-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY: Energy through the BP data lens

Ø COAL/POWER: No relief for Delhi electricity consumers: Why?

ANALYSIS/ISSUES

Ø Why Natural Gas is not Priced like Socks

DATA INSIGHT

Ø Petroleum Products Consumption in India: Controlled Vs De-controlled

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· ONGC to speed up development of Krishna Godavari gas finds

· RIL and partner BP relinquish yet another gas block

· Oil exploration resumes in Champang and Tsori in Nagaland

· Nagarjuna Oil's ` 250 bn petro refinery on stream by 2015

· Tide Water Oil Co signs equal JV with JX Nippon Oil & Energy Corp

· NEEPCO on drive to tap full electricity potential of NE region

· NTPC awaits land identification for 4 GW Telangana plant

· 'Unit 1 of KNPP to resume production in 30 to 35 days'

· AP Transco lines up ` 19 bn to improve power supply

· Alstom T&D India to upgrade Power Grid’s infrastructure in eastern India

· TPDDL says NDMC owes it ` 625 mn in electricity bills

· Tata Power Delhi seeks to exit 340 MW purchase pacts

· Sinopec first-half production increases 8 per cent on overseas output

· CNPC finds oil, gas shows in disputed waters in South China Sea

· China boosts June net diesel exports to highest in four yrs

· Hungry US power plant turns to Russia for coal shipment

POLICY & PRICE

· AP govt offers 26 per cent stake to Shell in Kakinada gas project

· Reliance pitches for linking gas prices to market rate for boosting domestic output

· RIL plans to invest ` 350 bn this year

· Fitch says no major new measures for O&G sector in Budget 2014

· UP cabinet okays 3 thermal power units totalling 1.9 GW

· Govt taking steps to overcome power shortages: Power Minister

· PFC under process to select developer for 3 coal blocks in Odisha

· UP to give free power connections to 1.72 lakh families

· Rural India to get a taste of Gujarat model of power reforms

· Delhi budget gives power subsidy

· Raising power tariffs in Delhi a regulatory decision: Power Minister

· Budget lacks 'specifics' for improvement in power sector: Fitch

· Fracking opponents renew call for South African shale-gas halt

· Colorado Governor doesn’t have support for fracking bill

· Japan rejoining nuclear club leaves fossil fuel appetite

· MNRE bats for strict renewable power obligation compliance

· India seen adding wind capacity after tax credit revived

· Suzlon plans to set up manufacturing plant in Brazil

· Power ministry, regulators contemplate ways to develop renewable energy

· Tata Power Solar partners Bajaj Finance for selling products

· India targets 35 per cent renewable energy share in installed capacity mix by 2050

· German coal power plants are Europe’s most climate-damaging

· Brazil gets $335 mn German development bank wind-power loan

· First Solar applies for 370 MW project in Chile

· China three yrs late on installing offshore wind farms

· Gamesa wins 290 MW of wind turbine orders in US, Mexico

· Shinsei plans $2 bn of loans for clean energy in Japan

WEEK IN REVIEW

ENERGY

Energy through the BP data lens

Lydia Powell, Observer Research Foundation

|

A |

s always, the presentation of the chief economist of BP Dr Christof Ruhl on the occasion of the release of BP’s annual statistical review 2014 on 1 July 2014 in New Delhi contained many insightful observations. The emergence of China as the largest consumer of energy, the acceptance of $100 per barrel of oil as normal and the unprecedented growth in hydrocarbon reserves on account of unconventional resources all of which we now take for granted were thought to be improbable ten years ago as Dr Ruhl pointed out. Dr Ruhl put these developments in the context of oil supply disruptions in 2013, to highlight how one unexpected development countered the impact of another unexpected and unconnected development in the context of oil.

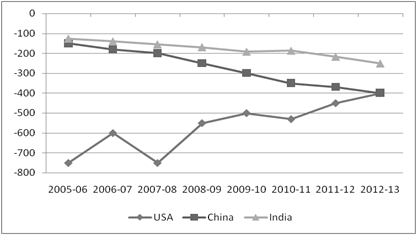

Chart 1: Change in fossil fuel imbalances India, China and the USA

Million tonnes of equivalent

Source: PNG Stats 2012-13, Import Export Bank, Department of Commerce & BP Statistics, 2014-07-03

Note: USA & China figures are approximations based on BP figures

Disruption of oil supply concentrated in North Africa and the Middle East removed an extraordinary 3 million barrels per day (mbpd) from the oil market since the dawn of the Arab Spring. In the absence of increase in US tight oil supply crude prices could have potentially reached levels not seen before. US production averted the crisis by replacing oil lost, almost barrel to barrel. A significant increase in oil prices would have been catastrophic for the world recovering from the financial crisis and devastating for India which continues to stand at the brink of a balance of payment crisis. More India specific observations made by Dr Ruhl sowed the dramatic growth in energy consumption in India with the attendant growth in imported energy. Coal consumption in India has more than doubled in the last decade, oil consumption has increased by over 50%, nuclear by over 80% and hydro by 90%, natural gas by over 70% and renewable by a factor of over 8. India’s net energy imports increased by over 10% in 2013 alone, taking the share of imports in India’s commercial energy consumption to over 40%. This is a number that we must watch closely as it will decide India’s economic and political position in the world.

A related insight from Dr Ruhl was that energy is emerging as a solution to global economic imbalances. This relates to Dr Ruhl’s opening remark that the energy-economy linkages are not appreciated to the extent that they should be. The dramatic shift in physical energy imbalances over the last decade has had an impact on global economic balances. China, the United States and Russia are the world’s top three consumers and producers of energy in that order and also the most important players in the current geo-political arena. As pointed out by Dr Ruhl, the physical energy balances of these countries have shifted dramatically in the last decade and so have their relative rankings in the geo-political hierarchy.

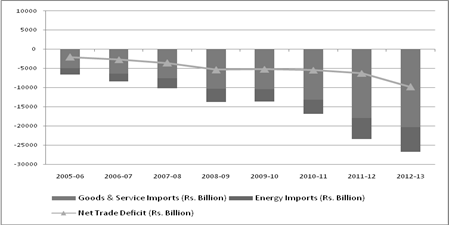

Chart 2: India’s Energy & Non-Energy Trade Deficit

Source: PNG Stats 2012-13 & Department of Commerce

The United States has demonstrated the biggest increase in oil and gas production and also the largest decline in oil and gas consumption. China has been responsible for the biggest increase in coal production and also the biggest increase in the consumption of all fossil fuels. Russia on the other hand has had the second largest increase in oil production. While China’s growth in consumption of fossil fuels has worsened its oil & gas deficit, US deficit of both has improved by almost the same extent. As a result China’s primary energy deficit has overtaken that of the United States for the first time in 2013. Russia’s surplus has improved for every fossil fuel over the last decade and this has allowed it to maintain its lead as the world’s largest holder of energy surplus. These shifts in physical energy balances have dramatically altered the balance of payment positions of these countries.

The most important of these changes is that US trade deficit is shrinking fast on account of falling oil & gas imports notwithstanding the fact that energy imports continue to make up about half of US trade deficits. China’s growing energy imports on the other hand are eating into its trade surplus. As Dr Ruhl put it, energy trade is emerging as a solution of global economic imbalances which were thought to be the most important threat to global economic stability ten years ago. No one, not even the wise populating the ‘think tanks’ around the world, anticipated this outcome. Most of their reports which came out in the last few years, just recycled the view that China is to blame for all imbalances in the world and must be punished with trade sanctions. India’s role is relatively small compared to that of China and the USA in global trade imbalances but India’s deteriorating trade deficit position poses a serious risk to India’s economic sustainability (see charts 1 & 2)

The third observation worth taking note of is the growth of renewables in power generation. Though renewables made the largest contribution to non-fossil fuel growth in 2013, the growth rate of 16.3% was the lowest growth rate since 2009 even though in volume terms renewable made a larger contribution to primary energy growth than natural gas. Even though the share of non-fossil fuels in power generation has increased substantially, global emissions of carbon dioxide have grown 55% over its 1990 level highlighting the poor return (in terms of carbon emission reduction) on investment in renewable energy.

As pointed out by Dr Ruhl, the slowdown in the growth of renewable may probably be signalling the existence of a glass ceiling on renewable energy subsidies. This is an important point that India should take note of as it embarks on ultra mega renewable (solar) projects. Ultra-mega renewable projects will require ‘ultra-mega’ subsidies as the Gujarat model of solar power development has shown. While it may be clever way of obtaining national and global green halos, it may have an ‘ultra-mega’ impact on the nation’s scare public resources.

Views are those of the author

Author can be contacted at [email protected]

COAL/POWER

No relief for Delhi electricity consumers: Why?

