[Pakistan: the next frontier for Indian power companies?]

“India’s power sector is also inefficient but we are in a relatively better position. Though there have been improvements in the generation side, half hearted approach to reform is leading Pakistan towards complete collapse. Pakistan is in need of experts who can assist in mending loose ends of the power sector. Many platforms on regional cooperation talk of energy and sustainability as binding forces between India and Pakistan…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy…………………

- Natural Gas in India: The Tale from Two Papers

Power………….

- Pakistan: the next frontier for Indian power companies?

ANALYSIS / ISSUES…………

- Gas Pricing Beyond Administered Prices (part IV)

DATA INSIGHT………………

- Municipal Solid Waste and Waste to Energy Scenario in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· OVL signs PSCs for two onshore blocks in Myanmar

· Govt gets profit of $7 bn from Rajasthan oil fields

Downstream……………………………

· IOC to begin commissioning Paradip refinery by Dec

· IOC to invest ` 87 bn in Mathura refinery expansion project

· BPCL plans over ` 166 bn Assam refinery expansion

· Siemens bags ` 2.2 bn orders from RIL

· Adani in talks with IOC for ` 300 bn Mundra refinery JV

· Essar to shut 40k barrel-per-day crude unit for seven days in August second half

Transportation / Trade………………

· Adani-IOC, GAIL among bidders for piped gas supply in 14 cities

· Adani Group, GSPC to build ` 45 bn Mundra LNG terminal by end 2016

· Naveen Jindal to exit O&G business, sell stakes to cut debt

Policy / Performance…………………

· Vijay Kelkar panel to submit O&G report by Sep end

· Petroleum Ministry for 5 per cent disinvestment in ONGC: Sitharaman

· Petrol price likely to be cut on Independence Day

· Oil ministry moves to allow explorers more flexibility

· Govt to decide new gas price after Budget session

· Oil marketing cos to get ` 110 bn on subsidy in Q1

· Former Australian judge slams govt before quitting KG-D6 arbitration body

· Delhi Police's ACB claims powers to probe RIL gas pricing case

· Govt lawyers wary of foreigner as 3rd arbiter in RIL gas dispute

· UAE, Kuwait offer to hire part of India's strategic oil storage

· Gas pricing: Justice Manmohan recuses from hearing pleas of Centre, RIL

[NATIONAL: POWER]

Generation………………

· DEC of China proposes to set up power plant in Telangana

· SembCorp to increase stake in Andhra Pradesh power plant

· Commissioning of HPPL's power plant likely in Nov

· Adani Enterprises sets aside ` 1.2 bn for Tiroda plant delay

Transmission / Distribution / Trade……

· AP refuses to share power with Telangana

· Monsoon reduces peak power shortage in July to 3.9 per cent

· Power Grid to invest ` 4.7 bn in two transmission projects

Policy / Performance…………………

· Modi may lose $3 bn Nalco plant to Iran on coal

· Rajasthan nuclear plant unit 5 sets world record

· Govt may opt for UMPP bidding model for coal mine auctions

· Arunachal Pradesh seeks Assam's cooperation for hydel project

· PM to dedicate to the nation 2 hydel projects in J&K

· Odisha opposes Centre's plan to phase out four NTPC units

· 29 hydro power projects await CWC evaluation: Goyal

· CERC passes order on Reliance Power's Sasan UMPP

· Chinese equipment used for 34 power projects: Govt

· UP CM orders expediting work on three power plants

· Modi to lay foundation stone for power projects in poll-bound states

· 25-yr-old power plants to be replaced: Govt

· Gas-based plants in India not viable: Goyal

· Power Ministry mulls fund to finance hydro projects

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Blackstone said in talks to buy shell’s Haynesville stake

· Putin praises Exxon alliance as Arctic drilling starts

· Abu Dhabi's TAQA suspends activity in Kurdistan block

· OGDCL finds gas, condensate in Pakistan

· Thai PTTEP signs deal for Myanmar onshore block exploration rights

· Mexico oil is boon for Exxon to BP as frontiers teeter

· Deep water fracking next frontier for offshore drilling

· Shell starts up oil production at Bonga North West

Downstream……………………

· US refiner Axeon say won't take disputed Kurdish crude

· Eni cutbacks bring welcome relief to Europe's oil refiners

Transportation / Trade…………

· Libya restarts third-biggest port as IEA warns of surplus

· Weakest oil demand growth since ’12 allays supply risk, IEA says

· BG’s former CEO to help InterOil build LNG plant as Chairman

· Ukraine promises smooth Russian gas transit to Europe

· Petrobras profit misses estimates as crude exports slide

· Blueknight plans to build $300 mn pipeline project in US

· California takes record amount of oil by rail from Utah

Policy / Performance………………

· Indonesia officials to press Widodo on fuel-subsidy cap in 2015

· Gabon signs offshore oil contracts with six companies

· China finds shale gas challenging, halves 2020 output target

· Egypt to pay energy companies via bond sale, Dimian says

· Venezuela considers selling US oil company Citgo

· ConocoPhillips to study oil, gas potential in Chile

· Russia sanctions failing to stanch energy deals with Japan

[INTERNATIONAL: POWER]

Generation…………………

· Glacier Power applies for time extension to complete Dunvegan Hydro power plant in Canada

· South Korea's Hyundai, Doosan suspend work on Libyan power plant

· Iran's hydroelectric power generation drops 1 GW

· 11 firms vie for gigantic power plant in Oman

Transmission / Distribution / Trade……

· World Bank to provide $500 mn for Vietnam’s electricity transmission project

· Coal’s price seen stunted at year-end amid supply glut

· Electricity T&D infrastructure annual investment will reach $198 bn by 2024: Northeast Group

Policy / Performance………………

· World Bank may support African coal power, Kim says

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Vikram Solar to build India’s first floating solar plant

· Govt aims to add 10 GW per year to lift wind energy sector

· Fulfilment of RPOs to shape domestic solar photo-voltaic power demand: Report

· New land act may impact cost of renewable energy projects: Govt

· Incentivise action on climate change: Javadekar

· Jakson Group wins contract from DMRC to set up solar plants

· Used-cigarette butts set to become the next generation energy storage device

· PTC India Financial Services approves loans of over ` 10 bn to power projects

· Fifth India-US Energy Summit to focus on renewable energy

GLOBAL………………

· Exploding lithium batteries riskier to planes: Research

· Sasol sees profit rising as much as 17 per cent as Synfuels output gains

· JBIC, Mizuho among lenders for UK offshore wind power project

· Mexico 2014 renewable investment may exceed $2.4 bn

· Vattenfall plans $1.6 bn wind farm in North Sea

· China, Brazil seek publicity blitz to steer climate talks

· SolarCity loss widens as new rooftop installations surge

· Dam burst threatens Canada projects seeking approval

· Armstrong provides $29 mn for Philippine solar power farms

· China adds Australia-sized solar capacity in energy push

· China solar makers gain on policies to spur installation

· Dirtiest fuel threatens 700-year-old villages in Europe

· Malaysia delays full implementation of B5 biodiesel mandate

· UK proposes new laws to criminalize energy-market rigging

[WEEK IN REVIEW]

Natural Gas in India: The Tale from Two Papers

Lydia Powell, Observer Research Foundation

The story of natural gas in India has been told and re-told in different ways by many observers in the last few years. It is possibly because the twists and turns in the sector have been intriguing enough to convert even the most laid back observers into investigative writers. In this context two fairly recent reports and their conclusions make interesting reading. The first is the ninth report of the Standing Committee on Petroleum & Natural gas (2013-14) of the Lok Sabha (the lower house of the Indian Parliament) and the other is from the Centre for Energy Studies of the Baker Institute of Rice University released in October 2013. The former reads like a crime thriller while the latter a tragedy. The former ends rather triumphantly as the culprits are caught and punishments pronounced by the time we reach the last pages. The latter ends with the well worn and simplistic western line: unless India does as it is told (move towards the market) it is doomed.

