bharat Petroleum Corporation Ltd (BPCL) and GAIL that operates in Delhi, Noida, Greater Noida and Ghaziabad — acquired a record one lakh households in 2014-15, expanding its domestic customer base to 5.6 lakh.

In the first five months of the current fiscal, the company added another 50,000 or so households. That leaves a staggering 250,000 households for the next seven months. The company is putting in place a technological interface that will enhance customers' convenience and satisfaction in installation and supply of piped gas with minimum offline interaction with company executives. IGL is also rapidly tying up with more suppliers of men and material for laying pipelines. The company hopes that the central government's recent efforts will succeed in convincing local governments to offer easy clearances for laying pipelines. But these steps may not be enough. The expansion of piped gas in Delhi is choked by a chaotic urban planning. Delhi has sprawling slums and so-called unauthorised colonies where it can be tremendously unsafe to take gas pipeline because of deep congestion in the streets or unventilated kitchens.

In case of a pipeline leakage, the gas must escape from the kitchen into the open or the streets must be wide enough for a fire tender to come in. Delhi may have a maximum of just 60%, or about 20 lakh, homes which can safely use piped gas. Moreover, tenants, or those with transferrable jobs prefer LPG cylinder because it can be transferred to other cities. The new well-planned apartments in Noida, Greater Noida and Ghaziabad have been the big hope for IGL but a sluggish property market means builders are either not delivering flats quickly or the ready ones aren't getting occupied easily, potentially losing revenue for the firm. (www.adageindia.in)

India's Iran oil imports fall to five-month low in August

September 4, 2015. India's oil imports from Iran slumped 27 percent to a five-month low in August from a high base last year and ahead of a planned shutdown by two refineries, according to ship tracking data and a report. Essar Oil and Mangalore Refinery and Petrochemicals Ltd (MRPL) would shut units at their refineries for about a month from mid-September, leading to lower purchases from last month. India shipped in about 198,800 barrels per day (bpd) of Iran oil in August, down 7.7 percent from July, the data showed.

Despite the drop, India is still expected to raise imports as sanctions against the OPEC country ease. Iran was India's second-biggest oil supplier in the fiscal year to March 31, 2007, but it slipped to seventh by last fiscal year as sanctions bit. India, the world's fourth-biggest oil consumer and Tehran's top client after China, bought 21 percent less Iranian oil at 214,100 bpd in the first eight months of this year, the data showed. April-August imports rose 21 percent to 266,000 bpd from a year ago. (www.reuters.com)

Policy / Performance………

O&G auction policy shifts risks to developers: India Ratings

September 7, 2015. The government's approval of the marginal fields policy (MFP) for 69 oil and gas (O&G) fields, proposing market linked prices and a revenue sharing mechanism, would shift the key risks to developers, India Ratings and Research has said. However, the policy is also likely to result in the simplification of the method to calculate the government's share, it said.

India Ratings expects the market-linked prices for such gas to be closer to the lower of the spot or term liquefied natural gas landed prices, as these would be the alternatives available with key end-user industries. Volume off-take at these prices should not pose a challenge and the gas is likely to see demand from consumers in the fertiliser, refinery and city gas sectors, the agency said. The methodology for the calculation of the government's share from the hydrocarbons produced from these marginal fields has been shifted to the percentage share of gross revenue. This is in stark contrast to the earlier production sharing contracts (PSC), which comprised two main elements—cost recovery and sharing of profits based on pre-tax investment multiple. (timesofindia.indiatimes.com)

Govt floats proposal to appoint consultant for oil CPSEs

September 4, 2015. The government has floated a proposal for appointment of a consultant to conduct a benchmark study to improve productivity, profitability, operational efficiency and future growth prospects of select midstream and downstream oil and gas sector CPSEs. The scope of work will include, but not be restricted to, identification of common key performance indicators and benchmarks used by the industry at both national and international levels. The consultant will also have to study the performance of Indian mainstream and downstream oil and gas industry, including private and public sector enterprises. (economictimes.indiatimes.com)

Govt to auction small oil fields to private companies

September 3, 2015. The government will auction 69 idle oil and gas fields of Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) to private firms on a new revenue sharing model, which will give the bidders pricing and marketing freedom. The 69 small and marginal fields, which hold 89 million tonne of oil and gas resources worth ` 70,000 crore at current rates, will be given to explorers offering the maximum revenue from hydrocarbon produced to the government. Bidders will be asked to quote the revenue they will share with the government at low and high end of the price and production band. The government will allow companies to sell oil as well as natural gas produced from these fields at market price and with no restriction on who they sell the produce to. While oil is priced at global benchmark currently, a complex international hub-based formula determines gas price, which is roughly half of the rate at which India imports gas.