Ashish Gupta, Observer Research Foundation

|

T |

he Railway Budget has given rise to many analyses over its merits and de-merits. Some say that the government did not succumb to populist expectation and addressed the real needs of the sector. But some believe this was not the case. Irrespective of whether the revision of freight tariff is necessary or not it will have an impact on the power sector. If the cost is passed on it will be the power consumer who pays the price. A hypothetical example is given below to illustrate this. Delhi is taken reference and it is assumed that their coal demand is 100,000 tonnes per year. The freight distance is taken to be 800 km (assumed) as Delhi is sourcing coal from outside states in the range of 700 – 1000 km. It is also assumed that the freight rates will be fully reflected in the power tariff. Now let’s estimate the impact of the freight revision on the power sector in Delhi:

Impact of Freight Revision on Power Generation

|

2014-15 |

2013-14 |

2013-14 |

|

Demand of Delhi (assumed) = 100,000 tonne Freight rate ` 1,097 per tonne for (Distance = 800 km) approved from 25/6/14) Cost = 1097 x 100, 000 = ` 109,700,000 |

Demand of Delhi (assumed) = 100,000 tonne Freight rate ` 1,030 per tonne for (Distance = 800 km) approved from 10/10/13 – 24/6/14 Cost = 1030 x 100, 000 = ` 103,000,000 |

Demand of Delhi (assumed) = 1, 00,000 tonne Freight rate `1,013 per tonne for (Distance = 800 km) approved from 1/4/13 - 9/10/13 Cost= 1013 x 100,000 = ` 101,300,000 |

|

Increment = 6.5% |

Increment = 1.7% |

|

|

Increment (1/4/13 – 25/6/14)= 8.2% |

In a time frame of just 1 year 2 months, the fright rates are hiked by 8.2 % |

|

Needless to say, these rates hikes will certainly be passed on to the consumers as a fuel price hike. There has been news that many analysts want the government to end the practice of cross-subsidisation in railways. If that happens in the future, again the consumers will have to burn their pockets not only for passenger fares but also in the form of electricity tariff hike. The situation will be devastating for power plants in the states that are sourcing coal from distance of 1500 km or above because they have to shell out something in the range of ` 1,612/tonne to ` 3,545/tonne. Another very important point is that nothing has improved in the last 1 year 2 months as far as railways is concerned except the rates. Apart from this, cost of constructing new power plants will also go up which will also be passed on to the consumers. Therefore one has to wait and watch to see whether the revision of freight rates leads to efficiency or just passed on as an increase in tariff to the poor consumers of India?

Impact on Power Tariff

|

Calculations |

Impact on lowest slab |

|

Old tariff = `3.90/kwh (lowest slab) Assuming 80% is the fuel cost for discoms = 80/100*3.90 = ` 3.12/kwh Revised fuel cost = 3.12*106.5/ 100 (6.5 % increment in fuel cost) = ` 3.32/kwh If Y is the new tariff then 3.32 = 80/100 *Y Y = 3.32 *100/ 80 = ` 4.15/kwh *Additionally assuming that there will be some increment in the overhead cost |

Delhi Regulatory Commission has increased the lowest slab by 10 paisa = ` 3.90 + Rs. 0.10 = ` 4.00/kwh Therefore Delhi consumers be ready for another hike of ` 0.15/kwh in power tariff in the coming months (mind you this revision is prior to the completion of impending CAG audit of discoms account) |

Will the notion of transparency be introduced in determining power tariff? It is highly doubtful! This is the fourth revision in tariffs. Unfortunately the story does not end here and so Delhi consumers need to be ready for another hike in the coming years. The idea is not to simply criticise the government but to put forward an important question: Can good economics be clubbed with good governance? Views are those of the author

Author can be contacted at [email protected]

ANALYSIS/ISSUES

Why Natural Gas is not Priced like Socks

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

|

T |

he Indian natural gas market currently faces a number of unresolved issues. In a bid to shed light on some of the most precarious and intensively discussed topics in the Indian energy scene the ORF Weekly Energy News Monitor intends to discuss in the upcoming weeks some more general aspects of gas markets and pricing, respectively. These shall focus on the more general aspects of gas pricing (like theoretical and empirical evidence) like

· an overview of different pricing approaches,

· how gas is priced around the globe,

· examples of the most prominent and widespread gas pricing paradigms as well as their evolution.

In this issue we focus on the theoretical economic foundations of energy commodities.

Energy in general and natural gas in particular faces sophisticated pricing challenges almost throughout the whole supply chain, for instance, characterized by huge long-term upfront investments at the upstream exploration and production level as well as midstream grid-bound transportation, storage and supply level or via the capital-intensive LNG chain, not to mention the construction of a functioning and comprehensive distribution network downstream to finally submit the gas molecules to the customers, which can happen more on the wholesale level (power stations, industrial sites, CNG) or highly branched in retailing (City Gas Distribution (CGD)). Having said this, it is already quite obvious that a grid-bound commodity like natural gas in any case will have to be treated quite differently from ordinary bulk commodities. Let’s take for instance - bananas, socks or bicycles - that can be traded on local, regional or global markets more or less in an efficient and transparent way following the corresponding supply and demand triggered pricing process. The price functions as an indication for the scarcity of the commodity on the one hand and as a signal for efficient capital allocation on the other hand. Nonetheless, especially energy markets are facing various market distortions like demand inelasticity, market concentration, long ranging investment cycles, regulatory or technical bottlenecks and subsidies, which lead to suboptimal functioning of markets and price incentives.

The Energy Charter Secretariat[1] has pointed out the fact that putting a price on energy necessarily comprises to distinguish (1) how prices are determined (i.e. pricing mechanism) and (2) what determines prices (i.e. the underlying forces): “The first is about the organisation of trade, exchange and market places, including access, and the ways prices are negotiated, communicated and made public. This does not necessarily give an insight into what influences decision-making by buyers and sellers, nor about the resulting market balance and price level.” As such, a liquid market might provide transparency about price formation (being an important precondition for competition), however, it does not by itself create competitive forces that can influence the prices.

Since energy commodities mostly cannot be regarded as typical commodities due to some of its already mentioned special characteristics, some restrictions have to be taken into account in comparison with a genuine competitive market approach dealing with easily market matching merchantable commodities. The Energy Charter Secretariat highlights some theoretical approaches addressing specific characteristics that make up the distinction between energy commodities and other goods:

· The high risk of E&P activities linked to resource development and the high specificity of oil and gas investments all down the whole energy chain might require risk reduction strategies like long-term contracts between the counterparts on production and marketing side. As a typical example oil-linked take-or-pay contracts, that are widely used in the European gas industry or in Asian LNG import contracts, can be seen as a means of risk-sharing mechanism between producers/sellers and buyers due to long lead times in investment planning and capital intensive operations: such contracts intends, that the buyer takes the volume risk (take or pay) whereas the seller takes the price risk (netback).

· The quality (geology and location) of natural resources might disclose pretty different outcomes from various production sites and/or wells with considerable site-specific production costs and marketing/transportation costs (these divergent surpluses are usually referred to quality or Ricardian Rent). Such as natural gas can be either a conventional resource produced at relative low costs from large basins or in shale gas basins associated with high costs of identifying the valuable reservoir sweet spots. Production costs can be differentiated moreover according to onshore or offshore ((ultra-) deepwater) production, for instance. In contrast, manufactured products like socks or televisions can be regarded as quite homogenous worldwide, at least superficially speaking.

· Since natural gas is a finite natural resource which cannot be replenished or reproduced endlessly, its economics are subject to the Hotelling’s Theorem based on replacement value. “Hotelling's rule states that the most socially and economically profitable extraction path of a non-renewable resource is one along which the price of the resource, determined by the marginal net revenue from the sale of the resource, increases at the rate of interest. It describes the time path of natural resource extraction which maximizes the value of the resource stock.”[2] However, in view of the fact that there is still an ongoing debate with respect to Hubbert’s curve peak (oil) production and against the backdrop of recent global development in unconventional shale gas and tight oil resource reassessments, it is quite ambiguous to determine to which extent the theorem has found its way into empirical findings of Hotelling’s rule-based resource pricing.

· The involvement of two decision makers on the production side, the producing company and resource owner (principally the state), often leads to different interests and to divergent developments of interests during the project’s lifetime. In economics these issues are addressed by the so-called principal-agent theory, dwelling upon the dilemma that the agent might be incentivised by other interests and time preference rates than those of the principal (usually preferring longer term rent maximisation). For instance, rent-sharing in production sharing agreements is a typical and rather present case of application for that kind of dilemma in economic relationships.