The report of the Standing Committee on Petroleum & Natural Gas starts with two descriptive chapters that capture historic and current details of the natural gas sector in India. The third chapter indulges in critical analysis of the effort to introduce elements of the market in the natural gas sector. The proxy for the culprit is what has come to be labelled as the Rangarajan formula for determining the price of natural gas in India. The chapter contains detailed information on examination of witnesses from various Ministries to bring out their role and position with regard to the formula. Part II of the report consists of observations and recommendations and an annexure of minutes of meetings held by the committee. The record of witnesses’ statements captures difference of opinion over the Rangarajan formula within the State machinery. The Ministry of Petroleum & Natural Gas (MoPNG) comes out as a strong defendant of the formula while the Ministry of Finance (MoF) questions every element in the formula. The Ministry of Power and the Department of Fertilisers come out as victims of the formula. From the narrow perspective of each of these stake holders, the arguments they have put up to make their case do appear to be rational.

For example, the MoPNG’s response that average prices paid in American, European and Japanese markets which account for over 63% of world consumption was a good indicator of price expectations by E&P companies appears to be a rational response to the question over inclusion of prices at these gas trading hubs in the formula. One can even accept the tangential reasoning offered by MoPNG that Japanese gas price was included in the formula as it was closest gas market to India as it is dependent on LNG like India. However a part of MoPNG response that without the Japanese market the price would have been too low for the producers gives away its bias that appears to favour producers. The argument essentially says that if only credible gas markets where gas to gas competition is present is included the price would not be to the taste of producers. Here the State seems to take the role of a guarantor of high prices but this appears to contradict the longer term goal of a move towards the market. In a truly market determined system, the producers cannot be protected from the downside of the market just as consumers cannot be protected from the upside of the market. Another MoPNG response that is recorded in the report talks of huge unmet demand for gas in India and the possibility of producers cartelising to exploit this demand. This narrative of huge unmet demand for gas and electricity in India has gained the status of a self-evident truth in India but it needs to be unpacked and analysed very carefully. Most of what is taken is demand is need that is not backed by purchasing power. The report also records the ultimatums of the fertiliser and power on base prices that they can absorb that are in the range of $11/mmbtu and $5/mmbtu respectively.

The observations of the MoF which has to shoulder the burden of subsidies from gas consuming industries such as power and fertilisers recorded in the report contest the observations of the MoPNG. It puts its arguments in the context of the clause in the production sharing contracts (PSC) signed with producing companies that states that price to be paid to the producers would be based on competitive arms length sales in the region with similar conditions and that the price would take into account domestic and international prices of comparable gas and the linkages with traded liquid fuels. It then states that the Rangarajan formula that links consumption volumes in USA, Japan and Europe cannot be justified in the context of the clause in the PSC. It recommends that the net back wellhead prices of suppliers in Qatar, Oman, Abu Dhabi and Malaysia which have supplied gas to India in the past may be taken in to account in arriving at a formula. In another statement the MoF quite correctly observes that every formula will have pros and cons and that pricing formulae used in China and South Africa which have been mentioned in the Rangarajan Committee report must be considered as alternative possibilities. This point requires further exploration.

China’s well-head prices are based on a cost plus model but it is moving to an oil linked formula based pricing regime in Guangdong and Guangxi regions. By linking the price of gas with international price of its competing fuels the formula aims to reflect international market fundamentals. The formula also has a discount rate to give natural gas a competitive advantage over competing fuels. In the regions under trial on the basis of the new formula, the main competing fuels are LPG and fuel oil. The pricing regime for gas in South Africa decides the maximum price of gas taking into account indicator prices (mostly market based prices) for alternatives that include coal, diesel, electricity, heavy fuel oil and LPG with appropriate weights decided by the regulator. The South African formula is designed to recognise that no single fuel is a perfect substitute for natural gas and to reflect a balance between encouraging a new fuel and equitable sharing of economic surplus between consumers and producers. In conclusion, the report offers many suggestions including the pooling of entire gas production and allocation on the basis of priority at uniform price. Essentially the report argues for the continued involvement of the State with pricing and allocation handled by the bureaucracy rather than the market.

The paper from Baker institute records positive supply developments and notes that political stasis (in October 2013) prevented significant energy policy reform and because of this the country suffers from natural gas shortages. It laments that production by the private sector had fallen below expectations on account of ‘poor investment and fiscal environment’. The report also concludes that ‘unlike US regulators who are institutionally required to be independent from Government, both the DGH and the PNGRB had assumed the role of technical advisors ceding regulatory decision making to the State’. The report also says that the State is infringing on market negotiations for gas prices and imposing third party access requirements for re-gasification facilities. It then blames regulatory uncertainty and regulatory ‘creep’ for having obstructed private investment. The report takes into account the political economy of decision making and reform in India and concludes correctly that various ministries have competing agendas and therefore propose and support conflicting policies. It also notes that there is no clear ideology on energy policy among key political parties except to propose market reforms when in government and oppose them when in opposition. Having come out at the fag-end of the UPA regime, the report quotes the then popular S&P line that ‘political paralysis pushed the government to support poor economic policies that damaged investment climate and business confidence.’ As it is the case with many reports that originate in the West, the report is critical on energy and fertiliser subsidies and promotes elimination of subsidies with missionary zeal.

The report ends with two possible scenarios for India in the context of natural gas. The first which it says is more likely is one of piecemeal but earnest reform that tries to balance competing industry, political and social needs. In the alternative scenario, it says that India’s efforts to revise upstream prices would not be coupled with downstream reforms and that even if higher prices may boost domestic supply shortages will continue as demand will grow unchecked. The paper optimistically concludes that the State’s overwhelming presence in allocation and pricing of gas may not be sustainable in the longer term thanks to the State’s fiscal constraints.

The tale captured by the two reports continues to hold true even though almost a year has passed since they were published and a government with supposedly progressive vision at least as far as the industry is concerned has replaced the government with supposedly not so progressive vision. Reams of paper can be filled with arguments that favour continued presence of the State in the energy sector to maintain status quo as the former report does. Yet more reams can be written on why the State should get out precisely for the same reason as the latter report does. While all this can keep analysts employed, nothing much is likely to change in India as slow growth (and possibly change) is part of the design in highly unequal societies such as that of India as Adam Posen observed in a recent column. The former report takes a view from the equal distribution of votes. The latter takes a view from the unequal distribution of power and wealth. As long as the equal distribution of votes and the unequal distribution of wealth coexist, ‘nothing new can be expected under the (Indian) Sun’ as King Solomon put is hundreds of years ago.

Views are those of the author

Author can be contacted at [email protected]

Pakistan: the next frontier for Indian power companies?

Ashish Gupta, Observer Research Foundation

Like India, Pakistan is a country plagued with high unrealistic electricity tariff, inefficiency, low recovery of dues and distorted subsidy mechanism. India’s power sector is also inefficient but we are in a relatively better position. Though there have been improvements in the generation side, half hearted approach to reform is leading Pakistan towards complete collapse. Pakistan is in need of experts who can assist in mending loose ends of the power sector. Many platforms on regional cooperation talk of energy and sustainability as binding forces between India and Pakistan.

Pakistan’s Power Sector Scenario: The energy infrastructure in Pakistan is not well developed and is poorly managed. The country is facing severe energy crises which peaked in the year 2008 when shortage of the electricity was estimated at 4000 MW. Currently, the country is facing energy shortage of 7000 MW which is likely to grow further in the coming years. Many parts of Pakistan witnessed 16-18 hours of load shedding in summer and winter with no relief in sight for consumers. Many people have lost jobs due to closure of industrial units on account of power shortages. According to the Pakistan Energy Outlook 2010/11 to 2025/26 energy import requirement may grow from the present 30% to over 75% of the energy mix by 2025/26 costing Pakistan over USD 50 Billion (bn) per annum in foreign exchange.

The structure of Power Sector: Prior to 1998, there were only two vertically integrated power utilities ie Karachi Electricity Supply Company (KESC) serving the Karachi area and the Water and Power Development Authority (WAPDA) serving other parts of the country. Later on, WAPDA was structured into different corporate entities comprising of 4 Gencos, 10 Discos and 1 Transco. Unfortunately most of them are financially illiquid now. Interestingly like India, privatization was seen as the panacea for bringing back the messy power sector into order and profit. Consequently, the power sector was opened for the private participation 1990 and currently private producers control 30% of the total generating capacity.