Oil Minister Dharmendra Pradhan said the Cabinet approved auctioning of the fields that firms have surrendered because they were uneconomical due to the size, geography and state-set low sale prices. The new revenue sharing regime, which Pradhan hinted will also be followed in the next licensing round, will replace the PSC model where oil and gas blocks are awarded to those firms which show they will do maximum work. All their investments can then be recovered from sale of oil and gas before sharing profits with the government. This model was criticised by CAG, which said it encouraged companies to keep raising cost so as to postpone higher share of profits to the government. Asked if big international firms will show interest in the auction at a time when oil prices are at a six-year low, Pradhan said the government was targeting small companies with lean structure and sound technology. Pradhan said a bid document will be brought out in three months after which the auction process will begin.

In all, ONGC has 110 small and marginal oil and gas discoveries in the blocks or areas it got from the government on nomination basis. Of these, the firm has been allowed to retain 47 where some work has been done and the rest have to be surrendered. OIL has surrendered all of its 6 small and marginal discoveries. Of the 69 fields to be auctioned, 36 are offshore and 33 onshore. Pradhan said the Cabinet decision is expected to stimulate investment and raise domestic oil and gas production. (indianexpress.com)

[NATIONAL: POWER]

Generation……………

Kudankulam Unit-I maintenance work to be completed this month

September 3, 2015. Loading of fuel in the first unit of Kudankulam Nuclear Power Plant (KNPP), shut down since June 24 for maintenance, was being delayed 'for some reasons' and would be completed by this month end. The loading of enriched uranium fuel in the 1000 MW Russian-made reactor would be completed by this month end and power generation resume thereafter, KNPP said. The first unit has been operational commercially since December 2014. KNPP said the concrete laying for the fourth and fifth units of the KNPP would begin next year. (economictimes.indiatimes.com)

India's mega power projects grind to a slow halt

September 3, 2015. At ` 1.19 a unit, power generated from the Sasan ultra mega power project (UMPP) in Madhya Pradesh is perhaps one of the cheapest in the country. Yet, Reliance Power wants Power Finance Corporation to buy it for "breach of representation" - the de-allocation of the Chhatrasal coal block, which was linked to the project. The company has already given up the Tilaiya UMPP because of the slow pace of land acquisition by the Jharkhand government and has not made progress on the Krishnapatnam UMPP in Tamil Nadu. Tata Power's UMPP at Mundra in Gujarat, based on imported coal is in financial trouble for selling power at ` 2.26 a unit. That's not all. The Union government had to cancel the two-year long bidding process for two UMPPs in Tamil Nadu and Odisha after all private companies pulled out and government-controlled NTPC and NHPC emerged as the winning bidders. For the Tamil Nadu UMPP, Adani Power, CLP India, Jindal Steel & Power, JSW Energy, Sterlite Energy and Tata Power were in the fray, but only four of them bought the 'request for proposal' document and none decided to proceed further. NTPC submitted its bid, which wasn't opened since it was felt that at least three quotes should be available for choosing the final winner. Similarly, the Odisha UMPP saw nine interested bidders but finally only NTPC and NHPC were left as the rest pulled out, which led to the cancellation of the auction. Despite Mundra and Sasan producing 8,000 Mw of power, the inescapable inference is that the UMPP experiment, launched with much fanfare during the first tenure of the Manmohan Singh-led United Progressive Alliance government, has failed. While putting the UMPPs on hold, the government decided to come out with a fresh draft for bidding. An expert committee was set up for the purpose. According to India Ratings, the proposed changes could increase developer interest in UMPPs as they try to address the concerns of investors and lenders on the previous guidelines. These guidelines cover risk areas including fuel price variation, fixed charge quote, ownership of asset, incentives for performance, land acquisition and termination of contract. (www.business-standard.com)

Transmission / Distribution / Trade…

JSW Energy set to buy Jaiprakash Power thermal power plant

September 8, 2015. JSW Energy Ltd is set to announce it will buy a power plant in Madhya Pradesh from debt-burdened Jaiprakash Power Ventures Ltd, as it boosts power capacity. The companies could announce the early stage agreement - for the purchase of the Bina power plant, in the state of Madhya Pradesh. JSW could pay about ` 35 billion ($525 million) for the 500 MW power plant. (in.reuters.com)