· The often highly inelastic demand for oil and natural gas (i.e. demand doesn’t react properly to price movements) and its interaction with high concentration and capacity restrictions on the supply side tends to result in considerable premiums of prices above such referring to the marginal cost of production. “A particularly important question is whether the resource rent should be monetised by governments of resource-owning states, or whether this rent should be passed on to the benefit of consumers (whether domestic or foreign) by providing resources at a cost-plus price.”I

· Market imperfections such as the ubiquitous externalities due to environmental impacts of energy use leads to severe distortions in market outcomes. Energy market imperfections typically comprise imperfect competition (monopolies), the existence of externalities (pollution and climate change due to emissions from fossil fuel combustion) and the problematic of public goods.

Nevertheless and (while) acknowledging the above stated issues, it is quite undisputed in economic theory, that the most efficient way to allocate and price energy resources is based on functioning markets. This explains why electricity and natural gas market liberalisation made its way forward to become the dominant regime in the United States and the European Union over the course of the last decades. In India, despite the adoption of liberal economic policies in the early 1990s, massive energy poverty and the consequent need for redistributive policies (subsidies) have largely limited the role of markets in the natural gas sector so far. Multiple and often competing policy objectives involving various political institutions at various federal and regional level with overlapping responsibilities and powers have constrained market dynamics. In addition, the painfully obvious lack of a comprehensive pipeline system is a structural drawback for developing an efficiently functioning gas market in India. However, to get the ball rolling, the government has recently announced in the context of its budget publications, that an additional 15,000 km of gas transport infrastructure is planned to set up under the public-private-partnership mode to further promote the usage of gas.

Views are those of the author

Author can be contacted at [email protected]

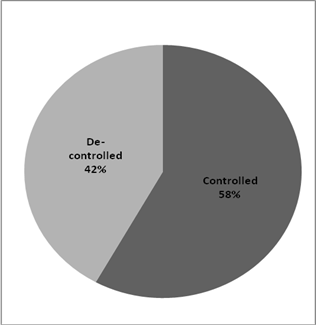

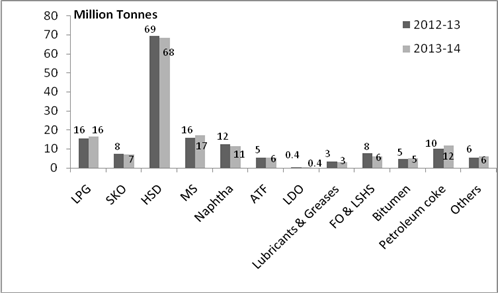

DATA INSIGHT

Petroleum Products Consumption in India: Controlled Vs De-controlled

Akhilesh Sati, Observer Research Foundation

|

Petroleum Product Consumption |

2013-14 (Thousand Tonnes) |

% |

|

Controlled Products |

||

|

LPG |

16336 |

10.3 |

|

SKO |

7165 |

4.5 |

|

HSD |

68369 |

43.2 |

|

De-controlled Products |

|

|

|

MS |

17128 |

10.8 |

|

Naphtha |

11454 |

7.2 |

|

ATF |

5505 |

3.5 |

|

LDO |

386 |

0.2 |

|

Lubricants & Greases |

2891 |

1.8 |

|

FO & LSHS |

6193 |

3.9 |

|

Bitumen |

4938 |

3.1 |

|

Petroleum Coke |

11651 |

7.4 |

|

Others |

6182 |

3.9 |

|

TOTAL |

158197 |

100.0 |

Total Consumption- 158 Million Tonnes

For 2013-14

Pet. Product Consumption: FY12 Vs FY13

Source: Petroleum Planning & Analysis Cell

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

ONGC to speed up development of Krishna Godavari gas finds

July 22, 2014. Oil and Natural Gas Corp (ONGC) will fast-track development of natural gas discoveries in its Krishna Godavari basin block with first gas planned no later than April 1, 2018. ONGC has made 11 oil and gas discoveries in the Block KG-DWN-98/2, which sits next to Reliance Industries' KG-D6 Block and Gujarat State Petroleum Corp's Deendayal gas field. The block is divided into a Northern Discovery Area (NDA) and Southern Discovery Area (SDA). It plans to invest $9 billion in producing from discoveries in NDA. ONGC recently held an on-site review meeting of Block KG-DWN-98/2 or KG-D5 and fixed April 1, 2018 as date for start of production. ONGC is looking at producing 2.5-3 million tonnes of oil per annum and 9-10 million standard cubic metres per day of gas from the Northern Development Area of KG-D5 block. NDA holds an estimated 92.30 million tonnes of oil reserves and 97.568 billion cubic metres of inplace gas reserves spread over seven fields. ONGC has submitted to the Directorate General of Hydrocarbons (DGH) a Declaration of Commerciality (DoC) for the oil find in the NDA and a detailed field development plan will be submitted by year end. (economictimes.indiatimes.com)

RIL and partner BP relinquish yet another gas block

July 21, 2014. Reliance Industries Ltd (RIL) and its partner British Petroleum (BP) have surrendered one more oil and gas block, reducing their tally to 5 from 21 exploration acreage they held three years back. RIL had in February 2011 announced a "transformational" deal when UK's BP picked up 30 per cent stake in its 23 oil and gas blocks. However in August that year, the government allowed them to form a partnership in only 21 blocks. Since 2012, RIL and BP have been pruning their portfolio, shedding not so viable acreage. This year, they shed CY-D6 block. RIL had in February 2012 announced a discovery in well SA1 in the block. This discovery was named D-53. RIL said its current portfolio includes producing KG-D6 block in Bay of Bengal and Panna/Mukta and Tapti oil and gas fields in the western offshore. With BP, it is left with 5 blocks including KG-D6 and gas discovery areas of NEC-25 and CY-D5. Besides, RIL also hold two coal-bed methane (CBM) blocks in Madhya Pradesh. (economictimes.indiatimes.com)

Oil exploration resumes in Champang and Tsori in Nagaland

July 21, 2014. After a gap of almost 20 years, Nagaland Chief Minister T R Zeliang officially launched the resumption of oil exploration in Champang and Tsori areas under the Wokha district of Nagaland. The exploration would be carried out by Metropolitan Oil and Gas Private Limited (MO&GPL), New Delhi. The Chief Minister said resumption of oil exploration in Champang and Tsori areas will usher in a new era of economic prosperity and development of the people of the two villages as well as the state. Zeliang said earlier the people of the area did not benefit from oil exploration though huge quantity of oil was extracted by the ONGC as there was no proper rule to regulate oil exploration activity in the state. ONGC had extracted 1.5 million tonnes of oil during its trial production, but only ` 33 crore was paid to the Nagaland government and ` 63 crore was paid to landowners as royalty, he said adding if calculated, as per the new Nagaland Petroleum and Natural Gas (NP&NG) Rules, the actual revenue would have been ` 329 crore. (economictimes.indiatimes.com)

ONGC restores 'near normalcy' at Mumbai High O&G fields

July 20, 2014. ONGC has restored "near normalcy" at its prime Mumbai High oil and gas fields after a minor gas leak from a well being drilled. The western offshore fields of ONGC are producing at near normal rate of 310,000 barrels per day and all personnel and facilities are unharmed. Drilling rig Sagar Uday, was operating at NS platform in Mumbai High North oil and gas field on well number NSBX for side-tracking. The depth reached is around 1,183 metres. Gas flow was observed from the outermost casing annulus. The Operation has been stopped for safety reasons. Forty eight persons have been evacuated to nearby installations. As a precaution, ONGC had shut gas injection into some of the nearby wells in the Mumbai High North fields. The wells will be put to production after the leak is plugged. (economictimes.indiatimes.com)

Oil Ministry to move Cabinet to allow RIL to retain gas finds

July 16, 2014. The Oil Ministry is seeking Cabinet nod to allow Reliance Industries Ltd (RIL) to retain three gas discoveries worth US $1.45 billion in the eastern offshore KG-D6 block even after expiry of timelines. RIL has not been able to submit a development plan for D-29, 30 and 31 gas discoveries, which hold an estimated 345 billion cubic feet of reserves, with the prescribed timelines due to dispute with the upstream regulator DGH over tests required to confirm them. (economictimes.indiatimes.com)

IOC, BPCL, HPCL to raise refining capacity to 185.3 mt by FY17

July 21, 2014. Public sector oil refiners Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) will jack up their refining capacity by 37 per cent to 185.3 million tonnes (mt) by 2016-17 by expanding existing units and commissioning a new plant at Paradip in Odisha. State refiners currently own 19 refineries with a total capacity of 135.066 million tonnes. IOC is the market leader with 54.2 million tonnes capacity at its seven refineries. It also controls Chennai Petroleum Corp Ltd (CPCL) that operates 11.5 million tonnes of capacity. IOC will this year commission its 15 million tonnes refinery at Paradip, Oil Minister Dharmendra Pradhan said. (economictimes.indiatimes.com)