Entry of Private Players: Initially they contributed to enhancing power generating capacity to a great extent but now they are working at below capacity due to working capital shortage. New power generating capacity is not coming up at the pace that was envisaged. Independent Power Producer (IPPs) can only sell power to single buyer ie WAPDA which exposes them to single customer risk. Most of the IPPs generate power from furnace oil and diesel which is very costly and the Discos are unable to pass on the cost to the end user. Consequently the complete value chain comprising Gencos, Discos and Transcos started defaulting on payments giving rise to ‘circular debt’ which stood at USD 5.85 bn in 2009. What was thought as panacea has become a problem and the classic example is KESC privatisation. KESC ownership was given to Saudi & Kuwait based company (Saudi Al-Jomaih Group and Kuwait National Industries Group) in 2005 which proved to be futile exercise as there was no achievement. Later on the ownership was given to Dubai based firm (Abraaj Capital) in 2008 but KESC is still struggling to revive.

The Energy Basket: When looking at the energy basket of Pakistan comprising of gas, hydel, coal, nuclear, biodiesel and renewable one can come to the conclusion that Pakistan had a good diversified energy basket. But lack of proper planning with no clear framework on how to prioritise generation from different sources has landed them in a precarious situation. It is forecast that Pakistan will be running out of natural gas in the next two decades leaving them with no option in the future but to rely on costly imports. Unfortunately, coal was not given any importance for generation though it is cheap! The chart is given below for the cost of power generation from various sources:

|

Sources

|

High Speed diesel

|

Residual Furnace Oil

|

Gas

|

Coal

|

Import from Iran

|

Nuclear

|

Hydro

|

|

Cost PKR/ Kwh

|

15.74

|

11.29

|

7.11

|

4.7

|

4.25

|

0.51

|

0.37

|

Source: Green Energy Report on Pakistan – ILO, 2011 (PKR – Pakistani Rupees)

Bridging gap through Rental Based Power Plants (RPPs): This kind of arrangement is for fixing the problem in the short term and generally brought into loop in the form of kit that can be installed in half a year’s time. These rental based power producers infuse more high cost fuel in the system and this has been increasing lately. The Asian Development Bank is of the opinion that the government of Pakistan should not execute more than 8 RPPs though 19 projects under different stages of development. Unfortunately these RPPs are not making any impact as far as load shedding is concerned. Also these RPPs are very fuel intensive, inefficient and obsolete.

Transmission Infrastructure: The power evacuation infrastructure is not very developed and Transmission & Distribution losses are still very high lingering at 30% to 40%. Theft of electricity is the norm because of very high electricity tariff ranging from PKR 4.54/ Kwh – PKR 13.29/ Kwh.

Opportunities for India:

· Constructing a power plant on Build, Own & Operate (BOO) basis is certainly not a good idea for Indian companies because of the security concerns. But if the Government of Pakistan (GoP) gives an assurance of safety to Indian Power developers, then Build & Transfer through joint venture with Pakistan state utilities could work out to be very a effective mechanism.

· India can impart technical knowledge which may be absorbed at various levels in the value chain of the power sector.

· Some of the power plants are non operational but they can be brought on-stream through some investment and technical improvements. Indian power producers have good experience with regard to technical competency and consulting which can be very useful for Pakistan.

· RPPs can be a major opportunity for India. India Power Producers can make these RPPs less fuel intensive by using coal rather than gas or furnace oil for power generation. India can also export coal for these RPPs and can earn major revenue as well trust. Also if there is any problem or threat, the contract could be designed so that GoP will pay a penalty.

· Pakistan has some major coal reserves in Thar (33 trillion tons as per Islamabad Chamber of Commerce Report) but currently these are not explored because most of the companies present in power sector are gulf based excluding few having very little experience in coal mining. India can help Pakistan in exploring and mining coal and thus reducing their unemployment rate.

· Upgrading transmission infrastructure is another area for mutual cooperation between the two countries.

· India can export renewable energy equipment to Pakistan as currently they are exploring renewable energy for power generation. This can be a major boost for Indian manufacturing companies.

· In the end, on a very positive note, India has offered to provide 5000 MW electricity to Pakistan which can be transmitted through Punjab. The Indian Government is looking to finalise the modalities shortly.

Rather than talking about big gas pipelines or exporting refinery products to Pakistan, these opportunities in the power sector which may look small can be very effective in bridging the political differences. An initiative in the right direction will make the empty glass at least hall full!

Reports studied:

An overview of Electricity Sector in Pakistan –Islamabad chamber of Commerce & Industry

Pakistan Power Sector Outlook: Appraisal of KESC in post Privatisation Period

Executive Summary – Pakistan Energy Outlook (2011/11 to 2025/26)

Views are those of the author

Author can be contacted at [email protected]

Gas Pricing Beyond Administered Prices (part IV)

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

Continued from Volume XI, Issue 8 (http://orfonline.org/cms/sites/orfonline/modules/enm-analysis/ENM-ANALYSISDetail.html?cmaid=70566&mmacmaid=70567)

Natural gas pricing linked to competing fuels is widely regarded as one of the most appropriate pricing methods for gas markets that are in the transitional phase of market development from a non-competitive towards a competitive design. India and China, probably the most determining and influential Asian gas markets, both can be assigned to step into this interim evolution period since these overall intensively growing markets with multiple supply options and a huge (potential) customer base are already far beyond its initial market phase. The scene for future market design is to be set right now.

The intensive and protracted discussions about the Indian gas pricing can be regarded as an expression of this challenge. External pressures driven by general globalization trends of trade and specifically by the gradual globalisation of the gas industry via LNG will have to be reflected. Any market design will have to overcome the power of markets forging ahead through consolidation of pricing and prices from domestic production (regulated prices at low level) vs. imported gas (market driven prices at higher level) at the national level. Decoupling from international markets developments is becoming more and more difficult and pressure will even rise in future, because of increasing integration and import dependence. Against this backdrop, it would be advisable to bring the domestic gas market framework as far as possible into line with these market requirements.

In this respect, the proper gas price reflecting (global) market dynamics is ideally determined by the interplay of supply and demand in a competitive market context, which incidentally turned out to be the prevailing pricing mechanism throughout the world. In general, market based gas pricing mechanisms are forging ahead globally and are currently adding up to almost two thirds of total gas pricing in the world. However, since effective gas to gas trading and pricing in India cannot be regarded as a realistic option for the foreseeable future due to lacking infrastructure and liquidity e.g., the second-best market based solution can be seen in gas pricing linked to the price of competing fuels.

The concept of Oil Price Escalation (OPE) has a long tradition in European gas markets and currently accounts for a share of about 20% in overall world gas price formation. In Europe its share still has been at dominating 80% in 2005, however, for various reasons such as advancing market liberalisation and widening gas‑oil spreads, OPE has been increasingly displaced by pricing based on Gas-on-Gas Competition (GOG) in recent years (Figure 1). This process reflects very much the general observed evolution of gas pricing moving from regulated (cost-plus) approaches via oil-related pricing in the transition period towards pure (spot/future) market pricing.

Figure 1: European Gas Price Formation

Source: IGU (2014)

The pricing concept originates from the early phase of Continental Europe’s import-based gas industry in 1961, when the Dutch government wanted to maximise the rent income from the super-giant Groningen gas field and needed to find a concept that allowed controlling the depletion rate of the field as well as the rate of market penetration: Gas should be sold based on the replacement value defined by its substitute energies, and change over time in line with the price changes and shares of the replacement fuels to remain competitive. The system of long-term contracts developed for the sale of Groningen gas then became the blueprint for subsequent imports from the Soviet Union/Russia, Norway and Algeria, for instance.

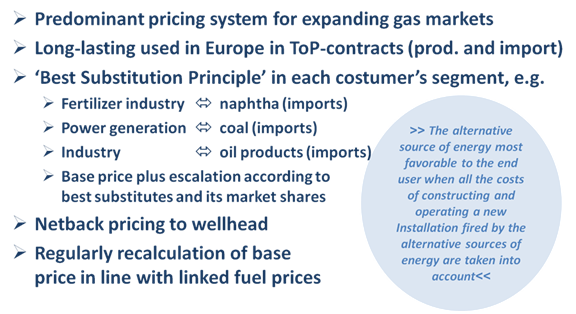

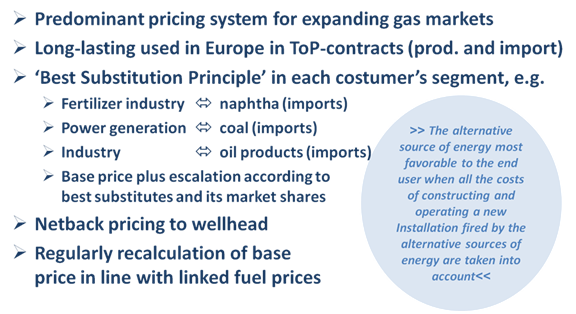

The basic concept of competitive fuel pricing is to link the price of gas through a base price and an escalation clause to its competing fuels (‘best substitutes’) in each sector gas faces competition from alternative fuels (Figure 1). The gas price will establish the sectoral and finally the overall market share of natural gas, because it will be squeezed out of the market if the price is too high in relation to the price of the competing fuel or gain share if it is too low. Since coal is the principal fuel for power generation in India, it will offer the greatest challenge for gas to increase its market share. Currently, gas is generally priced out of the market by cheap Indian coal. However, in future, the pendulum will swing in favour of gas due to the higher share of more expensive imported coal and constraints over carbon emissions and local pollution. If the cost of externalities such as pollution are internalised, it will trigger fuel switching towards natural gas. Finally, the price is netbacked to the wellhead, i.e. a backward calculation of the price starting from consumer to producer. The main characteristics of gas pricing linked to competitive fuels are summarised in Figure 2.

