-

CENTRES

Progammes & Centres

Location

[Carbon Emissions: Peaking Prematurely in China and India (Part II)]

“Is the peak in coal demand part of natural course of things rather than the result of policy shifts enforced by China (and to a lesser extent India) on account of carbon emissions as the reports quoted above claim? A more comprehensive and objective look at developments in the coal sector show that shifts in demography and the changes in manufacturing productivity appear to be closely correlated to the decline in demand for coal rather than policies to reduce the use of coal on account of carbon emissions…”

Energy News

[GOOD]

Opening new mines to boost coal supply will reduce imports!

Poor states having power surplus is sign of premature peak in power demand!

[UGLY]

Power plants running at the lowest PLF in 15 years is a sign of demand destruction!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

ANALYSIS / ISSUES…………

· Carbon Emissions: Peaking Prematurely in China and India (Part II)

DATA INSIGHT………………

· India & SAARC: Energy Trade

[NATIONAL: OIL & GAS]

Upstream…………………………

· RIL to produce 23 mmscmd from gas finds in KG-D6: Oil Ministry

· Essar Oil to ramp up coal gas production in Bengal

Downstream……………………………

· Fifth LNG terminal proposed in Gujarat

Transportation / Trade………………

· India's May Iran oil imports hit highest since March 2014

· RIL to get $1 bn from sale of stake in US shale gas JV

· IOC signs agreement to buy 0.7 mn tonnes LNG a year from US

· GAIL sells some of its US LNG to Shell

Policy / Performance…………………

· India's natural gas output projected to rise 60 percent in 4 yrs

· ATF price hiked by 7.5 percent, non-subsidised LPG by ` 10.50

· IOC shifts focus to expanding natural gas business

· ONGC sees new subsidy rules boosting first-quarter profit

· Govt to ensure exploration companies get faster approvals for their projects

· AP govt waives VAT on natural gas for two years

[NATIONAL: POWER]

Generation………………

· GMR Energy may start operations at stranded gas and coal-based power stations

· Gujarat thermal power plants set for major overhaul

· 'Work on Jaitapur nuclear power plant project likely to begin in 2 yrs'

· Hindustan Power projects commissions first unit of 600 MW plant

· Increase of 8.4 percent in power generation since 2014: Goyal

· Manipur to get 400 KW power project soon

· NLC aims 12.2 GW capacity by end of 13th five year plan

Transmission / Distribution / Trade……

· PGCIL plans to invest ` 225 bn in FY16

· Alstom produces its 200th 765kV transformer and reactor

· MNCs like Alstom, ABB & Siemens turn aggressive with power transmission bids

· Distribution companies launch power-saving measures to meet electricity demand

Policy / Performance…………………

· Jharkhand wants Tilaiya UMPP under ‘plug and play’ model

· Odisha to have 12 percent surplus power in peak period in 2015-16

· Tamil Nadu to ease out power cuts for industries from June 5

· Small hydro projects to be set up in Haryana: Haryana CM

· India will open 60 new coal mines to boost coal supply

· India sees lowest plant load factor in 15 yrs

· African countries to sign MoU with power surplus Gujarat

· Govt rescues Athena hydel project in Sikkim

· DERC may hike power tariff by 20 percent over delayed power purchase charges

· Coal linkage to Katwa power plant will help NTPC

· Power capacity addition at record 22.5 GW in 1 year: Goyal

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Russia keeps oil output at post-Soviet high before OPEC meet

· Petrobras and ONGC find new oil reservoir off Brazil's Sergipe

· OVL qualifies for Mexico oil block auction

· Indonesia's Pertamina proposes to take over Sanga-Sanga oil block

· Colombia's Ecopetrol plans to boost oil production by 20 percent by 2020

· CNOOC makes oil discovery at Liuhua 20-2 block in South China Sea

· Total reaches 2 bn barrel milestone offshore Angola

· Egypt extends gas exploration tender by 2 months and adds 4 blocks

· Venezuela, Russia's Rosneft agree on $14 bn oil, gas investment

Downstream……………………

· Taiwan's CPC Corp offers first gasoil cargo in 5 months

· $430 mn Dakota Prairie Refinery begins diesel sales

Transportation / Trade…………

· Thai PTT seeks to secure LNG imports with global suppliers

· Statoil extends gas supply contract with SSE

· OPEC oil output in May reaches highest since 2012

· Global LNG-prices capped by weak Asian demand

· GE, Shell sign deal to promote LNG adoption by trucking industry

· Jordan receives FSRU for its first LNG import terminal project

· MPPE seeks foreign partner in fuel distribution

· Peru says to open bidding this year on LPG pipeline

Policy / Performance………………

· Venezuela says cooperation best way to achieve oil stabilisation

· OPEC hopes for further oil price recovery despite glut

· Oman plans to invest US$7bn in Indonesian oil sector

· US gas prices edge up to $2.84 a gallon

· Somalia may pay 90 percent of oil revenue to explorer under draft deal

· China set to grant its first licence for imported oil to non-major refiner: NDRC

· Algeria PM says ready to relaunch Galsi gas project

· Federal govt orders pipeline company to clean California oil spill

[INTERNATIONAL: POWER]

Generation…………………

· One Asia plans 1.2 GW gas-fired power plant in Quang Tri

· Russia to begin building Iran’s 2nd nuclear power plant

· Medco and Harum Energy plan 2 GW coal-fired power project in Indonesia

· Marubeni takes part to 400 MW gas-fired power project in Myanmar

· Nuclear power generation set to restart in Japan

· Bolognesi signs contract for two 1.5 GW CCGT power projects in Brazil

Transmission / Distribution / Trade……

· Fortum completes sale of its electricity distribution assets in Sweden

· China nuclear power firms merge to fuel global clout

Policy / Performance………………

· Japan govt too bullish on nuclear role by 2030

· Texas regulators allowed coal-fired power plant owners to raise pollution limits far above federal standards

· Norway wealth fund faces ban on investing in coal assets

· Czech Republic plans nuclear tender in late 2016

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Azure Power commissions 10 MW solar plant in Chhattisgarh

· Govt’s target to set up 100 GW of solar plants drives local, foreign companies

· Goyal supports tax sops for roof top solar panel

· Researchers from Rajkot develops pollution free coal

· 'India's proposal on HFC will reduce emissions to 64 percent by 2050'

· New renewable energy model combines solar, bio-gas and H2

GLOBAL………………

· US EPA raises biofuel target under the RFS

· Scientists to launch $150 bn initiative to accelerate renewable energy projects worldwide

· Exxon CEO says Europe should see climate benefits of shale gas

· Europe's top oil firms jointly call for carbon pricing

· Renewables' share in US energy consumption peaked in 2014

· UN fosters use of pre-2020 carbon credits for climate plans

· Abengoa wins environmental approval for 210 MW solar project in Chile

· California-Quebec carbon permits sell out at $12.29 in auction

· Climate change will inform Alberta energy policy

· Algeria plans to commission 343 MW of solar PV by the end of 2015

· SunEdison to develop 14 MW of solar plants on Long Island

· US govt plan to protect sage grouse would limit O&G

· Egypt expects US$45bn investment in renewables by 2025

· Nippon Paper completes 5 MW biomass power plant in southern Japan

· UK aims to maximise oil production as wind loses out

· Mexico could cover 46 percent of its power mix with renewables by 2030

· Low Carbon gets $163 mn from Macquarie for UK solar

[WEEK IN REVIEW]

ANALYSIS / ISSUES……………

Carbon Emissions: Peaking Prematurely in China and India (Part II)

Lydia Powell and Akhilesh Sati, Observer Research Foundation

Continued from Volume XI, Issue 49

|

I |

n part I of this article we noted that the beginning of the end of coal demand growth in China began in 2015 and that decline in absolute demand for coal in China is expected by 2030. Though growth in coal demand from India is likely to continue well past 2030, India’s growth (in demand for coal) will not be comparable in scale to the demand growth from China in the previous two decades (Chart 2, please refer Volume XI, Issue 49).

Climate Tracker, a group that describes itself as ‘a team of financial specialists making climate risks real’ has attempted to present the decline in growth in demand for coal as exhibit 1 in its self proclaimed attempt to ‘make climate risks real’. In its report released in March 2015 celebrating the ‘coal crash’ in the United States, it argues that the decline in demand for coal in OECD countries will not be made up by China and India. It points out that the price of seaborne thermal coal has weakened and much of exported production (to China and India) will not cover costs and that future prices of coal are unlikely to show much improvement.[5] It also points out that China’s coal consumption fell for the first time in 14 years by 2.9 per cent and predicts that China’s coal consumption will peak before 2020. Carbon Tracker may be right but this may not much to do with China’s efforts to decrease carbon emissions. Other reports on the decline of coal demand in China roughly say the same thing as Climate Tracker.

The Economist in its last issue for March 2015 points out that China’s coal consumption decreased by 1.6 percent in 2014 despite economic growth of 7.3%.[6] It observes that though the coal industry has capabilities to cope with cycles in the coal business, the current slowdown could be a structural shift driven by (1) China following the western world in beginning to phase out coal (2) India increasingly producing its own coal and (3) gas displacing coal in most other coal consuming countries.