BSES discoms sells 16 lakh LED bulbs

September 7, 2015. Reliance Energy-backed BSES discoms have sold 16 lakh LED or light-emitting diode bulbs in the city in the past three months as part of their campaign to promote energy conservation. According to BSES discoms, these LED bulbs will help saving of a whopping 17 million units of power per annum in the energy-starved national capital. Both BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Ltd (BYPL) had launched a scheme to sell LED bulbs to their customers at a subsidised rate in June. BSES said a 7 watt LED bulb consumes 50 percent less electricity than an equivalent CFL and 85 percent less and than an equivalent incandescent bulb. It said the highest number of LED bulbs have been distributed in the Vikaspuri (1,50,371) division in BRPL followed by Khanpur (1,18,877) and SaritaVihar (91,306) divisions. Under the special scheme, the two discoms have offered the customers the option of buying the LED bulbs through easy monthly installment also. Under the scheme, a consumer can buy 4 LED bulbs of 7 watt at a heavily subsidised price of ` 93 each. Consumers can also pay ` 10 upfront per bulb and the balance in 9 installments, chargeable in their electricity bill. Each of the LEDs is backed by the manufacturer's 3 year warranty. (economictimes.indiatimes.com)

Gangavaram Port sets a record on steam coal handling

September 7, 2015. Gangavaram Port said it has crossed a milestone by discharging a record 1,12,599 metric tonnes of steam coal from an ultra large cargo vessel in 24 hours. The private port located where discharged a record 1,12,599 metric tonnes of steam coal from 'M V Cape Jupiter' in 24 hours (spread over September 4 & 5), the company said. M V Cape Jupiter is a capesize vessel, a class of ships that are very large in size and have a capacity to carry over 1,50,000 DWT (dead weight tonnage) of cargo. This record discharge rate only reaffirms the superior infrastructure and operational efficiency available at the Gangavaram port. With the commissioning of the second mechanised coal handling terminal and three other general cargo berths, the infrastructure at the Gangavaram Port has been strengthened with a capacity to handle about 64 million metric tonnes of cargo per annum, he said in the release. It has been developed as an all-weather, deep, modern and fully mechanised port in India, capable of handling capesize vessels. (economictimes.indiatimes.com)

KSEB buys power from NTPC unit

September 6, 2015. Kerala State Electricity Board (KSEB) has been purchasing power from National Thermal Power Corporation (NTPC) unit at Kayamkulam the tide over crisis. The rate of power being sold to KSEB is ` 8.60 a unit. The State had been refraining from purchasing power from the Kayamkulam unit as the rate was said to be higher in comparison to various other suppliers in the power sector. Kerala has been approaching the NTPC as a stopgap arrangement when the demand exceeded availability. (www.thehindu.com)

Haryana discoms losses shoot up to ` 293.6 bn in FY15

September 3, 2015. The losses of power distribution companies in Haryana which stood at ` 1,360 crore in 2005, surged up to ` 29,362 crore in financial year 2014-15. Transport Minister Krishan Lal Panwar said that in order to make utilities profitable and to provide people uninterrupted 24-hour power supply, "Mhara Gaon Jagmag Gaon" scheme has been started on 83 feeders spread over 90 constituencies of the state. He said that under the new scheme, 24-hour power would be supplied in areas where line losses were 20 percent on feeders and bills are paid to the extent of 90 percent. All conductors, which are more than 50-year-old, are being replaced and old meters are being replaced without any fine, he said. Panwar said that the Haryana Power Regulatory Commission had been advising the government from time to time to increase the power tariff, but the previous government allegedly did not do so and the losses of power distribution companies kept increasing. He said that power tariff was increased by 0.6 percent in 2001-02. (thefirstmail.in)

Adani loses key customer for Carmichael mine in Australia

September 3, 2015. In a fresh setback for Indian mining giant Adani in Australia, one of its key customers Korean major LG said that it will not purchase coal from its controversial 16 billion dollar project while reports emerged that a leading bank may not fund the venture. LG had signed a letter of intent (LoI) to purchase four million tonnes of coal last year. The withdrawal of LG leaves just Korean group Posco as the only other external buyer, with a prospective 5 million tonne demand. More than half the production is earmarked for the Indian upstream company Adani Power. Meanwhile, a Fairfax report claimed that National Australia Bank (NAB) has confirmed that it had no plans to be involved in the financing arrangements for Adani's Carmichael coal mine development. (timesofindia.indiatimes.com)

Strike would not impact coal production: Goyal

September 2, 2015. Coal and Power Minister Piyush Goyal said that the nation-wide strike called would not impact coal production much and there is sufficient stock to meet any eventualities. About four lakh coal workers across the country have joined the nation-wide strike called by ten trade unions protesting against changes in labours laws and privatisation in PSUs, including Coal India. The workers joined strike at a time when the government is putting pressure on the PSU to augment production and has set an ambitious production target of one billion tonne by 2020. Coal India accounts for over 80 percent of the domestic coal production. CIL achieved an output of 192.37 million tonnes in the first five months of the current fiscal, missing its target of 196.73 million tonnes. Coal India’s output target for the current fiscal is 550 million tonnes. During the 2014-15 fiscal, the PSU missed the production target by 3 percent recording an output of 494.23 million tonnes. In January, the coal trade unions had called for a strike, but later backed off after an agreement with the government, which ruled out denationalisation of Coal India and promised to protect interests of the PSU’s employees. The government will sell ten percent stake in the PSU through a public offer, which could fetch over ` 20,000 crore to the exchequer. (www.millenniumpost.in)

Policy / Performance………….

