-

CENTRES

Progammes & Centres

Location

[Arguments Over Under-Recoveries]

“The CAG report correctly observes that ‘in the absence of an explicit and consistent policy, the share of under-recovery to be borne by each stake-holder (Government, upstream oil companies and OMCs) remains uncertain and that timey disbursement of the compensation for under-recoveries would have substantially reduced the interest burden of OMCs which supports OMC positions. The report’s observation that the term under-recovery does not actually convey loss is not necessarily new.…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy…………………

· Arguments Over Under-Recoveries

· ‘Green’ may not be ‘Clean’

ANALYSIS / ISSUES…………

· Gas Priced On Gas Markets Is Coming Up In The World

COMMENTS...................

· on the ORF - PHD Chamber of Commerce report on India Energy Security Vision 2022: From Scarcity to Abundance

DATA INSIGHT………………

· State-wise Average Domestic LPG Consumers per Distributor

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn seeks ONGC nod to extend Rajasthan block permit beyond 2020

· Crude oil production in India grows at snail's pace in June

· Cairn India eyes O&G reserves of 7 bn barrels

· GSPC spent ` 79.9 bn on Krishna Godavari Basin

Downstream……………………………

· Essar seen in talks with Germany’s BASF for $ 2 bn petrochemical JV

· Indian Oil, BPCL, HPCL to revive premium petrol brands on excise cut

Transportation / Trade………………

· BPCL offers Q4 cargoes from Mumbai

· IOC offers Dahej cargo after long absence

· GAIL signs pact with Sumitomo Corporation of Japan

Policy / Performance…………………

· GAIL announces additional ` 5 lakh for Nagaram blast injured

· AP govt gives nod to LNG Terminal at Gangavaram Port

· LPG connections: OilMin, NSSO estimates differ by 7 crore

· Centre calls meeting with states on diesel price

· GAIL tenders for up to 8 LNG cargoes in 2015

· Petrol prices set to fall first time since April

· UK energy secretary meets Oil Minister, discusses hurdles faced by BP on KG-D6 issue

· RIL moves SC to appoint third arbitrator

· Gujarat Maritime Board decision handed ` 6.4 bn undue benefit to RPL, says CAG

· Expert group may be set up to study gas pricing

· Gas row: ONGC and RIL pick independent agency

· Petrol, diesel rates to go up in Goa from next month

· ONGC ramps up its disaster preparedness

· Cairn India gives $1.25 bn loan to its parent Vedanta

· India paid 3rd tranche of $550 mn to Iran towards oil bill

· Transparent fuel pricing system will help ONGC to present a clear picture of its earnings

[NATIONAL: POWER]

Generation………………

· Reliance Power mulls borrowing from Chinese banks for hydro power projects

· NTPC's Bangladesh project may be ready by Dec 2018

· GVK set to launch operations of two new power projects this year

· Power projects worth ` 360 bn stranded on coal shortages

· Tata Power generated 45,210 million units of electricity in financial year 2013-14

· Hydro power output continues downward trend

Transmission / Distribution / Trade……

· CIL yet to sign fuel supply pacts with 12 power units

· Discoms to challenge APTEL order on Adani Power, Tata Power

· Telangana to buy power from Chhattisgarh

· TAQA pulls out of $1.6 bn deal with Jaiprakash Power

· Assam CM gives nod to buy 200-300 MW power from National Grid

Policy / Performance…………………

· Assam CM’s son pitches construction of hydro power projects on River Brahmaputra to counter China

· Adani plans a 5 GW push into power sector

· Gujarat has highest share of new investments in power sector: Assocham

· India finalizes deal to export power to Nepal

· Reliance Power submits information on Sasan expansion to panel

· DVC seeks 51 per cent hike in power tariff for 2014-15

· Arunachal facing huge power shortage, says minister

· Subsidy dependence for discoms of 16 states may rise sharply, says ICRA

· No tiff between CIL, NTPC on 3rd party sampling of coal: Goyal

· Kudankulam plant's 2nd unit to be commissioned shortly: Govt

· HP Cabinet approves allotment of 37 hydropower project

· Govt reviewing hydro power projects: Javadekar

· Delhi discom BRPL offers toll-free 24x7 helpline

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Pemex predicts lowest production in more than two decades

· Angola’s goal to rival Nigerian oil output aided by Eni

Downstream……………………

· BP's Whiting refinery heavy crude processing reaches 270k bpd

Transportation / Trade…………

· Japan's Mitsui in talks to sell stake in Equatorial Guinea LNG

· Bulls fleeing natural gas as Goldman sees further decline

· Myanmar pipeline carries 1.87 bcm of gas to China in 1st year

· Tanker carrying oil from Kurdistan arrives off US coast

· Freeport plans $5 bn sales for deepwater growth

· Talisman Energy acknowledges approach from Spain’s Repsol

· US proposes new rules for moving crude oil by rail

Policy / Performance………………

· Iraq sues to seize $100 mn of Kurdish crude in Texas

· UK opens bidding for new round of shale gas exploration

· Longmont’s fracking ban tossed as Colorado vote looms

· Arctic ice melt seen freeing way for South Korean oil hub

· Oil draft regulations for South Africa ‘ready in weeks’

· EU's planned sanctions against Russia to hit South Stream, Yamal LNG

· Libya may offer deeper crude discounts after sale fails

[INTERNATIONAL: POWER]

Generation…………………

· Japan looks at hydrogen for power generation

· TransAlta to build $580 mn gas power plant in Australia

· Maibarara power plant all set for $25 mn expansion

· Construction of $500 mn power plant in South Huntingdon stalled

· EBRD gives Tajikistan $50 mn to modernize power plant

Transmission / Distribution / Trade……

· TCN plans 20 GW evacuation capacity by 2020

· US coal company pain accelerates as bankruptcy cases rise

· Saudi Electricity says will get $400 mn payment from Aramco

Policy / Performance………………

· German prompt power prices move higher as plant outage extended

· MNO signs agreement with Ontario power generation

· Anti-coal activist avoids prison after Whitehaven hoax

· Nigeria, US seal deal to build 1.5 GW of power plant

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Astonfield Renewables bags 4 MW solar power projects in Mauritius

· Delhi schools try out solar power

· GE invests in three wind projects in India

· BHEL to expand its solar power capacity in Karnataka

· Domestic solar cell makers set to vie with all countries save China

· AP can emerge as a solar hub: Piyush Goyal

· Suzlon Energy's board approves ` 50 bn fund raising proposal

· MNRE scheme to power un-electrified Odisha villages through solar

· Chennai Angels invests ` 30 mn in Fourth Partner Energy

· Govt restores accelerated depreciation scheme for wind energy

· UK looks to deepen partnership in energy sector with India

· Burden of ` 4.7 bn on people due to excess purchase of solar power: CAG

· Govt to set up ultra mega solar projects in Rajasthan, Gujarat, MP, J&K

GLOBAL………………

· Solar farms register 10.8 GW for Brazil auction

· Japan Asia Group to build 20 MW solar station in Miyagi

· China solar projects poised to fuel panel price rebound

· German utilities bail out electric grid at wind’s mercy

· Uganda’s Kakira Sugar plans to produce ethanol fuel by 2016

· Boris Johnson ‘could do better’ on London CO2 cuts: Panel

· China’s plan to limit coal use could spur consumption for years

· Orix plans to build as many as 15 geothermal plants in Japan

· SunEdison to provide solar energy to Southern Nevada Water

· Babcock & Wilcox wins $80 mn biomass contract from Dong

· Yingli to supply 32 MW solar-power project in Japan

· GE opens fuel cell pilot plant in New York

[WEEK IN REVIEW]

ENERGY………………

Arguments Over Under-Recoveries

Lydia Powell, Observer Research Foundation

|

T |

he performance audit report by the Comptroller Auditor General (CAG) of India on the Pricing Mechanism of Major Petroleum Products in Central Public Sector Oil Marketing Companies tabled to the parliament on the 18th of July 2014 raises the question as to whether the term ‘under-recoveries’ often used to under-score the plight of state oil marketing companies (OMCs) reflects a problem with pricing policy of petroleum products in the country as it is often presumed or a problem with the way state OMCs in the country are managed. The CAG report has concluded that both are perhaps true but news reports sensationalised only the observation that oil marketing companies may be hiding internal inefficiencies under the carpet of under-recoveries. Headlines such as ‘Oil Marketing Companies made a ` 50,000 crore (~$ 8 billion) killing: CAG’ (DNA 19 July), OMC's overcharged customers, collected additional ` 26,626 crore (~ $ 4.3 billion) in five years, says CAG’ (Times of India, mobile 19 July) and ‘OMCs gained from skewed pricing mechanism: CAG’ (Mint, 19 July) do not do justice to the CAGs detailed and considered analyses which go beyond pointing a finger at OMCs.