Is the peak in coal demand part of natural course of things rather than the result of policy shifts enforced by China (and to a lesser extent India) on account of carbon emissions as the reports quoted above claim? A more comprehensive and objective look at developments in the coal sector show that shifts in demography and the changes in manufacturing productivity appear to be closely correlated to the decline in demand for coal rather than policies to reduce the use of coal on account of carbon emissions. If we take a short digression into demographic shifts and structural changes in the economies of China and to a lesser extent India the close correlations become visible.

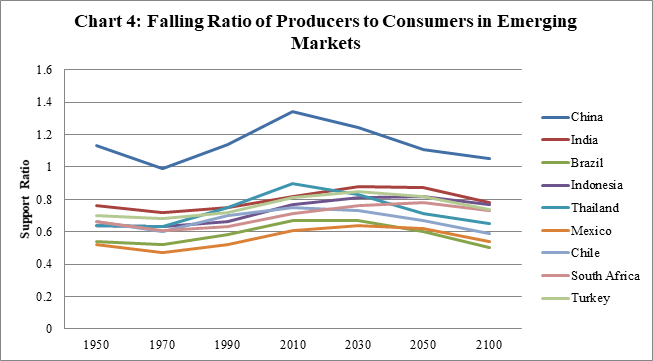

Demographic shifts as a driver of change is something we often overlook. Peter Drucker, a management expert argued that while it was sensible for investors in real estate to focus on ‘location, location and location’, the rest of us (including those who have made it our mission to write obituaries for coal and other fossil fuels) must focus on ‘demographics, demographics and demographics’. In 1937 John Maynard Keynes pointed out that ‘a change-over from an increasing to a declining population may be very dangerous.’ In 1938 Alvin Hansen, another economist worried that ‘America was running out of people, territory and new ideas and that the result was secular stagnation.’[7] The secular stagnation that Keynes and Hansen feared may be unfolding now in China. Recent studies[8] show that most of the world, excluding Africa and some parts of South America is now at a point where the support ratio defined as the ratio of producers to effective consumers is shifting sharply from being beneficial to being adverse (Chart 4).

Source: Charles Goodhart & Philipp Erfurth, 2014, Demography and economics: Look past the past, November 4th 2014, VoxEU.org

Chart 4 shows the decline in support ratio for China begins around 2010 and will continue for the foreseeable future. For India though the decline in support ratio does not begin until 2040, it does not cross 1 in the entire period. Support ratios above 1.2 in the period 1990-2013 in China explains the tremendous boost to manufacturing in China and consequently the dramatic increase in coal consumption.

In the period 2013-2050, support ratio begins to decline in China but it is still above 1 compared to less than 1 for India. The reasons are beyond the scope of this article but the point to note is that China is unlikely to see similar support ratios in the period 2013-2050.

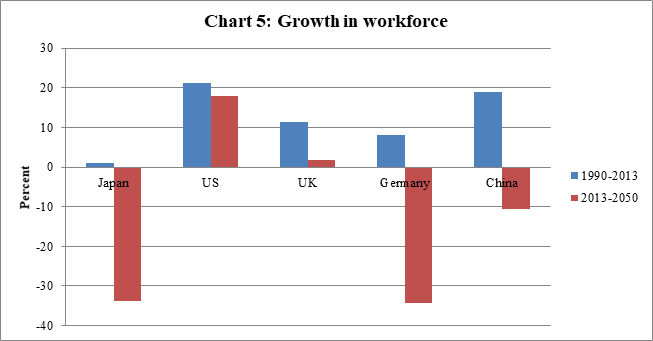

Apart from the fall in support ratio, the absolute number of those in working age (20-65 years) is beginning to decline and it is expected to be much lower in the next 35 years (2015-50) than the past 35 years (1980-2015). China is expected to see a 10 percent decrease in workforce in the period 2013-2050 compared to an increase of over 18 percent in the period 1990-2013.

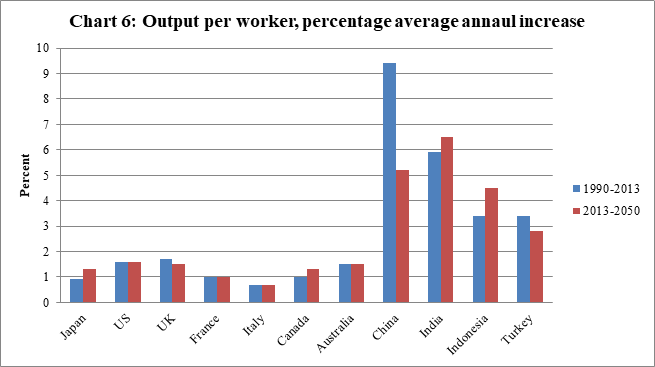

Though the decrease in workforce is much worse for Japan and Germany, in the context of coal consumption what matters is the change in China (Chart 5). Furthermore, the slower growth in the number of workers is expected to slow down absolute economic growth rate if there is no change in growth of output per worker (productivity Chart 6).

Source: Charles Goodhart & Philipp Erfurth, 2014, Demography and economics: Look past the past, November 4th 2014, VoxEU.org

Speaking at a World Resources Institute event this month (June 2015) Zou Ji, Deputy Director General, National Centre for Climate Change, China, underlined the importance of the Joint Announcement from the world's top two economies and emitters USA and China. He noted the significance of China's aim to peak emissions before reaching the income level of USD 20-25,000 per person. The question is whether China will reach incomes of USD 25,000 per person ever in the context of the dramatic change in coal consumption? What incomes will Indians have when its emissions peak? What do historical records of other countries show? We will look at these questions in part III of this article.

to be continued.......

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

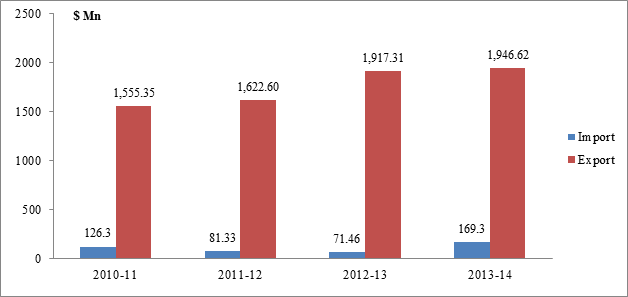

DATA INSIGHT……………

India & SAARC: Energy Trade

Akhilesh Sati, Observer Research Foundation

|

Trade ($ Million) |

Apr 12-13 |

Apr 13-14 |

% Growth |

|

Import |

|||

|

Petroleum (Crude & Products) |

71.46 |

169.3 |

137 |

|

Coal |

0.53 |

3.28 |

517 |

|

Export |

|||

|

Petroleum (Crude & Products) |

1,917.31 |

1,946.62 |

2 |

|

Coal |

154.96 |

172.07 |

11 |

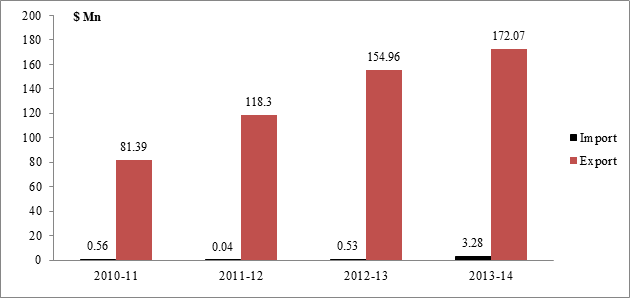

Trends in Coal Trade between India & SAARC

Trends in Petroleum Trade between India & SAARC

Source: Ministry of Commerce & Industry.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

RIL to produce 23 mmscmd from gas finds in KG-D6: Oil Ministry

June 2, 2015. Reliance Industries Ltd (RIL) will produce 23 million standard cubic meters per day (mmscmd) of more gas from five discoveries in the flagging KG-D6 block by 2016-17, the Oil Ministry said. The Ministry said 10 mmscmd gas will come from four satellite fields of D-2, D-6, D-19 and D-22 in the eastern offshore Krishna Godavari basin block KG-D6 and another 13 mmscmd from D-34 discovery. RIL and its partners BP plc of UK and Canada's Niko Resources currently produce natural gas from Dhirubhai-1 and 3 (D1&D3) and oil and gas from MA1 field in the KG-D6 block. Gas output from them averaged 11.5 mmscmd in January-March quarter. The Ministry said of the 254 blocks awarded for exploration of oil and gas under nine rounds of New Exploration Licensing Policy (NELP) since 1999, only 96 are operational with the rest being relinquished for either poor prospectivity or operational difficulty.

