-

CENTRES

Progammes & Centres

Location

[Looking back to move forward]

“The reformer’s contention is that the end-use consumer should patiently wait for ‘efficiency to trickle down’ through the ‘structural layers’, in the meantime pay heavily for the inadequate and low quality power being supplied or give up the subsidy being enjoyed, whichever may be the case. That ‘top-down’ and ‘trickle down’ methods cannot work in the Indian context, even a casual observer of the country’s economy would testify. It is more so with relation to supply of electric power because this is a commodity that is constantly required in adequate quantity and good quality to pursue even basic economic activities…”

Energy News

[GOOD]

If stressed discoms can be turned around in 3 years it would change what could not be changed in 30 years!

A green tax on coal washing will incentivise use of unwashed coal!

[UGLY]

CAG report on Delhi Discoms endorses the suspicion that the private sector is only good at appropriating rents!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

ANALYSIS / ISSUES…………

· Looking back to move forward

DATA INSIGHT………………

· Subsidised & Non-subsidised Electricity Scenario in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC to invest $7 bn to develop KG-D5 O&G block offshore India

· ONGC said to seek $900 mn stake in Rosneft Vankor field

· OIL targets first LNG cargo from Mozambique block by 2020

· Iran reassures India over development rights of gas field

Transportation / Trade………………

· RIL sells 1st crude cargo on Platts Dubai

· India to clear dues worth $6.5 bn to Iran in tranches: Finance Secretary

· Cairn seeks oil swaps to get higher margins

· India, Nepal set to sign agreement for oil pipeline: Rae

· AAI in talks with oil companies to set up single entity for supplying fuel

Policy / Performance…………………

· India's fuel demand rises 5.52 percent in July y/y

· Gas prices to dip below $4.2 per unit from October 1

· DBT scheme for LPG help save ` 150 bn in a year: PM Modi

· India to benefit as oil prices fall more after China devalues Yuan

· Cairn revives demand to review cess on Rajasthan oil

[NATIONAL: POWER]

Generation………………

· GMR begins operation of 370 MW Vemagiri power plant

· Krishnapatnam project to be fully operational soon

Transmission / Distribution / Trade……

· Power Grid to commission ` 120 bn Assam-Agra line

· Discoms made money from meters: CAG

· Siemens gets to modernise power distribution in 3 states

· CIL yet to sign fuel supply pacts for 2.5 GW

· DERC shows way out of costly power pacts

· Coal auction hits troubles, 2 mines go off bidding

Policy / Performance…………………

· India plans to resume UMPP auctions in October 2015

· Green tax on coal washery projects

· CESC average Electricity tariff for 2015-16 remains flat

· India plans to sell 10 percent in coal-mining company CIL

· Odisha govt approves scheme for providing 24x7 power supply

· Stressed discoms to turn around in 3 yrs: Power Minister

· India's coal bed methane output projected to quintuple by 2017-18

· UP govt wants Centre to suspend power bundling policy

· KSEB to revise cost estimate

· India to have excess coal if govt hits fuel production target

· West Bengal plans power ombudsman for each district

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Total abandons shale gas exploration at well in Denmark

· Brazil regulator tells Shell, partners to develop two oilfields as one

· Oman’s daily oil output tops 1 mn barrels for first time

· Russia's Rosneft plans to increase oil output

· Glencore to cut $790 mn off value of oil deal last year

· Brazil Manati field holds 13.5 bn cubic meters of gas: QGEP

Downstream……………………

· South Africa needs to restructure refinery plan on weak PetroSA

· US refinery outages give European gasoline late boost

· Saipem consortium awarded $1.5 bn contract for Kuwait refinery work

Transportation / Trade…………

· Angola to ship most crude in four years to meet Asian demand

· Shell in framework LNG deal with private Chinese firm

· Strong Dubai crude oil trades skew Asia price benchmark

· Russia sales outlook worst in BRIC markets on oil, recession

· OPEC oil supply reaches three-year high

Policy / Performance………………

· Shell receives final permit for Arctic oil drilling

· Cairn agrees six-well drilling plan with Senegal

· South Africa’s ANC backs oil-law plan in economic policy review

· Total on track to start Bulgaria offshore drill in early 2016

· Canadian NEB approves Bear Head LNG's export license

· Algeria calls for non-OPEC output cut to stop oil price fall

· UAE open to meeting Indian oil demand

· Israeli ministers approve blueprint for natural gas development

· OPEC may boost oil output to record with Iran back amid glut

· Britain changes rules to fast-track shale gas permits

· Malaysia, Brunei reach agreement on overlapping blocks

[INTERNATIONAL: POWER]

Generation…………………

· Gilgel Gibe III hydropower project starts test operations

· Engie said to plan sale of over $1 bn in Asian coal plants

· ContourGlobal acquires 405 MW hydropower plant in Armenia

· Iran, Spain firms sign power generation deal

Transmission / Distribution / Trade……

· Duke Energy to launch Foothills transmission line route in October

· ABB to support substations upgrade project in Saudi Arabia

· Three Chinese consortia bid for hydropower project in Romania

Policy / Performance………………

· South Africa’s ANC voices caution on nuclear power plan

· Kuwait will invest US$10 bn in power projects

· Ghana adopts Nuclear Regulatory Bill

· Brazil's govt plans to invest US$53 bn in its power sector by 2018

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Indraprastha power station to be converted into solar plant

· Gujarat farmers to be roped in to tap solar energy

· NLC plans to set up 100 MW solar power plant

· Shell Foundation seeks partnerships in clean energy

· GIC plans to buy assets of Greenko for ` 16.5 bn

· CIAL all set to become India’s first green airport

· West Bengal asks Centre to partially fund 1 GW solar power storage system

· OMCs start bio diesel supply at select outlets

· Govt approves MoUs with France & Mongolia on renewable energy

GLOBAL………………

· Google launches Project Sunroof to calculate rooftop solar cost in US

· RWE commissions power-to-gas plant in Ibbenbüren, Germany

· Trina Solar boosts forecast as profit reaches four-year high

· SunEdison, Goldman agree to form $1 bn clean-power fund

· BrightSource plans 810 MW solar CSP project in northwest China

· JA Solar begins production of 60-cell double-glass solar modules

· US EPA to propose rules to curb methane emissions from O&G sector

· Turkey plans 2 GW wind power auction in 2016

· Egypt seeks bidders to develop 500 MW of renewable energy projects

· Florida leads multistate suit to block EPA air quality rules

· Australia plans 26-28 percent cut in CO2 emissions from 2005 levels by 2030

· SkyWolf develops integrated solar and wind turbine technology

[WEEK IN REVIEW]

ANALYSIS / ISSUES……………

Looking back to move forward

Following the article ‘Privatizing Power Sector NPAs’ that showed that efficiency in the sector has reduced with the increase in participation of the private sector, we are publishing an article written more than a decade ago by M.G. Devasahayam that highlights the futility of pushing reforms based on the assumption that growth in private sector participation will automatically translate into efficiency trickling down and will transform the sector. The recent revelations of the CAG on the partially privatised distribution companies of Delhi also show that efficiency automatically does not trickle down from the private sector.

Power Sector Reforms – Advocating an ‘End-Use Efficiency’ Approach

M.G. Devasahayam (10-07-2000)

|

W |

hen power sector reforms in India were being deliberated at the World Bank some years ago, there were two schools of thought as to the basic approach to be adopted in initiating and pursuing the reform. The issue was whether it should be ‘structural’ oriented or ‘end-use efficiency’ oriented. Managers who knew the Indian realities suggested that end-use efficiency should lead the process, supported by structural reforms. But the consultants and ‘reform specialists’ pitched in for the structural approach with end-use efficiency as an add-on. The USAID sponsored study on “The role of Planning in India’s Restructured Power Sector” and the report submitted by US consultants in mid-’96 suggested a ‘structural’ approach. The report suggested creation of ‘independent organisations’ with ‘unbundled functions’ replacing the State Electricity Boards [SEB]. These organisations would then be turned into ‘privately owned firms’ which would provide much of the growth of the power sector since “the quest for profit will motivate their activities, and they will have a greater commercial orientation than most government-owned organisations”. End-use efficiency was sought to be achieved by a ‘trickle down’ process passing through the layers of restructuring, unbundling, privatisation and tariff rationalisation.