Figure 2: Synopsis of Gas Pricing Linked to Competing Fuels

Source: Compiled by author.

In principle, the price formula itself consists of the base price P0, to be agreed on between the contractual parties at a fixed point of starting time, and the escalation terms for each relevant sector, which indexes the gas price to the prices of competing fuels (e.g. fuel oil, coal, naphtha).

Gas Price = Base Price P0 + Esc 1 + Esc2 + ……

However, some more elements typically has to be taken into account such as the

· Weight factor that are the shares of gas market segments competing with respective fuels

· Energy conversion factor that converts the units of fuel prices into units of gas price

· Pass through factor that is set by negotiations representing risk and reward split

· Fuel price component that determines the difference between the best substitute proxy price on the recalculation date and the best substitute proxy price on the base date.

The following example demonstrates a resulting stylized gas price formula under the oil-linked gas pricing approach taking into account a slightly higher share of light fuel oil (LFO) in contrast to heavy fuel oil (HFO).

Figure 3: Paradigmatic Oil-Linked Gas Price Formula

Source: Energy Charter Secretariat (2007), p. 154.

However, this example formula above should be regarded as a simplistic model since in reality the real formula typically evolves in a negotiation process between the involved parties and the outcome might be fraught with some more restricting terms and conditions. Above all other fuels and commodities like coal, naphtha or even electricity or other product prices may find its way into it. Escalating prices could be effectively regulated by certain caps. For example, S-shaped formulae will limit risks for both parties. The cap can also be linked to price of competing fuels (e.g. coal capped oil-link). And besides, regular or requested price reviews provide the opportunity for adjustments to the contract pricing provisions referring to changing market conditions, ensuring that the gas would remain priced competitive as means of gaining market shares, if intended. Ultimately the formula mechanism offers a more dynamic, efficient and competitive way of gas pricing beyond administered cost-plus approaches. That’s the reason why it was adopted by so many European gas industries for such a long time period as the decisive gas pricing formulation and further on triggered the current rethinking process in China.

China’s staggering natural gas market is facing several challenges. In an move to mark-up gas prices to economic levels China forges ahead towards oil price escalation in recognition of the inefficiencies of its regulated pricing system and the adaption of low domestic prices in contrast to higher prices of surging imports via pipeline and LNG.

China’s natural gas import dependence has grown tremendously within the last decade: from a mere 6% to more than 30% in 2013. Figure 4 highlights the various import modes by cross-border pipeline and LNG China has contracted by now; concomitantly challenged by a vast range of prices unveiling the significant exposure to global gas in comparison with the domestic wellhead price at Ordos Basin, which was only about the half of the weighted average import price in 2013. Import prices spread out from lowest priced LNG imports from Australian and Indonesian (still benefitting from low level S-curve contracts originating from years with much lower oil prices) to highest from Qatar. Furthermore, in 2013 almost one fifth of total Chinese gas demand was satisfied by gas imports via the new Central Asian pipeline predominantly from Turkmenistan at prices of roughly twice as much as the domestic benchmark. Since the oil-indexed pipeline imports from Turkmenistan are contracted to double by 2020 (up to 65 bcm/a) and moreover the planned Siberian Gas pipeline is expected to ship a significant amount of Russian oil-indexed gas (38 bcm/a) to China by 2018 at prices of about 10‑11 $/MMBtu, these gas volumes can be expected to leave a significant mark in the Chinese price and pricing landscape.

Figure 4: Chinese Imports by Pipeline and LNG in 2013 (Prices in $/MMBtu, Volumes in bcm)

Source: OIES (2014), p. 7.

For some reasons gas is set to be the fuel of choice in China (e.g. to reduce air pollution and carbon emissions) and actively promoted by the government. In respect thereof energy price reforms are set to be accelerated towards more market based pricing to encourage competition (with other fuels), boost investment in (unconventional) gas production and reduce inefficient fuel consumption. The National Development and Reform Commission (NDRC) of the Government has implemented a new system linking gas prices more closely to higher international oil prices. In the course of this a pilot gas pricing reform has been launched in the southern provinces of Guangdong and Guangxi in 2011. The new pricing formation is based on a netback approach with city-gate prices linked 60% to the price of imported fuel oil and 40% to LPG. In addition, the price is adjusted for calorific differences and discounted by 10% to encourage gas usage. In its final phase formula induced price recalculations are envisaged on a quarterly basis.

The gas pricing reform was further extended to almost all the provinces of China and refined into a tiered pricing of existing and incremental gas. The new pricing scheme covers imported pipeline gas and most domestic onshore supplies. The price reform applies to incremental natural gas demand beyond 2012 level; however, NDRC intends price conversion by 2015. Gas prices have been concomitantly marked up in 2013 for non-residential users and another round of increases for residential consumers is announced for the end of 2015 for the sake of saving energy and improving the accounts of the gas companies. Besides, China has opened a gas spot trading market at the Shanghai Petroleum Exchange (SPEX) as part of its liberalization move.

India’s gas market is currently facing a lot of challenges. Some are issued from domestic market distortions all over the value chain from upstream, midstream and downstream and in relation with other sectors and policies (e.g. fertilizer industry, subsidies). On the other hand, pressures from globalisation won’t stop at Indian borders, for the gas industry they are even expected to increase over time with increasing exposure to imports in future. The future gas pricing mechanism will have to meet these requirements in a flexible and market-conforming manner. China has recently acknowledged the overall pressures of globalisation, gas market economics and environmental pollution as well as carbon emissions and has changed course towards a more competitive oil-linked natural gas pricing in order to abandon prevailing market distortions and to actively foster domestic (shale) gas production, attributing natural gas a greater role to play as the promising bridge fuel for the foreseeable future.

For sure India is not able to pull around in short time. However, now is the time to think, which incentives should be set for the developments towards more effective functioning markets throughout the next couple of years. The recent history has shown that administered pricing in India has not achieved the desired results, since gas production in 2013 was more or less the same it has been a decade ago and overall supply is nowhere near enough to satisfy demand, for instance. Thus a comprehensive gas price reform seems to be overdue, and it should comprise a proper pricing structure to incentivise upstream development as well as the necessary enlargement of required infrastructure on the one hand, and to cope with global market requirements on the other hand. Forging ahead to more efficient market approaches stringently necessitates a gradual tidying up with market distortions such as massive subsidies or prioritising customer segments. However, establishing a more market-oriented path will be a lengthy and bitter process since it involves additional steps even in associated fuel and commodity markets. Price hikes for customers seems to be a safe bet as current prices are beyond international price levels and won’t properly attract upstream investors. In a nutshell, to back the wrong horse here and now might have longstanding consequences for the development of this abundantly available and relative environmentally friendly fuel in India.

Sources:

Energy Charter Secretariat [ICS] (2007), Putting a Price on Energy - International Pricing Mechanisms

For Oil and Gas, Brussels.

Energy Information Administration [EIA] (2014), Country Briefs – China, www.eia.gov.

International Energy Agency [IEA] (2012), Gas Pricing and Regulation - China’s Challenges and IEA Experience, Paris.

International Gas Union [IGU] (2014), Wholesale Gas Price Survey - 2014 Edition - A global review of price formation mechanisms 2005 -2013.

The Oxford Institute for Energy Studies [OIES] (2014), The Development of Chinese Gas Pricing:

Drivers, Challenges and Implications for Demand, Michael Chen, Oxford.