Nagarjuna Oil's ` 250 bn petro refinery on stream by 2015

July 21, 2014. A ` 25,000-crore petroleum refinery project being set up at Thiruchopuram in Cuddalore district of this state by Nagarjuna Oil Corporation Ltd (NOCL), a joint venture of Nagarjuna Fertilizers and the government's Tamil Nadu Industrial Development Corporation, is expected to go on stream by 2015. This will be the first phase. The project was delayed due to damages caused by a cyclone about two years earlier. The proposed capacity is 12 million tonnes (mt) a year. The total investment is estimated to be ` 25,000 crore; till end-March this year, ` 7,400 crore had been spent. In the first phase, implementation of six mt yearly capacity will be completed. The refinery includes a captive port and power plant. (www.business-standard.com)

Transportation / Trade

India cuts down dependence on Iran oil to less than 6 per cent

July 22, 2014. India has cut its reliance on Iran for meeting its oil needs to less than 6 per cent as it raised imports from countries like Columbia and Mexico. India imported 11 million tonnes of crude oil from Iran in the fiscal year ending March 31, 2014, down from 13.14 million tonnes in the previous fiscal. The imports from Iran made up for 5.81 per cent of the nation's oil import needs in 2013-14 fiscal, down from 7.11 per cent in the previous year. India has steadily cut imports from Iran as US and western sanctions blocked payment channels and crippled shipping routes. It imported 21.20 million tonnes of crude oil from Iran in 2009-10, which got reduced to 18.50 million tonnes in 2010-11 and 18.11 million tonnes in 2011-12. (economictimes.indiatimes.com)

Tide Water Oil Co signs equal JV with JX Nippon Oil & Energy Corp

July 21, 2014. Tide Water Oil Co (India), a lubricant manufacturer and a member of the Andrew Yule Group, has signed an agreement with Japan's JX Nippon Oil & Energy Corp to form a joint venture (JV) company in India - JX Nippon TWO Lubricants India. Both companies will have equal stake in the new entity, Tide Water Oil said. The 50-50 joint venture will sell, market, distribute and manufacture the 'Eneos' brand of lubricants in India, Nepal, Bangladesh and Bhutan, apart from taking care of the Genuine Oil requirements of, mainly, the Japanese and Korean original equipment manufacturers in the automotive and industrial segments. (economictimes.indiatimes.com)

Finance Minister's Budget 2014 promise of 15,000 km gas pipeline sees GAIL India resistance

July 17, 2014. Finance Minister Arun Jaitley's Budget promise of building 15,000 kilometres (km) of new gas pipelines is facing resistance from the main state-run firm in the business. GAIL India is dithering on building a 2,050-km pipeline from Haldia to Jagdishpur, saying there are no customers or gas available to justify the ` 8,000-crore project. The pipeline would have carried 32 million standard cubic meters of gas per day to fuel fertiliser, power, steel, petrochemicals and several small industrial units in Uttar Pradesh, Bihar, Jharkhand and West Bengal. It was hoping sick fertiliser plants along the way would be revived by the time it starts ferrying gas. But now, GAIL has informed the government it has only spent ` 13.5 crore on the pipeline so far and is unlikely to pursue it further. To get the pipeline going, GAIL had even approached the Cabinet Committee on Investments under the UPA government for some clearances. It signed a gas cooperation pact with the Bihar government and has long-term gas sourcing agreements with Gazprom and Cheniere. Major consumers along the proposed pipeline route include Fertilizer Corporation of India's Sindri and Gorakhpur units as well as Hindustan Fertilizer's units in Barauni, Durgapur and Haldia which the government is trying to revive. Relogistics Infrastructure Ltd, a subsidiary of Reliance Gas Transportation Infrastructure Ltd, was authorised to lay the 928-km pipeline to carry gas from Andhra Pradesh gas fields to Haldia. But, the authorisation was cancelled in 2012 due to non-compliance of terms and conditions contained in the authorisation letter, the oil ministry said. (economictimes.indiatimes.com)

DoD to appoint merchant bankers for ONGC stake sale

July 16, 2014. The Department of Disinvestment (DoD) has kickstarted the process of 5 per cent stake sale in ONGC and invited bids for appointing merchant bankers to manage the share sale, which could fetch over ` 17,700 crore to the exchequer. The merchant bankers would advise the government on the timing and the modalities of the offer for sale (OFS) and ensure best return to the Government, the DoD said while inviting bids. The DoD will appoint up to five merchant bankers to manage the OFS and the bidders will have to submit bids by August 6. (economictimes.indiatimes.com)

Policy / Performance

Former Australian judge Michael Hudson McHugh withdraws from arbitration of RIL gas dispute

July 22, 2014. Michael Hudson McHugh, the presiding arbitrator in Reliance Industries' dispute with the petroleum ministry over cost recovery, has decided to withdraw from the case. In April, the Supreme Court had appointed the retired Australian judge as the presiding arbitrator in a dispute in which Reliance Industries challenged the petroleum ministry's 2011 decision to stop the company from recovering $1 billion of its investment in the KG-D6 block because the output had declined sharply. The company said this violated its production sharing contract with the government, and that production dropped because of geological reasons. McHugh had initially declined to preside over the arbitration but later accepted the position. The petroleum ministry then sought the law ministry's views about this and had separately written to McHugh, asking him not to take any action until he hears from the government. The petroleum ministry has also sought the law ministry's advice on payment to judges involved in the upcoming arbitration between the government and RIL over the KG-D6 block. The foreign arbitrator has proposed that each member of the tribunal would be paid $13,500 or ` 8.1 lakh each per hearing and another $1,350 per hour for "interlocutory matters" apart from administrative expenses. The petroleum ministry has stuck to the stand it had taken on disallowing costs and has increased the amount disallowed to $2.376 billion. (economictimes.indiatimes.com)

Govt studying CAG observations on oil cos: Oil Minister

July 21, 2014. The government said it is studying CAG's observation that state-owned oil firms overcharged customers by ` 26,626 crore in five years. In its audit report, the Comptroller and Auditor General (CAG) observed that state-owned oil firms overcharged customers by ` 26,626 crore in five years by charging notional levies like customs duty on fuel they sold. The top auditor has said price of petrol, diesel, domestic LPG and kerosene is calculated by adding customs duty, freight, insurance, ocean loss and wharfage charge to prevailing international price of these products. Oil Minister Dharmendra Pradhan said the country's total demand for petroleum products is estimated to be nearly 160 million metric tonnes in the current fiscal. (economictimes.indiatimes.com)

AP govt offers 26 per cent stake to Shell in Kakinada gas project

July 21, 2014. Andhra Pradesh (AP) government has approved a proposal for offering 26 per cent stake to Europe's largest oil company Royal Dutch Shell in a gas project at Kakinada. The AP government-owned AP Gas Infrastructure Corporation and GAIL floated AP Gas Distribution Company have set up a 3.5 million tonnes capacity (expandable up to 10 million tonnes) Floating LNG Storage Regasification Unit in the East Coast at Kakinada Deepwater Port. (economictimes.indiatimes.com)

Oil regulator to complete study on gas market margin by Dec: Govt

July 21, 2014. Oil regulator PNGRB will decide on the margin that natural gas sellers like GAIL and Reliance Industries Ltd (RIL) can charge from urea manufacturers and LPG plants by year end, Oil Minister Dharmendra Pradhan said. After grappling with the issue for two years, the Oil Ministry had on November 21, 2013, ordered that the margin to be charged, over and above the gas sale price, should be fixed between the seller and buyers in all sectors other than urea and LPG. The Ministry had on November 21, 2013 asked the Petroleum and Natural Gas Regulatory Board (PNGRB) to determine the margin for supply of domestic gas to urea and LPG producers through its independent process. The rates determined by the PNGRB would thereafter be notified by the government. (economictimes.indiatimes.com)

Reliance pitches for linking gas prices to market rate for boosting domestic output

July 21, 2014. Reliance Industries Ltd believes that linking gas prices to market rate would be key to boosting domestic production. The company, along with partners BP of UK and Niko Resources of Canada, has initiated two separate arbitration cases against the government. In the first of these the company has challenged the government's decision to impose penalties for not meeting production targets from the KG-D6 block. The company says the production sharing contract has no provision for such penalties. The second arbitration case seeks implementation of market-based pricing of gas. The government's stand is that pricing is a sovereign function. The company said that India's LNG imports would rise by over 50% to 79 mmscmd by 2019 from 47 mmscmd in 2013, leading to huge forex outflow. The company stated that the price of LNG, which is being imported to make up for the shortfall in domestic gas production, is likely to remain high due to several macro-economic factors, making for a strong case to scale up domestic gas production. (economictimes.indiatimes.com)