This report spawned the ‘management model’ approach, which the Government of India, Ministry of Power got endorsed from the Chief Minister’s Conference in late 1996. Since then the five ‘structural modules’ have become the mantra and the yardstick for appraising SEB Reforms. The extent of financial and technical assistance by multilateral development banks [World Bank, Asian Development Bank] and agencies for the reform process also depends upon the rigidity with which these modules are being adopted and implemented. In recent times (keep in mind that this refers to the early 2000s even though it is true even today) even the GOI, Ministry of Power and its organisations like Power Finance Corporation have started applying this criteria by segregating States into ‘reforming’ and ‘non-reforming’ ones! The cardinal elements of a ‘structural’ approach to reforms are: dismantling and unbundling of SEBs to form several companies centered around regions or functions such as Generation, Transmission and Distribution; these unbundled organisations being turned into privately owned firms whose commercial orientation, driven by ‘quest for profit’, will bring about efficiency; fixing of tariff on cost-plus basis and its continuous upward revision every year and elimination of all subsidies to the farming and other sectors. In short, it was prescribed that the massive inefficiencies of SEBs will be removed through physical restructuring and these entities made viable and profitable by a free wheeling market mechanism.

As an ideal ‘model in theory’ this cannot be faulted. But in practice such a straitjacket approach is bound to flounder due to several fundamental flaws. To start with, if cost-plus tariff, upwardly revised every year, could be levied on all categories of consumers and subsidies eliminated across the board, then every SEB, including the ones who are terminally sick, could turn around and start earning the mandated 3% Rate of Return. There would then be no need for the elaborate reform process being pursued at the cost of several billion dollars. But unfortunately the ‘Indian Infrastructure reality’ with its enormous wastages and inefficiencies does not allow this to happen. The ongoing reform process cannot make much headway unless the core issues of inefficiencies and wastages in the system are addressed first and foremost. Continuing with the inefficiencies and wastages along with its perpetrators and benefactors could only result in the reform process being sabotaged from within.

This is precisely what is happening and the reasons are not far to seek. Power sector has four broad stakeholders, three positives and one negative. The positive ones are the majority end-use consumers meaning the public, the Government consisting of political and administrative decision-makers and the Utility employees. The negative stakeholders are the vested interests from among these three groups who are opposed to any reform in any form. Unfortunately, these vested interests, though in the minority, carry lot of clout because of their capacity to obfuscate, bully and bluff. With the positive stakeholders confused and unconvinced about the objectives of the reform and its benefits in the near and long term, it is a field day for the negative stakeholders to spread doubts about the very need for reforms.

It is said that in politics as in marketing ‘truth is not the truth, perception is the truth’. The perception of power sector reforms among the positive stakeholders today is one of breaking down institutions, spending massive amounts of money to reduce jobs, clamouring for continuous tariff hike and elimination of subsidy without any visible, tangible or perceivable benefits. World Bank experts who prepared the Haryana Reform document concede this lucidly, “the reform process will not lead to immediate results: efficiency improvements will come when the investment measures are implemented: reduction in losses and improvement in quality of supply will come when the physical system is rehabilitated and the distribution business is restructured and privatised”. In short, the reformer’s contention is that the end-use consumer should patiently wait for ‘efficiency to trickle down’ through the ‘structural layers’, in the meantime pay heavily for the inadequate and low quality power being supplied or give up the subsidy being enjoyed, whichever may be the case.

That ‘top-down’ and ‘trickle down’ methods cannot work in the Indian context, even a casual observer of the country’s economy would testify. It is more so with relation to supply of electric power because this is a commodity that is constantly required in adequate quantity and good quality to pursue even basic economic activities. The Industrialist, if he is to pay higher tariff, would demand copious, uninterrupted and high quality power here and now. The agriculturist, if he were to forgo his subsidies and pay a reasonable price, would insist on getting good quality power when he wants, where he wants and in the manner he wants it. Same applies to all categories of consumers whether commercial, residential and institutional. These end-use consumers are not willing to go on paying high tariff and give up benefits while waiting indefinitely for things to improve and ‘efficiency’ to trickle down. Any reform process that does not satisfy this basic requirement of the end-users will not be perceived in a positive manner, no matter what kind of sophisticated restructuring that are taking place.

The market driven reform measures with excessive emphasis on tariff increase and subsidy elimination that are being implemented now do not enjoy a positive perception in the public mind. As the Haryana Reform document concedes, “End-users and other stakeholders will be ready to accept the reforms and the consequences provided that they perceive real prospects for an improved situation”. But this is not happening and may not happen as long as ‘structural dismantling’ continue to lead the reform process with end-use efficiency remaining only as an ‘embellishment’ (those following power sector reforms will know that the author’s prediction has unfortunately come true). Even the Electricity Regulatory Commissions set up to moderate the reform implementation with a bias towards the end-user are being perceived more as ‘tariff commissions’. As long as public perception is not in favour of reforms in its present form, there could hardly be sufficient political will to implement the same since ‘politicians are but creatures of public opinion’. This is the true cause for the extreme reluctance by several states in pursuing reforms despite many incentives and the tardy progress even in states that had opted for reforms. The situation has come to such a pass as to provoke stringent criticism of “slow progress” in Indian power sector reforms recently by Mr. James Wolfensohn, President of World Bank, who had specifically mentioned “uneconomical running of power plants” and high “line losses” as the main reasons for the poor performance. Incidentally these two are the ‘monumental realities’ of ‘inefficiency and wastage’ in the Indian power sector that should have been confronted ‘first and foremost’.

It is not that the reform experts were not aware of these realities. To quote again from the Project Appraisal Document of the Haryana Power Sector Restructuring and Development Programme, “The implementation of the reform programme will face strong opposition. It will impinge on large and powerful vested interests. The reform measures will change the framework under which staff and Government officials have been operating: fears about employment generate opposition to change. The political opposition and vested interest groups have used and will continue to use measures like privatisation of distribution and tariff adjustments as points of contention”. Despite these apprehensions expressed at the very commencement of reforms, no worthwhile strategy was evolved to overcome these hurdles and package reforms in an efficiency oriented and consumer friendly manner so as to appeal to the ‘positive stakeholders’ who constitute the majority. This would have effectively checkmated the numerically smaller ‘negative vested-interests’. Instead, ‘structural reforms’ were pushed through using the lure of soft funding and grants from World Bank and multi-lateral agencies which the free spending, fund starved states could not resist.

Though the above apprehensions are still valid, even more so, and the reforms are facing rough weather everywhere, the reformers and reform implementers seem to be persisting in the same path. In this context it will be worthwhile to quote from the recent World Bank note ‘Meeting India’s future power needs’:

· “India is moving from a publicly owned, vertically integrated, monopolistic power system with highly distorted prices for fuels and electricity to a more liberal system with market prices, competition, a greater role for the private sector, and commercial incentives”

· “When the tariff structure is changed to reflect the economic costs of production, higher prices for electricity in the residential and agricultural sectors will dampen demand"

World Bank reformers continue to insist on agricultural consumers paying ‘economic cost’ for power obviously to bring about economic efficiency in the utilities. A necessary condition for economic efficiency is that the price of product equals its long run marginal social cost [LRMSC], which reflects the social scarcity values and also internalise the environmental costs. As per research undertaken by the Madras School of Economics for the World Research Institute, the LRMSC of electricity supplied to agriculture in India is ` 7.62 per kWh [capital cost ` 6.24 and energy cost ` 1.38]! This is due to the excessively long and inefficient T & D system with the entire attendant wastage, ‘theft and dacoity’, to quote the late Union Power Minister Rangarajan Kumaramangalam. The moot question here is “Will it ever be feasible to make farmers pay this ‘economic cost’ for electricity supplied to them when the current average price per kWh for this category across the country is only ` 0.217 which is far below even the price of ` 0.50 per kWh decided at the meeting of State Power Ministers in 1994?”

Similarly, abolition of subsidy to agriculture is easily said than done because despite being skewed, misused and badly mismanaged, agricultural subsidies have social, historical and economic roots. Indian agriculture is a combination of 3S-Subsistence, Subsidy and Surplus. Of these subsidy is the catalyst, which has lifted Indian agriculture from subsistence level to a marginally surplus situation. Despite this, agriculture is still suffering from adverse terms of trade vis a vis other sectors of the economy. The disparity ratio between farm and non farm incomes have been continuously widening leading to a skewed economy favouring the minority industrial/trading community at the expense of agriculture dependant two third of the population. Considering all aspects, the first High Powered Committee on Agricultural Policies and Programmes set up by Government of India in 1990 made the following observation:

“Besides other services, farmers also need ‘social support’ for their occupation, which is one of the hardest, yet most essential for survival of mankind. In India the services available to farmers are inadequate, inefficient, and ‘social support’ lacking and often negative in the sense of being exploitative”. This is as relevant today as it was a decade ago.

