-

CENTRES

Progammes & Centres

Location

[Sub-Prime Crisis in the Indian Power Sector]

“While the objective of providing universal access to electricity cannot be questioned, it creates problems as it is forced to ride on a defunct system. The Centre provides capital subsidy for erection of infrastructure through schemes such as the Rajiv Gandhi Rural Electrification programme, but the electricity itself has to come from SEBs. …”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy/Power…………………

Power………….

ANALYSIS/ISSUES…………

DATA INSIGHT………………

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn to get 10 yr extension for Rajasthan block

· DGH rejects ONGC's three KG gas discoveries

· ONGC, OIL bid $1.5 bn for stake in Murphy Oil's Malaysia assets

Downstream……………………………

· India to be developed as a refinery hub: Govt

· IOC to set up two new plants in Uttarakhand

· Essar may raise $3.5 bn by stake sale in restructured refinery business

· Diesel sales beat high prices; grew 1.3 pc in May

· BORL defers 120K bpd Bina refinery maintenance to Q1 2015

Transportation / Trade………………

· Govt says it is keen to set up Jagdishpur-Haldia gas grid

· India to build pipeline from Bihar to Kathmandu for supply of oil products

· GAIL to buy one-third of LNG ships from Indian shipbuilders

Policy / Performance…………………

· Essar Projects bags $54 mn contract from Saudi Aramco

· Oil companies may deregulate diesel prices by Diwali

· Govt's gas pricing plan may try to keep buyers and sellers happy

· Oil Ministry wants RIL to sell natural gas at $4.2

· Govt persuading affluent customers to voluntarily give up subsidised LPG

· No final decision on gas prices yet: Finance Minister

· Petrol gets cheaper by ` 1.09 per litre, diesel prices up by 56 paise

· Oil Minister tells PSU oil companies to improve refining margins

· Govt seeks ` 155.4 bn fuel subsidy from upstream companies like ONGC and OIL

[NATIONAL: POWER]

Generation………………

· Coal power generating companies form new group

· NLC unit in Tamil Nadu to be commissioned this month

· Coal shortage hitting power generation in Maharashtra

· Mahan I project to be fully operational this fiscal: Essar Power

· BHEL commissions another 68 MW unit at Rampur hydel plant

· Nathpa Jhakri Hydro power station achieves highest-ever generation in July

· Adani eyes Indiabulls' 1.3 GW Amravati Thermal Power Project

· India and Russia hold major consultation to set up 22 nuclear power projects in India

Transmission / Distribution / Trade……

· NTPC to sell additional 75 MW power to Assam

· CAG pulls up PowerGrid for loss in revenue

· India, Nepal to firm up power trading pact soon

· Power cuts in parts of north Delhi due to snag in Mandaula grid station

· ` 52.8 bn Tamil Nadu power transmission corridor to be set up

· 'Odisha needs investment in power distribution projects'

· Siemens wins Power Grid Corp's ` 4.1 bn order

· Stolen India coal sold at black market in Modi’s backyard

· DERC move may help discoms in power purchase

Policy / Performance…………………

· Goyal asks CIL for action plan to augment output by 150 million tonnes

· Modi's $1 bn facility to help Indian infra cos in Nepal

· ‘Power plants face less than 4 days of coal stocks’

· Govt introduces ten measures to improve safety of coal mine workers

· Govt may finalise policy on utilisation of surplus coal by September

· CBI case against Lalu confidant in coal scam

· Delhi govt to shed load it doesn't need, tells Centre

· Reliance Power in talks with Temasek Holdings and PSP Investments to fund Jaypee Group deal

· Energy security to be high on the agenda during Modi's US visit

· BCG to guide CESC on power sector expansion

· No 'concrete' proposal to set up equity fund for power sector

· 1.8 GW nuke power generated after Indo-US nuclear deal

· ‘84 per cent of Delhi households to have reduced power bills’

· Audit firms vying for advisory mandate for R-Power's Jaypee deal

· Power tariff hike to spur SMEs flight from UP

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· US shale drilling outpaces research on its impact: Study

· Kurdistan oil explorers fall as militants seize oilfields

· Pluspetrol to invest $500 mn in Peru natural gas block

· Exxon bets on Russia as rivals stick to US wells

· Rosneft moves to thwart EU sanctions with Norwegian rigs

· Eni inks PSCs for 2 onshore exploration blocks in Myanmar

· BG beats profit estimates on Brazil production boost

Transportation / Trade…………

· Kurdish oil production seen doubling next year by Goldman Sachs

· Where’s that Irish oil, investors wonder two years later

· Kurdish pipeline exports unaffected by Iraq turmoil

· Triangle Petroleum said to seek advisers for services unit sale

· Japan's Hiroshima Gas to buy LNG from Osaka Gas

· Taiwan gas explosions kills 24 in southern city of Kaohsiung

· Oil market losing faith in Libya’s ability to ramp crude

· Asia to get most 2014 middle east fuel, ship hirings show

· US oil imports may fall as gulf prices drop below Brent

Policy / Performance………………

· Colorado fracking opponents losing local control fight

· Somalia sees oil results this year as BP, Exxon wooed

· Petrobras unlikely to meet 2014 oil output goal: Govt

· Mexico lower house passes final oil bills, sends them to senate

· EU sanctions threaten Rosneft offshore drilling plans

[INTERNATIONAL: POWER]

Generation…………………

· Alaska Energy Authority approves $20 mn hydro project loan

· AES plans $1 bn investment in Mexican power generation

Transmission / Distribution / Trade……

· Shipping rates drop as China hydro power cuts coal need

· Nepal prepares to sign power trade deal with India

· Waste Management to sell electricity-production business

Policy / Performance………………

· US to invest up to $498 mn in Ghana energy sector

· Iraq’s biggest dam at risk as Islamists fight Kurds for control

· Pakistan Finance Minister finalizes power projects for Chinese funding

· El Nino rains won’t refill Brazil’s key hydropower dams

· EU power set for biggest gain in 10 months on sanctions

· Ofgem proposes new price controls for electricity network firms

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· ‘Govt trying to address issues in renewable energy sector’

· ABB India working on remote monitoring of solar power plants

· 'Tax sops for wind energy to boost Suzlon’

· Govt modifies tender guidelines for projects under JNNSM

· India property developer plans 100 MW solar project

· Target of 29.8 GW of electricity from renewable sources

· Gedcol to set up 20 MW solar plant

· US wants to link power pacts with climate change agreement

· India solar-credit demand rises to 4 month high in July

· India's largest solar power plant planned in Madhya Pradesh

· 'India is fifth largest producer of wind energy'

· Local solar panel makers may help save $42 bn: KPMG

· Mytrah Energy to add 300 MW by next year at ` 20 bn

GLOBAL………………

· Japan may pull more approvals for solar projects behind schedule

· Impsa’s wind power energy declared in bankruptcy by Brazil judge

· Siemens eyes Mexico wind market as investment law relaxed

· Uruguay seeking $100 mn for wind project

· Sharp pushes energy management system in US to cap peak demand

· Bolivia expects 163 MW of renewable power within 10 yrs

· Orix, ADB, Robeco to set up climate change private-equity fund

· Tougher ozone standard would cost billions, shutter coal plants: Industry

· Renewable energy expansion continues in Ukraine with new biogas capacity

· UK renewables generated 14.9 per cent of electricity

· Brazil development bank to allow solar imports until 2020

· Coal miners clash with ski operators over EPA’s coal rule

· SunPower to supply 29 MW of solar panels for Japan plant

[WEEK IN REVIEW]

ENERGY/POWER………………

Sub-Prime Crisis in the Indian Power Sector

Lydia Powell, Observer Research Foundation

In 2011, a Brookings working paper titled ‘Does the Exuberance of the Indian Power Sector have legs?’ by Sugatha Bhattacharya and Urjit Patel (currently Deputy Governor of the Reserve Bank of India) asked if risk and leverage in the sector has been miscalculated leading to a case of irrational exuberance and sub-prime funding? Fortunately or unfortunately we do not have to wait long for the answer. News coming out of the power and banking sector seem to suggest that the worst fears of the authors of the Brookings paper may indeed be coming true.

As per figures from the Reserve Bank of India (RBI) ` 12 lakh crore (~$ 195 billion or about 12% of GDP) was held up in stalled infrastructure projects when the previous Government demitted office. At least ` 5 lakh crore of this may be attributed to the power sector. Though reasons such as the slow-down in GDP growth rate in the last two years, delays in obtaining environmental and other clearances and the difficulty in acquiring land could be assigned some of the blame, the bulk of the blame must be assigned to systematic problems in the sector that continue to be systematically rolled over to the future.