--------------------------------------------------------------------------------------------------------------------------------------

Reuters (2013), China looks to energy price reform to unlock gas supply, cut waste, Nov 15, 2013, uk.reuters.com.

The Wall Street Journal (2014), China to Raise Household Natural Gas Prices - Higher Prices for Residential Consumers by the End of 2015, March 20, 2014, online.wsj.com.

--------------------------------------------------------------------------------------------------------------------------------------

ORF and PHD Chamber (2014), India Energy Security Vision 2022 – From Scarcity to Abundance, New Delhi, July 2014.

Schuppe (2014), Globalisation is Driving Gas Pricing Evolution (Gas Pricing III), ORF Energy Monitor, Vol. XI, Issue 8, 05 August 2014.

Views are those of the author

Author can be contacted at [email protected]

Municipal Solid Waste and Waste to Energy Scenario in India

Akhilesh Sati, Observer Research Foundation

|

State/UT

|

Electricity Generation Potential (MW) from MSW

(1)

|

MSW Quantity

Generated (Tonnes per day)

(2)

|

Collected as % of (2)

|

Treated as % of (2)

|

|

Andaman & Nicobar

|

-

|

70

|

100

|

7

|

|

Andhra Pradesh

|

107

|

11500

|

93

|

82

|

|

Arunachal Pradesh

|

-

|

181

|

100

|

-

|

|

Assam

|

6

|

650

|

54

|

15

|

|

Bihar

|

67

|

1670

|

-

|

-

|

|

Chandigarh

|

5

|

340

|

97

|

74

|

|

Chhattisgarh

|

22

|

1896

|

90

|

9

|

|

Daman Diu & Dadra

|

-

|

85

|

100

|

-

|

|

Delhi

|

111

|

7500

|

60

|

33

|

|

Goa

|

-

|

183

|

99

|

99

|

|

Gujarat

|

98

|

8336

|

89

|

1

|

|

Haryana

|

18

|

3490

|

99

|

16

|

|

Himachal Pradesh

|

1

|

1370

|

20

|

12

|

|

Jammu & Kashmir

|

-

|

1792

|

74

|

18

|

|

Jharkhand

|

8

|

4450

|

42

|

2

|

|

Karnataka

|

125

|

9500

|

60

|

21

|

|

Kerala

|

32

|

1576

|

68

|

28

|

|

Lakshadweep

|

-

|

21

|

-

|

-

|

|

Madhya Pradesh

|

68

|

5079

|

85

|

16

|

|

Maharashtra

|

250

|

17000

|

88

|

28

|

|

Manipur

|

1.5

|

176

|

71

|

-

|

|

Meghalaya

|

1.5

|

268

|

74

|

37

|

|

Mizoram

|

1

|

552

|

50

|

-

|

|

Nagaland

|

|

270

|

69

|

7

|

|

Orissa

|

19

|

2383

|

83

|

1

|

|

Puducherry

|

2

|

495

|

100

|

-

|

|

Punjab

|

39

|

3853

|

100

|

9

|

|

Rajasthan

|

53

|

5037

|

49

|

10

|

|

Sikkim

|

|

40

|

63

|

63

|

|

Tamil Nadu

|

137

|

14532

|

100

|

11

|

|

Tripura

|

1

|

360

|

60

|

11

|

|

Uttar Pradesh

|

154

|

19180

|

-

|

-

|

|

Uttrakhand

|

4

|

1251

|

99

|

-

|

|

West Bengal

|

126

|

8674

|

83

|

16

|

|

Total

|

1457

|

133760

|

68

|

19

|

Source: 1) Report of the task force on Waste to Energy, Planning Commission

2) MNRE

NEWS BRIEF

[NATIONAL: OIL & GAS]

OVL signs PSCs for two onshore blocks in Myanmar

August 11, 2014. ONGC Videsh Ltd (OVL), the overseas arm of Oil and Natural Gas Corp (ONGC) has signed Production Sharing Contracts (PSCs) for two onshore blocks in Myanmar, ONGC said. The contracts were signed between OVL, Myanmar Oil & Gas Enterprises Ltd (MOGE), National Oil Company of Myanmar, and Machine & Solutions Co Ltd (M&S), the local partner. OVL had participated in the Myanmar Onland Bidding Round 2013, launched by the Myanmar government and was awarded two onshore blocks, B2 and EP-3, in October. OVL has participation in 35 projects in 16 countries including Bangladesh, Brazil, Colombia,Iraq, Kazakhstan, Libya, Mozambique, Myanmar, Russia, South Sudan, Sudan, and Vietnam. (economictimes.indiatimes.com)

Govt gets profit of $7 bn from Rajasthan oil fields

August 11, 2014. Cairn India has paid government $7.05 billion in profit petroleum from its Rajasthan oil fields in the last three fiscals, accounting for 60 per cent of the profit petroleum government earned from private fields. The government got $11.954 billion in profit petroleum from oil and gas fields operated by private firms like Cairn and Reliance Industries Ltd (RIL) during 2011-12 to 2013-14, Oil Minister Dharmendra Pradhan said. BG Group-operated Panna/Mukta and Tapti field gave $2.507 billion. Cairn's Ravva field gave $1.066 billion and its Cambay basin field CB-OS/2 an additional $316 million. RIL's eastern offshore KG-D6 block gave the government $486 million, Pradhan said. Pradhan said domestic natural gas production of 129 million standard cubic meters per day in 2014-15 will be way short of a demand of 405 mmscmd. The demand is projected to rise to 446 mmscmd next fiscal and to 473 mmscmd in 2016-17. Against this, domestic gas output will increase in 139 mmscmd in 2015-16 and 175 mmscmd in 2016-17. Similarly, crude oil production is projected to rise from 38.76 million tons in current fiscal to 42.54 million tons next year before dropping to 41.15 million tons in 2016-17. Against this, oil demand is projected at 159.8 million tons in 2014-15, 177.7 million tons in 2015-16 and 186.8 million tons in the following year, he said. (economictimes.indiatimes.com)

IOC to begin commissioning Paradip refinery by Dec

August 12, 2014. Indian Oil Corp (IOC) said it will begin commissioning its ` 30,000 crore Paradip refinery in Odisha by the end of the year. Commissioning of the full 15 million tons unit will take a few months. Paradip refinery has been delayed by two years. It was originally to come up in 2012 but got delayed due to several factors including cyclone and local law and order issues. The revised timelines for commissioning was set for August/September 2014 but that is unlikely to be achieved. (economictimes.indiatimes.com)

IOC to invest ` 87 bn in Mathura refinery expansion project

August 12, 2014. Uttar Pradesh government said Indian Oil Corp (IOC) will invest around ` 8,700 crores in the Mathura refinery expansion project which would lead to speedy development of the Mathura-Agra region besides creating job opportunities. IOC will invest ` 8,700 crores for the Mathura refinery extension project under which the oil refining capacity would be enhanced from the existing 8 lakh metric tonnes to 11 lakh metric tonnes and it would provide employment opportunities to some 10 thousand youths. This would be an important step in the direction of industrial development of the state. IOC said that a detailed proposal in this connection would be sent. (economictimes.indiatimes.com)

BPCL plans over ` 166 bn Assam refinery expansion

August 8, 2014. Bharat Petroleum Corp Ltd (BPCL) has drawn up plans to ramp up the capacity of its refinery at Numaligarh in Assam's Golaghat district from three million tonnes per annum to nine million tonnes at an investment of ` 16,600 crore. The project includes laying a 1,350-km pipeline to bring in crude from a port on the east coast. While the refinery expansion would cost about ` 8,800 crore, the remaining investment is expected to go into laying the pipeline and other assorted facilities. Government consultancy firm Engineers India Ltd is preparing the feasibility report for the project and the pipeline. BPCL has discussed the plan but a final call would be taken after the project report and other paperworks are completed. But, Bharat Petroleum wants 53% of capital subsidy on the ` 8,800 crore to be spent on the refinery expansion and extension of excise duty concession on the expanded capacity as a cushion against geographical, infrastructure and political difficulties in execution of the project. The company has approached the oil ministry for the relief measures. It has cited the example of Brahmaputra Cracker and Polymer Ltd, a joint venture with gas utility GAIL, which has been granted similar subsidy. The polymer project was drawn up as part of UPA government's initiative for the north-east. The present capacity of three million tonnes per annum of the Numaligarh refinery is considered too small to ensure efficient operations. Though the refinery is capable of running at 3.3 million tonnes per annum, it operates at only 2.5 million tonnes due to short supply of crude from Oil India Ltd. (economictimes.indiatimes.com)