Govt to hold directors of oil cos answerable for accidents

July 21, 2014. The government will hold directors of state firms accountable for accidents like the recent blast in a pipeline of GAIL India that killed 19 people at Tatipaka in Andhra Pradesh. ONGC evacuated 48 people from the offshore Mumbai High region after gas leakage, which is being plugged with the help of international experts. ONGC stopped operations for safety reasons so that there is no casualty. After the blast in GAIL's pipeline, the oil ministry announced a high-level inquiry committee to probe the incident and said action will be taken to adopt best international practices regarding safety and security of all pipelines in the country. Oil ministry said the order is meant to keep top management of oil companies on their toes as far as safety of installations and inhabitants living near such projects. (economictimes.indiatimes.com)

No hike in LPG, kerosene prices: Oil Minister

July 20, 2014. Cooking gas and kerosene prices will not be hiked keeping in view the impact of such a step on the people, Oil Minister Dharmendra Pradhan said. Pradhan, who was in Patna to attend the final day of the two-day BJP state executive meeting, however, said the petrol prices would move according to the prevalent market price mechanism. The minister expressed the hope that there would be no "oil shock" in the future as the "rupee was appreciating under the leadership of Prime Minister Narendra Modi and it was a good indication". He said bulk diesel prices for railways, defence, industries and other big consumers were decreased by around a rupee after duties were reduced on it. (economictimes.indiatimes.com)

RIL plans to invest ` 350 bn this year

July 19, 2014. Reliance Industries Ltd (RIL), which became the first private company to post close to USD 1 billion net profit in a quarter, plans to invest ` 35,000 crore this fiscal. RIL said Q1 profit jumped by 13.7 per cent to ` 5,957 crore on account of strong performance of the refining segment and significant contribution from shale and retail segments, which have now become a part of consolidated balance sheet. Domestic oil and gas production, he said, was a tad lower than previous quarter. On retail business, RIL had growth in revenue and margins are improving every quarter. (economictimes.indiatimes.com)

Fitch says no major new measures for O&G sector in Budget 2014

July 18, 2014. Fitch Ratings said the Budget did not introduce any major new measures for the oil and gas sector and would be neutral for its rated oil and gas entities. The budget, however, included some measures to encourage production from unconventional hydrocarbon resources. An allocation of ` 63,400 crore has been made for oil subsidies to cover under-recoveries, the difference between the market price and government regulated price. The ` 33,500 crore subsidy allocation for FY15 and the direct subsidies from upstream companies like ONGC of $ 56 per barrel to the refining companies are broadly adequate to cover the estimated total under recoveries. (economictimes.indiatimes.com)

Govt exploring possibilities for new petrochemical hubs: Fertiliser Minister

July 17, 2014. Fertiliser Minister Ananth Kumar said government is exploring the possibilities of setting-up more petrochemical hubs in the country. Kumar said that petrochemicals sector can play a decisive role in employment generation. Under the Petroleum, Chemicals and Petrochemical Investment Regions (PCPIR) policy, government had approved the setting up of four PCPIRs viz, Vishakhapatnam in Andhra Pradesh, Dahej in Gujarat, Paradeep in Orissa and Cuddalore in Tamil Nadu. Kumar assured that all the projects will be cleared on time. (economictimes.indiatimes.com)

Oil ministry plans to reduce energy imports from Gulf countries, turns to Russia for fuel

July 16, 2014. The oil ministry has chalked out a strategy to gradually reduce energy sourcing from politically volatile countries in the Gulf region and explore importing natural gas from Russia, Iran and CIS countries, the government said. The oil ministry also proposed a new regime to manage oil-field contracts. In the current system the contractor recovers costs before sharing profit with the government. In the proposed system, the two sides share revenues from the day production starts. The simpler new regime should minimize state interference in oil-field affairs and boost private investment, leading to higher output and better energy security. To improve energy security, oil ministry say the country should avoid heavy dependence on oil and look at opportunities to import natural gas from all possible sources. India has warm relations with Russia, which is the world's second-biggest producer of gas and third-largest producer of crude oil. According to US Energy Information administration, oil and gas revenues account for over 50 per cent of Russia's budget revenues. The government said the ambitious Iran-Pakistan-India (IPI) pipeline could be revived after Western sanctions against the country is eased. The project was put on backburner in 2008 by the UPA government citing reasons such as project structure, delivery period of gas, pricing and pipeline security. (economictimes.indiatimes.com)

POWER

Generation

NEEPCO on drive to tap full electricity potential of NE region

July 22, 2014. North East Power Corporation (NEEPCO), a public sector undertaking, is on a drive to tap the region's full potential for power generation and hopes to raise output from 1130 MW of power per day to 2000 MW by next two years. NEEPCO is currently contributing 1,130 MW power including thermal and hydroelectric power across all states of the NE region. A total of 927 MW installed capacity is currently under construction including 60 MW project in Mizoram, 5 MW solar power plant at Manarchak in Sipahijala district of Tripura, 600 MW plant at Kameing in Arunachal Pradesh and 52 MW extension project of the Agartala Gas Turbine Project (AGTP). The NEEPCO signed an MoU with the Tripura State Electricity Corporation Limited (TSECL) to set up a joint venture company for upgradation of three power projects of the state. (economictimes.indiatimes.com)

Indo-Bhutan JV power project worth ` 40 bn coming to life

July 22, 2014. ` 4,000 crore worth Kholongchu hydroelectric project in Bhutan will start coming into reality next month with the beginning of its construction work. The 600 MW project is coming into existence under Bhutan's commitment to provide 10k MW additional power to India by 2020. The beginning is through preparation of access road to the construction site suitable for heavy vehicles to carry equipments for the project. In April, 2014, India and Bhutan signed an agreement on four joint venture model Hydropower project with total capacity of 2120 MW. Out of these joint venture projects of Druk Green Power Corporation (DGPC), Kholongchu project is the first with a public sector undertaking of India. (economictimes.indiatimes.com)

NTPC awaits land identification for 4 GW Telangana plant

July 21, 2014. NTPC is awaiting identification of land by the Telangana government and establishment of coal linkage by the Coal Ministry for setting up a 4,000 MW power plant in the new state. NTPC is to establish a 4,000 MW power plant in Telangana as per the 13th Schedule of the Andhra Pradesh Re-organisation Act.

Telangana Chief Minister K Chandrasekhar Rao has also requested the Prime Minister for additional 500 MW power from NTPC for at least three years out of the central pool. (economictimes.indiatimes.com)

25 of 100 power plants have less than 4 days coal stock: Power Minister

July 21, 2014. One fourth of the 100 coal-based power plants monitored by Central Electricity Authority (CEA) are reeling under acute coal shortage with stocks to last less than four days, Coal and Power Minister Piyush Goyal said. Out of the 25 thermal power plants having super critical stock, four each are in states like Chhattisgarh, Madhya Pradesh, Maharashtra and Andhra Pradesh, three in Uttar Pradesh among others. (economictimes.indiatimes.com)

Power shortage in TN drops below 1 per cent in 2012-13

July 21, 2014. Peak power shortage in Tamil Nadu (TN) has dropped to 0.9 per cent in Apr-Jun 2014, down from 13.2 per cent in 2012-13. Electricity, prohibition and excise Minister Natham R Viswanathan said the installed production capacity is around 12,484 MW plus additional (8,219-MW of renewable energy). The peak power demand rose to 13,775-MW at 293.97 million units in June 2014, up from 10,702-MW at 233.59 million units in March 2011. The state added 2,500-MW between 2011 and 2014, including Mettur (600-MW), north Chennai (1200-MW) and NTPC (700-MW). The minister said the future demand for electricity is expected to touch 14,500-MW in 2014-15, from the current around 13,500-MW. (www.business-standard.com)

'Unit 1 of KNPP to resume production in 30 to 35 days'

July 17, 2014. Unit 1 of Kundankulam Nuclear Power Plant (KNPP), which has been shut down for maintenance, would commence production after 30 or 35 days, KNPP said. The Unit, which was shut down for maintenance, would commercially generate 1000 MW when it resumes production and power would be sent to the Central grid for distribution. KNPP had attained its full generation capacity, becoming the first nuclear plant in the country to generate 1,000 MWe. (economictimes.indiatimes.com)

Dabhol power project on brink of turning into bad debt

July 16, 2014. The Dabhol power project, once an iconic foreign venture, is on the brink of turning into a non-performing asset - or a bad loan for bankers - after it defaulted in clearing its dues to lenders, who have refused to either lend more or accept a government proposal to convert their debt into equity. The project has been lying idle since December as gas supply has come to a halt, resulting in no revenues to pay monthly installments on bank loans, estimated at close to ` 8,500 crore. (economictimes.indiatimes.com)