A recent RBI working paper on re-emerging stress in the asset quality of Indian Banks observes that after a sustained period of improvement during the crisis and post crisis phases, growth of Non Performing Assets (NPAs) attributed to the power sector rose by over 72% by March 2012. According to the paper, power generation accounted for 55% of credit while State Electricity Boards (SEBs) and corporatized distribution companies (discoms) took 25%. Over 17% of these assets could now be NPAs.

The RBI’s Financial Stability Report dated June 2014 points out that along with construction and steel & iron, electricity generation and supply is burdened with high leverage and interest expenses. Interest expenses of power companies as a percentage of earnings before income tax (EBIT) is between 40-50% and leverage is between 70-90%.

Most of the reports and papers cited above tend to assign blame primarily on coal supply problems and delay in obtaining approvals in the generation side and on mounting losses of State Electricity Boards (SEBs) on the distribution side. While coal supply is an issue for generating companies, the root of the problem lies elsewhere in the broader system.

As correctly pointed out by the Brookings working paper, as long as SEBs lack incentives for increasing their commercial orientation, the problems of the power sector will continue to be passed on to the generation side. The paper also correctly points out that while the poor financial status of SEBs is attributed to state governments and their policies for giving away free power to farmers and households, part of the responsibility lies with the Centre and its policy for universal access to electricity. While the objective of providing universal access to electricity cannot be questioned, it creates problems as it is forced to ride on a defunct system. The Centre provides capital subsidy for erection of infrastructure through schemes such as the Rajiv Gandhi Rural Electrification programme, but the electricity itself has to come from SEBs. The gap between average revenue realisation and average cost of supply is large when it comes to remote rural areas and this compounds losses of the SEBs.

There is also the SEBs legitimate fear of losing lucrative industrial and commercial consumers who subsidise urban households and rural consumption if open access is imposed. Though open access is a necessary condition to unleash commercial orientation of the SEBs in the current environment it is equivalent to asking the SEBs to commit suicide. Why would SEBs want to destroy themselves? More importantly how would state governments retain power if SEBs are not there to distribute free goods?

Returning to the generation side, acute coal shortage on account of inefficiency in coal production by Coal India Limited (CIL) is portrayed as self evident truth that explains problems in generation. In fact this week’s news compilation carries a routine story of power generation companies being on the verge of a coal supply crisis. However there is yet another story from Bloomberg in this week’s news compilation that says that the volume of ‘stolen’ coal turnover in the Varnasi market is a staggering 60 million tonnes. This could more than make up for the so-called shortages that we are now seeking to meet through imports. The volume quoted in the news story may or may not be accurate but it does expose yet another systematic problem in the power sector. It makes economic sense to convert regular coal into stolen coal and it will continue as long as it makes economic sense to do so. This basic economic force that creates and sustains black markets cannot addressed by signing stringent contractual agreements with CIL.

This leads to yet another systematic problem that links the generation side with the distribution side. Domestic coal available at a substantial discount over international market prices (in the range of 70%) to power generators ends up as power which is as expensive (if not more) as power produced with market priced coal. The reason is managerial, administrative and economic inefficiencies that sap the system of delivery. This raises questions over persistent calls for upward revision of power tariff to reduce the gap between average cost of supply and the average revenue realisation. What about calling for tariff reduction and rationalisation by systematic improvement in efficiency across the entire chain? Can we solve what is essentially an inefficiency problem by raising tariff? In fact increase in tariff may just provide an additional cushion to pad in more inefficiencies and leakages.

This leads to a question over claims by corporatized distribution companies or discoms (including ones in Delhi) that they have reduced aggregate commercial and technical losses (AT&C) substantially. Was such a reduction achieved through an increase in tariff rather than an actual reduction in losses?

Finally, there is the larger and more profound question over demand for electricity. In the last few weeks, two states, West Bengal and Jharkhand have declared that they may be power surplus states. This is not because they have managed to meet demand with adequate supply. It is because demand is lower than expected on account of de-industrialisation. If this is so it is definitely not an achievement. At the national level there is speculation that power demand projections of the CEA (in the latest 18th power survey) may have overestimated demand for power as it assumed economic growth rates of over 8%. There are also stories of dumping of power at power exchanges by utilities even as the states they are supposed to serve reel under power outages.

This raises the question over the quality of demand for electricity in India. Investing companies were told that huge unmet demand for power would limit and compensate for all downside risk in the power sector. Where is this huge unmet demand for power that we go around talking about?

We are on the verge of a sub-prime crisis in the power sector. What we can do without are sub-prime analysis and sub-prime solutions.

Views are those of the author

Author can be contacted at [email protected]

POWER……………

Hydro Projects: Welcome to the Jungle

Ashish Gupta, Observer Research Foundation

A recent conference on Hydro power organised by the well renowned Industry association in the capital was well received by the hydro community. The Hon’ble Minister of Power, Coal & Renewable (MoP) graced the occasion with his presence. Though he mentioned in his speech that he is not fully informed of the hydro sector, his speech provided food for thought to the audience. He mentioned that his ministry looked forward to work closely with all the energy stakeholders and welcomed suggestions/critiques on the ongoing issues plaguing the energy sector. He also mentioned the importance of environmental issues and how Ministry of Environment & Forests (MoEF) is working in tandem with the Ministry of Power (MoP). This is a good sign. Unlike the past where the MoEF was seen as a hurdle, it will now be a partner of MoP. He also emphasised that recent Nepal visit of the Hon’ble Prime Minister would open some new avenues for hydel projects. The Minister left on that happy and encouraging note.

The story does not end there as the deliberations at the conference revealed some of the more challenging issues facing the sector.

Hydro as a Panacea: As it is with all energy platforms one or the other form of energy is promoted as the panacea for the country. Hydro power was not an exception. This is a paradox for a country like India where there is no consensus among the energy stakeholders as to the priority among energy sources. Many presentations seemed like repetitions of problems that are common to all sectors. This sadly shows that nothing has changed in the last decade. The problems of the sector are well known but the objective of conference was to put them across once again to the new government. But the problem was there were no solutions presented – only problems were repeated.

Renewable vs Renewable: Though hydro is known as a renewable source, it is only considered partially renewable. Small hydro projects which come under the Ministry of New & Renewable Energy are considered as renewable and since large hydro projects comes under MoP, they are not renewable. The different ministries are not clear about how to clearly differentiate between renewable and non renewable sources. One very important point worth mentioning is that hydro is a mature technology unlike solar. Hydro projects do not require subsidies. Also if the hydel projects are constructed with proper due diligence it contributes to irrigation and flood control with no GHG emission. In the end hydro ‘wins’ and renewable ‘loses’. But policy climate is skewed towards renewable such as solar. Why?

Hydro is the cheapest source: US Energy Information Administration estimated the levelised cost of electricity for plants to be commissioned in 2019

|

Plant Type |

Levelised cost of electricity (USD/ MWh) |

|

Conventional coal fired plants |

95.6 |

|

Conventional combine cycle gas fired |

66.3 |

|

IGCC |

115.9 |

|

Nuclear |

96.1 |

|

Wind |

80.3 |

|

Wind offshore |

204.1 |

|

Solar PV |

130 |

|

Solar Thermal |

243.1 |

|

Hydropower |

84.5 |

As shown in the table, Hydro power will be one of the cheapest sources in 2019 since the fuel cost is almost nil for hydro plants. But comparing new hydel plants with conventional coal fired plants is inaccurate. The assumption that innovation may happen in all the other fuel type plants except coal fired ones which is certainly not correct. But this table also clears the air over solar power costs. Solar power will not achieve grid parity even in 2019. Cheap solar power may remain myth!

Land and Transmission issue: For hydel projects land is not a major problem but getting access to the plant sites is as many of them are situated in very difficult terrain. Many hydel projects do not even have the approach road making it even more difficult for the developer to construct the plant. Unfortunately if there is any approach road then Public Works Department (PWD) does not even know the carrying capacity of the same. There is no coordination among the project developers and the PWD and the result is unnecessary cost overruns and delays. Also constructing evacuation infrastructure is a huge challenge. To avoid losses it was suggested that transmission infrastructure must come online before the power plant. It is highly unrealistic, because the transmission line developer will incur huge losses due to non-utilisation. Also after the commissioning of the plant it will remain under- utilised because hydel plants work at 45% - 50% plant loan factor. There is little or no incentive for the transmission developer. When all this taken into account hydro power will not be cheap compared to thermal power. But since the plant life is much more than thermal plants, it will be economical in the long run.

Environmental & Forest Clearances: These are major hurdles but unfortunately approvals take time because either the information furnished by the companies is incomplete or sometimes the application is very badly prepared. Therefore rather than criticising MoEF all the time, companies must standardise their application procedure.