The CAG report correctly observes that ‘in the absence of an explicit and consistent policy, the share of under-recovery to be borne by each stake-holder (Government, upstream oil companies and OMCs) remains uncertain and that timey disbursement of the compensation for under-recoveries would have substantially reduced the interest burden of OMCs which supports OMC positions. The report’s observation that the term under-recovery does not actually convey loss is not necessarily new. Former Rajya Sabha member, late Shri Dipankar Mukherjee consistently made similar observations in many platforms including discussions organised by the Observer Research Foundation. In fact some of Shri Mukerjee’s views are reflected in the sixth report on Petroleum Product Pricing by the Standing Committee on Petroleum & Natural Gas (2004-05) of the fourteenth Lok Sabha, of which he was a member:

‘Though the basic price at the refinery gates calculated on import parity basis are uniform at all refineries throughout the country, the retail selling prices of the products for the consumer is computed by adding excise duty, freight up to depots, marketing cost/ margin, state specific irrecoverable levies, delivery charges from depot to retail pump outlets, sales tax/ other local levies and dealers’ commission to this basic price. Thus, the system artificially inflates the prices of petroleum products refined at home.’

The 2014 CAG report makes a similar observation:

‘Refinery gate price (RGP) is arrived at by adding various cost elements associated with import of products to their Free on Board (FOB) price, though it is the raw material or crude oil (and not the products) that is imported by refineries. OMCs do not incur bulk of these expenses as majority of the products are processes in OMC refineries rather than being imported.’

But the CAG, true to its reputation as an auditor of accounts, goes on to calculate the financial advantage derived from this anomaly. It estimates import related elements charged at the refinery gate on regulated products (Kerosene, LPG and Diesel) produced in refineries over and above FOB price during 2007-12 to be about ` 50,513 crore. After deducting import related expenses on the import of crude oil estimated at ` 23,887 crore in the same period, the CAG arrives at a price advantage of ` 26,626 crore for state OMCs. It observes that the resulting price advantage which could have potentially translated into efficiency improvements in refining margins, optimisation of costs of production and improvement of yields is being squandered away by OMCs.

The CAG report supports its view using a 2007-08 study by the Ministry of Finance (MOF) based on data of import of crude by Indian Oil Corporation Limited (IOCL) at Vadinar and Haldia ports and import by Hindustan Petroleum Corporation (HPCL) at Vizag port for a period of six months from April to September 2007. The conclusion of the study as quoted by CAG is that the cost actually incurred on freight is less than the benchmark adopted for calculating RGP by 50-70%. In addition the MOF study is quoted to have concluded that the cost for ocean loss was lower by about 32% and that of cost for insurance lower by 98%. The CAG also uses the fact that as much as 20-22% of crude is procured indigenously by refining companies to make its case. Indigenous crude is available at a discount of over 50% to international prices which means that the state refiners are not always at the losing end.

The defence put up by OMCs and the Ministry of Petroleum and Natural Gas (MOPNG) quoted in the CAG report include: (1) actual cost of production in Indian refineries is identical to the refinery gate price and hence the pricing methodology adopted is not a source of benefit to the oil companies (2) import of regulated products incurred additional cost over Trade Price Parity (TPP) which are lower than Import Parity Price (IPP) rates (3) OMCs have to bear unmet under-recoveries of ` 28,680 crore on regulated products, interest cost due to delay in payment of under-recovery amounting to ` 18,349 crore, import loss of ` 4927 crore and foreign exchange loss of ` 5030 crore.

The counter defence of the CAG to these also discussed in the report are (in the same order) (1) the composite nature of the refining process does not permit determination of the actual cost of producing each petroleum products. But as costs are allocated on the basis of sales realisation, higher costs are allocated to products for which sales realisation is high. As sales realisation for regulated products is higher than that for unregulated products, greater costs are allocated to regulated products which may be magnifying under-recoveries (2) import of regulated products such as diesel is necessitated by enforcement of quality norms in the country and that such import accounted for just 2% of total requirement in 2011-12. Import of LPG is necessitated in part by the declining production of LPG against increasing demand. Increase in production of distillate yields such as LPG will increase refinery efficiency and reduce import dependence (3) Under-recovery burden absorbed by OMCs was never higher than 21% (nil in 2008-09 and 0.3% in 2011-12) but the manner and time frame in which the compensation pertaining to under-recoveries was being received adversely affects the cash flows of OMCs along with attendant ill effects which must be addressed through concerted action from MOF and MOPNG.

We would be missing the point if we get into dissecting the positions of the CAG or OMCs deeply to either come out with a clear winner or muddy the waters further. That is the business of popular media platforms and we do not wish to step on their toes. What we want to do instead is call on policy makers to use the observations constructively to build a more resilient and efficient downstream oil sector in the long term interest of the country. To do this, we must get past being argumentative Indians who can only foster sub-optimal outcomes.

Views are those of the author

Author can be contacted at [email protected]

ENERGY………………

‘Green’ may not be ‘Clean’

Ashish Gupta, Observer Research Foundation

|

W |

henever it comes to climate negotiations or green energy, India is the country which becomes the ‘Bali ka Bakra’ (the target to be hammered). With due respect to green enthusiasts, it must be stated that India would like to be green but the responsibility of being green cannot lie only with India or just poor countries. The concept of going green as seen by developed nations starts with developing nations and ends with developing nations with clear mandate on ‘what to do and what not to do’ dictated by developed nations. We are vulnerable nations in every sense of the word. The concept of going green is not clear and it does not accommodate the needs of India and other developing nations. The whole idea of green growth is propagated without any clear articulation of the concept. It is opaque on carbon emission commitment, subsidies, the projections, the role of different stake holders and most importantly the role of developed nations. India is committed to reducing its carbon footprint and will remain committed. In this light it is interesting to analyse the green sector on the basis of different parameters and see whether green is really clean and if it has achieved anything?

Carbon Emissions: Quoting from the article Energy through the BP data lens: though the share of non-fossil fuels in power generation has increased substantially, global emissions of carbon dioxide have grown 55% over its 1990 level highlighting the poor return (in terms of carbon emission reduction) on investment in renewable energy. India too has invested heavily in the green sector but still we are given the culprit tag in climate platforms because we are burning coal. The important questions is, is India is really a culprit?

|

Region |

Population (Millions) |

Per Capita CO2 Emissions (Tonnes) |

|

World |

6609 |

4.38 |

|

USA |

302 |

19.10 |

|

UK |

61 |

8.60 |

|

Japan |

128 |

9.68 |

|

Germany |

82 |

9.71 |

|

South Africa |

48 |

7.27 |

|

France |

64 |

5.81 |

|

China |

1327 |

4.58 |

|

India |

1123 |

1.18 |

Source: Interim Report of the Expert Group on Low Carbon Strategies for Inclusive Growth, 2011

The study conducted by the Ministry of Environment & Forests in 2009 titled ‘India’s GHG Emissions Profile: Results of Five Climate Modelling Studies’ where four out of five studies projected that even by 2031-32, India’s per capita GHG emissions would be well below the global average 25 years earlier i.e., 4.22 tonnes whereas India’s total aggregate GHG emissions in 2031-32 would be well below 6 billion tonnes. Therefore the question is open to the intellectual minds to decide whether India is really a culprit or will ever become a culprit in the coming decades?

Green Potential: The proliferation of renewable energy started in India on the basis of projections for great green potential within India. It is always reminded to the stakeholders in the public platforms on renewable energy that India has 300 sunny days. 300 sunny days sounds like great potential but if we look at solar maps that clearly indicate regions potential areas for solar projects it is not that large. Recently one non government agency projected huge roof top PV potential for Delhi. On the other hand a recent feasibility study conducted by a government agency concluded that roof top PV is not feasible because the buildings structures are uneven in the capital. Then it was propagated that the government utilities including schools, hospitals etc must go green. Some schools deployed renewable but many have abandoned it recently. Some find it difficult to sustain even with subsidies because renewable projects are complex to manage and expensive in terms of man-hours required to maintain the system and also in terms of money. Renewable purchase obligations (RPOs) are being imposed on reluctant utilities. Despite enforcement utility involvement is marginal at best. The question is, if green is so cheap why isn’t everyone adopting it voluntarily? Why does it require such a heavy policy and subsidy push?

