-

CENTRES

Progammes & Centres

Location

[May 2015: Who Killed Power Demand?]

“In theory the huge unmet demand for energy in India can absorb primary energy from any source – be it gas from Iran and Turkmenistan, uranium from Kazakhstan, coal from anywhere and solar energy from everywhere that call all be turned into electricity. Apart from millions of un-electrified households that are longing for electricity, there are also urban household and business consumers that are eager to do away with expensive power back up systems. If there is surplus supply at one end and huge unmet demand at the other and we still have a problem then it must be the system in-between that is killing demand…”

Energy News

[GOOD]

India did the right thing by defending coal use in UN forum!

India overtaking China in coal imports is not a matter for celebration!

[UGLY]

Government ‘doing’ and courts ‘undoing’ coal auction outcomes is a coal scam in disguise!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Energy Reforms: An Uneven Road

· May 2015: Who Killed Power Demand?

DATA INSIGHT………………

· All India Electricity Scenario and Solar Power

[NATIONAL: OIL & GAS]

Upstream…………………………

· RIL-BP give up two more O&G blocks

· Indian firms ready to invest in Mexico oil, gas: Oil Minister

Downstream……………………………

· Total in talks with MRPL for fuel retailing joint venture in India

· RIL to restart petrol pump network by March next year

· IOC to raise stake in CPCL

Transportation / Trade………………

· IOC to sell about 50k tonnes of naptha to Unipec loading from Chennai and Haldia

· HPCL buys Iraq Basra Light at multi-year high premium

· WBPDA calls indefinite strike

· GAIL in talks with Shell to sell US LNG supply

Policy / Performance…………………

· PNGRB extends bidding to issue licenses for CNG retailing

· India eyeing expanding crude imports from Colombia

· India plans new oil subsidy rules to push ONGC stake sale

· Oil ministry seeks details of foreign lenders in KG-D6 consortium

[NATIONAL: POWER]

Generation………………

· BHEL adds 736 MW hydroelectric capacity in 2014-15

· NTPC assures entire power from proposed plant to Telangana

· Jaitapur gram sabhas pass resolution against nuclear project

· NTPC takes over DVC's Raghunathpur coal-fired power project

· Two more power units with capacity of 1 GW to be added to Tarapur Atomic Plant

· Tata Power reports 2014-15 standalone generation capacity at 11,974 mn units

Transmission / Distribution / Trade……

· Delhi govt asks discoms to maintain adequate power supply

· Indo-Bangla power venture ready to invite bids for construction

· CESC to pump in ` 20 bn to strengthen distribution

· Adani signs deals to sell two-thirds of production from Australia Mine

· India to overtake China as top coal importer in 2015

· Transmission schemes worth ` 339 bn notified

Policy / Performance…………………

· Electricity bills may shoot up by 5-20 percent this June

· ‘Centre to move carefully on nuclear projects’

· Delhi HC postpones hearing on power plant cost capping case

· CIL decision to cancel coal won by JPL comes under HC lens

· Chhattisgarh hikes power tariff by 14 percent

· India to seek CERN membership

· India seeks investments from US companies in power, coal sectors

· CIL allowed to expand underground mining at Jhanjra

· World Bank likely to fund for AP energy efficiency moves

· NTPC yet to get promised land from West Bengal govt

· Govt transfers forest clearance from earlier allotee to Essar

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· US shale oil producers to ramp up drilling at current price: Goldman Sachs

· Eni finds gas offshore Libya

· Russia's Rosneft says likely to quit gas project in UAE

· China's CNPC makes first tight oil find over 100 mn tonnes

· Iran to raise oil output by 170k bpd from new fields

· Oil platform in Gulf of Mexico shuts in production after fire

· Novatek starts production on Termokarstovoye gas field

· Brazilian gas producer PGN plans $500 mn output expansion

Downstream……………………

· Russia's refinery runs down 1.2 percent in April month-on-month

Transportation / Trade…………

· Oando Nigeria plans to truck compressed gas to industrial users

· Mexican crude oil exports drop nearly 16 percent in April

· Chinese independents get foothold in LNG trade as restrictions lifted

· US gas imports fell to their lowest since 1987 in 2014

· South Jersey Gas reapplies to build Pinelands pipeline

· Italy gives final go ahead for TAP gas pipeline construction

Policy / Performance………………

· Romania to send O&G royalty tax law to parliament in September

· Indonesia plans to offer more oil, gas blocks for bidding this year

· Israel Antitrust Commissioner resigns on natural gas policy

· Iran increases its fuel prices by 40 percent in a bid to boost revenue

· Italy grants construction permit to TAP

· Egypt allows private sector to import gas and LNG

· Vietnam cuts oil import taxes but raises retail fuel prices

· Dutch court to review gas output in part of Groningen field

[INTERNATIONAL: POWER]

Generation…………………

· New 950 MW CCGT power project planned in Pyeongtaek

· Iran to build 48 power plants in Indonesia

· Bhutan to continue hydropower capacity augmentation despite high power debt

· Japan's NRA approves third nuclear power plant for restart

· South Africa will start 9.6 GW nuclear procurement process by year-end

Transmission / Distribution / Trade……

· Consumers Energy upgrades 500k meters to enhance electric service in Michigan

· Brazil and Uruguay consider integrating their power distribution grids

· EU lends €112 mn to 3rd Estonian-Latvian electricity interconnection

· Germany must bury more power transmission lines

Policy / Performance………………

· Colombia cuts by 10 percent its 2015 coal output forecast

· Nigeria adds 1.5 GW of gas-fired power capacity to reduce power shortage

· Botswana to end Chinese power plant contract

· Japan Inc not as keen as Abe govt on nuclear power

· Uganda to borrow $95 mn to fund power plant

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Rays Power commissions 31.5 MW solar PV project in Punjab

· Australian solar company lights up India's slums

· JA Solar to set up 500 MW solar power unit in India with Essel Infraprojects

· Adani plans 1 GW solar park in Tamil Nadu

· DSM to step up focus on solar in India

· Vikram Solar to more than treble capacity in West Bengal

· India defends using coal for electricity at UN forum

GLOBAL………………

· Solar Power agrees to develop 500 MW of projects in Japan

· Angola will draft energy security strategic plan

· Goldman Sachs sets $1 bn goal for Japan clean-power bonds

· Carbon market value expands to $34 bn as Korea joins

· US, Canada and Mexico create new climate change partnership

· Australia caps Large-scale RET at 33 TWh by 2020

· UAE succeeds in generating solar power at the cost of thermal power

· United Utilities to invest $156 mn in renewables by 2020

· EIB approves €8 bn loan for renewables and infrastructure projects

· Indonesia raises investments in renewables and geothermal

· Greenhouse gas emissions under the EU ETS dipped by 4.5 percent in 2014

[WEEK IN REVIEW]

COMMENTS………………

Energy Reforms: An Uneven Road

Sunjoy Joshi, Director, Observer Research Foundation

|

T |

umbling oil prices have proved to be a boon for Prime Minister Narendra Modi’s administration. The government, given new space to reform pricing, moved immediately to rationalize subsidies, pragmatically continuing with the Aadhaar card–based biometric ID scheme for the direct transfer of cooking-gas subsidies, which will eliminate ghost beneficiaries and curtail leakage. Similarly, it adeptly used falling prices to deregulate petrol and diesel, allowing oil-marketing companies to fix prices for the first time in twelve years and, therefore, reverse the systemic under recovery of costs.

However, private actors, singed by the policy fluctuations of 2003–2004, have remained wary of entering the market, unsure of the government’s future policies should crude prices rise again.

Simultaneously, a half-hearted move on gas pricing did little to comfort investors. The government continued with restrictions on the sale of domestic gas. It then tied a sizeable chunk of the pricing formula to Russian-ruble-denominated local prices at a time when the ruble was in free fall and investors’ faith in the sanctity of Russian markets was at an all-time low.

Even though the pronouncements of the Supreme Court could have forced a rethink and provided the impetus for market-based liberalization, the government continued with end-use reservations for coal blocks, even as it made the process of auctions more open and transparent.

By not opening the coal sector to merchant mining, the government may have missed an opportunity. There is still no coal market in India, and major mining enterprises have little interest in acting as subcontractors and service providers, saddling the sector with poor technology and inefficiency. Meanwhile, even as the government goes about maximizing auction revenues, tariffs remain nonnegotiable. Should the projects turn unviable, the government as well as lending institutions may find themselves in a cleft stick again.