Siemens bags ` 2.2 bn orders from RIL

August 8, 2014. Siemens Ltd has bagged orders worth ` 228 crore from Reliance Industries Ltd (RIL) for supplying steam turbine generation units to its Jamnagar refinery in Gujarat. Reliance Industries is in the process of expansion of its J3 petrochemical complex at Jamnagar, Gujarat, Siemens Ltd said. The scope of work includes design, manufacture, supply and commissioning of steam turbine generation units, which would be manufactured at Siemen's Vadodara factory. (economictimes.indiatimes.com)

Adani in talks with IOC for ` 300 bn Mundra refinery JV

August 7, 2014. The Adani Group and Indian Oil Corp (IOC) are in talks to build a ` 30,000-crore joint venture (JV) refinery at Mundra, which would give Gautam Adani an entry into the oil sector while the state-run company would get land port facilities for the proposed export-focused unit. The proposed 30-million-tonne refinery at Mundra will make Prime Minister Narendra Modi's native state, Gujarat, a bigger energy hub. It already has refineries of Reliance Industries, Essar Oil and Indian Oil, apart from two LNG terminals and the country's biggest city-gas distribution network. Gautam Adani has held initial talks with top executives at IOC and offered around 3,500-4,000 acres of land for the project. In exchange, Adani is keen to get a minority stake in the project that may be equivalent to the price of the land. If the deal works out, it will provide IOC land with port facility adjacent to it on the western coast of India. Most of the refineries of IOC are landlocked and it is keen to set up an export-oriented refinery on the western cost. The deal will also mark the entry of Adani Group in crude oil refining business. The two companies currently have a joint venture for city gas distribution. Adani in talks with IOC for ` 30,000 crore Mundra refinery JV IOC has 10 refineries with a combined capacity of 65.7 million tonne per annum (mtpa) year, which accounts for 31 per cent of India's domestic refining capacity. The company aims to increase its refining capacity to 100 mtpa by 2021-22. (economictimes.indiatimes.com)

Essar to shut 40k barrel-per-day crude unit for seven days in August second half

August 7, 2014. Essar Oil will shut a 40,000-barrel-per-day unit at its Vadinar refinery for a week for maintenance in the second half of this month. Essar operates a 400,000-barrel-per-day refinery at Vadinar in Gujarat. Essar has scheduled the shutdown to the later part of the month to take advantage of a planned cut in supplies of locally produced Mangala crude for about 10 days. Cairn India Ltd, which operates an onland crude producing block at Barmer in Rajasthan, will shut its Mangala processing terminal for 10 days from Aug. 21 to add new units. (economictimes.indiatimes.com)

Transportation / Trade…………

Adani-IOC, GAIL among bidders for piped gas supply in 14 cities

August 12, 2014. Adani Gas-IOC combine and state gas utility GAIL were among nearly a dozen firms that bid for licenses to retail CNG and piped cooking gas in 14 cites including Bengaluru and Pune. Other firms that bid for city gas distribution licenses at the close of bidding included Bharat Petroleum Corp Ltd (BPCL), Hindustan Petroleum Corp Ltd (HPCL), Gujarat Gas and GSPC. Oil regulator PNGRB had invited bids for development of CGD networks in Eranakulam in Kerala; Rangareddy/Medak, Nalgonda and Khammam in Andhra Pradesh/ Telengana; Bengaluru rural and urban districts in Karnataka; Raigarh, Pune and Thane in Maharashtra; Daman; Dadar & Nagar Haveli; Shahjahanpur in UP; Guna in MP; Panipat in Haryana and Amritsar in Punjab. In all 44 bids were received with Bengaluru being the most sought after and Andhra Pradesh/Telengana faring poorly. Adani-IOC combine bid for Eranakulam, Bengaluru, Daman, Dadar and Nagar Haveli, Amritsar and Panipat. (economictimes.indiatimes.com)

Adani Group, GSPC to build ` 45 bn Mundra LNG terminal by end 2016

August 11, 2014. Adani Group and Gujarat State Petroleum Corp (GSPC) will set up a ` 4,500 crore LNG import terminal at Mundra SEZ in Gujarat by December 2016. GSPC LNG Ltd, a unit of Gujarat government-owned GSPC, won approval to become a co-developer of the multi- product special economic zone (SEZ) being developed by Adani Ports at Mundra, a move that will help trim cost by ` 700-800 crore. Commerce Ministry's Board of Approvals (BoA) gave nod to GSPC LNG's proposal to 5 million tons a year LNG terminal together with storage and re-gasification facilities over an area of 28 hectares. (economictimes.indiatimes.com)

Naveen Jindal to exit O&G business, sell stakes to cut debt

August 7, 2014. Naveen Jindal plans to exit from the oil and gas business and his listed entity Jindal Steel and Power Ltd (JSPL) will sell stakes in some projects to reduce the group's debt burden. JSPL had debt of ` 37,500 crore as of June against ` 36,500 crore in the year earlier. However, the company plans to continue its investment drive to expand in mining besides its steel and power plants. JSPL will invest ` 6,000 crore during the fiscal and it will be largely funded from internal cash generation. The group has already hired advisors to look for buyers for Jindal's investments in oil and gas blocks while JSPL is evaluating its options. In a bid to diversify in 2008, the group established Jindal Petroleum that acquired seven oil and gas blocks, including five in Georgia and one each in Bolivia and India. According to Jindal Petroleum, the company has so far committed an investment of $200 million and is currently producing about 550 barrels a day. It announced the discovery of crude oil in one of its blocks in Georgia and a $100 million development plan for the blocks. (economictimes.indiatimes.com)

Vijay Kelkar panel to submit O&G report by Sep end

August 12, 2014. The Vijay Kelkar committee, which is in favour of continuing with the oil and gas contract system with some modifications, will submit its report by end-September after a three-month extension, the government said. It was set up last year to prepare and suggest steps to enhance domestic oil and gas output and reduce imports. In the first part of its report, it controversially opposed the Rangarajan committee's suggestion that oil firms should share a part of revenue from the day output starts, instead of the current system in which they recover costs before sharing profit with the state. The suggestion comes when the oil ministry is preparing to adopt the Rangarajan panel's view. Two members of the Kelkar committee, including the oil ministry's nominee, RN Choubey, who was the director general of hydrocarbons, gave dissent notes. Choubey disassociated from the chapter that defended the cost recovery regime, questioning its facts and figures. The Kelkar panel's next report is likely to deal with taxation, unconventional energy sources and gas markets. Its first report criticised the Rangarajan panel's views on the contractual regime. Earlier, the comptroller and Auditor General (CAG) of India also criticised the contractual regime and its implementation. However, the Kelkar panel report said in the prevailing contracts, companies' interests are aligned with the government and there is "no incentive for the investor to gold-plate". (economictimes.indiatimes.com)

Petroleum Ministry for 5 per cent disinvestment in ONGC: Sitharaman

August 12, 2014. Petroleum Ministry has accorded in-principle approval for 5 per cent stake-sale in ONGC which may fetch the government about ` 18,000 crore to meet disinvestment target for the current fiscal. Ministry of Petroleum and Natural Gas has agreed in-principle to the proposal of disinvestment of 5 per cent government stake in ONGC, Minister of State for Finance Nirmala Sitharaman said. As per the Budget 2014-15, the disinvestment target is ` 58,425 crore including receipts from disinvestment of government stake in the non-government companies. Meanwhile, the Department of Disinvestment (DoD) has kickstarted the process of stake sale in ONGC and invited bids for appointing merchant bankers to manage the share sale. The merchant bankers would advise the government on the timing and the modalities of the offer for sale (OFS) and ensure best return to the government. The DoD will appoint up to five merchant bankers to manage the OFS. (economictimes.indiatimes.com)