11 hydropower projects can be executed in Tawang basin: Govt

September 8, 2015. As many as 11 hydropower projects with a total capacity of about 2,700 MW can be implemented out of the 13 planned in the Tawang river basin in Arunachal Pradesh, subject to strict environmental safeguards and mitigation measures, a government study said. However, the other two hydropower projects ‘Tsa chu-I’ and ‘Thingbu chu’ with a combined capacity of over 100 MW should not be implemented due to their possible impact on biodiversity-rich forests and mountain ecosystems, it said. The study said that 11 hydropower projects should be implemented in two phases. Of these, six projects — Nykcharong chu, Tawang-I, Tawang-II, Nyamjang chu, Jaswantgarh Stage-I and Paikangrong chu — should be implemented in the first phase (0-5 years). The rest five projects — Rho, New Melling, Mago chu, Tsa chu-I Lower and Tsa chu-II — in the second phase (5-10 years), it said. The study suggested mitigation measures to minimise the adverse impacts of 11 projects in Tawang river basin. According to the study, the projects proposed above 3200 metre elevation should not be implemented in the river basin. Under this criteria, the Tsa Chu-I project cannot be implemented as it is proposed at an elevation of 3,295 metre. Further, the projects above 2,500 metre have to follow strict environmental safeguards and adopt specific mitigation measures, subject to fulfilling of other conditions, it said. The environmental flow or e-flow of the river should be maintained by all the proposed projects — Nykcharong chu, Tawang-I, Tawang-II, Rho, Mago chu, New Melling, Tsa chu-I Lower and Tsa chu-II, it said. (www.theshillongtimes.com)

Odisha to seek Baitarani West coal block for OTPCL

September 7, 2015. The Odisha government would soon write to Coal Ministry, pressing for allocation of Baitarani West coal block in favour of its PSU Odisha Thermal Power Corporation Ltd (OTPCL). OTPCL is a 50:50 joint venture between two state run entities- Odisha Mining Corporation (OMC) and Odisha Hydro Power Corporation (OHPC). Initially, the state government had demanded allotment of Chhendipada and Chhendipada II coal blocks to OTPCL. But since these coal blocks have already been earmarked for auctions, the Coal Ministry asked the state government to seek an alternative coal block. The state government placed its demand for coal blocks before the visiting Coal minister Piyush Goyal. Being an underground coal reserve, Tentuloi block is very difficult to mine. Most of the reserve is below 900 metre depth. Even with the use of best technologies, only two million tonne of coal can be extracted from this mine annually while OTPCL's requirement for the power project is 16 million tonne per annum (mtpa). OTPCL is setting up a 2,400 MW coal-fired power plant at an estimated cost of Rs 17,000 crore. The power station has been proposed at Kamakhyanagar in Dhekanal district. The project needs 1,767.90 acres of land, including 1,074.95 acres of private land, 684.25 acres government land and 8.7 acres forest land. The power purchase agreement (PPA) for sale of entire power to be generated by the OTPCL power station has been executed with Gridco, the state owned power trading firm. (www.business-standard.com)

HP govt approves refund of ` 2.8 bn to Adani Power

September 6, 2015. Himachal Pradesh (HP) cabinet decided to refund the upfront premium of ` 280 crore in lieu of Jangi-Thopan (480 MW) and Thopan-Powari (480 MW) hydel projects to Adani Power Limited. With some ministers against the idea of returning the premium, heated arguments took place in the cabinet meeting as discussion on the issue lasted for more than one hour. Himachal Pradesh power department had even submitted a proposal to the government to forfeit ` 280 crore upfront premium paid by Brakel Corporation. In the cabinet meeting, the project was offered to Reliance Energy Limited (REL). REL has given its consent for the project and state government has already received a letter from the company to this effect. (timesofindia.indiatimes.com)