The Modi government’s biggest challenge is battling a legacy of distrust. The dominant political discourse in India remains deeply suspicious of market liberalization. Indeed, it was this throwback to the old patronage system that flourished during the “License Raj” era that led to arbitrary systems for allocation of coal blocks and the telecommunications spectrum. In terms of energy policy, there had been a hope that the new government’s focus on economic growth would shift the political discourse to an acknowledgment of the strength of market-based reforms. However, if the government continues to pursue a reform path of least resistance, the process may yet again be mixed, uneven, and viewed with deep skepticism.

Views are those of the author

Author can be contacted at [email protected]

Courtesy: carnegieendowment.org

COMMENTS………………

India monthly energy briefing

May 2015: Who Killed Power Demand?

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

O |

ne of the perverse energy messages coming out in May 2015 is that there are no takers for electricity in what is generally believed to be an electricity starved country. The trend has been in the making for some time now but when the Minister for Power and Renewable Energy Shri Piyush Goyal remarked in the lower house of the Parliament that there was surplus power at the national grid monitoring station indicating that power was available at ‘zero rupee per unit’ (` 0 a KWh) it must have shocked even the uninitiated. This meant that there are no takers for power even when it is free. The Minister urged utilities to buy power from exchanges and then went on to advise states to invest in more power supply through solar and gas based power plants. He probably did not realise that he was actually contradicting himself. If utilities which are the largest buyers of power do not want to buy power then who will want to invest in what is seen as expensive power?

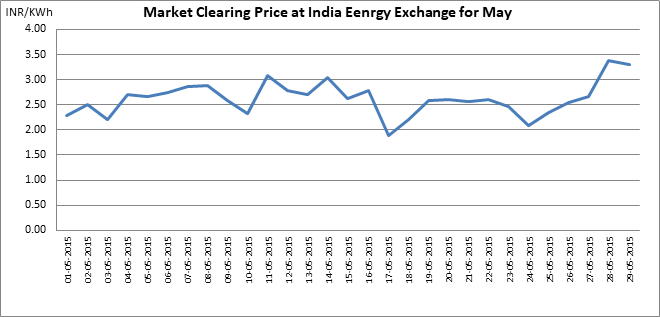

Data from the Indian Energy Exchange which is the largest among many power traders shows that the sell bids outnumbered buy bids by a significant margin on most days. In April there were buy bids for 2.9 billion units against sell bids for 4.9 billion units. The average market clearing price was ` 2.68/KWh which is low compared to average price of electricity available through long term contracts. The most puzzling story came out during the last week of May which said that 57 base-load thermal power plants with total capacity of over 8000 MW in the northern and western regions were facing ‘reserve shut-down’. In other words these plants were being asked to back off capacity on account of lack of demand. We also saw stories on key investors are walking away from thermal power projects and many observers attributed it to lack of demand growth. What is happening? Who killed demand for power in a power starved country?

Source: India Energy Exchange

The short answer can be given in two parts: the first part is the short term effects (1) Industrial slump partly explains lack of demand growth for power (2) The fact that cash strapped utilities are trapped in long term contracts that require at least the capacity charge to be paid even if power is not lifted is another reason why utilities cannot take advantage of lower prices in the spot market (3) The fact that there is no universal service obligation pushes utilities to opt for outages rather than supply. This is something any rational economic actor would do. The longer term questions for which there are no answers are more troubling. Who killed electricity demand in a country with one of the lowest per person electricity consumption in the developing world as well as the largest number of people without access to electricity?

In theory the huge unmet demand for energy in India can absorb primary energy from any source – be it gas from Iran and Turkmenistan, uranium from Kazakhstan, coal from anywhere and solar energy from everywhere that call all be turned into electricity. Apart from millions of un-electrified households that are longing for electricity, there are also urban household and business consumers that are eager to do away with expensive power back up systems. If there is surplus supply at one end and huge unmet demand at the other and we still have a problem then it must be the system in-between that is killing demand.

Both government failure and market failure can be blamed for this demand destruction. The market is not designed to provide electricity to poor un-electrified households with latent demand (which means that demand is not backed by purchasing power) but governments have an obligation to step in to this segment which the market has failed. But the government (and the utilities owned by the government) have failed to convert this huge latent demand for energy and electricity into a source of productive power and eventually market demand. In the urban and industrialised segment where demand is backed by purchasing power, the market has responded but perversely through diesel based generators (and countless number of small generators of less than 100 KvA along with millions of invertors) which is a perverse outcome in a country that can ill afford expensive power. Once again the market has failed to lead to the efficient fuel choice because the government has failed to provide an efficient market for fuels. Demand destruction in a country that is energy poor is a tragedy and it cannot be addressed if we limit our solutions to the unforgiving and predatory economic environment that we are forced to operate in. The situation in the electricity segment is not very different from that of the food grain segment which has grain surplus at one end and widespread malnutrition and starvation at the other. It is also not very different from the housing segment where large areas of unused land (and buildings) exist at one end and crowded and tiny homes in wretched slums at the other end. Simplistic answers to this complex problem must be resisted at all costs. We are all to blame – not just the utilities!

On the coal front the news coming out in May has been distressing as many outcomes of the supposedly successful coal auctions are moving into the courts. Guide posts are being changed mid course and auction participants are left with no choice but to seek judicial intervention. The bench hearing the case on Gare Palma coal mines has rightly remarked that ‘this is not the way a government should function’.

On the gas front the most important news in May was the revival of stranded gas based power projects through reverse bidding (bidder of lowest subsidy gets the gas) but this was accompanied by the news that there were few takers for gas based power even after the subsidy. This month the government also declared that it may allow market price for gas from complex fields but we don’t know yet which market the government is talking about. There is no market for gas or for that matter any fuel in India. We also saw news on GAIL’s talks with Shell to sell US LNG which once again raises questions over the prospects for LNG as a source for power generation. On LNG there was also news on preliminary agreements with France and South Korea on manufacturing LNG carriers in India. One cannot blame the government for its optimism over the demand for LNG carriers and LNG at a time when demand for everything is falling. The government has to be optimistic if it wants to stay in business.

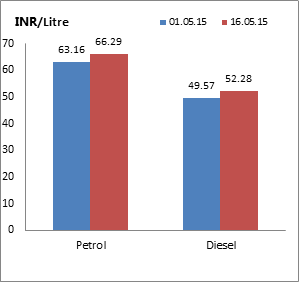

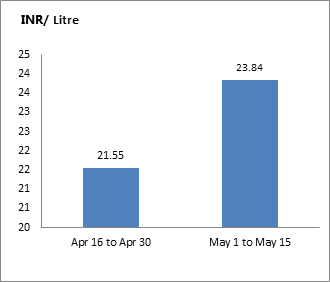

On the oil front we saw an increase in the price of Indian crude basket (by ` 2.29/Litre) which resulted in increase in prices of both petrol (by ` 3.13/Litre) and diesel (` 2.71/Litre). The fall in the value of the rupee is one reason why there was a somewhat disproportionate increase in the case of petrol.

Petrol & Diesel Prices at Delhi

Crude Price- Indian Basket

Source: PPAC & IOC

There was some conflicting news on the Jaitapur nuclear plant with gram sabha of Jaitapur passing a resolution against the nuclear power plant and a member of the Maharashtra ministry declaring that the Jaitapur plant will be completed. If we go by the precedent set in Kudankulam, we can be assured that protests against Jaitapur will be crushed using disproportionate force (physical and judicial) and the project will progress, provided the government wants it to succeed.

On the solar front many projects were announced by private players. Even coal companies such as Adani are throwing their hat in. This could indicate a gravy train on the move. Though it is too early to judge the success of these projects, concerned ministers were enthusiastically making announcements on cumulative solar GWs that have been committed. Government push will probably stop only after the count touches 100 GW.

May also had some interesting sound bites on climate negotiations. As negotiations on carbon mitigation in Paris draw near, concerned ministers were once again saying that India will have the cake and eat it too. The cake is a seat on the rich country table. The ticket for this table has already been purchased with stratospheric targets for renewable energy. The eating is in the joy of blaming rich countries for global warming. All concerned ministers are doing this with a committed sense of duty.