Rise in power generation narrows peak deficit to 3.7 per cent: CEA

July 16, 2014. An increase of nearly 20,000 MW of generation capacity narrowed the country's peak power deficit to 3.7% last month from 6.3% in June 2013, according to the Central Electricity Authority (CEA) data. Peak power deficit or shortfall in electricity supply when the demand is at its peak, last month, was 5,295 MW or 3.7%, the CEA data showed. The total power requirement during the month stood at 1,42,647 MW of which 1,37,352 MW was met. (www.business-standard.com)

Transmission / Distribution / Trade

AP Transco lines up ` 19 bn to improve power supply

July 22, 2014. AP Transco is spending ` 1,900 crore to set up new and high capacity substations in the jurisdiction of Andhra Pradesh Eastern Power Distribution Company Limited (EPDCL). The move is aimed at transferring bulk power for long distance to cut down losses. It would also improve power supply and to meet the future demand. Two sub-stations of 400 KV, six new sub-stations of 220 KV, 30 sub-stations of 132 KV and enhancement of power transformer capacities at 32 sub-stations have been proposed in the five districts of Srikakulam, Vizianagaram, Visakhapatnam, East Godavari and West Godavari. The work on these projects is expected to be completed in 12-18 months. (www.business-standard.com)

Alstom T&D India to upgrade Power Grid’s infrastructure in eastern India

July 21, 2014. Alstom T&D India has secured a ` 200 crore order from Power Grid Corp to supply transformers to upgrade and expand the transmission network operator's 400/220 kV grid substations across eastern India. The project is part of the Eastern Region Strengthening Scheme of Power Grid, which aims to improve the transmission infrastructure in West Bengal, Odisha and Bihar. The new equipment will strengthen power handling capacity of substations across these states, stabilising the network. Under this contract, Alstom will upgrade existing 400/220 kV substations by installing new equipment such as circuit breakers, instrument transformers, protection and control panels. (economictimes.indiatimes.com)

Power producers advised to import 54 mt of coal in FY'15: Power Minister

July 21, 2014. Amid fuel shortages, power producers have been advised to import 54 million tonnes (mt) of coal in the current fiscal, the government said. Stating that the power utilities, including NTPC, are importing coal to bridge the shortfall in availability of domestic coal, Coal and Power Minister Piyush Goyal said that during the April-June period of 2014 as against annual target of 16.6 mt, the country's largest power producer has so far imported 3.6 mt of dry fuel. Goyal said that import of coal in the last fiscal was 168.44 mt, while in 2012-13 the country imported 145.785 mt of dry fuel. (economictimes.indiatimes.com)

Delhi, NCR face power outages for at least twice a day: Survey

July 20, 2014. With the national capital region reeling under long spells of outages, a survey has found that power cuts occurred at least twice a day and up to four hours sometimes with worst hit being Gurgaon, Ghaziabad and Noida. As per the survey, more than 80% of its 12,000 respondents said that on an average power outages across Delhi and NCR took place at least twice a day. The survey by Market Xcel Data Matrix Pvt Ltd was conducted with sample size of 3,000 respondents each from Delhi, Gurgaon, Noida and Ghaziabad. 40% of the respondents, most of them from Ghaziabad, followed by Delhi and Gurgaon, complained of one to two hours of power outages on an average, while those from Noida said the power cut exceeded four hours in a day. There was no particular pattern of outages determined as to whether it was more on weekdays or weekend, however, 36% respondents in Noida said the power cuts were mostly on weekends. At least 15% claimed that power cuts occurred mostly during afternoons while 10% said outages took place in the evenings, especially in Gurgaon, Noida followed by Delhi. (www.business-standard.com)

TPDDL says NDMC owes it ` 625 mn in electricity bills

July 19, 2014. Tata Power DDL (TPDDL) said it has not fully paid electricity tax dues to North Delhi Municipal Corporation (NDMC) for two months as the latter has not paid electricity bills totalling over ` 62 crore. Claiming that the Corporation owes ` 62.53 crore in electricity consumption bills, the power distribution company said any further delay in payment of dues may result in blackout of streetlights in North and Northwest Delhi. The Corporation has not been paying the relevant tariff on electricity consumption as per the notified rates declared by the Delhi Electricity Regulatory Commission (DERC), it claimed. TPDDL is a joint venture between Tata Power and Delhi government with the majority stake being held by Tata Power (51 per cent). It distributes electricity in North and North-West parts of Delhi and serves a populace of 6 million. (economictimes.indiatimes.com)

Indo-Chinese consortium takes Tangedco to court

July 19, 2014. The bidding war between an Indo-Chinese consortium and an Indian PSU for a major power plant in Tamil Nadu has reached the courts, threatening to delay the project in an already power-starved state. The Consortium of India's Trishe Energy Infrastructure Services and Central Southern China Electric Power Design Institute (CSEPDI) accused the Tamil Nadu Generation and Distribution Corporation (Tangedco) of acting in an "arbitrary, discriminatory and unfair manner". CSEPDI-Trishe said Tangedco is compelling the consortium to compete with Bharat Heavy Electricals (BHEL) for the power project, though the PSU is not qualified to bid for the 2 x 660 MW supercritical thermal power project at Ennore Special Economic Zone. The Madras HC has asked Tangedco to file its counter by July 22. CSEPDI said it has executed projects in India across states such as Orissa, Jharkhand and Chattisgarh for private players such as Essar, Reliance and Jindals without any delays and well within the scheduled time. Unlike regular tenders, Tangedco floated tenders for this project on debt-cum-EPC model as a package. In this, the bidder has to arrange debt (financial assistance) for the procuring entity, factoring in the interest costs during construction to execute the project. (economictimes.indiatimes.com)

Delhi budget: More sub-stations but gas crisis to stay

July 19, 2014. Barring the subsidy announced for low-end and lower middle class consumers, the Delhi budget has nothing new to offer for the capital's power sector. The budget focuses on improvement in the city's distribution and transmission network for which a ` 200-crore allocation had already been announced in the Union budget. It also talks about augmenting Delhi's power supply but has no solution to the gas crisis plaguing the city's power plants. New sub-stations are routinely announced to augment Delhi's power demand. The new projects, however, are insufficient to deal with the quantum of power flowing through transmission lines, especially during peak demand in summers. (economictimes.indiatimes.com)

Bengal to end some power purchase pacts

July 18, 2014. With West Bengal turning a power surplus state, partly due to a lack of industrial activity, the state government has started the process to cancel some power purchase agreements (PPAs) totalling 1,000 MW. According to the state power department, PPAs with JSW Steel, Adhunik Group, Lanco Infratech and Ind-Barath Power Infra are being cancelled. (www.business-standard.com)

Coal India union says to oppose any stake sale

July 18, 2014. Unions representing workers at Coal India Ltd, the world's largest coal miner, will oppose any move to sell a stake in the state-owned company as part of the new government's plan to shore up its finances. The government, which has a 90 percent stake in the company whose total value is about $40 billion, is considering the sale of a 10 percent stake. Prime Minister Narendra Modi's administration is looking to raise a record $10.5 billion from asset sales this fiscal year ending March 31 to keep the deficit under control. Union leaders representing more than 350,000 Coal India workers will meet on Aug. 31 in Pune to discuss their strategy. (in.reuters.com)

Tata Power Delhi seeks to exit 340 MW purchase pacts

July 17, 2014. Tata Power Delhi Distribution (TPWR), which lights up every third home in the country's capital, wants to surrender purchase contracts for 340 MW of electricity because of higher fuel costs passed on by producers. The company is seeking the regulator's approval to end about 20 per cent of its long-term agreements with coal and natural gas-fired plants. Suppliers include NTPC, the nation's biggest power producer. The surrendered power will need to be allocated to other buyers. (www.business-standard.com)

BSES subsidiaries in Delhi clear electricity dues following court order

July 16, 2014. The spectre of blackouts in Delhi has receded as BSES subsidiaries that distribute electricity in the city are paying up their dues to suppliers, who had threatened cuts because of pending bills. BSES firms had borrowed ` 1,000 crore to settle the dues. BSES Rajdhani has already cleared its dues as on June 30. Meanwhile, BSES Yamuna is paying ` 161 crore to Indraprastha Power Generation, Delhi Transco, Pragati Power and the Bawana Power Plant. The distribution companies were unable to pay for the power purchased, leading to a tussle with generation firms. (economictimes.indiatimes.com)