Under the circumstances a purely market driven reform policy will continue to flounder in the public and political platforms unless accompanied by tangible and perceivable efficiencies in end-use delivery of power. Besides, in a low performing and low efficiency situation, promoting reforms through a tariff-centered approach to private participation can erect barriers to improve services to low-income groups where the levels of service are already dismal. If the intention is to make utilities viable through a cost-based tariff mechanism, each consumer segment should be made to pay its LRMSC per unit i.e. EHT and continuous process industries ` 2.30; HT industries ` 2.90; LT industry ` 6.37; LT agriculture ` 7.62; LT domestic ` 5.96 and LT commercial ` 6.06. With the EHT and HT industries already paying saturation level tariff, there is not much scope for cross subsidisation since large industries would quit the grid and go captive if pressed too hard. Besides, enforcement of such warped and distorted tariff mechanism is neither feasible nor desirable from political, economic and social points of view.

So, what is the remedy? How does power sector become an asset to the economy instead of being a drag? How do power utilities become viable and vibrant? How do SEBs deliver adequate and good quality power to the various categories of consumers? And how does this core infrastructure attract investment and modern technology from far and near without depending on artificial props like escrow and counter-guarantee? The possible answer is to make mid-course corrections in the reform process and focus on areas that are in the backburner now:

· End-use Efficiency should lead the reform process with major investments directed towards the various components of Energy Efficiency. The heavily subsidised high wastage agricultural and residential sectors should be targeted to achieve major energy savings through a judicious blend of Agricultural Demand Side Management [ADSM] and Residential Energy Efficiency [REE], which can be converted into Utility cash flow.

· The market centered mindset relying on tariff increase and subsidy elimination to achieve Utility viability need to be replaced by a ‘Tariff & Subsidy Management’ approach wherein the present Indian realities will be taken into account and factored in to realise the twin objectives of utility viability and end-use efficiency.

· Restructuring of SEBs need to be redefined to ‘ring-fence’ inefficiencies and wastages and convert them into opportunities instead of liabilities. For this new organisations and mechanism should be structured around ‘revenue streams’ instead of physical entities like generation, transmission and distribution. Broadly there are three categories of consumers-high tariff paying, low tariff paying and no tariff paying. Utilities could augment their cash flow by providing value-added services to the high paying category, by rationalising the tariff for the low paying category and by effecting huge energy savings in the no paying category. By capturing and selling the energy thus saved to the high paying category, utilities could substantially augment their cash flows and become commercially and financially viable while supplying quality power to end-use consumers.

To bring this point home succinctly, let us draw on the findings of the “Andhra Pradesh Distribution Upgrade and Agricultural DSM Procurement Project”[sponsored by CIDA] and similar technical project study carried out in Haryana [sponsored by USAID] and quantify them in cash terms. These projects have established an energy saving potential of 60 to 65% by implementing ADSM projects involving four components in a specified area:

i] Conversion of low-voltage distribution system to high-voltage, single-phase supply could reduce distribution losses by roughly 65% and virtually eliminate theft of energy.

ii] Installation of automated load control equipment to continue to improve SEBs ability to control the supply of electricity in rural areas.

iii] Replacement/Upgrading, rectification and retrofitting of agricultural pumpsets could reduce pumpset electricity consumption by roughly 50%

iv] Measurement and Verification of energy savings through metering of feeders and pumpsets could quantify the energy saved for commercial review and decision-making.

In the prevailing socio-economic milieu in India any Infrastructure Reform should proceed on the twin track of structural and end-use efficiency and make real and perceivable progress on product/service delivery and quality before any major exercise is undertaken to enhance tariff or eliminate subsidies. This is particularly true of the ongoing comprehensive and high cost Reforms in the power sector where the stated objective is to make the SEBs and Utilities strong and viable enough to attract investment from far and near. The single track ‘structural route’ has failed to achieve this so far and even props like escrow have not worked since there is just not enough cash to go around. As the Chief Executive of a leading American Power Utility who is very optimistic on India said in a presentation recently, “escrow is at best a temporary comfort, not even a solution. If investment is to flow to India’s power sector the only way is to improve utility viability leading to the eventual emergence of a competitive energy market”.

End-use efficiency measures briefly described above could bring about this in the near term of 4 to 5 years. With a national average of 31.5% of total power sales supplied to agriculture there could be huge savings across the country and substantial augmentation in utility cash flow and viability. In the tariff-centered approach, even with the best of will it may not be possible to levy a tariff of more than ` 0.75 to 0.80 per kWh for agricultural consumers. But under the end-use efficiency approach the gains are much larger. More importantly this approach would be acceptable to the positive stakeholders and this can effectively counter the vested interests that will have no legs to stand. The bonus would be a boost to good water management and environmental spin-offs.

ADSM could be supplemented by an REE drive targeting the distribution transformer, load points, meter and the equipments/devices consuming electric energy. Experts feel that a well conceived and implemented REE initiative could yield about 15 to 20% energy savings and correct the power factor of consumer to 0.9 lag which will have a salutary effect on grid quality and reliability. Agriculture [31.5%] and domestic [17.5%] sectors together consume about 50% of the electricity sold in the country but the returns are very low resulting in perpetual adverse cash flow for the SEBs and Utilities. Adopting tariff increase and subsidy elimination route would take decades to make these sectors contribute positively towards utility viability. In the meantime enormous quantity of electricity generated and transported at huge cost and damage to the environment would continue to get pilfered, stolen and wasted. If this continues private investments will also dry up over a period of time since according to the American developer, “Distribution sink in India is inefficient, loss making, unaccountable, subject to political interference and into which power sector investments are disappearing. And the reform process, whose primary goal is to boost investment, is driven merely by restructuring and unbundling at the top and not integrating end-user efficiency of power delivery”.

It is time the reformers and the decision-makers took a hard look at the realities on the ground, what the reforms have achieved in relation to these realities and in what direction it is proceeding. It is time for review and change of course to end-use efficiency and put in place appropriate institutional and financial mechanism to make it possible. The sooner it is done the better. There is no place for dogmas or fixed formats. The only consideration should be the objectives and goals of reform “to enable India’s power sector to emerge as a viable, credible, vibrant and professional entity, delivering adequate, cost effective and good quality power to it’s consumers”, and how best to achieve these.

NOTE: The author, formerly of the IAS, has the experience of working in Power and Transport Utilities. He was also a Member of the High Powered Committee on Agricultural Policies and Programmes set up by Government of India in 1990 and had anchored the core chapter in the Report. An Economist by education and training, he is a keen student of India’s Power Sector Reforms and has written extensively for ‘Hindu Business Line’, ‘Hindu Survey of Indian Industry-1999’ and ‘The Tribune’ on the subject. Views are those of the author

Author can be contacted at [email protected]

For latest data, you may please refer to Data Insight given at page no. 9.