The most number of discoveries, 51 are by RIL. These are made up 12 oil discoveries and 39 gas finds. Its KG-DWN-98/3 or KG-D6 block alone has 19 oil and gas finds. Oil and Natural Gas Corp (ONGC) made 45 discoveries (14 oil and 31 gas). While 23 mmscmd was listed as output from RIL's five finds in KG-D6 block, it said Gujarat State Petroleum Corp (GSPC) is to produce 1 mmscmd initially from its Deendayal block KG-OSN-2003/1 in KG basin and a peak of 5 mmscmd by 2016-17. The Ministry said all of the $ 14.496 billion investment committed in nine rounds of NELP have come in. Besides, $ 9.424 billion investment has come in as expense for developing oil and gas finds, the most $ 7.76 billion in NELP-1. Almost all of the development expense in NELP-1 was in KG-D6 block.

RIL's D-34 or R-Series discovery in KG-DWN-98/3 or KG-D6 block is estimated to hold 2.2 trillion cubic feet of reserves and $ 3.18 billion is being spent on bringing it to production. The four satellite gas discoveries of D-2, 6, 19 and 22 hold 617 billion cubic feet of reserves. The partners are investing $ 1.529 billion in developing the fields. RIL-BP also have other satellite fields of D-29, 30, 31 as well as the significant MJ-1 field for which field development plans detailing investment and likely production have so far not been firmed up. (economictimes.indiatimes.com)

Essar Oil to ramp up coal gas production in Bengal

May 31, 2015. Essar Oil is in the process of ramping up production of coal bed methane (CBM) by four times. Raniganj, the flagship asset in CBM, has already achieved production of 0.62 million standard cubic meters per day, Essar Oil said. The project was the first of its kind in India aimed to responsibly produce methane gas from the coal seams located 1,000 meters or deeper below the ground, Essar Oil said. Essar Oil remained optimistic on completing the development programme ahead of the May 2016 deadline as per the contract with the government. Essar Oil had said the total investment outlay in the project would be around ` 4,000 crore. (timesofindia.indiatimes.com)

Downstream………….

Fifth LNG terminal proposed in Gujarat

May 28, 2015. A fifth LNG terminal has been proposed by a private company in Nana Layja village of Kutch. The proposer company, Gujarat Integrated Maritime Complex Pvt Ltd (GIMCPL), a subsidiary of IL&FS Maritime Infrastructure Company Ltd, plans to development a ship yard cum captive jetty in the same complex. The LNG terminal is likely to be of 5 MMTPA (million metric tonnes Per annum) capacity.

Gujarat already has two LNG terminals operational at Hazira and Dahej with combined capacity of 17.5MMTPA, while two are under construction at Jafrabad in Amreli and Mundra in Kutch with 5 MMTPA capacity each. According to company, the LNG terminal will complement gas supply to the 2,000MW gas-based power plant the IL&FS group was planning in its energy special economic zone (SEZ) and the Free Trade Warehousing Zone (FTWZ) at Nana Layja village in Mandvitaluka of Kutch. (timesofindia.indiatimes.com)

Transportation / Trade…………

India's May Iran oil imports hit highest since March 2014

June 2, 2015. India's imports of Iranian crude oil rose last month to their highest level since March 2014 as refiners boosted purchases ahead of a final push by international negotiators to reach a deal on Tehran's disputed nuclear programme by end-June. The jump to a 14-month high comes just two months after India dropped its crude imports from Iran to zero under U.S. pressure to limit its purchases of the Islamic republic's oil. In March this year India did not take any Iranian oil for the first time in at least a decade. Many analysts say Tehran, the United States, Britain, France, Germany, Russia and China will reach an agreement by or shortly after a June 30 deadline for a deal, although the sanctions that have cut Iran's oil exports to less than half of pre-2012 levels aren't likely to be lifted until next year.

India, the world's fourth biggest oil consumer and Tehran's top client after China, shipped in 367,900 barrels per day (bpd) of Iranian crude in May in nine vessels, up 39 percent over April, according to data from trade sources. The May imports surged by two-thirds from a year ago, the data showed. Still, over January-May, India took 203,100 bpd from Iran, about 33 percent less oil than in the same period last year, as the nation's refiners cut imports in the first quarter to keep overall imports from the OPEC producer to a 2013/14 level of about 220,000 bpd. Mangalore Refinery and Petrochemical Ltd was Iran's biggest Indian client in May shipping in about 207,400 bpd from Iran, the data showed. MRPL stepped up purchases in May ahead of a three-month shutdown during the coming monsoon season of a single point mooring site that allows it to import oil in very large crude carriers, the data showed. Indian Oil Corp (IOC) received about a million barrels of Iranian oil in May, the data showed. In the first two months of the fiscal year that began in April India's Iran oil imports surged by 42 percent to 316,800 bpd, the data showed. (uk.reuters.com)

RIL to get $1 bn from sale of stake in US shale gas JV

June 1, 2015. Reliance Industries Ltd (RIL) will sell its 49.9 percent stake in a US joint venture (JV) that owns a pipeline network for transportation of shale oil and gas to New York-listed Enterprise Products Partners for $1.07 billion. Pioneer Natural Resources Company and Reliance Holding USA, an RIL subsidiary, will sell their Eagle Ford Shale Midstream business (EFS Midstream) for $2.15 billion to an affiliate of Enterprise Products Partners LP. EFS Midstream is in the business of treating, compression and condensate processing of shale gas at the Eagle Ford sedimentary rock formation located at South Texas. The purchase price will be paid in two instalments — $1.15 billion up front and the remaining $1 billion latest within a year from the closure of the deal. The deal is likely to be closed by the third quarter of 2015. Enterprise will pay Reliance approximately $574 million in cash at closing and make the final payment of $499 million in cash on or before the first anniversary of the closing date. The Eagle Ford assets, spread over 230,000 acres, have become more attractive after the US Commerce Department, in June last year, gave Pioneer permission to export a type of ultralight oil known as condensate produced from the region. Besides Eagle Ford, RIL has two more shale ventures in the US — a 40 percent stake in Chevron’s Marcellus shale acreage and a 60 percent interest in Carrizo Oil and Gas Inc’s Marcellus shale acreage in Central and Northeast Pennsylvania. (www.thehindubusinessline.com)

IOC signs agreement to buy 0.7 mn tonnes LNG a year from US

May 29, 2015. Indian Oil Corp (IOC) said it has signed an interim agreement to buy 0.7 million tonnes a year of LNG from US on a long-term contract beginning 2018. It last year bought 1.2 million tonnes a year of liquefied natural gas (LNG) for 20 years with Pacific North West LNG project of Canada. Delivery is expected to commence by 2020. IOC has signed an agreement with Mitsubishi Corp of Japan for 0.7 million tonnes a year of LNG for 20 years from Cameron LNG project in USA. The delivery is expected to start from the first quarter of 2018. IOC said an interim sale purchase agreement has been signed with Mitsubishi Corp which now has to be converted into a firm Gas Sales and Purchase Agreement (GSPA). LNG from US will be imported at IOC's under-planning Ennore import terminal in Tamil Nadu. (www.business-standard.com)

GAIL sells some of its US LNG to Shell

May 27, 2015. GAIL (India) Ltd has sold some of its liquefied natural gas (LNG) from the U.S. portfolio to European energy major Royal Dutch Shell ahead of production from early 2018, its head B.C. Tripathi said. GAIL has a deal to buy 3.5 million tonnes per annum (mtpa) of LNG for 20 years from U.S.-based Cheniere Energy and has also booked capacity for another 2.3 mtpa at Dominion Energy's Cove Point liquefaction plant. Tripathi refused to elaborate on the volumes, pricing and duration of the deal with Shell but a trade source said GAIL has sold at least 0.5 mtpa LNG to Shell. GAIL would also issue an LNG swap tender in two months to cut transport costs for supplies to India, he said, adding 0.5 million tonnes of its U.S. LNG has already been booked by local clients while talks were ongoing with domestic and foreign firms for more such deals. GAIL was keen to swap about 2 mtpa of its LNG, Tripathi had said. India's gas demand is set to rise as the federal government has approved policies to boost power and fertiliser production using imported gas. Gas demand in the world's second most populous nation however declined in the quarter ending in April as alternative fuel like furnace oil turned cheaper due to rout in global oil markets. Also prices of gas sourced under a long-term deal with Qatar have turned costly tapering the demand for the cleaner fuel. He said India has used a 10 percent reduction permissible under a 25-year contract with Qatar's RasGas to import up to 7.5 mtpa the super cooled fuel. This is the first time India has exercised its right to lift less volumes since the start of contract in 2004. GAIL has rights to sell about 60 percent of the gas volumes sourced under the long-term deal with Qatar. (www.reuters.com)

Policy / Performance………

India's natural gas output projected to rise 60 percent in 4 yrs

June 2, 2015. India's natural gas output will rise about 60 percent in four years, sufficient for less than 30 percent of the local gas demand then, according to a projection in the annual report of the oil ministry. The local gas production is expected to rise to 146.87 million metric standard cubic metres per day (mmscmd) in 2018-19, from 90.99 mmscmd in 2014-15. The projected output for 2014-15, however, was 98.15 mmscmd. The output is expected to touch 99.87 mmscmd in the current fiscal year. The demand for natural gas has been projected to increase to 523 mmscmd by 2018-19 from 405 mmscmd in 2014-15, mainly driven by the power, city gas and industrial customers. In the current fiscal year, the demand is expected to climb 10 percent.