TANGEDCO plans to add over 5.7 GW before 2020

July 22, 2014. Tamil Nadu Generation and Distribution Corporation Limited (TANGEDCO), power utility arm of the Tamil Nadu Government, is expected to add over 5700 MW before 2020. Projects which are in the pipeline, according to Energy Department's Policy note 2014-15, includes Ennore Thermal Power Station Expansion (1x660 MW) The project cost is ` 5,000 crore. The EPC contractor is Lanco Infratech Ltd and the project is expected to be commissioned in 2017. (www.business-standard.com)

UP cabinet okays 3 thermal power units totalling 1.9 GW

July 22, 2014. Uttar Pradesh (UP) cabinet approved plans to set up three thermal power units totalling 1,980 MW in the public sector. As per plans, state utility UP Rajya Vidyut Utpadan Nigam would set up a 660 MW unit in Panki Thermal Extention Project, Kanpur. It would cost over ` 4,712 crore, of which 80% would be met through institutional credit, while 20% would come through equity. Besides, the cabinet approval the proposal to set up 2X660 MW (1,320 MW) units in Meja thermal power project, Allahabad. The project is a joint venture between the Nigam and National Thermal Power Corporation (NTPC) for 2X660 MW (phase I) and the work is already underway. (www.business-standard.com)

'AAP govt violated laws to conduct CAG audit of discoms'

July 22, 2014. Aam Aadmi Party (AAP) had pre-decided to have CAG audit of private discoms and its government later violated statutory and constitutional provisions to fulfill the poll promise, Tata Power Delhi Distribution Ltd (TPDDL) told the Delhi High Court. The court is hearing a batch of petitions, including appeals filed by three private discoms, against the order of a single judge refusing to stay Delhi government's decision to have CAG audit of their accounts. Besides the plea of TPDDL and Reliance Anil Dhirubhai Ambani Group firms, BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd, the bench is also hearing a PIL filed by NGO United RWAs Joint Action, seeking CAG audit of the discoms' accounts. (economictimes.indiatimes.com)

Adani, Tata get APTEL nod for ` 435 bn boost

July 22, 2014. The Appellate Tribunal for Electricity (APTEL) has allowed Tata Power and Adani Power to charge higher rates from state utilities since March this year, on account of a rise in the cost of imported fuel. Upholding a landmark order of the Central Electricity Regulatory Commission (CERC), APTEL, however, disallowed the companies' plea to collect arrears before March this year. According to an estimate, dues for Tata Power's 4,000 MW Mundra plant in Gujarat before last March are ` 330 crore, and Adani's 1,980 MW Mundra plant has arrears of ` 830 crore. After March 2013, Tata's Mundra ultra-mega power project will be awarded a compensatory rate at 52 paise per unit, which will fetch the company ` 25,000 crore over the life of the plant. Adani's project will get compensatory tariff at 41 paise per unit, or ` 18,500 crore over its remaining life. (www.business-standard.com)

Govt taking steps to overcome power shortages: Power Minister

July 21, 2014. Power Minister Piyush Goyal said steps like strengthening inter-state and inter-regional transmission capacity was being undertaken to overcome the shortages. He also said that High Aggregate Technical and Commercial (AT&C) losses of state discoms and poor financial health of state utilities was responsible for shortfall in power. The steps being taken to overcome the power shortages are acceleration in generation capacity addition during 12th Plan with a proposed target of 88,537 MW from conventional sources and 30,000 MW from renewable energy sources. (economictimes.indiatimes.com)

Safety plan is in place to avert grid collapses: Power Minister

July 21, 2014. A safety plan is in place to monitor efficient functioning of power grids and avert their collapses, Power Minister Piyush Goyal said. It may be noted that northern electricity grid suffered a load loss of 8,000 MW, including 3,500 MW in the national capital, during a storm in the region in May. The overall operation of the inter-regional grids is supervised by the National Load Despatch Centre (NLDC)and the operation of the regional grids is supervised by the Regional Load Despatch Centres (RLDCs), the minister said. Further, the power system development fund (PSDF) which has recently been operationalised would also be used to implement various protection schemes for grid security, he said. (economictimes.indiatimes.com)

Chinese power equipment imports on rise: Power Minister

July 21, 2014. Imports of Chinese power generation equipment have increased in the last few years, the government said. The imports of power generation equipment (main plant equipment) from China have increased during the last few years. Out of thermal generation capacity of 48,540 MW commissioned in the 11th Plan, main plant equipment for 18,187 MW was imported from Chinese manufacturers. The trend has continued so far in the 12th Plan also, Minister of State for Power Piyush Goyal said. (economictimes.indiatimes.com)

MP would be power surplus in next four yrs: MP CM

July 21, 2014. Enthused by swift green clearance to a "number of projects" in Madhya Pradesh (MP), Chief Minister (CM) Shivraj Singh Chouhan asserted that the state would be power surplus in next four years and supply electricity to others. Outlining future development plans of MP which was once among the least developed BIMARU states, Chouhan said a number of its projects, which were neglected during the UPA rule at the Centre, were back on track under the NDA government. (www.business-standard.com)

PFC under process to select developer for 3 coal blocks in Odisha

July 20, 2014. Power Finance Corporation (PFC) is under the process of selecting a developer through international bids for three coal blocks that have been alloted to it for 4,000 MW Ultra Mega Power Project (UMPP) in Odisha. The Normative date of production from these coal blocks -- Meenakshi, Meenakshi-B and Dipside of Meenakshi -- was March 13, 2010 but production has not started so far. The Coal Ministry had alloted three mines in favour of Orissa Integrated Power Ltd (OIPL) which is a wholly-owned subsidiary of the Power Finance Corporation (PFC) and also a special purpose vehicle created for development of Ultra Mega Power Project in Odisha. (economictimes.indiatimes.com)

Karnataka CM's tips to improve power scene

July 20, 2014. Karnataka Chief Minister (CM) Siddaramaiah offered to energy minister D K Shiva Kumar to improve Karnataka's "dark" power scene. The occasion was the 45th foundation day of Karnataka Power Corporation Ltd in Bangalore. He said KPCL has been generating 6509 MW of hydel, thermal and wind energy. (timesofindia.indiatimes.com)

UP to give free power connections to 1.72 lakh families

July 19, 2014. The Uttar Pradesh (UP) government will provide free electricity connections to 1.72 lakh below poverty line (BPL) families in the state. Chief Secretary Alok Ranjan has issued an order for getting the desired logistics. He said the construction of 33/11 substations in 166 out of out of 201 tehsils will be completed by October later this year. The rest may be completed by March 2015. Ranjan said under the plan to provide 24-hour power supply, 122 transmission substations would be built. He has already ordered capacity building of 103 transmission substations on priority basis. (www.business-standard.com)

PSPCL withdraws power cuts after drop in demand

July 19, 2014. Punjab power utility Punjab State Power Corporation Limited (PSPCL) has stopped electricity cuts, bringing relief to all consumer categories. PSPCL is currently meeting 8500 MW of power demand from available resources. Earlier, the demand for power in Punjab had crossed 2,350 lakh units per day during paddy season as against 2,000 lakh units in the last season because of "unprecedented" high temperature and weak monsoon, PSPCL had said. (economictimes.indiatimes.com)

Delhi budget gives power subsidy

July 19, 2014. A day after the power regulator announced a rise in rates for Delhi customers, the government’s budget for 2014-15 announced a subsidy of ` 260 crore, for low-end consumers. This will cut the rates for those consuming up to 400 units a month. Even then, the government will have a fiscal surplus of ` 2,000 crore for the current financial year, compared to a deficit of ` 2,900 crore in 2012-13. DERC had announced an increase of power rates by 8.3 per cent for the distribution companies. While the new rates announced by DERC would have made every one cough up more, the subsidies announced in the budget would make those consuming up to 200 units a month shell out ` 2.8 a unit against ` 3.9 at present. Those using 201-400 units will pay ` 5.15 against ` 5.8 currently. Those consuming 401-800 units will pay ` 7.3 a unit against ` 6.8 at present. There was no provision of subsidy given to this class as well as those consuming more in the budget. The Budget estimated a fiscal surplus of ` 2,015 crore in 2014-15, against a deficit at ` 2,924 crore in the revised estimate (RE) of the previous year. (www.business-standard.com)

Rural India to get a taste of Gujarat model of power reforms

July 19, 2014. The Centre’s mega plan for the power transmission sector could start from Rajasthan and Andhra Pradesh, with public sector Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) incubating the programme. The Union government’s Deendayal Upadhyaya Gramjyoti Yojana, the first and largest replica of Gujarat's model of power reforms, will be executed through a special purpose vehicle with equity participation from PFC, REC and state governments. Along with the separation of transmission feeder lines, there will also be an emphasis on distribution reforms. Taking a cue out of Gujarat’s Jyotigram Yojana for rural electrification, finance minister Arun Jaitley announced a similar scheme for the nation, to augment the supply of power to rural areas and allocated ` 500 crore for it in the Union Budget.