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

DATA INSIGHT……………

All India Electricity Scenario and Solar Power

Akhilesh Sati, Observer Research Foundation

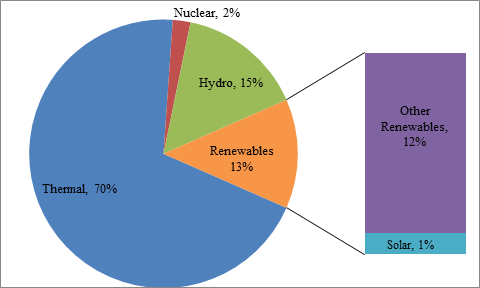

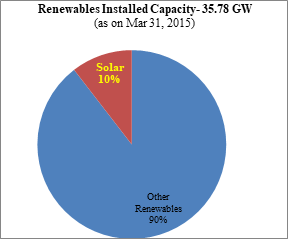

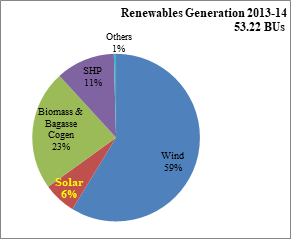

Share of Solar Power in All India Installed Capacity (271.72 GW) - as on Mar 31, 2015

Share of Solar Power in All India Renewables

Indian Imports of Solar Panels- Country-wise Share

|

Country |

Numbers 2014-15 (April – Feb) |

% Share of Total |

|

China PRP |

101,501,069 |

70 |

|

Malaysia |

10,532,965 |

7 |

|

Taiwan |

17,964,799 |

12 |

|

Others |

14,000,069 |

10 |

|

Total |

143,998,902 |

|

Source: Central Electricity Authority and Lok Sabha Unstarred Question No.6769.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

RIL-BP give up two more O&G blocks

May 21, 2015. Reliance Industries Ltd (RIL) and its partner BP Plc have surrendered two more oil and gas (O&G) blocks, reducing their tally to four exploration acreages from 21 they held four years back. During the year, RIL opted to relinquish two blocks KG-DWN-2003/1 and CY-PR-DWN-2001/3 as part of the ongoing effort to high grade its upstream asset portfolio, the company said. RIL had in February 2011 announced a transformational deal when UK's BP picked up 30 percent stake in its 23 oil and gas blocks. However, in August that year the government allowed them to form a partnership in only 21 blocks. In KG-DWN-2003/1 further progress in petroleum operations was impeded by defence restrictions imposed in October 2012. Since then the JV had continued to seek unrestricted access to the block without success. RIL and its JV partners finally decided to relinquish the block in line with government's policy. RIL had in February 2012 announced a discovery in well SA1 in CY-PR-DWN-2001/3 or CY-D6 block. This discovery was named D-53. RIL had 60 percent in KG-DWN-2003/1 while BP had 30 percent and Hardy Oil, 10 percent. In CY-PR-DWN-2001/3, RIL had 70 percent interest and BP 30 percent. In the annual report, RIL said its current portfolio includes producing KG-DWN-98/3 or KG-D6 block in Bay of Bengal and Panna/Mukta and Tapti oil and gas fields in the western offshore. With BP, it is left with four blocks including KG-D6 and gas discovery areas of NEC-OSN-97/2 (NEC-25) and CY-DWN-2001/2 (CY-D5). (businesstoday.intoday.in)

Indian firms ready to invest in Mexico oil, gas: Oil Minister

May 20, 2015. Indian companies are willing to participate in the exploration of even deep water and unconventional hydrocarbon resources in Mexico, Oil Minister Dharmendra Pradhan said. Pradhan offered to help Mexico upgrade its refining sector, saying India has emerged as a modern refining hub with expertise to develop complex refineries in a most cost-effective manner. Mexico's Energy Minister Pedro Joaquin Caldwell, and state-run PEMEX chief executive Emilio Lozoya Austin have invited Indian investments in all areas of the hydrocarbon sector. The two sides agreed to set up a joint working group on hydrocarbons at the official level to identify concrete areas of cooperation in the sector. ONGC Videsh Ltd (OVL) has decided to open its office in Mexico City to pursue opportunities in upstream sector. It has signed a Memorandum of Understanding (MoU) with PEMEX for cooperation in the upstream sector. Currently, Indian Oil, Reliance Industries and Essar buy about 6 million tonnes of crude oil from Mexico. Pradhan informed the Mexican officials that India is trying to diversify its imported sources of energy and more than 20 percent of crude imports is currently sourced from Latin America. (www.business-standard.com)

Downstream………….

Total in talks with MRPL for fuel retailing joint venture in India

May 25, 2015. French energy company Total is in preliminary talks with Mangalore Refinery and Petrochemicals Ltd (MRPL) for partnership in fuel retailing in India. If the deal goes through, it will mark the entry of the second major multinational company, after Shell, into India's petrol pump business dominated by the state. Total is ranked the world's fifth largest oil and gas company. It is not yet clear whether the agreement, if reached, will apply to all or just a few outlets. Similarly, the two companies will have to work out whether they want to use a common brand or separate brands at outlets which dispense products from both companies. Three state-run retailers — IOCL, HPCL and BPCL — together control 95% of about 53,000 petrol pumps across the country. Private firms Reliance Industries, Essar Oil and Shell have been slow in expanding since a second scrapping of diesel subsidy by the government late last year, fearing state control may snap back if crude prices were to flare up again. Total operates 42 Auto LPG Dispensing Stations (ALDS) across 22 cities, mainly in South India — a region MRPL is eyeing to open its first set of petrol pumps in the current fiscal. MRPL said it will set up 100 filling stations in the first phase given that the government has scrapped diesel deregulation. A government licence is needed to operate fuel dispensing stations in India. MRPL has licence to operate 500 filling stations from where it can sell petrol and diesel to retail customers. Its parent Oil and Natural Gas Corporation (ONGC) has licence for another 1,100 stations and intends to use this to boost MRPL's retail plans. Total has operated in India for more than two decades. Its interest in the country spans from a stake in Liquefied Natural Gas (LNG) terminal in Hazira, Gujarat, to underground LPG cavern storage facility and marketing of lubricants and adhesives. Total has the licence to operate car LPG dispensing stations. But it's not clear whether it has secured or sought licence to operate petrol and diesel dispensing stations. (economictimes.indiatimes.com)

RIL to restart petrol pump network by March next year

May 24, 2015. Reliance Industries Ltd (RIL) plans to fully resume its petrol pump network by March next year as government ending diesel subsidies have given it a level-playing field to compete with state-owned retailers. The firm had ventured into selling petrol and diesel through a network of nearly 1,400 petrol pumps in 2006, but had to shut operations as it wasn't getting subsidies extended to state-run operators. The subsidies made good losses state retailers incurred on selling fuel below market price, aimed at shielding the poor from inflation. The government deregulated petrol in June 2010 and diesel in October last year, paving the way for private operators' entry. Between 2006 and now, industry volumes of petrol and diesel sold have doubled from 40 million tons per annum in 2006 to 80 million tons. Demand for transportation fuels is expected to grow in line with growth in the country's GDP, RIL said. The retail network has increased from 31,000 in 2006 to over 53,000 outlets with majority owned by public sector units. Post fuel price deregulation, Essar Oil has begun selling from most of its 1,400 outlets, which it plans to scale up to 2,500 in a year's time. Mangalore Refinery and Petrochemicals Ltd (MRPL) announced plans to enter fuel retailing with 100 outlets. (economictimes.indiatimes.com)

IOC to raise stake in CPCL

May 22, 2015. Indian Oil Corp (IOC) will invest ` 1,000-1,500 crore to raise its stake in Chennai Petroleum Corp Ltd (CPCL), which will be used by the south Indian refiner to expand operations. The state-owned refiner will make the investment by buying fresh shares of CPCL through a proposed private placement. The firm currently holds 51.89 percent in CPCL, while the other promoter, Iran’s Naftiran Inter Trade Company Ltd, owns 15.40 percent. IOC would also ratify the proposed investment into CPCL. (www.thehindu.com)

Transportation / Trade…………

IOC to sell about 50k tonnes of naptha to Unipec loading from Chennai and Haldia

May 25, 2015. Indian Oil Corp (IOC) has sold 35,000 tonnes of naphtha for June 15-17 loading from Chennai to Unipec, and possibly another 15,000 tonnes for June 8-10 loading from Haldia, also to Unipec, traders said. These brought IOC's total sales for June to about 80,000 tonnes and the refiner still has outstanding tenders to sell another 45,000 tonnes for late June loading from Dahej and Haldia. IOC's naphtha exports in May - when it sold up to 135,000 tonnes - and June are significantly higher than the 50,000-tonne average monthly for the first four months of the year, data showed. (economictimes.indiatimes.com)

HPCL buys Iraq Basra Light at multi-year high premium

May 22, 2015. Indian refiner Hindustan Petroleum Corp Ltd (HPCL) has bought 2 million barrels of Basra Light at the highest premium in years for the Iraqi crude, traders said. HPCL bought the crude from BP via a tender at $1.40 a barrel above the grade's official selling price (OSP), which will load in June, they said. Iraq cut supply of Basra Light to export more of its new heavy oil in June, causing the differentials for the two grades to head in opposite directions. (uk.reuters.com)