Hydro Purchase Obligation (HPO): Following the pattern of Renewable Purchase Obligation (RPO), one suggestion put forth was that HPO must be implemented. It is not a valid suggestion as it will lead to the creation of an artificial demand for the concerned source in the name of providing relief to the project developers. Rather than enforcing another obligation, it must be coupled with RPO which may bring down the RPO cost for the distribution companies. The important thing is to keep in mind that artificial demand will lead to more nonperforming assets.

Views are those of the author

Author can be contacted at [email protected]

Globalisation is Driving Gas Pricing Evolution (part III)

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

Continued from Volume XI, Issue 7 (http://orfonline.org/cms/sites/orfonline/modules/enm-analysis/ENM-ANALYSISDetail.html?cmaid=70233&mmacmaid=70234.)

Natural gas pricing is internationally in a continuous state of flux. Although change is mostly slow and occurs over longer time periods due to its determinants, which are rather long-lasting like geology and technology, market maturity, changes of economical and political doctrines as well as shifts of institutional and political frameworks.[1] Although it is quite obvious that gas pricing is in a state of interdependence with some of its determining factors as pricing and resulting price levels influence market and concomitant technology developments as well, for instance.

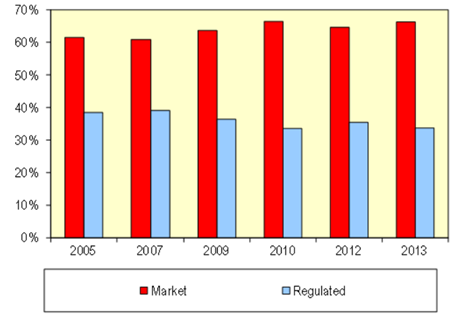

If one now looks on the evolution of natural gas pricing throughout the world in the past decades, some instructive trends can be observed over time, be it with respect to the transition of one pricing scheme to another, regional developments or market maturity. One general trend is stated by the International Gas Union (IGU) that has found in its series of surveys that market induced pricing schemes are forging ahead globally at the expense of administered or regulated pricing (Figure 1).[2]

Figure 1: Development of Market vs. Regulated Gas Pricing Categories (2005-2013)

Source: International Gas Union (2014).

Even though in numbers the tendency towards market pricing (from 61.5% in 2005 to 66% in 2013) and the move away from regulated pricing (from 38.5% in 2005 to 34% in 2013) seems not to be too bold, the IGU has pointed out that the switch to market pricing tends to be effectively understated[3]. Main contributors to this pricing switch can be found all over the globe: Russia (to GOG), Argentina (to GOG) and China (to OPE).

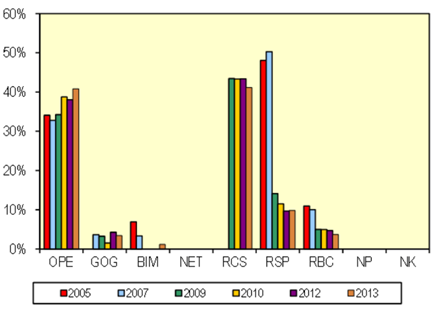

Figure 2 highlights the corresponding regional developments in Asia, which are dominated by China and India: the rise of OPE can be largely attributed to contractual changes of Qatar LNG supplied to India, as well as the commissioning of oil-indexed pipeline supplies from Turkmenistan to China and partially to Chinese pricing reforms. Furthermore, the considerable drop of social/political regulated pricing (RSP) towards regulated prices based on “cost of service” can be assigned to China’s efforts to mark-up prices to economic levels. In Asia, the basic tendency can be observed as well: away from (strict) regulated pricing schemes (RSP, RBC) into the direction of more market-driven gas pricing formations like oil-linked gas prices (OPE).

Figure 2: Development of Price Formation Categories in Asia (2005-2013)

Source: International Gas Union (2014).

Note: OPE= Oil Price Escalation, GOG = Gas-on-Gas Competition, BIM = Bilateral Monopoly

RCS = Regulation: Cost of Service, RSP = Regulation: Social and Political, RBC = Regulation: Below Cost

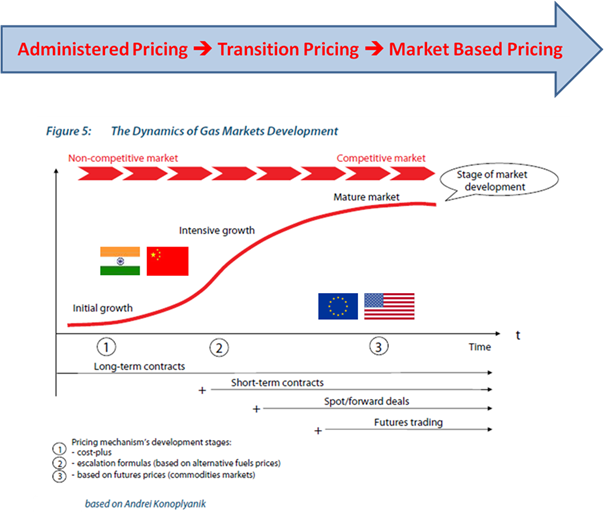

Gas markets dynamics can be tracked in accordance with the above-illustrated empirical evidence. In general, some different stages of market development can be distinguished (Figure 4) in its evolution from a non-competitive towards a competitive one. It is pretty clear that gas market dynamics towards market maturity have to be considered as a slow and lengthy process due to its nature of being a grid-based energy system. Therefore the achievement of building up effective gas transportation and distribution systems like in the U.S. and (Northwest) Europe took decades.[4] Shifting from one pricing scheme to another in fact implies another time-consuming process, as the longstanding efforts towards market liberalisation in the North American and European markets, which have emerged on the political agenda in the 1980s and 1990s, have illustrated. Significantly, the development in U.S. and U.K., who were the liberalisation forerunners, was initially based and driven on domestic gas production. However, nowadays the availability of gas is in general largely enhanced by the trade globalization via LNG.

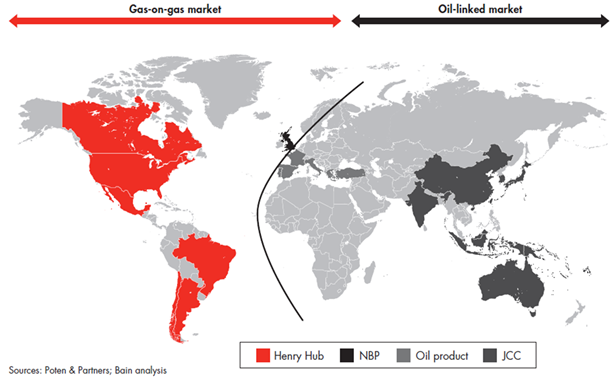

Figure 3 illustrates the global state of the play with respect to the distribution of the main market based gas pricing mechanisms. The diagram even somewhat conceals the fact that actually gas-on-gas markets have been spreading out further on eastwards onto Northwest European gas markets since new gas trading hubs have been established besides the NBP in UK in recent years, like the TTF (NL), Zeebrugge (BE), PEG (FR), NCE and Gaspool (GER), CEGH (AU), PSV (IT) concomitant with some financial gas trading options at European exchanges like the IPE, Powernext, ENDEX or EEX. In fact, the IGU gas price survey has demonstrated that especially Northwest Europe has experienced the most significant shift of gas pricing schemes in the last few years as the shares of oil-linked pricing and gas-on-gas pricing (now about 80 % share) have undergone a complete reversal since 2005, which was the result of increased hub trading. Even in post-communist Central European countries like Hungary and Poland, gas-on-gas pricing has increased from almost zero in 2005 to over 50% in 2013 due to increased imports of spot gas. Furthermore eastwards large parts of Asian gas prices are influenced by the Japanese Crude Cocktail (JCC), a commonly used oil index in long-term LNG contracts.

Figure 3: Evolution of Market Driven Pricing throughout the World

By the measure of the three stages of market development shown in Figure 4 the pioneer ones, U.S. and U.K. (and large parts of the internal EU gas market as well), can be definitely assigned to the most mature and competitive gas markets around the globe.

In contrast, many evolving gas industries, mostly located in the developing or emerging world, find themselves in a more initial and immature phase of gas market development, characterized by little or no competition and consequential administered / regulated pricing methods that range in its more appropriate schemes from cost-plus pricing to the economically most unreasonable pricing schemes below cost of production. As can be seen in Figure 4, after an initial growth phase gas market development typically passes through a phase of intensive growth that involves a gradual opening of market structures towards privatisation and deregulation, but also progress according to the applied gas pricing formations. Oil-linked gas pricing or more general gas pricing linked to competing fuels (which in fact is predominantly crude oil or oil products), is widely regarded as the most appropriate method of “transition pricing”. Indeed, it comprises terms of both the two worlds as the base price P0 is set (or fixed in a negotiation process) and might be capped on the one hand and the floating element to which the gas price is linked, is mostly formed on transparent and liquid markets (such as crude oil) on the other hand. This pricing concept has a long tradition in building up European gas markets, where it was the dominating type of gas pricing for decades, and currently accounts for a share of about 20 % in overall world gas price formation. Even China moves forward towards oil price escalation in recognition of the inefficiencies of its regulated pricing system and adaption of low domestic prices in contrast to higher prices of surging imports via pipeline and LNG.