2nd auction on subsidy to gas-based power projects on Sep 15

September 6, 2015. The government will, on September 15, hold the second phase of auction to give out subsidy support to idling gas-based power plants so that they can buy expensive imported LNG. Power Ministry has invited technical bids to undertake the reverse auction of Power System Development Fund (PSDF) support to eligible gas-based power plants for a period from October 1, 2015 to March 31, 2016, as per the tender. Under the plan, liquefied natural gas (LNG) will be imported and cash-strapped state power distribution companies will be financially supported to buy electricity from them. Power plants rarely use costly imported LNG as electricity produced from the fuel would cost much more than that from a domestic coal-fuelled plant or a domestic gas-fired plant, and there would be no takers for such expensive power. In the first round, 15 projects were shortlisted through a so-called reverse e-bidding process for supply of electricity to distribution companies that was conducted by state-owned MSTC Ltd. The auction notice said technical bids will be opened on September 11. The qualified bidders will be participating in the auction on September 15 for the financial aid, the tender said. The successful bidders will be given Letter of Award on September 17. In the May auction, subsidy support helped revive a cumulative gas-based generation capacity of 10,270 MW resulting in generation of additional 5.70 billion units of electricity during June to September summer. In the first round, government provided a subsidy support of ` 843.99 crore from the Power System Development Fund to the discoms. Earlier in May, government revived 10 stranded gas-based power projects under the PSDF scheme. These plants had successfully bid through reverse e-auction process for generating 5.05 billion units of electricity which will be supplied at or below ` 4.70 per unit to the purchaser discom during the peak summer months of June 1, 2015 to September 30, 2015, the Power Ministry had earlier said. Further, this involved the government support of ` 843.99 crore from the Power System Development Fund to the discoms. The reverse e-auction for the stranded gas based plants was conducted under the newly approved scheme for utilisation of stranded gas based generation capacity. (economictimes.indiatimes.com)

Power to all households of Odisha in 18 months: Goyal

September 4, 2015. The Centre is committed to ensuring electricity supply to all in Odisha within 18 months where about 50 lakh households remain unelectrified, Power Minister Piyush Goyal said. Odisha's Energy Minister Pranab Prakash Das said, however, it is 25 lakh households and not 50 lakh that remained unelectrified in the state. Earlier in the day, Prime Minister Narendra Modi said his government was targeting to achieve 24X7 power supply across the country by 2022, noting that electricity was key for effective implementation of Digital India programme aimed at empowering the common man and ensuring transparency. Goyal said that steps are also being taken for providing electricity connection to 25,000 hamlets in the state. Central schemes like Deen Dayal Upadhayaya Gram Jyoti Yojana and Integrated Power Development Scheme (IPDS) would ensure power for all, Goyal said. The state government was supportive of rural electrification works. However, he expressed concern over the high rate of transmission and distribution loss, about 38 percent, in the state. Goyal said only 2 percent of electricity is consumed for the agricultural purpose in the state. (www.newindianexpress.com)

Railway infrastructure upgrade needed for more coal from Talcher: Goyal

September 4, 2015. Targeting evacuation of 300 million tonnes of coal per annum from Talcher in Odisha, the Centre sought the state government’s support for upgradation of railway network in the region. A special purpose vehicle (SPV) — Mahanadi Coal Railway — has been incorporated for the purpose. Noting that expansion of railway network in Talcher area is essential for development of the country, Coal and Power Minister Piyush Goyal said the state will immensely benefit from the project. The state will earn as much as ` 1,000 crore per annum after upgradation of railway network in Talcher, he said. The government has assured “full support”. Meanwhile, Mahanadi Coalfield (MCL), a subsidiary of Coal India, recently partnered with IRCON International and state-owned IDCO (Industrial Infrastructure Development Corporation) and set up Mahanadi Coal Railway to develop the rail infrastructure in the state. MCL, IRCON and IDCO will have equity ratio of 64:26:10 in the joint venture, MCL said, adding one of the foremost tasks before the new company is to develop 14 km of Angul-Balram rail link in the initial phase, which could transport 92 million tonnes (mt) of coal. In due course, this rail link will complete the Angul- Balram-Talcher-Angul loop to facilitate uni-directional movement of wagons. In the second phase, the company is expected to take up Jharsuguda-Barpali-Serdega Rail link, which will enable Basundhara Coalfield to produce 85 mt compared with its production of only 10 mt. Both the rail projects are considered very critical for MCL for achieving its higher growth potential. MCL, which in 2014-15 produced 121 mt of coal, has planned to produce 250 mt by 2019-20. Improved coal evacuation in future through this SPV will help close the gap between demand and supply of coal. (www.india.com)