Role of Green Companies: It is well known that the renewable sector cannot run without subsidies. Apart from that it offers huge incentives for the big stakeholders and that is why the companies are competing for these projects (See ORF article: India’s solar mission: make it work for the economy class not just the business class). The companies which are promoting green are not clean in the financial sense. Reverse bidding is a mechanism wherein these companies can procure these projects by quoting irrationally low tariff and later renegotiate or just abandon the project. Many examples can be offered to illustrate unfair practices by green companies:

Example: In the first Phase of renewable projects bidding, the Ministry of New and Renewable Energy (MNRE) issued guidelines in 2010 that a company including its affiliate or ultimate parent or group company can bid for 5MW solar PV and 100MW solar thermal projects - together 105 MW only. But one well known private company procured 235 MW projects by floating many front or paper companies. MNRE instituted an investigation, the findings are awaited (Source: Governing Energy Resources – Challenges and the way ahead for India by Chandra Bhushan

Subsidy vs Hypocrisy: On the subsidy front, the commitment of industrialised countries is not at all clear. They are not in favour of providing cheap food to the poor of India as they seek to limit subsidy to 10 % of the total output. And that too at the 1986 -88 base prices whereas the prices have been increased by 200 - 300 % since then. But there is wide consensus among the developed nations that expensive green energy must be thrust upon the poor of India irrespective of their needs, desires and the extent of subsidies this will entail. Is this rationality or hypocrisy? But there is no interest or initiative to compromise with developed country lifestyle to bring their per capita carbon emission to world’s average level. Why is there no global outcry over this? But there is an outcry when India decides to feed its population or provide electricity even if only at bare minimum levels? Even the fancy models concern themselves on how poor country development paths must be altered while completely ignoring rich country trajectories? This is not a matter of green or clean, it is just power and commerce that is needed to sustain power.

Currently the renewable sector enjoys immunity from Environment Impact Assessment (EIA). This gives the sector undue advantage. However large scale grid connected solar projects do have an impact on environment and ecology. EIA should be made compulsory for large solar projects. Even small projects have an impact when equipment installed for households is abandoned. The green fraternity is loud in criticising coal but when it comes to availing extra money from the same dirty source they shout even louder. Clean cess on coal is an example. Notwithstanding vested interests in pushing green power, India will be working on making coal based power plants more efficient and coal will cross-subsidise renewable sector to flourish. The question that remains to be answered through balanced and careful monitoring is whether the investment on renewable will bring any gain or just drain India’s already stretched public funds?

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Gas Priced on Gas Markets is Coming up in the World

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

Continued from Volume XI, Issue 6...........

Gas Priced on Gas Markets is Coming up in the World

In the last issue of ORF Energy News Monitor (in the article Why Natural Gas is not Priced like Socks) we have given insights into some of the essential theoretical economic foundations regarding the pricing of energy commodities. In this issue we will take a quick glance at the patterns of empirical emergence and evolution of wholesale gas pricing mechanisms over time throughout the world. Gas pricing is subject to ongoing modification and change due of different underlying causes that comprise, for instance,

· technological changes driving upstream costs, e.g. shale gas or ultra-deepwater;

· share of gas in markets and sectors respectively, as well as market size and its liquidity;

· maturity of markets as well as market integration into international trade;

· infrastructure developments (like degree and functioning of transmission and distribution networks as well as new cross border interconnectors or LNG);

· changes of general doctrines in economic theory and politics. In the course of this most energy industries in the U.S. and Europe were steered from monopolies towards liberalised/deregulated markets;

· shifts of institutional and political frameworks (regulatory rules, directives and laws).

Against the backdrop of the economic and political framework some specific pricing regimes have emerged in the gas industries around the world, typically reflecting the specific conditions of various countries, regions as well as market maturity. As market evolution can be regarded as a continuously ongoing process based on the above listed issues, also shifts in gas pricing mechanisms will advance as a consequence thereof. In general a change in a gas pricing regime can be triggered by institutions (e.g. the EU has actively liberalised the European gas markets) or being determined by market developments (e.g. oil-linked pricing in order to drive European markets or rising liquidity due to a dash of gas leading towards market pricing). For sure, the current trend towards a more global gas market thanks to the recent shale gas developments and LNG as a means of quite flexible long-distance transportation logistics will lead to further adaption of gas price formation in the future, too.

The International Gas Union (IGU), a longstanding global gas industrys lobby group, has recently published its sixth Wholesale Gas Price Survey since 2005.[1] These periodic surveys provide rather good insights into the different categories of global gas price formation mechanisms and, moreover, indicate their changing trends embedded in a period of a fast changing global gas world. The IGU basically classifies between three principal types of pricing systems: (1) market based, (2) oil-linked and (3) regulated prices.[2] Definitions outlined as follows:

· Gas-on-Gas Competition [GOG]: gas price determined by the interplay of gas supply and gas demand. Trading takes place at physical hubs (e.g. Henry Hub or NBP). These are likely to be complemented by (liquid) futures markets (e.g. NYMEX or ICE).

· Oil Price Escalation [OPE]: gas price depends on the price of competing fuels, typically oil (crude or products), sometimes coal or commodity (e.g. electricity) prices or combinations.

· Cost of Service Regulation (RCS): gas price is determined/approved by a regulatory authority. The price level set to cover the “cost of service” (including the investment recovery and a reasonable rate of return).

· Social and Political Regulation (RSP): gas price is set on an “irregular basis”, in response to the need to cover increasing costs or possibly as a revenue raising exercise.

· Below Cost Regulation (RBC): gas price is set below the average cost of producing and transportation, often as a form of state subsidy to the population.

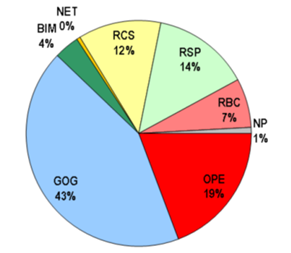

The breakdown of the observed gas pricing mechanisms around the globe in 2013 is shown in Figure 1. Accordingly, by far most of the traded gas molecules in the world are priced based on liquid gas markets (GOG), predominantly in the deregulated North American and European gas markets, but also in some other 40 countries. European countries, but also Asian gas markets are dominating oil-linked gas pricing (OPE) that amounts to about one fifth of the world’s gas. Taken together, one third of global gas is still set by regulatory authorities in any of the three categorised ways: RCS (mostly Russia and China), RSP (dominated by Middle East) and RBC (FSU states and Africa).

Figure 1: World Wholesale Gas Price Formation 2013 (in percent)

Source: IGU (2014).

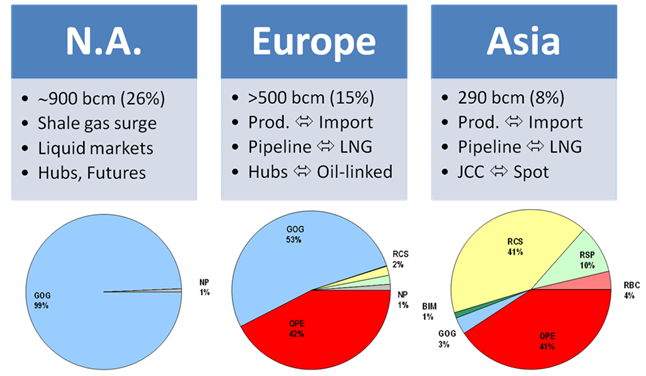

More than the half of Asian gas pricing is mostly regulated by RCS (China) and further by RSP (India). Anyhow OPE represents 41% in that region (Figure 2), mainly due to oil-linked pricing of domestic production in Pakistan and furthermore pipeline and LNG imports from China.

Overlooking the evolution trends of gas pricing throughout the globe the report makes out that gas market based pricing (GOG) is forging ahead, gaining a 12 percent share since 2005 mostly at the continuous expense of OPE (minus 5 percent) in European gas markets. OPE pricing in European markets has lost almost half of its nearly 80 percent market share since 2005, while in the meantime pricing based on GOG determines more than half of wholesale gas pricing (Figure 2). The changes have been triggered both by physical substitution from pipeline imports to rising spot gas imports and hub trading as well as contractual changes towards hub/spot pricing indexation.

Nevertheless, oil price escalation is not out of the picture, despite the significant losses overall and especially in Europe. The IGU has noticed, that there have been considerable gains in Asia with a rise from 34% to 41% since 2005 as China began to import more LNG volumes and pipeline gas from Turkmenistan, moreover changes in India’s pricing for LNG from Qatar. Remarkably enough is the domestic pricing reform in two Chinese provinces at the end of 2011 in a move away from administered cost-plus pricing towards oil-linked pricing triggered in recognition of the need of superior market based price signals to regulate marginal demand as well as stimulate investment in indigenous production.