Figure 4: Dynamics of Gas Market Development

Source: Energy Charter Secretariat (2007), complemented by author.

The observed trends towards more market based gas pricing schemes are driven by the general globalization trends of trade and specifically by globalisation of former regionally distinct gas industries by means of LNG, which provides far reaching flexibility in gas trade beyond regions defined by cross-border pipelines. Many importing countries will have to cope with this power of markets forging ahead through consolidation of pricing and prices from domestic production (regulated prices at low level) vs. imported gas (market driven prices at higher level) at the national level. Decoupling from international markets developments is becoming more and more difficult and pressure will even rise in future, because of increasing integration and import dependence. China’s move has acknowledged these requirements, India is awaited to follow.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Indian Coal and Power Sector 2013-14

Akhilesh Sati, Observer Research Foundation

Million Tonnes

|

Year |

Coal Production |

Import |

|

|

All India |

of which CIL |

||

|

2011-12 |

539.95 |

435.84 |

102.85 |

|

2012-13 |

556.40 |

452.21 |

145.79 |

|

2013-14 |

565.64 |

462.53 |

168.44 |

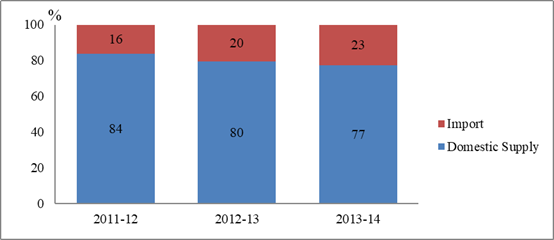

Share of Imports in All India Coal Consumption

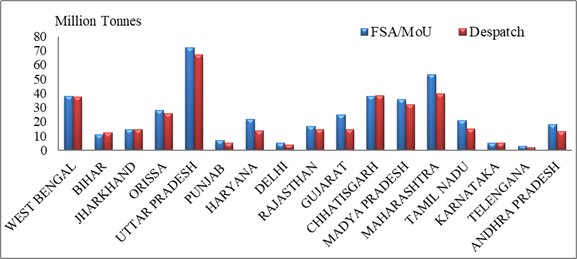

State-wise Despatch of Coal by CIL to Thermal Power Stations (2013-14)

Source: Compiled from Various Sources

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Cairn to get 10 yr extension for Rajasthan block

August 5, 2014. Cairn India is likely to get a 10-year extension for its license to explore and produce oil and gas from the prolific Rajasthan block but may have to pay more profit petroleum to the government to get a term beyond 2020. A Committee headed by the Directorate General of Hydrocarbons (DGH) on policy for grant of extension to the Production Sharing Contracts (PSC) for small, medium-sized and discovered fields that were awarded to private firms in 1990s, has recommended a uniform 10-year extension but on revised terms and conditions. The panel has recommended that contracts may be extended for 10 years for both oil and gas fields or the balance economic life of the field, whichever is earlier, but with revised terms and conditions. The current PSCs provide for a 5-year extension in case of an oil field and 10 years in case of gas discoveries. It recommended a minimum 50 per cent government share of profit petroleum from small fields and 60 per cent in case of medium-sized fields. At present, the government's profit petroleum ranges from 25 to 60 per cent. In case of Cairn's Rajasthan block, it is 50 per cent. Cairn's Rajasthan block is not among fields for which the Committee has recommended the extension policy but the same principals are likely to be used for it as well. Cairn block has been kept out of this policy as unlike other discovered fields like Panna/Mukta and Tapti and Ravva, Oil and Natural Gas Corp (ONGC) is the licensee of the Rajasthan block. ONGC holds 30 per cent interest in Rajasthan block and is also the licensee. As per terms of the Rajasthan PSC, the block is to return to the licensee after expiry of the term. Also, ONGC becomes the owner of all facilities once its cost is recovered from sale of crude oil. (economictimes.indiatimes.com)

DGH rejects ONGC's three KG gas discoveries

August 3, 2014. After rejecting Reliance Industries' gas finds, upstream regulator Directorate General of Hydrocarbons (DGH) has refused to recognise three gas discoveries of Oil and Natural Gas Corp (ONGC) for not doing its prescribed conformity tests. The Directorate General of Hydrocarbons (DGH) has not approved Declaration of Commerciality (DoC) for three out of the 11 discoveries ONGC has made in its Krishna Godavari block KG-DWN-98/2 (KG-D5) in Bay of Bengal. ONGC proposes to develop these finds in three clusters - combining finds D and E in KG-D5 block with discovery in neighbouring G-4 block as Cluster-I and developing all other finds except ultra deepsea UD-1 discovery as Cluster-II. The UD-1 find is to be developed as Cluster-III. (economictimes.indiatimes.com)

ONGC, OIL bid $1.5 bn for stake in Murphy Oil's Malaysia assets

July 31, 2014. Oil & Natural Gas Corp (ONGC) and Oil India Ltd (OIL) have submitted a joint bid worth about $1.5 billion to buy a stake in Murphy Oil Corp's Malaysian oil and gas assets. Arkansas-based Murphy, which has interests in oil and gas fields in Malaysia, Vietnam, Indonesia, Brunei and Australia, has invited bids for a 30 percent stake in its Malaysian assets. If successful, ONGC will own a 20 percent stake in the assets, while Oil India would own the remaining 10 percent. The bid value is below $1.5 billion, but the joint bid is preliminary and the final deal value may change depending on rival bids. India's state explorers including ONGC have been looking overseas as they struggle to boost the country's energy security and arrest decline from local gas fields. In June last year ONGC together with Oil India acquired a 10-percent stake in a deepwater gas field in Mozambique's Rovuma basin for $2.5 billion. In August ONGC agreed to buy another 10-percent stake in the field from Anadarko Petroleum. Malaysia is the biggest part of Murphy's Asian portfolio, accounting for more than 45 percent of its total 2012 net production. Murphy's net oil and gas production from Malaysia was about 86,000 barrels of oil equivalent per day in 2013, with total proved reserves of 125 million barrels of oil and 406 billion cubic feet of gas. (in.reuters.com)

Downstream………….

India to be developed as a refinery hub: Govt

August 4, 2014. India refines more oil than the domestic requirement and the government seeks to develop the country as a refinery hub. Petroleum Minister Dharmendra Pradhan said domestic requirement is 160 million metric tonnes (mmt), while India refines 215 mmt. He said it helps the country earn foreign exchange. Pradhan said the country also seeks to fulfil the need of SAARC countries and other developing economies. He said while some Gulf countries produce crude, they lack refining capacity. This, he said, has led to a situation where crude is cheaper while refined product is costly in those countries. The Minister was responding to a supplementary question on country reaching a saturation point in refined oil production. He said while several companies have applied for refinery in the private sector, Essar and Reliance have been contributing to the country's refinery production. The refinery sector was delicenced in June, 1998 and a refinery can be set up anywhere in India by a private or public sector company depending on its techno-commercial viability. India has exported petroleum products to the tune of ` 3,68,279 crore during 2013-14. (economictimes.indiatimes.com)

IOC to set up two new plants in Uttarakhand

August 1, 2014. Indian Oil Corp (IOC) will set up two new plants in the state besides doubling the capacity of its plants in Haridwar and Haldwani. The Corporation will double the current capacity of its Haldwani and Haridwar plants from 5,000 tonnes to 10000 tonnes and will also set up two new plants in the state, IOC said. The IOC will also set up two new plants in Uttarakhand, one each in Dehradun and Kotdwar to meet the state's LPG requirements. IOC has a capacity of only 10,000 tonnes of LPG per month against the state's total requirement of 16,000 tonnes of LPG per month. (economictimes.indiatimes.com)

Essar may raise $3.5 bn by stake sale in restructured refinery business

July 31, 2014. Ruia-owned Essar Group is looking at raising over $3.5 bn by selling stake in the refinery business. Essar Group is said to be in talks with two Chinese oil & gas majors for the deal. UK based Stanlow Refinery which is Essar Group's prized asset will be monetised in the transaction. The deal could be in several phases and will require restructuring of Essar Group's energy business. First step is already underway with both U.K- listed Essar Energy and India-based Essar Oil heading for a de-listing. Essar Energy is expected to sell its Stanlow Refinery to Essar Oil for $1 bn, post the de-listing process is complete. The restructured Essar Oil with Stanlow Refinery unit under it is expected to sell 49% stake in the company to the interested buyer. Company is expecting an Enterprise Value of $7.5 bn. (economictimes.indiatimes.com)