WBPDA calls indefinite strike

May 20, 2015. West Bengal Petroleum Dealers Association (WBPDA) has announced that it will hold an indefinite strike. This strike will prevent people from buying fuel once the stock at the petrol pumps is over. This ‘no-purchase’ agitation will be held at three terminals - Mourigram, Budge Budge and Haldia. The oil pumps in Kolkata are likely to go dry in the coming days if the strike is not being stopped. (www.iamin.in)

GAIL in talks with Shell to sell US LNG supply

May 20, 2015. Gas Authority of India Ltd (GAIL) has signed a preliminary deal with Shell for the potential sale of liquefied natural gas (LNG) supply sourced from its portfolio, made up of US production. GAIL has also signed preliminary agreements with other companies, the sources said, one of whom added that the talks with Shell were at an advanced stage. GAIL first announced plans to sell 1 million tonnes per annum (mtpa) of supply over a 5-year period in 2013 but negotiations with buyers got bogged down over differing price views. GAIL held out against accepting what it saw as overly stingy premiums to the price it paid Cheniere to acquire the gas in the first place, according to information reported at the time. The company has purchased 3.5 mtpa of LNG over 20 years from U.S.-based Cheniere Energy from 2017. It has also booked capacity to export another 2.3 mtpa at US-based Dominion Energy’s Cove Point liquefaction plant from 2017. (www.livemint.com)

Policy / Performance………

PNGRB extends bidding to issue licenses for CNG retailing

May 25, 2015. Oil regulator PNGRB has extended bidding to issue licenses for retailing CNG and piped cooking gas in 20 cities, including Haridwar and Aligarh, by one month following poor response for more than half of the cities. Of the 20 cities for which Petroleum and Natural Gas Regulatory Board (PNGRB) wanted to issue city gas distribution licenses, 8 did not get any bid while 4 others got single bids at the close of tender. Bids can be submitted by June 22. In February, PNGRB invited bids for development of city gas distribution networks in East Godavari, West Godavari, Belgaum, Ahmadnagar, Krishna, Muzaffarnagar, Badaun, Aligarh, Bulandshahr, Banaskantha, Tumkur, Latur, Dhar, Dahod, Shivpuri Haridwar, Dharwad, Bidar, Osmanabd and Udham Singh Nagar. PNGRB said it received no bids for Badaun, Aligarh and Bulandshahr in Uttar Pradesh, Latur in Maharashtra, Dhar and Shivpuri in Madhya Pradesh, Bidar in Karnataka and Osmanabad in Maharashtra. Further, only single bid was received for Ahmadnagar in Maharashtra, Muzaffarnagar in Uttar Pradesh, Banaskantha and Dahod in Gujarat, it said. Bidders were asked to quote the tariff they will charge for the pipeline network to be laid in the city and the compression charge for dispensing CNG (compressed natural gas) over the 25 years. They were also asked to quote the inch-kilometre of steel pipelines they will lay during first five years and the number of domestic consumers proposed to be connected by piped natural gas, according to the regulator. (economictimes.indiatimes.com)

India eyeing expanding crude imports from Colombia

May 23, 2015. India is looking at importing more crude oil from Colombia as part of an effort to diversify its crude oil import basket, Petroleum Minister Dharmendra Pradhan told his Colombian counterpart during the visit by an Indian delegation to that nation. Pradhan also said Indian and Colombian companies had to expand the scope for cooperation in the exploration and production of petroleum. India imports around 6.3 million tonne (MT) of crude from Colombia of the total imports of 189 MT every year. Pradhan met the leadership of Colombia’s national oil company, Ecopetrol, and visited the Moriche oil field where ONGC Videsh Ltd (OVL), SINOPEC of China and Ecopetrol have formed a consortium called Mansarover Energy, which is producing about 2 MMT oil per year. Pradhan highlighted the scope of enhancing cooperation between Colombia and Indian public and private sector companies in the areas of exploration and production in Colombia, including in deep-water and unconventional resources, refining and infrastructure related to oil and gas. (www.business-standard.com)

India plans new oil subsidy rules to push ONGC stake sale

May 22, 2015. India plans to reform rules governing the level of discounts upstream state oil firms including Oil and Natural Gas Corp (ONGC) offer to retailers, the finance ministry said, a move that could expedite the sale of a stake in the company. The government hopes to sell shares in ONGC and India Oil Corp. to raise about a third of its budget target for asset sales of $11 billion - and reduce its fiscal deficit to 3.9 percent of GDP in the 2015/16 fiscal year. Currently ONGC, Oil India and GAIL (India) sell crude and fuels like cooking gas at discounted rates to partly compensate retailers for losses they incur on selling fuels at government-set rates. But the finance ministry and oil ministry are in talks to work out a mechanism for easing the subsidy burden for the upstream companies. The oil ministry had set a new subsidy formula for the April-June quarter that would exempt upstream companies from discounting sales of crude oil and refined products if global oil prices are up to $60 per barrel. India had to defer plans to sell a 5 percent stake in ONGC last year as investors wanted a clarity on subsidy payments, which had previously been set by government decree, creating uncertainty around its earnings outlook. Market experts said that if talks between the two ministries lead to the temporary subsidy arrangement being prolonged, that would make the ONGC stake sale a more bankable proposition. (in.reuters.com)

Oil ministry seeks details of foreign lenders in KG-D6 consortium

May 21, 2015. The Oil ministry has asked the finance ministry to verify the antecedents of 22 foreign lenders to the Reliance Industries operated KG-D6 consortium. The government said that the scrutiny is with regard to the funding plans of Niko Resources, one of the members of the consortium. Niko has submitted a list of investors from whom it plans to raise funds in order to invest in the KG-D6 block. These lenders are mostly private equity funds, including Apollo Asia Private Credit Master Fund PTE, ARCM Master Fund and Best Investments Delaware. Niko, which is a 10% partner in the block, is raising funds for development of oil and gas fields in KG-D6 block. RIL, which holds a 60% stake, is the operator of the block while BP is the third partner with 30% participating interest in the block. An email query sent to the ministry of petroleum and natural gas did not elicit any response. According to government, the developments at the block are under close scrutiny as the oil ministry and the KG-D6 consortium have been at loggerheads over the diminishing gas output from the block. Both have accused the other of failing to stick to contractual terms. The oil ministry blames RIL for the fall in output while the company has attributed the decline to geological factors. In December 2014, Niko Resources had engaged Jefferies as its financial advisor to look for a buyer for its KG-D6 stake stating that there is uncertainty around the long-term natural gas price outlook in India. In April 2015, Niko Resources had said that it will be working on plans to develop the new find in the KG-D6 block. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

BHEL adds 736 MW hydroelectric capacity in 2014-15

May 25, 2015. Bharat Heavy Electricals Ltd (BHEL) said it commissioned six hydro sets with a combined 736 MW capacity in 2014-15. This accounts for 100 percent of hydro power capacity addition in the country in the said fiscal, BHEL said. The highest addition in a single year by BHEL over the last decade, this was achieved by commissioning of projects of three major central utilities -- NTPC, NHPC and SJVNL – it said. The projects commissioned include two units (200 MW each) of Koldam Hydro Electric Project (HEP), with which NTPC has made its maiden foray into the hydro sector. On top of that, a 130 MW unit of NHPC's Parbati III HEP and 3 units of SJVNL's Rampur (68.67 MW each) were started. BHEL is executing three other hydro projects of NTPC -- Tapovan Vishnugad HEP (4x130 MW), Lata Tapovan HEP (3x57 MW) and Rammam Stage-III HEP (3x40 MW), with a fourth unit of 4x130 MW Parbati III HEP being commissioned. BHEL has started the last three units of Rampur HEP of SJVN. These HEPs will contribute to reduction in the greenhouse gas emission and help in achieving a low carbon development path. BHEL bagged orders for two major hydro projects aggregating 564 MW in 2014-15 and has so far commissioned some 400 hydro generating sets in the country, with a cumulative capacity of more than 19,600 MW. It is currently executing hydro power projects of around 4,600 MW, which are at various stages of implementation. (economictimes.indiatimes.com)

NTPC assures entire power from proposed plant to Telangana

May 25, 2015. National Thermal Power Corporation (NTPC) assured the Telangana Government that the entire power generated from the proposed 4000 MW thermal power project would be fully dedicated to the State. NTPC agreed that the entire 4000 MW coming up at Ramagundam would be dedicated to Telangana as per AP Reorganisation Act on their existing land. The Chief Minister said the required water allocation will be ensured and informed the Arup Roy Choudhury, Chairman and Managing Director (CMD), NTPC that he would personally take up the issue of coal linkage with Prime Minister Narendra Modi. The NTPC Chief assured the Chief Minister to commission the project within four years. (www.thehindubusinessline.com)