India pushes for early implementation of nuke deal with Australia

September 2, 2015. India conveyed to Australia its eagerness to conclude negotiations for early implementation of the bilateral nuclear deal besides pushing for joint production of defence equipment. In her talks with Australian Defence Minister Kevin Andrews, External Affairs Minister Sushma Swaraj particularly emphasised on scope for nuclear cooperation between the two countries and said the atomic deal must be taken forward. Both Ms Swaraj and Mr Andrews also discussed first ever naval joint exercise to be held later this month at the Bay of Bengal. Ms Swaraj said India was keen on early implementation of the nuclear deal signed last year. The Australia-India Nuclear Cooperation Agreement signed in September last year will provide a framework for greater cooperation between both the countries on a broad range of nuclear-related areas, such as nuclear safety, production of radioisotopes and regulatory and technological advances in the nuclear fuel cycle. India and Australia, which has about a third of the world's recoverable uranium resources and exports nearly 7,000 tonnes of it a year, had first launched talks on uranium sales in 2012 after Canberra lifted a long-time ban on exporting the valuable yellowcake to Delhi to meet its ambitious nuclear energy programme. (www.ndtv.com)

CIL to hire retired govt officials to increase production

September 2, 2015. Coal India Ltd (CIL) has taken cues from private sector giants and hired former government employees to resolve issues of land acquisition, rail connectivity and corruption in tendering, in a move that helped it increase production by 12% in recent months. The public sector coal monopoly, often criticised for its inefficient ways of operations, has acquired huge tracts of land in few months, put rail arrangement in order and smoothened its tendering process, leading to the record production. Appointments of three retired government officials a former vigilance department official, a land expert and a railway board member as advisors were decided by the government and present Coal India chairman Sutirtha Bhattacharya even before he took charge of the PSU. The company has also made online procurement mandatory for all major purchases, resulting in huge savings. It saved nearly ` 585 crore in a single tender for procurement of explosives for the next two years, as it implemented a reverse ebidding process. Coal India annually spends about ` 1,600 crore on purchase of explosives including bulk explosives, used exclusively in opencast mines, and cartridge explosives and accessories. Its coal production has increased by 12% in the quarter ended June over the same period last fiscal. Coal India said the company towed lines of top private companies in infrastructure sectors that hire retired government officials and PSU employees for key positions. (www.coalpost.in)

[INTERNATIONAL: OIL & GAS]

Upstream……………

CNPC adds 163 bcm of shale gas reserves in the Sichuan basin

September 8, 2015. Chinese energy group CNPC has added 208 km² of new shale gas areas (well blocks Wei-202, Ning-201, and YS108 in the Sichuan basin of China) to its portfolio, corresponding to proven gas reserves of 163.5 billion cubic meters (bcm) in place and technically recoverable reserves of 41 bcm. In late August 2015, 47 wells had been put into production in the newly proved areas, producing 3.6 mcm/d of gas. (www.enerdata.net)

Woodside Petroleum seeks to acquire Oil Search for $8 bn

September 8, 2015. Australian petroleum exploration and production company Woodside Petroleum has offered to buy the Papua New Guinea-focused oil and gas company Oil Search for A$11.6 bn ($8.1 bn). Under the proposal, each shareholder of Oil Search are expected to receive 0.25 Woodside shares for every Oil Search share and will also become shareholders in the combined entity. The non-binding proposal is subject to due diligence completion by Woodside on Oil Search, execution of agreement, Woodside being satisfied that the transaction to be supported by the PNG Government as well as Oil Search granting an agreed period of exclusivity and securing stakeholders and shareholders support. Upon satisfying the conditions, the deal would be further subject to approval from Oil Search shareholders, Court and Papua New Guinea regulatory bodies. The proposal is a part of Woodside's effort to boost core assets value while leveraging its capabilities and portfolio. Oil Search selected Morgan Stanley as its financial advisers for the proposal while Woodside selected Bank of America Merrill Lynch and Gresham. (explorationanddevelopment.energy-business-review.com)

Lekoil achieves first oil from Otakikpo in Niger Delta

September 7, 2015. Lekoil announced the start of oil production from the Otakikpo Marginal Field in OML 11, which is located on the shore line in the south-eastern part of the Niger Delta. First oil flowed to surface at the Otakikpo-002 well late on September 5, 2015 with production testing being conducted over the weekend. The well flowed oil at various choke sizes for over 24 hours at a peak rate of 5,703 barrels of oil per day. The original production estimate of the well is likely to be exceeded, although further testing and analysis will be required before the company is able to provide formal guidance. (www.rigzone.com)