Diesel sales beat high prices; grew 1.3 pc in May

July 31, 2014. India's oil sector grew at the highest pace since January 2013, helped by a spurt in fuel demand due to better performance of the automobiles sector and higher use of diesel by farmers who used pumps in the absence of rain, power deficit and higher vehicular movement. Diesel sales had been declining since the middle of last year but demand picked up in the last two months even though the fuel's price has risen by ` 10.70 per litre since January last year. Prices have increased in small doses of 50 paise per month. Another routine diesel price increase is expected that would cut revenue losses on the fuel to about ` 1.50 per litre, providing an opportunity to the government to deregulate the fuel. Oil companies may also slash petrol prices by more than ` 1 a litre. Rising price of diesel had initially impacted its sales, but its demand started growing gradually with the economic recovery since May. Diesel demand rose because of growth in port traffic by 3.3% last month, mainly at all major ports except Kolkata, Chennai and Cochin. The resumption of the mining activities and increased cargo movement in Goa during 2014-15 have improved the consumption of petroleum products. (economictimes.indiatimes.com)

BORL defers 120K bpd Bina refinery maintenance to Q1 2015

July 31, 2014. India's Bharat Oman Refineries Ltd (BORL) has postponed a maintenance plan for its Bina refinery in central India, likely to be the first quarter of 2015 from this year, Bharat Petroleum Corp Ltd (BPCL) said. BORL is majority owned by BPCL, with Oman Oil Co holding a small stake in the 120,000 barrels per day (bpd) refinery. The Bina refinery has only one crude distillation unit (CDU), and the month-long maintenance, which involves shutting the entire plant including secondary units, was initially planned for September this year. (economictimes.indiatimes.com)

Transportation / Trade…………

Govt says it is keen to set up Jagdishpur-Haldia gas grid

August 5, 2014. Keen to set up a 'gas grid' in the country, government is working on the Jagdishpur-Haldia gas pipeline and termed it as the first ever gas corridor in the Hindi heartland. It said once the pipeline is completed, it will not only help fertiliser plants but will also provide fuel to steel mills. Chemicals and Fertilisers Minister Ananth Kumar said that the proposed pipeline will help fertiliser plants in Gorakhpur (UP), Sindhri (Jharkhand), Barauni (Bihar), Durgapur and Haldia (both West Bengal). He said the Budget speech of the Finance Minister also has a reference to the 'gas grid' and it is an important vision of the Modi government. (economictimes.indiatimes.com)

India to build pipeline from Bihar to Kathmandu for supply of oil products

August 4, 2014. India agreed to build a pipeline from Bihar to Kathmandu for supply of petrol, diesel and ATF. Prime Minister Narendra Modi signalled India's willingness to build the ` 200-crore pipeline to supply fuel during his visit to Himalayan nation, the first by an Indian Prime Minister in 17 years. Nepal is dependent on India for meeting all of its fuel requirement. Petrol, diesel, domestic LPG and jet fuel (ATF) are currently trucked from Indian Oil Corp's (IOC) depot at Raxaul in Bihar to Nepal. In 2006, a 41-km pipeline from Raxaul to Amlekhgunj in Nepal was proposed for transportation of the fuel. The pipeline was to be funded 50:50 by Indian Oil Corp (IOC) and Nepal Oil Corp (NOC). The project, however, never took off as Nepal refused to fund its share of cost. IOC in the meanwhile has decided to shift its oil storage depot from Raxaul to Motihari and the pipeline origin point too may have to be shifted to Motihari. Motihari- Amlekhgunj pipeline will be about 81-kms long and cost ` 200 crore. IOC said the pipeline will now be built by the company. (economictimes.indiatimes.com)

GAIL to buy one-third of LNG ships from Indian shipbuilders

July 30, 2014. GAIL India Ltd has decided to buy from Indian shipbuilder’s a third of the LNG ships for ferrying gas from the US. GAIL wants 9 ships to ferry liquefied natural gas (LNG) it has contracted from US producers to India. The previous Oil Secretary Vivek Rae saw the GAIL's chunky contract as an opportunity to push the case for domestic LNG shipbuilding and pushed the company to include Indian shipbuilders, who currently don't have the technology, in the tender. After Rae, the current Oil Secretary Saurabh Chandra nudged GAIL to reserve a part of the USD 7.6 billion contract for Indian shippers so that global majors transfer LNG shipbuilding technology to India. Initially, GAIL resisted saying it will be a time consuming process, but when the ministry mulled issue a Presidential directive it backed down. GAIL decided to give Indian shipbuilders six years to deliver the ships as opposed to two-and-half-year deadline for foreign firms. GAIL had been for past 6-7 months resisting the inclusion of domestic ship makers in the tender on grounds that Indian shipyards would need at least six years and huge finances to develop the capability to build cryogenic LNG carriers. The Ministry was of the view that GAIL should promote domestic industry and mulled issuing a Presidential directive - an order in the name of the President who is the owner of public sector companies. In October 2004, a Presidential Directive was issued to GAIL following which it cancelled a ` 1,400 crore tender for supply of pipes and issue a fresh one incorporating new terms that including more suppliers. GAIL said it has signed long term agreements with the US based Cheniere Energy Partner and Dominion Resources for transportation of 5.8 million tonnes per annum of LNG from Sabine Pass and Cove Point terminals. It plans to charter newly built ships to transport this gas to India. (economictimes.indiatimes.com)

Policy / Performance………

Essar Projects bags $54 mn contract from Saudi Aramco

August 5, 2014. Essar Projects said it has bagged a $ 54 million (over ` 328 crore) maiden contract from Saudi Arabian national oil company Saudi Aramco. The scope of work entails engineering, procurement and construction of a crude tank, replacement of crude pumps and associated civil, piping, electrical and instrumentation facilities. The project is scheduled to be completed in 29 months. The Hydrocarbon SBU of Essar Projects, a global engineering, procurement, construction (EPC) contractor, has secured the contract from Saudi Aramco. The company is already executing five other projects in the region in the hydrocarbon sector. The company has experience in refinery projects having previously executed a world-scale grass-roots refinery at Vadinar, Gujarat, with an initial capacity of 10 million tons per annum, which was gradually expanded to 14 million tons and then 20 million tons. (economictimes.indiatimes.com)

Oil companies may deregulate diesel prices by Diwali

August 4, 2014. Diesel, the nation's most consumed fuel, is headed for full deregulation by Diwali. After the government raised diesel prices by 50 paise, under-recoveries — the difference between cost price and selling price — on every litre of diesel sold has now reduced to just ` 1.33. And if the international crude prices and rupee-dollar exchange rate remain stable, the losses will be completely wiped out by October-end. Diesel currently retails at ` 66.63 per litre in Mumbai and ` 50.40 in Delhi. (economictimes.indiatimes.com)

Govt's gas pricing plan may try to keep buyers and sellers happy

August 4, 2014. The government wants to usher in a new gas-pricing regime that will balance conflicting interests of producers and consumers and rule out conflicts with gas producers without diluting the stand it has taken in disputes in gas-related matters. The oil ministry has recently discussed merits of setting the price roughly mid-way between the existing $4.2 per unit and the rate of $8.4 calculated by the Rangarajan formula that the UPA's Cabinet had approved, but not implemented because the Elections Commission did not allow it during the poll campaign. The government is also keeping in mind the stand it has taken on gaspricing issues in the dispute with Reliance Industries. The oil ministry, under UPA's Jaipal Reddy and Veerappa Moily as well as NDA's Dharmendra Pradhan, has consistently taken the stand that it must penalise RIL for the fall in gas production at the KG-D6 block. RIL says output fell because of geological reasons and that its contract does not provide for such penalty. However, since the oil ministry feels that gas production declined because the company did not drill more wells as suggested by the director general of hydrocarbons, it is not keen to let RIL charge higher rates unless the company produces the amount of gas that it was expected to produce according to the field development plan for the producing fields of the KG-D6 block. The government is also considering specifying the gas price formula in the contract of oil and gas blocks it plans to auction with simplified revenue-sharing terms, which will avoid disputes. Discussions are on in several ministries such as oil, power, fertiliser and finance to resolve the vexed gas pricing issues as the Cabinet had set the deadline of September 30, the government said. (economictimes.indiatimes.com)