Jaitapur gram sabhas pass resolution against nuclear project

May 25, 2015. The gram sabhas of Madban and Mithgavhane, two of the villages which are in the vicinity of the project, have passed a resolution opposing the project. The gram sabhas of Madban and Mithgavhane, two of the villages which are in the vicinity of the project, have passed a resolution opposing the project, implying that the villagers are yet in opposition to the 9900 MW Jaitapur Nuclear Power Project (JNPP). Accepting compensation package from the government does not mean we have agreed to the nuclear power project in our backyard, the villagers in and around proposed JNPP have told the government. The gram sabhas of Madban and Mithgavhane, two of the villages which are in the vicinity of the project, have passed a resolution opposing the project, implying that the villagers are yet in opposition to the project. The resolution at the Madban is important as the village, ground zero of JNPP project, has1851 PAPs. It is the largest number among all other villages. Following Madban, another village called Mithgavhane too has passed one line resolution which opposed the project. Several other villages too are likely to pass the identical resolution in coming week. The developments at the ground level hold importance after several state-level leaders of the Bharatiya Janata Party (BJP) reiterated that the project will go ahead at any cost. (www.thehindu.com)

NTPC takes over DVC's Raghunathpur coal-fired power project

May 25, 2015. India's largest thermal power generation company NTPC will take over Damodar Valley Corporation (DVC)'s Raghunathpur coal-fired power project in Purulia district of Bengal (India). The first phase of the project consisting of two 600 MW units was commissioned in 2013 and 2014, but only the first unit is operating (second unit stuck due to the absence of infrastructure for water and coal supply). In addition, DVC is facing financing difficulties in the construction of the second phase of two 660 MW units, though equipment contracts have been placed with BHEL and BMR. The company is heavily indebted and may not be able to complete the construction of the project. (www.enerdata.net)

Two more power units with capacity of 1 GW to be added to Tarapur Atomic Plant

May 22, 2015. Two more nuclear power units with an installed capacity of 1,000 MW is expected to be added to the Tarapur Atomic Power plant here, Palghar MP Chintaman Wanga said. There are plans to install two more units to the existing four in Tarapur Atomic Power Station (TAPS), Wanga said. The two new plants would generate a total of 1,000 mega watt power and the survey for this addition is already underway, he said. Nuclear Power Corporation of India Ltd (NPCIL), which operates the facility, however remained tight-lipped about the expansion programme. The Tarapur Power plant which started operations way back in 1969 with two units (No 1 and 2) having an installed capacity of 210 MW each but could generate only 160 MW of power in each of the units later due to technical difficulties. (economictimes.indiatimes.com)

Tata Power reports 2014-15 standalone generation capacity at 11,974 mn units

May 22, 2015. Tata Power said its standalone generation capacity stood at 11,974 MUs (million units) in 2014-15. Besides, the company has an installed power generation capacity of 8,750 MW, including 1,383 MW from renewable sources. The company's hydro power stations generated 1,443 MUs, wind farms generated 635 MUs, and solar plants recorded a generation of 4 MU. The company has 1,383 MW renewable generation capacity, including 511 MW (wind), 56 MW (solar), 576 MW (hydro) and 240 MW (waste gas based generation). (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Delhi govt asks discoms to maintain adequate power supply

May 26, 2015. To discuss the issue of unscheduled power cuts in the city, Delhi power minister Satyendra Jain held a meeting with the three power distribution companies. Jain said that the discoms should ensure there is no power shortage in the city. He also told the power discoms that a heavy fine will be imposed on them in case they failed to maintain adequate power supply. With the representatives of the discoms telling the minister that there was no unscheduled power cut from their end, the government asked them to share their data with it. Power department is keeping a close watch on the power situation in the city, officials said, adding that, as the temperature rises, unscheduled power cuts are becoming more frequent. Delhi government has asked the power companies to inform residents in advance about the power cuts. Power department officials said the peak demand in coming days can go up to 6,400 MW this season. (www.business-standard.com)

Indo-Bangla power venture ready to invite bids for construction

May 26, 2015. Bangladesh India Friendship Power Company Ltd (BIFPCL) -- a 50:50 joint venture (JV) between Indian power generation major NTPC and Bangladesh Power Development Board (BPDB) –- may invite bids for turnkey construction of 2 X 660 super-critical coal-fired thermal power plant at Rampal, near Mangala river port in June. A pre-bid meeting held was attended by six power gear majors including BHEL and L&T from India; Doosan and Hyundai from South Korea and two Chinese companies. Apart from construction of the plant, the turnkey contractor would also be responsible for building a coal terminal at Mangala for importing a little over 4.5 million tonnes of fuel annually. The NTPC JV is going to further integrate the energy ties between the two nations. Though described as an equal JV, India is expected to play a lead role in financing the NTPC operated project. (www.thehindubusinessline.com)

CESC to pump in ` 20 bn to strengthen distribution

May 22, 2015. Private power producer CESC will invest about ` 2,000 crore to strengthen its distribution network in Kolkata, its permit area, chairman Sanjiv Goenka has said. The company said it aims to reduce the time taken to provide a new connection to 24 hours from 72 hours at present. (economictimes.indiatimes.com)

Adani signs deals to sell two-thirds of production from Australia Mine

May 21, 2015. Adani Mining has signed contracts with buyers for selling nearly two-thirds of the coal it plans to produce from the Carmichael mine in Australia. Conglomerate Adani Enterprises had said that it is in advanced talks with power firms and traders in different countries for selling coal from Carmichael mine. Adani Mining Pty, a wholly-owned subsidiary of Adani Enterprises, is in discussion with various power utilities and coal traders in different countries for offtake arrangements of the fuel from Carmichael mine, it had said. The company said that it has signed certain letters of intent with these power utilities and coal traders as part of discussions to sell the fuel. Adani Group is implementing coal mining projects with total annual coal production capacity of around 110 MTPA (million tonnes per annum). The company plans to achieve a mining capacity of 200 MTPA of coal by 2020. (profit.ndtv.com)

India to overtake China as top coal importer in 2015

May 20, 2015. India is expected to overtake China as the world's top coal importer in 2015, faster than previously expected, traders and consultants said. India's coal imports should rise to around 200 million tonnes this year, from around 180 million tonnes in 2014, consultancy Venerable Energy Solutions said. Consultancy said that Indian imports could rise to 250 million tonnes within three to four years if prices remained around current levels. Global coal prices have been depressed in recent years by a glut in supply. Meanwhile a fall in Chinese imports has been sharper than had been expected. A poll showed top coal consumer China's thermal coal imports are expected to drop by 52 million tonnes or around a quarter in 2015, as the country seeks to support its domestic producers and address environmental concerns. International Energy Agency data showed China imported 229 million tonnes of thermal coal, including lignite, in 2014. (www.firstpost.com)

Transmission schemes worth ` 339 bn notified

May 20, 2015. The government said as many as 14 transmission schemes entailing an investment of ` 33,900 crore have been notified, which will help import of power from Bhutan. These schemes will facilitate transfer of power from hydro-electric projects in Bhutan and generation-linked projects in Chhattisgarh and Odisha, which include 765 KV and 400 KV transmission programmes in northern, western, southern and north-eastern regions. Nine schemes aggregating ` 12,272 crore were notified in July 2014 and 5 more totalling ` 21,659 crore in February 2015. The said projects had been allocated to the Bid Process Coordinator (BPC), namely RECTPCL and PFCCL, for carrying out bidding under the tariff-based competitive bidding (TBCB) route. According to the Ministry, a total of 22,100 circuit kilometres (CKM) of transmission lines and 65,554 megavolt ampere (MVA) transformation capacity have been achieved in 2014-15 as against the target of 20,882 CKM and 47,871 MVA, the highest ever in a year. The Ministry had said India has achieved the highest ever power generation capacity of 22,566 MW in 2014-15 against the target of 17,830 MW. (www.ptinews.com)

Policy / Performance………….