DATA INSIGHT……………

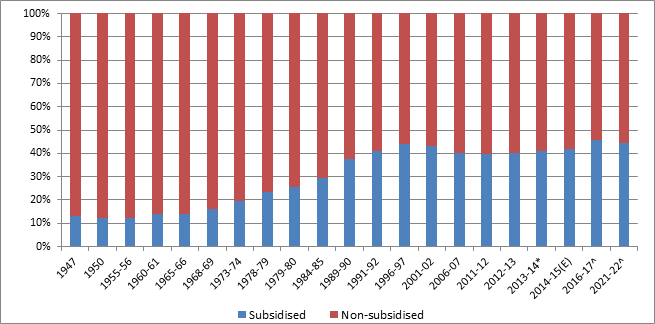

Subsidised & Non-subsidised Electricity Scenario in India

Akhilesh Sati, Observer Research Foundation

|

Five Year Plans |

Electricity Consumption in GWh (Million Unit) |

|

|

Subsidised |

Non-subsidised |

|

|

End of 1st Plan Period |

1250 |

8900 |

|

End of 2nd Plan Period |

2325 |

14479 |

|

End of 3rd Plan Period |

4247 |

26208 |

|

End of 4th Plan Period |

10955 |

44602 |

|

End of 5th Plan Period |

19604 |

64401 |

|

End of 6th Plan Period |

36467 |

88102 |

|

End of 7th Plan Period |

73633 |

121465 |

|

End of 8th Plan Period |

139286 |

176008 |

|

End of 9th Plan Period |

161367 |

213303 |

|

End of 10th Plan Period |

210025 |

315647 |

|

End of 11th Plan Period |

312064 |

473130 |

|

2012-13 (12th Plan) |

331162 |

493139 |

|

2013-14 (12th Plan) |

362628 |

518934 |

|

2014-15 (12th Plan) |

394094 |

544729 |

* - Provisional, E - Estimated, ^ - Projected

Note: Domestic & Agriculture Sector are taken as Subsidised

Industrial, Commercial, Traction etc. are taken as Non-subsidised sector

Source: Compiled from ‘Growth of Electricity Sector in India from 1947 to 2015’ by Central Electricity Authority

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC to invest $7 bn to develop KG-D5 O&G block offshore India

August 14, 2015. Oil and Natural Gas (ONGC) is planning to develop its KG-DWN-98/2 block (KG-D5) oil and gas (O&G) block in Krishna-Godavari basin off the east coast of India with an investment of up to $7 bn over the next three years. The company expects to commence gas and oil production at the block in 2018 and 2019, respectively. The company is preparing to submit the draft field development plan to the upstream regulator Directorate General of Hydrocarbons for approval. The KG-D5 block, which divided into the northern discovery area and southern discovery area, is expected to have peak oil production capacity of 77,000 barrels per day and up to 17 million cubic meters of natural gas per day. (www.energy-business-review.com)

ONGC said to seek $900 mn stake in Rosneft Vankor field

August 13, 2015. Oil & Natural Gas Corp (ONGC) is seeking through its overseas unit to buy a stake in Russia’s second-largest oil producing development from OAO Rosneft. ONGC Videsh Ltd (OVL) is in discussions to purchase a share of the Vankor oil field in East Siberia. The New Delhi-based company is seeking to pay $900 million for the stake, which will secure about 3.5 million metric tons of oil a year (about 70,290 barrels a day), and expects to sign a deal as early as next month. Vankor, which started production in 2009, is one of the largest oil fields in Russia, with recoverable reserves estimated at about 500 million tons. Vankor pumped about 40.2 million barrels of oil in January to March (about 447,000 barrels a day), according to the company. ONGC plans to spend ` 11 trillion ($169 billion) by 2030 to add reserves in India and overseas and reverse a decline in output from aging domestic fields. OVL, which spent $6 billion in the past two years buying assets outside India, plans to more than double its output from overseas fields in four years. (www.bloomberg.com)

OIL targets first LNG cargo from Mozambique block by 2020

August 12, 2015. Oil India Ltd (OIL) expects to receive the first cargo of liquefied natural gas (LNG) from Mozambique's offshore Area 1 Block in the first quarter of 2020, the company said. The company has a 4 percent stake in the block. OIL said the Carabobo Basin asset in Venezuela was producing 16,000 barrels per day (bpd), and the rate could jump to 90,000 bpd by 2017. It has a 3.5 percent stake in the block. (lta.reuters.com)

Iran reassures India over development rights of gas field

August 12, 2015. Iran has said the development rights for its Farzad-B gas field will be available to Indian companies after concerns in New Delhi that cash-rich European firms could clinch the contract. A consortium headed by ONGC Videsh Ltd (OVL), the overseas investment arm of Oil and Natural Gas Corp (ONGC), in 2008 discovered the Farzad-B gas field in the Farsi offshore block. The consortium, which also include Oil India Ltd (OIL) and Indian Oil Corp (IOC), has been seeking development rights for the field. An Indian delegation that went to Iran in the last week of July was told Tehran was working out a new production sharing contract, OIL said. Iran has asked Indian firms to submit a development plan for the Farzad-B gas field, OIL said. Tehran had offered a draft contract, known as the Iran Petroleum Contract (IPC), to Indian companies. The new contract for the block is a mix of production sharing and service contract, OIL said. The delegation also renewed talks over the purchase of Iranian liquefied natural gas (LNG) once sanctions against the country are lifted and Tehran sets up a liquefaction facility, Indian Oil Minister Dharmendra Pradhan said. India signed a deal with Iran in 2005 to buy 5 million tonnes a year of LNG but the contract was never implemented. (in.reuters.com)

Transportation / Trade…………

RIL sells 1st crude cargo on Platts Dubai

August 17, 2015. Reliance Industries Ltd (RIL) sold its first cargo during an Asia crude price assessment process, traders said. The Indian refiner will deliver 500,000 barrels of Upper Zakum crude to Chinaoil after completing the sale of 20 Dubai lots during the Platts Market on Close (MoC) process, they said. RIL made its first appearance on the MoC this month, selling Dubai partials alongside Unipec, the trading arm of Asia's largest refiner Sinopec, and Royal Dutch Shell. (in.reuters.com)

India to clear dues worth $6.5 bn to Iran in tranches: Finance Secretary

August 17, 2015. India will clear $6.5 billion of dues it owes to Iran for oil import in tranches, with the first installment going out as early as in a week, Finance Secretary Rajiv Mehrishi has said. Mehrishi led a high level delegation to Iran to discuss payment options, indicated that the payments can be in a combination of US dollar or euro and Indian rupees. Since February 2013, refiners like Mangalore Refinery and Petrochemicals (MRPL) and Essar Oil have been paying 45 percent of payment due on purchase of crude oil from Iran in rupees through UCO Bank, Kolkata. The remaining has been accumulating, pending finalisation of a payment route and mechanism. They had paid nearly $3 billion in six installments through a limited payment channel following start of nuclear talks between the Western world and Iran. The outstanding has since climbed to over $6.5 billion. Essar Oil owes $3.34 billion, MRPL ($2.49 billion) and Indian Oil Corp (IOC) ($581 million) to Iran. RBI will detail out the banking channels as well as payment schedule with its Iranian counterpart. HPCL-Mittal Energy Ltd (HMEL) owes $97 million and Hindustan Petroleum Corp Ltd (HPCL) another $29 million. Besides, about ` 17,000 crore was lying in Iranian account with UCO Bank. (www.business-standard.com)

Cairn seeks oil swaps to get higher margins

August 16, 2015. Cairn India Ltd has proposed a swap deal to skirt an oil export ban, by selling its high-way Rajasthan crude oil to foreign firms at higher rates and in return supplying an equivalent quantity of oil. The nation's biggest onshore crude oil producer wants the government to allow refiners like those based in Singapore and Japanese utilities interested in high-wax crude to pick up the Rajasthan crude and replenish the exported volume with no loss to any of the parties.

Cairn India has sought government approval for a tripartite agreement wherein Barmer crude oil will go to the international market where it will get better price than the ones realised locally. The firm getting access to low-sulfur crude oil will supply equivalent quality of crude oil to Indian refiners. Shipping the Rajasthan oil to customers who are best equipped to process the low-sulfur crude will help Cairn India get a premium versus a 10-12 percent discount on Brent prices that local refiners, including Indian Oil Corp (IOC), Essar Oil and Reliance Industries Ltd (RIL), currently pay.