Sahara plans to dual list O&G unit in London, Lagos

September 7, 2015. Sahara Group, a Nigerian energy company, plans to raise as much as $1.4 billion through a dual listing of its oil and gas (O&G) unit in London and Lagos along with a debut dollar bond sale. Lagos-based Sahara, which trades crude oil and owns Nigeria’s largest power plant, wants the money to buy oil blocs in Africa’s largest producer as it seeks to ramp up production five-fold to 60,000 barrels a day. Sahara and others including Seplat Petroleum Development Co. and Shoreline Group are taking advantage of so-called indigenization laws in Nigeria’s oil industry that are meant to boost production by local companies. Those groups account for about 20 percent of Nigeria’s production of nearly 2 million barrels a day. (www.bloomberg.com)

Rosneft and Japan Drilling partner to drill offshore exploration wells in Vietnam

September 7, 2015. Rosneft Vietnam and Japan Drilling have inked an agreement for drilling offshore exploration wells in Vietnam. Under the agreed terms, the companies will use the Hakuryu-5 marine drilling rig for the exploration wells in Rosneft's projects in Vietnam. The companies will drill two wells in blocks 06.1 and 05-3/11 in the Nam Con Son basin offshore Vietnam in 2016. Rosneft said that the implementation of drilling works at both blocks simultaneously will ensure synergy between the two projects. The blocks 06.1 and 05-3/11 are 35% and 100% owned by Rosneft Vietnam respectively. Rosneft is the operator of the block 06.1, and operates as part of a production sharing contract (PSC). The PSC area comprises two gas condensate fields. The block 05-3/11 has an estimated hydrocarbon potential of 40 billion cubic meters of gas and 9 million tons of gas condensate. (explorationanddevelopment.energy-business-review.com)

YPF, Gazprom sign pact to develop gas projects in Argentina

September 4, 2015. YPF SA Chief Executive Officer Miguel Galuccio and his counterpart at Gazprom PJSC, Alexey Miller, signed an agreement to develop projects in Argentina. The agreement to develop tight and shale hydrocarbons in Argentina sets out the principles for cooperation for a final accord that could be signed in the Russian spring, Sergei Kupriyanov, Gazprom said. YPF is seeking partners to finance development of a shale formation the size of Belgium that contains at least 23 billion barrels of oil, known as Vaca Muerta. Chevron Corp. is now producing 43,000 barrels of oil equivalent a day with YPF, while Dow Chemical Corp. is developing gas in an area called El Orejano. Similar deals have been signed with Malaysia’s Petroliam Nasional Bhd. and China Petroleum & Chemical Corp. (www.bloomberg.com)

Inpex submits revised plan for Abadi FLNG project in Indonesia to triple production

September 4, 2015. Japan-based oil and gas exploration and production company Inpex is seeking approval from the Indonesian authorities to triple production capacity from the Abadi gas field in the Masela Block, Arafura Sea, Indonesia. The company has submitted a revised development plan of the Abadi LNG project to the Indonesian Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas), following discovery of additional natural gas reserves. The revised plan calls for the development of the filed using floating liquefied natural gas (FLNG) plant with capacity of 7.5 million tons per year while the initial development plan envisaged a capacity of 2.5 million tons per year. Inpex determined the presence of additional gas reserves in the field following evaluations of three appraisal wells which were drilled between June 2013 and April 2014. Inpex estimates that the field contains enough reserve to support production of 24,000 barrels of condensate per day, apart from 7.5 million tons of LNG per year, for more than 20 years. Inpex is also seeking a 20-year extension of license to operate the Masela Block until 2048, which is scheduled to expire in 2028. (transportationandstorage.energy-business-review.com)

Statoil hits oil in northern North Sea

September 4, 2015. The Norwegian Petroleum Directorate (NPD) announced that Statoil has made an oil discovery at wildcat well 30/9-27 S, located in production license 104 in the northern North Sea. Well 30/9-27 S encountered a 111 foot oil column in sandstone with moderate to good reservoir quality. Preliminary estimates of the size of the discovery range between 35 million cubic feet and 70 million cubic feet of recoverable oil equivalents, according to the NPD. (www.rigzone.com)

PPL makes gas, condensate find in Hala Block in Pakistan's Sindh province

September 3, 2015. Pakistan Petroleum Limited (PPL) reported that it has made a gas and condensate discovery at its Fazl X-1 exploration well in Block 2568-13 (Hala) in District Matiari, Sindh, Pakistan. The company, holder of a 65 percent operating stake in the Hala Block, said the hydrocarbon find at Fazl X-1 is the third discovery in the area. Fazl X-1 reached the final depth of 13,343 feet. PPL said based on wireline logs and drilling results, potential hydrocarbon bearing zones were identified in Massive Sand of Lower Goru Formation. The company's joint venture partner is Mari Petroleum Company Limited, which holds the remaining 35 percent stake in the block. (www.rigzone.com)