As the biggest loser in the eight years time period 2005-2013 has emerged subsidised pricing below cost (RBC), whereas prices set as cost of service (RCS) have gained significantly. Thereof, important changes have been recognised in Russia as Gazprom has improved margins on their domestic gas sales and in China as pricing reforms in the 2009 period has turned pricing of domestic gas more into the direction of cost-plus calculations. Moreover, Iran has risen below cost prices to RSP in 2012.

Figure 2 highlights the main differences in natural gas pricing mechanisms in three important regional markets: North America (entirely GOG), Europe (more GOG than OPE) and Asia (balanced RCS and OPE).

Figure 2: Synopsis of Market Structures and Gas Pricing Mechanisms in different Regions (2013)

Source: IGU (2014), assembled by author.

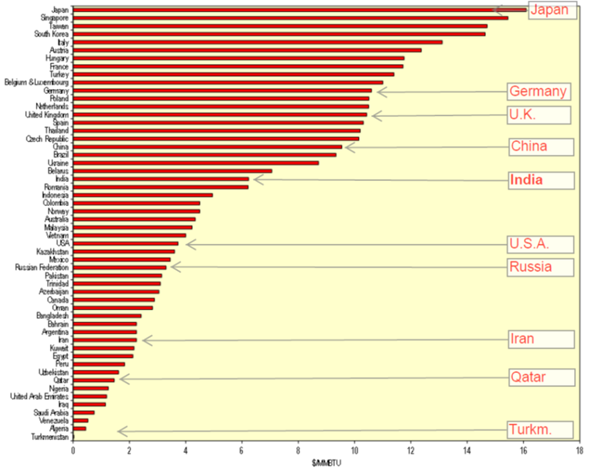

Looking at the development of the outcome of natural gas pricing, the price level, the IGU study points out the well-known fact, that North American wholesale gas prices have significantly slumped by about a half since 2005 due to the shale gas boom, whereas the rest of the world has been struggling with price surges. Price rises have been observed in Asia as well, largely due to increases in China, but also in India: Both have been facing more expensive gas imports as well as administered raise of domestic gas prices. In 2013, highest wholesale prices can generally be observed in Asia Pacific as well as Europe, and, with some margin below, Asia. The low U.S. gas price level is even undercut by highly subdued wholesale prices in Africa and the Middle East due to subsidies.

Price levels with respect to different pricing mechanisms are revealing nothing unexpectable: due to the widening oil-gas spread over past time, OPE price level are more than twice as high as GOG prices, and regulated (subsidised) prices are even lower.

The above outlined price level orders are finally reflected on country level as well (Figure 3).

Source: IGU (2014)

It has become apparent, that – around the globe - there are some distinct ways to price gas molecules in order to trade it on the wholesale level. Which pricing method is to be chosen depends on various arguments comprising economic and policy issues as well as the availability of gas, for instance. Often there is only a thin line that divides pressure for higher prices from the supply side versus demand destruction or market expansion on the other side. The price level as the outcome of the applied pricing mechanism largely defines speed and scope of the market evolution, which can be clearly observed in the current situation of the Indian gas market. However, pricing mechanisms are not carved in stone; they even more concomitantly develop with market size and maturity and vice versa. This is very much reflected in success story of gas on gas competition based pricing mechanism around the globe, but also in the fact that China is obviously getting started into a new pricing era towards oil linked pricing as its fast growing gas market requires continuous adaption. Gas pricing linked to competing energy commodities like oil or coal has been positively established in expanding European gas markets for a long time period before ideas of market liberalisation became prevalent.

It should be mentioned, that in future, besides pricing of the intrinsic commodity, further external price components will quite probably have to be paid attention to, as any form of carbon pricing to tackle the impending climate change process can be expected to be implemented. However, since natural gas can be regarded as a relatively environmentally friendly energy source at large scale, this will turn out to be a cost-competitive advantage against the main competitor coal in the power sector.

Views are those of the author

Author can be contacted at [email protected]

COMMENTS................

on the ORF - PHD Chamber of Commerce report on India Energy Security Vision 2022: From Scarcity to Abundance

In my view it deals only with managerial and technical issues, not those of governance, regulation and control, I would have expected from ORF and PHDC, recommendations that do not gingerly step around the most critical issues, namely ownership and control, as well as regulation.

I suggest:

1. Coal should be denationalized. The mines should be leased out transparently to private companies. Targets must be laid down for delivery, quantities, productivity, technology, costs. An Energy Regulator must determine lease rentals to government, allow tariffs that take account of capital and operational costs and allow a attractive return. If coal prices are to be kept low in order to keep power tariffs low, the subsidy should be calculated and refunded to the mining companies every month. The Regulator should monitor this and punish governments that do not pay up in time.

2. The Petroleum Regulatory Board should be integrated with the energy Regulator and the CERC. it should have authority to determine all tariffs, subsidy payments, monitor their payment, closely monitor technology and productivity for all energy forms.

3. All oil and gas producers must commit to supply and tariffs determined by the Energy Regulator, with a share to government as owner.

4. Shortfalls in supply commitments for coal, gas and oil, must be met with strict penalties, rising up to withdrawing the lease if persisted with.

Best wishes,

SLRAO

Surendra L. Rao [email protected]

Note: The report is available at http://orfonline.org/cms/export/orfonline/documents/phdJuly16.pdf

DATA INSIGHT……………

State-wise Average Domestic LPG Consumers per Distributor

Akhilesh Sati, Observer Research Foundation

|

State/UT |

Average LPG Customers per Distributor |

|

CHANDIGARH |

14508 |

|

DELHI |

18594 |

|

HARYANA |

13000 |

|

HIMACHAL PRADESH |

11877 |

|

JAMMU & KASHMIR |

11111 |

|

PUNJAB |

11709 |

|

RAJASTHAN |

9832 |

|

UTTAR PRADESH |

9716 |

|

UTTARAKHAND |

11744 |

|

SUB TOTAL NORTH |

11108 |

|

ANDAMAN & NICOBAR |

16308 |

|

ARUNACHAL PRADESH |

5205 |

|

ASSAM |

9268 |

|

BIHAR |

7213 |

|

JHARKHAND |

6131 |

|

MANIPUR |

6439 |

|

MEGHALAYA |

4852 |

|

MIZORAM |

6057 |

|

NAGALAND |

5675 |

|

ODISHA |

6900 |

|

SIKKIM |

13641 |

|

TRIPURA |

9198 |

|

WEST BENGAL |

13312 |

|

SUBTOTAL EAST |

8806 |

|

CHATTISGARH |

6915 |

|

DADRA & NAGAR HAVELI |

32359 |

|

DAMAN & DIU |

32049 |

|

GOA |

10253 |

|

GUJARAT |

12603 |

|

MADHYA PRADESH |

7923 |

|

MAHARASHTRA |

14600 |

|

SUB TOTAL WEST |

11717 |

|

ANDHRA PRADESH |

14686 |

|

KARNATAKA |

13769 |

|

KERALA |

16439 |

|

LAKSHADWEEP |

2629 |

|

PUDUCHERRY |

16691 |

|

TAMILNADU |

16315 |

|

SUB TOTAL SOUTH |

15214 |

|

ALL INDIA |

11814 |

Source: Compiled from PPAC & Lok Sabha Starred Question 13 dated July 7, 2014

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Cairn seeks ONGC nod to extend Rajasthan block permit beyond 2020

July 27, 2014. Cairn India has sought partner Oil and Natural Gas Corporation's (ONGC) nod for extension of the licence of their prolific Rajasthan oil block beyond the contractual deadline of 2020. Cairn's contractual term for exploring and producing oil and gas from the Rajasthan Block RJ-ON-90/2 expires in 2020 and the area is to return to the block licensee, ONGC. ONGC, which currently holds 30 per cent stake in the block, has told the Oil Ministry that the Production Sharing Contract (PSC) can be extended beyond 2020 if all parties to the contract agree on mutually agreeable terms. The state-owned firm will decide on terms on which it can agree on allowing Cairn to continue to operate the fields. Once ONGC agrees, a formal resolution will be passed by the block's Operating Committee which has the two partners as members. After this, the proposal will go to the block oversight panel called the Management Committee headed by upstream regulator DGH and then to the government. As a licensee, ONGC has concerns on royalty which it would be like to be addressed at the time of extension. ONGC as a licensee of the block, which produces just over 181,000 barrels per day of oil, pays royalty to the government on not just its 30 per cent stake but also on Cairn's 70 per cent interest. Though the royalty is later cost recovered, the company faces cash flow issues because of the payment. For agreeing to Cairn's proposal, ONGC may put a condition that royalty be shared by the partners in proportion to their shareholding. Also, it can seek a higher stake of 50 per cent. The Rajasthan PSC provides for ONGC becoming the owner of all facilities once their cost is recovered from sale of crude oil. (economictimes.indiatimes.com)