Cairn India had previously sought approval to export the oil but the government had rejected it as the nation is 80 percent import dependent to meet its oil needs. The company says it is not seeking a permission for exports but only a swap arrangement. The three-way deal would essentially mean Cairn India will export Rajasthan oil but the deficit at its local customer will be made up by sourcing the commodity from an overseas supplier. The company believes the pricing of Barmer crude oil at a discount to Brent has led to USD 1.94 billion loss to all stakeholders, including the government, on over 282 million barrels of oil produced since 2009. Most Indian refineries are designed to process cheaper, high-sulfur crude, while that produced from the Rajasthan fields has low sulfur content. The unique nature of the Barmer crude makes it difficult to optimise it in Indian refineries and so the crude is being sold at a discount. At present, Essar and RIL buy bulk of 170,000 barrels per day of output from Rajasthan. (www.business-standard.com)

India, Nepal set to sign agreement for oil pipeline: Rae

August 15, 2015. India and Nepal are set to sign an agreement for the construction of the much-touted cross border oil pipeline for supplying petroleum products to the land-locked Himalayan country, India's Ambassador to Nepal Ranjit Rae said in Kathmandu. Rae said that if the two countries work together and exploit the natural resources at their disposal, economic prosperity and poverty alleviation can both be attained. The Indian government had approved signing of the agreement to lay an oil pipeline from Raxaul in Bihar to Amlekhgunj in Nepal to supply petrol, diesel and Aviation Turbine Fuel and the re-engineering of Amlekhgunj Depot and allied facilities. Indian Oil Corp (IOC) has agreed to foot the ` 200 crore cost for constructing the 41-km pipeline, about 39 km of which would lie in Nepal, in exchange for Nepal committing to buy products for at least 15 years. Nepal depends on India for meeting all of its fuel requirements. (www.ndtv.com)

AAI in talks with oil companies to set up single entity for supplying fuel

August 12, 2015. The Airports Authority of India (AAI) has started discussions with state-owned oil companies to set up common infrastructure for the supply of aviation turbine fuel (ATF) at the airfields it operates. Such a facility could also be used by carriers to import fuel. Under the proposed arrangement, common storage facilities would be set up for use by oil marketing companies for a fee. Airlines will have a choice of fuel suppliers, which should spur competition and result in better prices and services. The facility is proposed to be set up by a new company, which will be 37.5% owned by Indian Oil and 25% owned by AAI. Bharat Petroleum Corporation and Hindustan Petroleum Corporation will own 18.75% each. Currently, each oil company has its own infrastructure at AAI-operated airports, while private airports such as those in New Delhi and Mumbai have a common facility for supplying fuel. According to some estimates, a shared facility could lower fuel costs by anywhere between 5% and 10%. Analysts do not share the optimism on the benefit of the initiative and want AAI to improve conditions at smaller airports. Fuel accounts for as much as 50% of an airline's operational expenses in India. Value added tax on ATF varies in each state and ranges from zero to 30%. The government's decision in February 2012 to allow airlines to import fuel hasn't taken off in the absence of infrastructure to transport ATF to airports and storage facilities. (economictimes.indiatimes.com)

Policy / Performance………

India's fuel demand rises 5.52 percent in July y/y

August 17, 2015. India's fuel consumption rose an annual 5.52 percent in July, driven by higher gasoline sales which reflected a surge in passenger vehicles sales, government data showed. Fuel consumption, a proxy for oil demand, totalled 14.03 million tonnes last month, data posted on the website of the Petroleum Planning and Analysis Cell showed. India ended subsidies on diesel sales in October and since then regular changes in retail prices have narrowed the pricing gap with gasoline, boosting demand for petrol-driven cheaper vehicles. Local diesel sales last month declined to the lowest since October at 5.7 million tonnes, a fall of 0.55 percent from a year earlier, the data showed. Diesel demand also waned as market-driven prices ended its role as a substitute to fuel oil, demand for which rose 25.4 percent in July. Last month improved monsoon rains and electricity supply also dented sales of diesel, widely used by farmers for running gensets to irrigate farm lands. Sales of gasoline, widely used for transportation, surged 12.9 percent from a year earlier, depicting an 11.43 percent rise in passenger vehicle sales. Local cooking gas sales surged an annual 10.4 percent on improved supplies aimed at curbing use of kerosene, demand for which fell 2.52 percent. Naphtha consumption rose about 15.3 percent as a new plant, operated by ONGC Mangalore Petrochemicals Ltd, started operation in southern India. (in.reuters.com)

Gas prices to dip below $4.2 per unit from October 1

August 16, 2015. Natural gas prices in India may, from October 1, fall below $4.2 per unit, a rate that was used last year to devise a new pricing formula to incentivise domestic exploration. Using prevailing price in gas surplus nations like the US, Russia and Canada, the government had in October last year announced a new pricing formula that led to rates rising by about 33% to $5.61 per million British thermal unit (mmBtu) for a period up to March 31, 2015 from the long-standing price of $4.2. The rates, on net calorific value (NCV) basis, dropped to $5.05 per mmBtu for six month period beginning April 1, 2015. On gross calorific value (GCV) basis, the rate will be about $3.8 per mmBtu as compared to $4.66 currently.

The October 1 price cut will be the second reduction in rates ever - the first being on April 1. While the cut will impact the revenue of producers like Oil and Natural Gas Corp (ONGC) and Reliance Industries, it will bring gains for users in the power and fertiliser sector in the form of lower feedstock cost. As per the mechanism approved in October 2014, price of domestically produced natural gas is to be revised every six months using weighted average or rates prevalent in gas-surplus economies of US/Mexico, Canada and Russia to incentivise exploration in deep-sea that wasn't viable at $4.2 rate. Indian gas price is calculated by taking weighted average price at Henry Hub of US, National Balancing Point of UK, rates in Alberta (Canada) and Russia with a lag of one quarter.

So, the rates for April 1 to September 30 period were based on average price at the international hubs during January to December 2014. The October 1, 2015 to March 31, 2016 rate will be based on average of prices during July 1, 2014 to June 30, 2015. The current price of $5.61 per mmBtu is already among the lowest in Asia Pacific. China pays explorers $11.9 per mmBtu rate for new projects while Indonesia and the Philippines price the fuel at $11 and $10.5, respectively. Gas from offshore fields in Myanmar, where Indian firms ONGC and GAIL have stake, are sold to China for $7.72. Thailand prices gas from new projects at $8.2 per mmBtu. The only nations with lower rates than prevailing price are Vietnam ($5.2) and Malaysia ($5). (www.business-standard.com)

DBT scheme for LPG help save ` 150 bn in a year: PM Modi

August 15, 2015. The programme to pay cash subsidy to cooking gas consumers directly in their bank accounts has helped save about ` 15,000 crore by stopping black marketing and diversions, Prime Minister (PM) Narendra Modi said. Modi said about 20 lakh people have voluntarily given up subsidy on LPG, helping widen the reach the scarce fuel. The Direct Benefit Transfer (DBT) on LPG, which has been recognised by the Guinness Book of World Records as the largest cash transfer programme in the world, has eliminated “middle-men and black marketers” and ensured the fuel is delivered to right people, he said. Since the launch of DBTL, now named PAHAL, domestic LPG all over the country is sold at market price. Households get cash subsidy in their bank accounts to make good the difference between old subsidised rate and market price.

Out of 15.65 crore active domestic LPG consumers, 13.8 crore have joined the DBTL and are getting subsidy in their bank accounts. The scheme was launched in 54 districts on November 15, 2014, and extended to all over the country from January 1, 2015 with a view to cut diversion and subsidised fuel being consumed by unintended segments like restaurants and other commercial establishments. LPG subsidy payout from Union Budget in 2014-15 was ` 40,591 crore as against a dole of ` 52,231 crore in 2013-14, a saving of ` 11,640 crore. Modi said he had requested the well-off people who can afford to pay market price, to voluntarily give up their subsidy to help extend its reach to the most needy. Middle class families and teachers are among the people who have left subsidy. Assuming that each of these consume an average of 8 cylinders per annum and at the average subsidy rate of ` 200 per bottle, the saving amounts to about ` 320 crore. Presently, a household is entitled to receive subsidy to buy up to 12 cylinders of 14.2-kg each every year. Cash advance is transferred into the beneficiary account on first enrollment and another installment is given the moment it is used to buy a LPG refill. (indianexpress.com)

India to benefit as oil prices fall more after China devalues Yuan

August 13, 2015. Indian consumers can expect fuel prices to decline as crude oil prices fall more tracking the devaluation of the Chinese currency even as Organization of Petroleum Exporting Countries (OPEC) continues to pump in more, helping the country save big bucks on energy imports. China, the world's second-biggest consumer of oil, devalued its currency yuan for the second consecutive day to support the slowing Chinese economy, aggravating concerns that energy demand from the country would fall more, adding to the glut in the market. While demand continues to decline, OPEC, which accounts for 40 percent of world's crude oil output, has been pumping in more oil after Iran restored output after international sanctions were lifted. Rating firm ICRA estimates that for every $1 per barrel decline in crude prices, India saved ` 6,500 crore on the import bill. Analysts said LNG prices may soften too, giving relief to Indian consumers who have long-term contracts which offer most expensive prices in Asia. While global energy majors are cutting capital expenditure, Indian state-run oil firms have lined up investments of over ` 76,565 crore on capital expenditure for 2015-16, up 5% on year. Of this, explorer ONGC alone would invest ` 36,250 crore. The fall in crude prices have improved their cash position, giving them a stronger position to invest more. (economictimes.indiatimes.com)

Cairn revives demand to review cess on Rajasthan oil

August 12, 2015. Cairn India has once again demanded a review of the cess being levied on its Rajasthan oil field output. While maintaining that the production sharing contract (PSC) for Rajasthan is silent on cess, Cairn and its joint venture partner in the block ONGC, want the Government to reduce the cess to ₹ 2,500 a tonne from ₹ 4,500 a tonne. The joint venture proposes to approach the Ministry for Petroleum & Natural Gas shortly.