The demand of gas is highly price sensitive, and the actual demand has varied widely from the projection in the past, the report warned. A lower availability of cheap local gas and expensive liquefied natural gas (LNG) imports have kept many of India's power plants idle or underutilized. Local gas production fell 5.5% in 2014-15, when the country imported nearly a third of the natural gas it consumed. The government has taken several steps to enhance the availability of gas in the country, including intensification of domestic exploration and production activities, development of shale gas policy framework, import of LNG, exploration in the Mining Lease Area with certain conditions and acquisition of overseas oil and gas assets, the report said. (economictimes.indiatimes.com)

ATF price hiked by 7.5 percent, non-subsidised LPG by ` 10.50

June 1, 2015. Jet fuel price was hiked by a steep 7.5 percent and rates of non-subsidised cooking gas (LPG) by ` 10.50 per cylinder in step with global firming of rates. Price of aviation turbine fuel (ATF), or jet fuel, in Delhi was raised by Rs 3,744.08 per kilolitre (kl), or 7.54 percent, to ` 53,353.92, oil companies announced. On May 1, ATF price was hiked by a marginal ` 272 per kl or 0.5 percent to ` 49,609.84. Following global trends, the price of non-subsidised or market-priced domestic cooking gas (LPG) was hiked to ` 626.50 per 14.2-kg cylinder in Delhi from ` 616. The price hike comes on the back of a ` 5 per 14.2-kg cut in rates effected from May 1. Non-domestic LPG, which consumers buy after exhausting their quota of 12 bottles of 14.2-kg each at subsidised rates, will cost ` 626.50 as against ` 616 per 14.2-kg cylinder. Households are entitled to 12 cylinders of 14.2-kg each or 34 bottles of 5-kg each at subsidised rates of ` 417 or ` 155, respectively in Delhi.

Any requirement beyond this has to be bought at the market price. While the market priced or non-subsidised 14.2-kg cylinder will cost ` 626.50, the in 5-kg pack will cost ` 318.50. Following similar trends, rates of market-priced 19 kg LPG cylinder has been hiked to ` 1,151 per bottle from ` 1,134. Rates vary from state-to-state depending on the incidence of local sales tax or VAT. Jet fuel constitutes over 40 percent of an airline's operating costs and the price cut will reduce the financial burden on cash-strapped carriers. State-owned fuel retailers, Indian Oil Corp (IOC), Bharat Petroleum Corp (BPCL) and Hindustan Petroleum Corp (HPCL) revise jet fuel and non-subsidised LPG prices on the first of every month based on average imported cost and rupee-dollar exchange rate. The same on petrol and diesel is done on a fortnightly basis. (economictimes.indiatimes.com)

IOC shifts focus to expanding natural gas business

May 30, 2015. Indian Oil Corp (IOC), the country's biggest refiner, is expanding its natural gas business as the south Asian nation, the world's third-largest carbon emitter, aims to cut its dependence on coal and oil. Thirteen of the world's 20 dirtiest cities are in India, with New Delhi taking top spot, a report by the World Health Organisation said. As part of Prime Minister Narendra Modi's "Clean India Mission", the country launched an air quality index to help citizens understand complex pollution data and its implications for their health. IOC is the country's biggest fuel retailer, meeting 46.7 percent of India's fuel demand through its 24,400 fuel stations. India, the world's fourth-biggest oil consumer, is expanding its gas import infrastructure to increase usage of the cleaner fuel and raise its share in the country's overall energy mix from the current 8 percent. IOC already supplies compressed natural gas (CNG), widely used in urban public transit, through its 160 stations. The facility would be installed in fuel pumps in cities that need to use gas for public transport. (dc.asianage.com)

ONGC sees new subsidy rules boosting first-quarter profit

May 29, 2015. Oil and Natural Gas Corp (ONGC) said it expects current-quarter profit to be boosted by an interim rule change on discounts offered by upstream oil companies to state retailers. ONGC, majority-owned by the government, reported net profit down nearly a fifth from a year earlier to ` 39.35 billion ($616 million) in its fiscal fourth quarter to March 31, missing analysts' estimates averaging 54.91 billion. India keeps a lid on retail prices of liquefied petroleum gas and kerosene to tame inflation, with upstream companies such as ONGC and Oil India Ltd (OIL) offering discounts on crude sales to help cut the losses of state refiners.

For the June quarter, the oil ministry has set interim rules to exempt upstream state firms from giving any discounts on crude and refined fuels if global oil prices average up to $60 a barrel this quarter. For prices above $60 a barrel the companies will have to give a discount of 85 percent of the incremental oil price increase and the discount will rise to 90 percent for prices beyond $100 a barrel. ONGC did not have to pay any discount in the March quarter as crude prices fell sharply and the government was working on new subsidy rules as part of broader reforms in the sector. Still, its net profit was lower than a year earlier due to higher costs and tax outgoings. (in.reuters.com)

Govt to ensure exploration companies get faster approvals for their projects

May 28, 2015. The oil ministry has accelerated the pace of approvals for explorers' budgets and work programmes, ensuring that companies begin the current fiscal with clear investment plans, as opposed to previous years when operators would complain of uncertainty due to delays. Faster approval is part of the government's plan to boost oil exploration and production activity in the country. India currently imports 78% of its crude oil requirement.

Prime Minister Narendra Modi has set an ambitious target of raising crude oil output to cut import dependence by 10% in seven years. The government held about 100 meetings of the management committee in March, many times more than the usual number of such meetings, to consider and approve operators' annual budgets and work programmes, the oil ministry said.

The management committee comprises representatives of the government, regulator (directorate general of hydrocarbons) and the operator, and all must agree on the operator's work-plan. In India, the rule allows operators to recover cost before sharing profit with the government, and to ensure that the cost incurred by the operator is genuine, the committee must approve all cost proposals. Ordinarily, the work-plan proposed by the operator must get approved before the beginning of the following fiscal year to offer certainty to operators. (economictimes.indiatimes.com)

AP govt waives VAT on natural gas for two years

May 27, 2015. The Andhra Pradesh (AP) government has issued orders withdrawing the Value Added Tax (VAT) on regasified liquefied natural gas (RLNG). The gas is being supplied to private promoters by Gas Authority of India Ltd (GAIL) and Gujarat State Petroleum Corporation Limited (GSPCL). The commercial taxes department issued GOs (No. 181 and 182) exempting VAT on RLNG and bio-gas for two years.

The exemption is estimated to result in a loss of ` 2,300 crore revenue to the exchequer for the two-year period. The TDP government said it was providing the exemption to join the gas pooling system launched by the Centre to avail the RLNG supply through e-bidding. Earlier, the commercial taxes department had said that the proposed VAT exemption on gas would result in a loss of ` 1,100 crore per year to the state exchequer and cautioned that such a move would end up benefiting the private power companies, which are in financial doldrums as their units have been shut due to lack of gas. However, according to sources, energy department officials successfully convinced chief minister Chandrababu Naidu to agree to the VAT exemption on the plea that the stranded power units can resume operations by availing RLNG supplied by GAIL and GSPCL. (timesofindia.indiatimes.com)

[NATIONAL: POWER]

Generation……………

GMR Energy may start operations at stranded gas and coal-based power stations

June 2, 2015. GMR Energy expects to begin operations at its stranded gas and coal-based power stations in the next couple of months as it has won two coal mines in the recent auctions and secured imported gas supply under the reverse auction process, the company said. GMR Energy has coal security for all its coal-based assets worth 3,000 MW, while its two gas-based plants — GMR Vemagiri Power Generation Ltd and GMR Rajahmundry Energy — with a combined capacity of 772 MW have won imported gas supply through the government's reverse auction process. The gas supply will allow the plants to run at 25 percent capacity during June-September and sell power for ` 6.14 per unit to distribution companies. As per the scheme the government will subsidise the distribution companies to the extent of ` 1.44 per unit from the Power Sector Development Fund. The company's 1,370 MW Chhattisgarh power plant is expected to start commercial operations soon with fuel assurance from two captive coal blocks. GMR said the Talabira-I coal mine in Odisha, which it secured in the auction, is expected to become operational this month. (economictimes.indiatimes.com)

Gujarat thermal power plants set for major overhaul

June 1, 2015. State-run thermal power plants in Gujarat are set for a major overhaul. This would make them more energy efficient; reduce variable cost of power generation and maintenance cost. The state power generation company Gujarat State electricity Corporation Limited (GSECL) has decided to replace existing old and inefficient units by new supercritical technology units. First phase would see replacement of over three decade old 120 MW units at Gandhinagar, Ukai and Sikka thermal power plants. Current GSECL is having total installed thermal power capacity of 5884 MW using fuels like coal, lignite and gas. It operated runs over a dozen power plants including hydro power plants in the state. This is first major initiative of the state government to improve the efficiency of the state-run power plants. GSECL has commissioned a feasibility study to replace the existing units with super critical technology. In the first phase, two 120 MW units each in Gandhinagar, Ukai and Sikka thermal power plant will be replaced. Recently, GSECL awarded ` 206 crore contract to renovate and modernize two steam turbines at Ukai and Wanakbori thermal plant. Under this contract the 200 MW turbines at Ukai and Wanakbori would be retrofitted to increase its efficiency by around 14 percent from existing operating conditions thereby reducing coal consumption and carbon dioxide emissions. (timesofindia.indiatimes.com)