Crude oil production in India grows at snail's pace in June

July 25, 2014. Domestic crude oil production for June 2014 grew at a snail's pace of 0.1 per cent to 3.125 million tonnes as against 3.123 million tonnes in the same month last year. While crude oil production grew slowly, natural gas production fell as compared to last year. The country produced 2.895 billion cubic meters of natural gas as against 2.945 billion cubic meters in the same month last year. This was a fall of 1.7 per cent as compared to the same month last year. India’s refinery throughput also grew at a slow pace of 1.2 per cent in the month of June 2014. During the month, the refinery throughput was 18.353 million tonnes as compared to 18.135 million tonnes in the same month last year. (www.thehindubusinessline.com)

Cairn India eyes O&G reserves of 7 bn barrels

July 24, 2014. Cairn India is stepping up its exploration programme with the aim to increase its reserves of oil and oil equivalent gas to 7 billion barrels from the earlier estimate of 4.6 billion barrels, the company said. The company indicated that gas would play a key role in the company's growth going ahead and it is gearing up to double output from 48 million standard cubic feet per day (mmscfd) produced in the first quarter of 2014-15. The Vedanta group-controlled Cairn India said it will invest $200 million over the next three years in developing the Raageshwari Deep Gas field and associated field facilities and pipeline. The company estimates that it can produce 100 mmscfd of gas from the Rajasthan block and is building pipeline infrastructure to support it. (economictimes.indiatimes.com)

GSPC spent ` 79.9 bn on Krishna Godavari Basin

July 23, 2014. Gujarat government said that its public sector undertaking Gujarat State Petroleum Corporation Ltd (GSPC) spent ` 7992.47 crore during the last 5 years on its ambitious project of oil and gas exploration in the Krishna Godavari Basin. The state government also said that gas production is yet to begin after spending that much money. Gujarat Energy and Petroleum Minister Saurabh Patel said that ` 7992.47 crore was spent by the GSPC on the Krishna Godavari Basin project during the last five years, ending on 2013-14. According to Patel, ` 1327.42 crore were spent in 2009-10, ` 916.23 crore in 2010-11, ` 1615.43 crore in 2011-12, ` 2866.36 crore in 2012-13, and ` 1231.03 crore were spent in 2013-14. Answering the second question, Patel admitted that production of oil or gas is yet to commence in the c block KG/OSN/2001/3. (economictimes.indiatimes.com)

Downstream………….

Essar seen in talks with Germany’s BASF for $ 2 bn petrochemical JV

July 28, 2014. Steel-to-BPO conglomerate Essar is in talks with Germany's BASF, the largest chemicals player in the world, for a petrochemicals joint venture (JV). The move revives a diversification plan which had been put on hold for long, both because of the global factors and the company's high debt burden. Essar has long nurtured a desire to be an integrated oil and gas major and had conceptualized an integrated petrochemicals complex along with its refinery expansion in Vadinar, Gujarat. With Essar Oil, the country's second largest private refiner, trudging back to profitability in FY'14, the plans are back on track. Moreover, the petrochemicals industry, experts say, is poised for a strong rebound from fiscal 2016. Already key Indian players, notably Reliance, is working towards completing a mega $8 billion expansion to ramp up overall petrochemicals capacity by 66% and offer a much bigger product basket. Essar's refinery currently has a 20 million tonne per annum (MMTA) capacity and is capable of refining a diverse range of crude. Essar seen in talks with Germany’s BASF for $ 2 billion petrochemical JV The total project cost is expected to be $2 billion, inclusive of debt and equity. (economictimes.indiatimes.com)

Indian Oil, BPCL, HPCL to revive premium petrol brands on excise cut

July 24, 2014. The state-run oil marketing companies (OMCs) plan to revive branded petrol such as IndianOil's XtraPremium and Bharat Petroleum's Speed, backed by aggressive marketing, to make the most of a significant excise duty cut announced in the budget. Sales of branded petrol, which contain additives that enhance automobile's performance, had plummeted in recent years as they became ` 7-10 per litre more expensive than the regular fuel, forcing companies such as Hindustan Petroleum Corp (HPCL), Indian Oil Corp (IOC) and Bharat Petroleum Corp (BPCL) to pull out such products from most outlets. But with finance minister Arun Jaitley announcing a cut in central excise duty on branded petrol to ` 2.35 for every litre from ` 7.50 a litre, such fuel would now be just about ` 3 per litre costlier than regular petrol.

IOC said it plans to offer XtraPremium petrol on more outlets and may consider re-launching XtraMile branded diesel which it had stopped selling. At present, the country's largest oil marketing company sells XtraPremium in only 600 outlets in the country, down from a peak of over 4,000 in 2007-08, when premium petrol was priced just about ` 1 more than regular petrol. The companies plan to roll out new marketing campaigns for their branded fuels over the next couple of months. (economictimes.indiatimes.com)

Transportation / Trade…………

BPCL offers Q4 cargoes from Mumbai

July 29, 2014. Bharat Petroleum Corp Ltd (BPCL) has offered a total of 105,000 tonnes of naphtha for fourth-quarter lifting from Mumbai, about 8 percent lower in volumes compared to what it had sold for the third quarter. BPCL is offering a 35,000-tonne cargo from Mumbai every month from October to December through a tender closing on Aug. 5. The refiner currently has an existing term for July to September cargoes lifting from Mumbai with Idemitsu. It also has a contract with Unipec for cargoes lifting July to October, but from Kochi. BPCL used to export spot naphtha regularly from Kochi and Mumbai but is now mostly tying up cargoes from the two ports through quarterly tenders. (economictimes.indiatimes.com)

IOC offers Dahej cargo after long absence

July 29, 2014. Indian Oil Corp (IOC) offered 35,000 to 40,000 tonnes of naphtha for Aug. 14-16 loading from Dahej, making this its first offer since it sold a cargo for January loading from the same port. IOC used to regularly export naphtha from ports including Dahej, Kandla, Chennai, but the exports became irregular as the refiner had maintenance lined up this year at several plants including Koyali, Manali and Panipat, which may have affected its output. Between January and June 2013, IOC sold a monthly average of 107,000 tonnes, lifting from various ports, versus 40,000 tonnes during the same period this year. It is currently looking to sell the Dahej cargo through a tender which will close on Aug. 31. India's overall naphtha exports have been low since the start of this year, falling mostly below 600,000 tonnes, with the exception of July where levels hit about 700,000 tonnes. (economictimes.indiatimes.com)

GAIL signs pact with Sumitomo Corporation of Japan

July 25, 2014. GAIL India Ltd said it has signed an agreement with Sumitomo Corp, Japan's third-largest trading house, for cooperation in gas procurement and petrochemicals. GAIL and Sumitomo have each booked a capacity of 2.3 million tonnes at Dominion Resources Inc's Cove Point liquefied natural gas (LNG) export terminal at Lusby, Maryland, USA. Both the firms view US market as a growth area for their line of businesses and would cooperate on businesses ranging from upstream to downstream. GAIL is India's largest gas transmission and marketing firm. In USA, its wholly owned subsidiary, GAIL Global (USA) Inc has acquired a stake in Eagle Ford shale acreage. It also has signed a contract to buy 3.5 million tonnes per annum of LNG from Sabine Pass for 20 years. Another 2.3 million tonnes has been contracted from Cove Point terminal. Gas from Sumitomo's fields in the northeast of US will be liquefied at the Cove Point terminal for shipping to countries like India and Japan. (economictimes.indiatimes.com)

Policy / Performance………

GAIL announces additional ` 5 lakh for Nagaram blast injured

July 29, 2014. A month after the gas pipeline explosion in the Nagaram village that claimed 21 lives, GAIL has announced to give an additional compensation of ` 5 lakh to the injured. The state-owned gas utility had disbursed amount of ` 25 lakh to the family of the deceased and ` 5 lakh to injured, as announced by the Andhra Pradesh government, soon after the incident which took place on June 27. Regarding compensation of the damaged coconut fields and crop, an additional of ` 2,000 would be given to farmers for the damage for cultivation of new crop. Farmers, were earlier given a compensation of ` 6,000 each for the damage. A survey would also be undertaken by the Horticulture department. A compensation of ` 15,000 per acre for a year, where coconut plant cultivation was completely damaged with no scope of further cultivation, would be given to the affected families. A sum of ` 1.20 lakh would also be paid to them for next eight years for the severe damage caused. The GAIL authorities also said after the through enquiry of Horticultural Department, compensation would be paid to mango and paddy cultivating families. Employment would be provided to the family members of the deceased and vocational training be given to members of the injured. (economictimes.indiatimes.com)