The Government levies cess on domestic crude oil production as a duty of excise. According to the company, the cess of ₹ 4,500 a tonne was imposed in the 2012-13 Budgets when the crude price was over $100 a barrel. But the crude price has since dropped significantly. Cairn’s net profit for the first quarter of the current fiscal was ₹ 834.98 crore and the cess paid was ₹ 691 crore. The cess will result in estimated revenue impact of $2.5 billion for the life of the field. When the Government had doubled the cess amount Cairn had approached the then Prime Minister’s Office seeking review as it was only the Rajasthan block production sharing contract which was materially affected by the increase. While the Petroleum Ministry had then agreed that it would adversely affect Cairn, it had left the private sector explorer to fight its own battle. NELP (New Exploration Licensing Policy) PSCs are exempted from cess. For most other blocks, offered before the licensing rounds and producing crude oil, like Ravva and Panna-Mukta-Tapti joint venture fields, cess is fixed at ₹ 900 a tonne. (www.thehindubusinessline.com)

[NATIONAL: POWER]

Generation……………

GMR begins operation of 370 MW Vemagiri power plant

August 13, 2015. GMR Infrastructure Ltd has commenced the operation of its 370 MW GMR Vemagiri Power Generation Ltd's gas-based project at Vemagiri in Andhra Pradesh (AP). The project commenced operation under the 'Scheme for utilisation of stranded gas-based power plants' as launched by Government of India in March 2015. The plant is operating at 95 percent plant load factor (PLF) at present thereby generating 350 MW and supplying power to AP Transco. (www.thehindubusinessline.com)

Krishnapatnam project to be fully operational soon

August 13, 2015. The 1600 MW (800x2) Krishnapatnam thermal power project of AP Genco is set to be fully operational for supply of power to the grid and the necessary transmission network has also been commissioned. The commissioning of the project, backed 70 percent domestic coal and 30 percent imported, would significantly boost the power supply situation in the State, according to AP Genco. As a part of the Andhra Pradesh Government’s move to increase the generation capacity, the expansion project of 800 MW third unit at Krishnapatnam and another 800 MW unit, the eighth unit at the Vijayawada Thermal Power Station would be taken up. The tenders for these two projects are now under process for supplies and contractors, he told Business Line. Referring to the power demand-supply situation in Andhra Pradesh, the State was able to meet the demand of about 157-160 million units (MU) per day on an average. However, this has come down to about 140 MU per day due to low temperatures and lower demand now. (www.thehindubusinessline.com)

Transmission / Distribution / Trade…

Power Grid to commission ` 120 bn Assam-Agra line

August 18, 2015. Public sector Power Grid said the ` 12,000 crore transmission line between Assam and Agra having 6,000 MW capacity will be commissioned by month-end. A consortium of BHEL and ABB was given the order for the supply of equipment for the transmission line. The planning of the project was started in 2006-07 and its execution took place in 2012, PGCIL said. The high capacity high voltage direct current (HDVC) corridor shall integrate the North-Eastern region with other regions of the country to facilitate smooth and reliable power transfer giving rise to stable national grid, PGCIL said. The very nature of control power flow of the HVDC interconnection provides additional flexibility in Grid operation thereby improving various grid parameters, PGCIL said. The link will act as a highway from North-Eastern region to rest of the country and will play a significant role in the hydro potential in the (North-Eastern) parts as well as lead to socio-economic development of India as a whole and the region in particular, PGCIL said. (www.business-standard.com)

Discoms made money from meters: CAG

August 18, 2015. Electricity meters in Delhi homes could well capture the reality of the national capital's privatization of power distribution with the CAG audit pointing to an array of anomalies and exaggerations around these humble meters. Following complaints from consumers, Delhi Electricity Regulatory Commission (DERC) had formed a committee in 2003 to examine the quality of meters. Based on the committee's report, DERC directed discoms that meters manufactured by TTL and Elymer should be replaced on priority. The report said government schools, hospitals and other institutions were over charged by discoms. However, it is in the business of electricity meters that several bizarre twists were seen. Only meters put to use and installed at the consumers' premises should be included as fixed assets (capitalized) on which discoms are allowed returns. The CAG audit found that as on March 31, 2013, BRPL had capitalized 22.10 lakh meters while there were only 18.49 lakh consumers. The number of consumers intimated by the company to DERC differed widely from the number of consumers as per the billing data furnished to the audit. Meters removed from consumers' premises are auctioned as scrap. In the list of discarded assets produced to the audit by BRPL, it showed 9.96 lakh meters to have been discarded between 2005-06 and 2011-12. However, from the meter utilization data, the audit found that 14.41 lakh meters were actually removed from consumers' premises. Therefore, 4.45 lakh meters valued at ` 58.39 crore remained unaccounted for. In BYPL, 16.94 lakh meters were capitalized while the number of consumers was only 12.89 lakh. TPDDL showed that 11.93 lakh new meters were installed during between 2008-09 and 2012-13 while only 3.83 lakh new consumers were added during this period. The audit said in BYPL, an unwarranted burden of ` 65.24 crore was placed on consumers because of the discrepancy in meters. In BRPL, the unwanted burden on consumers because of meters was ` 63.06 crore. The audit found that the cost of replacing meters within the warranty period was borne by the discoms and capitalized. For example, ` 19.33 crore was borne by BRPL, instead of the manufacturers, and passed on to the consumers. Similarly, BYPL replaced 1.12 lakh defective meters and the cost of ` 12.09 crore was not recovered from the manufacturer but passed on to consumers. Similarly, TPDDL placed a burden of ` 27.54 crore on consumers. The audit found that the discoms delayed installation of KVA meters which were meant to improve consumption efficiency. (timesofindia.indiatimes.com)

Siemens gets to modernise power distribution in 3 states

August 17, 2015. Siemens said it's modernising electricity distribution network in three states - Punjab, Uttarakhand and Haryana - with Smart Grid solutions at a total cost of ` 75 crore. The objective of these projects is to improve quality and availability of power supply to residents and reduce the downtime in the event of a blackout in the entire grid. As part of the modernisation, Siemens will implement its Spectrum Power network control system and equip the grid with SCADA/DMS functions (Supervisory Control and Data Acquisition/Distribution Management System) for monitoring and control.

The company will execute the project for three utility providers -- Punjab State Power Corporation, Uttarakhand Power Corporation, and Dakshin Haryana Bijli Vitran Nigam. For Maharashtra State Electricity Distribution Company, Siemens is equipping power distribution grids of eight cities with turnkey monitoring and control systems (SCADA/DMS). This contract was also awarded as part of the Indian government's energy development programme. In Maharashtra, the SCADA/DMS systems implemented by Siemens improve availability of the grids and increase reliability of power supply. (www.business-standard.com)

CIL yet to sign fuel supply pacts for 2.5 GW

August 16, 2015. Coal India Ltd (CIL) is yet to enter into fuel supply pacts with power plants for 2,560 MW generation capacity. CIL had been directed to sign supply pacts with power plants for total generation capacity of 78,535 MW to ensure fuel availability. The supply pacts could not be signed due to various reasons such as clarification of tapering linkages, approval for change of name of the company, refusal of company to sign cost plus agreement and clarification on block allocation. Tapering Linkage is short-term coal linkage provided to coal consumers.