'Work on Jaitapur nuclear power plant project likely to begin in 2 yrs'

May 31, 2015. Spurred by two agreements signed during Prime Minister Narendra Modi's recent visit to France, work on the Jaitapur nuclear power plant is likely to start in the next two years, French government said. The Nuclear Power Corporation of India Ltd (NPCIL) and Areva had last month during Modi's visit to France signed a pre-engineering agreement that discussed technical and financial modalities on how to take the project forward. Areva had signed an agreement with Larsen & Toubro under which equipment could be built for reactors. The pre-engineering agreement will not only help in the financial and technical optimisation of the project but will also contribute towards addressing the licensability of the reactors as per the guidelines of the Indian regulator, Atomic Energy Regulatory Board. The agreement between Areva and L&T, on the other hand, will help in localisation efforts. India has already told France that it cannot move ahead if the cost per unit shoots up to ` 6.50 per unit. NPCIL has already acquired land at the Jaitapur site in Maharashtra and has built the basic necessary structures. Fencing has been done at the site, where six reactors with a capacity of 1,650 MW each are expected to come up. (zeenews.india.com)

Hindustan Power projects commissions first unit of 600 MW plant

May 29, 2015. Hindustan Powerprojects commissioned the first unit of 600 MW of its Anuppur thermal power plant at Jaithari village near Anuppur. In the second phase, two units of 660 MW each (2x660 MW) will be raised by the company at its Jaithari Power station in Madhya Pradesh (MP), which will have a total installed capacity to generate 2,520 MW electricity. Power from the project will be wheeled to Madhya Pradesh and Uttar Pradesh (UP), which have already signed power-purchase agreements with Hindustan Powerprojects, it said. The coal required to run the project will be secured from the South Eastern Coalfield. This project will play a key role in addressing power sufficiency in MP and UP, it said. (economictimes.indiatimes.com)

Increase of 8.4 percent in power generation since 2014: Goyal

May 31, 2015. Coal, Power and Renewable Energy Minister Piyush Goyal claimed that the Modi-led government is working for the welfare of the last man at the bottom of the pyramid, noting that there has been an overall increase in power generation by 8.4% since last year. Goyal said that over the last one year, the cost of LED bulbs has come down drastically. (www.business-standard.com)

Manipur to get 400 KW power project soon

May 29, 2015. The Northeastern state of Manipur will soon get a 400 KW power project at an estimated cost of ` 124 crore. This was announced by Union minister for Development of North Eastern Region (DoNER), Jitendra Singh, after having a meeting with the state's chief minister Okram Ibobi Singh in Imphal, the state capital. The DoNER minister informed that work on the National Sports University for Manipur, announced by the Prime Minister during his visit in November, would start soon. He said that he had been informed by Manipur chief minister that the state government had acquired 300 acres of land for the purpose at village Yathivi around 25 km from Imphal. (www.business-standard.com)

NLC aims 12.2 GW capacity by end of 13th five year plan

May 28, 2015. Neyveli Lignite Corp (NLC) plans to achieve a total generation capacity of 12,221 MW by the end of the 13th five year plan in 2022, against 2,990 MW at present, the company said. NLC expects to achieve a lignite mining capacity of 49 million tonnes per annum (MTPA) by that year, compared to 30.60 MTPA in the lignite mines of Tamil Nadu/ Rajasthan at present, NLC said. This would result in total power generating capacity going up to about 12,221 MW against 2,990 MW in NLC-owned power projects in Tamil Nadu/ Rajasthan, NLC said. NLC said work is on to erect a 1,000 MW unit at Neyveli and another 250 MW plant in the town. NLC said the 1,000 MW thermal power plant (2x500 MW) at Tuticorin, a joint venture between NLC and Tamil Nadu Power Limited, is expected to go on stream in June this year. The 4,000 MW coal-based Sirkali thermal power project in Nagapattinam district is also under the active consideration of NLC and they are constantly pursuing the matter with the state government to get in-principle approval for land allocation, NLC said. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

PGCIL plans to invest ` 225 bn in FY16

June 2, 2015. Power Grid Corp of India Ltd (PGCIL) is planning to invest ` 22,500 crore this fiscal to fuel its expansion plans. The company has already deployed ` 4,000 crore for various projects in the last two months. The company has earmarked a capital expenditure of up to ` 1 lakh crore for five years, ending 2016-17. The company has planned to raise up to ` 12,000 crore through domestic bonds during the year. PGCIL currently owns and operates transmission network of about 1,15,600 ckm and 192 extra high voltage double current (EHVAC) and high voltage double current (HVAC) substations having transformation capacity of more than 2,31,000 MVA. (www.business-standard.com)

Alstom produces its 200th 765kV transformer and reactor

May 29, 2015. Alstom has produced its 200th unit of the 765kV transformer and reactor from its facility at Vadodara in Gujarat. Since its inception in March 2009, this plant has gradually ramped up its production capabilities, the company said. Alstom supplies its transformers to Power Grid Corp of India and state utilities including Uttar Pradesh Power Transmission Company, Rajasthan Rajya Vidyut Prasaran Nigam and Maharashtra State Electricity Transmission Company, apart from independent power producers such as Larsen & Toubro and Essar. (economictimes.indiatimes.com)

MNCs like Alstom, ABB & Siemens turn aggressive with power transmission bids

May 28, 2015. Multinational companies (MNCs) have made a comeback in power transmission projects in India, with parent companies of Alstom, ABB and Siemens picking up big-ticket orders following aggressive bidding. Aggressive bidding is likely to continue even in 2015-16, given that these companies are keen to secure more orders in India to offset the impact of slowdown in their local markets, according to sector players. Even companies from Korea, China and Japan have stepped up their bidding to grab more orders. The foreign firms together have picked around 35% of around Rs 20,500 crore of orders awarded by Power Grid Corp of India Ltd (PGCIL) in 2014-15, according to industry data. This compares with around 20% of the orders a year ago. The local markets for most MNCs are witnessing a slowdown and they do not have many jobs to bag. Given the oversupply in their local markets, many of these companies are keen to sell to India, even at lower profits. (economictimes.indiatimes.com)

Distribution companies launch power-saving measures to meet electricity demand

May 28, 2015. With electricity demand continuing to be in an upward spiral due to the heat wave, power distribution companies have turned their attention to energy conservation schemes to bridge the demand-supply gap. While the power utilities claim they are prepared for an anticipated 6,400 MW peak power demand this summer, they have also launched numerous energy saving measures to help meet the peak afternoon and late evening demand. Delhi witnesses an annual growth of 15 percent-20 percent in power demand in summers and last year it peaked at close to 6,000 MW. Currently, the demand is approximately 5,500 MW, but power sector officials said it will rise in late June and July. It's not just Delhi which witnesses unprecedented power demand this time of the year. There is always an acute shortage in the northern region with all states scrambling to meet rising load and turn to overdrawing from the Northern Grid. This year, power firms have turned inventive and rolled out various energy saving measures. From June 1, an LED scheme will be launched. Industry officials estimate annual savings of up to 500 million units if everyone switches from incandescent bulbs to LEDs. Each registered consumer can get up to four LEDs at subsidized rates, thereby saving 125 kWH per year. Delhi has about 42 lakh power consumers for whom Energy Efficiency Services Limited is planning to procure about 1.5 crore LED lights. Also, from mid-June, north and northwest Delhi residents will have another way of conserving energy. DERC has approved a proposal floated by Tata Power Delhi for its consumers for adoption of BEE 5-star rated ACs through a consumer rebate scheme. Consumers who replace their old, non-star rated ACs with the new ones will get a rebate up to ` 8,000 in their power bills. The scheme will be available for the first 2 lakh consumers. The discom said energy savings by this scheme are expected to be approximately 45.7 million units and will not only help meet peak load, but also curtail power purchase costs. Findings show that 1.5 ton ACs are commonly used with average households having two units used for six hours a day for 150 days over the months of May-September. (economictimes.indiatimes.com)

Policy / Performance………….