AP govt gives nod to LNG Terminal at Gangavaram Port

July 29, 2014. The Andhra Pradesh (AP) government has given its nod for setting up the LNG Terminal by Petronet LNG Ltd at Gangavaram Port on the East Coast near Visakhapatnam. However, it has refused Gangavaram Port's proposal to collect the water front charges at the rate of ` 103.68 per metric tonne of LNG cargo handled from Petronet. Petronet is a Joint Venture set up by GAIL (India) Ltd ONGC, Indian Oil Corporation Ltd and Bharat Petroleum Corporation Ltd to import LNG and set up LNG terminals in the country with an authorised capital is ` 1,200 crore (USD 240 million). According to a government order issued, the Gangavaram Port Ltd will submit to the government the Detailed Project Report that was submitted to the lenders for achieving Financial Closure and ensure financial sustainability of the project. (economictimes.indiatimes.com)

LPG connections: OilMin, NSSO estimates differ by 7 crore

July 29, 2014. The oil ministry’s claim that there are about 16 crore live LPG connections in the country is far higher than the picture that comes from another government agency. Numbers estimated from the National Sample Survey Organisation (NSSO) under the ministry of statistics shows the actual number of LPG connections in India are possibly much less at just above 9 crore. The ministry numbers have been worked out by adding the records available with the public sector oil companies. These in turn are provided by the oil dealers spread across the country from their registers. But the NSSO data from the latest 68th round of national sample survey is far more conservative. It shows that of the total urban households in India, 71 per cent own an LPG connection. Similarly the same data shows “21 per cent in rural areas reported consumption of LPG for household use during the last 30 days”. Since the number of households in urban India again as per NSSO data, is 78.87 million and that for rural areas is 167.83 million, this puts the number of LPG owning families at 90.6 million or 9 crore. The data is for the period 2011-12, but even assuming for a growth rate since then, the chasm between 9 and 16 crore seems too far to bridge. The data provides an enormous opportunity for the government to cut down on its annual subsidy bill and one that does not require raising the prices of subsidised cylinders. The requirement of each of these 9 crore families is for 12 cylinders annually as various government estimates have shown. At the current price of ` 414 per subsidised cylinder the annual cost will work out to ` 44,712 crore while the government is paying over ` 79,488 crore for the ghost bill. The difference can provide a saving of ` 34,776 crore to finance minister Arun Jaitley in fiscal 2014-15 itself. According to Pronab Sen, former chief statistician of India, the numbers show there is enormous scope for savings within the government allocation. “To me this indicates there is a problem in the oil ministry numbers of over allocation but not necessarily an institutional fraud”. Sen said there is obviously a good percentage of the connections that does not require 12 cylinders, even more than what the government estimates. These are the ones where there could be leakage through collusion between the suppliers and those who have the connections. This means the political cost could become even easier for the government to handle since it would not mean having to cut down real connections. According to estimates of the oil ministry released in May, the subsidy on account of LPG was ` 46,458 crore in FY14 which is about 32 per cent of the annual subsidy bill. (indianexpress.com)

ORF said it two years ago

ORF said it two years ago

Please refer to the article ‘Use and Abuse of India’s Subsidized Fuels’ published in Vol. VIII, Issue 39 (of March 2012) available at http://orfonline.org/cms/sites/orfonline/modules/enm-analysis/ENM-ANALYSISDetail.html?cmaid=34704&mmacmaid=34705

Centre calls meeting with states on diesel price

July 28, 2014. With state specific levies adding up to ` 7 a litre in price of diesel, the Centre has called a meeting with 12 states with the highest incidence of taxes like octroi and entry tax, to impress upon them to cut these duties and bring down prices. A litre of diesel in Delhi costs ` 57.84 while in Mumbai it costs ` 66.01 and in rest of Maharashtra ` 65.99. This difference is primarily because of higher local sales tax or VAT and levy of state specific taxes like octroi and entry tax on the fuel. Carrying Prime Minister Narendra Modi's governance model of federal cooperativism where states are equal partners with the Centre, the Petroleum Ministry on instructions from Oil Minister Dharmendra Pradhan, has initiated the consultation process with the states. The ministry wrote to the state governments on the issue and has now called a meeting with the states to impress upon them on the need for a uniform taxation policy and doing away with state specific multiple levies. A meeting has been called with concerned officials from six states of Assam, Bihar, Haryana, Karnataka, Uttarakhand and Kerala on July 30/31. A similar meeting with officials from Maharashtra, Madhya Pradesh, Rajasthan, Tamil Nadu, West Bengal and Uttar Pradesh has been scheduled for August 5-6. Diesel in West Bengal costs ` 62.64 while the same is priced at ` 61.70 in Tamil Nadu. In Madhya Pradesh it costs ` 63.94, ` 62.21 in Uttarakhand, ` 63.25 in Uttar Pradesh, ` 62.85 in Karnataka and ` 63.04 in Andhra Pradesh. Similarly, petrol in Delhi costs ` 73.54 while in Mumbai it costs ` 81.68 and the rest of Maharashtra ` 82.16. If states do away with these levies, price of petrol and diesel in those places will fall, benefiting local population. (economictimes.indiatimes.com)

GAIL tenders for up to 8 LNG cargoes in 2015

July 28, 2014. GAIL India Ltd has launched a tender to buy up to eight liquefied natural gas (LNG) cargoes from Jan-Dec 2015, mainly unloading at its western Dabhol terminal. GAIL is seeking the cargoes on a delivered-ex-ship basis. During the monsoon months of May-September, cargoes will be unloaded at the Dahej or Hazira import terminals in Gujarat state. The deadline for offers is Aug. 14. (economictimes.indiatimes.com)

Petrol prices set to fall first time since April

July 28, 2014. Petrol prices are likely to fall at least by ` 1 a litre, the first drop since April, if the current trend in international oil rates continues through this month. Also, the revenue loss of state-run marketers on diesel is expected to narrow to less than ` 1.40, taking the fuel closer to deregulation. IOC, BPCL and HPCL are supposed to be free to fix prices of petrol since June 2010, but company say the oil ministry exercises informal control. (economictimes.indiatimes.com)

UK energy secretary meets Oil Minister, discusses hurdles faced by BP on KG-D6 issue

July 26, 2014. UK's Secretary of State for Energy Edward Davey told Oil Minister Dharmendra Pradhan that British investors are keen to invest in India provided the country has "stable, predictable and transparent policies" and suggested setting up a forum to resolve disputes impeding investment. Davey also discussed policy hurdles faced by British firm BP Plc in exploration and pricing issues related to the KG-D6 block. BP had acquired 30% interest in Reliance Industries-operated blocks including the KG-D6 gas fields for over $7 billion in 2011. RIL, BP and its Canadian partner Niko Resources have since initiated arbitration proceedings against the government's decision disallowing recovery of part of the investment in developing the gas fields. While the production sharing contract allows the investor to recover its costs, the government has disallowed a part of the cost recovery as a penalty for missing production target. The consortium says such penalties are not envisaged by the production sharing contract (PSC). There is also a separate arbitration case for delaying announcement of a new price of gas. Pradhan assured Davey that India would auction oil and gas blocks under a simplified and investor-friendly regime. The oil ministry said the Davey-led UK government delegation paid a "courtesy" visit and discussed enhancing the cooperation between the two countries in the energy sector. Pradhan told the visiting delegation that the Indian government it is taking steps to enhance exploration and production of oil and gas in the country. (economictimes.indiatimes.com)

RIL moves SC to appoint third arbitrator

July 26, 2014. Reliance Industries Ltd (RIL) moved the Supreme Court (SC), requesting it to appoint a third arbitrator, replacing the earlier court-appointed one, Michael Hudson McHugh. The latter quit after the government challenged his decision to initially withdraw and then accept the offer to arbitrate the cost recovery row between RIL and the government. (economictimes.indiatimes.com)

Gujarat Maritime Board decision handed ` 6.4 bn undue benefit to RPL, says CAG

July 25, 2014. The state government-run Gujarat Maritime Board (GMB) handed an "undue favour" to Reliance Petroleum Ltd (RPL) by allowing it to pay only half the stipulated port fees, which led to a loss of ` 649.29 crore, a report of Comptroller and Auditor General of India (CAG) has said. As per the report, GMB entered into an agreement with RPL in July 1999 to allow the petroleum giant to build its own captive jetty in Sikka near Jamnagar, for its liquid and gas cargo. According to CAG, the cost of construction of the jetty was ` 362.01 crore. As per the agreement and the government policy to encourage private players, GMB allowed a 50 per cent rebate on the stipulated wharfage (port fees) at the rate of ` 36 per metric tonne to RPL till construction cost was recovered. (economictimes.indiatimes.com)