Petrol price likely to be cut on Independence Day

August 12, 2014. Petrol price is likely to be cut on Independence Day on the back of softening in international rates, Indian Oil Corp (IOC), the nation's largest fuel retailer, indicated. State retailers revise petrol price on 1st and 16th of every month based on average international oil price and rupee-dollar exchange rate in the previous fortnight. Oil firms had last cut rates on August 1 by ` 1.09 per litre, the first reduction in price since mid-April. Petrol currently costs ` 72.51 per litre in Delhi. There are indications that the rates may be cut by a similar amount on August 15 though Ashok refused to speculate on the quantum. This will be the second reduction in rates this month. The government had in June 2010 freed petrol prices and since then rates have moved in tandem with the cost on most occasions. For diesel, the government had in January 2013 decided to eliminate the subsidy in stages through monthly increases in prices by up to 50 paise per litre. With monthly increases continuing, subsidy or losses on diesel have been trimmed to ` 1.33 per litre but this will go up as there is a marginal increase in international gasoil (diesel) prices. Diesel price revision is due only on September 1 as per the policy of raising rates every month. (economictimes.indiatimes.com)

Oil ministry moves to allow explorers more flexibility

August 12, 2014. The oil ministry is proposing about 11 changes in production sharing contracts (PSCs) to allow explorers more flexibility in meeting timelines for developing fields or make it easier for them to exit in case of defence and environmental restrictions as well as give block oversight committees powers to decide dispute over technicalities. The government said the proposed changes, once approved by the Cabinet Committee on Economic Affairs, would apply to existing and future contracts. Dispute between Directorate General of Hydrocarbons (DGH), the ministry's technical arm which monitors PSCs, and explorers over PSC technicalities have stalled work on bringing as many as 62 discoveries into production and soured investment climate in the oil sector. (economictimes.indiatimes.com)

Govt to decide new gas price after Budget session

August 11, 2014. The government is considering a new price for domestic gas that would be lower than that suggested by the C. Rangarajan panel, while the decision would be taken after the budget session of Parliament. Finance Minister Arun Jaitley, who will take the final decision on the formula to be applied for pricing domestic gas, said that the government was considering the matter. The Cabinet Committee on Economic Affairs had decided to defer implementation of the Rangarajan formula till Sep 30 and come up with a new regime by Oct 1. The current gas price of $4.2 per million British thermal unit (mBtu) would have risen to $8.8 per mBtu based on the Rangarajan formula linking domestic price to the cost of importing liquefied natural gas (LNG) and rates in the US, Britain and Japan. The new government has decided to defer the implementation till September-end to hold wider consultations with various stakeholders. The petroleum ministry has suggested a deadline of end-August for completing discussions with gas producers as well as consumers such as urea and power plants. The petroleum ministry said that a new panel is being asked to take into consideration the concerns of the power and fertilizer ministries about the impact of the steep hike recommended by the Rangarajan committee. Critics of the Rangarajan formula point out that it includes Japan's import prices even though that country is not a producer. Among the options being considered is rupee-pricing of gas, as has been suggested by Jaitley, so as to cushion prices against foreign exchange volatility. (economictimes.indiatimes.com)

Oil marketing cos to get ` 110 bn on subsidy in Q1

August 11, 2014. Government will pay fuel retailers Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) ` 11,000 crore in subsidy for the first quarter. Fuel retailers sell diesel, domestic LPG and kerosene at government controlled rates which are below market price. The loss they thus incur is made good through cash subsidy from the government and dole from upstream firms like Oil and Natural Gas Corporation (ONGC). Of this, IOC will get ` 6,076 crore, BPCL ` 2,407 crore and HPCL ` 2,517 crore. During April-June, the three fuel retailers cumulatively lost ` 28,690.74 crore on the three fuel. Of this, the upstream firms ONGC, Oil India Ltd and GAIL have been asked to meet ` 15,546.65 crore or 54 per cent of the under-recovery or revenue loss. After accounting for government cash subsidy, fuel retailers are still left with about ` 2,145 crore of unmet losses. (www.rediff.com)

Former Australian judge slams govt before quitting KG-D6 arbitration body

August 10, 2014. Former Australian judge Michael McHugh, who was appointed by Supreme Court to adjudicate on Reliance Industries' KG-D6 dispute, had slammed the government interpretation of his statements before quitting the tribunal. McHugh, who was on April 29 appointed by the apex court as third arbitrator to a Tribunal to decide if the government was right in disallowing recovery of $2.37 billion of KG-D6 cost for gas output lagging targets, had initially declined to the offer saying his consent was not taken. He, however, later agreed after lawyers for KG-D6 partners contacted him on May 29 explaining the process. But the government and its lawyers maintained that he cannot return once he has declined the offer, a stand that finally made him quit the Tribunal on July 20. Before his July 20 decision, he wrote to government lawyers saying his May 25 email expressing intention of not accepting the Supreme Court offer cannot be construed as withdrawal from the Tribunal until the court accepts the move. (economictimes.indiatimes.com)

Delhi Police's ACB claims powers to probe RIL gas pricing case

August 9, 2014. A complaint against Reliance Industries Ltd (RIL) and its chairman Mukesh Ambani, in the KG-basin gas pricing issue, has revealed some serious cognizable offences, the anti-corruption branch (ACB) of the Delhi Police has said. In an affidavit filed before the Delhi High Court in relation with RIL's petition challenging a first information report (FIR) against Ambani, ACB has claimed the matter falls under its jurisdiction and it is duty-bound to probe it. (www.business-standard.com)

Govt lawyers wary of foreigner as 3rd arbiter in RIL gas dispute

August 7, 2014. Government lawyers for the Reliance Industries Ltd's (RIL) arbitration proceedings have told the oil ministry that appointment of a foreigner as the presiding arbiter would be "undesirable" in the absence of any such contractual provision and difficulty in ascertaining the person's "independence and impartiality" in the face of "global presence" of RIL's 30% partner British energy major BP Plc. RIL had on November 23, 2011 initiated the arbitration proceeding against the oil ministry's decision to slap a penalty — which has now increased to $2.3 billion — for failing to meet gas supply target for the KG-D6 block, off the Andhra coast. The advocates for the government, Swarup & Associates, have given a brief to the ministry, saying the Article 33.6 of the state's contract did "not provide for appointment of a foreign national as a third arbitrator". But, the real reason for reservations against a foreigner seems to be apprehensions over BP's global presence and reach. (economictimes.indiatimes.com)

UAE, Kuwait offer to hire part of India's strategic oil storage

August 6, 2014. UAE's national oil company Adnoc and Kuwait Petroleum Corp (KPC) have evinced interest in hiring a part of India's under-construction strategic storage, Oil Minister Dharmendra Pradhan said. India, which is 79 per cent dependent on imports to meet its crude oil needs, is building underground storages at Visakhapatnam in Andhra Pradesh and Mangalore and Padur in Karnataka to store about 5.33 million tonnes of crude oil to guard against crude price shocks and supply disruptions. The storages at Visakhapatnam, Mangalore and Padur will be enough to meet nation's oil requirement of about 10 days. The 1.33 million tonnes storage at Visakhapatnam would be ready by September/October while the 1.5 million tonnes Mangalore facility and 2.5 million tonnes unit at Padur would be completed by mid-2015. Visakhapatnam facility would have the capacity to store 1.33 million tonnes of crude oil in underground rock caverns. Huge underground cavities, almost ten storey tall and approximately 3.3 km long are being built. With the commissioning of Visakhapatnam storage, India will join nations like the US, Japan and China that have strategic reserves. These nations use the stockpiles not only as insurance against supply disruptions but also to buy and store oil when prices are low and release them to refiners when there is a spike in global rates. Originally, India Strategic Petroleum Reserves Ltd (ISPRL), the state-owned firm building the strategic stockpile, was to build the Visakhapatnam facility by October 2011 while the Mangalore storages were to be mechanically completed by November 2012. The storage at Padur was scheduled for completion in December, 2012. However, construction got delayed. The Cabinet had in January 2006 approved the building of the strategic crude oil storages at a cost of ` 2,397 crore but due to cost and time overrun the capital required is now estimated at ` 3,958 crore. The Visakhapatnam facility will cost ` 1,038 crore, Mangalore ` 1,227 crore and Padur ` 1,693 crore. (economictimes.indiatimes.com)

Gas pricing: Justice Manmohan recuses from hearing pleas of Centre, RIL

August 6, 2014. A Delhi High Court judge recused from hearing two separate pleas of the Centre and Reliance Industries Ltd (RIL) seeking quashing of an FIR lodged against RIL, Mukesh Ambani and former Petroleum Minister M Veerappa Moily for alleged collusion among them in increasing gas prices. Justice Manmohan then listed the matters for August 19. Meanwhile, the court said its earlier interim order will continue and asked the Centre and the RIL to co-operate in the probe by Anti-Corruption Bureau of Delhi government. Earlier, the court had issued notices on the plea of RIL seeking quashing of the FIR lodged against it, Mukesh Ambani and Moily by the then AAP government. The Arvind Kejriwal-led Delhi government had lodged an FIR naming Moily, Mukesh Ambani and others on gas pricing issue and alleged the Congress-led UPA government "favoured" RIL with an eye on 2014 general elections and BJP maintained "silence" hoping to gain corporate funding for the polls. Both the Centre and RIL have moved the high court seeking quashing of the FIR and both matters will now come up for hearing on August 19. (economictimes.indiatimes.com)