Jharkhand wants Tilaiya UMPP under ‘plug and play’ model

June 2, 2015. The Jharkhand government has urged the Union government to consider fresh bidding for the Tilaiya Ultra Mega Power Project (UMPP) or offering it on a 'plug and play' model after Reliance Power walked away from it one month ago. This will help avoid any further delay in implementing the 3,960 MW project, the state said in a letter to the Union power ministry. Under the 'plug and play' model for big ticket infrastructure projects, proposed in this year's Union budget, all regulatory clearances will be put in place before a project is awarded to a private developer through a transparent auction. The Modi Government has announced plans to auction five new UMPPs of 4000 MW each in the "plug-and-play" model. Reliance Power's subsidiary Jharkhand Integrated Power Ltd, which bagged the Tilaiya UMPP in 2009, pulled out of the ` 36,000 crore project on the ground that the state had failed to make adequate land available. Out of 1,700 acres of land required for the project, the state had acquired only 417 acres even though the ministry of environment and forest (MoEF) had given its nod for 1,220 acres of forest land in November 2010 it had said. Reliance Power also moved the Delhi High Court, which granted a stay against any move to encash the ` 800 crore bank guarantee the company provided for the project. Reliance's pullout came at a time when Jharkhand's first stable government in its 14-year history is working overtime to prove itself. While it pursues "all necessary legal recourse", including challenging the High Court stay and issuing a notice for arbitration, the Jharkhand government is keen to reboot the project as quickly as possible. When it won the UMPP in 2009, Reliance Power had committed to provide power at ` 1.77 a unit for over 25 years under the UMPP that would have provided power to 18 power utilities of ten states, including Jharkhand. (economictimes.indiatimes.com)

Odisha to have 12 percent surplus power in peak period in 2015-16

June 2, 2015. Odisha will have 11.8 percent surplus peak power availability during 2015-16, according to Load Generation Balance Report (LGBR) brought out by the Central Electricity Authority (CEA). The report has projected that the total demand of power during the peak period will be 4050 MW while the availability will be 4526 MW, a surplus of 476 MW during the fiscal. All the months in the year will have surplus power availability during the peak hours. The maximum surplus will be in the month of July (13.2 percent). Against the demand of ` 4000 MW, the availability in the month is pegged at 4526 MW, a surplus of 526 MW. CEA has also made a 6.2 percent surplus projection of total energy availability in the state during 2015-16. It has assessed that the total energy requirement during the fiscal will be 26985 million units (mu) against the availability of 28652 mu, an excess of 1667 mu. The energy availability will be surplus in all the months except December (0.2 percent deficit), January (1.2 percent deficit) and March (3.6 percent deficit). In 2014-15, Odisha faced marginal actual energy shortage of 1.6 percent against the anticipated shortage of 0.8 percent. Against the requirement of 26482 mu, the availability was 26052 mw, a deficit of 430 mu. (www.business-standard.com)

Tamil Nadu to ease out power cuts for industries from June 5

June 1, 2015. Tamil Nadu Chief Minister Jayalalithaa ordered easing of 'Restrictions and Controls' entailing substantial power cuts for High Tension electricity consumers from June 5. Under the 90 percent norm, industries can draw only 10 percent power from the grid for lighting and security purposes between 6 PM and 10 PM during peak hour. Also, during non-peak hours, a power cut of 20 percent on base demand and energy for HT industrial and commercial services is now being followed. Load shedding for domestic and other Low Tension power consumers was ended effective June 1 last year. (economictimes.indiatimes.com)

Small hydro projects to be set up in Haryana: Haryana CM

June 1, 2015. The Haryana government is mulling setting up small hydro projects on canals in the State and power generated from it would be supplied to local areas, Chief Minister (CM) Manohar Lal Khattar said. The Chief Minister said that electricity wires would be changed at a cost of ` 3,000 crore. (www.thehindu.com)

India will open 60 new coal mines to boost coal supply

June 1, 2015. The Ministry of Coal and Power of India has announced that 60 new coal mines would be open across the country in late May and June 2015. These new mine openings are part of the overall plan for state-owned mining group Coal India Ltd (CIL) to double its current production of 500 Mt/year in five years to reach India's total production target of 1,500 Mt by 2020. In the last fiscal year (April 2014-March 2015), CIL succeeded in raising its coal production by 32 Mt. India aims to become self-sufficient for its coal consumption, though the country will continue to import in the coming years. (www.enerdata.net)

India sees lowest plant load factor in 15 yrs

May 29, 2015. The Modi government has claimed several records in the power sector in its first year in office, including the highest annual capacity addition ever and the best generation growth in two decades with output touching the trillion unit mark. What it hasn't pointed out is that 2014-15 also recorded the lowest plant load factor (PLF) in over 15 years with the country's power capacities operating at a mere 65%. That the power sector, which till recently was only worried about fuel supplies, is sitting on a fresh time bomb has been brought to Prime Minister Narendra Modi's attention by top government officials in a recent meeting to assess infrastructure sectors. Discoms across all states had incurred accumulated losses of ` 2.51 lakh crore in 2012-13. In 2014-15, 22,566 MW of capacity was commissioned, which officials and experts said were stuck in the pipeline for years till they were put on the fast track by the UPA in its fag end through the Cabinet Committee on Investments. India has an installed power capacity of 158,000 MW with 30,000 MW more in the pipeline. Another 1,00,000 MW would be added from solar power over the next five years, as per the government's plans. Power firms already owe Coal India around ` 8,000 crore as they haven't been paid by discoms. (economictimes.indiatimes.com)

African countries to sign MoU with power surplus Gujarat

May 28, 2015. African countries see India as a "solution partner" to develop and explore various sectors of the continent as well as train people there for sustainable growth, Indo-African Chamber of Commerce and Industries (IACCI) General Secretary Sunanda Rajendran said. Rajendran said that African countries are set to sign an MoU (memorandum of understanding) with the Gujarat government for their requirements in the power and energy sector. There are 126 power projects pending in Africa that has not been awarded so far, she said. She said that current bilateral trade between India and Africa stands at $135 billion and the aim is to take it to USD 160 billion. (economictimes.indiatimes.com)

Govt rescues Athena hydel project in Sikkim

May 28, 2015. The power ministry has stepped in to rescue the country's largest public-private hydel project with a deal that would see a joint venture of the Sikkim government and central utility NHPC buying out the Athena group and partially mopping up stake of six global private equity funds in Teesta Urja, a special purpose vehicle (SPV) implementing the project. The deal, sewed up by power minister Piyush Goyal, would prevent the 1,200 MW project in the Himalayan state from turning into a bad investment and reassure overseas investors at a time when the Modi government is making efforts to attract FDI. The deal envisages the Sikkim government-NHPC joint venture operating and maintaining the project for 25 years once it is completed. Sikkim will raise its stake in the project from 26% to 51% by buying out the Athena group and PTC, which formed the SPV. Thereafter, the six international investors will partially dilute their stake to 40-42%. (economictimes.indiatimes.com)

DERC may hike power tariff by 20 percent over delayed power purchase charges

May 28, 2015. Delhi Electricity Regulatory Commission (DERC) is likely to pass an order in the first fortnight of June that will see power bills shoot up in the city. In compliance with the Appellate Tribunal of Electricity's (APTEL) order to pass the delayed power purchase adjustment charges (PPAC) for the three power companies, BRPL, BYPL and Tata Power Delhi, the regulator is expected to pass an order to the effect early next month. This could see power bills increase by upto 20 percent across the city. While Tata Power Delhi has sought upto 4 percent in their petitions, the BSES discoms, Rajdhani and Yamuna, cited a higher PPAC demand of 17 percent-20 percent in their two petitions submitted to the regulator. The discoms had filed a petition in APTEL over their grievances for not getting PPAC for three quarters, (July 1, 2014 to March 31, 2015) despite submitting their petitions to DERC on a regular basis. While the APTEL has directed DERC to pass PPAC order for the latter two quarters, the controversial PPAC order for the first quarter will be heard on merit later in July. (economictimes.indiatimes.com)

Coal linkage to Katwa power plant will help NTPC

May 27, 2015. With the Centre's assurance to extend coal linkage to Katwa Thermal Power Plant, the NTPC, which is setting up the project, would be able to float tender for equipment soon, West Bengal Power Minister Manish Gupta said. The minister said that the NTPC was unable to float tender without this coal linkage. Gupta said Chief Minister Mamata Banerjee had discussed the issue with Union Minister of State for Coal, Power and Renewable Energy Piyush Goyal during the inauguration of Coal India Ltd's new corporate office at Rajarhat recently. The chief minister on her part too assured the Centre of all help and cooperation in the setting up of the plant. Coal linkage and Environment Impact Assessment are the two prerequisites for the project to get off the ground. Out of 853 acres of land required for the project, the state government has already handed over to the NTPC 556 acres for the 1,320 MW thermal power plant, while another 97 acres would soon be handed over, Gupta said adding the NTPC on its own acquired 200 acres of land. The NTPC stepped in to set up the plant after West Bengal Power Development Corporation (WBPDCL), which was supposed to construct it, gave up unable to acquire the requisite land. The minister said the state government had taken measures to expedite electrification in the Sundarbans. Electrification in the area of Patharpratima, Gosaba and Namkhana blocks were in progress and would be completed by April, 2016. (www.ptinews.com)

Power capacity addition at record 22.5 GW in 1 year: Goyal

May 27, 2015. Buoyed by the lowest-ever power deficit at 3.6 percent on the back of 22,566 MW capacity addition, Coal and Power Minister Piyush Goyal said the stage has been set for energy security by 'Team India' for 50 years. During the past one year, the minister said, 22,566 MW of generation capacity was added to the existing level and there has been highest-ever increase in transmission line capacity of 22,100 circuit kilometres over and above the highest jump in sub-station capacity of 66,554 MW. Goyal said transparent coal auctions, corruption-free governance and de-bureaucratisation, among others, will help the Prime Minister's vision of 24X7 affordable power to all become a reality. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Russia keeps oil output at post-Soviet high before OPEC meet