Oil Ministry wants RIL to sell natural gas at $4.2

August 3, 2014. The oil ministry is looking at a price of US $ 6-6.5 for all domestic natural gas but wants Reliance Industries Ltd (RIL) to sell KG-D6 gas at old rate of US $ 4.2 till it makes up for shortfall in supplies of past four years. The ministry internally discussed tweaking the formula suggested by the C Rangarajan Committee to bring down the proposed increase from US $ 8.4-8.8 per million British thermal unit to US $ 6-6.5, a rate that will be affordable to most consumers and also incentivise exploration. The new rate, the ministry believes, would be acceptable to the international investors and would help in monetising discoveries of Gujarat State Petroleum Corp (GPSC) in Deendayal Block in Bay of Bengal as well as those of RIL in Cauvery (CY-D5), KG-D6 (R-Series) and Mahanadi (NEC-25) block, which are not viable at current US $ 4.2 per mmBtu rate. The new price will be applicable in case of RIL's KG-D6 block only after shortfall in gas production of last four years (about 1.9 trillion cubic feet) is delivered at old price. For subsequent production (about 2.5 Tcf), the new price will apply. (economictimes.indiatimes.com)

Govt persuading affluent customers to voluntarily give up subsidised LPG

August 2, 2014. The Narendra Modi government hopes to save ` 3,500 crore in oil subsidies by persuading 1 crore affluent customers to voluntarily pay market rates for cooking gas in response to text messages to customers inviting them to opt out of the subsidy for the sake of 'nation building'. The subsidy cut is significant as it amounts to half the annual net profit of Indian Oil Corp (IOC), the country's largest refining and marketing firm. It will also help oil companies expand cooking gas supply to rural areas, which would give the government political mileage, reduce pollution in rural kitchens, which causes many diseases, and also help control deforestation by reducing the need for firewood. Oil firm say the list of customers opting out of subsidy would publicly expose the rich and powerful who want to hang on to benefits meant for the poor and ignore text messages saying: 'Give up your LPG subsidy and be part of nation-building movement to provide subsidised cooking fuel only to needy'. This is the second stage of the campaign, in which many executives of state oil firms have started buying cooking gas at market rates, or about 450 more than the subsidised rates. The scheme would soon be launched for the public through portals, which do not involve cumbersome paper work. In the past one month, nearly 2,000 consumers have opted out of the subsidy net, saving over 1 crore per annum. (economictimes.indiatimes.com)

No final decision on gas prices yet: Finance Minister

August 1, 2014. The Government said it has not taken a final decision on the issue yet. The previous UPA government had decided to price all domestic gas from April 1, 2014 according to a formula suggested by the Rangarajan Committee. The formula was notified but before a new rate could be announced, General Elections were declared and the issue was left for the new government to decide. The new government decided to defer the implementation till September-end to hold wider consultations. The Rangarajan formula would lead to doubling of natural gas prices to $ 8.4 per million British thermal unit, an increase that would jack up urea production cost, electricity tariff and CNG rates. Finance Minister Arun Jaitley said the previous Government had taken a decision to price natural gas based on the Rangarajan Committee Report. (economictimes.indiatimes.com)

Petrol gets cheaper by ` 1.09 per litre, diesel prices up by 56 paise

August 1, 2014. Petrol became cheaper by ` 1.09 per litre in Delhi after state oil companies slashed the price of the fuel for the first time since mid-April because benchmark gasoline rates in the international market dropped. Companies, however, raised the price of diesel by 56 paise in Delhi, helping to reduce the gap between pump and market rates by about ` 1.50 per litre and increasing the prospects of deregulating the fuel soon. If the trend continues, diesel pricing could be freed from state control in three months. Prices of diesel sold to bulk consumers such as the railways and state transport companies at market rates have been reduced, IOC said. LPG sold at market prices also became cheaper. The selling price of domestic non-subsidised LPG was cut by ` 2.50 for a 14.2 kg cylinder and that of commercial LPG by ` 4 for a 19 kg cylinder at Delhi, with corresponding decreases in other states, IOC said. (economictimes.indiatimes.com)

Oil Minister tells PSU oil companies to improve refining margins

August 1, 2014. Oil Minister Dharmendra Pradhan told state-run oil firms to improve refining margins and manage petrol pumps better to withstand competition from the private sector. The price gap between the administered and market price of diesel has narrowed significantly, setting the stage for a competitive market in a few months. Petrol is already sold at market rates. In 2002, when state firms faced private competition, Reliance and Essar competed fiercely to grab 17% of the market in three years but subsidised sales by government companies from 2005 eliminated private competition. Pradhan is concerned that the average refining margin of state firms — Indian Oil Corporation (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) — is barely $4 per barrel, about half that of private refiners. Global energy giant BP, which has already invested more than $8 billion in India, is preparing to storm the Indian fuel retailing market when state controls are gradually withdrawn. (economictimes.indiatimes.com)

Govt seeks ` 155.4 bn fuel subsidy from upstream companies like ONGC and OIL

July 31, 2014. Indian Oil Corp (IOC) will get ` 8,107 crore from upstream firms in fuel subsidy support for the first quarter while Hindustan Petroleum Corp Ltd (HPCL) will get ` 3,608.88 crore. The Oil Ministry has fixed the subsidy payout by upstream firms like Oil and Natural Gas Corp (ONGC) and Oil India Ltd at ` 15,546.65 crore for the April-June quarter. Of this, ONGC will pay ` 13,200.10 crore and another ` 1,846.55 crore will come from OIL. State gas utility GAIL will pay ` 500 crore. Fuel retailers IOC, HPCL and Bharat Petroleum Corp Ltd (BPCL) sell diesel, domestic LPG and kerosene at government controlled rates which are way below the cost. The losses they incur is compensated through a combination of government cash subsidy and support from upstream firms. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Coal power generating companies form new group

August 5, 2014. Private power firms, which put up a united front to combat fuel scarcity, policy uncertainty and procedural hurdles, are now a divided lot with some corporate leaders such as Naveen Jindal and Anil Agarwal breaking away from the Association of Power Producers (APP) which has many prominent members such as Anil Ambani's Reliance Power and Tata Power. The association had taken the lead in persuading the government to act after investment worth thousands of crores of rupees was at risk due to a vast range of problems facing the sector. But now, Jindal Steel & Power Ltd, Agarwal's Sterlite Industries and Sandeep Jajodia-owned Monnet Ispat and others have floated a new association known as the Domestic Coal Based Power Producers Association and are withdrawing from the APP. (economictimes.indiatimes.com)

NLC unit in Tamil Nadu to be commissioned this month

August 4, 2014. The first unit of the 1000 MW power project of the Neyveli Lignite Corporation (NLC) Tamilnadu Power Ltd - joint venture of TANGEDCO and NLC - is expected to be commissioned this month, Coal and Power Minister Piyush Goyal said. The cost of the project is estimated to be ` 6,602.74 crore. The 500 MW Thermal Power Station-II expansion project, with an approved cost of ` 3,027.59 crore, is nearing completion, he said. At present, NLC operates four lignite based power stations with a total capacity of 2,740 MW. (economictimes.indiatimes.com)

Coal shortage hitting power generation in Maharashtra

August 4, 2014. Maharashtra State Power Generating Company (Mahagenco) has temporarily shut down five of its 210 MW coal-fired power generation units due to fuel shortage. The power generation capacity of the five units — 1,050 MW — make up for about 12% of the total power generation capacity of Mahagenco, which is the country’s second largest power generator after NTPC. Maharashtra gets bulk of its coal supplies for power generation from Odisha. Mahagenco’s other plants coal stocks are also running low. (www.financialexpress.com)

Mahan I project to be fully operational this fiscal: Essar Power

August 3, 2014. Essar Power expects to commission the second 600 MW unit of the Mahan I project this fiscal, taking its overall installed generation capacity to over 4,500 MW. The private power utility, part of the diversified Essar Group, has an installed generation capacity of 3,910 MW. Essar Energy said that about 1,800 MW capacity is being set up. The 1,200 MW Mahan I plant is located in Madhya Pradesh and the first unit was commissioned in April 2013. Once the plant becomes fully operational, the company's total generation capacity would cross 4,500 MW. (economictimes.indiatimes.com)

BHEL commissions another 68 MW unit at Rampur hydel plant

August 1, 2014. Bharat Heavy Electricals Ltd (BHEL) has commissioned the fifth 68 MW unit of the Rampur hydro power project in Himachal Pradesh. The project is located on Satluj river. BHEL's scope of work in the project includes supply, erection and commissioning of six 68 MW Francis turbines, among others. Nine hydro sets totalling 641 MW were commissioned by BHEL in 2013-14 period. The company is currently executing hydel projects having about 5,000 MW generation capacity. (economictimes.indiatimes.com)

Nathpa Jhakri Hydro power station achieves highest-ever generation in July

August 1, 2014. The 1,500-MW Nathpa Jhakri Hydro power station of Satluj Jal Vidyut Nigam (SJVN) has achieved highest ever power generation of 1,191.217 million units (MU) of electricity against the MoU target of 1,083 million units in July 2014. The earlier highest record was 1,186.5 million units achieved during July, 2012. During July, 2014 the power station operated at over 1,600 MW during all the 31 days of the month against the installed capacity of 1,500 MW. (economictimes.indiatimes.com)