POWER PLAN

• Deendayal Upadhyaya Gramjyoti Yojana to be a replica of Jyotigram Yojana of Gujarat

• Feeder separation for rural areas, wherein domestic and agricultural load is segregated

• Fixed duration power for agriculture use, and continuous supply for domestic users

• To be rolled out in Rajasthan and Andhra Pradesh

• REC & PFC to form a special purpose vehicle with state electricity boards

• Budget outlay of ` 2,500 crore

• Budget allocation of ` 500 crore

• Integrated Power Development Scheme: Sub-transmission and distribution reforms along with 100% metering across the country

With a Budget outlay of ` 2,500 crore, the scheme would be merged with ‘Integrated Power Development Scheme’, which aims at improving India’s sub-transmission and distribution network. He said that the central government would infuse initial equity; the rest would come from the states, which would come on board to restructure their transmission infrastructure. (www.business-standard.com)

Separate ministers needed for Coal and power ministries: Jaiswal

July 18, 2014. Former Coal Minister Sriprakash Jaiswal accused the BJP government of improper management of coal reserves in the country and said the party has committed a 'mistake' by appointing one minister for both power and coal ministries. The former MP from Kanpur said there are enough coal reserves in the country but no proper management to look after them. Presently, Piyush Goyal is handling both the coal and power ministries under the BJP government. Jaiswal said when he was the Coal minister there were abundant coal reserves but it was not just supplied to power plants but efforts were also made to increase its production. He said the only solution to the problem is to allot coal and power ministries to two separate ministers so that one can focus on coal production while the other can look after power issues. (www.business-standard.com)

Subsidy for small power consumers in Delhi: Finance Minister

July 18, 2014. Union Finance Minister Arun Jaitley announced subsidy of ` 0.80 to ` 1.20 per unit for small consumers earmarking ` 260 crore for power subsidy. He had already proposed ` 200 crore for power reforms in the national capital in the Union Budget 2014-15. Jaitley proposed to develop the New Delhi Municipal Council (NDMC) area as a solar city under the scheme of Development of Solar Cities of Ministry of New and Renewable Energy (MNRE). (economictimes.indiatimes.com)

IMTF created to review rationalisation of coal linkages

July 17, 2014. A new Inter-Ministerial Task Force (IMTF) has been constituted to undertake a comprehensive review of existing coal sources and consider feasibility for rationalisation of linkages, the government said. The major recommendations of the Task Force include acceptance of the recommendations of the functional directors of Coal India Ltd (CIL) in respect of rationalisation of existing sources for which it received applications from captive power plants. Coal India has received a total of 31 applications for rationalisation including eight from captive power plants, out of which it recommended rationalisation in seven cases. (economictimes.indiatimes.com)

Raising power tariffs in Delhi a regulatory decision: Power Minister

July 17, 2014. Power Minister Piyush Goyal said the move to hike electricity tariff in Delhi is a decision taken by the Delhi Electricity Regulatory Commission (DERC) on the basis of costing. The State Electricity Regulatory Commissions (SERCs) and Central Regulatory Commission (CERC) are fully independent and autonomous bodies, Goyal said. (economictimes.indiatimes.com)

Budget lacks 'specifics' for improvement in power sector: Fitch

July 16, 2014. The measures unveiled in the Union Budget for the power sector are "directionally correct" but lack specifics to support a meaningful improvement in the short term, Fitch Ratings said. The rating agency said inadequate domestic production and infrastructure bottlenecks continue to act as constraints for ensuring adequate supplies to power plants. In the Union Budget, the government announced various measures for the power sector including an extension of the tax holiday for power projects till March 2017. As per Fitch, this step would be "positive for investment activity". Besides, there is no immediate rating impact on any of the power companies - NTPC, NHPC and Power Grid Corp - rated by it. These entities have 'BBB-/Stable' rating. (www.business-standard.com)

Modi invites Putin to visit Kudankulam power plant

July 16, 2014. Prime Minister Narendra Modi has favoured broadening of strategic partnership with Russia in nuclear, defence and energy sectors and invited President Vladimir Putin to visit Kudankulam atomic power project during his trip in December for his annual summit. Mr. Putin said Russia places its relations with India high enough in the strategic framework. Nuclear power project has been a symbol of India-Russia relations. (www.thehindu.com)

INTERNATIONAL

OIL & GAS

Upstream

Sinopec first-half production increases 8 per cent on overseas output

July 22, 2014. China Petroleum & Chemical Corp, Asia’s biggest refiner, reported an 8 percent gain in first-half oil and gas production as overseas output doubled. Output rose to 237 million barrels in the six months ended June 30, the Beijing-based company known as Sinopec said. Production rose faster than the 3.8 percent increase a year earlier. Overseas crude oil production increased to 23.7 million barrels in the first-half, Sinopec said. Sinopec’s domestic crude output was little changed at 154.2 million barrels, while natural gas output rose 9.5 percent to 354.8 billion cubic feet during the period. (www.bloomberg.com)

Halliburton says demand for North American fracking turn

July 22, 2014. Halliburton Co., the world’s largest provider of hydraulic fracturing services, said demand for fracking in North America has turned a corner and it’s adding crews this year as the industry burns through excess capacity that has kept prices low. Services companies like Halliburton in past years flooded the market in response to a surge in demand for fracking, a process in which water, sand and chemicals are shot underground to free oil and natural gas in shale and other hard-rock formations. That flood may now be coming closer to equilibrium - - after two years of a falling prices, they are expected to increase 2 percent this year in the U.S. and another 4 percent in 2015, according to the report by PacWest Consulting Partners LLC. (www.bloomberg.com)

Asian, western firms bid for UAE oilfields

July 21, 2014. Asian and western firms have bid to help operate the UAE's biggest oilfields after a deal with oil majors expired this year but the Gulf Arab state is yet to decide whether to let Asian oil buyers in for the long haul. A final decision on the winning firms is unlikely before early 2015 as political leaders in Abu Dhabi, the capital of the United Arab Emirates, weigh whether to bring in Asian firms or stick with old partners. At least one oil major, ExxonMobil, appears to have decided against bidding. (www.rigzone.com)

CNPC finds oil, gas shows in disputed waters in South China Sea

July 16, 2014. China National Petroleum Corporation (CNPC) announced that the petroleum drilling and exploration operation of Zhongjiannan Project in the South China Sea was smoothly completed on schedule July 15 with oil and gas shows found. In accordance with the work procedures of deepsea petroleum exploration and development, a comprehensive assessment of hydrocarbon horizons is to be implemented based on the geological and analytical data collected through the drilling and exploration operation. Next phase arrangements are subject to the aforesaid comprehensive assessment. (www.rigzone.com)

OMV finds new Black Sea oil off Romania

July 16, 2014. Austrian energy group OMV said it had found a new oil reservoir in the Black Sea off Romania with production potential of 1,500 to 2,000 barrels of oil equivalent per day (boe/d). The reservoir in the shallow-water Istria XVIII offshore perimeter was identified by OMV's Marina 1 exploration well at a cost of around 19 million euros ($26 million), OMV said. (www.rigzone.com)

Downstream

Delta deal to bring US crude to Pennsylvania refinery

July 21, 2014. Delta Air Lines Inc., the largest U.S. carrier by market value, is trying to cash in on the biggest oil boom in the nation’s history by bringing more domestic crude to its refinery near Philadelphia. The Atlanta-based airline signed a five-year agreement with Addison, Texas-based midstream company Bridger LLC to supply the Trainer, Pennsylvania, refinery with 65,000 barrels of crude a day, more than a third of the plant’s capacity. (www.bloomberg.com)

Pertamina hopes to cut Indonesia's gas imports with Refinery expansion

July 17, 2014. Pertamina, Indonesia's state-owned energy company, plans to expand the liquid petroleum gas processing capacity at its Mundu refinery in Indramayu, West Java, in an effort to support growing gas demand and cut costly imports. PT Pertamina Gas (Pertagas), a subsidiary of Pertamina, will revitalise the Mundu refinery and develop its gas infrastructure, Pertagas said. The project includes the development of a 20.8-kilometer gas pipeline connecting Pertamina's Balongan onshore processing facility to the Mundu refinery as well as other modifications. Pertagas hopes the project will reduce LPG import volumes by 27,000 tonnes a year. This year Indonesia's LPG imports are expected to reach 4.9 million tonnes, supplying about 60 percent of domestic demand. (www.downstreamtoday.com)

Transportation / Trade

TAPI has potential to transform the future of entire region: US