Electricity bills may shoot up by 5-20 percent this June

May 26, 2015. Electricity bills are expected to shoot up by 5%-20% from June as the Apellate Tribunal of Electricity (APTEL) has pulled up Delhi Electricity Regulatory Commission (DERC) over failure to pass on power purchase adjustment charges (PPAC). APTEL has ordered DERC to pass on the charges for two quarters (from October 2014 to March 2015). A copy of the order has been sent to DERC. The controversial PPAC order for the first quarter of 2015-16 will be heard in July. The petition to APTEL was filed by Tata Power Delhi in March and pleadings were completed by April. Later, the BSES discoms supported the petition citing worsening financial problems with the withdrawal of PPAC. The discoms stated that they were getting PPAC for three quarters (July 1, 2014 to March 31, 2015) despite submitting petitions to DERC regularly. The charges of July 1 to September 30, 2014 were the first ones denied to discoms. DERC had on November 13, 2014 allowed the charges to discoms, but a day later this order was withdrawn after citing non-furnishing of complete details of the fuel bills of generators. Following this, two more quarters (October 1 to December 31, 2014 and January 1 to March 31, 2015) passed without PPAC charges. While Tata Power Delhi has sought up to 4% in its petitions, BSES discoms Rajdhani and Yamuna have demanded 17%-20%. Discoms claimed they moved APTEL as DERC was mum on the issue. The power distribution companies, however, cited financial crunch and argued that in 2011 the tribunal had passed clear directions that PPAC was to be provided monthly or maximum on quarterly basis. (economictimes.indiatimes.com)

‘Centre to move carefully on nuclear projects’

May 26, 2015. The Minister of State (MoS) for Atomic Union Jitendra Singh said the Centre had to move cautiously while dealing with projects related to nuclear and atomic energy looking carefully into their sensitivity aspect, security angle and also the budget implications. He said the Department of Atomic Energy (DAE) had in mind new areas which could be explored, as earlier the concentration was mostly on conventional areas such as south India. According to the MoS, the DAE is also trying to brush aside apprehensions expressed by some of the states that there will be hazards if projects of this kind come up. (www.newindianexpress.com)

Delhi HC postpones hearing on power plant cost capping case

May 26, 2015. The Delhi High Court (HC) postponed for a second time hearing on a petition challenging the government's move to put a ceiling on the fixed costs that a power plant can factor into electricity tariffs. The petition, filed by Mandakini Explorationand Mining Ltd, a joint venture of Jindal India Thermal Power and Monnet Power Company, was earlier listed for hearing on May 13. The company has argued that capping fixed costs after the auction of coal blocks "amounts to ex-post facto change in bidding conditions of coal mines for power sector". It has said that the move will render its project "unviable" to service debt. In April, the power ministry issued an order to amend guidelines for power procurement by states. According to the new guidelines, state power distribution companies, in consultation with their regulatory commissions, will determine an upper ceiling for fixed costs for every unit of power. The fixed cost will be indicated in advance to all bidders before the distribution companies invite bids for power supply. The high court has now listed the matter for July 30. (economictimes.indiatimes.com)

CIL decision to cancel coal won by JPL comes under HC lens

May 25, 2015. The Delhi High Court (HC) asked Coal India Ltd (CIL) how it was offering coal from two Chhattisgarh mines to NTPC when it had cited production issues to cancel an e-auction of 49,000 metric tonnes (MT) of the mineral, mined from the same area, which was won by Jindal Power Ltd (JPL). JPL, in an affidavit, has contended that while the 49,000 MT of non-coking coal won by it was cancelled citing production issues at Gare Palma IV/2 and IV/3 mines, 2.5 lakh tonne per month of coal from same area was being offered to National Thermal Power Corporation Ltd (NTPC) on 'as is where is basis'. CIL had invited bids for 4.05 lakh tonne of non-coking coal and 1.5 lakh tonne of coking coal. Of the 4.05 lakh tonne of non-coking coal, 60,000 metric tonne was to be auctioned from the two Gare Palma mines, JPL has said in the affidavit filed by it. (www.business-standard.com)

Chhattisgarh hikes power tariff by 14 percent

May 25, 2015. Chhattisgarh State Electricity Regulatory Commission (CSERC) decided to effect on average 14 percent increase for all categories of customers. While the domestic consumers have to pay around 11 percent more, the industrial consumers would pay 14 percent more electricity bill on average from different categories. The biggest shock would be received by the common people who would have to pay more for the power consumed in the "power surplus" state. The consumers using 0 to 40 units of power would pay ` 3 per unit against the old tariff of ` 2.70 per unit while those consuming more than 600 units of power would have to pay ` 6.50 per unit. The farmers would also feel the heat. The commission had decided to hike the power tariff by whopping around 34 percent for the agriculture consumers. As against the existing tariff of ` 2.55 per unit, agriculture consumers would pay ` 3.41 for a single unit of power consumer from next month. The industrialists facing recession in the state found no respite as the commission had hike tariff for all categories of industrial consumers. The steel units consuming power in the category of 220/132 KV consumer would pay 14.34 percent more electricity bill. The power tariff had been hiked from ` 5.09 to ` 5.82 per unit. Similarly, the steel makers categories in the list of 33/11 KV consumers would pay ` 5.34 per unit against the existing tariff of ` 4.32 - an increase of about 23 percent. Cement and other industries would also pay 13 percent more. The new power tariff had been announced despite strong protest from the consumers who had raised objection during the public hearings conducted by the commission. The members of the opposition Congress party had even stormed the venue of public hearing and created ruckus. (www.business-standard.com)

India to seek CERN membership

May 25, 2015. The much-delayed process of India acquiring the associate membership of premier research institute CERN has already begun, Ratan Kumar Sinha, Chairman of the Atomic Energy Commission of India said. The European Organisation for Nuclear Research, known as CERN, operates the largest particle physics laboratory in the world. Sinha said the Cabinet Committee on Security (CCS) has given its nod to acquire the membership about two months back. The process of approving India's membership for CERN was pending since the UPA days due to budgetary reasons. India's contribution to CERN is believed to be around ` 40-60 crore every year. India has been associated with the organisation since 1970s with scientists mainly from the Tata Institute of Fundamental Research (TIFR), have been participating in experiments at CERN since the 1970s. (zeenews.india.com)

India seeks investments from US companies in power, coal sectors

May 22, 2015. Power, coal and renewable energy minister Piyush Goyal urged United States (US)-based companies to invest in India while outlining the government's efforts to revive investments in energy sector. At a conference of US India Business Council (USIBC), Goyal briefed US energy secretary Ernest Moniz and US commerce secretary Penny Pritzker on initiatives taken by his ministries for creating a framework for private sector participation in coal mining and production, increasing renewable energy capacity 175 GW over the next seven years and doubling electricity production over the next seven years. (economictimes.indiatimes.com)

CIL allowed to expand underground mining at Jhanjra

May 21, 2015. The environment ministry has given Coal India Ltd (CIL) the go-ahead to expand the Jhanjra underground mining project in West Bengal, one of the few such proposals in recent years, which will help the state monopoly extract coal worth more than ` 8,000 crore without destroying forests. Coal India, under pressure to boost production, depends heavily on opencast mining, which is easier and cheaper, but faces hurdles as it often requires uprooting trees and displacing people. Other countries such as China and Australia use underground mining more than India. The Forest Advisory Committee (FAC), at a meeting, approved the diversion of 78 hectares of forest land in favour of Eastern Coalfields Ltd, Coal India's subsidiary, for the Jhanjra underground mining project at Raniganj in West Bengal. The approval for Jhanjra comes when Coal India's underground output faces decline and the coal ministry has asked the PSU to draw up detailed plans to boost output from such mines. Delays in forest clearances have been repeatedly cited for low production. Pending clearance since 2012, the Jhanjra mine is considerably important for Coal India's expansion plans. Eastern Coalfields is said to be importing a special 'longwall' machine from China. Coal India is also said to be now focusing on underground mines and switching to partial mechanisation for increasing coal extraction from them. The state government also showed renewed interest in the project. While West Bengal has traditionally gone slow on mining projects, in this case, the state government submitted a fresh proposal to the environment ministry on March 5, 2014, requesting forest clearance. (economictimes.indiatimes.com)

World Bank likely to fund for AP energy efficiency moves

May 21, 2015. The World Bank is likely to extend a ` 2,500-crore credit line to Andhra Pradesh (AP) for enhancing the efficiency in the power sector, including bringing down transmission and distribution (T&D) losses. As the State moves towards bringing down the T&D losses to single digit, and sets up Green energy corridor, the new credit line assumes importance for the State, according to the Energy Conservation Cell. The Central Government and German lending agency KFW have agreed to fund the green Energy Corridor in the planned with an outlay of ` 1,289 crore. Of this, the Centre has agreed to grant ` 515 crore for evacuation of wind and solar power through the green energy corridor. (www.thehindubusinessline.com)