Adani eyes Indiabulls' 1.3 GW Amravati Thermal Power Project

July 30, 2014. The Adani Group is in advanced stages of negotiations with Indiabulls Power to buy out its 1,350 MW Amravati Thermal Power Project. What makes Amravati power project attractive for the Gautam Adani-led group is that its phase one has been completed with two operational units of 270 MW each. Indiabulls will eventually exit power business as it has only two projects, one in Amravati and the other in Nashik. The deal is likely to further consolidate Adani Group's position as India's largest private sector power producer with a capacity of about 10,000 MW. The group, with a capacity of 8,620 MW, plans to more than double its generation to over 20,000 MW in the next five years. (economictimes.indiatimes.com)

India and Russia hold major consultation to set up 22 nuclear power projects in India

July 30, 2014. India and Russia held major consultation in the realm of nuclear research away from the public eye ahead of Prime Minister Narendra Modi's meeting with President Vladimir Putin in Brazil in July. Nuclear energy was a key element at Modi-Putin talks. Both countries are discussing to set up Russian assisted 22 nuclear power projects in India. Last month a scientific forum was held at the Joint Institute for Nuclear Research (JINR) in the Russian city of Dubna with support from both the governments. The aim of the forum were to strengthen the existing co-operation further as well as explore the possibility of stronger ties between scientific research centers of India and JINR in the fields of fundamental theoretical and experimental physics. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

NTPC to sell additional 75 MW power to Assam

August 5, 2014. State run power producer NTPC said it has inked an agreement with Assam Power Distribution Company for selling 75 MW of electricity to the state. The power will be supplied to Assam from NTPC's Farakka Super Thermal Power Station Stage-III. At present, Assam Power Distribution Company Ltd (APDCL) is allocated 190 MW power from unallocated capacity of NTPC stations Farakka Stage-I, II and III, Kahalgaon Stage-I and II and Talcher Stage-I. APDCL will also be provided with 381 MW from the under- construction Bongaigaon Thermal Power Project of NTPC. (economictimes.indiatimes.com)

CAG pulls up PowerGrid for loss in revenue

August 5, 2014. Inadequacies in the power transmission network and delays in commissioning of projects may not only lead to revenue loss for PowerGrid Corp, but may also result in congestion in evacuation of power, the Comptroller and Auditor General of India (CAG) has said. The CAG has said that creating lines of capacities higher than required, or abnormal redundancies in transmission assets, may result in extra financial burden for state power distribution companies, or discoms, and the public at large. The CAG had undertaken an audit of PowerGrid Corp of India Ltd and its grid management arm, Power System Operation Corp Ltd (POSOCO), to assess the effectiveness of their planning and implementation of transmission projects between 2007 and 2012. (economictimes.indiatimes.com)

India, Nepal to firm up power trading pact soon

August 4, 2014. India and Nepal are likely to firm up an agreement on power trading soon amid Prime Minister Narendra Modi's emphasis that cooperation in this sector will be beneficial to both countries. The 'Power Trade Agreement (PTA)', a framework pact, is ready and a draft has been given to India. This draft will go through various approvals including from the Cabinet after which the pact could be signed. A parliamentary panel in Nepal had asked the government to sign the PTA with India as soon as possible to open the door of economic prosperity for the country suffering from long power outages. (zeenews.india.com)

Power cuts in parts of north Delhi due to snag in Mandaula grid station

August 1, 2014. Several parts of north Delhi faced power cuts due to technical snags in the 400-KV transmission network in Mandaula Grid station. The areas that were affected were Azadpur, Model Town, Indira Vihar, Tripolia, Shakti Nagar and Gopal Pur. However, Tata Power Delhi Distribution Limited (TPDDL) managed to restore most of the power supply within 20 to 60 minutes of the interruption due to back feeding and alternate supply source, TPDDL said. (economictimes.indiatimes.com)

` 52.8 bn Tamil Nadu power transmission corridor to be set up

July 31, 2014. Tamil Nadu Chief Minister Jayalalithaa made a series of announcements covering Energy, Transport and Adi Dravidar welfare sectors running into several crores of rupees. As part of her government's efforts to ensure uninterrupted power supply and develop the infrastructure for the purpose, 60 sub-stations and 2500 km of high voltage power transmission corridor will be set up at a cost of ` 5284 crore in the current financial year, she said. Two sub-stations of 230 kv at an estimated ` 338.08 crore will be set up in Chennai--one each at West Mambalam and Porur. Jayalalithaa proposed modernisation and up-gradation of two of the existing units of Solayar Hydroelectric station in Coimbatore district at a cost of ` 120 crore. (economictimes.indiatimes.com)

'Odisha needs investment in power distribution projects'

July 31, 2014. Odisha needs investor participation in various distribution network strengthening schemes floated by the state government, energy minister Pranab Prakash Das said. The state has signed agreements with 29 companies to produce thermal power with generation capacity of nearly 37,000 Mw and also has entered into arrangement with various companies for supply of renewable energy (small hydro, solar and biomass power) with installation capacity of nearly 800 MW. Projects totalling thermal power capacity of 20,000 MW is under various stages of implementation as of now. So far, the state government has approved nine projects of around ` 11,000 crore for strengthening power transmission network. The energy department is working on disaster resilient transmission and distribution system in Ganjam district with a total project cost of ` 1,000 crore. It has requested Asian Development Bank (ADB) to lend ` 713 crore for the project. About ` 1450 crore will be spent on radial to ring conversion project in next three years, dedicated to minimise transmission loss. Other projects include strengthening of district headquarters power system with total investment of ` 200 crore and a smart grid project for entire state with ` 380 crore expenses in next three years. It has earmarked ` 4,400 crore to be spent in two projects for establishing transformers, substations and dedicated feeders for agriculture. (www.business-standard.com)

Siemens wins Power Grid Corp's ` 4.1 bn order

July 30, 2014. Siemens Limited has won a crucial turnkey order (design, engineering, commissioning and installation) from Power Grid Corporation of India Limited (PGCIL) worth approximately ` 411 crores. The order is for static var compensators (SVCs) for three of PGCIL’s substations - Ludhiana in Punjab, Kankroli in Rajasthan and New Wangpoh in Jammu & Kashmir. A static var compensator is a high-voltage system that dynamically controls the network voltage and keeps the network voltage constant. The order is for one of a series of SVC projects planned by Power Grid Corporation to improve grid stability across India. (www.business-standard.com)

Stolen India coal sold at black market in Modi’s backyard

July 30, 2014. Every night, about 30 tractors loaded with coal arrive at the edge of a forest in eastern India. A fleet of trucks, engines and lights switched off, is waiting to ferry the cargo to the country’s biggest black market for the fuel in Varanasi. Stolen coal from Coal India Ltd’s mines and other quarries may reach as much as 60 million metric tons a year, about 13 percent of the annual output for the world’s biggest producer, according to Kuntala Lahiri-Dutt, a senior fellow at Australian National University’s Crawford School in Canberra. It’s worth about $1.5 billion and is a small but growing part of the widespread energy theft that reduces India’s GDP by more than 1 percent a year. Newly elected Prime Minister Narendra Modi vowed during his campaign to curb coal theft, which has been part of his parliament constituency’s underground economy for decades. Now he must find a way to keep that promise as domestic shortages lead to record coal imports. Coal India’s annual output is about 463 million tons, which it sells for an average of about $25 a ton. The coal would be worth more on the international market, because the company sells it domestically at a discount. Power station coal in Australia, an Asian benchmark, costs about $70 a ton. India’s former coal minister Sriprakash Jaiswal estimated losses from theft at as much as 15 percent of the company’s production, in an October 2011 interview. A month later he told lawmakers in parliament the loss couldn’t be ascertained. Coal India and the federal government, which owns 89.7 percent of the company, say they haven’t estimated the quantity of coal stolen from the mines. The issue is becoming more pressing as rising demand leads to shortages. Years of operational inefficiency and delays in acquiring land and environmental approvals has left Coal India without new mines. The company’s Eastern Coalfields Ltd. unit closed 3,236 sites in Jharkhand and neighboring West Bengal states in the two years ended March 2013, according to its annual report, in part because of concerns that local residents were illegally mining coal at the sites. That’s driving up purchases from countries including Australia, Indonesia and South Africa. Imports of power-station coal may climb 7.4 percent to a record 145 million tons this year, said Andrew Cosgrove, a Princeton, New Jersey-based analyst. India paid about $158 billion for coal and crude oil imports in the year ended March 31, about 35 percent of the country’s total import bill for the year. The pilfered coal adds to losses from stolen diesel, gasoline and electricity. India loses about a quarter of its electricity through theft, according to government data, costing utilities almost ` 1.1 trillion ($18.3 billion) annually. That’s about 1 percent of India’s $1.88 trillion gross domestic product. (www.bloomberg.com)

DERC move may help discoms in power purchase

July 30, 2014. Delhi Electricity Regulatory Commission (DERC) is in the process of finalizing new demand side management regulations, expected to help all three discoms-BYPL, BRPL and Tata Power Delhi -plan their power procurement more efficiently. The regulations will help in managing the load demands between high and low peak periods, and is aimed at reducing the discoms' overall power purchase costs. The electricity demand curve in Delhi has seen a shift in recent years. DERC said that its target for demand side management would be mostly consumers in the commercial and industrial categories. The regulations are expected to be finalized within a month. A public hearing for the demand side management regulations has already been held and suggestions given by stakeholders are being incorporated in the regulations as well. (economictimes.indiatimes.com)

Policy / Performance………….