June 2, 2015. Russian oil output remained unchanged in May at a post-Soviet high of 10.71 million barrels per day (bpd), Energy Ministry data showed, three days before OPEC meets to decide on output levels. In tonnes, oil output rose to 45.288 million from 43.830 million in April while gas production fell to 48.28 billion cubic meters (bcm) last month, or 1.56 bcm a day, from 52.64 bcm in April. The Organization of the Petroleum Exporting Countries (OPEC), which controls more than 40 percent of the world's crude oil production, meets in Vienna. Analysts expect the bloc to maintain current output levels. OPEC said an output cut would only be possible if other oil-producing nations such as Russia join in. Oil revenues are the cornerstone for many countries' budgets, including Russia. Russian Energy Minister Alexander Novak said Russia did not plan to seek an agreement with OPEC on any specific production levels. Russia has raised its output by 200,000 bpd over the past year, hitting the post-Soviet high of 10.71 million bpd in April. (www.reuters.com)

Petrobras and ONGC find new oil reservoir off Brazil's Sergipe

June 1, 2015. Brazil's state-run Petroleo Brasileiro SA (Petrobras) discovered a new deposit of light oil in deep waters off the coast of the northern state of Sergipe, the company said. Well 3-SES-189, located in the Poço Verde area discovered in 2012 in the BM-SEAL-4 exploration block, was drilled down to 5,350 meters in waters 2,479 meters deep. Drilling began on April 6 by Diamond Offshore Drilling Inc with its Ocean Courage semisubmersible rig. It said another test is needed to confirm the conditions and establish the well's potential. Petrobras is the operator and has a 75 percent stake in the prospect, in partnership with India's Oil and Natural Gas Corp, which holds 25 percent. Deepwater exploration in the Sergipe-Alagoas Basin by Petrobras, ONGC and India's Videocon Industries Ltd and Bharat Petroleum Corp. has resulted in some of Brazil's largest oil discoveries outside the giant finds in the Santos Basin. (www.reuters.com)

OVL qualifies for Mexico oil block auction

May 31, 2015. ONGC Videsh Ltd (OVL) is among the 19 companies and seven groups to have pre-qualified to bid for Mexico's maiden offshore oil blocks auction. OVL has been pre-qualified alongside likes of supermajors Chevron and ExxonMobil to submit bids for Mexico's Round 1 to be held on July 15, the country's upstream regulator, National Hydrocarbons Commission (CNH) said. In all 34 companies had applied to pre-qualify to bid for 14 oil blocks in the Mexico's first licensing round since 1938. The CNH will also auction 9 other shallow-water blocks in the Gulf of Mexico in September and 26 onshore blocks in December. The 14 shallow water exploration blocks covering nine fields in Round-1 are estimated to hold reserves of 356 million barrels of oil and oil equivalent gas.

The pre-qualification criteria specified knowledge and experience in working in at least three shallow waters exploration and production of oil and gas or in one or two large-scale projects, which together involve capital investments of $1 billion. According to the bid criteria, companies will have an initial exploration period of four years with the possibility of a two-year extension. They also have to drill at least one well after winning the block. While Mexico is offering shallow waters in the Gulf of Mexico in Round-1, more costly production in shale rock formations will be offered later. Mexico is expecting $50 billion investment by opening up its exploration sector to private and foreign players by 2018. (timesofindia.indiatimes.com)

Indonesia's Pertamina proposes to take over Sanga-Sanga oil block

May 29, 2015. Indonesia's state oil and gas company Pertamina has put forward a proposal for it to take over the Sanga-Sanga oil block, Indonesia's energy ministry said. The block currently produces 16,733 barrel oil per day and is operated by VICO Indonesia, whose contract is due to expire in 2018. Among the block's shareholders are BP East Kalimantan, controlling 26.25 percent, and Virginia International Co, controlling 15.6 percent. (www.rigzone.com)

Colombia's Ecopetrol plans to boost oil production by 20 percent by 2020

May 28, 2015. Colombia's oil company Ecopetrol has unveiled its strategic plan through 2020, which includes investments of around US$6bn/year until 2020. The company plans to invest approximately US$4bn/year in production and to raise proven reserves by 1.7 Gbl by 2020. The group aims to reach a production level of 870,000 bbl/d by 2020, a 20% increase over the current 722,000 bbl/d. Ecopetrol will invest between US$1bn and US$1.5bn per year until 2020 in exploration and will invest US$2.5bn (about US$500m/year) to improve its transportation capacities. Ecopetrol accounts for 60% of national production in Colombia. The group is active in exploration and production in Brazil, Peru and the United States (Gulf of Mexico). The group owns and operate the main refinery in Colombia and most of the pipeline network and pipelines in the country. (www.enerdata.net)

CNOOC makes oil discovery at Liuhua 20-2 block in South China Sea

May 28, 2015. China National Offshore Oil Corp. Ltd. (CNOOC) announced that it has made a mid-sized discovery at the Liuhua 20-2 block in the Eastern South China Sea. The Liuhua 20-2 structure is located in Northern Slope Belt of Baiyun Sag in the Pearl River Mouth Basin of the South China Sea with an average water depth of about 1,280 feet (390 meters). The discovery well LH20-2-1 was drilled and completed at a depth of about 9,744 feet (2,970 meters) and encountered oil pay zones with a total thickness of 116 feet (35.2 meters). The oil production of the well tested around 8,000 barrels per day and the crude oil density is approximately 0.75. The successful exploration of Liuhua 20-2 has further proved the huge exploration potential of Baiyun Sag in the Pearl River Mouth Basin, and Baiyun Sag is expected to become the new reserves growth area of deepwater exploration of crude oil in South China Sea. (www.rigzone.com)

Total reaches 2 bn barrel milestone offshore Angola

May 27, 2015. Total has reached the milestone of producing two billion barrels of oil from its deep offshore Block 17, which is located approximately 90 miles off the coast of Angola. Block 17 is currently Total’s most prolific site with a production rate of over 700,000 barrels per day. Total operates the region with a 40 percent interest alongside Statoil, which holds a 23.33 percent interest, Esso Exploration Angola Block 17, which holds a 20 percent interest and BP Exploration Angola, which holds a 16.67 percent interest. Sonangol is the concessionaire of the license. (www.rigzone.com)

Egypt extends gas exploration tender by 2 months and adds 4 blocks

May 27, 2015. The Egyptian Natural Gas Holding Company (EGAS), Egypt's state gas board, has extended by two months its tender for gas exploration in the Mediterranean Sea, while adding four new blocks for exploration, namely Northeast Habi Marine, North Farma Marine, North Tabiya Marine and Northeast Amiriya Marine. The tender will now include 12 offshore blocks, instead of eight (West Arish Marine, East Port Said Marine, North Rumana Marine, North Ras al-Ash Marine, West al-Timsah Marine, South Taneen Marine, North Hammad Marine and East Alexandria Marine). It will now run until 30 July 2015. Egypt is facing a severe energy crisis with declining gas production and rising consumption; the country has now become a net energy importer and is seeking to tackle energy shortages by encouraging domestic hydrocarbon production, building new energy infrastructures and by raising energy prices. (www.enerdata.net)

Venezuela, Russia's Rosneft agree on $14 bn oil, gas investment

May 27, 2015. Venezuela and Russia's top oil producer, Rosneft, have agreed on around $14 billion in investment in the South American OPEC country's oil and gas sector, President Nicolas Maduro said. PDVSA has formal ambitious targets to double national production to 6 million barrels a day by 2019, with 4 million of that projected to come from the Orinoco Belt, but few industry experts or foreign investors expect those goals to be met. PDVSA and the Venezuelan Oil Ministry did not immediately respond to requests for details. It was not immediately possible to contact Rosneft. Rosneft and PDVSA signed a new contract for supplies of oil and oil products of Venezuelan production, the Russian company said. The document envisages the supplies of over 1.6 million tonnes of oil and 9 million tonnes of oil products to Rosneft within five years. PDVSA said the two countries had agreed to "create companies together" to boost crude production, adding both nations want to expand crude extraction in the oil-rich Orinoco Belt, where Rosneft already has joint ventures with PDVSA. The Venezuelan company said Rosneft had proposed increasing its stake in the Petromonagas joint venture from the current 16.7 percent to reach 40 percent, the maximum allowed for a foreign partner in oil joint ventures in the South American country. (www.reuters.com)

Downstream…………

Taiwan's CPC Corp offers first gasoil cargo in 5 months

June 2, 2015. Taiwan's CPC Corp offered its first gasoil cargo in five months, a move that is expected to weigh on the adequately supplied market, traders said. The company has offered 300,000 barrels of either 500ppm or 0.25 percent sulphur gasoil for loading from Kaohsiung, Taiwan over July 1 to July 31, they said. CPC last sold 300,000 barrels of 500ppm sulphur gasoil for Feb. 4 to Feb. 15 loading to Winson Oil at a discount of 70 cents a barrel to Singapore quotes, traders said. CPC is planning to permanently shut its 220,000 barrels per day (bpd) Kaohsiung refinery and petrochemical complex by year-end, according to the company. CPC operates a 200,000 bpd refinery at Taoyuan and a 300,000 bpd refinery at Dalin. (af.reuters.com)

$430 mn Dakota Prairie Refinery begins diesel sales

June 1, 2015. Diesel sales have started at a new oil refinery in western North Dakota. Bismarck-based MDU Resources Group and Indianapolis-based Calumet Specialty Products Partners built the $430 million Dakota Prairie Refinery near Dickinson. Officials said that some diesel was sold last month. But they say June is expected to be the first full month of production at 20,000 barrels per day. A barrel is 42 gallons. Crews broke ground on the refinery in March 2013. The only other refinery producing fuel in North Dakota is the Tesoro Corp. plant at Mandan. (www.downstreamtoday.com)

Transportation / Trade……….