NTPC yet to get promised land from West Bengal govt

May 20, 2015. Nearly 15 months after West Bengal chief minister Mamata Banerjee announced handing over of 96 acres to NTPC for setting up a proposed 1,320 MW power plant, the state government is yet to hand over land to the firm. NTPC is also waiting for waiver of landholding ceiling to buy some 150 acres from villagers directly, with the result that the project has been delayed by at least five years already In February last year, Banerjee had announced handing over of the land to the power producer to speed up industrialisation in the state. NTPC had decided to acquire 150 acres from the farmers directly. After a series of dialogues with company officials, owners agreed to sell their land to NTPC, after which the power company entered into a land purchase agreement with nearly 100 families at the project site. (economictimes.indiatimes.com)

Govt transfers forest clearance from earlier allotee to Essar

May 20, 2015. Essar Power need not apply for fresh forest clearances for captive coal mines in Jharkhand as the government has transferred to it the approvals granted to the earlier allotee. The forest clearance (FC) was given for diversion of 374.87 hectare of forest land for captive coal mine in Tokisud north block in Hazaribag and Ramgarh districts in Jharkhand. The Environment Ministry has transfered the FC from earlier allottee GVK group to Essar Power Ltd following the request from the Coal Ministry. The FC has been transferred to Essar Power with certain conditions, the ministry said. The conditions include that the lease transfer charges at 10 percent of the net present value (NPV) or ` 1,00,000 whichever is less will be realised from Essar and will be deposited in ad-hoc CAMPA before execution of the lease. Essar Power would be required to pay the NPV as per the approval granted under FC Act if not paid earlier. The company should furnish an undertaking to pay the additional NPV, if so determined by the Supreme Court, the ministry said. Reimbursement of amount paid by GVK would be dealt as per the provisions in in the Coal Mines (Special Provisions) second Ordinance, 2014 and rules framed thereunder, it said. In a bid to expedite operations from the recently allocated coal mines, the Environment Ministry has amended environment clearance (ECs) norms to facilitate transfer of ECs to successful coal bidders. The Centre recently auctioned 29 blocks in two phases to companies like Monnet, GMR Chhattisgarh, Hindalco, Reliance Cement among others, garnering about ` 2 lakh crore. The auction followed the Supreme Court's cancellation of 204 coal blocks last year. (timesofindia.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

US shale oil producers to ramp up drilling at current price: Goldman Sachs

May 26, 2015. Shale oil producers, benefiting from lower costs, are expected to ramp up drilling activity if the price of U.S. oil stays near $60 a barrel, Goldman Sachs said. U.S. drillers cut the number of rigs by just one, data from oil services firm Baker Hughes Inc showed, signaling that higher crude prices may be starting to steady the sector after 24 straight weeks of drill rig declines. (www.reuters.com)

Eni finds gas offshore Libya

May 26, 2015. Italian energy company Eni announced it made its second discovery of the year at an exploration prospect off the coast of Libya. Eni said it made a natural gas and condensate discovery in so-called Area 3, a reserve area about 85 miles off the Libyan coast. Production tests yielded a preliminary flow rate from the well at 1,340 barrels of oil equivalent (boe) per day. Eni estimates the well should be able to produce at least 3,000 boe per day at its peak. Before NATO forces intervened in Libyan civil war in 2011, the country was producing more than 1 million bpd. The Organization of Petroleum Exporting Countries (OPEC) in its latest market report said production from member-state Libya was around 300,000 bpd. Italy received nearly 10 percent of its natural gas from Libya's Greenstream pipeline before the Libyan civil war began in February 2011. Eni started production from Libyan offshore fields feeding that pipeline in 2004. With a legacy extending back to 1959, Eni said it's the largest international oil company working in Libya and is producing 250,000 barrels of oil equivalent from its assets there. (www.upi.com)

Russia's Rosneft says likely to quit gas project in UAE

May 26, 2015. Russia's top oil producer Rosneft said it is considering quitting a gas project with UAE-based Crescent Petroleum in the emirate of Sharjah after exploration drilling failed to confirm commercial reserves. Abandoning the project would be yet another setback for Rosneft's efforts to expand its global reach. The company also failed to secure a deal to acquire Morgan Stanley's trading business earlier this year due to restrictions from the United States, which has imposed sanctions against the Kremlin-controlled company over Moscow's role in Ukraine crisis. Rosneft and Crescent Petroleum had initially aimed to start production at the field, which was estimated to contain 70 billion cubic meters of gas and 16 million tonnes of gas condensate, in 2013 after signing a deal in 2010. Rosneft said the company drilled two exploration wells with Crescent Group between 2011 and 2014 but tests failed to show commercial hydrocarbon reserves. (af.reuters.com)

China's CNPC makes first tight oil find over 100 mn tonnes

May 26, 2015. China National Petroleum Corp (CNPC) has discovered more than 100 million tonnes of tight oil geological reserves in its Changqing field, the company said. The discovery, located in the western province of Shaanxi, is the first Chinese tight oil find to surpass 100 million tonnes. Technically recoverable reserves may be considerably lower. Tight oil production capacity in the Ordos basin, where Changqing is located, is more than 1 million tonnes, the paper said. In the first quarter of 2015, Changqing produced 6 million tonnes of crude oil, or 487,600 barrels per day. (www.reuters.com)

Iran to raise oil output by 170k bpd from new fields

May 25, 2015. Iran plans to raise its oil output by 170,000 barrels per day by end of the current Iranian year, which ends on March 20, 2016. Arvandan Oil and Gas Company, a subsidiary of the state's National Iranian Oil Company (NIOC), said the "additional output will be available once the initial phases of North Azadegan and Yadavaran oilfields come into operations". The OPEC producer aims to boost crude exports by up to 1 million bpd if Tehran and six major powers finalize a nuclear agreement by a June 30 deadline. (www.reuters.com)

Oil platform in Gulf of Mexico shuts in production after fire

May 23, 2015. A platform gathering oil in the Gulf of Mexico shut in about 2,200 barrels a day of output after a compressor caught fire. The Texas Petroleum Investment Co. platform in Breton Sound Block 21, near the southeastern Louisiana coast, evacuated 28 workers without injury after the compressor fire, according to U.S. Coast Guard. The platform gathers crude from about 50 to 60 wells and sends it to shore by pipeline, the Houston-based company said. There were about 100 barrels of crude in storage on the platform at the time of the fire. Louisiana’s offshore crude production averaged about 14,000 barrels a day in March, according to state data. Total Gulf production in federal waters, which are more than three miles from the coast, was 1.46 million barrels a day in February, according to the Energy Information Administration. (www.bloomberg.com)

Novatek starts production on Termokarstovoye gas field

May 21, 2015. Russian gas producer Novatek has started production on the Termokarstovoye gas and condensate field in Russia, developed by Terneftegas, a joint venture between Novatek (51%) and Total (49%). The Termokarstovoye field is expected to reach its production level of about 2.4 bcm/d (876 bcm/year) of natural gas and 0.8 Mt/year of gas condensate as early as June 2015. (www.enerdata.net)

Brazilian gas producer PGN plans $500 mn output expansion

May 21, 2015. Parnaiba Gas Natural SA (PGN), Brazil’s biggest independent natural gas producer, is investing 1.5 billion reais ($500 million) in projects including five fields in the country’s northeast. The producer backed by Cambuhy Investimentos, which counts Brazilian billionaire Pedro Moreira Salles as an investor, expects the plan to increase gas output 71 percent to 8.4 million cubic meters (297 million cubic feet) a day by July 2016. The company, which is Brazil’s fourth largest operator of oil and gas fields, has a long-term agreement to supply the fossil fuel to four Eneva SA thermoelectric plants in the Maranhao state. PGN received an environmental license to build a 40-kilometer pipeline connecting the Gaviao Branco fields to a gas treatment plant in Maranhao. (www.bloomberg.com)

Downstream…………

Russia's refinery runs down 1.2 percent in April month-on-month

May 25, 2015. Russian oil refinery runs in April fell by 1.2 percent month-on-month or 64,098 barrels per day (bpd) due to seasonal maintenance, data from the Energy Ministry showed. According to the Energy Ministry data, Russia's offline oil refining capacity has been revised up by 16 percent to 2.6 million tonnes in April due to unplanned maintenance. The idle capacity in May expected on 1.3 million tonnes from the previously 1.9 million tonnes. Refineries processed 5.490 million barrels of crude oil per day in April versus 5.554 million in March. In April, Novokuibyshev and Ryazan refineries, owned by Rosneft, decreased their refinery runs by 9.9 percent and 17.1 percent, respectively due to major planned maintenance on crude distillation units (CDU). Kirishi refinery, owned by Surgutneftegaz, stopped its CDU for unplanned maintenance in the end of the month. Year-on-year April refinery runs were up by 1.1 percent, or 59,935 bpd. Overall, April gasoline and fuel oil output increased by 3.2 percent and 0.8 percent year-on-year respectively. Gas oil production was down by 4.3 percent from a year ago, while jet kerosene output fell by 1.3 percent. (af.reuters.com)

Transportation / Trade……….