Of the 1,08,000 MW capacity, the government had in 2013 approved signing of fuel supply agreements (FSAs) in respect of 78,535 MW capacity power plants which were already commissioned by then or were likely to be commissioned by March 31, 2015. Government is considering a policy for coal linkage auction and has sought comments from stakeholders on the draft auction methodology it has prepared. An Inter-Ministerial Committee (IMC) was set up in January to consider various models, including auctioning of coal linkages/LoAs (Letter of Assurances) through competitive bidding as the selection process and to recommend the optimal structure that would meet the requirements of all the stakeholders. (timesofindia.indiatimes.com)

DERC shows way out of costly power pacts

August 14, 2015. Discoms finally have a way out of purchasing "costly" electricity from central sector plants as the Delhi Electricity Regulatory Commission (DERC) has directed them not to renew power purchase agreements (PPAs) which are lapsing in the near future. Agreeing to the stand taken by Delhi government, the regulator said that they concur with the discoms that these PPAs contribute to higher tariffs. Since there is no exit clause, power companies will have to wait for the agreement to lapse. The directive could be part of the tariff order scheduled to be announced early next month. The commission is under immense pressure not to hike electricity tariffs and has already hinted that such a step may not be taken. PPAs with three central sector plants—Anta, Auraiya and Dadri—lapsed recently, but the discoms renewed them without DERC approval. This led to the commission denying adjustment of power purchase costs from these stations to the discoms in its order in June. The PPA with Rajghat power plant will lapse soon, with Singrauli to follow in the next few months. Discoms said that getting out of the PPAs is no easy task. The power ministry said that Delhi could not be allowed to surrender PPAs till alternate buyers were found. Delhi government had written to the Union power ministry saying they wanted to surrender 2200 MW from central sector stations and asked that it be re-allocated to other needy states. The ministry has not yet formally replied to the proposal. (timesofindia.indiatimes.com)

Coal auction hits troubles, 2 mines go off bidding

August 12, 2015. Coal auctions ran into legal tangles with the government deferring bids for one mine in Jharkhand where giants like Hindalco, Vedanta and Jindal Steel and Power Ltd (JSPL) were in the fray, while another block was withdrawn from the ongoing third round of bidding. The government deferred the auction of Chitarpur coal mine in Jharkhand because of a court case. The other coal block - Parbatpur Central Coal Mine in Jharkhand - has been withdrawn from the process on representation that it contains gas. The date of e-auction of Chitarpur Coal Mine, the notice said, will be intimated later. Companies like Hindalco, JSPL and Vedanta were in the fray for Chitarpur coal mine after qualifying technical bidding. Firms like JSW Steel, RashtriyaIspat Nigam and SAIL were in the fray for Parbatpur Central mine. (profit.ndtv.com)

Policy / Performance………….

India plans to resume UMPP auctions in October 2015

August 18, 2015. The central government of India plans to resume the auction of Ultra Mega Power Projects (UMPPs) in the next two months and is finalising the proposed UMPPs to be offered. Under the new norms, the proposed UMPPs will have two special purpose vehicles (SPVs), one for the land and coal blocks (leased out to the bidders for 30 years) and the other to own requisite regulatory clearances (transferred to the successful bidders). The Ministry of Coal has deallocated three coal blocks attached with the proposed Bedhabahal UMPP in Odisha, namely Meenakshi, Meenakshi-B and Dipside, that had been awarded to Odisha Integrated Power and that will be transferred to another special purpose vehicle called Odisha Infra Power, attached to the Odisha UMPP. The Ministry plans to propose five UMPPs, including the Odisha UMPP and the Cheyyur UMPP in Tamil Nadu. So far, the government has identified land in Banka (Bihar), Deogarh (Jharkhand) and Etah (Uttah Pradesh), along with two additional sites in Odisha to develop UMMPs. (www.enerdata.net)

Green tax on coal washery projects

August 17, 2015. The State Pollution Control Board (SPCB) has proposed levy of environment cess at the rate of ` 10 per tonne for standalone and pithed coal washery projects. The proceeds would go to the Odisha Environment Fund. The minimum size of a coal washery is likely to be pegged at one million tonne per annum (mtpa). All coal washery plants would be based on automation. Water levy on coal washery projects would be three times the normal water rate if the developer uses fresh surface water. Such units would not be permitted to use ground water. The state government would allow establishment of coal washery in the premises of sponge iron plants or integrated steel plants only if such plants have FBC (fluidised bed combustion) boilers or CBFC (circulating fluidised bed combustion boilers) to consume the rejects generated from the washery and use it for power generation. Since washery rejects are often dumped in the open that causes water and air pollution, it has been proposed that the washeries should mandatorily enter into an agreement with a power generator who will use 100 percent of these rejects. Establishment of coal washery plants beyond a certain distance would not be allowed. (www.business-standard.com)

CESC average Electricity tariff for 2015-16 remains flat

August 17, 2015. RP Sanjiv Goenka Group flagship company CESC Ltd's average tariff for 2015-16 remains unchanged. CESC said that average tariff for 2015-16 remained same at ` 6.97 a unit as cleared by state regulator. West Bengal State Electricity Regulatory Commission has cleared the tariff for 2015-16. CESC had asked for a tariff of ` 7.55 a unit during their multi-year tariff petition filed earlier. (www.business-standard.com)

India plans to sell 10 percent in coal-mining company CIL

August 17, 2015. The Indian government plans to sell a 10% stake in the country's largest coal-mining company Coal India Ltd (CIL) through a stock market auction. The state owns a 78.65% interest in the group and expects to raise US$3.7 bn from the sale of the 10% stake in CIL, as part of a broader privatisation plan expected to raise up to US$11 bn. (www.enerdata.net)

Odisha govt approves scheme for providing 24x7 power supply

August 14, 2015. In an effort to provide 24x7 quality power supply to the people in and around the state capital of Bhubaneswar, the Odisha government has approved a ` 1,500 crore State Capital Region Improvement of Power System (SCRIPS) scheme to be implemented in five years. A proposal in this regard got state Cabinet's nod. The Cabinet meeting, chaired by Chief Minister Naveen Patnaik, has decided to spend the money over a five years timeframe from 2015-16 to 2019-20. (www.business-standard.com)

Stressed discoms to turn around in 3 yrs: Power Minister

August 14, 2015. Power Minister Piyush Goyal has said that the government is in active dialogue with the discoms on turnaround plans and there will be a noticeable changes in the situation of stressed utilities in the next three years. The combined debt of the power distribution companies (discoms) is over ` 3 lakh crore. Faced with acute financial stress, many of these discoms are unable to buy power. He said that the Financial Restructuring Plan (FRP) which was originally introduced in April 2012 and implemented in October 2013, had actually not changed the situation on the ground. In an attempt to restore power purchasing capacity of the debt ridden discom and also to enable banks to recover their loans, the Cabinet Committee on Economic Affairs had approved the scheme for Financial Restructuring of state distribution companies (Discoms) in September 2012. (www.ndtv.com)

India's coal bed methane output projected to quintuple by 2017-18

August 13, 2015. India's coal bed methane (CBM) production, currently a little over one million standard cubic meters per day (mscmd), is envisaged to reach 5.77 mscmd in 2017-18. The current level of production of CBM is 1.07 mscmd. The production of CBM is envisaged to reach 5.77 mscmd in 2017-18, Power and Coal Minister Piyush Goyal said. He said that of the 33 coal blocks offered by the petroleum ministry for CBM exploitation, 8 blocks have reached the development stage, of which only one block has started commercial production, while 4 others are producing incidental CBM. Finance Minister Arun Jaitley had in his budget 2015-16 speech said the government was preparing a note for approval by the cabinet committee on economic affairs (CCEA) that seeks to amend the CBM policy to boost production. The amendments being sought would allow exploration and exploitation from areas under coal mining leases allotted to public and private companies. Moreover, contractors would be allowed to sell gas based on price bidding, without restriction by any allocation priority. The amendments also seek put in place a mechanism for resolving the issue of overlap of CBM blocks with coal, oil or gas fields. India has 92 trillion cubic feet of CBM reserves, spread over 26,000 sq km of coal-bearing areas. (www.business-standard.com)

UP govt wants Centre to suspend power bundling policy

August 13, 2015. Uttar Pradesh (UP) Chief Minister Akhilesh Yadav has requested Prime Minister Narendra Modi to suspend Union Power Ministry's decision to bundle power generated by coal-based units of NTPC with its renewable energy. In his letter, Akhilesh Yadav has said that he has come to know that to increase renewable energy the central government was installing new solar power generation units. (www.niticentral.com)