Thai PTT seeks to secure LNG imports with global suppliers

June 2, 2015. Thailand's PTT PCL said it plans to negotiate arrangements for import of liquefied natural gas (LNG) with several gas suppliers, including Chevron Corp, to offset a decline in domestic resources and to secure long-term supply. State-controlled PTT plans to expand its partnership with Qatar Liquefied Gas Co Ltd, a major long-term LNG supplier. PTT, Thailand's sole gas supplier, has a 20-year contract to buy 2 million tonnes of LNG a year from Qatar starting this year. The company has so far not revealed the names of the firms with which it is talks for LNG supplies, except for Anadarko Petroleum Corp, an operator of a Mozambique gas field in which PTT's unit has a stake Natural gas is used for almost 70 percent of Thailand's power generation. About a fifth of supplies are piped from Myanmar. But imports from Myanmar are likely to fall, given Thailand's neighbour is expected to use more of its natural gas resources for its own development. PTT planned to have talks with Malaysia's Petronas about potential LNG cooperation in the future. To secure short term supply, PTT is looking to form partnerships with France's Total SA and Shell about possibilities to buy LNG from the spot market, it said without elaborating. Thailand's domestic gas consumption is expected to average 4,800 million cubic feet per day this year, or a growth rate of about 3-4 percent a year, PTT said. State-run Electricity Generating Authority of Thailand said it signed a preliminary agreement with Tokyo Electric Power co to cooperate on LNG imports. (uk.reuters.com)

Statoil extends gas supply contract with SSE

June 2, 2015. Norwegian oil and gas company Statoil has agreed to extend a six-year gas supply agreement signed with British energy group SSE in October 2014, raising annual deliveries from 0.5 bcm/year to 2.5 bcm/year. Statoil already supplies gas to SSE under a 10-year agreement for 0.5 bcm/year between October 2012 and October 2022. In May 2015, Statoil and Centrica announced a new gas supply agreement raising Statoil's total gas supply to Centrica up to 7.3 bcm/year over the 2015-2025 period. (www.enerdata.net)

OPEC oil output in May reaches highest since 2012

May 31, 2015. OPEC oil supply in May climbed further to its highest in more than two years as increasing Angolan exports and record or near-record output from Saudi Arabia and Iraq outweighed outages in smaller producers, a survey showed. The boost from the Organization of the Petroleum Exporting Countries (OPEC) puts output further above its target of 30 million barrels per day (bpd), underlining the focus of top exporter Saudi Arabia and other key members on market share. OPEC supply rose in May to 31.22 million bpd from a revised 31.16 million bpd in April, according to the survey, based on shipping data and information from sources at oil companies, OPEC and consultants.

The group meets and is not expected to alter policy as oil has risen to $65 a barrel from a low close to $45 in January and there are signs of slowing growth in the higher-cost supplies that have been eroding OPEC's market share. The biggest increase came from Angola, which exported 58 cargoes in May, more than originally planned in April, according to loading schedules. Top exporter Saudi Arabia has not reduced output from April's record high of 10.30 million bpd, the survey said, as it meets higher demand from export customers and in domestic power plants. Of the countries with lower output, Libya posted a decline as more supply was disrupted by unrest, and production in Nigeria slipped because of pipeline leaks that prompted Royal Dutch Shell's local venture to declare force majeure on exports from the Forcados stream. Iraqi exports, which have helped push OPEC output higher this year, look set to have fallen slightly short of April's record level, according to this survey. Although Iraq increased its northern exports further following a deal between Baghdad and the Kurdistan Regional Government, flows declined from the south, which produces the bulk of Iraq's oil. (www.reuters.com)

Global LNG-prices capped by weak Asian demand

May 29, 2015. Asian spot liquefied natural gas (LNG) prices for July were steady this week, as limited deals in the region made it difficult to assess prices and supply continued to outstrip demand, traders said. The price of Asian spot cargoes was $7.60 per million British thermal units (mmBtu), in line with the previous week. The LNG market has been struggling with oversupply as Australian projects ramp up output, ahead of more new projects coming online from the United States in the coming year. While some new demand has come from North Africa and the Middle East, traders and analysts said this was not enough to absorb all of the new supply coming on line. Traders were awaiting cargo awards from sale tenders launched by exporters including Nigeria, Papua New Guinea, Australia and Indonesia. The main supply disruption continued to be from Yemen, where the LNG plant declared force majeure in April due to worsening security. (af.reuters.com)

GE, Shell sign deal to promote LNG adoption by trucking industry

May 28, 2015. GE Capital, Canada announced the signing of a commercial agreement with Shell Canada Products (Shell) with a view to facilitate the trucking industry's adoption in Canada of liquefied natural gas (LNG), a cleaner-burning, less expensive fuel. Under this agreement, GE Capital and Shell will work together to reduce monthly payments for truck fleets that lease natural gas vehicles (NGVs). Specifically, fleets owners can sign natural gas fueling contracts with Shell and, separately, secure leases for LNG vehicles with GE Capital. The agreement covers equipment that will purchase fuel from Shell's facilities. GE Capital has been providing wholesale and retail financing to the country's commercial trucking sector for 35 years. In general, LNG is used for vehicles that undertake long hauls, while compressed natural gas (CNG) is used for those that undertake shorter hauls. (www.downstreamtoday.com)

Jordan receives FSRU for its first LNG import terminal project

May 27, 2015. The Floating Storage and Regasificaton Unit (FSRU) Golar Eskimo has arrived to the port of Aqaba in southern Jordan. The FSRU was built by Samsung Heavy Industries and is loaded with LNG from Qatar. It will be moored at a purpose-built structure constructed by the Aqaba Development Corporation off the Red Sea port of Aqaba. The FSRU, the first LNG import terminal in Jordan, has a regasification capacity of 500 mcf/d (14 mcm/d or 5.1 bcm/year) with a peak regasification capacity of 750 mcf/d (21 mcm/d or 7.7 bcm/year) and a storage capacity of 160,000 m3. So far, Jordan has signed only one LNG import agreement with Shell, which will deliver 4.2 mcm/d (1.5 bcm/year) over a 5-year period. (www.enerdata.net)

MPPE seeks foreign partner in fuel distribution

May 27, 2015. Myanma Petroleum Products Enterprise (MPPE), Myanmar's state-owned oil company, has decided to re-enter the fuel distribution market and to soon invite foreign companies to bid to partner in a new fuel distribution venture. MPPE had exited this market in 2010 when fuel distribution was privatised; MPPE had then transferred 216 service stations to private companies, only retaining 12 filling stations to supply state-owned vehicles. This market is offering bright perspectives, as the total number of registered cars in Myanmar more than doubled between late 2010 (more than 267,000 vehicles) and April 2015 (700,500), boosting fuel demand; fuel imports have risen by 20% between 2010-2011 fiscal year (US$1.92bn) and 2013-2014 (US$2.3bn). (www.enerdata.net)

Peru says to open bidding this year on LPG pipeline

May 27, 2015. Peru will likely open bidding late this year on the rights to build a liquefied petroleum gas (LPG) pipeline to help prevent supply crunches that have prompted the import of 292,000 barrels of the fuel, its government said. The proposed pipeline will transport LPG from a processing plant in the coastal town of Pisco to Lima, helping boost reserves in the capital, the deputy energy minister Raul Perez said. The pipeline will cost about $250 million. Recent repairs on pipelines that move natural gas to Pisco from Peru's central jungle curbed production of LPG in recent weeks while rough seas disrupted shipments to Lima, Perez said. LPG is mostly derived from natural gas in Peru. The local units of Repsol and Grupo Zeta distribute LPG for use in homes and cars in Peru. (af.reuters.com)

Policy / Performance…………

Venezuela says cooperation best way to achieve oil stabilisation

June 2, 2015. Venezuela's oil minister Asdrubal Chavez said that the best way toward achieving stabilisation in the oil market is through agreement and active cooperation among all exporters. He highlighted the work being undertaken at a technical level by OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC countries. (www.reuters.com)

OPEC hopes for further oil price recovery despite glut