[NATIONAL: POWER]

DEC of China proposes to set up power plant in Telangana

August 12, 2014. Dongfang Electric Corporation (DEC) of China has come forward to set up a 660-1,000 MW power generation facility in Telangana in the shortest time possible. DEC was stated have expressed its keen interest to participate in the Telangana government’s efforts to add power generation capacity in the shortest time possible and in an effective way. The government of Sichuan Province will actively support DEC’s business with Telangana for power projects. It also stated that project finance will be arranged on mutually agreed terms and conditions. (www.business-standard.com)

SembCorp to increase stake in Andhra Pradesh power plant

August 12, 2014. Singapore's Sembcorp Industries Ltd expects a formal approval to increase its 45 per cent stake in the 1,320 MW power plant in Andhra Pradesh within a "couple of months". NCC Infrastructure Holdings Ltd, jointly with Gayatri Energy Ventures Pvt Ltd, is building the plant which would start operation by end of next year. Meanwhile, Sembcorp's 60 per cent owned first power plant, also of 1,320-MW at Krishnapatnam, is expected to commence operation from end of this year. Thermal Powertech Corporation India, a joint venture between Sembcorp and India's Gayatri Energy Venture, is building the plant. (economictimes.indiatimes.com)

Commissioning of HPPL's power plant likely in Nov

August 11, 2014. Hindustan Powerprojects Pvt Ltd (HPPL), formerly known as Moser Baer Projects Pvt Ltd, has said its thermal power project in Madhya Pradesh is progressing and first unit of first phase is expected to come up in November this year. The company is setting up its thermal power project of 2,520 MW in in Jaithari village of Anuppur district in Madhya Pradesh. The company is investing ` 7,500 crore in the first phase of the project. It had signed Fuel Supply Agreement (FSA) with South Eastern Coalfields Ltd in 2010. The plant, which is taking shape through a special purpose vehicle Moser Baer Madhya Pradesh Ltd, is expected to come up in multiple phases is in proximity of coalfields of South Eastern Coalfields Ltd and is close to power deficit markets of Maharashtra, Madhya Pradesh and Uttar Pradesh. (www.business-standard.com)

Adani Enterprises sets aside ` 1.2 bn for Tiroda plant delay

August 10, 2014. Adani Enterprises has set aside about ` 126 crore as payment to authorities on account of delay in starting commercial operations of its Tiroda thermal power plant in Maharashtra. Adani Power Maharashtra, a subsidiary of the company, is executing the 3,300 MW capacity thermal power project at Tiroda in Maharashtra. The third 660 MW unit of the project was commissioned in June last year. The company intends to sell power from this plant under the long term PPAs (power purchase agreements) as well as in the open market. Entire 3,300 MW capacity was earlier expected to be commissioned by the end of financial year 2013-14. Adani Power, another group company has 8,620 MW capacity and plans to take it to 9,280 MW. It is developing six power projects across Gujarat, Maharashtra, Rajasthan and Madhya Pradesh. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

AP refuses to share power with Telangana

August 12, 2014. The Andhra Pradesh (AP) government once again refused to honour a set of power purchase agreements (PPAs) that ensure 53 per cent of the available supply to the new state citing technical reasons. The AP government rejected the orders — issued by the outgoing AP Electricity Regulatory Commission (Aperc) — which said the attempted withdrawal of the select PPAs by APGenco was not valid. The PPAs pertain to 1,700-MW Vijayawada thermal power station and 1,200-MW Rayalaseema thermal power project by the Genco. As it resulted in widespread power cuts, the Telangana power utility had approached the regulator questioning APGenco's decision. AP government said Aperc's action was devoid of any legal sanctity as both the governments had constituted their own state electricity regulators as stated in the Schedule 12 of the AP Reorganisation Act, 2014, by August 1 itself. (www.business-standard.com)

Monsoon reduces peak power shortage in July to 3.9 per cent

August 12, 2014. Lower demand for electricity due to monsoons led to a fall in the country's peak power deficit to 3.9 per cent last month. Peak power deficit or supply of electricity when demand is maximum was down to 3.9 per cent in July from 5.1 per cent in June, as per latest data by the Central Electricity Authority (CEA). CEA provides assistance to the Ministry of Power in all technical and economic matters. The total electricity demand of the country during July was 1,45,014 MW, of which 1,39,320 MW was met, leaving a gap of 5,694 MW. North Indian states (including Punjab, Haryana, Rajasthan and Himachal Pradesh), which braved heat and humidity during July reported a deficit of 5.8 per cent or 2,855 MW, the CEA data said. Temperatures in the region hovered around 40-42 degrees during the month. The western region comprising Gujarat, Maharashtra, Madhya Pradesh and Chhattisgarh was the least affected with 0.9 per cent. The total peak demand was 41,598 MW of which 41,213 MW was met, CEA data said. South Indian states of Andhra Pradesh, Tamil Nadu, Karnataka and Kerala had a peak power requirement of 35,748 MW of which 33,839 MW was met leaving a deficit of 1,909 MW or 5.3 per cent. The eastern region states of Bihar, Jharkhand, Odisha, West Bengal reported a deficit of 1.7 per cent during the month. The north-eastern region (Assam, Meghalaya, Manipur, Nagaland, Arunachal Pradesh, Mizoram and Tripura) was the worst affected with a peak power shortage of 11.8 per cent. The total peak power demand of the seven sister states was 2,263 MW of which 1,996 MW was met. (economictimes.indiatimes.com)

Power Grid to invest ` 4.7 bn in two transmission projects

August 8, 2014. State-owned Power Grid Corp has received approval of its board for investing ` 477.24 crore in two transmission projects. The utility will invest ` 288.49 crore for 'System Strengthening - XX in Southern Regional Grid'. Another ` 188.75 crore would be put in for 'Transmission System for Connectivity for NCC Power Projects Ltd (1,320 MW)'. Both projects are expected to be commissioned in 30 months from the date of investment approval. (www.business-standard.com)

Policy / Performance………….

Modi may lose $3 bn Nalco plant to Iran on coal

August 12, 2014. Domestic coal shortages are prompting India’s National Aluminium Co Ltd (Nalco) to plan construction of a $3 billion smelter complex abroad, possibly in Iran, underscoring the task Prime Minister Narendra Modi faces to boost energy output. Indonesia, Vietnam, Malaysia, Oman and United Arab Emirates are other potential sites for the 500,000 metric ton smelter and a 1,000 MW captive power plant, Nalco said. Using imports to make up for a lack of sufficient local coal output is too costly, Nalco said. While Modi has pledged to fix energy woes over time, graft probes, environmental objections and slow land acquisition are holding back efforts to mine more of the fuel. India produced 565.6 million metric tons of coal in the 12 months through March 2014, compared with demand of 739.4 million tons. Supplies to captive power plants dropped 31 percent to 37.80 million tons, according to the Power Ministry. Making aluminium with imported coal isn’t viable as it costs $1,900-$1,950 a ton, about $250 more than with local coal. Electricity accounts for almost 40 percent of smelting costs. Building a plant in Iran depends in part on nuclear negotiations between it and six world powers. The talks could lead to an easing of sanctions on the central Asian nation, which the U.S. Energy Information Administration estimates holds the world’s second-largest natural gas reserves. Bhubaneswar, Odisha-based Nalco, which has been forced to idle some capacity at home because of an increase in energy costs, has tried to expand abroad for a decade to boost fuel-supply security. Obstacles in India include coal supply disruption at Nalco’s captive power plant in Odisha, Nalco said. (www.bloomberg.com)

Rajasthan nuclear plant unit 5 sets world record

August 12, 2014. Nuclear Power Corporation (NPC) run Rajasthan atomic power station (RAPS) unit 5 on set a world record for continuous operation for 740 days. The 220 MW unit has generated 4,120 million units (MUs) during the continuous operation. It has so far generated 8,525 MUs since it attained commercial operation on February 4, 2010.