Expert group may be set up to study gas pricing

July 25, 2014. The government plans to consult a group of eminent people possibly led by former minister Suresh Prabhu or a "specialised agency" to review natural gas pricing, including the UPA-approved Rangarajan Formula that would have doubled gas rates to $8.4 per unit in April if the Election Commission had not vetoed it. Some officials say engaging organisations having "generic expertise" in this matter would be time consuming and the government would miss the September 30 deadline, hence a committee under Prabhu should be asked to revisit the entire gas pricing issue. Other names proposed for the panel are Pratap Bhanu Mehta, chief executive of the Centre for Policy Research, and Bibek Debroy, a faculty member in the same institution. The Cabinet Committee on Economic Affairs decided to "comprehensively review" the issues related with gas pricing in public interest, and asked gas producers to keep selling at the old price of $4.2 per unit until the end of September. The government is studying various aspects of gas pricing including Reliance's move to initiate arbitration against the government on the issue of delay in implanting the Rangarajan formula. Also, the Supreme Court is hearing a public-interest litigation on the matter. In this background, the oil ministry may consult the law ministry's opinion before taking any decisive step. (economictimes.indiatimes.com)

Gas row: ONGC and RIL pick independent agency

July 24, 2014. Oil & Natural Gas Corporation (ONGC) and Reliance Industries Ltd (RIL) have selected an independent agency to verify the state explorer's allegation that RIL may be drawing gas from a common reservoir in the two companies' adjoining blocks in the KG Basin, Oil Minister Dharmendra Pradhan said. ONGC's blocks have a common boundary with Reliance's KG-D6 block. Reliance has strongly denied the allegation, but the company has stuck to its stand and even filed a case against the oil ministry in the Delhi HC, alleging that the government had turned a blind eye to the matter. (economictimes.indiatimes.com)

Petrol, diesel rates to go up in Goa from next month

July 24, 2014. Goa Chief Minister Manohar Parrikar announced that petrol and diesel rates would be hiked by ` 2 and ` 1, respectively from August 1 in the state. The hike will bring additional revenue of ` 7 crore a month. Parrikar also announced that he would quit the office if garbage was not cleared from the roads in the state by December 19, 2015. (economictimes.indiatimes.com)

ONGC ramps up its disaster preparedness

July 24, 2014. In the wake of the recent GAIL pipeline mishap at Nagaram village in East Godavari district of Andhra Pradesh, ONGC has ramped up its disaster preparedness and has been focusing on zero scope of error initiatives in its operational areas. Apart from the three-tier monitoring system that includes consistent real-time monitoring for arresting any operational snag, ONGC Rajahmundry Asset has recently deployed two emergency ambulances and two additional fire tenders at its operational station in East Godavari District.

The station at Tatipaka has now two emergency ambulances and five fire tenders for crisis handling. The emergency ambulance facility can be availed by the general public in case of extreme emergency on recommendation from government hospital in-charge and police officials. (economictimes.indiatimes.com)

Cairn India gives $1.25 bn loan to its parent Vedanta

July 24, 2014. Cairn India has extended a loan of $1.25 billion (` 7,500 crore) to its parent ` Vedanta for a two-year period as a part of the former's treasury operations. In the first quarter of 2014-15, Cairn India had already given Vedanta $800 million of the total loan committed while the balance would be disbursed in the coming quarters.

According to the loan agreement, Cairn India will get interest of 300 basis points above the benchmark London Interbank Of fered Rate. The company has cash surplus over and above its current capital expenditure needs and thus decided to extend a loan to the parent company purely as a treasury investment. (economictimes.indiatimes.com)

India paid 3rd tranche of $550 mn to Iran towards oil bill

July 24, 2014. India made a third payment of $550 million to Iran to take the total amount cleared over past one month to $1.65 billion. Indian refiners had paid the first instalment of $550 million on June 26 and second on July 8. After payment of the third tranche, one-fourth of their dues to Iran have now been settled, government and industry said. Since February 2013, when the US blocked payment channels to Iran for its nuclear programme,

India has been paying 45 per cent of its Iran oil bill in rupees through a UCO Bank branch in Kolkata. For the remainder, it has been waiting for a way to make the payment. As much as $4 billion has been accumulated in past dues. (economictimes.indiatimes.com)

Transparent fuel pricing system will help ONGC to present a clear picture of its earnings

July 23, 2014. The government plans to tweak the system of calculating fuel subsidies to make ONGC's public offer more attractive for investors. It plans to make subsidy sharing more predictable and transparent so that analysts can properly assess the ONGC's earnings outlook. Currently they are unable to assess the amount and the timing of the huge subsidy payout. This diminishes the interest of top institutions in the stock.

The oil ministry may soon approach the Cabinet to overhaul the fuel pricing system to incorporate some of the observations of the Comptroller and Auditor General of India, which recently submitted a report on the matter. The pricing system has a direct impact on ONGC, which shares a part of the cost of selling diesel, kerosene and cooking gas below market rates. After paying subsidy in the form of discounts to state refiners, ONGC was able to charge a net price of only $40.97 per barrel in the last fiscal year although the market price was about $106. This may rise to $60, which is close to the industry's demand of $65. The government has plans to raise about ` 18,000 crore through from sale of its 5% stake in ONGC this year. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Reliance Power mulls borrowing from Chinese banks for hydro power projects

July 29, 2014. To support the recently acquired hydro power assets from Jaypee Power Ventures Ltd, Reliance Power could look at Chinese banks for lending around ` 9,500 crore. Reliance CleanGen, a wholly-owned subsidiary of Reliance Power, signed a memorandum of understanding with Jaiprakash Power Ventures Ltd to buy off the company’s entire hydro power portfolio. The deal size, as shared by sources at Reliance Power, is ` 12,000 crore, out which the company will infuse ` 2,500 crore as equity, rest would be debt. The current rate of interest for loans sought by power projects is around 12-14 per cent, though Chinese federal banks offer cheap debt in the range of 7-9 per cent, at the minimum. (www.business-standard.com)

NTPC's Bangladesh project may be ready by Dec 2018

July 26, 2014. The 1,320 MW Maitree super thermal power project in Bangladesh, being developed by NTPC through a joint venture, is expected to start electricity generation by December 2018. The plant is to be implemented by Bangladesh India Friendship Power Company Ltd (BIFPCL) - an equal joint venture between NTPC and the Bangladesh Power Development Board. It would have two units, each having 660 MW generation capacity, fired by coal. (www.business-standard.com)

GVK set to launch operations of two new power projects this year

July 25, 2014. Hyderabad-based GVK Power & Infrastructure Ltd (GVKPIL) is set to commence commercial operations of two of its power projects, which are under execution, during the current financial year. According to GVKPIL, its step down subsidiaries, the ` 4,750-crore Alaknanda Hydro Power Company (AHPC) and ` 4,000 crore GVK Power (Goindwal Sahib) Ltd will start power generation this year. Though the 330 MW AHPC project on river Alaknanda in Uttarakhand had to start operations during mid 2013, the unprecedented natural calamity that occurred in the state during June that year delayed operations. Incessant rains and resultant floods had breached the dyke in front of the power house submerging the already erected Units I, II and III that were ready for commissioning with a huge deposit of silt.

The company said Units I and II would be synchronised upon completion of transmission lines for commencing power generation. The other two units of AHPC were expected to be operational during the second half of 2014-15. The company said, the commercial operations of Units I and II of the 540 MW Goindwal Sahib thermal power project in Taran district of Punjab were expected to be started by the end of 2014. Around 97 per cent of the works had been completed and the two units were ready for coal firing. The company is now in the process of obtaining the consent from the Punjab Pollution Control Board to operate. It has a dedicated power purchase agreement with the Punjab government. (www.business-standard.com)

Power projects worth ` 360 bn stranded on coal shortages

July 24, 2014. Power projects worth over ` 36,000 crore and having total generation capacity of 7,230 MW are stranded due to shortage of coal, the government said. Efforts are being made for supplying adequate coal to power projects, the government said. The 7,230 MW capacity is spread across 12 projects.