Goyal asks CIL for action plan to augment output by 150 million tonnes

August 5, 2014. Coal and Power Minister Piyush Goyal has directed state-owned Coal India Ltd (CIL) and its subsidiaries to submit an immediate action plan to augment their output by 150 million tonnes within a year. The minister assured all support to CIL in this regard. He also asked coal companies to draw the demand-supply graphs of coal after taking realistic inputs from the Central Electricity Authority. (economictimes.indiatimes.com)

Modi's $1 bn facility to help Indian infra cos in Nepal

August 5, 2014. The central government’s offer to Nepal of $1 billion in concessional loans to help build power plants and roads will be a big help to Indian infrastructure companies. Some of India’s biggest infra companies, such as GMR, Tata Power, Jindal Power and government-owned SJVN have already bid to set up projects in Nepal, which has the potential to develop 42,000 MW of hydro power, of which it has done only 600 MW. For the Indian companies, to raise funds for the hydro projects was a big obstacle, and with the new loan facility from the government, it will be much easier to set up projects there. Most of the power generated from these new projects is to be sold to power-starved North India. In recent years, the hydro power sector has emerged as an attractive sector for Indian investments. The government of Nepal has issued 28 survey licences for hydro power projects having generation capacity of 8,249 MW to Indian companies and joint ventures. Indian companies account for close to half of all foreign direct investment proposals approved in Nepal. (www.business-standard.com)

‘Power plants face less than 4 days of coal stocks’

August 4, 2014. Twenty-two coal-based power plants monitored by Central Electricity Authority (CEA) were reeling under fuel shortages with stocks to last less than four days as of last week, Coal and Power Minister Piyush Goyal said. He said efforts were being made to supply adequate coal to critical power plants to maintain generation. As on July 29, 2014, the availability of coal in thermal power plants which are monitored by CEA is 9.88 million tonnes, the minister said. (www.business-standard.com)

Govt introduces ten measures to improve safety of coal mine workers

August 4, 2014. The government has announced ten measures to improve the safety of workers in coal mines. Minister of State for Power, Coal and New and Renewable Energy Piyush Goyal said that the safety measures are as follows: (i) To promote and propagate safety awareness in mines, National Safety Awards (Mines) and National Conference on Safety in Mines are organized by DGMS. The recommendations of National Conference on Safety in Mines are being implemented to enhance safety of mine workers. (ii) Workers participation and sensitization in matters of safety are ensured through training in safety and by initiatives like celebration of safety week and safety campaigns, etc. (iii) Safety training programmes are organized among Managers and Supervisors for improving safety standards in mines. (iv) Risk assessment techniques are being introduced which aim to eliminate, control and manage the personal risks in mines. (v) Standard operating procedures are established to avoid unsafe practices in mines. (vi) A special safety awareness campaign has been launched to increase awareness of mine workers. i.e., 'Safety is My Responsibility' and steps have been taken to propagate this to each miner. (vii) Other safety measures initiated recently:

• Special training programme for safety officers and other key mining official directly engaged in ensuing safety at mines by SIMTARS, Australia accredited trainers.

• Several R and D projects on safety have also been initiated.

• Spreading knowledge and coal mine safety information through publication of quarterly safety bulleting.

(viii) Internal safety organizations of coal companies regularly visit the mines for assessing the safety status and advise the management for corrective steps required if any. (ix) Coal companies also conduct safety audits through engaging experts in mine safety and take appropriate corrective measures for improving safety in mines. (x) Standing Committee on Safety in Coal Mines under the Chairmanship of Minister of Coal periodically reviews the status of safety in coal mines in the country and issues are addressed for ensuring safety of persons deployed in coal mines. (www.dnaindia.com)

Govt may finalise policy on utilisation of surplus coal by September

August 3, 2014. The policy on utilisation of surplus coal from captive mines is likely by the next month. The development comes amid reports of sale of surplus coal by some private parties in open market against norms of captive coal block use. The government will "finalise policies of surplus coal" by "September, 2014". Policy would be approved after detailed consultations among ministries. The coal ministry has begun consultations with other ministries on the policy, two-and-a-half years after the proposal was shelved by the office then Prime Minister Manmohan Singh. The government had earlier said that it has prepared a draft policy on utilisation of surplus coal from captive mines and was awaiting comments from various departments. As per the Coal Mines (Nationalisation) Act, 1973, there is no provision of sale of coal from the coal blocks allotted for captive use. The modalities of disposal of surplus coal would be as per prevailing policy and could also include handing over such coal to the local Coal India subsidiary or to any person designated by it at a transfer price to be determined by the government, the government had said. The Power Ministry has said that any excess fuel mined by the private firms from captive blocks should be returned to Coal India. Tata Power had sought government approval for using surplus coal from the Mandakini coal mine for its Maithon thermal power project (Jharkhand) that is facing coal shortage. (economictimes.indiatimes.com)

CBI case against Lalu confidant in coal scam

August 2, 2014. The Central Bureau of Investigation (CBI) registered a case against former Union minister Prem Chand Gupta, a close aide of RJD chief Lalu Prasad, and his son for allegedly falsifying records in getting a coal block in Maharashtra. The case was registered against Gupta, at present a Rajya Sabha member, and his son Gaurav after the Central Vigilance Commission agreed with the CBI that a case was made out. This is the 24th FIR registered by the probe agency in connection with the coal block allocation scam, being monitored by the Supreme Court. The allegation is that the company had allegedly falsified records submitted to the government that it had spent ` 100 crore on power plants, but a close scrutiny of the papers showed that only ` 80 crore had been spent. The company allegedly falsified the records to meet the basic requirements for getting a coal block. (www.deccanherald.com)

Delhi govt to shed load it doesn't need, tells Centre

August 1, 2014. The Delhi government has formally moved a proposal to the Centre for reassigning the capital's share in several public sector generating units. Apart from surrendering Delhi's 750 MW share in the Aravali super-thermal power plant in Jhajjar, the government has moved to surrender power from three units of Badarpur plant for winter and Tata Power Delhi's share in Dadri plant. (economictimes.indiatimes.com)

Reliance Power in talks with Temasek Holdings and PSP Investments to fund Jaypee Group deal

August 1, 2014. Reliance Power has initiated early stage discussions with Temasek Holdings, the Singapore government-owned investment firm, to raise up to $500 million and tie up funding for the three Jaypee Group hydroelectric power assets that it's acquiring. A clutch of other marquee global pension and infrastructure focused funds have also been tapped as RPower begins to firm up its funding strategy for the ` 12,300-crore ($2 billion) acquisition - the biggest in the domestic power sector as well as for the entire group. Other than Temasek, Reliance is also in discussions with Canadian pension fund giant PSP Investments and homegrown PE firm IDFC Alternatives, part of infrastructure finance company IDFC, for equity funding, added the people cited above. Reliance Power in talks with Temasek Holdings and PSP Investments to fund Jaypee Group deal Both had joined Abu Dhabi's TAQA as 49% financial investors in a consortium that had agreed to buy the same hydro assets in March. Reliance Group plans to raise ` 9,500 crore debt on the back of cash flows of the Jaypee assets that have already touched ` 800 crore in FY14. (economictimes.indiatimes.com)

Energy security to be high on the agenda during Modi's US visit

August 1, 2014. Cooperation between India and the United States (US) in nuclear energy, shale gas, electricity and renewable power will be high on the agenda during Prime Minister Narendra Modi's visit to the US in September, the government said. US Secretary of State John Kerry, who landed in India for the India-US Strategic Dialogue ahead of Modi's visit to the US, also has energy issues on his agenda. Power, coal and renewable energy minister Piyush Goyal said there was a lot of scope for energy cooperation. (economictimes.indiatimes.com)

BCG to guide CESC on power sector expansion