KSEB to revise cost estimate

August 12, 2015. With the Expert Appraisal Committee (EAC) for River Valley and Hydroelectric Projects clearing the 163 MW Athirappilly Hydro Electric Project, the Kerala State Electricity Board (KSEB) will soon revise the project estimate. KSEB said that the proposal will be submitted to the State government for administrative sanction after revising the estimate. The question of cost overrun and the expenditure for generating power from the project could be ascertained after the revision. A member of the KSEB director board said the process of revising the estimate may take two months. The project cost was estimated as ` 570 crore when it was prepared nearly a decade ago. The board will also have to prepare a detailed project report after the revision. (www.thehindu.com)

India to have excess coal if govt hits fuel production target

August 12, 2015. India is likely to see an oversupply of 400 million tonnes of coal if the government achieves its target of producing 1.5 billion tonnes of the fuel by 2020. The nation will, however, not be able to export this volume as international market for coal will be almost dead by then, experts from US-based Institute of Energy Economics and Financial Analysis (IEEFA) said. According to IEEFA's estimate, the power demand in India will rise by almost 60 percent in 2022. In absolute terms, this will be around 50 billion units, touching 131.8 billion units per annum by 2022. The government has adopted a multi-pronged approach to equate demand, including capacity addition of 175 GW of renewable energy by 2022, sustained reduction in the aggregate technical and commercial (AT&C) losses, and increased usage of energy efficient lighting systems as well as three-fold rise in coal production. IEEFA estimates that reducing AT&C losses by just 1 percent per annum could deliver 11.4 billion units of power savings, equating to a whopping 23 percent of India's required increase in net electricity generation. If energy-efficiency initiatives can deliver a net electricity savings of just 1 percent per annum, those likewise could reduce required electricity generation growth by 7.5 billion units or 15 percent of the total required. The plan to install 75 GW of solar power capacity by 2021-22 alone can deliver 11 billion units of power or 22 percent of the required electricity demand increase. (economictimes.indiatimes.com)

West Bengal plans power ombudsman for each district

August 12, 2015. West Bengal Electricity Regulatory Commission (WBERC) has decided to appoint an ombudsman for each district to allow power consumers to get their grievances redressed at the local level. WBERC said that the commission, with the help of CESC and West Bengal State Electricity Distribution Company, would educate consumers on their rights in respect of power consumption. Meanwhile, West Bengal aims to generate about 100 MW from rooftop solar units over the next two to three years. (www.ndtv.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Total abandons shale gas exploration at well in Denmark

August 18, 2015. French oil major Total has abandoned exploration work at its shale well Vendsyssel-1 in northwestern Denmark, the Danish Energy Agency said. The well, which is 80 percent owned by Total and 20 percent by Denmark's state oil company Nordsofonden, confirmed the presence of gas but the thickness of the layer was smaller than expected. (uk.reuters.com)

Brazil regulator tells Shell, partners to develop two oilfields as one

August 18, 2015. Brazil's National Petroleum Agency (ANP) ruled that Royal Dutch Shell and its Qatari and Indian partners need to treat oil and gas fields in the Parque das Conchas area as a single deposit, Shell said, a move that could increase taxes on output. Shell owns 50 percent of Parque das Conchas, its main Brazilian asset. Qatar's state oil company Qatar Petroleum owns 23 percent and India's ONGC owns 27 percent. The ANP's decision to treat the fields as a single deposit applies to two of Shell's four fields in the block, also known as BC-10, for which it holds exploration and production rights. The decision comes as Shell prepares to expand production in the block that now produces 50,000 barrels per day of oil equivalent and take over the Brazilian properties of Britain's BG Group Plc, which it is buying.

Shell said the ANP has approved its development plan for the Nautilus field but also stipulated that it must be joined with the Argonauta field. The ANP previously made a similar decision with the Lula and Cernambi fields and seven other fields in the Parque das Baleias area, all operated by state oil company Petroleo Brasileiro. Petrobras ended up challenging the ANP's previous decisions, which are still tied up in court and in international arbitration. Shell's production expansion plans at Parque das Conchas is expected to boost output by 30,000 barrels a day (bpd). The company said it would not comment on the ANP's decision until its management had discussed it. The Brazilian Oil Institute said the companies operating in Brazil's oil exploration industry are very concerned about the ANP's decision. (in.reuters.com)

Oman’s daily oil output tops 1 mn barrels for first time

August 15, 2015. Oman, the biggest oil producer in the Middle East outside OPEC, said its crude and condensate production in July exceeded 1 million barrels a day for the first time. In July 2015 the Sultanate broke a new record, the Oil and Gas Ministry said in a report. Production rose 0.5 percent from June because of efficiency achieved through maintenance work. Daily crude output was 894,000 barrels and condensate -- a light oil extracted from gas -- accounted for 107,000 barrels, it said. Exports dropped 13% from a month earlier to 797,000 barrels a day as local refiner Orpic increased its intake of crude, according to the report. All shipments were to Asia, with China and Japan keeping first and second place among Oman’s customers, accounting for about 69 percent and 15 percent of sales respectively. The rest was sold to Taiwan, Singapore and Thailand. Oman started reversing an oil output decline in 2008 by making new discoveries and using technology to improve recovery of oil from aging fields, according to the U.S. Energy Information Administration. Production rose from 710,000 barrels a day in 2007 to 960,000 barrels a day in 2014, according to the International Energy Agency. (www.bloomberg.com)

Russia's Rosneft plans to increase oil output

August 14, 2015. Russia's Rosneft, the world's top listed oil producer by output, plans to increase production, Chief Executive Igor Sechin told Prime Minister Dmitry Medvedev, according to the government. Rosneft oil production was slightly down last year to 4.1 million barrels per day (bpd) from 4.2 million bpd in 2013, due to lower output at mature fields. Sechin said that Yuganskneftegaz, Rosneft's largest oil producing unit, could be one of the sources of growth. Sechin said that Yugansk, a former Yukos asset, was expected to produce around 66 million tonnes of oil this year. He said new wells would be added in the field which pumped 64.5 million tonnes of oil last year. According to the Russian Energy Ministry, Rosneft's oil production was down 1.2 percent in July, year-on-year. (uk.reuters.com)

Glencore to cut $790 mn off value of oil deal last year

August 13, 2015. Glencore Plc is set to wipe $790 million off the value of oil and gas assets in Chad that it bought just last year, and cut planned spending in 2015 by about the same again. Glencore paid about $1.35 billion, a 61 percent premium, for Caracal Energy Inc. in the central African nation in April 2014. The mining and commodities company expects to write down the assets’ value after world oil prices slumped, it said. Crude slid back into a bear market last month amid an enduring supply glut, and slumped to a six-year low near $40 a barrel in New York. The Caracal deal has proved a headache for Glencore this year after Chad’s government sought to delay repayment of about $1.5 billion of Glencore-led loans to conserve cash as crude prices collapsed. (www.bloomberg.com)

Brazil Manati field holds 13.5 bn cubic meters of gas: QGEP

August 12, 2015. Queiroz Galvão Exploração e Produção SA (QGEP) said that the Manati offshore oil field in Brazil holds 13.5 billion cubic meters (477 billion cubic feet) of proven and probable, or "P2", natural gas reserves. The Manati field is 45 percent owned by QGEP. Brazil's state-run oil company Petroleo Brasileiro SA owns 35 percent and is the field operator, Brazilian-Canadian oil company Brasoil owns 10 percent and Chile's Geopark owns 10 percent. (www.reuters.com)

Downstream…………

South Africa needs to restructure refinery plan on weak PetroSA

August 18, 2015. South Africa needs to restructure a project to build what may be the sub-Saharan region’s biggest refinery because the finances of the state-owned oil company in charge of the plan are weak, according to the government. The 300,000 barrel-a-day Mthombo “refinery is needed and the location is right, but the project needs to be restructured by the government” because PetroSA Ltd. doesn’t have the balance sheet to support it, Energy Department Deputy Director-General Tseliso Maqubela told lawmakers in Cape Town. Mthombo, which would be South Africa’s largest refinery, would raise South Africa’s total processing capacity of 703,000 barrels daily by 43 percent. PetroSA’s loss widened to about 15 billion rand last year after the biggest impairment yet recorded by a government company. PetroSA is planning the facility in Port Elizabeth with China Petroleum & Chemical Corp. as diesel and gasoline imports rose on the back of economic expansion, with demand exceeding local refinery output for the first time in 2007. (www.bloomberg.com)

US refinery outages give European gasoline late boost