Minister of State for Power Piyush Goyal said generation capacity of 42,480 MW commissioned after 2009 is presently entitled to only 65% of their Letter of Assurance (LoA) commitment. With regard to gas-based capacity, about 5,349 MW is ready for commissioning and is awaiting gas allocation. (www.business-standard.com)

Tata Power generated 45,210 million units of electricity in financial year 2013-14

July 23, 2014. Tata Power said it had generated 45,210 million units of electricity in the 2013-14 financial year, an increase of 30 per cent compared to the previous fiscal. In 2012-13, the amount of electricity generated was 34,683 million units. Tata Power said the company is in the process of executing a number of projects and aims to generate 18,000 MW by 2022 as well as additional 4,000 MW of management of distribution networks. (economictimes.indiatimes.com)

Hydro power output continues downward trend

July 23, 2014. Insufficient rainfall in the country has crimped hydro power output, which slumped by a fifth over the weekend from a year ago, continuing its downward trend. On July 20, the load dispatch system received 418 million units of hydro power, which was almost 20% less compared with the 515 million units generated on July 20 last year, according to data from the National Load Dispatch Centre. Data show that hydro power generation has been falling from the 468 million units reported on July 14. Experts attribute the downtrend to the weak progress of monsoon rains in parts of India that together account for about 44,000 MW of hydro power generation capacity.

Experts say the gap in output when compared with 2013 could have been wider if hydel projects on snow-fed rivers had not received more water due to a severe summer. Hydro projects in the north reported generation of 277 million units compared with 271 million units the same day a year ago. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

CIL yet to sign fuel supply pacts with 12 power units

July 27, 2014. Coal India Ltd (CIL) is yet to enter into fuel supply pacts with 12 power units as issues like change in ownership and extension of coal supplies are still being examined by the government. Tapering linkage is short-term fuel linkage provided to those consumers who have been allocated captive coal blocks but which could not be developed on time. As many as 177 LoAs (Letter of Assurances) were issued by Coal India and its subsidiaries for the power projects to be commissioned in the 11th and 12th Five Year Plan. For these projects Fuel Supply Agreements (FSAs) were to be signed for 172 units covering 134 LoAs. (www.business-standard.com)

Discoms to challenge APTEL order on Adani Power, Tata Power

July 27, 2014. Electricity distribution companies of states like Gujarat and Maharashtra are likely to appeal against sector tribunal's order allowing power producers to recover increased imported fuel cost from March 2013. Prior to Appellate Tribunal for Electricity (APTEL), the CERC had allowed Tata Power and Adani Power to charge compensatory tariff from procurers with whom they have signed PPAs.

The APTEL had allowed Tata Power and Adani Power to recover power dues from March 2013 on account of rise in imported fuel cost. However, the Tribunal said the companies will not recover any pre-March 2013 arrears. The ruling would provide a cushion to the companies against escalation in cost of imported coal for the plant. (www.business-standard.com)

Telangana to buy power from Chhattisgarh

July 25, 2014. The Telangana government decided to buy power from Chhattisgarh on medium and long-term basis. K Chandrasekhar Rao, chief minister of Telangana gave instructions to Managing Director Transco to buy 1,000 MW power from Chhattisgarh State Power Distribution Company and enter into power purchase agreement (PPA) for Power Grid Corporation of India Ltd (PGCL) lines, the chief minister said.

The Chief Minister asked the company to obtain 1,500 MW of power through dedicated lines and float tenders to set up those lines. The chief minister said the neighbouring state has surplus power and in a position to spare to other states and it is the only state from where Telangana can obtain power. (economictimes.indiatimes.com)

TAQA pulls out of $1.6 bn deal with Jaiprakash Power

July 24, 2014. Abu Dhabi National Energy Co (TAQA) is pulling out of a $1.6 billion deal to buy two Indian hydroelectric power plants because of "a change in strategy". TAQA said a consortium led by it had agreed to buy the two power plants from Jaiprakash Power Ventures.

TAQA, with 51% of the consortium, was to control the operations and management of both plants. PSP Investments, one of Canada's largest institutional investors, would own 39% and an infrastructure fund run by India's IDFC Alternatives was to hold 10% (www.business-standard.com)

July 24, 2014. Assam Chief Minister (CM) Tarun Gogoi asked Power department officials to purchase electricity from national grid to meet the existing daily shortfall of 200-300 MW in the state. Gogoi asked the officials to procure power from the national grid to meet the current shortfall of 200-300 MW daily. It was decided that a dedicated security force would be deployed at NTPC power project at Salakati so that the people could work round the clock and complete the delayed project by 2015.

Gogoi also emphasised that coal linkages to power projects in the state should be taken up with the Centre with renewed vigour at all levels. Gogoi asked officials to improve the utilisation of the plan funds and to submit the utilisation certificates for timely release of funds from the Ministries of Government of India. (economictimes.indiatimes.com)

Policy / Performance………….

Assam CM’s son pitches construction of hydro power projects on River Brahmaputra to counter China

July 29, 2014. Assam Chief minister Tarun Gogoi's son and first time MP, Gaurav Gogoi pitched for expediting the construction of hydro power projects on River Brahmaputra to counter China's massive activity on Brahmaputra which is called Yarlung Tsangpo in Tibet. Union Minister of State for Water Resources, River Development and Ganga Rejuvenation Santosh Kumar Gangwar in parliament recently stated Government of India is aware of construction activity on the Chinese side which is a Run of the River (RoR) hydroelectric project. He had stated recently released 'Outline of the 12th Five Year Plan for National Economic and Social Development of the People's Republic of China indicates that three more hydropower projects on the main stream of the Yarlung Tsangpo/Brahmaputra River in Tibet Autonomous Region have been approved for implementation by the Chinese authorities. The MP from Koliabor, Gaurav added various use of river Brahmaputra including hydro power and transportation will help India in establishing users right over the river. (economictimes.indiatimes.com)

Adani plans a 5 GW push into power sector

July 29, 2014. Gautam Adani plans to acquire power plants with a total capacity of 5,000 MW, but he will avoid aggressive bids to ensure good returns. Gautam Adani is directly involved in evaluating offers and negotiations, something he left to company executives in the past. The company is in talks with several power sector players, including GMR, Lanco, Indiabulls, Avantha Power and Athena. The Adani Group said there are many sellers in the market, offering projects with a combined capacity of nearly 50,000 MW. The Adani Group was also in the race for the Jaypee's assets, which Reliance Power clinched for about ` 12,000 crore. The Adani group is already India's biggest private power producer with a capacity of 8,620 MW, but it plans to grow much bigger and is looking at various projects as a number of developers are willing to sell off their delayed and fuel-starved power generation projects. (economictimes.indiatimes.com)

Gujarat has highest share of new investments in power sector: Assocham

July 28, 2014. Gujarat has the highest share with over 17 per cent in new investments attracted by the power sector from 2004-05 to 2012-13, apex industry body Associated Chambers of Commerce and Industry of India (ASSOCHAM) said. The analysis forms part of a study titled ‘State-wise Analysis of Power Sector: Consumption, Demand and Investment’ conducted by ASSOCHAM. Private sector accounted for 56 per cent share of the new investments worth over ` 1,560 crore attracted by Gujarat in 2012-13 while public sector contributed 44 per cent of new investments. Stating that 65 per cent of the total investment projects in the power sector attracted by India have remained non-starter as of 2012-13, the study stressed on the need for focus on smooth implementation of power projects as slow pace of implementation transforms into huge financial losses for the investors. (www.business-standard.com)

India finalizes deal to export power to Nepal

July 27, 2014. India and Nepal are finalizing an agreement to provide the energy-starved Himalayan nation with electricity, India's foreign minister Sushma Swaraj said at the end of a three-day official visit. Nepal's communist insurgency, which lasted until 2006, and ensuing political instability have hampered the construction of new power plants, and Nepal could not afford to map out an energy strategy on its own. Indian Foreign Minister Sushma Swaraj's visit to Nepal said the two countries were able to agree on 26 issues including finalizing the power deal. Under the agreement, India would export electricity to Nepal and help build hydroelectric power plants. Nepal has suffered from major power shortages with consumers facing power cuts up to 12 hours daily because the power plants are able to meet only half the total demand. India has a major influence over both the economy and politics in Nepal, and supplies all of Nepal's oil needs and much of its trade. (economictimes.indiatimes.com)

Reliance Power submits information on Sasan expansion to panel

July 26, 2014. Reliance Power has submitted additional information to a panel in order to get environmental clearance for expanding its coal mining operations for the Sasan power project. In its June 27 meeting to consider proposal for Moher and Moher Amlori coal mine capacity expansion, the Expert Appraisal Committee (EAC) had sought additional information from the company. Reliance Power has submitted the requisite information sought by EAC. The proposal was for expansion of production capacity at Moher coal mine from 12 million tonne per annum (mtpa) to 15 mtpa and that at Moher Amlori mine from 16 mtpa to 20 mtpa to feed the ultra-mega Sasan power project. Reliance Power had in September 2012 started mining for coal for the 4,000 MW Sasan project. (www.business-standard.com)

DVC seeks 51 per cent hike in power tariff for 2014-15