ConocoPhillips begins production at Surmont 2 oil sands facility in Canada

September 2, 2015. ConocoPhillips has commenced production from the Surmont 2 in-situ oil sands facility in Alberta, Canada. The company started construction on the project in 2010, which claimed to be largest single-phase steam-assisted gravity drainage (SAGD) project. ConocoPhillips Canada operates the Surmont field with 50% stake while Total E&P Canada owns the remaining 50% stake. The Surmont phase 2 project involves the expansion of the Surmont SAGD plant to boost production capacity from the existing 27,000 barrels of bitumen a day to 136,000 barrels of bitumen a day. ConocoPhillips plans to boost production at the project to about 118,000 barrels of oil per day gross capacity through 2017, bringing the combined production capacity of Surmont 1 and 2 to 150,000 barrels of oil per day. Production start up from the oil sands project follows ConocoPhillips's plan to reduce workforce by 10% to more than 500 jobs in Houston amid plunging global oil prices. (drillingandproduction.energy-business-review.com)

Atlantic Petroleum continues to increase production

September 2, 2015. Atlantic Petroleum revealed that its total production output from the Chestnut, Ettrick and Blackbird fields, located offshore UK, has increased by 9,000 barrels of oil equivalent (boe) year-on-year from August 2014 to August 2015. The company produced a net total of 48,000 boe from the three UK fields in August 2015 and the average daily production for the month reached 1,548 boe. Atlantic Petroleum announced that production for the second quarter of 2015 was 134,200 boe, compared to 106,000 boe in the first quarter of the year. The daily average output for 2Q 2015 was 1,475 boe. (www.rigzone.com)

Downstream…………

European oil refiners' good times are not over yet

September 8, 2015. A rare run of strong European refining profits will extend to the end of the year and beyond due to extensive plant maintenance, strong fuel demand and low crude oil prices, beating earlier expectations, analysts said. Integrated oil companies such as Royal Dutch Shell and Total, Europe's largest refiner, have seen refining offset heavy losses from oil production as prices more than halved since last June to around $50 a barrel. Seasonal refinery maintenance around the world is expected to average 5 million barrels per day (bpd) in September and October, around 7 percent of global refining capacity, limiting oil product supplies, according to Barclays. Although Europe's maintenance schedule this autumn is expected to be relatively low, a high number of diesel producing units totalling some 300,000 barrel per day (bpd) is planned to go down for turnaround, a fact which has supported refining margins. Several refining projects that have been cancelled or delayed in recent months such as Shell and Qatar Petroleum's Karaana petrochemicals project, also mean that less than expected new refining capacity is set to come on line in the coming years. Between 2015 and 2017, 1.2 million bpd of new refining capacity is expected to come on line around the world, mostly in the Middle East and Asia, according to UBS. (uk.reuters.com)

Total Port Arthur refinery operating at 50 percent capacity

September 7, 2015. Total SA's Port Arthur, Texas, refinery is running at about half of its 225,500 barrel per day (bpd) capacity as coker throughput is minimal following a fatal accident at the unit. Total is considering bringing in additional feedstocks to boost gasoline output while the refinery's production is reduced. Kinder Morgan said the company is working with Total to restore the refinery's production. (in.reuters.com)

Transportation / Trade……….

Asia's slowing economies and oversupply weigh on oil markets

September 8, 2015. Oil prices remained weak as the global economic outlook darkened further and cooperation between oil producing countries to curb oversupply looked unlikely. China's crude oil imports fell 13.4 percent in August to 26.59 million tonnes (6.29 million barrels per day) from the previous month, although underlying demand remains strong. Morgan Stanley said it expected prices to remain low until a global overhang in production was worked off by the fourth quarter of 2016. (www.reuters.com)

Nigeria's state oil company to receive military help to curb oil theft

September 8, 2015. Nigerian troops will provide security for the state oil company's pipelines in a bid to prevent the theft of oil, the presidency said. President Muhammadu Buhari has said about 250,000 barrels per day (bpd) of crude is stolen in Nigeria, which produces more than 2 million bpd and is Africa's biggest producer of crude. The head of the National Nigerian Petroleum Corporation (NNPC), Emmanuel Ibe Kachikwu, met armed forces chief General Gabriel Olonishakin to discuss a proposal for soldiers to provide security for the corporation's equipment and assets. The oil-rich Niger delta has been plagued by crude theft for years that has left the region heavily polluted and prompted foreign oil companies, particularly Shell, to sell onshore assets. Under Buhari's predecessor, Goodluck Jonathan, ex-delta militants who had attacked oil installations in the early 2000s were given pipeline protection contracts after an amnesty but theft has continued to grow. (www.reuters.com)

Iran hopes to export gas to EU through Spain