Oando Nigeria plans to truck compressed gas to industrial users

May 26, 2015. Oando Plc, a Nigerian energy company, is building a business to truck natural gas to industrial users whenever they are cut off from pipeline supply. Oando is investing $36 million to build three gas-compression plants in the country’s southern industrial belt within a year to produce 20 million cubic feet of gas a day initially, and then increase capacity as demand rises. Though Nigeria, Africa’s biggest oil producer, also has the continent’s largest gas reserves of more than 184 trillion feet, it lacks the pipeline network to reach most potential users. Existing pipelines passing through the restive Niger River delta are frequently sabotaged, causing supply disruptions. Average daily output of gas in Nigeria is about 9 billion cubic feet, according to the state-owned Nigerian National Petroleum Corp (NNPC). With domestic gas demand projected by the NNPC to reach 5 billion cubic feet daily in the next two years, Oando is targeting “big energy users” such as cement and steel plants, who currently rely on diesel to generate at least 1.5 megawatts of power per factor, to switch to gas, Osunsanya said.

Compressed to become more than 200 times smaller than its original volume, gas could be delivered to companies connected to pipelines during supply disruptions. The plants are to be located in the southeastern industrial town of Aba, the oil hub of Port Harcourt and a third to be located in central Nigeria. Oando concluded a $1.65 billion acquisition of ConocoPhillip’s Nigerian oil and gas assets in June. Its gas and power unit operates a 228-kilometer naturals-gas link that supplies industrial users in Lagos, as well as Port Harcourt. (www.bloomberg.com)

Mexican crude oil exports drop nearly 16 percent in April

May 25, 2015. Crude oil exports fell 15.8 percent in April for Mexico's national oil company Pemex, as the state-run producer is opening up to competition for the first time in decades. April crude exports totaled 1.034 million barrels per day (bpd) compared with 1.228 million bpd in March, according to company data. Crude exports to Asian markets led the decline, by more than 182,000 bpd or about 70 percent, to an average 82,316 bpd. But exports to Europe also fell sharply, by nearly 40 percent, to total about 183,000 bpd. Pemex's crude production in April fell 5 percent from March to 2.201 million bpd. Crude shipments have fallen nearly 40 percent over the past decade, while production is down about a third over the same period. Pemex expects 2015 crude output to average 2.288 million bpd.

Mexico's Congress finalized a historic energy overhaul last year that ended Pemex's decades-long monopoly on oil production, and allows the company to enter into joint-venture partnerships. The overhaul aims to boost crude output and exports via significant new streams of private and foreign investment into the long-closed Mexican oil patch. (www.reuters.com)

Chinese independents get foothold in LNG trade as restrictions lifted

May 22, 2015. China's independent buyers of liquefied natural gas (LNG) are taking their first cargoes of the fuel as Beijing permits third-party use of idle capacity at import terminals and approves the new players' long-term plans to build their own facilities. Privately run city gas distributor ENN Group and onshore LNG investor Guanghui Energy Co Ltd were among the first to start importing spot cargoes, renting space at PetroChina's underutilised receiving terminals at Rudong and Dalian and each bringing in at least one cargo since late 2014, according to company.

Other new importers include trader JOVO Group and independent oil and gas company Pacific Oil and Gas as China works to meet clean energy targets calling for natural gas' share in its energy mix to double. Beijing is freeing up the nation's LNG trade as part of broad reforms that allow private companies to invest in oil and gas exploration as well as pipelines and tank farms, and to engage in importing and exporting. The aim is to help secure supplies while boosting competition and efficiency in an energy sector long dominated by state firms. The new non-state buyers have taken about six spot cargoes so far this year, said traders involved in LNG trades into China. That compares with around 45 total cargoes of LNG imported in the first four months of the year, based on official customs data and the typical size of LNG tanker shipments. Independents could account for as much as 30 percent of China's LNG import market by around 2030, said industry experts, benefiting suppliers from Australia to North America in a market where spot prices LNG-AS tumbled over the past year as slowing Asian economies met expanding supplies.

Import terminals built by state-run energy companies over the past decade are being used at just over 50 percent of capacity, in part because of receiving room built ahead of supplies to be delivered out of Australia when new LNG projects come online there this year and next. In the first four months of the year, LNG imports are running 4.5 percent behind last year due to high contract prices and overstocking ahead of last winter, while pipeline flows have surged 32 percent over the same period. China is raising gas imports from Central Asia and Russia via pipelines and from producers such as Qatar and Papua New Guinea as LNG. Some experts are forecasting LNG shipments to triple by 2025 from last year's 20 million tonnes. The country's current 12 terminals - with a total capacity of about 38 million tonnes per year - were used at just 52 percent of their capacity in the first four months of 2015, leaving plenty of room for new players to enter the market. While welcoming the new buyers, suppliers remain cautious, especially when negotiating longer-term supplies with the independent companies. (uk.reuters.com)

US gas imports fell to their lowest since 1987 in 2014

May 22, 2015. According to the US Energy Information Administration, US net gas imports fell by 9% in 2014, for the eighth successive year, reaching 1,171 bcf (33 bcm), their lowest level since 1987. Soaring domestic production contributed to lower gas prices, displacing gas imports. Net LNG imports fell by 54% in 2014 to 43 bcf (1.2 bcm), continuing a 5-year trend, as total LNG imports fell by 40% and LNG exports increased slightly. Canada remained the largest gas supplier to the United States, with nearly 98% of all gas imports, though the share of Canada is the US gas consumption fell from 11% in 2009 to 7% in 2014. US gas exports decreased slightly in 2014 but remain 9% above the previous 5-year average, while gas exports to Mexico (half of US gas exports) increased by 12% during the year. (www.enerdata.net)

South Jersey Gas reapplies to build Pinelands pipeline

May 21, 2015. South Jersey Gas is again seeking permission to build a 22-mile natural gas pipeline in New Jersey's Pinelands. The company filed an amendment to its 2013 application, which government regulators rejected in 2014. The company argues the pipeline to the B.L. England Generating Station in Upper Township meets standards for approval. At issue is how much gas would be used by customers outside the Pinelands. The company says the pipeline would make customers less vulnerable to an outage in the event of an accident or natural disaster. About 500,000 people live in the Pinelands National Reserve, which covers 1.1 million acres in seven counties and 56 municipalities. (www.downstreamtoday.com)

Italy gives final go ahead for TAP gas pipeline construction

May 20, 2015. Italy signed a decree authorising the construction of the Trans Adriatic Pipeline (TAP) that will carry gas from Azerbaijan to Europe, the Industry Ministry said. Work on the pipeline will start before May 16 next year and it will be completed and ready for use before the end of 2020, the ministry said. The decree is the final step in a complex permitting process. Rome has said the TAP pipeline is strategic infrastructure for Italy which is seeking to diversify its energy sources. (www.reuters.com)

Policy / Performance…………

Romania to send O&G royalty tax law to parliament in September

May 25, 2015. Romania's government will send a draft law on royalty taxes for the oil and gas sector to parliament in September, Deputy Finance Minister Dan Manolescu said. The new tax system will likely include differentiated royalties for onshore and offshore extraction and will apply only to new contracts. It will also include a levy on profit from upstream activities, in addition to the global flat 16 percent tax on profit, and a system of deductions based on investment, Manolescu said. Romania is one of the European Union's poorest states, but it has a wide range of energy resources, including gas and coal, and some analysts have said relatively low royalties prevent it from making the most of what it has. Companies currently pay royalties ranging from 3.5 to 13.5 percent of production for oil and gas, depending on the amount extracted. They also pay a tax on special buildings such as oil wells and a tax of up to 60 percent on income from higher prices due to ongoing energy market deregulation. Both levies are temporary. Romania has left royalties unchanged since 2004, a condition it agreed to under the 2004 privatisation of oil and gas group Petrom, now owned by Austria's OMV. It planned to introduce the new system last year, but a November presidential election delayed the debate. The government has said any new system would have to ensure it does not stifle investment. Meanwhile, a plan to tender 36 new concessions for onshore and offshore hydrocarbon licences would be held after the royalties law is approved, the National Agency for Mineral Resources said. (www.reuters.com)

Indonesia plans to offer more oil, gas blocks for bidding this year